As filed with the Securities and Exchange Commission on January 7, 2016

1933 Act Registration No. 333-208231

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-14/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| | | | | | | | | | | | |

| | x | | Pre-Effective Amendment No. 2 | | | | ¨ | | Post-Effective Amendment No. | | |

METROPOLITAN SERIES FUND*

(Exact Name of Registrant as Specified in Charter)

(617) 578-4036

Area Code and Telephone Number

One Financial Center

Boston, Massachusetts 02111

(Address of Principal Executive Offices)

Michael Lawlor, Esq.

Assistant Secretary

Metropolitan Series Fund

One Financial Center

Boston, Massachusetts 02111

(Name and Address of Agent for Service)

Copies to:

David C. Mahaffey, Esq.

Sullivan & Worcester LLP

1666 K Street, N.W.

Washington, D.C. 20006

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Class A and Class B shares of beneficial interest, par value $0.00001 per share, of the Registrant’s WMC Core Equity Opportunities Portfolio.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| * | On behalf of its WMC Core Equity Opportunities Portfolio |

MET INVESTORS SERIES TRUST

One Financial Center

Boston, Massachusetts 02111

January , 2016

Dear Contract Owner:

As an owner (“Contract Owner”) of a variable annuity or variable life insurance contract (the “Contract”) issued by Metropolitan Life Insurance Company or one of its affiliated insurance companies (each an “Insurance Company”), you have the right to instruct the Insurance Company how to vote certain shares of the Pioneer Fund Portfolio (“MIST Portfolio”) of the Met Investors Series Trust (“MIST”) at a Special Meeting of Shareholders to be held on February 26, 2016 (the “Meeting”). Although you are not directly a shareholder of MIST Portfolio, some or all of your Contract value is invested, as provided by your Contract, in MIST Portfolio. Accordingly, you have the right under your Contract to instruct the Insurance Company how to vote the MIST Portfolio shares that are attributable to your Contract at the Meeting. Before the Meeting, I would like your voting instructions on the important proposal described in the accompanying Prospectus/Proxy Statement.

The Prospectus/Proxy Statement describes the proposed reorganization of MIST Portfolio. All of the assets of MIST Portfolio would be acquired by WMC Core Equity Opportunities Portfolio (“MSF Portfolio”), a series of the Metropolitan Series Fund (“MSF”), in exchange for shares of MSF Portfolio and the assumption by MSF Portfolio of the liabilities of MIST Portfolio. MSF Portfolio’s investment objective and principal investment strategies are similar to those of MIST Portfolio.

You will receive shares of MSF Portfolio having an aggregate net asset value equal to the aggregate net asset value of your MIST Portfolio’s shares immediately prior to the reorganization. You will receive Class A or Class B shares of MSF Portfolio, depending on the class of shares of MIST Portfolio you currently hold. Details about MSF Portfolio’s investment objective, performance, and management team are contained in the attached Prospectus/Proxy Statement. For federal income tax purposes, the reorganization is expected to be a non-taxable event for shareholders and Contract Owners.

The Board of Trustees of MIST has approved the proposal for MIST Portfolio and recommends that you instruct the Insurance Company to vote FOR the proposal.

I realize that this Prospectus/Proxy Statement will take time to review, but your vote is very important. Please take the time to familiarize yourself with the proposal. If you attend the Meeting, you may give your voting instructions in person. If you do not expect to attend the Meeting, please complete, date, sign and return the enclosed voting instructions form in the enclosed postage-paid envelope. You may also transmit your voting instructions by telephone or through the Internet. Instructions on how to complete the voting instructions form or vote by telephone or through the Internet are included immediately after the Notice of Special Meeting.

If you have any questions about the voting instructions form please call MIST at 1-800-638-7732. If we do not receive your completed voting instructions form or your telephone or Internet vote within several weeks, you may be contacted by Computershare Fund Services, our proxy solicitor, who will remind you to pass on your voting instructions.

Thank you for taking this matter seriously and participating in this important process.

| | |

| | Sincerely, |

| |

| |  |

| | Elizabeth M. Forget |

| | President |

| | Met Investors Series Trust |

MET INVESTORS SERIES TRUST

One Financial Center

Boston, Massachusetts 02111

Pioneer Fund Portfolio

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held on February 26, 2016

To the Shareholders of Pioneer Fund Portfolio:

NOTICE IS HEREBY GIVEN THAT a Special Meeting of the Shareholders of the Pioneer Fund Portfolio of Met Investors Series Trust (“MIST”), a Delaware statutory trust, will be held at the offices of MetLife Advisers, LLC, One Financial Center Boston, Massachusetts 02111, on February 26, 2016 at 10:00 a.m. Eastern Time and any adjournments thereof (the “Meeting”) for the following purpose:

| | 1. | To consider and act upon an Agreement and Plan of Reorganization (the “Plan”) providing for the acquisition of all of the assets of Pioneer Fund Portfolio (“MIST Portfolio”) by WMC Core Equity Opportunities Portfolio (“MSF Portfolio”), a series of Metropolitan Series Fund, in exchange for shares of MSF Portfolio and the assumption by MSF Portfolio of the liabilities of MIST Portfolio. The Plan also provides for the distribution of these shares of MSF Portfolio to shareholders of MIST Portfolio in liquidation and subsequent termination of MIST Portfolio. A vote in favor of the Plan is a vote in favor of the liquidation and dissolution of MIST Portfolio. |

| | 2. | To consider and act upon any other matters that properly come before the Meeting and any adjourned or postponed session of the Meeting. |

The Board of Trustees of MIST has fixed the close of business on November 30, 2015 as the record date for determination of shareholders entitled to notice of and to vote at the Meeting.

| | |

| | By order of the Board of Trustees |

| |

| |  |

| | Michael P. Lawlor |

| | Assistant Secretary |

| | Met Investors Series Trust |

January , 2016

CONTRACT OWNERS WHO DO NOT EXPECT TO ATTEND THE MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING VOTING INSTRUCTIONS FORM IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES, OR FOLLOW THE INSTRUCTIONS IN THE MATERIALS RELATING TO TELEPHONE OR INTERNET VOTING. INSTRUCTIONS ON HOW TO COMPLETE THE VOTING INSTRUCTIONS FORM OR VOTE BY TELEPHONE OR OVER THE INTERNET ARE INCLUDED IMMEDIATELY FOLLOWING THIS NOTICE. IT IS IMPORTANT THAT YOU PROVIDE VOTING INSTRUCTIONS PROMPTLY.

INSTRUCTIONS FOR SIGNING VOTING INSTRUCTIONS FORM

The following general rules for signing voting instructions forms may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your voting instructions form properly.

| 1. | Individual Accounts: Sign your name exactly as it appears in the registration on the voting instructions form. |

| 2. | Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the voting instructions form. |

| 3. | All Other Accounts: The capacity of the individual signing the voting instructions form should be indicated unless it is reflected in the form of registration. For example: |

| | |

Registration | | Valid Signature |

| |

Corporate Accounts | | |

| |

(1) ABC Corp. | | ABC Corp. |

(2) ABC Corp. | | John Doe, Treasurer |

(3) ABC Corp.

c/o John Doe, Treasurer | | John Doe |

(4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| |

Trust Accounts | | |

| |

(1) ABC Trust | | Jane B. Doe, Trustee |

(2) Jane B. Doe, Trustee u/t/d 12/28/78 | | Jane B. Doe |

|

Custodial or Estate Accounts |

| |

(1) John B. Smith, Cust.

f/b/o John B. Smith, Jr. UGMA | | John B. Smith |

(2) Estate of John B. Smith | | John B. Smith, Jr., Executor |

After completing your voting instructions form, return it in the enclosed postage-paid envelope.

INSTRUCTIONS FOR VOTING BY TELEPHONE

To vote by telephone, follow the steps below.

| 1. | Read the accompanying proxy information and voting instructions form. |

| 3. | Follow the recorded instructions. Have your voting instructions form ready. |

You do not need to return your voting instructions form if you vote by telephone.

INSTRUCTIONS FOR VOTING OVER THE INTERNET

To vote over the Internet, follow the steps below.

| 1. | Read the accompanying proxy information and voting instructions form. |

| 2. | Log on to www.proxy-direct.com. |

| 3. | Follow the on-screen instructions. |

You do not need to return your voting instructions form if you vote over the Internet.

* * *

If you have any questions about how to provide voting instructions, please call MIST at 1-800-638-7732.

ACQUISITION OF ASSETS AND ASSUMPTION OF LIABILITIES OF

PIONEER FUND PORTFOLIO

a series of

Met Investors Series Trust

One Financial Center

Boston, Massachusetts 02111

(800) 638-7732

BY AND IN EXCHANGE FOR SHARES OF

WMC CORE EQUITY OPPORTUNITIES PORTFOLIO

a series of

Metropolitan Series Fund

One Financial Center

Boston, Massachusetts 02111

(800) 638-7732

PROSPECTUS/PROXY STATEMENT

DATED JANUARY , 2016

This Prospectus/Proxy Statement is being furnished in connection with the proposed Agreement and Plan of Reorganization (the “Plan”) which will be submitted to shareholders of Pioneer Fund Portfolio (“MIST Portfolio”) for consideration at a Special Meeting of Shareholders to be held on February 26, 2016 at 10:00 a.m. Eastern time at the offices of MetLife Advisers, LLC (“MetLife Advisers” or the “Adviser”), One Financial Center, Boston, Massachusetts 02111, and any adjournments thereof (the “Meeting”).

GENERAL

Subject to the approval of MIST Portfolio’s shareholders, the Board of Trustees of Met Investors Series Trust (“MIST”) has approved the proposed reorganization of MIST Portfolio, which is a series of MIST, into WMC Core Equity Opportunities Portfolio (“MSF Portfolio”), a series of Metropolitan Series Fund (“MSF”). MIST Portfolio and MSF Portfolio are sometimes referred to in this Prospectus/Proxy Statement individually as a “Portfolio” and collectively as the “Portfolios.”

The Securities and Exchange Commission has not determined that the information in this Prospectus/Proxy Statement is accurate or adequate, nor has it approved or disapproved these securities. Anyone who tells you otherwise is committing a criminal offense.

Separate accounts established by Metropolitan Life Insurance Company (“MetLife”) and other affiliated insurance companies (each an “Insurance Company” and, collectively, the “Insurance Companies”) are the record owners of MIST Portfolio’s shares and at the Meeting will vote the shares of MIST Portfolio held in their separate accounts.

As an owner of a variable life insurance or annuity contract (a “Contract”) issued by an Insurance Company, you have the right to instruct the Insurance Company how to vote the shares of MIST Portfolio at the Meeting that are attributable to your Contract. Although you are not directly a shareholder of MIST Portfolio, you have this right because some or all of your Contract value is invested, as provided by your Contract, in MIST Portfolio. For simplicity, in this Prospectus/Proxy Statement:

| �� | • | | “Record Holder” of MIST Portfolio refers to each Insurance Company which holds MIST Portfolio’s shares of record, unless indicated otherwise in this Prospectus/Proxy Statement; |

| | • | | “shares” refers generally to your shares of beneficial interest in MIST Portfolio; and |

| | • | | “shareholder” or “Contract Owner” refers to you. |

In the reorganization, all of the assets of MIST Portfolio will be acquired by MSF Portfolio in exchange for Class A and Class B shares of MSF Portfolio and the assumption by MSF Portfolio of the liabilities of MIST Portfolio (the “Reorganization”). Class E shares of MSF Portfolio are not involved in the Reorganization. If the Reorganization is approved, shares of MSF Portfolio will be distributed to each Record Holder in liquidation of MIST Portfolio, and MIST Portfolio will be terminated as a series of MIST. You will receive Class A or Class B shares of MSF Portfolio, depending on the class of shares of MIST Portfolio you currently hold. Immediately after the Reorganization, you will hold that number of full and fractional shares of MSF Portfolio which have an aggregate net asset value equal to the aggregate net asset value of the shares of MIST Portfolio you held immediately before the Reorganization.

MIST Portfolio is a separate diversified series of MIST, a Delaware statutory trust, which is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). MSF Portfolio is a separate diversified series of MSF, a Delaware statutory trust, which is also registered as an open-end management investment company under the 1940 Act. The primary investment objective of MIST Portfolio is similar to that of MSF Portfolio, as follows:

| | |

Portfolio | | Investment Objective |

MIST Portfolio | | Reasonable income and capital growth. |

MSF Portfolio | | Provide a growing stream of income over time and, secondarily, long-term capital appreciation and current income. |

This Prospectus/Proxy Statement explains concisely the information about MSF Portfolio that you should know before voting on the Reorganization. Please read it carefully and keep it for future reference. Additional information concerning each Portfolio and the Reorganization is contained in the documents described below, all of which have been filed with the Securities and Exchange Commission (“SEC”):

| | |

Information about MIST Portfolio: | | How to Obtain this Information: |

Prospectus of MIST relating to MIST Portfolio, dated May 1, 2015, as amended Statement of Additional Information of MIST relating to MIST Portfolio, dated May 1, 2015, as amended Annual Report of MIST relating to MIST Portfolio for the year ended December 31, 2014 Semiannual Report of MIST relating to MIST Portfolio for the six month period ended June 30, 2015 (Unaudited) | | Copies are available upon request and without charge if you: • Write to MIST at the address listed on the cover page of this Prospectus/Proxy Statement; or • Call (800) 638-7732 toll-free. |

| |

Information about MSF Portfolio: | | How to Obtain this Information: |

Prospectus of MSF relating to MSF Portfolio, dated May 1, 2015, which accompanies this Prospectus/Proxy Statement Statement of Additional Information of MSF relating to MSF Portfolio, dated May 1, 2015, as amended Annual Report of MSF relating to MSF Portfolio for the year ended December 31, 2014 Semiannual Report of MSF relating to MSF Portfolio for the six month period ended June 30, 2015 (Unaudited) | | Copies are available upon request and without charge if you: • Write to MSF at the address listed on the cover page of this Prospectus/Proxy Statement; or • Call (800) 638-7732 toll-free. |

-2-

| | |

Information about the Reorganization: | | How to Obtain this Information: |

| Statement of Additional Information dated January , 2016, which relates to this Prospectus/Proxy Statement and the Reorganization | | A copy is available upon request and without charge if you: • Write to MSF at the address listed on the cover page of this Prospectus/Proxy Statement; or • Call (800) 638-7732 toll-free. |

You can also obtain copies of any of these documents without charge on the EDGAR database on the SEC’s Internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549.

Information relating to MIST Portfolio contained in the Prospectus of MIST dated May 1, 2015 (SEC File No. 811-10183) is incorporated by reference into this document. Information relating to MSF Portfolio contained in the Prospectus of MSF dated May 1, 2015 (SEC File No. 811-03618) is incorporated by reference into this document. (This means that such information is legally considered to be part of this Prospectus/Proxy Statement.) The Statement of Additional Information dated January , 2016 relating to this Prospectus/Proxy Statement and the Reorganization, which includes the Annual Report of MSF relating to MSF Portfolio for the year ended December 31, 2014 (SEC File No. 811-03618), the Semiannual Report of MSF relating to MSF Portfolio for the six-month period ended June 30, 2015 (SEC File No. 811-03618), the Annual Report of MIST relating to MIST Portfolio for the year ended December 31, 2014 (SEC File No. 811-10183), the Semiannual Report of MIST relating to MIST Portfolio for the six-month period ended June 30, 2015 (SEC File No. 811-10183), and pro forma financial statements of MIST relating to MIST Portfolio and MSF relating to MSF Portfolio for the twelve-month period ended June 30, 2015, is incorporated by reference into this document.

An investment in MSF Portfolio through a Contract:

| | • | | is not a deposit of, or guaranteed by, any bank |

| | • | | is not insured by the FDIC, the Federal Reserve Board or any other government agency |

| | • | | is not endorsed by any bank or government agency |

| | • | | involves investment risk, including possible loss of the purchase payment of your original investment |

-3-

TABLE OF CONTENTS

-4-

SUMMARY

THIS SECTION SUMMARIZES THE PRIMARY FEATURES AND CONSEQUENCES OF THE REORGANIZATION. IT MAY NOT CONTAIN ALL OF THE INFORMATION THAT IS IMPORTANT TO YOU. TO UNDERSTAND THE REORGANIZATION, YOU SHOULD READ THIS ENTIRE PROSPECTUS/PROXY STATEMENT AND THE EXHIBIT.

This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Proxy Statement, the Prospectuses and Statements of Additional Information relating to the Portfolios and the form of the Agreement and Plan of Reorganization (the “Plan”), which is attached to this Prospectus/Proxy Statement as Exhibit A.

Why is the Reorganization being proposed?

As investment adviser to the Portfolios, MetLife Advisers is responsible for overseeing the Portfolios’ subadvisers and for making recommendations to the Boards of Trustees of MIST and MSF relating to the subadvisers. In this capacity, MetLife Advisers has concerns about the long-term stability of the subadviser to the MIST Portfolio in view of its anticipated combination with another asset management firm in 2016. Accordingly, the Adviser recommended to the Board the Reorganization of the MIST Portfolio into the MSF Portfolio, citing its confidence in the stability and investment capabilities of the subadviser to the MSF Portfolio. MIST Portfolio and MSF Portfolio have similar investment objectives and principal investment strategies. In addition, MSF Portfolio’s performance over the one-, five- and ten-year periods ending December 31, 2014, has been comparable to the performance of the MIST Portfolio over the one-, five- and ten-year periods for Class A shares and the one-, five- and since-inception periods for Class B shares. The total annual operating expenses for Class A and Class B shares of MSF Portfolio, before fee waivers, are higher than the total annual operating expenses for Class A and Class B shares of MIST Portfolio. However, following the Reorganization, MSF Portfolio’s total annual operating expenses for Class A and Class B shares, after fee waivers, are expected to be lower than MIST Portfolio’s total annual operating expenses, after fee waivers, for Class A and Class B shares, respectively, prior to the Reorganization. Consequently, MetLife Advisers has recommended that MIST Portfolio merge into MSF Portfolio, which has a similar investment objective and principal investment strategies, comparable investment performance and lower net operating expenses. Moreover, following the Reorganization, MSF Portfolio may in the future benefit from lower expenses that are achieved through economies of scale. MSF Portfolio’s subadviser has agreed to pay all of the costs of the Meeting and any adjourned session, all of the costs associated with this proxy solicitation and all of the expenses incurred in connection with the preparation of this Prospectus/Proxy Statement and any of its enclosures. If the Reorganization is not consummated, no portion of these costs or expenses will be borne directly or indirectly by MIST Portfolio, MSF Portfolio or their shareholders. MetLife Advisers or one of its affiliates will pay such costs and expenses. For the reasons set forth above, the Board of Trustees of MIST believes that the Reorganization is in the best interests of MIST Portfolio.

What are the key features of the Reorganization?

The Plan sets forth the key features of the Reorganization. For a complete description of the Reorganization, see Exhibit A. The Plan generally provides for the following:

| | • | | the in-kind transfer of all of the assets of MIST Portfolio to MSF Portfolio in exchange for Class A and Class B shares of MSF Portfolio; |

| | • | | the assumption by MSF Portfolio of all of the liabilities of MIST Portfolio; |

| | • | | the liquidation of MIST Portfolio by distribution of Class A and Class B shares of MSF Portfolio to MIST Portfolio’s Class A and Class B shareholders, respectively; and |

| | • | | the structuring of the Reorganization as a tax-free reorganization for federal income tax purposes. |

The Reorganization is expected to be completed on or about May 1, 2016.

-5-

After the Reorganization, what shares of MSF Portfolio will I own?

If you own Class A or Class B shares of MIST Portfolio, you will own Class A or Class B shares of MSF Portfolio. The new shares you receive will have the same total value as your shares of MIST Portfolio as of the close of business on the day immediately prior to the Reorganization.

How will the Reorganization affect me?

The effective management fee for MIST Portfolio is 0.67% and, after the Reorganization, the effective management fee for MSF Portfolio, after fee waivers, is expected to be 0.70%. Total portfolio operating expenses (after the contractual fee waivers) for the twelve months ended June 30, 2015 for Class A and Class B shares of MIST Portfolio were 0.67% and 0.92%, respectively, while total portfolio operating expenses (after the contractual fee waivers) for the twelve months ended June 30, 2015 for the Class A and Class B shares of MSF Portfolio were 0.62% and 0.87%, respectively. Wellington Management Company LLP (“Wellington Management” or the “Subadviser”), the subadviser to MSF Portfolio, has agreed to add an additional breakpoint to the subadvisory fee schedule for the MSF Portfolio effective December 1, 2015. MetLife Advisers will waive advisory fees for MSF Portfolio equal to the amount of the subadvisory fee reduction due to the additional breakpoint.

The Reorganization will not affect your Contract rights. The value of your Contract will remain the same immediately following the Reorganization. MSF Portfolio will sell its shares on a continuous basis at net asset value only to Insurance Companies. Each Insurance Company will keep the same separate account. Your Contract values will be allocated to the same separate account and that separate account will invest in MSF Portfolio after the Reorganization. After the Reorganization, your Contract values will depend on the performance of MSF Portfolio rather than on that of MIST Portfolio. Neither MIST Portfolio, MSF Portfolio nor their respective shareholders will bear any costs of the Meeting or any adjourned session, any of the costs associated with this proxy solicitation or any of the expenses incurred in connection with the preparation of this Prospectus/Proxy Statement or any of its enclosures. All of these costs will be paid by Wellington Management. If the Reorganization is not consummated, no portion of these costs or expenses will be borne directly or indirectly by MIST Portfolio, MSF Portfolio or their shareholders. MetLife Advisers or one of its affiliates will pay such costs and expenses.

Although MIST Portfolio and MSF Portfolio have similar investment objectives and principal investment strategies, it is currently expected that a substantial portion of MIST Portfolio’s portfolio assets (approximately 75%) will be sold prior to the consummation of the Reorganization, which may result in MIST Portfolio realizing capital gains. Actual portfolio sales will depend on the portfolio composition, market conditions and other factors at the time of the Reorganization and will be at the discretion of MSF Portfolio’s subadviser. Because Contract Owners hold their interests in MIST Portfolio through variable products, no Contract Owner will recognize any capital gains as a result of the portfolio repositioning. It is estimated that such repositioning will result in brokerage and other transaction costs of approximately $1 million, or 0.21%.

Like MIST Portfolio, MSF Portfolio will declare and pay dividends from net investment income and will distribute net realized capital gains, if any, to the Insurance Company separate accounts (not to you) once a year. These dividends and distributions will continue to be reinvested by your Insurance Company in additional Class A or Class B shares, as applicable, of MSF Portfolio.

Will I be able to purchase and redeem shares, change my investment options, annuitize and receive distributions the same way?

The Reorganization will not affect your right to purchase and redeem shares, to change among the Insurance Company’s separate account options, to annuitize, or to receive distributions as permitted by your Contract. After the Reorganization, you will be able under your current Contract to purchase additional Class A or Class B shares, as applicable, of MSF Portfolio. For more information, see “Purchase and Redemption Procedures,” “Exchange Privileges” and “Dividend Policy” below.

How do the Trustees recommend that I vote?

The Board of Trustees of MIST, including the Trustees who are not “interested persons” of MIST (the “Independent Trustees”), as such term is defined in the 1940 Act, has concluded that the Reorganization would

-6-

be in the best interests of MIST Portfolio, and that the interests of the shareholders of MIST Portfolio would not be diluted as a result of the Reorganization. Accordingly, the Trustees have submitted the Plan for the approval of the shareholders of MIST Portfolio.

THE TRUSTEES RECOMMEND THAT YOU VOTE FOR THE PROPOSED REORGANIZATION

The Board of Trustees of MSF has also approved the Plan on behalf of MSF Portfolio.

Who will be the adviser and subadviser of my Portfolio after the Reorganization?

MetLife Advisers serves as the investment adviser to MSF Portfolio and Wellington Management serves as the subadviser to MSF Portfolio and both will serve in these respective capacities after the Reorganization. MetLife Advisers serves as the investment adviser to MIST Portfolio and Pioneer Investment Management, Inc. (“Pioneer” serves as the subadviser to the MIST Portfolio. For more information, see “Comparison of the Portfolios—Who will be the adviser, subadviser and portfolio manager of my Portfolio after the Reorganization? What will the management fee be after the Reorganization?”

How do the Portfolios’ investment objectives and principal investment strategies compare?

The investment objective and principal investment strategies of MIST Portfolio are similar to those of MSF Portfolio. The investment objective of each Portfolio is non-fundamental, which means that it may be changed by vote of the Trustees and without shareholder approval.

Although the principal investment strategies for MIST Portfolio are similar to those for MSF Portfolio, there are some differences between the Portfolios. For example, while MIST Portfolio invests, under normal circumstances, in a broad group of carefully selected, reasonably priced securities rather than in securities whose prices reflect a premium resulting from their current market popularity, MSF Portfolio seeks to provide total returns in excess of the broader market as represented by the Russell 1000® Index over the long term by identifying companies that are expected to consistently return cash to shareholders in the form of a growing dividend and, under normal circumstances, invests at least 80% of its net assets in equity securities. In addition, MIST Portfolio seeks securities that it believes are selling at reasonable prices or substantial discounts to their underlying values and holds these securities until the market values reflect their intrinsic values, whereas MSF Portfolio focuses its investments on large capitalization growth companies. Further, MIST Portfolio may invest up to 20% of its assets in foreign equity securities while MSF Portfolio generally is limited to investing up to 25% of its total assets in foreign securities. For more information, see “Comparison of the Portfolios—How do the Portfolios’ investment objectives and principal investment strategies compare?”

Are the risk factors for the Portfolios similar?

Yes. The risk factors are identical due to the similar investment objectives and principal investment strategies of MIST Portfolio and MSF Portfolio. For more information, see “Comparison of the Portfolios—What are the principal risks of investing in each Portfolio?” and “Comparison of the Portfolios—Are there any other risks of investing in each Portfolio?”

How do the Portfolios’ fees and expenses compare?

MIST Portfolio offers two classes of shares (Class A and Class B) and MSF Portfolio offer three classes of shares (Class A, Class B and Class E). Class E shares of MSF Portfolio are not involved in the Reorganization. You will not pay any initial or deferred sales charge in connection with the Reorganization.

The following tables describe the fees and expenses that you may pay if you buy and hold shares of each Portfolio. The information provided for “MSF Portfolio (Pro Forma After Reorganization)” shows you what fees and expenses are estimated to be assuming the Reorganization takes place. Actual expenses may be greater or

-7-

less than those shown. Expense ratios reflect annual fund operating expenses for the twelve month period ended June 30, 2015. Pro forma information is estimated as if the Reorganization had taken place as of July 1, 2014.

THE TABLES AND EXAMPLES BELOW DO NOT REFLECT THE FEES, EXPENSES OR WITHDRAWAL CHARGES IMPOSED BY YOUR CONTRACT. SEE THE CONTRACT PROSPECTUS FOR A DESCRIPTION OF THESE FEES, EXPENSES AND CHARGES. IF CONTRACT CHARGES WERE REFLECTED, THE FEES AND EXPENSES IN THE TABLES AND EXAMPLES BELOW WOULD BE HIGHER.

Shareholder Fees (fees paid directly from your investment)—None

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | |

| | | MIST Portfolio | | | MSF Portfolio | | | MSF Portfolio

(Pro Forma After

Reorganization) | |

| | | Class A | | | Class A | | | Class A | |

Management Fee | | | 0.67 | % | | | 0.70 | % | | | 0.70 | % |

Distribution and/or Service (12b-1) Fees | | | None | | | | None | | | | None | |

Other Expenses | | | 0.05 | % | | | 0.03 | % | | | 0.03 | % |

| | | | | | | | | | | | |

Total Annual Portfolio Operating Expenses | | | 0.72 | % | | | 0.73 | % | | | 0.73 | % |

Fee Waiver | | | (0.05 | %)* | | | (0.11 | %)** | | | (0.11 | %)** |

| | | | | | | | | | | | |

Net Operating Expenses After Fee Waiver | | | 0.67 | % | | | 0.62 | % | | | 0.62 | % |

| * | MetLife Advisers, LLC, has contractually agreed, for the period May 1, 2015, through April 30, 2017, to reduce the Management Fee for each Class of MIST Portfolio to the annual rate of 0.625% of the first $400 million of the Portfolio’s average daily net assets, 0.600% of such assets over $400 million up to $900 million and 0.550% of such assets over $900 million. This arrangement may be modified or discontinued prior to April 30, 2017, only with the approval of the Board of Trustees of the Portfolio. |

| ** | MetLife Advisers, LLC, has contractually agreed, for the period May 1, 2015, through April 30, 2017, to reduce the Management Fee for each Class of MSF Portfolio to the annual rate of 0.630% of the first $500 million of the Portfolio’s average daily net assets, 0.605% of the next $500 million, 0.580% of the next $3.5 billion and 0.555% of amounts over $4.5 billion. This arrangement may be modified or discontinued prior to April 30, 2017, only with the approval of the Board of Trustees of the Portfolio. |

Shareholder Fees (fees paid directly from your investment)—None

| | | | | | | | | | | | |

| | | MIST Portfolio | | | MSF Portfolio | | | MSF Portfolio

(Pro Forma After

Reorganization) | |

| | | Class B | | | Class B | | | Class B | |

Management Fee | | | 0.67 | % | | | 0.70 | % | | | 0.70 | % |

Distribution and/or Service (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

Other Expenses | | | 0.05 | % | | | 0.03 | % | | | 0.03 | % |

| | | | | | | | | | | | |

Total Annual Portfolio Operating Expenses | | | 0.97 | % | | | 0.98 | % | | | 0.98 | % |

Fee Waiver | | | (0.05 | %)* | | | (0.11 | %)** | | | (0.11 | %)** |

| | | | | | | | | | | | |

Net Operating Expenses After Fee Waiver | | | 0.92 | % | | | 0.87 | % | | | 0.87 | % |

| * | MetLife Advisers, LLC, has contractually agreed, for the period May 1, 2015, through April 30, 2017, to reduce the Management Fee for each Class of MIST Portfolio to the annual rate of 0.625% of the first $400 million of the Portfolio’s average daily net assets, 0.600% of such assets over $400 million up to $900 million and 0.550% of such assets over $900 million. This arrangement may be modified or discontinued prior to April 30, 2017, only with the approval of the Board of Trustees of the Portfolio. |

-8-

| ** | MetLife Advisers, LLC, has contractually agreed, for the period May 1, 2015, through April 30, 2017, to reduce the Management Fee for each Class of MSF Portfolio to the annual rate of 0.630% of the first $500 million of the Portfolio’s average daily net assets, 0.605% of the next $500 million, 0.580% of the next $3.5 billion and 0.555% of amounts over $4.5 billion. This arrangement may be modified or discontinued prior to April 30, 2017, only with the approval of the Board of Trustees of the Portfolio. |

Examples of Portfolio Expenses

The following examples are intended to help you compare the cost of investing in each Portfolio, MSF Portfolio (Pro Forma After Reorganization), assuming the Reorganization takes place. The examples assume that you invest $10,000 for the time periods indicated and then redeem all of your shares at the end of those periods. The examples also assume that your investment has a 5% return each year, that the operating expenses remain the same, and that all fee waivers will expire after one year. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | | | | | | | | | | | |

Class A | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

MIST Portfolio | | $ | 68 | | | $ | 225 | | | $ | 396 | | | $ | 890 | |

MSF Portfolio | | $ | 63 | | | $ | 222 | | | $ | 395 | | | $ | 896 | |

MSF Portfolio (Pro Forma After Reorganization) | | $ | 63 | | | $ | 222 | | | $ | 395 | | | $ | 896 | |

| | | | |

Class B | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

MIST Portfolio | | $ | 94 | | | $ | 304 | | | $ | 531 | | | $ | 1,185 | |

MSF Portfolio | | $ | 89 | | | $ | 301 | | | $ | 531 | | | $ | 1,191 | |

MSF Portfolio (Pro Forma After Reorganization) | | $ | 89 | | | $ | 301 | | | $ | 531 | | | $ | 1,191 | |

What will be the primary federal tax consequences of the Reorganization?

Prior to and as a condition to the closing of the Reorganization, MIST Portfolio and MSF Portfolio will have received an opinion from the law firm of Sullivan & Worcester LLP that, while the matter is not entirely free from doubt: (1) no gain or loss will be recognized by MIST Portfolio or the separate accounts through which each Insurance Company owns its shares (“Record Holders”) for federal income tax purposes as a result of receiving shares of MSF Portfolio in connection with the Reorganization; (2) the holding period and aggregate tax basis of the shares of MSF Portfolio that are received by the Record Holders of MIST Portfolio will be the same as the holding period and aggregate tax basis of the shares of MIST Portfolio previously held by such Record Holders, provided that such shares of MIST Portfolio are held as capital assets; (3) the holding period and tax basis of the assets of MIST Portfolio in the hands of MSF Portfolio as a result of the Reorganization will be the same as the holding period and tax basis of such assets in the hands of MIST Portfolio immediately prior to the Reorganization; and (4) no gain or loss will be recognized by MSF Portfolio upon the receipt of the assets of MIST Portfolio in exchange for shares of MSF Portfolio and the assumption by MSF Portfolio of MIST Portfolio’s liabilities.

-9-

COMPARISON OF THE PORTFOLIOS

What are the principal risks of investing in each Portfolio?

An investment in each Portfolio is subject to certain risks. The risk factors are identical due to the similar investment objectives and principal investment strategies of MIST Portfolio and MSF Portfolio. There is no assurance that the investment performance of either Portfolio will be positive or that the Portfolios will meet their investment objectives. The following discussion highlights the principal risks associated with investment in each of the Portfolios.

Market Risk

A Portfolio’s share price can fall because of, among other things, weakness in the broad market, a particular industry or specific holding, or changes in general economic conditions, such as prevailing interest rates or investor sentiment. The market as a whole can decline for many reasons, including disappointing corporate earnings, adverse political or economic developments here or abroad, changes in investor psychology, or heavy institutional selling. The value of a particular investment may fall as a result of factors directly relating to the company that issued the investment, such as decisions made by its management or lower demand for the company’s products or services. A security’s value may also fall because of factors affecting not just the company but also companies in the same industry or in a number of different industries such as increases in production costs. In addition, an assessment by a Portfolio’s Subadviser of particular companies may prove incorrect, resulting in losses or poor performance by those holdings, even in a rising market. A Portfolio could also miss attractive investment opportunities if its Subadviser underweights markets or industries where there are significant returns, and could lose value if the Subadviser overweights markets or industries where there are significant declines. Stocks and other equity securities are generally considered to be more volatile than fixed income securities.

Markets tend to move in cycles with periods of rising prices and periods of falling prices. Like the stock market generally, the investment performance of a Portfolio will fluctuate within a wide range, so an investor may lose money over short or even long periods.

Significant disruptions to the financial markets could adversely affect the liquidity and volatility of securities. During periods of extreme market volatility, prices of securities may be negatively impacted due to imbalances between market participants seeking to sell particular securities or similar securities and market participants willing or able to buy such securities. As a result, the market price of a security held by a Portfolio could decline at times without regard to the financial condition of or specific events impacting the issuer of the security.

Stocks purchased in initial public offerings (“IPOs”) have a tendency to fluctuate in value significantly shortly after the IPO relative to the price at which they were purchased. These fluctuations could impact the net asset value and return earned on the Portfolio’s shares.

Market Capitalization Risk

Stocks fall into three broad market capitalization categories—large, medium and small. A Portfolio that invests primarily in one of these categories carries the risk that due to current market conditions that category may be out of favor with investors.

If valuations of large capitalization companies appear to be greatly out of proportion to the valuations of small or medium capitalization companies, investors may migrate to the stocks of small and medium-sized companies. Larger, more established companies may also be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes. Many larger companies also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion.

-10-

Investing in medium and small capitalization companies may be subject to special risks associated with narrower product lines, more limited financial resources, fewer experienced managers, dependence on a few key employees, and a more limited trading market for their stocks, as compared with larger companies. In addition, securities of these companies are subject to the risk that, during certain periods, the liquidity of particular issuers or industries will shrink or disappear with little forewarning as a result of adverse economic or market conditions, or adverse investor perceptions, whether or not accurate. Securities of medium and smaller capitalization issuers may therefore be subject to greater price volatility and may decline more significantly in market downturns than securities of larger companies. Smaller and medium capitalization issuers may also require substantial additional capital to support their operations, to finance expansion or to maintain their competitive position; and may have substantial borrowings or may otherwise have a weak financial condition, and may be susceptible to bankruptcy. Transaction costs for these investments are often higher than those of larger capitalization companies. There is typically less publicly available information about small capitalization companies.

Some small and medium capitalization companies also may be relatively new issuers, which carries risks in addition to the risks of other medium and small capitalization companies. New issuers may be more speculative because such companies are relatively unseasoned. These companies will often be involved in the development or marketing of a new product with no established market, which could lead to significant losses.

Investment Style Risk

Different investment styles tend to shift in and out of favor depending upon market and economic conditions, as well as investor sentiment. A Portfolio may outperform or underperform other funds that employ a different investment style. A Portfolio may also employ a combination of styles that impact its risk characteristics. Examples of different investment styles include growth and value.

Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions of the issuing company’s growth of earnings potential. Also, because growth companies usually invest a high portion of earnings in their business, growth stocks may lack the dividends of some value stocks that can cushion stock prices in a falling market. Growth oriented funds will typically underperform when value investing is in favor.

Value stocks are those which are undervalued in comparison to their peers due to adverse business developments or other factors. Value investing carries the risk that the market will not recognize a security’s inherent value for a long time, or that a stock judged to be undervalued by a Portfolio’s Subadviser may actually be appropriately priced or overvalued. Value oriented funds will typically underperform when growth investing is in favor.

Real Estate Investment Risk

Real estate investments are subject to market risk, interest rate risk and credit risk. The performance of a Portfolio that invests a substantial portion of its assets in the real estate industry or in securities related to the real estate industry may be adversely affected when the real estate market declines. When a Portfolio focuses its investments in particular sub-sectors of the real estate industry (e.g., apartments, retail, hotels, offices, industrial, health care) or particular geographic regions, the Portfolio’s performance would be especially sensitive to developments that significantly affected those particular sub-sectors or geographic regions. The shares of a Portfolio that concentrates its investments in the real estate industry may be more volatile compared to the value of shares of a portfolio with investments in a mix of different industries.

Investments in real estate investment trusts (“REITs”) may be particularly sensitive to falling property values and increasing defaults on real estate mortgages. Due to their dependence on the management skills of their managers, REITs may underperform if their managers are incorrect in their assessment of particular real estate investments. REITs are subject to heavy cash flow dependency, defaults by borrowers, self-liquidation and the possibility of failing to qualify for tax-free pass through of income under the Internal Revenue Code of 1986

-11-

or failing to maintain exemption from the Investment Company Act of 1940, as amended. An adverse development in any of these areas could cause the value of a REIT to fall and the performance of the Portfolio to decline. In the event an issuer of debt securities collateralized by real estate defaults, it is conceivable that a REIT could end up holding the underlying real estate. The disposition of such real estate could cause a REIT to incur unforeseen expenses that could reduce the value of the REIT.

Foreign Investment Risk

Investments in foreign securities, including depositary receipts, tend to be more volatile and less liquid than investments in U.S. securities because, among other things, they involve risks not associated with investing in U.S. securities. These additional risks may adversely affect a Portfolio’s performance.

Investments in foreign securities, whether denominated in U.S. dollars or foreign currencies, are subject to political, social and economic developments in the countries and regions where the issuers operate or are domiciled or where the securities are traded.

Less information may be publicly available about foreign companies than about U.S. companies. Foreign companies are generally not subject to the same accounting, auditing and financial reporting standards and practices as are U.S. companies. In addition, a Portfolio’s investments in foreign securities may be subject to the risk of nationalization or expropriation of assets, imposition of currency exchange controls or restrictions on the repatriation of foreign currency and confiscatory taxation. Moreover, a Portfolio may have more limited recourse against a foreign issuer than it would in the United States.

The costs of buying, selling and holding foreign securities, including brokerage, tax and custody costs, may be higher than those involved in domestic transactions. Foreign settlement and clearance procedures and trade regulations may involve certain risks (such as delays in payment for or delivery of securities) not typically associated with the settlement of U.S. investments.

To the extent a Portfolio owns foreign securities denominated in foreign currencies, directly holds foreign currencies or purchases and sells foreign currencies, changes in currency exchange rates may affect the Portfolio’s net asset value, as well as the value of dividends and interest earned, and gains and losses realized on the sale of foreign securities. An increase in the strength of the U.S. dollar relative to these other currencies may cause the value of the Portfolio to decline. Certain foreign currencies may be particularly volatile, and foreign governments may intervene in the currency markets, causing a decline in value or liquidity of a Portfolio’s foreign currency or securities holdings. Although a Portfolio may employ certain techniques, such as forward contracts and futures contracts, in an effort to reduce the risk of unfavorable changes in currency exchange rates, there is no assurance that those techniques will be effective. If such techniques are employed and are effective, they will generally reduce or eliminate the benefit of any changes in currency exchange rates that otherwise would have been favorable to the Portfolio.

All of the risks of investing in foreign securities are typically increased by investing in emerging market countries. Generally, economic structures in these countries are less diverse and mature than those in developed countries, and their political systems are less stable. Investments in emerging market countries may be affected by national policies that restrict foreign investment in certain issuers or industries or that prevent foreign investors from withdrawing their money at will. Small securities markets and low trading volumes in emerging market countries can make investments illiquid and more volatile than investments in developed countries, and such securities may be subject to abrupt and severe price declines.

To the extent a Portfolio invests in depositary receipts or participation certificates in order to obtain exposure to a security or pool of securities issued by a foreign issuer, it is subject to the risks associated with an investment in the underlying security or pool of securities. Investments in depositary receipts that are traded over the counter and participation certificates may subject a Portfolio to liquidity risk, which is the risk that an investment may become less liquid or illiquid in response to market developments or adverse investor

-12-

perceptions. Illiquid investments may be more difficult to value. Participation certificates also may expose a Portfolio to counterparty risk, which is the risk that the bank or broker-dealer that issues the certificates will not fulfill its contractual obligations to timely pay the Portfolio the amount owned under the certificates.

How do the Portfolios’ investment objectives and principal investment strategies compare?

Although the principal investment strategies for MIST Portfolio are similar to those for MSF Portfolio, there are some differences between the Portfolios. For example, while MIST Portfolio invests, under normal circumstances, in a broad group of carefully selected, reasonably priced securities rather than in securities whose prices reflect a premium resulting from their current market popularity, MSF Portfolio seeks to provide total returns in excess of the broader market as represented by the Russell 1000® Index over the long term by identifying companies that are expected to consistently return cash to shareholders in the form of a growing dividend and, under normal circumstances, invests at least 80% of its net assets in equity securities. In addition, MIST Portfolio seeks securities that it believes are selling at reasonable prices or substantial discounts to their underlying values and holds these securities until the market values reflect their intrinsic values, whereas MSF Portfolio focuses its investments on large capitalization growth companies. Further, MIST Portfolio may invest up to 20% of its assets in foreign equity securities while MSF Portfolio generally is limited to investing up to 25% of its total assets in foreign securities.

Although MIST Portfolio and MSF Portfolio have similar investment objectives and principal investment strategies, it is currently expected that the substantial portion of MIST Portfolio’s portfolio assets that are represented by securities not held by MSF Portfolio (which represents approximately 75% of MIST Portfolio’s assets) will be sold prior to the consummation of the Reorganization, which may result in MIST Portfolio realizing capital gains. Actual portfolio sales will depend on the portfolio composition, market conditions and other factors at the time of the Reorganization and will be at the discretion of MSF Portfolio’s subadviser. Because Contract Owners hold their interests in MIST Portfolio through variable products, no Contract Owner will recognize any capital gains as a result of the portfolio repositioning. It is estimated that such repositioning will result in brokerage and other transaction costs of approximately $1 million, or 0.21%.

The following table summarizes a comparison of MIST Portfolio and MSF Portfolio with respect to their investment objectives and principal investment strategies, as set forth more fully in the Prospectuses and Statements of Additional Information relating to the Portfolios.

| | | | |

| | | MIST Portfolio | | MSF Portfolio |

| Investment Objective | | Reasonable income and capital growth. | | Provide a growing stream of income over time and, secondarily, long-term capital appreciation and current income. |

| | |

| Principal Investment Strategies | | Pioneer, subadviser to the Portfolio, invests the Portfolio’s assets, under normal circumstances, in a broad group of carefully selected, reasonably priced securities rather than in securities whose prices reflect a premium resulting from their current market popularity. The Portfolio invests predominantly in equity securities. Equity securities include common stocks, depositary receipts, warrants, rights, preferred stocks, and equity interests in real estate investment trusts (“REITs”). The Portfolio may invest in securities of any market capitalization, although the Portfolio normally invests a significant portion of its assets in equity securities of large cap companies. The Portfolio may invest up to | | Wellington Management, subadviser to the Portfolio, utilizes an investment approach in managing the Portfolio that seeks to provide total returns in excess of the broader market as represented by the Russell 1000® Index over the long term by identifying companies that are expected to consistently return cash to shareholders in the form of a growing dividend. Under normal circumstances, the Portfolio invests at least 80% of its net assets in equity securities. Equity securities include common stocks, preferred stocks, American Depositary Receipts (“ADRs”), rights and warrants. Although the Portfolio may invest in the securities of companies with any market capitalization, the Portfolio normally invests a significant portion of its |

-13-

| | | | |

| | | MIST Portfolio | | MSF Portfolio |

| | |

| | 20% of its net assets in REITs. The Portfolio may invest up to 20% of its total assets in non-U.S. issuers. Pioneer uses a value approach to select the Portfolio’s investments. Pioneer seeks securities that it believes are selling at reasonable prices or substantial discounts to their underlying values and holds these securities until the market values reflect their intrinsic values. Pioneer focuses on the quality and price of individual issuers, not on economic sector or market timing strategies. Factors that Pioneer uses in selecting investments include, but are not limited to: • favorable expected returns relative to perceived risk • above average potential for earnings and revenue growth • a sustainable competitive advantage (e.g., brand name, customer base, proprietary technology, economies of scale) • potential to provide reasonable income • low market valuations relative to earnings forecast, book value, cash flow and sales | | assets in the equity securities of large-capitalization companies. The Portfolio may invest in real estate investment trusts, and may invest up to 25% of its assets in foreign securities, including ADRs. The investment process that Wellington Management uses to manage the Portfolio is based on the belief that above-average growth in dividends is an effective and often overlooked indicator of high quality, shareholder-oriented companies that produce consistent, above-average returns over time with lower volatility than the broad market. In order to grow dividends, Wellington Management believes companies need to produce not only growth in reported earnings, but also growth in free cash flow, which requires prudent management of balance sheet accruals as well as margins. In Wellington Management’s view, companies also need to allocate free cash flow effectively by reinvesting capital selectively and returning excess capital to shareholders. Historically, companies which have returned excess capital to shareholders via dividends have produced higher returns on capital over time. Wellington Management believes that a portfolio of high-quality stocks with superior prospects for dividend growth, selling at reasonable valuation levels, can produce superior total returns over time. Leveraging the firm’s global industry analysts, the portfolio manager focuses on identifying high-quality companies that have the ability, propensity, and commitment to return capital to shareholders in the form of a growing dividend. From a financial perspective, the approach seeks to identify companies with a below average debt-to-capital ratio relative to their industry, higher than average and improving returns on capital, modest reinvestment needs, positive balance sheet trends, and free cash flow conversion. The unifying characteristic among the companies held in the Portfolio will be quality cash flow characteristics. Importantly, the portfolio manager also pays close attention to insider activity and management compensation schemes in order |

-14-

| | | | |

| | | MIST Portfolio | | MSF Portfolio |

| | |

| | | | to judge the proper alignment of shareholder interests with those of the senior executives. High-quality companies that meet Wellington Management’s dividend and valuation criteria are ranked on a similar basis. While dividend growth is an important focus of Wellington Management’s investment process, capital appreciation is also considered in determining the attractiveness of the valuation for each security. The portfolio manager monitors the risk/reward profile of each stock, but the most important driver of purchase and sale decisions is the potential for dividend growth and the fundamentals that support that analysis. |

How do the Portfolios’ portfolio turnover rates compare?

Each Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, MIST Portfolio’s and MSF Portfolio’s portfolio turnover rates were 24% and 105%, respectively, of the average value of their portfolios.

How do the Portfolios’ performance records compare?

The investment performance for MIST Portfolio and MSF Portfolio over the one-, five- and ten-year periods ended December 31, 2014 has been comparable. Class A shares of MIST Portfolio outperformed Class A shares of MSF Portfolio for the one-, five- and ten-year periods ended December 31, 2014, and Class B shares of MIST Portfolio outperformed Class B shares of MSF Portfolio for the one- and five-year periods ended December 31, 2014.

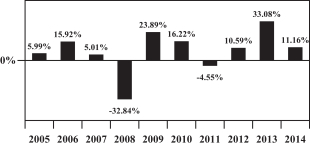

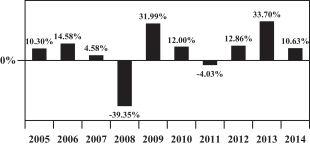

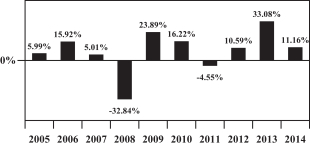

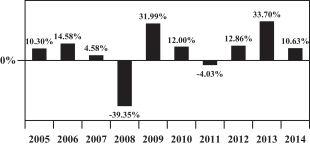

The information in the bar charts and tables below provides some indication of the risks of investing in the Portfolios by showing changes in each Portfolio’s performance from year to year and how each Portfolio’s average annual returns over time compare with those of a broad-based securities market index. Note that the results in the bar chart and table do not include the effect of fees, expenses or withdrawal charges imposed by your Contract. If these Contract charges had been included, performance would have been lower. As with all mutual funds, past performance does not indicate how the Portfolios will perform in the future.

Year-by-Year Total Return For Class A Shares as of December 31 of Each Year

MIST Portfolio Class A Shares

Highest Quarter: 2nd – 2009 14.10%

Lowest Quarter: 4th – 2008 -20.24%

-15-

MSF Portfolio Class A Shares

Highest Quarter: 2nd – 2009 20.45%

Lowest Quarter: 4th – 2008 -24.07%

The next set of tables lists the average annual total return of the Class A and Class B shares of MIST Portfolio and MSF Portfolio for the one-, five- and ten-year periods and since inception (ended December 31, 2014), as applicable. These tables include the effects of portfolio expenses and compare each Portfolio’s average annual compounded total returns for each class with index returns. A description of the relevant index can be found following the table. It is not possible to invest directly in an index.

Average Annual Total Return as of December 31, 2014

| | | | | | | | | | | | | | | | | | | | |

MIST Portfolio | | 1 Year | | | 5 Years | | | 10 Years | | | Since

Inception | | | Inception

Date | |

Class A shares | | | 11.16 | % | | | 12.66 | % | | | 6.90 | % | | | — | | | | — | |

Class B shares | | | 10.93 | % | | | 12.38 | % | | | N/A | | | | 16.26 | % | | | 4-28-09 | |

S&P 500 Index (reflects no deduction for mutual fund fees or expenses) | | | 13.69 | % | | | 15.45 | % | | | 7.67 | % | | | — | | | | — | |

| | | | | | | | | | | | |

MSF Portfolio | | 1 Year | | | 5 Years | | | 10 Years | |

Class A shares | | | 10.63 | % | | | 12.40 | % | | | 6.62 | % |

Class B shares | | | 10.35 | % | | | 12.13 | % | | | 6.35 | % |

Russell 1000 Growth Index (reflects no deduction for mutual fund fees or expenses) | | | 13.24 | % | | | 15.64 | % | | | 7.96 | % |

S&P 500 Index (reflects no deduction for mutual fund fees or expenses) | | | 13.69 | % | | | 15.45 | % | | | 7.67 | % |

The Russell 1000 Index is an unmanaged measure of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 90% of the investable U.S. equity market.

The S&P 500 Index is a widely recognized unmanaged index that measures the stock performance of 500 large- and medium-sized companies and is often used to indicate the performance of the overall stock market.

It is not possible to invest directly in an index.

For a detailed discussion of the manner of calculating total return, please see the Statement of Additional Information for MSF Portfolio. Generally, the calculations of total return assume the reinvestment of all dividends and capital gain distributions on the reinvestment date and the deduction of all recurring expenses that were charged to shareholders’ accounts.

Important information about MSF Portfolio is also contained in management’s discussion of MSF Portfolio performance which appears in the most recent Annual Report of MSF relating to MSF Portfolio.

-16-

Who will be the adviser, subadviser and portfolio manager of my Portfolio after the Reorganization? What will the management fee be after the Reorganization?

Management of the Portfolios

The overall management of MIST Portfolio and of MSF Portfolio is the responsibility of, and is supervised by, the Board of Trustees of MIST and the Board of Trustees of MSF, respectively.

Adviser

MetLife Advisers is the investment adviser for MSF Portfolio and will continue in this capacity after the Reorganization. MetLife Advisers is the investment adviser for MIST Portfolio. MetLife Advisers selects and pays the fees of the Subadviser for MSF Portfolio and monitors the Subadviser’s investment program. MetLife Investors Group, LLC, an affiliate of MetLife, owns all of the outstanding common shares of MetLife Advisers.

Facts about MetLife Advisers:

| | • | | MetLife Advisers is an affiliate of MetLife. |

| | • | | MetLife Advisers manages a family of investment portfolios sold to separate accounts of MetLife and its affiliates to fund variable life insurance contracts and variable annuity certificates and contracts, with assets of approximately $135.1 billion as of September 30, 2015. |

| | • | | MetLife Advisers is located at One Financial Center, Boston, Massachusetts 02111. |

MIST and MSF each rely on an exemptive order from the SEC that permits MetLife Advisers to enter into a new subadvisory agreement with either a current or a new subadviser that is not an affiliate of MetLife Advisers or MIST or MSF, as the case may be, without obtaining shareholder approval. The Trustees of MIST or MSF, as applicable, must approve any new subadvisory agreements entered into in reliance on the exemptive order, and MIST and MSF must comply with certain other conditions set forth in the order.

The exemptive order also permits MIST and MSF to continue to employ an existing subadviser, or to amend an existing subadvisory agreement, without shareholder approval after certain events that would otherwise require a shareholder vote. Any new or amended subadvisory agreement must be approved by the Trustees of MIST or MSF, as applicable. MIST and MSF, as applicable, will notify shareholders of any subadviser changes and any other event of which notification is required under the exemptive order.

Subadviser

Wellington Management is the subadviser to MSF Portfolio and will continue in this capacity after the Reorganization. Pioneer is the subadviser to MIST Portfolio. Pursuant to a Subadvisory Agreement with MetLife Advisers, the Subadviser continuously furnishes an investment program for MSF Portfolio, makes day-to-day investment decisions on behalf of the Portfolio, and arranges for the execution of portfolio transactions.

Facts about the Subadviser:

| | • | | The Subadviser is a Delaware limited liability partnership dating back to 1928. |

| | • | | The Subadviser had assets under management of approximately $898 billion as of September 30, 2015. |

| | • | | The Subadviser is located at 280 Congress Street, Boston, Massachusetts 02210 |

-17-

Portfolio Management

Donald J. Kilbride, Senior Managing Director and Equity Portfolio Manager of Wellington Management, has served as the Portfolio Manager of MSF Portfolio since February 2014. Mr. Kilbride joined Wellington Management as an investment professional in 2002.

Please refer to MSF’s Statement of Additional Information for information about the portfolio manager’s compensation, other accounts managed and ownership of securities in MSF Portfolio.

Management Fees

For its management and supervision of the daily business affairs of MIST Portfolio, MetLife Advisers receives monthly compensation at an annual rate of a percentage of the average daily net assets as follows: 0.70% of the first $200 million of such assets plus 0.65% of such assets over $200 million up to $500 million plus 0.60% of such assets over $500 million up to $2 billion plus 0.55% of such assets over $2 billion. For the year ended December 31, 2014, the Portfolio paid MetLife Advisers an investment advisory fee of 0.62% of the Portfolio’s average daily net assets.

MetLife Advisers has contractually agreed, for the period May 1, 2015, through April 30, 2017, to reduce the management fee for each Class of MIST Portfolio to the annual rate of 0.625% of the first $400 million of the Portfolio’s average daily net assets, 0.600% of such assets over $400 million up to $900 million and 0.550% of such assets over $900 billion. This arrangement may be modified or discontinued prior to April 30, 2017, only with the approval of the Board of Trustees of the Portfolio.

As compensation for its services to MSF Portfolio, MetLife Advisers receives monthly compensation at an annual rate of a percentage of the average daily net assets as follows: 0.75% for the first $1 billion of MSF Portfolio’s average daily net assets, 0.70% for the next $2 billion and 0.65% for amounts over $3 billion. For the year ended December 31, 2014, the Portfolio paid MetLife Advisers an investment advisory fee of 0.56% of the Portfolio’s average daily net assets.

MetLife Advisers has agreed to waive a portion of the management fee reflecting a portion of the savings from the application of a discount to the subadvisory fees payable by MetLife Advisers to Wellington Management.

In addition, MetLife Advisers has contractually agreed, for the period May 1, 2015, through April 30, 2016, to reduce the management fee for each Class of MSF Portfolio to the annual rate of 0.630% of the first $500 million of the Portfolio’s average daily net assets, 0.605% of the next $500 million, 0.580% of the next $3.5 billion and 0.555% of amounts over $4.5 billion. This arrangement may be modified or discontinued prior to April 30, 2016, only with the approval of the Board of Trustees of the Portfolio.

Subadvisory Fees

MetLife Advisers pays Pioneer a fee based on MIST Portfolio’s average daily net assets. MIST Portfolio is not responsible for the fees paid to Pioneer. For the year ended December 31, 2014, MetLife Advisers paid to Pioneer a subadvisory fee of 0.30% of MIST Portfolio’s average daily net assets.

MetLife Advisers pays the Subadviser a fee based on the Portfolio’s average daily net assets. The Portfolio is not responsible for the fees paid to the Subadviser. For the year ended December 31, 2014, MetLife Advisers paid to the Subadviser and the former investment subadviser an aggregate subadvisory fee of 0.21% of the Portfolio’s average daily net assets.

-18-

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

As investment adviser to the Portfolios, MetLife Advisers is responsible for overseeing the Portfolios’ subadvisers and for making recommendations to the Boards of Trustees of MIST and MSF relating to the subadvisers. In this capacity, MetLife Advisers has concerns about the long-term stability of the subadviser to the MIST Portfolio in view of its anticipated combination with another asset management firm in 2016. Accordingly, the Adviser recommended to the Board the Reorganization of the MIST Portfolio into the MSF Portfolio, citing the Adviser’s confidence in the stability and investment capabilities of Wellington Management, the subadviser to the MSF Portfolio.

At a meeting held on November 17-18, 2015, all of the Trustees of MIST, including the Independent Trustees, considered and approved the Reorganization; they determined that the Reorganization was in the best interests of MIST Portfolio, and that the interests of existing shareholders of MIST Portfolio will not be diluted as a result of the Reorganization.

Before approving the Plan, the Trustees evaluated extensive information that was provided by MetLife Advisers about the Portfolios and the terms of the proposed Reorganization. The information provided by MetLife Advisers showed that the Reorganization presented the potential for current MIST Portfolio shareholders to pursue similar investment objectives in a Portfolio with comparable past performance and lower overall expenses. Specifically, the Trustees noted that the shareholders of MIST Portfolio may benefit from the Reorganization because MSF Portfolio’s total annual operating expenses, after fee waivers, are expected to be lower than the total annual operating expenses, after fee waivers, of MIST Portfolio prior to the Reorganization. In addition, MSF Portfolio’s performance over the one-, five- and ten-year periods ending December 31, 2014, has been comparable to the performance of the MIST Portfolio over the one-, five- and ten-year periods for Class A shares and the one-, five- and since-inception periods for Class B shares.

The combination of the two Portfolios which have similar investment objectives and principal investment strategies also is expected to result in operational efficiencies for MSF Portfolio following the Reorganization, although no assurance can be given that these efficiencies will be achieved.

In addition, the Trustees considered, among other things:

| | • | | the terms and conditions of the Reorganization; |

| | • | | the fact that the Reorganization would not result in the dilution of the interests of the shareholders of MIST Portfolio; |

| | • | | the fact that MIST Portfolio and MSF Portfolio have similar investment objectives and principal investment strategies; |

| | • | | the fees and expenses of each Portfolio before and after applicable fee waivers; |

| | • | | the fact that Wellington Management will bear all of the costs of the Meeting and any adjourned session, all of the costs associated with this proxy solicitation, and all of the expenses incurred in connection with the preparation of this Prospectus/Proxy Statement and any of its enclosures, and that no portion of these costs or expenses will be borne by MIST Portfolio, MSF Portfolio or their respective shareholders; |

| | • | | the anticipated transaction costs associated with the Reorganization; |

| | • | | the fact that MSF Portfolio will assume all of the liabilities of MIST Portfolio; |

| | • | | the fact that the Reorganization is expected to be a tax free transaction for federal income tax purposes; and |

| | • | | alternatives available to shareholders of MIST Portfolio, including the ability to exchange their shares for shares of other funds that are offered as investment options under their Contracts. |

-19-

During their consideration of the Reorganization, the Trustees of MIST met with counsel to MIST and independent legal counsel to the Independent Trustees regarding the legal issues involved.

After consideration of the factors noted above, together with other factors and information considered to be relevant, and recognizing that there can be no assurance that any particular benefit will in fact be realized, the Trustees of MIST concluded that the proposed Reorganization would be in the best interests of MIST Portfolio. Consequently, they approved the Plan and directed that the Plan be submitted to shareholders of MIST Portfolio for approval.

The Trustees of MSF, including the Trustees who are not “interested persons” of the Trust, as such term is defined in the 1940 Act, also considered and approved the Reorganization, including the Plan, on behalf of MSF Portfolio based upon determinations that the Reorganization is in the best interests of MSF Portfolio, and that the interests of the existing shareholders of MSF Portfolio would not be diluted as a result of the Reorganization.

Agreement and Plan of Reorganization

The following summary is qualified in its entirety by reference to the Plan (the form of which is attached as Exhibit A to this Prospectus/Proxy Statement).

The Plan provides that all of the assets of MIST Portfolio will be acquired by MSF Portfolio in exchange for shares of MSF Portfolio and the assumption by MSF Portfolio of all of the liabilities of MIST Portfolio on or about May 1, 2016 or such other date as may be agreed upon by the parties (the “Closing Date”). MIST Portfolio will prepare an unaudited statement of its assets and liabilities as of the close of regular trading on the New York Stock Exchange (“NYSE”), usually at 4:00 p.m. Eastern time, on the business day immediately prior to the Closing Date (the “Valuation Date”).

On or prior to the Closing Date, MIST Portfolio will declare a dividend or dividends and distribution or distributions which, together with all previous dividends and distributions, shall have the effect of distributing to the Portfolio’s Record Holders all of the Portfolio’s investment company taxable income for the taxable period ending on the Closing Date (computed without regard to any deduction for dividends paid) and all of the Portfolio’s net capital gains realized in all taxable periods ending on the Closing Date (after reductions for any capital loss carryforward).

The number of full and fractional Class A and Class B shares of MSF Portfolio to be received by the Record Holders of MIST Portfolio will be determined by dividing the net asset value of the Class A and Class B shares of MIST Portfolio by the net asset value of one share of the corresponding class of MSF Portfolio. These computations will take place as of the Valuation Date. The net asset value per share of each class will be determined by dividing assets, less liabilities, in each case attributable to the respective class, by the total number of outstanding shares.