1 BILL NUTI, CHAIRMAN & CEO MARK BENJAMIN, PRESIDENT & COO BOB FISHMAN, CFO April 20, 2017

2 FORWARD-LOOKING STATEMENTS. Comments made during this conference call and in these materials contain forward-looking statements. Statements that describe or relate to NCR's plans, goals, intentions, strategies or financial outlook, and statements that do not relate to historical or current fact, are examples of forward-looking statements. The forward-looking statements in these materials include statements about NCR’s omni-channel market momentum; expected demand for NCR’s Channel Transformation solutions; NCR’s business process improvement initiatives and their effect on gross margin rate; the expected areas of focus for NCR’s Services segment in 2017; the expansion of new product introductions into global markets; NCR’s FY 2017, 2017 segment and Q2 2017 financial guidance and the expected type and magnitude of the non-operational adjustments included in any forward-looking non-GAAP measures; NCR’s confidence in its full year results; NCR’s solution offerings and their alignment with major market trends and customer demands; NCR’s backlog and key metrics; expectations for margin expansion and the drivers of margin expansion; the expected drivers of NCR’s growth; and the prioritization of free cash flow generation and a balanced capital allocation strategy. Forward-looking statements are not guarantees of future performance, and there are a number of important factors that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements, including those factors listed in Item 1a "Risk Factors" of NCR's Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC) on February 24, 2017, and those factors detailed from time to time in NCR's other SEC reports. These materials are dated April 20, 2017, and NCR does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. NON-GAAP MEASURES. While NCR reports its results in accordance with generally accepted accounting principles in the United States (GAAP), comments made during this conference call and these materials will include or make reference to the following "non-GAAP" measures: selected measures, such as period-over-period revenue growth, expressed on a constant currency basis and adjusted constant currency basis, gross margin rate (non-GAAP), diluted earnings per share (non-GAAP), free cash flow (FCF), gross margin (non-GAAP), free cash flow as a percentage of non-GAAP net income (or free cash flow conversion rate), net debt, adjusted EBITDA, the ratio of net debt to adjusted EBITDA, operating expenses (non-GAAP), operating income (non-GAAP), interest and other expense (non-GAAP), income tax expense (non-GAAP), income tax rate (non-GAAP), and net income (non-GAAP). These measures are included to provide additional useful information regarding NCR's financial results, and are not a substitute for their comparable GAAP measures. Explanations of these non- GAAP measures, and reconciliations of these non-GAAP measures to their directly comparable GAAP measures, are included in the accompanying "Supplementary Materials" and are available on the Investor Relations page of NCR's website at www.ncr.com. Descriptions of many of these non-GAAP measures are also included in NCR's SEC reports. USE OF CERTAIN TERMS. As used in these materials, (i) the term "recurring revenue" means the sum of cloud, hardware maintenance and software maintenance revenue, (ii) The term “net annual contract value” or “net ACV” for any particular period means NCR’s net bookings for cloud revenue during the period, and is calculated as twelve months of expected subscription revenues under new cloud contracts during such period less twelve months of subscription revenues under cloud contracts that expired or were terminated during such period, and (iii) the term "CC" means constant currency. These presentation materials and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together. NOTES TO INVESTORS

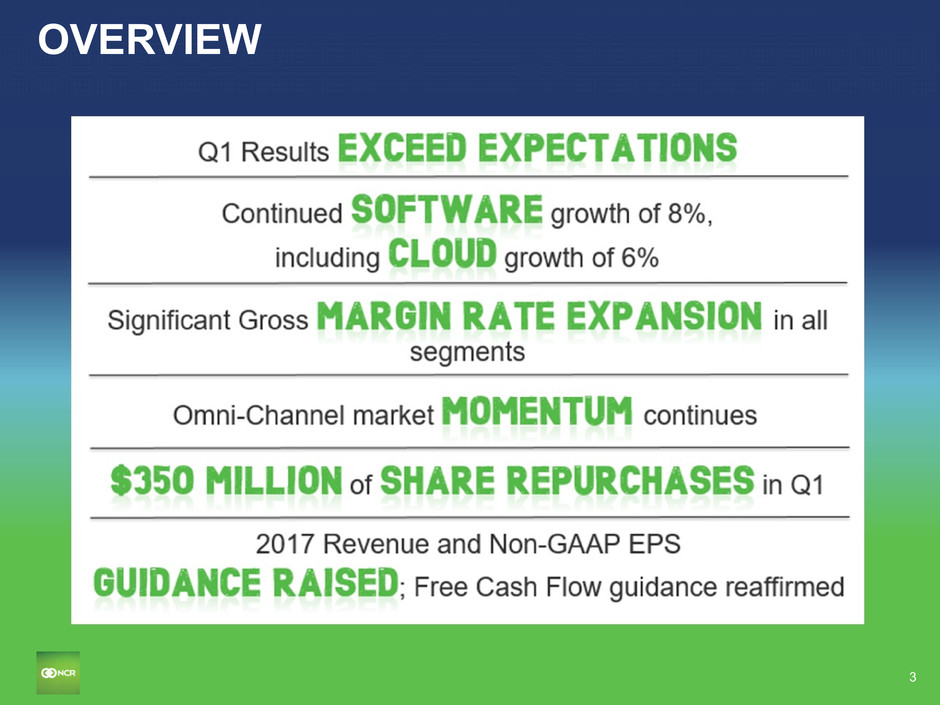

3 OVERVIEW

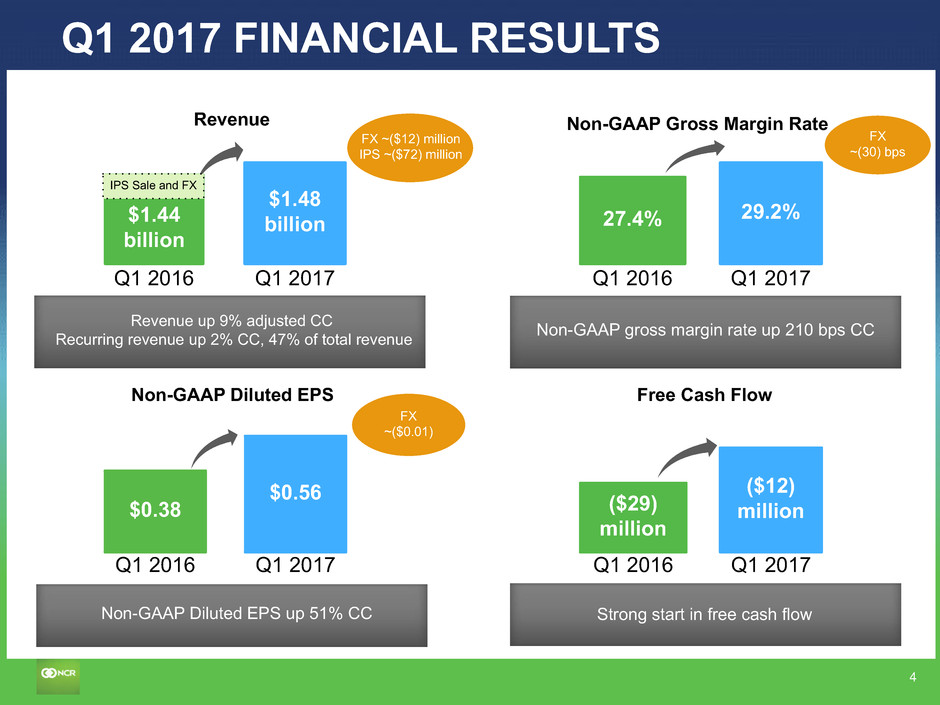

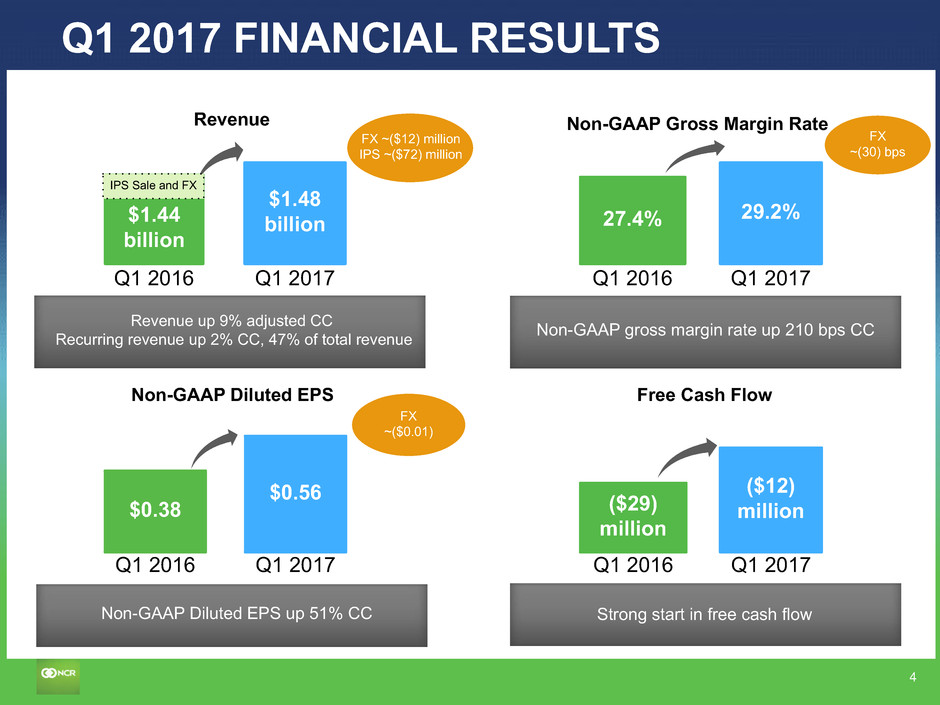

4 Q1 2017 FINANCIAL RESULTS Non-GAAP gross margin rate up 210 bps CC Non-GAAP Diluted EPS up 51% CC Strong start in free cash flow FX ~(30) bps FX ~($0.01) $1.44 billion 27.4% 29.2% Q1 2016 Q1 2016 Q1 2017 $0.56 Q1 2016 Q1 2017 ($29) million Q1 2016 ($12) million Q1 2017 Revenue Non-GAAP Gross Margin Rate Non-GAAP Diluted EPS Free Cash Flow Revenue up 9% adjusted CC Recurring revenue up 2% CC, 47% of total revenue $1.48 billion Q1 2017 $0.38 IPS Sale and FX FX ~($12) million IPS ~($72) million

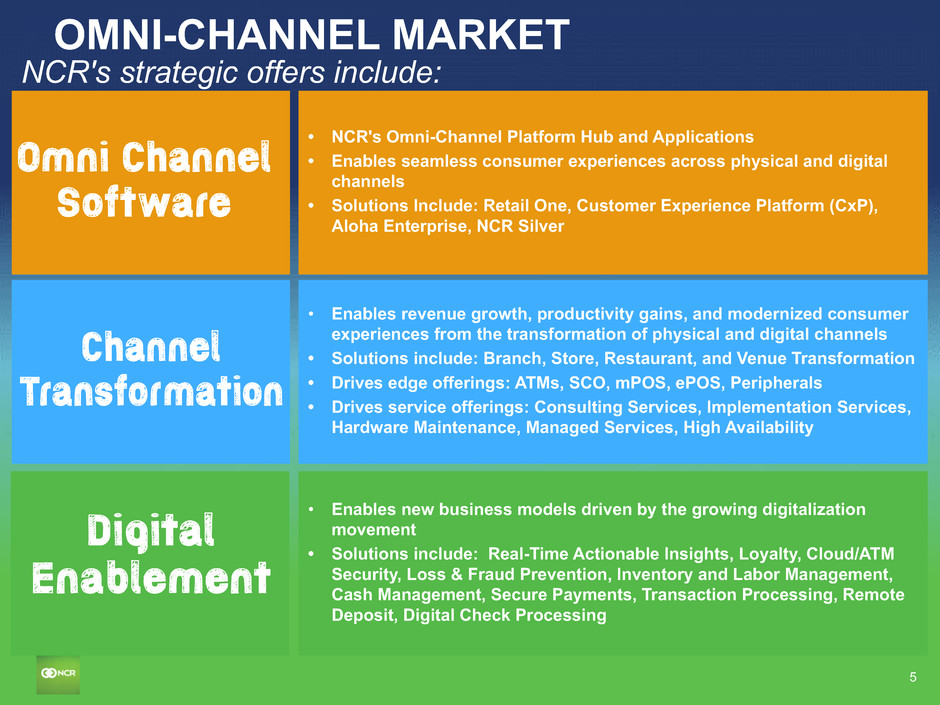

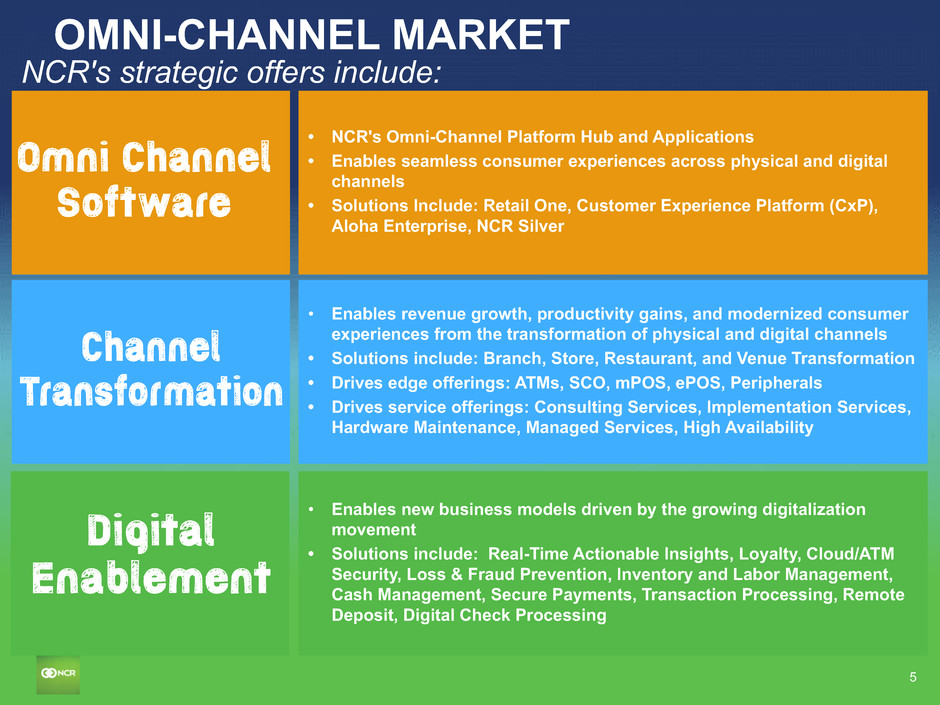

5 OMNI-CHANNEL MARKET NCR's strategic offers include: • Enables revenue growth, productivity gains, and modernized consumer experiences from the transformation of physical and digital channels • Solutions include: Branch, Store, Restaurant, and Venue Transformation • Drives edge offerings: ATMs, SCO, mPOS, ePOS, Peripherals • Drives service offerings: Consulting Services, Implementation Services, Hardware Maintenance, Managed Services, High Availability • NCR's Omni-Channel Platform Hub and Applications • Enables seamless consumer experiences across physical and digital channels • Solutions Include: Retail One, Customer Experience Platform (CxP), Aloha Enterprise, NCR Silver • Enables new business models driven by the growing digitalization movement • Solutions include: Real-Time Actionable Insights, Loyalty, Cloud/ATM Security, Loss & Fraud Prevention, Inventory and Labor Management, Cash Management, Secure Payments, Transaction Processing, Remote Deposit, Digital Check Processing

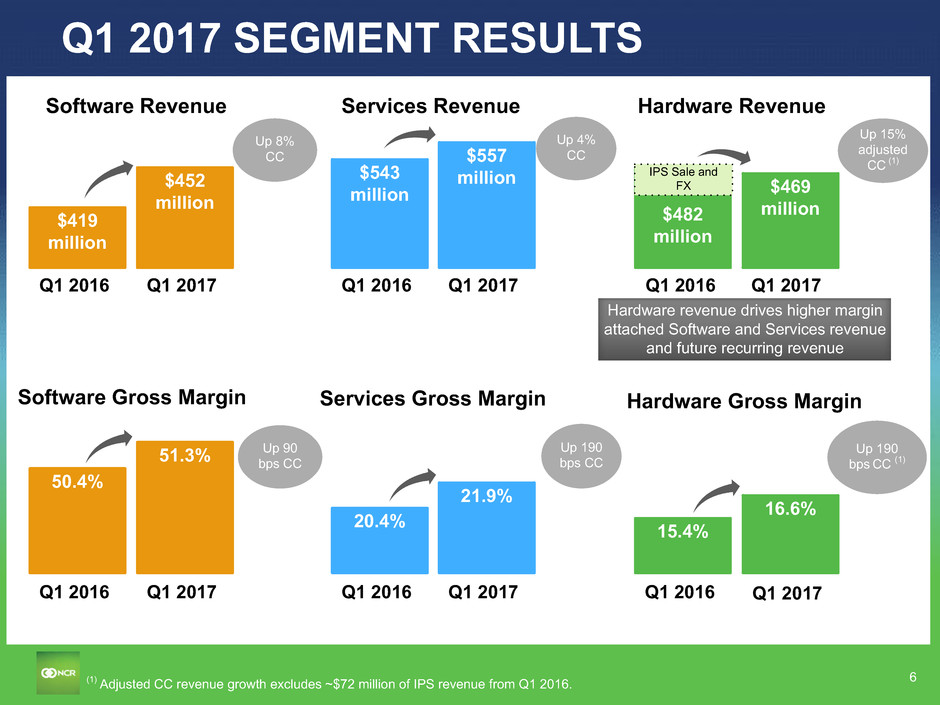

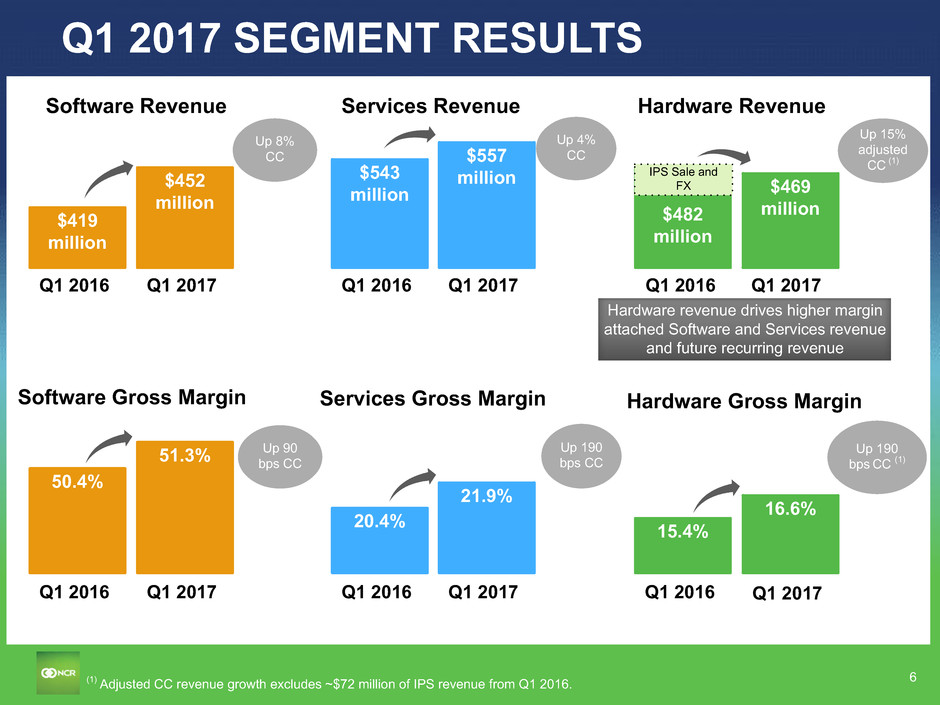

6 Q1 2017 SEGMENT RESULTS Up 8% CC Up 4% CC Up 15% adjusted CC (1) (1) Adjusted CC revenue growth excludes ~$72 million of IPS revenue from Q1 2016. Up 90 bps CC Up 190 bps CC Up 190 bps CC (1) Hardware revenue drives higher margin attached Software and Services revenue and future recurring revenue 50.4% 51.3% 20.4% 21.9% Q1 2016 Q1 2017 Q1 2016 Q1 2017 Software Gross Margin Services Gross Margin 15.4% 16.6% Q1 2016 Q1 2017 Hardware Gross Margin $419 million $452 million Q1 2016 Q1 2017 $543 million $557 million Q1 2017Q1 2016 Software Revenue Services Revenue $482 million $469 million Hardware Revenue IPS Sale and FX Q1 2017Q1 2016

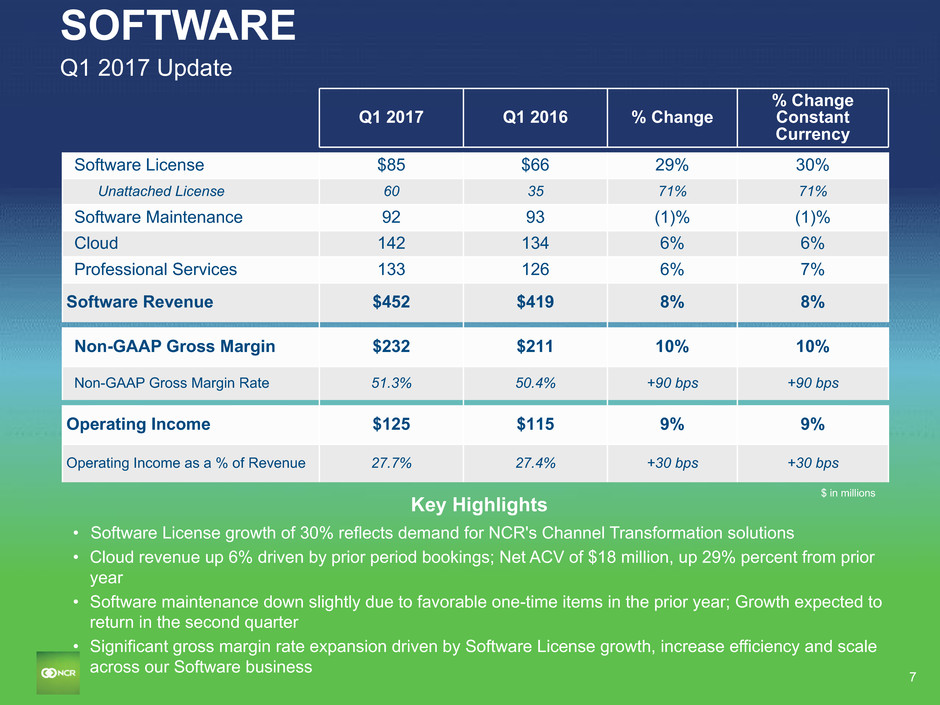

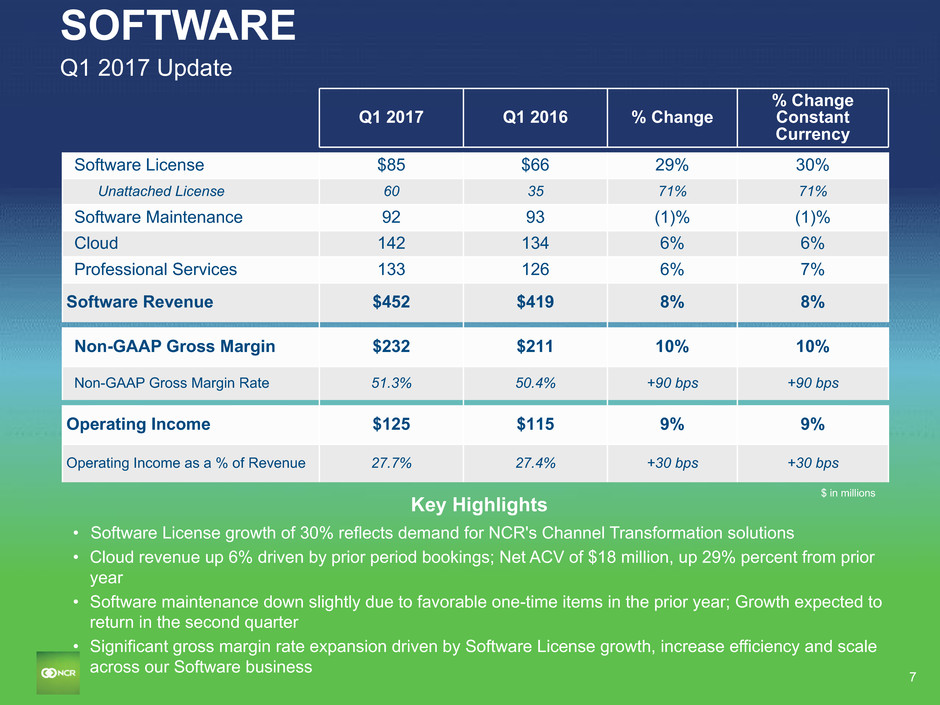

7 SOFTWARE Q1 2017 Update Key Highlights Q1 2017 Q1 2016 % Change % Change Constant Currency Software License $85 $66 29% 30% Unattached License 60 35 71% 71% Software Maintenance 92 93 (1)% (1)% Cloud 142 134 6% 6% Professional Services 133 126 6% 7% Software Revenue $452 $419 8% 8% Non-GAAP Gross Margin $232 $211 10% 10% Non-GAAP Gross Margin Rate 51.3% 50.4% +90 bps +90 bps Operating Income $125 $115 9% 9% Operating Income as a % of Revenue 27.7% 27.4% +30 bps +30 bps • Software License growth of 30% reflects demand for NCR's Channel Transformation solutions • Cloud revenue up 6% driven by prior period bookings; Net ACV of $18 million, up 29% percent from prior year • Software maintenance down slightly due to favorable one-time items in the prior year; Growth expected to return in the second quarter • Significant gross margin rate expansion driven by Software License growth, increase efficiency and scale across our Software business $ in millions

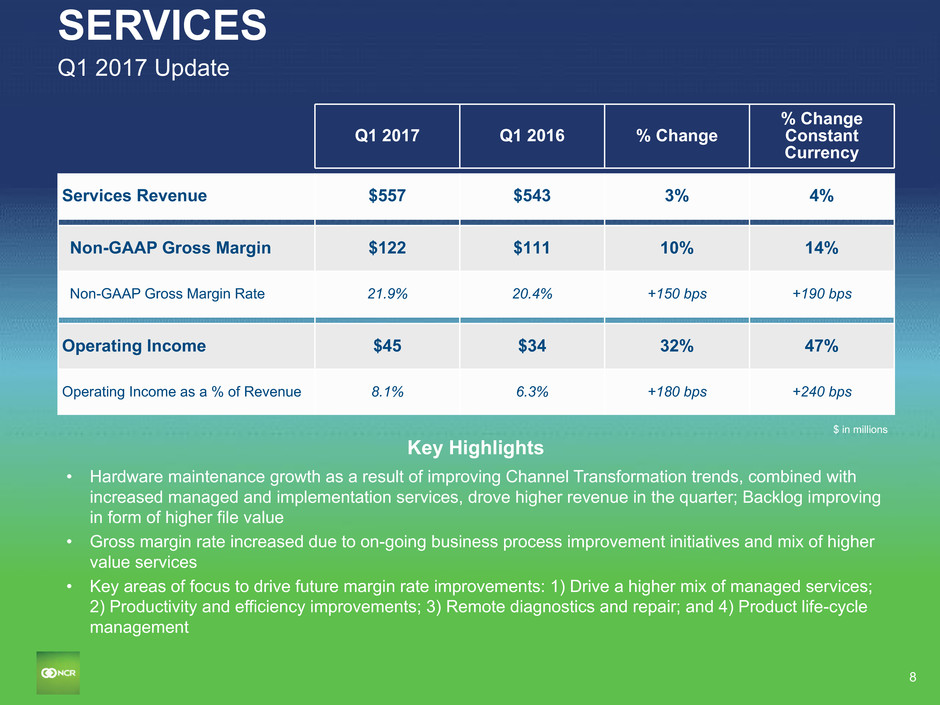

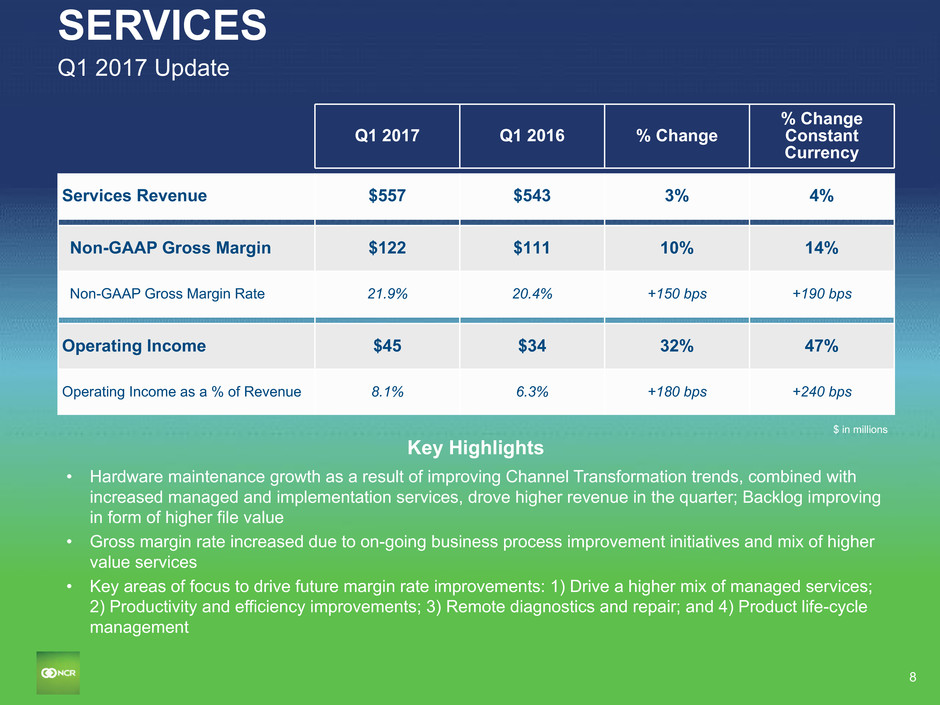

8 SERVICES Q1 2017 Update Q1 2017 Q1 2016 % Change % Change Constant Currency Services Revenue $557 $543 3% 4% Non-GAAP Gross Margin $122 $111 10% 14% Non-GAAP Gross Margin Rate 21.9% 20.4% +150 bps +190 bps Operating Income $45 $34 32% 47% Operating Income as a % of Revenue 8.1% 6.3% +180 bps +240 bps $ in millions • Hardware maintenance growth as a result of improving Channel Transformation trends, combined with increased managed and implementation services, drove higher revenue in the quarter; Backlog improving in form of higher file value • Gross margin rate increased due to on-going business process improvement initiatives and mix of higher value services • Key areas of focus to drive future margin rate improvements: 1) Drive a higher mix of managed services; 2) Productivity and efficiency improvements; 3) Remote diagnostics and repair; and 4) Product life-cycle management Key Highlights

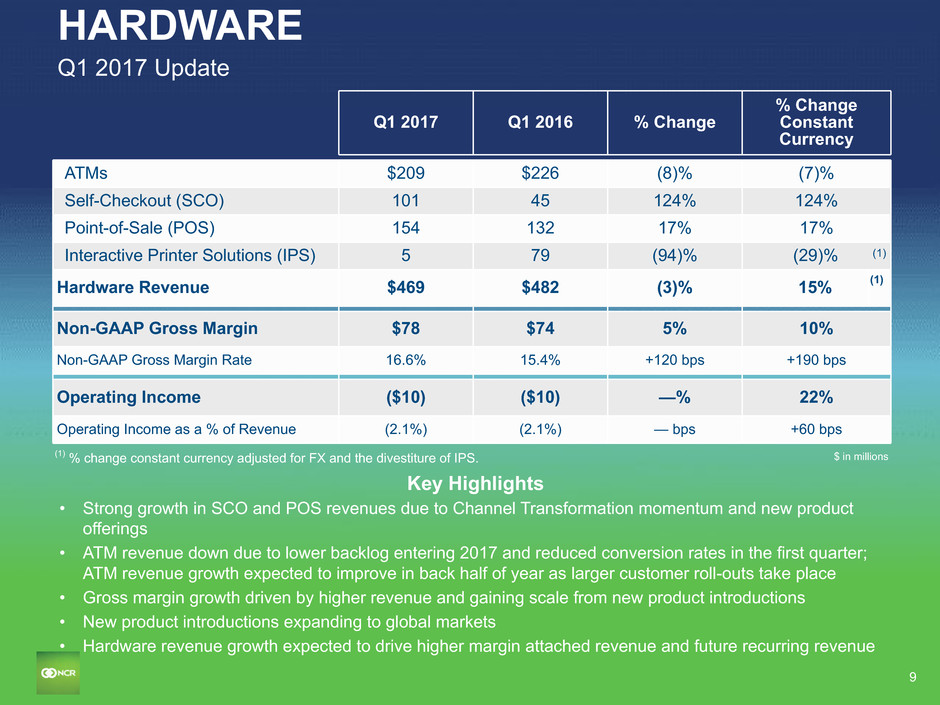

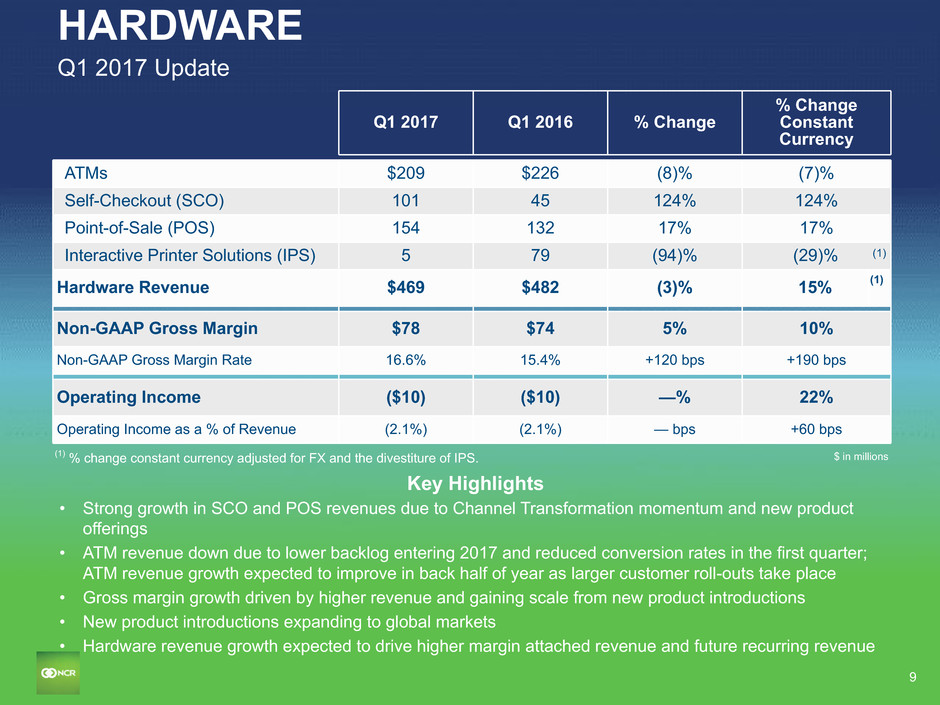

9 HARDWARE Q1 2017 Update • Strong growth in SCO and POS revenues due to Channel Transformation momentum and new product offerings • ATM revenue down due to lower backlog entering 2017 and reduced conversion rates in the first quarter; ATM revenue growth expected to improve in back half of year as larger customer roll-outs take place • Gross margin growth driven by higher revenue and gaining scale from new product introductions • New product introductions expanding to global markets • Hardware revenue growth expected to drive higher margin attached revenue and future recurring revenue Key Highlights Q1 2017 Q1 2016 % Change % Change Constant Currency ATMs $209 $226 (8)% (7)% Self-Checkout (SCO) 101 45 124% 124% Point-of-Sale (POS) 154 132 17% 17% Interactive Printer Solutions (IPS) 5 79 (94)% (29)% (1) Hardware Revenue $469 $482 (3)% 15% (1) Non-GAAP Gross Margin $78 $74 5% 10% Non-GAAP Gross Margin Rate 16.6% 15.4% +120 bps +190 bps Operating Income ($10) ($10) —% 22% Operating Income as a % of Revenue (2.1%) (2.1%) — bps +60 bps $ in millions(1) % change constant currency adjusted for FX and the divestiture of IPS.

10 Q1 2017 FREE CASH FLOW Q1 2017 Q1 2016 FY 2017e FY 2016 Cash Provided by Operating Activities $43 $23 $805 - $830 $894 Total capital expenditures (1) (52) (40) (285) (227) Cash used in Discontinued Operations (3) (12) (20) (39) Free Cash Flow ($12) ($29) $500 - $525 $628 Free Cash Flow as a % of non-GAAP net income (2) 95% - 100% 132% $ in millions (1) The total capital expenditures of $285 million in 2017 includes $70 million related to the new world headquarters in Atlanta, Georgia. This $70 million is offset by $45 million of expected reimbursements by the lessor included in net cash provided by operating activities. (2) Also referred to as Free Cash Flow Conversion Rate.

11 NET DEBT & EBITDA METRICS Q1 2016 FY 2016 Q1 2017 Debt $3,519 $3,051 $3,328 Cash (333) (498) (401) Net Debt $3,186 $2,553 $2,927 Adjusted EBITDA $1,008 $1,061 $1,095 (1) Net Debt / Adjusted EBITDA 3.2x 2.4x 2.7x $ in millions, except metrics (1) Adjusted EBITDA for the trailing twelve-month period.

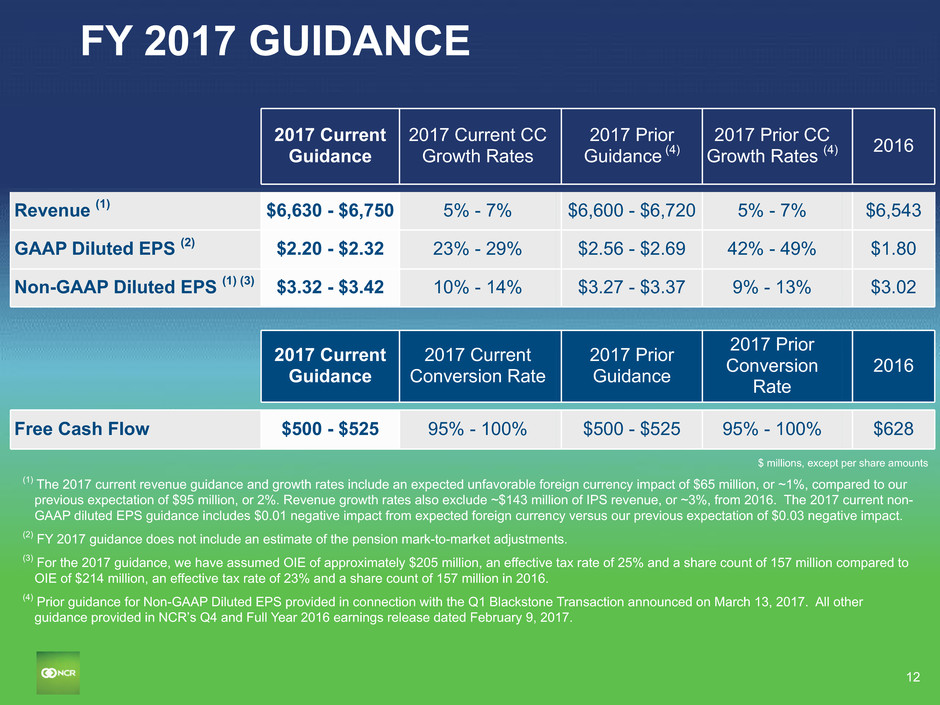

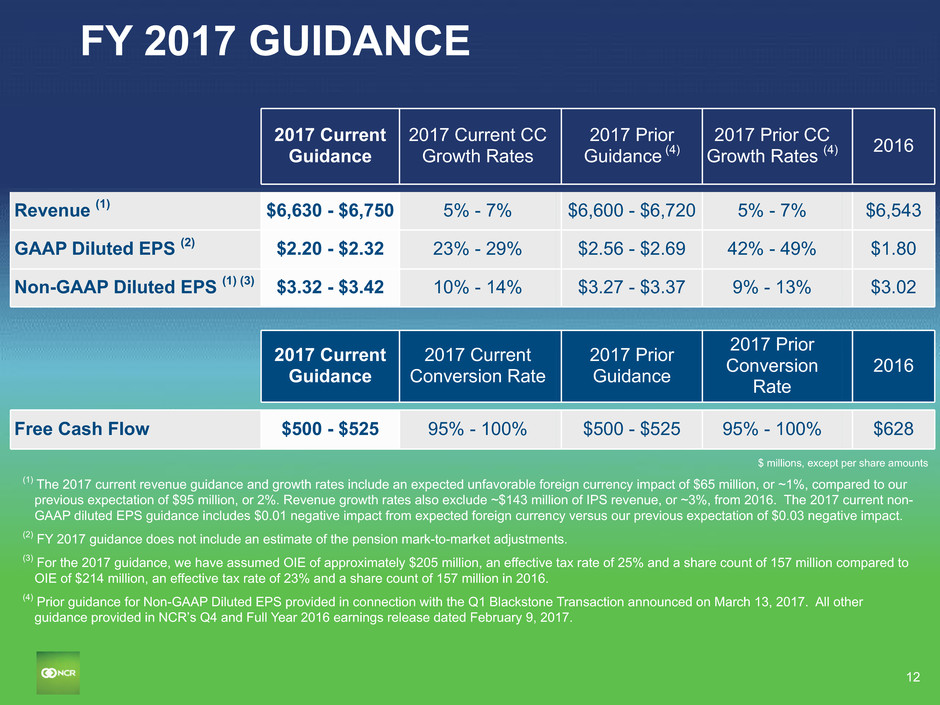

12 2017 Current Guidance 2017 Current CC Growth Rates 2017 Prior Guidance (4) 2017 Prior CC Growth Rates (4) 2016 Revenue (1) $6,630 - $6,750 5% - 7% $6,600 - $6,720 5% - 7% $6,543 GAAP Diluted EPS (2) $2.20 - $2.32 23% - 29% $2.56 - $2.69 42% - 49% $1.80 Non-GAAP Diluted EPS (1) (3) $3.32 - $3.42 10% - 14% $3.27 - $3.37 9% - 13% $3.02 2017 Current Guidance 2017 Current Conversion Rate 2017 Prior Guidance 2017 Prior Conversion Rate 2016 Free Cash Flow $500 - $525 95% - 100% $500 - $525 95% - 100% $628 FY 2017 GUIDANCE (1) The 2017 current revenue guidance and growth rates include an expected unfavorable foreign currency impact of $65 million, or ~1%, compared to our previous expectation of $95 million, or 2%. Revenue growth rates also exclude ~$143 million of IPS revenue, or ~3%, from 2016. The 2017 current non- GAAP diluted EPS guidance includes $0.01 negative impact from expected foreign currency versus our previous expectation of $0.03 negative impact. (2) FY 2017 guidance does not include an estimate of the pension mark-to-market adjustments. (3) For the 2017 guidance, we have assumed OIE of approximately $205 million, an effective tax rate of 25% and a share count of 157 million compared to OIE of $214 million, an effective tax rate of 23% and a share count of 157 million in 2016. (4) Prior guidance for Non-GAAP Diluted EPS provided in connection with the Q1 Blackstone Transaction announced on March 13, 2017. All other guidance provided in NCR’s Q4 and Full Year 2016 earnings release dated February 9, 2017. $ millions, except per share amounts

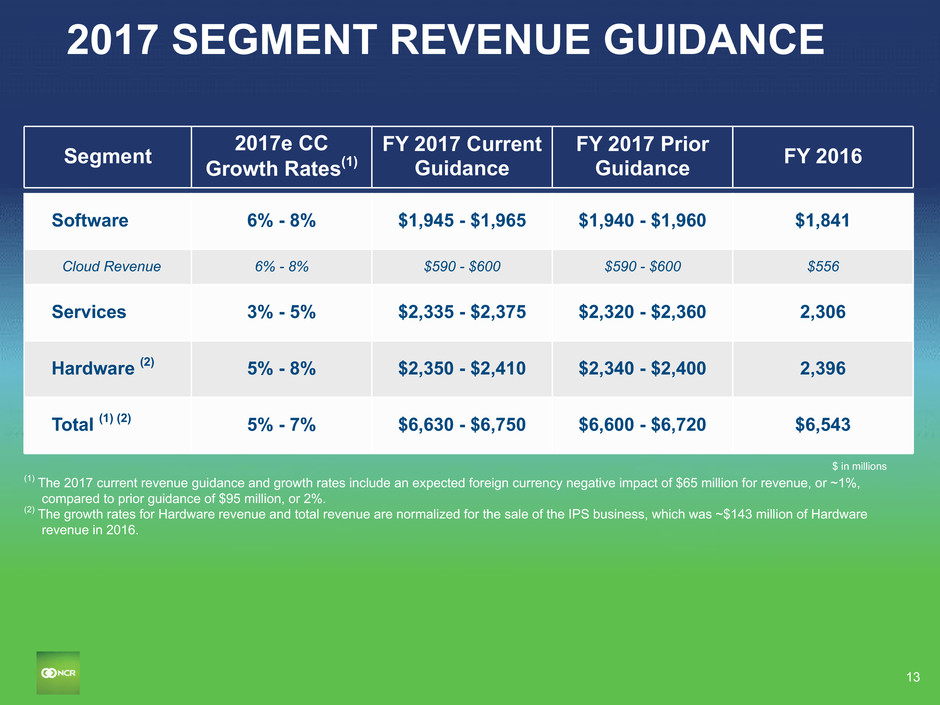

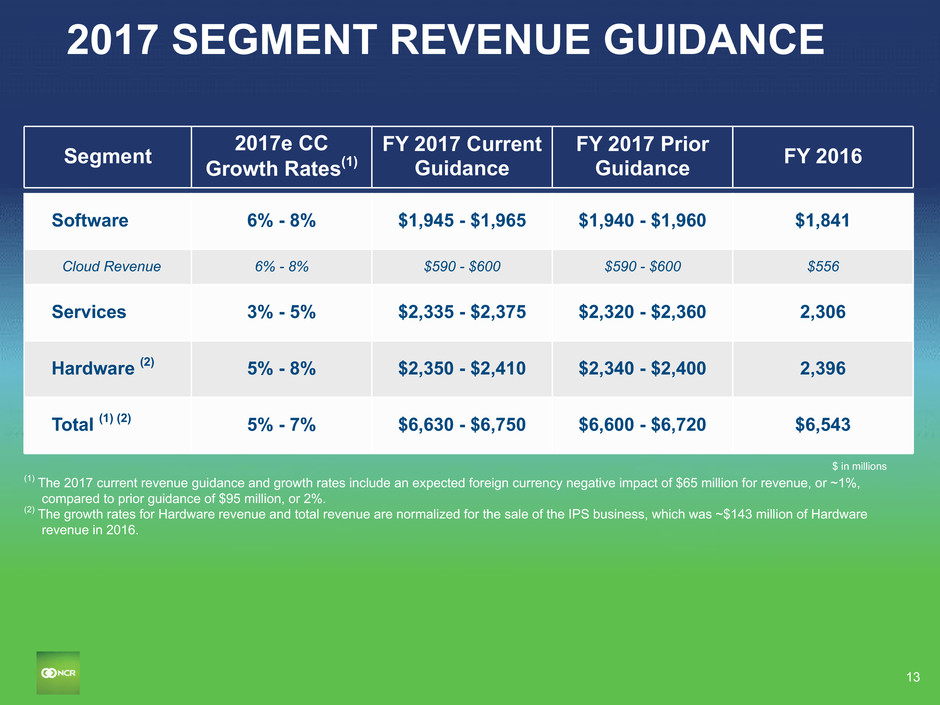

13 2017 SEGMENT REVENUE GUIDANCE Segment 2017e CC Growth Rates(1) FY 2017 Current Guidance FY 2017 Prior Guidance FY 2016 Software 6% - 8% $1,945 - $1,965 $1,940 - $1,960 $1,841 Cloud Revenue 6% - 8% $590 - $600 $590 - $600 $556 Services 3% - 5% $2,335 - $2,375 $2,320 - $2,360 2,306 Hardware (2) 5% - 8% $2,350 - $2,410 $2,340 - $2,400 2,396 Total (1) (2) 5% - 7% $6,630 - $6,750 $6,600 - $6,720 $6,543 $ in millions (1) The 2017 current revenue guidance and growth rates include an expected foreign currency negative impact of $65 million for revenue, or ~1%, compared to prior guidance of $95 million, or 2%. (2) The growth rates for Hardware revenue and total revenue are normalized for the sale of the IPS business, which was ~$143 million of Hardware revenue in 2016.

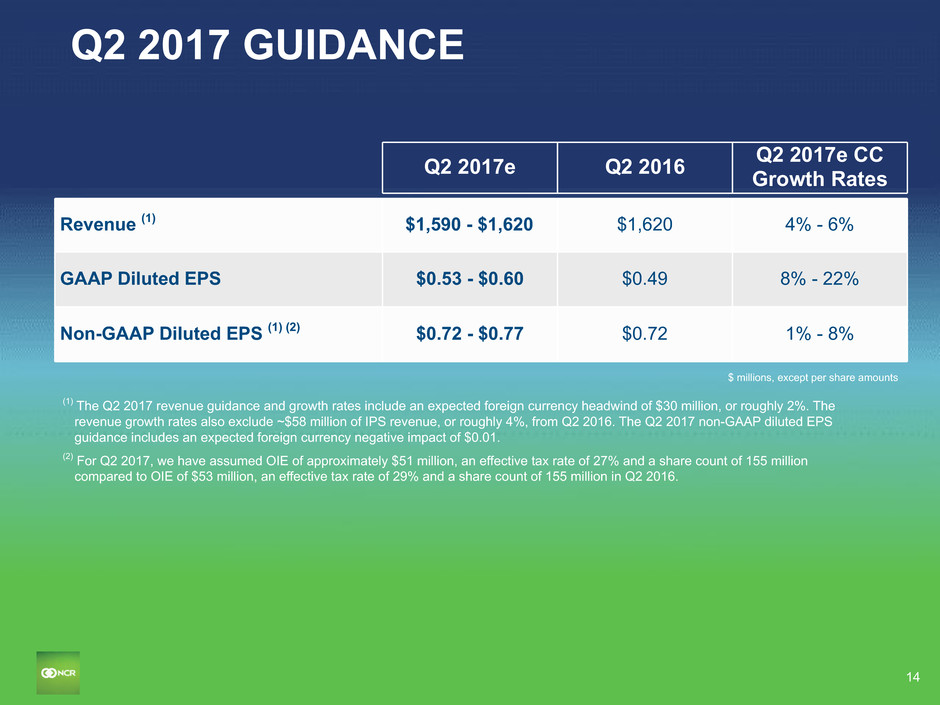

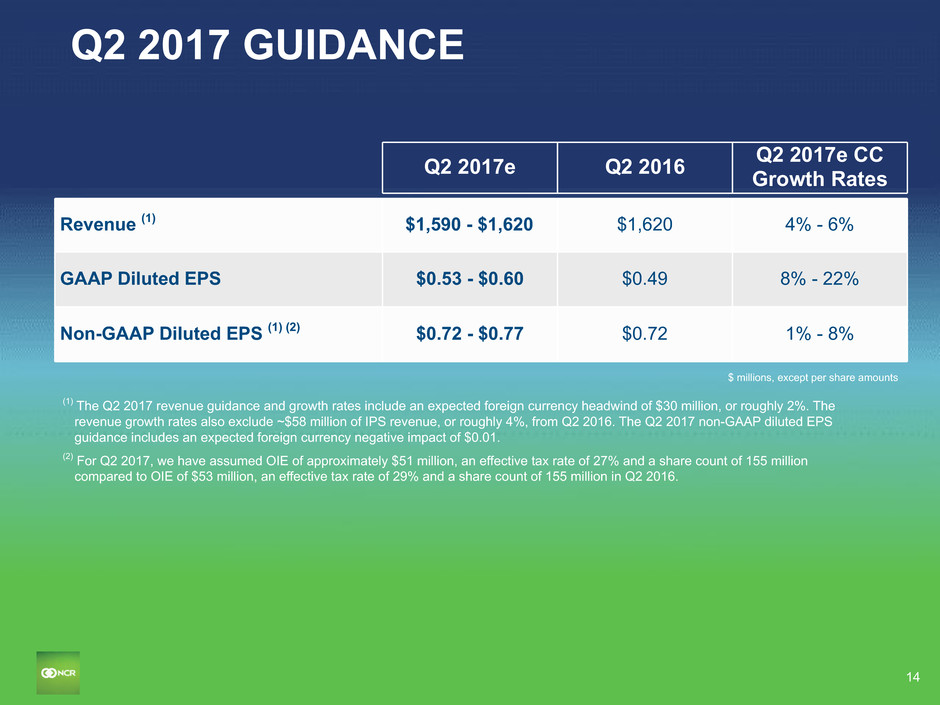

14 Q2 2017 GUIDANCE Q2 2017e Q2 2016 Q2 2017e CCGrowth Rates Revenue (1) $1,590 - $1,620 $1,620 4% - 6% GAAP Diluted EPS $0.53 - $0.60 $0.49 8% - 22% Non-GAAP Diluted EPS (1) (2) $0.72 - $0.77 $0.72 1% - 8% $ millions, except per share amounts (1) The Q2 2017 revenue guidance and growth rates include an expected foreign currency headwind of $30 million, or roughly 2%. The revenue growth rates also exclude ~$58 million of IPS revenue, or roughly 4%, from Q2 2016. The Q2 2017 non-GAAP diluted EPS guidance includes an expected foreign currency negative impact of $0.01. (2) For Q2 2017, we have assumed OIE of approximately $51 million, an effective tax rate of 27% and a share count of 155 million compared to OIE of $53 million, an effective tax rate of 29% and a share count of 155 million in Q2 2016.

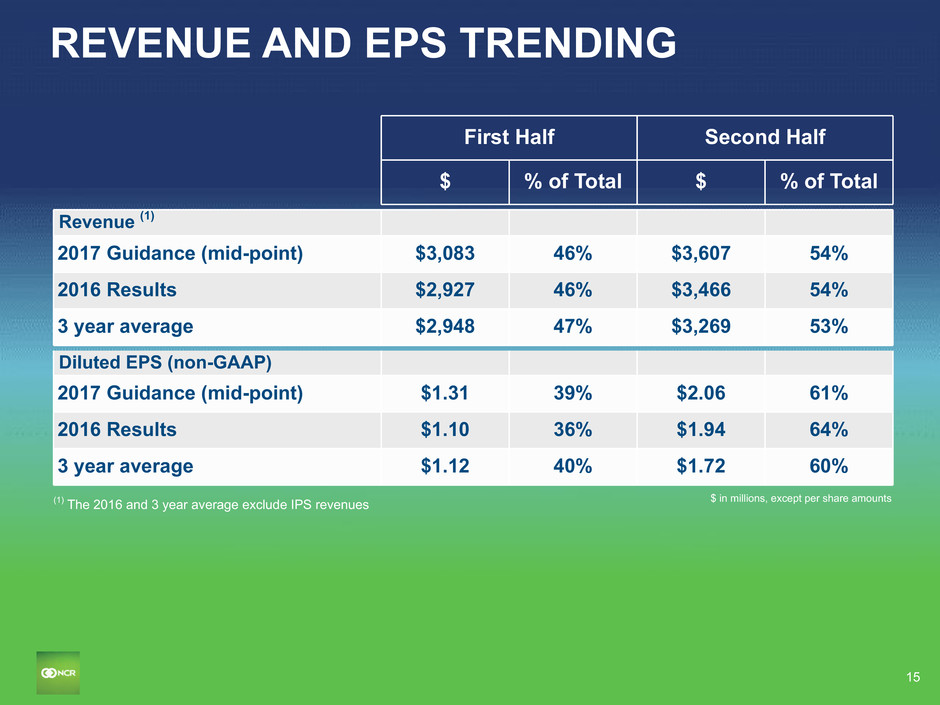

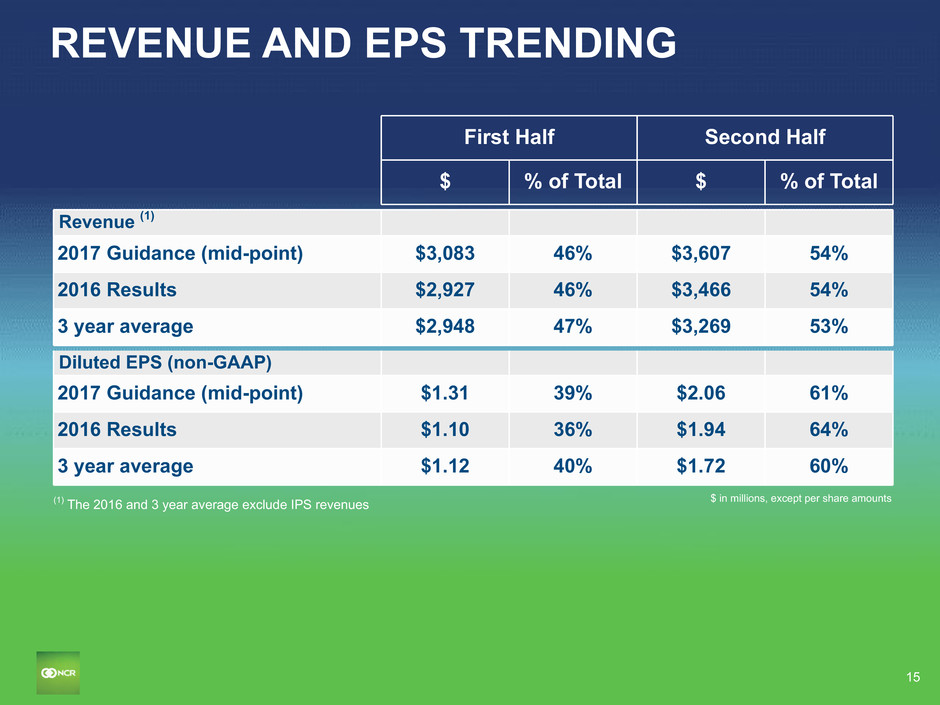

15 REVENUE AND EPS TRENDING First Half Second Half $ % of Total $ % of Total Revenue (1) 2017 Guidance (mid-point) $3,083 46% $3,607 54% 2016 Results $2,927 46% $3,466 54% 3 year average $2,948 47% $3,269 53% Diluted EPS (non-GAAP) 2017 Guidance (mid-point) $1.31 39% $2.06 61% 2016 Results $1.10 36% $1.94 64% 3 year average $1.12 40% $1.72 60% $ in millions, except per share amounts(1) The 2016 and 3 year average exclude IPS revenues

16 • Strong execution in Q1 improves full year confidence • NCR's solution offerings aligned with major market trends and customer demands • Backlog and key metrics remain strong • Software growth combined with our business transformation program is the key to margin expansion • Omni-Channel, Channel Transformation, and Digital Enablement continue to be strong growth drivers • Free cash flow generation and balanced capital allocation strategy remains a top priority LOOKING FORWARD

17

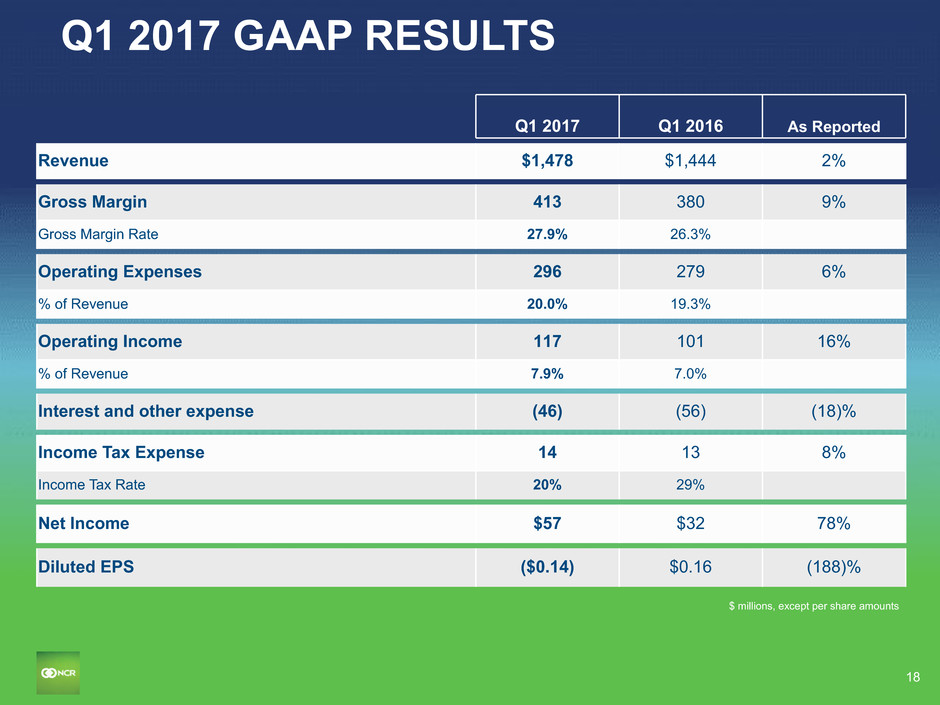

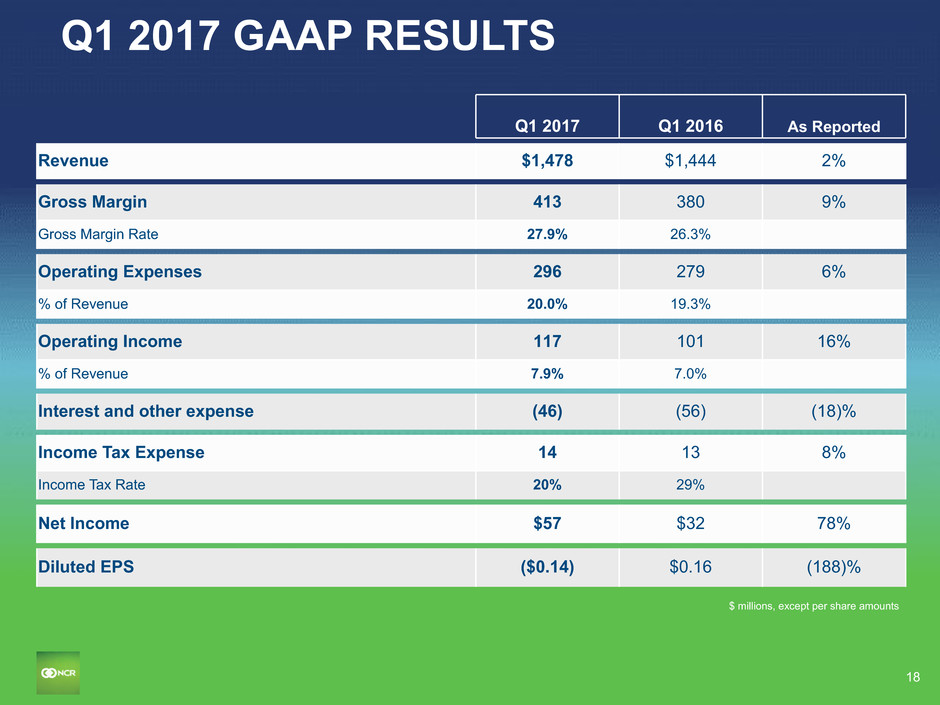

18 Q1 2017 Q1 2016 As Reported Revenue $1,478 $1,444 2% Gross Margin 413 380 9% Gross Margin Rate 27.9% 26.3% Operating Expenses 296 279 6% % of Revenue 20.0% 19.3% Operating Income 117 101 16% % of Revenue 7.9% 7.0% Interest and other expense (46) (56) (18)% Income Tax Expense 14 13 8% Income Tax Rate 20% 29% Net Income $57 $32 78% Diluted EPS ($0.14) $0.16 (188)% Q1 2017 GAAP RESULTS $ millions, except per share amounts

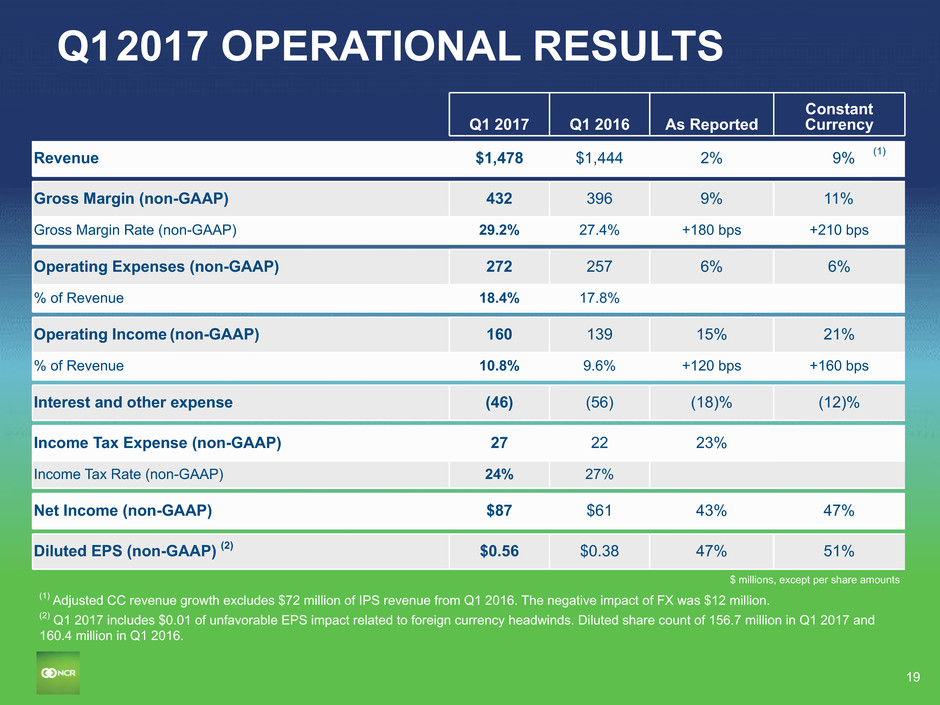

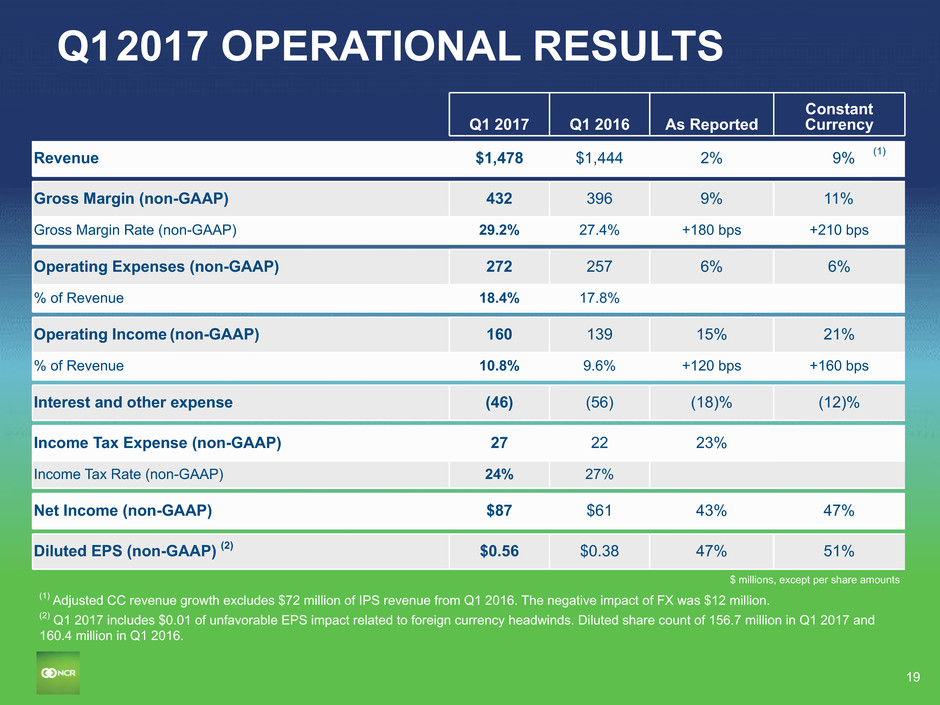

19 Q1 2017 Q1 2016 As Reported Constant Currency Revenue $1,478 $1,444 2% 9% (1) Gross Margin (non-GAAP) 432 396 9% 11% Gross Margin Rate (non-GAAP) 29.2% 27.4% +180 bps +210 bps Operating Expenses (non-GAAP) 272 257 6% 6% % of Revenue 18.4% 17.8% Operating Income (non-GAAP) 160 139 15% 21% % of Revenue 10.8% 9.6% +120 bps +160 bps Interest and other expense (46) (56) (18)% (12)% Income Tax Expense (non-GAAP) 27 22 23% Income Tax Rate (non-GAAP) 24% 27% Net Income (non-GAAP) $87 $61 43% 47% Diluted EPS (non-GAAP) (2) $0.56 $0.38 47% 51% Q1 2017 OPERATIONAL RESULTS (1) Adjusted CC revenue growth excludes $72 million of IPS revenue from Q1 2016. The negative impact of FX was $12 million. (2) Q1 2017 includes $0.01 of unfavorable EPS impact related to foreign currency headwinds. Diluted share count of 156.7 million in Q1 2017 and 160.4 million in Q1 2016. $ millions, except per share amounts

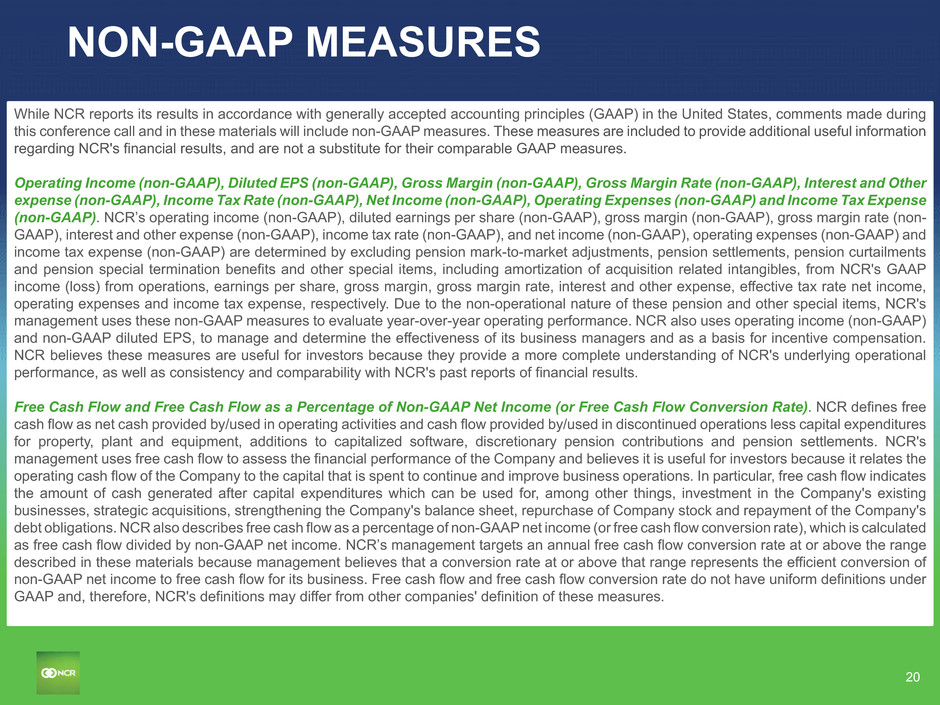

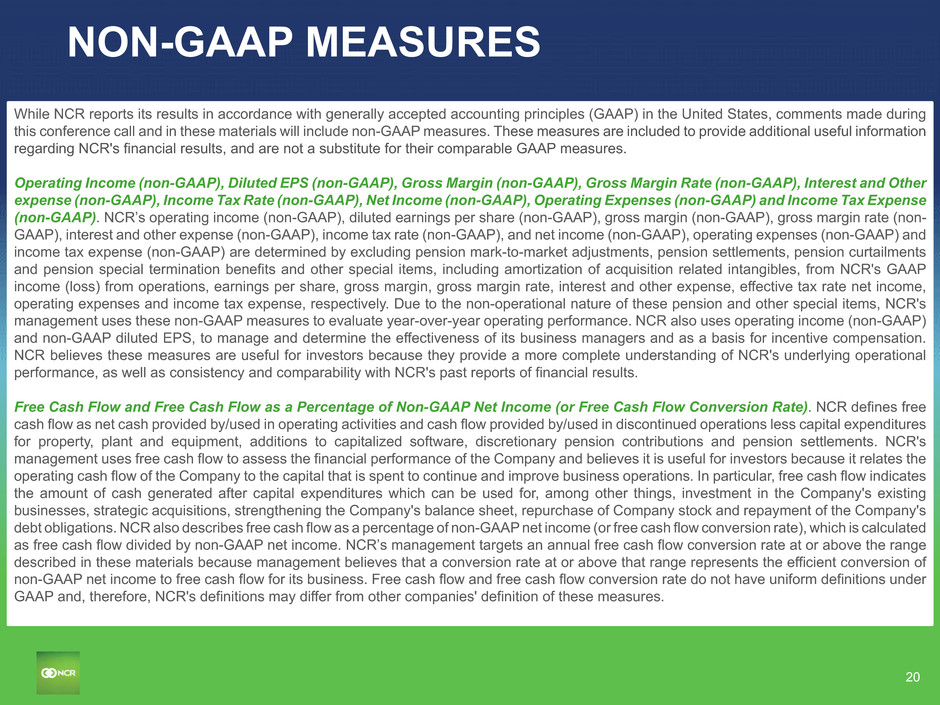

20 NON-GAAP MEASURES While NCR reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this conference call and in these materials will include non-GAAP measures. These measures are included to provide additional useful information regarding NCR's financial results, and are not a substitute for their comparable GAAP measures. Operating Income (non-GAAP), Diluted EPS (non-GAAP), Gross Margin (non-GAAP), Gross Margin Rate (non-GAAP), Interest and Other expense (non-GAAP), Income Tax Rate (non-GAAP), Net Income (non-GAAP), Operating Expenses (non-GAAP) and Income Tax Expense (non-GAAP). NCR’s operating income (non-GAAP), diluted earnings per share (non-GAAP), gross margin (non-GAAP), gross margin rate (non- GAAP), interest and other expense (non-GAAP), income tax rate (non-GAAP), and net income (non-GAAP), operating expenses (non-GAAP) and income tax expense (non-GAAP) are determined by excluding pension mark-to-market adjustments, pension settlements, pension curtailments and pension special termination benefits and other special items, including amortization of acquisition related intangibles, from NCR's GAAP income (loss) from operations, earnings per share, gross margin, gross margin rate, interest and other expense, effective tax rate net income, operating expenses and income tax expense, respectively. Due to the non-operational nature of these pension and other special items, NCR's management uses these non-GAAP measures to evaluate year-over-year operating performance. NCR also uses operating income (non-GAAP) and non-GAAP diluted EPS, to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. NCR believes these measures are useful for investors because they provide a more complete understanding of NCR's underlying operational performance, as well as consistency and comparability with NCR's past reports of financial results. Free Cash Flow and Free Cash Flow as a Percentage of Non-GAAP Net Income (or Free Cash Flow Conversion Rate). NCR defines free cash flow as net cash provided by/used in operating activities and cash flow provided by/used in discontinued operations less capital expenditures for property, plant and equipment, additions to capitalized software, discretionary pension contributions and pension settlements. NCR's management uses free cash flow to assess the financial performance of the Company and believes it is useful for investors because it relates the operating cash flow of the Company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures which can be used for, among other things, investment in the Company's existing businesses, strategic acquisitions, strengthening the Company's balance sheet, repurchase of Company stock and repayment of the Company's debt obligations. NCR also describes free cash flow as a percentage of non-GAAP net income (or free cash flow conversion rate), which is calculated as free cash flow divided by non-GAAP net income. NCR’s management targets an annual free cash flow conversion rate at or above the range described in these materials because management believes that a conversion rate at or above that range represents the efficient conversion of non-GAAP net income to free cash flow for its business. Free cash flow and free cash flow conversion rate do not have uniform definitions under GAAP and, therefore, NCR's definitions may differ from other companies' definition of these measures.

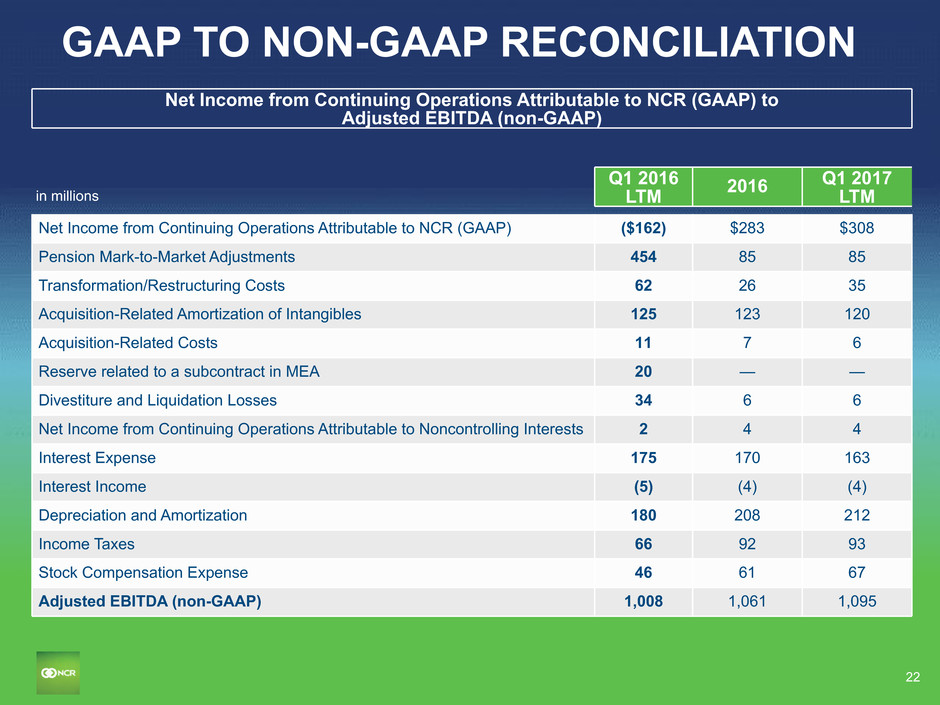

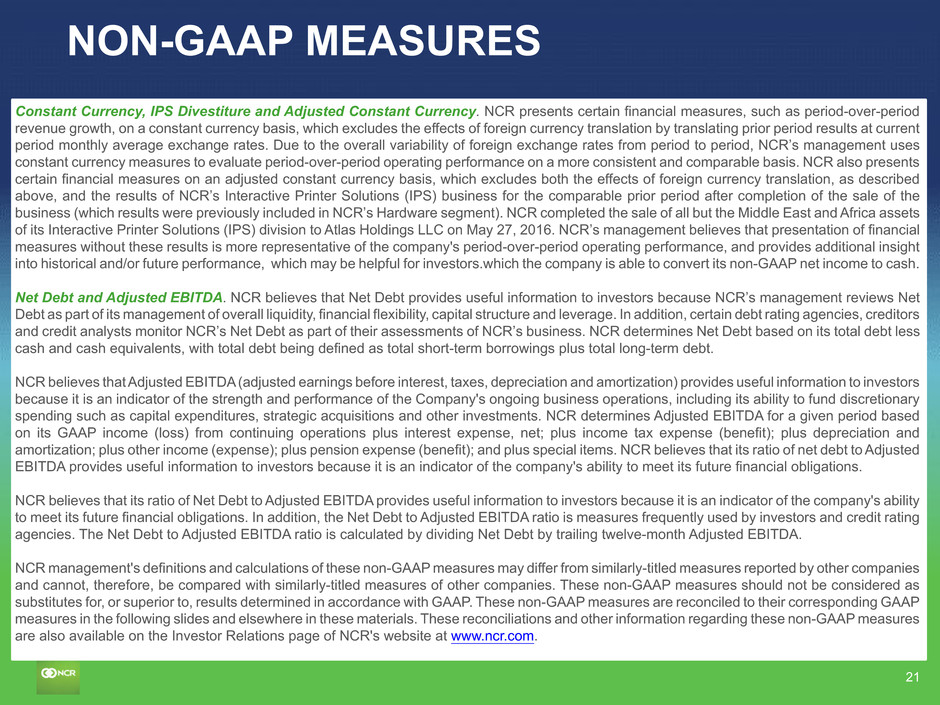

21 NON-GAAP MEASURES Constant Currency, IPS Divestiture and Adjusted Constant Currency. NCR presents certain financial measures, such as period-over-period revenue growth, on a constant currency basis, which excludes the effects of foreign currency translation by translating prior period results at current period monthly average exchange rates. Due to the overall variability of foreign exchange rates from period to period, NCR’s management uses constant currency measures to evaluate period-over-period operating performance on a more consistent and comparable basis. NCR also presents certain financial measures on an adjusted constant currency basis, which excludes both the effects of foreign currency translation, as described above, and the results of NCR’s Interactive Printer Solutions (IPS) business for the comparable prior period after completion of the sale of the business (which results were previously included in NCR’s Hardware segment). NCR completed the sale of all but the Middle East and Africa assets of its Interactive Printer Solutions (IPS) division to Atlas Holdings LLC on May 27, 2016. NCR’s management believes that presentation of financial measures without these results is more representative of the company's period-over-period operating performance, and provides additional insight into historical and/or future performance, which may be helpful for investors.which the company is able to convert its non-GAAP net income to cash. Net Debt and Adjusted EBITDA. NCR believes that Net Debt provides useful information to investors because NCR’s management reviews Net Debt as part of its management of overall liquidity, financial flexibility, capital structure and leverage. In addition, certain debt rating agencies, creditors and credit analysts monitor NCR’s Net Debt as part of their assessments of NCR’s business. NCR determines Net Debt based on its total debt less cash and cash equivalents, with total debt being defined as total short-term borrowings plus total long-term debt. NCR believes that Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation and amortization) provides useful information to investors because it is an indicator of the strength and performance of the Company's ongoing business operations, including its ability to fund discretionary spending such as capital expenditures, strategic acquisitions and other investments. NCR determines Adjusted EBITDA for a given period based on its GAAP income (loss) from continuing operations plus interest expense, net; plus income tax expense (benefit); plus depreciation and amortization; plus other income (expense); plus pension expense (benefit); and plus special items. NCR believes that its ratio of net debt to Adjusted EBITDA provides useful information to investors because it is an indicator of the company's ability to meet its future financial obligations. NCR believes that its ratio of Net Debt to Adjusted EBITDA provides useful information to investors because it is an indicator of the company's ability to meet its future financial obligations. In addition, the Net Debt to Adjusted EBITDA ratio is measures frequently used by investors and credit rating agencies. The Net Debt to Adjusted EBITDA ratio is calculated by dividing Net Debt by trailing twelve-month Adjusted EBITDA. NCR management's definitions and calculations of these non-GAAP measures may differ from similarly-titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. These non-GAAP measures are reconciled to their corresponding GAAP measures in the following slides and elsewhere in these materials. These reconciliations and other information regarding these non-GAAP measures are also available on the Investor Relations page of NCR's website at www.ncr.com.

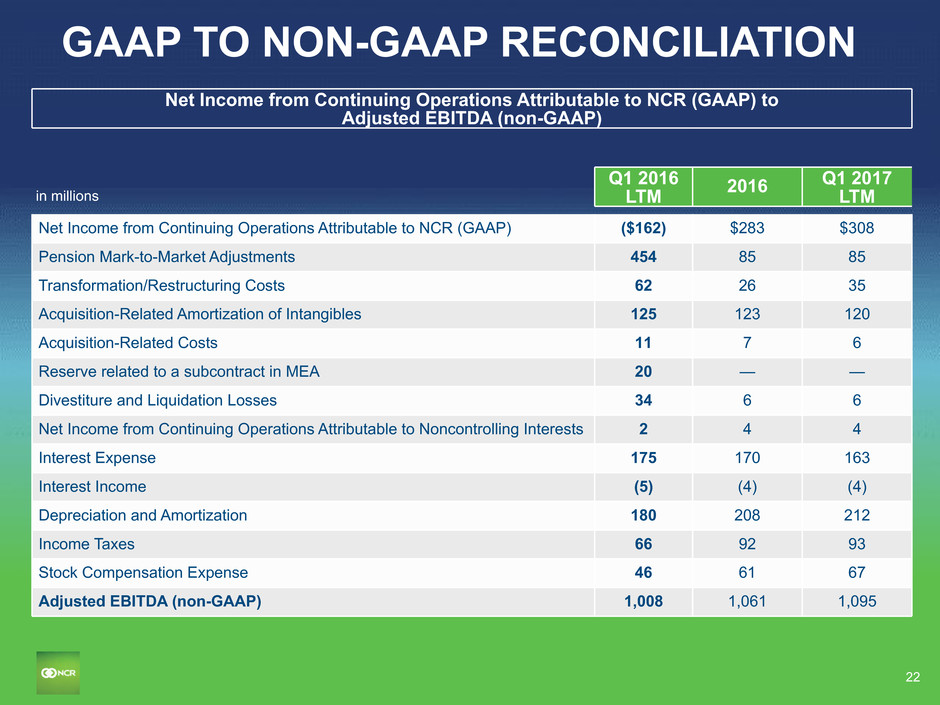

22 Net Income from Continuing Operations Attributable to NCR (GAAP) to Adjusted EBITDA (non-GAAP) in millions Q1 2016 LTM 2016 Q1 2017 LTM Net Income from Continuing Operations Attributable to NCR (GAAP) ($162) $283 $308 Pension Mark-to-Market Adjustments 454 85 85 Transformation/Restructuring Costs 62 26 35 Acquisition-Related Amortization of Intangibles 125 123 120 Acquisition-Related Costs 11 7 6 Reserve related to a subcontract in MEA 20 — — Divestiture and Liquidation Losses 34 6 6 Net Income from Continuing Operations Attributable to Noncontrolling Interests 2 4 4 Interest Expense 175 170 163 Interest Income (5) (4) (4) Depreciation and Amortization 180 208 212 Income Taxes 66 92 93 Stock Compensation Expense 46 61 67 Adjusted EBITDA (non-GAAP) 1,008 1,061 1,095 GAAP TO NON-GAAP RECONCILIATION

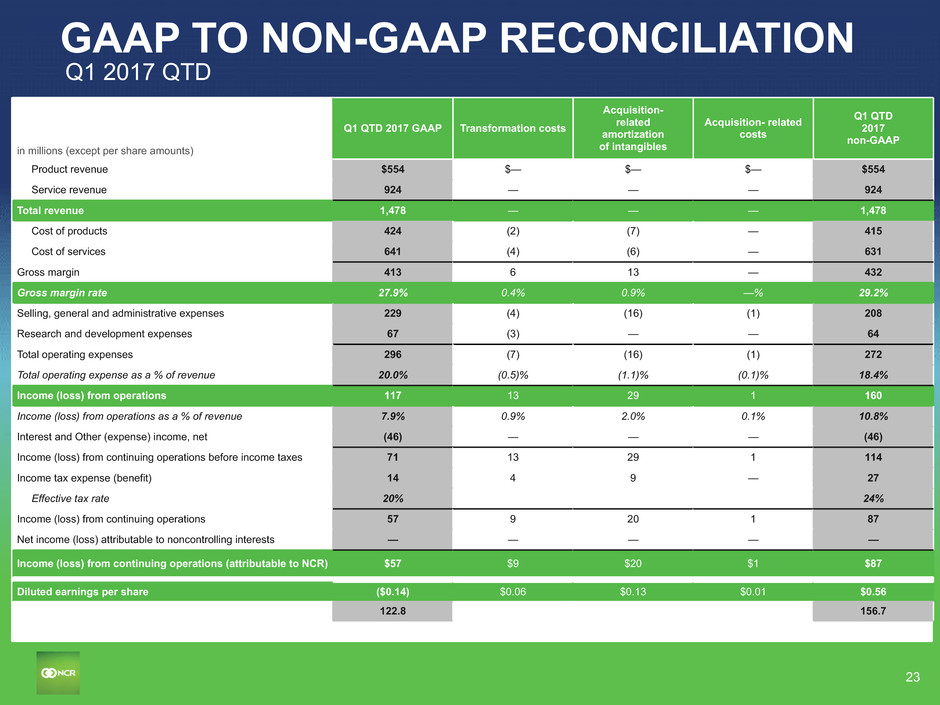

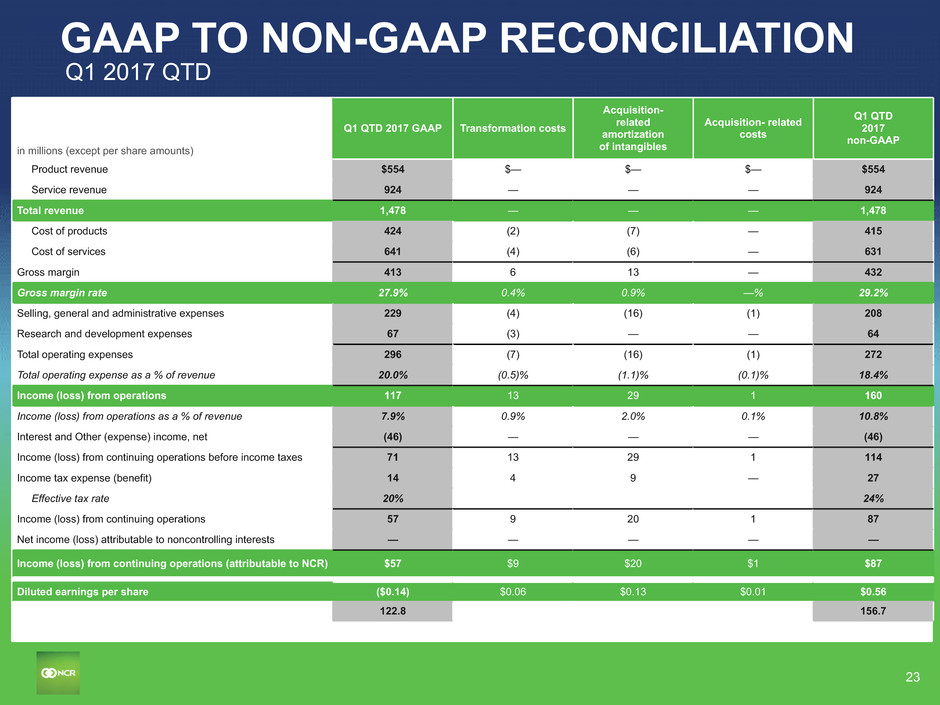

23 in millions (except per share amounts) Q1 QTD 2017 GAAP Transformation costs Acquisition- related amortization of intangibles Acquisition- related costs Q1 QTD 2017 non-GAAP Product revenue $554 $— $— $— $554 Service revenue 924 — — — 924 Total revenue 1,478 — — — 1,478 Cost of products 424 (2) (7) — 415 Cost of services 641 (4) (6) — 631 Gross margin 413 6 13 — 432 Gross margin rate 27.9% 0.4% 0.9% —% 29.2% Selling, general and administrative expenses 229 (4) (16) (1) 208 Research and development expenses 67 (3) — — 64 Total operating expenses 296 (7) (16) (1) 272 Total operating expense as a % of revenue 20.0% (0.5)% (1.1)% (0.1)% 18.4% Income (loss) from operations 117 13 29 1 160 Income (loss) from operations as a % of revenue 7.9% 0.9% 2.0% 0.1% 10.8% Interest and Other (expense) income, net (46) — — — (46) Income (loss) from continuing operations before income taxes 71 13 29 1 114 Income tax expense (benefit) 14 4 9 — 27 Effective tax rate 20% 24% Income (loss) from continuing operations 57 9 20 1 87 Net income (loss) attributable to noncontrolling interests — — — — — Income (loss) from continuing operations (attributable to NCR) $57 $9 $20 $1 $87 Diluted earnings per share ($0.14) $0.06 $0.13 $0.01 $0.56 122.8 156.7 GAAP TO NON-GAAP RECONCILIATION Q1 2017 QTD

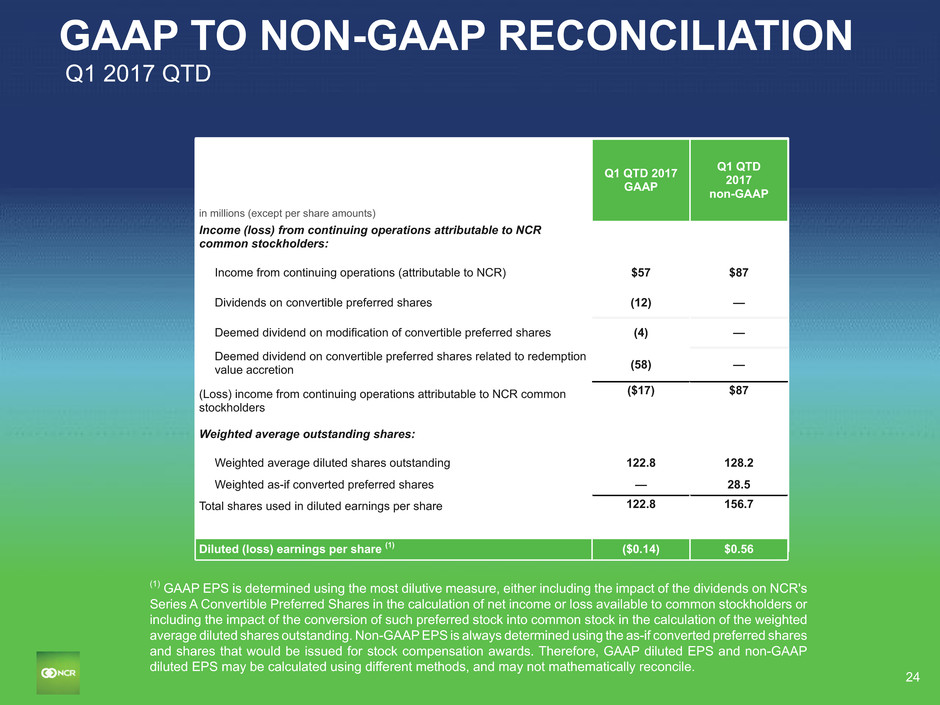

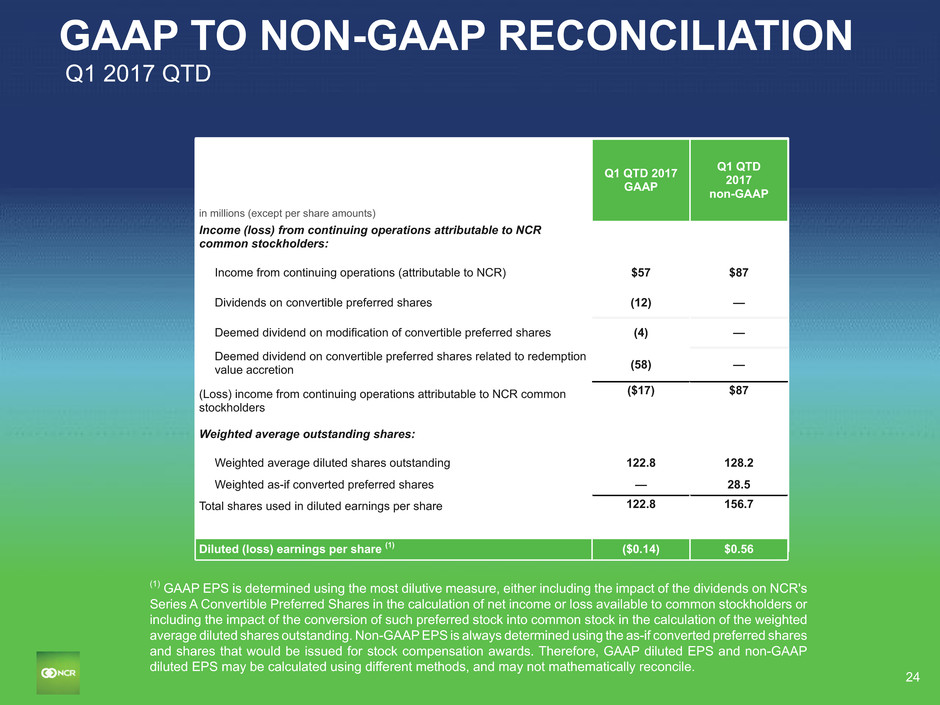

24 in millions (except per share amounts) Q1 QTD 2017 GAAP Q1 QTD 2017 non-GAAP Income (loss) from continuing operations attributable to NCR common stockholders: Income from continuing operations (attributable to NCR) $57 $87 Dividends on convertible preferred shares (12) — Deemed dividend on modification of convertible preferred shares (4) — Deemed dividend on convertible preferred shares related to redemption value accretion (58) — (Loss) income from continuing operations attributable to NCR common stockholders ($17) $87 Weighted average outstanding shares: Weighted average diluted shares outstanding 122.8 128.2 Weighted as-if converted preferred shares — 28.5 Total shares used in diluted earnings per share 122.8 156.7 Diluted (loss) earnings per share (1) ($0.14) $0.56 GAAP TO NON-GAAP RECONCILIATION Q1 2017 QTD (1) GAAP EPS is determined using the most dilutive measure, either including the impact of the dividends on NCR's Series A Convertible Preferred Shares in the calculation of net income or loss available to common stockholders or including the impact of the conversion of such preferred stock into common stock in the calculation of the weighted average diluted shares outstanding. Non-GAAP EPS is always determined using the as-if converted preferred shares and shares that would be issued for stock compensation awards. Therefore, GAAP diluted EPS and non-GAAP diluted EPS may be calculated using different methods, and may not mathematically reconcile.

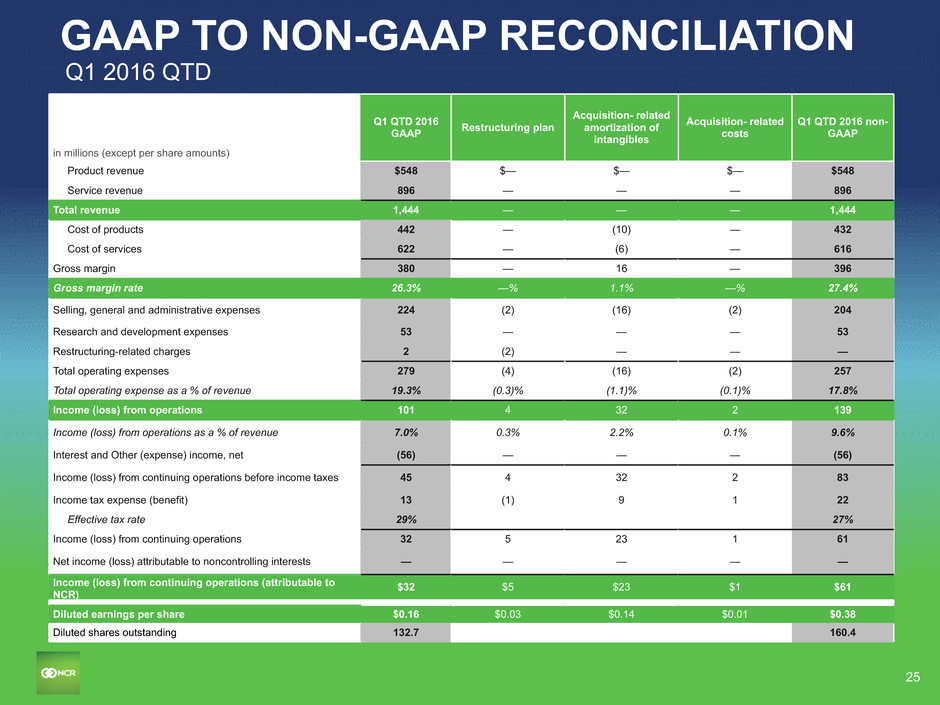

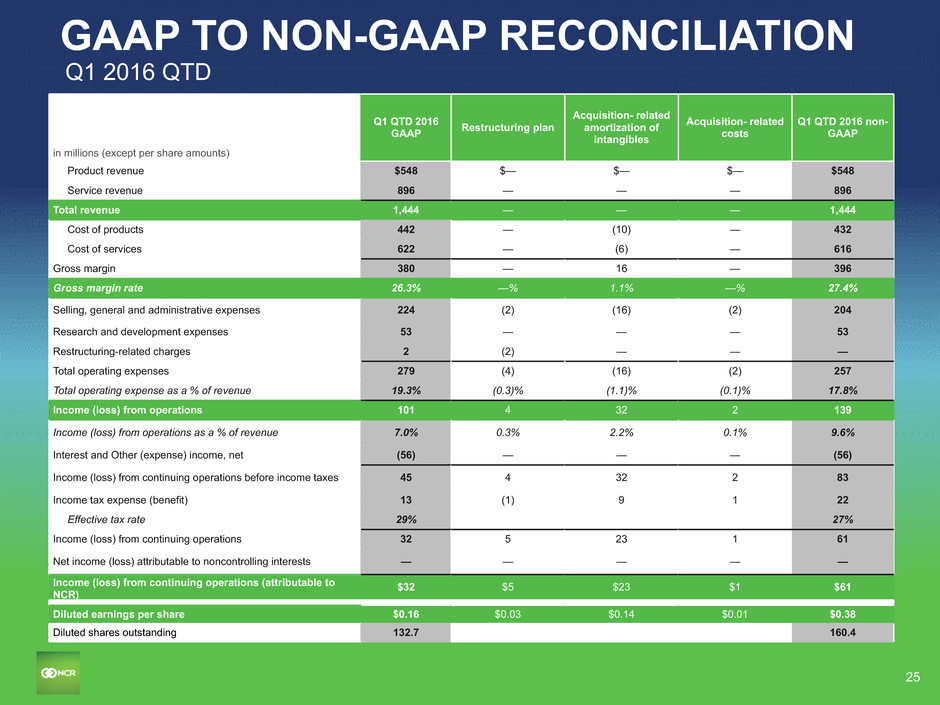

25 in millions (except per share amounts) Q1 QTD 2016 GAAP Restructuring plan Acquisition- related amortization of intangibles Acquisition- related costs Q1 QTD 2016 non- GAAP Product revenue $548 $— $— $— $548 Service revenue 896 — — — 896 Total revenue 1,444 — — — 1,444 Cost of products 442 — (10) — 432 Cost of services 622 — (6) — 616 Gross margin 380 — 16 — 396 Gross margin rate 26.3% —% 1.1% —% 27.4% Selling, general and administrative expenses 224 (2) (16) (2) 204 Research and development expenses 53 — — — 53 Restructuring-related charges 2 (2) — — — Total operating expenses 279 (4) (16) (2) 257 Total operating expense as a % of revenue 19.3% (0.3)% (1.1)% (0.1)% 17.8% Income (loss) from operations 101 4 32 2 139 Income (loss) from operations as a % of revenue 7.0% 0.3% 2.2% 0.1% 9.6% Interest and Other (expense) income, net (56) — — — (56) Income (loss) from continuing operations before income taxes 45 4 32 2 83 Income tax expense (benefit) 13 (1) 9 1 22 Effective tax rate 29% 27% Income (loss) from continuing operations 32 5 23 1 61 Net income (loss) attributable to noncontrolling interests — — — — — Income (loss) from continuing operations (attributable to NCR) $32 $5 $23 $1 $61 Diluted earnings per share $0.16 $0.03 $0.14 $0.01 $0.38 Diluted shares outstanding 132.7 160.4 GAAP TO NON-GAAP RECONCILIATION Q1 2016 QTD

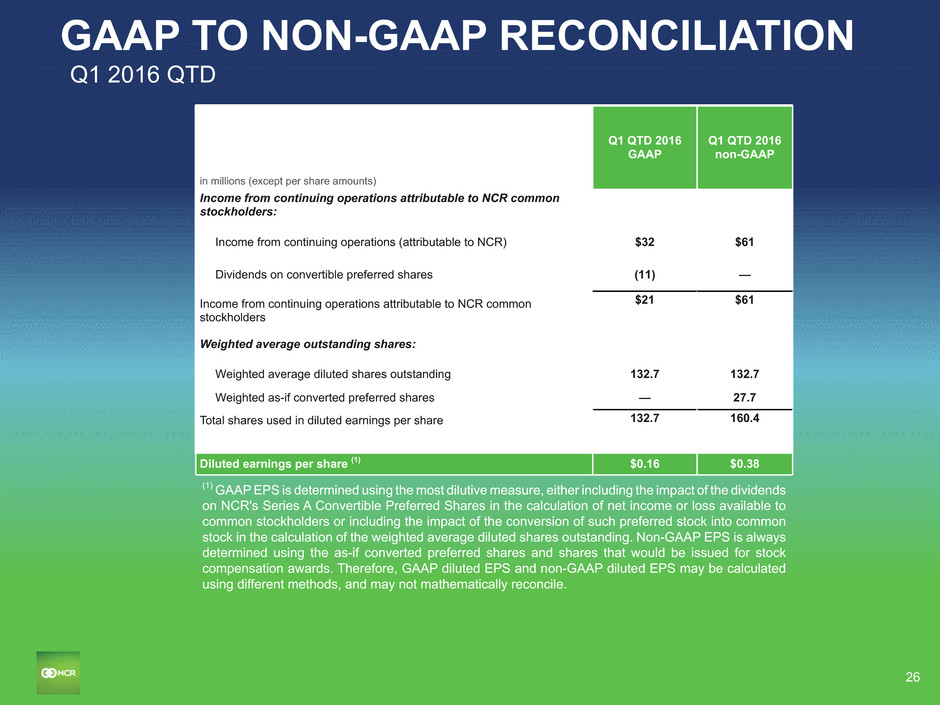

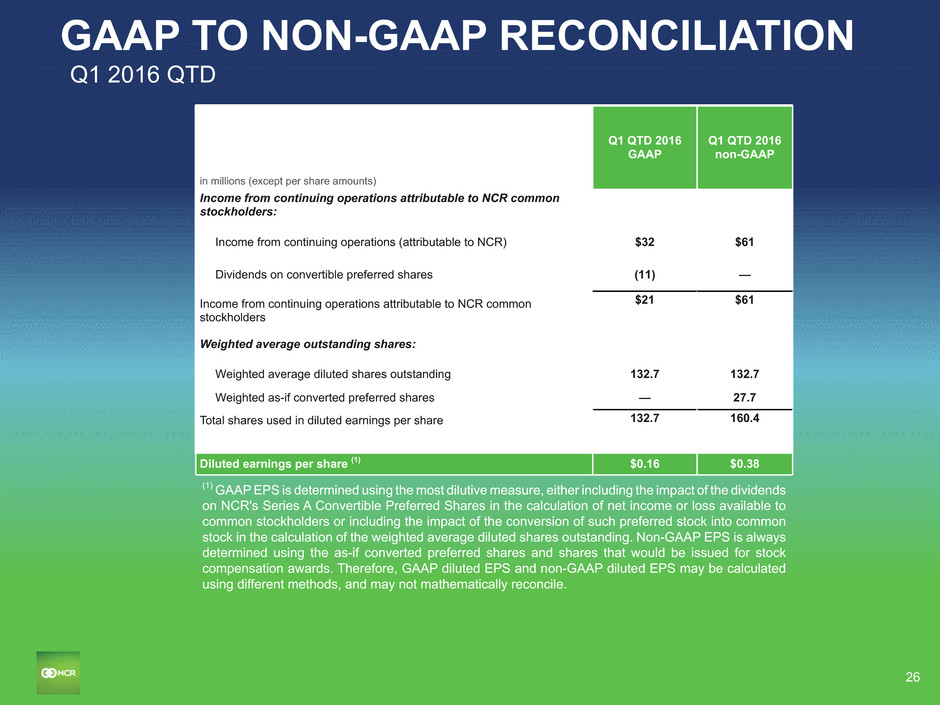

26 in millions (except per share amounts) Q1 QTD 2016 GAAP Q1 QTD 2016 non-GAAP Income from continuing operations attributable to NCR common stockholders: Income from continuing operations (attributable to NCR) $32 $61 Dividends on convertible preferred shares (11) — Income from continuing operations attributable to NCR common stockholders $21 $61 Weighted average outstanding shares: Weighted average diluted shares outstanding 132.7 132.7 Weighted as-if converted preferred shares — 27.7 Total shares used in diluted earnings per share 132.7 160.4 Diluted earnings per share (1) $0.16 $0.38 GAAP TO NON-GAAP RECONCILIATION Q1 2016 QTD (1) GAAP EPS is determined using the most dilutive measure, either including the impact of the dividends on NCR's Series A Convertible Preferred Shares in the calculation of net income or loss available to common stockholders or including the impact of the conversion of such preferred stock into common stock in the calculation of the weighted average diluted shares outstanding. Non-GAAP EPS is always determined using the as-if converted preferred shares and shares that would be issued for stock compensation awards. Therefore, GAAP diluted EPS and non-GAAP diluted EPS may be calculated using different methods, and may not mathematically reconcile.

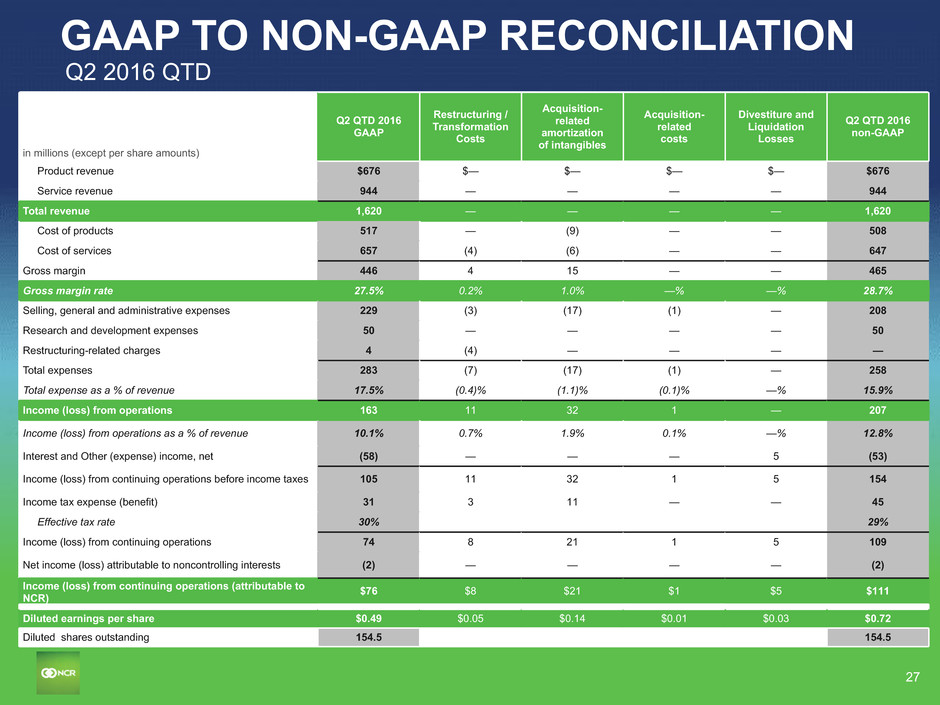

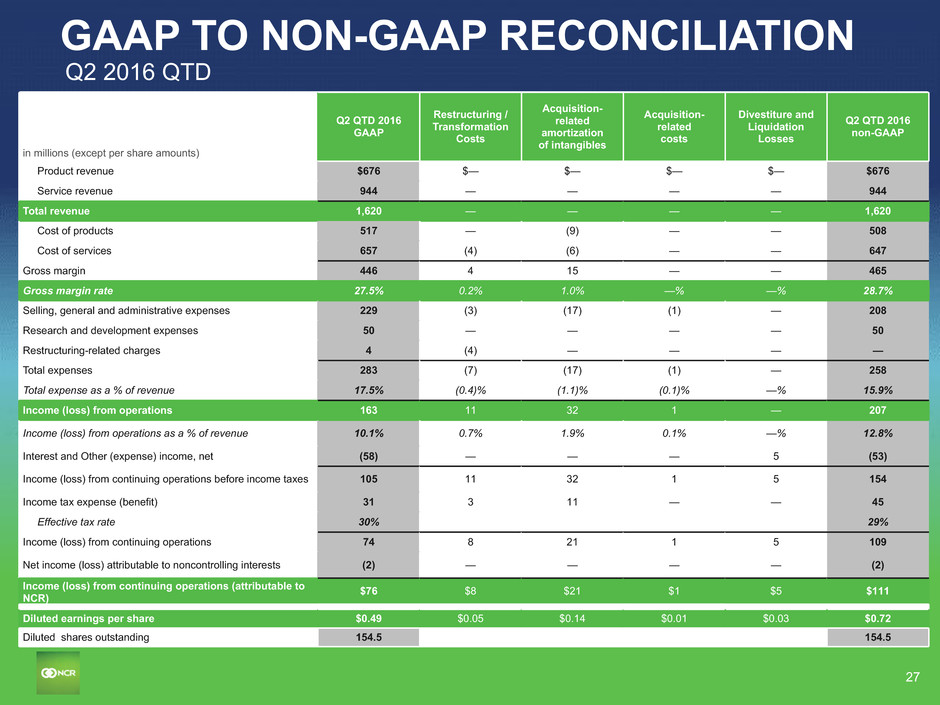

27 in millions (except per share amounts) Q2 QTD 2016 GAAP Restructuring / Transformation Costs Acquisition- related amortization of intangibles Acquisition- related costs Divestiture and Liquidation Losses Q2 QTD 2016 non-GAAP Product revenue $676 $— $— $— $— $676 Service revenue 944 — — — — 944 Total revenue 1,620 — — — — 1,620 Cost of products 517 — (9) — — 508 Cost of services 657 (4) (6) — — 647 Gross margin 446 4 15 — — 465 Gross margin rate 27.5% 0.2% 1.0% —% —% 28.7% Selling, general and administrative expenses 229 (3) (17) (1) — 208 Research and development expenses 50 — — — — 50 Restructuring-related charges 4 (4) — — — — Total expenses 283 (7) (17) (1) — 258 Total expense as a % of revenue 17.5% (0.4)% (1.1)% (0.1)% —% 15.9% Income (loss) from operations 163 11 32 1 — 207 Income (loss) from operations as a % of revenue 10.1% 0.7% 1.9% 0.1% —% 12.8% Interest and Other (expense) income, net (58) — — — 5 (53) Income (loss) from continuing operations before income taxes 105 11 32 1 5 154 Income tax expense (benefit) 31 3 11 — — 45 Effective tax rate 30% 29% Income (loss) from continuing operations 74 8 21 1 5 109 Net income (loss) attributable to noncontrolling interests (2) — — — — (2) Income (loss) from continuing operations (attributable to NCR) $76 $8 $21 $1 $5 $111 Diluted earnings per share $0.49 $0.05 $0.14 $0.01 $0.03 $0.72 Diluted shares outstanding 154.5 154.5 GAAP TO NON-GAAP RECONCILIATION Q2 2016 QTD

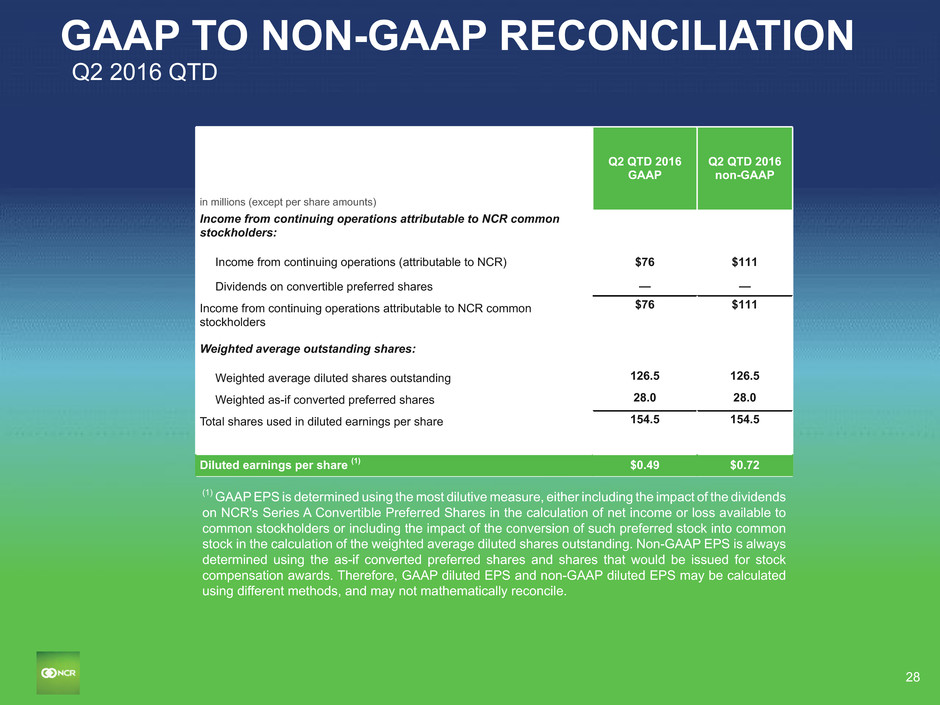

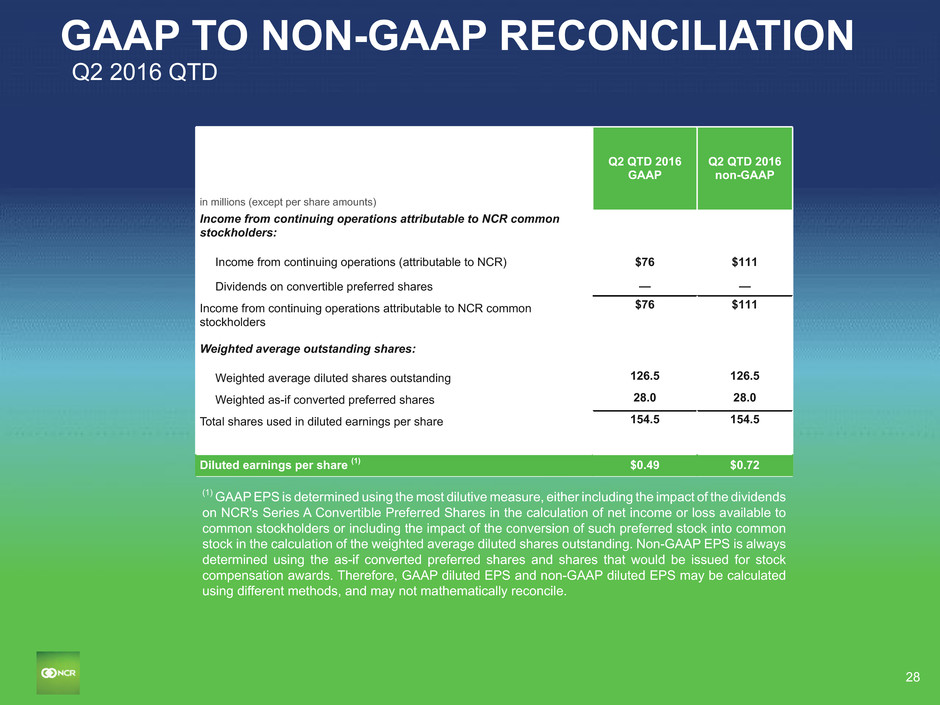

28 in millions (except per share amounts) Q2 QTD 2016 GAAP Q2 QTD 2016 non-GAAP Income from continuing operations attributable to NCR common stockholders: Income from continuing operations (attributable to NCR) $76 $111 Dividends on convertible preferred shares — — Income from continuing operations attributable to NCR common stockholders $76 $111 Weighted average outstanding shares: Weighted average diluted shares outstanding 126.5 126.5 Weighted as-if converted preferred shares 28.0 28.0 Total shares used in diluted earnings per share 154.5 154.5 Diluted earnings per share (1) $0.49 $0.72 (1) GAAP EPS is determined using the most dilutive measure, either including the impact of the dividends on NCR's Series A Convertible Preferred Shares in the calculation of net income or loss available to common stockholders or including the impact of the conversion of such preferred stock into common stock in the calculation of the weighted average diluted shares outstanding. Non-GAAP EPS is always determined using the as-if converted preferred shares and shares that would be issued for stock compensation awards. Therefore, GAAP diluted EPS and non-GAAP diluted EPS may be calculated using different methods, and may not mathematically reconcile. GAAP TO NON-GAAP RECONCILIATION Q2 2016 QTD

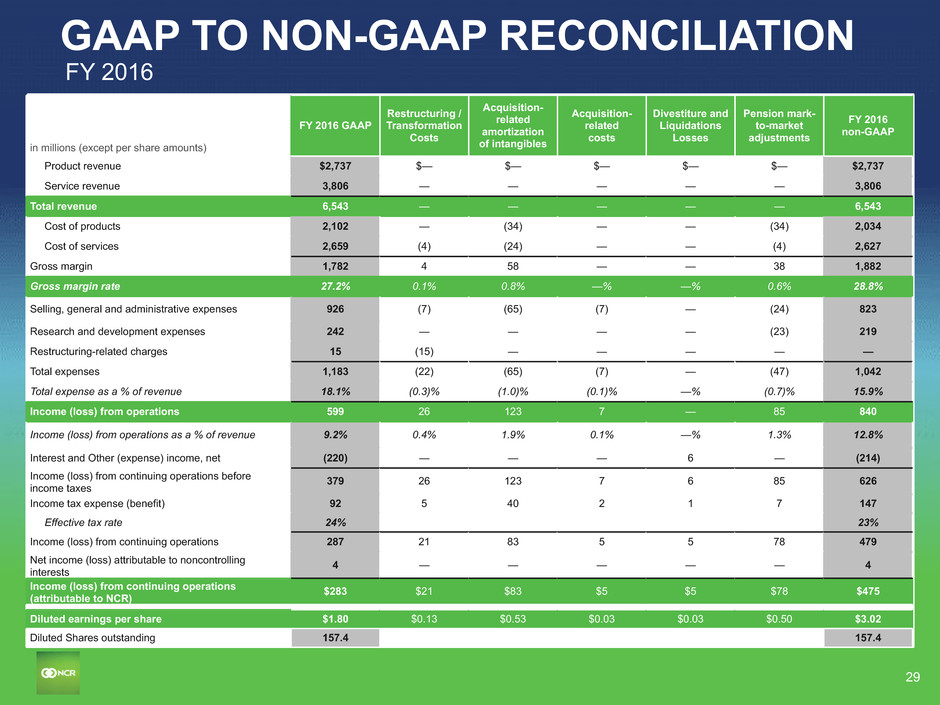

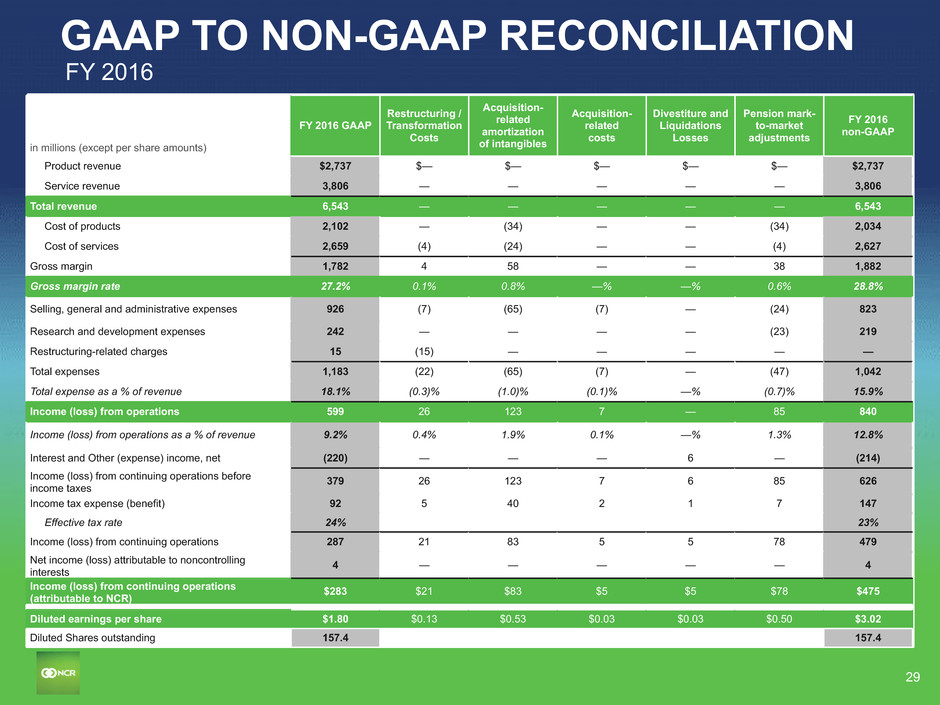

29 in millions (except per share amounts) FY 2016 GAAP Restructuring / Transformation Costs Acquisition- related amortization of intangibles Acquisition- related costs Divestiture and Liquidations Losses Pension mark- to-market adjustments FY 2016 non-GAAP Product revenue $2,737 $— $— $— $— $— $2,737 Service revenue 3,806 — — — — — 3,806 Total revenue 6,543 — — — — — 6,543 Cost of products 2,102 — (34) — — (34) 2,034 Cost of services 2,659 (4) (24) — — (4) 2,627 Gross margin 1,782 4 58 — — 38 1,882 Gross margin rate 27.2% 0.1% 0.8% —% —% 0.6% 28.8% Selling, general and administrative expenses 926 (7) (65) (7) — (24) 823 Research and development expenses 242 — — — — (23) 219 Restructuring-related charges 15 (15) — — — — — Total expenses 1,183 (22) (65) (7) — (47) 1,042 Total expense as a % of revenue 18.1% (0.3)% (1.0)% (0.1)% —% (0.7)% 15.9% Income (loss) from operations 599 26 123 7 — 85 840 Income (loss) from operations as a % of revenue 9.2% 0.4% 1.9% 0.1% —% 1.3% 12.8% Interest and Other (expense) income, net (220) — — — 6 — (214) Income (loss) from continuing operations before income taxes 379 26 123 7 6 85 626 Income tax expense (benefit) 92 5 40 2 1 7 147 Effective tax rate 24% 23% Income (loss) from continuing operations 287 21 83 5 5 78 479 Net income (loss) attributable to noncontrolling interests 4 — — — — — 4 Income (loss) from continuing operations (attributable to NCR) $283 $21 $83 $5 $5 $78 $475 Diluted earnings per share $1.80 $0.13 $0.53 $0.03 $0.03 $0.50 $3.02 Diluted Shares outstanding 157.4 157.4 GAAP TO NON-GAAP RECONCILIATION FY 2016

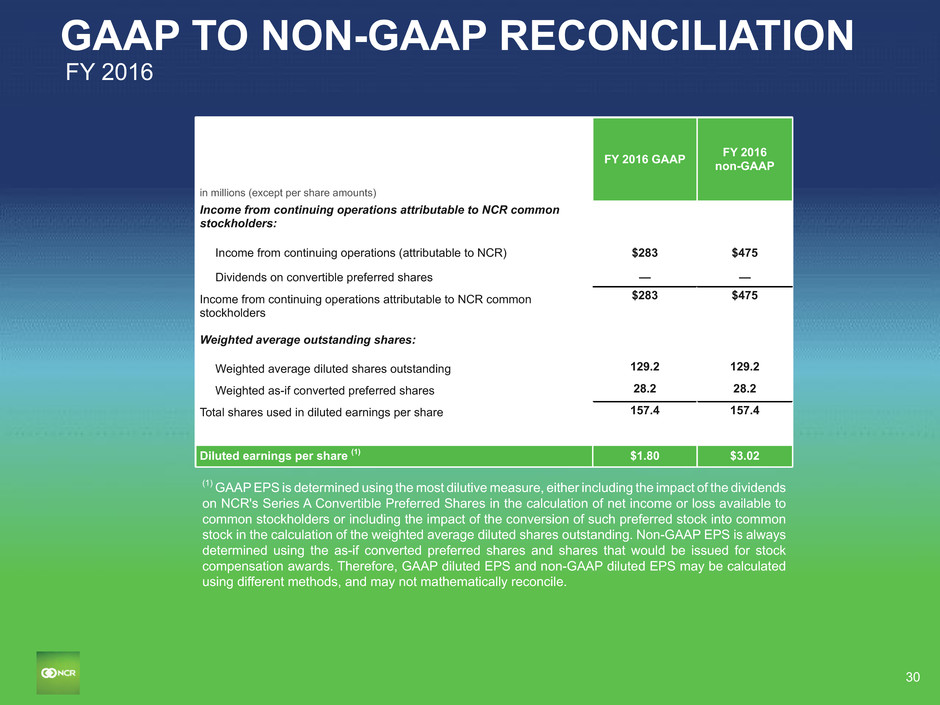

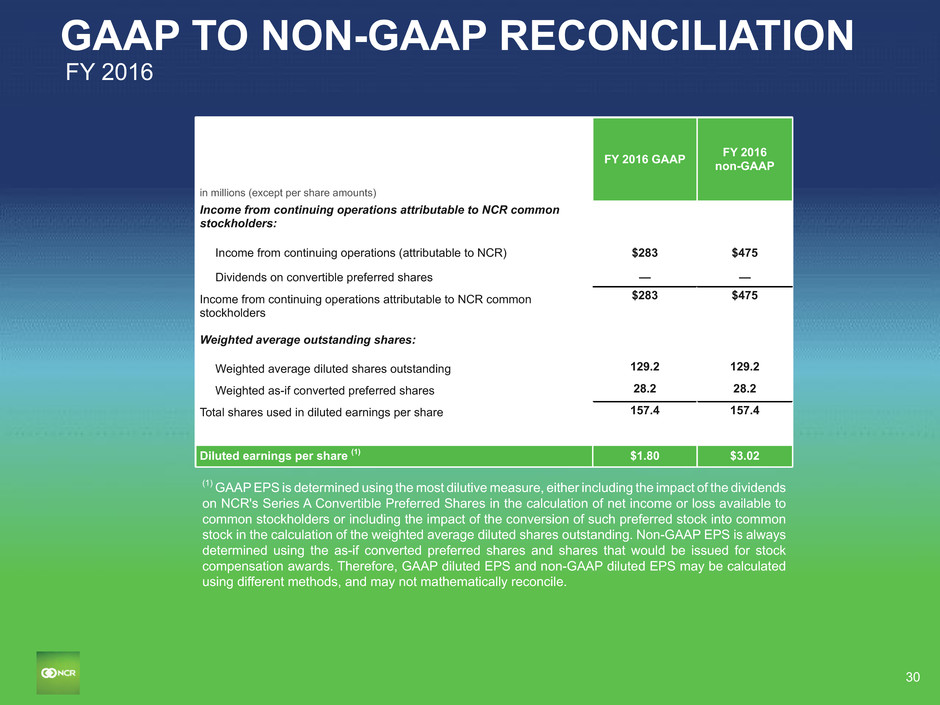

30 in millions (except per share amounts) FY 2016 GAAP FY 2016non-GAAP Income from continuing operations attributable to NCR common stockholders: Income from continuing operations (attributable to NCR) $283 $475 Dividends on convertible preferred shares — — Income from continuing operations attributable to NCR common stockholders $283 $475 Weighted average outstanding shares: Weighted average diluted shares outstanding 129.2 129.2 Weighted as-if converted preferred shares 28.2 28.2 Total shares used in diluted earnings per share 157.4 157.4 Diluted earnings per share (1) $1.80 $3.02 GAAP TO NON-GAAP RECONCILIATION FY 2016 (1) GAAP EPS is determined using the most dilutive measure, either including the impact of the dividends on NCR's Series A Convertible Preferred Shares in the calculation of net income or loss available to common stockholders or including the impact of the conversion of such preferred stock into common stock in the calculation of the weighted average diluted shares outstanding. Non-GAAP EPS is always determined using the as-if converted preferred shares and shares that would be issued for stock compensation awards. Therefore, GAAP diluted EPS and non-GAAP diluted EPS may be calculated using different methods, and may not mathematically reconcile.

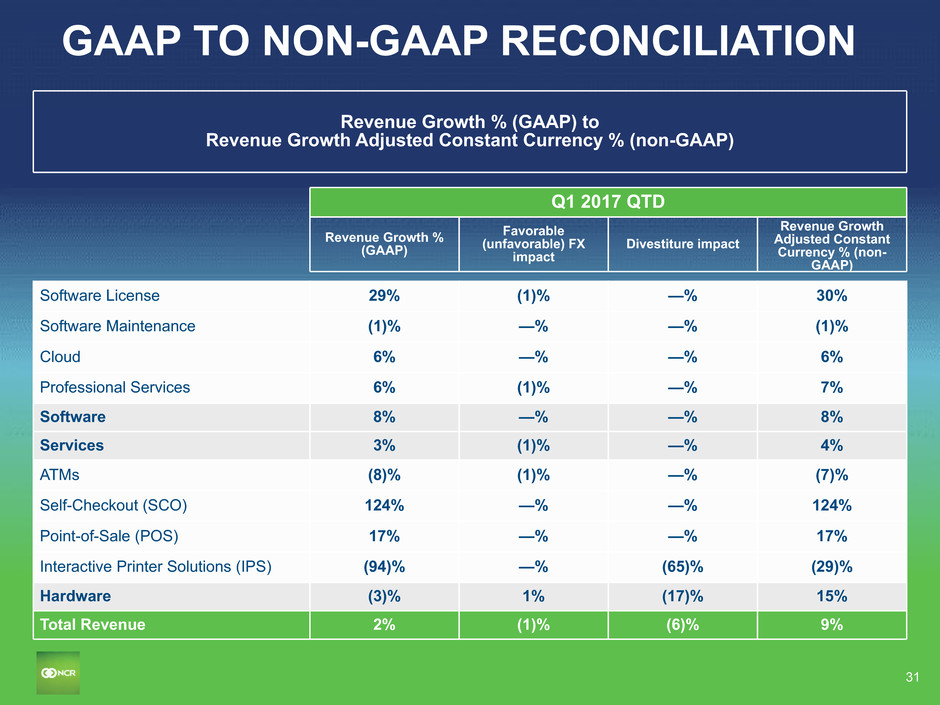

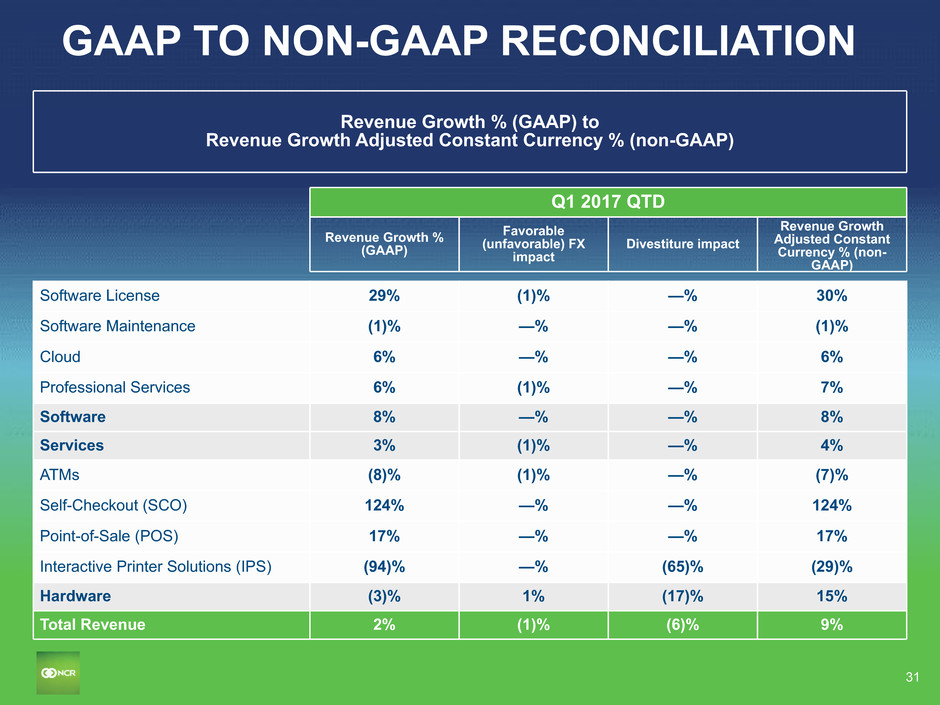

31 GAAP TO NON-GAAP RECONCILIATION Revenue Growth % (GAAP) to Revenue Growth Adjusted Constant Currency % (non-GAAP) Q1 2017 QTD Revenue Growth % (GAAP) Favorable (unfavorable) FX impact Divestiture impact Revenue Growth Adjusted Constant Currency % (non- GAAP) Software License 29% (1)% —% 30% Software Maintenance (1)% —% —% (1)% Cloud 6% —% —% 6% Professional Services 6% (1)% —% 7% Software 8% —% —% 8% Services 3% (1)% —% 4% ATMs (8)% (1)% —% (7)% Self-Checkout (SCO) 124% —% —% 124% Point-of-Sale (POS) 17% —% —% 17% Interactive Printer Solutions (IPS) (94)% —% (65)% (29)% Hardware (3)% 1% (17)% 15% Total Revenue 2% (1)% (6)% 9%

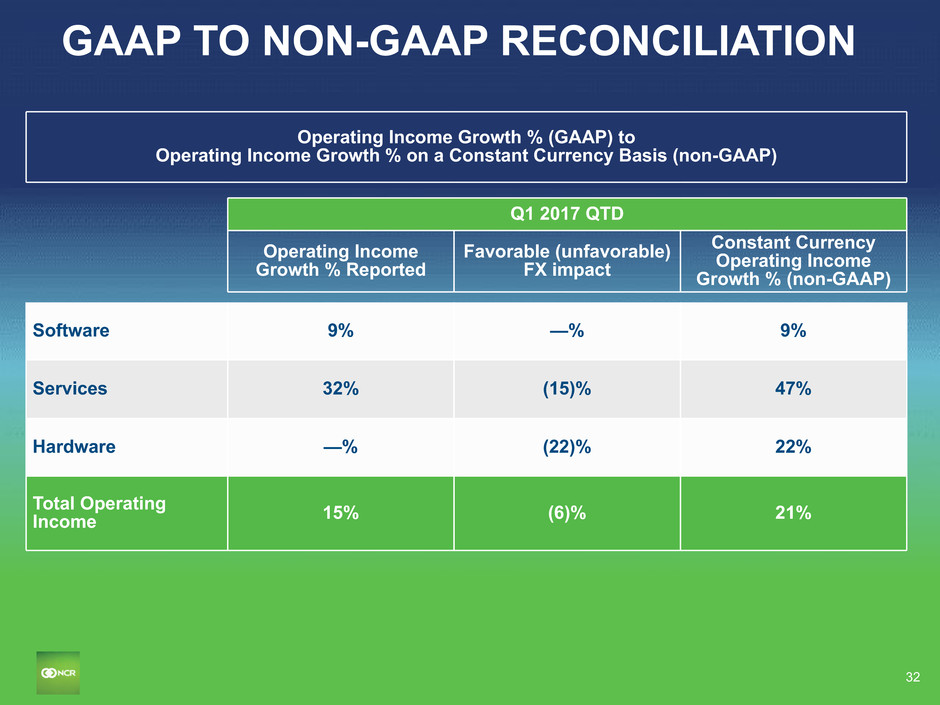

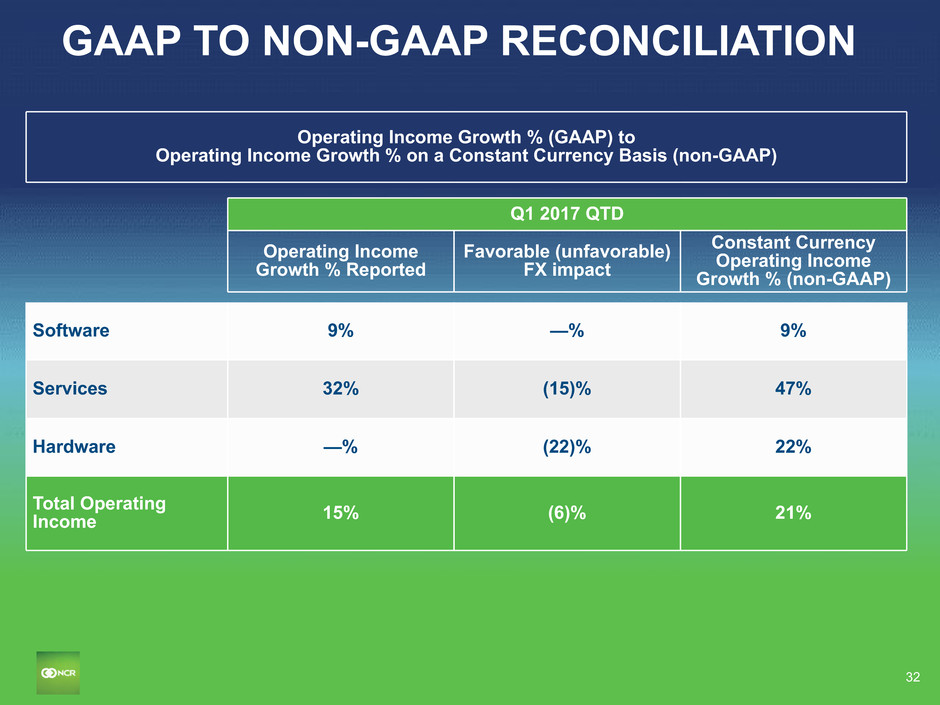

32 GAAP TO NON-GAAP RECONCILIATION Operating Income Growth % (GAAP) to Operating Income Growth % on a Constant Currency Basis (non-GAAP) Q1 2017 QTD Operating Income Growth % Reported Favorable (unfavorable) FX impact Constant Currency Operating Income Growth % (non-GAAP) Software 9% —% 9% Services 32% (15)% 47% Hardware —% (22)% 22% Total Operating Income 15% (6)% 21%

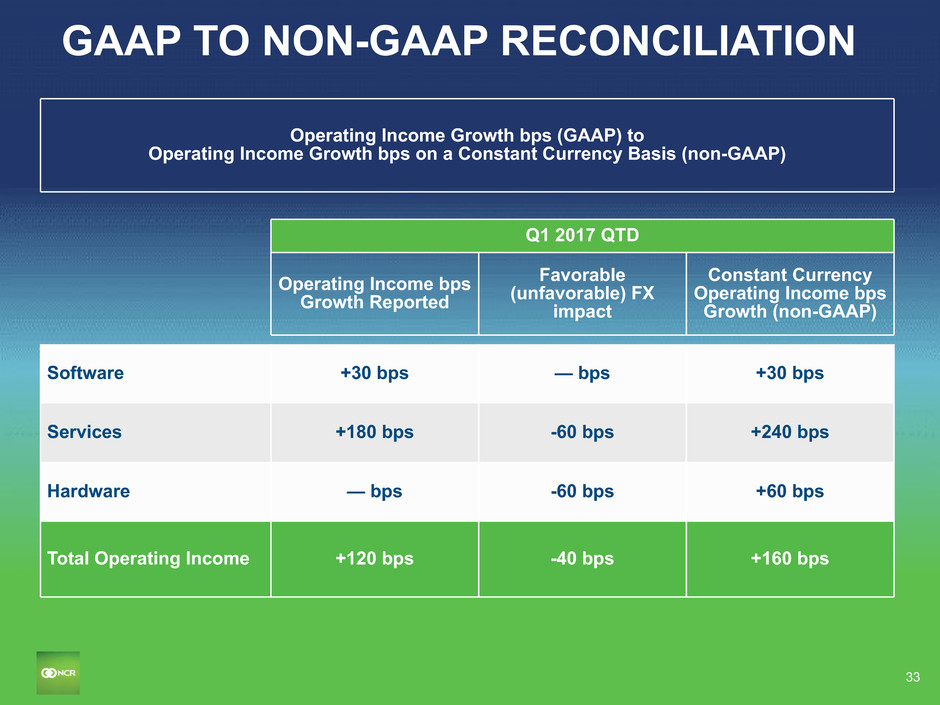

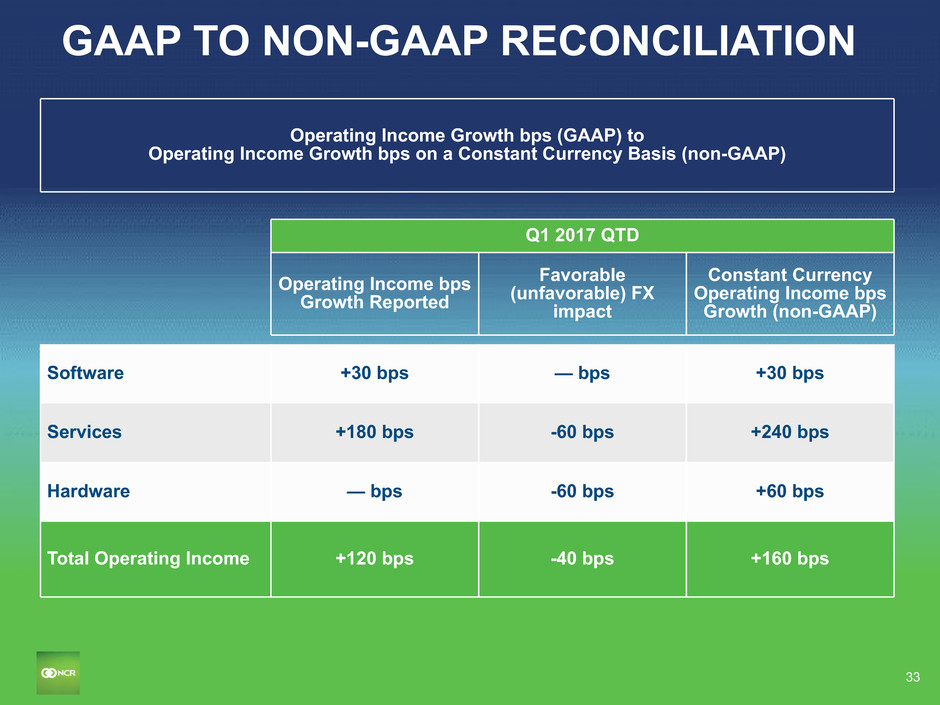

33 GAAP TO NON-GAAP RECONCILIATION Operating Income Growth bps (GAAP) to Operating Income Growth bps on a Constant Currency Basis (non-GAAP) Q1 2017 QTD Operating Income bps Growth Reported Favorable (unfavorable) FX impact Constant Currency Operating Income bps Growth (non-GAAP) Software +30 bps — bps +30 bps Services +180 bps -60 bps +240 bps Hardware — bps -60 bps +60 bps Total Operating Income +120 bps -40 bps +160 bps

34 GAAP TO NON-GAAP RECONCILIATION Diluted Earnings per Share (GAAP) to Diluted Earnings per Share (non-GAAP) 2017 Current Guidance 2017 Prior Guidance Q2 2017e Diluted EPS (GAAP) (1) $2.20 - $2.32 $2.56 - $2.69 $0.53 - $0.60 Transformation costs 0.14 - 0.17 0.15 - 0.18 0.02 - 0.05 Acquisition-Related Amortization of Intangibles 0.49 0.48 0.13 Acquisition-Related Costs 0.03 0.03 0.01 Deemed dividends related to Blackstone Transaction 0.39 — — Non-GAAP Diluted EPS $3.32 - $3.42 $3.27 - $3.37 $0.72 - $0.77 (1) Except for the adjustments noted herein, this guidance does not include the effects of any future acquisitions/divestitures, restructuring activities, pension mark-to-market adjustments, taxes or other events, which are difficult to predict and which may or may not be significant.

35