Exhibit 99.2

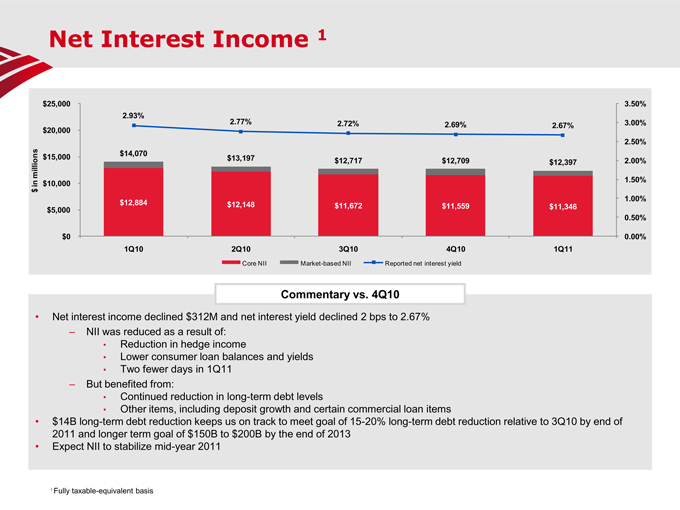

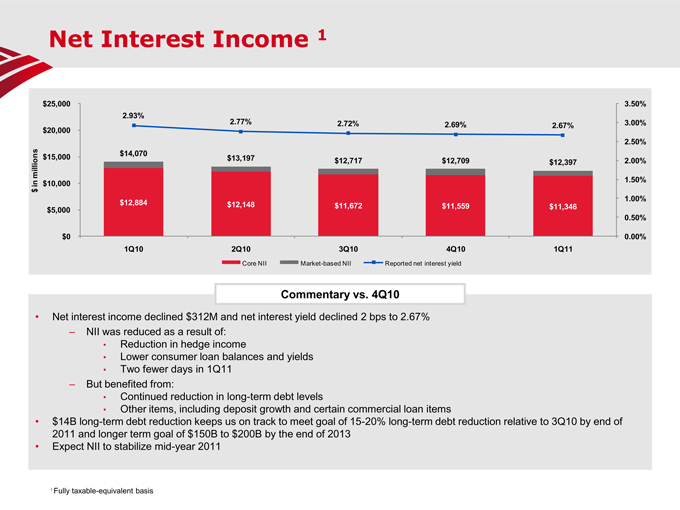

Net Interest Income 1

$25,000 3.50%

2.93%

$20,000 2.77% 2.72% 2.69% 2.67% 3.00%

2.50%

$14,070

millions $15,000 $13,197 $12,717 $12,709 $12,397 2.00%

in $10,000 1.50%

$ 1.00%

$5,000 $12,884 $12,148 $11,672 $11,559 $11,346

0.50%

$0 0.00%

1Q10 2Q10 3Q10 4Q10 1Q11

Core NII Market-based NII Reported net interest yield

Commentary vs. 4Q10

• Net interest income declined $312M and net interest yield declined 2 bps to 2.67%

– NII was reduced as a result of:

• Reduction in hedge income

• Lower consumer loan balances and yields

• Two fewer days in 1Q11

– But benefited from:

• Continued reduction in long-term debt levels

• Other items, including deposit growth and certain commercial loan items

• $14B long-term debt reduction keeps us on track to meet goal of 15-20% long-term debt reduction relative to 3Q10 by end of 2011 and longer term goal of $150B to $200B by the end of 2013

• Expect NII to stabilize mid-year 2011

1 Fully taxable-equivalent basis

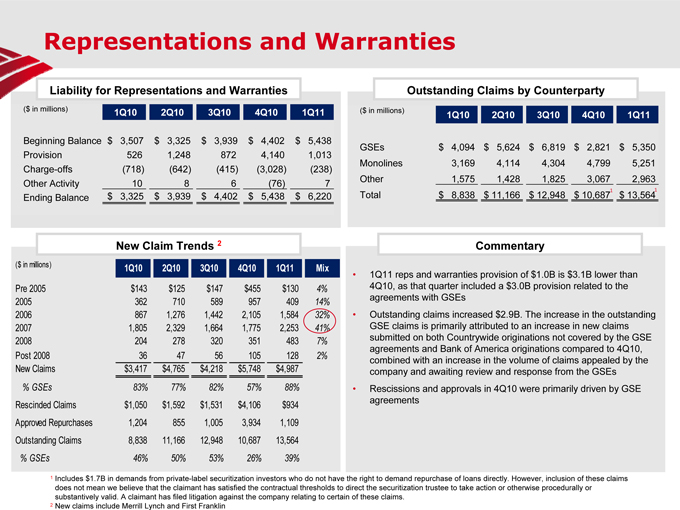

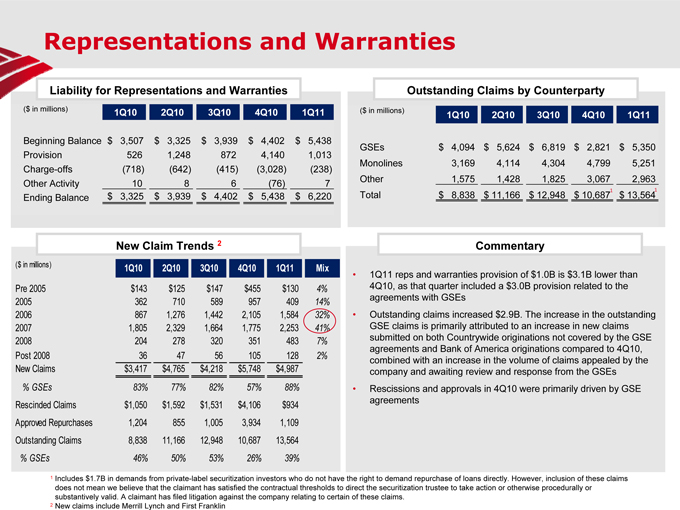

Representations and Warranties

Liability for Representations and Warranties

($ in millions) 1Q10 2Q10 3Q10 4Q10 1Q11

Beginning Balance $ 3,507 $ 3,325 $ 3,939 $ 4,402 $ 5,438

Provision 526 1,248 872 4,140 1,013

Charge-offs (718) (642) (415) (3,028) (238)

Other Activity 10 8 6 (76) 7

Ending Balance $ 3,325 $ 3,939 $ 4,402 $ 5,438 $ 6,220

New Claim Trends 2

($ in millions) 1Q10 2Q10 3Q10 4Q10 1Q11 Mix

Pre 2005 $143 $125 $147 $455 $130 4%

2005 362 710 589 957 409 14%

2006 867 1,276 1,442 2,105 1,584 32%

2007 1,805 2,329 1,664 1,775 2,253 41%

2008 204 278 320 351 483 7%

Post 2008 36 47 56 105 128 2%

New Claims $3,417 $4,765 $4,218 $5,748 $4,987

% GSEs 83% 77% 82% 57% 88%

Rescinded Claims $1,050 $1,592 $1,531 $4,106 $934

Approved Repurchases 1,204 855 1,005 3,934 1,109

Outstanding Claims 8,838 11,166 12,948 10,687 13,564

% GSEs 46% 50% 53% 26% 39%

Outstanding Claims by Counterparty

($ in millions) 1Q10 2Q10 3Q10 4Q10 1Q11

GSEs $ 4,094 $ 5,624 $ 6,819 $ 2,821 $ 5,350

Monolines 3,169 4,114 4,304 4,799 5,251

Other 1,575 1,428 1,825 3,067 2,963

Total $ 8,838 $ 11,166 $ 12,948 $ 10,6871 $ 13,5641

Commentary

1Q11 reps and warranties provision of $1.0B is $3.1B lower than 4Q10, as that quarter included a $3.0B provision related to the agreements with GSEs

Outstanding claims increased $2.9B. The increase in the outstanding GSE claims is primarily attributed to an increase in new claims submitted on both Countrywide originations not covered by the GSE agreements and Bank of America originations compared to 4Q10, combined with an increase in the volume of claims appealed by the company and awaiting review and response from the GSEs

Rescissions and approvals in 4Q10 were primarily driven by GSE agreements

1 Includes $1.7B in demands from private-label securitization investors who do not have the right to demand repurchase of loans directly. However, inclusion of these claims does not mean we believe that the claimant has satisfied the contractual thresholds to direct the securitization trustee to take action or otherwise procedurally or substantively valid. A claimant has filed litigation against the company relating to certain of these claims.

2 New claims include Merrill Lynch and First Franklin

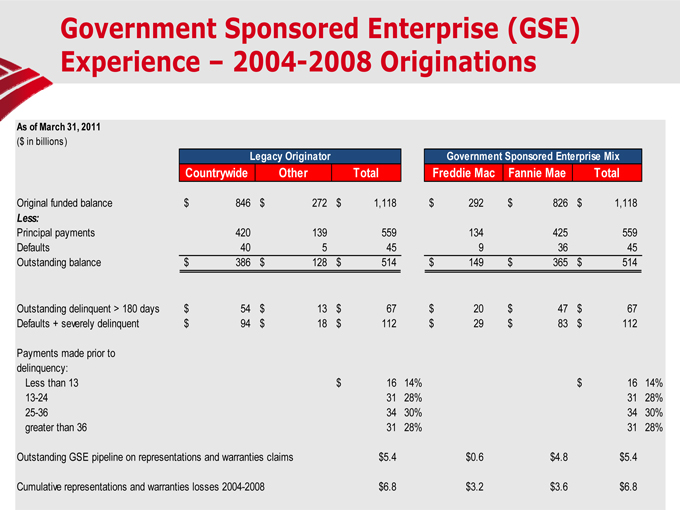

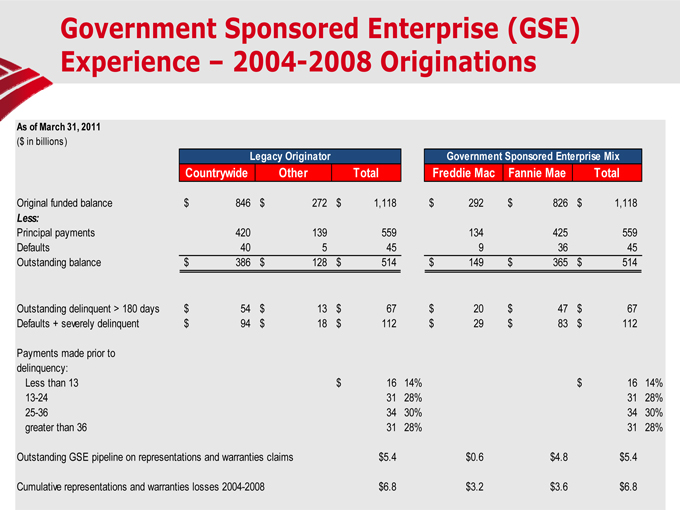

Government Sponsored Enterprise (GSE) Experience – 2004-2008 Originations

As of March 31, 2011

($ in billions)

Legacy Originator Countrywide Other Government Sponsored Enterprise Mix Total Freddie Mac Fannie Mae Total

Original funded balance $ 846 $ 272 $ 1,118 $ 292 $ 826 $ 1,118

Less:

Principal payments 420 139 559 134 425 559

Defaults 40 5 45 9 36 45

Outstanding balance $ 386 $ 128 $ 514 $ 149 $ 365 $ 514

Outstanding delinquent > 180 days $ 54 $ 13 $ 67 $ 20 $ 47 $ 67

Defaults + severely delinquent $ 94 $ 18 $ 112 $ 29 $ 83 $ 112

Payments made prior to

delinquency:

Less than 13 $ 16 14% $ 16 14%

13-24 31 28% 31 28%

25-36 34 30% 34 30%

greater than 36 31 28% 31 28%

Outstanding GSE pipeline on representations and warranties claims $5.4 $0.6 $4.8 $5.4

Cumulative representations and warranties losses 2004-2008 $6.8 $3.2 $3.6 $6.8

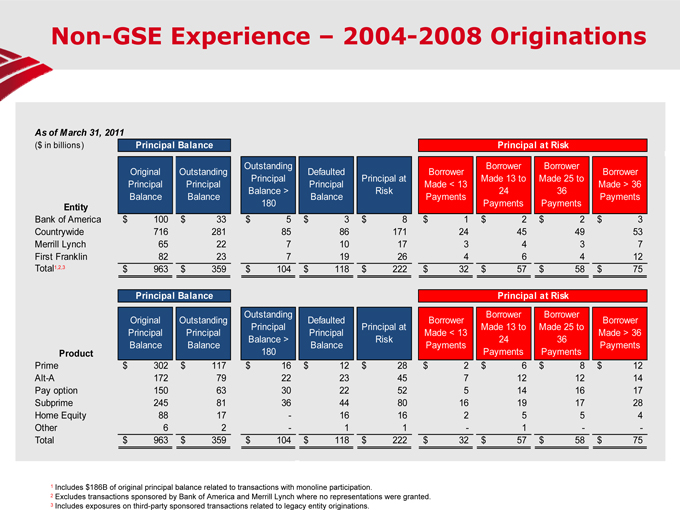

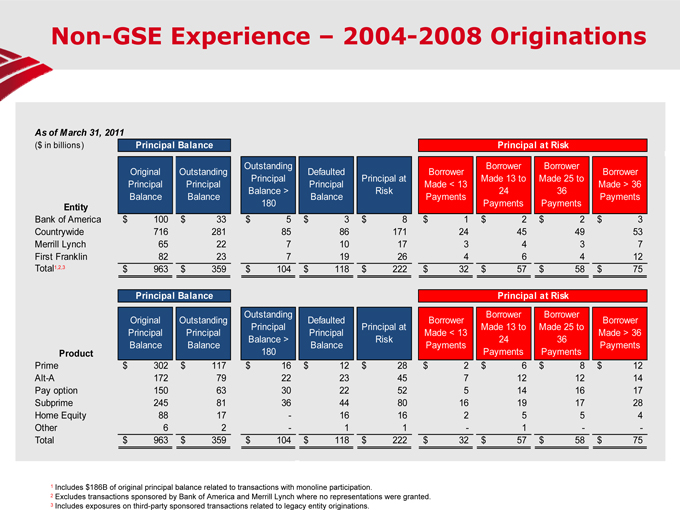

Non-GSE Experience – 2004-2008 Originations

As of March 31, 2011

($ in billions) Entity Principal Balance Original Principal Balance Outstanding Principal Balance Outstanding Defaulted Principal Balance > 180 Principal Risk Balance Borrower Principal at Principal at Risk Borrower Made 36 Payments

Bank of America $ 100 $ 33 $ 5 $ 3 $ 8 $ 1 $ 2 $ 2 $ 3

Countrywide 716 281 85 86 171 24 45 49 53

Merrill Lynch 65 22 7 10 17 3 4 3 7

First Franklin 82 23 7 19 26 4 6 4 12

Total 1,2,3 $ 963 $ 359 $ 104 $ 118 $ 222 $ 32 $ 57 $ 58 $ 75

Product Principal Balance Original Principal Balance Outstanding Principal Balance Outstanding Defaulted Principal Balance 180 Principal Risk Balance Borrower Principal at Principal at Risk Borrower Made 36 Payments

Prime $ 302 $ 117 $ 16 $ 12 $ 28 $ 2 $ 6 $ 8 $ 12

Alt-A 172 79 22 23 45 7 12 12 14

Pay option 150 63 30 22 52 5 14 16 17

Subprime 245 81 36 44 80 16 19 17 28

Home Equity 88 17 - 16 16 2 5 5 4

Other 6 2 - 1 1 - 1 - -

Total $ 963 $ 359 $ 104 $ 118 $ 222 $ 32 $ 57 $ 58 $ 75

1 Includes $186B of original principal balance related to transactions with monoline participation.

2 Excludes transactions sponsored by Bank of America and Merrill Lynch where no representations were granted.

3 Includes exposures on third-party sponsored transactions related to legacy entity originations.