Supplemental Information

First Quarter 2012

This information is preliminary and based on company data available at the time of the earnings presentation. It speaks only as of the particular date or dates included in the accompanying pages. Bank of America does not undertake an obligation to, and disclaims any duty to, update any of the information provided. Any forward-looking statements in this information are subject to the forward-looking language contained in Bank of America’s reports filed with the SEC pursuant to the Securities Exchange Act of 1934, which are available at the SEC’s website (www.sec.gov) or at Bank of America’s website (www.bankofamerica.com). Bank of America’s future financial performance is subject to risks and uncertainties as described in its SEC filings.

|

| |

| | |

| Bank of America Corporation and Subsidiaries | |

| Table of Contents | Page |

| |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Consumer & Business Banking | |

| |

| |

| |

| Consumer Real Estate Services | |

| |

| |

| |

| Global Banking | |

| |

| |

| |

| Global Markets | |

| |

| |

| |

| Global Wealth & Investment Management | |

| |

| |

| All Other | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| |

| | |

| | |

|

| | | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Consolidated Financial Highlights |

| (Dollars in millions, except per share information; shares in thousands) |

| | | First

Quarter

2012 | | Fourth

Quarter

2011 | | Third

Quarter

2011 | | Second

Quarter

2011 | | First

Quarter

2011 |

| Income statement | | | | | | | | | | |

| Net interest income | | $ | 10,846 |

| | $ | 10,701 |

| | $ | 10,490 |

| | $ | 11,246 |

| | $ | 12,179 |

|

| Noninterest income | | 11,432 |

| | 14,187 |

| | 17,963 |

| | 1,990 |

| | 14,698 |

|

| Total revenue, net of interest expense | | 22,278 |

| | 24,888 |

| | 28,453 |

| | 13,236 |

| | 26,877 |

|

| Provision for credit losses | | 2,418 |

| | 2,934 |

| | 3,407 |

| | 3,255 |

| | 3,814 |

|

| Goodwill impairment | | — |

| | 581 |

| | — |

| | 2,603 |

| | — |

|

| Merger and restructuring charges | | — |

| | 101 |

| | 176 |

| | 159 |

| | 202 |

|

All other noninterest expense (1) | | 19,141 |

| | 18,840 |

| | 17,437 |

| | 20,094 |

| | 20,081 |

|

| Income tax expense (benefit) | | 66 |

| | 441 |

| | 1,201 |

| | (4,049 | ) | | 731 |

|

| Net income (loss) | | 653 |

| | 1,991 |

| | 6,232 |

| | (8,826 | ) | | 2,049 |

|

| Preferred stock dividends | | 325 |

| | 407 |

| | 343 |

| | 301 |

| | 310 |

|

| Net income (loss) applicable to common shareholders | | 328 |

| | 1,584 |

| | 5,889 |

| | (9,127 | ) | | 1,739 |

|

Diluted earnings (loss) per common share (2) | | 0.03 |

| | 0.15 |

| | 0.56 |

| | (0.90 | ) | | 0.17 |

|

Average diluted common shares issued and outstanding (2) | | 10,761,917 |

| | 11,124,523 |

| | 10,464,395 |

| | 10,094,928 |

| | 10,181,351 |

|

| Dividends paid per common share | | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.01 |

|

| | | | | | | | | | | |

| Performance ratios | | | | | | | | | | |

| Return on average assets | | 0.12 | % | | 0.36 | % | | 1.07 | % | | n/m |

| | 0.36 | % |

| Return on average common shareholders' equity | | 0.62 |

| | 3.00 |

| | 11.40 |

| | n/m |

| | 3.29 |

|

Return on average tangible common shareholders' equity (3) | | 0.95 |

| | 4.72 |

| | 18.30 |

| | n/m |

| | 5.28 |

|

Return on average tangible shareholders' equity (3) | | 1.67 |

| | 5.20 |

| | 17.03 |

| | n/m |

| | 5.54 |

|

| | | | | | | | | | | |

| At period end | | | | | | | | | | |

| Book value per share of common stock | | $ | 19.83 |

| | $ | 20.09 |

| | $ | 20.80 |

| | $ | 20.29 |

| | $ | 21.15 |

|

Tangible book value per share of common stock (3) | | 12.87 |

| | 12.95 |

| | 13.22 |

| | 12.65 |

| | 13.21 |

|

| Market price per share of common stock: | | | | | | | | | | |

| Closing price | | $ | 9.57 |

| | $ | 5.56 |

| | $ | 6.12 |

| | $ | 10.96 |

| | $ | 13.33 |

|

| High closing price for the period | | 9.93 |

| | 7.35 |

| | 11.09 |

| | 13.72 |

| | 15.25 |

|

| Low closing price for the period | | 5.80 |

| | 4.99 |

| | 6.06 |

| | 10.50 |

| | 13.33 |

|

| Market capitalization | | 103,123 |

| | 58,580 |

| | 62,023 |

| | 111,060 |

| | 135,057 |

|

| | | | | | | | | | | |

| Number of banking centers - U.S. | | 5,651 |

| | 5,702 |

| | 5,715 |

| | 5,742 |

| | 5,805 |

|

| Number of branded ATMs - U.S. | | 17,255 |

| | 17,756 |

| | 17,752 |

| | 17,817 |

| | 17,886 |

|

| Full-time equivalent employees | | 278,688 |

| | 281,791 |

| | 288,739 |

| | 288,084 |

| | 288,913 |

|

| | | | | | | | | | | |

| |

(1) | Excludes merger and restructuring charges and goodwill impairment charges. |

| |

(2) | Due to a net loss applicable to common shareholders for the second quarter of 2011, the impact of antidilutive equity instruments was excluded from diluted earnings per share and average diluted common shares. |

| |

(3) | Tangible equity ratios and tangible book value per share of common stock are non-GAAP financial measures. We believe the use of these non-GAAP financial measures provides additional clarity in assessing the results of the Corporation. Other companies may define or calculate non-GAAP financial measures differently. (See Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 42-45.) |

n/m = not meaningful

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 2 |

|

| | | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Supplemental Financial Data |

| (Dollars in millions, except per share information) | | | | | | | | | | |

| | | | | | | | | | | |

Fully taxable-equivalent (FTE) basis data (1) | | | | | | | |

| | | | | | | | | | | |

| | | First

Quarter

2012 | | Fourth

Quarter

2011 | | Third

Quarter

2011 | | Second

Quarter

2011 | | First

Quarter

2011 |

| | | | | | |

| Net interest income | | $ | 11,053 |

| | $ | 10,959 |

| | $ | 10,739 |

| | $ | 11,493 |

| | $ | 12,397 |

|

| Total revenue, net of interest expense | | 22,485 |

| | 25,146 |

| | 28,702 |

| | 13,483 |

| | 27,095 |

|

Net interest yield (2) | | 2.51 | % | | 2.45 | % | | 2.32 | % | | 2.50 | % | | 2.67 | % |

| Efficiency ratio | | 85.13 |

| | 77.64 |

| | 61.37 |

| | n/m |

| | 74.86 |

|

| | | | | | | | | | | |

| | | | | | | | | | | |

Performance ratios, excluding goodwill impairment charges (3, 4) | | | | | | | |

| | | | | | | | | | | |

| | | | | Fourth

Quarter

2011 | | | | Second

Quarter

2011 | | |

| | | | | | |

| Per common share information | | | | | | | | | | |

| Earnings (loss) | | | | $ | 0.21 |

| | | | $ | (0.65 | ) | | |

| Diluted earnings (loss) | | | | 0.20 |

| | | | (0.65 | ) | | |

| Efficiency ratio (FTE basis) | | | | 75.33 | % | | | | n/m |

| | |

| Return on average assets | | | | 0.46 |

| | | | n/m |

| | |

| Return on average common shareholders’ equity | | | | 4.10 |

| | | | n/m |

| | |

| Return on average tangible common shareholders’ equity | | | | 6.46 |

| | | | n/m |

| | |

| Return on average tangible shareholders’ equity | | | | 6.72 |

| | | | n/m |

| | |

| | | | | | | | | | | |

| |

(1) | FTE basis is a non-GAAP financial measure. FTE basis is a performance measure used by management in operating the business that management believes provides investors with a more accurate picture of the interest margin for comparative purposes. (See Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 42-45.) |

| |

(2) | Calculation includes fees earned on overnight deposits placed with the Federal Reserve of $47 million for the first quarter of 2012, and $36 million, $38 million, $49 million and $63 million for the fourth, third, second and first quarters of 2011, respectively. For more information, see Quarter-to-Date Average Balances and Interest Rates - Fully Taxable-equivalent Basis on pages 10-11. |

| |

(3) | Performance ratios, excluding goodwill impairment charges, are non-GAAP financial measures. We believe the use of these non-GAAP financial measures provides additional clarity in assessing the results of the Corporation. (See Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 42-45.) |

| |

(4) | There were no goodwill impairment charges for the first quarter of 2012, and the third and first quarters of 2011. |

n/m = not meaningful

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 3 |

|

| | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Consolidated Statement of Income |

| (Dollars in millions, except per share information; shares in thousands) |

| | First

Quarter

2012 | | Fourth

Quarter

2011 | | Third

Quarter

2011 | | Second

Quarter

2011 | | First

Quarter

2011 |

| Interest income | | | | | | | | | |

| Loans and leases | $ | 10,173 |

| | $ | 10,512 |

| | $ | 11,205 |

| | $ | 11,320 |

| | $ | 11,929 |

|

| Debt securities | 2,725 |

| | 2,235 |

| | 1,729 |

| | 2,675 |

| | 2,882 |

|

| Federal funds sold and securities borrowed or purchased under agreements to resell | 460 |

| | 449 |

| | 584 |

| | 597 |

| | 517 |

|

| Trading account assets | 1,352 |

| | 1,297 |

| | 1,500 |

| | 1,538 |

| | 1,626 |

|

| Other interest income | 751 |

| | 920 |

| | 835 |

| | 918 |

| | 968 |

|

| Total interest income | 15,461 |

| | 15,413 |

| | 15,853 |

| | 17,048 |

| | 17,922 |

|

| | | | | | | | | | |

| Interest expense | | | | | | | | | |

| Deposits | 549 |

| | 616 |

| | 704 |

| | 843 |

| | 839 |

|

| Short-term borrowings | 881 |

| | 921 |

| | 1,153 |

| | 1,341 |

| | 1,184 |

|

| Trading account liabilities | 477 |

| | 411 |

| | 547 |

| | 627 |

| | 627 |

|

| Long-term debt | 2,708 |

| | 2,764 |

| | 2,959 |

| | 2,991 |

| | 3,093 |

|

| Total interest expense | 4,615 |

| | 4,712 |

| | 5,363 |

| | 5,802 |

| | 5,743 |

|

| Net interest income | 10,846 |

| | 10,701 |

| | 10,490 |

| | 11,246 |

| | 12,179 |

|

| | | | | | | | | | |

| Noninterest income | | | | | | | | | |

| Card income | 1,457 |

| | 1,478 |

| | 1,911 |

| | 1,967 |

| | 1,828 |

|

| Service charges | 1,912 |

| | 1,982 |

| | 2,068 |

| | 2,012 |

| | 2,032 |

|

| Investment and brokerage services | 2,876 |

| | 2,694 |

| | 3,022 |

| | 3,009 |

| | 3,101 |

|

| Investment banking income | 1,217 |

| | 1,013 |

| | 942 |

| | 1,684 |

| | 1,578 |

|

| Equity investment income | 765 |

| | 3,227 |

| | 1,446 |

| | 1,212 |

| | 1,475 |

|

| Trading account profits | 2,075 |

| | 280 |

| | 1,604 |

| | 2,091 |

| | 2,722 |

|

| Mortgage banking income (loss) | 1,612 |

| | 2,119 |

| | 1,617 |

| | (13,196 | ) | | 630 |

|

| Insurance income (loss) | (60 | ) | | 143 |

| | 190 |

| | 400 |

| | 613 |

|

| Gains on sales of debt securities | 752 |

| | 1,192 |

| | 737 |

| | 899 |

| | 546 |

|

| Other income (loss) | (1,134 | ) | | 140 |

| | 4,511 |

| | 1,957 |

| | 261 |

|

| Other-than-temporary impairment losses on available-for-sale debt securities: | | | | | | | | | |

| Total other-than-temporary impairment losses | (51 | ) | | (127 | ) | | (114 | ) | | (63 | ) | | (111 | ) |

| Less: Portion of other-than-temporary impairment losses recognized in other comprehensive income | 11 |

| | 46 |

| | 29 |

| | 18 |

| | 23 |

|

| Net impairment losses recognized in earnings on available-for-sale debt securities | (40 | ) | | (81 | ) | | (85 | ) | | (45 | ) | | (88 | ) |

| Total noninterest income | 11,432 |

| | 14,187 |

| | 17,963 |

| | 1,990 |

| | 14,698 |

|

| Total revenue, net of interest expense | 22,278 |

| | 24,888 |

| | 28,453 |

| | 13,236 |

| | 26,877 |

|

| | | | | | | | | | |

| Provision for credit losses | 2,418 |

| | 2,934 |

| | 3,407 |

| | 3,255 |

| | 3,814 |

|

| | | | | | | | | | |

| Noninterest expense | | | | | | | | | |

| Personnel | 10,188 |

| | 8,761 |

| | 8,865 |

| | 9,171 |

| | 10,168 |

|

| Occupancy | 1,142 |

| | 1,131 |

| | 1,183 |

| | 1,245 |

| | 1,189 |

|

| Equipment | 611 |

| | 525 |

| | 616 |

| | 593 |

| | 606 |

|

| Marketing | 465 |

| | 523 |

| | 556 |

| | 560 |

| | 564 |

|

| Professional fees | 783 |

| | 1,032 |

| | 937 |

| | 766 |

| | 646 |

|

| Amortization of intangibles | 319 |

| | 365 |

| | 377 |

| | 382 |

| | 385 |

|

| Data processing | 856 |

| | 688 |

| | 626 |

| | 643 |

| | 695 |

|

| Telecommunications | 400 |

| | 386 |

| | 405 |

| | 391 |

| | 371 |

|

| Other general operating | 4,377 |

| | 5,429 |

| | 3,872 |

| | 6,343 |

| | 5,457 |

|

| Goodwill impairment | — |

| | 581 |

| | — |

| | 2,603 |

| | — |

|

| Merger and restructuring charges | — |

| | 101 |

| | 176 |

| | 159 |

| | 202 |

|

| Total noninterest expense | 19,141 |

| | 19,522 |

| | 17,613 |

| | 22,856 |

| | 20,283 |

|

| Income (loss) before income taxes | 719 |

| | 2,432 |

| | 7,433 |

| | (12,875 | ) | | 2,780 |

|

| Income tax expense (benefit) | 66 |

| | 441 |

| | 1,201 |

| | (4,049 | ) | | 731 |

|

| Net income (loss) | $ | 653 |

| | $ | 1,991 |

| | $ | 6,232 |

| | $ | (8,826 | ) | | $ | 2,049 |

|

| Preferred stock dividends | 325 |

| | 407 |

| | 343 |

| | 301 |

| | 310 |

|

| Net income (loss) applicable to common shareholders | $ | 328 |

| | $ | 1,584 |

| | $ | 5,889 |

| | $ | (9,127 | ) | | $ | 1,739 |

|

| | | | | | | | | | |

| Per common share information | | | | | | | | | |

| Earnings (loss) | $ | 0.03 |

| | $ | 0.15 |

| | $ | 0.58 |

| | $ | (0.90 | ) | | $ | 0.17 |

|

Diluted earnings (loss) (1) | 0.03 |

| | 0.15 |

| | 0.56 |

| | (0.90 | ) | | 0.17 |

|

| Dividends paid | 0.01 |

| | 0.01 |

| | 0.01 |

| | 0.01 |

| | 0.01 |

|

| Average common shares issued and outstanding | 10,651,367 |

| | 10,281,397 |

| | 10,116,284 |

| | 10,094,928 |

| | 10,075,875 |

|

Average diluted common shares issued and outstanding (1) | 10,761,917 |

| | 11,124,523 |

| | 10,464,395 |

| | 10,094,928 |

| | 10,181,351 |

|

| | | | | | | | | | |

| |

(1) | Due to a net loss applicable to common shareholders for the second quarter of 2011, the impact of antidilutive equity instruments was excluded from diluted earnings per share and average diluted common shares. |

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 4 |

|

| | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Consolidated Statement of Comprehensive Income |

| (Dollars in millions) | First

Quarter

2012 | | Fourth

Quarter

2011 | | Third

Quarter

2011 | | Second

Quarter

2011 | | First

Quarter

2011 |

| Net income (loss) | $ | 653 |

| | $ | 1,991 |

| | $ | 6,232 |

| | $ | (8,826 | ) | | $ | 2,049 |

|

| Other comprehensive income, net of tax: | | | | | | | | | |

| Net change in available-for-sale debt and marketable equity securities | (924 | ) | | (2,866 | ) | | (2,158 | ) | | 593 |

| | 161 |

|

| Net change in derivatives | 382 |

| | 281 |

| | (764 | ) | | (332 | ) | | 266 |

|

| Employee benefit plan adjustments | 952 |

| | (648 | ) | | 66 |

| | 63 |

| | 75 |

|

| Net change in foreign currency translation adjustments | 31 |

| | (133 | ) | | (8 | ) | | 6 |

| | 27 |

|

| Other comprehensive income (loss) | 441 |

| | (3,366 | ) | | (2,864 | ) | | 330 |

| | 529 |

|

| Comprehensive income (loss) | $ | 1,094 |

| | $ | (1,375 | ) | | $ | 3,368 |

| | $ | (8,496 | ) | | $ | 2,578 |

|

| | | | | | | | | | |

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 5 |

|

| | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Consolidated Balance Sheet |

| (Dollars in millions) | | | | | |

| | March 31

2012 | | December 31

2011 | | March 31

2011 |

| Assets | | | | | |

| Cash and cash equivalents | $ | 128,792 |

| | $ | 120,102 |

| | $ | 97,542 |

|

| Time deposits placed and other short-term investments | 20,479 |

| | 26,004 |

| | 23,707 |

|

| Federal funds sold and securities borrowed or purchased under agreements to resell | 225,784 |

| | 211,183 |

| | 234,056 |

|

| Trading account assets | 209,775 |

| | 169,319 |

| | 208,761 |

|

| Derivative assets | 59,051 |

| | 73,023 |

| | 65,334 |

|

| Debt securities: | | | | | |

| Available-for-sale | 297,040 |

| | 276,151 |

| | 330,345 |

|

| Held-to-maturity, at cost | 34,205 |

| | 35,265 |

| | 431 |

|

| Total debt securities | 331,245 |

| | 311,416 |

| | 330,776 |

|

| Loans and leases | 902,294 |

| | 926,200 |

| | 932,425 |

|

| Allowance for loan and lease losses | (32,211 | ) | | (33,783 | ) | | (39,843 | ) |

| Loans and leases, net of allowance | 870,083 |

| | 892,417 |

| | 892,582 |

|

| Premises and equipment, net | 13,104 |

| | 13,637 |

| | 14,151 |

|

Mortgage servicing rights (includes $7,589, $7,378 and $15,282 measured at fair value) | 7,723 |

| | 7,510 |

| | 15,560 |

|

| Goodwill | 69,976 |

| | 69,967 |

| | 73,869 |

|

| Intangible assets | 7,696 |

| | 8,021 |

| | 9,560 |

|

| Loans held-for-sale | 12,973 |

| | 13,762 |

| | 25,003 |

|

| Customer and other receivables | 74,358 |

| | 66,999 |

| | 97,318 |

|

| Other assets | 150,410 |

| | 145,686 |

| | 186,313 |

|

| Total assets | $ | 2,181,449 |

| | $ | 2,129,046 |

| | $ | 2,274,532 |

|

| | | | | | |

| Assets of consolidated VIEs included in total assets above (substantially all pledged as collateral) |

| Trading account assets | $ | 8,920 |

| | $ | 8,595 |

| | $ | 12,012 |

|

| Derivative assets | 1,109 |

| | 1,634 |

| | 2,280 |

|

| Available-for-sale debt securities | — |

| | — |

| | 2,104 |

|

| Loans and leases | 133,742 |

| | 140,194 |

| | 146,309 |

|

| Allowance for loan and lease losses | (4,509 | ) | | (5,066 | ) | | (8,335 | ) |

| Loans and leases, net of allowance | 129,233 |

| | 135,128 |

| | 137,974 |

|

| Loans held-for-sale | 1,577 |

| | 1,635 |

| | 1,605 |

|

| All other assets | 3,118 |

| | 4,769 |

| | 4,883 |

|

| Total assets of consolidated VIEs | $ | 143,957 |

| | $ | 151,761 |

| | $ | 160,858 |

|

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 6 |

|

| | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries | | | | | |

| Consolidated Balance Sheet (continued) | | | | | |

| (Dollars in millions) | | | | | |

| | March 31

2012 | | December 31

2011 | | March 31

2011 |

| Liabilities | | | | | |

| Deposits in U.S. offices: | | | | | |

| Noninterest-bearing | $ | 338,215 |

| | $ | 332,228 |

| | $ | 286,357 |

|

| Interest-bearing | 630,822 |

| | 624,814 |

| | 652,096 |

|

| Deposits in non-U.S. offices: | | | | | |

| Noninterest-bearing | 7,240 |

| | 6,839 |

| | 7,894 |

|

| Interest-bearing | 65,034 |

| | 69,160 |

| | 73,828 |

|

| Total deposits | 1,041,311 |

| | 1,033,041 |

| | 1,020,175 |

|

| Federal funds purchased and securities loaned or sold under agreements to repurchase | 258,491 |

| | 214,864 |

| | 260,521 |

|

| Trading account liabilities | 70,414 |

| | 60,508 |

| | 88,478 |

|

| Derivative liabilities | 49,172 |

| | 59,520 |

| | 53,501 |

|

| Commercial paper and other short-term borrowings | 39,254 |

| | 35,698 |

| | 58,324 |

|

Accrued expenses and other liabilities (includes $651, $714 and $961 of reserve for unfunded lending commitments) | 135,396 |

| | 123,049 |

| | 128,221 |

|

| Long-term debt | 354,912 |

| | 372,265 |

| | 434,436 |

|

| Total liabilities | 1,948,950 |

| | 1,898,945 |

| | 2,043,656 |

|

| Shareholders’ equity | | | | | |

Preferred stock, $0.01 par value; authorized -100,000,000 shares; issued and outstanding - 3,685,410, 3,689,084 and 3,943,660 shares | 18,788 |

| | 18,397 |

| | 16,562 |

|

Common stock and additional paid-in capital, $0.01 par value; authorized - 12,800,000,000, 12,800,000,000 and 12,800,000,000 shares; issued and outstanding - 10,775,604,276, 10,535,937,957 and 10,131,803,417 shares | 157,973 |

| | 156,621 |

| | 151,379 |

|

| Retained earnings | 60,734 |

| | 60,520 |

| | 62,483 |

|

| Accumulated other comprehensive income (loss) | (4,996 | ) | | (5,437 | ) | | 463 |

|

| Other | — |

| | — |

| | (11 | ) |

| Total shareholders’ equity | 232,499 |

| | 230,101 |

| | 230,876 |

|

| Total liabilities and shareholders’ equity | $ | 2,181,449 |

| | $ | 2,129,046 |

| | $ | 2,274,532 |

|

| | | | | | |

| Liabilities of consolidated VIEs included in total liabilities above |

| Commercial paper and other short-term borrowings | $ | 5,598 |

| | $ | 5,777 |

| | $ | 6,954 |

|

| Long-term debt | 44,267 |

| | 49,054 |

| | 65,197 |

|

| All other liabilities | 978 |

| | 1,116 |

| | 1,240 |

|

| Total liabilities of consolidated VIEs | $ | 50,843 |

| | $ | 55,947 |

| | $ | 73,391 |

|

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 7 |

|

| | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

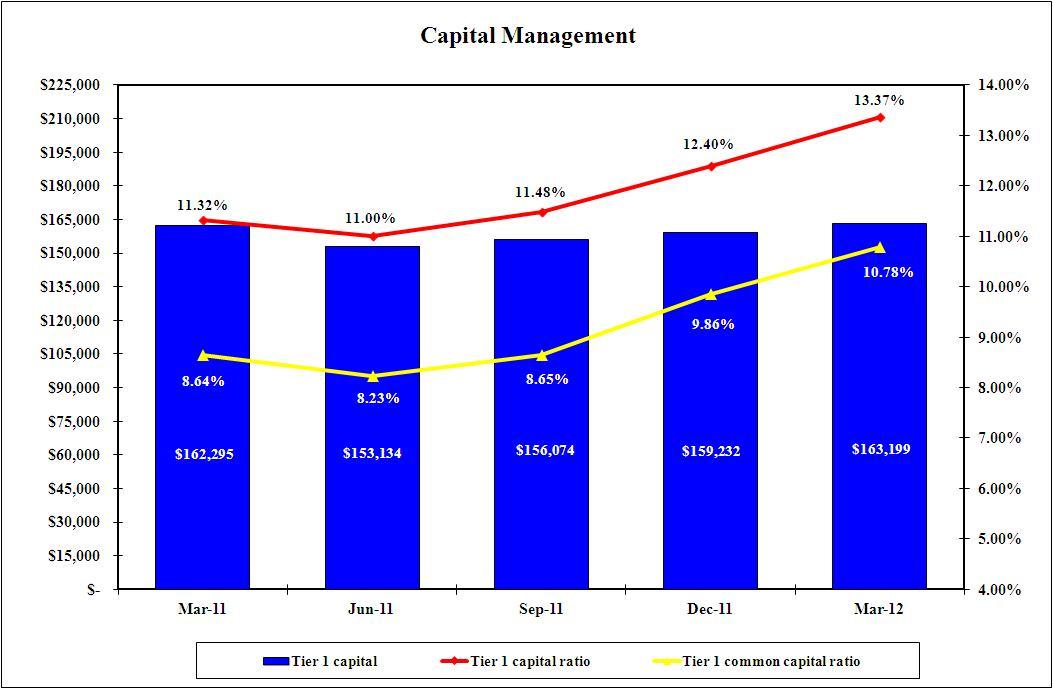

| Capital Management |

| (Dollars in millions) |

| | First

Quarter

2012 | | Fourth

Quarter

2011 | | Third

Quarter

2011 | | Second

Quarter

2011 | | First

Quarter

2011 |

Risk-based capital (1): | | | | | | | | | |

| Tier 1 common | $ | 131,602 |

| | $ | 126,690 |

| | $ | 117,658 |

| | $ | 114,684 |

| | $ | 123,882 |

|

| Tier 1 capital | 163,199 |

| | 159,232 |

| | 156,074 |

| | 153,134 |

| | 162,295 |

|

| Total capital | 213,480 |

| | 215,101 |

| | 215,596 |

| | 217,986 |

| | 229,094 |

|

| Risk-weighted assets | 1,220,827 |

| | 1,284,467 |

| | 1,359,564 |

| | 1,392,747 |

| | 1,433,377 |

|

Tier 1 common capital ratio (2) | 10.78 | % | | 9.86 | % | | 8.65 | % | | 8.23 | % | | 8.64 | % |

| Tier 1 capital ratio | 13.37 |

| | 12.40 |

| | 11.48 |

| | 11.00 |

| | 11.32 |

|

| Total capital ratio | 17.49 |

| | 16.75 |

| | 15.86 |

| | 15.65 |

| | 15.98 |

|

| Tier 1 leverage ratio | 7.79 |

| | 7.53 |

| | 7.11 |

| | 6.86 |

| | 7.25 |

|

Tangible equity ratio (3) | 7.48 |

| | 7.54 |

| | 7.16 |

| | 6.63 |

| | 6.85 |

|

Tangible common equity ratio (3) | 6.58 |

| | 6.64 |

| | 6.25 |

| | 5.87 |

| | 6.10 |

|

| | | | | | | | | | |

| |

(1) | Reflects preliminary data for current period risk-based capital. |

| |

(2) | Tier 1 common capital ratio equals Tier 1 capital excluding preferred stock, trust preferred securities, hybrid securities and minority interest divided by risk-weighted assets. |

| |

(3) | Tangible equity ratio equals period-end tangible shareholders’ equity divided by period-end tangible assets. Tangible common equity equals period-end tangible common shareholders’ equity divided by period-end tangible assets. Tangible shareholders’ equity and tangible assets are non-GAAP financial measures. We believe the use of these non-GAAP financial measures provides additional clarity in assessing the results of the Corporation. (See Exhibit A: Non-GAAP Reconciliations - Reconciliation to GAAP Financial Measures on pages 42-45.) |

*Preliminary data on risk-based capital

|

| | | | |

| Outstanding Common Stock |

| No common shares were repurchased in the first quarter of 2012. |

| There is no existing Board authorized share repurchase program. |

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 8 |

|

| | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Core Net Interest Income |

| (Dollars in millions) |

| | First

Quarter

2012 | | Fourth

Quarter

2011 | | Third

Quarter

2011 | | Second

Quarter

2011 | | First

Quarter

2011 |

| | | | | |

| Net interest income (FTE basis) | | | | | | | | | |

As reported (1) | $ | 11,053 |

| | $ | 10,959 |

| | $ | 10,739 |

| | $ | 11,493 |

| | $ | 12,397 |

|

Impact of market-based net interest income (2) | (796 | ) | | (866 | ) | | (929 | ) | | (874 | ) | | (1,020 | ) |

| Core net interest income | $ | 10,257 |

| | $ | 10,093 |

| | $ | 9,810 |

| | $ | 10,619 |

| | $ | 11,377 |

|

| | | | | | | | | | |

| Average earning assets | | | | | | | | | |

| As reported | $ | 1,768,105 |

| | $ | 1,783,986 |

| | $ | 1,841,135 |

| | $ | 1,844,525 |

| | $ | 1,869,863 |

|

Impact of market-based earning assets (2) | (424,336 | ) | | (414,141 | ) | | (445,435 | ) | | (457,857 | ) | | (465,255 | ) |

| Core average earning assets | $ | 1,343,769 |

| | $ | 1,369,845 |

| | $ | 1,395,700 |

| | $ | 1,386,668 |

| | $ | 1,404,608 |

|

| | | | | | | | | | |

Net interest yield contribution (FTE basis) (3) | | | | | | | | | |

As reported (1) | 2.51 | % | | 2.45 | % | | 2.32 | % | | 2.50 | % | | 2.67 | % |

Impact of market-based activities (2) | 0.55 |

| | 0.49 |

| | 0.48 |

| | 0.57 |

| | 0.59 |

|

| Core net interest yield on earning assets | 3.06 | % | | 2.94 | % | | 2.80 | % | | 3.07 | % | | 3.26 | % |

| | | | | | | | | | |

| |

(1) | Net interest income and net interest yield include fees earned on overnight deposits placed with the Federal Reserve of $47 million for the first quarter of 2012 and $36 million, $38 million, $49 million and $63 million for the fourth, third, second and first quarters of 2011, respectively. |

| |

(2) | Represents the impact of market-based amounts included in Global Markets. |

| |

(3) | Calculated on an annualized basis. |

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 9 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis |

| (Dollars in millions) |

| | | First Quarter 2012 | | | Fourth Quarter 2011 | | | First Quarter 2011 |

| | | Average Balance | | Interest Income/ Expense | | Yield/ Rate | | | Average Balance | | Interest Income/ Expense | | Yield/ Rate | | | Average Balance | | Interest Income/ Expense | | Yield/ Rate |

| Earning assets | | | | | | | | | | | | | | | | | | | | |

Time deposits placed and other short-term investments (1) | | $ | 31,404 |

| | $ | 65 |

| | 0.83 | % | | | $ | 27,688 |

| | $ | 85 |

| | 1.19 | % | | | $ | 31,294 |

| | $ | 88 |

| | 1.14 | % |

| Federal funds sold and securities borrowed or purchased under agreements to resell | | 233,061 |

| | 460 |

| | 0.79 |

| | | 237,453 |

| | 449 |

| | 0.75 |

| | | 227,379 |

| | 517 |

| | 0.92 |

|

| Trading account assets | | 175,778 |

| | 1,399 |

| | 3.19 |

| | | 161,848 |

| | 1,354 |

| | 3.33 |

| | | 221,041 |

| | 1,669 |

| | 3.05 |

|

Debt securities (2) | | 327,758 |

| | 2,732 |

| | 3.33 |

| | | 332,990 |

| | 2,245 |

| | 2.69 |

| | | 335,847 |

| | 2,917 |

| | 3.49 |

|

Loans and leases (3): | | | | | | | | | | | | | | | | | | | | |

Residential mortgage (4) | | 260,573 |

| | 2,489 |

| | 3.82 |

| | | 266,144 |

| | 2,596 |

| | 3.90 |

| | | 262,049 |

| | 2,881 |

| | 4.40 |

|

| Home equity | | 122,933 |

| | 1,164 |

| | 3.80 |

| | | 126,251 |

| | 1,207 |

| | 3.80 |

| | | 136,089 |

| | 1,335 |

| | 3.96 |

|

| Discontinued real estate | | 12,082 |

| | 103 |

| | 3.42 |

| | | 14,073 |

| | 128 |

| | 3.65 |

| | | 12,899 |

| | 110 |

| | 3.42 |

|

| U.S. credit card | | 98,334 |

| | 2,459 |

| | 10.06 |

| | | 102,241 |

| | 2,603 |

| | 10.10 |

| | | 109,941 |

| | 2,837 |

| | 10.47 |

|

| Non-U.S. credit card | | 14,151 |

| | 408 |

| | 11.60 |

| | | 15,981 |

| | 420 |

| | 10.41 |

| | | 27,633 |

| | 779 |

| | 11.43 |

|

Direct/Indirect consumer (5) | | 88,321 |

| | 801 |

| | 3.65 |

| | | 90,861 |

| | 863 |

| | 3.77 |

| | | 90,097 |

| | 993 |

| | 4.47 |

|

Other consumer (6) | | 2,617 |

| | 40 |

| | 6.24 |

| | | 2,751 |

| | 41 |

| | 6.14 |

| | | 2,753 |

| | 45 |

| | 6.58 |

|

| Total consumer | | 599,011 |

| | 7,464 |

| | 5.00 |

| | | 618,302 |

| | 7,858 |

| | 5.06 |

| | | 641,461 |

| | 8,980 |

| | 5.65 |

|

| U.S. commercial | | 195,111 |

| | 1,756 |

| | 3.62 |

| | | 196,778 |

| | 1,798 |

| | 3.63 |

| | | 191,353 |

| | 1,926 |

| | 4.08 |

|

Commercial real estate (7) | | 39,190 |

| | 339 |

| | 3.48 |

| | | 40,673 |

| | 343 |

| | 3.34 |

| | | 48,359 |

| | 437 |

| | 3.66 |

|

| Commercial lease financing | | 21,679 |

| | 272 |

| | 5.01 |

| | | 21,278 |

| | 204 |

| | 3.84 |

| | | 21,634 |

| | 322 |

| | 5.95 |

|

| Non-U.S. commercial | | 58,731 |

| | 391 |

| | 2.68 |

| | | 55,867 |

| | 395 |

| | 2.80 |

| | | 36,159 |

| | 299 |

| | 3.35 |

|

| Total commercial | | 314,711 |

| | 2,758 |

| | 3.52 |

| | | 314,596 |

| | 2,740 |

| | 3.46 |

| | | 297,505 |

| | 2,984 |

| | 4.06 |

|

| Total loans and leases | | 913,722 |

| | 10,222 |

| | 4.49 |

| | | 932,898 |

| | 10,598 |

| | 4.52 |

| | | 938,966 |

| | 11,964 |

| | 5.14 |

|

| Other earning assets | | 86,382 |

| | 743 |

| | 3.46 |

| | | 91,109 |

| | 904 |

| | 3.95 |

| | | 115,336 |

| | 922 |

| | 3.24 |

|

Total earning assets (8) | | 1,768,105 |

| | 15,621 |

| | 3.55 |

| | | 1,783,986 |

| | 15,635 |

| | 3.49 |

| | | 1,869,863 |

| | 18,077 |

| | 3.92 |

|

Cash and cash equivalents (1) | | 112,512 |

| | 47 |

| | | | | 94,287 |

| | 36 |

| | | | | 138,241 |

| | 63 |

| | |

| Other assets, less allowance for loan and lease losses | | 306,557 |

| | | | | | | 329,294 |

| | | | | | | 330,434 |

| | | | |

| Total assets | | $ | 2,187,174 |

| | | | | | | $ | 2,207,567 |

| | | | | | | $ | 2,338,538 |

| | | | |

| | | | | | | | | | | | | | | | | | | | | |

| |

(1) | For this presentation, fees earned on overnight deposits placed with the Federal Reserve are included in the cash and cash equivalents line, consistent with the Corporation’s Consolidated Balance Sheet presentation of these deposits. Net interest income and net interest yield are calculated excluding these fees. |

| |

(2) | Yields on available-for-sale debt securities are calculated based on fair value rather than the cost basis. The use of fair value does not have a material impact on net interest yield. |

| |

(3) | Nonperforming loans are included in the respective average loan balances. Income on these nonperforming loans is recognized on a cash basis. Purchased credit-impaired loans were recorded at fair value upon acquisition and accrete interest income over the remaining life of the loan. |

| |

(4) | Includes non-U.S. residential mortgages of $86 million in the first quarter of 2012, and $88 million and $92 million in the fourth and first quarters of 2011. |

| |

(5) | Includes non-U.S. consumer loans of $7.5 billion in the first quarter of 2012, and $8.4 billion and $8.2 billion in the fourth and first quarters of 2011. |

| |

(6) | Includes consumer finance loans of $1.6 billion in the first quarter of 2012, and $1.7 billion and $1.9 billion in the fourth and first quarters of 2011; other non-U.S. consumer loans of $903 million in the first quarter of 2012, and $959 million and $777 million in the fourth and first quarters of 2011; and consumer overdrafts of $90 million in the first quarter of 2012, and $107 million and $76 million in the fourth and first quarters of 2011. |

| |

(7) | Includes U.S. commercial real estate loans of $37.4 billion in the first quarter of 2012, and $38.7 billion and $45.7 billion in the fourth and first quarters of 2011, and non-U.S. commercial real estate loans of $1.8 billion in the first quarter of 2012, and $1.9 billion and $2.7 billion in the fourth and first quarters of 2011. |

| |

(8) | The impact of interest rate risk management derivatives on interest income is presented below. Interest income includes the impact of interest rate risk management contracts, which increased (decreased) interest income on: |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter 2012 | | | | | Fourth Quarter 2011 | | | | | First Quarter 2011 | | |

| Federal funds sold and securities borrowed or purchased under agreements to resell | | | | $ | 51 |

| | | | | | | $ | 52 |

| | | | | | | $ | 55 |

| | |

| Trading account assets | | | | — |

| | | | | | | — |

| | | | | | | (70 | ) | | |

| Debt securities | | | | (140 | ) | | | | | | | (462 | ) | | | | | | | (362 | ) | | |

| U.S. commercial | | | | (16 | ) | | | | | | | (17 | ) | | | | | | | (11 | ) | | |

| Non-U.S. commercial | | | | (1 | ) | | | | | | | — |

| | | | | | | — |

| | |

| Net hedge expenses on assets | | | | $ | (106 | ) | | | | | | | $ | (427 | ) | | | | | | | $ | (388 | ) | | |

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 10 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis (continued) |

| (Dollars in millions) |

| | | First Quarter 2012 | | | Fourth Quarter 2011 | | | First Quarter 2011 |

| | | Average Balance | | Interest Income/ Expense | | Yield/ Rate | | | Average Balance | | Interest Income/ Expense | | Yield/ Rate | | | Average Balance | | Interest Income/ Expense | | Yield/ Rate |

| Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | | |

| U.S. interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | |

| Savings | | $ | 40,543 |

| | $ | 14 |

| | 0.14 | % | | | $ | 39,609 |

| | $ | 16 |

| | 0.16 | % | | | $ | 38,905 |

| | $ | 32 |

| | 0.34 | % |

| NOW and money market deposit accounts | | 458,649 |

| | 186 |

| | 0.16 |

| | | 454,249 |

| | 192 |

| | 0.17 |

| | | 475,954 |

| | 316 |

| | 0.27 |

|

| Consumer CDs and IRAs | | 100,044 |

| | 194 |

| | 0.78 |

| | | 103,488 |

| | 220 |

| | 0.84 |

| | | 118,306 |

| | 300 |

| | 1.03 |

|

| Negotiable CDs, public funds and other time deposits | | 22,586 |

| | 36 |

| | 0.64 |

| | | 22,413 |

| | 34 |

| | 0.60 |

| | | 13,995 |

| | 39 |

| | 1.11 |

|

| Total U.S. interest-bearing deposits | | 621,822 |

| | 430 |

| | 0.28 |

| | | 619,759 |

| | 462 |

| | 0.30 |

| | | 647,160 |

| | 687 |

| | 0.43 |

|

| Non-U.S. interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | |

| Banks located in non-U.S. countries | | 18,170 |

| | 28 |

| | 0.62 |

| | | 20,454 |

| | 29 |

| | 0.55 |

| | | 21,534 |

| | 38 |

| | 0.72 |

|

| Governments and official institutions | | 1,286 |

| | 1 |

| | 0.41 |

| | | 1,466 |

| | 1 |

| | 0.36 |

| | | 2,307 |

| | 2 |

| | 0.35 |

|

| Time, savings and other | | 55,241 |

| | 90 |

| | 0.66 |

| | | 57,814 |

| | 124 |

| | 0.85 |

| | | 60,432 |

| | 112 |

| | 0.76 |

|

| Total non-U.S. interest-bearing deposits | | 74,697 |

| | 119 |

| | 0.64 |

| | | 79,734 |

| | 154 |

| | 0.77 |

| | | 84,273 |

| | 152 |

| | 0.73 |

|

| Total interest-bearing deposits | | 696,519 |

| | 549 |

| | 0.32 |

| | | 699,493 |

| | 616 |

| | 0.35 |

| | | 731,433 |

| | 839 |

| | 0.46 |

|

| Federal funds purchased, securities loaned or sold under agreements to repurchase and other short-term borrowings | | 293,056 |

| | 881 |

| | 1.21 |

| | | 284,766 |

| | 921 |

| | 1.28 |

| | | 371,573 |

| | 1,184 |

| | 1.29 |

|

| Trading account liabilities | | 71,872 |

| | 477 |

| | 2.67 |

| | | 70,999 |

| | 411 |

| | 2.29 |

| | | 83,914 |

| | 627 |

| | 3.03 |

|

| Long-term debt | | 363,518 |

| | 2,708 |

| | 2.99 |

| | | 389,557 |

| | 2,764 |

| | 2.80 |

| | | 440,511 |

| | 3,093 |

| | 2.84 |

|

Total interest-bearing liabilities (1) | | 1,424,965 |

| | 4,615 |

| | 1.30 |

| | | 1,444,815 |

| | 4,712 |

| | 1.29 |

| | | 1,627,431 |

| | 5,743 |

| | 1.43 |

|

| Noninterest-bearing sources: | | | | | | | | | | | | | | | | | | | | |

| Noninterest-bearing deposits | | 333,593 |

| | | | | | | 333,038 |

| | | | | | | 291,707 |

| | | | |

| Other liabilities | | 196,050 |

| | | | | | | 201,479 |

| | | | | | | 188,631 |

| | | | |

| Shareholders’ equity | | 232,566 |

| | | | | | | 228,235 |

| | | | | | | 230,769 |

| | | | |

| Total liabilities and shareholders’ equity | | $ | 2,187,174 |

| | | | | | | $ | 2,207,567 |

| | | | | | | $ | 2,338,538 |

| | | | |

| Net interest spread | | | | | | 2.25 | % | | | | | | | 2.20 | % | | | | | | | 2.49 | % |

| Impact of noninterest-bearing sources | | | | | | 0.25 |

| | | | | | | 0.24 |

| | | | | | | 0.17 |

|

Net interest income/yield on earning assets (2) | | | | $ | 11,006 |

| | 2.50 | % | | | | | $ | 10,923 |

| | 2.44 | % | | | | | $ | 12,334 |

| | 2.66 | % |

| | | | | | | | | | | | | | | | | | | | | |

| |

(1) | The impact of interest rate risk management derivatives on interest expense is presented below. Interest expense includes the impact of interest rate risk management contracts, which increased (decreased) interest expense on: |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter 2012 | | | | | Fourth Quarter 2011 | | | | | First Quarter 2011 | | |

| NOW and money market deposit accounts | | | | $ | — |

| | | | | | | $ | — |

| | | | | | | $ | (1 | ) | | |

| Consumer CDs and IRAs | | | | 34 |

| | | | | | | 36 |

| | | | | | | 47 |

| | |

| Negotiable CDs, public funds and other time deposits | | | | 3 |

| | | | | | | 3 |

| | | | | | | 4 |

| | |

| Banks located in non-U.S. countries | | | | 4 |

| | | | | | | 8 |

| | | | | | | 18 |

| | |

| Federal funds purchased and securities loaned or sold under agreements to repurchase and other short-term borrowings | | | | 325 |

| | | | | | | 367 |

| | | | | | | 445 |

| | |

| Long-term debt | | | | (1,024 | ) | | | | | | | (1,177 | ) | | | | | | | (1,134 | ) | | |

| Net hedge income on liabilities | | | | $ | (658 | ) | | | | | | | $ | (763 | ) | | | | | | | $ | (621 | ) | | |

| |

(2) | For this presentation, fees earned on overnight deposits placed with the Federal Reserve are included in the cash and cash equivalents line, consistent with the Corporation's Consolidated Balance Sheet presentation of these deposits. Net interest income and net interest yield are calculated excluding these fees. |

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 11 |

|

| | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Debt Securities and Available-for-Sale Marketable Equity Securities |

| (Dollars in millions) |

| | | March 31, 2012 |

| | | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value |

| Available-for-sale debt securities | | | | | | | | |

| U.S. Treasury and agency securities | | $ | 40,609 |

| | $ | 231 |

| | $ | (874 | ) | | $ | 39,966 |

|

| Mortgage-backed securities: | | | | | | | | |

| Agency | | 172,335 |

| | 3,177 |

| | (421 | ) | | 175,091 |

|

| Agency collateralized mortgage obligations | | 41,698 |

| | 802 |

| | (145 | ) | | 42,355 |

|

| Non-agency residential | | 11,398 |

| | 300 |

| | (228 | ) | | 11,470 |

|

| Non-agency commercial | | 4,333 |

| | 567 |

| | (1 | ) | | 4,899 |

|

| Non-U.S. securities | | 6,530 |

| | 56 |

| | (18 | ) | | 6,568 |

|

| Corporate bonds | | 2,364 |

| | 85 |

| | (28 | ) | | 2,421 |

|

Other taxable securities (1) | | 10,595 |

| | 74 |

| | (52 | ) | | 10,617 |

|

| Total taxable securities | | $ | 289,862 |

| | $ | 5,292 |

| | $ | (1,767 | ) | | $ | 293,387 |

|

| Tax-exempt securities | | 3,694 |

| | 16 |

| | (57 | ) | | 3,653 |

|

| Total available-for-sale debt securities | | $ | 293,556 |

| | $ | 5,308 |

| | $ | (1,824 | ) | | $ | 297,040 |

|

| Held-to-maturity debt securities | | 34,205 |

| | 246 |

| | (11 | ) | | 34,440 |

|

| Total debt securities | | $ | 327,761 |

| | $ | 5,554 |

| | $ | (1,835 | ) | | $ | 331,480 |

|

Available-for-sale marketable equity securities (2) | | $ | 64 |

| | $ | 28 |

| | $ | (5 | ) | | $ | 87 |

|

| | | | | | | | | |

| | | December 31, 2011 |

| | | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value |

| Available-for-sale debt securities | | | | | | | | |

| U.S. Treasury and agency securities | | $ | 43,433 |

| | $ | 242 |

| | $ | (811 | ) | | $ | 42,864 |

|

| Mortgage-backed securities: | | | | | | | | |

| Agency | | 138,073 |

| | 4,511 |

| | (21 | ) | | 142,563 |

|

| Agency collateralized mortgage obligations | | 44,392 |

| | 774 |

| | (167 | ) | | 44,999 |

|

| Non-agency residential | | 14,948 |

| | 301 |

| | (482 | ) | | 14,767 |

|

| Non-agency commercial | | 4,894 |

| | 629 |

| | (1 | ) | | 5,522 |

|

| Non-U.S. securities | | 4,872 |

| | 62 |

| | (14 | ) | | 4,920 |

|

| Corporate bonds | | 2,993 |

| | 79 |

| | (37 | ) | | 3,035 |

|

Other taxable securities (1) | | 12,889 |

| | 49 |

| | (60 | ) | | 12,878 |

|

| Total taxable securities | | $ | 266,494 |

| | $ | 6,647 |

| | $ | (1,593 | ) | | $ | 271,548 |

|

| Tax-exempt securities | | 4,678 |

| | 15 |

| | (90 | ) | | 4,603 |

|

| Total available-for-sale debt securities | | $ | 271,172 |

| | $ | 6,662 |

| | $ | (1,683 | ) | | $ | 276,151 |

|

| Held-to-maturity debt securities | | 35,265 |

| | 181 |

| | (4 | ) | | 35,442 |

|

| Total debt securities | | $ | 306,437 |

| | $ | 6,843 |

| | $ | (1,687 | ) | | $ | 311,593 |

|

Available-for-sale marketable equity securities (2) | | $ | 65 |

| | $ | 10 |

| | $ | (7 | ) | | $ | 68 |

|

| | | | | | | | | |

| |

(1) | Substantially all asset-backed securities. |

| |

(2) | Classified in other assets on the Consolidated Balance Sheet. |

Certain prior period amounts have been reclassified to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 12 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Bank of America Corporation and Subsidiaries |

| | Quarterly Results by Business Segment |

| | (Dollars in millions) | | | | | | | | | | | | | | | |

| | | | First Quarter 2012 |

| | | | Total Corporation | | | Consumer & Business Banking | | Consumer Real Estate Services | | Global Banking | | Global Markets | | GWIM | | All Other |

| |

| | Net interest income (FTE basis) | | $ | 11,053 |

| | | $ | 5,079 |

| | $ | 775 |

| | $ | 2,399 |

| | $ | 798 |

| | $ | 1,578 |

| | $ | 424 |

|

| | Noninterest income (loss) | | 11,432 |

| | | 2,341 |

| | 1,899 |

| | 2,052 |

| | 3,395 |

| | 2,782 |

| | (1,037 | ) |

| | Total revenue, net of interest expense (FTE basis) | | 22,485 |

| | | 7,420 |

| | 2,674 |

| | 4,451 |

| | 4,193 |

| | 4,360 |

| | (613 | ) |

| | Provision for credit losses | | 2,418 |

| | | 877 |

| | 507 |

| | (238 | ) | | (20 | ) | | 46 |

| | 1,246 |

|

| | Noninterest expense | | 19,141 |

| | | 4,246 |

| | 3,905 |

| | 2,178 |

| | 3,076 |

| | 3,450 |

| | 2,286 |

|

| | Income (loss) before income taxes | | 926 |

| | | 2,297 |

| | (1,738 | ) | | 2,511 |

| | 1,137 |

| | 864 |

| | (4,145 | ) |

| | Income tax expense (benefit) (FTE basis) | | 273 |

| | | 843 |

| | (593 | ) | | 921 |

| | 339 |

| | 317 |

| | (1,554 | ) |

| | Net income (loss) | | $ | 653 |

| | | $ | 1,454 |

| | $ | (1,145 | ) | | $ | 1,590 |

| | $ | 798 |

| | $ | 547 |

| | $ | (2,591 | ) |

| | | | | | | | | | | | | | | | | |

| | Average | | | | | | | | | | | | | | | |

| | Total loans and leases | | $ | 913,722 |

| | | $ | 141,578 |

| | $ | 110,755 |

| | $ | 277,096 |

| | n/m |

| | $ | 103,036 |

| | $ | 264,113 |

|

| | Total assets (1) | | 2,187,174 |

| | | 523,074 |

| | 159,105 |

| | 350,526 |

| | $ | 557,911 |

| | 284,926 |

| | 311,632 |

|

| | Total deposits | | 1,030,112 |

| | | 466,239 |

| | n/m |

| | 237,532 |

| | n/m |

| | 252,705 |

| | 39,774 |

|

| | Period end | | | | | | | | | | | | | | | |

| | Total loans and leases | | $ | 902,294 |

| | | $ | 138,909 |

| | $ | 109,264 |

| | $ | 272,224 |

| | n/m |

| | $ | 102,903 |

| | $ | 260,006 |

|

| | Total assets (1) | | 2,181,449 |

| | | 543,189 |

| | 158,207 |

| |

|

| | $ | 548,612 |

| | 278,185 |

| | 311,272 |

|

| | Total deposits | | 1,041,311 |

| | | 486,160 |

| | n/m |

| | 237,608 |

| | n/m |

| | 252,755 |

| | 30,146 |

|

| | | | | | | | | | | | | | | | | |

| | | | Fourth Quarter 2011 |

| | | | Total Corporation | | | Consumer & Business Banking | | Consumer Real Estate Services | | Global Banking | | Global Markets | | GWIM | | All Other |

| | Net interest income (FTE basis) | | $ | 10,959 |

| | | $ | 5,079 |

| | $ | 809 |

| | $ | 2,309 |

| | $ | 863 |

| | $ | 1,496 |

| | $ | 403 |

|

| | Noninterest income | | 14,187 |

| | | 2,526 |

| | 2,467 |

| | 1,694 |

| | 942 |

| | 2,671 |

| | 3,887 |

|

| | Total revenue, net of interest expense (FTE basis) | | 25,146 |

| | | 7,605 |

| | 3,276 |

| | 4,003 |

| | 1,805 |

| | 4,167 |

| | 4,290 |

|

| | Provision for credit losses | | 2,934 |

| | | 1,297 |

| | 1,001 |

| | (256 | ) | | (18 | ) | | 118 |

| | 792 |

|

| | Noninterest expense | | 19,522 |

| | | 4,426 |

| | 4,573 |

| | 2,137 |

| | 2,893 |

| | 3,637 |

| | 1,856 |

|

| | Income (loss) before income taxes | | 2,690 |

| | | 1,882 |

| | (2,298 | ) | | 2,122 |

| | (1,070 | ) | | 412 |

| | 1,642 |

|

| | Income tax expense (benefit) (FTE basis) | | 699 |

| | | 639 |

| | (854 | ) | | 785 |

| | (302 | ) | | 153 |

| | 278 |

|

| | Net income (loss) | | $ | 1,991 |

| | | $ | 1,243 |

| | $ | (1,444 | ) | | $ | 1,337 |

| | $ | (768 | ) | | $ | 259 |

| | $ | 1,364 |

|

| | | | | | | | | | | | | | | | | |

| | Average | | | | | | | | | | | | | | | |

| | Total loans and leases | | $ | 932,898 |

| | | $ | 147,150 |

| | $ | 116,993 |

| | $ | 276,844 |

| | n/m |

| | $ | 102,709 |

| | $ | 272,808 |

|

| | Total assets (1) | | 2,207,567 |

| | | 514,798 |

| | 171,763 |

| | 348,469 |

| | $ | 552,190 |

| | 284,629 |

| | 335,718 |

|

| | Total deposits | | 1,032,531 |

| | | 459,819 |

| | n/m |

| | 240,732 |

| | n/m |

| | 250,040 |

| | 46,055 |

|

| | Period end | | | | | | | | | | | | | | | |

| | Total loans and leases | | $ | 926,200 |

| | | $ | 146,378 |

| | $ | 112,359 |

| | $ | 278,177 |

| | n/m |

| | $ | 103,460 |

| | $ | 267,621 |

|

| | Total assets (1) | | 2,129,046 |

| | | 520,503 |

| | 163,712 |

| | 350,148 |

| | $ | 501,150 |

| | 284,062 |

| | 309,471 |

|

| | Total deposits | | 1,033,041 |

| | | 464,263 |

| | n/m |

| | 246,466 |

| | n/m |

| | 253,264 |

| | 32,729 |

|

| | | | | | | | | | | | | | | | | |

| | | | First Quarter 2011 |

| | | | Total Corporation | | | Consumer & Business Banking | | Consumer Real Estate Services | | Global Banking | | Global Markets | | GWIM | | All Other |

| | Net interest income (FTE basis) | | $ | 12,397 |

| | | $ | 5,600 |

| | $ | 896 |

| | $ | 2,482 |

| | $ | 1,020 |

| | $ | 1,571 |

| | $ | 828 |

|

| | Noninterest income | | 14,698 |

| | | 2,864 |

| | 1,167 |

| | 2,220 |

| | 4,252 |

| | 2,925 |

| | 1,270 |

|

| | Total revenue, net of interest expense (FTE basis) | | 27,095 |

| | | 8,464 |

| | 2,063 |

| | 4,702 |

| | 5,272 |

| | 4,496 |

| | 2,098 |

|

| | Provision for credit losses | | 3,814 |

| | | 661 |

| | 1,098 |

| | (123 | ) | | (33 | ) | | 46 |

| | 2,165 |

|

| | Noninterest expense | | 20,283 |

| | | 4,561 |

| | 4,777 |

| | 2,309 |

| | 3,114 |

| | 3,589 |

| | 1,933 |

|

| | Income (loss) before income taxes | | 2,998 |

| | | 3,242 |

| | (3,812 | ) | | 2,516 |

| | 2,191 |

| | 861 |

| | (2,000 | ) |

| | Income tax expense (benefit) (FTE basis) | | 949 |

| | | 1,201 |

| | (1,412 | ) | | 932 |

| | 797 |

| | 319 |

| | (888 | ) |

| | Net income (loss) | | $ | 2,049 |

| | | $ | 2,041 |

| | $ | (2,400 | ) | | $ | 1,584 |

| | $ | 1,394 |

| | $ | 542 |

| | $ | (1,112 | ) |

| | | | | | | | | | | | | | | | | |

| | Average | | | | | | | | | | | | | | | |

| | Total loans and leases | | $ | 938,966 |

| | | $ | 160,976 |

| | $ | 120,560 |

| | $ | 256,846 |

| | n/m |

| | $ | 100,852 |

| | $ | 288,301 |

|

| | Total assets (1) | | 2,338,538 |

| | | 513,629 |

| | 209,328 |

| | 323,357 |

| | $ | 581,074 |

| | 297,531 |

| | 413,619 |

|

| | Total deposits | | 1,023,140 |

| | | 457,037 |

| | n/m |

| | 225,785 |

| | n/m |

| | 258,719 |

| | 50,107 |

|

| | Period end | | | | | | | | | | | | | | | |

| | Total loans and leases | | $ | 932,425 |

| | | $ | 156,950 |

| | $ | 118,749 |

| | $ | 257,468 |

| | n/m |

| | $ | 101,287 |

| | $ | 286,531 |

|

| | Total assets (1) | | 2,274,532 |

| | | 526,848 |

| | 204,484 |

| | 327,611 |

| | $ | 576,487 |

| | 285,690 |

| | 353,412 |

|

| | Total deposits | | 1,020,175 |

| | | 471,009 |

| | n/m |

| | 229,199 |

| | n/m |

| | 256,751 |

| | 36,154 |

|

| | | | | | | | | | | | | | | | | |

| |

(1) | Total assets include asset allocations to match liabilities (i.e., deposits). |

n/m = not meaningful

Certain prior period amounts have been reclassified among the segments to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 13 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Consumer & Business Banking Segment Results |

| (Dollars in millions) |

| | | | | | First

Quarter

2012 | | Fourth

Quarter

2011 | | Third

Quarter

2011 | | Second

Quarter

2011 | | First

Quarter

2011 |

| | | | | | | | |

| Net interest income (FTE basis) | | | | | | | $ | 5,079 |

| | $ | 5,079 |

| | $ | 5,149 |

| | $ | 5,549 |

| | $ | 5,600 |

|

| Noninterest income: | | | | | | | | | | | | | | | |

| Card income | | | | | | | 1,278 |

| | 1,303 |

| | 1,720 |

| | 1,686 |

| | 1,577 |

|

| Service charges | | | | | | | 1,063 |

| | 1,144 |

| | 1,202 |

| | 1,094 |

| | 1,078 |

|

| All other income | | | | | | | — |

| | 79 |

| | 54 |

| | 350 |

| | 209 |

|

| Total noninterest income | | | | | | | 2,341 |

| | 2,526 |

| | 2,976 |

| | 3,130 |

| | 2,864 |

|

| Total revenue, net of interest expense (FTE basis) | | | | | | | 7,420 |

| | 7,605 |

| | 8,125 |

| | 8,679 |

| | 8,464 |

|

| | | | | | | | | | | | | | | | |

| Provision for credit losses | | | | | | | 877 |

| | 1,297 |

| | 1,132 |

| | 400 |

| | 661 |

|

| | | | | | | | | | | | | | | | |

| Noninterest expense | | | | | | | 4,246 |

| | 4,426 |

| | 4,342 |

| | 4,375 |

| | 4,561 |

|

| Income before income taxes | | | | | | | 2,297 |

| | 1,882 |

| | 2,651 |

| | 3,904 |

| | 3,242 |

|

| Income tax expense (FTE basis) | | | | | | | 843 |

| | 639 |

| | 985 |

| | 1,402 |

| | 1,201 |

|

| Net income | | | | | | | $ | 1,454 |

| | $ | 1,243 |

| | $ | 1,666 |

| | $ | 2,502 |

| | $ | 2,041 |

|

| | | | | | | | | | | | | | | | |

| Net interest yield (FTE basis) | | | | | | | 4.22 | % | | 4.23 | % | | 4.26 | % | | 4.58 | % | | 4.75 | % |

| Return on average allocated equity | | | | | | | 11.05 |

| | 9.31 |

| | 12.61 |

| | 19.09 |

| | 15.41 |

|

Return on average economic capital (1) | | | | | | | 26.15 |

| | 22.10 |

| | 30.45 |

| | 45.86 |

| | 36.10 |

|

| Efficiency ratio (FTE basis) | | | | | | | 57.23 |

| | 58.20 |

| | 53.44 |

| | 50.41 |

| | 53.89 |

|

| | | | | | | | | | | | | | | | |

| Balance Sheet | | | | | | | | | | | | | | | |

| Average | | | | | | | | | | | | | | | |

| Total loans and leases | | | | | | | $ | 141,578 |

| | $ | 147,150 |

| | $ | 151,492 |

| | $ | 155,122 |

| | $ | 160,976 |

|

Total earning assets (2) | | | | | | | 483,983 |

| | 475,859 |

| | 479,746 |

| | 486,115 |

| | 478,468 |

|

Total assets (2) | | | | | | | 523,074 |

| | 514,798 |

| | 518,945 |

| | 522,693 |

| | 513,629 |

|

| Total deposits | | | | | | | 466,239 |

| | 459,819 |

| | 464,256 |

| | 467,179 |

| | 457,037 |

|

| Allocated equity | | | | | | | 52,947 |

| | 53,005 |

| | 52,382 |

| | 52,559 |

| | 53,700 |

|

Economic capital (1) | | | | | | | 22,424 |

| | 22,418 |

| | 21,781 |

| | 21,904 |

| | 23,002 |

|

| | | | | | | | | | | | | | | | |

| Period end | | | | | | | | | | | | | | | |

| Total loans and leases | | | | | | | $ | 138,909 |

| | $ | 146,378 |

| | $ | 149,739 |

| | $ | 153,391 |

| | $ | 156,950 |

|

Total earning assets (2) | | | | | | | 502,124 |

| | 480,378 |

| | 480,597 |

| | 482,728 |

| | 490,106 |

|

Total assets (2) | | | | | | | 543,189 |

| | 520,503 |

| | 519,562 |

| | 521,306 |

| | 526,848 |

|

| Total deposits | | | | | | | 486,160 |

| | 464,263 |

| | 465,773 |

| | 465,457 |

| | 471,009 |

|

| | | | | | | | | | | | | | | | |

| |

(1) | Return on average economic capital is calculated as net income adjusted for cost of funds and earnings credits and certain expenses related to intangibles, divided by average economic capital. Economic capital represents allocated equity less goodwill and a percentage of intangible assets. Economic capital and return on average economic capital are non-GAAP financial measures. We believe the use of these non-GAAP financial measures provides additional clarity in assessing the results of the segments. Other companies may define or calculate these measures differently. (See Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 42-45.) |

| |

(2) | Total earning assets and total assets include asset allocations to match liabilities (i.e., deposits). |

n/m = not meaningful

Certain prior period amounts have been reclassified among the segments to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 14 |

|

| | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries | | |

| Consumer & Business Banking Quarterly Results | | |

| (Dollars in millions) |

| | | First Quarter 2012 |

| | | Total Consumer & Business Banking | | | Deposits | | Card Services | | Business Banking (1) |

| Net interest income (FTE basis) | | $ | 5,079 |

| | | $ | 2,119 |

| | $ | 2,616 |

| | $ | 344 |

|

| Noninterest income: | | | | | | | | | |

| Card income | | 1,278 |

| | | — |

| | 1,278 |

| | — |

|

| Service charges | | 1,063 |

| | | 968 |

| | — |

| | 95 |

|

| All other income (loss) | | — |

| | | 60 |

| | (85 | ) | | 25 |

|

| Total noninterest income | | 2,341 |

| | | 1,028 |

| | 1,193 |

| | 120 |

|

| Total revenue, net of interest expense (FTE basis) | | 7,420 |

| | | 3,147 |

| | 3,809 |

| | 464 |

|

| | | | | | | | | |

|

| Provision for credit losses | | 877 |

| | | 51 |

| | 790 |

| | 36 |

|

| | | | | | | | | | |

| Noninterest expense | | 4,246 |

| | | 2,606 |

| | 1,380 |

| | 260 |

|

| Income before income taxes | | 2,297 |

| | | 490 |

| | 1,639 |

| | 168 |

|

| Income tax expense (FTE basis) | | 843 |

| | | 180 |

| | 601 |

| | 62 |

|

| Net income | | $ | 1,454 |

| | | $ | 310 |

| | $ | 1,038 |

| | $ | 106 |

|

| | | | | | | | | | |

| Net interest yield (FTE basis) | | 4.22 | % | | | 2.02 | % | | 8.95 | % | | 2.93 | % |

| Return on average allocated equity | | 11.05 |

| | | 5.37 |

| | 20.19 |

| | 4.73 |

|

Return on average economic capital (2) | | 26.15 |

| | | 23.71 |

| | 41.14 |

| | 6.14 |

|

| Efficiency ratio (FTE basis) | | 57.23 |

| | | 82.83 |

| | 36.22 |

| | 56.04 |

|

| | | | | | | | | | |

| Balance Sheet | | | | | | | | | |

| Average | | | | | | | | | |

| Total loans and leases | | $ | 141,578 |

| | | n/m |

| | $ | 116,267 |

| | $ | 24,603 |

|

Total earning assets (3) | | 483,983 |

| | | $ | 421,551 |

| | 117,580 |

| | 47,145 |

|

Total assets (3) | | 523,074 |

| | | 447,917 |

| | 123,179 |

| | 54,272 |

|

| Total deposits | | 466,239 |

| | | 424,023 |

| | n/m |

| | 41,908 |

|

| Allocated equity | | 52,947 |

| | | 23,194 |

| | 20,671 |

| | 9,082 |

|

Economic capital (2) | | 22,424 |

| | | 5,262 |

| | 10,179 |

| | 6,983 |

|

| | | | | | | | | | |

| Period end | | | | | | | | | |

| Total loans and leases | | $ | 138,909 |

| | | n/m |

| | $ | 113,861 |

| | $ | 24,376 |

|

Total earning assets (3) | | 502,124 |

| | | $ | 440,491 |

| | 115,177 |

| | 47,325 |

|

Total assets (3) | | 543,189 |

| | | 467,058 |

| | 121,425 |

| | 55,575 |

|

| Total deposits | | 486,160 |

| | | 443,129 |

| | n/m |

| | 42,221 |

|

| | | | | | | | | | |

| | | Fourth Quarter 2011 |

| | | Total Consumer & Business Banking | | | Deposits | | Card Services | | Business Banking (1) |

| Net interest income (FTE basis) | | $ | 5,079 |

| | | $ | 1,998 |

| | $ | 2,766 |

| | $ | 315 |

|

| Noninterest income: | | | | | | | | | |

| Card income | | 1,303 |

| | | — |

| | 1,303 |

| | — |

|

| Service charges | | 1,144 |

| | | 1,036 |

| | — |

| | 108 |

|

| All other income (loss) | | 79 |

| | | 46 |

| | (15 | ) | | 48 |

|

| Total noninterest income | | 2,526 |

| | | 1,082 |

| | 1,288 |

| | 156 |

|

| Total revenue, net of interest expense (FTE basis) | | 7,605 |

| | | 3,080 |

| | 4,054 |

| | 471 |

|

| | | | | | | | | | |

| Provision for credit losses | | 1,297 |

| | | 57 |

| | 1,138 |

| | 102 |

|

| | | | | | | | | | |

| Noninterest expense | | 4,426 |

| | | 2,785 |

| | 1,376 |

| | 265 |

|

| Income before income taxes | | 1,882 |

| | | 238 |

| | 1,540 |

| | 104 |

|

| Income tax expense (FTE basis) | | 639 |

| | | 89 |

| | 511 |

| | 39 |

|

| Net income | | $ | 1,243 |

| | | $ | 149 |

| | $ | 1,029 |

| | $ | 65 |

|

| | | | | | | | | | |

| Net interest yield (FTE basis) | | 4.23 | % | | | 1.91 | % | | 8.96 | % | | 2.69 | % |

| Return on average allocated equity | | 9.31 |

| | | 2.46 |

| | 19.80 |

| | 3.13 |

|

Return on average economic capital (2) | | 22.10 |

| | | 10.00 |

| | 40.71 |

| | 4.15 |

|

| Efficiency ratio (FTE basis) | | 58.20 |

| | | 90.46 |

| | 33.97 |

| | 55.82 |

|

| | | | | | | | | | |

| Balance Sheet | | | | | | | | | |

| Average | | | | | | | | | |

| Total loans and leases | | $ | 147,150 |

| | | n/m |

| | $ | 121,122 |

| | $ | 25,306 |

|

Total earning assets (3) | | 475,859 |

| | | $ | 414,905 |

| | 122,374 |

| | 46,707 |

|

Total assets (3) | | 514,798 |

| | | 441,629 |

| | 127,530 |

| | 53,767 |

|

| Total deposits | | 459,819 |

| | | 417,110 |

| | n/m |

| | 42,388 |

|

| Allocated equity | | 53,005 |

| | | 23,862 |

| | 20,610 |

| | 8,533 |

|

Economic capital (2) | | 22,418 |

| | | 5,923 |

| | 10,061 |

| | 6,434 |

|

| | | | | | | | | | |

| Period end | | | | | | | | | |

| Total loans and leases | | $ | 146,378 |

| | | n/m |

| | $ | 120,668 |

| | $ | 25,006 |

|

Total earning assets (3) | | 480,378 |

| | | $ | 418,622 |

| | 121,991 |

| | 46,515 |

|

Total assets (3) | | 520,503 |

| | | 445,680 |

| | 127,623 |

| | 53,949 |

|

| Total deposits | | 464,263 |

| | | 421,871 |

| | n/m |

| | 41,518 |

|

| | | | | | | | | | |

For footnotes see page 16.

Certain prior period amounts have been reclassified among the segments to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 15 |

|

| | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries | | |

| Consumer & Business Banking Quarterly Results (continued) | | |

| (Dollars in millions) |

| | | First Quarter 2011 |

| | | Total Consumer & Business Banking | | | Deposits | | Card Services | | Business Banking (1) |

| Net interest income (FTE basis) | | $ | 5,600 |

| | | $ | 2,205 |

| | $ | 3,013 |

| | $ | 382 |

|

| Noninterest income: | | | | | | | | | |

| Card income | | 1,577 |

| | | — |

| | 1,577 |

| | — |

|

| Service charges | | 1,078 |

| | | 923 |

| | — |

| | 155 |

|

| All other income | | 209 |

| | | 61 |

| | 125 |

| | 23 |

|

| Total noninterest income | | 2,864 |

| | | 984 |

| | 1,702 |

| | 178 |

|

| Total revenue, net of interest expense (FTE basis) | | 8,464 |

| | | 3,189 |

| | 4,715 |

| | 560 |

|

| | | | | | | | | | |

| Provision for credit losses | | 661 |

| | | 33 |

| | 595 |

| | 33 |

|

| | | | | | | | | | |

| Noninterest expense | | 4,561 |

| | | 2,583 |

| | 1,624 |

| | 354 |

|

| Income before income taxes | | 3,242 |

| | | 573 |

| | 2,496 |

| | 173 |

|

| Income tax expense (FTE basis) | | 1,201 |

| | | 212 |

| | 925 |

| | 64 |

|

| Net income | | $ | 2,041 |

| | | $ | 361 |

| | $ | 1,571 |

| | $ | 109 |

|

| | | | | | | | | | |

| Net interest yield (FTE basis) | 4.75 | % | | | 2.14 | % | | 9.15 | % | | 3.81 | % |

| Return on average allocated equity | 15.41 |

| | | 6.19 |

| | 28.77 |

| | 5.58 |

|

Return on average economic capital (2) | 36.10 |

| | | 25.87 |

| | 55.54 |

| | 7.60 |

|

| Efficiency ratio (FTE basis) | 53.89 |

| | | 80.98 |

| | 34.44 |

| | 63.34 |

|

| | | | | | | | | | |

| Balance Sheet | | | | | | | | | |

| Average | | | | | | | | | |

| Total loans and leases | | $ | 160,976 |

| | | n/m |

| | $ | 132,472 |

| | $ | 27,864 |

|

Total earning assets (3) | | 478,468 |

| | | $ | 417,218 |

| | 133,538 |

| | 40,690 |

|

Total assets (3) | | 513,629 |

| | | 443,461 |

| | 134,043 |

| | 49,103 |

|

| Total deposits | | 457,037 |

| | | 418,298 |

| | n/m |

| | 38,462 |

|

| Allocated equity | | 53,700 |

| | | 23,641 |

| | 22,149 |

| | 7,910 |

|

Economic capital (2) | | 23,002 |

| | | 5,683 |

| | 11,509 |

| | 5,810 |

|

| | | | | | | | | | |

| Period end | | | | | | | | | |

| Total loans and leases | | $ | 156,950 |

| | | n/m |

| | $ | 128,844 |

| | $ | 27,491 |

|

Total earning assets (3) | | 490,106 |

| | | $ | 429,956 |

| | 129,944 |

| | 41,536 |

|

Total assets (3) | | 526,848 |

| | | 456,247 |

| | 132,410 |

| | 49,520 |

|

| Total deposits | | 471,009 |

| | | 431,022 |

| | n/m |

| | 39,693 |

|

| | | | | | | | | | |

| |

(1) | Business Banking, formerly part of Global Commercial Banking, provides a wide range of lending-related products and services, integrated working capital and treasury solutions to U.S.-based companies with annual sales generally in the range of $1 million to $50 million, and also includes the results of the Corporation's investment in a merchant processing joint venture. |

| |

(2) | Return on average economic capital is calculated as net income adjusted for cost of funds and earnings credits and certain expenses related to intangibles, divided by average economic capital. Economic capital represents allocated equity less goodwill and a percentage of intangible assets. Economic capital and return on average economic capital are non-GAAP financial measures. We believe the use of these non-GAAP financial measures provides additional clarity in assessing the results of the segments. Other companies may define or calculate these measures differently. (See Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 42-45.) |

| |

(3) | Total earning assets and total assets include asset allocations to match liabilities (i.e., deposits) for total Consumer & Business Banking, Deposits and Business Banking. Card Services does not require an asset allocation. As a result, the sum of the businesses does not agree to total Consumer & Business Banking results. |

n/m = not meaningful

Certain prior period amounts have been reclassified among the segments to conform to current period presentation.

|

| |

| This information is preliminary and based on company data available at the time of the presentation. | 16 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Bank of America Corporation and Subsidiaries |

| Consumer & Business Banking Key Indicators |

| (Dollars in millions) |

| | | | | | First

Quarter

2012 | | Fourth

Quarter

2011 | | Third

Quarter

2011 | | Second

Quarter

2011 | | First

Quarter

2011 |