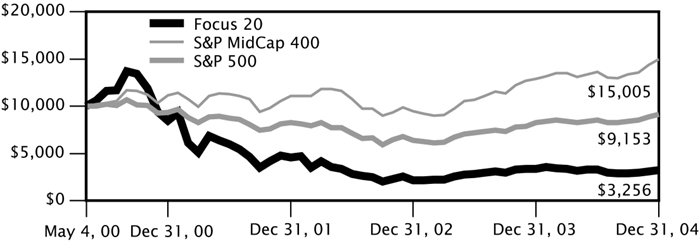

The Focus 20 Portfolio returned -2.99% for the twelve months ended December 31, 2004. This compares to 10.88% for the benchmark S&P 500 Index and 16.48% for the benchmark S&P MidCap 400 Index. (1)

The Portfolio underperformed in 2004 due to its lack of exposure to the Energy, Materials and Industrial sectors. These sectors benefited from the sharp rise in commodity prices that typically occurs in the early stages of an economic recovery. Oak does not manage the portfolio in relationship to a benchmark and, therefore, did not have exposure to these groups. Oak has avoided these sectors as we believe their performance is tied to the short-term rein-flation of commodities — something which is inconsistent with our 3-5 year investment time horizon.

Performance difference was also exacerbated by Oak’s overweight in technology compared to the benchmark. Within Technology, semiconductor stocks in particular weighed on performance as companies such as PMC-Sierra, Intersil and Xilinx suffered from inventory concerns following a robust 2003. Storage software vendor Veritas Software also hampered performance after the company reported weak second quarter sales. This announcement was not well received following recent management turnover in the company and concerns over their credibility. Veritas was ultimately sold from the Portfolio.

Additionally, despite being underweight in Health Care compared to the benchmark, weakness in Cardinal Health caused Oak’s Health Care weighting to underperform the benchmark. This drug distribution company has struggled not only with meeting earnings forecasts, but also with the transition to a fee-for-service business model. Pfizer also suffered after the FDA's concerns over the Cox-2 class of drugs dragged down the large-cap pharmaceutical companies.

On a positive note, online auctioneer eBay helped offset the weaknesses in Tech and Health Care by propelling the consumer discretionary sector performance significantly higher than the benchmark.

The holdings which most enhanced the return of the Portfolio included eBay, Inc., Juniper Networks, Inc., Electronic Arts, Inc., EMC Corp. and Dell, Inc.

The holdings which had the greatest negative impact on Portfolio performance included PMC-Sierra, Inc., Veritas Software Co., Intersil Corp., Xilinx, Inc. and Cardinal Health, Inc.

All of the names that detracted from performance were sold. They were not sold for the sole reason of poor performance but for better relative opportunities in some of the new names that we added to the portfolio.

We are optimistic about the economy and the stock market in 2005. For the first three quarters of 2004, the US equity markets suffered from concerns over the political elections, interest rate increases, possible inflation and their resulting impact on the economy. In 2005, investors will refocus on the potential for solid earnings growth, the end to the Federal Reserve’s interest rate tightening cycle and eventual reacceleration of earnings that might occur in 2006.

For the market as a whole, stocks appear rather attractive, particularly with long-term interest rates at low levels. With the ten-year Treasury yielding around 4.25%, there is certainly room for upside in stock multiples, which are currently trading at less than 17 times 2005 expected earnings per share. We believe growth stocks are especially attractive and should do well. The growth style of investing has underperformed a value discipline for five consecutive years. This type of trend eventually must reverse, and we would argue that the longer it takes to reverse, the more powerful the reversal will be when it occurs.

We expect the Fed to continue tightening interest rates but don’t necessarily see this leading to higher long-term rates. As a result, the yield curve may flatten. Normalizing the interest-rate environment ensures the Federal Reserve will maintain its ability to tweak the economy as needed.

Merger and acquisition activity, which has already picked up, should continue to be strong with corporate cash at high levels. This strong cash position could also lead to a jump in capital spending. Both of which benefit our financial holdings and technology stocks.

In our opinion, Technology remains the most attractive sector, given the long-term growth prospects of many of its sub-sectors. Technology is a broad area, and we continue to look for new areas of growth within the sector. In a very competitive global economy, businesses must seek to remain productive or risk succumbing to their competition. Technology companies remain key suppliers of productivity enhancing or cost-saving equipment that helps other companies achieve earnings growth in the tough global marketplace.

From our perspective, we think things look pretty good for 2005 and believe that the market could surprise some people.

Oak Associates, ltd.

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | | December 31, 2004 |

| Focus 20 Portfolio | | |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

Semiconductor & Semiconductor Equipment (11.8%) | |

| 3,500 | | Applied Materials, Inc. (a) | $ 59,850 |

| 1,600 | | Linear Technology Corp. | 62,016 |

| 1,500 | | Maxim Integrated Products, Inc. | 63,585 |

| | | | 185,451 |

| | | |

Software (13.3%) | | |

| 1,300 | | Electronic Arts, Inc. (a) | 80,184 |

| 2,300 | | Microsoft Corp. | 61,433 |

| 2,600 | | Symantec Corp. (a) | 66,976 |

| | | | 208,593 |

| | | Total common stocks (cost $1,398,771) | 1,494,580 |

| | | |

SHORT TERM INVESTMENTS (5.0%) | | |

| $ 70,000 | | AIM Liquid Asset Portfolio. | 70,000 |

| 8,000 | | Nations Treasury Reserve. | 8,000 |

| | | Total short term investments (cost $78,000) | 78,000 |

| | | | |

| | | Total investments (cost $1,476,771) (100.4%) | 1,572,580 |

| | | Liabilities in excess of other assets (0.4%) | (6,722) |

| | | Total net assets (100.0%) | $1,565,858 |

| | | | |

| | | | |

| (a) | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

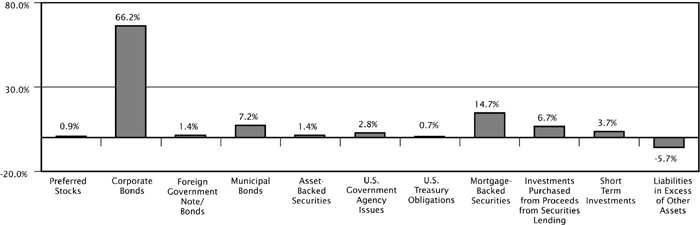

| Portfolio Manager’s Review (unaudited) | | December 31, 2004 |

Equity Portfolio

How did the Portfolio perform relative to its benchmark?

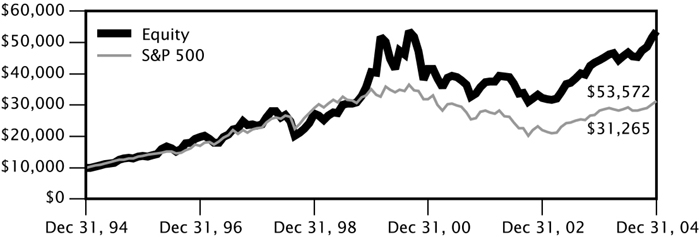

The Equity Portfolio posted a return of 20.94% for the one year ending December 31, 2004. The benchmark S&P 500 Index returned 10.88% over the same period.(1)

What caused the variance in performance between the Portfolio and its benchmark?

After the benchmark’s 2003 28% total return, we consider 2004 to be a return to normalcy in terms of economic growth, earnings, and market performance. However, there were several emotional factors that made 2004 a tough year: re-emergence of the twin deficit story, weakening U.S. dollar, $55 crude oil (at peak), persistently depressing news from Iraq, and a contentious election. Throughout the year, we saw a pick-up in Mergers & Acquisitions and Initial Public Offering activity, as the global volume of announced mergers totaled $1.95 trillion, up 41% from 2003. Some 238 companies went public in 2004, up 180% from 2003, and $43.5 billion was raised. And last, low volatility was a theme that played throughout the year, as most indices traded in a tight range throughout the year. Of the three broad factors in our model (Value, Quality, Earnings Expectations), the Value factors, which include statistics such as price/earnings, price/book, price/cash flow, have provided the greatest amount of alpha this year. Earnings Expectation (Momentum) factors strengthened in the second half of the year.

Which portfolio holdings enhanced the Portfolio’s performance?

In terms of performance during the year, stock selection in Industrial, Technology, and Utility sectors were the largest contributors relative to the benchmark. The largest contributors relative to the benchmark were over-weight positions (relative to benchmark weight) in TXU Corp., Cree, Inc., and Adobe Systems, Inc.

Which holdings detracted from performance?

Within the Portfolio, stock selection in the Financial, Telecom, and Materials sectors detracted the most in 2004 relative to the benchmark. The largest detractors relative to the benchmark were an underweight position (relative to the benchmark weight) in Apple Computer, Inc., and overweight positions in Foundry Networks, Inc., and Cypress Semiconductor Corp.

What is your outlook for the next fiscal year?

For 2005, we believe that low volatility, and moderate economic and profit growth will be positive for the stock market. These elements lay the foundation for a rational market. In such an environment, investors tend to focus on long term fundamentals which bode well for our disciplined philosophy and process. Overall, our philosophy will not change based on short-term trends or conditions in the market. Our goal is to add value through security selection, while attempting to neutralize other risk factors, such as market timing and sector rotation, for which there is not adequate compensation by the market.

Chicago Equity Partners, LLC

40|86 Series Trust | |

| Portfolio Manager’s Review (unaudited) | | December 31, 2004 |

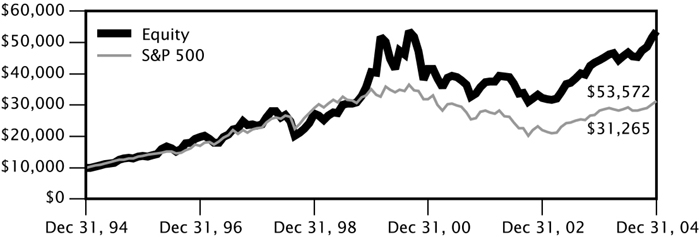

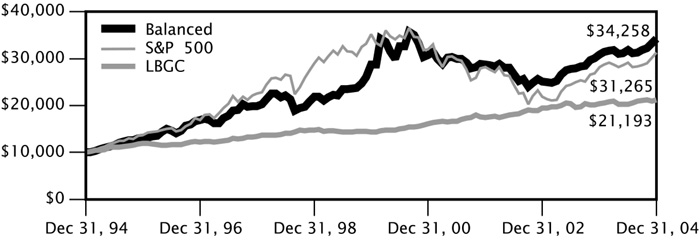

GROWTH OF $10,000

The growth of $10,000 chart is a comparison of the change in value of a $10,000 investment with dividends and capital gains reinvested for the 10-year period ended 12/31/04. Past performance is no guarantee of future results.

AVERAGE ANNUAL TOTAL RETURN(1) (as of 12/31/04)

| | | | 1 YEAR | | 5 YEARS | | 10 YEARS |

| Equity Portfolio | | | 20.94 | % | | 5.76 | % | | 18.28 | % |

| S&P 500 Index | | | 10.88 | % | | -2.29 | % | | 12.07 | % |

| (1) | Past performance does not guarantee future results. Your investment return and principal will fluctuate, and your shares may be worth more or less than their original cost. Total return is provided in accordance with SEC guidelines for comparative purposes and reflects certain contractual expense reimbursements through April 30, 2005. If the expense reimbursements were not in place, the portfolio's return would have been lower. The total returns shown do not include separate account expenses or the deduction of taxes that a contractholder would pay on portfolio distributions or the redemption of portfolio shares. The S&P 500 Index is an unmanaged index considered to be representative of the U.S. stock market in general. Investors cannot actually invest in an index. |

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Equity Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | | |

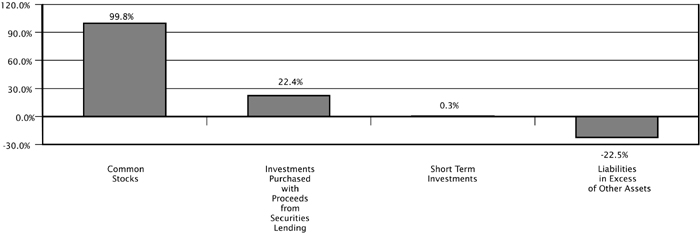

COMMON STOCKS (99.8%) | |

| | | |

Aerospace & Defense (0.7%) | |

| 28,400 | | Rockwell Collins, Inc. | $ 1,120,096 |

| | | |

Air Freight & Logistics (0.8%) | | |

| 29,800 | | Ryder System, Inc. | 1,423,546 |

| | | |

Auto Components (1.4%) | | |

| 22,900 | | Autoliv, Inc. | 1,106,070 |

| 21,700 | | BorgWarner, Inc. (b) | 1,175,489 |

| | | | 2,281,559 |

Beverages (0.7%) | | |

| 14,800 | | Constellation Brands, Inc. — Class A (a)(b) | 688,348 |

| 23,700 | | PepsiAmericas, Inc. | 503,388 |

| | | | 1,191,736 |

Biotechnology (1.9%) | | |

| 19,000 | | Charles River Laboratories International, Inc. (a)(b) | 874,190 |

| 19,500 | | Genzyme Corp. (a)(b) | 1,132,365 |

| 16,900 | | Invitrogen Corp. (a)(b) | 1,134,497 |

| | | | 3,141,052 |

Capital Markets (2.2%) | | |

| 40,000 | | SEI Investments Co. | 1,677,200 |

| 20,200 | | The Bear Stearns Companies Inc. (b) | 2,066,662 |

| | | | 3,743,862 |

Chemicals (2.9%) | | |

| 27,800 | | Ecolab, Inc. (b) | 976,614 |

| 23,700 | | PPG Industries, Inc. | 1,615,392 |

| 27,800 | | Praxair, Inc. | 1,227,370 |

| 19,000 | | Sigma-Aldrich Corp. (b) | 1,148,740 |

| | | | 4,968,116 |

Commercial Banks (5.7%) | | |

| 53,800 | | Associated Banc-Corp | 1,786,698 |

| 28,400 | | Comerica, Inc. (b) | 1,732,968 |

| 27,100 | | Hibernia Corp. | 799,721 |

| 32,600 | | Huntington Bancshares, Inc. (b) | 807,828 |

| 35,200 | | Marshall & Ilsley Corp. (b) | 1,555,840 |

| 44,600 | | Regions Financial Corp. | 1,587,314 |

| 21,700 | | UnionBanCal Corp. | 1,399,216 |

| | | | 9,669,585 |

Commercial Services & Supplies (2.0%) | | |

| 23,800 | | Copart, Inc. (a) | 626,416 |

| 12,900 | | Dun & Bradstreet Corp. (a) | 769,485 |

| 28,400 | | Republic Services, Inc. | 952,536 |

| 30,200 | | RR Donnelley & SonsCo. (b) | 1,065,758 |

| | | 3,414,195 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Equity Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | | |

Communications Equipment (1.9%) | |

| 25,100 | | Harris Corp. | $ 1,550,929 |

| 44,700 | | Polycom, Inc. (a) | 1,042,404 |

| 19,400 | | Scientific-Atlanta, Inc. (b) | 640,394 |

| | | | 3,233,727 |

Computers & Peripherals (3.0%) | | |

| 12,200 | | Lexmark International, Inc. (a) | 1,037,000 |

| 25,100 | | NCR Corp. (a) | 1,737,673 |

| 18,900 | | QLogic Corp. (a) | 694,197 |

| 36,600 | | Storage Technology Corp. (a) | 1,156,926 |

| 48,300 | | Western Digital Corp. (a) | 523,572 |

| | | | 5,149,368 |

Consumer Finance (0.8%) | | |

| 57,700 | | AmeriCredit Corp. (a)(b) | 1,410,765 |

| | | |

Containers & Packaging (0.4%) | | |

| 23,000 | | Bemis Co. | 669,070 |

| | | |

Diversified Financial Services (2.2%) | | |

| 52,800 | | CIT Group, Inc. | 2,419,296 |

| 14,800 | | Moody's Corp. | 1,285,380 |

| | | | 3,704,676 |

Diversified Telecommunication Services (0.7%) | | |

| 22,400 | | Commonwealth Telephone Enterprises, Inc. (a) | 1,112,384 |

| | | |

Electric Utilities (4.4%) | | |

| 108,000 | | PG&E Corp. (a)(b) | 3,594,240 |

| 60,300 | | TXU Corp. (b) | 3,892,968 |

| | | | 7,487,208 |

Electronic Equipment & Instruments (1.1%) | | |

| 29,100 | | Avnet, Inc. (a)(b) | 530,784 |

| 34,900 | | Ingram Micro, Inc. (a) | 725,920 |

| 41,300 | | Vishay Intertechnology, Inc. (a) | 620,326 |

| | | | 1,877,030 |

Energy Equipment & Services (1.6%) | | |

| 31,800 | | Baker Hughes, Inc. | 1,356,906 |

| 48,900 | | Varco International, Inc. (a) | 1,425,435 |

| | | | 2,782,341 |

Food & Staples Retailing (1.3%) | | |

| 27,800 | | Albertson's, Inc. (b) | 663,864 |

| 43,300 | | Supervalu, Inc. (b) | 1,494,716 |

| | | | 2,158,580 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Equity Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | | |

Food Products (1.5%) | |

| 16,300 | | Hershey Foods Corp. | $ 905,302 |

| 88,700 | | Tyson Foods, Inc. (b) | 1,632,080 |

| | | | 2,537,382 |

Health Care Equipment & Supplies (2.9%) | | |

| 10,800 | | Bausch & Lomb, Inc. (b) | 696,168 |

| 19,600 | | Becton, Dickinson & Co. | 1,113,280 |

| 16,300 | | C.R. Bard, Inc. | 1,042,874 |

| 33,900 | | Cytyc Corp. (a) | 934,623 |

| 34,700 | | Thermo Electron Corp. (a) | 1,047,593 |

| | | | 4,834,538 |

Health Care Providers & Services (4.8%) | | |

| 21,700 | | Aetna, Inc. | 2,707,075 |

| 12,100 | | AmerisourceBergen Corp. (b) | 710,028 |

| 35,900 | | Apria Healthcare Group, Inc. (a)(b) | 1,182,905 |

| 30,800 | | Coventry Health Care, Inc. (a) | 1,634,864 |

| 23,700 | | Laboratory Corp Of America Holdings (a) | 1,180,734 |

| 20,350 | | Renal Care Group, Inc. (a) | 732,397 |

| | | | 8,148,003 |

Hotels Restaurants & Leisure (2.6%) | | |

| 43,000 | | Caesars Entertainment, Inc. (a)(b) | 866,020 |

| 58,200 | | Darden Restaurants, Inc. | 1,614,468 |

| 33,700 | | GTECH Holdings Corp. | 874,515 |

| 21,300 | | Yum! Brands, Inc. | 1,004,934 |

| | | | 4,359,937 |

Household Durables (3.6%) | | |

| 14,900 | | Fortune Brands, Inc. | 1,149,982 |

| 4,600 | | NVR, Inc. (a)(b) | 3,539,240 |

| 14,900 | | The Black & Decker Corp. (b) | 1,316,117 |

| | | | 6,005,339 |

Household Products (0.6%) | | |

| 17,600 | | Clorox Co. | 1,037,168 |

| | | |

Insurance (4.3%) | | |

| 33,100 | | Allmerica Financial Corp. (a) | 1,086,673 |

| 43,300 | | American Financial Group Inc. | 1,355,723 |

| 32,500 | | Genworth Financial, Inc. | 877,500 |

| 18,300 | | Lincoln National Corp. | 854,244 |

| 31,100 | | Protective Life Corp. | 1,327,659 |

| 32,500 | | Safeco Corp. (b) | 1,697,800 |

| | | | 7,199,599 |

IT Services (1.7%) | | |

| 14,200 | | Affiliated Computer Services, Inc. (a)(b) | 854,698 |

| 35,200 | | Computer Sciences Corp. (a)(b) | 1,984,224 |

| | | | 2,838,922 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Equity Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | | |

Leisure Equipment & Products (1.9%) | |

| 35,900 | | Eastman Kodak Co. (b) | $ 1,157,775 |

| 29,800 | | Polaris Industries, Inc. (b) | 2,026,996 |

| | | | 3,184,771 |

Machinery (2.3%) | | |

| 20,900 | | Cummins, Inc. (b) | 1,751,211 |

| 25,675 | | Paccar, Inc. | 2,066,324 |

| | | | 3,817,535 |

Media (2.2%) | | |

| 44,400 | | Harte-Hanks, Inc. (b) | 1,153,512 |

| 13,500 | | McClatchy Co. | 969,435 |

| 44,900 | | Valassis Communications, Inc. (a) | 1,571,949 |

| | | | 3,694,896 |

Metals & Mining (2.2%) | | |

| 51,400 | | Nucor Corp. (b) | 2,690,276 |

| 10,800 | | Phelps Dodge Corp. (b) | 1,068,336 |

| | | | 3,758,612 |

Multiline Retail (2.5%) | | |

| 35,900 | | Federated Department Stores | 2,074,661 |

| 36,100 | | J.C. Penney Co. Inc. Holding Co. | 1,494,540 |

| 11,500 | | Sears Roebuck and Co. | 586,845 |

| | | | 4,156,046 |

Multi-Utilities & Unregulated Power (3.8%) | | |

| 104,700 | | Oneok, Inc. | 2,975,574 |

| 37,900 | | Questar Corp. | 1,931,384 |

| 114,400 | | Reliant Energy, Inc. (a)(b) | 1,561,560 |

| | | | 6,468,518 |

Oil & Gas (3.2%) | | |

| 10,800 | | Amerada Hess Corp. (b) | 889,704 |

| 18,300 | | Newfield Exploration Co. (a) | 1,080,615 |

| 27,800 | | Pogo Producing Co. | 1,348,022 |

| 47,600 | | Valero Energy Corp. | 2,161,040 |

| | | | 5,479,381 |

Paper & Forest Products (0.5%) | | |

| 23,800 | | MeadWestvaco Corp. | 806,582 |

| | | |

Pharmaceuticals (1.1%) | | |

| 37,600 | | Eon Labs, Inc. (a) | 1,015,200 |

| 45,400 | | Perrigo Co. | 784,058 |

| | | | 1,799,258 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Equity Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | | |

Real Estate (5.9%) | |

| 23,000 | | AvalonBay Communities, Inc. | $ 1,731,900 |

| 20,200 | | CBL & Associates Properties, Inc. | 1,542,270 |

| 49,700 | | General Growth Properties, Inc. | 1,797,152 |

| 144,000 | | HRPT Properties Trust | 1,847,520 |

| 27,100 | | LNR Property Corp. (b) | 1,704,861 |

| 27,800 | | Mack-Cali Realty Corp. | 1,279,634 |

| | | | 9,903,337 |

Road & Rail (1.5%) | | |

| 34,500 | | Burlington Northern Santa Fe Corp. | 1,632,195 |

| 19,000 | | JB Hunt Transport Services, Inc. | 852,150 |

| | | | 2,484,345 |

Semiconductor & Semiconductor Equipment (3.0%) | | |

| 69,100 | | Cree, Inc. (a)(b) | 2,769,528 |

| 100,500 | | MEMC Electronic Materials, Inc. (a) | 1,331,625 |

| 52,100 | | National Semiconductor Corp. (b) | 935,195 |

| | | | 5,036,348 |

Software (3.3%) | | |

| 33,200 | | Activision, Inc. (a) | 669,976 |

| 61,600 | | Adobe Systems, Inc. | 3,864,784 |

| 29,800 | | Autodesk, Inc. | 1,130,910 |

| | | | 5,665,670 |

Specialty Retail (4.5%) | | |

| 40,600 | | Abercrombie & Fitch Co. — Class A | 1,906,170 |

| 47,900 | | American Eagle Outfitters (b) | 2,256,090 |

| 53,600 | | Circuit City Stores, Inc. | 838,304 |

| 24,800 | | RadioShack Corp. | 815,424 |

| 16,400 | | Rent-A-Center, Inc. (a) | 434,600 |

| 29,800 | | The Sherwin-Williams Co. | 1,329,974 |

| | | | 7,580,562 |

Textiles, Apparel & Luxury Goods (1.0%) | | |

| 15,600 | | Coach, Inc. (a) | 879,840 |

| 12,900 | | Timberland Co. (a) | 808,443 |

| | | | 1,688,283 |

Thrifts & Mortgage Finance (0.7%) | | |

| 19,000 | | Astoria Financial Corp. (b) | 759,430 |

| 14,200 | | IndyMac Bancorp, Inc. (b) | 489,190 |

| | | | 1,248,620 |

Tobacco (0.8%) | | |

| 16,900 | | Reynolds American, Inc. (b) | 1,328,340 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Equity Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | | |

Trading Companies & Distributors (1.1%) |

| 20,400 | | Hughes Supply, Inc. | $ 659,940 |

| 18,800 | | W.W. Grainger, Inc. | 1,252,456 |

| | | | 1,912,396 |

Wireless Telecommunication Services (0.6%) |

| 33,400 | | Western Wireless Corp. (a) | 978,620 |

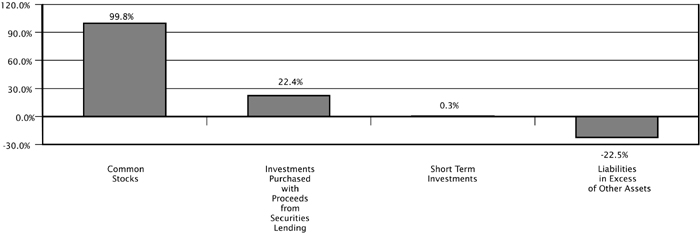

| | | Total common stocks (cost $130,538,845) | 168,491,904 |

| |

INVESTMENTS PURCHASED WITH CASH PROCEEDS FROM SECURITIES LENDING (22.4%) |

| $ 1,800,000 | | Amsterdam Funding Commercial Paper, 2.355%, due 01/25/2005 | 1,796,801 |

| 2,000,000 | | AIG Sunamerica Global Finance XXV Note, 2.550% due 03/11/2005 | 2,002,717 |

| 1,500,000 | | Bank of Ireland Commercial Paper, 2.352%, due 01/12/2005 | 1,498,923 |

| 17,629,000 | | Bank of New York Institutional Cash Reserve Fund | 17,629,000 |

| 1,800,000 | | Clipper Receivables Corp. Commercial Paper, 2.356%, due 01/28/2005 | 1,796,445 |

| 1,800,000 | | Fairway Finance Corp. Commercial Paper, 2.355%, due 01/20/2005 | 1,797,393 |

| 1,500,000 | | Ivory Funding Corp. Commercial Paper, 2.364%, due 01/25/2005 | 1,497,334 |

| 1,800,000 | | Liberty Street Funding Corp. Commercial Paper, 2.355%, due 01/28/2005 | 1,796,445 |

| 1,800,000 | | Mane Funding Corp. Commercial Paper, 2.355%, due 01/20/2005 | 1,797,439 |

| 915,000 | | Three Pillars Funding Inc. Commercial Paper, 2.354%, due 01/26/2005 | 913,314 |

| 1,000,000 | | TIAA Global Markets Note, 2.203%, due 01/13/2005 | 1,005,343 |

| 1,500,000 | | Wells Fargo Bank Certificate of Deposit, 2.350%, due 01/28/2005 | 1,500,000 |

| 1,000,000 | | White Pine Finance Note, 2.413%, due 01/20/2005 | 999,940 |

| 1,800,000 | | Windmill Funding Corp. Commercial Paper, 2.355%, due 01/24/2005 | 1,796,918 |

| | | Total investments purchased with cash proceeds from securities lending (cost $37,828,012) | 37,828,012 |

| |

SHORT TERM INVESTMENTS (0.3%) |

| 568,000 | | AIM Liquid Asset Portfolio | 568,000 |

| | | Total short term investments (cost $568,000) | 568,000 |

| | | | |

| | | Total investments (cost $168,934,857) (122.5%) | 206,887,916 |

| | | Liabilities in excess of other assets (22.5%) | (37,986,926) |

| | | Total net assets (100.0%) | $168,900,990 |

| | | | |

| (a) | Non-income producing security. |

| (b) | Securities (partial/entire) out on loan. |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Portfolio Managers’ Review (unaudited) | December 31, 2004 |

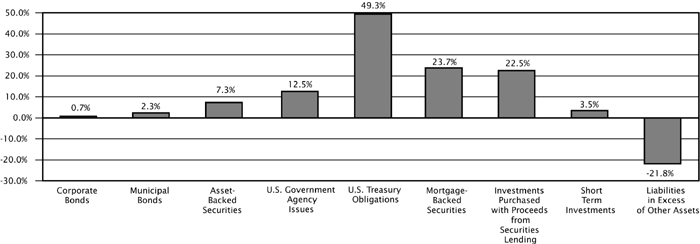

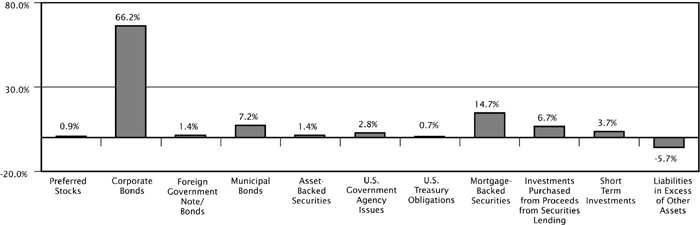

Balanced Portfolio

How did the Portfolio perform relative to its benchmarks?

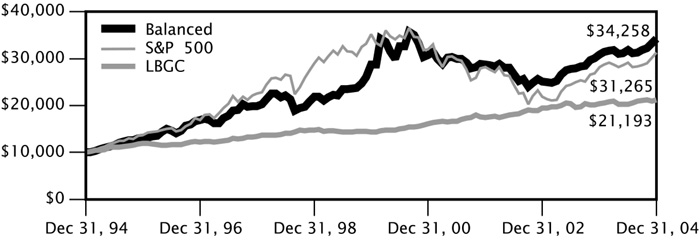

The Balanced Portfolio posted a return of 10.84% for the one year ended December 31, 2004. The benchmarks, the S&P 500 Index and the Lehman Brothers Government/Credit Index, returned 10.88% and 4.19%, respectively. (1)

What caused the variance in performance between the Portfolio and its benchmarks?

After 2003, we consider 2004 to be a return to normalcy in terms of economic growth, earnings, and market performance on the equity side. However, there were several emotional factors that made 2004 a tough year: re-emergence of the twin deficit story, weakening U.S. dollar, $55 crude oil (at peak), persistently depressing news from Iraq, and a contentious election. Throughout the year, we saw a pick-up in Mergers & Acquisitions (“M&A”) and Initial Public Offering activity, as the global volume of announced mergers totaled $1.95 trillion, up 41% from 2003. Some 238 companies went public in 2004, up 180% from 2003, and $43.5 billion was raised. And last, low volatility was a theme that played throughout the year, as most indices traded in a tight range throughout the year. Of the three broad factors in our model (Value, Quality, Earnings Expectations), the Value factors, which include statistics such as price/earnings, price/book, price/cash flow, have provided the greatest amount of alpha this year. Earnings Expectation (Momentum) factors strengthened in the second half of the year.

For the fixed income portion of the Portfolio, we maintained a short duration bias and a barbell structure in the portfolio versus the benchmark, which included holding an above average cash position. This helped the performance of the portfolio as the yield curve flattened during the fourth quarter. The yield differential between the 2-year Treasury note and the 30-year Treasury bond reduced from 229 bps to 176 bps in the fourth quarter. The High Yield sector was the best performing sector by far, followed by the Credit sector and the Mortgage-Backed Security (“MBS”) sector. However, the underweight to the MBS sector hurt the performance.

Which portfolio holdings enhanced the Portfolio’s performance?

In terms of equity performance during the year, stock selection in Utility, Financial, and Consumer Staples sectors were the largest contributors relative to the benchmark. The largest contributors relative to the benchmark were over-weight positions (relative to benchmark weight) in TXU Corp., Adobe Systems, Inc. and Tyco International Ltd.

On the fixed income side, holdings that enhanced the Portfolio’s performance for the period were Time Warner Inc., Sprint Capital Corp., Comcast Corp. and Nextel Communication.

Which holdings detracted from performance?

Within the Portfolio, stock selection in the Telecom, Health Care, and Technology sectors detracted the most in 2004 relative to the index. The largest detractors relative to the benchmark were an under-weight position (relative to the benchmark weight) in General Electric and over-weight positions in Merck & Co. and Pfizer.

On the fixed income side, holdings that detracted from the Portfolio’s performance for the period include General Motors and Health Care REIT, Inc.

What is your outlook for the next fiscal year?

On the equity side, we believe that low volatility, and moderate economic and profit growth will be positive for the stock market in 2005. These elements lay the foundation for a rational market. In such an environment, investors tend to focus on long term fundamentals which bode well for our disciplined philosophy and process. Overall, our philosophy will not change based on short-term trends or conditions in the market. Our goal is to add value through security selection, while attempting to neutralize other risk factors, such as market timing and sector rotation, for which there is not adequate compensation by the market.

On the fixed income side of the Portfolio, low bond yields and a range bound interest rate environment suggest that investors are still concerned about the economy. However, this is inconsistent with the performance of the stock market, commodity prices, and business surveys. As we interpret economic data and investor sentiment during 2005, we will draw on several themes, which we describe below.

| · | The Yield Curve Will Continue to Flatten — The Fed will continue to raise short-term interest rates until Fed Funds reach a more normalized rate (between 3.0 and 3.5%). Short-term interest rates will rise faster than long-term interest rates resulting in a flatter yield curve. In this environment, investors will be rewarded more for investing in a portfolio that owns a combination of long and short maturities (such as the 2-year and 30-year U.S. Treasury bonds) rather than a similar duration portfolio that owns one security (such as the 10-year U.S. Treasury note). |

| · | Credit Risk Is Overvalued — Credit spreads are at the tightest levels we have seen since 1996 and 1997. With the improvement in credit fundamentals, corporations now have excess cash flow that needs to be put to work. We are seeing an increase in stock buy-backs, special dividends, and M&As. These are all negative for corporate credit. Even though corporate default rates are at their lowest levels in 20 years, all the good news may be behind us. We remain concerned with the deterioration in the domestic |

40|86 Series Trust | |

Portfolio Managers’ Review (unaudited) | December 31, 2004 |

auto sector and will continue to view the debt of GeneralMotors and Ford as short-term holdings over the coming year.With the contraction in credit spreads, we are looking for everyopportunity to move up in credit quality. Avoiding credit blowupswill be extremely important to outperforming the benchmarkin 2005. Expect to see lower excess returns in all spreadsectors for 2005.

| · | Interest Rates Will Rise in 2005 — The yield on the 30-yearU.S. Treasury finished the year pretty much where it started, inspite of tighter monetary policy, healthy productivity gains,high consumer and government debt levels, and strong realGross Domestic Product (GDP) growth. While we still believeinterest rates are too low, given the rate of domestic growth, ourcapital markets are still attractive for foreign investors on aglobal basis. At some point, economic fundamentals will matterand interest rates will rise. Our portfolio strategies willcontinue to recognize a range bound market and a bias towardrising rates. Expect to see more callable bonds in the Portfolio.In a range bound interest rate environment, callable bonds willoutperform. |

| · | Inflation Will Inch Higher — During 2003, the Fed orchestratedthe lowest levels of short-term interest rates seen in fifty years.An acceleration in inflation often results from an overly stimulativemonetary policy. However, slack resources, excess capacity,and slow wage growth will contain any pick-up in inflation.Excess global capital and strong retirement investment by agingpopulations will help keep interest rates from rising too much.In the fourth quarter of 2004, we saw a pick-up in the ConsumerPrice Index (CPI) to 3.5%. During 2004, Treasury InflationProtected Securities (TIPS) outperformed other Treasury securitiesas expectations for inflation increased. We expect TIPS tocontinue to outperform in 2005, and we will be looking foropportunities to add TIPS selectively to the Portfolio during theyear. |

| · | The Financial Markets Eventually Will Need to Reprice Risk —Low levels of interest rates over the past several years havehelped compress risk spreads across the major asset sectors. Asan example, high yield bond spreads are marginally wider thaninvestment grade spreads. At some point, probably sometimein 2005, the market will be forced to reprice risk. The result willbe significant underperformance to the risk sectors over a shortperiod of time. The challenge portfolio managers face, is to bepatient enough to stick to a discipline designed to control portfoliovolatility. |

Once again we are at an interesting time in our financial markethistory. Financial assets, including bonds and equities, appearovervalued by almost every measure. At some point, the financialmarkets will reprice the level of risk in the bond markets, causinga dislocation that will impair performance and liquidity. Weexpect 2005 to be a difficult year for financial assets. While a bullishoutlook is always more pleasant to the reader, we believe thatour job is to directly communicate a realistic view of the opportunitiesand risks inherent in the financial markets.

Gregory J. Hahn, CFA Chicago Equity Partners, LLC

Chief Investment Officer

40|86 Advisors, Inc.

40|86 Series Trust | |

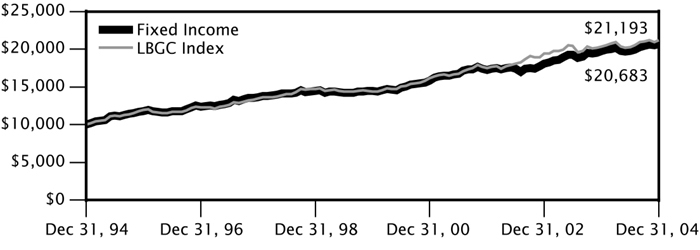

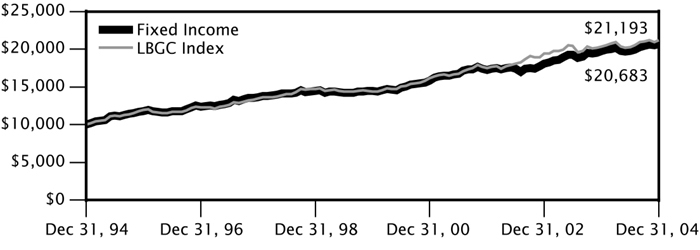

| Portfolio Manager’s Review (unaudited) | | December 31, 2004 |

The growth of $10,000 chart is a comparison of the change in value of a $10,000 investment with dividends and capital gains reinvested for the 10-year period ended 12/31/04. Past performance is no guarantee of future results.

AVERAGE ANNUAL TOTAL RETURN(1) (as of 12/31/04)

| | | | 1 YEAR | | 5 YEARS | | 10 YEARS |

| Balanced Portfolio | | | 10.84 | % | | 3.59 | % | | 13.10 | % |

| S&P 500 Index | | | 10.88 | % | | -2.29 | % | | 12.07 | % |

| LBGC Index | | | 4.19 | % | | 8.00 | % | | 7.80 | % |

| (1) | Past performance does not guarantee future results. Your investment return and principal will fluctuate, and your shares may be worth more or less than their original cost. Total return is provided in accordance with SEC guidelines for comparative purposes and reflects certain contractual expense reimbursements through April 30, 2005. If the expense reimbursements were not in place, the portfolio's return would have been lower. The total returns shown do not include separate account expenses or the deduction of taxes that a contractholder would pay on portfolio distributions or the redemption of portfolio shares. The S&P 500 Index is an unmanaged index considered to be representative of the U.S. stock market in general. The Lehman Brothers Government/Credit ("LBGC") Index is an unmanaged index considered to be representative of government and corporate fixed-rate debt issues in general. Investors cannot actually invest in an index. |

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Balanced Portfolio | |

| |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

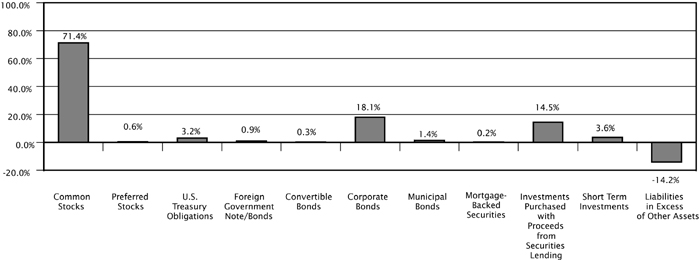

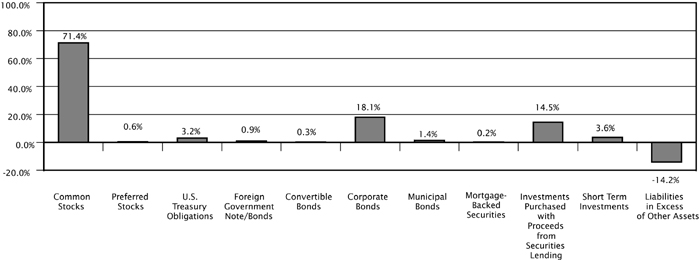

COMMON STOCKS (71.4%) | |

Aerospace & Defense (1.2%) | |

| 2,4002,400 | | General Dynamics Corp. | $ 251,040 |

| 5,600 | | Northrop Grumman Corp. (e) | 304,416 |

| | | | 555,456 |

Air Freight & Logistics (0.6%) | | |

| 6,300 | | Ryder System, Inc. | 300,951 |

| | | |

Automobiles (0.5%) | | |

| 16,000 | | Ford Motor Co. | 234,240 |

| | | |

Beverages (1.4%) | | |

| 900 | | Adolph Coors Co. — Class B (e) | 68,103 |

| 4,600 | | Constellation Brands, Inc. — Class A (a)(e) | 213,946 |

| 6,860 | | PepsiCo, Inc. | 358,092 |

| | | | 640,141 |

Biotechnology (1.3%) | | |

| 4,800 | | Amgen, Inc. (a) | 307,920 |

| 600 | | Cephalon, Inc. (a)(e) | 30,528 |

| 2,300 | | Charles River Laboratories International, Inc. (a) | 105,823 |

| 2,900 | | Genentech, Inc. (a) | 157,876 |

| | | | 602,147 |

Building Products (0.5%) | | |

| 6,200 | | Masco Corp. (e) | 226,486 |

| | | |

Capital Markets (2.4%) | | |

| 3,500 | | The Bear Stearns Companies Inc. (e) | 358,085 |

| 2,500 | | The Goldman Sachs Group, Inc. | 260,100 |

| 4,700 | | Merrill Lynch & Co, Inc. | 280,919 |

| 5,600 | | SEI Investments Co. | 234,808 |

| | | | 1,133,912 |

Chemicals (1.2%) | | |

| 6,100 | | PPG Industries, Inc. | 415,776 |

| 2,100 | | Sigma-Aldrich Corp. (e) | 126,966 |

| | | | 542,742 |

| | | |

Commercial Banks (5.4%) | | |

| 23,600 | | Bank of America Corp. | 1,108,964 |

| 4,100 | | Comerica, Inc. | 250,182 |

| 5,200 | | Huntington Bancshares, Inc. | 128,856 |

| 6,900 | | KeyCorp. | 233,910 |

| 15,500 | | Wachovia Corp. | 815,300 |

| | | | 2,537,212 |

| | | |

Commercial Services & Supplies (0.3%) | | |

| 1,795 | | Apollo Group, Inc. (a)(e) | 144,875 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Balanced Portfolio |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

Communications Equipment (2.3%) | |

| 24,770 | | Cisco Systems, Inc. (a) | $ 478,061 |

| 1,900 | | Harris Corp. | 117,401 |

| 13,600 | | Motorola, Inc. | 233,920 |

| 4,400 | | QUALCOMM, Inc. | 186,560 |

| 1,400 | | Scientific-Atlanta, Inc. | 46,214 |

| | | | 1,062,156 |

Communications Services (2.4%) | | |

| 19,300 | | AT&T Corp. (e) | 367,858 |

| 12,400 | | Sprint Corp. | 308,140 |

| 11,200 | | Verizon Communications, Inc. | 453,712 |

| | | | 1,129,710 |

Computers & Peripherals (2.9%) | | |

| 11,300 | | Dell, Inc. (a) | 476,182 |

| 16,288 | | Hewlett-Packard Co. | 341,559 |

| 2,250 | | International Business Machines Corp. | 221,805 |

| 1,300 | | Lexmark International, Inc. (a) | 110,500 |

| 1,900 | | NCR Corp. (a) | 131,537 |

| 2,100 | | Qlogic Corp. (a) | 77,133 |

| | | | 1,358,716 |

Consumer Finance (0.6%) | | |

| 3,600 | | Capital One Financial Corp. (e) | 303,156 |

| | | |

Diversified Financial Services (2.6%) | | |

| 4,100 | | CIT Group, Inc. | 187,862 |

| 7,132 | | Citigroup, Inc. (e) | 343,620 |

| 4,840 | | J.P. Morgan Chase & Co. | 188,808 |

| 4,200 | | Moody’s Corp. | 364,770 |

| 3,400 | | Principal Financial Group, Inc. | 139,196 |

| | | | 1,224,256 |

Electric Utilities (1.6%) | | |

| 11,700 | | TXU Corp. (e) | 755,352 |

| | | |

Electronic Equipment & Instruments (1.8%) | | |

| 6,300 | | Ingram Micro, Inc. (a) | 131,040 |

| 17,600 | | Tyco International Ltd. (c)(e) | 629,024 |

| 5,300 | | Vishay Intertechnology, Inc. (a) | 79,606 |

| | | | 839,670 |

Energy Equipment & Services (0.5%) | | |

| 5,000 | | Baker Hughes, Inc. | 213,350 |

| | | |

Food & Staples Retailing (0.6%) | | |

| 2,400 | | CVS Corp. | 108,168 |

| 5,500 | | Supervalu, Inc. | 189,860 |

| | | | 298,028 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Balanced Portfolio |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

Food Products (1.0%) | |

| 4,000 | | Hershey Foods Corp. | $ 222,160 |

| 12,200 | | Tyson Foods, Inc. | 224,480 |

| | | | 446,640 |

Health Care Equipment & Supplies (1.5%) | | |

| 5,200 | | Becton, Dickinson & Co. | 295,360 |

| 4,100 | | C.R. Bard, Inc. | 262,318 |

| 3,200 | | Varian Medical Systems, Inc. (a) | 138,368 |

| | | | 696,046 |

Health Care Providers & Services (1.9%) | | |

| 1,500 | | AmerisourceBergen Corp. | 88,020 |

| 3,650 | | Coventry Health Care, Inc. (a) | 193,742 |

| 9,500 | | Humana, Inc. (a) | 282,055 |

| 3,600 | | Laboratory Corp Of America Holdings (a) | 179,352 |

| 3,696 | | Medco Health Solutions, Inc. (a) | 153,754 |

| | | | 896,923 |

Hotels Restaurants & Leisure (1.3%) | | |

| 7,100 | | Darden Restaurants, Inc. | 196,954 |

| 13,000 | | McDonald’s Corp. | 416,780 |

| | | | 613,734 |

Household Durables (0.5%) | | |

| 1,600 | | Fortune Brands, Inc. | 123,488 |

| 170 | | NVR, Inc. (a)(e) | 130,798 |

| | | | 254,286 |

Household Products (0.6%) | | |

| 2,100 | | Clorox Co. | 123,753 |

| 3,000 | | Procter & Gamble Co. | 165,240 |

| | | | 288,993 |

Industrial Conglomerates (1.3%) | | |

| 8,200 | | Textron, Inc. | 605,160 |

| | | |

Insurance (3.0%) | | |

| 11,400 | | The Allstate Corp. | 589,608 |

| 6,800 | | Genworth Financial, Inc. | 183,600 |

| 2,900 | | Lincoln National Corp. | 135,372 |

| 6,600 | | Metlife, Inc. | 267,366 |

| 4,300 | | Prudential Financial, Inc. | 236,328 |

| | | | 1,412,274 |

IT Services (0.7%) | | |

| 6,100 | | Computer Sciences Corp. (a) | 343,857 |

| | | |

Machinery (1.0%) | | |

| 3,600 | | Cummins, Inc. (e) | 301,644 |

| 4,900 | | Graco, Inc. | 183,015 |

| | | | 484,659 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Balanced Portfolio |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

Media (3.3%) | |

| 2,600 | | Harte-Hanks, Inc. | $ 67,548 |

| 3,525 | | The McGraw-Hill Companies, Inc. | 322,679 |

| 19,330 | | Time Warner, Inc. (a) | 375,775 |

| 9,200 | | Viacom, Inc. — Class B. | 334,788 |

| 15,700 | | The Walt Disney Co. | 436,460 |

| | | | 1,537,250 |

Metals & Mining (0.4%) | | |

| 3,700 | | Nucor Corp. | 193,658 |

| | | |

Multiline Retail (1.2%) | | |

| 4,800 | | Federated Department Stores. | 277,392 |

| 5,800 | | JC Penney Co Inc Holding Co. | 240,120 |

| 900 | | Sears Roebuck and Co. | 45,927 |

| | | | 563,439 |

Multi-Utilities & Unregulated Power (0.9%) | | |

| 8,900 | | Oneok, Inc. (e) | 252,938 |

| 2,900 | | Questar Corp. | 147,784 |

| | | | 400,722 |

Oil & Gas (4.1%) | | |

| 2,900 | | Amerada Hess Corp. | 238,902 |

| 5,300 | | Burlington Resources, Inc. | 230,550 |

| 9,734 | | ChevronTexaco Corp. | 511,132 |

| 9,840 | | Exxon Mobil Corp. | 504,399 |

| 2,900 | | Newfield Exploration Co. (a) | 171,245 |

| 4,900 | | Occidental Petroleum Corp. | 285,964 |

| | | | 1,942,192 |

Paper & Forest Products (0.7%) | | |

| 12,600 | | Louisiana-Pacific Corp. | 336,924 |

| | | |

Personal Products (0.9%) | | |

| 3,400 | | Avon Products, Inc. | 131,580 |

| 6,600 | | The Gillette Co. | 295,548 |

| | | | 427,128 |

Pharmaceuticals (4.7%) | | |

| 2,400 | | Eon Labs, Inc. (a) | 64,800 |

| 4,100 | | Forest Laboratories, Inc. (a)(e) | 183,926 |

| 16,480 | | Johnson & Johnson. | 1,045,161 |

| 29,540 | | Pfizer, Inc. | 794,331 |

| 3,000 | | Wyeth. | 127,770 |

| | | | 2,215,988 |

Photographic Equipment And Supplies (0.2%) | | |

| 2,800 | | Eastman Kodak Co. | 90,300 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Balanced Portfolio |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

Real Estate Investment Trusts (1.2%) | |

| 900 | | AvalonBay Communities, Inc. | $ 67,770 |

| 5,400 | | CarrAmerica Realty Corp. | 178,200 |

| 9,100 | | General Growth Properties, Inc. | 329,056 |

| | | | 575,026 |

Road & Rail (0.4%) | | |

| 4,300 | | JB Hunt Transport Services, Inc. | 192,855 |

| | | |

Semiconductor & Semiconductor Equipment (1.8%) | | |

| 1,900 | | Cree, Inc. (a)(e) | 76,152 |

| 23,880 | | Intel Corp. | 558,553 |

| 9,700 | | MEMC Electronic Materials, Inc. (a) | 128,525 |

| 5,100 | | National Semiconductor Corp. (e) | 91,545 |

| | | | 854,775 |

Software (3.1%) | | |

| 7,000 | | Adobe Systems, Inc. | 439,180 |

| 22,140 | | Microsoft Corp. | 591,359 |

| 30,300 | | Oracle Corp. (a) | 415,716 |

| | | | 1,446,255 |

Specialty Retail (2.5%) | | |

| 4,500 | | Abercrombie & Fitch Co. — Class A (e) | 211,275 |

| 10,000 | | Circuit City Stores, Inc. (e) | 156,400 |

| 16,490 | | Home Depot, Inc. | 704,783 |

| 4,700 | | Limited Brands | 108,194 |

| | | | 1,180,652 |

Textiles, Apparel & Luxury Goods (0.1%) | | |

| 1,100 | | Timberland Co. (a) | 68,937 |

| | | |

Thrifts & Mortgage Finance (1.3%) | | |

| 3,998 | | Countrywide Financial Corp. | 147,966 |

| 4,300 | | Freddie Mac. | 316,910 |

| 2,200 | | Golden West Financial Corp. | 135,124 |

| | | | 600,000 |

Tobacco (1.1%) | | |

| 6,610 | | Altria Group, Inc. | 403,871 |

| 1,400 | | Reynolds American, Inc. (e) | 110,040 |

| | | | 513,911 |

Trading Companies & Distributors (0.6%) | | |

| 4,500 | | W.W. Grainger, Inc. | 299,790 |

| | | Total common stocks (cost $27,585,694) | 33,584,930 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Balanced Portfolio |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

PREFERRED STOCKS (0.6%) | |

Communications Services (0.4%) | |

| 145 | | Centaur Funding Corp., (b) Cost — $171,062; Acquired — 07/22/2003 (a) | $ 191,355 |

| | | |

Men's And Boy's Clothing And Furnishings (0.2%) | | |

| 4,000 | | Tommy Hilfiger USA, 9.000%, due 12/01/2031 | 102,320 |

| | | Total preferred stocks (cost $273,002) | 293,675 |

| | | |

U.S. TREASURY OBLIGATIONS (3.2%) | | |

| $ 465,000 | | 3.500%, due 12/15/2009 (e) | 462,893 |

| 465,000 | | 4.250%, due 11/15/2014 (e) | 466,362 |

| 525,000 | | 5.375%, due 02/15/2031 (e) | 567,862 |

| | | Total U.S. treasury obligations (cost $1,498,258) | 1,497,117 |

| | | |

FOREIGN GOVERNMENT NOTE/BONDS (0.9%) | | |

| 155,000 | | Export-Import Bank of Korea, 4.500%, due 08/12/2009 (c) | 156,489 |

| 205,000 | | United Mexican States, 9.875%, due 02/01/2010 (c) | 252,457 |

| | | Total foreign government note/bonds (cost $411,940) | 408,946 |

| | | |

CONVERTIBLE BONDS (0.3%) | | |

Electronic Equipment & Instruments (0.3%) | | |

| 280,000 | | Celestica, Inc., 0.000%, due 08/01/2020 (c)(d) | 156,100 |

| | | Total convertible bonds (cost $137,808) | 156,100 |

| | | |

CORPORATE BONDS (18.1%) | | |

Aircraft (0.3%) | | |

| 150,000 | | Boeing Capital Corp., 4.750%, due 08/25/2008 (e) | 155,266 |

| | | |

Apparel (0.1%) | | |

| 55,000 | | Jones Apparel Group Inc ., 5.125%, due 11/15/2014, (b) Cost — $54,954; Acquired — 11/17/2004 | 54,620 |

| | | |

Automobiles (0.7%) | | |

| 200,000 | | General Motors Corp., 7.125%, due 07/15/2013 (e) | 204,992 |

| 100,000 | | General Motors Corp., 8.375%, due 07/15/2033 (e) | 103,895 |

| | | | 308,887 |

Chemicals (1.0%) | | |

| 80,000 | | Lyondell Chemical Co., 11.125%, due 07/15/2012 | 95,400 |

| 190,000 | | Terra Capital, Inc., 12.875%, due 10/15/2008 | 238,450 |

| 120,000 | | Union Carbide Corp., 6.790%, due 06/01/2025 (e) | 122,700 |

| | | | 456,550 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Balanced Portfolio |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

Communications Services (2.6%) | |

| $ 365,000 | | British Telecommunications PLC, 7.875%, due 12/15/2005 (c) | $ 380,778 |

| 155,000 | | Charter Communications, Inc., 8.000%, due 04/30/2012, (b) Cost — $155,180; Acquired — 04/21/2004 | 161,975 |

| 105,000 | | DirecTV Holdings LLC, 8.375%, due 03/15/2013 | 118,256 |

| 100,000 | | Echostar DBS Corp., 6.625%, due 10/01/2014, (b) Cost — $99,118; Acquired — 09/20/2004 | 101,750 |

| 125,000 | | News America, Inc., 6.200%, due 12/15/2034, (b) Cost — $124,000; Acquired — 11/30/2004 | 127,123 |

| 190,000 | | Sprint Capital Corp., 6.875%, due 11/15/2028 | 208,644 |

| 84,000 | | TELUS Corp., 8.000%, due 06/01/2011 (c) | 99,675 |

| | | | 1,198,201 |

Containers & Packaging (0.9%) | | |

| 375,000 | | Owens-Brockway, 8.875%, due 02/15/2009 | 409,219 |

| | | |

Electric And Other Services Combined (0.4%) | | |

| 195,000 | | Pacific Gas & Electric Co., 6.050%, due 03/01/2034. | 203,236 |

| | | |

Electronic Equipment & Instruments (0.9%) | | |

| 35,000 | | Jabil Circuit, Inc., 5.875%, due 07/15/2010 (e) | 36,885 |

| 70,000 | | Nortel Networks Ltd., 6.125%, due 02/15/2006 (c)(e) | 71,575 |

| 100,000 | | Tyco International Group SA, 6.000%, due 11/15/2013 (c) | 109,135 |

| 200,000 | | Tyco International Group SA, 6.875%, due 01/15/2029 (c) | 229,819 |

| | | | 447,414 |

Food Products (0.6%) | | |

| 280,000 | | Kraft Foods, Inc., 5.250%, due 10/01/2013 | 288,581 |

| | | |

Health Care Equipment & Supplies (0.8%) | | |

| 105,000 | | Guidant Corp., 6.150%, due 02/15/2006 | 108,308 |

| 270,000 | | Hillenbrand Industries, Inc., 4.500%, due 06/15/2009 | 273,408 |

| | | | 381,716 |

Health Care Providers & Services (0.4%) | | |

| 45,000 | | AmerisourceBergen Corp., 7.250%, due 11/15/2012 | 50,512 |

| 155,000 | | Service Corp International, 6.875%, due 10/01/2007 | 162,169 |

| | | | 212,681 |

Hotels Restaurants & Leisure (0.9%) | | |

| 150,000 | | Caesars Entertainment, Inc., 8.125%, due 05/15/2011 | 174,000 |

| 77,500 | | Carnival Corp., 6.150%, due 04/15/2008 (c) | 83,071 |

| 155,000 | | Hyatt Equities LLC, 6.875%, due 06/15/2007, (b) Cost — $154,804; Acquired — 06/12/2002 | 163,173 |

| | | | 420,244 |

Household Durables (0.9%) | | |

| 175,000 | | KB Home, 5.750%, due 02/01/2014 | 174,125 |

| 240,000 | | NVR, Inc., 5.000%, due 06/15/2010 (e) | 241,200 |

| | | | 415,325 |

Insurance (0.6%) | | |

| 60,000 | | Assured Guaranty US Holdings, Inc., 7.000%, due 06/01/2034 | 66,059 |

| 60,000 | | Liberty Mutual Group, 5.750%, due 03/15/2014, (b) Cost — $59,072; Acquired — 11/15/2004 | 59,091 |

| 225,000 | | RenaissanceRe Holdings Ltd., 7.000%, due 07/15/2008 (c) | 243,675 |

| | | | 368,825 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Balanced Portfolio |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

Liquefied Petroleum Gas Dealers (0.2%) | |

| $ 87,020 | | Ras Laffan Liquefied Natural Gas Co. Ltd., 3.437%, due 09/15/2009 (b) Cost — $85,653; Acquired — 07/02/2004 (c) | $ 85,542 |

| | | | |

Media (0.5%) | | |

| 200,000 | | Quebecor Media, Inc., 11.125%, due 07/15/2011 (c) | 229,500 |

| | | |

Miscellaneous Retail Stores (0.2%) | | |

| 75,000 | | JC Penney Co Inc., 8.000%, due 03/01/2010 | 86,062 |

| | | |

National Commercial Banks (0.1%) | | |

| 40,000 | | Union Planters Bank NA, 6.500%, due 03/15/2018 | 43,216 |

| | | |

Natural Gas Transmission (0.3%) | | |

| 110,000 | | Southern Natural Gas Co., 8.875%, due 03/15/2010 (e) | 123,750 |

| | | |

Paper & Forest Products (0.7%) | | |

| 95,000 | | Boise Cascade LLC, 7.125%, due 10/15/2014, (b) Cost — $95,000; Acquired — 10/15/2004 | 100,937 |

| 180,000 | | Georgia-Pacific Corp., 7.700%, due 06/15/2015 | 206,550 |

| | | | 307,487 |

Personal Credit Institutions (0.4%) | | |

| 200,000 | | Household Finance Corp., 4.125%, due 11/16/2009 | 199,142 |

| | | |

Photographic Equipment And Supplies (0.4%) | | |

| 170,000 | | Eastman Kodak Co., 7.250%, due 06/15/2005 (e) | 172,965 |

| | | |

Radiotelephone Communications (0.2%) | | |

| 75,000 | | L-3 Communications Corp., 5.875%, due 01/15/2015, (b) Cost — $75,188; Acquired — 11/02/2004 | 75,187 |

| | | |

Real Estate Investment Trusts (1.9%) | | |

| 70,000 | | Colonial Realty Limited Partnership, 6.250%, due 06/15/2014 | 73,716 |

| 250,000 | | Health Care REIT, Inc., 7.500%, due 08/15/2007 | 270,650 |

| 215,000 | | Hospitality Properties Trust, 6.750%, due 02/15/2013 | 237,777 |

| 55,000 | | iStar Financial, Inc., 8.750%, due 08/15/2008 | 62,767 |

| 200,000 | | Senior Housing Properties Trust, 8.625%, due 01/15/2012 | 229,500 |

| | | | 874,410 |

Refuse Systems (0.7%) | | |

| 120,000 | | Allied Waste North America, 8.875%, due 04/01/2008 | 129,000 |

| 200,000 | | Waste Management Inc., 7.000%, due 05/15/2005 | 202,102 |

| | | | 331,102 |

Special Purpose Entity (0.2%) | | |

| 119,656 | | PLC Trust, 2.709%, due 03/31/2006, (b) Cost — $119,656; Acquired — 12/12/2003 | 119,187 |

| | | |

Steel Foundries (0.1%) | | |

| 65,000 | | International Steel Group, Inc., 6.500%, due 04/15/2014 | 70,037 |

| | | |

Wireless Telecommunication Services (1.1%) | | |

| 155,000 | | AT&T Wireless Services, Inc., 8.750%, due 03/01/2031 | 209,626 |

| 270,000 | | Nextel Communications, Inc., 6.875%, due 10/31/2013 | 294,300 |

| | | | 503,926 |

| | | Total corporate bonds (cost $8,015,665) | 8,542,278 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| Balanced Portfolio |

SHARES OR PRINCIPAL AMOUNT | | VALUE |

| | |

MUNICIPAL BONDS (1.4%) | |

| $ 190,000 | | California County TOB Securitization Agency, 7.500%, due 06/01/2019 | $ 192,926 |

| 180,716 | | Louisiana Tobacco Settlement Financing Corp., 6.360%, due 05/15/2025 | 178,112 |

| 175,000 | | Rhode Island Tobacco Settlement Financing Corp., 5.920%, due 06/01/2012. | 174,417 |

| 140,922 | | South Dakota Educational Enhancement Funding Corp., 6.720%, due 06/01/2025 | 135,416 |

| | | Total municipal bonds (cost $688,007) | 680,871 |

| | | |

MORTGAGE BACKED SECURITIES (0.2%) | | |

| 72,159 | | First Union National Bank Commercial Mortgage, Series # 1999-C4 A1, 7.184%, due 12/15/2031 | 76,013 |

| | | Total mortgage backed securities (cost $72,462) | 76,013 |

| | | |

INVESTMENTS PURCHASED WITH CASH PROCEEDS FROM SECURITIES LENDING (14.5%) | | |

| 300,000 | | Amsterdam Funding Commercial Paper, 2.355%, due 01/25/2005 | 299,467 |

| 200,000 | | AIG Sunamerica Global Finance XXV Note, 2.550% due 03/11/2005 | 200,272 |

| 300,000 | | Atlantic Asset Securitization Commercial Paper, due 01/24/2005 | 299,486 |

| 200,000 | | Bank of Ireland Commercial Paper, 2.352%, due 01/12/2005. | 199,856 |

| 3,417,000 | | Bank of New York Institutional Cash Reserve Fund | 3,417,000 |

| 300,000 | | Clipper Receivables Corp. Commercial Paper, 2.356%, due 01/28/2005 | 299,408 |

| 300,000 | | Fairway Finance Corp. Commercial Paper, 2.355%, due 01/20/2005 | 299,565 |

| 300,000 | | Ivory Funding Corp. Commercial Paper, 2.364%, due 01/25/2005 | 299,467 |

| 300,000 | | Liberty Street Funding Corp. Commercial Paper, 2.355%, due 01/28/2005 | 299,408 |

| 300,000 | | Mane Funding Corp. Commercial Paper, 2.355%, due 01/20/2005 | 299,573 |

| 300,000 | | Three Pillars Funding Inc. Commercial Paper, 2.354%, due 01/26/2005 | 299,447 |

| 300,000 | | Wells Fargo Bank Certificate of Deposit, 2.350%, due 01/28/2005. | 300,000 |

| 300,000 | | Windmill Funding Corp. Commercial Paper, 2.355%, due 01/24/2005 | 299,486 |

| | | Total investments purchased with cash proceeds from securities lending (cost $6,812,435) | 6,812,435 |

| | | |

SHORT TERM INVESTMENTS (3.6%) | | |

| 1,678,000 | | AIM Liquid Asset Portfolio. | 1,678,000 |

| | | Total short term investments (cost $1,678,000) | 1,678,000 |

| | | | |

| | | Total investments (cost $47,173,271) (114.2%) | 53,730,365 |

| | | Liabilities in excess of other assets (14.2%) | (6,674,229) |

| | | Total net assets (100.0%) | $47,056,136 |

___________

| (a) | Non-income producing security. |

| (b) | Restricted under Rule 144A of the Securities Act of 1933. |

| (c) | Foreign security or a U.S. security of a foreign company. |

| (d) | Zero Coupon — Bonds that make no interest payments. |

| (e) | Securities (partial/entire) out on loan. |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Portfolio Managers’ Review (unaudited) | December 31, 2004 |

High Yield Portfolio

How did the Portfolio perform relative to its benchmark?

The High Yield Portfolio returned 10.69% for the twelve months ended December 31, 2004. This compares to 10.87% for the benchmark

Merrill Lynch High Yield Master II Index. (1)

What caused the variance in performance between the Portfolio and its benchmark?

During 2004, Portfolio performance was driven in large part by our migration to high single B and low BB rated securities starting at the

beginning of the second half of the year. In addition, our bottom-up research efforts resulted in excellent relative value credit selections during

the year.

What portfolio holdings enhanced the Portfolio’s performance?

For the twelve months ended December 31, 2004, Portfolio performance was driven by our holdings in the Energy, Wireless Communications

and the Leisure sectors, specifically El Paso Production Holdings, Starwood Hotels, Hilton Hotels, Airgate PCS and Qwest Communications.

Which holdings detracted from performance?

For the twelve months ended December 31, 2004, Portfolio performance was negatively impacted by investments in the Technology

and Homebuilder sectors, specifically Amkor Technologies, William Lyons Homes, and Hovnanian Enterprises.

What is your outlook for the next fiscal year?

We anticipate that interest rates will continue to rise during 2005, although the rate of increase will be slow and the amount, potentially modest except for short-term rates. As a result of this environment, we don’t expect that we will see inflows into fixed income products and most likely will continue to experience outflows that started in mid-2004. Higher interest rates and investment outflows will put pressure on high yield returns during 2005.

Investors may recall in our semi-annual report we described our plan of action to mitigate the potential impact of increasing interest rates. We moved from a barbell approach, meaning that we had a portion of high quality, lower yield investments also known as "crossover" credits on one end, and higher risk, high yield credits on the other. The plan we implemented was a general migration to the middle of the high yield market or high single B and low BB credits.

Our strategy has worked well and we intend to maintain this plan going into 2005 for several reasons. First, we believe higher interest rates will negatively impact crossover issuers, as they are more likely to trade on spread and not dollar price. Secondly, we believe that lower quality issuers will be negatively impacted by the higher costs of capital, lowering earnings and, in turn, a decline in credit quality.

We have selected credits in the middle of the high yield market based on the recommendations of our credit research team. We focused on those credits that have stronger balance sheets, manageable maturity schedules, and positive business prospects. Specifically, these include Blount Inc., HealthSouth Corporation, Chesapeake Energy Corp., and Boise Cascade Corp. Our intensive credit process historically has served us well. As we enter a period of rising interest rates, credit selection based on bottom-up analysis will continue to guide our investment decisions. Our proprietary portfolio structuring tools help us measure risk and return as compared to our performance benchmark to help ensure that we focus on relative value. We believe this will continue to deliver competitive risk adjusted returns over time.

| Gregory J. Hahn, CFA | Leo J. Dierckman |

| Chief Investment Officer | Second Vice President |

| 40|86 Advisors, Inc. | 40|86 Advisors, Inc. |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

| Portfolio Manager’s Review (unaudited) | | December 31, 2004 |

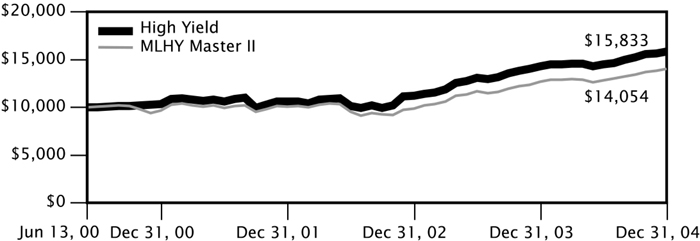

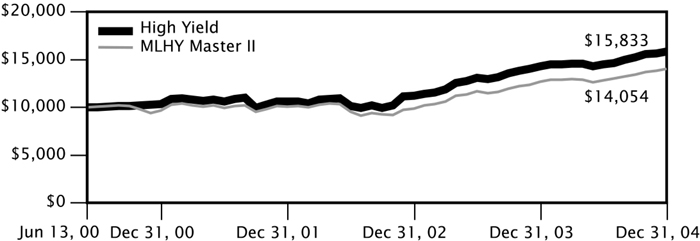

GROWTH OF $10,000

The growth of $10,000 chart is a comparison of the change in value of a $10,000 investment with dividends and capital gains reinvested for the period from inception of the Portfolio through 12/31/04. Past performance is no guarantee of future results.

AVERAGE ANNUAL TOTAL RETURN(1) (as of 12/31/04)

| | | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION |

| High Yield Portfolio | | | 10.69 | % | | n/a | | | 10.63 | % |

| MLHY Master II Index | | | 10.87 | % | | n/a | | | 7.71 | % |

| (1) | The inception date of this portfolio was June 13, 2000. Past performance does not guarantee future results. Your investment return and principal will fluctuate, and your shares may be worth more or less than their original cost. Total return is provided in accordance with SEC guidelines for comparative purposes and reflects certain contractual expense reimbursements through April 30, 2005. If the expense reimbursements were not in place, the portfolio's return would have been lower. The total returns shown do not include separate account expenses or the deduction of taxes that a contractholder would pay on portfolio distributions or the redemption of portfolio shares. The Merrill Lynch High Yield ("MLHY") Master II Index is an unmanaged market capitalization weighted index of all domestic and Yankee high yield bonds. Investors cannot actually invest in an index. |

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| High Yield Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | | | VALUE |

| |

PREFERRED STOCKS (0.8%) |

Men’s And Boy’s Clothing And Furnishings (0.8%) |

| 2,768 | | Tommy Hilfiger USA, 9.000%, due 12/01/2031 | | $ 70,806 |

| | | Total preferred stocks (cost $69,222) | | 70,806 |

| |

WARRANTS (0.2%) |

| 121 | | Huntsman LLC, (b) Cost — $5,972; Acquired — 07/02/2004 (a) | | 20,232 |

| | | Total warrants (cost $5,972) | | 20,232 |

| |

CERTIFICATES OF BENEFICIAL INTEREST (0.3%) |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,311; Acquired — 06/10/2004 (a)(f)(g) | | 2,698 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,311; Acquired — 06/10/2004 (a)(f)(g) | | 2,698 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,311; Acquired — 06/10/2004 (a)(f)(g) | | 2,698 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,311; Acquired — 06/10/2004 (a)(f)(g) | | 2,698 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,310; Acquired — 06/10/2004 (a)(f)(g) | | 2,697 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,310; Acquired — 06/10/2004 (a)(f)(g) | | 2,697 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,310; Acquired — 06/10/2004 (a)(f)(g) | | 2,697 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,310; Acquired — 06/10/2004 (a)(f)(g) | | 2,697 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,310; Acquired — 06/10/2004 (a)(f)(g) | | 2,697 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,310; Acquired — 06/10/2004 (a)(f)(g) | | 2,697 |

| 89,915 | | 1989 US Airways ETC, (b) Cost — $5,310; Acquired — 06/10/2004 (a)(f)(g) | | 2,697 |

| | | Total certificates of beneficial interest (cost $58,414) | | 29,671 |

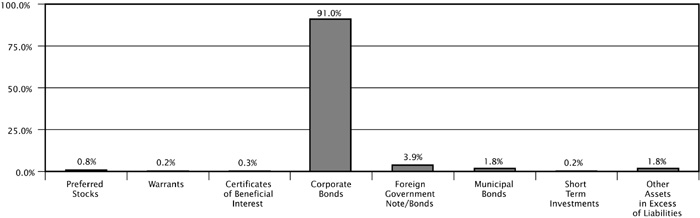

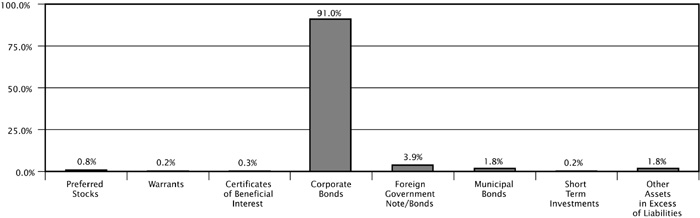

CORPORATE BONDS (91.0%) |

Aerospace & Defense (0.8%) |

| $ 70,000 | | DRS Technologies, Inc., 6.875%, due 11/01/2013 | | 73,500 |

| |

Air-conditioning And Warm Air Heating Equipment And Commercial (2.9%) |

| 155,000 | | Goodman Global Hldgs, Inc., 7.875%, due 12/15/2012, (b) Cost — $155,000; Acquired — 12/15/2004 | | 154,225 |

| 95,000 | | THL Buildco, Inc., 8.500%, due 09/01/2014, (b) Cost — $95,000; Acquired — 08/12/2004 | | 99,750 |

| | | | | 253,975 |

| |

Building Products (0.6%) |

| 50,000 | | Jacuzzi Brands, Inc., 9.625%, due 07/01/2010 | | 55,750 |

| |

Chemicals (3.6%) |

| 100,000 | | Huntsman International LLC, 7.375%, due 01/01/2015, (b) Cost — $100,000; Acquired — 12/03/2004 | | 100,750 |

| 75,000 | | Lyondell Chemical Co., 11.125%, due 07/15/2012 | | 89,438 |

| 70,000 | | Rockwood Specialties Group, Inc., 10.625%, due 05/15/2011 | | 80,850 |

| 40,000 | | Terra Capital, Inc., 12.875%, due 10/15/2008 | | 50,200 |

| | | | | 321,238 |

| |

| |

Commercial Services & Supplies (1.7%) |

| 145,000 | | Adesa, Inc., 7.625%, due 06/15/2012 | | 153,700 |

| |

Communications Services (9.9%) |

| 105,000 | | Charter Communications, 8.375%, due 04/30/2014, (b) Cost — $106,575; Acquired — 11/05/2004 | | 111,300 |

| 100,000 | | Cincinnati Bell, Inc., 8.375%, due 01/15/2014 | | 101,750 |

| 105,000 | | Echostar DBS Corp., 6.625%, due 10/01/2014, (b) Cost — $104,074; Acquired — 09/20/2004 | | 106,837 |

| 60,000 | | Fairpoint Communications, Inc., 12.500%, due 05/01/2010 | | 65,100 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| High Yield Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | | | VALUE |

| |

Communications Services (continued) |

| $ 105,000 | | Innova S de RL, 9.375%, due 09/19/2013 (c) | | $ 119,962 |

| 94,000 | | PanAmSat Corp., 9.000%, due 08/15/2014, (b) Cost — $94,000; Acquired — 08/02/2004 | | 105,398 |

| 110,000 | | Qwest Communications International, 7.250%, due 02/15/2011, (b) Cost — $109,326; Acquired — 01/30/2004 | | 113,300 |

| 45,000 | | Superior Essex Communications, 9.000%, due 04/15/2012 | | 46,575 |

| 110,000 | | Warner Music Group, 7.375%, due 04/15/2014, (b) Cost — $108,655; Acquired — 04/01/2004 & 07/21/2004 | | 113,300 |

| | | | | 883,522 |

| | | | | |

Computers & Peripherals (0.7%) |

| 60,000 | | UNOVA, Inc., 7.000%, due 03/15/2008 | | 61,950 |

| |

Construction Materials (1.5%) |

| 120,000 | | US Concrete, Inc., 8.375%, due 04/01/2014 | | 129,900 |

| |

Containers & Packaging (2.6%) |

| 100,000 | | Owens-Brockway, 8.250%, due 05/15/2013 | | 110,500 |

| 110,000 | | Stone Container Finance Holdings, 7.375%, due 07/15/2014 (c) | | 117,700 |

| | | | | 228,200 |

Electric Services (3.0%) |

| 75,000 | | Midwest Generation LLC, 8.560%, due 01/02/2016 | | 83,297 |

| 55,000 | | Nevada Power Co., 5.875%, due 01/15/2015, (b) Cost — $55,000; Acquired — 11/09/2004 | | 55,688 |

| 20,000 | | Reliant Energy, Inc., 6.750%, due 12/15/2014 | | 19,975 |

| 100,000 | | Texas Genco LLC, 6.875%, due 12/15/2014, (b) Cost — $100,000; Acquired — 12/08/2004 | | 103,875 |

| | | | | 262,835 |

Electronic Equipment & Instruments (4.5%) |

| 75,000 | | Celestica, Inc., 7.875%, due 07/01/2011 (c) | | 80,812 |

| 105,000 | | Flextronics International Ltd., 6.250%, due 11/15/2014, (b) Cost — $105,000; Acquired — 11/09/2004 (c) | | 104,475 |

| 100,000 | | IPC Acquisition Corp., 11.500%, due 12/15/2009 | | 110,000 |

| 90,000 | | ITT Corp., 7.375%, due 11/15/2015 | | 100,575 |

| | | | | 395,862 |

General Contractors (2.6%) |

| 160,000 | | Blount, Inc., 8.875%, due 08/01/2012 | | 174,400 |

| 55,000 | | William Lyon Homes, Inc., 7.625%, due 12/15/2012, (b) Cost — $55,000; Acquired — 11/15/2004 | | 53,969 |

| | | | | 228,369 |

Health Care Equipment & Supplies (2.9%) |

| 43,000 | | HMP Equity Holdings Corp., 0.000%, due 05/15/2008 (e) | | 28,649 |

| 110,000 | | Fisher Scientific International, 6.750%, due 08/15/2014, (b) Cost — $110,225; Acquired — 07/22/2004 | | 118,525 |

| 105,000 | | Universal Hospital Services, Inc., 10.125%, due 11/01/2011 | | 109,725 |

| | | | | 256,899 |

Health Care Providers & Services (2.5%) |

| 50,000 | | Healthsouth Corp., 7.375%, due 10/01/2006 | | 51,375 |

| 110,000 | | Healthsouth Corp., 10.750%, due 10/01/2008 | | 116,600 |

| 55,000 | | Omnicare, Inc., 6.125%, due 06/01/2013 | | 55,550 |

| | | | | 223,525 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| High Yield Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | | | VALUE |

| |

Hotels, Restaurants, & Leisure (8.2%) |

| $ 90,000 | | Caesars Entertainment, Inc., 8.125%, due 05/15/2011 | | $ 104,400 |

| 80,000 | | Hilton Hotels Corp., 7.500%, due 12/15/2017 | | 93,736 |

| 95,000 | | Host Marriott LP, 7.000%, due 08/15/2012, (b) Cost — $93,620; Acquired — 07/27/2004 | | 100,938 |

| 80,000 | | MGM Mirage, 8.500%, due 09/15/2010 | | 91,400 |

| 105,000 | | Pinnacle Entertainment, Inc., 8.250%, due 03/15/2012 | | 112,087 |

| 95,000 | | Vail Resorts, Inc., 6.750%, due 02/15/2014 | | 97,138 |

| 125,000 | | Wynn Las Vegas LLC, 6.625%, due 12/01/2014, (b) Cost — $124,276; Acquired — 12/17/2004 | | 124,375 |

| | | | | 724,074 |

Household Products (1.3%) |

| 45,000 | | Church & Dwight, Inc., 6.000%, due 12/15/2012, (b) Cost — $45,000; Acquired — 12/15/2004 | | 46,012 |

| 60,000 | | Rayovac Corp., 8.500%, due 10/01/2013 | | 66,900 |

| | | | | 112,912 |

Leisure Equipment & Products (1.0%) |

| 85,000 | | K2, Inc., 7.375%, due 07/01/2014, (b) Cost — $86,913; Acquired — 07/28/2004 | | 93,500 |

| |

Machinery (0.7%) |

| 60,000 | | Terex Corp., 7.375%, due 01/15/2014 | | 64,650 |

| |

Manufacturing Industries (0.4%) |

| 35,000 | | Polypore, Inc., 8.750%, due 05/15/2012 | | 36,750 |

| |

Mechanical Power Transmission Equipment (0.3%) |

| 23,000 | | Rexnord Corp., 10.125%, due 12/15/2012 | | 26,105 |

| | | | | |

Media (3.8%) | | | | |

| 80,000 | | Cablevision Systems Corp., 8.000%, due 04/15/2012, (b) Cost — $80,000; Acquired — 03/30/2004 | | 85,800 |

| 110,000 | | Insight Communications Co, Inc., 0.000%/12.500%, due 02/15/2011 (d) | | 107,525 |

| 85,000 | | Sinclair Broadcast Group, Inc., 8.000%, due 03/15/2012 | | 90,737 |

| 45,000 | | Sun Media Corp., 7.625%, due 02/15/2013 (c) | | 49,331 |

| | | | | 333,393 |

Miscellaneous Fabricated Products (0.7%) |

| 55,000 | | FastenTech, Inc., 11.500%, due 05/01/2011, (b) Cost — $60,897; Acquired — 07/27/2004 | | 63,525 |

| |

Motor Vehicle Supplies And New Parts (1.3%) |

| 10,000 | | Cooper-Standard Automotive, Inc., 7.000%, due 12/15/2012, (b) Cost — $10,000; Acquired — 12/16/2004 | | 10,200 |

| 35,000 | | Cooper-Standard Automotive, Inc., 8.375%, due 12/15/2014, (b) Cost — $35,000; Acquired — 12/16/2004 | | 35,087 |

| 60,000 | | United Components, Inc., 9.375%, due 06/15/2013 | | 65,400 |

| | | | | 110,687 |

Offices Of Holding Companies (0.3%) |

| 25,000 | | Affinia Group, Inc., 9.000%, due 11/30/2014, (b) Cost — $25,000; Acquired — 11/12/2004 | | 26,187 |

| |

Oil & Gas (4.3%) |

| 45,000 | | Chesapeake Energy Corp., 6.375%, due 06/15/2015, (b) Cost — $44,576; Acquired — 12/01/2004 | | 46,462 |

| 60,000 | | Chesapeake Energy Corp., 6.875%, due 01/15/2016 | | 63,150 |

| 40,000 | | Dynegy Holdings, Inc., 10.125%, due 07/15/2013, (b) Cost — $39,709; Acquired — 08/01/2003 | | 46,000 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| High Yield Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | | | VALUE |

| |

Oil & Gas (continued) |

| $ 55,000 | | El Paso Production Holding Co., 7.750%, due 06/01/2013 | | $ 57,888 |

| 60,000 | | Houston Exploration Co., 7.000%, due 06/15/2013 | | 63,900 |

| 100,000 | | Transmontaigne, Inc., 9.125%, due 06/01/2010 | | 109,000 |

| | | | | 386,400 |

Paper & Forest Products (6.1%) |

| 95,000 | | Ainsworth Lumber Co Ltd., 6.750%, due 03/15/2014 (c) | | 93,456 |

| 105,000 | | Boise Cascade LLC, 7.125%, due 10/15/2014, (b) Cost — $105,000; Acquired — 10/15/2004 | | 111,562 |

| 35,000 | | Cenveo Corp., 7.875%, due 12/01/2013 | | 32,725 |

| 75,000 | | Cenveo Corp., 9.625%, due 03/15/2012 | | 82,688 |

| 75,000 | | Georgia-Pacific Corp., 7.700%, due 06/15/2015 | | 86,062 |

| 95,000 | | Graphic Packaging International Corp., 9.500%, due 08/15/2013 | | 108,538 |

| 25,000 | | Neenah Paper, Inc., 7.375%, due 11/15/2014, (b) Cost — $25,000; Acquired — 11/18/2004 | | 25,500 |

| | | | | 540,531 |

Personal Products (1.2%) |

| 100,000 | | Elizabeth Arden, Inc., 7.750%, due 01/15/2014 | | 106,500 |

| |

Plastics Products (2.5%) |

| 80,000 | | Graham Packaging Co. LP, 8.500%, due 10/15/2012, (b) Cost — $81,031; Acquired — 09/29/2004 | | 84,400 |

| 135,000 | | Park Ohio Industries Inc., 8.375%, due 11/15/2014, (b) Cost — $135,550; Acquired — 11/19/2004 | | 135,675 |

| | | | | 220,075 |

Radiotelephone Communications (3.6%) |

| 32,000 | | Alamosa Delaware, Inc., 11.000%, due 07/31/2010 | | 37,840 |

| 100,000 | | L-3 Communications Corp., 5.875%, due 01/15/2015, (b) Cost — $100,000; Acquired — 11/01/2004 | | 100,250 |

| 25,000 | | New Skies Satellites NV, 9.125%, due 11/01/2012, (b) Cost — $25,000; Acquired — 10/22/2004 (c) | | 25,625 |

| 40,000 | | Rogers Wireless Communications, Inc., 9.625%, due 05/01/2011 (c) | | 47,100 |

| 50,000 | | Rogers Wireless, Inc., 7.500%, due 03/15/2015, (b) Cost — $50,000; Acquired — 11/19/2004 (c) | | 53,000 |

| 50,000 | | Rural Cellular Corp., 8.250%, due 03/15/2012 | | 53,125 |

| | | | | 316,940 |

Real Estate Investment Trusts (1.9%) |

| 80,000 | | Senior Housing Properties Trust, 7.875%, due 04/15/2015 | | 88,600 |

| 20,000 | | Senior Housing Properties Trust, 8.625%, due 01/15/2012 | | 22,950 |

| 55,000 | | Ventas Realty Limited Partnership, 6.625%, due 10/15/2014, (b) Cost — $55,000; Acquired — 10/08/2004 | | 56,513 |

| | | | | 168,063 |

Refrigerated Warehousing And Storage (0.6%) |

| 50,000 | | Reddy Ice Group, Inc., 8.875%, due 08/01/2011 | | 54,250 |

| |

Specialty Retail (2.6%) |

| 125,000 | | Blockbuster, Inc., 9.000%, due 09/01/2012, (b) Cost — $127,611; Acquired — 08/13/2004, | | |

| | | 09/29/2004, & 11/12/2004 | | 124,062 |

| 100,000 | | Jean Coutu Group, Inc., 7.625%, due 08/01/2012, (b) Cost — $102,438; Acquired — 07/22/2004 & 09/14/2004 (c) | | 106,250 |

| | | | | 230,312 |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Schedule of Investments | December 31, 2004 |

| High Yield Portfolio | |

SHARES OR PRINCIPAL AMOUNT | | | VALUE |

| |

Sporting And Athletic Goods ( 0.9%) |

| $ 80,000 | | Riddell Bell Hldgs, Inc., 8.375%, due 10/01/2012, (b) Cost — $81,219; Acquired — 09/23/2004 | $ 83,200 |

| |

Textiles, Apparel & Luxury Goods (2.3%) |

| 75,000 | | Phillips-Van Heusen, 7.250%, due 02/15/2011 | 79,125 |

| 115,000 | | Russell Corp., 9.250%, due 05/01/2010 | 123,913 |

| | | | 203,038 |

| |

Tobacco (1.2%) |

| 100,000 | | DIMON, Inc., 7.750%, due 06/01/2013 | 105,500 |

| |

Wireless Telecommunication Services (6.0%) |

| 69,300 | | AirGate PCS, Inc., 9.375%, due 09/01/2009, (b) Cost — $60,107; Acquired — 02/13/2004 | 75,017 |

| 110,000 | | American Tower Corp., 7.125%, due 10/15/2012, (b) Cost — $110,069; Acquired — 09/28/2004 & 09/29/2004 | 113,025 |

| 80,000 | | Crown Castle International Corp., 7.500%, due 12/01/2013 | 86,400 |

| 105,000 | | LG Telecom Ltd., 8.250%, due 07/15/2009, (b) Cost — $104,340; Acquired — 07/09/2004 & 07/28/2004 (c) | 113,954 |

| 60,000 | | Nextel Communications, Inc., 6.875%, due 10/31/2013 | 65,400 |

| 25,000 | | Spectrasite, Inc., 8.250%, due 05/15/2010 | 26,812 |

| 45,000 | | Spectrasite, Inc., 8.250%, due 05/15/2010, (b) Cost — $45,150; Acquired — 05/16/2004 & 05/19/2004 | 48,263 |

| | | | 528,871 |

| | | Total corporate bonds (cost $7,655,145) | 8,064,688 |

| |

FOREIGN GOVERNMENT NOTE/BONDS (3.9%) |

| 55,000 | | Republic of Panama, 7.250%, due 03/15/2015 (c) | 57,475 |

| 75,000 | | Republic of Turkey, 7.250%, due 03/15/2015 (c) | 77,438 |

| 130,000 | | Republic of Brazil, 10.500%, due 07/14/2014 (c) | 154,375 |

| 55,000 | | Russian Federation, 0.000%/7.500%, due 03/31/2030, (b) Cost — $53,016; Acquired — 09/29/2004 (c)(d) | 56,925 |

| | | Total foreign government note/bonds (cost $322,760) | 346,213 |

| |

MUNICIPAL BONDS (1.8%) |

| 60,000 | | Academica Charter Schools, 8.100%, due 08/15/2024, (b) Cost — $60,000; Acquired — 08/18/2004 | 61,809 |

| 100,398 | | Tobacco Settlement Financing Corp., 6.360%, due 05/15/2025 | 98,951 |

| | | Total municipal bonds (cost $159,120) | 160,760 |

| |

SHORT TERM INVESTMENTS (0.2%) |

| 20,000 | | AIM Liquid Asset Portfolio | 20,000 |

| | | Total short term investments (cost $20,000) | 20,000 |

| | | | |

| | | Total investments (cost $8,290,633) (98.2%) | 8,712,370 |

| | | Other assets in excess of liabilities 1.8% | 163,399 |

| | | Total net assets (100.0%) | $8,875,769 |

____________

| (a) | Non-Income Producing Security. |

| (b) | Restricted under Rule 144A of the Securities Act of 1933. |

| (c) | Foreign Security or U.S. Security of a foreign company. |

| (d) | STEP — Bonds where the coupon increases or steps up at a predetermined rate. |

| (e) | Zero coupon — Bonds that make no interest payments. |

| (g) | Security is fair valued. |

The accompanying notes are an integral part of these financial statements.

40|86 Series Trust | |

Portfolio Managers’ Review (unaudited) | December 31, 2004 |

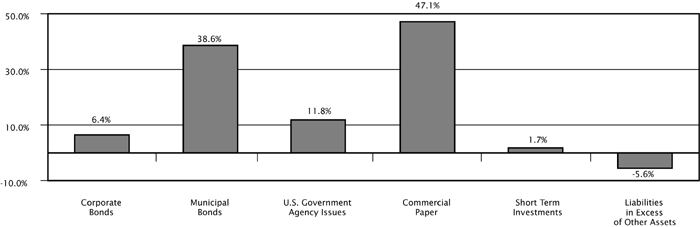

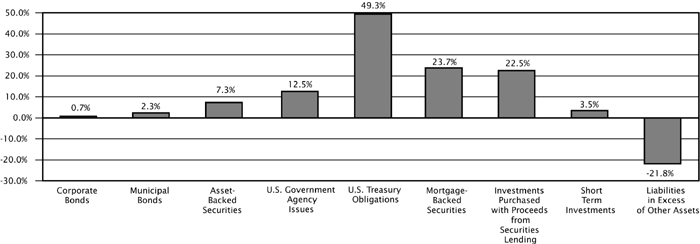

Fixed Income Portfolio

How did the Portfolio perform relative to its benchmark?