1 Q3 2021 EARNINGS CONFERENCE CALL MICHAEL HAYFORD, CEO OWEN SULLIVAN, PRESIDENT & COO TIM OLIVER, CFO October 26, 2021

2 FORWARD-LOOKING STATEMENTS. Comments made during this conference call and in these materials contain “forward- looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements use words such as “expect,” “anticipate,” “outlook,” “intend,” “plan,” “believe,” “will,” “should,” “would,” “potential,” “proposed,” “objective,” “could,” “may,” and words of similar meaning, as well as other words or expressions referencing future events, conditions or circumstances. We intend these forward-looking statements to be covered by the safe harbor provisions for forward looking statements contained in the Act. Statements that describe or relate to NCR’s plans, goals, intentions, strategies, or financial outlook, and statements that do not relate to historical or current fact, are examples of forward-looking statements. Examples of forward-looking statements in these materials include, without limitation, statements regarding NCR’s expansion, acceleration, and execution of our strategy to shift to a software platform and payments company and our NCR-as-a-Service and 80/60/20 strategy, statements regarding our financial position, expectations regarding delivery of increased value to customers and customer satisfaction, expectations regarding growth and long-term value creation for our stockholders, statements regarding momentum and continued investment in strategic growth platforms, expectations regarding the impact of the Cardtronics acquisition on NCR, statements regarding our plans to manage our business through the COVID-19 pandemic including safeguarding our employees, helping our customers, and managing impacts on our supply chain, the expected impact of the COVID-19 pandemic on our business, expectations regarding demand for our products and services, statements regarding supply chain challenges and cost escalations including materials, labor and freight, statements regarding our second half 2021 financial outlook including revenue, adjusted EBITDA, earnings per share and free cash flow, statements regarding our focus on capitalization of opportunities, the integration of Cardtronics and opportunities to accelerate profitable growth, acceleration of payments and transaction processing solutions, allocation of capital and return on investment, and customer satisfaction. Forward-looking statements are based on our current beliefs, expectations and assumptions, which may not prove to be accurate, and involve a number of known and unknown risks and uncertainties, many of which are out of NCR’s control. Forward-looking statements are not guarantees of future performance, and there are a number of important factors that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements, including those factors listed in Item 1A “Risk Factors” of NCR’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (SEC) on February 26, 2021 and those factors detailed from time to time in NCR’s other SEC reports including quarterly reports on Form 10-Q and current reports on Form 8-K. These materials are dated October 26, 2021, and NCR does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as otherwise required by law. NOTES TO INVESTORS

3 NON-GAAP MEASURES. While NCR reports its results in accordance with generally accepted accounting principles in the United States, or GAAP, comments made during this conference call and in these materials will include or make reference to certain "non-GAAP" measures, including: selected measures, such as period-over-period revenue growth; gross margin rate (non-GAAP); diluted earnings per share (non-GAAP); free cash flow; gross margin (non-GAAP); net debt; adjusted EBITDA; the ratio of net debt to adjusted EBITDA; operating income (non-GAAP); interest and other expense (non-GAAP); income tax expense (non-GAAP); effective income tax rate (non-GAAP); and net income (non-GAAP). These measures are included to provide additional useful information regarding NCR's financial results, and are not a substitute for their comparable GAAP measures. Explanations of these non-GAAP measures, and reconciliations of these non-GAAP measures to their directly comparable GAAP measures, are included in the accompanying "Supplementary Materials" and are available on the Investor Relations page of NCR's website at www.ncr.com. Descriptions of many of these non-GAAP measures are also included in NCR's SEC reports. USE OF CERTAIN TERMS. As used in these materials: (i) the term "recurring revenue" includes all revenue streams from contracts where there is a predictable revenue pattern that will occur at regular intervals with a relatively high degree of certainty. This includes hardware and software maintenance revenue, cloud revenue, payment processing revenue, interchange and network revenue, and certain professional services arrangements, as well as term-based software license arrangements that include customer termination rights. These presentation materials and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together. NOTES TO INVESTORS

4 OVERVIEW Free Cash Flow of $125M in Q3 Revenue up 20% Y/Y; Recurring revenue up 39% Adjusted EBITDA growth of 41% Y/Y Adjusted EBITDA margin expansion of 280 bps to 18.5% Cardtronics integration on-track

5 STRATEGIC UPDATE Accelerating NCR-as-a-Service transformation Strong momentum across strategic growth platforms Retail - Accelerating growth in NCR EmeraldTM software platform Hospitality - AlohaTM Essentials momentum across both Enterprise and SMB customers Banking – Digital banking momentum and continued shift to recurring revenue Payments - Gaining traction upselling to existing customers

6 Adjusted EBITDA up 41% and margin rate up 280 bps y/y Non-GAAP EPS up 28% y/y Driving strong and linear free cash flow production Total Revenue/Recurring Adjusted EBITDA Non-GAAP Diluted EPS Free Cash Flow Revenue up 20% y/y; Recurring revenue up 39% y/y; Pro forma revenue up 3%; Pro forma(1) recurring revenue up 7% Q3 2021 FINANCIAL RESULTS Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0 $900 $1,800 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0 $180 $360 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0.00 $0.35 $0.70 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0 $85 $170 $ in millions, except for EPS $1,589 $249 $160 15.7% $1,677 $281 18.5% $0.54 $0.62 $142 $125 $1,901 $352 $0.69 16.8% $848 $929 $1,181 (1) Proforma recurring revenue includes the historical recurring revenue of Cardtronics for the three month period ending Q3 20 adjusted for $26M of intercompany.

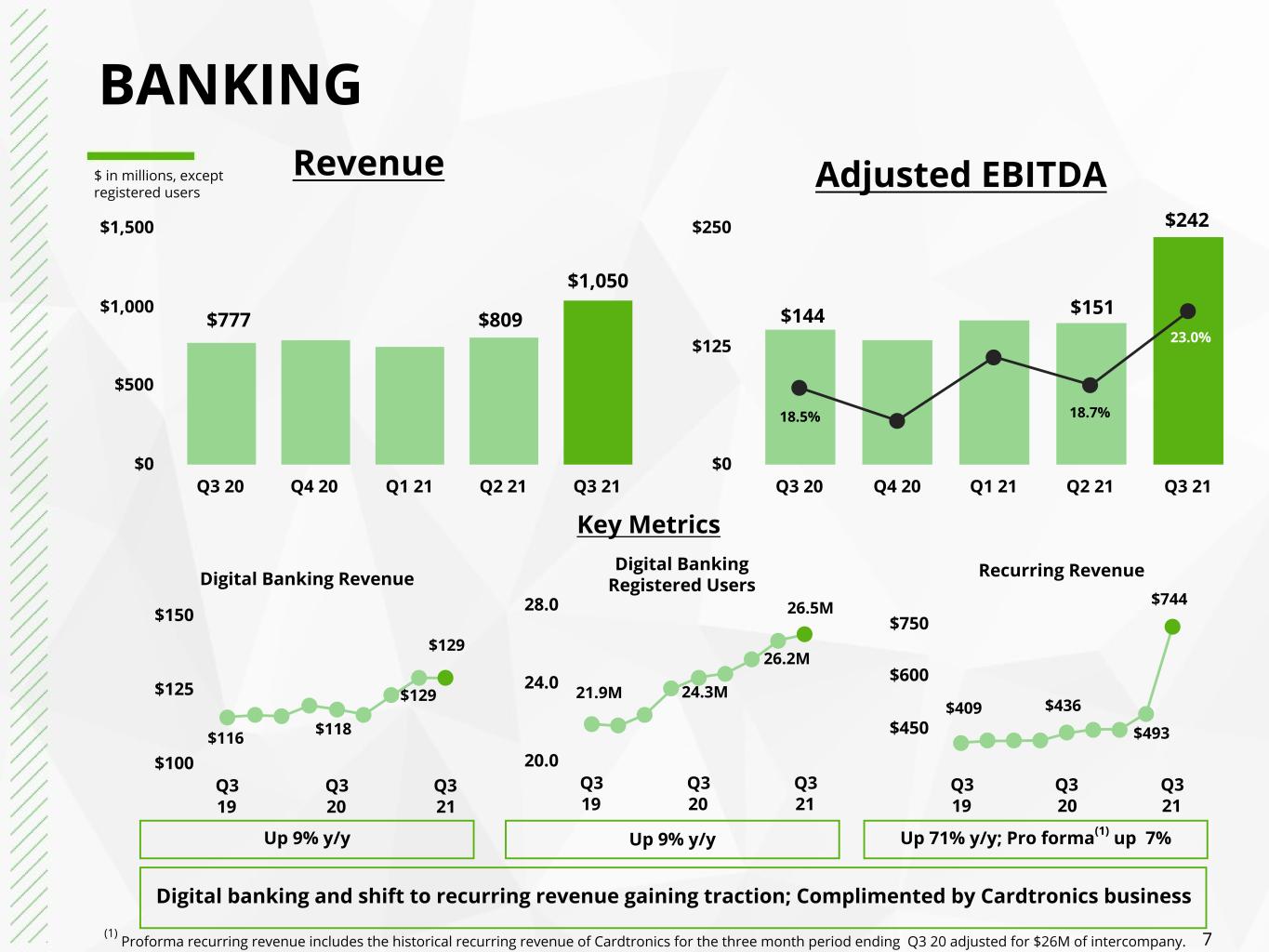

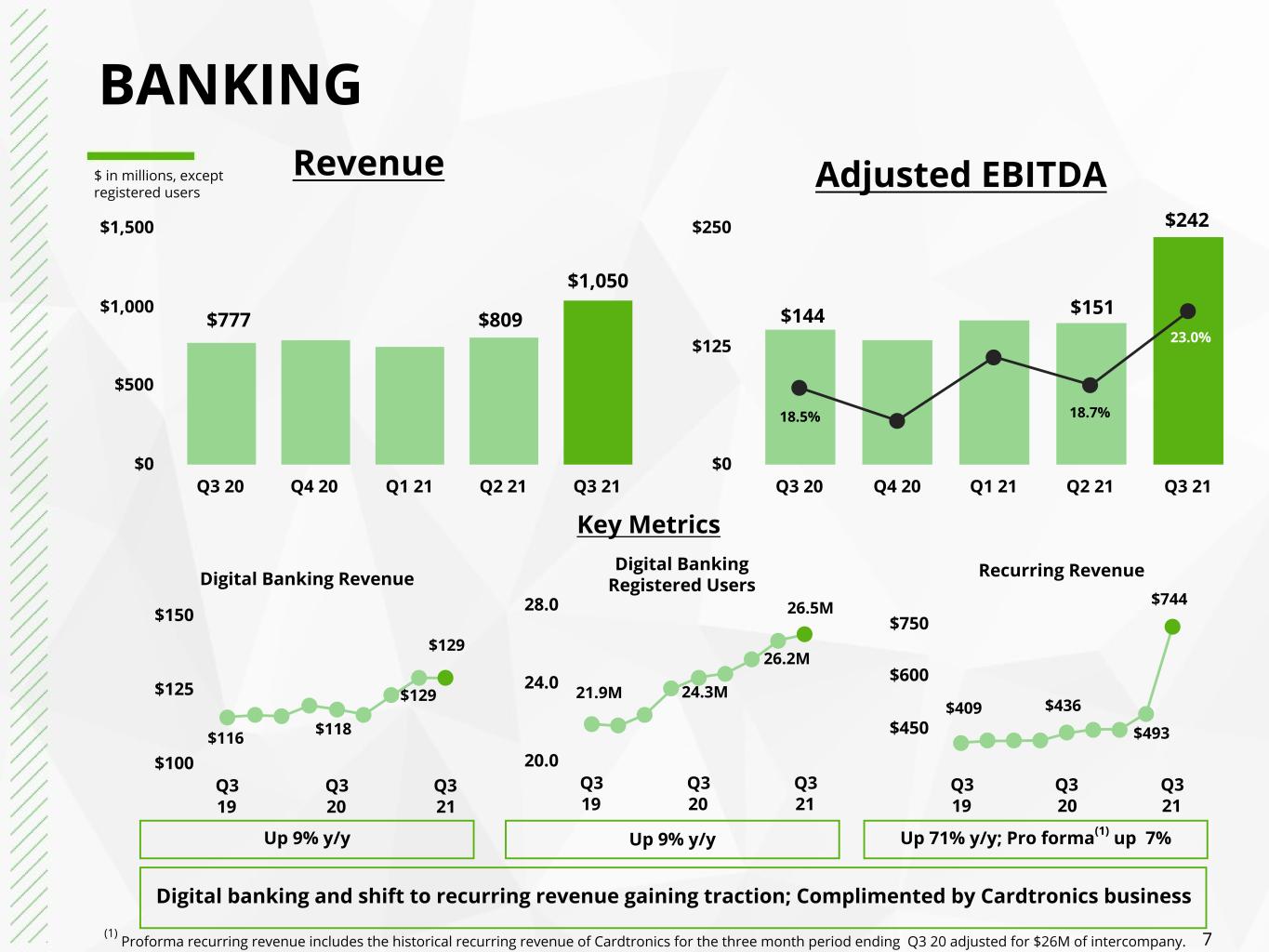

7 Q3 19 Q3 20 Q3 21 $100 $125 $150 $ in millions, except registered users BANKING Revenue Adjusted EBITDA Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0 $500 $1,000 $1,500 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0 $125 $250 $777 Q3 19 Q3 20 Q3 21 20.0 24.0 28.0 Digital Banking Revenue Digital Banking Registered Users Recurring Revenue Up 9% y/y Up 9% y/y Q3 19 Q3 20 Q3 21 $450 $600 $750 Up 71% y/y; Pro forma(1) up 7% Digital banking and shift to recurring revenue gaining traction; Complimented by Cardtronics business Key Metrics $809 $116 $151$144 24.3M 26.2M $436 $493$118 $129 $1,050 $242 26.5M $744 $129 23.0% 18.5% 18.7% (1) Proforma recurring revenue includes the historical recurring revenue of Cardtronics for the three month period ending Q3 20 adjusted for $26M of intercompany. 21.9M $409

8 Conversion to Platform Lanes gaining traction $ in millions, except platform lanes RETAIL Revenue Adjusted EBITDA Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0 $250 $500 $750 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0 $40 $80 $120 SCO Revenue Platform Lanes Q3 19 Q3 20 Q3 21 0 8,000 16,000 Recurring Revenue Down 11% y/y Q3 19 Q3 20 Q3 21 $150 $225 $300 Q3 19 Q3 20 Q3 21 $0 $200 $400 Key Metrics Up 4% y/yUp >4x $556 $576 $81 $92 3,587 5,146 $252 $269 $273$271 $553 $70 $262 15,032 $242 14.6% 16.0% 12.7% $219 1037 $222

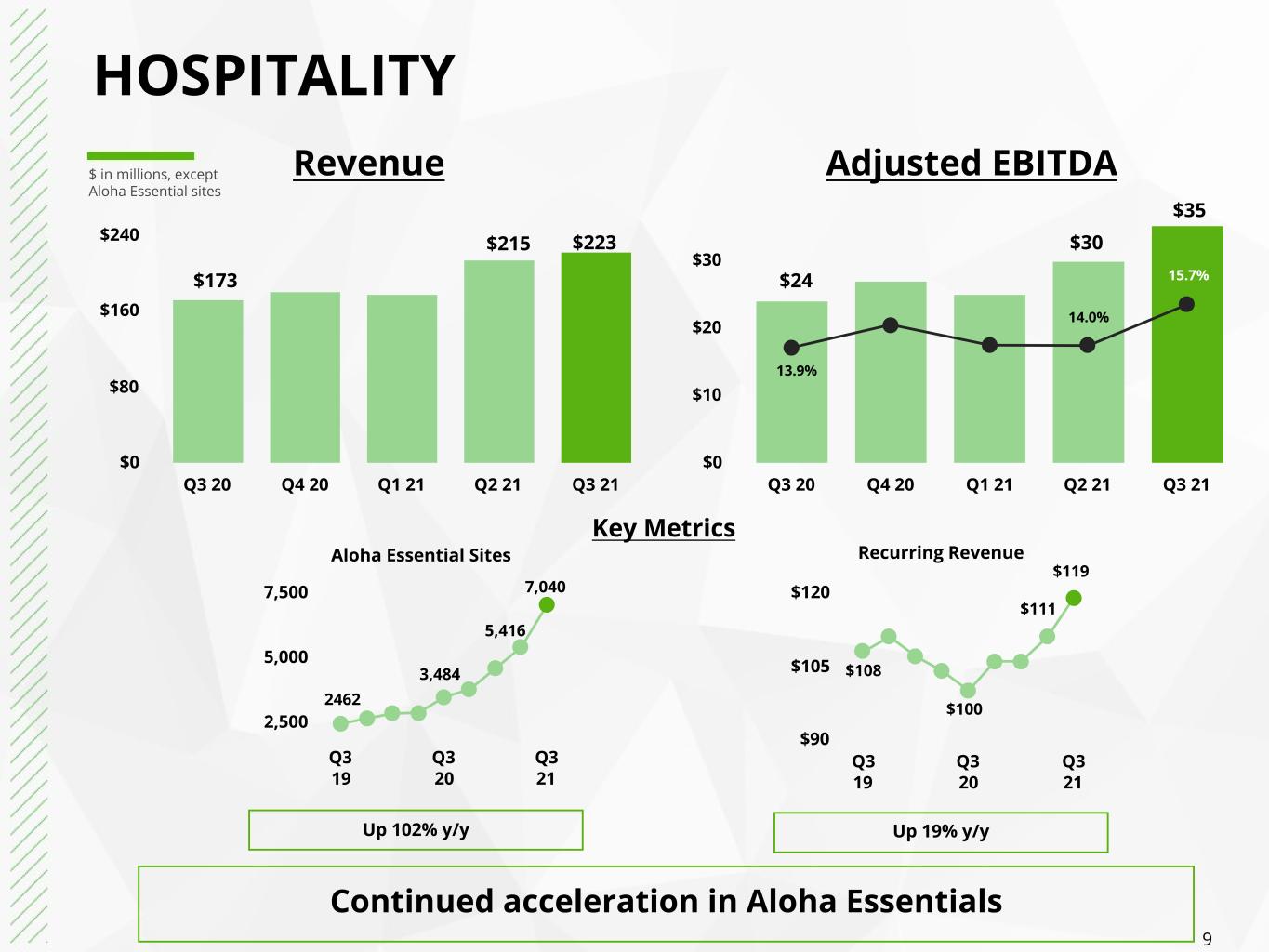

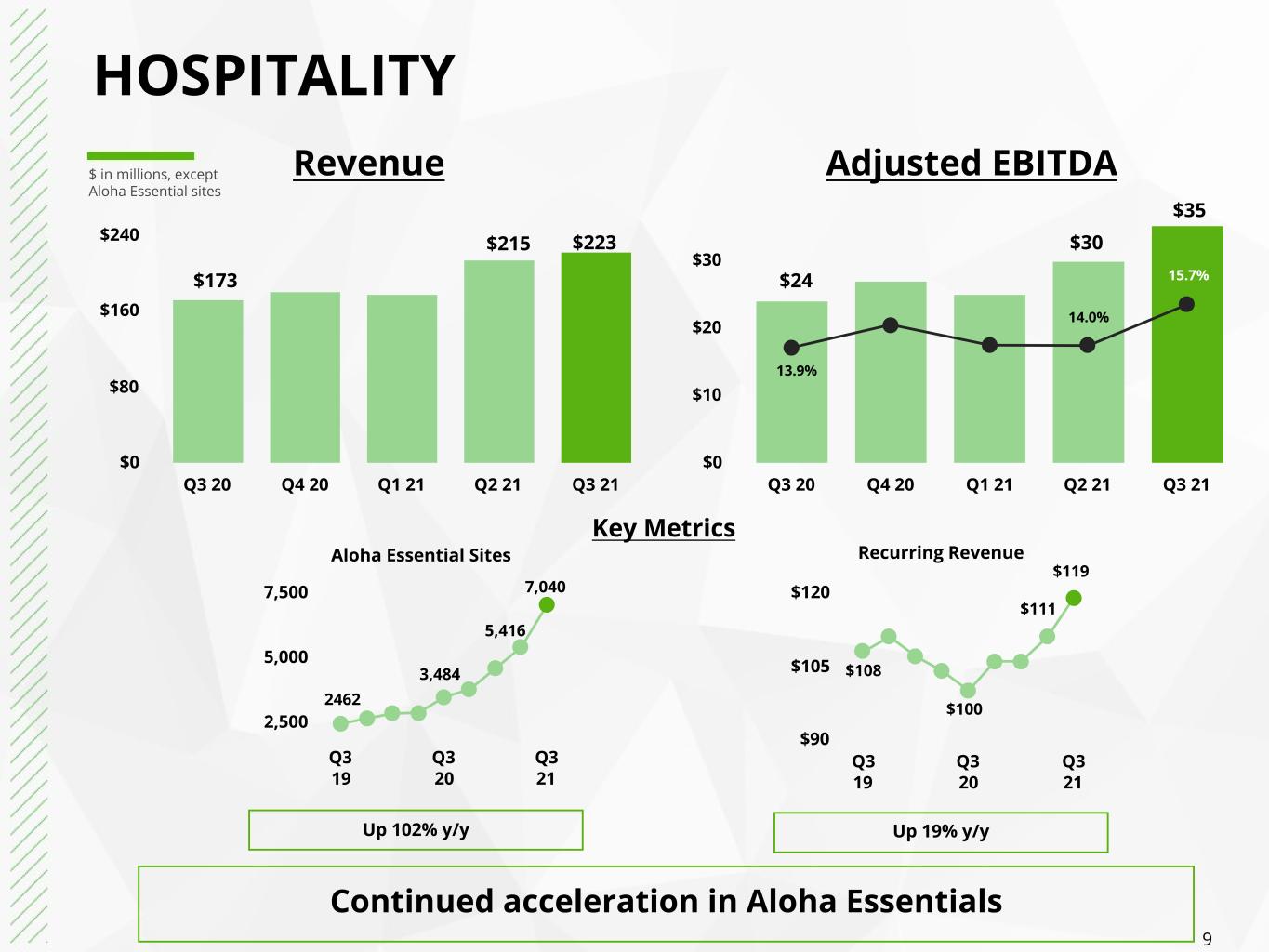

9 $ in millions, except Aloha Essential sites HOSPITALITY Revenue Adjusted EBITDA Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0 $80 $160 $240 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 $0 $10 $20 $30 Aloha Essential Sites Recurring Revenue Q3 19 Q3 20 Q3 21 2,500 5,000 7,500 Up 102% y/y Up 19% y/y Q3 19 Q3 20 Q3 21 $90 $105 $120 Continued acceleration in Aloha Essentials Key Metrics $173 $215 $24 $30 3,484 5,416 $100 $111 $223 $35 $119 7,040 13.9% 14.0% 15.7% $108 2462

10 Q3 2021 Q3 2020 80% of NCR's revenue will come from software and services 76% 71% 60% of NCR's revenue will come from recurring revenue 62% 53% 20% goal for Adjusted EBITDA as a percent of revenue 18.5% 15.7% Progress on NCR 80/60/20 Goals

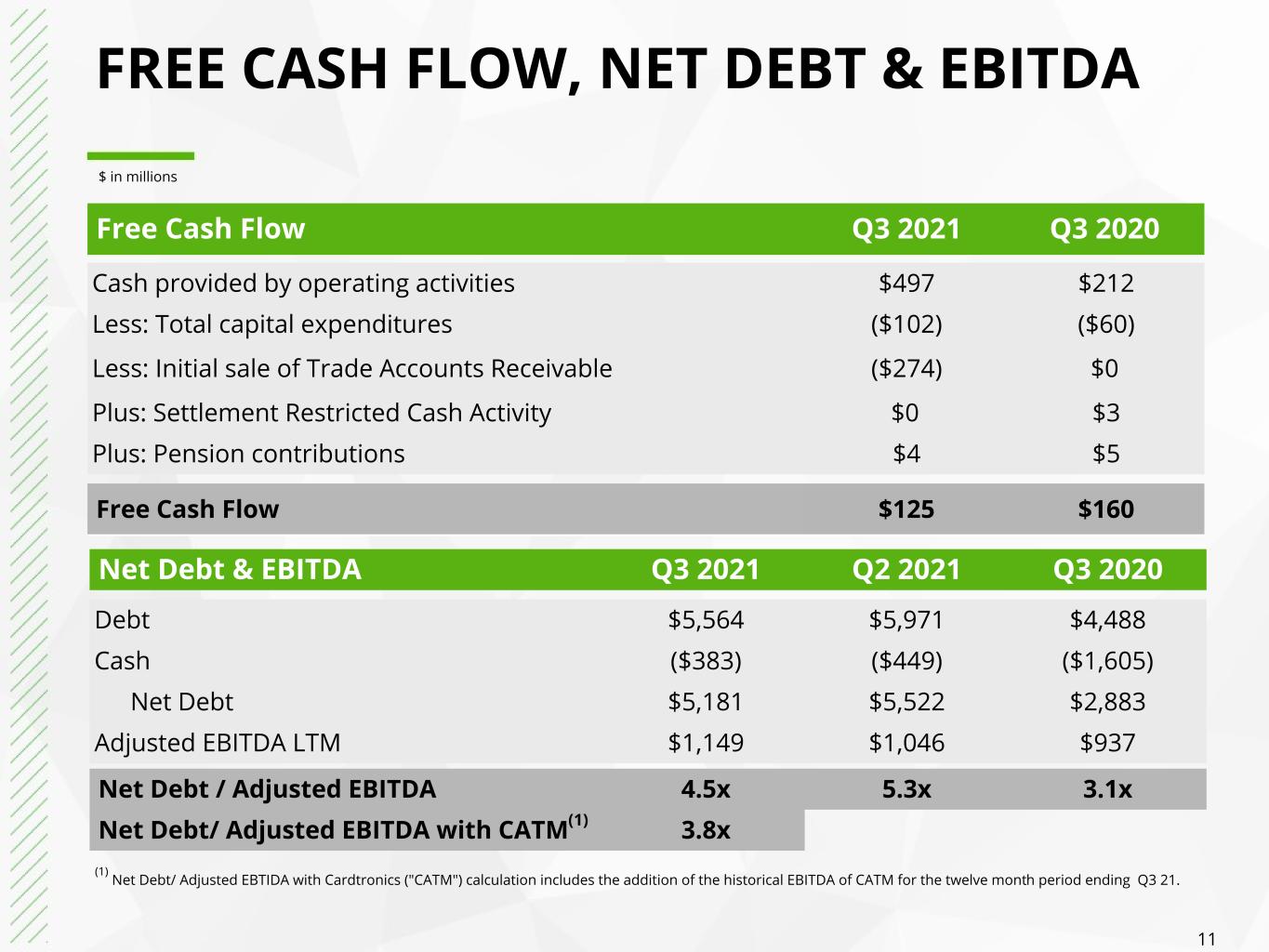

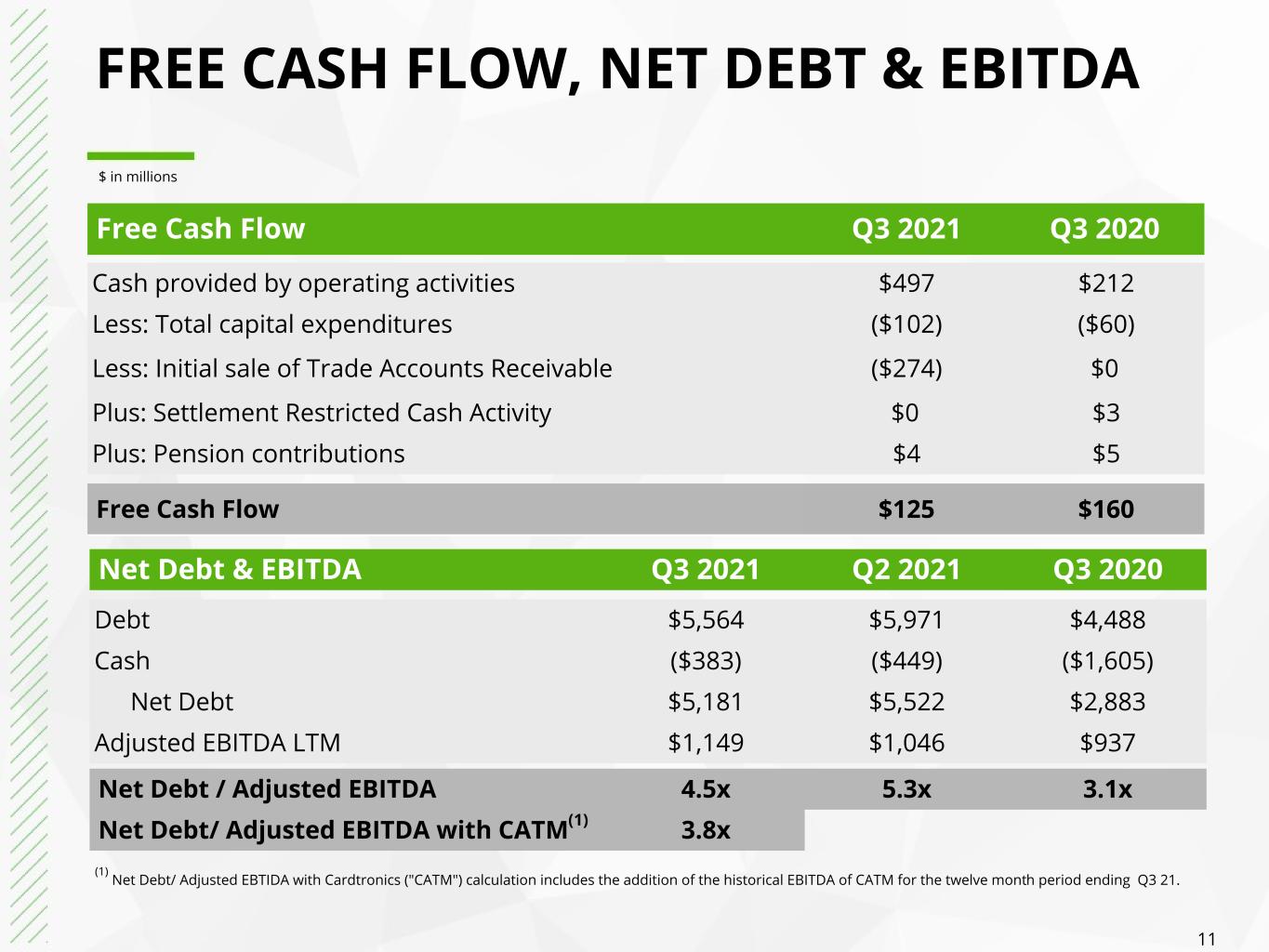

11 Free Cash Flow Q3 2021 Q3 2020 Cash provided by operating activities $497 $212 Less: Total capital expenditures ($102) ($60) Less: Initial sale of Trade Accounts Receivable ($274) $0 Plus: Settlement Restricted Cash Activity $0 $3 Plus: Pension contributions $4 $5 Free Cash Flow $125 $160 $ in millions FREE CASH FLOW, NET DEBT & EBITDA Net Debt & EBITDA Q3 2021 Q2 2021 Q3 2020 Debt $5,564 $5,971 $4,488 Cash ($383) ($449) ($1,605) Net Debt $5,181 $5,522 $2,883 Adjusted EBITDA LTM $1,149 $1,046 $937 Net Debt / Adjusted EBITDA 4.5x 5.3x 3.1x Net Debt/ Adjusted EBITDA with CATM(1) 3.8x (1) Net Debt/ Adjusted EBTIDA with Cardtronics ("CATM") calculation includes the addition of the historical EBITDA of CATM for the twelve month period ending Q3 21.

12 LOOKING FORWARD Capitalize on Cardtronics opportunities Accelerate payments and transaction processing solutions Allocate capital to highest growth and return on investment opportunities Focus on customer satisfaction initiatives Virtual Investor Day scheduled for December 9th, 2021 Continue to execute well in difficult supply chain environment

13 SUPPLEMENTARY MATERIALS

14 Q3 2021 Q3 2020 % Change Revenue $1,901 $1,589 20% Gross Margin 520 427 22% Gross Margin Rate 27.4% 26.9% Operating Expenses 363 309 17% % of Revenue 19.1% 19.4% Operating Income 157 118 33% % of Revenue 8.3% 7.4% Interest and other expense (115) (86) 34% Income Tax Expense (Benefit) 29 — Effective Income Tax Rate 69.0% —% Net Income from Continuing Operations (attributable to NCR) $12 $31 (61%) Diluted EPS $0.06 $0.19 (68)% $ in millions, except per share amounts Q3 2021 GAAP RESULTS

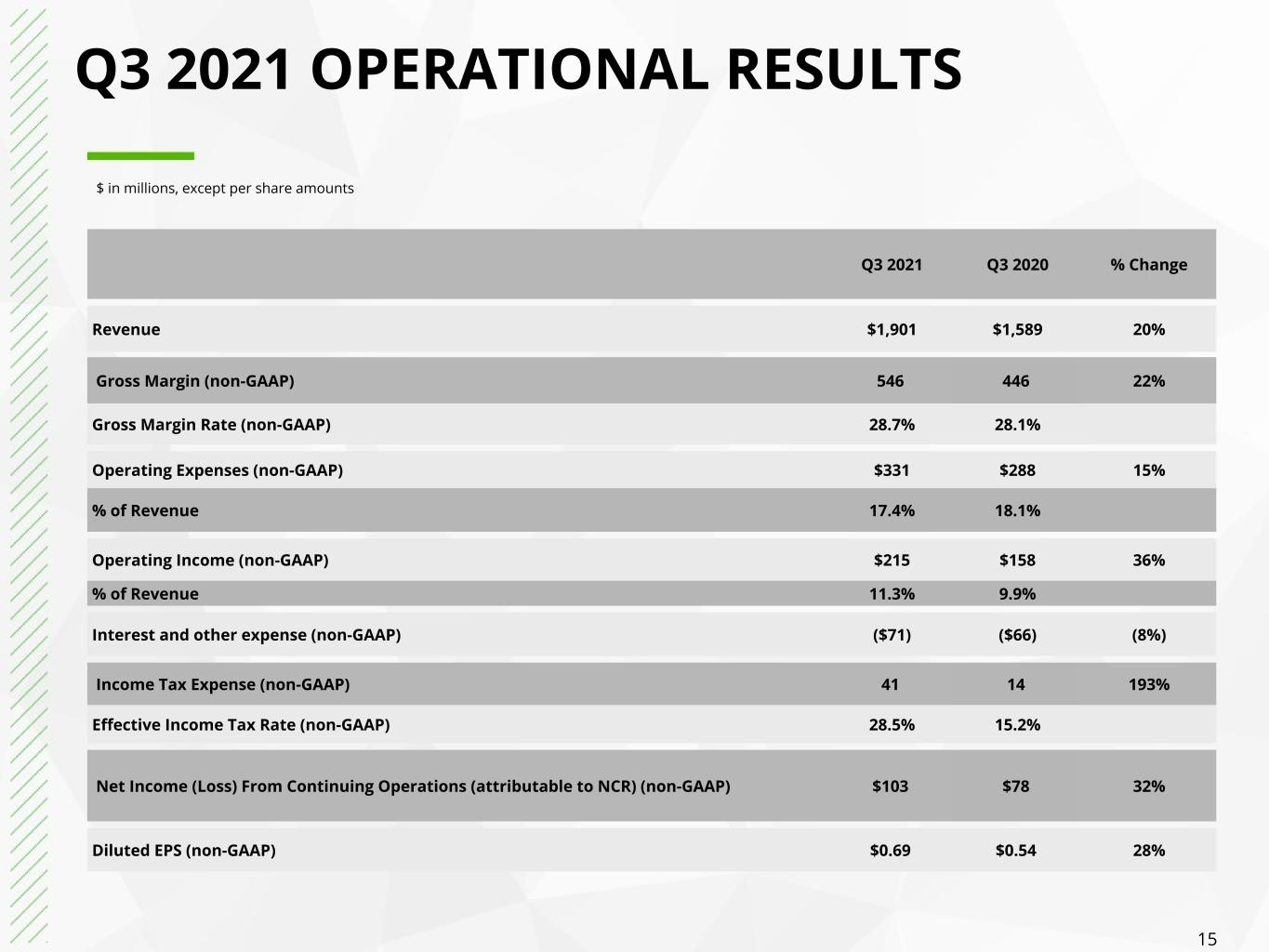

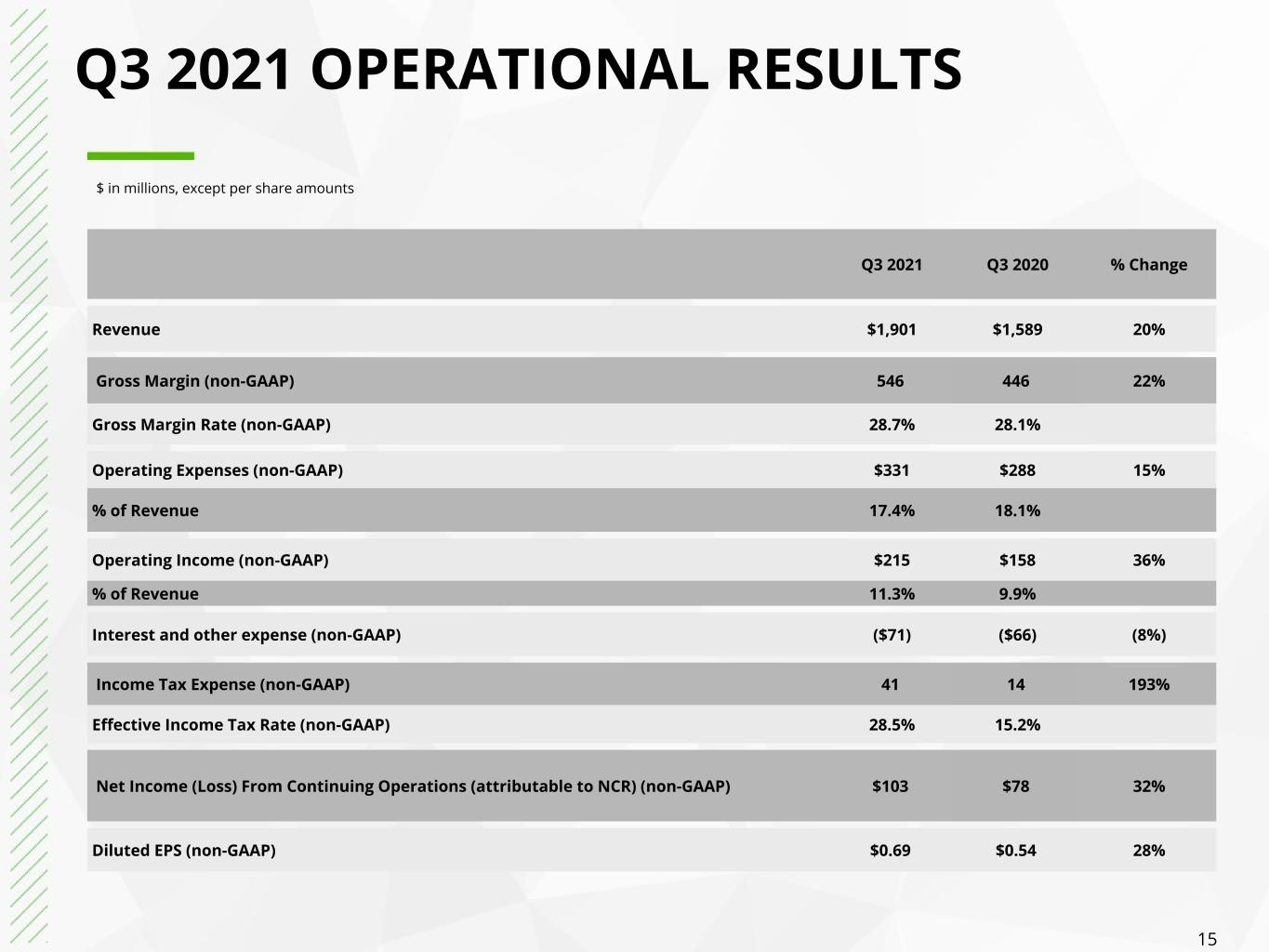

15 Q3 2021 Q3 2020 % Change Revenue $1,901 $1,589 20% Gross Margin (non-GAAP) 546 446 22% Gross Margin Rate (non-GAAP) 28.7% 28.1% Operating Expenses (non-GAAP) $331 $288 15% % of Revenue 17.4% 18.1% Operating Income (non-GAAP) $215 $158 36% % of Revenue 11.3% 9.9% Interest and other expense (non-GAAP) ($71) ($66) (8%) Income Tax Expense (non-GAAP) 41 14 193% Effective Income Tax Rate (non-GAAP) 28.5% 15.2% Net Income (Loss) From Continuing Operations (attributable to NCR) (non-GAAP) $103 $78 32% Diluted EPS (non-GAAP) $0.69 $0.54 28% $ in millions, except per share amounts Q3 2021 OPERATIONAL RESULTS

16 While NCR reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this conference call and in these materials will include non-GAAP measures. These measures are included to provide additional useful information regarding NCR's financial results, and are not a substitute for their comparable GAAP measures. Non-GAAP Diluted Earnings Per Share (EPS), Gross Margin (non-GAAP), Gross Margin Rate (non-GAAP), Operating Expenses (non- GAAP), Operating Income (non-GAAP), Operating Margin Rate (non-GAAP), Other (Expense) (non-GAAP), Income Tax Expense (non-GAAP), Effective Income Tax Rate (non-GAAP), and Net Income from Continuing Operations Attributable to NCR (non- GAAP). NCR’s non-GAAP diluted EPS, gross margin (non-GAAP), gross margin rate (non-GAAP), operating expenses (non-GAAP), operating income (non-GAAP), operating margin rate (non-GAAP), other (expense) (non-GAAP), income tax expense (non-GAAP), effective income tax rate (non-GAAP), and net income from continuing operations attributable to NCR (non-GAAP) are determined by excluding, as applicable, pension mark-to-market adjustments, pension settlements, pension curtailments and pension special termination benefits, as well as other special items, including amortization of acquisition related intangibles and transformation and restructuring activities, from NCR’s GAAP earnings per share, gross margin, gross margin rate, expenses, income from operations, operating margin rate, other (expense), income tax expense, effective income tax rate and net income from continuing operations attributable to NCR, respectively. Due to the non-operational nature of these pension and other special items, NCR's management uses these non-GAAP measures to evaluate year-over-year operating performance. NCR believes these measures are useful for investors because they provide a more complete understanding of NCR's underlying operational performance, as well as consistency and comparability with NCR's past reports of financial results. Free Cash Flow. NCR defines free cash flow as net cash provided by (used in) operating activities less capital expenditures for property, plant and equipment, less additions to capitalized software, plus/minus restricted cash settlement activity, plus acquisition related items, less the impact from the initial sale of Trade accounts receivables under the agreement entered into during the 3rd quarter of 2021, and plus pension contributions and pension settlements. NCR's management uses free cash flow to assess the financial performance of the Company and believes it is useful for investors because it relates the operating cash flow of the Company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures, which can be used for, among other things, investment in the Company's existing businesses, strategic acquisitions, strengthening the Company's balance sheet, repurchase of Company stock and repayment of the Company's debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Free cash flow does not have uniform definitions under GAAP and, therefore, NCR's definitions may differ from other companies' definitions of these measures. NON-GAAP MEASURES

17 Net Debt and Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA). NCR determines Net Debt based on its total debt less cash and cash equivalents, with total debt being defined as total short-term borrowings plus total long-term debt. NCR believes that Net Debt provides useful information to investors because NCR’s management reviews Net Debt as part of its management of overall liquidity, financial flexibility, capital structure and leverage. In addition, certain debt rating agencies, creditors and credit analysts monitor NCR’s Net Debt as part of their assessments of NCR’s business. NCR determines Adjusted EBITDA for a given period based on its GAAP net income from continuing operations attributable to NCR plus interest expense, net; plus income tax expense (benefit); plus depreciation and amortization; plus other income (expense); plus pension mark-to-market adjustments, pension settlements, pension curtailments and pension special termination benefits and other special items, including amortization of acquisition related intangibles and restructuring charges, among others. NCR uses Adjusted EBITDA to manage and measure the performance of its business segments. NCR also uses Adjusted EBITDA to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. NCR believes that Adjusted EBITDA provides useful information to investors because it is an indicator of the strength and performance of the Company's ongoing business operations, including its ability to fund discretionary spending such as capital expenditures, strategic acquisitions and other investments. NCR believes that its ratio of Net Debt to Adjusted EBITDA provides useful information to investors because it is an indicator of the company's ability to meet its future financial obligations. In addition, the Net Debt to Adjusted EBITDA ratio is measures frequently used by investors and credit rating agencies. The Net Debt to Adjusted EBITDA ratio is calculated by dividing Net Debt by trailing twelve-month Adjusted EBITDA. NCR management's definitions and calculations of these non-GAAP measures may differ from similarly-titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. These non- GAAP measures are reconciled to their corresponding GAAP measures in the following slides and elsewhere in these materials. These reconciliations and other information regarding these non-GAAP measures are also available on the Investor Relations page of NCR's website at www.ncr.com. NON-GAAP MEASURES

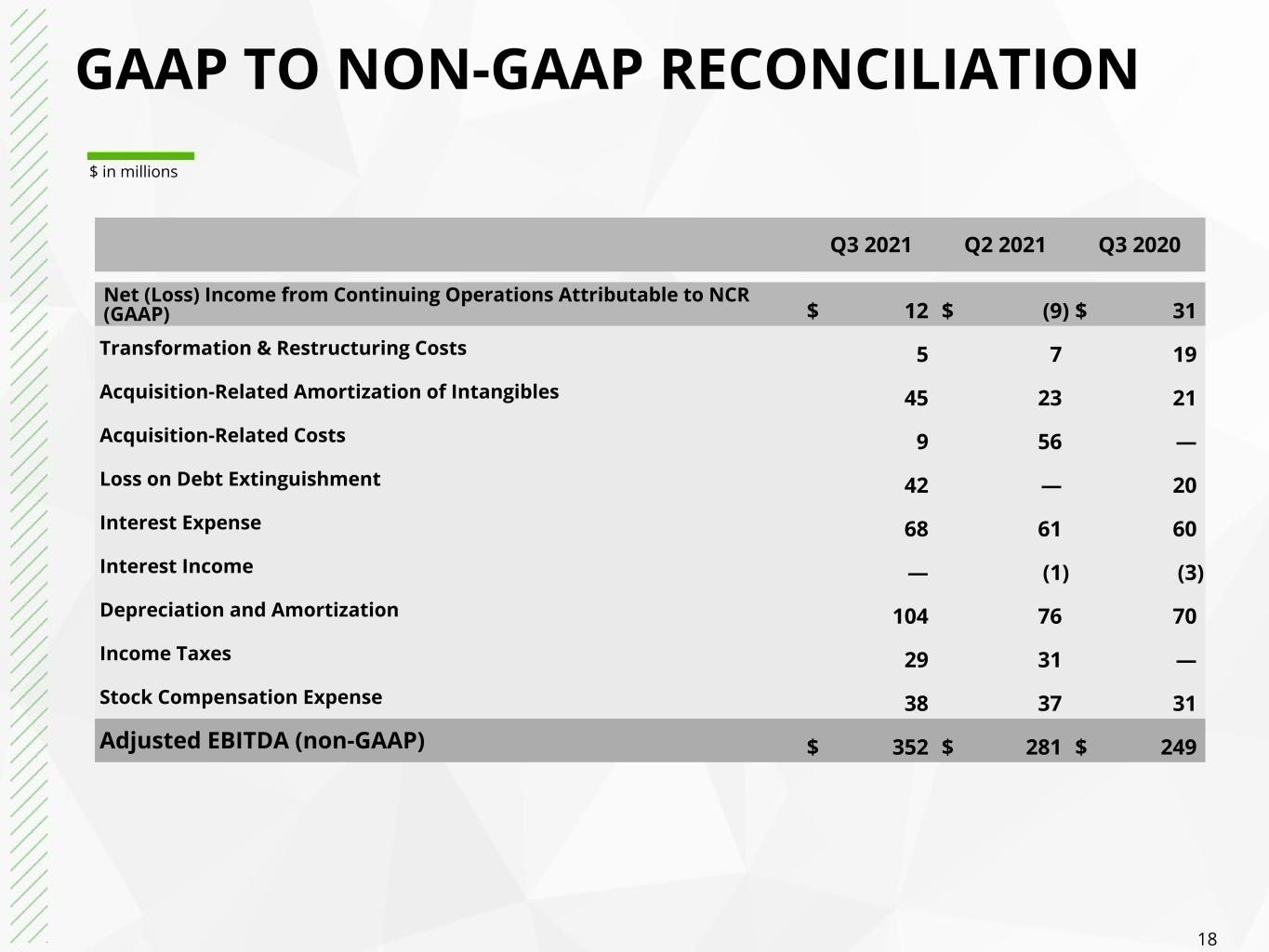

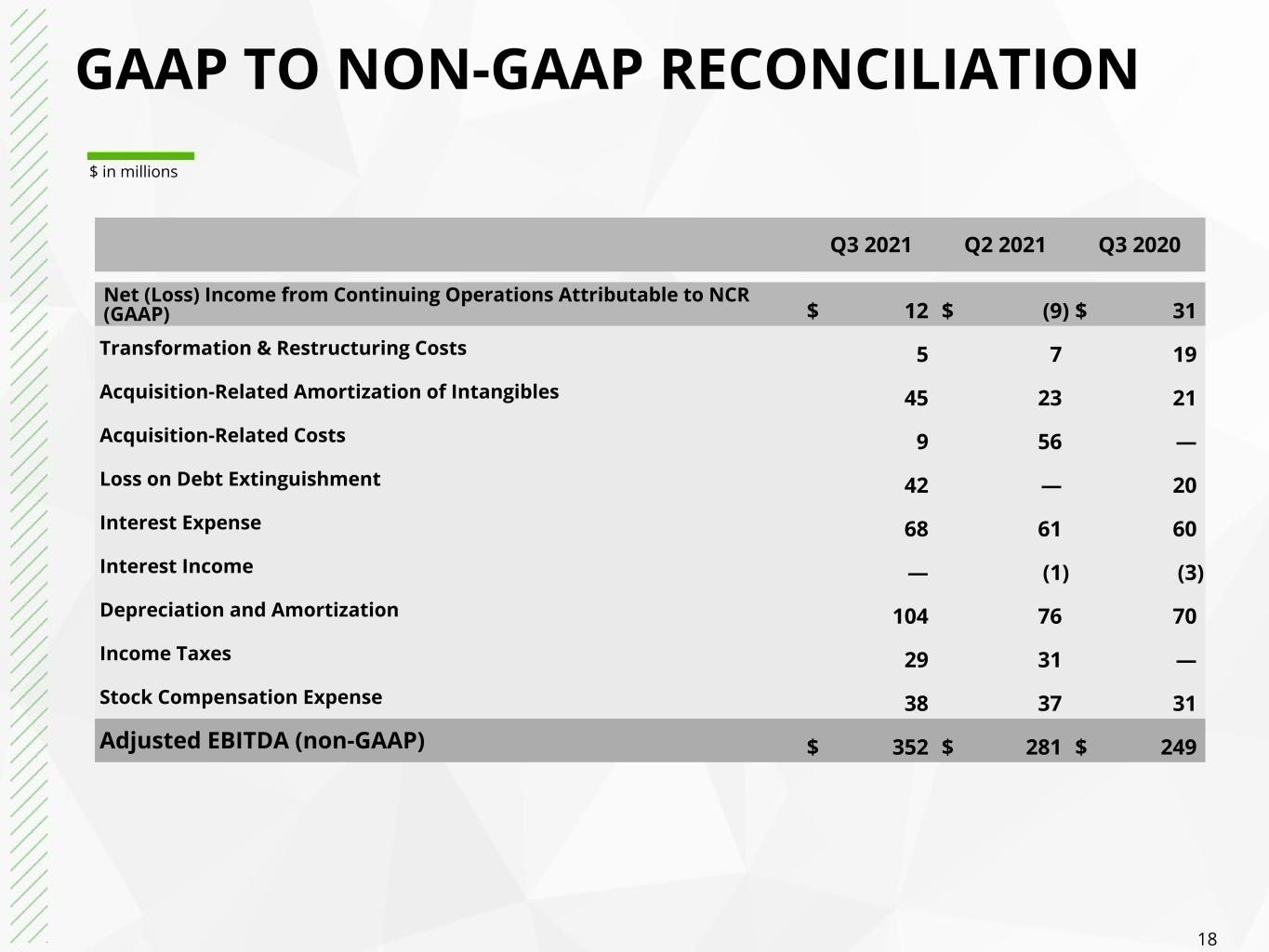

18 Q3 2021 Q2 2021 Q3 2020 Net (Loss) Income from Continuing Operations Attributable to NCR (GAAP) $ 12 $ (9) $ 31 Transformation & Restructuring Costs 5 7 19 Acquisition-Related Amortization of Intangibles 45 23 21 Acquisition-Related Costs 9 56 — Loss on Debt Extinguishment 42 — 20 Interest Expense 68 61 60 Interest Income — (1) (3) Depreciation and Amortization 104 76 70 Income Taxes 29 31 — Stock Compensation Expense 38 37 31 Adjusted EBITDA (non-GAAP) $ 352 $ 281 $ 249 GAAP TO NON-GAAP RECONCILIATION $ in millions

19 Q3 2021 LTM Q2 2021 LTM Q3 2020 LTM Net (Loss) Income from Continuing Operations Attributable to NCR (GAAP) $ (92) $ (73) $ 502 Pension Mark-to-Market Adjustments 34 34 75 Transformation & Restructuring Costs 222 236 43 Acquisition-Related Amortization of Intangibles 107 83 84 Acquisition-Related Costs 86 77 2 Internal reorganization & IP Transfer — — (37) Loss on Debt Extinguishment 42 20 20 Interest Expense 225 217 221 Interest Income (7) (10) (6) Depreciation and Amortization 324 290 260 Income Taxes 57 28 (334) Stock Compensation Expense 151 144 107 Adjusted EBITDA (non-GAAP) $ 1,149 $ 1,046 $ 937 GAAP TO NON-GAAP RECONCILIATION $ in millions

20 Q3 2021 Q2 2021 Q3 2020 Banking $ 242 $ 151 $ 144 Retail 70 92 81 Hospitality 35 30 24 Other 10 9 10 Adjusted EBITDA by Segment $ 357 $ 282 $ 259 Corporate and Other (5) (1) (10) Adjusted EBITDA $ 352 $ 281 $ 249 ADJUSTED EBITDA BY SEGMENT $ in millions

21 Q3 QTD 2021 GAAP Transform ation Costs Acquisition- related amortization of intangibles Acquisition- related costs Debt Refinancing & Extinguishment Tax Related Items Q3 QTD 2021 non- GAAP Product revenue $520 $— $— $— $— $— $520 Service revenue 1,381 — — — — — 1,381 Total revenue 1,901 — — — — — 1,901 Cost of products 429 — (3) — — — 426 Cost of services 952 (3) (20) — — — 929 Gross margin 520 3 23 — — — 546 Gross margin rate 27.4% 0.1% 1.2% —% —% —% 28.7% Selling, general and administrative expenses 294 (2) (22) (8) — — 262 Research and development expenses 69 — — — — — 69 Total operating expenses 363 (2) (22) (8) — — 331 Total operating expense as a % of revenue 19.1% (0.1)% (1.2)% (0.4)% — — 17.4% Income from operations 157 5 45 8 — — 215 Income from operations as a % of revenue 8.3% 0.3% 2.3% 0.4% — — 11.3% Interest and Other (expense) income, net (115) — — 1 43 — (71) Income from continuing operations before income taxes 42 5 45 9 43 — 144 Income tax (benefit) expense 29 — 10 1 1 — 41 Effective income tax rate 69.0% —% —% —% —% —% 28.5% Income from continuing operations 13 5 35 8 42 — 103 Net income (loss) attributable to noncontrolling interests 1 — — — — — 1 Income from continuing operations (attributable to NCR) $12 $5 $35 $8 $42 $— $102 Diluted earnings per share $0.06 $0.03 $0.24 $0.05 $0.29 $— $0.69 Diluted shares outstanding 137.8 147.0 GAAP TO NON-GAAP RECONCILIATION Q3 2021 $ in millions, except per share amounts

22 Q3 QTD 2021 GAAP Q3 QTD 2021 non-GAAP Income from continuing operations attributable to NCR common stockholders: Income from continuing operations (attributable to NCR) $12 $102 Dividends on convertible preferred shares (4) — Income from continuing operations attributable to NCR common stockholders $8 $102 Weighted average outstanding shares: Weighted average diluted shares outstanding 137.8 137.8 Weighted as-if converted preferred shares — 9.2 Total shares used in diluted earnings per share 137.8 147.0 Diluted earnings per share (1) $0.06 $0.69 (1) GAAP EPS is determined using the most dilutive measure, either including the impact of the dividends or deemed dividends on NCR's Series A Convertible Preferred Shares in the calculation of net income or loss available to common stockholders or including the impact of the conversion of such preferred stock into common stock in the calculation of the weighted average diluted shares outstanding. Non-GAAP EPS is always determined using the as-if converted preferred shares and shares that would be issued for stock compensation awards. Therefore, GAAP diluted EPS and non-GAAP diluted EPS may be calculated using different methods, and may not mathematically reconcile. GAAP TO NON-GAAP RECONCILIATION Q3 2021 $ in millions, except per share amounts

23 Q3 QTD 2020 GAAP Transformation Costs Acquisition- related amortization of intangibles Debt Financing Q3 QTD 2020 non- GAAP Product revenue $521 $— $— $— $521 Service revenue 1,068 — — — 1,068 Total revenue 1,589 — — — 1,589 Cost of products 452 (10) (2) — 440 Cost of services 710 (4) (3) — 703 Gross margin 427 14 5 — 446 Gross margin rate 26.9% 0.9% 0.3% —% 28.1% Selling, general and administrative expenses 254 (2) (16) — 236 Research and development expenses 55 (3) — — 52 Total expenses 309 (5) (16) — 288 Total expense as a % of revenue 19.4% (0.3)% (1.0)% —% 18.1% Income from operations 118 19 21 — 158 Income from operations as a % of revenue 7.4% 1.2% 1.3% —% 9.9% Interest and Other (expense) income, net (86) — — 20 (66) Income from continuing operations before income taxes 32 19 21 20 92 Income tax expense — 5 4 5 14 Effective income tax rate —% 15.2% Income from continuing operations 32 14 17 15 78 Net income attributable to noncontrolling interests 1 — — — 1 Income from continuing operations (attributable to NCR) $31 $14 $17 $15 $77 0 Diluted (loss) earnings per share $0.19 $0.10 $0.12 $0.10 $0.54 Diluted shares outstanding 129.7 143.3 GAAP TO NON-GAAP RECONCILIATION Q3 2020 $ in millions, except per share amounts

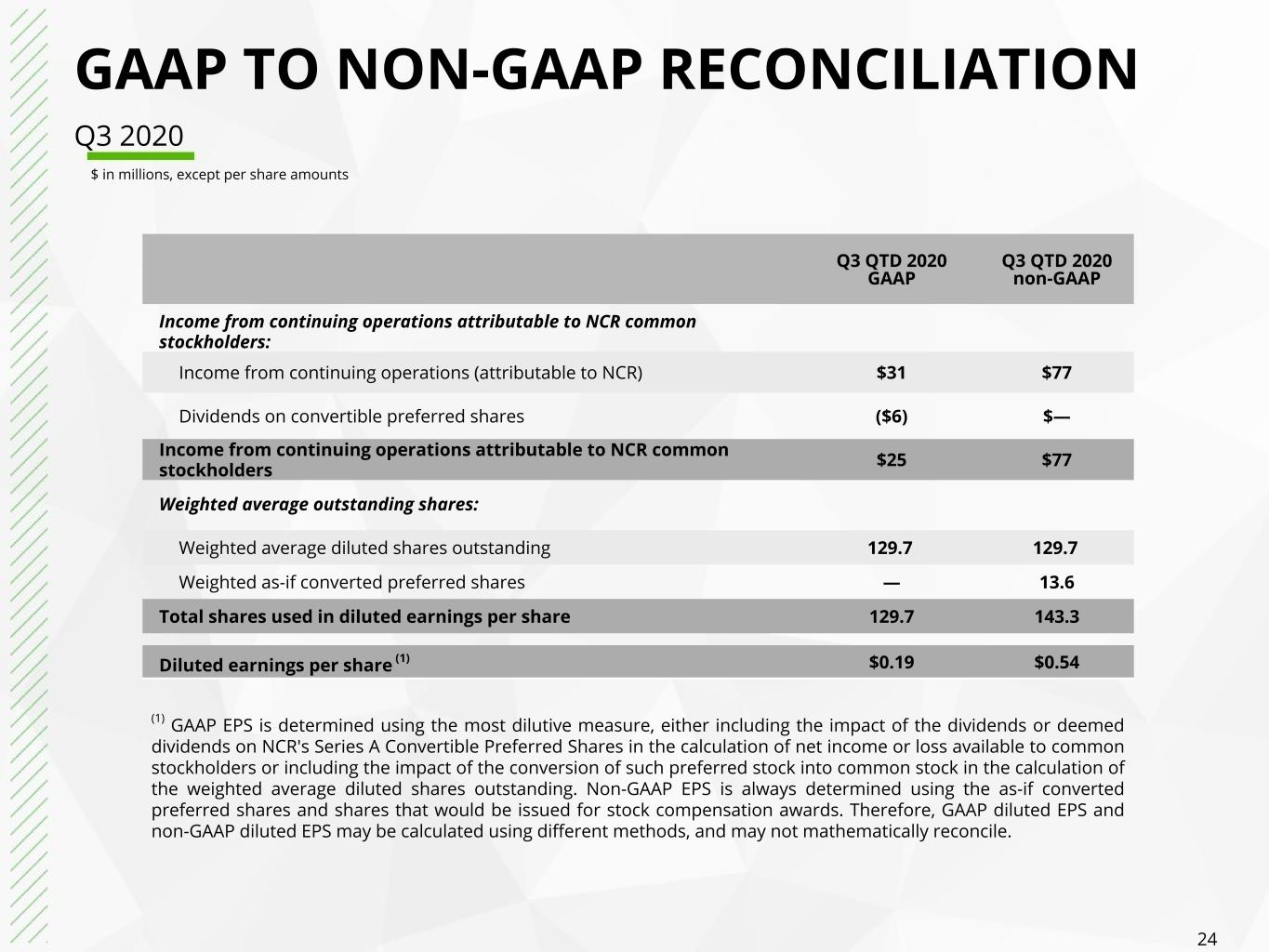

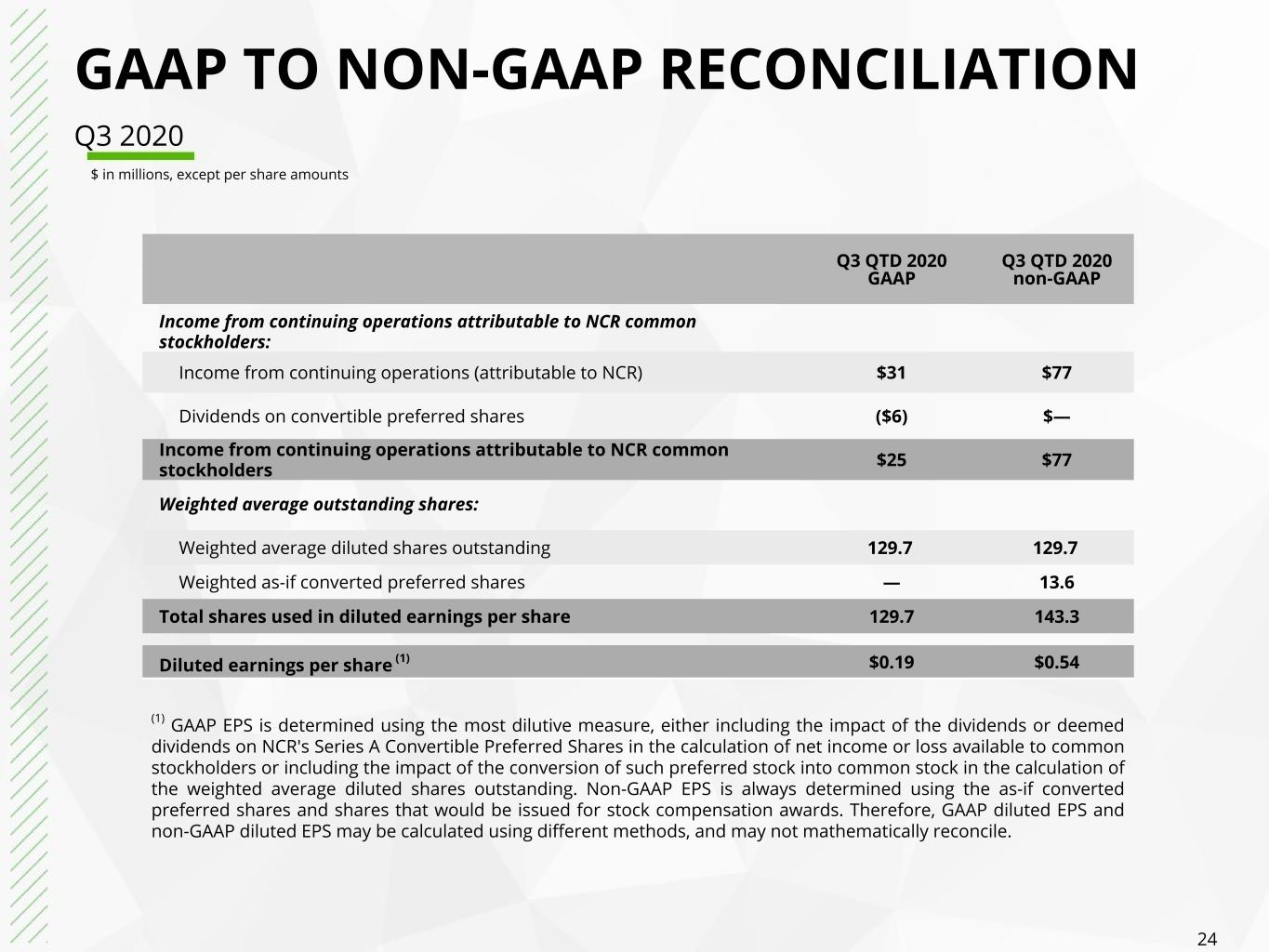

24 Q3 QTD 2020 GAAP Q3 QTD 2020 non-GAAP Income from continuing operations attributable to NCR common stockholders: Income from continuing operations (attributable to NCR) $31 $77 Dividends on convertible preferred shares ($6) $— Income from continuing operations attributable to NCR common stockholders $25 $77 Weighted average outstanding shares: Weighted average diluted shares outstanding 129.7 129.7 Weighted as-if converted preferred shares — 13.6 Total shares used in diluted earnings per share 129.7 143.3 Diluted earnings per share (1) $0.19 $0.54 (1) GAAP EPS is determined using the most dilutive measure, either including the impact of the dividends or deemed dividends on NCR's Series A Convertible Preferred Shares in the calculation of net income or loss available to common stockholders or including the impact of the conversion of such preferred stock into common stock in the calculation of the weighted average diluted shares outstanding. Non-GAAP EPS is always determined using the as-if converted preferred shares and shares that would be issued for stock compensation awards. Therefore, GAAP diluted EPS and non-GAAP diluted EPS may be calculated using different methods, and may not mathematically reconcile. GAAP TO NON-GAAP RECONCILIATION Q3 2020 $ in millions, except per share amounts

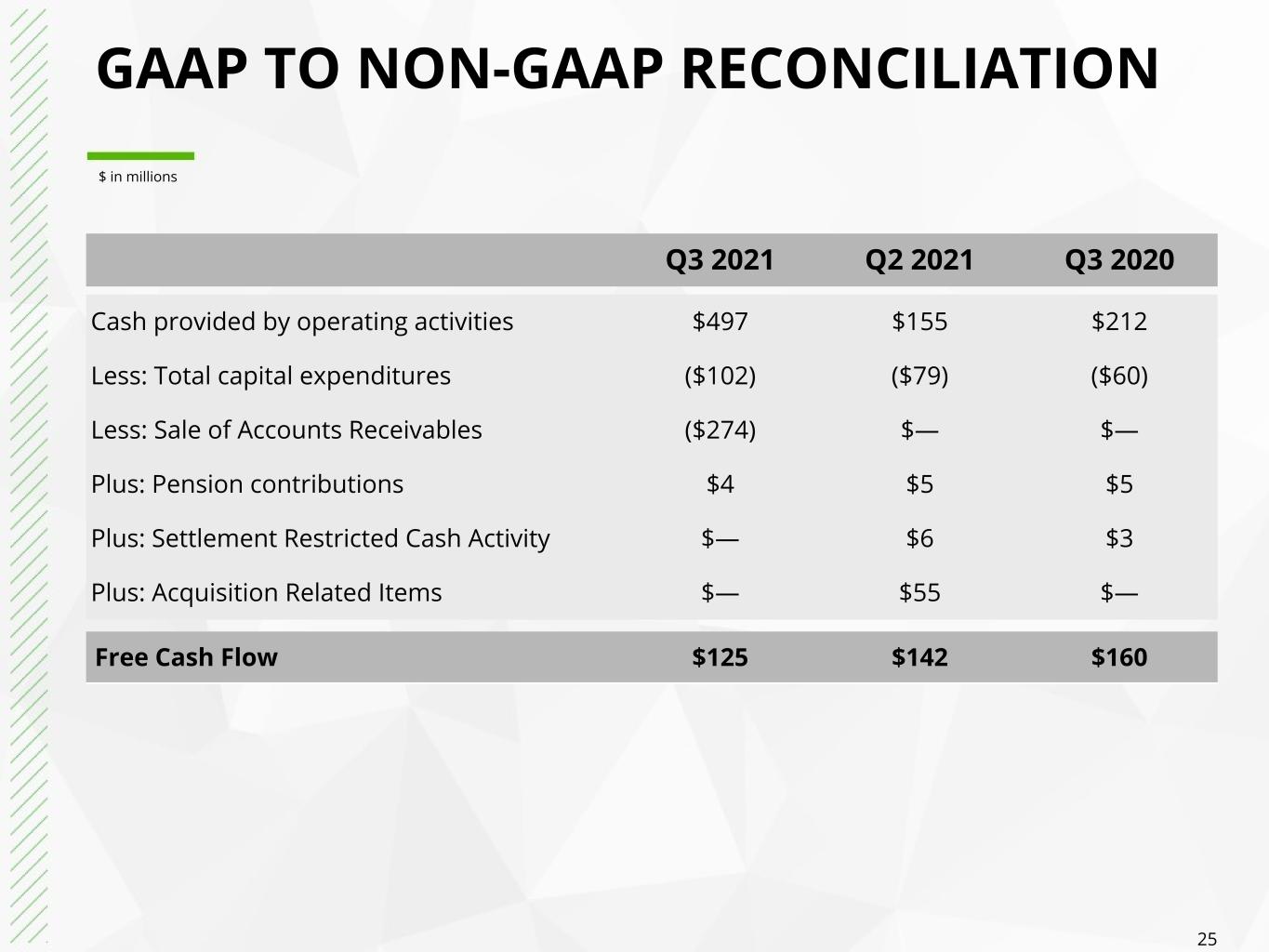

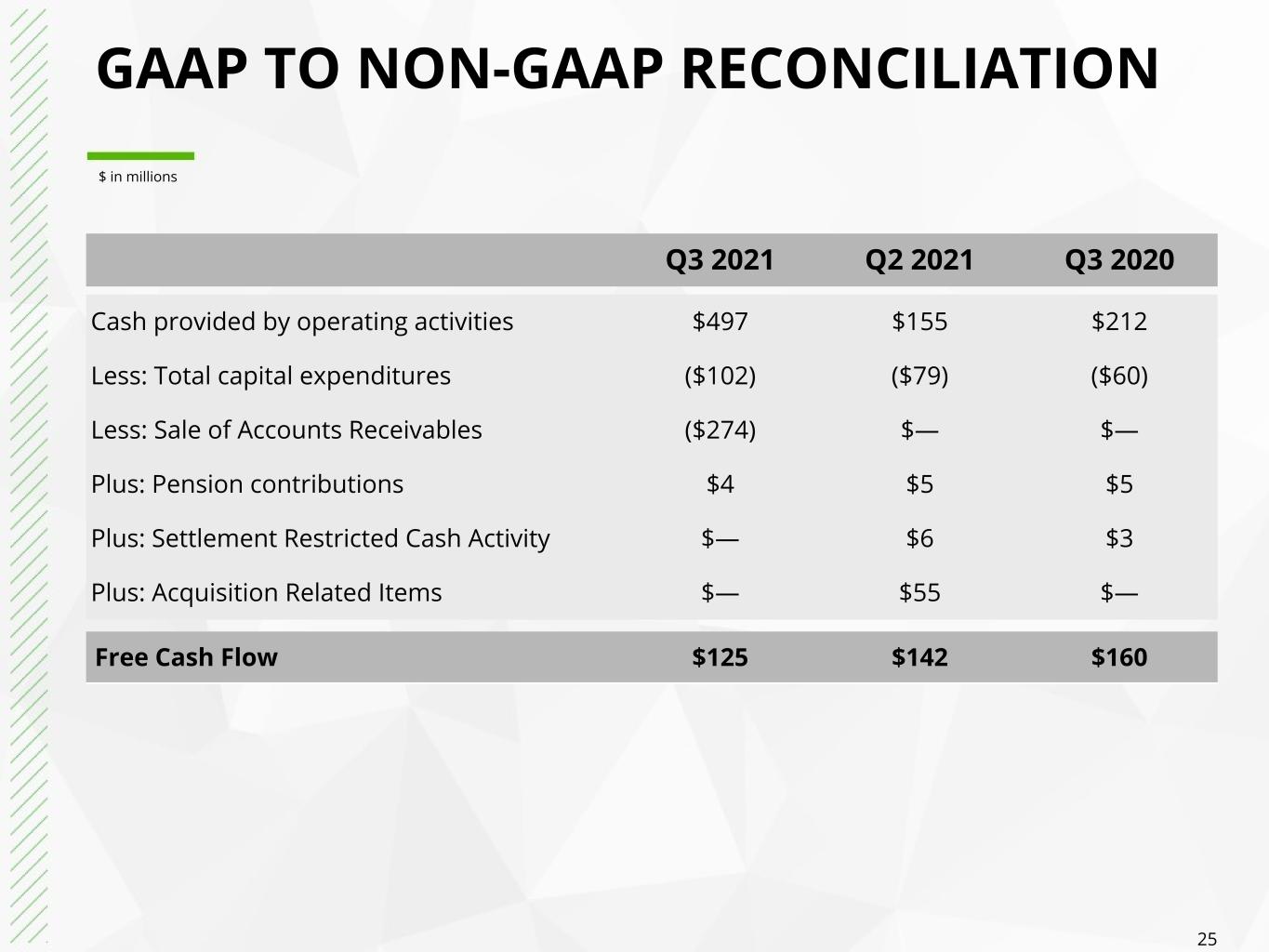

25 Q3 2021 Q2 2021 Q3 2020 Cash provided by operating activities $497 $155 $212 Less: Total capital expenditures ($102) ($79) ($60) Less: Sale of Accounts Receivables ($274) $— $— Plus: Pension contributions $4 $5 $5 Plus: Settlement Restricted Cash Activity $— $6 $3 Plus: Acquisition Related Items $— $55 $— Free Cash Flow $125 $142 $160 $ in millions GAAP TO NON-GAAP RECONCILIATION

26 THANK YOU