UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-3596

Seligman Communications and Information Fund, Inc.

(Exact name of Registrant as specified in charter)

100 Park Avenue

New York, New York 10017

(Address of principal executive offices) (Zip code)

Lawrence P. Vogel

100 Park Avenue

New York, New York 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 850-1864

Date of fiscal year end: 12/31

Date of reporting period: 6/30/05

FORM N-CSR

ITEM 1. REPORTS TO STOCKHOLDERS.

Seligman | |

Communications and Information Fund, Inc.

|

| |

| | Mid-Year Report June 30, 2005 Seeking Capital Gain by Investing in Companies Operating in the Communications, Information, and Related Industries |

Seligman 141 Years of Investment Experience |

J. & W. Seligman & Co. Incorporated is a firm with a long tradition of investment expertise, offering a broad array of investment choices to help today’s investors seek their long-term financial goals.

Established in 1864, Seligman has a history of providing financial services marked not by fanfare, but rather by a quiet and firm adherence to financial prudence. While the world has changed dramatically in the 141 years since Seligman first opened its doors, the firm has continued to offer its clients high-quality investment solutions through changing times.

In the late 19th century, as the country grew, Seligman helped finance the westward expansion of the railroads, the construction of the Panama Canal, and the launching of urban transit systems. In the early 20th century, the firm helped fund the growing capital needs of new industries, including the nascent automobile and steel industries.

With the formation of Tri-Continental Corporation in 1929 — today, one of the nation’s largest diversified publicly-traded closed-end equity investment companies — Seligman began shifting its emphasis to investment management. In 1930, Seligman established what would be the first in an impressive lineup of mutual funds.

Seligman is proud of its distinctive past and of the traditional values that continue to shape the firm’s business decisions and investment judgment. While much has changed over the years, the firm’s commitment to providing prudent investment management that seeks to build wealth for clients over time is an enduring value that will continue to guide Seligman.

Table of Contents | |

| | |

| To The Shareholders | 1 |

| | |

| Performance and Portfolio Overview | 2 |

| | |

| Understanding and Comparing Your Fund’s Expenses | 7 |

| | |

| Portfolio of Investments | 8 |

| | |

| Statement of Assets and Liabilities | 11 |

| | |

| Statement of Operations | 13 |

| | |

| Statements of Changes in Net Assets | 14 |

| | |

| Notes to Financial Statements | 15 |

| | |

| Financial Highlights | 25 |

| | |

| Report of Independent Registered Public Accounting Firm | 31 |

| | |

Board of Directors and Executive Officers | 32 |

| | |

| Additional Fund Information | Back cover |

We are pleased to present your mid-year report for Seligman Communications and Information Fund, Inc. The report contains the Fund’s investment results and financial statements, as well as a portfolio of the Fund’s investments.

For the six months ended June 30, 2005, the Fund posted a total return of -3.86% based on the net asset value of Class A shares. This compared favorably to the Lipper Science & Technology Funds Average, which returned -6.05%, and to the Goldman Sachs Technology Index, which returned -7.33%.

We thank you for your continued support of Seligman Communications and Information Fund, Inc. and look forward to serving your investment needs for many years to come.

By Order of the Board of Directors,

William C. Morris

Chairman

Brian T. Zino

President

August 24, 2005

Manager | Shareholder Service Agent | Important Telephone Numbers |

| J. & W. Seligman & Co. | Seligman Data Corp. | (800) 221-2450 Stockholder Services |

| Incorporated | 100 Park Avenue | (800) 445-1777 Retirement Plan Services |

| 100 Park Avenue | New York, NY 10017 | (212) 682-7600 Outside the United States |

| New York, NY 10017 | | (800) 622-4597 24-Hour Automated Telephone Access Service |

| | | |

General Distributor | General Counsel | |

| Seligman Advisors, Inc. | Sullivan & Cromwell LLP | |

| 100 Park Avenue | | |

| New York, NY 10017 | Independent Registered | |

| | Public Accounting Firm | |

| | Deloitte & Touche LLP | |

Performance and Portfolio Overview

This section of the report is intended to help you understand the performance of Seligman Communications and Information Fund and to provide a summary of the Fund’s portfolio characteristics.

Performance data quoted in this report represents past performance and does not guarantee future investment results. The rates of return will vary and the principal value of an investment will fluctuate. Shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Total returns of the Fund as of the most recent month end will be available at www.seligman.com1 by the seventh business day following that month end. Calculations assume reinvestment of distributions. Performance data quoted does not reflect the deduction of taxes that an investor may pay on distributions or the redemption of shares. J. & W. Seligman & Co. Incorporated (the “Manager”) agreed to waive a portion of the management fee equal to 0.05% per annum of the Fund’s net assets for the period June 1, 2004 through May 31, 2006. Absent such a waiver, total returns that include this period would have been lower.

Returns for Class A shares are calculated with and without the effect of the initial 4.75% maximum sales charge. Returns for Class B shares are calculated with and without the effect of the maximum 5% contingent deferred sales charge (“CDSC”), charged on redemptions made within one year of purchase, declining to 1% in the sixth year and 0% thereafter. The return from inception for Class B shares reflects automatic conversion to Class A shares approximately eight years after inception date. Returns for Class C shares are calculated with and without the effect of the initial 1% maximum sales charge and the 1% CDSC that is charged on redemptions made within 18 months of the date of purchase. Returns for Class D and Class R shares are calculated with and without the effect of the 1% CDSC, charged on redemptions made within one year of purchase. Class I shares do not have sales charges.

| 1 | The reference to Seligman’s website is an inactive textual reference and information contained in or otherwise accessible through Seligman’s website does not form a part of this report or the Fund’s prospectus. |

Performance and Portfolio Overview

Investment Results

Total Returns For Periods Ended June 30, 2005 | | | |

| | | | Average Annual |

Class A | Six Months* | | One Year | | Five Years | | Ten Years | | Class B Since Inception 4/22/96 | | Class C Since Inception 5/27/99 | | Class I Since Inception 11/30/01 | | Class R Since Inception 4/30/03 |

| With Sales Charge | (8.43 | )% | | (4.57 | )% | | (10.69 | )% | | 6.27 | % | | n/a | | | n/a | | | n/a | | | n/a | |

| Without Sales Charge | (3.86 | ) | | 0.20 | | | (9.82 | ) | | 6.79 | | | n/a | | | n/a | | | n/a | | | n/a | |

Class B | | | | | | | | | | | | | | | | | | | | | | | |

| With CDSC† | (9.00 | ) | | (5.49 | ) | | (10.78 | ) | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | |

| Without CDSC | (4.21 | ) | | (0.52 | ) | | (10.48 | ) | | n/a | | | 6.97 | %‡ | | n/a | | | n/a | | | n/a | |

Class C | | | | | | | | | | | | | | | | | | | | | | | |

| With Sales Charge | | | | | | | | | | | | | | | | | | | | | | | |

| and CDSC†† | (6.11 | ) | | (2.47 | ) | | (10.64 | ) | | n/a | | | n/a | | | (0.06 | )% | | n/a | | | n/a | |

| Without Sales Charge | | | | | | | | | | | | | | | | | | | | | | | |

| and CDSC | (4.21 | ) | | (0.52 | ) | | (10.47 | ) | | n/a | | | n/a | | | 0.11 | | | n/a | | | n/a | |

Class D | | | | | | | | | | | | | | | | | | | | | | | |

| With 1% CDSC | (5.13 | ) | | (1.51 | ) | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | |

| Without CDSC | (4.17 | ) | | (0.52 | ) | | (10.47 | ) | | 5.99 | | | n/a | | | n/a | | | n/a | | | n/a | |

Class I | (3.64 | ) | | 0.69 | | | n/a | | | n/a | | | n/a | | | n/a | | | 0.51 | % | | n/a | |

Class R | | | | | | | | | | | | | | | | | | | | | | | |

| With 1% CDSC | (4.92 | ) | | (0.96 | ) | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | |

| Without CDSC | (3.95 | ) | | 0.04 | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | 16.93 | % |

Lipper Science & | | | | | | | | | | | | | | | | | | | | | | | |

Technology Funds | | | | | | | | | | | | | | | | | | | | | | | |

Average** | (6.05 | ) | | (2.92 | ) | | (18.73 | ) | | 6.08 | | | 5.16 | ††† | | (4.52 | ) | | (3.37 | ) | | 16.42 | |

Goldman Sachs | | | | | | | | | | | | | | | | | | | | | | | |

Technology Index** | (7.33 | ) | | (5.33 | ) | | (18.06 | ) | | n/a | | | n/a | | | (6.52 | ) | | (4.04 | ) | | 14.37 | |

S&P 500 Index** | (0.81 | ) | | 6.32 | | | (2.37 | ) | | 9.94 | | | 8.56 | | | 0.32 | | | 3.01 | | | 14.85 | |

Net Asset Value Per Share

| | Class A | Class B | Class C | Class D | Class I | Class R |

6/30/05 | $24.44 | $21.15 | $21.15 | $21.14 | $24.87 | $24.29 |

12/31/04 | 25.42 | 22.08 | 22.08 | 22.06 | 25.81 | 25.29 |

6/30/04 | 24.39 | 21.26 | 21.26 | 21.25 | 24.70 | 24.28 |

_____________

| * | | Returns for periods of less than one year are not annualized. |

| ** | | The Goldman Sachs Technology Index (“Goldman Index”), the Standard and Poor’s 500 Composite Stock Index (“S&P 500”), and the Lipper Science & Technology Funds Average (“Lipper Average”) are unmanaged benchmarks that assume the reinvestment of all distributions. The Lipper Average does not reflect any taxes or sales charges and the Goldman Index and the S&P 500 do not reflect any taxes, fees or sales charges. The S&P 500 measures the performance of 500 of the largest US companies based on market capitalizations. The Lipper Average measures the performance of funds that invest at least 65% of their equity portfolios in science and technology stocks. The Goldman Index is a broad-based index of publicly-owned US technology stocks, designed to measure the performance of the technology sector. Investors cannot invest directly in an average or an index. |

| † | | The CDSC is 5% for periods of one year or less and 2% for the five-year period. |

| †† | | The CDSC is 1% for periods up to 18 months. |

| ††† | | From April 25, 1996. |

| ‡ | | Return from inception for Class B shares reflects automatic conversion to Class A shares approximately eight years after inception date. |

Performance and Portfolio Overview

Securities That Had the Greatest Impact

on Net Asset Value (NAV)

For the Six Months Ended June 30, 2005

Top Contributors | | | Top Detractors | |

Security | Impact on NAV | | Security | Impact on NAV |

| MEMC Electronic Materials | $0.29 | | Avocent | $(0.20) |

| Take-Two Interactive Software | 0.13 | | Synopsys | (0.16) |

| Corning | 0.11 | | Boston Scientific | (0.14) |

| Infosys Technologies | 0.06 | | eBay | (0.13) |

| Motorola | 0.05 | | Computer Associates International | (0.11) |

| McAfee | 0.04 | | Magma Design Automation | (0.11) |

| Ask Jeeves | 0.03 | | Microsoft | (0.10) |

| Amphenol (Class A) | 0.03 | | QUALCOMM | (0.10) |

| Quest Diagnostics | 0.03 | | Brocade Communications Systems | (0.06) |

| Satyam Computer Services | 0.03 | | Check Point Software Technologies | (0.06) |

| Total | $0.80 | | Total | $(1.17) |

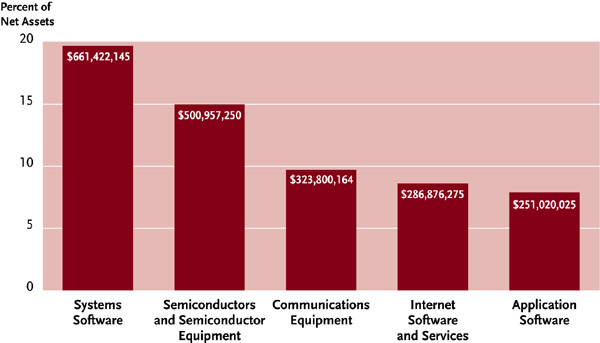

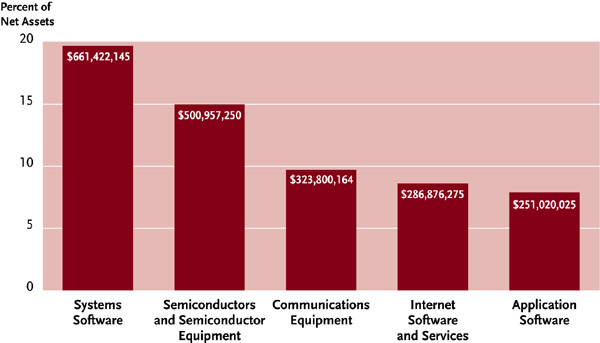

Largest Industries

June 30, 2005

Performance and Portfolio Overview

Diversification of Net Assets

June 30, 2005

| | | | | | | | | Percent of Net Assets | |

| | | Issues | | Cost | | Value | | June 30, 2005 | | December 31, 2004* |

Common Stocks: | | | | | | | | | | | |

| Application Software | | | 5 | | $ | 326,919,509 | | $ | 262,885,050 | | | 7.9 | | | 6.6 | |

| Biotechnology | | | — | | | — | | | — | | | — | | | 2.1 | |

| Communications Equipment | | | 8 | | | 338,207,014 | | | 323,800,164 | | | 9.7 | | | 9.1 | |

| Computers and Peripherals | | | 7 | | | 222,993,959 | | | 213,239,860 | | | 6.4 | | | 6.1 | |

| Consumer Software | | | 2 | | | 120,486,403 | | | 129,033,000 | | | 3.9 | | | 3.9 | |

| Data Processing and Outsourced Services | | | — | | | — | | | — | | | — | | | 1.3 | |

| Diversified Telecommunication Services | | | 2 | | | 47,008,947 | | | 48,609,343 | | | 1.4 | | | 0.8 | |

| Electronic Equipment and Instruments | | | 4 | | | 97,500,436 | | | 111,502,366 | | | 3.3 | | | 3.4 | |

| Health Care Equipment and Supplies | | | 5 | | | 191,279,143 | | | 188,360,250 | | | 5.6 | | | 7.8 | |

| Health Care Providers and Services | | | 1 | | | 27,564,800 | | | 46,157,500 | | | 1.4 | | | 3.4 | |

| Internet and Catalog Retail | | | — | | | — | | | — | | | — | | | 2.9 | |

| Internet Software and Services | | | 6 | | | 294,701,409 | | | 286,876,275 | | | 8.6 | | | 4.1 | |

| IT Services | | | 4 | | | 247,907,741 | | | 246,167,423 | | | 7.3 | | | 6.6 | |

| Leisure Equipment and Products | | | — | | | — | | | — | | | — | | | 0.7 | |

| Media | | | 1 | | | 49,171,406 | | | 46,012,500 | | | 1.4 | | | 1.1 | |

| Semiconductors | | | — | | | — | | | — | | | — | | | 0.8 | |

| Semiconductors and | | | | | | | | | | | | | | | | |

| Semiconductor Equipment | | | 9 | | | 403,468,874 | | | 500,957,250 | | | 15.0 | | | 13.0 | |

| Systems Software | | | 6 | | | 671,882,891 | | | 661,422,145 | | | 19.7 | | | 16.9 | |

| Technical Software | | | 2 | | | 284,414,078 | | | 208,363,000 | | | 6.2 | | | 3.7 | |

| Total Common Stocks | | | 62 | | | 3,323,506,610 | | | 3,273,386,126 | | | 97.8 | | | 94.3 | |

Venture Capital Investments | | | 43 | | | 40,998,166 | | | 11,320,071 | | | 0.3 | | | 0.3 | |

Short-Term Holding and | | | | | | | | | | | | | | | | |

Other Assets Less Liabilities | | | 1 | | | 64,170,528 | | | 64,170,528 | | | 1.9 | | | 5.4 | |

Net Assets | | | 106 | | $ | 3,428,675,304 | | $ | 3,348,876,725 | | | 100.0 | | | 100.0 | |

_____________

* Restated to conform to the current period’s classifications.

Performance and Portfolio Overview

Largest Portfolio Changes

During Past Six Months

Largest Purchases | | Largest Sales |

| VERITAS Software | | Boston Scientific** |

| Advanced Micro Devices | | Take-Two Interactive Software |

| Cadence Design Systems* | | Citrix Systems** |

| EMC | | Hewlett-Packard |

| Cytyc* | | Ask Jeeves** |

| THQ* | | Quest Diagnostics** |

| McAfee* | | Invitrogen** |

| Seagate Technology* | | Fisher Scientific International |

| Kinetic Concepts* | | Intel** |

| Oracle | | eBay** |

Largest portfolio changes from the previous period to the current period are based on cost of purchases and proceeds from sales of securities, listed in descending order.

_____________

| * | | Position added during the period. |

| ** | | Position eliminated during the period. |

Largest Portfolio Holdings

June 30, 2005

Security | | Value | | Percent of Net Assets | |

| MEMC Electronic Materials | | $ | 252,320,000 | | 7.5 | |

| BMC Software | | | 197,450,000 | | 5.9 | |

| Microsoft | | | 196,117,500 | | 5.9 | |

| VERITAS Software | | | 176,936,250 | | 5.3 | |

| Synopsys | | | 149,625,000 | | 4.5 | |

| Amdocs | | | 139,735,410 | | 4.2 | |

| Computer Associates International | | | 139,249,130 | | 4.2 | |

| Advanced Micro Devices | | | 138,720,000 | | 4.1 | |

| Cisco Systems | | | 105,022,500 | | 3.1 | |

| Oracle | | | 98,101,265 | | 2.9 | |

Understanding and Comparing Your Fund’s Expenses

As a shareholder of the Fund, you incur ongoing expenses, such as management fees, distribution and/or service (12b-1) fees, and other fund expenses. The information below is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare them with the ongoing expenses of investing in other mutual funds. Please note that the expenses shown in the table are meant to highlight your ongoing expenses only and do not reflect any transactional costs, such as sales charges (also known as loads) on certain purchases or redemptions. Therefore, the table is useful in comparing ongoing expenses only, and will not help you to determine the relative total expenses of owning different funds. In addition, if transactional costs were included, your total expenses would have been higher.

The table is based on an investment of $1,000 invested at the beginning of January 1, 2005 and held for the entire six-month period ended June 30, 2005.

Actual Expenses

The table below provides information about actual expenses and actual account values. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value at the beginning of the period by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” for the Fund’s share class that you own to estimate the expenses that you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical expenses and hypothetical account values based on the actual expense ratio of each class and an assumed rate of return of 5% per year before expenses, which is not the actual return of any class of the Fund. The hypothetical expenses and account values may not be used to estimate the ending account value or the actual expenses you paid for the period. You may use this information to compare the ongoing expenses of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

| | | | | | | Actual | | Hypothetical | |

| | | Beginning Account Value 1/1/05 | | Annualized Expense Ratio* | | Ending Account Value 6/30/05 | | Expenses Paid During Period** 1/1/05 to 6/30/05 | | Ending Account Value 6/30/05 | | Expenses Paid During Period** 1/1/05 to 6/30/05 | |

| Class A | | $ | 1,000.00 | | | 1.54% | | $ | 961.40 | | $ | 7.49 | | $ | 1,017.16 | | $ | 7.70 | |

| Class B | | | 1,000.00 | | | 2.29 | | | 957.90 | | | 11.12 | | | 1,013.44 | | | 11.43 | |

| Class C | | | 1,000.00 | | | 2.29 | | | 957.90 | | | 11.12 | | | 1,013.44 | | | 11.43 | |

| Class D | | | 1,000.00 | | | 2.29 | | | 958.30 | | | 11.12 | | | 1,013.44 | | | 11.43 | |

| Class I | | | 1,000.00 | | | 1.04 | | | 963.60 | | | 5.06 | | | 1,019.64 | | | 5.21 | |

| Class R | | | 1,000.00 | | | 1.79 | | | 960.50 | | | 8.70 | | | 1,015.92 | | | 8.95 | |

| * | | Expenses of Class B, Class C, Class D, Class I and Class R shares differ from the expenses of Class A shares due to the differences in 12b-1 fees and other class-specific expenses paid by each share class. See the Fund’s prospectus for a description of each share class and its expenses and sales charges. The Manager has agreed to waive a portion of its management fee equal to 0.05% per annum of the Fund’s average net assets. Absent such waiver, the expense ratios and expenses paid for the period would have been higher. |

| ** | | Expenses are equal to the annualized expense ratio based on actual expenses for the period January 1, 2005 to June 30, 2005, multiplied by the average account value over the period, multiplied by 181/365 (number of days in the period). |

Portfolio of Investments

June 30, 2005

| | | Shares | | Value | |

Common Stocks 97.8% |

| | | | | | |

Application Software 7.9% | | | | | |

| BEA Systems* | | | 2,000,000 | | $ | 17,550,000 | |

| Cogent* | | | 635,000 | | | 18,116,550 | |

| Compuware* | | | 2,000,000 | | | 14,370,000 | |

| Microsoft | | | 7,900,000 | | | 196,117,500 | |

| NAVTEQ* | | | 450,000 | | | 16,731,000 | |

| | | | | | | 262,885,050 | |

| | | | | | | | |

Communications Equipment 9.7% | | | | | | | |

| Avocent* | | | 1,250,000 | | | 32,681,250 | |

| Cisco Systems* | | | 5,500,000 | | | 105,022,500 | |

| Corning* | | | 2,000,000 | | | 33,240,000 | |

| Motorola | | | 2,400,000 | | | 43,824,000 | |

| Nokia (ADR) | | | 2,400,000 | | | 39,936,000 | |

| Plantronics | | | 260,000 | | | 9,453,600 | |

| QUALCOMM | | | 1,750,000 | | | 57,776,250 | |

| TomTom* | | | 85,050 | | | 1,866,564 | |

| | | | | | | 323,800,164 | |

| | | | | | | | |

Computers and Peripherals 6.4% | | | | | | | |

| Avid Technology* | | | 400,000 | | | 21,326,000 | |

| Brocade Communications Systems* | | | 2,500,000 | | | 9,662,500 | |

| EMC* | | | 6,000,000 | | | 82,260,000 | |

| Hewlett-Packard | | | 700,000 | | | 16,457,000 | |

| International Business Machines | | | 450,800 | | | 33,449,360 | |

| Komag* | | | 250,000 | | | 7,087,500 | |

| Seagate Technology* | | | 2,450,000 | | | 42,997,500 | |

| | | | | | | 213,239,860 | |

| | | | | | | | |

Consumer Software 3.9% | | | | | | | |

Take-Two Interactive Software*Ø | | | 3,000,000 | | | 76,365,000 | |

| THQ* | | | 1,800,000 | | | 52,668,000 | |

| | | | | | | 129,033,000 | |

| | | | | | | | |

Diversified Telecommunication Services 1.4% | | | | | | | |

| NeuStar (Class A)* | | | 688,700 | | | 17,630,720 | |

| Sprint | | | 1,234,700 | | | 30,978,623 | |

| | | | | | | 48,609,343 | |

_____________

See footnotes on page 10.

Portfolio of Investments

June 30, 2005

| | | Shares | | Value | |

Electronic Equipment and Instruments 3.3% | | | | | |

| Amphenol (Class A) | | | 934,200 | | $ | 37,526,814 | |

| Ibiden | | | 645,300 | | | 16,931,052 | |

Orbotech*Ø | | | 2,350,000 | | | 50,830,500 | |

| Xyratex* | | | 400,000 | | | 6,214,000 | |

| | | | | | | 111,502,366 | |

| | | | | | | | |

Health Care Equipment and Supplies 5.6% | | | | | | | |

| Cytyc* | | | 2,500,000 | | | 55,225,000 | |

| Fisher Scientific International* | | | 650,000 | | | 42,185,000 | |

| Gen-Probe* | | | 450,000 | | | 16,310,250 | |

| Kinetic Concepts* | | | 740,000 | | | 44,400,000 | |

| PerkinElmer | | | 1,600,000 | | | 30,240,000 | |

| | | | | | | 188,360,250 | |

| | | | | | | | |

Health Care Providers and Services 1.4% | | | | | | | |

| Laboratory Corporation of America Holdings* | | | 925,000 | | | 46,157,500 | |

| | | | | | | | |

Internet Software and Services 8.6% | | | | | | | |

Digital River*Ø | | | 2,125,000 | | | 67,479,375 | |

| Google (Class A)* | | | 120,000 | | | 35,297,400 | |

| McAfee* | | | 2,150,000 | | | 56,287,000 | |

| Monster Worldwide* | | | 1,250,000 | | | 35,856,250 | |

| Symantec* | | | 1,600,000 | | | 34,792,000 | |

| Yahoo!* | | | 1,650,000 | | | 57,164,250 | |

| | | | | | | 286,876,275 | |

| | | | | | | | |

IT Services 7.3% | | | | | | | |

| Amdocs* | | | 5,287,000 | | | 139,735,410 | |

| Infosys Technologies | | | 1,192,360 | | | 64,602,265 | |

| Ness Technologies* | | | 557,500 | | | 5,937,375 | |

| Satyam Computer Services | | | 3,077,550 | | | 35,892,373 | |

| | | | | | | 246,167,423 | |

| | | | | | | | |

Media 1.4% | | | | | | | |

| Comcast (Class A)* | | | 1,500,000 | | | 46,012,500 | |

| | | | | | | | |

Semiconductors and Semiconductor Equipment 15.0% | | | | | | | |

| Advanced Micro Devices* | | | 8,000,000 | | | 138,720,000 | |

| Altera* | | | 850,000 | | | 16,825,750 | |

| Analog Devices | | | 500,000 | | | 18,655,000 | |

| ATI Technologies* | | | 1,300,000 | | | 15,411,500 | |

| Integrated Device Technology* | | | 1,400,000 | | | 15,043,000 | |

| Lam Research* | | | 650,000 | | | 18,807,750 | |

Mattson Technology*Ø | | | 1,750,000 | | | 12,477,500 | |

MEMC Electronic Materials*Ø | | | 16,000,000 | | | 252,320,000 | |

Monolithic Power Systems*Ø | | | 1,425,000 | | | 12,696,750 | |

| | | | | | | 500,957,250 | |

_____________

See footnotes on page 10.

Portfolio of Investments

June 30, 2005

| | | Shares or Principal Amount | | | | Value | |

Systems Software 19.7% | | | | | | | |

BMC Software*Ø | | | 11,000,000 | shs. | | | | $ | 197,450,000 | |

| Check Point Software Technologies* | | | 800,000 | | | | | | 15,868,000 | |

| Computer Associates International | | | 5,067,290 | | | | | | 139,249,130 | |

| Macrovision* | | | 1,500,000 | | | | | | 33,817,500 | |

| Oracle* | | | 7,429,100 | | | | | | 98,101,265 | |

| VERITAS Software* | | | 7,250,000 | | | | | | 176,936,250 | |

| | | | | | | | | | 661,422,145 | |

| | | | | | | | | | | |

Technical Software 6.2% | | | | | | | | | | |

| Cadence Design Systems* | | | 4,300,000 | | | | | | 58,738,000 | |

Synopsys*Ø | | | 9,000,000 | | | | | | 149,625,000 | |

| | | | | | | | | | 208,363,000 | |

Total Common Stocks (Cost $3,323,506,610) | | | | | | | | | 3,273,386,126 | |

Venture Capital Investments†(Cost $40,998,166) 0.3% | | | | | | | | | 11,320,071 | |

Fixed Time Deposit 1.3% | | | | | | | | | | |

| Rabobank Nederland 3.35%, 7/1/05 (Cost $44,598,000) | | $ | 44,598,000 | | | | | | 44,598,000 | |

| | | | | | | | | | | |

Total Investments (Cost $3,409,102,776) 99.4% | | | | | | | | | 3,329,304,197 | |

Other Assets Less Liabilities 0.6% | | | | | | | | | 19,572,528 | |

Net Assets 100.0% | | | | | | | | $ | 3,348,876,725 | |

____________

| * | Non-income producing security. |

| † | Restricted and non-income producing securities (Note 9). |

| Ø | Affiliated issuers (Fund’s holdings representing 5% or more of the outstanding voting securities). |

| ADR—American Depositary Receipts. |

| See Notes to Financial Statements. |

Statement of Assets and Liabilities

June 30, 2005

Assets: | | | |

| Investments, at value: | | | |

| Common stocks* (cost $3,323,506,610) | | $ | 3,273,386,126 | |

| Venture capital investments (cost $40,998,166) | | | 11,320,071 | |

| Fixed time deposit (cost $44,598,000) | | | 44,598,000 | |

| Total investments (cost $3,409,102,776) | | | 3,329,304,197 | |

| Cash denominated in foreign currencies | | | 6,718,307 | |

| Receivable for securities sold | | | 80,225,375 | |

| Receivable for Capital Stock sold | | | 1,186,375 | |

| Expenses prepaid to shareholder service agent | | | 711,090 | |

| Receivable for dividends and interest | | | 147,881 | |

| Other | | | 1,976,114 | |

Total Assets | | | 3,420,269,339 | |

| | | | | |

Liabilities: | | | | |

| Bank overdraft | | | 45,421 | |

| Payable for securities purchased | | | 54,979,699 | |

| Payable for Capital Stock repurchased | | | 11,665,509 | |

| Management fee payable | | | 2,369,569 | |

| Distribution and service fees payable | | | 1,481,444 | |

| Unrealized depreciation on forward currency contracts | | | 15,336 | |

| Accrued expenses and other | | | 835,636 | |

Total Liabilities | | | 71,392,614 | |

Net Assets | | $ | 3,348,876,725 | |

| | | | | |

Composition of Net Assets: | | | | |

Capital Stock, at par ($0.10 par value; 1,000,000,000 shares authorized; 144,918,697 shares outstanding): | | | | |

| Class A | | $ | 8,537,125 | |

| Class B | | | 2,724,772 | |

| Class C | | | 779,575 | |

| Class D | | | 2,365,489 | |

| Class I | | | 68,957 | |

| Class R | | | 15,952 | |

| Additional paid-in capital | | | 5,064,684,784 | |

| Accumulated net investment loss | | | (26,782,116 | ) |

| Accumulated net realized loss | | | (1,623,628,755 | ) |

| Net unrealized depreciation of investments and foreign currency transactions | | | (79,889,058 | ) |

Net Assets | | $ | 3,348,876,725 | |

(Continued on page 12.)

____________

See footnotes on page 12.

Statement of Assets and Liabilities

June 30, 2005

Net Asset Value Per Share: | |

Class A | ($2,086,801,564 ÷ 85,371,247 shares) | $24.44 |

Class B | ($576,231,693 ÷ 27,247,724 shares) | $21.15 |

Class C | ($164,871,805 ÷ 7,795,750 shares) | $21.15 |

Class D | ($499,946,589 ÷ 23,654,887 shares) | $21.14 |

Class I | ($17,150,941 ÷ 689,568 shares) | $24.87 |

Class R | ($3,874,133 ÷ 159,521 shares) | $24.29 |

____________

| * | Includes affiliated issuers (issuers in which the Fund's holdings represent 5% or more of the outstanding voting securities) with a cost of $793,497,651 and a value of $819,244,125. |

| See Notes to Financial Statements. |

Statement of Operations

For the Six Months Ended June 30, 2005

Investment Income: | | | | |

| Dividends (net of foreign taxes withheld of $114,525) | | $ | 4,036,596 | |

| Interest | | | 1,195,710 | |

Total Investment Income | | | 5,232,306 | |

| | | | | |

Expenses: | | | | |

| Management fee | | | 15,465,622 | |

| Distribution and service fees | | | 9,265,488 | |

| Shareholder account services | | | 5,737,833 | |

| Custody and related services | | | 1,228,789 | |

| Shareholder reports and communications | | | 232,822 | |

| Registration | | | 188,390 | |

| Auditing and legal fees | | | 77,196 | |

| Directors’ fees and expenses | | | 50,752 | |

| Miscellaneous | | | 156,643 | |

Total Expenses Before Fee Waiver | | | 32,403,535 | |

Fee Waiver | | | (865,987 | ) |

Total Expenses After Fee Waiver | | | 31,537,548 | |

Net Investment Loss | | | (26,305,242 | ) |

| | | | | |

Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions: | | | | |

| Net realized gain on investments and foreign currency transactions* | | | 77,603,014 | |

| Net change in unrealized appreciation of investments and foreign currency transactions | | | (215,039,869 | ) |

Net Loss on Investments and Foreign Currency Transactions | | | (137,436,855 | ) |

Decrease in Net Assets from Operations | | $ | (163,742,097 | ) |

____________

| * | Includes net realized losses from affiliated issuers of $21,767,911. |

See Notes to Financial Statements.

Statements of Changes in Net Assets

| | | Six Months Ended June 30, 2005 | | Year Ended December 31, 2004 | |

Operations: | | | | | |

| Net investment loss | | $ | (26,305,242 | ) | $ | (38,122,982 | ) |

| Net realized gain on investments and foreign currency transactions | | | 77,603,014 | | | 644,157,849 | |

| Net realized loss on options written | | | — | | | (78,794 | ) |

| Payments received from the Manager (Note 11) | | | — | | | 630,399 | |

| Net change in unrealized appreciation of investments and foreign currency transactions | | | (215,039,869 | ) | | (237,020,283 | ) |

Increase (Decrease) in Net Assets from Operations | | | (163,742,097 | ) | | 369,566,189 | |

| | | | | | | | |

Capital Share Transactions: | | | | | | | |

| Net proceeds from sales of shares | | | 97,726,080 | | | 237,684,224 | |

| Exchanged from associated funds | | | 10,943,504 | | | 35,868,223 | |

| Total | | | 108,669,584 | | | 273,552,447 | |

| Cost of shares repurchased | | | (491,536,935 | ) | | (835,216,724 | ) |

| Exchanged into associated funds | | | (29,986,988 | ) | | (56,056,677 | ) |

| Total | | | (521,523,923 | ) | | (891,273,401 | ) |

| | | | | | | | |

Decrease in Net Assets from Capital Share Transactions | | | (412,854,339 | ) | | (617,720,954 | ) |

| | | | | | | | |

Decrease in Net Assets | | | (576,596,436 | ) | | (248,154,765 | ) |

| | | | | | | | |

Net Assets: | | | | | | | |

| Beginning of period | | | 3,925,473,161 | | | 4,173,627,926 | |

End of Period (net of accumulated net investment loss of $26,782,116 and $85,084, respectively) | | $ | 3,348,876,725 | | $ | 3,925,473,161 | |

____________

See Notes to Financial Statements.

Notes to Financial Statements

1. | Multiple Classes of Shares — Seligman Communications and Information Fund, Inc. (the “Fund”) offers the following six classes of shares: |

| | | |

| | Class A shares are sold with an initial sales charge of up to 4.75% and a continuing service fee of up to 0.25% on an annual basis. Class A shares purchased in an amount of $1,000,000 or more are sold without an initial sales charge but are subject to a contingent deferred sales charge (“CDSC”) of 1% on redemptions within 18 months of purchase. |

| | | |

| | Class B shares are sold without an initial sales charge but are subject to a distribution fee of 0.75% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 5% on redemptions in the first year of purchase, declining to 1% in the sixth year and 0% thereafter. Class B shares will automatically convert to Class A shares approximately eight years after their date of purchase. If Class B shares of the Fund are exchanged for Class B shares of another Seligman Mutual Fund, the holding period of the shares exchanged will be added to the holding period of the shares acquired, both for determining the applicable CDSC and the conversion of Class B shares to Class A shares. |

| | | |

| | Class C shares are sold primarily with an initial sales charge of up to 1%, and a CDSC, if applicable, of 1% imposed on redemptions made within 18 months of purchase. Class C shares purchased through certain financial intermediaries may be bought without an initial sales charge and with a 1% CDSC on redemptions made within 12 months of purchase. All Class C shares are subject to a distribution fee of up to 0.75% and a service fee of up to 0.25% on an annual basis. |

| | | |

| | Class D shares are sold without an initial sales charge but are subject to a distribution fee of up to 0.75% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 1% imposed on redemptions made within one year of purchase. |

| | | |

| | Class I shares are offered to certain institutional clients. Class I shares are sold without any sales charges and are not subject to distribution and service fees. |

| | | |

| | Class R shares are offered to certain employee benefit plans and are not available to all investors. They are sold without an initial sales charge, but are subject to a distribution fee of up to 0.25% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 1% on certain redemptions made within one year of a plan’s initial purchase of Class R shares. |

| | | |

| | All classes of shares represent interests in the same portfolio of investments, have the same rights and are generally identical in all respects except that each class bears its own class-specific expenses, and has exclusive voting rights with respect to any matter on which a separate vote of any class is required. |

| | | |

2. | Significant Accounting Policies— The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results may differ from these estimates. These interim financial statements reflect all adjustments which are, in the opinion of management, necessary to a fair statement of the results for the interim period presented. All such adjustments are of a normal recurring nature. The following summarizes the significant accounting policies of the Fund: |

| | | |

| | a. | Security Valuation— Securities traded on an exchange are valued at the last sales price on the primary exchange or market on which they are traded. Securities not listed on an exchange or security market, or securites for which there is no last sales price, are valued at the mean of the most recent bid and asked prices or are valued by J. & W. Seligman & Co. Incorporated (the “Manager”) based on quotations provided by primary market makers in such securities. Securities for which market quotations are not readily available (or are otherwise no longer valid or reliable) are valued at fair value determined in accordance with procedures approved by the Board of Directors. This can occur |

Notes to Financial Statements

| | | in the event of, among other things, natural disasters, acts of terrorism, market disruptions, intra-day trading halts, and extreme market volatility. Short-term holdings that mature in more than 60 days are valued at current market quotations. Short-term holdings maturing in 60 days or less are valued at amortized cost. |

| | | |

| | b. | Foreign Currency Transactions — The books and records of the Fund are maintained in US dollars. The market value of investment securities, other assets and liabilities denominated in foreign currencies are translated into US dollars at the daily rate of exchange as reported by a pricing service. Purchases and sales of investment securities, income, and expenses are translated into US dollars at the rate of exchange prevailing on the respective dates of such transactions. |

| | | |

| | | The Fund does not isolate that portion of the results of operations resulting from changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held in the portfolio. Such fluctuations are included with the net realized and unrealized gain or loss from investments. The value of cash held in foreign currencies at June 30, 2005, was substantially the same as its cost. |

| | | |

| | c. | Forward Currency Contracts — The Fund may enter into forward currency contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, or other amounts receivable or payable in foreign currency. A forward contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward rate. Certain risks may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts. The contracts are valued daily at current or forward exchange rates and any unrealized gain or loss is included in net unrealized appreciation or depreciation on translation of assets and liabilities denominated in foreign currencies and forward currency contracts. The gain or loss, if any, arising from the difference between the settlement value of the forward contract and the closing of such contract, is included in net realized gain or loss from foreign currency transactions. |

| | | |

| | d. | Federal Taxes — There is no provision for federal income tax. The Fund has elected to be taxed as a regulated investment company and intends to distribute substantially all taxable net income and net gain realized. |

| | | |

| | e. | Security Transactions and Related Investment Income — Investment transactions are recorded on trade dates. Identified cost of investments sold is used for both financial reporting and federal income tax purposes. Dividends receivable and payable are recorded on ex-dividend dates. Interest income is recorded on an accrual basis. |

| | | |

| | f. | Options — The Fund is authorized to write and purchase put and call options. When the Fund writes an option, an amount equal to the premium received by the Fund is reflected as an asset and an equivalent liability. The amount of the liability is subsequently marked to market to reflect the current market value of the option written. When a security is purchased or sold through an exercise of an option, the related premium paid (or received) is added to (or deducted from) the basis of the security acquired or deducted from (or added to) the proceeds of the security sold. When an option expires (or the Fund enters into a closing transaction), the Fund realizes a gain or loss on the option to the extent of the premiums received or paid (or gain or loss to the extent the cost of the closing transaction exceeds the premium paid or received). The Fund, as writer of an option, bears the market risk of an unfavorable change in the price of the security underlying the written option. Written and purchased options are non-income producing investments. |

| | | |

| | g. | Repurchase Agreements — The Fund may enter into repurchase agreements with commercial banks and with broker/dealers deemed to be creditworthy by the Manager. Securities received as collateral subject to repurchase agreements are deposited with the Fund’s custodian and, pursuant to the terms of the repurchase agreements, must have an aggregate market value greater than or equal to |

Notes to Financial Statements

| | | the repurchase price plus accrued interest at all times. Procedures have been established to monitor, on a daily basis, the market value of repurchase agreements’ underlying securities to ensure the existence of the proper level of collateral. |

| | | |

| | h. | Multiple Class Allocations — All income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares based upon the relative value of shares of each class. Class-specific expenses, which include distribution and service fees and any other items that are specifically attributable to a particular class, are charged directly to such class. For the six months ended June 30, 2005, distribution and service fees, shareholder account services and registration expenses were class-specific expenses. |

| | | |

| | i. | Distributions to Shareholders — Dividends and distributions to shareholders are recorded on ex-dividend date. |

| | | |

3. | Management Fee, Distribution Services, and Other Transactions — The Manager manages the affairs of the Fund and provides the necessary personnel and facilities. Compensation of all officers of the Fund, all directors of the Fund who are employees of the Manager, and all personnel of the Fund and the Manager is paid by the Manager. The Manager receives a fee, calculated daily and payable monthly, equal to 0.90% per annum of the first $3 billion of the Fund’s average daily net assets, 0.85% per annum of the next $3 billion of the Fund’s average daily net assets, and 0.75% per annum of the Fund’s average daily net assets in excess of $6 billion. The management fee reflected in the Statement of Operations represents 0.89% per annum of the Fund’s average daily net assets. The Manager agreed to waive a portion of its management fee equal to 0.05% per annum of the Fund’s average net assets for a two-year period beginning June 1, 2004. For the six months ended June 30, 2005, the management fee waived by the Manager amounted to $865,987. For additional information, see Note 11 — Other Matters. |

| | | |

| | Seligman Advisors, Inc. (the “Distributor”), agent for the distribution of the Fund’s shares and an affiliate of the Manager, received concessions of $60,270 from sales of Class A shares. Commissions of $482,692 and $22,419, were paid to dealers from sales of Class A and Class C shares, respectively. |

| | | |

| | The Fund has an Administration, Shareholder Services and Distribution Plan (the “Plan”) with respect to distribution of its shares. Under the Plan, with respect to Class A shares, service organizations can enter into agreements with the Distributor and receive a continuing fee of up to 0.25% on an annual basis, payable monthly, of the average daily net assets of the Class A shares attributable to the particular service organizations for providing personal services and/or the maintenance of shareholder accounts. The Distributor charges such fees to the Fund pursuant to the Plan. For the six months ended June 30, 2005, fees incurred under the Plan aggregated $2,657,116, or 0.25% per annum of the average daily net assets of Class A shares. |

| | | |

| | Under the Plan, with respect to Class B shares, Class C shares, Class D shares, and Class R shares, service organizations can enter into agreements with the Distributor and receive a continuing fee for providing personal services and/or the maintenance of shareholder accounts of up to 0.25% on an annual basis of the average daily net assets of the Class B, Class C, Class D and Class R shares for which the organizations are responsible; and, for Class C, Class D and R shares, fees for providing other distribution assistance of up to 0.75% (0.25%, in the case of Class R shares) on an annual basis of such average daily net assets. Such fees are paid monthly by the Fund to the Distributor pursuant to the Plan. |

| | | |

| | With respect to Class B shares, a distribution fee of 0.75% on an annual basis of average daily net assets is payable monthly by the Fund to the Distributor; however, the Distributor has sold its rights to this fee with respect to a substantial portion of Class B shares to third parties (the “Purchasers”), which provide funding to the Distributor to enable it to pay commissions to dealers at the time of the sale of the related Class B shares. Distribution fees retained by the Distributor for the six months ended June 30, 2005, amounted to $29,982. |

Notes to Financial Statements

| | For the six months ended June 30, 2005, fees incurred under the Plan, equivalent to 1% per annum of the average daily net assets of Class B, Class C, Class D shares, and 0.50% per annum of average daily net assets of Class R shares amounted to $3,139,394, $859,369, $2,601,245, and $8,364, respectively. |

| | |

| | The Distributor is entitled to retain any CDSC imposed on certain redemptions of Class A, Class C, Class D and Class R shares. For the six months ended June 30, 2005, such charges amounted to $52,239. The Distributor has sold its rights to collect any CDSC imposed on redemptions of Class B shares to the Purchasers. |

| | |

| | Seligman Services, Inc., an affiliate of the Manager, is eligible to receive commissions from certain sales of shares of the Fund, as well as distribution and service fees pursuant to the Plan. For the six months ended June 30, 2005, Seligman Services, Inc. received commissions of $14,524, from the sales of shares of the Fund. Seligman Services, Inc. also received distribution and service fees of $308,670, pursuant to the Plan. |

| | |

| | Seligman Data Corp., which is owned by certain associated investment companies, charged the Fund at cost $5,737,833 for shareholder account services in accordance with a methodology approved by the Fund’s directors. Class I shares receive more limited shareholder services than the Fund’s other classes of shares (the “Retail Classes”). Seligman Data Corp. does not allocate to Class I the costs of any of its departments that do not provide services to the Class I shareholders. |

| | |

| | Costs of Seligman Data Corp. directly attributable to the Retail Classes of the Fund were charged to those classes in proportion to their respective net asset values. Costs directly attributable to Class I shares were charged to Class I. The remaining charges were allocated to the Retail Classes and Class I by Seligman Data Corp. pursuant to a formula based on their net assets, shareholder transaction volumes and number of shareholder accounts. The Fund and certain other associated investment companies (together, the “Guarantors”) have severally but not jointly guaranteed the performance and observance of all the terms and conditions of two leases entered into by Seligman Data Corp., including the payment of rent by Seligman Data Corp. (the “Guaranties”). The leases and the Guaranties expire in September 2008 and January 2009. The obligation of the Fund to pay any amount due under either Guaranty is limited to a specified percentage of the full amount, which generally is based on the Fund’s percentage of the expenses billed by Seligman Data Corp. to all Guarantors in the preceding calendar quarter. As of June 30, 2005, the Fund’s potential obligation under the Guaranties is $2,124,300. As of June 30, 2005, no event has occurred which would result in the Fund becoming liable to make any payment under a Guaranty. A portion of rent paid by Seligman Data Corp. is charged to the Fund as part of Seligman Data Corp.’s shareholder account services cost. |

| | |

| | Certain officers and directors of the Fund are officers or directors of the Manager, the Distributor, Seligman Services, Inc., and/or Seligman Data Corp. |

| | |

| | The Fund has a compensation arrangement under which directors who receive fees may elect to defer receiving such fees. Directors may elect to have their deferred fees accrue interest or earn a return based on the performance of the Fund or other funds in the Seligman Group of Investment Companies. The cost of such fees and earnings/loss accrued thereon is included in directors’ fees and expenses, and the accumulated balance thereof at June 30, 2005, of $74,905 is included in accrued expenses and other liabilities. Deferred fees and related accrued earnings are not deductible by the Fund for federal income tax purposes until such amounts are paid. |

| | |

4. | Committed Line of Credit — The Fund is a participant in a joint $400 million committed line of credit that is shared by substantially all funds in the Seligman Group of Investment Companies. The directors have currently limited the Fund’s borrowings to 10% of its net assets. Borrowings pursuant to the credit facility are subject to interest at a rate equal to the overnight federal funds rate plus 0.50%. The Fund incurs a commitment fee of 0.10% per annum on its share of the unused portion of the credit facility. The credit facility may be drawn upon only for temporary purposes and is subject to certain other customary |

Notes to Financial Statements

| | restrictions. The credit facility commitment expires in June 2006, but is renewable annually with the consent of the participating banks. For the six months ended June 30, 2005, the Fund did not borrow from the credit facility. |

| | |

5. | Purchases and Sales of Securities — Purchases and sales of portfolio securities, excluding options and short-term investments, for the six months ended June 30, 2005, amounted to $1,984,732,991 and $2,276,707,225, respectively. |

| | |

6. | Federal Tax Information — Certain components of income, expense and realized capital gain and loss are recognized at different times or have a different character for federal income tax purposes and for financial reporting purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share of the Fund. As a result of the differences described above, the treatment for financial reporting purposes of distributions made during the year from net investment income or net realized gains may differ from their treatment for federal income tax purposes. Further, the cost of investments also can differ for federal income tax purposes. |

| | |

| | The tax basis information presented below is based on operating results for the six months ended June 30, 2005 and will vary from the final tax information as of the Fund’s year-end. |

| | |

| | At June 30, 2005, the cost of investments for federal income tax purposes was $3,430,193,723. The tax basis cost was greater than the cost for financial reporting purposes primarily due to the tax deferral of losses on wash sales in the amount of $21,090,947. |

| | |

| | At June 30, 2005, the tax basis components of accumulated losses were as follows: |

| | Gross unrealized appreciation of portfolio securities* | | $ | 256,216,144 | |

| | Gross unrealized depreciation of portfolio securities* | | | (357,196,149 | ) |

| | Net unrealized depreciation of portfolio securities* | | | (100,980,005 | ) |

| | Capital loss carryforwards | | | (1,676,659,518 | ) |

| | Current period net realized gain | | | 74,121,710 | |

| | Total accumulated losses | | $ | (1,703,517,813 | ) |

| | * | Includes the effect of foreign currency translations. |

| | At December 31, 2004, the Fund had a capital loss carryforward for federal income tax purposes of $1,676,659,518, which is available for offset against future taxable net capital gains, with $527,537,995 expiring in 2009, $932,173,039 expiring in 2010 and $216,948,484 expiring in 2011. The amount was determined after adjustments for certain differences between financial reporting and tax purposes, such as wash sale losses. Accordingly, no capital gain distributions are expected to be paid to shareholders until net capital gains have been realized in excess of the available capital loss carryforward. |

| | |

7. | Forward Exchange Currency Contracts — At June 30, 2005, the Fund had outstanding forward exchange currency contracts to purchase foreign currencies as follows: |

| | Contract | | | Foreign Currency | | In Exchange for US$ | | Settlement Date | | Value US$ | | Unrealized Depreciation | |

| | Bought: | | | | | | | | | | | | |

| | Japanese yen | | | | | 882,817,603 | | | 7,966,949 | | | 7/1/05 | | | 7,959,766 | | $ | 7,183 | |

| | Japanese yen | | | | | 1,001,968,362 | | | 9,042,220 | | | 7/5/05 | | | 9,034,067 | | | 8,153 | |

| | Total | | | | | | | | | | | | | | | | $ | 15,336 | |

8. | Capital Share Transactions — The Fund has authorized 1,000,000,000 shares of $0.10 par value Capital Stock. Transactions in shares of Capital Stock were as follows: |

Notes to Financial Statements

| | | | Six Months Ended June 30, 2005 | | Year Ended December 31, 2004 | |

| | Class A | | Shares | | Amount | | Shares | | Amount | |

| | Net proceeds from sales of shares | | | | 3,100,727 | | $ | 74,550,352 | | | 7,069,180 | | $ | 165,708,385 | |

| | Exchanged from associated funds | | | | 281,920 | | | 6,803,497 | | | 793,244 | | | 18,798,117 | |

| | Converted from Class B* | | | | 1,689,615 | | | 40,759,263 | | | 2,592,454 | | | 59,949,752 | |

| | Total | | | | 5,072,262 | | | 122,113,112 | | | 10,454,878 | | | 244,456,254 | |

| | Cost of shares repurchased | | | | (12,306,373 | ) | | (295,605,401 | ) | | (21,138,115 | ) | | (492,964,053 | ) |

| | Exchanged into associated funds | | | | (679,698 | ) | | (16,329,991 | ) | | (1,128,393 | ) | | (26,184,379 | ) |

| | Total | | | | (12,986,071 | ) | | (311,935,392 | ) | | (22,266,508 | ) | | (519,148,432 | ) |

| | Decrease | | | | (7,913,809 | ) | $ | (189,822,280 | ) | | (11,811,630 | ) | $ | (274,692,178 | ) |

| | Class B | | | | Shares | | | Amount | | | Shares | | | Amount | |

| | Net proceeds from sales of shares | | | | 282,801 | | $ | 5,884,007 | | | 1,125,758 | | $ | 22,995,032 | |

| | Exchanged from associated funds | | | | 80,319 | | | 1,669,944 | | | 310,009 | | | 6,445,009 | |

| | Total | | | | 363,120 | | | 7,553,951 | | | 1,435,767 | | | 29,440,041 | |

| | Cost of shares repurchased | | | | (4,420,725 | ) | | (92,003,477 | ) | | (8,275,962 | ) | | (168,085,925 | ) |

| | Exchanged into associated funds | | | | (333,298 | ) | | (6,922,717 | ) | | (709,692 | ) | | (14,290,017 | ) |

| | Converted to Class A* | | | | (1,949,291 | ) | | (40,759,263 | ) | | (2,975,080 | ) | | (59,949,752 | ) |

| | Total | | | | (6,703,314 | ) | | (139,685,457 | ) | | (11,960,734 | ) | | (242,325,694 | ) |

| | Decrease | | | | (6,340,194 | ) | $ | (132,131,506 | ) | | (10,524,967 | ) | $ | (212,885,653 | ) |

| | Class C | | | | Shares | | | Amount | | | Shares | | | Amount | |

| | Net proceeds from sales of shares | | | | 315,035 | | $ | 6,574,699 | | | 1,140,017 | | $ | 23,489,731 | |

| | Exchanged from associated funds | | | | 12,492 | | | 261,211 | | | 124,954 | | | 2,549,881 | |

| | Total | | | | 327,527 | | | 6,835,910 | | | 1,264,971 | | | 26,039,612 | |

| | Cost of shares repurchased | | | | (1,371,172 | ) | | (28,552,536 | ) | | (2,228,445 | ) | | (45,159,650 | ) |

| | Exchanged into associated funds | | | | (87,822 | ) | | (1,813,229 | ) | | (177,216 | ) | | (3,574,720 | ) |

| | Total | | | | (1,458,994 | ) | | (30,365,765 | ) | | (2,405,661 | ) | | (48,734,370 | ) |

| | Decrease | | | | (1,131,467 | ) | $ | (23,529,855 | ) | | (1,140,690 | ) | $ | (22,694,758 | ) |

| | Class D | | | | Shares | | | Amount | | | Shares | | | Amount | |

| | Net proceeds from sales of shares | | | | 374,769 | | $ | 7,793,893 | | | 907,169 | | $ | 18,603,978 | |

| | Exchanged from associated funds | | | | 105,247 | | | 2,202,583 | | | 401,145 | | | 8,022,006 | |

| | Total | | | | 480,016 | | | 9,996,476 | | | 1,308,314 | | | 26,625,984 | |

| | Cost of shares repurchased | | | | (3,481,657 | ) | | (72,443,845 | ) | | (6,202,654 | ) | | (125,978,092 | ) |

| | Exchanged into associated funds | | | | (236,832 | ) | | (4,921,051 | ) | | (591,338 | ) | | (12,007,561 | ) |

| | Total | | | | (3,718,489 | ) | | (77,364,896 | ) | | (6,793,992 | ) | | (137,985,653 | ) |

| | Decrease | | | | (3,238,473 | ) | $ | (67,368,420 | ) | | (5,485,678 | ) | $ | (111,359,669 | ) |

| | Class I | | | | Shares | | | Amount | | | Shares | | | Amount | |

| | Net proceeds from sales of shares | | | | 56,438 | | $ | 1,368,451 | | | 155,629 | | $ | 3,645,198 | |

| | Cost of shares repurchased | | | | (100,521 | ) | | (2,492,858 | ) | | (100,772 | ) | | (2,413,248 | ) |

| | Increase (decrease) | | | | (44,083 | ) | $ | (1,124,407 | ) | | 54,857 | | $ | 1,231,950 | |

| | Class R | | | | Shares | | | Amount | | | Shares | | | Amount | |

| | Net proceeds from sales of shares | | | | 64,998 | | $ | 1,554,678 | | | 135,731 | | $ | 3,241,900 | |

| | Exchanged from associated funds | | | | 261 | | | 6,269 | | | 2,168 | | | 53,210 | |

| | Total | | | | 65,259 | | | 1,560,947 | | | 137,899 | | | 3,295,110 | |

| | Cost of shares repurchased | | | | (18,339 | ) | | (438,818 | ) | | (26,875 | ) | | (615,756 | ) |

| | Increase | | | | 46,920 | | $ | 1,122,129 | | | 111,024 | | $ | 2,679,354 | |

| | * Automatic conversion of Class B shares to Class A shares approximately eight years after the initial purchase date. |

____________

See Notes to Financial Statements.

Notes to Financial Statements

9. | Restricted Securities — At June 30, 2005, the Fund owned investments that were purchased through private offerings and cannot be sold without prior registration under the Securities Act of 1933 or pursuant to an exemption therefrom. In addition, the Fund has agreed to further restrictions on the disposition of its shares as set forth in various agreements entered into in connection with the purchase of these investments. These investments are valued at fair value as determined in accordance with procedures approved by the Board of Directors of the Fund. The acquisition dates of these investments, along with their cost and values at June 30, 2005, are as follows: |

| | Investments | | | Acquisition Date(s) | | Shares or Warrants | | | Cost | | Value | |

| | Venture Capital Investments: | | | | | | | | | | | |

| | Convertible Preferred Stocks and Warrants: | | | | | | | | | | | |

| | Bernard Technologies (Series D) | | | | 11/8/99 | | 363,636 | | shs. | | $ | 1,001,774 | | $ | — | |

| | Coventor (Series F) | | | | 5/25/01 | | 10,799 | | | | | 12,420 | | | 2,592 | |

| | ePolicy (Series B) | | | | 5/2/00 | | 562,114 | | | | | 2,000,002 | | | 140,528 | |

| | FlashPoint Technology (Series E) | | | | 9/10/99 | | 246,914 | | | | | 1,000,844 | | | — | |

| | Geographic Network Affiliates International (Series A) | | | | 12/29/99 | | 20,000 | | | | | 2,002,218 | | | — | |

| | Geographic Network Affiliates International (Series B) | | | | 12/5/01 | | 100,000 | | | | | — | | | — | |

| | Global Commerce Systems (Series A) | | | | 4/6/00 | | 952 | | | | | 16,360 | | | — | |

| | Global Commerce Systems (Series D) | | | | 4/6/00 | | 613,720 | | | | | 2,986,283 | | | — | |

| | GMP Companies (Series A) | | | | 9/15/99 | | 200,000 | | | | | 1,002,743 | | | 3,106,000 | |

| | GMP Companies (Series B) | | | | 4/3/00 | | 111,111 | | | | | 1,999,998 | | | 1,847,776 | |

| | GMP Companies (Series C) | | | | 6/3/02 | | 15,969 | | | | | 542,946 | | | 286,963 | |

| | GoSolutions (Series A) ($0.01 per warrant for 3.9434 shares of GoSolutions (Series A) Preferred Stock) | | | | 5/24/01 | | 118,302 | | wts. | | | 30,000 | | | 44,955 | |

| | iBiquity Digital (Series A) | | | | 1/19/00 | | 107,875 | | shs. | | | 1,001,189 | | | 454,154 | |

| | iBiquity Digital (Series C) | | | | 4/24/02 | | 128,532 | | | | | 394,594 | | | 394,593 | |

| | Index Stock Imagery (Series A) | | | | 3/20/00 to 4/16/04 | | 418,676 | | | | | 1,222,885 | | | 209,338 | |

| | LifeMasters Supported SelfCare (Series E) | | | | 1/31/00 | | 129,194 | | | | | 1,033,556 | | | 806,171 | |

| | LifeMasters Supported SelfCare (Series F) | | | | 11/12/02 | | 4,528 | | | | | 50,004 | | | 29,749 | |

| | NeoPlanet (Series B) | | | | 2/18/00 | | 425,412 | | | | | 2,000,001 | | | 7,649 | |

| | Nextest Systems (Series B) | | | | 11/27/01 | | 1,026,718 | | | | | 2,570,481 | | | 2,710,536 | |

| | NSI Software (Series B) | | | | 4/14/00 to 11/13/02 | | 253,333 | | | | | 2,144,314 | | | 493,999 | |

| | OurHouse (Series D) | | | | 2/11/00 | | 333,334 | | | | | 2,000,004 | | | — | |

| | Petroleum Place (Series C) | | | | 3/7/00 | | 16,915 | | | | | 1,000,015 | | | 298,888 | |

| | SensAble Technologies (Series C) | | | | 4/5/00 | | 301,205 | | | | | 1,000,001 | | | — | |

| | Techies.com (Series C) | | | | 1/27/00 | | 235,294 | | | | | 1,999,999 | | | — | |

| | Total Convertible Preferred Stocks and Warrants: | | | | | | | | | | | 29,012,631 | | | 10,833,891 | |

Notes to Financial Statements

Investments | | | Acquisition Date(s) | | Shares, Warrants or Principal Amount | | | Cost | | Value | |

Venture Capital Investments (continued) | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | |

| Access Data (Class A) | | | | 3/29/00 | | | 606,061 | | shs. | | $ | 1,000,001 | | $ | 175,758 | |

| Coventor | | | | 3/8/00 to 5/25/01 | | | 942,320 | | | | | 1,083,580 | | | 113,078 | |

| DecisionPoint Applications | | | | 4/20/00 | | | 38,461 | | | | | 1,000,629 | | | 26,153 | |

| Entegrity Solutions | | | | 2/16/00 to 4/25/02 | | | 18,802 | | | | | 1,011,147 | | | — | |

| etang.com | | | | 1/6/00 | | | 22,613 | | | | | — | | | 1,583 | |

| GoSolutions | | | | 4/3/00 to 3/19/01 | | | 174,694 | | | | | 2,087,394 | | | 33,192 | |

| Interactive Video Technologies | | | | 12/23/99 | | | 12,956 | | | | | 1,000,001 | | | — | |

| NSI Software | | | | 4/14/00 | | | 11,844 | | | | | 45,685 | | | 4,856 | |

| Qpass | | | | 5/02/00 to 5/11/01 | | | 38,279 | | | | | 2,160,000 | | | 19,905 | |

| SensAble Technologies | | | | 10/1/04 | | | 1,581,292 | | | | | — | | | — | |

| Workstream | | | | 3/23/00 | | | 9,364 | | | | | 2,001,249 | | | 14,474 | |

| Total Common Stocks | | | | | | | | | | | | 11,389,686 | | | 388,999 | |

| | | | | | | | | | | | | | | | | |

Convertible Promissory Notes and Warrants: | | | | | | | | | | | | | | | | |

Geographic Network Affiliates International: 9%, payable on demand | | | | 12/5/01 to 3/12/02 | | $ | 352,000 | | | | | 320,173 | | | 11,200 | |

| Geographic Network Affiliates International: | | | | | | | | | | | | | | | | |

| $10 exercise price expiring 12/5/08 | | | | 12/5/01 | | | 8,000 | | wts. | | | — | | | — | |

| $10 exercise price expiring 1/11/09 | | | | 1/11/02 | | | 8,000 | | | | | — | | | — | |

| $10 exercise price expiring 2/4/09 | | | | 2/4/02 | | | 8,000 | | | | | — | | | — | |

| $10 exercise price expiring 3/12/09 | | | | 3/12/02 | | | 8,000 | | | | | — | | | — | |

| Techies.com 9%, payable on demand | | | | 6/7/00 | | $ | 488,592 | | | | | 244,296 | | | — | |

| SensAble Technologies 8% 12/30/05 | | | | 12/30/03 | | | 31,380 | | | | | 31,380 | | | 85,981 | |

SensAble Technologies Series D ($0.01 exercise price for Series D Preferred Stock, expiring 12/30/08) | | | | 12/23/03 | | | 15,690 | | wts. | | | — | | | — | |

| Total Convertible Promissory Notes and Warrants | | | | | | | | | | | | 595,849 | | | 97,181 | |

| Total Venture Capital Investments | | | | | | | | | | | $ | 40,998,166 | | $ | 11,320,071 | |

10. | Affiliated Issuers — As defined under the Investment Company Act of 1940, as amended, affiliated issuers are those issuers in which the Fund’s holdings of an issuer represent 5% or more of the outstanding voting securities of the issuer. A summary of the Fund’s transactions in the securities of these issuers during the six months ended June 30, 2005, is as follows: |

Notes to Financial Statements

| | Affiliate | | Beginning Shares | | Gross Purchases and Additions | | Gross Sales and Reductions | | Ending Shares | | Realized Gain (Loss) | | Ending Value | |

| | BMC Software | | | 11,000,000 | | | — | | | — | | | 11,000,000 | | $ | — | | $ | 197,450,000 | |

| | Digital River | | | 1,000,000 | | | 1,125,000 | | | — | | | 2,125,000 | | | — | | | 67,479,375 | |

| | | | | 2,000,000 | | | 600,000 | | | 2,600,000 | | | — | | | (32,301,413 | ) | | — | |

| | Mattson Technology | | | 1,500,000 | | | 250,000 | | | — | | | 1,750,000 | | | — | | | 12,477,500 | |

| | MEMC Electronic Materials | | | 16,500,000 | | | — | | | 500,000 | | | 16,000,000 | | | 3,256,188 | | | 252,320,000 | |

| | | | | 195,100 | | | 1,229,900 | | | — | | | 1,425,000 | | | — | | | 12,696,750 | |

| | NETGEAR | | | 2,000,000 | | | 350,000 | | | 2,350,000 | | | — | | | 1,949,847 | | | — | |

| | Orbotech | | | 2,350,000 | | | — | | | — | | | 2,350,000 | | | — | | | 50,830,500 | |

| | Photon Dynamics | | | 1,500,000 | | | — | | | 1,500,000 | | | — | | | (14,439,448 | ) | | — | |

| | Synopsys | | | 7,500,000 | | | 1,500,000 | | | — | | | 9,000,000 | | | — | | | 149,625,000 | |

| | Take-Two Interactive Software | | | 4,400,000 | | | 2,178,700 | | | 3,578,700 | | | 3,000,000 | | | 19,766,915 | | | 76,365,000 | |

| | Total | | | | | | | | | | | | | | $ | (21,767,911 | ) | $ | 819,244,125 | |

| | There was no dividend income earned from these investments for the six months ended June 30, 2005. |

| | |

11. | Other Matters — The Manager conducted an extensive internal review in response to developments regarding disruptive or illegal trading practices within the mutual fund industry. As of September 2003, the Manager had one arrangement that permitted frequent trading in the Seligman registered investment companies (“Seligman Funds”). This arrangement was in the process of being closed down by the Manager before the first proceedings relating to trading practices within the mutual fund industry were publicly announced. Based on a review of the Manager’s records for 2001 through 2003, the Manager identified three other arrangements that had permitted frequent trading in the Seligman Funds. All three had already been terminated prior to the end of September 2002. The Securities and Exchange Commission (the “SEC”) and the Attorney General of the State of New York also are reviewing these matters. |

| | |

| | The Manager also reviewed its practice of placing some of the Seligman Funds’ orders to buy and sell portfolio securities with brokerage firms in recognition of their sales of Seligman Funds. At the time such orders were placed, this practice was permissible when done properly; however, the Manager believes that it may have violated applicable requirements for certain of such orders as a result of compensation arrangements the Manager had with certain brokerage firms. The Manager discontinued this practice entirely in October 2003. The Manager is confident that the execution of all such orders was consistent with its best execution obligations and that the Seligman Funds did not pay higher brokerage commissions than they would otherwise have paid for comparable transactions. The Manager also responded fully to information requests from the SEC and the NASD relating to the Manager’s use of revenue sharing and fund portfolio brokerage commissions and will continue to provide additional information if, and as, requested. |

Notes to Financial Statements

| | The results of the Manager’s internal reviews were presented to the Independent Directors of the Seligman Funds. In order to resolve matters with the Independent Directors relating to the four arrangements that permitted frequent trading, in May 2004, the Manager made payments to three funds and agreed to waive a portion of its management fee with respect to Seligman Communications and Information Fund equal to 0.05% per annum of the Fund’s average daily net assets for a two-year period beginning June 1, 2004. In order to resolve matters with the Independent Directors with regard to portfolio brokerage commissions, in May 2004, the Manager made payments to each of twenty-four funds in an amount equal to the commissions paid by each such fund during the period from 1998 through 2003 to certain brokerage firms in recognition of sales of fund shares, including $630,399 paid to Seligman Communications and Information Fund, which has been reported as Payments received from the Manager in the Statement of Changes in Net Assets for the year ended December 31, 2004. |

Financial Highlights

The tables below are intended to help you understand each Class’s financial performance for the periods presented. Certain information reflects financial results for a single share of a Class that was held throughout the periods shown. Per share amounts are calculated using average shares outstanding. “Total Return” shows the rate that you would have earned (or lost) on an investment in each Class, assuming you reinvested all your capital gain distributions. Total returns do not reflect any sales charges or taxes and are not annualized for periods of less than one year.

CLASS A | | | | | | | | | | | | | |

| | | Six Months Ended 6/30/05 | | | |

| | | Year Ended December 31, | |

| | | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| | | | | | | | | | | | | | |

Per Share Data: | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | $ | 25.42 | | $ | 22.99 | | $ | 16.16 | | $ | 25.56 | | $ | 25.30 | | $ | 47.25 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.15 | ) | | (0.15 | ) | | (0.25 | ) | | (0.27 | ) | | (0.28 | ) | | (0.44 | ) |

Net realized and unrealized gain (loss) on investments | | | (0.83 | ) | | 2.58 | | | 7.08 | | | (9.13 | ) | | 1.10 | | | (15.82 | ) |

Total from Investment Operations | | | (0.98 | ) | | 2.43 | | | 6.83 | | | (9.40 | ) | | 0.82 | | | (16.26 | ) |

Less Distributions: | | | | | | | | | | | | | | | | | | | |

Distributions from net realized capital gain | | | — | | | — | | | — | | | — | | | (0.56 | ) | | (5.69 | ) |

Net Asset Value, End of Period | | $ | 24.44 | | $ | 25.42 | | $ | 22.99 | | $ | 16.16 | | $ | 25.56 | | $ | 25.30 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return | | | (3.86 | )% | | 10.57 | %# | | 42.26 | % | | (36.78 | )% | | 3.58 | % | | (37.50 | )% |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | $ | 2,086,802 | | $ | 2,371,647 | | $ | 2,416,538 | | $ | 1,875,512 | | $ | 3,582,757 | | $ | 3,817,360 | |

Ratio of expenses to average net assets | | | 1.54 | %† | | 1.51 | % | | 1.57 | % | | 1.59 | % | | 1.44 | % | | 1.31 | % |

Ratio of net investment loss to average net assets | | | (1.24 | )%† | | (0.66 | )% | | (1.33 | )% | | (1.39 | )% | | (1.11 | )% | | (1.01 | )% |

| Portfolio turnover rate | | | 57.73 | % | | 127.49 | % | | 105.97 | % | | 89.61 | % | | 122.83 | % | | 106.93 | % |

Without expense reimbursement:** | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 1.59 | %† | | 1.54 | % | | | | | | | | | | | | |

Ratio of net investment loss to average net assets | | | (1.29 | )%† | | (0.69 | )% | | | | | | | | | | | | |

____________

See footnotes on page 30.

Financial Highlights

CLASS B | | | | | | | | | | | | | |

| | | Six Months Ended 6/30/05 | | | |

| | | Year Ended December 31, | |

| | | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| | | | | | | | | | | | | | |

Per Share Data: | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | $ | 22.08 | | $ | 20.12 | | $ | 14.25 | | $ | 22.71 | | $ | 22.72 | | $ | 43.41 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.21 | ) | | (0.29 | ) | | (0.35 | ) | | (0.37 | ) | | (0.43 | ) | | (0.70 | ) |

| Net realized and unrealized gain (loss) on investments | | | (0.72 | ) | | 2.25 | | | 6.22 | | | (8.09 | ) | | 0.98 | | | (14.30 | ) |

Total from Investment Operations | | | (0.93 | ) | | 1.96 | | | 5.87 | | | (8.46 | ) | | 0.55 | | | (15.00 | ) |

Less Distributions: | | | | | | | | | | | | | | | | | | | |

Distributions from net realized capital gain | | | — | | | — | | | — | | | — | | | (0.56 | ) | | (5.69 | ) |

Net Asset Value, End of Period | | $ | 21.15 | | $ | 22.08 | | $ | 20.12 | | $ | 14.25 | | $ | 22.71 | | $ | 22.72 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return | | | (4.21 | )% | | 9.74 | %# | | 41.19 | % | | (37.25 | )% | | 2.79 | % | | (37.93 | )% |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s omitted) | | $ | 576,232 | | $ | 741,563 | | $ | 887,662 | | $ | 719,591 | | $ | 1,414,602 | | $ | 1,515,992 | |

| Ratio of expenses to average net assets | | | 2.29 | %† | | 2.26 | % | | 2.32 | % | | 2.34 | % | | 2.19 | % | | 2.06 | % |

| Ratio of net investment loss to average net assets | | | (1.99 | )%† | | (1.41 | )% | | (2.08 | )% | | (2.14 | )% | | (1.86 | )% | | (1.76 | )% |

| Portfolio turnover rate | | | 57.73 | % | | 127.49 | % | | 105.97 | % | | 89.61 | % | | 122.83 | % | | 106.93 | % |

| Without expense reimbursement:** | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 2.34 | %† | | 2.29 | % | | | | | | | | | | | | |

| Ratio of net investment loss to average net assets | | | (2.04 | )%† | | (1.44 | )% | | | | | | | | | | | | |

____________

See footnotes on page 30.

Financial Highlights

CLASS C | | | | | | | | | | | | | |

| | | Six Months Ended 6/30/05 | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 |

| | | | | | | | | | | | | | | | | | | | |

Per Share Data: | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | $ | 22.08 | | $ | 20.12 | | $ | 14.25 | | $ | 22.70 | | $ | 22.71 | | $ | 43.39 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.21 | ) | | (0.29 | ) | | (0.35 | ) | | (0.37 | ) | | (0.43 | ) | | (0.70 | ) |

| Net realized and unrealized gain (loss) on investments | | | (0.72 | ) | | 2.25 | | | 6.22 | | | (8.08 | ) | | 0.98 | | | (14.29 | ) |

Total from Investment Operations | | | (0.93 | ) | | 1.96 | | | 5.87 | | | (8.45 | ) | | 0.55 | | | (14.99 | ) |

Less Distributions: | | | | | | | | | | | | | | | | | | | |

Distributions from net realized capital gain | | | — | | | — | | | — | | | — | | | (0.56 | ) | | (5.69 | ) |

Net Asset Value, End of Period | | $ | 21.15 | | $ | 22.08 | | $ | 20.12 | | $ | 14.25 | | $ | 22.70 | | $ | 22.71 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return | | | (4.21 | )% | | 9.74 | %# | | 41.19 | % | | (37.22 | )% | | 2.79 | % | | (37.92 | )% |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s omitted) | | $ | 164,872 | | $ | 197,103 | | $ | 202,568 | | $ | 154,859 | | $ | 279,024 | | $ | 235,243 | |

| Ratio of expenses to average net assets | | | 2.29 | %† | | 2.26 | % | | 2.32 | % | | 2.34 | % | | 2.19 | % | | 2.06 | % |

| Ratio of net investment loss to average net assets | | | (1.99 | )%† | | (1.41 | )% | | (2.08 | )% | | (2.14 | )% | | (1.86 | )% | | (1.76 | )% |

| Portfolio turnover rate | | | 57.73 | % | | 127.49 | % | | 105.97 | % | | 89.61 | % | | 122.83 | % | | 106.93 | % |

| Without expense reimbursement:** | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 2.34 | %† | | 2.29 | % | | | | | | | | | | | | |

| Ratio of net investment loss to average net assets | | | (2.04 | )%† | | (1.44 | )% | | | | | | | | | | | | |

____________

See footnotes on page 30.

Financial Highlights