As of ______, 2005, to the knowledge of the Trust, none of the Independent Trustees, nor his or her immediate family members, beneficially owned any class of securities in the Adviser, principal underwriter of the Trust, nor any person (other than a registered investment company) director or indirectly controlling, controlled by, or under common control with the Adviser or principal underwriter of the Trust.

To the knowledge of the Trust’s management, as of the Record Date, the Trustees and officers of the Trust owned an aggregate of less than one percent of the outstanding shares of the Fund.

Each Independent Trustee receives an annual retainer fee of $7,500, a fee of $1,500 for each Board of Trustees meeting, Independent Trustee meeting or separate committee meeting (that is, committee meeting(s) not conducted in conjunction with a Board of Trustees meeting or Independent Trustee meeting) he or she attends. Additionally, each Independent Trustee receives a fee of $500 for Board of Trustee meetings and separate committee meetings attended that are conducted by telephone. The Chairman of the Board of Trustees receives an additional per-meeting fee of $375 for in-person Board meetings. The Trust also reimburses each Independent Trustee for travel and out-of-pocket expenses. The Adviser pays all compensation to all officers of the Trust and all Trustees of the Fund who are affiliated with the Adviser. The Trust does not pay any other remuneration to its officers and Trustees, and the Trust does not have a bonus, pension, profit-sharing or retirement plan.

During the Fund’s fiscal year ended December 31, 2004, the Board of Trustees held six meetings. Each of the Trustees then in office attended at least 75% of the aggregate of the total number of meetings of the Board of Trustees and committee meetings held during the fiscal year.

The aggregate amount of compensation paid to each Independent Trustee by the Fund for the fiscal year ended December 31, 2004, and by all funds in the 40|86 Family of Funds for which such Trustee was a Board member (the number of which is set forth in parenthesis next to each Trustee’s total compensation) was as follows:

| 2 | Representstotal compensation from all investment companies in the fund complex, including the Trust, for which the Trustee serves as a member of the Board of Trustees. Messrs. Hartley, LeCroy and Walthall served as Trustees for Conseco Fund Group (8 portfolios) until April 30, 2004, and as Directors for Conseco StockCar Stocks Mutual Fund, Inc. (1 portfolio) until October 29, 2004. |

Committees of the Board of Trustees

Audit Committee

Mr. Hartley (Chairperson), Dr. LeCroy, Mr. Walthall, Ms. Hamilton and Mr. Neff serve as members of the Audit Committee. The Audit Committee is comprised of all of the Independent Trustees who are “independent” as defined in the listing standards of the New York Stock Exchange (NYSE). During the fiscal year ended December 31, 2004, the Audit Committee held three meetings.

The principal purposes of the Audit Committee are to (1) oversee the accounting and financial reporting processes of the Fund and each of its series and its internal control over financial reporting and, as the Committee deems appropriate, to inquire into the internal control over financial reporting of certain third-party service providers; (2) oversee, or, as appropriate, assist Board oversight of, the quality and integrity of the Fund’s financial statements and the independent audit thereof; (3) oversee, or, as appropriate, assist Board oversight of, the Fund’s compliance with legal and regulatory requirements that relate to the Fund’s accounting and financial reporting, internal control over financial reporting and independent audits; (4) approve prior to appointment the engagement of the Fund’s independent auditors and, in connection therewith, to review and evaluate the qualifications, independence and performance of the Fund’s independent auditors; and (5) to act as a liaison between the Fund’s independent auditors and the full Board.

Set forth in the tables below are fees billed by PricewaterhouseCoopers (“PwC”), the Trust’s auditor, for the Trust’s last two fiscal years ended December 31:

2003 |

Audit Fees | Audit Related Fees | Tax Fees | Other Fees |

| $103,000 | $0 | $18,200 | $0 |

2004 |

Audit Fees | Audit Related Fees | Tax Fees | Other Fees |

| $113,400 | $0 | $22,400 | $0 |

PwC did not provide any Audit Related or other services and therefore, did not receive any Audit Related Fees or Other Fees from the Trust.

The Audit Committee is required to pre-approve permitted non-audit services provided by PwC to the Trust, the Adviser and certain of its affiliates to the extent that the services related directly to the operations and financial reporting of the Trust. No such non-audit services were provided by PwC during the Fund’s 2003 or 2004 fiscal years.

Nominating Committee

Ms. Hamilton (Chairperson), Mr. Hartley, Dr. LeCroy, Mr. Walthall and Mr. Neff serve as members of the Nominating Committee. The Nominating Committee is responsible for nominating individuals to serve as Trustees, including as Independent Trustees. Each member of the Nominating Committee must be an Independent Trustee. During the fiscal year ended December 31, 2004, the Nominating Committee held four meetings.

During the fiscal year ended December 31, 2004, members of the Nominating Committee reviewed resumes and questionnaires for prospective nominees. The Nominating Committee met on August 20 and August 31 to interview prospective nominees and nominated two individuals on November 22 to be elected by the existing Trustees.

Nominating Committee Charter. The Nominating Committee has a written charter. A copy of the Trust’s Nominating Committee Charter is attached as Appendix B to this proxy statement.

Nominee Qualifications. The Committee requires that Trustee candidates have a college degree or equivalent business experience. While there is no formal list of qualifications, the Nominating Committee considers, among other things, whether prospective nominees have distinguished records in their primary careers, integrity, and substantive knowledge in areas important to the Board of Trustees’ operations, such as background or education in finance, auditing, securities law, the workings of the securities markets, or investment advice. For candidates to serve as Independent Trustees, they must be independent from the Adviser, its affiliates and other principal service providers. The Nominating Committee also considers whether the prospective candidates’ workloads would allow them to attend meetings of the Board of Trustees, be available for service on Board committees, and devote the time and effort necessary to attend to Board matters and the rapidly changing regulatory environment in which the Trust operates.

Different substantive areas may assume greater or lesser significance at particular times, in light of the Board’s present composition and the Nominating Committee’s (or the Board’s) perceptions about future issues and needs.

Identifying Nominees. In identifying potential nominees for the Board, the Nominating Committee may consider candidates recommended by one or more of the following sources: (i) the Fund’s current Trustees, (ii) the Fund’s officers, (iii) the Fund’s investment adviser, and (iv) any other source the Committee deems to be appropriate, including shareholders. Resumes of candidates may be sent to the Secretary of the Trust at 11825 N. Pennsylvania Street, Carmel, Indiana 46032. The Committee may, but is not required to, retain a third party search firm at the Fund’s expense to identify potential candidates. The Nominating Committee initially evaluates prospective candidates on the basis of their resumes, considered in light of the criteria discussed above. Those prospective candidates that appear likely to be able to fill a significant need of the Board would be contacted by a Nominating Committee member by telephone to discuss the position; if there appeared to be sufficient interest, an in-person meeting with one or more Nominating Committee members would be arranged. If the Nominating Committee, based on the results of these contacts, believed it had identified a viable candidate, it would air the matter with all Trustees for input. The Trust has not paid a fee to third parties to assist in finding nominees. The Nominating Committee may consider candidates proposed by personnel of the Adviser or its affiliates.

Compensation Committee

Dr. LeCroy (Chairperson), Mr. Hartley, Mr. Walthall, Ms. Hamilton and Mr. Neff serve as members of the Compensation Committee. The Compensation Committee periodically reviews and evaluates the compensation of the Independent Trustees and recommends any appropriate changes, as necessary. During the fiscal year ended December 31, 2004, the Compensation Committee held one meeting.

Insurance Committee

Mr. Neff (Chairperson), Mr. Hartley, Dr. LeCroy, Mr. Walthall and Ms. Hamilton serve as members of the Insurance Committee. The Insurance Committee periodically reviews and evaluates the insurance coverage that protects the Trust and the Trustees. During the fiscal year ended December 31, 2004, the Insurance Committee held one meeting.

Retirement Committee

Mr. Walthall (Chairperson), Mr. Hartley, Dr. LeCroy, Ms. Hamilton and Mr. Neff serve as members of the Retirement Committee. The Retirement Committee periodically reviews and evaluates the retirement policy and recommends any appropriate changes, as necessary. During the fiscal year ended December 31, 2004, the Retirement Committee held one meeting.

Trustee Attendance at the Meeting

The Trust has no formal policy regarding Trustee attendance at shareholder meetings. The President of the Trust, who is also a Trustee, attended the Annual Meeting held in February 2004.

Required Vote

Approval of the nominees for the Board of Trustees requires the affirmative vote of a plurality of the shares of the Trust.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES TO SERVE AS TRUSTEES OF THE TRUST.

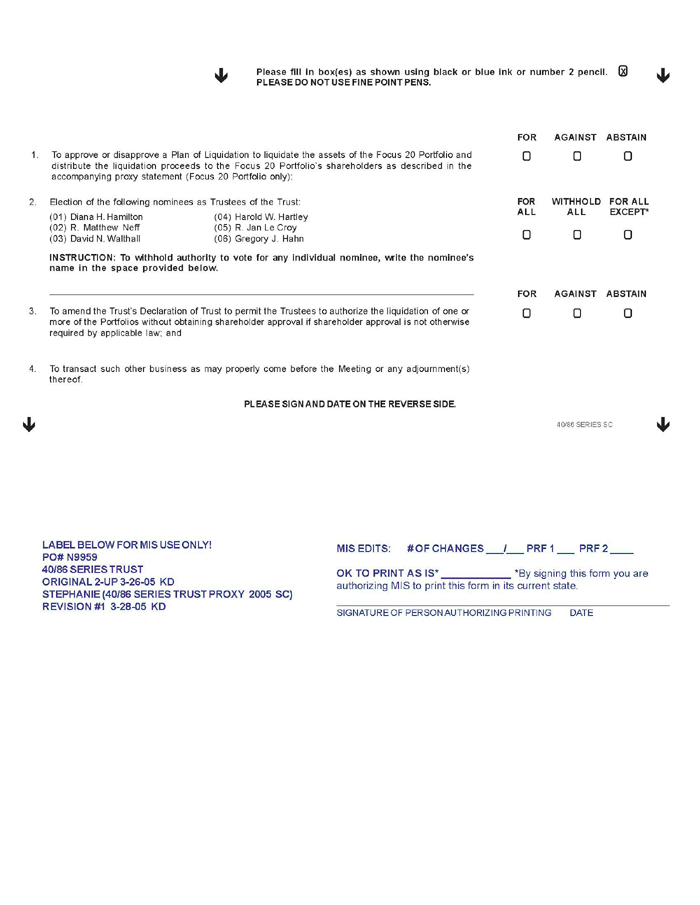

PROPOSAL 3

TO AMEND THE TRUST’S DECLARATION OF TRUST

TO PERMIT THE TRUSTEES TO AUTHORIZE THE LIQUIDATION OF ONE OR MORE OF THE PORTFOLIOS WITHOUT OBTAINING SHAREHOLDER APPROVAL IF SHAREHOLDER APPROVAL IS NOT OTHERWISE REQUIRED BY APPLICABLE LAW

(ALL PORTFOLIOS VOTING TOGETHER)

Introduction

Amendment of Section 13.1 of the Declaration of Trust

Currently, Section 13.1 of the Trust’s Declaration of Trust provides that the Trust may be terminated at any meeting of the shareholders called for the purpose of voting on such termination, by (1) the affirmative vote of the holders of a majority of the shares outstanding and entitled to vote, or (2) by a written instrument or instruments signed by a majority of the Trustees and the holders of a majority of shares. The Declaration of Trust is silent with respect to liquidating or otherwise terminating a Portfolio of the Trust. Under this Proposal 3, you are being asked to vote on an amendment of Section 13.1 which would permit the Trustees to authorize a liquidation of a Portfolio without a shareholder vote if shareholder approval is not otherwise required by applicable law. Shareholders of the Focus 20 Portfolio are being asked to approve the liquidation of the Focus 20 Portfolio as set forth in Proposal 1 of this Proxy Statement. No other Portfolio liquidations are contemplated at this time.

The amendment of Section 13.1 of the Declaration of Trust will provide the Trustees with more flexibility and broader authority to act with respect to the operations of the Trust and its Portfolios, subject to the applicable requirements of the 1940 Act and Massachusetts law. This amendment, however, will not alter in any way the Trustees’ existing fiduciary obligations to act with due care and in the shareholders’ interests.

If Proposal 3 is approved, Section 13.1 of the Trust’s Declaration of Trust will be amended to add the following new paragraph immediately prior to the last paragraph of Section 13.1:

“Notwithstanding the foregoing, any Portfolio may be terminated at any time by the affirmative vote of the holders of a majority of the Shares of such Portfolio outstanding and entitled to vote, or by a majority vote of the Trustees. Upon termination of the Portfolio and distribution to the Shareholders, a majority of the Trustees shall execute and lodge among the records of the Trust an instrument in writing setting forth the fact of such termination, and the Trustees shall thereupon be discharged from all further liabilities and duties hereunder, and the right, title and interest of all Shareholders of such Portfolio shall cease and be cancelled and discharged.”

Required Vote

Approval of Proposal 3 with respect to the Trust requires the affirmative vote of the holders of a majority of the Trust.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE AMENDMENT OF SECTION 13.1 OF THE TRUST’S DECLARATION OF TRUST UNDER THIS PROPOSAL 3.

OTHER INFORMATION

Investment Adviser

40|86 Advisors, Inc., a registered investment adviser located at 535 College Drive, Carmel, Indiana 46032, is a wholly-owned subsidiary of Conseco, Inc. (“Conseco”), a publicly held financial services company (NYSE: CNO), and serves as the investment adviser of the Portfolios.

Administrator

Conseco Services, LLC, located at 11825 N. Pennsylvania Street, Carmel, Indiana 46032, is a wholly-owned subsidiary of Conseco, and acts administrator to the Trust.

Principal Underwriter

Conseco Equity Sales, Inc., located at 11825 N. Pennsylvania Street, Carmel, Indiana 46032, is a wholly-owned subsidiary of Conseco, and serves as the principal underwriter for each Portfolio.

Custodian

The Bank of New York, 90 Washington Street, 22nd Floor, New York, New York 10826, services as custodian of the assets of each Portfolio.

Shareholder Proposals

As a general matter, the Trust does not hold regular annual or other regular meetings of shareholders. Any shareholder that wishes to submit proposals to be considered at a special meeting of the Trust’s shareholders should send such proposals to the Trust at 11825 North Pennsylvania Street, Carmel, Indiana 46032. Proposals must be received within a reasonable period of time prior to any meeting to be included in the proxy materials or otherwise to be considered at the meeting. Moreover, inclusion of such proposals is subject to limitations under the federal securities laws. Persons named as proxies for any subsequent shareholders’ meeting will vote in their discretion with respect to proposals submitted on an untimely basis.

Other Business

The Trust’s management knows of no other business to be presented to the Meeting other than the matters set forth in this Proxy Statement, but should any other matter requiring a vote of the Trust’s shareholders arise, the proxies will vote thereon according to their best judgment in the interests of the Trust.

Only one proxy statement is being delivered to multiple shareholders sharing an address unless the Trust has received contrary instructions from one or more of the shareholders. The Trust will deliver promptly upon written or oral request a separate copy of the proxy statement to a shareholder at a shared address to which a single copy of the document was delivered. If a shareholder wishes to receive a separate copy of the proxy statement, please call 1-866-299-4086 or notify the Trust in writing addressed to the Secretary of the Trust (11815 North Pennsylvania Street, Carmel, Indiana 46032). You may also call or write to the Trust at the number and address specified above to notify the Trust that (1) you wish to receive a separate copy of any annual report or proxy statement in the future or (2) you wish to receive delivery of a single copy of any annual report or proxy statement in the future (if you are currently receiving multiple copies of annual reports or proxy statements).

Shareholders may send written communications to the Fund’s Board of Trustees or to an individual Trustee by mailing such correspondence to the Secretary of the Trust (addressed to 11815 North Pennsylvania Street, Carmel, Indiana 46032). Such communications must be signed by the shareholder and identify the number of shares held by the shareholder. Properly submitted shareholder communications will, as appropriate, be forwarded to the entire Board or to the individual Trustee.

APPENDIX A

PLAN OF LIQUIDATION

40|86 SERIES TRUST

Focus 20 Portfolio

RECITALS

This Plan of Liquidation is dated ____________ 2005, by 40|86 Series Trust (the “Trust”), on behalf of its separately designated series, the Focus 20 Portfolio.

The Trust was organized as a Massachusetts business trust on November 15, 1982, and is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust is a series type of mutual fund that issues separate series of shares, each of which represents a separate portfolio of investments (each, a “Portfolio”).

Shares of each Portfolio, including the Focus 20 Portfolio, are offered to insurance companies in order to fund certain of their separate accounts used to support variable annuity and variable life insurance contracts (collectively, “variable contracts”). Currently, shares of the Focus 20 Portfolio are held only by separate accounts owned by Jefferson National Life Insurance Company (“Jefferson National”).

40|86 Advisors, Inc. (the “Adviser”) is the investment adviser to each of the Portfolios, including the Focus 20 Portfolio. Oak Associates, ltd (“Oak”) currently serves as the investment subadviser to the Focus 20 Portfolio. The Adviser and Oak are each registered as investment advisers under the Investment Advisers Act of 1940, as amended.

The Board of Trustees of the Trust (“Board of Trustees”) has determined that it is in the best interests of the Trust, the Focus 20 Portfolio, and owners of variable contracts indirectly invested in the Focus 20 Portfolio (“Contract Owners”) to liquidate the Focus 20 Portfolio pursuant to the terms described in this Plan of Liquidation.

ARTICLE I

The Liquidation

The date of the liquidation of the Focus 20 Portfolio (the “Liquidation Date”) shall be [May 31], 2005, or such other date as shall be specified by the Board of Trustees or the appropriate officers of the Trust pursuant to authority granted by the Board of Trustees. In the event that trading on the New York Stock Exchange or on another exchange or market on which the securities or other investments held by the Focus 20 Portfolio is disrupted on the Liquidation Date so that, in the judgment of the Board of Trustees or appropriate officers of the Trust acting pursuant to authority granted by the Board of Trustees, accurate appraisal of the net assets of the Focus 20 Portfolio is impracticable, the Liquidation Date shall be postponed until the first business day after the day on which trading on such exchange or in such market shall have been resumed without disruption.

Provided that each of the conditions specified in Article II of this Plan of Liquidation are satisfied, on the Liquidation Date, the Trust shall cause the Focus 20 Portfolio to distribute its assets to its shareholders by redeeming their shares for cash, and the shares of the Focus 20 Portfolio shall be cancelled. After such liquidation, the Focus 20 Portfolio shall engage in no other business except to wind up its operations and completely terminate.

ARTICLE II

Conditions Precedent to the Liquidation

By the Liquidation Date, the Focus 20 Portfolio will sell its portfolio securities for cash or permit them to mature, and will reduce any other assets to cash or cash equivalents and pay any liabilities. The Board of Trustees, or appropriate officers of the Trust acting pursuant to authority granted by the Board of Trustees, will declare and pay a dividend on the shares of the Focus 20 Portfolio that represents substantially all of the Focus 20 Portfolio’s accrued but undistributed net investment income through the Liquidation Date as well as any other dividend necessary to enable the Focus 20 Portfolio to avoid any liability for excise taxes.

The Board of Trustees will call a meeting of the shareholders of the Focus 20 Portfolio (the “Meeting”) to submit to the shareholders this Plan of Liquidation for their approval or disapproval. The date of the Meeting of the shareholders shall be prior to the Liquidation Date. Approval of this Plan of Liquidation by the shareholders requires an affirmative vote of a majority of the shares entitled to vote at the Meeting.

Prior to the Meeting, the Trust shall distribute to the shareholders entitled to vote at the Meeting and to Contract Owners indirectly invested in such shares a proxy statement and other proxy materials, including voting instruction forms, that comply in all material respects with the applicable provisions of Section 14(a) of the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

ARTICLE III

Miscellaneous

The Board of Trustees may authorize variations from, or amendments to, the provisions of this Plan of Liquidation (other than the terms of the liquidating distributions contained in Article I hereof) that it deems necessary or appropriate to effect the distributions in cancellation and redemption of the shares of the Focus 20 Portfolio and the liquidation and termination of the Focus 20 Portfolio’s existence.

At any time prior to the Liquidation Date, the Liquidation may be postponed or abandoned by the Board of Trustees or appropriate officers of the Trust acting pursuant to authority granted by the Board of Trustees. If the Liquidation is abandoned, this Plan of Liquidation shall become void and have no effect, without liability on the part of either the Focus 20 Portfolio, the shareholders of the Focus 20 Portfolio, the Trust or the holders of any other series of the Trust’s shares.

This Plan of Liquidation and all amendments hereto shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts.

[___________ will pay the expenses incurred in connection with the liquidation of the Focus 20 Portfolio, including, without limitation, (1) expenses associated with the preparation and filing of a proxy statement relating to the liquidation, (2) postage, printing and proxy solicitation costs, (3) brokerage commissions and other direct expenses of liquidating investments held by the Focus 20 Portfolio, and (4) fees and disbursements of legal counsel and other professionals.]

As soon as is reasonably practically, after the Liquidation Date, the Trust will: (1) prepare and file all federal and other tax returns and reports of the Focus 20 Portfolio required by law with respect to all periods ending on or before the Liquidation Date, (2) pay all federal and other taxes due on, but not paid by, the Liquidation Date, (3) prepare and file any other required regulatory reports, and (4) take any other steps necessary or proper to effect the termination or dissolution of the Focus 20 Portfolio under federal or state law.

APPENDIX B

40|86 Series Trust

Nominating Committee Charter

Adopted as of December 2, 2004

The Board of Trustees (the “Board”) of 40|86 Series Trust (the “Fund”) has adopted this Charter to govern the activities of the Nominating Committee (the “Committee”) of the Board.

Statement of Purpose and Responsibility

The selection and nomination of the independent Trustees of the Fund is committed to the discretion of the then independent Trustees of the Fund. The primary purpose and responsibility of the Committee is the screening and nomination of candidates for election to the Board as independent trustee.

Organization and Governance

The Committee shall be comprised of as many Trustees as the Board shall determine, but in any event not fewer than two (2) Trustees. The Committee must consist entirely of Board members who are not “interested persons” of the Fund, as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended. The Board may remove or replace any member of the Committee at any time in its sole discretion.

One or more members of the Committee may be designated by the Board as the Committee’s chairman or co-chairman, as the case may be.

The Committee will not have regularly scheduled meetings. Committee meetings shall be held as and when the Committee of the Board determines necessary or appropriate in accordance with the Fund’s Bylaws.

Qualifications for Trustee Nominees

The Committee requires that Trustee candidates have a college degree or equivalent business experience. The Committee may take into account a wide variety of factors in considering Trustee candidates, including (but not limited to): (i) availability and commitment of a candidate to attend meetings and perform his or her responsibilities on the Board, (ii) relevant industry and related experience, (iii) educational background, and (iv) ability, judgment and experience.

Identification of Nominees

In identifying potential nominees for the Board, the Committee may consider candidates recommended by on or more of the following sources: (i) the Fund’s current Trustees, (ii) the Fund’s officers, (iii) the Fund’s investment adviser, and (iv) any other source the Committee deems to be appropriate. The Committee may, but is not required to, retain a third party search firm at the Fund’s expense to identify potential candidates.