Bank of America 1Q12 Financial Results April 19, 2012

Bank of America and its management may make certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could.” The forward-looking statements made in this presentation represent Bank of America's current expectations, plans or forecasts of its future results and revenues and include statements about: the company’s ongoing momentum on several fronts; we continue to find ways to accelerate mitigating actions ahead of Basel III implementation; our belief that we will be substantially above any minimum requirements under Basel III with lower debt levels and high liquidity levels; Basel III fully phased in Tier 1 common equity ratio expected to be above 7.50% by YE12; the company being well prepared for $34B of parent company unsecured debt maturities in 2Q12; that the company expects liquidity levels to come down somewhat in the second quarter, primarily due to $34B of parent company debt that will mature during the quarter, including $24B of TLGP maturities; that we anticipate that even though the absolute level of liquidity will be lower, the Time to Required Funding will remain close to its current level and significantly above our target minimum of 21 months; we expect that our benchmark issuance for the remainder of 2012 will be less than $5B; expected long-term debt reductions, including long-term debt declines of $50-$100 billion by YE2013; the $800 million charge in the 3Q12 from the anticipated U.K. tax rate reduction; the expected tax rate of approximately 27 percent for the remainder of 2012, except for unusual items; we continue to expect zero issuance of parent company and broker/dealer short-term unsecured funding; we believe the company is near the peak in staffing levels for Legacy Assets & Servicing and making progress, including cost reductions over the remaining quarters in 2012; expected cost savings in non-Legacy Assets & Servicing areas of the company; expected completion in May of, and increased savings later in 2012 from, Phase II of Project New BAC; we believe we can realize substantial cost savings in the second half of this year from lower head count, Project New BAC Phase 1 and Phase 2 results and an improving delinquent mortgage loan servicing pool; expected improvement, although at a slower rate, in residential mortgage and home equity 30+ days performing delinquencies; Bank of America will continue in 2012 to focus on capital levels, cost base, core business and customer growth, managing residual legacy risks down, including reducing negative impact on earnings; expected continued improvement in credit risk as legacy portfolios continue to run off; favorable returns on capital; continued management of mortgage issues; and other similar matters. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumptions that are difficult to predict and are often beyond Bank of America's control. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. You should not place undue reliance on any forward-looking statement and should consider all of the following uncertainties and risks, as well as those more fully discussed under Item 1A. “Risk Factors” of Bank of America's 2011 Annual Report on Form 10-K and in any of Bank of America's subsequent SEC filings; the accuracy and variability of estimates and assumptions in determining the expected value of the loss-sharing reinsurance arrangement relating to the agreement with Assured Guaranty Ltd. and the total cost of the agreement to the company; our resolution of certain representations and warranties obligations with the government-sponsored enterprises (GSEs) and our ability to resolve the GSEs’ remaining claims; our ability to resolve our representations and warranties obligations, and any related servicing, securities, fraud, indemnity or other claims with monolines, and private-label investors and other investors, including those monolines and investors from whom we have not yet received claims or with whom we have not yet reached any resolutions; our mortgage modification policies and related results; the timing and amount of any potential dividend increase, including any necessary approvals; adverse changes to the company’s credit ratings from the major credit ratings agencies; estimates of the fair value of certain of our assets and liabilities; the identification and effectiveness of any initiatives to mitigate the negative impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act; our ability to limit liabilities acquired as a result of the Merrill Lynch & Co., Inc. and Countrywide Financial Corporation acquisitions; and decisions to downsize, sell or close units or otherwise change the business mix of the company. Forward-looking statements speak only as of the date they are made, and Bank of America undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made. 2 Forward-Looking Statements

• This information is preliminary and based on company data available at the time of the presentation • Certain prior period amounts have been reclassified to conform to current period presentation • Certain financial measures contained herein represent non-GAAP financial measures. For more information about the non-GAAP financial measures contained herein, please see the presentation of the most directly comparable financial measures calculated in accordance with GAAP and accompanying reconciliations in the earnings press release and other earnings-related information available through the Bank of America Investor Relations web site at: http://investor.bankofamerica.com 3 Important Presentation Format Information

Key Takeaways for 1Q12 Results • Reported earnings of $653MM or $0.03 per diluted share • Results include negative valuation adjustments of $4.8B pre-tax, or $0.28 per share, resulting from the narrowing of the company's credit spreads • Capital and liquidity continued to increase and are at record levels • Capital markets activity improved driving sales and trading results significantly above 4Q11 and in line with 1Q11 results, excluding DVA valuations • All business segments reflect improved profitability from 4Q11 • Lowest provision expense quarter since 3Q07 as credit quality continues to improve • Expenses declined from 4Q11 despite higher revenue-related incentive and annual retirement-eligible compensation costs • The low level of interest rates continues to be a headwind • Capitalized on opportunity to realize $1.2B of gains on debt and trust preferred repurchases 4

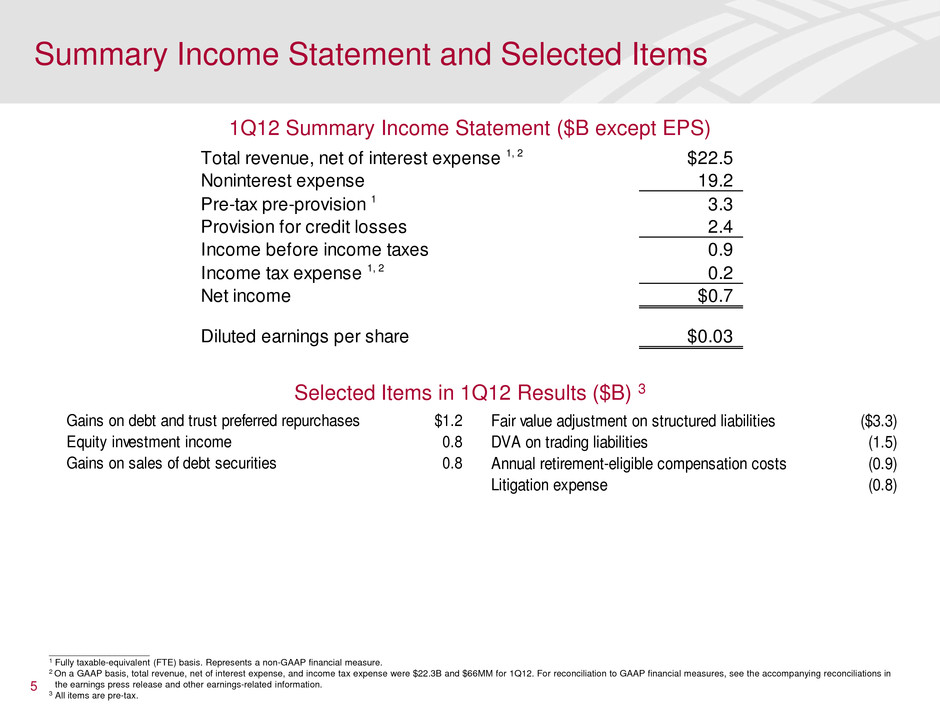

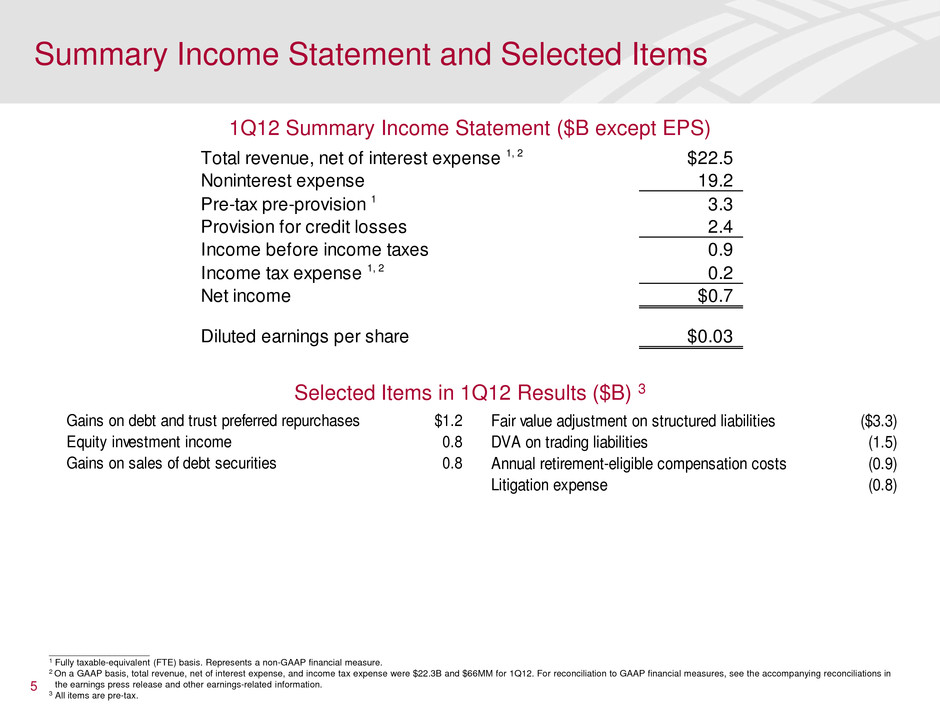

Summary Income Statement and Selected Items Selected Items in 1Q12 Results ($B) 3 5 1Q12 Summary Income Statement ($B except EPS) ____________________ 1 Fully taxable-equivalent (FTE) basis. Represents a non-GAAP financial measure. 2 On a GAAP basis, total revenue, net of interest expense, and income tax expense were $22.3B and $66MM for 1Q12. For reconciliation to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 3 All items are pre-tax. Total revenue, net of interest expense 1, 2 $22.5 Noninterest expense 19.2 Pre-tax pre-provision 1 3.3 Provision for credit losses 2.4 Income before income taxes 0.9 Income tax expense 1, 2 0.2 Net income $0.7 Diluted earnings per share $0.03 Gains on debt and trust preferred repurchases $1.2 Equity investment income 0.8 Gains on sales of debt securities 0.8 Fair valu adjustment on structured liabilities ($3.3) DVA on trading liabilities (1.5) Annual reti ement-eligible compensation costs (0.9) Litigation expense (0.8)

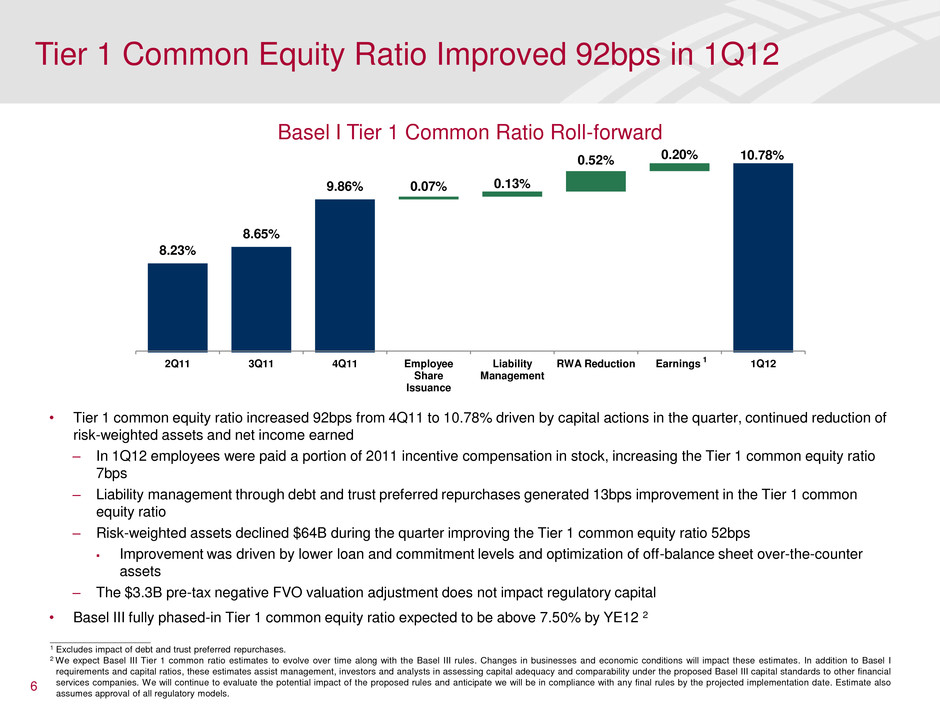

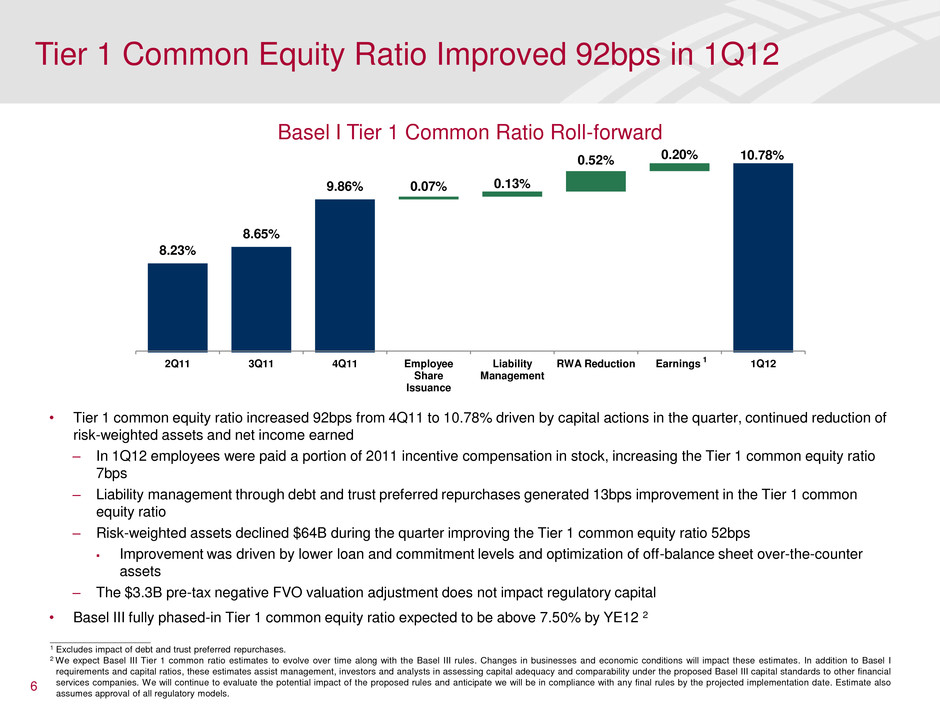

Tier 1 Common Equity Ratio Improved 92bps in 1Q12 • Tier 1 common equity ratio increased 92bps from 4Q11 to 10.78% driven by capital actions in the quarter, continued reduction of risk-weighted assets and net income earned – In 1Q12 employees were paid a portion of 2011 incentive compensation in stock, increasing the Tier 1 common equity ratio 7bps – Liability management through debt and trust preferred repurchases generated 13bps improvement in the Tier 1 common equity ratio – Risk-weighted assets declined $64B during the quarter improving the Tier 1 common equity ratio 52bps Improvement was driven by lower loan and commitment levels and optimization of off-balance sheet over-the-counter assets – The $3.3B pre-tax negative FVO valuation adjustment does not impact regulatory capital • Basel III fully phased-in Tier 1 common equity ratio expected to be above 7.50% by YE12 2 Basel I Tier 1 Common Ratio Roll-forward 6 8.23% 8.65% 9.86% 0.07% 0.13% 0.52% 0.20% 10.78% 2Q11 3Q11 4Q11 Employee Share Issuance Liability Management RWA Reduction Earnings 1Q12 1 ____________________ 1 Excludes impact of debt and trust preferred repurchases. 2 We expect Basel III Tier 1 common ratio estimates to evolve over time along with the Basel III rules. Changes in businesses and economic conditions will impact these estimates. In addition to Basel I requirements and capital ratios, these estimates assist management, investors and analysts in assessing capital adequacy and comparability under the proposed Basel III capital standards to other financial services companies. We will continue to evaluate the potential impact of the proposed rules and anticipate we will be in compliance with any final rules by the projected implementation date. Estimate also assumes approval of all regulatory models.

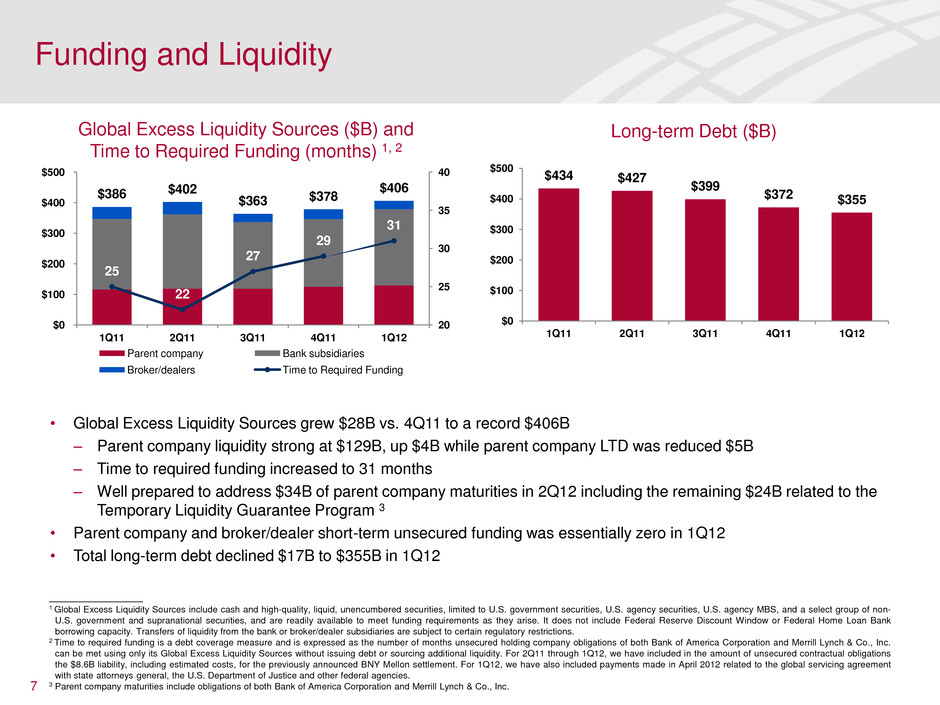

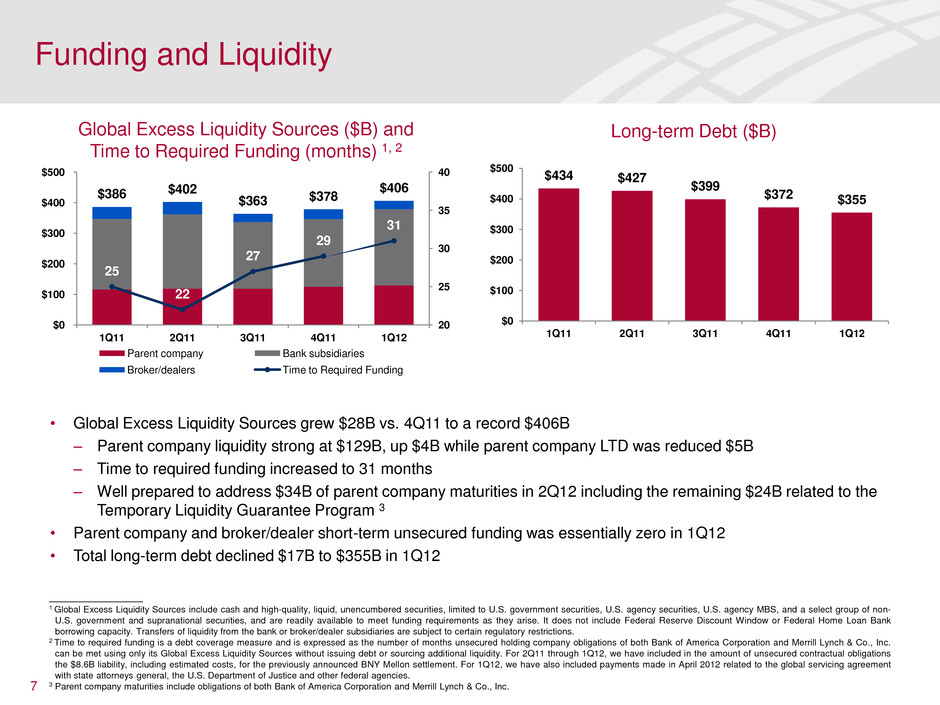

Funding and Liquidity • Global Excess Liquidity Sources grew $28B vs. 4Q11 to a record $406B ‒ Parent company liquidity strong at $129B, up $4B while parent company LTD was reduced $5B ‒ Time to required funding increased to 31 months ‒ Well prepared to address $34B of parent company maturities in 2Q12 including the remaining $24B related to the Temporary Liquidity Guarantee Program 3 • Parent company and broker/dealer short-term unsecured funding was essentially zero in 1Q12 • Total long-term debt declined $17B to $355B in 1Q12 7 Global Excess Liquidity Sources ($B) and Time to Required Funding (months) 1, 2 1 Global Excess Liquidity Sources include cash and high-quality, liquid, unencumbered securities, limited to U.S. government securities, U.S. agency securities, U.S. agency MBS, and a select group of non- U.S. government and supranational securities, and are readily available to meet funding requirements as they arise. It does not include Federal Reserve Discount Window or Federal Home Loan Bank borrowing capacity. Transfers of liquidity from the bank or broker/dealer subsidiaries are subject to certain regulatory restrictions. 2 Time to required funding is a debt coverage measure and is expressed as the number of months unsecured holding company obligations of both Bank of America Corporation and Merrill Lynch & Co., Inc. can be met using only its Global Excess Liquidity Sources without issuing debt or sourcing additional liquidity. For 2Q11 through 1Q12, we have included in the amount of unsecured contractual obligations the $8.6B liability, including estimated costs, for the previously announced BNY Mellon settlement. For 1Q12, we have also included payments made in April 2012 related to the global servicing agreement with state attorneys general, the U.S. Department of Justice and other federal agencies. 3 Parent company maturities include obligations of both Bank of America Corporation and Merrill Lynch & Co., Inc. $386 $402 $363 $378 $406 25 22 27 29 31 20 25 30 35 40 $0 $100 $200 $300 $400 $500 1Q11 2Q11 3Q11 4Q11 1Q12 Parent company Bank subsidiaries Broker/dealers Time to Required Funding Long-term Debt ($B) $434 $427 $399 $372 $355 $0 $100 $200 $300 $400 $500 1Q11 2Q11 3Q11 4Q11 1Q12

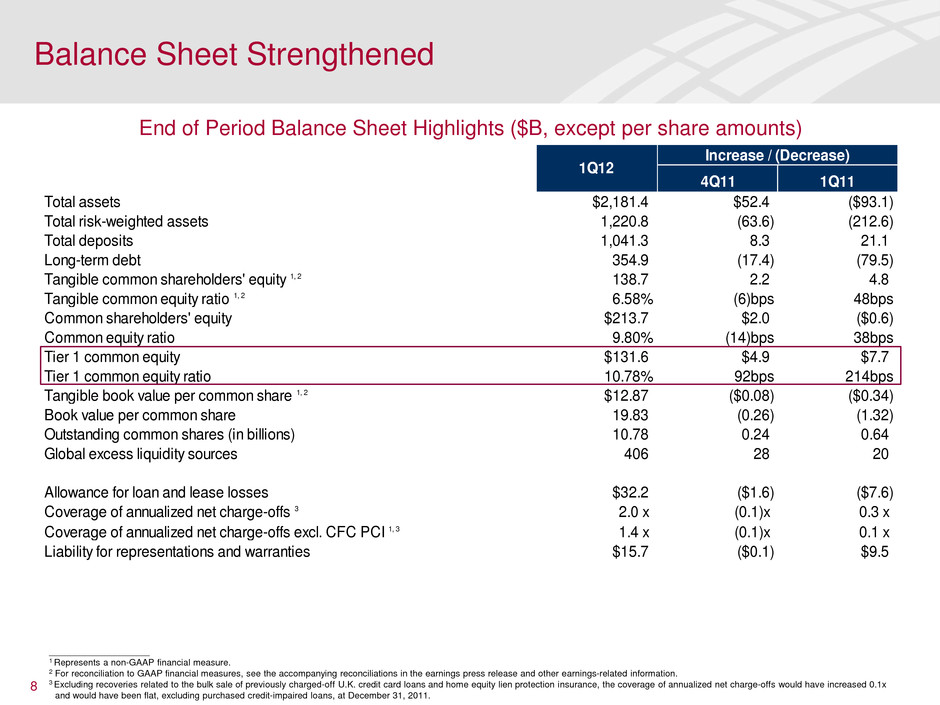

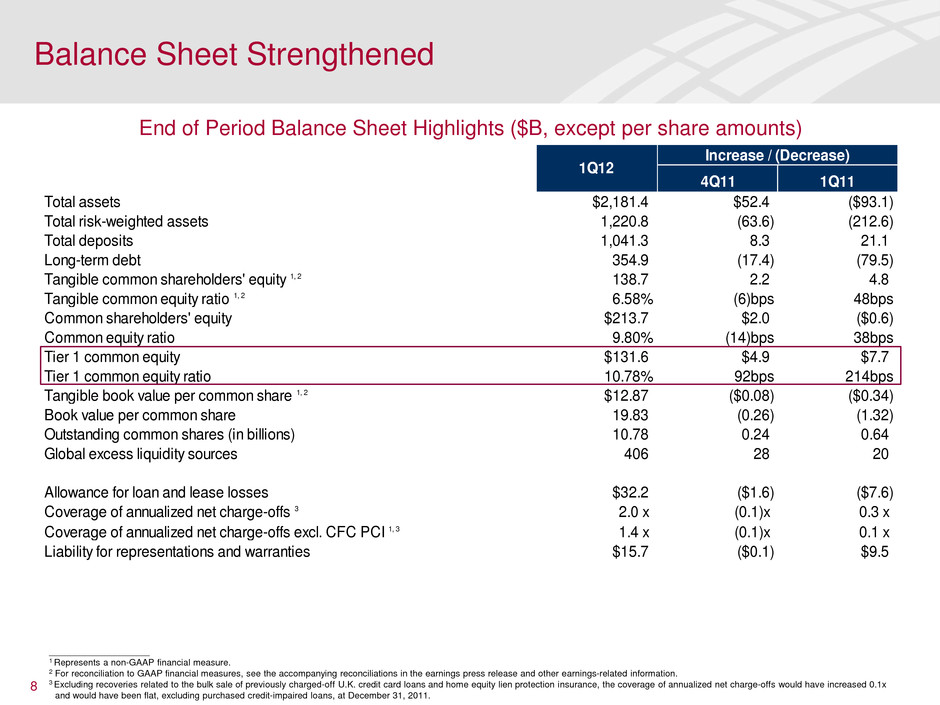

____________________ 1 Represents a non-GAAP financial measure. 2 For reconciliation to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 3 Excluding recoveries related to the bulk sale of previously charged-off U.K. credit card loans and home equity lien protection insurance, the coverage of annualized net charge-offs would have increased 0.1x and would have been flat, excluding purchased credit-impaired loans, at December 31, 2011. End of Period Balance Sheet Highlights ($B, except per share amounts) 8 Balance Sheet Strengthened 4Q11 1Q11 Total assets $2,181.4 $52.4 ($93.1) Total risk-weighted assets 1,220.8 (63.6) (212.6) Total deposits 1,041.3 8.3 21.1 Long-term debt 354.9 (17.4) (79.5) Tangible common shareholders' equity 1, 2 138.7 2.2 4.8 Tangible common equity ratio 1, 2 6.58% (6)bps 48bps Common shareholders' equity $213.7 $2.0 ($0.6) Common equity ratio 9.80% (14)bps 38bps Tier 1 common equity $131.6 $4.9 $7.7 Tier 1 common equity ratio 10.78% 92bps 214bps Tangible book value per common share 1, 2 $12.87 ($0.08) ($0.34) Book value per common share 19.83 (0.26) (1.32) Outstanding common shares (in billions) 10.78 0.24 0.64 Global excess liquidity sources 406 28 20 Allowance for loan and lease losses $32.2 ($1.6) ($7.6) Coverage of annualized net charge-offs 3 2.0 x (0.1)x 0.3 x Coverage of annualized net charge-offs excl. CFC PCI 1, 3 1.4 x (0.1)x 0.1 x Liability for representations and warranties $15.7 ($0.1) $9.5 1Q12 Increase / (Decrease)

9 ____________________ 1 FTE basis. Represents a non-GAAP financial measure. On a GAAP basis, net interest income was $10.8B, $10.7B, $10.5B, $11.2B and $12.2B for 1Q12, 4Q11, 3Q11, 2Q11 and 1Q11, respectively. For reconciliation to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. Net Interest Income ($MM) 1 Net Interest Income $11,377 $10,619 $9,810 $10,093 $10,257 $12,397 $11,493 $10,739 $10,959 $11,053 2.67% 2.50% 2.32% 2.45% 2.51% 3.26% 3.07% 2.80% 2.94% 3.06% 0.00% 0.60% 1.20% 1.80% 2.40% 3.00% 3.60% $0 $5,000 $10,000 $15,000 $20,000 1Q11 2Q11 3Q11 4Q11 1Q12 Core NII Market-based NII Reported net interest yield Net interest yield excl. market-based • Net interest income increased $94MM and net interest yield increased 6bps to 2.51% from 4Q11 – Positive impacts in 1Q12 vs. 4Q11 include: Less premium amortization and hedge ineffectiveness as a result of an improved interest rate environment ($0.5B) Continued reductions in our long-term debt footprint and lower rates paid on deposits ($0.1B) – Partially offset by: Reductions from declines in consumer balances and yields including full quarter impact of selling our Canadian consumer card business ($0.4B) – Our overall interest rate risk position continues to be asset sensitive

Business Segment Reporting Changes 10 • Realigned certain segments to reflect changes in how we manage our business to better serve our customers • Consumer & Business Banking (CBB) ‒ Combined the former Deposits and Card Services segments, as well as Business Banking (formerly included in Global Commercial Banking) to reflect new CBB segment • Global Banking ‒ Consolidated the former Global Commercial Banking segment, excluding Business Banking, with the Global Corporate and Investment Banking business (formerly included in Global Banking & Markets) to reflect new Global Banking segment • Global Markets ‒ Global Markets businesses, formerly part of Global Banking & Markets segment, reflect Sales & Trading and share of certain deal economics and expenses from capital markets and loan origination activities • Certain management accounting methodologies and related allocations (e.g., noninterest expense) were refined

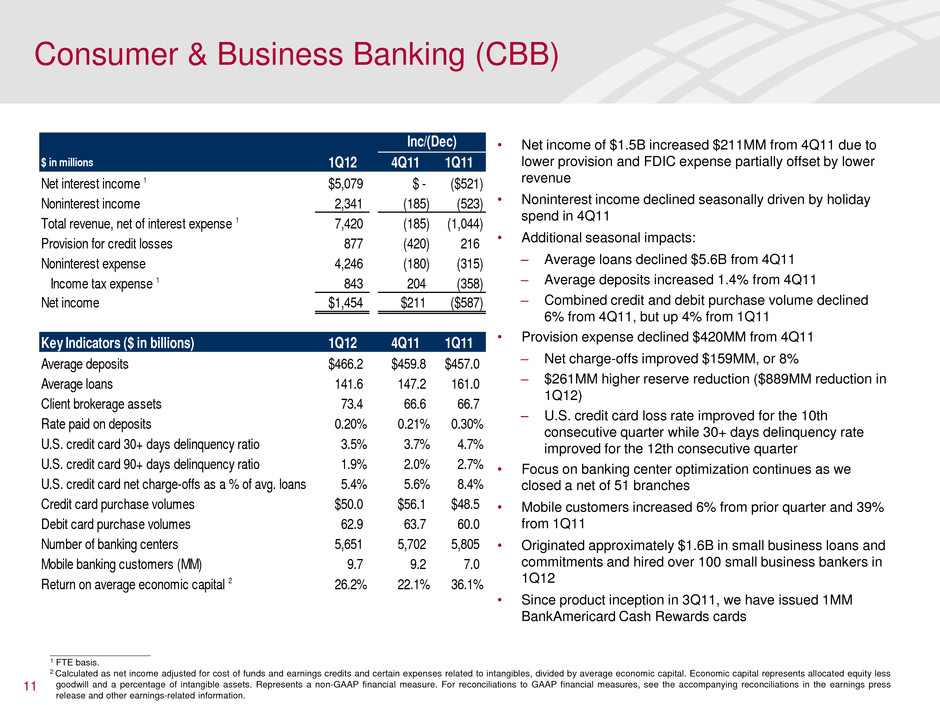

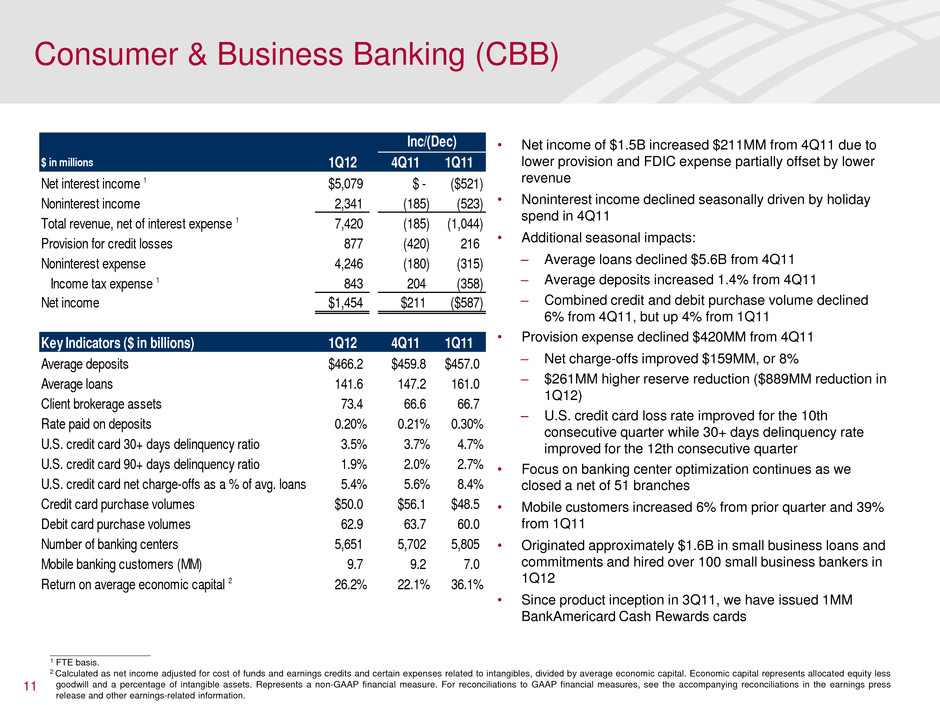

11 • Net income of $1.5B increased $211MM from 4Q11 due to lower provision and FDIC expense partially offset by lower revenue • Noninterest income declined seasonally driven by holiday spend in 4Q11 • Additional seasonal impacts: – Average loans declined $5.6B from 4Q11 – Average deposits increased 1.4% from 4Q11 – Combined credit and debit purchase volume declined 6% from 4Q11, but up 4% from 1Q11 • Provision expense declined $420MM from 4Q11 – Net charge-offs improved $159MM, or 8% – $261MM higher reserve reduction ($889MM reduction in 1Q12) – U.S. credit card loss rate improved for the 10th consecutive quarter while 30+ days delinquency rate improved for the 12th consecutive quarter • Focus on banking center optimization continues as we closed a net of 51 branches • Mobile customers increased 6% from prior quarter and 39% from 1Q11 • Originated approximately $1.6B in small business loans and commitments and hired over 100 small business bankers in 1Q12 • Since product inception in 3Q11, we have issued 1MM BankAmericard Cash Rewards cards Consumer & Business Banking (CBB) $ in millions 1Q12 4Q11 1Q11 Net interest income 1 $5,079 $ - ($521) Noninterest income 2,341 (185) (523) Total revenue, net of interest expense 1 7,420 (185) (1,044) Provision for credit losses 877 (420) 216 Noninterest expense 4,246 (180) (315) Income tax expense 1 843 204 (358) Net income $1,454 $211 ($587) Key Indicators ($ in billions) 1Q12 4Q11 1Q11 Average deposits $466.2 $459.8 $457.0 Average loans 141.6 147.2 161.0 Client brokerage assets 73.4 66.6 66.7 Rate paid on deposits 0.20% 0.21% 0.30% U.S. credit card 30+ days delinquency ratio 3.5% 3.7% 4.7% U.S. credit card 90+ days delinquency ratio 1.9% 2.0% 2.7% U.S. credit card net charge-offs as a % of avg. loans 5.4% 5.6% 8.4% Credit card purchase volumes $50.0 $56.1 $48.5 Debit card purchase volumes 62.9 63.7 60.0 Number of banking c nters 5,651 5,702 5,805 Mobile banking custo ers (MM) 9.7 9.2 7.0 Return on average economic capital 2 26.2% 22.1% 36.1% Inc/(Dec) ____________________ 1 FTE basis. 2 Calculated as net income adjusted for cost of funds and earnings credits and certain expenses related to intangibles, divided by average economic capital. Economic capital represents allocated equity less goodwill and a percentage of intangible assets. Represents a non-GAAP financial measure. For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information.

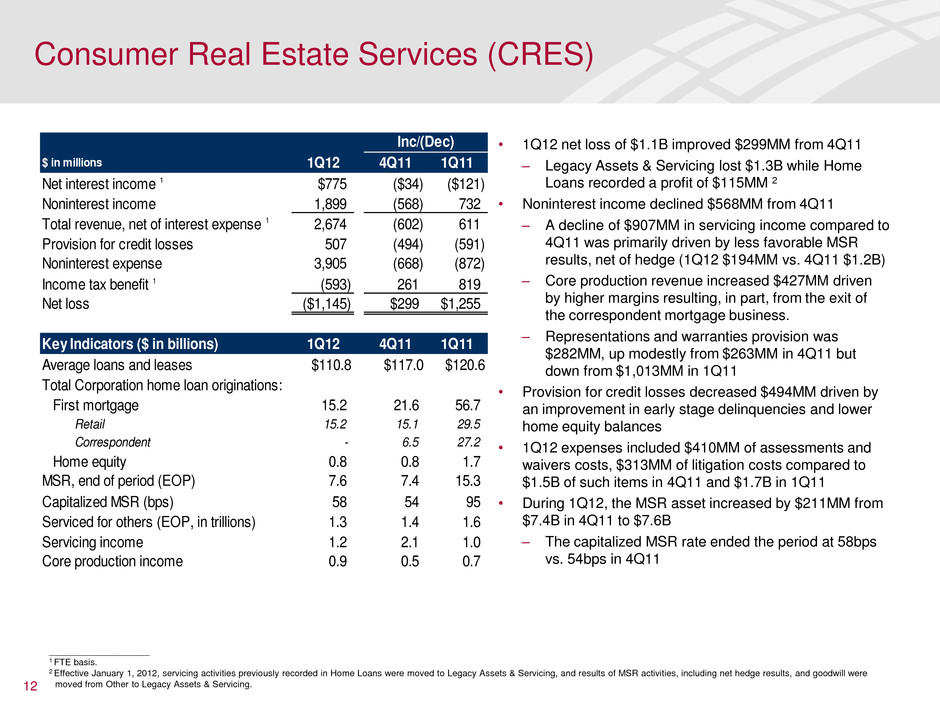

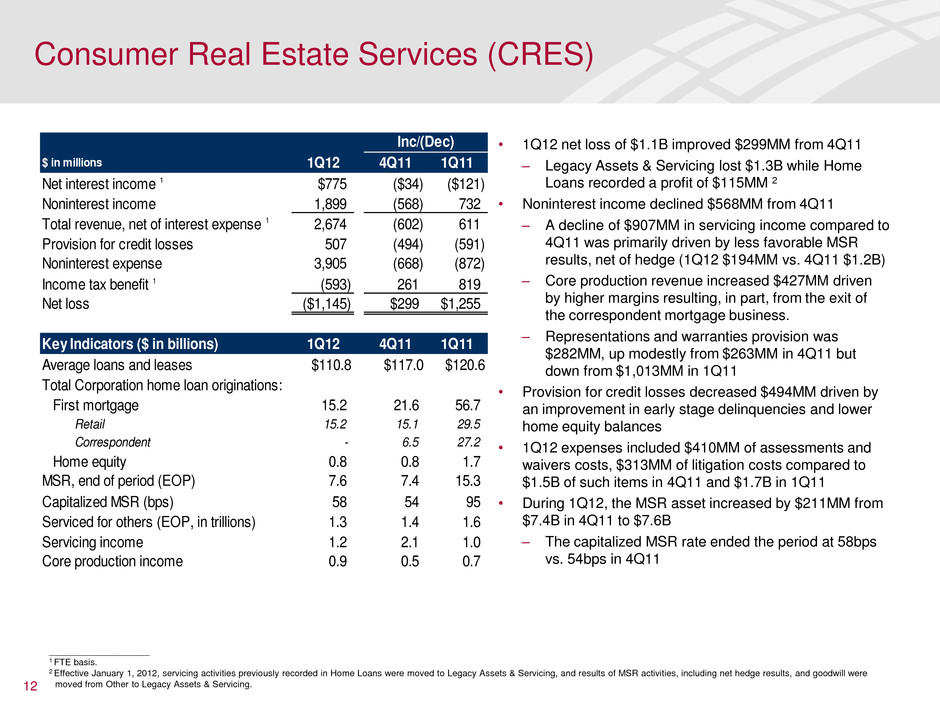

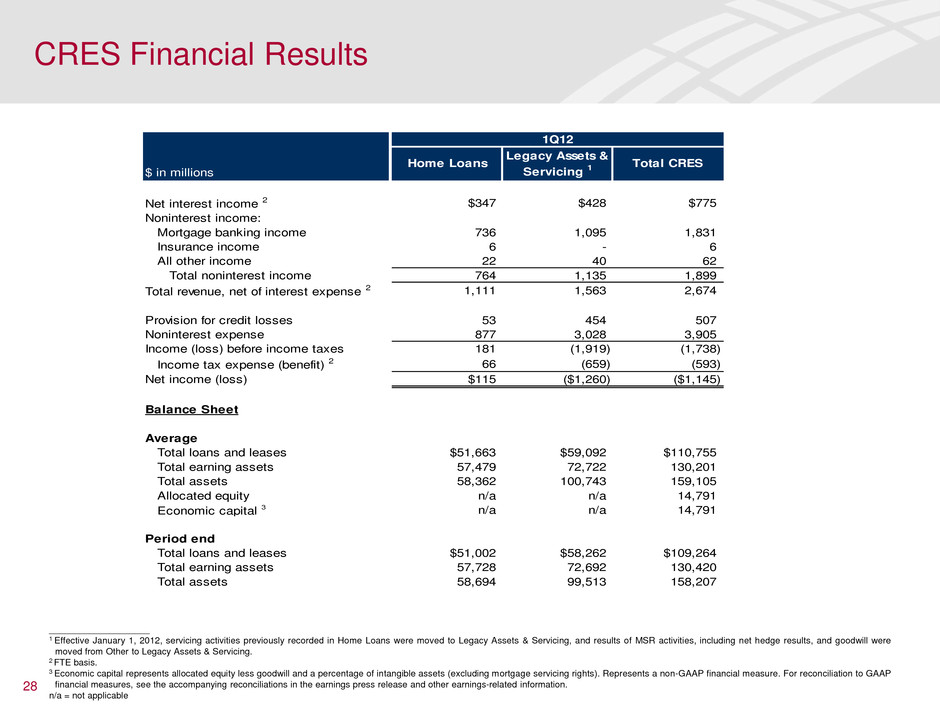

12 ____________________ 1 FTE basis. 2 Effective January 1, 2012, servicing activities previously recorded in Home Loans were moved to Legacy Assets & Servicing, and results of MSR activities, including net hedge results, and goodwill were moved from Other to Legacy Assets & Servicing. • 1Q12 net loss of $1.1B improved $299MM from 4Q11 – Legacy Assets & Servicing lost $1.3B while Home Loans recorded a profit of $115MM 2 • Noninterest income declined $568MM from 4Q11 – A decline of $907MM in servicing income compared to 4Q11 was primarily driven by less favorable MSR results, net of hedge (1Q12 $194MM vs. 4Q11 $1.2B) – Core production revenue increased $427MM driven by higher margins resulting, in part, from the exit of the correspondent mortgage business. – Representations and warranties provision was $282MM, up modestly from $263MM in 4Q11 but down from $1,013MM in 1Q11 • Provision for credit losses decreased $494MM driven by an improvement in early stage delinquencies and lower home equity balances • 1Q12 expenses included $410MM of assessments and waivers costs, $313MM of litigation costs compared to $1.5B of such items in 4Q11 and $1.7B in 1Q11 • During 1Q12, the MSR asset increased by $211MM from $7.4B in 4Q11 to $7.6B – The capitalized MSR rate ended the period at 58bps vs. 54bps in 4Q11 Consumer Real Estate Services (CRES) $ in millions 1Q12 4Q11 1Q11 Net interest income 1 $775 ($34) ($121) Noninterest income 1,899 (568) 732 Total revenue, net of interest expense 1 2,674 (602) 611 Provision for credit losses 507 (494) (591) Noninterest expense 3,905 (668) (872) Income tax benefit 1 (593) 261 819 Net loss ($1,145) $299 $1,255 Key Indicators ($ in billions) 1Q12 4Q11 1Q11 Average loans and leases $110.8 $117.0 $120.6 Total Corporation home loan originations: First mortgage 15.2 21.6 56.7 Retail 15.2 15.1 29.5 Correspondent - 6.5 27.2 Home equity 0.8 0.8 1.7 MSR, end of period (EOP) 7.6 7.4 15.3 Capitalized MSR (bps) 58 54 95 Serviced for others (EOP, i trillions) 1.3 1.4 1.6 Servicing income 1.2 2.1 1.0 Core production income 0.9 0.5 0.7 Inc/(Dec)

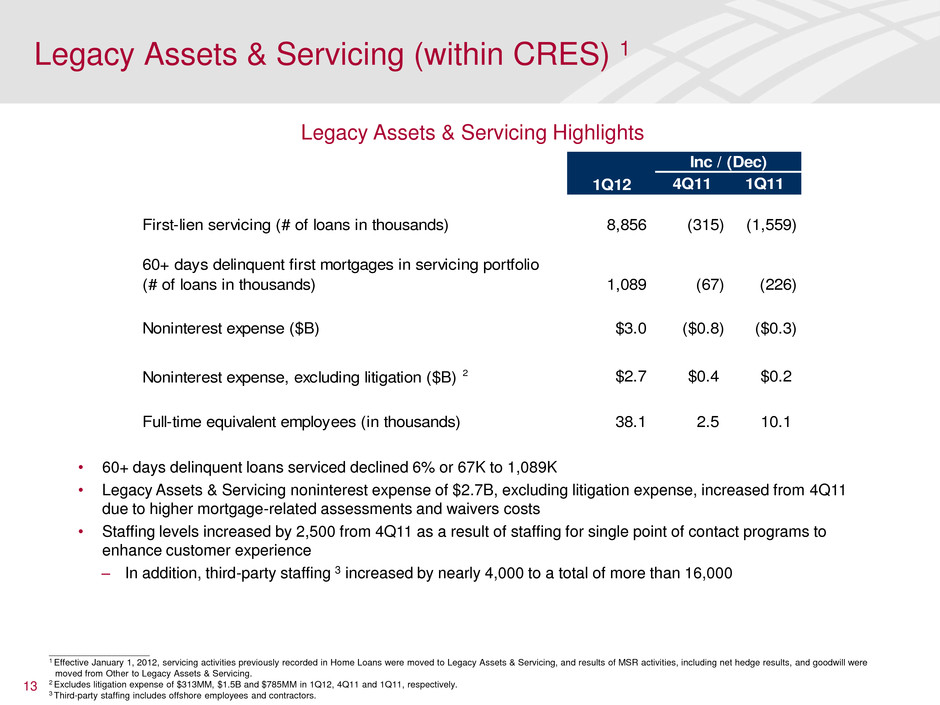

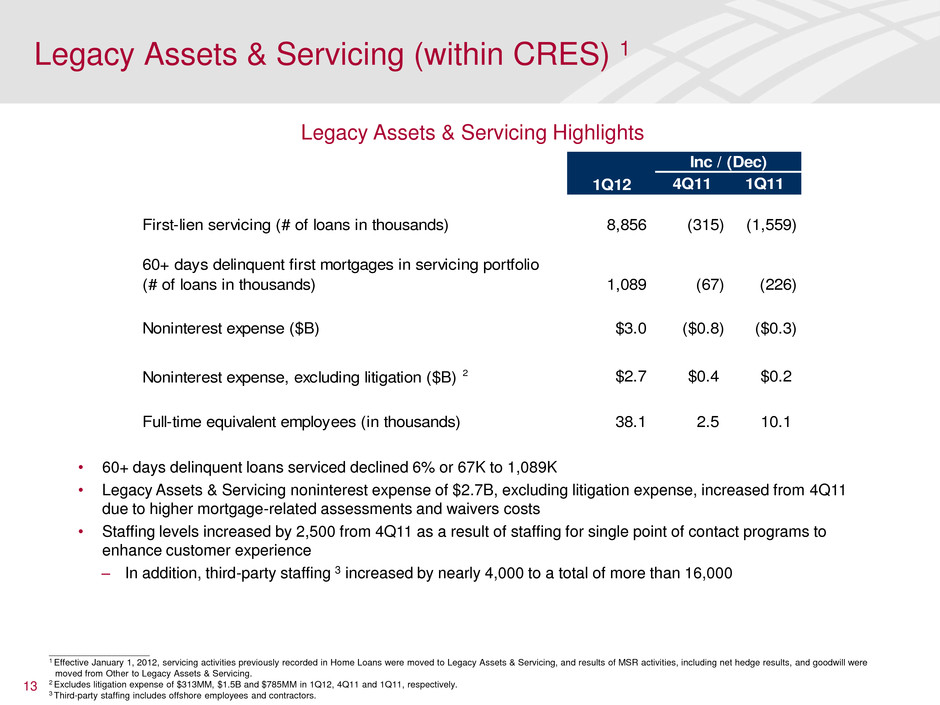

13 Legacy Assets & Servicing (within CRES) 1 ____________________ 1 Effective January 1, 2012, servicing activities previously recorded in Home Loans were moved to Legacy Assets & Servicing, and results of MSR activities, including net hedge results, and goodwill were moved from Other to Legacy Assets & Servicing. 2 Excludes litigation expense of $313MM, $1.5B and $785MM in 1Q12, 4Q11 and 1Q11, respectively. 3 Third-party staffing includes offshore employees and contractors. • 60+ days delinquent loans serviced declined 6% or 67K to 1,089K • Legacy Assets & Servicing noninterest expense of $2.7B, excluding litigation expense, increased from 4Q11 due to higher mortgage-related assessments and waivers costs • Staffing levels increased by 2,500 from 4Q11 as a result of staffing for single point of contact programs to enhance customer experience – In addition, third-party staffing 3 increased by nearly 4,000 to a total of more than 16,000 4Q11 1Q11 First-lien servicing (# of loans in thousands) 8,856 (315) (1,559) 60+ days delinquent first mortgages in servicing portfolio (# of loans in thousands) 1,089 (67) (226) Noninterest expense ($B) $3.0 ($0.8) ($0.3) Noninterest expense, excluding litigation ($B) 2 $2.7 $0.4 $0.2 Full-time equivalent employees (in thousands) 38.1 2.5 10.1 Inc / (Dec) 1Q12 Legacy Assets & Servicing Highlights

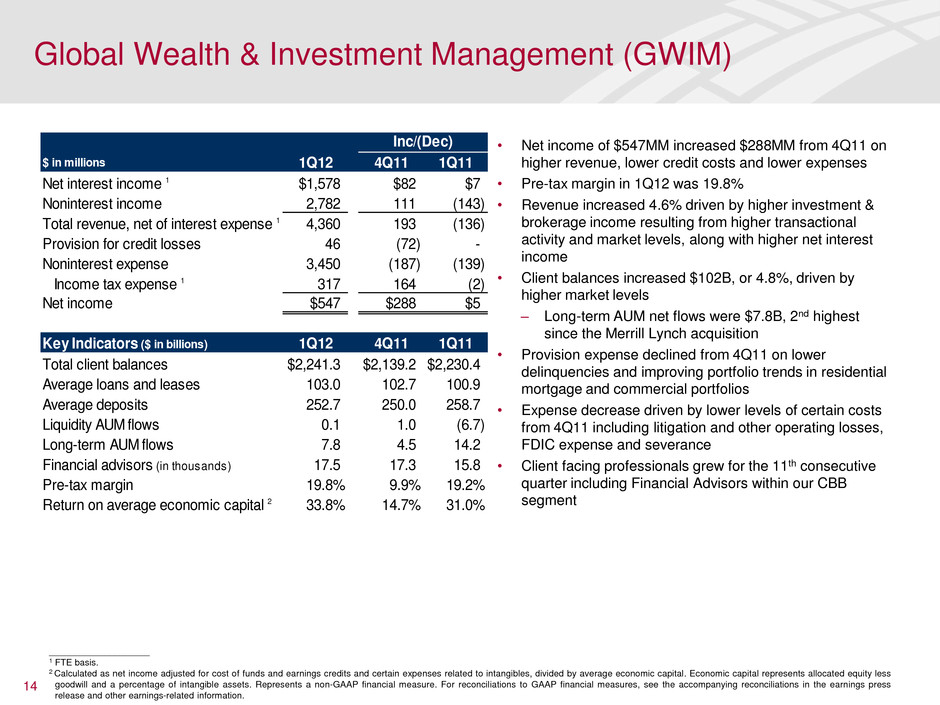

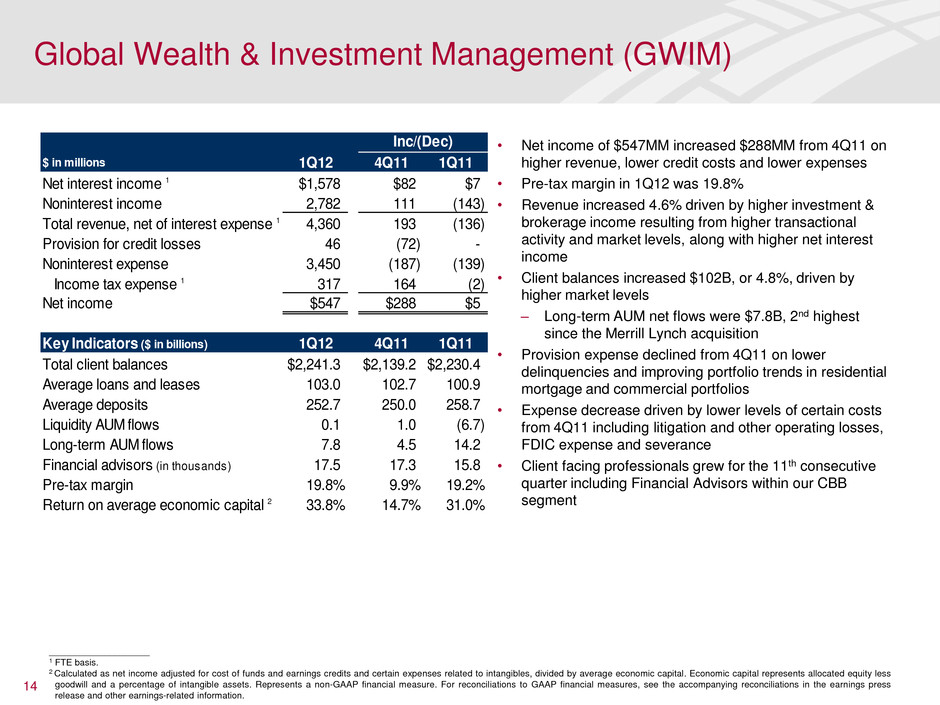

14 • Net income of $547MM increased $288MM from 4Q11 on higher revenue, lower credit costs and lower expenses • Pre-tax margin in 1Q12 was 19.8% • Revenue increased 4.6% driven by higher investment & brokerage income resulting from higher transactional activity and market levels, along with higher net interest income • Client balances increased $102B, or 4.8%, driven by higher market levels – Long-term AUM net flows were $7.8B, 2nd highest since the Merrill Lynch acquisition • Provision expense declined from 4Q11 on lower delinquencies and improving portfolio trends in residential mortgage and commercial portfolios • Expense decrease driven by lower levels of certain costs from 4Q11 including litigation and other operating losses, FDIC expense and severance • Client facing professionals grew for the 11th consecutive quarter including Financial Advisors within our CBB segment Global Wealth & Investment Management (GWIM) $ in millions 1Q12 4Q11 1Q11 Net interest income 1 $1,578 $82 $7 Noninterest income 2,782 111 (143) Total revenue, net of interest expense 1 4,360 193 (136) Provision for credit losses 46 (72) - Noninterest expense 3,450 (187) (139) Income tax expense 1 317 164 (2) Net income $547 $288 $5 Key Indicators ($ in billions) 1Q12 4Q11 1Q11 Total client balances $2,241.3 $2,139.2 $2,230.4 Average loans and leases 103.0 102.7 100.9 Average deposits 252.7 250.0 258.7 Liquidity AUM flows 0.1 1.0 (6.7) Long-term AUM flows 7.8 4.5 14.2 Financial advisors ( n th usands) 17.5 17.3 15.8 Pre-tax margin 19.8% 9.9% 19.2% Return on avera e econ mic capital 2 33.8% 14.7% 31.0% Inc/(Dec) ____________________ 1 FTE basis. 2 Calculated as net income adjusted for cost of funds and earnings credits and certain expenses related to intangibles, divided by average economic capital. Economic capital represents allocated equity less goodwill and a percentage of intangible assets. Represents a non-GAAP financial measure. For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information.

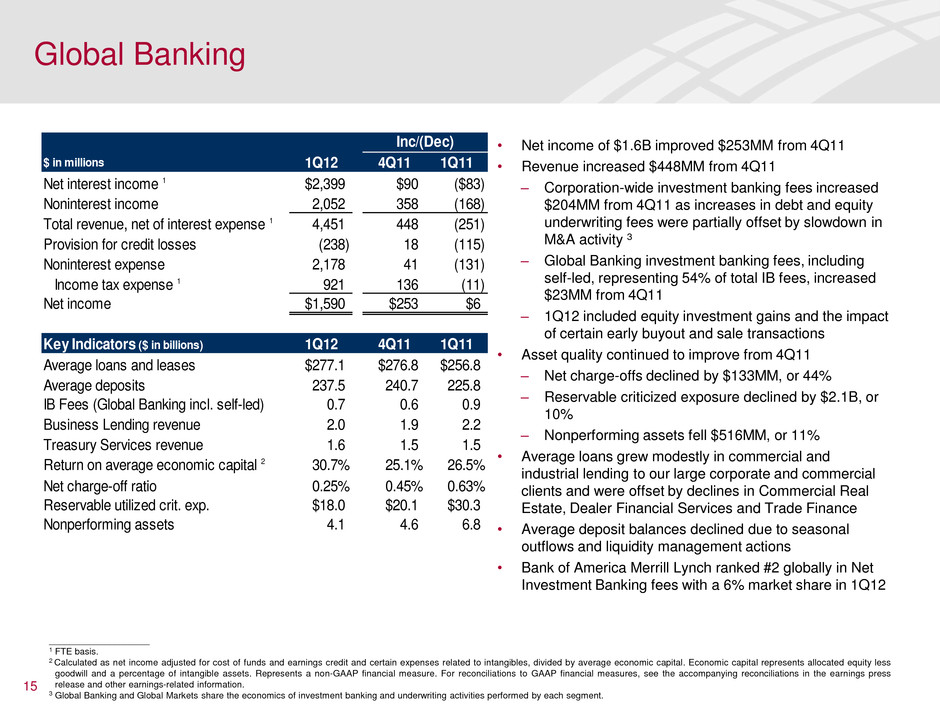

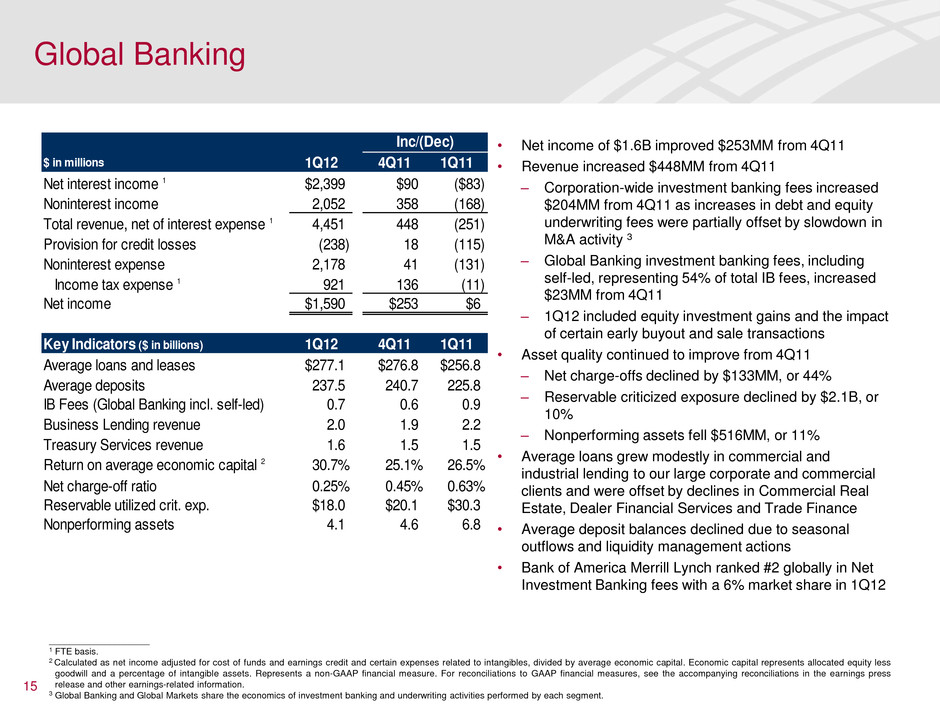

15 • Net income of $1.6B improved $253MM from 4Q11 • Revenue increased $448MM from 4Q11 – Corporation-wide investment banking fees increased $204MM from 4Q11 as increases in debt and equity underwriting fees were partially offset by slowdown in M&A activity 3 – Global Banking investment banking fees, including self-led, representing 54% of total IB fees, increased $23MM from 4Q11 – 1Q12 included equity investment gains and the impact of certain early buyout and sale transactions • Asset quality continued to improve from 4Q11 – Net charge-offs declined by $133MM, or 44% – Reservable criticized exposure declined by $2.1B, or 10% – Nonperforming assets fell $516MM, or 11% • Average loans grew modestly in commercial and industrial lending to our large corporate and commercial clients and were offset by declines in Commercial Real Estate, Dealer Financial Services and Trade Finance • Average deposit balances declined due to seasonal outflows and liquidity management actions • Bank of America Merrill Lynch ranked #2 globally in Net Investment Banking fees with a 6% market share in 1Q12 Global Banking $ in millions 1Q12 4Q11 1Q11 Net interest income 1 $2,399 $90 ($83) Noninterest income 2,052 358 (168) Total revenue, net of interest expense 1 4,451 448 (251) Provision for credit losses (238) 18 (115) Noninterest expense 2,178 41 (131) Income tax expense 1 921 136 (11) Net income $1,590 $253 $6 Key Indicators ($ in billions) 1Q12 4Q11 1Q11 Average loans and leases $277.1 $276.8 $256.8 Average deposits 237.5 240.7 225.8 IB Fees (Global Banking incl. self-led) 0.7 0.6 0.9 Business Lending revenue 2.0 1.9 2.2 Treasury Services revenue 1.6 1.5 1.5 Return on average economic capital 2 30.7% 25.1% 26.5% Net charge-off ratio 0.25% 0.45% 0.63% Reservable utilized crit. exp. $18.0 $20.1 $30.3 Nonperforming assets 4.1 4.6 6.8 Inc/(Dec) ____________________ 1 FTE basis. 2 Calculated as net income adjusted for cost of funds and earnings credit and certain expenses related to intangibles, divided by average economic capital. Economic capital represents allocated equity less goodwill and a percentage of intangible assets. Represents a non-GAAP financial measure. For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 3 Global Banking and Global Markets share the economics of investment banking and underwriting activities performed by each segment.

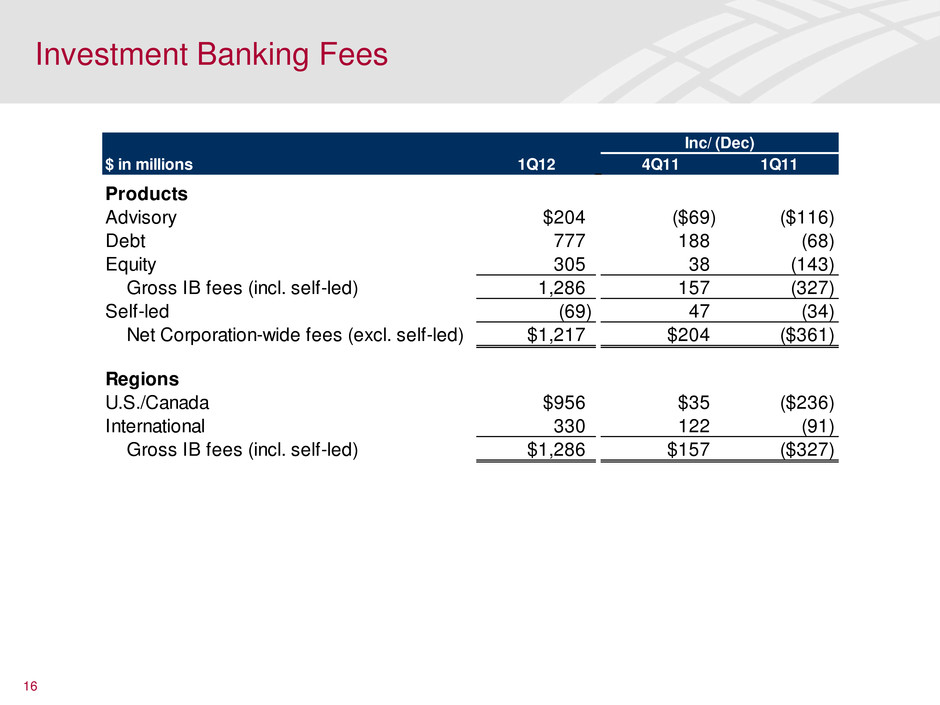

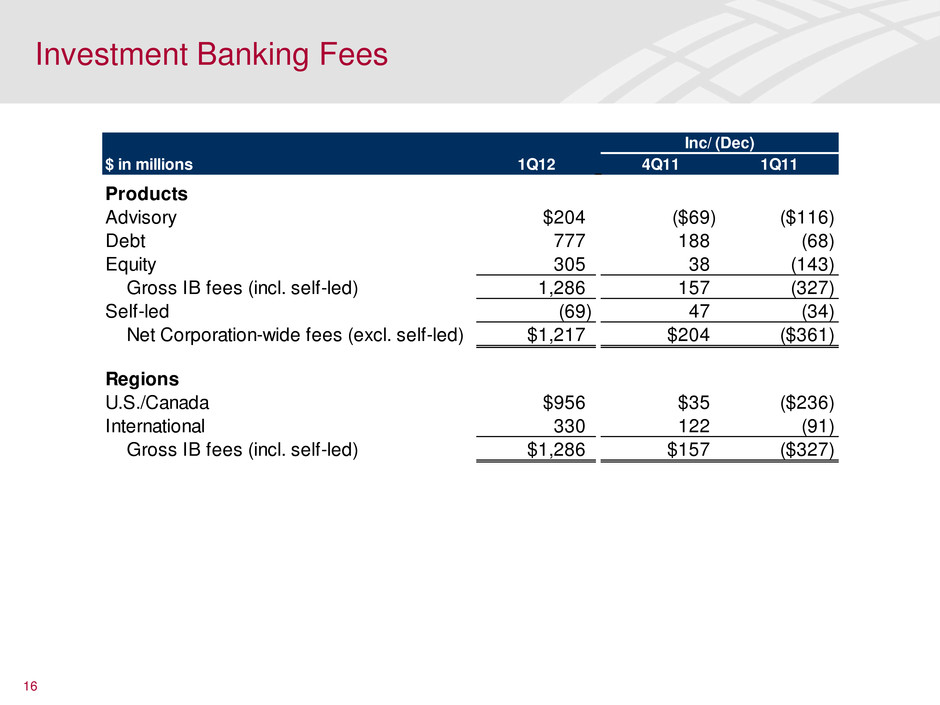

Investment Banking Fees $ in millions 1Q12 4Q11 1Q11 Products Advisory $204 ($69) ($116) Debt 777 188 (68) Equity 305 38 (143) Gross IB fees (incl. self-led) 1,286 157 (327) Self-led (69) 47 (34) Net Corporation-wide fees (excl. self-led) $1,217 $204 ($361) Regions U.S./Canada $956 $35 ($236) International 330 122 (91) Gross IB fees (incl. self-led) $1,286 $157 ($327) Inc/ (Dec) 16

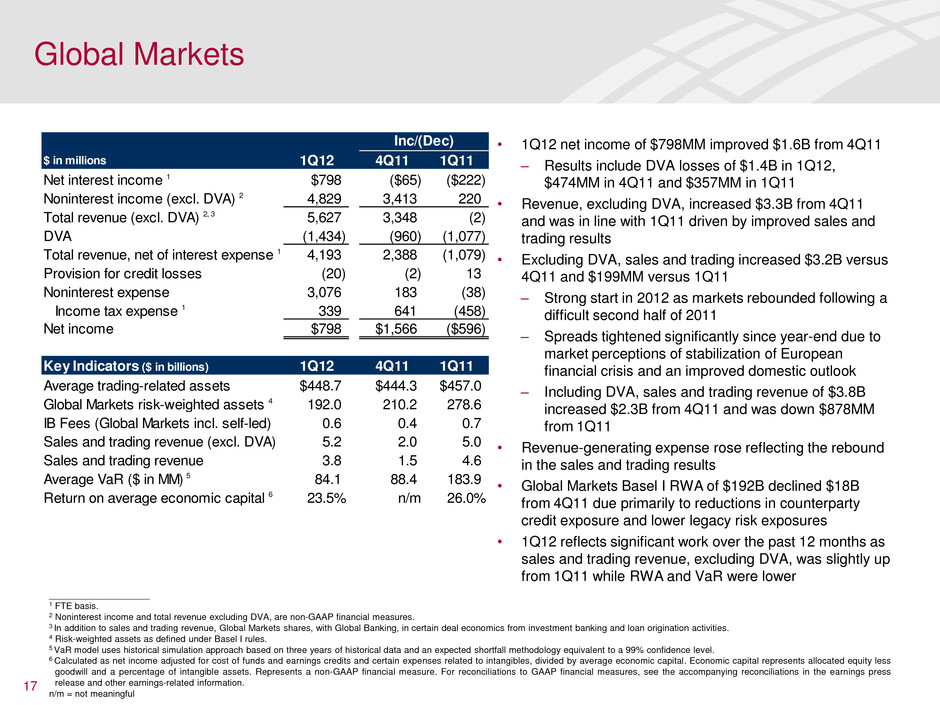

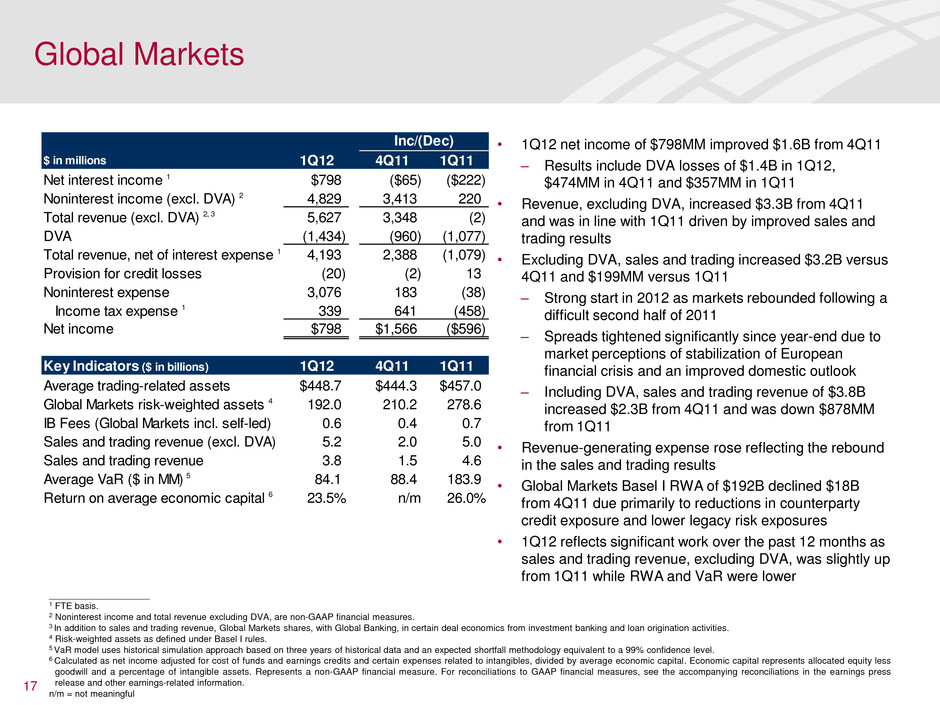

17 • 1Q12 net income of $798MM improved $1.6B from 4Q11 – Results include DVA losses of $1.4B in 1Q12, $474MM in 4Q11 and $357MM in 1Q11 • Revenue, excluding DVA, increased $3.3B from 4Q11 and was in line with 1Q11 driven by improved sales and trading results • Excluding DVA, sales and trading increased $3.2B versus 4Q11 and $199MM versus 1Q11 – Strong start in 2012 as markets rebounded following a difficult second half of 2011 – Spreads tightened significantly since year-end due to market perceptions of stabilization of European financial crisis and an improved domestic outlook – Including DVA, sales and trading revenue of $3.8B increased $2.3B from 4Q11 and was down $878MM from 1Q11 • Revenue-generating expense rose reflecting the rebound in the sales and trading results • Global Markets Basel I RWA of $192B declined $18B from 4Q11 due primarily to reductions in counterparty credit exposure and lower legacy risk exposures • 1Q12 reflects significant work over the past 12 months as sales and trading revenue, excluding DVA, was slightly up from 1Q11 while RWA and VaR were lower ____________________ 1 FTE basis. 2 Noninterest income and total revenue excluding DVA, are non-GAAP financial measures. 3 In addition to sales and trading revenue, Global Markets shares, with Global Banking, in certain deal economics from investment banking and loan origination activities. 4 Risk-weighted assets as defined under Basel I rules. 5 VaR model uses historical simulation approach based on three years of historical data and an expected shortfall methodology equivalent to a 99% confidence level. 6 Calculated as net income adjusted for cost of funds and earnings credits and certain expenses related to intangibles, divided by average economic capital. Economic capital represents allocated equity less goodwill and a percentage of intangible assets. Represents a non-GAAP financial measure. For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. n/m = not meaningful Global Markets $ in millions 1Q12 4Q11 1Q11 Net interest income 1 $798 ($65) ($222) Noninterest income (excl. DVA) 2 4,829 3,413 220 Total revenue (excl. DVA) 2, 3 5,627 3,348 (2) DVA (1,434) (960) (1,077) Total revenue, net of interest expense 1 4,193 2,388 (1,079) Provision for credit losses (20) (2) 13 Noninterest expense 3,076 183 (38) Income tax expense 1 339 641 (458) Net income $798 $1,566 ($596) Key Indicators ($ in billions) 1Q12 4Q11 1Q11 Average trading-related assets $448.7 $444.3 $457.0 Global Markets risk-weighted assets 4 192.0 210.2 278.6 IB Fees (Global Markets incl. self-led) 0.6 0.4 0.7 Sales and tradin revenue (excl. DVA) 5.2 2.0 5.0 Sales and trading revenu 3.8 1.5 4.6 Average VaR ($ in MM) 5 84.1 88.4 183.9 Return on average c nomic capital 6 23.5% n/m 26.0% Inc/(Dec)

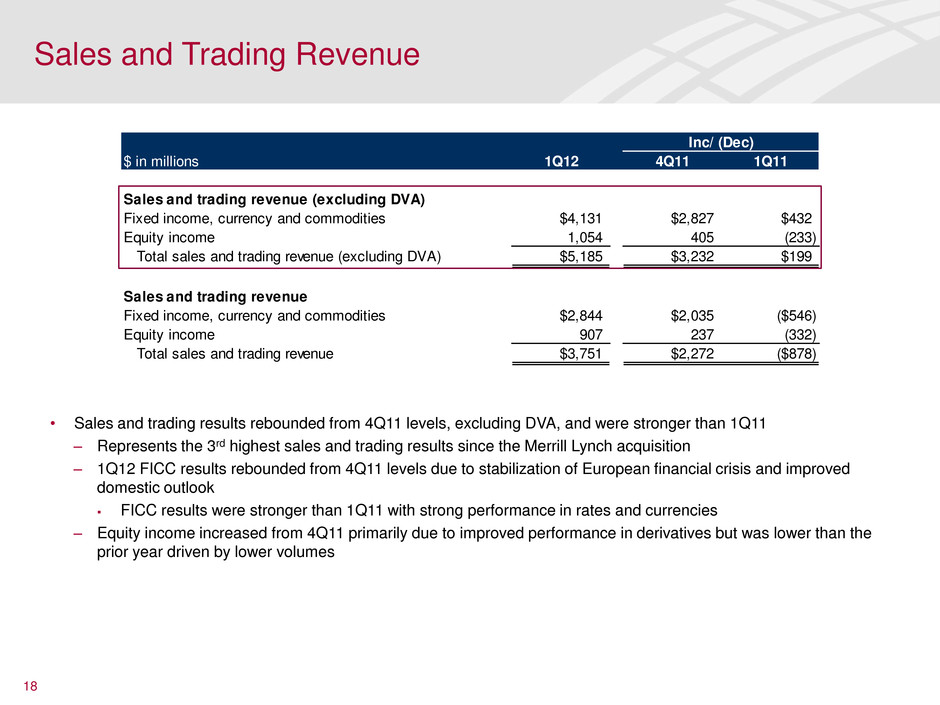

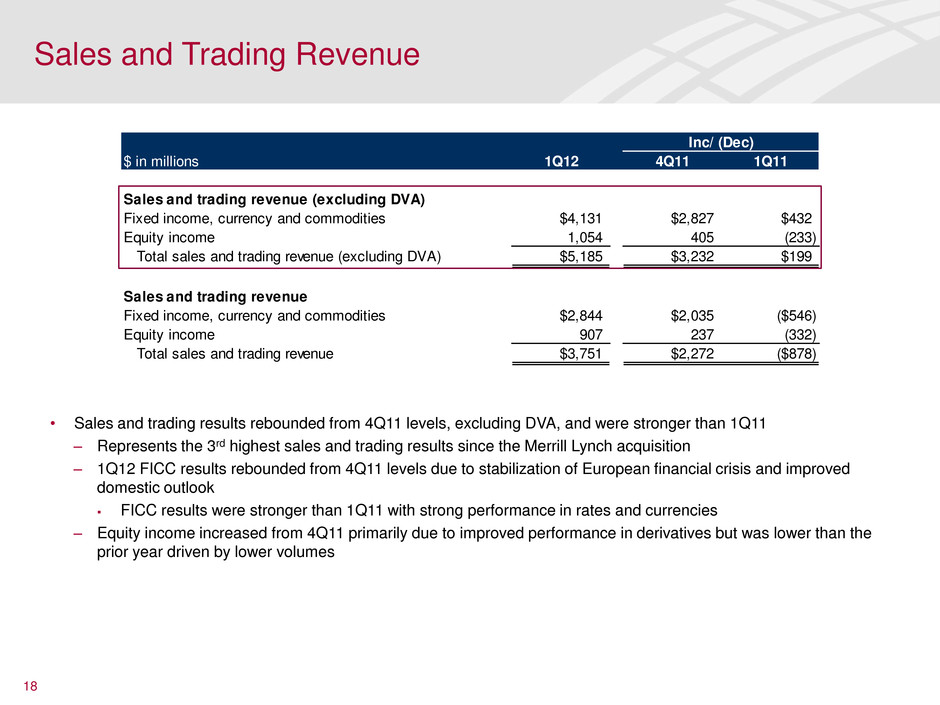

1Q12 4Q11 1Q11 Sales and trading revenue (excluding DVA) Fixed income, currency and commodities $4,131 $2,827 $432 Equity income 1,054 405 (233) Total sales and trading revenue (excluding DVA) $5,185 $3,232 $199 Sales and trading revenue Fixed income, currency and commodities $2,844 $2,035 ($546) Equity income 907 237 (332) Total sales and trading revenue $3,751 $2,272 ($878) Inc/ (Dec) $ in millions Sales and Trading Revenue 18 • Sales and trading results rebounded from 4Q11 levels, excluding DVA, and were stronger than 1Q11 – Represents the 3rd highest sales and trading results since the Merrill Lynch acquisition – 1Q12 FICC results rebounded from 4Q11 levels due to stabilization of European financial crisis and improved domestic outlook FICC results were stronger than 1Q11 with strong performance in rates and currencies – Equity income increased from 4Q11 primarily due to improved performance in derivatives but was lower than the prior year driven by lower volumes

• Net loss of $2.6B declined $4.0B from 4Q11 driven by the $3.3B negative valuation adjustment on structured liabilities and lower equity gains • Revenue was impacted by the following selected items: • Noninterest expense increased from 4Q11 primarily due to the annual retirement-eligible compensation costs and higher non-mortgage litigation expense ____________________ 1 All Other consists of two broad groupings, Equity Investments and Other. Equity Investments includes Global Principal Investments, Strategic and other investments. Other includes liquidating businesses, merger and restructuring charges, ALM functions (i.e., residential mortgage portfolio and investment securities) and related activities (i.e., economic hedges, fair value option on structured liabilities), and the impact of certain allocation methodologies. Other also includes certain residential mortgage and discontinued real estate products that are managed by Legacy Assets & Servicing within CRES. 2 FTE basis. 19 All Other 1 $ in millions 1Q12 4Q11 1Q11 Total revenue, net of interest expense 2 ($613) ($4,903) ($2,711) Provision for credit losses 1,246 454 (919) Noninterest expense 2,286 430 353 Income tax benefit 2 (1,554) (1,832) (666) Net loss ($2,591) ($3,955) ($1,479) Key Indicators ($ in billions) 1Q12 4Q11 1Q11 Average loans and le ses $264.1 $272.8 $288.3 Average deposits 39.8 46.1 50.1 Book value of Global Principal Investments 4.7 5.6 11.2 Total BAC equity invest ent exposure 17.2 19.0 49.1 Inc/(Dec) $ in millions 1Q12 4Q11 1Q11 FVO on structured liabilities ($3,314) ($814) ($586) Equity investment income 417 3,110 1,415 Gains on sales of debt securities 712 1,102 468 Gains on debt and trust preferred repurchases 1,218 1,200 - Payment protection insurance provision (200) - -

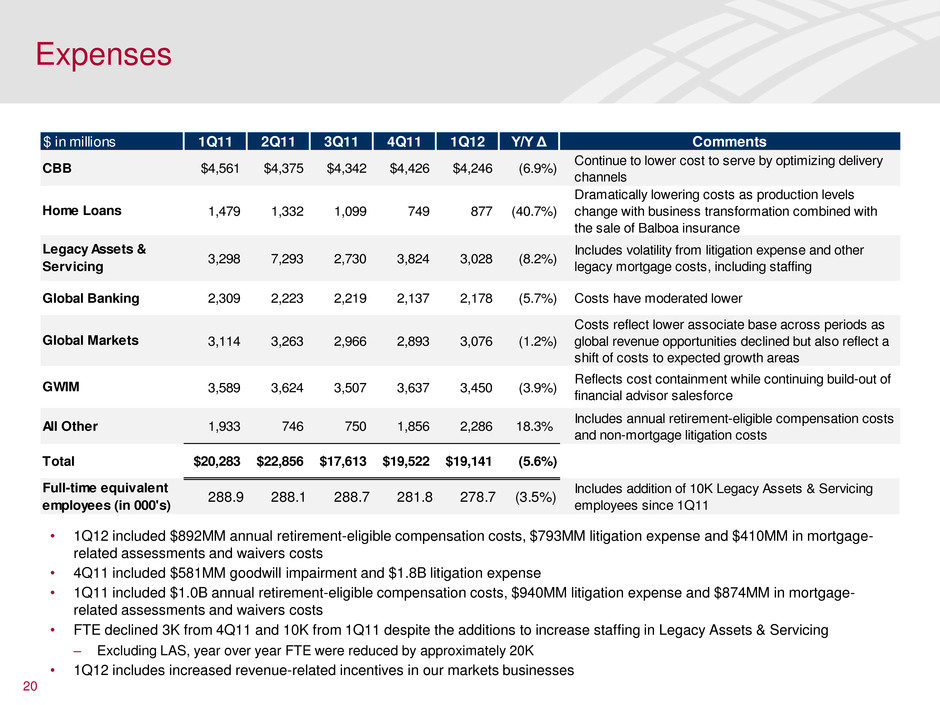

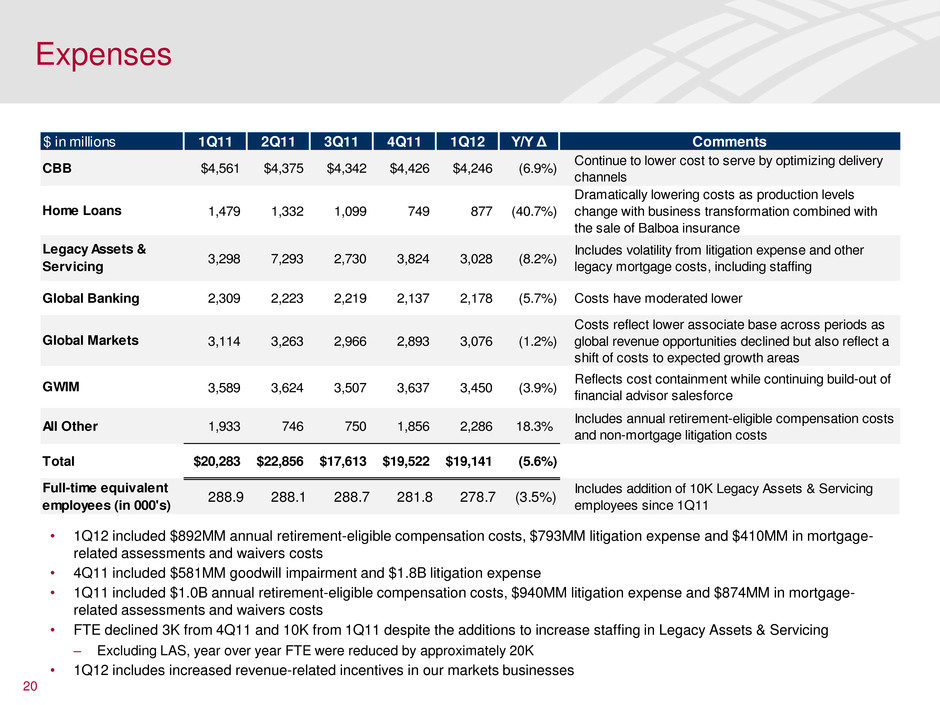

$ in millions 1Q11 2Q11 3Q11 4Q11 1Q12 Y/Y Δ CBB $4,561 $4,375 $4,342 $4,426 $4,246 (6.9%) Continue to lower cost to serve by optimizing delivery channels Home Loans 1,479 1,332 1,099 749 877 (40.7%) Dramatically lowering costs as production levels change with business transformation combined with the sale of Balboa insurance Legacy Assets & Servicing 3,298 7,293 2,730 3,824 3,028 (8.2%) Includes volatility from litigation expense and other legacy mortgage costs, including staffing Global Banking 2,309 2,223 2,219 2,137 2,178 (5.7%) Costs have moderated lower Global Markets 3,114 3,263 2,966 2,893 3,076 (1.2%) Costs reflect lower associate base across periods as global revenue opportunities declined but also reflect a shift of costs to expected growth areas GWIM 3,589 3,624 3,507 3,637 3,450 (3.9%) Reflects cost containment while continuing build-out of financial advisor salesforce All Other 1,933 746 750 1,856 2,286 18.3% Includes annual retirement-eligible compensation costs and non-mortgage litigation costs Total $20,283 $22,856 $17,613 $19,522 $19,141 (5.6%) Full-time equivalent employees (in 000's) 288.9 288.1 288.7 281.8 278.7 (3.5%) Includes addition of 10K Legacy Assets & Servicing employees since 1Q11 Comments Expenses • 1Q12 included $892MM annual retirement-eligible compensation costs, $793MM litigation expense and $410MM in mortgage- related assessments and waivers costs • 4Q11 included $581MM goodwill impairment and $1.8B litigation expense • 1Q11 included $1.0B annual retirement-eligible compensation costs, $940MM litigation expense and $874MM in mortgage- related assessments and waivers costs • FTE declined 3K from 4Q11 and 10K from 1Q11 despite the additions to increase staffing in Legacy Assets & Servicing – Excluding LAS, year over year FTE were reduced by approximately 20K • 1Q12 includes increased revenue-related incentives in our markets businesses 20

• Net charge-offs increased $149MM in 1Q12 compared to 4Q11 – 4Q11 benefitted from a sale of previously charged-off U.K. credit card loans ($289MM) – In 1Q12 we experienced continued improvement in card losses resulting from a decrease in U.S. credit card bankruptcies and seasonal trends • 30+ days performing delinquencies (excluding fully-insured consumer real estate loans) improved for the 12th consecutive quarter, down $1.9B, with $264MM of the decline due to new guidance from bank regulatory agencies to reclassify to nonperforming status, performing junior-lien loans with first-liens 90 days or more past due • Nonperforming loans and foreclosed properties increased $770MM primarily due to the impact of the above new guidance on Home Equity NPAs ($1.85B). Excluding this change, nonperforming loans and foreclosed properties continue to improve • Total provision expense was $2.6B ($3.7B charge-offs and reserve reduction of $1.1B) including a $487MM impairment to the PCI portfolio • $28.6B allowance for loan and lease losses, provides 4.88% coverage of loans (unchanged from 4Q11) – Allowance covers 1.93 times current period annualized net charge-offs compared to 2.11 times in 4Q11 (excluding PCI allowance: 1.33 times in 1Q12 vs. 1.51 times in 4Q11) 21 ____________________ 1 Excludes FHA-insured loans and other loans individually insured under long-term standby agreements. 2 Represents a non-GAAP financial measure. 3 Excludes FVO loans. Consumer Credit Trends $ in millions 4Q11 1Q11 Net charge-offs $3,687 $149 ($1,658) 30+ days performing delinquencies 1 10,173 (1,890) (4,938) Nonperforming loans and foreclosed properties 21,529 770 (258) Provision expense 2,644 (510) (1,283) Allowance for loan and lease losses 28,637 (1,011) (4,731) Allowance for loan and lease losses excl. CFC PCI 2 19,691 (1,498) (5,832) % coverage of loans and leases 3 4.88% 0 bps (38)bps % coverage of loans and leases excl. CFC PCI 2, 3 3.54% (14)bps (71)bps # times of annualized net charge-offs 1.93x (0.18)x 0.39x # times of annua ized n t charge-offs excl. CFC PCI 2 1.33x (0.18)x 0.15x 1Q12 Inc/(Dec) Consumer Net Charge-offs ($MM) $5,345 $5,162 $4,475 $3,538 $3,687 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 1Q11 2Q11 3Q11 4Q11 1Q12 Credit card Home equity Residential mortgage Direct/Indirect Other Consumer

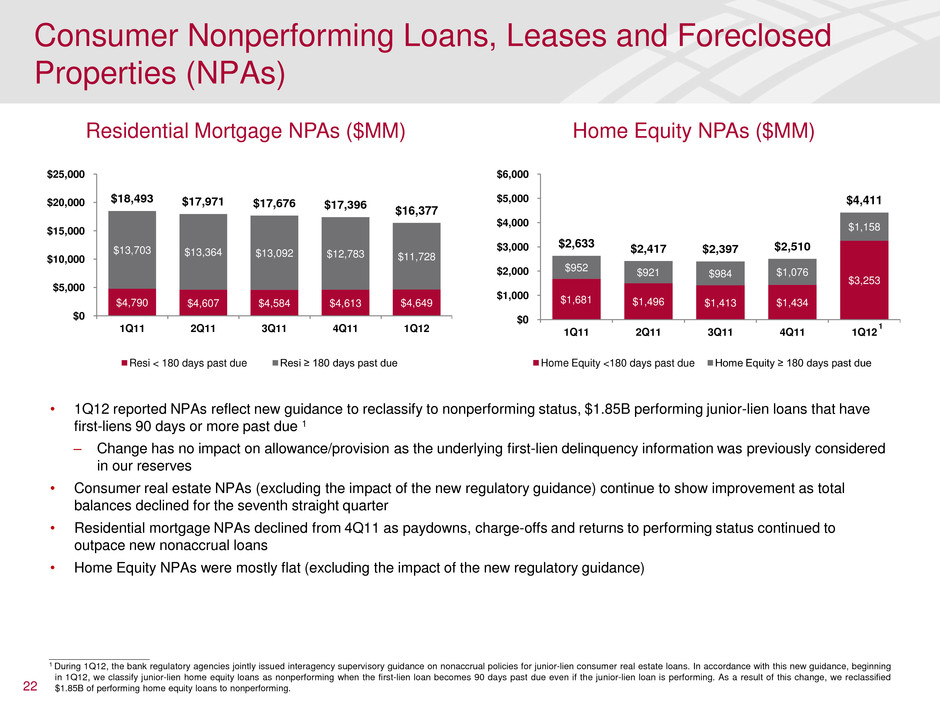

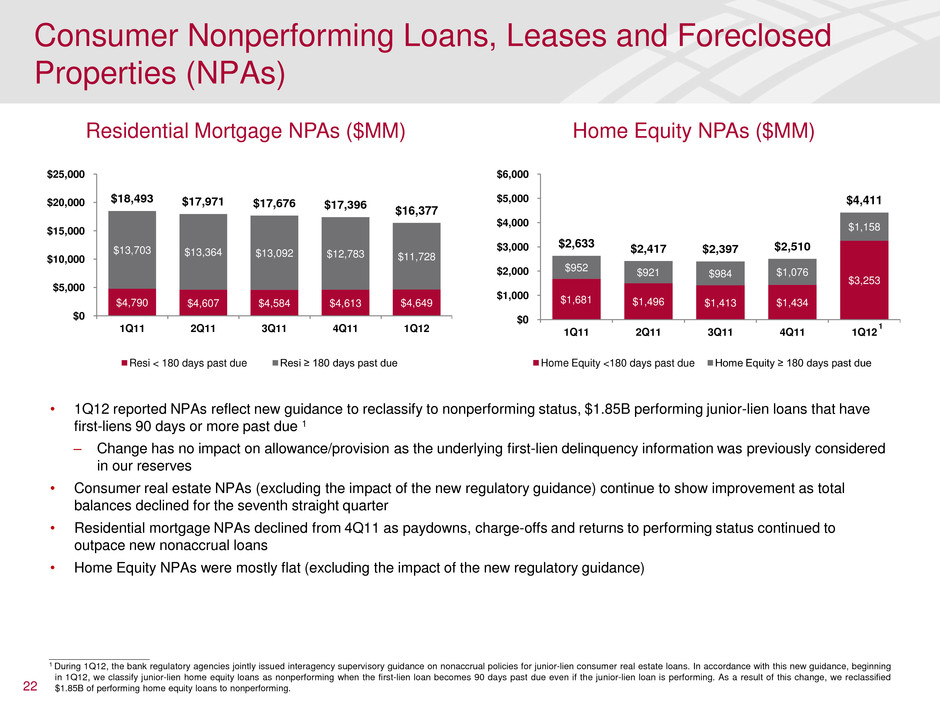

22 Residential Mortgage NPAs ($MM) Home Equity NPAs ($MM) Consumer Nonperforming Loans, Leases and Foreclosed Properties (NPAs) $4,790 $4,607 $4,584 $4,613 $4,649 $13,703 $13,364 $13,092 $12,783 $11,728 $18,493 $17,971 $17,676 $17,396 $16,377 $0 $5,000 $10,000 $15,000 $20,000 $25,000 1Q11 2Q11 3Q11 4Q11 1Q12 Resi < 180 days past due Resi ≥ 180 days past due $1,681 $1,496 $1,413 $1,434 $3,253 $952 $921 $984 $1,076 $1,158 $2,633 $2,417 $2,397 $2,510 $4,411 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 1Q11 2Q11 3Q11 4Q11 1Q12 Home Equity <180 days past due Home Equity ≥ 180 days past due • 1Q12 reported NPAs reflect new guidance to reclassify to nonperforming status, $1.85B performing junior-lien loans that have first-liens 90 days or more past due 1 – Change has no impact on allowance/provision as the underlying first-lien delinquency information was previously considered in our reserves • Consumer real estate NPAs (excluding the impact of the new regulatory guidance) continue to show improvement as total balances declined for the seventh straight quarter • Residential mortgage NPAs declined from 4Q11 as paydowns, charge-offs and returns to performing status continued to outpace new nonaccrual loans • Home Equity NPAs were mostly flat (excluding the impact of the new regulatory guidance) ____________________ 1 During 1Q12, the bank regulatory agencies jointly issued interagency supervisory guidance on nonaccrual policies for junior-lien consumer real estate loans. In accordance with this new guidance, beginning in 1Q12, we classify junior-lien home equity loans as nonperforming when the first-lien loan becomes 90 days past due even if the junior-lien loan is performing. As a result of this change, we reclassified $1.85B of performing home equity loans to nonperforming. 1

23 ____________________ 1 Excludes FHA-insured loans and other loans individually insured under long-term standby agreements. 2 Excludes PCI loans. 3 During 1Q12, the bank regulatory agencies jointly issued interagency supervisory guidance on nonaccrual policies for junior-lien consumer real estate loans. In accordance with this new guidance, beginning in 1Q12, we classify junior-lien home equity loans as nonperforming when the first-lien loan becomes 90 days past due even if the junior-lien loan is performing. The reclassification resulted in a decrease of $264MM in home equity loans 30+ days performing past due. Residential Mortgage, 30+ Days Performing Past Due ($B,%) 1, 2 Home Equity, 30+ Days Performing Past Due ($B,%) 2 Residential Mortgage and Home Equity 30+ Days Performing Delinquencies $4.0 $7.5 $5.9 $4.4 $4.3 $4.0 $4.0 $3.3 1.5% 3.0% 2.8% 2.6% 2.5% 2.4% 2.5% 2.2% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% $2.5 $3.5 $4.5 $5.5 $6.5 $7.5 $8.5 1Q08 1Q09 1Q10 1Q11 2Q11 3Q11 4Q11 1Q12 30+ days past due 30+ days past due % $1.6 $2.6 $2.2 $1.8 $1.7 $1.7 $1.7 $1.3 1.3% 1.8% 1.6% 1.5% 1.4% 1.5% 1.5% 1.2% 0.0% 0.5% 1.0% 1.5% 2.0% $1.0 $1.5 $2.0 $2.5 $3.0 1Q08 1Q09 1Q10 1Q11 2Q11 3Q11 4Q11 1Q12 30+ days past due 30+ days past due % 3

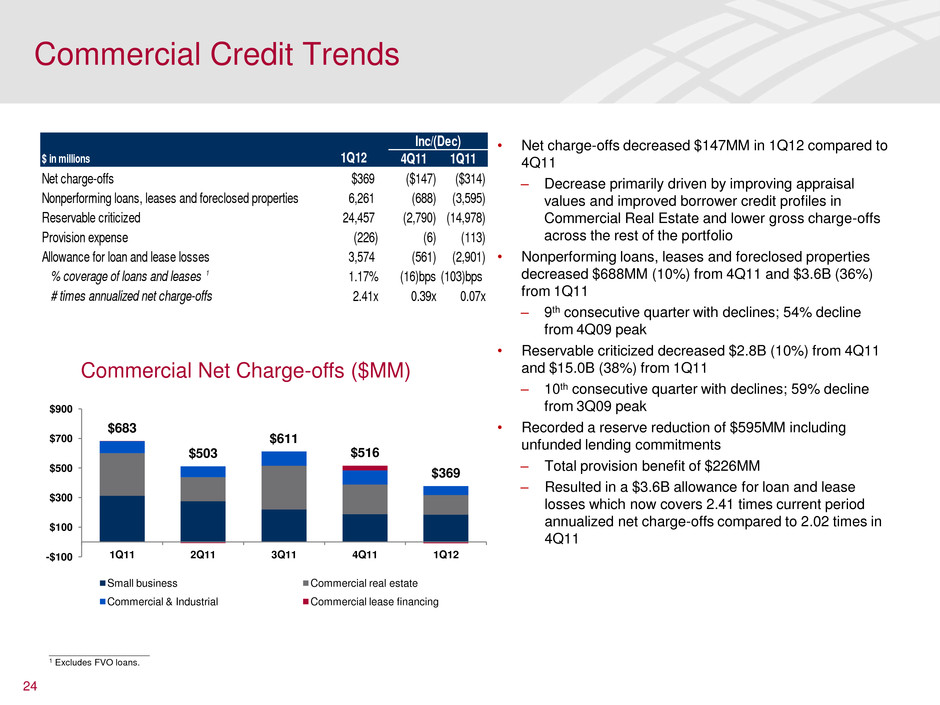

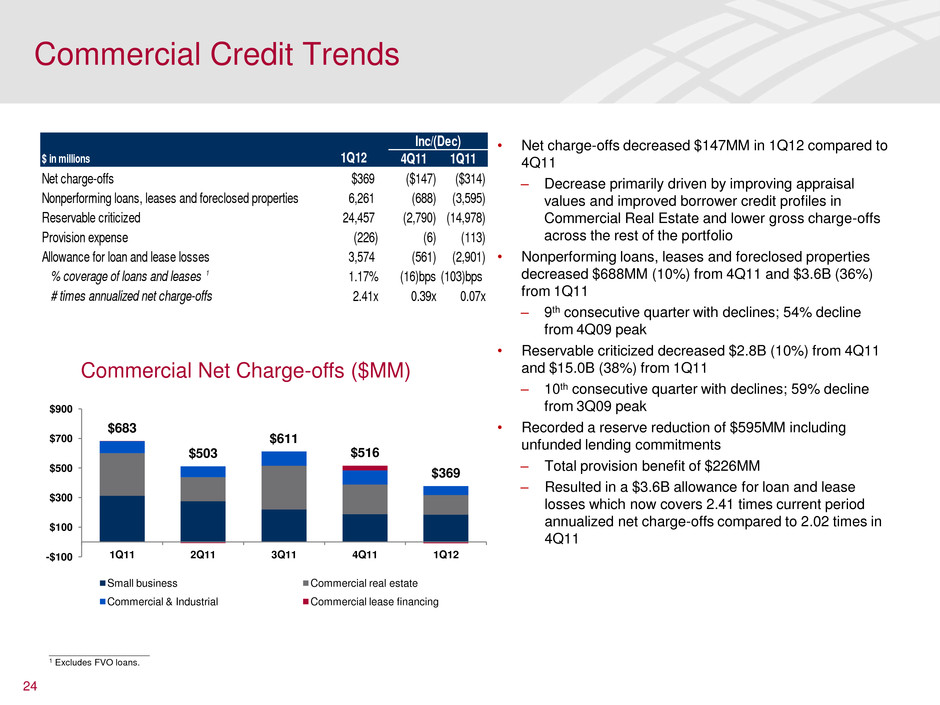

• Net charge-offs decreased $147MM in 1Q12 compared to 4Q11 – Decrease primarily driven by improving appraisal values and improved borrower credit profiles in Commercial Real Estate and lower gross charge-offs across the rest of the portfolio • Nonperforming loans, leases and foreclosed properties decreased $688MM (10%) from 4Q11 and $3.6B (36%) from 1Q11 – 9th consecutive quarter with declines; 54% decline from 4Q09 peak • Reservable criticized decreased $2.8B (10%) from 4Q11 and $15.0B (38%) from 1Q11 – 10th consecutive quarter with declines; 59% decline from 3Q09 peak • Recorded a reserve reduction of $595MM including unfunded lending commitments – Total provision benefit of $226MM – Resulted in a $3.6B allowance for loan and lease losses which now covers 2.41 times current period annualized net charge-offs compared to 2.02 times in 4Q11 24 ____________________ 1 Excludes FVO loans. Commercial Credit Trends $ in millions 4Q11 1Q11 Net charge-offs $369 ($147) ($314) Nonperforming loans, leases and foreclosed properties 6,261 (688) (3,595) Reservable criticized 24,457 (2,790) (14,978) Provision expense (226) (6) (113) Allowance for loan and lease losses 3,574 (561) (2,901) % coverage of lo ns and leases 1 1.17% (16)bps (103)bps # times annualized net charge-offs 2.41x 0.39x 0.07x 1Q12 Inc/(Dec) Commercial Net Charge-offs ($MM) $683 $503 $611 $516 $369 -$100 $100 $300 $500 $700 $900 1Q11 2Q11 3Q11 4Q11 1Q12 Small business Commercial real estate Commercial & Industrial Commercial lease financing

Appendix

____________________ 1 FTE basis. FTE basis for the Total Corporation and pre-tax, pre-provision are non-GAAP financial measures. 2 For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 26 1Q12 Results by Business Segment $ in millions Total Corporation CBB CRES GWIM Global Banking Global Markets All Other Net interest income 1, 2 $11,053 $5,079 $775 $1,578 $2,399 $798 $424 Card income 1,457 1,278 - 3 89 - 87 Service charges 1,912 1,063 - 24 809 13 3 Investment and brokerage services 2,876 46 - 2,296 34 510 (10) Investment banking income (loss) 1,217 2 - 76 652 556 (69) Equity investment income 765 25 - 13 13 297 417 Trading account profits (losses) 2,075 (1) - 41 (15) 2,038 12 Mortgage banking income (loss) 1,612 - 1,831 8 - 13 (240) Insurance income (loss) (60) 27 6 79 1 - (173) Gains on sales of debt securities 752 - 2 - 2 36 712 All other income (loss) (1,174) (99) 60 242 467 (68) (1,776) Total noninterest income 11,432 2,341 1,899 2,782 2,052 3,395 (1,037) Total revenue, net of interest expense 1, 2 22,485 7,420 2,674 4,360 4,451 4,193 (613) Total noninterest expense 19,141 4,246 3,905 3,450 2,178 3,076 2,286 Pre-tax, pre-provision earnings (loss) 1 3,344 3,174 (1,231) 910 2,273 1,117 (2,899) Provision for credit losses 2,418 877 507 46 (238) (20) 1,246 Income (loss) before income taxes 926 2,297 (1,738) 864 2,511 1,137 (4,145) Income tax expense (benefit) 1, 2 273 843 (593) 317 921 339 (1,554) Net income (loss) $653 $1,454 ($1,145) $547 $1,590 $798 ($2,591)

27 ____________________ 1 FTE basis. 2 Economic capital represents allocated equity less goodwill and a percentage of intangible assets. Represents a non-GAAP financial measure. For reconciliation to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 3 Total earning assets and total assets include asset allocations to match liabilities (i.e., deposits) for total CBB, Deposits and Business Banking. Card Services does not require as asset allocation. As a result, the sum of the businesses does not agree to total CBB results. n/m = not meaningful CBB Financial Results Net interest income 1 $2,119 $2,616 $344 $5,079 Noninterest income: Card income - 1,278 - 1,278 Service charges 968 - 95 1,063 All other income 60 (85) 25 - Total noninterest income 1,028 1,193 120 2,341 Total revenue, net of interest expense 1 3,147 3,809 464 7,420 Provision for credit losses 51 790 36 877 Noninterest expense 2,606 1,380 260 4,246 Income before income taxes 490 1,639 168 2,297 Income tax expense 1 180 601 62 843 Net income $310 $1,038 $106 $1,454 Net interest yield 1 2.02% 8.95% 2.93% 4.22% Return on average allocated equity 5.37% 20.19% 4.73% 11.05% Return on average economic capital 2 23.71% 41.14% 6.14% 26.15% Efficiency ratio 1 82.83% 36.22% 56.04% 57.23% Balance Sheet Average Total loans and leases n/m $116,267 $24,603 $141,578 Total earning assets 3 $421,551 117,580 47,145 483,983 Total assets 3 447,917 123,179 54,272 523,074 Total deposits 424,023 n/m 41,908 466,239 Allocated equity 23,194 20,671 9,082 52,947 Economic capital 2 5,262 10,179 6,983 22,424 Period end Total loans and leases n/m $113,861 $24,376 $138,909 Total earning assets 3 $440,491 115,177 47,325 502,124 Total assets 3 467,058 121,425 55,575 543,189 Total deposits 443,129 n/m 42,221 486,160 $ in millions Total CBBDeposits Card Services Business Banking 1Q12

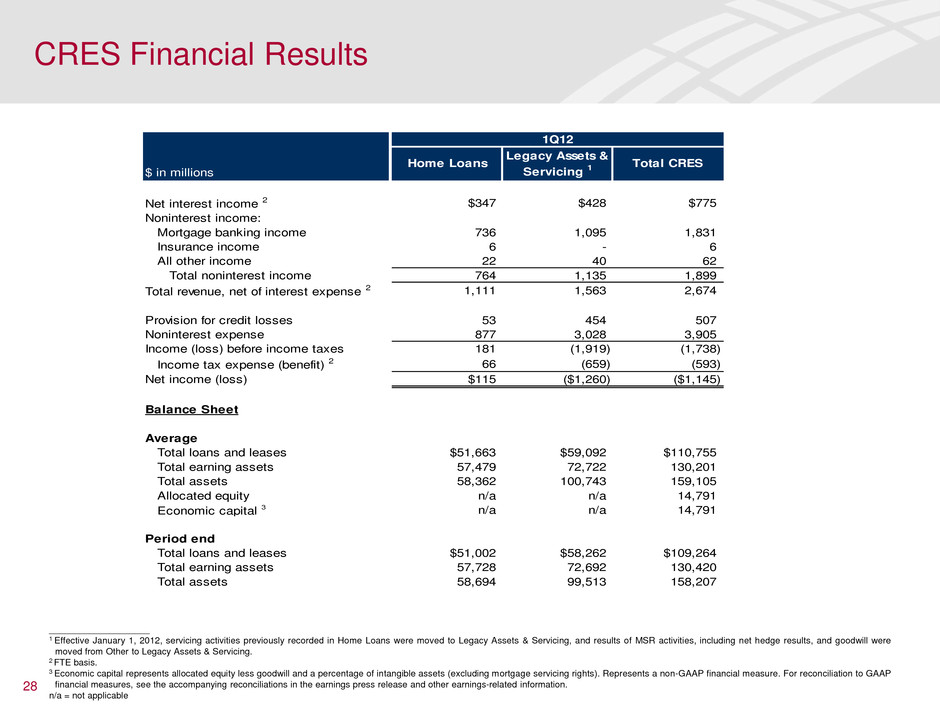

28 ____________________ 1 Effective January 1, 2012, servicing activities previously recorded in Home Loans were moved to Legacy Assets & Servicing, and results of MSR activities, including net hedge results, and goodwill were moved from Other to Legacy Assets & Servicing. 2 FTE basis. 3 Economic capital represents allocated equity less goodwill and a percentage of intangible assets (excluding mortgage servicing rights). Represents a non-GAAP financial measure. For reconciliation to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. n/a = not applicable CRES Financial Results Net interest income 2 $347 $428 $775 Noninterest income: Mortgage banking income 736 1,095 1,831 Insurance income 6 - 6 All other income 22 40 62 Total noninterest income 764 1,135 1,899 Total revenue, net of interest expense 2 1,111 1,563 2,674 Provision for credit losses 53 454 507 Noninterest expense 877 3,028 3,905 Income (loss) before income taxes 181 (1,919) (1,738) Income tax expense (benefit) 2 66 (659) (593) Net income (loss) $115 ($1,260) ($1,145) Balance Sheet Average Total loans and leases $51,663 $59,092 $110,755 Total earning assets 57,479 72,722 130,201 Total assets 58,362 100,743 159,105 Allocated equity n/a n/a 14,791 Economic capital 3 n/a n/a 14,791 Period end Total loans and leases $51,002 $58,262 $109,264 Total earning assets 57,728 72,692 130,420 Total assets 58,694 99,513 158,207 $ in millions Total CRESHome Loans Legacy Assets & Servicing 1 1Q12

Representations and Warranties Information

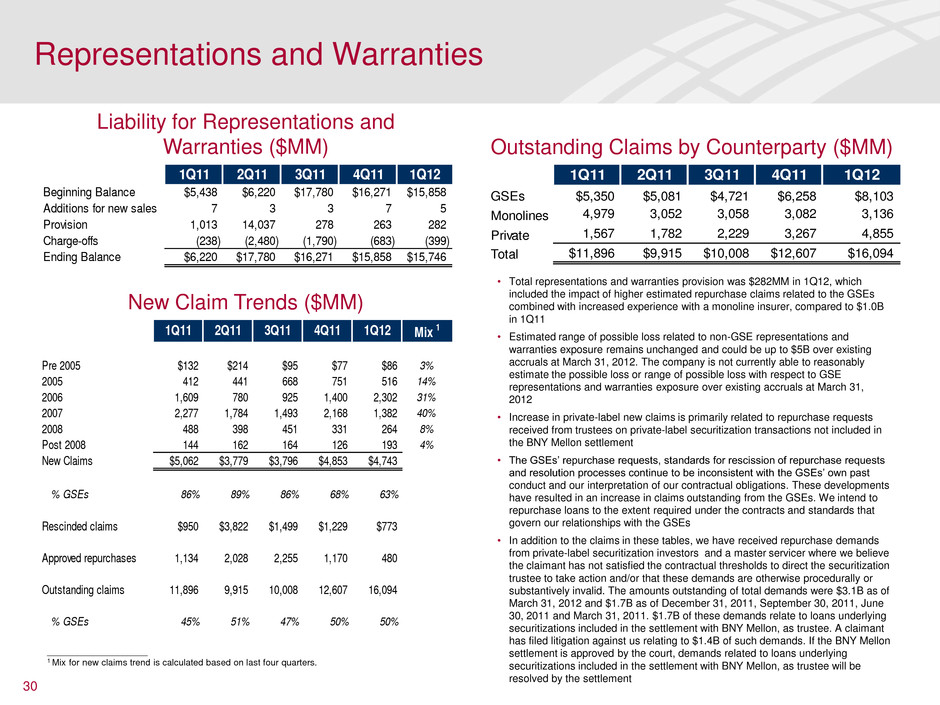

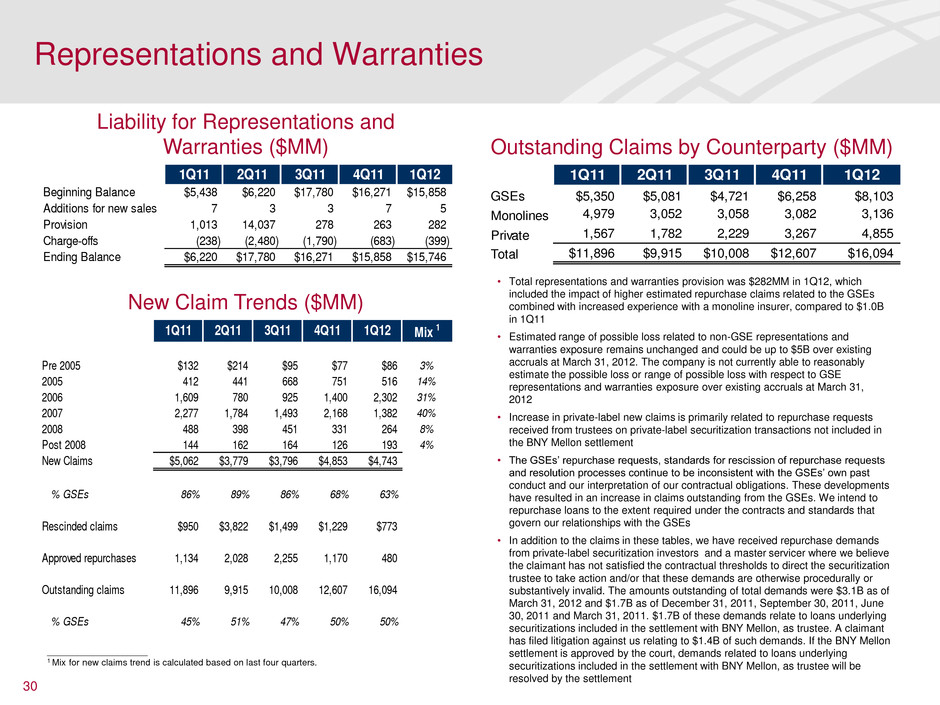

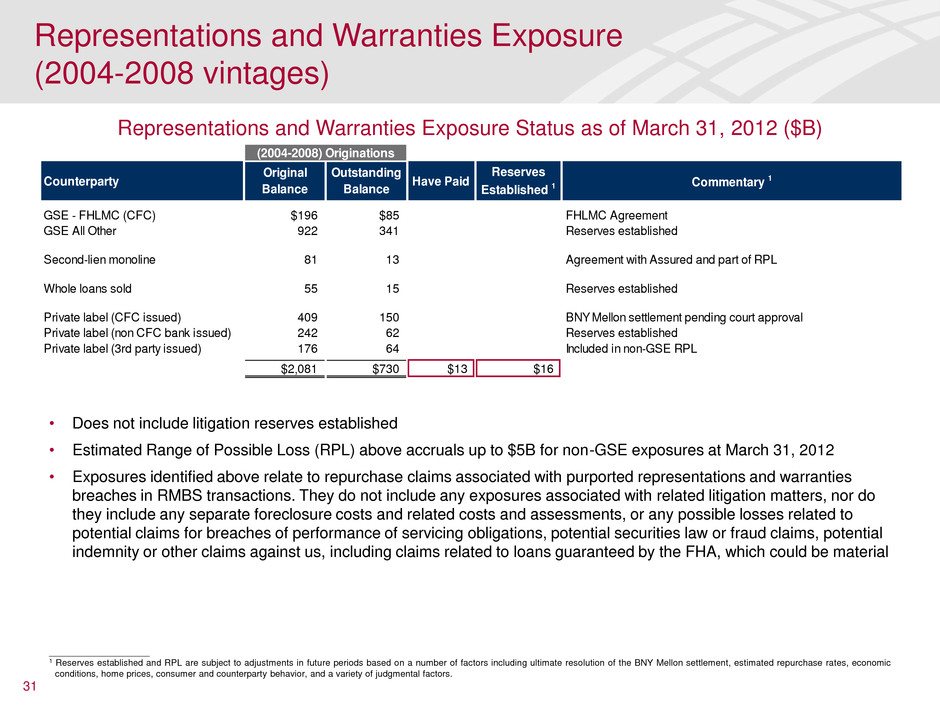

1Q11 2Q11 3Q11 4Q11 1Q12 GSEs $5,350 $5,081 $4,721 $6,258 $8,103 Monolines 4,979 3,052 3,058 3,082 3,136 Private 1,567 1,782 2,229 3,267 4,855 Total $11,896 $9,915 $10,008 $12,607 $16,094 • Total representations and warranties provision was $282MM in 1Q12, which included the impact of higher estimated repurchase claims related to the GSEs combined with increased experience with a monoline insurer, compared to $1.0B in 1Q11 • Estimated range of possible loss related to non-GSE representations and warranties exposure remains unchanged and could be up to $5B over existing accruals at March 31, 2012. The company is not currently able to reasonably estimate the possible loss or range of possible loss with respect to GSE representations and warranties exposure over existing accruals at March 31, 2012 • Increase in private-label new claims is primarily related to repurchase requests received from trustees on private-label securitization transactions not included in the BNY Mellon settlement • The GSEs’ repurchase requests, standards for rescission of repurchase requests and resolution processes continue to be inconsistent with the GSEs’ own past conduct and our interpretation of our contractual obligations. These developments have resulted in an increase in claims outstanding from the GSEs. We intend to repurchase loans to the extent required under the contracts and standards that govern our relationships with the GSEs • In addition to the claims in these tables, we have received repurchase demands from private-label securitization investors and a master servicer where we believe the claimant has not satisfied the contractual thresholds to direct the securitization trustee to take action and/or that these demands are otherwise procedurally or substantively invalid. The amounts outstanding of total demands were $3.1B as of March 31, 2012 and $1.7B as of December 31, 2011, September 30, 2011, June 30, 2011 and March 31, 2011. $1.7B of these demands relate to loans underlying securitizations included in the settlement with BNY Mellon, as trustee. A claimant has filed litigation against us relating to $1.4B of such demands. If the BNY Mellon settlement is approved by the court, demands related to loans underlying securitizations included in the settlement with BNY Mellon, as trustee will be resolved by the settlement 30 Liability for Representations and Warranties ($MM) Outstanding Claims by Counterparty ($MM) New Claim Trends ($MM) Representations and Warranties 1Q1 2Q11 3Q11 4Q11 1Q12 Beginning Balance $5,438 $6,220 $17,780 $16,271 $15,858 Additions for new sales 7 3 3 7 5 Provision 1,013 14,037 278 26 282 Charge-offs (238) (2,480) (1,790) (68 ) (399) Ending Balance $6,220 $17,780 $16,271 $15,858 $15,746 1Q11 2Q11 3Q11 4Q11 1Q12 Mix 1 Pre 2005 $132 $214 $95 $77 $86 3% 2005 412 441 668 751 516 14% 2006 1,609 780 925 1,400 2,302 31% 2007 2,277 1,784 1,493 2,168 1,382 40% 2008 488 398 451 331 264 8% Post 2008 144 162 164 126 193 4% New Claims $5,062 $3,779 $3,796 $4,853 $4,743 % GSEs 86% 89% 86% 68% 63% Rescinded claims $950 $3,822 $1,499 $1,229 $773 Approved repurchas 1,134 2,028 2,255 1,170 480 Outstanding claims 11,896 9,915 10,008 12,607 16,094 % GSEs 45% 51% 47% 50% 50% ____________________ 1 Mix for new claims trend is calculated based on last four quarters.

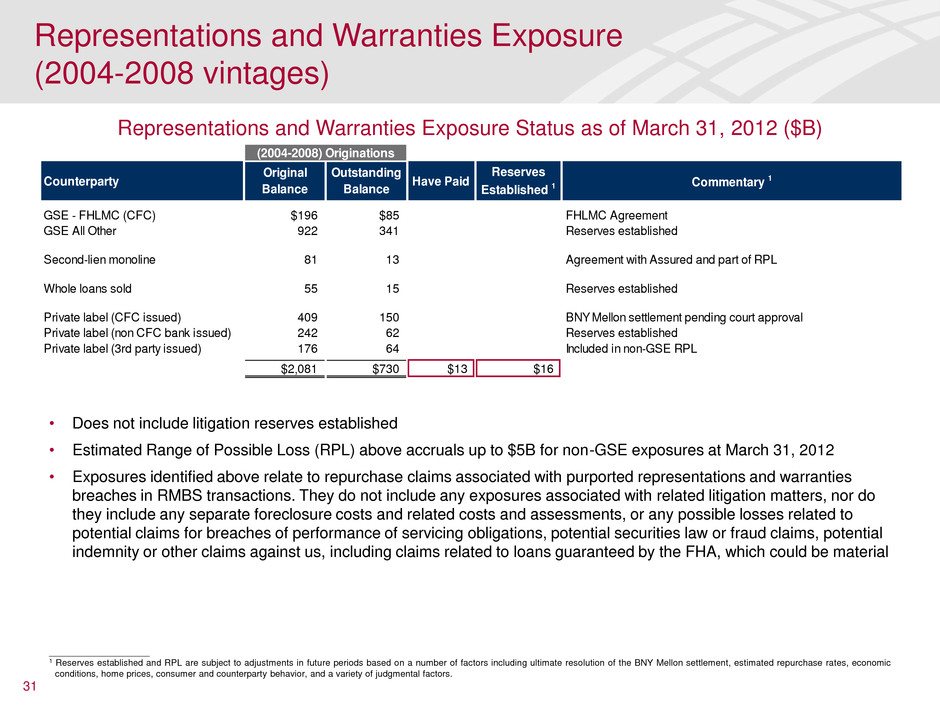

• Does not include litigation reserves established • Estimated Range of Possible Loss (RPL) above accruals up to $5B for non-GSE exposures at March 31, 2012 • Exposures identified above relate to repurchase claims associated with purported representations and warranties breaches in RMBS transactions. They do not include any exposures associated with related litigation matters, nor do they include any separate foreclosure costs and related costs and assessments, or any possible losses related to potential claims for breaches of performance of servicing obligations, potential securities law or fraud claims, potential indemnity or other claims against us, including claims related to loans guaranteed by the FHA, which could be material 31 ____________________ 1 Reserves established and RPL are subject to adjustments in future periods based on a number of factors including ultimate resolution of the BNY Mellon settlement, estimated repurchase rates, economic conditions, home prices, consumer and counterparty behavior, and a variety of judgmental factors. Representations and Warranties Exposure Status as of March 31, 2012 ($B) Representations and Warranties Exposure (2004-2008 vintages) Counterparty Original Balance Outstanding Balance Have Paid Reserves Established 1 Commentary 1 GSE - FHLMC (CFC) $196 $85 FHLMC Agreement GSE All Other 922 341 Reserves established Second-lien monoline 81 13 Agreement with Assured and part of RPL Whole loans sold 55 15 Reserves established Private l bel (CFC issued) 409 150 BNY Mellon settlement pending court approval Private label (non CFC bank issued) 242 62 Reserves established Private label (3rd party issued) 176 64 Included in non-GSE RPL $2,081 $730 $13 $16 (2004-2008) Originations

Additional Asset Quality Information

33 ____________________ 1 Includes FHA-insured loans and loans individually insured under long-term standby agreements. 2 Excludes PCI loans. FHA and Other Fully-insured Consumer Real Estate Loans ($MM) • During 1Q12, our 30+ days performing delinquency trends continued to improve – Total consumer 30+ days performing delinquency excluding fully-insured consumer real estate loans improved for the 12th consecutive quarter, down $1.9B – Residential Mortgage ($654MM excluding FHA and other fully-insured consumer real estate loans) led the decline followed by total consumer credit card ($512MM) and home equity ($364MM) – Home Equity decrease included $264MM in 1Q12 to reclassify to nonperforming status performing junior-lien loans that have first-liens 90 days or more past due as determined by new regulatory guidance. (Decrease to performing as loans now considered nonperforming) Impact of FHA and Other Fully-insured Consumer Real Estate Loans on Delinquencies 1 1Q12 4Q11 3Q11 2Q11 1Q11 FHA and Other Fully-insured Consumer Real Estate Loans 30+ Days Performing Delinquencies $24,094 $24,738 $24,140 $23,802 $22,961 Change from prior period (644) 598 338 841 3,811 30+ Days Performing Delinquency Amounts Total consumer as reported $34,267 $36,801 $36,692 $37,319 $38,072 Total consumer excluding FHA and other fully-insured consumer real estate loans 2 10,173 12,063 12,552 13,517 15,111 Residential mortgages as reported 27,390 28,688 28,146 28,091 27,381 Residential mortgages excluding FHA and other fully-insured consumer real estate loans 2 3,296 3,950 4,006 4,289 4,420 30+ Days Performing Delinquency Ratios Total consumer as reported 5.84% 6.06% 5.94% 5.90% 6.00% Total consumer excluding FHA and other fully-insured consumer real estate loans 2 2.20% 2.51% 2.54% 2.63% 2.90% Residential mortgages as reported 10.68% 10.94% 10.56% 10.55% 10.45% Residential mortgages excluding FHA and other fully-insured consumer real estate loans 2 2.16% 2.49% 2.44% 2.52% 2.57%

34 ____________________ 1 Excludes FVO loans. 2 Loan-to-value (LTV) calculations apply to the residential mortgage portfolio. Combined loan-to-value (CLTV) calculations apply to the home equity portfolio. 3 As of 1Q12, home equity FICO metrics are based on FICO 08. Previous periods were reported using FICO 04 and have been restated. Residential mortgage FICO scores remain on FICO 04. Home Loans Asset Quality Key Indicators As Reported Excluding Countrywide Purchased Credit- impaired and Fully- insured Loans As Reported Excluding Countrywide Purchased Credit- impaired and Fully- insured Loans As Reported Excluding Countrywide Purchased Credit- impaired As Reported Excluding Countrywide Purchased Credit- impaired Loans end of period $256,431 $152,645 $262,290 $158,470 $121,246 $109,428 $124,699 $112,721 Loans average 259,672 156,203 264,992 161,585 122,933 111,072 126,251 114,226 Net charge-offs $898 $898 $834 $834 $957 $957 $939 $939 % of average loans 1.39% 2.31% 1.25% 2.05% 3.13% 3.47% 2.95% 3.27% Allowance for loan losses $6,141 $4,514 $5,935 $4,604 $12,701 $7,466 $13,094 $7,965 % of loans 2.39% 2.96% 2.26% 2.91% 10.48% 6.82% 10.50% 7.07% Average refreshed (C)LTV 2 83 83 86 86 90%+ refreshed (C)LTV 2 36% 37% 44% 43% Average refreshed FICO 3 719 716 742 742 % below 620 FICO 3 15% 15% 9% 9% $ in millions Residential Mortgage 1 Home Equity 1Q12 4Q11 1Q12 4Q11

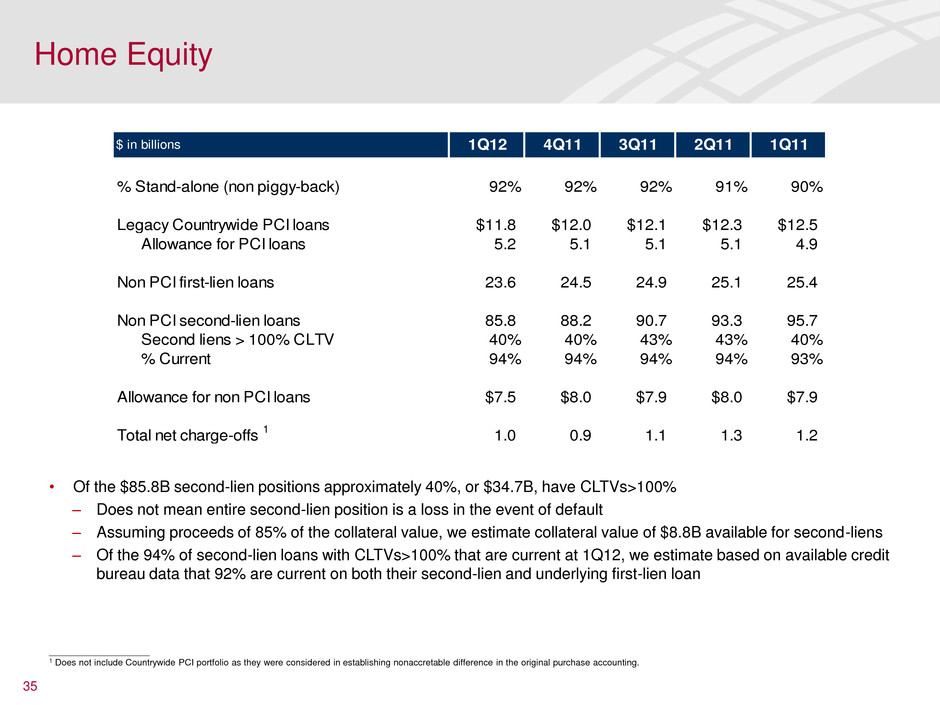

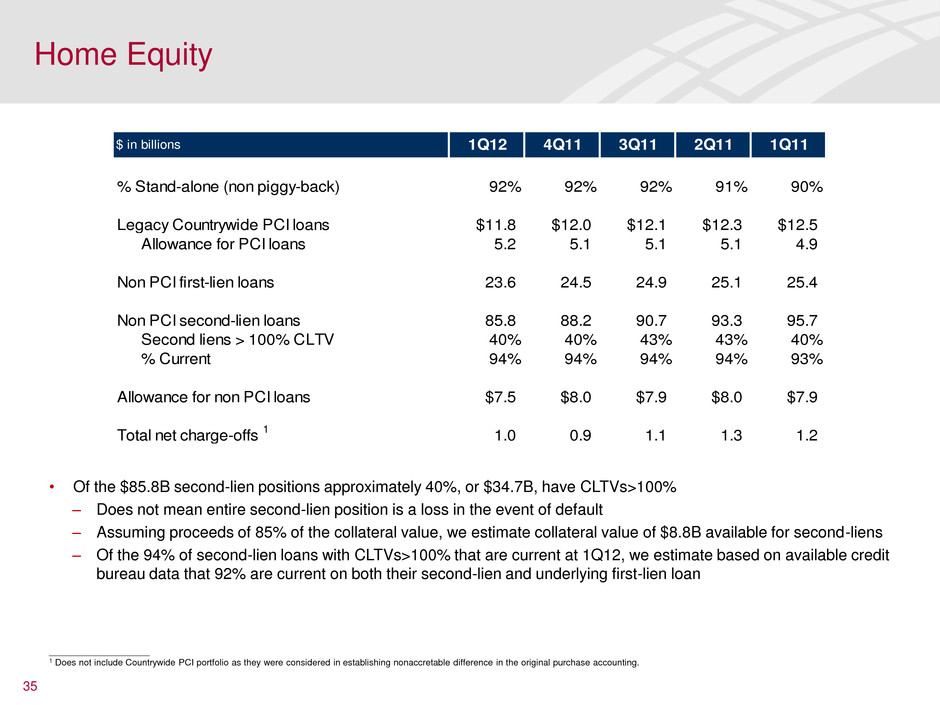

35 Home Equity • Of the $85.8B second-lien positions approximately 40%, or $34.7B, have CLTVs>100% – Does not mean entire second-lien position is a loss in the event of default – Assuming proceeds of 85% of the collateral value, we estimate collateral value of $8.8B available for second-liens – Of the 94% of second-lien loans with CLTVs>100% that are current at 1Q12, we estimate based on available credit bureau data that 92% are current on both their second-lien and underlying first-lien loan ____________________ 1 Does not include Countrywide PCI portfolio as they were considered in establishing nonaccretable difference in the original purchase accounting. $ in billions 1Q12 4Q11 3Q11 2Q11 1Q11 % Stand-alone (non piggy-back) 92% 92% 92% 91% 90% Legacy Countrywide PCI loans $11.8 $12.0 $12.1 $12.3 $12.5 Allowance for PCI loans 5.2 5.1 5.1 5.1 4.9 Non PCI first-lien loans 23.6 24.5 24.9 25.1 25.4 Non PCI second-lien loans 85.8 88.2 90.7 93.3 95.7 Second liens > 100% CLTV 40% 40% 43% 43% 40% % Current 94% 94% 94% 94% 93% Allowance for non PCI loans $7.5 $8.0 $7.9 $8.0 $7.9 Total net charge-offs 1 1.0 0.9 1.1 1.3 1.2