Exhibit 99.3

Supplemental Information

First Quarter 2011

This information is preliminary and based on company data available at the time of the earnings presentation. It speaks only as of the particular date or dates included in the accompanying pages. Bank of America does not undertake an obligation to, and disclaims any duty to, update any of the information provided. Any forward-looking statements in this information are subject to the forward-looking language contained in Bank of America’s reports filed with the SEC pursuant to the Securities Exchange Act of 1934, which are available at the SEC’s website (www.sec.gov) or at Bank of America’s website (www.bankofamerica.com). Bank of America’s future financial performance is subject to risks and uncertainties as described in its SEC filings.

| | | | |

| Bank of America Corporation and Subsidiaries | | | |

| Table of Contents | | | Page | |

| | |

| |

Consolidated Financial Highlights | | | 2 | |

Supplemental Financial Data | | | 3 | |

Consolidated Statement of Income | | | 4 | |

Consolidated Balance Sheet | | | 5,6 | |

Capital Management | | | 7 | |

Core Net Interest Income | | | 8 | |

Quarterly Average Balances and Interest Rates | | | 9,10 | |

Quarterly Average Balances and Interest Rates - Isolating Hedge Income/Expense | | | 11,12 | |

Debt Securities and Available-for-Sale Marketable Equity Securities | | | 13 | |

Quarterly Results by Business Segment | | | 14 | |

Deposits | | | | |

Total Segment Results | | | 15 | |

Key Indicators | | | 16 | |

Global Card Services | | | | |

Total Segment Results | | | 17 | |

Key Indicators | | | 18 | |

Consumer Real Estate Services | | | | |

Total Segment Results | | | 19 | |

Quarter-to-Date Results | | | 20 | |

Key Indicators | | | 21 | |

Global Commercial Banking | | | | |

Total Segment Results | | | 22 | |

Key Indicators | | | 23 | |

Global Banking & Markets | | | | |

Total Segment Results | | | 24 | |

Key Indicators | | | 25 | |

Super Senior Collateralized Debt Obligation Exposure | | | 26 | |

Investment Banking Product Rankings | | | 27 | |

Global Wealth & Investment Management | | | | |

Total Segment Results | | | 28 | |

Key Indicators | | | 29 | |

All Other | | | | |

Total Segment Results | | | 30 | |

Equity Investments | | | 31 | |

Outstanding Loans and Leases | | | 32 | |

Quarterly Average Loans and Leases by Business Segment | | | 33 | |

Commercial Credit Exposure by Industry | | | 34 | |

Net Credit Default Protection by Maturity Profile and Credit Exposure Debt Rating | | | 35 | |

Selected Emerging Markets | | | 36 | |

Nonperforming Loans, Leases and Foreclosed Properties | | | 37 | |

Nonperforming Loans, Leases and Foreclosed Properties Activity | | | 38 | |

Quarterly Net Charge-offs and Net Charge-off Ratios | | | 39 | |

Allocation of the Allowance for Credit Losses by Product Type | | | 40 | |

| |

Exhibit A: Non-GAAP Reconciliations | | | 41,42 | |

| |

Appendix: Selected Slides from the First Quarter 2011 Earnings Release Presentation | | | 43 | |

1

Bank of America Corporation and Subsidiaries

Consolidated Financial Highlights

(Dollars in millions, except per share information; shares in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | First

Quarter

2011 | | | Fourth

Quarter

2010 | | | Third

Quarter

2010 | | | Second

Quarter

2010 | | | First

Quarter

2010 | |

Income statement | | | | | | | | | | | | | | | | | | | | |

Net interest income | | $ | 12,179 | | | $ | 12,439 | | | $ | 12,435 | | | $ | 12,900 | | | $ | 13,749 | |

Noninterest income | | | 14,698 | | | | 9,959 | | | | 14,265 | | | | 16,253 | | | | 18,220 | |

Total revenue, net of interest expense | | | 26,877 | | | | 22,398 | | | | 26,700 | | | | 29,153 | | | | 31,969 | |

Provision for credit losses | | | 3,814 | | | | 5,129 | | | | 5,396 | | | | 8,105 | | | | 9,805 | |

Goodwill impairment | | | — | | | | 2,000 | | | | 10,400 | | | | — | | | | — | |

Merger and restructuring charges | | | 202 | | | | 370 | | | | 421 | | | | 508 | | | | 521 | |

All other noninterest expense(1) | | | 20,081 | | | | 18,494 | | | | 16,395 | | | | 16,745 | | | | 17,254 | |

Income tax expense (benefit) | | | 731 | | | | (2,351 | ) | | | 1,387 | | | | 672 | | | | 1,207 | |

Net income (loss) | | | 2,049 | | | | (1,244 | ) | | | (7,299 | ) | | | 3,123 | | | | 3,182 | |

Preferred stock dividends | | | 310 | | | | 321 | | | | 348 | | | | 340 | | | | 348 | |

Net income (loss) applicable to common shareholders | | | 1,739 | | | | (1,565 | ) | | | (7,647 | ) | | | 2,783 | | | | 2,834 | |

Diluted earnings (loss) per common share(2) | | | 0.17 | | | | (0.16 | ) | | | (0.77 | ) | | | 0.27 | | | | 0.28 | |

Average diluted common shares issued and outstanding(2) | | | 10,181,351 | | | | 10,036,575 | | | | 9,976,351 | | | | 10,029,776 | | | | 10,005,254 | |

Dividends paid per common share | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.01 | |

| | | | | |

Performance ratios | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.36 | % | | | n/m | | | | n/m | | | | 0.50 | % | | | 0.51 | % |

Return on average common shareholders’ equity | | | 3.29 | | | | n/m | | | | n/m | | | | 5.18 | | | | 5.73 | |

Return on average tangible common shareholders’ equity(3) | | | 5.28 | | | | n/m | | | | n/m | | | | 9.19 | | | | 9.79 | |

Return on average tangible shareholders’ equity(3) | | | 5.54 | | | | n/m | | | | n/m | | | | 8.98 | | | | 9.55 | |

| At period end | | | | | | | | | | | | | | | | | | | | |

Book value per share of common stock | | $ | 21.15 | | | $ | 20.99 | | | $ | 21.17 | | | $ | 21.45 | | | $ | 21.12 | |

Tangible book value per share of common stock(3) | | | 13.21 | | | | 12.98 | | | | 12.91 | | | | 12.14 | | | | 11.70 | |

Market price per share of common stock: | | | | | | | | | | | | | | | | | | | | |

Closing price | | $ | 13.33 | | | $ | 13.34 | | | $ | 13.10 | | | $ | 14.37 | | | $ | 17.85 | |

High closing price for the period | | | 15.25 | | | | 13.56 | | | | 15.67 | | | | 19.48 | | | | 18.04 | |

Low closing price for the period | | | 13.33 | | | | 10.95 | | | | 12.32 | | | | 14.37 | | | | 14.45 | |

Market capitalization | | | 135,057 | | | | 134,536 | | | | 131,442 | | | | 144,174 | | | | 179,071 | |

| | | | | |

Number of banking centers - U.S. | | | 5,805 | | | | 5,856 | | | | 5,879 | | | | 5,900 | | | | 5,939 | |

Number of branded ATMs - U.S. | | | 17,886 | | | | 17,931 | | | | 17,929 | | | | 18,078 | | | | 18,135 | |

Full-time equivalent employees | | | 288,062 | | | | 288,471 | | | | 287,293 | | | | 284,628 | | | | 284,638 | |

| (1) | Excludes merger and restructuring charges and goodwill impairment charge. |

| (2) | Due to a net loss applicable to common shareholders for the fourth and third quarters of 2010, no dilutive potential common shares were included in the calculations of diluted earnings per share and average diluted common shares because they were antidilutive. |

| (3) | Tangible equity ratios and tangible book value per share of common stock are non-GAAP measures. We believe the use of these non-GAAP measures provides additional clarity in assessing the results of the Corporation. (See Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 41-42.) |

n/m = not meaningful

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 2 |

Bank of America Corporation and Subsidiaries

Supplemental Financial Data

(Dollars in millions, except per share information)

Fully taxable-equivalent basis data(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First

Quarter

2011 | | | | | | Fourth

Quarter

2010 | | | | | | Third

Quarter

2010 | | | | | | Second

Quarter

2010 | | | | | | First

Quarter

2010 | | | | |

Net interest income | | $ | 12,397 | | | | | | | $ | 12,709 | | | | | | | $ | 12,717 | | | | | | | $ | 13,197 | | | | | | | $ | 14,070 | | | | | |

Total revenue, net of interest expense | | | 27,095 | | | | | | | | 22,668 | | | | | | | | 26,982 | | | | | | | | 29,450 | | | | | | | | 32,290 | | | | | |

Net interest yield(2) | | | 2.67 | | | | % | | | | 2.69 | | | | % | | | | 2.72 | | | | % | | | | 2.77 | | | | % | | | | 2.93 | | | | % | |

Efficiency ratio | | | 74.86 | | | | | | | | 92.04 | | | | | | | | 100.87 | | | | | | | | 58.58 | | | | | | | | 55.05 | | | | | |

Performance ratios, excluding goodwill impairment charges(3)

| | | | | | | | | | | | | | | | |

| | | Fourth

Quarter

2010 | | | | | | Third

Quarter

2010 | | | | |

Per common share information | | | | | | | | | | | | | | | | |

Earnings | | $ | 0.04 | | | | | | | $ | 0.27 | | | | | |

Diluted earnings | | | 0.04 | | | | | | | | 0.27 | | | | | |

Efficiency ratio(1) | | | 83.22 | | | | % | | | | 62.33 | | | | % | |

Return on average assets | | | 0.13 | | | | | | | | 0.52 | | | | | |

Return on average common shareholders’ equity | | | 0.79 | | | | | | | | 5.06 | | | | | |

Return on average tangible common shareholders’ equity(3) | | | 1.27 | | | | | | | | 8.67 | | | | | |

Return on average tangible shareholders’ equity(3) | | | 1.96 | | | | | | | | 8.54 | | | | | |

| (1) | Fully taxable-equivalent basis is a non-GAAP measure. Fully taxable-equivalent basis is a performance measure used by management in operating the business that management believes provides investors with a more accurate picture of the interest margin for comparative purposes. (See Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 41-42). |

| (2) | Calculation includes fees earned on overnight deposits placed with the Federal Reserve of $63 million for the first quarter of 2011, and $63 million, $107 million, $106 million and $92 million for the fourth, third, second and first quarters of 2010, respectively. For more information see Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis on pages 9-10. |

| (3) | Total noninterest expense, excluding goodwill impairment charges, net income, excluding goodwill impairment charges and net income applicable to common shareholders, excluding goodwill impairment charges and tangible equity ratios are non-GAAP measures. We believe the use of these non-GAAP measures provides additional clarity in assessing the results of the Corporation.(See Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 41-42). |

| Certain | prior period amounts have been reclassified to conform to current period presentation. |

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 3 |

Bank of America Corporation and Subsidiaries

Consolidated Statement of Income

(Dollars in millions, except per share information; shares in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | First

Quarter

2011 | | | Fourth

Quarter

2010 | | | Third

Quarter

2010 | | | Second

Quarter

2010 | | | First

Quarter

2010 | |

Interest income | | | | | | | | | | | | | | | | | | | | |

Loans and leases | | $ | 11,929 | | | $ | 12,149 | | | $ | 12,485 | | | $ | 12,887 | | | $ | 13,475 | |

Debt securities | | | 2,882 | | | | 3,029 | | | | 2,605 | | | | 2,917 | | | | 3,116 | |

Federal funds sold and securities borrowed or purchased under agreements to resell | | | 517 | | | | 486 | | | | 441 | | | | 457 | | | | 448 | |

Trading account assets | | | 1,626 | | | | 1,661 | | | | 1,641 | | | | 1,796 | | | | 1,743 | |

Other interest income | | | 968 | | | | 965 | | | | 1,037 | | | | 1,062 | | | | 1,097 | |

| | | | | | | | | | | | | | | | | | | | |

Total interest income | | | 17,922 | | | | 18,290 | | | | 18,209 | | | | 19,119 | | | | 19,879 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Interest expense | | | | | | | | | | | | | | | | | | | | |

Deposits | | | 839 | | | | 894 | | | | 950 | | | | 1,031 | | | | 1,122 | |

Short-term borrowings | | | 1,184 | | | | 1,142 | | | | 848 | | | | 891 | | | | 818 | |

Trading account liabilities | | | 627 | | | | 561 | | | | 635 | | | | 715 | | | | 660 | |

Long-term debt | | | 3,093 | | | | 3,254 | | | | 3,341 | | | | 3,582 | | | | 3,530 | |

| | | | | | | | | | | | | | | | | | | | |

Total interest expense | | | 5,743 | | | | 5,851 | | | | 5,774 | | | | 6,219 | | | | 6,130 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 12,179 | | | | 12,439 | | | | 12,435 | | | | 12,900 | | | | 13,749 | |

| | | | | |

Noninterest income | | | | | | | | | | | | | | | | | | | | |

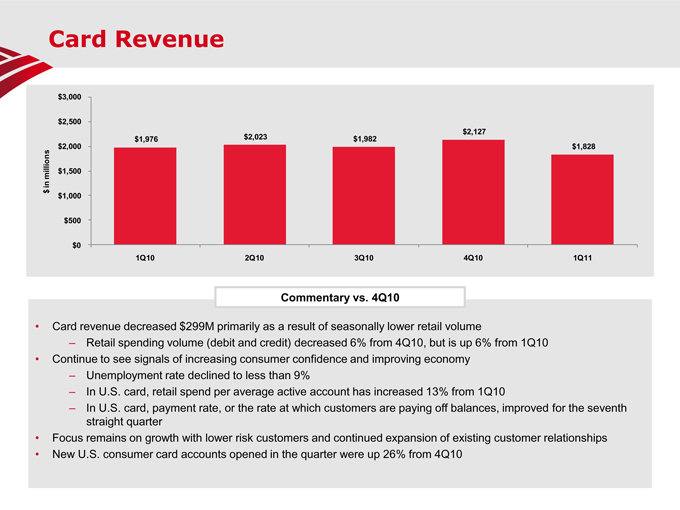

Card income | | | 1,828 | | | | 2,127 | | | | 1,982 | | | | 2,023 | | | | 1,976 | |

Service charges | | | 2,032 | | | | 2,036 | | | | 2,212 | | | | 2,576 | | | | 2,566 | |

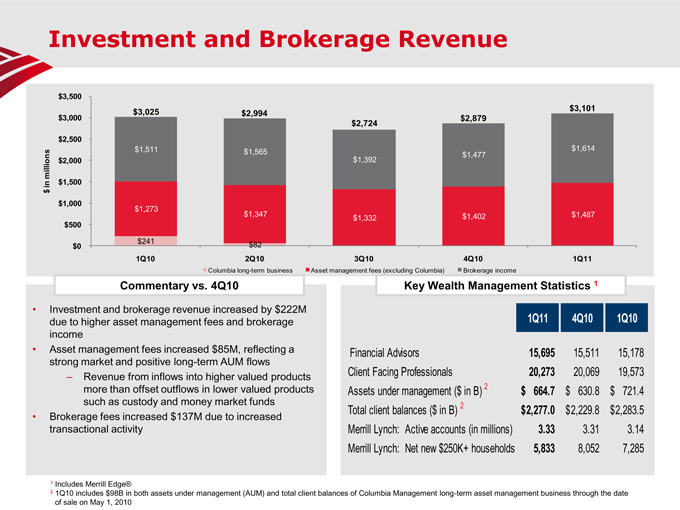

Investment and brokerage services | | | 3,101 | | | | 2,879 | | | | 2,724 | | | | 2,994 | | | | 3,025 | |

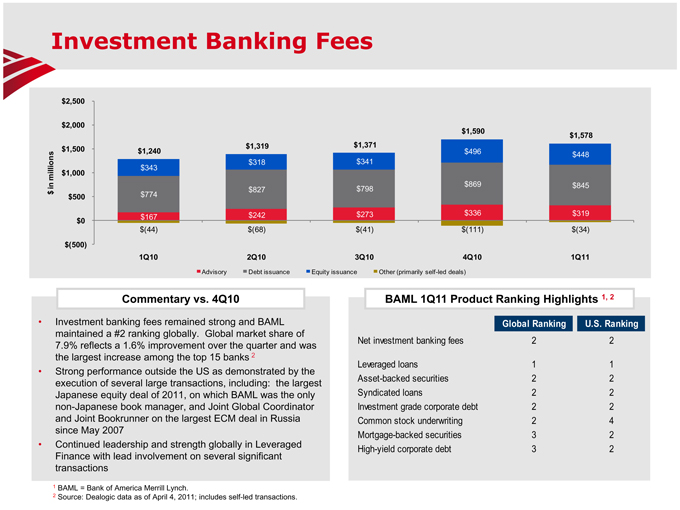

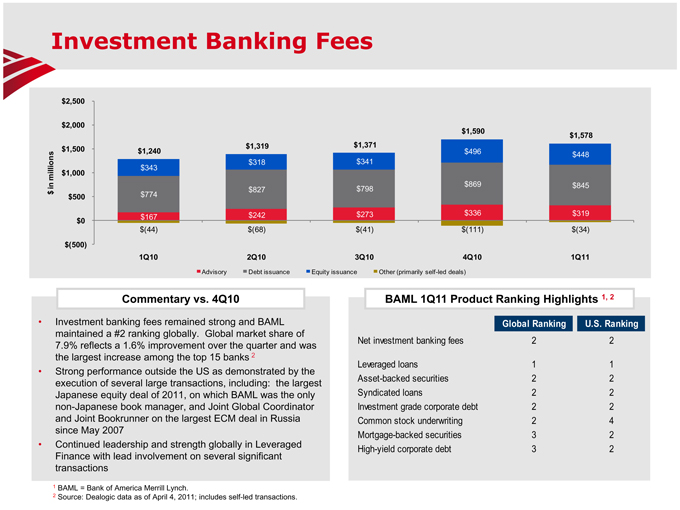

Investment banking income | | | 1,578 | | | | 1,590 | | | | 1,371 | | | | 1,319 | | | | 1,240 | |

Equity investment income | | | 1,475 | | | | 1,512 | | | | 357 | | | | 2,766 | | | | 625 | |

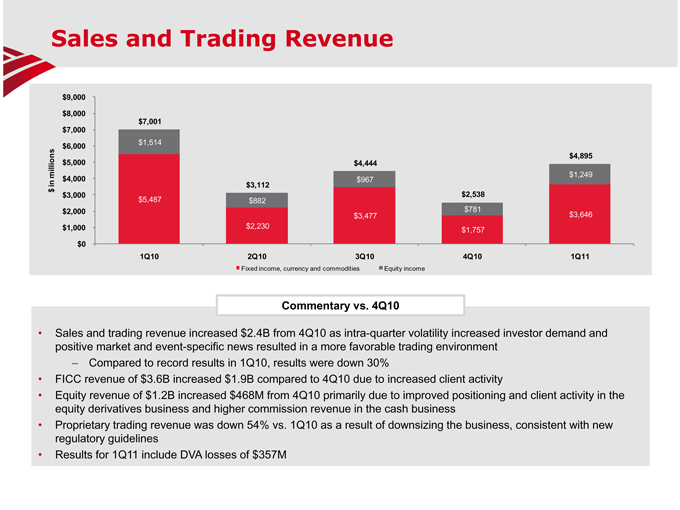

Trading account profits | | | 2,722 | | | | 995 | | | | 2,596 | | | | 1,227 | | | | 5,236 | |

Mortgage banking income (loss) | | | 630 | | | | (1,419 | ) | | | 1,755 | | | | 898 | | | | 1,500 | |

Insurance income | | | 613 | | | | 598 | | | | 75 | | | | 678 | | | | 715 | |

Gains on sales of debt securities | | | 546 | | | | 872 | | | | 883 | | | | 37 | | | | 734 | |

Other income (loss) | | | 261 | | | | (1,114 | ) | | | 433 | | | | 1,861 | | | | 1,204 | |

Other-than-temporary impairment losses on available-for-sale debt securities: | | | | | | | | | | | | | | | | | | | | |

Total other-than-temporary impairment losses | | | (111 | ) | | | (612 | ) | | | (156 | ) | | | (462 | ) | | | (1,819 | ) |

Less: Portion of other-than-temporary impairment losses recognized in other comprehensive income | | | 23 | | | | 495 | | | | 33 | | | | 336 | | | | 1,218 | |

| | | | | | | | | | | | | | | | | | | | |

Net impairment losses recognized in earnings on available-for-sale debt securities | | | (88 | ) | | | (117 | ) | | | (123 | ) | | | (126 | ) | | | (601 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total noninterest income | | | 14,698 | | | | 9,959 | | | | 14,265 | | | | 16,253 | | | | 18,220 | |

| | | | | | | | | | | | | | | | | | | | |

Total revenue, net of interest expense | | | 26,877 | | | | 22,398 | | | | 26,700 | | | | 29,153 | | | | 31,969 | |

| | | | | |

Provision for credit losses | | | 3,814 | | | | 5,129 | | | | 5,396 | | | | 8,105 | | | | 9,805 | |

| | | | | |

Noninterest expense | | | | | | | | | | | | | | | | | | | | |

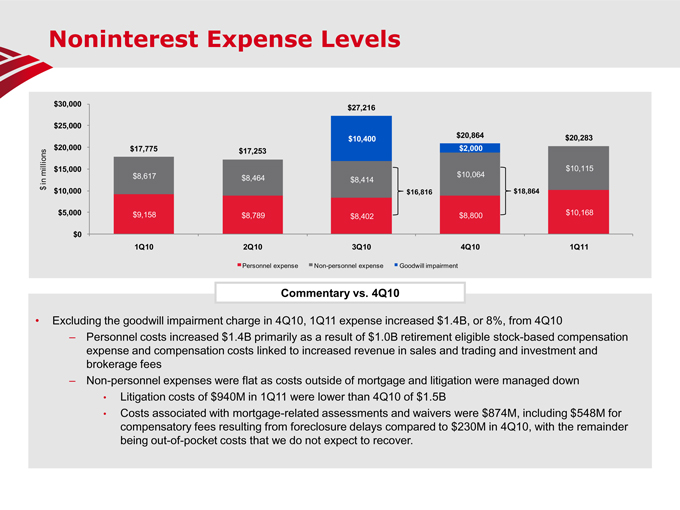

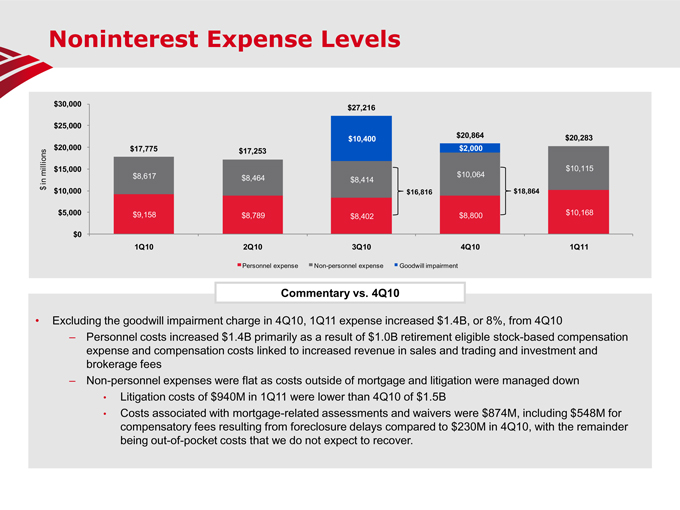

Personnel | | | 10,168 | | | | 8,800 | | | | 8,402 | | | | 8,789 | | | | 9,158 | |

Occupancy | | | 1,189 | | | | 1,212 | | | | 1,150 | | | | 1,182 | | | | 1,172 | |

Equipment | | | 606 | | | | 607 | | | | 619 | | | | 613 | | | | 613 | |

Marketing | | | 564 | | | | 484 | | | | 497 | | | | 495 | | | | 487 | |

Professional fees | | | 646 | | | | 883 | | | | 651 | | | | 644 | | | | 517 | |

Amortization of intangibles | | | 385 | | | | 420 | | | | 426 | | | | 439 | | | | 446 | |

Data processing | | | 695 | | | | 662 | | | | 602 | | | | 632 | | | | 648 | |

Telecommunications | | | 371 | | | | 366 | | | | 361 | | | | 359 | | | | 330 | |

Other general operating | | | 5,457 | | | | 5,060 | | | | 3,687 | | | | 3,592 | | | | 3,883 | |

Goodwill impairment | | | — | | | | 2,000 | | | | 10,400 | | | | — | | | | — | |

Merger and restructuring charges | | | 202 | | | | 370 | | | | 421 | | | | 508 | | | | 521 | |

| | | | | | | | | | | | | | | | | | | | |

Total noninterest expense | | | 20,283 | | | | 20,864 | | | | 27,216 | | | | 17,253 | | | | 17,775 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 2,780 | | | | (3,595 | ) | | | (5,912 | ) | | | 3,795 | | | | 4,389 | |

Income tax expense (benefit) | | | 731 | | | | (2,351 | ) | | | 1,387 | | | | 672 | | | | 1,207 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 2,049 | | | $ | (1,244 | ) | | $ | (7,299 | ) | | $ | 3,123 | | | $ | 3,182 | |

| | | | | | | | | | | | | | | | | | | | |

Preferred stock dividends | | | 310 | | | | 321 | | | | 348 | | | | 340 | | | | 348 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) applicable to common shareholders | | $ | 1,739 | | | $ | (1,565 | ) | | $ | (7,647 | ) | | $ | 2,783 | | | $ | 2,834 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per common share information | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) | | $ | 0.17 | | | $ | (0.16 | ) | | $ | (0.77 | ) | | $ | 0.28 | | | $ | 0.28 | |

Diluted earnings (loss)(1) | | | 0.17 | | | | (0.16 | ) | | | (0.77 | ) | | | 0.27 | | | | 0.28 | |

Dividends paid | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | |

Average common shares issued and outstanding | | | 10,075,875 | | | | 10,036,575 | | | | 9,976,351 | | | | 9,956,773 | | | | 9,177,468 | |

| | | | | | | | | | | | | | | | | | | | |

Average diluted common shares issued and outstanding(1) | | | 10,181,351 | | | | 10,036,575 | | | | 9,976,351 | | | | 10,029,776 | | | | 10,005,254 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Due to a net loss applicable to common shareholders for the fourth and third quarters of 2010, the impact of antidilutive equity instruments was excluded from diluted earnings per share and average diluted common shares. |

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 4 |

Bank of America Corporation and Subsidiaries

Consolidated Balance Sheet

(Dollars in millions)

| | | | | | | | | | | | |

| | | March 31

2011 | | | December 31

2010 | | | March 31

2010 | |

Assets | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 97,542 | | | $ | 108,427 | | | $ | 144,794 | |

Time deposits placed and other short-term investments | | | 23,707 | | | | 26,433 | | | | 20,256 | |

Federal funds sold and securities borrowed or purchased under agreements to resell | | | 234,056 | | | | 209,616 | | | | 197,038 | |

Trading account assets | | | 208,761 | | | | 194,671 | | | | 206,018 | |

Derivative assets | | | 65,334 | | | | 73,000 | | | | 83,511 | |

Debt securities: | | | | | | | | | | | | |

Available-for-sale | | | 330,345 | | | | 337,627 | | | | 316,020 | |

Held-to-maturity, at cost | | | 431 | | | | 427 | | | | 340 | |

Total debt securities | | | 330,776 | | | | 338,054 | | | | 316,360 | |

Loans and leases | | | 932,425 | | | | 940,440 | | | | 976,042 | |

Allowance for loan and lease losses | | | (39,843 | ) | | | (41,885 | ) | | | (46,835 | ) |

Loans and leases, net of allowance | | | 892,582 | | | | 898,555 | | | | 929,207 | |

Premises and equipment, net | | | 14,151 | | | | 14,306 | | | | 15,147 | |

Mortgage servicing rights (includes$15,282, $14,900 and $18,842 measured at fair value) | | | 15,560 | | | | 15,177 | | | | 19,146 | |

Goodwill | | | 73,869 | | | | 73,861 | | | | 86,305 | |

Intangible assets | | | 9,560 | | | | 9,923 | | | | 11,548 | |

Loans held-for-sale | | | 25,003 | | | | 35,058 | | | | 35,386 | |

Customer and other receivables | | | 97,318 | | | | 85,704 | | | | 83,636 | |

Other assets | | | 186,313 | | | | 182,124 | | | | 196,282 | |

Total assets | | $ | 2,274,532 | | | $ | 2,264,909 | | | $ | 2,344,634 | |

| | | |

Assets of consolidated VIEs included in total assets above (substantially all pledged as collateral) | | | | | | | | | | | | |

Trading account assets | | $ | 12,012 | | | $ | 19,627 | | | $ | 11,826 | |

Derivative assets | | | 2,280 | | | | 2,027 | | | | 4,194 | |

Available-for-sale debt securities | | | 2,104 | | | | 2,601 | | | | 12,074 | |

Loans and leases | | | 146,309 | | | | 145,469 | | | | 129,432 | |

Allowance for loan and lease losses | | | (8,335 | ) | | | (8,935 | ) | | | (11,140 | ) |

Loans and leases, net of allowance | | | 137,974 | | | | 136,534 | | | | 118,292 | |

Loans held-for-sale | | | 1,605 | | | | 1,953 | | | | 5,471 | |

All other assets | | | 4,883 | | | | 7,086 | | | | 9,637 | |

Total assets of consolidated VIEs | | $ | 160,858 | | | $ | 169,828 | | | $ | 161,494 | |

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 5 |

Bank of America Corporation and Subsidiaries

Consolidated Balance Sheet (continued)

(Dollars in millions)

| | | | | | | | | | | | |

| | | March 31

2011 | | | December 31

2010 | | | March 31

2010 | |

Liabilities | | | | | | | | | | | | |

Deposits in U.S. offices: | | | | | | | | | | | | |

Noninterest-bearing | | $ | 286,357 | | | $ | 285,200 | | | $ | 255,470 | |

Interest-bearing | | | 652,096 | | | | 645,713 | | | | 643,943 | |

Deposits in non-U.S. offices: | | | | | | | | | | | | |

Noninterest-bearing | | | 7,894 | | | | 6,101 | | | | 5,614 | |

Interest-bearing | | | 73,828 | | | | 73,416 | | | | 71,075 | |

Total deposits | | | 1,020,175 | | | | 1,010,430 | | | | 976,102 | |

Federal funds purchased and securities loaned or sold under agreements to repurchase | | | 260,521 | | | | 245,359 | | | | 270,601 | |

Trading account liabilities | | | 88,478 | | | | 71,985 | | | | 82,532 | |

Derivative liabilities | | | 53,501 | | | | 55,914 | | | | 52,861 | |

Commercial paper and other short-term borrowings | | | 58,324 | | | | 59,962 | | | | 85,406 | |

Accrued expenses and other liabilities (includes$961, $1,188 and $1,521 of reserve for unfunded lending commitments) | | | 128,221 | | | | 144,580 | | | | 135,656 | |

Long-term debt | | | 434,436 | | | | 448,431 | | | | 511,653 | |

Total liabilities | | | 2,043,656 | | | | 2,036,661 | | | | 2,114,811 | |

Shareholders’ equity | | | | | | | | | | | | |

Preferred stock, $0.01 par value; authorized - 100,000,000 shares; issued and outstanding -3,943,660, 3,943,660 and 3,960,660 shares | | | 16,562 | | | | 16,562 | | | | 17,964 | |

Common stock and additional paid-in capital, $0.01 par value; authorized - 12,800,000,000, 12,800,000,000 and 11,300,000,000 shares; issued and outstanding - 10,131,803,417, 10,085,154,806 and 10,032,001,150 shares | | | 151,379 | | | | 150,905 | | | | 149,048 | |

Retained earnings | | | 62,483 | | | | 60,849 | | | | 67,811 | |

Accumulated other comprehensive income (loss) | | | 463 | | | | (66 | ) | | | (4,929 | ) |

Other | | | (11 | ) | | | (2 | ) | | | (71 | ) |

Total shareholders’ equity | | | 230,876 | | | | 228,248 | | | | 229,823 | |

Total liabilities and shareholders’ equity | | $ | 2,274,532 | | | $ | 2,264,909 | | | $ | 2,344,634 | |

| | | |

Liabilities of consolidated VIEs included in total liabilities above | | | | | | | | | | | | |

Commercial paper and other short-term borrowings | | $ | 6,954 | | | $ | 6,742 | | | $ | 21,631 | |

Long-term debt | | | 65,197 | | | | 71,013 | | | | 90,329 | |

All other liabilities | | | 1,240 | | | | 9,141 | | | | 5,135 | |

Total liabilities of consolidated VIEs | | $ | 73,391 | | | $ | 86,896 | | | $ | 117,095 | |

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 6 |

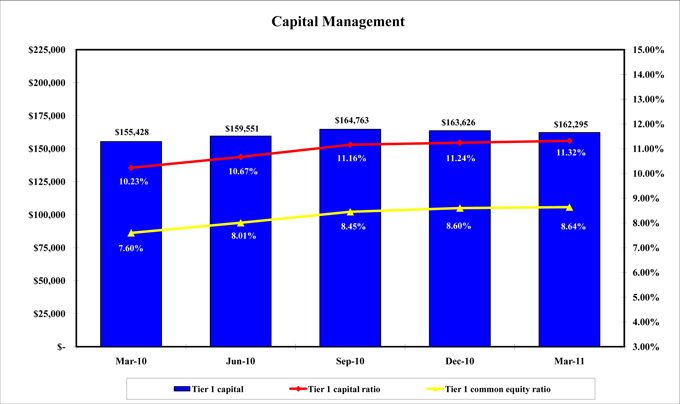

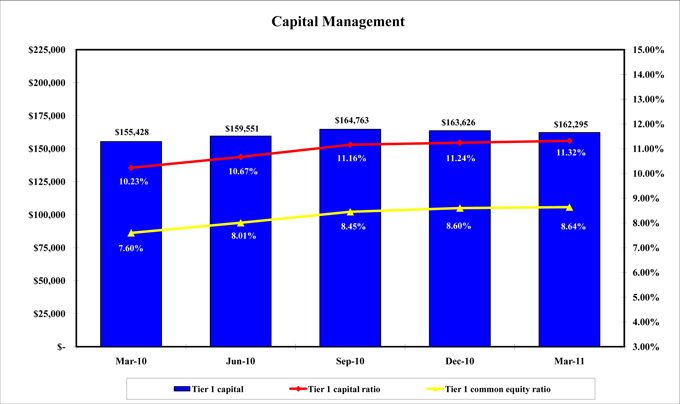

Bank of America Corporation and Subsidiaries

Capital Management

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First

Quarter

2011 | | | | | Fourth

Quarter

2010 | | | | | Third

Quarter

2010 | | | | | Second

Quarter

2010 | | | | | First

Quarter

2010 | | | |

Risk-based capital(1): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tier 1 common | | $ | 123,882 | | | | | $ | 125,139 | | | | | $ | 124,756 | | | | | $ | 119,716 | | | | | $ | 115,520 | | | |

Tier 1 capital | | | 162,295 | | | | | | 163,626 | | | | | | 164,763 | | | | | | 159,551 | | | | | | 155,428 | | | |

Total capital | | | 229,094 | | | | | | 229,594 | | | | | | 231,120 | | | | | | 220,827 | | | | | | 219,913 | | | |

Risk-weighted assets | | | 1,433,377 | | | | | | 1,455,951 | | | | | | 1,476,774 | | | | | | 1,494,990 | | | | | | 1,519,723 | | | |

Tier 1 common equity ratio(2) | | | 8.64 | | | % | | | 8.60 | | | % | | | 8.45 | | | % | | | 8.01 | | | % | | | 7.60 | | | % |

Tier 1 capital ratio | | | 11.32 | | | | | | 11.24 | | | | | | 11.16 | | | | | | 10.67 | | | | | | 10.23 | | | |

Total capital ratio | | | 15.98 | | | | | | 15.77 | | | | | | 15.65 | | | | | | 14.77 | | | | | | 14.47 | | | |

Tier 1 leverage ratio | | | 7.25 | | | | | | 7.21 | | | | | | 7.21 | | | | | | 6.68 | | | | | | 6.44 | | | |

Tangible equity ratio(3) | | | 6.85 | | | | | | 6.75 | | | | | | 6.54 | | | | | | 6.14 | | | | | | 6.02 | | | |

Tangible common equity ratio(3) | | | 6.10 | | | | | | 5.99 | | | | | | 5.74 | | | | | | 5.35 | | | | | | 5.22 | | | |

| (1) | Reflects preliminary data for current period risk-based capital. |

| (2) | Tier 1 common equity ratio equals Tier 1 capital excluding preferred stock, trust preferred securities, hybrid securities and minority interest divided by risk-weighted assets. |

| (3) | Tangible equity ratio equals period end tangible shareholders’ equity divided by period end tangible assets. Tangible common equity equals period end tangible common shareholders’ equity divided by period end tangible assets. Tangible shareholders’ equity and tangible assets are non-GAAP measures. We believe the use of these non-GAAP measures provide additional clarity in assessing the results of the Corporation. (See Exhibit A: Non-GAAP Reconciliations - Reconciliation to GAAP Financial Measures on pages 41-42). |

| * | Preliminary data on risk-based capital |

Outstanding Common Stock

No common shares were repurchased in the first quarter of 2011.

There is no existing Board authorized share repurchase program.

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 7 |

Bank of America Corporation and Subsidiaries

Core Net Interest Income

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First

Quarter

2011 | | | | | | Fourth

Quarter

2010 | | | | | | Third

Quarter

2010 | | | | | | Second

Quarter

2010 | | | | | | First

Quarter

2010 | | | | |

Net interest income(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As reported (2) | | $ | 12,397 | | | | | | | $ | 12,709 | | | | | | | $ | 12,717 | | | | | | | $ | 13,197 | | | | | | | $ | 14,070 | | | | | |

Impact of market-based net interest income(3) | | | (1,051 | ) | | | | | | | (1,150 | ) | | | | | | | (1,045 | ) | | | | | | | (1,049 | ) | | | | | | | (1,186 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core net interest income | | $ | 11,346 | | | | | | | $ | 11,559 | | | | | | | $ | 11,672 | | | | | | | $ | 12,148 | | | | | | | $ | 12,884 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Average earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As reported | | $ | 1,869,863 | | | | | | | $ | 1,883,539 | | | | | | | $ | 1,863,819 | | | | | | | $ | 1,910,790 | | | | | | | $ | 1,933,060 | | | | | |

Impact of market-based earning assets(3) | | | (467,042 | ) | | | | | | | (475,021 | ) | | | | | | | (494,772 | ) | | | | | | | (521,010 | ) | | | | | | | (527,316 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core average earning assets | | $ | 1,402,821 | | | | | | | $ | 1,408,518 | | | | | | | $ | 1,369,047 | | | | | | | $ | 1,389,780 | | | | | | | $ | 1,405,744 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Net interest yield contribution(1, 4) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As reported (2) | | | 2.67 | | | | % | | | | 2.69 | | | | % | | | | 2.72 | | | | % | | | | 2.77 | | | | % | | | | 2.93 | | | | % | |

Impact of market-based activities(3) | | | 0.59 | | | | | | | | 0.58 | | | | | | | | 0.67 | | | | | | | | 0.73 | | | | | | | | 0.76 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core net interest yield on earning assets | | | 3.26 | | | | % | | | | 3.27 | | | | % | | | | 3.39 | | | | % | | | | 3.50 | | | | % | | | | 3.69 | | | | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Fully taxable-equivalent basis |

| (2) | Balance and calculation include fees earned on overnight deposits placed with the Federal Reserve of $63 million for the first quarter of 2011 and $63 million, $107 million, $106 million, and $92 million for the fourth, third, second and first quarters of 2010, respectively. |

| (3) | Represents the impact of market-based amounts included in Global Banking & Markets. |

| (4) | Calculated on an annualized basis. |

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 8 |

Bank of America Corporation and Subsidiaries

Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter 2011 | | | | | | Fourth Quarter 2010 | | | | | | First Quarter 2010 | | | | |

| | | | | | Interest | | | | | | | | | | | | Interest | | | | | | | | | | | | Interest | | | | | | | |

| | | Average | | | Income/ | | | Yield/ | | | | | | Average | | | Income/ | | | Yield/ | | | | | | Average | | | Income/ | | | Yield/ | | | | |

| | | Balance | | | Expense | | | Rate | | | | | | Balance | | | Expense | | | Rate | | | | | | Balance | | | Expense | | | Rate | | | | |

Earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Time deposits placed and other short-term investments(1) | | $ | 31,294 | | | $ | 88 | | | | 1.14 | | | | % | | | $ | 28,141 | | | $ | 75 | | | | 1.07 | | | | % | | | $ | 27,600 | | | $ | 61 | | | | 0.89 | | | | % | |

Federal funds sold and securities borrowed or purchased under agreements to resell | | | 227,379 | | | | 517 | | | | 0.92 | | | | | | | | 243,589 | | | | 486 | | | | 0.79 | | | | | | | | 266,070 | | | | 448 | | | | 0.68 | | | | | |

Trading account assets | | | 221,041 | | | | 1,669 | | | | 3.05 | | | | | | | | 216,003 | | | | 1,710 | | | | 3.15 | | | | | | | | 214,542 | | | | 1,795 | | | | 3.37 | | | | | |

Debt securities(2) | | | 335,847 | | | | 2,917 | | | | 3.49 | | | | | | | | 341,867 | | | | 3,065 | | | | 3.58 | | | | | | | | 311,136 | | | | 3,173 | | | | 4.09 | | | | | |

Loans and leases(3): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Residential mortgage(4) | | | 262,049 | | | | 2,881 | | | | 4.40 | | | | | | | | 254,051 | | | | 2,857 | | | | 4.50 | | | | | | | | 243,833 | | | | 3,100 | | | | 5.09 | | | | | |

Home equity | | | 136,089 | | | | 1,335 | | | | 3.96 | | | | | | | | 139,772 | | | | 1,410 | | | | 4.01 | | | | | | | | 152,536 | | | | 1,586 | | | | 4.20 | | | | | |

Discontinued real estate | | | 12,899 | | | | 110 | | | | 3.42 | | | | | | | | 13,297 | | | | 118 | | | | 3.57 | | | | | | | | 14,433 | | | | 153 | | | | 4.24 | | | | | |

U.S. credit card | | | 109,941 | | | | 2,837 | | | | 10.47 | | | | | | | | 112,673 | | | | 3,040 | | | | 10.70 | | | | | | | | 125,353 | | | | 3,370 | | | | 10.90 | | | | | |

Non-U.S. credit card | | | 27,633 | | | | 779 | | | | 11.43 | | | | | | | | 27,457 | | | | 815 | | | | 11.77 | | | | | | | | 29,872 | | | | 906 | | | | 12.30 | | | | | |

Direct/Indirect consumer (5) | | | 90,097 | | | | 993 | | | | 4.47 | | | | | | | | 91,549 | | | | 1,088 | | | | 4.72 | | | | | | | | 100,920 | | | | 1,302 | | | | 5.23 | | | | | |

Other consumer(6) | | | 2,753 | | | | 45 | | | | 6.58 | | | | | | | | 2,796 | | | | 45 | | | | 6.32 | | | | | | | | 3,002 | | | | 48 | | | | 6.35 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total consumer | | | 641,461 | | | | 8,980 | | | | 5.65 | | | | | | | | 641,595 | | | | 9,373 | | | | 5.81 | | | | | | | | 669,949 | | | | 10,465 | | | | 6.30 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. commercial | | | 191,353 | | | | 1,926 | | | | 4.08 | | | | | | | | 193,608 | | | | 1,894 | | | | 3.88 | | | | | | | | 202,662 | | | | 1,970 | | | | 3.94 | | | | | |

Commercial real estate(7) | | | 48,359 | | | | 437 | | | | 3.66 | | | | | | | | 51,617 | | | | 432 | | | | 3.32 | | | | | | | | 68,526 | | | | 575 | | | | 3.40 | | | | | |

Commercial lease financing | | | 21,634 | | | | 322 | | | | 5.95 | | | | | | | | 21,363 | | | | 250 | | | | 4.69 | | | | | | | | 21,675 | | | | 304 | | | | 5.60 | | | | | |

Non-U.S. commercial | | | 36,159 | | | | 299 | | | | 3.35 | | | | | | | | 32,431 | | | | 289 | | | | 3.53 | | | | | | | | 28,803 | | | | 264 | | | | 3.72 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total commercial | | | 297,505 | | | | 2,984 | | | | 4.06 | | | | | | | | 299,019 | | | | 2,865 | | | | 3.81 | | | | | | | | 321,666 | | | | 3,113 | | | | 3.92 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total loans and leases | | | 938,966 | | | | 11,964 | | | | 5.14 | | | | | | | | 940,614 | | | | 12,238 | | | | 5.18 | | | | | | | | 991,615 | | | | 13,578 | | | | 5.53 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other earning assets | | | 115,336 | | | | 922 | | | | 3.24 | | | | | | | | 113,325 | | | | 923 | | | | 3.23 | | | | | | | | 122,097 | | | | 1,053 | | | | 3.50 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total earning assets(8) | | | 1,869,863 | | | | 18,077 | | | | 3.92 | | | | | | | | 1,883,539 | | | | 18,497 | | | | 3.90 | | | | | | | | 1,933,060 | | | | 20,108 | | | | 4.19 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents(1) | | | 138,241 | | | | 63 | | | | | | | | | | | | 136,967 | | | | 63 | | | | | | | | | | | | 196,911 | | | | 92 | | | | | | | | | |

Other assets, less allowance for loan and lease losses | | | 330,434 | | | | | | | | | | | | | | | | 349,752 | | | | | | | | | | | | | | | | 386,638 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 2,338,538 | | | | | | | | | | | | | | | $ | 2,370,258 | | | | | | | | | | | | | | | $ | 2,516,609 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | For this presentation, fees earned on overnight deposits placed with the Federal Reserve are included in the cash and cash equivalents line, consistent with the Corporation's Consolidated Balance Sheet presentation of these deposits. Net interest income and net interest yield are calculated excluding these fees. |

| (2) | Yields on available-for-sale debt securities are calculated based on fair value rather than the cost basis. The use of fair value does not have a material impact on net interest yield. |

| (3) | Nonperforming loans are included in the respective average loan balances. Income on these nonperforming loans is recognized on a cash basis. Purchased credit-impaired loans were written down to fair value upon acquisition and accrete interest income over the remaining life of the loan. |

| (4) | Includes non-U.S. residential mortgages of $92 million in the first quarter of 2011, and $96 million and $538 million in the fourth and first quarters of 2010. |

| (5) | Includes non-U.S. consumer loans of $8.2 billion in the first quarter of 2011, and $7.9 billion and $8.1 billion in the fourth and first quarters of 2010. |

| (6) | Includes consumer finance loans of $1.9 billion in the first quarter of 2011, and $2.0 billion and $2.2 billion in the fourth and first quarters of 2010; other non-U.S. consumer loans of $777 million in the first quarter of 2011, and $791 million and $664 million in the fourth and first quarters of 2010; and consumer overdrafts of $76 million in the first quarter of 2011, and $34 million and $132 million for the fourth and first quarters of 2010. |

| (7) | Includes U.S. commercial real estate loans of $45.7 billion in the first quarter of 2011, and $49.0 billion and $65.6 billion in the fourth and first quarters of 2010, and non-U.S. commercial real estate loans of $2.7 billion in the first quarter of 2011, and $2.6 billion and $3.0 billion in the fourth and first quarters of 2010. |

| (8) | Interest income includes the impact of interest rate risk management contracts, which decreased interest income on the underlying assets $388 million in the first quarter of 2011, and $29 million and $272 million in the fourth and first quarters of 2010. Interest expense includes the impact of interest rate risk management contracts, which decreased interest expense on the underlying liabilities $621 million in the first quarter of 2011, and $672 million and $970 million in the fourth and first quarters of 2010. |

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 9 |

Bank of America Corporation and Subsidiaries

Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis (continued)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter 2011 | | | Fourth Quarter 2010 | | | First Quarter 2010 | | | | |

| | | | | | Interest | | | | | | | | | | | | Interest | | | | | | | | | | | | Interest | | | | | | | |

| | | Average | | | Income/ | | | Yield/ | | | | | | Average | | | Income/ | | | Yield/ | | | | | | Average | | | Income/ | | | Yield/ | | | | |

| | | Balance | | | Expense | | | Rate | | | | | | Balance | | | Expense | | | Rate | | | | | | Balance | | | Expense | | | Rate | | | | |

Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Savings | | $ | 38,905 | | | $ | 32 | | | | 0.34 | | | | % | | | $ | 37,145 | | | $ | 35 | | | | 0.36 | | | | % | | | $ | 35,126 | | | $ | 43 | | | | 0.50 | | | | % | |

NOW and money market deposit accounts | | | 475,954 | | | | 316 | | | | 0.27 | | | | | | | | 464,531 | | | | 333 | | | | 0.28 | | | | | | | | 416,110 | | | | 341 | | | | 0.33 | | | | | |

Consumer CDs and IRAs | | | 118,306 | | | | 300 | | | | 1.03 | | | | | | | | 124,855 | | | | 338 | | | | 1.07 | | | | | | | | 166,189 | | | | 567 | | | | 1.38 | | | | | |

Negotiable CDs, public funds and other time deposits | | | 13,995 | | | | 39 | | | | 1.11 | | | | | | | | 16,334 | | | | 47 | | | | 1.16 | | | | | | | | 19,763 | | | | 63 | | | | 1.31 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total U.S. interest-bearing deposits | | | 647,160 | | | | 687 | | | | 0.43 | | | | | | | | 642,865 | | | | 753 | | | | 0.46 | | | | | | | | 637,188 | | | | 1,014 | | | | 0.65 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-U.S. interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Banks located in non-U.S. countries | | | 21,534 | | | | 38 | | | | 0.72 | | | | | | | | 16,827 | | | | 38 | | | | 0.91 | | | | | | | | 18,424 | | | | 32 | | | | 0.71 | | | | | |

Governments and official institutions | | | 2,307 | | | | 2 | | | | 0.35 | | | | | | | | 1,560 | | | | 2 | | | | 0.42 | | | | | | | | 5,626 | | | | 3 | | | | 0.22 | | | | | |

Time, savings and other | | | 60,432 | | | | 112 | | | | 0.76 | | | | | | | | 58,746 | | | | 101 | | | | 0.69 | | | | | | | | 54,885 | | | | 73 | | | | 0.53 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total non-U.S. interest-bearing deposits | | | 84,273 | | | | 152 | | | | 0.73 | | | | | | | | 77,133 | | | | 141 | | | | 0.73 | | | | | | | | 78,935 | | | | 108 | | | | 0.55 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing deposits | | | 731,433 | | | | 839 | | | | 0.46 | | | | | | | | 719,998 | | | | 894 | | | | 0.49 | | | | | | | | 716,123 | | | | 1,122 | | | | 0.64 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Federal funds purchased, securities loaned or sold under agreements to repurchase and other short-term borrowings | | | 371,573 | | | | 1,184 | | | | 1.29 | | | | | | | | 369,738 | | | | 1,142 | | | | 1.23 | | | | | | | | 508,332 | | | | 818 | | | | 0.65 | | | | | |

Trading account liabilities | | | 83,914 | | | | 627 | | | | 3.03 | | | | | | | | 81,313 | | | | 561 | | | | 2.74 | | | | | | | | 90,134 | | | | 660 | | | | 2.97 | | | | | |

Long-term debt | | | 440,511 | | | | 3,093 | | | | 2.84 | | | | | | | | 465,875 | | | | 3,254 | | | | 2.78 | | | | | | | | 513,634 | | | | 3,530 | | | | 2.77 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities(8) | | | 1,627,431 | | | | 5,743 | | | | 1.43 | | | | | | | | 1,636,924 | | | | 5,851 | | | | 1.42 | | | | | | | | 1,828,223 | | | | 6,130 | | | | 1.35 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing sources: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing deposits | | | 291,707 | | | | | | | | | | | | | | | | 287,740 | | | | | | | | | | | | | | | | 264,892 | | | | | | | | | | | | | |

Other liabilities | | | 188,631 | | | | | | | | | | | | | | | | 210,069 | | | | | | | | | | | | | | | | 193,584 | | | | | | | | | | | | | |

Shareholders’ equity | | | 230,769 | | | | | | | | | | | | | | | | 235,525 | | | | | | | | | | | | | | | | 229,910 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 2,338,538 | | | | | | | | | | | | | | | $ | 2,370,258 | | | | | | | | | | | | | | | $ | 2,516,609 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | | | | | | | 2.49 | | | | % | | | | | | | | | | | | 2.48 | | | | % | | | | | | | | | | | | 2.84 | | | | % | |

Impact of noninterest-bearing sources | | | | | | | | | | | 0.17 | | | | | | | | | | | | | | | | 0.18 | | | | | | | | | | | | | | | | 0.08 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income/yield on earning assets(1) | | | | | | $ | 12,334 | | | | 2.66 | | | | % | | | | | | | $ | 12,646 | | | | 2.66 | | | | % | | | | | | | $ | 13,978 | | | | 2.92 | | | | % | |

| | | | | | | | | | | | | | | | | | | | | | | | |

For footnotes see page 9.

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 10 |

Bank of America Corporation and Subsidiaries

Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis - Isolating Hedge Income/Expense(1)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter 2011 | | | | | | Fourth Quarter 2010 | | | | | | First Quarter 2010 | | | | |

| | | Average

Balance | | | Interest

Income/

Expense | | | Yield/

Rate | | | | | | Average

Balance | | | Interest

Income/

Expense | | | Yield/

Rate | | | | | | Average

Balance | | | Interest

Income/

Expense | | | Yield/

Rate | | | | |

Earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Time deposits placed and other short-term investments | | $ | 31,294 | | | $ | 88 | | | | 1.14 | | | | % | | | $ | 28,141 | | | $ | 75 | | | | 1.07 | | | | % | | | $ | 27,600 | | | $ | 61 | | | | 0.89 | | | | % | |

Federal funds sold and securities borrowed or purchased under agreements to resell(2) | | | 227,379 | | | | 462 | | | | 0.82 | | | | | | | | 243,589 | | | | 420 | | | | 0.68 | | | | | | | | 266,070 | | | | 368 | | | | 0.56 | | | | | |

Trading account assets (2) | | | 221,041 | | | | 1,739 | | | | 3.19 | | | | | | | | 216,003 | | | | 1,776 | | | | 3.27 | | | | | | | | 214,542 | | | | 1,833 | | | | 3.45 | | | | | |

Debt securities(2) | | | 335,847 | | | | 3,279 | | | | 3.96 | | | | | | | | 341,867 | | | | 3,085 | | | | 3.58 | | | | | | | | 311,136 | | | | 3,454 | | | | 4.45 | | | | | |

Loans and leases: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Residential mortgage | | | 262,049 | | | | 2,881 | | | | 4.40 | | | | | | | | 254,051 | | | | 2,857 | | | | 4.50 | | | | | | | | 243,833 | | | | 3,100 | | | | 5.09 | | | | | |

Home equity | | | 136,089 | | | | 1,335 | | | | 3.96 | | | | | | | | 139,772 | | | | 1,410 | | | | 4.01 | | | | | | | | 152,536 | | | | 1,586 | | | | 4.20 | | | | | |

Discontinued real estate | | | 12,899 | | | | 110 | | | | 3.42 | | | | | | | | 13,297 | | | | 118 | | | | 3.57 | | | | | | | | 14,433 | | | | 153 | | | | 4.24 | | | | | |

U.S. credit card | | | 109,941 | | | | 2,837 | | | | 10.47 | | | | | | | | 112,673 | | | | 3,040 | | | | 10.70 | | | | | | | | 125,353 | | | | 3,370 | | | | 10.90 | | | | | |

Non-U.S. credit card | | | 27,633 | | | | 779 | | | | 11.43 | | | | | | | | 27,457 | | | | 815 | | | | 11.77 | | | | | | | | 29,872 | | | | 906 | | | | 12.30 | | | | | |

Direct/Indirect consumer | | | 90,097 | | | | 993 | | | | 4.47 | | | | | | | | 91,549 | | | | 1,088 | | | | 4.72 | | | | | | | | 100,920 | | | | 1,302 | | | | 5.23 | | | | | |

Other consumer | | | 2,753 | | | | 45 | | | | 6.58 | | | | | | | | 2,796 | | | | 45 | | | | 6.32 | | | | | | | | 3,002 | | | | 48 | | | | 6.35 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total consumer | | | 641,461 | | | | 8,980 | | | | 5.65 | | | | | | | | 641,595 | | | | 9,373 | | | | 5.81 | | | | | | | | 669,949 | | | | 10,465 | | | | 6.30 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. commercial(2) | | | 191,353 | | | | 1,937 | | | | 4.11 | | | | | | | | 193,608 | | | | 1,902 | | | | 3.90 | | | | | | | | 202,662 | | | | 2,003 | | | | 4.01 | | | | | |

Commercial real estate | | | 48,359 | | | | 437 | | | | 3.66 | | | | | | | | 51,617 | | | | 432 | | | | 3.32 | | | | | | | | 68,526 | | | | 575 | | | | 3.40 | | | | | |

Commercial lease financing | | | 21,634 | | | | 322 | | | | 5.95 | | | | | | | | 21,363 | | | | 250 | | | | 4.69 | | | | | | | | 21,675 | | | | 304 | | | | 5.60 | | | | | |

Non-U.S. commercial(2) | | | 36,159 | | | | 299 | | | | 3.35 | | | | | | | | 32,431 | | | | 290 | | | | 3.54 | | | | | | | | 28,803 | | | | 264 | | | | 3.72 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total commercial | | | 297,505 | | | | 2,995 | | | | 4.08 | | | | | | | | 299,019 | | | | 2,874 | | | | 3.82 | | | | | | | | 321,666 | | | | 3,146 | | | | 3.96 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total loans and leases | | | 938,966 | | | | 11,975 | | | | 5.17 | | | | | | | | 940,614 | | | | 12,247 | | | | 5.18 | | | | | | | | 991,615 | | | | 13,611 | | | | 5.54 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other earning assets | | | 115,336 | | | | 922 | | | | 3.24 | | | | | | | | 113,325 | | | | 923 | | | | 3.23 | | | | | | | | 122,097 | | | | 1,053 | | | | 3.50 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total earning assets - excluding hedge impact | | | 1,869,863 | | | | 18,465 | | | | 4.00 | | | | | | | | 1,883,539 | | | | 18,526 | | | | 3.90 | | | | | | | | 1,933,060 | | | | 20,380 | | | | 4.27 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net hedge expense on assets | | | | | | | (388 | ) | | | | | | | | | | | | | | | (29 | ) | | | | | | | | | | | | | | | (272 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total earning assets - including hedge impact | | | 1,869,863 | | | | 18,077 | | | | 3.92 | | | | | | | | 1,883,539 | | | | 18,497 | | | | 3.90 | | | | | | | | 1,933,060 | | | | 20,108 | | | | 4.19 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | | 138,241 | | | | 63 | | | | | | | | | | | | 136,967 | | | | 63 | | | | | | | | | | | | 196,911 | | | | 92 | | | | | | | | | |

Other assets, less allowance for loan and lease losses | | | 330,434 | | | | | | | | | | | | | | | | 349,752 | | | | | | | | | | | | | | | | 386,638 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 2,338,538 | | | | | | | | | | | | | | | $ | 2,370,258 | | | | | | | | | | | | | | | $ | 2,516,609 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | This table presents a non-GAAP financial measure. The impact of interest rate risk management derivatives is shown separately. Interest income and interest expense amounts, and the yields and rates have been adjusted. Management believes this presentation is useful to investors because it adjusts for the impact of our hedging decisions and provides a better understanding of our hedging activities. The impact of interest rate risk management derivatives is not material to the average balances presented above. |

| (2) | The impact of interest rate risk management derivatives on interest income and interest expense is presented below. |

Interest income excludes the impact of interest rate risk management contracts, which increased (decreased) interest income on:

| | | | | | | | | | | | |

| | | First

Quarter

2011 | | | Fourth

Quarter

2010 | | | First

Quarter

2010 | |

Federal funds sold and securities borrowed or purchased under agreements to resell | | $ | 55 | | | $ | 66 | | | $ | 80 | |

Trading account assets | | | (70 | ) | | | (66 | ) | | | (38 | ) |

Debt securities | | | (362 | ) | | | (20 | ) | | | (281 | ) |

U.S. commercial | | | (11 | ) | | | (8 | ) | | | (33 | ) |

Non-U.S. commercial | | | — | | | | (1 | ) | | | — | |

| | | | | | | | | | | | |

Net hedge expense on assets | | $ | (388 | ) | | $ | (29 | ) | | $ | (272 | ) |

| | | | | | | | | | | | |

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 11 |

Bank of America Corporation and Subsidiaries

Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis - Isolating Hedge Income/Expense(1) (continued)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter 2011 | | | | | | Fourth Quarter 2010 | | | | | | First Quarter 2010 | | | | |

| | | Average

Balance | | | Interest

Income/

Expense | | | Yield/

Rate | | | | | | Average

Balance | | | Interest

Income/

Expense | | | Yield/

Rate | | | | | | Average

Balance | | | Interest

Income/

Expense | | | Yield/

Rate | | | | |

Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Savings | | $ | 38,905 | | | $ | 32 | | | | 0.34 | | | | % | | | $ | 37,145 | | | $ | 35 | | | | 0.36 | | | | % | | | $ | 35,126 | | | $ | 43 | | | | 0.50 | | | | % | |

NOW and money market deposit accounts(2) | | | 475,954 | | | | 317 | | | | 0.27 | | | | | | | | 464,531 | | | | 333 | | | | 0.28 | | | | | | | | 416,110 | | | | 341 | | | | 0.33 | | | | | |

Consumer CDs and IRAs (2) | | | 118,306 | | | | 253 | | | | 0.87 | | | | | | | | 124,855 | | | | 290 | | | | 0.92 | | | | | | | | 166,189 | | | | 523 | | | | 1.28 | | | | | |

Negotiable CDs, public funds and other time deposits(2) | | | 13,995 | | | | 35 | | | | 1.01 | | | | | | | | 16,334 | | | | 44 | | | | 1.08 | | | | | | | | 19,763 | | | | 60 | | | | 1.23 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total U.S. interest-bearing deposits | | | 647,160 | | | | 637 | | | | 0.40 | | | | | | | | 642,865 | | | | 702 | | | | 0.43 | | | | | | | | 637,188 | | | | 967 | | | | 0.62 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-U.S. interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Banks located in non-U.S. countries(2) | | | 21,534 | | | | 20 | | | | 0.38 | | | | | | | | 16,827 | | | | 19 | | | | 0.47 | | | | | | | | 18,424 | | | | 15 | | | | 0.33 | | | | | |

Governments and official institutions | | | 2,307 | | | | 2 | | | | 0.35 | | | | | | | | 1,560 | | | | 2 | | | | 0.42 | | | | | | | | 5,626 | | | | 3 | | | | 0.22 | | | | | |

Time, savings and other | | | 60,432 | | | | 112 | | | | 0.76 | | | | | | | | 58,746 | | | | 101 | | | | 0.69 | | | | | | | | 54,885 | | | | 73 | | | | 0.53 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total non-U.S. interest-bearing deposits | | | 84,273 | | | | 134 | | | | 0.64 | | | | | | | | 77,133 | | | | 122 | | | | 0.63 | | | | | | | | 78,935 | | | | 91 | | | | 0.47 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing deposits | | | 731,433 | | | | 771 | | | | 0.43 | | | | | | | | 719,998 | | | | 824 | | | | 0.45 | | | | | | | | 716,123 | | | | 1,058 | | | | 0.60 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Federal funds purchased, securities loaned or sold under agreements to repurchase and other short-term borrowings(2) | | | 371,573 | | | | 739 | | | | 0.81 | | | | | | | | 369,738 | | | | 740 | | | | 0.79 | | | | | | | | 508,332 | | | | 716 | | | | 0.57 | | | | | |

Trading account liabilities | | | 83,914 | | | | 627 | | | | 3.03 | | | | | | | | 81,313 | | | | 561 | | | | 2.74 | | | | | | | | 90,134 | | | | 660 | | | | 2.97 | | | | | |

Long-term debt(2) | | | 440,511 | | | | 4,227 | | | | 3.89 | | | | | | | | 465,875 | | | | 4,398 | | | | 3.76 | | | | | | | | 513,634 | | | | 4,666 | | | | 3.66 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities - excluding hedge impact | | | 1,627,431 | | | | 6,364 | | | | 1.59 | | | | | | | | 1,636,924 | | | | 6,523 | | | | 1.59 | | | | | | | | 1,828,223 | | | | 7,100 | | | | 1.57 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net hedge income on liabilities | | | | | | | (621 | ) | | | | | | | | | | | | | | | (672 | ) | | | | | | | | | | | | | | | (970 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities - including hedge impact | | | 1,627,431 | | | | 5,743 | | | | 1.43 | | | | | | | | 1,636,924 | | | | 5,851 | | | | 1.42 | | | | | | | | 1,828,223 | | | | 6,130 | | | | 1.35 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing sources: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing deposits | | | 291,707 | | | | | | | | | | | | | | | | 287,740 | | | | | | | | | | | | | | | | 264,892 | | | | | | | | | | | | | |

Other liabilities | | | 188,631 | | | | | | | | | | | | | | | | 210,069 | | | | | | | | | | | | | | | | 193,584 | | | | | | | | | | | | | |

Shareholders’ equity | | | 230,769 | | | | | | | | | | | | | | | | 235,525 | | | | | | | | | | | | | | | | 229,910 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 2,338,538 | | | | | | | | | | | | | | | $ | 2,370,258 | | | | | | | | | | | | | | | $ | 2,516,609 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | | | | | | | 2.41 | | | | % | | | | | | | | | | | | 2.31 | | | | % | | | | | | | | | | | | 2.70 | | | | % | |

Impact of noninterest-bearing sources | | | | | | | | | | | 0.21 | | | | | | | | | | | | | | | | 0.22 | | | | | | | | | | | | | | | | 0.09 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income/yield on earning assets - excluding hedge impact | | | | | | | 12,101 | | | | 2.62 | | | | % | | | | | | | | 12,003 | | | | 2.53 | | | | % | | | | | | | | 13,280 | | | | 2.79 | | | | % | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net impact of hedge income | | | | | | | 233 | | | | 0.04 | | | | | | | | | | | | 643 | | | | 0.13 | | | | | | | | | | | | 698 | | | | 0.13 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income/yield on earning assets | | | | | | $ | 12,334 | | | | 2.66 | | | | % | | | | | | | $ | 12,646 | | | | 2.66 | | | | % | | | | | | | $ | 13,978 | | | | 2.92 | | | | % | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | This table presents a non-GAAP financial measure. The impact of interest rate risk management derivatives is shown separately. Interest income and interest expense amounts, and the yields and rates have been adjusted. Management believes this presentation is useful to investors because it adjusts for the impact of our hedging decisions and provides a better understanding of our hedging activities. The impact of interest rate risk management derivatives is not material to the average balances presented above. |

| (2) | The impact of interest rate risk management derivatives on interest income and interest expense is presented below. |

Interest expense excludes the impact of interest rate risk management contracts, which increased (decreased) interest expense on:

| | | | | | | | | | | | |

| | | First

Quarter

2011 | | | Fourth

Quarter

2010 | | | First

Quarter

2010 | |

NOW and money market deposit accounts | | $ | (1 | ) | | $ | — | | | $ | — | |

Consumer CDs and IRAs | | | 47 | | | | 48 | | | | 44 | |

Negotiable CDs, public funds and other time deposits | | | 4 | | | | 3 | | | | 3 | |

Banks located in non-U.S. countries | | | 18 | | | | 19 | | | | 17 | |

Federal funds purchased and securities loaned or sold under agreements to repurchase and other short-term borrowings | | | 445 | | | | 402 | | | | 102 | |

Long-term debt | | | (1,134 | ) | | | (1,144 | ) | | | (1,136 | ) |

| | | | | | | | | | | | |

Net hedge income on liabilities | | $ | (621 | ) | | $ | (672 | ) | | $ | (970 | ) |

| | | | | | | | | | | | |

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 12 |

Bank of America Corporation and Subsidiaries

Debt Securities and Available-for-Sale Marketable Equity Securities

(Dollars in millions)

| | | | | | | | | | | | | | | | |

| | | March 31, 2011 | |

| | | Amortized

Cost | | | Gross

Unrealized

Gains | | | Gross

Unrealized

Losses | | | Fair

Value | |

Available-for-sale debt securities | | | | | | | | | | | | | | | | |

U.S. Treasury and agency securities | | $ | 49,361 | | | $ | 625 | | | $ | (887 | ) | | $ | 49,099 | |

Mortgage-backed securities: | | | | | | | | | | | | | | | | |

Agency | | | 192,301 | | | | 2,605 | | | | (3,136 | ) | | | 191,770 | |

Agency collateralized mortgage obligations | | | 34,819 | | | | 237 | | | | (29 | ) | | | 35,027 | |

Non-agency residential | | | 20,625 | | | | 536 | | | | (507 | ) | | | 20,654 | |

Non-agency commercial | | | 6,116 | | | | 684 | | | | (1 | ) | | | 6,799 | |

Non-U.S. securities | | | 4,250 | | | | 63 | | | | (11 | ) | | | 4,302 | |

Corporate bonds | | | 4,340 | | | | 134 | | | | (5 | ) | | | 4,469 | |

Other taxable securities(1) | | | 12,883 | | | | 75 | | | | (90 | ) | | | 12,868 | |

| | | | | | | | | | | | | | | | |

Total taxable securities | | $ | 324,695 | | | $ | 4,959 | | | $ | (4,666 | ) | | $ | 324,988 | |

Tax-exempt securities | | | 5,546 | | | | 31 | | | | (220 | ) | | | 5,357 | |

| | | | | | | | | | | | | | | | |

Total available-for-sale debt securities | | $ | 330,241 | | | $ | 4,990 | | | $ | (4,886 | ) | | $ | 330,345 | |

| | | | | | | | | | | | | | | | |

Held-to-maturity debt securities | | | 431 | | | | — | | | | — | | | | 431 | |

| | | | | | | | | | | | | | | | |

Total debt securities | | $ | 330,672 | | | $ | 4,990 | | | $ | (4,886 | ) | | $ | 330,776 | |

| | | | | | | | | | | | | | | | |

Available-for-sale marketable equity securities(2) | | $ | 8,535 | | | $ | 11,925 | | | $ | (15 | ) | | $ | 20,445 | |

| | | | | | | | | | | | | | | | |

| |

| | | December 31, 2010 | |

| | | Amortized

Cost | | | Gross

Unrealized

Gains | | | Gross

Unrealized

Losses | | | Fair

Value | |

Available-for-sale debt securities | | | | | | | | | | | | | | | | |

U.S. Treasury and agency securities | | $ | 49,413 | | | $ | 604 | | | $ | (912 | ) | | $ | 49,105 | |

Mortgage-backed securities: | | | | | | | | | | | | | | | | |

Agency | | | 190,409 | | | | 3,048 | | | | (2,240 | ) | | | 191,217 | |

Agency collateralized mortgage obligations | | | 36,639 | | | | 401 | | | | (23 | ) | | | 37,017 | |

Non-agency residential | | | 23,458 | | | | 588 | | | | (929 | ) | | | 23,117 | |

Non-agency commercial | | | 6,167 | | | | 686 | | | | (1 | ) | | | 6,852 | |

Non-U.S. securities | | | 4,054 | | | | 92 | | | | (7 | ) | | | 4,139 | |

Corporate bonds | | | 5,157 | | | | 144 | | | | (10 | ) | | | 5,291 | |

Other taxable securities(1) | | | 15,514 | | | | 39 | | | | (161 | ) | | | 15,392 | |

| | | | | | | | | | | | | | | | |

Total taxable securities | | $ | 330,811 | | | $ | 5,602 | | | $ | (4,283 | ) | | $ | 332,130 | |

Tax-exempt securities | | | 5,687 | | | | 32 | | | | (222 | ) | | | 5,497 | |

| | | | | | | | | | | | | | | | |

Total available-for-sale debt securities | | $ | 336,498 | | | $ | 5,634 | | | $ | (4,505 | ) | | $ | 337,627 | |

| | | | | | | | | | | | | | | | |

Held-to-maturity debt securities | | | 427 | | | | — | | | | — | | | | 427 | |

| | | | | | | | | | | | | | | | |

Total debt securities | | $ | 336,925 | | | $ | 5,634 | | | $ | (4,505 | ) | | $ | 338,054 | |

| | | | | | | | | | | | | | | | |

Available-for-sale marketable equity securities(2) | | $ | 8,650 | | | $ | 10,628 | | | $ | (13 | ) | | $ | 19,265 | |

| | | | | | | | | | | | | | | | |

| (1) | Substantially all asset-backed securities. |

| (2) | Classified in other assets on the Consolidated Balance Sheet. |

Certain prior period amounts have been reclassified to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 13 |

Bank of America Corporation and Subsidiaries

Quarterly Results by Business Segment

(Dollars in millions)

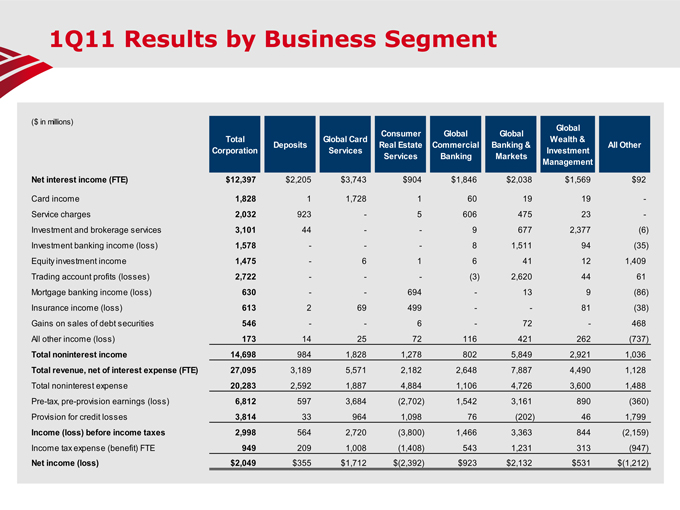

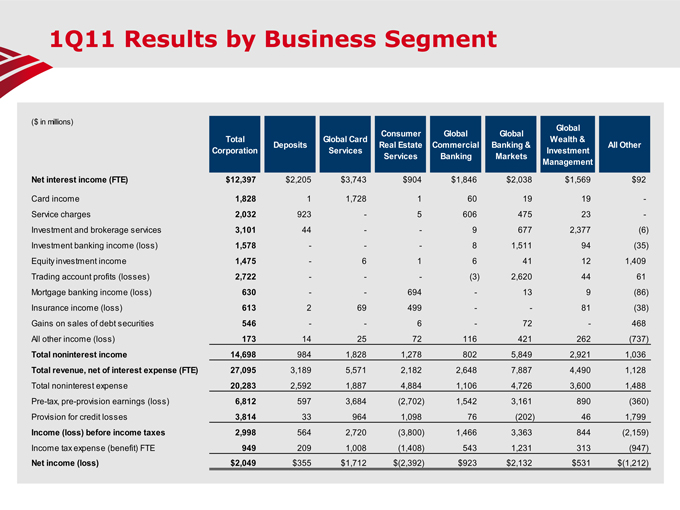

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter 2011 | |

| | | Total

Corporation | | | | | | Deposits | | | Global

Card

Services | | | Consumer

Real Estate

Services | | | Global

Commercial

Banking | | | Global

Banking &

Markets | | | GWIM | | | All

Other | |

Net interest income(1) | | $ | 12,397 | | | | | | | $ | 2,205 | | | $ | 3,743 | | | $ | 904 | | | $ | 1,846 | | | $ | 2,038 | | | $ | 1,569 | | | $ | 92 | |

Noninterest income | | | 14,698 | | | | | | | | 984 | | | | 1,828 | | | | 1,278 | | | | 802 | | | | 5,849 | | | | 2,921 | | | | 1,036 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue, net of interest expense | | | 27,095 | | | | | | | | 3,189 | | | | 5,571 | | | | 2,182 | | | | 2,648 | | | | 7,887 | | | | 4,490 | | | | 1,128 | |

| | | | | | | | | |

Provision for credit losses | | | 3,814 | | | | | | | | 33 | | | | 964 | | | | 1,098 | | | | 76 | | | | (202 | ) | | | 46 | | | | 1,799 | |

Noninterest expense | | | 20,283 | | | | | | | | 2,592 | | | | 1,887 | | | | 4,884 | | | | 1,106 | | | | 4,726 | | | | 3,600 | | | | 1,488 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 2,998 | | | | | | | | 564 | | | | 2,720 | | | | (3,800 | ) | | | 1,466 | | | | 3,363 | | | | 844 | | | | (2,159 | ) |

Income tax expense (benefit)(1) | | | 949 | | | | | | | | 209 | | | | 1,008 | | | | (1,408 | ) | | | 543 | | | | 1,231 | | | | 313 | | | | (947 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 2,049 | | | | | | | $ | 355 | | | $ | 1,712 | | | $ | (2,392 | ) | | $ | 923 | | | $ | 2,132 | | | $ | 531 | | | $ | (1,212 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Average | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total loans and leases | | $ | 938,966 | | | | | | | | n/m | | | $ | 162,885 | | | $ | 120,560 | | | $ | 191,977 | | | $ | 103,704 | | | $ | 100,851 | | | $ | 258,350 | |

Total assets(2) | | | 2,338,538 | | | | | | | $ | 443,461 | | | | 165,170 | | | | 210,302 | | | | 312,557 | | | | 708,231 | | | | 291,907 | | | | 206,910 | |

Total deposits | | | 1,023,140 | | | | | | | | 418,298 | | | | n/m | | | | n/m | | | | 160,217 | | | | 112,028 | | | | 258,518 | | | | 48,608 | |

| | | | | | | | | |

Period end | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total loans and leases | | $ | 932,425 | | | | | | | | n/m | | | $ | 158,900 | | | $ | 118,750 | | | $ | 190,293 | | | $ | 105,651 | | | $ | 101,286 | | | $ | 256,930 | |

Total assets(2) | | | 2,274,532 | | | | | | | $ | 456,248 | | | | 163,435 | | | | 205,504 | | | | 309,917 | | | | 698,399 | | | | 280,524 | | | | 160,505 | |

Total deposits | | | 1,020,175 | | | | | | | | 431,022 | | | | n/m | | | | n/m | | | | 161,584 | | | | 115,212 | | | | 256,526 | | | | 34,817 | |

| |

| | | Fourth Quarter 2010 | |

| | | Total

Corporation | | | | | | Deposits | | | Global

Card

Services | | | Consumer

Real Estate

Services | | | Global

Commercial

Banking | | | Global

Banking &

Markets | | | GWIM | | | All

Other | |

Net interest income(1) | | $ | 12,709 | | | | | | | $ | 2,006 | | | $ | 4,203 | | | $ | 1,131 | | | $ | 1,861 | | | $ | 2,007 | | | $ | 1,425 | | | $ | 76 | |

Noninterest income (loss) | | | 9,959 | | | | | | | | 997 | | | | 2,043 | | | | (647 | ) | | | 749 | | | | 3,481 | | | | 2,734 | | | | 602 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue, net of interest expense | | | 22,668 | | | | | | | | 3,003 | | | | 6,246 | | | | 484 | | | | 2,610 | | | | 5,488 | | | | 4,159 | | | | 678 | |

| | | | | | | | | |

Provision for credit losses | | | 5,129 | | | | | | | | 41 | | | | 2,141 | | | | 1,198 | | | | (132 | ) | | | (112 | ) | | | 155 | | | | 1,838 | |

Noninterest expense | | | 20,864 | | | | | | | | 3,253 | | | | 1,741 | | | | 6,046 | | | | 1,058 | | | | 4,394 | | | | 3,494 | | | | 878 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (3,325 | ) | | | | | | | (291 | ) | | | 2,364 | | | | (6,760 | ) | | | 1,684 | | | | 1,206 | | | | 510 | | | | (2,038 | ) |

Income tax expense (benefit)(1) | | | (2,081 | ) | | | | | | | (101 | ) | | | 876 | | | | (1,784 | ) | | | 634 | | | | 505 | | | | 195 | | | | (2,406 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (1,244 | ) | | | | | | $ | (190 | ) | | $ | 1,488 | | | $ | (4,976 | ) | | $ | 1,050 | | | $ | 701 | | | $ | 315 | | | $ | 368 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Average | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total loans and leases | | $ | 940,614 | | | | | | | | n/m | | | $ | 167,156 | | | $ | 124,934 | | | $ | 194,819 | | | $ | 100,606 | | | $ | 100,306 | | | $ | 252,180 | |

Total assets(2) | | | 2,370,258 | | | | | | | $ | 438,346 | | | | 167,722 | | | | 219,106 | | | | 314,766 | | | | 738,036 | | | | 284,881 | | | | 207,401 | |

Total deposits | | | 1,007,738 | | | | | | | | 413,150 | | | | n/m | | | | n/m | | | | 156,671 | | | | 114,942 | | | | 246,281 | | | | 44,841 | |

| | | | | | | | | |

Period end | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total loans and leases | | $ | 940,440 | | | | | | | | n/m | | | $ | 167,367 | | | $ | 122,934 | | | $ | 193,568 | | | $ | 99,964 | | | $ | 100,724 | | | $ | 255,213 | |

Total assets(2) | | | 2,264,909 | | | | | | | $ | 440,954 | | | | 169,745 | | | | 213,363 | | | | 312,787 | | | | 651,638 | | | | 289,954 | | | | 186,468 | |

Total deposits | | | 1,010,430 | | | | | | | | 415,189 | | | | n/m | | | | n/m | | | | 161,278 | | | | 110,971 | | | | 257,983 | | | | 38,748 | |

| |

| | | First Quarter 2010 | |

| | | Total

Corporation | | | | | | Deposits | | | Global

Card

Services | | | Consumer

Real Estate

Services | | | Global

Commercial

Banking | | | Global

Banking &

Markets | | | GWIM | | | All

Other | |

Net interest income(1) | | $ | 14,070 | | | | | | | $ | 2,175 | | | $ | 4,818 | | | $ | 1,213 | | | $ | 2,189 | | | $ | 2,170 | | | $ | 1,464 | | | $ | 41 | |

Noninterest income | | | 18,220 | | | | | | | | 1,543 | | | | 1,985 | | | | 2,410 | | | | 899 | | | | 7,523 | | | | 2,574 | | | | 1,286 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue, net of interest expense | | | 32,290 | | | | | | | | 3,718 | | | | 6,803 | | | | 3,623 | | | | 3,088 | | | | 9,693 | | | | 4,038 | | | | 1,327 | |

| | | | | | | | | |

Provision for credit losses | | | 9,805 | | | | | | | | 38 | | | | 3,535 | | | | 3,600 | | | | 936 | | | | 236 | | | | 242 | | | | 1,218 | |

Noninterest expense | | | 17,775 | | | | | | | | 2,562 | | | | 1,732 | | | | 3,328 | | | | 1,030 | | | | 4,292 | | | | 3,103 | | | | 1,728 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 4,710 | | | | | | | | 1,118 | | | | 1,536 | | | | (3,305 | ) | | | 1,122 | | | | 5,165 | | | | 693 | | | | (1,619 | ) |

Income tax expense (benefit)(1) | | | 1,528 | | | | | | | | 417 | | | | 573 | | | | (1,233 | ) | | | 419 | | | | 1,927 | | | | 259 | | | | (834 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 3,182 | | | | | | | $ | 701 | | | $ | 963 | | | $ | (2,072 | ) | | $ | 703 | | | $ | 3,238 | | | $ | 434 | | | $ | (785 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Average | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total loans and leases | | $ | 991,615 | | | | | | | | n/m | | | $ | 189,307 | | | $ | 133,744 | | | $ | 213,838 | | | $ | 99,034 | | | $ | 98,841 | | | $ | 256,156 | |

Total assets(2) | | | 2,516,609 | | | | | | | $ | 441,854 | | | | 195,809 | | | | 234,010 | | | | 298,007 | | | | 776,584 | | | | 249,799 | | | | 320,546 | |

Total deposits | | | 981,015 | | | | | | | | 416,842 | | | | n/m | | | | n/m | | | | 143,635 | | | | 103,634 | | | | 221,613 | | | | 70,858 | |

| | | | | | | | | |

Period end | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total loans and leases | | $ | 976,042 | | | | | | | | n/m | | | $ | 181,763 | | | $ | 132,427 | | | $ | 211,250 | | | $ | 95,580 | | | $ | 98,343 | | | $ | 255,869 | |

Total assets(2) | | | 2,344,634 | | | | | | | $ | 445,237 | | | | 190,949 | | | | 224,469 | | | | 304,058 | | | | 685,445 | | | | 257,299 | | | | 237,177 | |

Total deposits | | | 976,102 | | | | | | | | 420,251 | | | | n/m | | | | n/m | | | | 145,669 | | | | 104,700 | | | | 227,148 | | | | 56,855 | |

| (1) | Fully taxable-equivalent basis |

| (2) | Total assets include asset allocations to match liabilities (i.e., deposits). |

Certain prior period amounts have been reclassified among the segments to conform to current period presentation.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 14 |

Bank of America Corporation and Subsidiaries

Deposits Segment Results

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First

Quarter

2011 | | | | | | Fourth

Quarter

2010 | | | | | | Third

Quarter

2010 | | | | | | Second

Quarter

2010 | | | | | | First

Quarter

2010 | | | | |

Net interest income(1) | | $ | 2,205 | | | | | | | $ | 2,006 | | | | | | | $ | 1,953 | | | | | | | $ | 2,144 | | | | | | | $ | 2,175 | | | | | |

Noninterest income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Service charges | | | 923 | | | | | | | | 946 | | | | | | | | 1,138 | | | | | | | | 1,494 | | | | | | | | 1,479 | | | | | |

All other income | | | 61 | | | | | | | | 51 | | | | | | | | 55 | | | | | | | | 57 | | | | | | | | 64 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total noninterest income | | | 984 | | | | | | | | 997 | | | | | | | | 1,193 | | | | | | | | 1,551 | | | | | | | | 1,543 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue, net of interest expense | | | 3,189 | | | | | | | | 3,003 | | | | | | | | 3,146 | | | | | | | | 3,695 | | | | | | | | 3,718 | | | | | |

| | | | | | | | | | |

Provision for credit losses | | | 33 | | | | | | | | 41 | | | | | | | | 62 | | | | | | | | 60 | | | | | | | | 38 | | | | | |

Noninterest expense | | | 2,592 | | | | | | | | 3,253 | | | | | | | | 2,756 | | | | | | | | 2,567 | | | | | | | | 2,562 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 564 | | | | | | | | (291 | ) | | | | | | | 328 | | | | | | | | 1,068 | | | | | | | | 1,118 | | | | | |

Income tax expense (benefit)(1) | | | 209 | | | | | | | | (101 | ) | | | | | | | 119 | | | | | | | | 390 | | | | | | | | 417 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |