| | | Per note | | | Total | |

Public offering price | | | $ | | | $ |

Underwriting discounts and commissions | | | $ | | | $ |

Proceeds to us, before expenses | | | $ | | | $ |

BTIG | | | Needham & Company | | | Craig Hallum |

| | | Per note | | | Total | |

Public offering price | | | $ | | | $ |

Underwriting discounts and commissions | | | $ | | | $ |

Proceeds to us, before expenses | | | $ | | | $ |

BTIG | | | Needham & Company | | | Craig Hallum |

| • | during any calendar quarter commencing after the calendar quarter ending on December 31, 2021 (and only during such calendar quarter), if the last reported sale price of our common stock for each of at least 20 trading days (whether or not consecutive) during the 30 consecutive trading days ending on, and including, the last trading day of the immediately preceding calendar quarter is greater than 130% of the conversion price on such trading day; |

| • | during the five consecutive business day period immediately after any five consecutive trading day period (the five consecutive trading day period being referred to as the “measurement period”) in which the trading price (as defined in this prospectus supplement) per $1,000 principal amount of the notes, as determined following a request by a holder of the notes in the manner described in this prospectus supplement, for each trading day of the measurement period was less than 98% of the product of the last reported sale price of our common stock and the conversion rate on such trading day; |

| • | upon the occurrence of the specified corporate events described under “Description of Notes—Conversion Rights—Conversion Upon Specified Corporate Events”; or |

| • | if we have called the notes for redemption as described under “Description of Notes—Optional Redemption.” |

| | | Year Ended December 31, | | | Six Months Ended June 30, | ||||||||||

| | | 2018 | | | 2019(1) | | | 2020 | | | 2020 | | | 2021(1) | |

| | | (in thousands, except per share data) | |||||||||||||

Consolidated Statements of Operations Data: | | | |||||||||||||

Net revenues: | | | | | | | | | | | |||||

Product | | | $78,787 | | | $66,329 | | | $73,228 | | | $30,967 | | | $42,495 |

Service | | | 55,282 | | | 56,978 | | | 69,284 | | | 34,075 | | | 45,213 |

Contract | | | 67,177 | | | 63,925 | | | 71,274 | | | 35,381 | | | 35,709 |

Total net revenues | | | 201,246 | | | 187,232 | | | 213,786 | | | 100,423 | | | 123,417 |

Costs of sales: | | | | | | | | | | | |||||

Product | | | 60,694 | | | 51,189 | | | 58,887 | | | 24,887 | | | 33,372 |

Service | | | 43,051 | | | 40,389 | | | 49,933 | | | 22,558 | | | 31,635 |

Contract | | | 59,982 | | | 58,243 | | | 65,641 | | | 32,852 | | | 33,107 |

Total cost of sales | | | 163,727 | | | 149,821 | | | 174,461 | | | 80,297 | | | 98,114 |

Gross margin | | | 37,519 | | | 37,411 | | | 39,325 | | | 20,126 | | | 25,303 |

Operating expenses: | | | | | | | | | | | |||||

Selling, general and administrative | | | 35,810 | | | 38,068 | | | 46,196 | | | 21,476 | | | 37,483 |

Research and development | | | 12,412 | | | 13,372 | | | 19,252 | | | 9,403 | | | 14,452 |

Amortization of identifiable | | | | | | | | | | | |||||

intangible assets | | | 22 | | | 156 | | | 1,163 | | | 420 | | | 764 |

Adjustment to contingent consideration liability | | | (450) | | | — | | | (3,340) | | | — | | | — |

Gain on insurance proceeds | | | — | | | — | | | — | | | — | | | (4,400) |

Total operating expenses | | | 47,794 | | | 51,596 | | | 63,271 | | | 31,299 | | | 48,299 |

Operating loss | | | (10,275) | | | (14,185) | | | (23,946) | | | (11,173) | | | (22,996) |

Other income (expense), net | | | 683 | | | (449) | | | 808 | | | (764) | | | (392) |

Interest expense | | | (387) | | | (4,571) | | | (8,287) | | | (4,083) | | | (7,097) |

Loss on extinguishment of debt | | | — | | | — | | | (8,123) | | | (8,123) | | | — |

Loss before (provision for) benefit from income taxes | | | (9,979) | | | (19,205) | | | (39,548) | | | (24,143) | | | (30,485) |

(Provision for) benefit from income taxes | | | (14,143) | | | 3,634 | | | 2,986 | | | 4,257 | | | 12,258 |

Net loss | | | $(24,122) | | | $(15,571) | | | $(36,562) | | | $(19,886) | | | $(18,227) |

Net loss per share | | | $(1.50) | | | $(0.96) | | | $(1.92) | | | $(1.10) | | | $(0.77) |

Weighted average shares outstanding (basic and diluted) | | | 16,041 | | | 16,223 | | | 19,014 | | | 18,092 | | | 23,716 |

| (1) | The results of Data Central are included in the Company’s consolidated results as of December 19, 2019 and the results of Punchh are included in the Company’s consolidated results as of April 8, 2021. |

| | | Year Ended December 31, | | | Six Months Ended June 30, | ||||||||||

| | | 2018 | | | 2019 | | | 2020 | | | 2020 | | | 2021(1) | |

| | | (in thousands) | |||||||||||||

Selected Operating Data: | | | |||||||||||||

Segments Revenue: | | | | | | | | | | | |||||

Restaurant/Retail | | | $134,069 | | | $123,307 | | | $142,512 | | | $65,042 | | | $87,708 |

Government | | | 67,177 | | | 63,925 | | | 71,274 | | | 35,381 | | | 35,709 |

Segments Gross Margin: | | | | | | | | | | | |||||

Restaurant/Retail | | | 22.6% | | | 25.7% | | | 23.6% | | | 27.1% | | | 25.9% |

Government | | | 10.7% | | | 8.9% | | | 7.9% | | | 7.1% | | | 7.3% |

Brink Annualized Recurring Revenue (ARR)(2) | | | $14,474 | | | $19,220 | | | $24,705 | | | $21,504 | | | $27,605 |

Data Central Annualized Recurring Revenue (ARR)(2)(4) | | | — | | | $7,390 | | | $8,794 | | | $8,152 | | | $8,757 |

Punchh Annualized Recurring Revenue (ARR)(2)(5) | | | — | | | — | | | — | | | — | | | $40,302 |

Brink Average Revenue per User (ARPU)(3) | | | $1,943 | | | $2,015 | | | $2,108 | | | $2,098 | | | $2,092 |

| (1) | The results of Data Central are included in the Company’s consolidated results as of December 19, 2019 and the results of Punchh are included in the Company’s consolidated results as of April 8, 2021. |

| (2) | “Annual Recurring Revenue” or “ARR” is our annualized revenue from subscription as a service (SaaS) and related revenue of our software product. We calculate ARR by annualizing the monthly recurring revenue, or MRR, for the last month of each reporting period. ARR also includes recurring payment processing services revenue, net of expenses. PAR charges a per-transaction fee each time a customer payment is processed electronically. |

| (3) | “Average Revenue Per User” or “ARPU” is defined as annual revenue per user. We calculate ARPU by dividing the ARR by the active number of stores. |

| (4) | Data Central had ARR of approximately $6.3 million in the fiscal year ended December 31, 2018. |

| (5) | Punchh had ARR of approximately $18.6 million, $26.5 million and $31.7 million in the fiscal years ended December 31, 2018, 2019 and 2020. |

| | | Year Ended December 31, | | | Six Months Ended June 30, | |||||||

| | | 2019 | | | 2020 | | | 2020 | | | 2021 | |

Selected Brink Operating Data: | | | (Brink installation, Bookings(1), Activations(2) and Churn(3) data) | |||||||||

Brink Installations (at end of period) | | | 9,800 | | | 11,722 | | | 10,280 | | | 13,234 |

Brink Bookings | | | 3,326 | | | 4,245 | | | 1,539 | | | 2,357 |

Brink Activations | | | 2,666 | | | 3,099 | | | 1,453 | | | 1,603 |

Brink Annualized Churn Rate | | | 6.8% | | | 4.8% | | | 4.7% | | | 4.6% |

| (1) | “Booking” is a customer purchase order for SaaS; upon PAR’s acceptance, the customer is obligated to purchase the SaaS and pay PAR for the services. |

| (2) | “Activations” are calculated as of the end of each month based on the number of SaaS customers that have initiated use of our software products/platforms. Once “activated”, PAR begins to invoice/bill the customer. |

| (3) | “Churn” reflects the negative change in SaaS subscription levels of PAR customers, calculated by dollars for a specific period. |

| | | As of June 30, 2021 | |||||||

| | | Actuals | | | As Adjusted for this Offering of Convertible Notes(2) | | | As Further Adjusted for the Concurrent Common Stock Offering(3) | |

| | | (in thousands) | |||||||

Consolidated Balance Sheet Data: | | | |||||||

Assets | | | | | | | |||

Cash and cash equivalents | | | $85,218 | | | $ | | | $ |

Working capital(1) | | | 116,652 | | | | | ||

Accounts receivable – net | | | 45,248 | | | | | ||

Inventories – net | | | 29,947 | | | | | ||

Total assets | | | 797,675 | | | | | ||

Total liabilities | | | 361,114 | | | | | ||

Total shareholders’ equity | | | 436,561 | | | | | ||

| (1) | We define working capital as current assets less current liabilities. |

| (2) | The as adjusted consolidated balance sheet data gives effect to the issuance and sales by us of the notes in this offering (assuming no exercise of the underwriters’ option to purchase additional notes) after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | The as further adjusted consolidated balance sheet data gives effect to the issuance and sales by us of the common stock in the concurrent common stock offering at the public offering price of $ per share (assuming no exercise of the underwriters’ options to purchase additional shares of common stock in the concurrent common stock offering), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| • | require us to maintain any financial ratios or specific levels of net worth, revenues, income, cash flows or liquidity; |

| • | protect holders of the notes in the event that we experience significant adverse changes in our financial condition or results of operations; |

| • | limit our ability to pledge assets to secure our future debt; |

| • | limit our ability to incur indebtedness that is equal in right of payment to the notes; |

| • | limit our ability to incur indebtedness with a maturity date earlier than the maturity date of the notes; |

| • | prohibit us from redeeming the 2024 Convertible Notes and 2026 Convertible Notes and not the notes; |

| • | restrict the ability of our subsidiaries to issue securities or incur liability that would be structurally senior to our indebtedness; |

| • | restrict our ability to purchase or prepay our securities; or |

| • | restrict our ability to make investments or to purchase or pay dividends or make other payments in respect of our common stock or other securities ranking junior to the notes. |

| • | the issuance of certain share and cash dividends on our common stock; |

| • | the issuance of certain rights or warrants; |

| • | certain subdivisions and combinations of our capital stock; |

| • | certain distributions of capital stock, indebtedness or assets; and |

| • | certain tender or exchange offers. |

| • | on an actual basis; |

| • | on an as adjusted basis to give effect to the issuance and sales by us of the notes in this offering (assuming no exercise of the underwriters’ option to purchase additional notes) after deducting underwriting discounts and commissions and estimated offering expenses payable by us; and |

| • | on a further adjusted basis to give effect to the issuance and sales by us of the common stock in the concurrent common stock offering (assuming no exercise of the underwriters’ options to purchase additional shares of common stock in the concurrent common stock offering), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| | | | | As of June 30, 2021 | |||||

| | | Actual | | | As Adjusted for this Offering of Convertible Notes | | | As Further Adjusted for the Concurrent Common Stock Offering | |

| | | (in thousands, except share amounts) | |||||||

Cash and cash equivalents | | | $85,218 | | | $ | | | $ |

Debt: | | | | | | | |||

Owl Rock Term Loan | | | 171,211 | | | | | ||

Subordinated promissory note due 2022 | | | 1,044 | | | | | ||

2024 Convertible Notes* | | | 11,479 | | | | | ||

2026 Convertible Notes* | | | 96,038 | | | | | ||

The notes offered in this offering | | | — | | | | | ||

Total | | | 279,772 | | | | | ||

Equity: | | | | | | | |||

Preferred stock $0.02 par value, 1,000,000 shares authorized | | | — | | | — | | | — |

Common stock $0.02 par value, 58,000,000 shares authorized; 26,998,216 and 28,498,216 shares issued, 25,848,889 and 27,348,889 shares outstanding at June 30, 2021 actual and as further adjusted, respectively. | | | 540 | | | | | ||

Additional paid in capital | | | 514,295 | | | | | ||

Accumulated deficit | | | (64,933) | | | | | ||

Accumulated other comprehensive loss | | | (3,883) | | | | | ||

Treasury stock | | | (9,458) | | | | | ||

Total stockholders’ equity | | | 436,561 | | | | | ||

Total capitalization | | | $716,333 | | | $ | | | $ |

| * | Net of unamortized discount (including unamortized issuance cost) |

| • | 2,518,444 shares of common stock reserved for issuance under our equity incentive plans in respect of which (1) we have granted options to purchase 1,403,009 shares of common stock at a weighted average exercise price of $11.83 per share, and (2) 417,559 shares are issuable upon vesting of outstanding restricted stock units; |

| • | 39,753 shares of common stock reserved for issuance upon vesting of restricted stock units issued by us in connection with our assumption of awards granted by Restaurant Magic under its long term incentive plan prior to the closing of our acquisition of AccSys, LLC (“Restaurant Magic”); |

| • | an aggregate of 4,338,322 shares of common stock reserved for issuance in connection with conversions of our 2024 Convertible Notes and our 2026 Convertible Notes; |

| • | 330,000 shares of common stock reserved for issuance under our 2021 employee stock purchase plan; |

| • | 500,000 shares of common stock that we may issue in the future pursuant to a warrant with an exercise price of $76.50 per share issued to PAR Act III, LLC on April 8, 2021 in connection with our acquisition of Punchh (as such number may be adjusted from time to time as a result of anti-dilution provisions in the warrant, including an immaterial increase to the number of shares and an immaterial decrease to the exercise price in connection with the concurrent stock offering); and |

| • | the shares of common stock to be reserved for issuance upon conversion of the notes being offered by us in connection with this notes offering. |

| • | will be our general unsecured, senior obligations; |

| • | will initially be limited to an aggregate principal amount of $200.0 million (or $230.0 million if the underwriters exercise their option to purchase additional notes in full); |

| • | will bear cash interest from , 2021, at an annual rate of % payable on April 15 and October 15 of each year, beginning on April 15, 2022; |

| • | will be convertible, at your option, subject to the fulfillment of certain conditions and during the periods described below under “—Conversion Rights,” into cash, shares of our common stock, or a combination thereof, at our election, as described below under “—Conversion Rights—Settlement Upon Conversion;” |

| • | will be subject to redemption at our option on or after October 15, 2024, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date if the last reported sale price (as defined below) of our common stock equals or exceeds 130% of the applicable conversion price (as defined below) for at least 20 trading days (as defined below), whether or not consecutive, during the 30 consecutive trading day period (including the last trading day of such period) ending on the trading day immediately prior to the date we deliver notice of the redemption; |

| • | will be subject to repurchase by us at the option of the holders following a fundamental change (as defined below under “—Fundamental Change Permits Holders to Require Us to Repurchase Notes”), at a price equal to 100% of the principal amount of the notes to be repurchased, plus accrued and unpaid interest to, but excluding, the fundamental change repurchase date; |

| • | will mature on October 15, 2027, unless earlier converted, redeemed or repurchased; |

| • | will be issued in minimum denominations of $1,000 principal amount and in integral multiples thereof; and |

| • | will be represented by one or more registered notes in global form, but in certain limited circumstances may be represented by notes in definitive form. See “—Book-Entry, Settlement and Clearance.” |

| (a) | General |

| • | the principal amount of your note; and |

| • | accrued and unpaid interest, if any, on the notes held by you to, but excluding, the conversion date. |

| • | for conversions following the record date immediately preceding the maturity date; |

| • | if we have specified a redemption date that is after a record date and on or prior to the business day immediately following the corresponding interest payment date and the conversion occurs after such record date and on or prior to the open of business on such interest payment date; |

| • | if we have specified a fundamental change repurchase date that is after a record date and on or prior to the business day immediately following the corresponding interest payment date and the conversion occurs after such record date and on or prior to the open of business on such interest payment date; or |

| • | to the extent of any overdue interest, if any overdue interest exists at the time of conversion with respect to such note. |

| (b) | Conversion Upon Satisfaction of Sale Price Condition |

| (c) | Conversion Upon Satisfaction of Trading Price Condition |

| (d) | Conversion Upon Specified Corporate Events |

| • | issue to all or substantially all holders of our common stock any rights, options or warrants entitling them, for a period of not more than 60 calendar days after the record date of such issuance, to subscribe for or purchase shares of our common stock at a price per share less than the average of the last reported sale prices of our common stock for the 10 consecutive trading day period ending on, and including, the trading day immediately preceding the date of announcement of such issuance; or |

| • | distribute to all or substantially all holders of our common stock our assets, debt securities or rights to purchase our securities, which distribution has a per share value, as reasonably determined by our board of directors or a committee thereof, exceeding 10% of the last reported sale price of our common stock on the trading day immediately preceding the date of announcement for such distribution, |

| (e) | Conversion Based on Redemption |

| (f) | Conversions on or after April 15, 2027 |

| (g) | Conversion Procedures |

| • | complete and manually sign the conversion notice on the back of the note, or a facsimile of the conversion notice; |

| • | deliver the conversion notice, which is irrevocable, and the note to the conversion agent; |

| • | if required, furnish appropriate endorsements and transfer documents; |

| • | if required, pay all transfer or similar taxes; and |

| • | if required, pay funds equal to the interest payable on the next interest payment date as described above. |

| (h) | Settlement upon Conversion |

| • | if we elect physical settlement, we will deliver, in respect of each $1,000 principal amount of notes being converted, a number of whole shares of our common stock equal to the conversion rate (and cash in lieu of any fractional share as described below); |

| • | if we elect cash settlement, we will pay, in respect of each $1,000 principal amount of notes being converted, cash in an amount equal to the sum of the daily conversion values for each of the 50 consecutive trading days in the relevant observation period; and |

| • | if we elect (or are deemed to have elected) combination settlement, we will pay or deliver, as the case may be, in respect of each $1,000 principal amount of notes being converted, a settlement amount equal to the sum of the daily settlement amounts for each of the 50 consecutive trading days in the relevant observation period (and cash in lieu of any fractional share as described below). |

| • | cash equal to the lesser of: |

| • | the maximum cash amount per $1,000 principal amount of notes being converted to be received upon conversion (excluding cash in lieu of any fractional share of our common stock) as specified in the notice specifying our chosen settlement method, or deemed to be so specified (the “specified dollar amount”), divided by 50 (such quotient being referred to as the “daily measurement value”); and |

| • | the daily conversion value (as defined below) on such trading day; and |

| • | if such daily conversion value exceeds such daily measurement value, a number of shares of common stock (the “daily net share settlement number”) equal to (1) the difference between such daily conversion value and such daily measurement value, divided by (2) the daily VWAP for such trading day. |

| • | subject to the second immediately succeeding bullet, if the relevant conversion date occurs before April 15, 2027, the 50 consecutive trading-day period beginning on, and including, the second trading day after such conversion date; |

| • | subject to the immediately succeeding bullet, if the relevant conversion date occurs on or after April 15, 2027, the 50 consecutive trading days beginning on, and including, the 51st scheduled trading day immediately preceding the maturity date; and |

| • | if the relevant conversion date occurs on or after the date of our delivery of a notice of redemption with respect to the notes as described above under “—Optional Redemption” and prior to the relevant redemption date, the 50 consecutive trading days beginning on, and including, the 51st scheduled trading day immediately preceding such redemption date. |

| (i) | Conversion Rate Adjustments |

| (1) | If we exclusively issue to all or substantially all holders of our common stock shares of our common stock as a dividend or distribution on shares of our common stock, or if we effect a share split or share combination, the conversion rate will be adjusted based on the following formula: |

CR0 = | the conversion rate in effect immediately prior to the open of business on the ex-dividend date (as defined below) of such dividend or distribution, or immediately prior to the open of business on the effective date (as defined below) of such share split or combination, as applicable; |

CR1 = | the conversion rate in effect immediately after the open of business on such ex-dividend date or the open of business on such effective date; |

OS0 = | the number of shares of our common stock outstanding immediately prior to the open of business on such ex-dividend date or effective date, as applicable, prior to giving effect to such dividend, distribution, share split or share combination; and |

OS1 = | the number of shares of our common stock outstanding immediately after the open of business on such ex-dividend date or effective date, as applicable, after, and solely as a result of, giving effect to such dividend, distribution, share split or share combination. |

| (2) | If we issue to all or substantially all holders of our common stock any rights, options or warrants entitling them, for a period of not more than 60 calendar days after the record date of such issuance, to subscribe for or purchase shares of our common stock, at a price per share less than the average of the last reported sale prices of our common stock for the 10 consecutive trading day period ending on, and including, the trading day immediately preceding the date of announcement of such issuance, the conversion rate will be increased based on the following formula: |

CR0 = | the conversion rate in effect immediately prior to the open of business on the ex-dividend date for such issuance; |

CR1 = | the conversion rate in effect immediately after the open of business on such ex-dividend date; |

| OS = | the number of shares of our common stock outstanding immediately prior to the open of business on such ex-dividend date; |

| X = | the total number of shares of our common stock issuable pursuant to such rights, options or warrants; and |

| Y = | the number of shares of our common stock equal to the quotient of (i) the aggregate price payable to exercise such rights, options or warrants over (ii) the average of the last reported sale prices of our common stock over the 10 consecutive trading day period ending on, and including, the trading day immediately preceding the date of announcement of the issuance of such rights, options or warrants. |

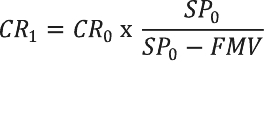

| (3) | If we distribute shares of our capital stock, evidences of our indebtedness, other assets or property of ours or rights, options or warrants to acquire our capital stock or other securities to all or substantially all holders of our common stock, excluding: |

CR0 = | the conversion rate in effect immediately prior to the open of business on the ex-dividend date for such distribution; |

CR1 = | the conversion rate in effect immediately after the open of business on such ex-dividend date; |

SP0 = | the average of the last reported sale prices of our common stock over the 10 consecutive trading day period ending on, and including, the trading day immediately preceding the ex-dividend date for such distribution; and |

| FMV = | the fair market value (as determined by our board of directors (or, for the avoidance of doubt, any committee thereof)) of the shares of capital stock, evidences of indebtedness, assets, property, rights, options or warrants distributed with respect to each outstanding share of our common stock on the ex- dividend date for such distribution. |

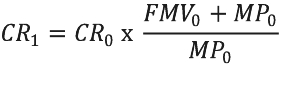

CR0 = | the conversion rate in effect immediately prior to the open of business on the ex-dividend date of the spin-off; CR1 = the conversion rate in effect immediately after the open of business on the ex-dividend date of the spin-off; |

FMV0 = | the average of the last reported sale prices of the capital stock or similar equity interest distributed to holders of our common stock applicable to one share of our common stock (determined for purposes of the definition of last reported sale price as if such capital stock or similar equity interest were our common stock) over the first 10 consecutive trading day period after, and including, the ex-dividend date of the spin-off (the “valuation period”); and |

MP0 = | the average of the last reported sale prices of our common stock over the valuation period. |

| (4) | If any cash dividend or distribution is made to all, or substantially all, holders of our outstanding common stock, the conversion rate will be increased based on the following formula: |

CR0 = | the conversion rate in effect immediately prior to the open of business on the ex-dividend date for such dividend or distribution; |

CR1 = | the conversion rate in effect immediately after the open of business on the ex-dividend date for such dividend or distribution; |

SP0 = | the last reported sale price of our common stock on the trading day immediately preceding the ex-dividend date for such dividend or distribution; and |

| C = | the amount in cash per share we distribute to holders of our common stock. |

| (5) | If we or any of our subsidiaries make a payment in respect of a tender offer or exchange offer for our common stock, to the extent that the cash and value of any other consideration included in the payment per share of common stock exceeds the last reported sale price of our common stock on the trading day next succeeding the last date (the “expiration date”) on which tenders or exchanges may be made pursuant to such tender or exchange offer, the conversion rate will be increased based on the following formula: |

CR0 = | the conversion rate in effect immediately prior to the expiration time (as defined below); CR1 = the conversion rate in effect immediately after the expiration time; |

| AC = | the aggregate value of all cash and any other consideration (as determined by our board of directors (or, for the avoidance of doubt, any committee thereof)) paid or payable for shares purchased in such tender or exchange offer; |

OS0 = | the number of shares of our common stock outstanding immediately prior to the time (the “expiration time”) on the date such tender or exchange offer expires (prior to giving effect to the purchase of all shares accepted for purchase or exchange in such tender offer or exchange offer); |

OS1 = | the number of shares of our common stock outstanding immediately after the expiration time (after giving effect to the purchase of all shares accepted for purchase or exchange in such tender or exchange offer); and |

SP1 = | the average of the last reported sale prices of our common stock over the 10 consecutive trading day period (the “averaging period”) commencing on, and including, the trading day next succeeding the date such tender or exchange offer expires. |

| • | we elect to satisfy our conversion obligation through a combination settlement and shares of common stock are deliverable to settle the daily net share settlement number for a given trading day within the conversion period applicable to notes that you have converted, |

| • | any distribution, transaction or event described in clauses (1) to (5) above has not yet resulted in an adjustment to the applicable conversion rate on the trading day in question, and |

| • | the shares you will receive in respect of such trading day are not entitled to participate in the relevant distribution or transaction (because they were not held on a related record date or otherwise), |

| • | we elect to satisfy our conversion obligation through a physical settlement, |

| • | any distribution or transaction described in clauses (1) to (5) above has not yet resulted in an adjustment to the applicable conversion rate on a given conversion date, and |

| • | the shares you will receive on settlement of the related conversion are not entitled to participate in the relevant distribution or transaction (because they were not held on a related record date or otherwise), |

| • | upon the issuance of any shares of our common stock pursuant to any present or future plan providing for the reinvestment of dividends or interest payable on our securities and the investment of additional optional amounts in shares of our common stock under any plan; |

| • | upon the issuance of any shares of our common stock or options or rights to purchase those shares pursuant to any present or future employee, director or consultant benefit plan or program of or assumed by us or any of our subsidiaries; |

| • | upon the issuance of any shares of our common stock pursuant to any option, warrant, right or exercisable, exchangeable or convertible security not described in the preceding bullet and outstanding as of the date the notes were first issued; |

| • | for a change in the par value of the common stock; or |

| • | for accrued and unpaid interest. |

| (j) | Recapitalizations, Reclassifications, Mergers and Other Changes to Our Common Stock |

EFFECTIVE DATE / DATE OF NOTICE OF REDEMPTION | | | STOCK PRICE | |||||||||||||||||||||||||||

| | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

September , 2021 | | | | | | | | | | | | | | | | | | | | | ||||||||||

October 15, 2022 | | | | | | | | | | | | | | | | | | | | | ||||||||||

October 15, 2023 | | | | | | | | | | | | | | | | | | | | | ||||||||||

October 15, 2024 | | | | | | | | | | | | | | | | | | | | | ||||||||||

October 15, 2025 | | | | | | | | | | | | | | | | | | | | | ||||||||||

October 15, 2026 | | | | | | | | | | | | | | | | | | | | | ||||||||||

October 15, 2027 | | | | | | | | | | | | | | | | | | | | | ||||||||||

| • | If the stock price is between two stock prices in the table or the effective date is between two effective dates in the table, the number of additional shares will be determined by a straight-line interpolation between the number of additional shares set forth for the higher and lower stock prices and the earlier and the later effective dates, as applicable, based on a 365- or 366-day year, as applicable. |

| • | If the stock price is greater than $ (subject to adjustment in the same manner as the stock prices set forth in the column headings of the table above), no additional shares will be added to the conversion rate. |

| • | If the stock price is less than $ (subject to adjustment in the same manner as the stock prices set forth in the column headings of the table above), no additional shares will be added to the conversion rate. |

| (1) | a “person” or “group” within the meaning of Section 13(d) of the Exchange Act other than us, our subsidiaries and our and their employee benefit plans files a Schedule TO or any schedule, form or report under the Exchange Act disclosing that such person or group has become the direct or indirect “beneficial owner” (as defined below) of shares of our common equity representing more than 50% of the voting power of our common equity generally entitled to vote in the election of our directors; |

| (2) | the consummation of: |

| • | any sale, lease or other transfer in one transaction or a series of transactions of all or substantially all of the consolidated assets of us and our subsidiaries, taken as a whole, to any person; or |

| • | any transaction or series of related transactions in connection with which (whether by means of exchange, liquidation, consolidation, merger, combination, reclassification, recapitalization, acquisition or otherwise) all of our common stock is exchanged for, converted into, acquired for or constitutes solely the right to receive other securities, other property, assets or cash, but excluding any merger, consolidation, share exchange or acquisition of us with or by another person pursuant to which the persons that beneficially owned (as defined below), directly or indirectly, the shares of our voting stock immediately prior to such transaction beneficially own, directly or indirectly, immediately after such transaction, shares of the surviving, continuing or acquiring corporation’s voting stock representing more than 50% of the total outstanding voting power of all outstanding classes of voting stock of the surviving, continuing or acquiring corporation in substantially the same proportions vis-à-vis each other as immediately prior to such transaction; |

| (3) | our stockholders approve any plan or proposal for the liquidation or dissolution of us; or |

| (4) | our common stock (or other common stock or depositary shares or receipts in respect thereof that underlie the notes) ceases to be listed or quoted on any of The New York Stock Exchange, The NASDAQ Global Market or The NASDAQ Global Select Market (or any of their respective successors). |

| • | the events causing a fundamental change; |

| • | the date of the fundamental change; |

| • | the last date on which a holder may exercise the repurchase right; |

| • | the fundamental change repurchase price; |

| • | the fundamental change repurchase date; |

| • | the name and address of the paying agent and the conversion agent, if applicable; |

| • | if applicable, the applicable conversion rate and any adjustments to the applicable conversion rate; |

| • | if applicable, that the notes with respect to which a repurchase notice has been delivered by a holder may be converted only if the holder withdraws the repurchase notice in accordance with the terms of the indenture or to the extent such notes are not subject to such repurchase notice; and |

| • | the procedures that holders must follow to require us to repurchase their notes. |

| • | if certificated, the certificate numbers of your notes to be delivered for repurchase, or if not certificated, your notice must comply with the appropriate DTC procedures; |

| • | the portion of the principal amount of notes to be repurchased, which must equal $1,000 or an integral multiple thereof; and |

| • | that the notes are to be repurchased by us pursuant to the applicable provisions of the notes and the indenture. |

| • | the principal amount of the withdrawn notes, which principal amount must equal $1,000 or an integral multiple thereof; |

| • | if certificated notes have been issued, the certificate numbers of the withdrawn notes, or if not certificated, your notice must comply with the appropriate DTC procedures; and |

| • | the principal amount, if any, which remains subject to the repurchase notice. |

| • | the fundamental change repurchase date; and |

| • | if the notes are in global form, the time of book-entry transfer or the delivery of the notes (or, if certificated, the date you surrender the certificates representing the notes to be repurchased, duly endorsed, to the paying agent). |

| • | the notes will cease to be outstanding and interest (except default interest) will cease to accrue (whether or not book-entry transfer of the notes is made or whether or not the notes are delivered to the paying agent); and |

| • | all other rights of the holder will terminate (other than the right to receive the fundamental change repurchase price and other than the right of a holder of record on a relevant record date to receive the related interest payment on the corresponding interest payment date, as described above). |

| • | comply with the provisions of the tender offer rules under the Exchange Act that may then be applicable; and |

| • | file a Schedule TO or any other required schedule under the Exchange Act. |

| • | the resulting, surviving or transferee person (if not us) (the “successor company”) will be a corporation organized and existing under the laws of the United States of America, any state thereof or the District of Columbia, and such successor company (if not us) expressly assumes, by a supplemental indenture, executed and delivered to the trustee, all of our obligations under the notes and the indenture; |

| • | immediately after giving effect to such transaction, no default under the indenture shall have occurred and be continuing; and |

| • | we shall have delivered to the trustee an officers’ certificate and an opinion of counsel, each stating that the consolidation, merger, sale, conveyance, transfer or lease and such supplemental indenture (if any) comply with the indenture, and that such supplemental indenture (if any) is valid, binding and enforceable against the successor company and that all conditions precedent provided for in the indenture related to such transaction have been complied with. |

| • | we fail to pay principal of the notes (including any fundamental change repurchase price or redemption price) when due at maturity, upon optional redemption, repurchase, declaration of acceleration or otherwise; |

| • | we fail to pay any interest on the notes when due and such failure continues for a period of 30 days past the applicable due date; |

| • | we fail to give a fundamental change notice, a notice of a make-whole fundamental change or a notice of redemption, in each case when due; |

| • | we fail to comply with our obligation to convert the notes in accordance with the indenture upon exercise of any holder’s conversion right, and such failure continues for a period of three business days; |

| • | we fail to comply with our obligations under “—Consolidation, Merger and Sale of Assets;” |

| • | we fail to perform or observe any of our other covenants or warranties in the indenture or in the notes for 60 days after written notice to us from the trustee or to us and the trustee from the holders of at least 25% of the aggregate principal amount of then outstanding notes has been received by us; |

| • | default by us or any of our significant subsidiaries (as defined in Article 1, Rule 1-02 of Regulation S-X) with respect to any mortgage, agreement or other instrument under which there may be outstanding, or by which there may be secured or evidenced, any indebtedness for money borrowed in excess of $15.0 million in the aggregate of us and/or any of our significant subsidiaries (including, for the avoidance of doubt, the Owl Rock Term Loan), whether such indebtedness now exists or shall hereafter be created (i) resulting in such indebtedness becoming or being declared due and payable or (ii) constituting a failure to pay the principal or interest of any such debt when due and payable at its stated maturity, upon required repurchase, upon declaration or otherwise; |

| • | a final judgment for the payment of $15.0 million or more (excluding any amounts covered by insurance) rendered against us or any of our significant subsidiaries, which judgment is not discharged or stayed within 60 days after (i) the date on which the right to appeal thereof has expired if no such appeal has commenced, or (ii) the date on which all rights to appeal have been extinguished; and |

| • | certain events of bankruptcy, insolvency and reorganization of us or any of our significant subsidiaries. |

| • | the holder has given the trustee written notice of such event of default; |

| • | the holders of at least 25% in principal amount of outstanding notes make a written request to the trustee to pursue the remedy; |

| • | such holders have offered the trustee security and/or indemnity satisfactory to the trustee in its sole discretion; |

| • | the trustee does not receive an inconsistent direction from the holders of a majority in aggregate principal amount of outstanding notes; and |

| • | the trustee fails to comply with the request within 60 days after receipt of the request and offer of security and/or indemnity. |

| • | the principal (including the fundamental change repurchase price or redemption price) of, |

| • | accrued and unpaid interest, if any, on, and |

| • | the consideration due upon conversion of, |

| • | reduce the principal amount of or change the stated maturity of any note; |

| • | reduce the rate or extend the time for payment of interest on any note; |

| • | reduce any amount payable upon redemption or repurchase of any note or change the time at which or circumstances under which the notes may or shall be redeemed or repurchased; |

| • | impair the right of a holder to institute suit for payment on any note, including with respect to any consideration due upon conversion of any note; |

| • | change the currency in which any note is payable; |

| • | impair the right of a holder to convert any note or reduce the number of shares of common stock or amount of cash or any other property receivable upon conversion; |

| • | change the ranking of the notes; |

| • | reduce any voting requirements under the indenture; |

| • | amend or modify provisions of the amendment, modification or waiver of provisions of the indenture that require each holder’s consent; or |

| • | reduce the percentage of the aggregate principal amount of notes required for consent to any amendment or modification of the indenture or to waive any past default. |

| • | add guarantees with respect to the notes or secure the notes; |

| • | evidence the assumption of our obligations by a successor person under the provisions of the indenture relating to consolidations, mergers and sales of assets; |

| • | surrender any of our rights or powers under the indenture; |

| • | add covenants or events of default for the benefit of the holders of notes; |

| • | cure any ambiguity or correct any inconsistency or defect in the indenture or in the notes; |

| • | modify or amend the indenture to permit the qualification of the indenture or any supplemental indenture under the Trust Indenture Act as then in effect; |

| • | irrevocably elect or eliminate any settlement method or specified dollar amount, or eliminate our right to choose a particular settlement method, on conversion of notes, in each case prior to the deadline for electing a settlement method for such conversion or actually electing (or deemed electing) a settlement method as described under “—Conversion Rights—Settlement upon Conversion” above; provided, however, that no such election or elimination will affect any settlement method theretofore elected (or deemed to be elected); |

| • | evidence the acceptance of appointment by a successor trustee; |

| • | comply with the applicable procedures of the applicable depositary; |

| • | conform the indenture and the form or terms of the notes to the “Description of Notes” set forth in this prospectus supplement with the provision being conformed to be set forth in an officers’ certificate; and |

| • | make other changes to the indenture or forms or terms of the notes; provided that no such change individually or in the aggregate with all other such changes has or will have an adverse effect on the interests of the holders of the notes. |

| • | upon deposit of a global note with DTC’s custodian, DTC will credit portions of the principal amount of the global note to the accounts of the DTC participants designated by the underwriters; and |

| • | ownership of beneficial interests in a global note will be shown on, and transfer of ownership of those interests will be effected only through, records maintained by DTC (with respect to interests of DTC participants) and the records of DTC participants (with respect to other owners of beneficial interests in the global note). |

| • | a limited purpose trust company organized under the laws of the State of New York; |

| • | a “banking organization” within the meaning of the New York State Banking Law; |

| • | a member of the Federal Reserve System; |

| • | a “clearing corporation” within the meaning of the Uniform Commercial Code; and |

| • | a “clearing agency” registered under Section 17A of the Exchange Act. |

| • | will not be entitled to have notes represented by the global note registered in their names; |

| • | will not receive or be entitled to receive physical, certificated notes; and |

| • | will not be considered the owners or holders of the notes under the indenture for any purpose, including with respect to the giving of any direction, instruction or approval to the trustee under the indenture. |

| • | DTC notifies us at any time that it is unwilling or unable to continue as depositary for the global notes and a successor depositary is not appointed within 90 days; |

| • | DTC ceases to be registered as a clearing agency under the Exchange Act and a successor depositary is not appointed within 90 days; or |

| • | an event of default with respect to the notes has occurred and is continuing and such beneficial owner requests that its notes be issued in physical, certificated form. |

| (i) | the gain is effectively connected with the non-U.S. holder’s conduct of a trade or business in the United States (and, in the case of certain applicable tax treaties, the gain is attributable to a permanent establishment or fixed base within the United States); |

| (ii) | in the case of an individual, such individual is present in the United States for 183 days or more during the taxable year in which gain is realized and certain other conditions are met; or |

| (iii) | we are or have been a U.S. real property holding corporation, as defined in the Code, at any time within the five-year period preceding the disposition or the non-U.S. holder’s holding period, whichever period is shorter. |

Underwriters | | | Principal Amount of Notes |

Goldman Sachs & Co. LLC | | | |

BTIG, LLC | | | |

Needham & Company, LLC | | | |

Craig-Hallum Capital Group LLC | | | |

Total | | | $200,000,000 |

| | | Per Note | | | Total | |||||||

| | | Without Option to Purchase Additional Notes | | | With Option to Purchase Additional Notes | | | Without Option to Purchase Additional Notes | | | With Option to Purchase Additional Notes | |

Public offering price | | | $ | | | $ | | | $ | | | $ |

Underwriting discounts and commissions paid by us | | | $ | | | $ | | | $ | | | $ |

Proceeds to us, before expenses | | | $ | | | $ | | | $ | | | $ |

| (a) | to any legal entity which is a qualified investor as defined under Article 2 of the Prospectus Regulation; |

| (b) | to fewer than 150 natural or legal persons (other than qualified investors as defined under Article 2 of the Prospectus Regulation), subject to obtaining the prior consent of Goldman Sachs & Co. LLC for any such offer; or |

| (c) | in any other circumstances falling within Article 1(4) of the Prospectus Regulation, |

| (a) | it is a qualified investor within the meaning of the Prospectus Regulation; and |

| (b) | in the case of any notes acquired by it as a financial intermediary, as that term is used in Article 5 of the Prospectus Regulation, (i) the notes acquired by it in this offering has not been acquired on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in any Relevant State other than qualified investors, as that term is defined |

| (i) | to any legal entity which is a qualified investor as defined under Article 2 of the UK Prospectus Regulation; |

| (ii) | to fewer than 150 natural or legal persons (other than qualified investors as defined under Article 2 of the UK Prospectus Regulation), subject to obtaining the prior consent of Goldman Sachs & Co. LLC for any such offer; or |

| (iii) | in any other circumstances falling within Section 86 of the FSMA |

| • | our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as filed with the SEC on March 16, 2021; |

| • | the portions of our Definitive Proxy Statement for the 2021 Annual Meeting of Stockholders, as filed with the SEC on April 19, 2021, that are incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended December 31, 2020; |

| • | our Quarterly Reports on Form 10-Q for the three months ended March 31, 2021 and June 30, 2021, as filed with the SEC on May 10, 2021 and August 9, 2021, respectively; |

| • | our Current Reports on Form 8-K or Form 8-K/A as filed with the SEC on February 17, 2021, March 8, 2021, March 8, 2021, April 8, 2021, April 12, 2021, June 8, 2021 and June 24, 2021; and |

| • | the description of our common stock included in our registration statement on Form 8-B (File No. 001-35987) filed on August 23, 1993, pursuant the Exchange Act, as updated by Exhibit 4.4 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed with the SEC on March 16, 2021 and including any amendments and reports filed for the purpose of updating such description. |

| • | Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC on March 16, 2020 including the information specifically incorporated by reference into the Annual Report on Form 10-K from our definitive proxy statement for the 2020 Annual Meeting of Stockholders filed April 21, 2020; |

| • | Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2020 and June 30, 2020, as filed with the SEC on May 11, 2020 and August 7, 2020, respectively; |

| • | Current Reports on Form 8-K or Form 8-K/A as filed with the SEC on February 3, 2020, February 10, 2020, March 2, 2020, March 6, 2020, March 24, 2020, March 30, 2020, June 9, 2020, July 7, 2020 and September 30, 2020; and |

| • | The description of our common stock contained in our Registration Statement on Form 8-B as filed with the SEC on August 23, 1993, as the description therein has been updated and superseded by the description of our capital stock contained in Exhibit 4.6 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC on March 16, 2020 and including any amendments and reports filed for the purpose of updating such description. |

| • | the title and type of the debt securities; |

| • | whether the debt securities will be senior or subordinated debt securities, and, with respect to any subordinated debt securities the terms on which they are subordinated; |

| • | the initial aggregate principal amount of the debt securities; |

| • | the price or prices at which we will sell the debt securities; |

| • | the maturity date or dates of the debt securities and the right, if any, to extend such date or dates; |

| • | the rate or rates, if any, at which the debt securities will bear interest, or the method of determining such rate or rates; |

| • | the date or dates from which such interest will accrue, the interest payment dates on which such interest will be payable or the method of determination of such dates; |

| • | the right, if any, to extend the interest payment periods and the duration of that extension; |

| • | the manner of paying principal and interest and the place or places where principal and interest will be payable; |

| • | the denominations of the debt securities if other than $2,000 or multiples of $1,000; |

| • | provisions for a sinking fund, purchase fund or other analogous fund, if any; |

| • | any redemption dates, prices, obligations and restrictions on the debt securities; |

| • | the currency, currencies or currency units in which the debt securities will be denominated and the currency, currencies or currency units in which principal and interest, if any, on the debt securities may be payable; |

| • | any conversion or exchange features of the debt securities; |

| • | whether the debt securities will be subject to the defeasance provisions in the indenture; |

| • | whether the debt securities will be issued in definitive or global form or in definitive form only upon satisfaction of certain conditions; |

| • | whether the debt securities will be guaranteed as to payment or performance; |

| • | any special tax implications of the debt securities; |

| • | any events of defaults or covenants in addition to or in lieu of those set forth in the indenture; and |

| • | any other material terms of the debt securities. |

| • | the successor entity, if any, is a U.S. corporation, limited liability company, partnership or trust; |

| • | the successor entity assumes our obligations on the senior debt securities and under the senior indenture; |

| • | immediately after giving effect to the transaction, no default or event of default shall have occurred and be continuing; and |

| • | we have delivered to the senior trustee an officer’s certificate and an opinion of counsel, each stating that the consolidation, merger, conveyance, transfer or lease and, if a supplemental indenture is required in connection with such transaction, such supplemental indenture, comply with the senior indenture and all conditions precedent provided for in the senior indenture relating to such transaction have been complied with. |

| • | failure to pay interest on any senior debt securities of such series when due and payable, if that default continues for a period of 30 days (or such other period as may be specified for such series); |

| • | failure to pay principal on the senior debt securities of such series when due and payable whether at maturity, upon redemption, by declaration or otherwise (and, if specified for such series, the continuance of such failure for a specified period); |

| • | default in the performance of or breach of any of our covenants or agreements in the senior indenture applicable to senior debt securities of such series, other than a covenant breach which is specifically dealt with elsewhere in the senior indenture, and that default or breach continues for a period of 90 days after we receive written notice from the trustee or from the holders of 25% or more in aggregate principal amount of the senior debt securities of such series; |

| • | certain events of bankruptcy or insolvency, whether or not voluntary; and |

| • | any other event of default provided for in such series of senior debt securities as may be specified in the applicable prospectus supplement. |

| • | the holder gives the trustee written notice of a continuing event of default; |

| • | the holders of at least 25% in aggregate principal amount of such series of senior debt securities make a written request to the trustee to pursue the remedy in respect of such event of default; |

| • | the requesting holder or holders offer the trustee indemnity satisfactory to the trustee against any costs, liability or expense; |

| • | the trustee does not comply with the request within 60 days after receipt of the request and the offer of indemnity; and |

| • | during such 60-day period, the holders of a majority in aggregate principal amount of such series of senior debt securities do not give the trustee a direction that is inconsistent with the request. |

| • | we have paid or caused to be paid the principal of and interest on all senior debt securities of such series (with certain limited exceptions) when due and payable; or |

| • | we deliver to the senior trustee for cancellation all senior debt securities of such series theretofore authenticated under the senior indenture (with certain limited exceptions); or |

| • | all senior debt securities of such series have become due and payable or will become due and payable within one year (or are to be called for redemption within one year under arrangements satisfactory to the senior trustee) and we deposit in trust an amount of cash or a combination of cash and U.S. government or U.S. government agency obligations (or in the case of senior debt securities denominated in a foreign currency, foreign government securities or foreign government agency securities) sufficient to make interest, principal and any other payments on the debt securities of that series on their various due dates; |

| • | We deposit in trust for the benefit of all direct holders of the debt securities of the same series cash or a combination of cash and U.S. government or U.S. government agency obligations (or, in the case of senior debt securities denominated in a foreign currency, foreign government or foreign government agency obligations) that will generate enough cash to make interest, principal and any other payments on the debt securities of that series on their various due dates. |

| • | There is a change in current U.S. federal income tax law or an IRS ruling that lets us make the above deposit without causing holders to be taxed on the debt securities any differently than if we did not make the deposit and instead repaid the debt securities ourselves when due. Under current U.S. federal income tax law, the deposit and our legal release from the debt securities would be treated as though we took back the debt securities and gave holders thereof, their pro-rata share of the cash and debt securities or bonds deposited in trust. In that event, a holder of the debt securities could recognize gain or loss on the debt securities it gives back to us. |

| • | We deliver to the trustee a legal opinion of our counsel confirming the tax law change or ruling described above. |

| • | We must deposit in trust for the benefit of all direct holders of the debt securities of the same series cash or a combination of cash and U.S. government or U.S. government agency obligations (or, in the case of senior debt securities denominated in a foreign currency, foreign government or foreign government agency obligations) that will generate enough cash to make interest, principal and any other payments on the debt securities of that series on their various due dates. |

| • | We must deliver to the trustee a legal opinion of our counsel confirming that under current U.S. federal income tax law we may make the above deposit without causing holders to be taxed on the debt securities any differently than if we did not make the deposit and instead repaid the debt securities ourselves when due. |

| • | to convey, transfer, assign, mortgage or pledge any assets as security for the senior debt securities of one or more series; |

| • | to evidence the succession of a corporation, limited liability company, partnership or trust to us, and the assumption by such successor of our covenants, agreements and obligations under the senior indenture or to otherwise comply with the covenant relating to mergers, consolidations and sales of assets; |

| • | to comply with requirements of the SEC in order to effect or maintain the qualification of the senior indenture under the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”); |

| • | to add to our covenants such new covenants, restrictions, conditions or provisions for the protection of the holders, and to make the occurrence, or the occurrence and continuance, of a default in any such additional covenants, restrictions, conditions or provisions an event of default; |

| • | to cure any ambiguity, defect or inconsistency in the senior indenture or in any supplemental indenture or to conform the senior indenture or the senior debt securities to the description of senior debt securities of such series set forth in this prospectus or any applicable prospectus supplement; |

| • | to provide for or add guarantors with respect to the senior debt securities of any series; |

| • | to establish the form or forms or terms of the senior debt securities as permitted by the senior indenture; |

| • | to evidence and provide for the acceptance of appointment under the senior indenture by a successor trustee, or to make such changes as shall be necessary to provide for or facilitate the administration of the trusts in the senior indenture by more than one trustee; |

| • | to add to, change or eliminate any of the provisions of the senior indenture in respect of one or more series of senior debt securities, provided that any such addition, change or elimination shall (a) neither (1) apply to any senior debt security of any series created prior to the execution of such supplemental |

| • | to make any change to the senior debt securities of any series so long as no senior debt securities of such series are outstanding; or |

| • | to make any change that does not adversely affect the rights of any holder in any material respect. |

| • | extends the final maturity of any senior debt securities of such series; |

| • | reduces the principal amount of any senior debt securities of such series; |

| • | reduces the rate, or extends the time for payment of, interest on any senior debt securities of such series; |

| • | reduces the amount payable upon the redemption of any senior debt securities of such series; |

| • | changes the currency of payment of principal of or interest on any senior debt securities of such series; |

| • | reduces the principal amount of original issue discount securities payable upon acceleration of maturity or the amount provable in bankruptcy; |

| • | waives a continuing default in the payment of principal of or interest on the senior debt securities (other than any such default in payment resulting solely from an acceleration of the senior debt securities); |

| • | changes the provisions relating to the waiver of past defaults or impairs the right of holders to receive payment or to institute suit for the enforcement of any payment or conversion of any senior debt securities of such series on or after the due date therefor; |

| • | modifies any of the provisions of these restrictions on amendments and modifications, except to increase any required percentage or to provide that certain other provisions cannot be modified or waived without the consent of the holder of each senior debt security of such series affected by the modification; |

| • | adversely affects the right to convert or exchange senior debt securities into common stock or other property in accordance with the terms of the senior debt securities; or |

| • | reduces the above-stated percentage of outstanding senior debt securities of such series whose holders must consent to a supplemental indenture or modifies or amends or waives certain provisions of or defaults under the senior indenture. |

| • | all of the indebtedness of that person for money borrowed; |

| • | all of the indebtedness of that person evidenced by notes, debentures, bonds or other securities sold by that person for money; |

| • | all of the lease obligations that are capitalized on the books of that person in accordance with generally accepted accounting principles; |

| • | all indebtedness of others of the kinds described in the first two bullet points above and all lease obligations of others of the kind described in the third bullet point above that the person, in any manner, assumes or guarantees or that the person in effect guarantees through an agreement to purchase, whether that agreement is contingent or otherwise; and |

| • | all renewals, extensions or refinancings of indebtedness of the kinds described in the first, second or fourth bullet point above and all renewals or extensions of leases of the kinds described in the third or fourth bullet point above; |

| • | any derivative action or proceeding brought on our behalf; |

| • | any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers, employees, or agents to us or our stockholders; |

| • | any action asserting a claim against us arising pursuant to any provision of the DGCL or our Certificate of Incorporation or Bylaws; or |

| • | any action asserting a claim governed by the internal affairs doctrine. |

| • | all outstanding depositary shares have been redeemed; or |

| • | there has been a final distribution of the preferred stock in connection with our dissolution and such distribution has been made to all the holders of depositary shares. |

| • | the specific designation and aggregate number of, and the offering price at which we will issue, the warrants; |

| • | the currency or currency units in which the offering price, if any, and the exercise price are payable; |

| • | the date on which the right to exercise the warrants will begin and the date on which that right will expire or, if you may not continuously exercise the warrants throughout that period, the specific date or dates on which you may exercise the warrants; |

| • | whether the warrants are to be sold separately or with other securities as parts of units; |

| • | whether the warrants will be issued in definitive or global form or in any combination of these forms, although, in any case, the form of a warrant included in a unit will correspond to the form of the unit and of any security included in that unit; |

| • | any applicable material U.S. federal income tax consequences; |

| • | the identity of the warrant agent for the warrants and of any other depositaries, execution or paying agents, transfer agents, registrars or other agents; |

| • | the proposed listing, if any, of the warrants or any securities purchasable upon exercise of the warrants on any securities exchange; |

| • | the designation and terms of any equity securities purchasable upon exercise of the warrants; |

| • | the designation, aggregate principal amount, currency and terms of any debt securities that may be purchased upon exercise of the warrants; |

| • | if applicable, the designation and terms of the preferred stock or depositary shares with which the warrants are issued and the number of warrants issued with each security; |

| • | if applicable, the date from and after which any warrants issued as part of a unit and the related debt securities, preferred stock, depositary shares or common stock will be separately transferable; |

| • | the number of shares of common stock, preferred stock or depositary shares purchasable upon exercise of a warrant and the price at which those shares may be purchased; |

| • | if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time; |

| • | information with respect to book-entry procedures, if any; |

| • | the anti-dilution provisions of, and other provisions for changes to or adjustment in the exercise price of, the warrants, if any; |

| • | any redemption or call provisions; and |

| • | any additional terms of the warrants, including terms, procedures and limitations relating to the exchange or exercise of the warrants. |

| • | the designation and the terms of the units and of the securities constituting the units, including whether and under what circumstances the securities comprising the units may be traded separately; |

| • | the identity of any unit agent for the units, if applicable, and of any other depositaries, execution or paying agents, transfer agents, registrars or other agents; |

| • | any additional terms of the governing unit agreement, if applicable; |

| • | any additional provisions for the issuance, payment, settlement, transfer or exchange of the units or of the debt securities, common stock, preferred stock, purchase contracts or warrants constituting the unit; and |

| • | any applicable material U.S. federal income tax consequences. |

| • | through underwriters; |

| • | through dealers (acting as agents or principals); |

| • | through agents; |

| • | directly to one or more purchasers, on a negotiated basis or otherwise; or |

| • | through a combination of any of these methods or any other method permitted by law. |

| • | at a fixed price, or prices, which may be changed from time to time; |

| • | on any stock exchange, market, or trading facility on which the securities are traded or in private transactions; |

| • | at market prices prevailing at the time of sale; |

| • | at prices related to such prevailing market prices; or |

| • | at negotiated prices. |

| • | the public offering or purchase price and the proceeds we will receive from the sale of the securities; |

| • | any discounts and commissions to be allowed or re-allowed or paid to the agent or underwriters; |

| • | all other items constituting underwriting compensation; |

| • | any over-allotment options under which underwriters may purchase additional securities from us; |

| • | any discounts and commissions to be allowed or re-allowed or paid to dealers; and |

| • | any exchanges on which the securities will be listed. |

| • | the purchase by an institution of the securities covered under that contract shall not at the time of delivery be prohibited under the laws of the jurisdiction to which that institution is subject; and |

| • | if the securities are also being sold to underwriters acting as principals for their own account, the underwriters shall have purchased such securities not sold for delayed delivery. The underwriters and other persons acting as our agents will not have any responsibility in respect of the validity or performance of delayed delivery contracts. |