PROSPECTUS SUPPLEMENT

(to Prospectus dated September 30, 2020)

$235,000,000

PAR Technology Corporation

1.50% Convertible Senior Notes due 2027

We are offering $235.0 million aggregate principal amount of our 1.50% Convertible Senior Notes due 2027 (the “notes”). The notes will bear interest at a rate equal to 1.50% per year. Interest on the notes will be payable semiannually in arrears on April 15 and October 15 of each year, beginning April 15, 2022. Interest will accrue on the notes from the last date to which interest has been paid or duly provided for or, if no interest has been paid or duly provided for, from September 17, 2021. Unless earlier converted, redeemed or repurchased, the notes will mature on October 15, 2027.

You may convert your notes, at your option, at any time prior to the close of business on the business day immediately preceding April 15, 2027, but only in the following circumstances: (1) during any calendar quarter commencing after the calendar quarter ending on December 31, 2021 (and only during such calendar quarter), if the last reported sale price of our common stock for each of at least 20 trading days (whether or not consecutive) during the 30 consecutive trading days ending on, and including, the last trading day of the immediately preceding calendar quarter is greater than 130% of the conversion price on such trading day; (2) during the five consecutive business day period immediately after any five consecutive trading day period (the five consecutive trading day period being referred to as the “measurement period”) in which the trading price (as defined in this prospectus supplement) per $1,000 principal amount of the notes, as determined following a request by a holder of the notes in the manner described in this prospectus supplement, for each trading day of the measurement period was less than 98% of the product of the last reported sale price of our common stock and the conversion rate on such trading day; (3) upon the occurrence of specified corporate events described in this prospectus supplement; or (4) if we have called the notes for redemption. In addition, regardless of the foregoing circumstances, holders may convert their notes at any time on or after April 15, 2027 until the close of business on the second business day immediately preceding the maturity date. Upon conversion, we will satisfy our conversion obligation by paying or delivering, as the case may be, cash, shares of our common stock or a combination of cash and shares of our common stock, at our election, all as described in “Description of Notes—Conversion Rights—Settlement upon Conversion.”

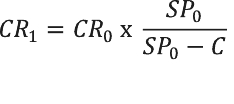

The conversion rate will initially equal 12.9870 shares of our common stock per $1,000 principal amount of notes (equivalent to an initial conversion price of approximately $77.00 per share of our common stock), and will be subject to adjustment as described in this prospectus supplement. In addition, we will, in certain circumstances, increase the conversion rate for holders who convert their notes in connection with a make-whole fundamental change. See “Description of Notes—Conversion Rights—Adjustment to Shares Delivered upon Conversion upon a Make-Whole Fundamental Change.”

We may not redeem the notes prior to October 15, 2024. On and after October 15, 2024, we may redeem for cash all, but not less than all, of the notes if the last reported sale price of our common stock equals or exceeds 130% of the applicable conversion price for at least 20 trading days (whether or not consecutive) during the 30 consecutive trading day period (including the last trading day of such period) ending on the trading day immediately prior to the date on which we deliver notice of the redemption. The redemption price will equal 100% of the principal amount of the notes to be redeemed, plus any accrued and unpaid interest to, but excluding, the redemption date. In addition, if we call the notes for redemption, a make-whole fundamental change will be deemed to occur. As a result, we will, in certain circumstances, increase the conversion rate for holders who convert their notes after we deliver a notice of redemption and before the close of business on the second business day immediately preceding the relevant redemption date. See “Description of Notes—Conversion Rights—Adjustment to Shares Delivered upon Conversion upon a Make-Whole Fundamental Change.”

If a fundamental change occurs, you will have the right, at your option, to require us to repurchase your notes in cash at a price equal to 100% of the principal amount of the notes to be repurchased, plus accrued and unpaid interest to, but excluding, the fundamental change repurchase date.

The notes will be our senior, unsecured obligations and will rank equal in right of payment with our existing and future senior unsecured debt, including our 4.500% Convertible Senior Notes due 2024 (the “2024 Convertible Notes”) and 2.875% Convertible Senior Notes due 2026 (the “2026 Convertible Notes”), and will be senior in right of payment to any future debt that is expressly subordinated to the notes. The notes will be structurally subordinated to all debt and other liabilities and commitments of our subsidiaries, including trade payables and any guarantees that they may provide with respect to any of our existing or future debt, and will be effectively subordinated to our existing and future secured debt to the extent of the assets securing such debt, including our senior secured debt under the credit agreement dated as of April 8, 2021 by and among the Company and, among others, Owl Rock First Lien Master Fund, L.P., as administrative agent and collateral agent (the “Owl Rock Credit Agreement”), which provides for a term loan in an initial aggregate principal amount of $180.0 million (the “Owl Rock Term Loan”).

The notes will not be listed on any securities exchange or included in any inter-dealer quotation system. Our common stock is quoted under the symbol “PAR” on The New York Stock Exchange. The last reported sale price of our common stock on The New York Stock Exchange on September 10, 2021 was $69.76 per share.

We have granted the underwriters an option for a period of 30 days to purchase up to an additional $30.0 million aggregate principal amount of notes.

Concurrently with this offering of the notes, we are offering 892,857 shares of our common stock, plus up to an additional 89,286 shares of our common stock that the underwriters of the concurrent common stock offering have the option to purchase from us, in an underwritten offering pursuant to a separate prospectus supplement. The closing of this offering of the notes is not contingent upon the closing of the concurrent common stock offering, and the closing of the concurrent common stock offering is not contingent upon the closing of this offering of the notes, so it is possible that the notes offering occurs and the concurrent common stock offering does not occur, and vice versa. Moreover, amounts sold in each offering are subject to change based on market conditions relating to a particular security; there are no assurances that one or both of the offerings will be completed or completed on the terms described herein or, with respect to the concurrent common stock offering, in the prospectus supplement for that offering. Nothing in this prospectus supplement shall constitute an offer to sell or the solicitation of an offer to buy the common stock.

We expect that the notes will be delivered to investors in book-entry form through The Depository Trust Company on or about September 17, 2021.

Investing in our notes and any common stock issuable upon conversion of the notes involves a high degree of risk. Before making an investment decision, please read “Risk Factors” beginning on page S-

13 of this prospectus supplement, page

5 of the accompanying prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2020 and in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2021 and June 30, 2021, which have been filed with the Securities and Exchange Commission and are incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the prospectus to which it relates. Any representation to the contrary is a criminal offense.

Public offering price | | | $1,000 | | | $235,000,000 |

Underwriting discounts and commissions | | | $30 | | | $7,050,000 |

Proceeds to us, before expenses | | | $970 | | | $227,950,000 |

Sole Book-Running Manager

Goldman Sachs & Co. LLC

Co-Managers

BTIG | | | Needham & Company | | | Craig-Hallum |

Prospectus Supplement dated September 14, 2021