UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | [X] |

| | |

| Filed by a Party other than the Registrant | [ ] |

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| | |

| [ ] | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E) (2)) |

| | |

| [X] | Definitive Proxy Statement |

| | |

| [ ] | Definitive Additional Materials |

| | |

| [ ] | Soliciting Material Pursuant to Sec. 240.14a-12 |

40|86 SERIES TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

| | | |

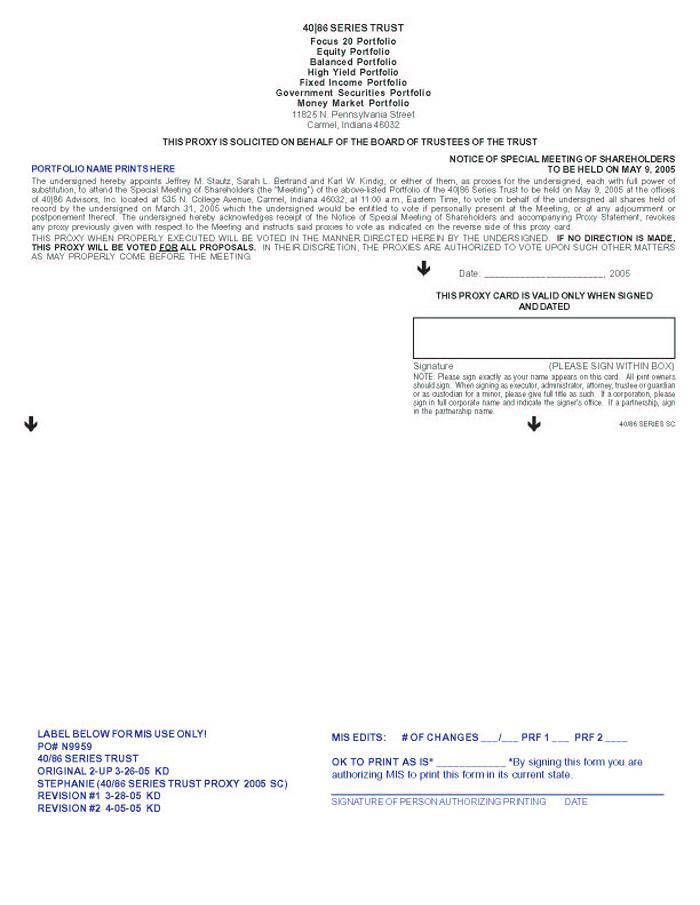

40|86 SERIES TRUST

Focus 20 Portfolio

Equity Portfolio

Balanced Portfolio

High Yield Portfolio

Fixed Income Portfolio

Government Securities Portfolio

Money Market Portfolio

11825 N. Pennsylvania Street

Carmel, Indiana 46032

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 9, 2005

NOTICE IS HEREBY GIVEN of a Special Meeting of Shareholders (the “Meeting”) of each of the above-listed portfolios (each a “Portfolio”) of the 40|86 Series Trust, a Massachusetts business trust (the “Trust”). The Meeting will be held on May 9, 2005 at the offices of 40|86 Advisors, Inc. located at 535 N. College Avenue, Carmel, Indiana 46032, at 11:00 a.m., Eastern Time, to vote on the following proposals (“Proposals”):

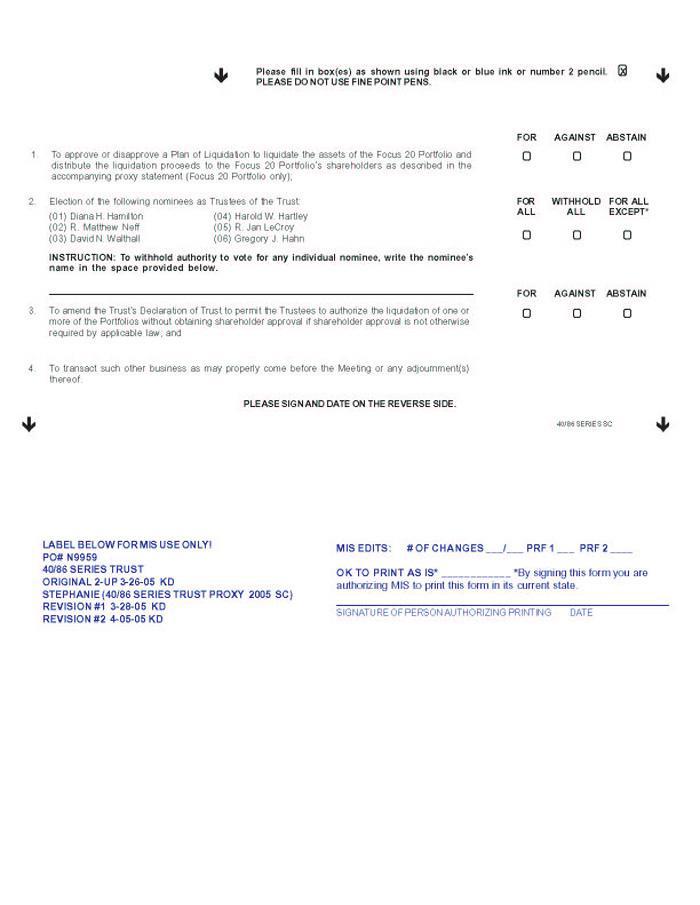

| | 1. | For the Focus 20 Portfolio, to approve or disapprove a Plan of Liquidation to liquidate the assets of the Focus 20 Portfolio and distribute the liquidation proceeds to the Focus 20 Portfolio’s shareholders as described in the accompanying proxy statement; |

| | 2. | For each Portfolio, to elect the Trustees of the Trust; |

| | 3. | For each Portfolio, to amend the Trust’s Declaration of Trust to permit the Trustees to authorize the liquidation of one or more of the Portfolios without obtaining shareholder approval if shareholder approval is not otherwise required by applicable law; and |

| | 4. | To transact such other business as may properly come before the Meeting or any adjournment(s) thereof. |

Separate accounts of Jefferson National Insurance Company, Business Men’s Assurance Company of America and Washington National Insurance Company (the “Insurance Companies”) are the only shareholders of the Portfolios. The Insurance Companies will solicit and vote the shares of the Portfolios at the Meeting in accordance with timely instructions received from owners of the variable annuity contracts and variable life insurance contracts (“variable contracts”) having contract values allocated to a separate account invested in such shares.

If you are a variable contract owner of record at the close of business on March 31, 2005, you have the right to instruct the Insurance Company sponsoring your variable contract as to the manner in which shares of the Portfolios attributable to your variable contract should be voted.

An Insurance Company may revoke its proxy at any time before it is exercised by the subsequent execution and submission of a revised proxy card, by giving written notice of revocation to the Trust at any time before the proxy is exercised, or by voting at the Meeting.

| | By order of the Board of Trustees, |

| | |

| | |

| | Sarah L. Bertrand |

| | Secretary |

April 7, 2005

11825 N. Pennsylvania Street

Carmel, Indiana 46032

40|86 SERIES TRUST

Focus 20 Portfolio

Equity Portfolio

Balanced Portfolio

High Yield Portfolio

Fixed Income Portfolio

Government Securities Portfolio

Money Market Portfolio

11825 N. Pennsylvania Street

Carmel, Indiana 46032

PROXY STATEMENT

April 7, 2005

This Proxy Statement is being furnished on behalf of the board of trustees (the “Board”) of 40|86 Series Trust, a Massachusetts business trust (the “Trust”), currently offering shares of the Focus 20 Portfolio, Equity Portfolio, Balanced Portfolio, High Yield Portfolio, Fixed Income Portfolio, Government Securities Portfolio and Money Market Portfolio (each a “Portfolio”, and collectively the “Portfolios”), for use at the Special Meeting of Shareholders of the Trust (the “Meeting”) to be held on May 9, 2005 at the offices of 40|86 Advisors, Inc. located at 535 N. College Avenue, Carmel, Indiana 46032, at 11:00 a.m., Eastern Time, and any adjournment thereof. This Proxy Statement and the accompanying voting instruction card are first being mailed on or about April 7, 2005.

At the Meeting, shareholders will be asked to vote on the following proposals (each a “Proposal”):

| | 1. | For the Focus 20 Portfolio, to approve or disapprove a Plan of Liquidation to liquidate the assets of the Focus 20 Portfolio and distribute the liquidation proceeds to the Focus 20 Portfolio’s shareholders as described in the accompanying proxy statement; |

| | 2. | For each Portfolio, to elect the Trustees of the Trust; |

| | 3. | For each Portfolio, to amend the Trust’s Declaration of Trust to permit the Trustees to authorize the liquidation of one or more of the Portfolios without obtaining shareholder approval if shareholder approval is not otherwise required by applicable law; and |

| | 4. | To transact such other business as may properly come before the Meeting or any adjournment(s) thereof. |

The following table shows which Proposals apply to your Portfolio(s):

Portfolio | Applicable Proposals |

| Focus 20 Portfolio | 1, 2, 3, 4 |

| Equity Portfolio | 2, 3, 4 |

| Balanced Portfolio | 2, 3, 4 |

| High Yield Portfolio | 2, 3, 4 |

| Fixed Income Portfolio | 2, 3, 4 |

| Government Securities Portfolio | 2, 3, 4 |

| Money Market Portfolio | 2, 3, 4 |

Shares of the Portfolios are held exclusively by certain insurance company separate accounts (“Separate Accounts”, or also referred to as the “Shareholders”) pursuant to agreements with each participating insurance company (“Participation Agreements”). The Separate Accounts are being asked to approve the aforementioned Proposals and the transactions contemplated thereunder as discussed in this Proxy Statement. If you are an owner (“Owner”) of a variable annuity contract or variable life insurance contract (each, a “Variable Contract”) funded by a Separate Account, you have received this Proxy Statement because shares of one or more of the Portfolios have been purchased at your direction by your insurance company (“Insurance Company”) through the Separate Accounts. You are being asked by your Insurance Company on behalf of the Separate Accounts for instructions as to how to vote the shares of the Portfolios that are attributable to your Variable Contract. Your Insurance Company will vote all of its shares in the same proportion as the voting instructions actually received from its Owners.

COPIES OF THE PORTFOLIOS’ MOST RECENT ANNUAL AND SEMI-ANNUAL REPORTS, INCLUDING FINANCIAL STATEMENTS, HAVE PREVIOUSLY BEEN DELIVERED TO SHAREHOLDERS. SHAREHOLDERS MAY REQUEST COPIES OF THE PORTFOLIOS’ ANNUAL AND SEMI-ANNUAL REPORTS, WHICH WILL BE FURNISHED WITHOUT CHARGED, BY WRITING THE PORTFOLIOS AT 11825 NORTH PENNSYLVANIA STREET, CARMEL, INDIANA 46032, OR BY CALLING 1-866-299-4086.

GENERAL VOTING INFORMATION

The persons named as proxies will vote those proxies that they are entitled to vote “FOR” the Proposals in favor of such an adjournment and will vote those proxies required to be voted “AGAINST” the Proposals against such adjournment. A shareholder vote may be taken on one or more of the Proposals in this Proxy Statement prior to any such adjournment if sufficient votes have been received and it is otherwise appropriate.

All properly executed and unrevoked proxies received in time for the Meeting will be voted as instructed by shareholders. If you execute your proxy but give no voting instructions, your shares that are represented by proxies will be voted “FOR” each Proposal and “FOR” or “AGAINST” any other business which may properly arise at the Meeting, in the proxies’ discretion. If an Owner does not submit a voting instruction card on time, the Owner’s Insurance Company will vote the Owner’s interests in the same proportion as interests for which it has received timely instructions. Abstentions will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum and will have a negative effect on the Proposals. Each Insurance Company will vote shares of the Portfolios held by each of its Separate Accounts in accordance with instructions received from the Owners. Each Insurance Company will also vote shares of the Portfolios held in each Separate Account for which it has not received timely instructions, as well as any shares held in its general account, in the same proportion as it votes shares held by that Separate Account for which it has received instructions. Shareholders of the Portfolios and Owners permitted to give instructions, and the number of shares for which such instructions may be given for purposes of voting at the Meeting and any adjournment thereof, will be determined as of the record date.

An Insurance Company giving a proxy has the power to revoke it at any time prior to its exercise by executing a superseding proxy card or by submitting a written notice of revocation to the Secretary of the Trust (“Secretary”). To be effective, such revocation must be received by the Secretary prior to the Meeting. In addition, although mere attendance at the Meeting will not revoke a proxy, a Shareholder present at the Meeting may withdraw its proxy by voting at the Meeting.

Shareholder Information

Shareholders of record as of the close of business on March 31, 2005 (“Record Date”), are entitled to vote at the Meeting. Information as to the number of outstanding shares for each Portfolio as of the Record Date is set forth below:

Portfolio | Outstanding Shares |

| Focus 20 Portfolio | 390,705.060 |

| Equity Portfolio | 6,735,015.726 |

| Balanced Portfolio | 3,403,304.479 |

| High Yield Portfolio | 757,445.130 |

| Fixed Income Portfolio | 2,573,873.343 |

| Government Securities Portfolio | 1,151,258.524 |

| Money Market Portfolio | 34,605,563.905 |

The shares have been issued only in connection with the sale of the following:

| · | Various contracts offered by Jefferson National Life Insurance Company; |

| · | Variable Account B issued by Washington National Insurance Company, formerly Bankers National Life Insurance Company; |

| · | BMA Variable Account A issued by Business Men’s Assurance Company of America. |

The addresses of the Insurance Companies listed above are:

Jefferson National Life Insurance Company, 1002 S. 12th Street, Louisville, Kentucky 40210

Business Men’s Assurance Company of America, 2000 Wade Hampton Boulevard, Greenville, South Carolina 29615

Washington National Insurance Company, 11825 N. Pennsylvania Street, Carmel, Indiana 46032

As of March 31, 2005, to the Trust’s knowledge, the following are the only persons who had or shared voting or investment power over more than 5% of the outstanding Shares of the 40|86 Series Trust Portfolios:

Portfolio Name | Name and Address of Owner | Number of Shares Beneficially Owned1 | Percentage of Portfolio Owned |

| Focus 20 Portfolio | Separate Accounts of Jefferson National Life Insurance Company 1002 S. 12th Street Louisville, KY 40210 | 390,705.060 | 100.0% |

| Equity Portfolio | Separate Accounts of Jefferson National Life Insurance Company 1002 S. 12th Street Louisville, KY 40210 | 6,688,620.777 | 99.3% |

| Balanced Portfolio | Separate Accounts of Jefferson National Life Insurance Company 1002 S. 12th Street Louisville, KY 40210 | 3,325,763.732 | 97.7% |

| High Yield Portfolio | Separate Accounts of Jefferson National Life Insurance Company 1002 S. 12th Street Louisville, KY 40210 | 757,445.130 | 100.0% |

| Fixed Income Portfolio | Separate Accounts of Jefferson National Life Insurance Company 1002 S. 12th Street Louisville, KY 40210 | 2,573,734.825 | 100.0% |

| Government Securities Portfolio | Separate Accounts of Jefferson National Life Insurance Company 1002 S. 12th Street Louisville, KY 40210 | 1,123,154.428 | 97.6% |

| Money Market Portfolio | Separate Accounts of Jefferson National Life Insurance Company 1002 S. 12th Street Louisville, KY 40210 | 34,542,684.788 | 99.8% |

| 1 | The Shareholder will vote these Shares in accordance with voting instructions received in a timely manner from Owners of variable contracts. |

As of March 31, 2005, to the Trust’s knowledge, the Trustees and officers of the Trust, as a group, owned less than 1% of the outstanding shares of each Portfolio.

Solicitation of Proxies and Voting Instructions

The solicitation of proxies and voting instructions from Owners, the cost of which will be borne by the Trust, may be made by mail, telephone, facsimile, personal contact by officers or employees of the Insurance Companies or the Trust or their affiliates. The Portfolios’ officers and employees of 40|86 Advisors, Inc., the investment adviser of the Trust (the “Adviser”), who assist in the proxy solicitation will not receive any additional or special compensation for any such efforts.

Quorum

For each Portfolio, the presence, in person or by proxy, of a majority of the shares of the Portfolio outstanding and entitled to vote will constitute a quorum with respect to that Portfolio.

Vote Required

The affirmative vote of a majority of the outstanding shares of the Focus 20 Portfolio present in person or by proxy is required for the approval of Proposal 1. The affirmative vote of a majority of the outstanding shares of the Portfolios present in person or by proxy is required for the approval of Proposal 3. A majority means more than 50% of the outstanding shares on the Record Date. The election of Trustees under Proposal 2 requires the affirmative vote of a plurality of the outstanding shares of the Portfolios present in person or by proxy. Abstentions will be counted as present at the Meeting for purposes of determining a quorum and will have the effect of a “AGAINST” vote on the Proposal.

Adjournments

In the absence of a quorum or in the event that a quorum is present at the Meeting, but votes sufficient to approve the Proposals are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares represented at the Meeting in person or by proxy.

Recommendation of the Board of Trustees

The Board of Trustees unanimously recommends that shareholders vote “FOR” each of the Proposals.

PROPOSAL 1

TO APPROVE OR DISAPPROVE A PLAN OF LIQUIDATION

TO LIQUIDATE AND TERMINATE THE FOCUS 20 PORTFOLIO

(SHAREHOLDERS OF THE FOCUS 20 PORTFOLIO)

Introduction

At a meeting held on February 17, 2005, the Board of Trustees approved the liquidation of the Focus 20 Portfolio. The liquidation of the Focus 20 Portfolio will be governed by the terms of a Plan of Liquidation, a form of which is attached hereto as Appendix A.

The proposed liquidation of the Focus 20 Portfolio, if consummated, would result in: (1) the liabilities (if any) of the Focus 20 Portfolio being paid by the Focus 20 Portfolio, (2) the assets of the Focus 20 Portfolio being sold for cash or permitted to mature, and (3) the reduction of any other assets to cash or cash equivalents, followed by the distribution of the liquidation proceeds to shareholders of the Focus 20 Portfolio in proportion to their share ownership in the Focus 20 Portfolio. After the distribution of the liquidation proceeds, the Trust would terminate the Focus 20 Portfolio. Upon the liquidation of the Focus 20 Portfolio, the Insurance Companies each intend to arrange for the transfer (as described below) of liquidation proceeds distributed to its Separate Accounts from subaccounts invested in the Focus 20 Portfolio to subaccounts investing in other funds available as investment options under the Variable Contracts issued through that Separate Account. Consequently, if Owners vote to approve the proposed liquidation, the Focus 20 Portfolio will be liquidated and the Insurance Companies will reinvest the liquidation proceeds applicable to each Owner’s interest in the Focus 20 Portfolio by purchasing shares of another investment option available under the Owner’s Variable Contract pursuant to transfer instructions timely received from Owners, or if no transfer instructions are timely received, in the PIMCO VIT Money Market Fund. After the liquidation proceeds are distributed, the Trust will terminate the Portfolio’s existence.

Reasons for the Proposed Liquidation

The Board of Trustees, including Trustees who are not deemed to be “interested persons” of the Trust as defined under the 1940 Act (“Independent Trustees”) determined at a meeting held on February 17, 2005 upon the recommendation of the Adviser that the continued operation of the Focus 20 Portfolio was not economically viable and that it would be in the best interests of shareholders to liquidate and dissolve the Focus 20 Portfolio.

At the February 17, 2005 meeting, the Board considered, among other things, the limited prospects for growth of the Focus 20 Portfolio’s assets along with the fact that the Focus 20 Portfolio has not achieved the growth expected by the Adviser at the time it commenced operations on May 4, 2000. The Board considered, among other things, the small asset size of the Focus 20 Portfolio as shown by the table below:

| | Assets as of December 31, 2002 | Assets as of December 31, 2003 | Assets as of December 31, 2004 |

Focus 20 Portfolio | $897,884 | $5,099,325 | $1,565,858 |

Because the Focus 20 Portfolio has not grown as anticipated, its expenses generally are higher in proportion to its net assets than the expenses associated with its peer funds. In order to reduce the expenses borne by investors, the Adviser has waived or reimbursed certain of the fees and expenses of the Focus 20 Portfolio. The Board considered that one of the effects of the small asset size of the Focus 20 Portfolio was the inability of the Focus 20 Portfolio to maintain a competitive expense ratio (before the Adviser’s waivers and reimbursements). Expenses (before the Adviser’s waivers and reimbursements) of the Focus 20 Portfolio as of the end of fiscal years 2002-2004 are shown in the table below:

| | Expenses for Year Ended December 31, 2002 | Expenses for Year Ended December 31, 2003 | Expenses for Year Ended December 31, 2004 |

Focus 20 Portfolio | 1.96% | 1.30% | 1.20% |

The Board considered that the Adviser and Conseco Services, LLC, the administrator of the Trust (the “Administrator”), contractually agreed to waive a portion of their investment advisory fee and administrative fee, respectively, and/or reimburse the Focus 20 Portfolio to the extent that the ratio of expenses to net assets on an annual basis exceeded 1.15% in order to maintain competitive expense ratios and improve the performance of the Focus 20 Portfolio. The Board also considered that the Adviser and Administrator could discontinue these contractual waivers and/or reimbursements at any time after April 30, 2005 and could recover any money waived under the contract provisions, to the extent that actual fees and expenses were less than the expense limitation, for a period of three years after the date of the waiver.

The Board recognized that, given the limited prospects for sales growth, it was unlikely that the Focus 20 Portfolio’s assets would increase to an appropriate size such that it could conduct its businesses and operations in an economically viable manner. Given the Focus 20 Portfolio’s small asset size and high expenses relative to its asset size, the Board concluded that, if the Adviser and Administrator discontinued their fee and expense waivers and reimbursements, it would be unlikely for the Focus 20 Portfolio to be able to realize acceptable performance levels. If these waivers and reimbursements were discontinued, the resulting increase in expense ratios may also cause the Focus 20 Portfolio to experience even greater net redemptions, resulting in even higher expense ratios for the remaining shareholders since the expenses of the Focus 20 Portfolio would be spread over a smaller asset base.

After careful consideration of these and other factors and information, including other options for the Focus 20 Portfolio such as merging the Focus 20 Portfolio into another mutual fund, the Board concluded that approval of the Plan of Liquidation was in the best interests of the Focus 20 Portfolio and its respective shareholders, as well as the Owners indirectly invested therein. Accordingly, the Board unanimously approved the Plan of Liquidation and voted to recommend to the Focus 20 Portfolio’s shareholders that they approve the Plan of Liquidation.

Plan of Liquidation

Under the Plan of Liquidation, the Focus 20 Portfolio will, by the liquidation date, (1) sell its portfolio securities for cash or permit them to mature and reduce any other assets to cash or cash equivalents, (2) pay any of the Focus 20 Portfolio’s known expenses, charges, liabilities, and other obligations, including those expenses incurred in connection with the liquidation, and (3) pay ordinary and capital gains dividends. After this process is completed, each Shareholder of the Focus 20 Portfolio, meaning the applicable separate accounts of Jefferson National, will receive a cash distribution in an amount equal to the net asset value per share, together with accrued and unpaid dividends and distributions, of the Shareholder’s shares. Such net asset value per share will be determined in accordance with the Focus 20 Portfolio’s current Prospectus and Statement of Additional Information. The Plan of Liquidation provides that as of the liquidation date, the Focus 20 Portfolio will: (1) distribute its assets to shareholders by redeeming their shares for cash, (2) wind up its operations, and (3) terminate its existence.

Immediately following the distribution of liquidation proceeds to shareholders, the Insurance Companies are expected to reinvest the cash proceeds distributed to each of their Separate Accounts by transferring the proceeds from the subaccounts that held Focus 20 Portfolio shares to other subaccounts. With respect to each Variable Contract, the Insurance Companies are expected to transfer contract value from the subaccount(s) that held shares of the Focus 20 Portfolio to alternative subaccounts available under the contract pursuant to the Owner’s prior instructions. For Variable Contracts as to which the Owner has not provided transfer instructions, the Insurance Companies will transfer contract value to the subaccount that invests in shares of the PIMCO VIT Money Market Portfolio.

All fees and expenses incurred in connection with carrying out the terms of the Plan of Liquidation, including, without limitation: (1) expenses associated with the preparation and filing of this Proxy Statement, (2) postageand printing costs, (3) brokerage commissions and other direct expenses of liquidating portfolio investments, and (4) fees and disbursements of legal counsel and other professionals, shall be paid by the Focus 20 Portfolio. However, due to the commitments of the Adviser and the Administrator to reimburse and waiver fees and expenses of the Focus 20 Portfolio beyond a certain threshold, much of these expenses are expected to be borne by the Adviser and Administrator.

Effects on Owners

The proposed liquidation will not in any way affect Owners’ rights or the obligations of the Insurance Companies under the variable contracts. An Owner may reallocate his or her contract values allocated to the Focus 20 Portfolio in accordance with procedures set forth in the applicable Variable Contract and its prospectus without the necessity of waiting for the Portfolio to take action. As of the date of this Proxy Statement, subject to any applicable restriction on frequent trading, Owners may transfer Variable Contract value out of any subaccount investing in the Focus 20 Portfolio free of any otherwise applicable transfer charge at any time without that transfer counting as one of a limited number of transfers permitted during any period or a limited number of transfers permitted during any period free of charge. Likewise, until May 31, 2005 liquidation date and within 30 days after the liquidation date, Owners may transfer contract value transferred from a subaccount investing in the Focus 20 Portfolio out of the subaccount investing in the PIMCO VIT Money Market Portfolio free of any otherwise applicable transfer charge and, subject to any applicable restriction on frequent trading, without that transfer counting as one of a limited number of transfers permitted during any period or a limited number of transfers permitted during any period free of charge.

As of the liquidation date and on behalf of Owners who have not exercised their transfer rights prior to the liquidation date, the Insurance Companies are expected to take one of two actions: (1) for Owners who have provided transfer instructions, the Insurance Companies will arrange for the transfer of any contract value representing liquidation proceeds to the subaccount(s) selected by the Owner in accordance with his or her prior instructions, or (2) for Owners who have not provided transfer instructions prior to the liquidation date, the Insurance Companies will transfer contract value representing liquidation proceeds to the subaccount investing in shares of the PIMCO VIT Money Market Portfolio.

Shortly after the proposed liquidations, the Insurance Companies expect to send to each Owner whose contract value was transferred to a subaccount investing in the PIMCO VIT Money Market Portfolio following the liquidations due to the failure to provide any transfer instructions, a confirmation of the transaction.

If an Owner does not provide transfer instructions, the liquidation of the Focus 20 Portfolio is expected to have the effect of substituting shares of PIMCO VIT Money Market Portfolio for shares of Focus 20 Portfolio held in any subaccount currently investing in the Focus 20 Portfolio. Therefore, a vote to approve the Plan of Liquidation will in effect be a vote in favor of such a substitution for Owners who do not provide transfer instructions.

Current prospectuses for the mutual funds available as investment options under the Variable Contracts, as well as copies of the funds' statements of additional information, may be obtained without charge by calling Jefferson National Life Insurance Company at 1-866-667-0561. These prospectuses set forth important information about the other mutual funds that an Owner should know before providing transfer instructions relating to the reallocation of his or her contract values.

Tax Consequences

The Trust anticipates that the Focus 20 Portfolio will retain its qualifications as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”), during the liquidation period. Accordingly, a gain recognized by the Focus 20 Portfolio on sale of its assets following the adoption of the Plan of Liquidation will be offset by a deduction for dividends paid to its Shareholders. Owners, for whose variable contracts shares of the Focus 20 Portfolio are underlying investments, will not recognize a gain or loss for federal income tax purposes as a result of the liquidation of the Focus 20 Portfolio (meaning there will be no federal tax liability.

The Separate Accounts that have shares of the Focus 20 Portfolio as underlying investments in their variable contracts will not incur tax on any dividends or distribution from the Plan of Liquidation that may be paid to them by the Focus 20 Portfolio, and will not impose any charges under the variable contracts as a result of the liquidation of the Focus 20 Portfolio.

The foregoing is only a summary of the principal federal income tax consequences of the liquidation of the Focus 20 Portfolio and should not be considered tax advice. There can be no assurance that the Internal Revenue Service will concur on all or any of the issues discussed above. You may wish to consult with your own tax advisers regarding the federal, state and local tax consequences with respect the foregoing matters and any other considerations that may apply in your particular circumstances.

Required Vote

Approval of Proposal 1 with respect to the Focus 20 Portfolio requires the affirmative vote of the holders of a majority of the shares of the Focus 20 Portfolio.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE PLAN OF LIQUIDATION OF THE FOCUS 20 PORTFOLIO.

PROPOSAL 2

TO ELECT THE TRUSTEES OF THE TRUST

(ALL PORTFOLIOS VOTING TOGETHER)

The Board proposes that the six individuals named in the table below be elected to serve as members of the Board. All Trustees will serve until their successors are duly elected and qualified. Ms. Hamilton and Mr. Neff were elected to the Board by the other Board members on December 2, 2004 while each of the other Trustees were elected to the Board by the Trust’s shareholders on March 29, 2001.

The following information regarding each person nominated for election as a Trustee includes such person’s age, positions with the Adviser (if any), principal occupation and business experience for the last five years, and the number of years each has served as a Trustee. None of the persons nominated is related to any other.

Name, Address and Age of Trustee1 | Position(s) Held with Trust | Term of Office and Length of Time Served | Principal Occupation and Business Experience During Past 5 Years | Number of 40|86 Family of Funds and Portfolios Overseen2 | Other Directorships held by Nominee for Trustee |

Nominees for Independent Trustee |

| Diana H. Hamilton, 48 | Trustee | Since December 2004 | Independent Consultant in Municipal Finance Advisory; Formerly, State of Indiana Director of Public Finance; Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 8 portfolios | None |

| R. Matthew Neff, 49 | Trustee | Since December 2004 | Chairman and Co-Chief Executive Officer of Senex Financial Corp., a financial services company engaged in the healthcare finance field; Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 8 portfolios | None |

| David N. Walthall, 59 | Trustee, Chairman of the Board | Since October 1998 | Chairman of the Board and Trustee of the Trust; Principal, Walthall Asset Management; Formerly, President, Chief Executive Officer and Director of Lyrick Corporation (Producer and distributor of Barney and Friends); Formerly, President and CEO, Heritage Media Corporation; Formerly, Director, Eagle National Bank; Chairman of the Board and Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 8 portfolios | Da-Lite Screen Company |

| Harold W. Hartley, 81 | Trustee | Since November 1993 | Trustee of the Trust; Chartered Financial Analyst; Retired, Executive Vice President, Tenneco Financial Services, Inc.; Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 8 portfolios | Ennis Business Forms, Inc. |

| Dr. R. Jan LeCroy, 73 | Trustee | Since November 1993 | Trustee of the Trust; Retired, President, Dallas Citizens Council; Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 8 portfolios | SWS Group, Inc. |

Nominee for Interested Trustee3 |

| Gregory J. Hahn, 43 | President and Trustee | Since March 2001 | President and Trustee of the Trust; Chartered Financial Analyst; Chief Investment Officer and Senior Vice President, Adviser; President and Trustee of one other investment company managed by the Adviser. | 2 registered investment companies consisting of 8 portfolios | None |

| 1 | All Trustees and officers have a mailing address c/o 40|86 Advisors, Inc., 535 College Drive, Carmel, IN 46032. |

| 2 | The 40|86 family of funds consists of the Trust and 40|86 Strategic Income Fund, a closed-end investment company. |

| 3 | Mr. Hahn is considered an “interested person” of the Trust as defined in the 1940 Act due to his employment with the Adviser. |

Beneficial Ownership of Shares of the Trust Held by Each Trustee and Nominee for Election as Trustee

The following table shows the dollar range of equity securities beneficially owned by each Trustee or nominee for Trustee in the Trust and on an aggregate basis, in the registered investment companies overseen by the Trustee or nominee within the Conseco Mutual Fund Complex as of March 31, 2005:

Name of Trustee or Nominee | Dollar Range of Equity Securities in the Trust | Aggregate Dollar Range of Equity Securities in All Funds Overseen or to be Overseen by the Trustee or Nominee in the Family of Investment Companies |

Independent Trustees |

| Diana H. Hamilton | None | None |

| R. Matthew Neff | None | None |

| David N. Walthall | None | None |

| Harold W. Hartley | None | $10,001 - $50,000 |

| Dr. R. Jan LeCroy | None | None |

Interested Trustee | | |

| Gregory J. Hahn | None | None |

As of March 31, 2005, to the knowledge of the Trust, none of the Independent Trustees, nor his or her immediate family members, beneficially owned any class of securities in the Adviser, principal underwriter of the Trust, nor any person (other than a registered investment company) director or indirectly controlling, controlled by, or under common control with the Adviser or principal underwriter of the Trust.

To the knowledge of the Trust’s management, as of the Record Date, the Trustees and officers of the Trust owned an aggregate of less than one percent of the outstanding shares of the Fund.

Compensation of Trustees

Each Independent Trustee receives an annual retainer fee of $7,500, a fee of $1,500 for each Board of Trustees meeting, Independent Trustee meeting or separate committee meeting (that is, committee meeting(s) not conducted in conjunction with a Board of Trustees meeting or Independent Trustee meeting) he or she attends. Additionally, each Independent Trustee receives a fee of $500 for Board of Trustee meetings and separate committee meetings attended that are conducted by telephone. The Chairman of the Board of Trustees receives an additional per-meeting fee of $375 for in-person Board meetings. The Trust also reimburses each Independent Trustee for travel and out-of-pocket expenses. The Adviser pays all compensation to all officers of the Trust and all Trustees of the Fund who are affiliated with the Adviser. The Trust does not pay any other remuneration to its officers and Trustees, and the Trust does not have a bonus, pension, profit-sharing or retirement plan.

During the Fund’s fiscal year ended December 31, 2004, the Board of Trustees held six meetings. Each of the Trustees then in office attended at least 75% of the aggregate of the total number of meetings of the Board of Trustees and committee meetings held during the fiscal year.

The aggregate amount of compensation paid to each Independent Trustee by the Fund for the fiscal year ended December 31, 2004, and by all funds in the 40|86 Family of Funds for which such Trustee was a Board member (the number of which is set forth in parenthesis next to each Trustee’s total compensation) was as follows:

Name of Trustee or Nominee | Aggregate Compensation from Trust1 | Total Compensation From Trust and Fund Complex Paid to Trustee2 |

Independent Trustees |

| Diana H. Hamilton | $1,750 | $1,750 |

| R. Matthew Neff | $1,750 | $1,750 |

| David N. Walthall | $15,333 | $39,750 |

| Harold W. Hartley | $14,208 | $36,750 |

| Dr. R. Jan LeCroy | $14,208 | $36,750 |

Interested Trustee and Officers |

| Gregory J. Hahn | $0 | $0 |

| William T. Devanney, Jr. | $0 | $0 |

| Audrey L. Kurzawa | $0 | $0 |

| 1 | Amount does not include reimbursed expenses for attending meetings of the Board of Trustees, which amounted to $9,843 for all Trustees as a group. |

| 2 | Representstotal compensation from all investment companies in the fund complex, including the Trust, for which the Trustee serves as a member of the Board of Trustees. Messrs. Hartley, LeCroy and Walthall served as Trustees for Conseco Fund Group (8 portfolios) until April 30, 2004, and as Directors for Conseco StockCar Stocks Mutual Fund, Inc. (1 portfolio) until October 29, 2004. |

Committees of the Board of Trustees

Audit Committee

Mr. Hartley (Chairperson), Dr. LeCroy, Mr. Walthall, Ms. Hamilton and Mr. Neff serve as members of the Audit Committee. The Audit Committee is comprised of all of the Independent Trustees who are “independent” as defined in the listing standards of the New York Stock Exchange (NYSE). During the fiscal year ended December 31, 2004, the Audit Committee held three meetings.

The principal purposes of the Audit Committee are to (1) oversee the accounting and financial reporting processes of the Fund and each of its series and its internal control over financial reporting and, as the Committee deems appropriate, to inquire into the internal control over financial reporting of certain third-party service providers; (2) oversee, or, as appropriate, assist Board oversight of, the quality and integrity of the Fund’s financial statements and the independent audit thereof; (3) oversee, or, as appropriate, assist Board oversight of, the Fund’s compliance with legal and regulatory requirements that relate to the Fund’s accounting and financial reporting, internal control over financial reporting and independent audits; (4) approve prior to appointment the engagement of the Fund’s independent auditors and, in connection therewith, to review and evaluate the qualifications, independence and performance of the Fund’s independent auditors; and (5) to act as a liaison between the Fund’s independent auditors and the full Board.

Set forth in the tables below are fees billed by PricewaterhouseCoopers (“PwC”), the Trust’s auditor, for the Trust’s last two fiscal years ended December 31:

2003 |

Audit Fees | Audit Related Fees | Tax Fees | Other Fees |

| $103,000 | $0 | $18,200 | $0 |

2004 |

Audit Fees | Audit Related Fees | Tax Fees | Other Fees |

| $113,400 | $0 | $22,400 | $0 |

The Audit Committee pre-approved the tax related services listed above and determined that the provision of such services is compatible with PwC maintaining its independence. PwC’s tax services include reviewing both federal and state income tax returns and capital gains distributions.

PwC did not provide any Audit Related or other services and therefore, did not receive any Audit Related Fees or Other Fees from the Trust.

The Audit Committee is required to pre-approve permitted non-audit services provided by PwC to the Adviser and certain of its affiliates to the extent that the services related directly to the operations and financial reporting of the Trust. The aggregate fees paid by the Trust, its Adviser and certain of its affiliates to PwC for non-audit services totaled approximately $30,233 in 2003 and $10,436 in 2004. The Audit Committee has considered whether the provision of these non-audit services to the Adviser and certain of its affiliates, which did not require Audit Committee pre-approval, is compatible with maintaining PwC’s independence and concluded that the provision of these non-audit services has not compromised PwC’s independence.

Representatives of PwC are not expected to be present at the Special Meeting but have been given the opportunity to make a statement if they so desire and are expected to be available to respond to appropriate questions.

Nominating Committee

Ms. Hamilton (Chairperson), Mr. Hartley, Dr. LeCroy, Mr. Walthall and Mr. Neff serve as members of the Nominating Committee. The Nominating Committee is responsible for nominating individuals to serve as Trustees, including as Independent Trustees. Each member of the Nominating Committee must be an Independent Trustee. During the fiscal year ended December 31, 2004, the Nominating Committee held four meetings.

During the fiscal year ended December 31, 2004, members of the Nominating Committee reviewed resumes and questionnaires for prospective nominees. The Nominating Committee met on August 20 and August 31 to interview prospective nominees and nominated two individuals on November 22 to be elected by the existing Trustees.

Nominating Committee Charter. The Nominating Committee has a written charter. A copy of the Trust’s Nominating Committee Charter is attached as Appendix B to this proxy statement.

Nominee Qualifications. The Committee requires that Trustee candidates have a college degree or equivalent business experience. While there is no formal list of qualifications, the Nominating Committee considers, among other things, whether prospective nominees have distinguished records in their primary careers, integrity, and substantive knowledge in areas important to the Board of Trustees’ operations, such as background or education in finance, auditing, securities law, the workings of the securities markets, or investment advice. For candidates to serve as Independent Trustees, they must be independent from the Adviser, its affiliates and other principal service providers. The Nominating Committee also considers whether the prospective candidates’ workloads would allow them to attend meetings of the Board of Trustees, be available for service on Board committees, and devote the time and effort necessary to attend to Board matters and the rapidly changing regulatory environment in which the Trust operates.

Different substantive areas may assume greater or lesser significance at particular times, in light of the Board’s present composition and the Nominating Committee’s (or the Board’s) perceptions about future issues and needs.

Identifying Nominees. In identifying potential nominees for the Board, the Nominating Committee may consider candidates recommended by one or more of the following sources: (i) the Fund’s current Trustees, (ii) the Fund’s officers, (iii) the Fund’s investment adviser, and (iv) any other source the Committee deems to be appropriate, including shareholders. Resumes of candidates may be sent to the Secretary of the Trust at 11825 N. Pennsylvania Street, Carmel, Indiana 46032. The Committee may, but is not required to, retain a third party search firm at the Fund’s expense to identify potential candidates. The Nominating Committee initially evaluates prospective candidates on the basis of their resumes, considered in light of the criteria discussed above. Those prospective candidates that appear likely to be able to fill a significant need of the Board would be contacted by a Nominating Committee member by telephone to discuss the position; if there appeared to be sufficient interest, an in-person meeting with one or more Nominating Committee members would be arranged. If the Nominating Committee, based on the results of these contacts, believed it had identified a viable candidate, it would air the matter with all Trustees for input. The Trust has not paid a fee to third parties to assist in finding nominees. The Nominating Committee may consider candidates proposed by personnel of the Adviser or its affiliates.

Compensation Committee

Dr. LeCroy (Chairperson), Mr. Hartley, Mr. Walthall, Ms. Hamilton and Mr. Neff serve as members of the Compensation Committee. The Compensation Committee periodically reviews and evaluates the compensation of the Independent Trustees and recommends any appropriate changes, as necessary. During the fiscal year ended December 31, 2004, the Compensation Committee held one meeting.

Insurance Committee

Mr. Neff (Chairperson), Mr. Hartley, Dr. LeCroy, Mr. Walthall and Ms. Hamilton serve as members of the Insurance Committee. The Insurance Committee periodically reviews and evaluates the insurance coverage that protects the Trust and the Trustees. During the fiscal year ended December 31, 2004, the Insurance Committee held one meeting.

Retirement Committee

Mr. Walthall (Chairperson), Mr. Hartley, Dr. LeCroy, Ms. Hamilton and Mr. Neff serve as members of the Retirement Committee. The Retirement Committee periodically reviews and evaluates the retirement policy and recommends any appropriate changes, as necessary. During the fiscal year ended December 31, 2004, the Retirement Committee held one meeting.

Trustee Attendance at the Meeting

The Trust has no formal policy regarding Trustee attendance at shareholder meetings. The President of the Trust, who is also a Trustee, attended the Annual Meeting held in February 2004.

Required Vote

Approval of the nominees for the Board of Trustees requires the affirmative vote of a plurality of the shares of the Trust.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES TO SERVE AS TRUSTEES OF THE TRUST.

PROPOSAL 3

TO AMEND THE TRUST’S DECLARATION OF TRUST

TO PERMIT THE TRUSTEES TO AUTHORIZE THE LIQUIDATION OF ONE OR MORE OF THE PORTFOLIOS WITHOUT OBTAINING SHAREHOLDER APPROVAL IF SHAREHOLDER APPROVAL IS NOT OTHERWISE REQUIRED BY APPLICABLE LAW

(ALL PORTFOLIOS VOTING TOGETHER)

Introduction

Amendment of Section 13.1 of the Declaration of Trust

Currently, Section 13.1 of the Trust’s Declaration of Trust provides that the Trust may be terminated at any meeting of the shareholders called for the purpose of voting on such termination, by (1) the affirmative vote of the holders of a majority of the shares outstanding and entitled to vote, or (2) by a written instrument or instruments signed by a majority of the Trustees and the holders of a majority of shares. The Declaration of Trust is silent with respect to liquidating or otherwise terminating a Portfolio of the Trust. Under this Proposal 3, you are being asked to vote on an amendment of Section 13.1 which would permit the Trustees to authorize a liquidation of a Portfolio without a shareholder vote if shareholder approval is not otherwise required by applicable law. Shareholders of the Focus 20 Portfolio are being asked to approve the liquidation of the Focus 20 Portfolio as set forth in Proposal 1 of this Proxy Statement. No other Portfolio liquidations are contemplated at this time.

The amendment of Section 13.1 of the Declaration of Trust will provide the Trustees with more flexibility and broader authority to act with respect to the operations of the Trust and its Portfolios, subject to the applicable requirements of the 1940 Act and Massachusetts law. This amendment, however, will not alter in any way the Trustees’ existing fiduciary obligations to act with due care and in the shareholders’ interests.

If Proposal 3 is approved, Section 13.1 of the Trust’s Declaration of Trust will be amended to add the following new paragraph immediately prior to the last paragraph of Section 13.1:

“Notwithstanding the foregoing, any Portfolio may be terminated at any time by the affirmative vote of the holders of a majority of the Shares of such Portfolio outstanding and entitled to vote, or by a majority vote of the Trustees. Upon termination of the Portfolio and distribution to the Shareholders, a majority of the Trustees shall execute and lodge among the records of the Trust an instrument in writing setting forth the fact of such termination, and the Trustees shall thereupon be discharged from all further liabilities and duties hereunder, and the right, title and interest of all Shareholders of such Portfolio shall cease and be cancelled and discharged.”

Required Vote

Approval of Proposal 3 with respect to the Trust requires the affirmative vote of the holders of a majority of the Trust.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE AMENDMENT OF SECTION 13.1 OF THE TRUST’S DECLARATION OF TRUST UNDER THIS PROPOSAL 3.

OTHER INFORMATION

Executive Officers of the Trust

| Name and Age | Position Held with the Trust | Principal Occupation and Business Experience for the Last Five Years |

| Audrey L. Kurzawa, 38 | Treasurer Since October 2002 | Certified Public Accountant; Senior Vice President and Controller, 40|86 Advisors, Inc.; Treasurer of one other mutual fund managed by the Adviser. |

| Sarah L. Bertrand, 37 | Chief Compliance Officer and Secretary Since December 2004 | Assistant Vice President, Legal & Compliance, 40|86 Advisors, Inc. Chief Compliance Officer and Secretary of one other mutual fund managed by the Adviser. |

| William T. Devanney, 48 | Vice President, Corporate Taxes Since June 1993 | Senior Vice President, Corporate Taxes of Conseco Services, LLC and various Conseco affiliates. Vice President of one other mutual fund managed by the Adviser. |

Investment Adviser

40|86 Advisors, Inc., a registered investment adviser located at 535 College Drive, Carmel, Indiana 46032, is a wholly-owned subsidiary of Conseco, Inc. (“Conseco”), a publicly held financial services company (NYSE: CNO), and serves as the investment adviser of the Portfolios.

Administrator

Conseco Services, LLC, located at 11825 N. Pennsylvania Street, Carmel, Indiana 46032, is a wholly-owned subsidiary of Conseco, and acts administrator to the Trust.

Principal Underwriter

Conseco Equity Sales, Inc., located at 11825 N. Pennsylvania Street, Carmel, Indiana 46032, is a wholly-owned subsidiary of Conseco, and serves as the principal underwriter for each Portfolio.

Custodian

The Bank of New York, 90 Washington Street, 22nd Floor, New York, New York 10826, services as custodian of the assets of each Portfolio.

Shareholder Proposals

As a general matter, the Trust does not hold regular annual or other regular meetings of shareholders. Any shareholder that wishes to submit proposals to be considered at a special meeting of the Trust’s shareholders should send such proposals to the Trust at 11825 North Pennsylvania Street, Carmel, Indiana 46032. Proposals must be received within a reasonable period of time prior to any meeting to be included in the proxy materials or otherwise to be considered at the meeting. Moreover, inclusion of such proposals is subject to limitations under the federal securities laws. Persons named as proxies for any subsequent shareholders’ meeting will vote in their discretion with respect to proposals submitted on an untimely basis.

Other Business

The Trust’s management knows of no other business to be presented to the Meeting other than the matters set forth in this Proxy Statement, but should any other matter requiring a vote of the Trust’s shareholders arise, the proxies will vote thereon according to their best judgment in the interests of the Trust.

Only one proxy statement is being delivered to multiple shareholders sharing an address unless the Trust has received contrary instructions from one or more of the shareholders. The Trust will deliver promptly upon written or oral request a separate copy of the proxy statement to a shareholder at a shared address to which a single copy of the document was delivered. If a shareholder wishes to receive a separate copy of the proxy statement, please call 1-866-299-4086 or notify the Trust in writing addressed to the Secretary of the Trust (11815 North Pennsylvania Street, Carmel, Indiana 46032). You may also call or write to the Trust at the number and address specified above to notify the Trust that (1) you wish to receive a separate copy of any annual report or proxy statement in the future or (2) you wish to receive delivery of a single copy of any annual report or proxy statement in the future (if you are currently receiving multiple copies of annual reports or proxy statements).

Shareholders may send written communications to the Fund’s Board of Trustees or to an individual Trustee by mailing such correspondence to the Secretary of the Trust (addressed to 11815 North Pennsylvania Street, Carmel, Indiana 46032). Such communications must be signed by the shareholder and identify the number of shares held by the shareholder. Properly submitted shareholder communications will, as appropriate, be forwarded to the entire Board or to the individual Trustee.

APPENDIX A

PLAN OF LIQUIDATION

40|86 SERIES TRUST

Focus 20 Portfolio

RECITALS

This Plan of Liquidation is dated ____________ 2005, by 40|86 Series Trust (the “Trust”), on behalf of its separately designated series, the Focus 20 Portfolio.

The Trust was organized as a Massachusetts business trust on November 15, 1982, and is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust is a series type of mutual fund that issues separate series of shares, each of which represents a separate portfolio of investments (each, a “Portfolio”).

Shares of each Portfolio, including the Focus 20 Portfolio, are offered to insurance companies in order to fund certain of their separate accounts used to support variable annuity and variable life insurance contracts (collectively, “variable contracts”). Currently, shares of the Focus 20 Portfolio are held only by separate accounts owned by Jefferson National Life Insurance Company (“Jefferson National”).

40|86 Advisors, Inc. (the “Adviser”) is the investment adviser to each of the Portfolios, including the Focus 20 Portfolio. Oak Associates, ltd (“Oak”) currently serves as the investment subadviser to the Focus 20 Portfolio. The Adviser and Oak are each registered as investment advisers under the Investment Advisers Act of 1940, as amended.

The Board of Trustees of the Trust (“Board of Trustees”) has determined that it is in the best interests of the Trust, the Focus 20 Portfolio, and owners of variable contracts indirectly invested in the Focus 20 Portfolio (“Contract Owners”) to liquidate the Focus 20 Portfolio pursuant to the terms described in this Plan of Liquidation.

ARTICLE I

The Liquidation

The date of the liquidation of the Focus 20 Portfolio (the “Liquidation Date”) shall be May 31, 2005, or such other date as shall be specified by the Board of Trustees or the appropriate officers of the Trust pursuant to authority granted by the Board of Trustees. In the event that trading on the New York Stock Exchange or on another exchange or market on which the securities or other investments held by the Focus 20 Portfolio is disrupted on the Liquidation Date so that, in the judgment of the Board of Trustees or appropriate officers of the Trust acting pursuant to authority granted by the Board of Trustees, accurate appraisal of the net assets of the Focus 20 Portfolio is impracticable, the Liquidation Date shall be postponed until the first business day after the day on which trading on such exchange or in such market shall have been resumed without disruption.

Provided that each of the conditions specified in Article II of this Plan of Liquidation are satisfied, on the Liquidation Date, the Trust shall cause the Focus 20 Portfolio to distribute its assets to its shareholders by redeeming their shares for cash, and the shares of the Focus 20 Portfolio shall be cancelled. After such liquidation, the Focus 20 Portfolio shall engage in no other business except to wind up its operations and completely terminate.

ARTICLE II

Conditions Precedent to the Liquidation

By the Liquidation Date, the Focus 20 Portfolio will sell its portfolio securities for cash or permit them to mature, and will reduce any other assets to cash or cash equivalents and pay any liabilities. The Board of Trustees, or appropriate officers of the Trust acting pursuant to authority granted by the Board of Trustees, will declare and pay a dividend on the shares of the Focus 20 Portfolio that represents substantially all of the Focus 20 Portfolio’s accrued but undistributed net investment income through the Liquidation Date as well as any other dividend necessary to enable the Focus 20 Portfolio to avoid any liability for excise taxes.

The Board of Trustees will call a meeting of the shareholders of the Focus 20 Portfolio (the “Meeting”) to submit to the shareholders this Plan of Liquidation for their approval or disapproval. The date of the Meeting of the shareholders shall be prior to the Liquidation Date. Approval of this Plan of Liquidation by the shareholders requires an affirmative vote of a majority of the shares entitled to vote at the Meeting.

Prior to the Meeting, the Trust shall distribute to the shareholders entitled to vote at the Meeting and to Contract Owners indirectly invested in such shares a proxy statement and other proxy materials, including voting instruction forms, that comply in all material respects with the applicable provisions of Section 14(a) of the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

ARTICLE III

Miscellaneous

The Board of Trustees may authorize variations from, or amendments to, the provisions of this Plan of Liquidation (other than the terms of the liquidating distributions contained in Article I hereof) that it deems necessary or appropriate to effect the distributions in cancellation and redemption of the shares of the Focus 20 Portfolio and the liquidation and termination of the Focus 20 Portfolio’s existence.

At any time prior to the Liquidation Date, the Liquidation may be postponed or abandoned by the Board of Trustees or appropriate officers of the Trust acting pursuant to authority granted by the Board of Trustees. If the Liquidation is abandoned, this Plan of Liquidation shall become void and have no effect, without liability on the part of either the Focus 20 Portfolio, the shareholders of the Focus 20 Portfolio, the Trust or the holders of any other series of the Trust’s shares.

This Plan of Liquidation and all amendments hereto shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts.

The Portfolio will pay the expenses incurred in connection with the liquidation of the Focus 20 Portfolio, including, without limitation, (1) expenses associated with the preparation and filing of a proxy statement relating to the liquidation, (2) postage and printing, (3) brokerage commissions and other direct expenses of liquidating investments held by the Focus 20 Portfolio, and (4) fees and disbursements of legal counsel and other professionals.

As soon as is reasonably practically, after the Liquidation Date, the Trust will: (1) prepare and file all federal and other tax returns and reports of the Focus 20 Portfolio required by law with respect to all periods ending on or before the Liquidation Date, (2) pay all federal and other taxes due on, but not paid by, the Liquidation Date, (3) prepare and file any other required regulatory reports, and (4) take any other steps necessary or proper to effect the termination or dissolution of the Focus 20 Portfolio under federal or state law.

APPENDIX B

40|86 Series Trust

Nominating Committee Charter

Adopted as of December 2, 2004

The Board of Trustees (the “Board”) of 40|86 Series Trust (the “Fund”) has adopted this Charter to govern the activities of the Nominating Committee (the “Committee”) of the Board.

Statement of Purpose and Responsibility

The selection and nomination of the independent Trustees of the Fund is committed to the discretion of the then independent Trustees of the Fund. The primary purpose and responsibility of the Committee is the screening and nomination of candidates for election to the Board as independent trustee.

Organization and Governance

The Committee shall be comprised of as many Trustees as the Board shall determine, but in any event not fewer than two (2) Trustees. The Committee must consist entirely of Board members who are not “interested persons” of the Fund, as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended. The Board may remove or replace any member of the Committee at any time in its sole discretion.

One or more members of the Committee may be designated by the Board as the Committee’s chairman or co-chairman, as the case may be.

The Committee will not have regularly scheduled meetings. Committee meetings shall be held as and when the Committee of the Board determines necessary or appropriate in accordance with the Fund’s Bylaws.

Qualifications for Trustee Nominees

The Committee requires that Trustee candidates have a college degree or equivalent business experience. The Committee may take into account a wide variety of factors in considering Trustee candidates, including (but not limited to): (i) availability and commitment of a candidate to attend meetings and perform his or her responsibilities on the Board, (ii) relevant industry and related experience, (iii) educational background, and (iv) ability, judgment and experience.

Identification of Nominees

In identifying potential nominees for the Board, the Committee may consider candidates recommended by on or more of the following sources: (i) the Fund’s current Trustees, (ii) the Fund’s officers, (iii) the Fund’s investment adviser, and (iv) any other source the Committee deems to be appropriate. The Committee may, but is not required to, retain a third party search firm at the Fund’s expense to identify potential candidates.