As filed with the Securities and Exchange Commission on November 29, 2017

Securities Act File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| | | | |

| | THE SECURITIES ACT OF 1933 | | |

| | Pre-Effective Amendment No. | | ☐ |

| | Post-Effective Amendment No. | | ☐ |

Brighthouse Funds Trust II

(formerly, Met Investors Series Trust)

(Exact Name of Registrant as Specified in Charter)

One Financial Center

Boston, Massachusetts 02111

(Address of Principal Executive Offices)

Registrant’s Telephone Number, Including Area Code: (617) 578-4036

MICHAEL LAWLOR, ESQ.

Brighthouse Funds Trust II

One Financial Center, Boston, Massachusetts 02111

(Name and Address of Agent for Service)

Copies to:

| | |

| BRIAN D. MCCABE, ESQ. | | JEREMY C. SMITH, ESQ. |

| Ropes & Gray LLP | | Ropes & Gray LLP |

| Prudential Tower | | 1211 Avenue of the Americas, New York, New York 11036 |

| 800 Boylston Street, Boston, Massachusetts 02199 | | |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Class A, Class B and Class E shares of beneficial interest of the MFS Value Portfolio series of the Registrant.

No filing fee is due because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on December 29, 2017 pursuant to Rule 488 under the Securities Act of 1933, as amended.

This Registration Statement relates solely to the MFS Value Portfolio series of the Registrant. Information contained in this Registration Statement relating to any other series of the Registrant is neither amended nor superseded hereby.

BRIGHTHOUSE FUNDS TRUST I

Schroders Global Multi-Asset Portfolio II

(formerly, Pyramis Managed Risk Portfolio)

Allianz Global Investors Dynamic Multi-Asset Plus Portfolio

BRIGHTHOUSE FUNDS TRUST II

MFS Value Portfolio II

(formerly, BlackRock Large Cap Value Portfolio)

COMBINED PROXY STATEMENT/PROSPECTUS

[December 29], 2017

This is a brief overview of the reorganization proposed for your portfolio. We encourage you to read the full text of the enclosed combined proxy statement/prospectus.

Q: Why are you sending me this information?

Mutual funds are required to obtain shareholder approval for certain kinds of changes, like the reorganizations proposed in the enclosed combined proxy statement/prospectus. Shares of the above-listed funds are owned of record by sub-accounts of insurance companies (the “Participating Insurance Companies”) established to fund benefits under variable annuity contracts and/or variable life insurance policies (each a “Contract”) issued by the Participating Insurance Companies. References to “shareholders” herein refer to separate accounts of Participating Insurance Companies and/or to other permissible investors under relevant U.S. federal income tax rules. Persons holding Contracts are referred to herein as “Contract Owners.” As a Contract Owner with Contract values allocated to one of the above-listed funds, you are being asked to provide voting instructions to the Participating Insurance Company that issued your Contract regarding a reorganization involving your fund.

Q: What is a reorganization?

A fund reorganization involves one portfolio transferring all of its assets and liabilities to another portfolio in exchange for shares of such portfolio. Once completed, Contract Owners with interests in the selling portfolio will have interests in the buying portfolio.

Q: Are my voting instructions important?

Absolutely! While the board of trustees (the “Board”) of each portfolio listed above has reviewed its proposed reorganization and recommends that you approve it, these proposals cannot go forward without the approval of Contract Owners of the Selling Portfolios (defined below).

Q: What are the proposals?

Contract Owners are being asked to provide voting instructions regarding the reorganization of one or more funds (each a “Selling Portfolio” and together, the “Selling Portfolios”) into other corresponding funds (each a “Buying Portfolio” and together, the “Buying Portfolios”), as noted in the table below (each a “Reorganziation” and together, the “Reorganizations”):

| | |

Selling Portfolio | | Buying Portfolio |

Schroders Global Multi-Asset Portfolio II | | Schroders Global Multi-Asset Portfolio |

Allianz Global Investors Dynamic Multi-Asset Plus Portfolio | | JPMorgan Global Active Allocation Portfolio |

MFS Value Portfolio II | | MFS Value Portfolio |

The Participating Insurance Company that issued your Contract is the legal owner of your Selling Portfolio’s shares and will vote those shares at a joint special meeting of shareholders of the Selling Portfolio. However, as a Contract Owner, you are entitled to instruct that Participating Insurance Company how to vote the shares attributable to your Contract.

If the Reorganization of your Selling Portfolio is approved by the Participating Insurance Companies and the other closing conditions are met, interests in your Selling Portfolio attributable to your Contract will, in effect, be converted into interests in the corresponding Buying Portfolio with the same aggregate net asset value as that of your Selling Portfolio interests at the time of the Reorganization. (The Selling Portfolios and the Buying Portfolios are referred to individually or collectively as a “Portfolio” or the “Portfolios,” respectively.) While the aggregate net asset value of shares attributable to your Contract will not change as a result of the Reorganization, the number of shares attributable to your Contract may differ based on each Portfolio’s net asset value.

We encourage you to read the full text of the enclosed combined proxy statement/prospectus to obtain a more detailed understanding of the matters relating to each proposed Reorganization.

Q: Why are the Reorganizations being proposed?

Brighthouse Investment Advisers, LLC (“BIA”), each Portfolio’s investment manager, proposed the Reorganizations to the Board in order to streamline the product offerings of the funds managed by BIA, so that management, distribution and other resources can be focused more effectively on a smaller group of funds. The Reorganization of each Selling Portfolio into the corresponding Buying Portfolio will enable shareholders of each Selling Portfolio to invest in a larger, potentially more efficient portfolio while continuing to pursue a similar or, in some cases, the same investment strategy. It is expected that following the proposed Reorganizations, the expenses borne by Selling Portfolio shareholders would be the same as or lower than the expenses they currently bear after giving effect to contractual management fee waivers.

Q: Are there costs or tax consequences of the Reorganizations?

The subadviser for each Buying Portfolio has agreed to bear the costs of its applicable Reorganization. Provided that the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), or annuity contracts under Section 72 of the Code, a Reorganization will not be a taxable event for Contract Owners regardless of the tax status of the Reorganization. See the section of the combined proxy statement/prospectus entitled “Tax Status of the Reorganizations” for more detail regarding the tax consequences of the Reorganizations.

Q: Will there be any changes to my fees and expenses as a result of the Reorganizations?

It is expected that, following the proposed Reorganizations, the expenses borne by Selling Portfolio shareholders would be the same as or lower than the expenses they currently bear after giving effect to contractual management fee waivers, as described in detail in the combined proxy statement/prospectus under “Reorganization Proposals – Summary – Fees and Expenses.”

Q: If approved, when will the Reorganizations happen?

The Reorganizations will take place following shareholder approval of each Reorganization, and are expected to close in the second quarter of 2018.

Q: How does the Board recommend that I instruct my Participating Insurance Company to vote?

After careful consideration, your Board recommends that you instruct your Participating Insurance Company to vote FOR the Reorganization of your Selling Portfolio.

Q: How can I provide voting instructions?

You can instruct your Participating Insurance Company how to vote the shares attributable to your Contract in one of three ways:

| | • | | By telephone (call the toll free number listed on your proxy card) |

| | • | | By internet (log on to the internet site listed on your proxy card) |

| | • | | By mail (using the enclosed postage prepaid envelope) |

We encourage you to vote as soon as possible. Please refer to the enclosed voting instruction card for information on voting by telephone, internet or mail.

Q: Whom should I call if I have questions?

If you have questions about any of the proposals described in the combined proxy statement/prospectus or about procedures for providing voting instructions, please call the Participating Insurance Company that issued your Contract. Computershare Fund Services (“Computershare”) has been engaged to provide mailing and tabulation services. It is not expected that the Selling Portfolios will require active solicitation services for any proposal or that Computershare will receive any amount for solicitation services.

NOTICE OF A JOINT SPECIAL MEETING OF SHAREHOLDERS

BRIGHTHOUSE FUNDS TRUST I

Schroders Global Multi-Asset Portfolio II

(formerly, Pyramis Managed Risk Portfolio)

Allianz Global Investors Dynamic Multi-Asset Plus Portfolio

BRIGHTHOUSE FUNDS TRUST II

MFS Value Portfolio II

(formerly, BlackRock Large Cap Value Portfolio)

To be held February 23, 2018

A Joint Special Meeting of Shareholders (the “Meeting”) of each of the portfolios listed above (each a “Selling Portfolio”) will be held at 10:00 a.m. ET on February 23, 2018, at One Financial Center, 21st Floor, Boston, Massachusetts, 02111. At the Meeting, shareholders will consider, with respect to their Selling Portfolio:

An Agreement and Plan of Reorganization (the “Agreement”) by and among Brighthouse Funds Trust I, on behalf of its Schroders Global Multi-Asset Portfolio II and Allianz Global Investors Dynamic Multi-Asset Plus Portfolio series, Brighthouse Funds Trust II, on behalf of its MFS Value Portfolio II series, and certain other registered investment companies, pursuant to which each Selling Portfolio, as indicated below (each a “Selling Portfolio”), will transfer that portion of its assets attributable to each class of its shares (in aggregate, all of its assets) to the corresponding Buying Portfolio, as indicated below (each a “Buying Portfolio”), each a series of Brighthouse Funds Trust I or Brighthouse Funds Trust II, in exchange for shares of a corresponding class of the Buying Portfolio and the assumption by the Buying Portfolio of all of the liabilities of the Selling Portfolio. Shares of each class of the Buying Portfolio will be distributed proportionately to shareholders of the relevant class of the Selling Portfolio.

Shareholders of each Selling Portfolio will vote separately on the proposals, as shown below.

| | | | | | |

Selling Portfolio | | Buying Portfolio | | Proposal # | |

Schroders Global Multi-Asset Portfolio II | | Schroders Global Multi-Asset Portfolio | | | 1 | |

Allianz Global Investors Dynamic Multi-Asset Plus Portfolio | | JPMorgan Global Active Allocation Portfolio | | | 2 | |

MFS Value Portfolio II | | MFS Value Portfolio | | | 3 | |

Please carefully read the enclosed combined proxy statement/prospectus, as it discusses these proposals in more detail. Shares of the Selling Portfolio are owned of record predominantly by sub-accounts of separate accounts of insurance companies (the “Participating Insurance Companies”) established to fund benefits under variable annuity contracts and/or variable life insurance policies (each a “Contract”) issued by the Participating Insurance Companies. If you held a Contract as of the close of business on November 30, 2017, you may instruct your Participating Insurance Company how to vote the shares attributable to your Contract at the Meeting or at any adjournment or postponement of the Meeting. You are welcome to attend the Meeting in person. If you cannot attend in person, please instruct your Participating Insurance Company how to vote by mail, telephone or internet. Just follow the instructions on the enclosed voting instruction card. If you have questions, please call the Participating Insurance Company that issued your Contract. It is important that you instruct your Participating Insurance Company how to vote the shares attributable to your Contract. The board of trustees of each Selling Portfolio recommends that you instruct your Participating Insurance Company to vote FOR the reorganization of your Selling Portfolio.

| | |

| | By order of the boards of trustees |

| |

| |  |

| | Michael P. Lawlor, Assistant Secretary |

| | [December 29], 2017 |

BRIGHTHOUSE FUNDS TRUST I

Schroders Global Multi-Asset Portfolio II

(formerly, Pyramis Managed Risk Portfolio)

Allianz Global Investors Dynamic Multi-Asset Plus Portfolio

BRIGHTHOUSE FUNDS TRUST II

MFS Value Portfolio II

(formerly, BlackRock Large Cap Value Portfolio)

COMBINED PROXY STATEMENT/PROSPECTUS

[December 29], 2017

This document is a proxy statement for each Selling Portfolio (as defined below) and a prospectus for each Buying Portfolio (as defined below). The address and telephone number of each Selling Portfolio and each Buying Portfolio are c/o Brighthouse Investment Advisers, LLC, One Financial Center, Boston, Massachusetts 02111, and 800-638-7732. This combined proxy statement/prospectus (“Combined Proxy Statement/Prospectus”) and the enclosed proxy card or voting instruction card were first mailed to shareholders of each Selling Portfolio beginning on or about [January [ ], 2018]. This Combined Proxy Statement/Prospectus contains information you should know before providing voting instructions on the following proposals with respect to your Selling Portfolio, as indicated below. You should retain this document for future reference.

| | | | |

Proposal | | To be voted on by

shareholders of: |

| 1. | | To approve an Agreement and Plan of Reorganization by and among Brighthouse Funds Trust I, on behalf of its Schroders Global Multi-Asset Portfolio II series (a “Selling Portfolio”), Brighthouse Funds Trust I, on behalf of its Schroders Global Multi-Asset Portfolio series (a “Buying Portfolio”), and certain other registered investment companies. Under the agreement, the Selling Portfolio will transfer all of its assets to the Buying Portfolio in exchange for shares of the Buying Portfolio (as indicated below) and the assumption by the Buying Portfolio of all of the liabilities of the Selling Portfolio. Shares of the Buying Portfolio will be distributed proportionately to shareholders of the Selling Portfolio. | | Schroders Global Multi-Asset Portfolio II |

| | | | | | |

Selling Portfolio Share Class | | | | | Buying Portfolio Share Class |

Class B | | g | | | | Class B |

| | | | |

Proposal | | To be voted on by

shareholders of: |

| 2. | | To approve an Agreement and Plan of Reorganization by and among Brighthouse Funds Trust I, on behalf of its Allianz Global Investors Dynamic Multi-Asset Plus Portfolio series (a “Selling Portfolio”), Brighthouse Funds Trust I, on behalf of its JPMorgan Global Active Allocation Portfolio series (a “Buying Portfolio”), and certain other registered investment companies. Under the agreement, the Selling Portfolio will transfer all of its assets to the Buying Portfolio in exchange for shares of the Buying Portfolio (as indicated below) and the assumption by the Buying Portfolio of all of the liabilities of the Selling Portfolio. Shares of the Buying Portfolio will be distributed proportionately to shareholders of the Selling Portfolio. | | Allianz Global

Investors Dynamic

Multi-Asset Plus

Portfolio |

| | | | | | |

Selling Portfolio Share Class | | | | | Buying Portfolio Share Class |

Class B | | g | | | | Class B |

| | | | |

Proposal | | To be voted on by

shareholders of: |

| 3. | | To approve an Agreement and Plan of Reorganization by and among Brighthouse Funds Trust II, on behalf of its MFS Value Portfolio II series (a “Selling Portfolio”), Brighthouse Funds Trust I, on behalf of its MFS Value Portfolio series (a “Buying Portfolio”), and certain other registered investment companies. Under the agreement, the Selling Portfolio will transfer that portion of its assets attributable to each class of its shares (in aggregate, all of its assets) to the Buying Portfolio in exchange for shares of the corresponding class of the Buying Portfolio (as indicated below) and the assumption by the Buying Portfolio of all of the liabilities of the Selling Portfolio. Shares of each class of the Buying Portfolio will be distributed proportionately to shareholders of the corresponding class of the Selling Portfolio. | | MFS Value

Portfolio II |

| | | | | | |

Selling Portfolio Share Class | | | | | Buying Portfolio Share Class |

Class A | | g | | | | Class A |

Class B | | g | | | | Class B |

Class E | | g | | | | Class E |

The proposals will be considered by shareholders who owned shares of the Selling Portfolios on November 30, 2017 at a joint special meeting of shareholders (the “Meeting”) that will be held at 10:00 a.m. ET on February 23, 2018, at One Financial Center, 21st Floor Boston, Massachusetts. Each of the Selling Portfolios and the Buying Portfolios (each a “Portfolio” and collectively, the “Portfolios”) is a registered open-end management investment company (or a series thereof).

Shares of the Selling Portfolios are owned of record by sub-accounts of insurance companies (the “Participating Insurance Companies”) established to fund benefits under variable annuity contracts and/or variable life insurance policies (each a “Contract”) issued by the Participating Insurance Companies. The Participating Insurance Company that issued your Contract is the legal owner of your Selling Portfolio’s shares and therefore holds all voting rights with respect to those shares. Persons holding Contracts are referred to herein as “Contract Owners.” References to “shareholder” refer to a separate account of a Participating Insurance Company.

The Participating Insurance Company that issued your Contract sponsors a separate account that funds your Contract. This separate account, along with any other separate accounts sponsored by a Participating Insurance Company, is the shareholder of your Selling Portfolio. The separate account is composed of sub-accounts. Because you allocated Contract values to a sub-account that invests in your Selling Portfolio, you are entitled to instruct the Participating Insurance Company how to vote the shares of your Selling Portfolio attributable to your Contract.

The board of trustees (the “Board”) of each Selling Portfolio recommends that shareholders approve the reorganization of each Selling Portfolio into the corresponding Buying Portfolio (each a “Reorganization”). The Reorganization of each Selling Portfolio is not conditioned upon the Reorganization of any other Selling Portfolio. Accordingly, if shareholders of one Selling Portfolio approve its Reorganization, but shareholders of a second Selling Portfolio do not approve the second Selling Portfolio’s Reorganization, it is expected that the Reorganization of the first Selling Portfolio will take place as described in this Combined Proxy Statement/Prospectus. If shareholders of any Selling Portfolio fail to approve its Reorganization, the Board of such Selling Portfolio will consider what other actions, if any, may be appropriate.

How Each Reorganization Will Work

| | • | | Each Selling Portfolio will transfer all of its assets to the corresponding Buying Portfolio in exchange for shares of such Buying Portfolio (“Reorganization Shares”) and the assumption by the corresponding Buying Portfolio of all of the Selling Portfolio’s liabilities. |

| | • | | Each Buying Portfolio will issue Reorganization Shares with an aggregate net asset value equal to the aggregate value of the assets that it receives from the corresponding Selling Portfolio, less the liabilities |

| | it assumes from the corresponding Selling Portfolio. Reorganization Shares of each class of each Buying Portfolio will be distributed to the shareholders of the corresponding class of the corresponding Selling Portfolio in proportion to their holdings of such class of the Selling Portfolio. For example, holders of Class B shares of a Selling Portfolio will receive Class B shares of the corresponding Buying Portfolio with the same aggregate net asset value as the aggregate net asset value of their Selling Portfolio Class B shares at the time of the Reorganization. |

| | • | | The costs of each Reorganization will be borne by the subadviser of the applicable Buying Portfolio. |

| | • | | Provided that the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the Code or annuity contracts under Section 72 of the Internal Revenue Code of 1986, as amended (the “Code”), a Reorganization will not be a taxable event for Contract Owners regardless of the tax status of the Reorganization. |

| | • | | After a Reorganization is completed, Selling Portfolio shareholders will be shareholders of the corresponding Buying Portfolio, and the Selling Portfolio will be dissolved. |

Where to Get More Information

The following documents have been filed with the Securities and Exchange Commission (the “SEC”) and are incorporated into this Combined Proxy Statement/Prospectus by reference:

| | • | | the Statement of Additional Information of the Buying Portfolios relating to the Reorganizations (the “Merger SAI”), dated [December 29, 2017]; |

Schroders Global Multi-Asset Portfolio II (SEC file nos. 811-10183 and 333-48456) (known as Pyramis Managed Risk Portfolio prior to [December 15], 2017)

| | • | | the prospectus of Schroders Global Multi-Asset Portfolio II , dated May 1, 2017, as supplemented to date; |

| | • | | the Statement of Additional Information relating to Schroders Global Multi-Asset Portfolio II, dated May 1, 2017, as amended June 9, 2017 and as supplemented to date; |

| | • | | the Report of the Independent Registered Public Accounting Firm and the audited financial statements included in the Annual Report to Shareholders of Schroders Global Multi-Asset Portfolio II for the year ended December 31, 2016 and the unaudited financial statements included in the Semiannual Report to Shareholders of Schroders Global Multi-Asset Portfolio II for the period ended June 30, 2017; |

Allianz Global Investors Dynamic Multi-Asset Plus Portfolio (SEC file nos. 811-10183 and 333-48456)

| | • | | the prospectus of Allianz Global Investors Dynamic Multi-Asset Plus Portfolio, dated May 1, 2017, as supplemented to date; |

| | • | | the Statement of Additional Information relating to Allianz Global Investors Dynamic Multi-Asset Plus Portfolio, dated May 1, 2017, as amended June 9, 2017; |

| | • | | the Report of the Independent Registered Public Accounting Firm and the audited financial statements included in the Annual Report to Shareholders of Allianz Global Investors Dynamic Multi-Asset Plus Portfolio for the year ended December 31, 2016 and the unaudited financial statements included in the Semiannual Report to Shareholders of Allianz Global Investors Dynamic Multi-Asset Plus Portfolio for the period ended June 30, 2017; and |

MFS Value Portfolio II (SEC file nos. 811-03618 and 002-80751) (known as BlackRock Large Cap Value Portfolio prior to September 1, 2017)

| | • | | the prospectus of MFS Value Portfolio II, dated May 1, 2017, as supplemented to date; |

| | • | | the Statement of Additional Information relating to MFS Value Portfolio II, dated May 1, 2017, as amended June 9, 2017 and as supplemented to date; |

| | • | | the Report of the Independent Registered Public Accounting Firm and the audited financial statements included in the Annual Report to Shareholders of MFS Value Portfolio II for the year ended December 31, 2016 and the unaudited financial statements included in the Semiannual Report to Shareholders of MFS Value Portfolio II for the period ended June 30, 2017. |

For a free copy of any of the documents listed above and/or to ask questions about this Combined Proxy Statement/Prospectus, please call the Participating Insurance Company that issued your Contract.

Each of the Portfolios is subject to the information requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and files reports, proxy materials and other information with the SEC. These reports, proxy materials and other information can be inspected and copied at the Public Reference Room maintained by the SEC. Copies may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov, or by writing to the Public Reference Branch of the SEC Office of Consumer Affairs and Information Services, 100 F Street, N.E., Washington, D.C. 20549-0102. In addition, copies of these documents may be viewed online or downloaded from the SEC’s website at www.sec.gov.

Please note that investments in the Portfolios are not bank deposits, are not federally insured, are not guaranteed by any bank or government agency and may lose value. There is no assurance that any Portfolio will achieve its investment objectives.

As with all mutual funds, the SEC has not approved or disapproved these securities or passed on the adequacy of this Combined Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

-i-

SECTION A — REORGANIZATION PROPOSALS

The following information describes each proposed Reorganization.

SUMMARY

This Combined Proxy Statement/Prospectus is being used by each Selling Portfolio to solicit proxies to vote at a joint special meeting of shareholders. Shareholders of each Selling Portfolio will consider a proposal to approve the Agreement and Plan of Reorganization (the “Agreement”) providing for the Reorganization of their Selling Portfolio into the corresponding Buying Portfolio.

The following is a summary. More complete information appears later in this Combined Proxy Statement/Prospectus. You should carefully read the entire Combined Proxy Statement/Prospectus and the exhibits because they contain details that are not included in this summary.

How Each Reorganization Will Work

| | • | | Each Selling Portfolio will transfer all of its assets to the corresponding Buying Portfolio in exchange for Reorganization Shares and the assumption by the corresponding Buying Portfolio of all of the Selling Portfolio’s liabilities. |

| | • | | Each Buying Portfolio will issue Reorganization Shares with an aggregate net asset value equal to the aggregate value of the assets that it receives from the corresponding Selling Portfolio, less the liabilities it assumes from the corresponding Selling Portfolio. Reorganization Shares of each class of each Buying Portfolio will be distributed to the shareholders of the corresponding class of the corresponding Selling Portfolio in proportion to their holdings of such class of the Selling Portfolio. For example, holders of Class B shares of a Selling Portfolio will receive Class B shares of the corresponding Buying Portfolio with the same aggregate net asset value as the aggregate net asset value of their Selling Portfolio Class B shares at the time of the Reorganization. |

| | • | | The costs of each Reorganization will be borne by the subadviser of the applicable Buying Portfolio. |

| | • | | Provided that the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the Code or annuity contracts under Section 72 of the Code, a Reorganization will not be a taxable event for Contract Owners regardless of the tax status of the Reorganization. |

| | • | | After a Reorganization is completed, Selling Portfolio shareholders will be shareholders of the corresponding Buying Portfolio, and the Selling Portfolio will be dissolved. |

Tax Consequences

For U.S. federal income tax purposes, although not free from doubt, it is expected that each Reorganization will be tax-free and accordingly that Selling Portfolio shareholders will not and the Selling Portfolio will not recognize gain or loss as a direct result of the Reorganization. Each Reorganization will not take place unless the Selling Portfolio and the corresponding Buying Portfolio receive a satisfactory opinion of tax counsel substantially to the effect that the Reorganization will be tax-free, as described in more detail in the section entitled “Tax Status of the Reorganizations.”

Each Selling Portfolio shareholder’s aggregate tax basis in the Reorganization Shares it receives is expected to carry over from the shareholder’s corresponding Selling Portfolio shares, and each Selling Portfolio shareholder’s holding period in the Reorganization Shares it receives is expected to include the shareholder’s holding period in the corresponding Selling Portfolio shares.

-1-

Provided that the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the Code, or annuity contracts under Section 72 of the Code, a Reorganization will not be a taxable event for Contract Owners regardless of the tax status of the Reorganization.

For more information about the U.S. federal income tax consequences of the Reorganizations, see the section entitled “Tax Status of the Reorganizations.”

Fees and Expenses of the Reorganizations

The following tables describe the fees and expenses that you may pay if you buy and hold shares of a Portfolio. The tables do not reflect fees or expenses imposed under your Contract, if any. The total fees and expenses you bear may therefore be higher than those shown in the tables.

Annual portfolio operating expense ratios are based on expenses incurred during each Portfolio’s most recently completed fiscal year, and are expressed as a percentage (expense ratio) of the Portfolio’s average net assets during the period. Pro forma expense ratios are based on the average net assets of each Buying Portfolio and the corresponding Selling Portfolio for the fiscal year ended December 31, 2016, adjusted to reflect current and expected fees and expense limitation arrangements. As of the date of this Combined Proxy Statement/Prospectus, each Portfolio’s net assets may be lower or higher than the Portfolio’s average net assets over such period. In general, a Portfolio’s annual operating expense ratios will increase as the Portfolio’s assets decrease and will decrease as the Portfolio’s assets increase. Accordingly, each Portfolio’s annual operating expense ratios, if adjusted based on net assets as of the date of this Combined Proxy Statement/Prospectus, could be higher or lower than those shown in the tables below. The commitment by Brighthouse Investment Advisers, LLC (“BIA”) to waive fees and/or to reimburse expenses for a Buying Portfolio, if applicable and as noted below, may limit the effect that any decrease in the Buying Portfolio’s net assets will have on its annual net operating expense ratios in the current fiscal year.

The Selling Portfolios have contractual fee waiver and/or expense reimbursement arrangements. For more information, see the Selling Portfolios’ prospectuses or semi-annual shareholder report.

Proposal 1. Fees and Expenses. Reorganization of Schroders Global Multi-Asset Portfolio II into Schroders Global Multi-Asset Portfolio

Current and Pro Forma Expenses

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| | | | |

| | | Class B | |

Schroders Global Multi-Asset Portfolio II (Current) (Selling Portfolio) | | | | |

Management Fees | | | 0.45 | % |

Distribution and/or Service (12b-1) Fees | | | 0.25 | % |

Other Expenses | | | 0.03 | % |

Acquired Fund Fees and Expenses (Underlying Portfolio Fees and Expenses) | | | 0.47 | % |

| | | | |

Total Annual Portfolio Operating Expenses | | | 1.20 | % |

Fee Waiver1 | | | (0.10 | %) |

| | | | |

Net Operating Expenses | | | 1.10 | % |

-2-

| | | | |

| | | Class B | |

Schroders Global Multi-Asset Portfolio (Current) (Buying Portfolio) | | | | |

Management fees | | | 0.64 | % |

Distribution and/or Service (12b-1) Fees | | | 0.25 | % |

Other Expenses | | | 0.07 | % |

Acquired Fund Fees and Expenses | | | 0.01 | % |

| | | | |

Total Annual Portfolio Operating Expenses | | | 0.97 | % |

| |

| | | Class B | |

Schroders Global Multi-Asset Portfolio (Pro Forma) (Buying Portfolio) | | | | |

Management fees | | | 0.63 | % |

Distribution and/or Service (12b-1) Fees | | | 0.25 | % |

Other Expenses | | | 0.05 | % |

Acquired Fund Fees and Expenses | | | 0.01 | % |

Total Annual Portfolio Operating Expenses | | | 0.94 | % |

| | | | |

Fee Waiver2 | | | (0.02 | %) |

Net Operating Expenses | | | 0.92 | % |

| 1 | BIA has contractually agreed to waive its management fee in the same amount as any fees Metropolitan Life Insurance Company or its affiliates receive from the Selling Portfolio’s prior subadviser and its affiliates for recordkeeping and other administrative services through at least the earlier of December 31, 2018 or termination of the subadvisory agreement with the prior subadviser. This arrangement may be earlier modified or discontinued only with the approval of the Board. |

| 2 | BIA has contractually agreed to waive a portion of its management fee through at least December 31, 2018 to reflect a portion of the savings from the difference between the subadvisory fee payable by BIA to Schroders Investment Management North America Inc. and the subadvisory fee previously payable by BIA to the Selling Portfolio’s prior subadviser. This arrangement may be earlier modified or discontinued only with the approval of the Board. |

Expense example: The example is intended to help you compare the cost of investing in each Portfolio with the cost of investing in other mutual funds. The example does not reflect fees and expenses imposed under your Contract, if any. If the example reflected those fees and expenses, the figures shown would be higher. The example assumes that you invest $10,000 in the applicable Portfolio for the time periods indicated and then redeem all of your shares at the end of those periods, both under the current arrangements and, for the Buying Portfolio, assuming completion of the proposed Reorganization. The example also assumes that your investment has a 5% return each year and that each Portfolio’s operating expenses remain the same as those shown in the Annual Portfolio Operating Expenses table above. The example includes any contractual fee waiver/expense reimbursement arrangement only for the period indicated in the Portfolio’s Annual Portfolio Operating Expenses table. Although your actual costs may be higher or lower, based on those assumptions, your costs would be:

| | | | | | | | | | | | | | | | |

| | | 1 year | | | 3 years | | | 5 years | | | 10 years | |

Schroders Global Multi-Asset Portfolio II (Current) (Selling Portfolio) | | | | | | | | | | | | | | | | |

Class B | | $ | 113 | | | $ | 373 | | | $ | 653 | | | $ | 1,452 | |

Schroders Global Multi-Asset Portfolio (Current) (Buying Portfolio) | | | | | | | | | | | | | | | | |

Class B | | $ | 99 | | | $ | 310 | | | $ | 539 | | | $ | 1,194 | |

Schroders Global Multi-Asset Portfolio (Pro Forma) (Buying Portfolio) | | | | | | | | | | | | | | | | |

Class B | | $ | 94 | | | $ | 299 | | | $ | 520 | | | $ | 1,157 | |

Because Class B shares do not have a deferred sales charge, you would pay the same costs shown in the table above if you did not redeem your shares at the end of the periods indicated.

-3-

Proposal 2. Fees and Expenses. Reorganization of Allianz Global Investors Dynamic Multi-Asset Plus Portfolio into JPMorgan Global Active Allocation Portfolio

Current and Pro Forma Expenses

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| | | | |

| | | Class B | |

Allianz Global Investors Dynamic Multi-Asset Plus Portfolio (Current) (Selling Portfolio) | | | | |

Management Fees | | | 0.68 | % |

Distribution and/or Service (12b-1) Fees | | | 0.25 | % |

Other Expenses | | | 0.27 | % |

Acquired Fund Fees and Expenses | | | 0.03 | % |

| | | | |

Total Annual Portfolio Operating Expenses | | | 1.23 | % |

| |

| | | Class B | |

JPMorgan Global Active Allocation Portfolio (Current) (Buying Portfolio) | | | | |

Management fees | | | 0.72 | % |

Distribution and/or Service (12b-1) Fees | | | 0.25 | % |

Other Expenses | | | 0.05 | % |

| | | | |

Total Annual Portfolio Operating Expenses | | | 1.02 | % |

Fee Waiver1 | | | (0.04 | %) |

| | | | |

Net Operating Expenses | | | 0.98 | % |

| |

| | | Class B | |

JPMorgan Global Active Allocation Portfolio (Pro Forma) (Buying Portfolio) | | | | |

Management fees | | | 0.72 | % |

Distribution and/or Service (12b-1) Fees | | | 0.25 | % |

Other Expenses | | | 0.05 | % |

| | | | |

Total Annual Portfolio Operating Expenses | | | 1.02 | % |

Fee Waiver2 | | | (0.06 | %) |

| | | | |

Net Operating Expenses | | | 0.96 | % |

| 1 | BIA has contractually agreed to waive its management fee through at least December 31, 2018 to the annual rate of 0.700% of the first $1 billion of the Portfolio’s average daily net assets, 0.650% of such assets over $1 billion up to $3 billion, 0.630% of such assets over $3 billion up to $5 billion, and 0.620% of such assets over $5 billion. This arrangement may be earlier modified or discontinued only with the approval of the Board. |

| 2 | BIA has contractually agreed to waive a portion of its management fee through at least December 31, 2018 to reflect a portion of the savings from the difference between the subadvisory fee payable by BIA to J.P. Morgan Investment Management, Inc. and the subadvisory fee payable by BIA to the Selling Portfolio’s subadviser. This arrangement may be earlier modified or discontinued only with the approval of the Board. |

Expense example: The example is intended to help you compare the cost of investing in each Portfolio with the cost of investing in other mutual funds. The example does not reflect fees and expenses imposed under your Contract, if any. If the example reflected those fees and expenses, the figures shown would be higher. The example assumes that you invest $10,000 in the applicable Portfolio for the time periods indicated and then redeem all of your shares at the end of those periods, both under the current arrangements and, for the Buying Portfolio, assuming completion of the proposed Reorganization. The example also assumes that your investment

-4-

has a 5% return each year and that each Portfolio’s operating expenses remain the same as those shown in the Annual Portfolio Operating Expenses table above. The example includes any contractual fee waiver/expense reimbursement arrangement only for the period indicated in the Portfolio’s Annual Portfolio Operating Expenses table. Although your actual costs may be higher or lower, based on those assumptions, your costs would be:

| | | | | | | | | | | | | | | | |

| | | 1 year | | | 3 years | | | 5 years | | | 10 years | |

Allianz Global Investors Dynamic Multi-Asset Plus Portfolio (Current) (Selling Portfolio) | | | | | | | | | | | | | | | | |

Class B | | $ | 126 | | | $ | 393 | | | $ | 679 | | | $ | 1,496 | |

JPMorgan Global Active Allocation Portfolio (Current) (Buying Portfolio) | | | | | | | | | | | | | | | | |

Class B | | $ | 100 | | | $ | 322 | | | $ | 562 | | | $ | 1,249 | |

JPMorgan Global Active Allocation Portfolio (Pro Forma) (Buying Portfolio) | | | | | | | | | | | | | | | | |

Class B | | $ | 98 | | | $ | 320 | | | $ | 560 | | | $ | 1,247 | |

Because Class B shares do not have a deferred sales charge, you would pay the same costs shown in the table above if you did not redeem your shares at the end of the periods indicated.

Proposal 3. Fees and Expenses. Reorganization of MFS Value Portfolio II into MFS Value Portfolio

Current and Pro Forma Expenses

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| | | | | | | | | | | | |

| | | Class A | | | Class B | | | Class E | |

MFS Value Portfolio II (Current) (Selling Portfolio) | | | | | | | | | | | | |

Management Fees | | | 0.63 | % | | | 0.63 | % | | | 0.63 | % |

Distribution and/or Service (12b-1) Fees | | | None | | | | 0.25 | % | | | 0.15 | % |

Other Expenses | | | 0.03 | % | | | 0.03 | % | | | 0.03 | % |

Total Annual Portfolio Operating Expenses | | | 0.66 | % | | | 0.91 | % | | | 0.81 | % |

Fee Waiver1 | | | (0.03 | %) | | | (0.03 | %) | | | (0.03 | %) |

| | | | | | | | | | | | |

Net Operating Expenses | | | 0.63 | % | | | 0.88 | % | | | 0.78 | % |

| | | |

| | | Class A | | | Class B | | | Class E | |

MFS Value Portfolio (Current) (Buying Portfolio) | | | | | | | | | | | | |

Management fees | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % |

Distribution and/or Service (12b-1) Fees | | | None | | | | 0.25 | % | | | 0.15 | % |

Other Expenses | | | 0.02 | % | | | 0.02 | % | | | 0.02 | % |

Total Annual Portfolio Operating Expenses | | | 0.72 | % | | | 0.97 | % | | | 0.87 | % |

Fee Waiver2 | | | (0.14 | %) | | | (0.14 | %) | | | (0.14 | %) |

| | | | | | | | | | | | |

Net Operating Expenses | | | 0.58 | % | | | 0.83 | % | | | 0.73 | % |

| | | |

| | | Class A | | | Class B | | | Class E | |

MFS Value Portfolio (Pro Forma) (Buying Portfolio) | | | | | | | | | | | | |

Management fees3 | | | 0.61 | % | | | 0.61 | % | | | 0.61 | % |

Distribution and/or Service (12b-1) Fees | | | None | | | | 0.25 | % | | | 0.15 | % |

Other Expenses | | | 0.02 | % | | | 0.02 | % | | | 0.02 | % |

| | | | | | | | | | | | |

Total Annual Portfolio Operating Expenses | | | 0.63 | % | | | 0.88 | % | | | 0.78 | % |

Fee Waiver4 | | | (0.08 | %) | | | (0.08 | %) | | | (0.08 | %) |

| | | | | | | | | | | | |

Net Operating Expenses | | | 0.55 | % | | | 0.80 | % | | | 0.70 | % |

-5-

| 1 | BIA has contractually agreed to waive its management fee through at least December 31, 2018 for each Class of the Selling Portfolio to the annual rate of 0.68% of the first $250 million of the Selling Portfolio’s average daily net assets, 0.625% of the next $500 million, 0.60% of the next $250 million and 0.55% of amounts over $1 billion. This arrangement may be earlier modified or discontinued only with the approval of the Board. |

| 2 | BIA has contractually agreed to waive its management fee through at least December 31, 2018 for each Class of the Buying Portfolio to 0.65% of the first $200 million of the Buying Portfolio’s average daily net assets, 0.625% of the next $1.3 billion and 0.50% of amounts over $1.5 billion. This arrangement may be earlier modified or discontinued only with the approval of the Board. |

| 3 | If the Reorganization is approved, BIA has agreed to receive reduced monthly compensation at an annual rate of a percentage of the Buying Portfolio’s average daily net assets as follows: 0.700% for the first $250 million of the Buying Portfolio’s average daily net assets, 0.650% for the next $500 million, and 0.600% for amounts over $750 million. |

| 4 | BIA has further contractually agreed to waive a portion of its management fee through at least December 31, 2018 to reflect a portion of the savings from the difference between the subadvisory fee payable by BIA to Massachusetts Financial Services Company and the subadvisory fee previously payable by BIA to the Selling Portfolio’s prior subadviser. This arrangement may be earlier modified or discontinued only with the approval of the Board. |

Expense example: The example is intended to help you compare the cost of investing in each Portfolio with the cost of investing in other mutual funds. The example does not reflect fees and expenses imposed under your Contract, if any. If the example reflected those fees and expenses, the figures shown would be higher. The example assumes that you invest $10,000 in the applicable Portfolio for the time periods indicated and then redeem all of your shares at the end of those periods, both under the current arrangements and, for the Buying Portfolio, assuming completion of the proposed Reorganization. The example also assumes that your investment has a 5% return each year and that each Portfolio’s operating expenses remain the same as those shown in the Annual Portfolio Operating Expenses table above. The example includes any contractual fee waiver/expense reimbursement arrangement only for the period indicated in the Portfolio’s Annual Portfolio Operating Expenses table. Although your actual costs may be higher or lower, based on those assumptions, your costs would be:

| | | | | | | | | | | | | | | | |

| | | 1 year | | | 3 years | | | 5 years | | | 10 years | |

MFS Value Portfolio II (Current) (Selling Portfolio) | | | | | | | | | | | | | | | | |

Class A | | $ | 65 | | | $ | 209 | | | $ | 366 | | | $ | 822 | |

Class B | | $ | 90 | | | $ | 288 | | | $ | 503 | | | $ | 1,121 | |

Class E | | $ | 80 | | | $ | 257 | | | $ | 448 | | | $ | 1,002 | |

MFS Value Portfolio (Current) (Buying Portfolio) | | | | | | | | | | | | | | | | |

Class A | | $ | 59 | | | $ | 217 | | | $ | 388 | | | $ | 884 | |

Class B | | $ | 85 | | | $ | 296 | | | $ | 525 | | | $ | 1,181 | |

Class E | | $ | 75 | | | $ | 265 | | | $ | 470 | | | $ | 1,063 | |

MFS Value Portfolio (Pro Forma) (Buying Portfolio) | | | | | | | | | | | | | | | | |

Class A | | $ | 56 | | | $ | 194 | | | $ | 344 | | | $ | 781 | |

Class B | | $ | 82 | | | $ | 274 | | | $ | 482 | | | $ | 1,080 | |

Class E | | $ | 72 | | | $ | 242 | | | $ | 427 | | | $ | 961 | |

Because none of the share classes has a deferred sales charge, you would pay the same costs shown in the table above if you did not redeem your shares at the end of the periods indicated.

-6-

Proposal 1. Comparison of Objectives, Strategies and Risks. Reorganization of Schroders Global Multi-Asset Portfolio II into Schroders Global Multi-Asset Portfolio

Comparison of Objectives, Strategies and Risks

The Selling Portfolio and the Buying Portfolio:

| | • | | Have BIA as investment manager. |

| | • | | Share the same subadviser, Schroders Investment Management North America Inc. (“Schroders”), and portfolio management team.1 |

| | • | | Have the same investment objectives and principal investment strategies. |

| | • | | Have the same policies for buying and selling shares and the same exchange rights. Please see Exhibit A for a description of these policies for the Buying Portfolio. |

| | • | | Are structured as series of Brighthouse Funds Trust I (a “Trust”). |

Unless otherwise noted, references to “the Portfolio” are intended to refer to each of the Buying Portfolio and the Selling Portfolio.

Comparison of Investment Objectives

The Portfolios seek the same investment objective: capital appreciation and current income.

Because any investment involves risk, there can be no assurance that a Portfolio’s investment objective will be achieved. The investment objective of each Portfolio may be changed without shareholder approval.

Comparison of Principal Investment Strategies

The Portfolios have the same investment strategies. Schroders allocates each Portfolio’s investments among asset classes in response to changing market, economic, and political factors and events that Schroders believes may affect the value of the Portfolio’s investments. Each Portfolio invests in globally diverse equity and fixed income securities and may invest in U.S., non-U.S. and emerging market issuers. Each Portfolio may also invest up to 10% of its total assets in any combination of the following alternative asset classes: emerging market equities, emerging market debt, high yield debt (commonly known as “junk bonds”), commodities, Treasury Inflation-Protected Securities (“TIPS”) and real estate securities.

Each Portfolio is expected, under normal circumstances, to have a strategic asset allocation to global equities in the range of 40%-70% (the “Equity Component”), fixed income securities in the range of 20%-50% (the “Fixed Income Component”), and alternative assets (as described above) to a maximum of 10% (the “Alternatives Component”) and cash and cash equivalents in the range of 0%-20%. The allocation will be dynamically adjusted within these ranges as market conditions change; however, the net equity or fixed income exposures could fall below their minimums when the volatility cap mechanism is triggered (as described below). Combined investments in the Equity Component and any emerging market equities in the Alternative Component are limited to 70% of the Portfolio’s assets at the time of investment.

Schroders reviews each asset class on an ongoing basis to determine whether it provides the opportunity to enhance performance or to reduce risk. Schroders makes use of fundamental macro research and proprietary asset allocation models to aid the asset allocation decision making process. When making these allocation decisions Schroders considers a common set of drivers (e.g. valuation, cyclical and sentiment) and a range of time horizons (e.g. shorter-term tactical, medium-term thematic and longer-term structural). By adjusting investment exposure

| 1 | Prior to [December 15], 2017, the Selling Portfolio was known as Pyramis Managed Risk Portfolio, and another subadviser provided day-to-day management of the Selling Portfolio’s investments pursuant to a different investment strategy. |

-7-

among the various asset classes in each Portfolio, Schroders seeks to reduce overall portfolio volatility and mitigate the effects of extreme market environments, while continuing to pursue the Portfolios’ investment objective.

Each Portfolio may invest in any type of equity or fixed income security, including common and preferred stocks, warrants and convertible securities, mortgage-backed securities, asset-backed securities and government and corporate bonds. Each Portfolio may invest in securities of companies across the capitalization spectrum, including smaller capitalization companies, and the Portfolio may also invest in exchange-traded funds (“ETFs”). Each Portfolio also may invest in commodities or investments intended to provide exposure to one or more commodities or securities indices, currencies, and real estate-related securities, either by investing directly in such instruments, or indirectly by investing in its wholly-owned subsidiary as discussed below. Each Portfolio is expected to be highly diversified across industries, sectors, and countries. Schroders may sell securities when it believes that they no longer offer attractive potential future returns compared to other investment opportunities or that they present undesirable risks, or to limit losses on securities that have declined in value.

In selecting securities for the Equity Component, Schroders analyzes company fundamentals of value, quality, growth stability and financial strength. This approach seeks to maximize each Portfolio’s exposure to stocks having a higher probability of good performance—and avoid or underweight stocks with a higher probability of poor performance.

The Fixed Income Component consists of investment grade fixed and floating rate securities. In selecting securities for the Fixed Income Component, Schroders exploits the asymmetric risks of the credit premium through downside risk management. Schroders accomplishes this through detailed credit analysis that uses the firm’s fundamental research to gain a full perspective of the issuer and its capital structure.

Schroders will seek to limit the annual total volatility of each Portfolio to 10% (excluding any contribution to volatility from exposure to Interest Rate Derivatives, defined below). Volatility is a statistical measurement of the magnitude of up and down fluctuations in the value of a financial instrument or index over time. High volatility may result from rapid and dramatic price swings. To the extent that adequate volatility management cannot be obtained through asset allocation, Schroders will systematically employ a volatility cap mechanism which seeks to limit the Portfolio’s volatility. In seeking to limit each Portfolio’s volatility, Schroders expects to use liquid equity and fixed income futures as the principal tools to reduce market exposure in each Portfolio. While Schroders attempts to manage each Portfolio’s volatility exposure to stabilize performance, there can be no assurance that the Portfolios will achieve the targeted volatility.

Each Portfolio may make substantial use of derivatives. Schroders may seek to obtain, or reduce, exposure to one or more asset classes through the use of exchange-traded or over-the-counter derivatives, such as futures contracts, interest rate swaps, total return swaps, credit default swaps, options (puts and calls) purchased or sold by each Portfolio, and structured notes. Each Portfolio may use derivatives for a variety of purposes, including: as a hedge against adverse changes in the market price of securities, interest rates, or currency exchange rates; as a substitute for purchasing or selling securities; to increase each Portfolio’s return as a non-hedging strategy that may be considered speculative; and to manage portfolio characteristics.

Each Portfolio will also make use of an interest rate overlay that: (1) will use a combination of interest rate swaps, interest rate futures and/or total return swaps (“Interest Rate Derivatives”) and (2) in combination, will have an effective notional value (meaning the fixed face value, rather than the market value, of these instruments) equal to approximately 30% of each Portfolio’s net assets under normal market conditions. The percentage of each Portfolio’s net assets represented by Interest Rate Derivatives within the interest rate overlay may change in different market environments, but is normally expected to stay within the range of approximately 25% to 35% of net assets. Schroders expects these instruments to provide additional diversification and balance the sources of risk in each Portfolio. Under certain market conditions, however, the investment performance of each Portfolio may be less favorable than it would be if the Portfolio did not make use of the interest rate overlay. Schroders anticipates that under normal market conditions the Interest Rate Derivatives within the interest rate overlay will have an effective maturity of approximately 10 years.

-8-

Each Portfolio may allocate up to 10% of its total assets to its wholly-owned and controlled subsidiary, organized under the laws of the Cayman Islands as an exempted company (a “Subsidiary”) in order to gain exposure to the commodities markets within the limitations of the federal tax laws, rules and regulations that apply to regulated investment companies. Schroders also manages the assets of each Subsidiary. Generally, each Subsidiary will invest primarily in commodity derivatives, exchange-traded notes and total return swaps. Unlike the Portfolios, each Subsidiary may invest without limitation in commodity-linked derivatives; however, the Subsidiaries will comply with the same Investment Company Act of 1940 (the “1940 Act”) asset coverage requirements with respect to its investments in commodity-linked derivatives that are applicable to the Portfolio’s transactions in derivatives. In addition, to the extent applicable to the investment activities of each Subsidiary, the Subsidiaries will be subject to the same fundamental investment restrictions and will follow the same compliance policies and procedures as the Portfolios. Each Portfolio is the sole shareholder of its respective Subsidiary and does not expect shares of the Subsidiary to be offered or sold to other investors.

Comparison of Fundamental and Non-Fundamental Investment Policies

The fundamental and non-fundamental investment policies of the Selling Portfolio and the Buying Portfolio are the same. A “fundamental” investment policy is one that may not be changed without a shareholder vote. A “non-fundamental” investment policy is one that may be changed for any Portfolio by the Trust’s Board of Trustees without a vote of that Portfolio’s shareholders.

Comparison of Principal Risks

The principal risks associated with investments in the Buying Portfolio and the Selling Portfolio are the same because the Portfolios have the same investment objectives, principal investment strategies, and investment policies. The actual risks of investing in each Portfolio depend on the securities held in each Portfolio’s portfolio and on market conditions, both of which change over time. The Buying Portfolio and the Selling Portfolio are subject to the principal risks described below.

Volatility Management Risk. Although the Portfolio’s Subadviser attempts to adjust the Portfolio’s overall exposure to volatility, there can be no guarantee that the Portfolio’s Subadviser will be successful in managing the Portfolio’s overall level of volatility. The Portfolio may not realize the anticipated benefits from its volatility management strategies or it may realize losses because of the investment techniques employed by the Subadviser to manage volatility, the implementation of those strategies by the Subadviser or the limitations of those strategies in times of extremely low volatility or extremely high volatility. Under certain market conditions, the use of volatility management strategies by the Subadviser may also result in less favorable performance than if such strategies had not been used. For example, if the Portfolio has reduced its overall exposure to equities to avoid losses in certain market environments, the Portfolio may forego some of the returns that can be associated with periods of rising equity values.

Model and Data Risk. When the quantitative models (“Models”) and information and data (“Data”) used in managing the Portfolio prove to be incorrect or incomplete, any investment decisions made in reliance on the Models and Data may not produce the desired results and the Portfolio may realize losses. In addition, any hedging based on faulty Models and Data may prove to be unsuccessful. Furthermore, the success of Models that are predictive in nature is dependent largely on the accuracy and reliability of the supplied historical data. All Models are susceptible to input errors which may cause the resulting information to be incorrect.

Asset Allocation Risk. The Portfolio’s ability to achieve its investment objective depends upon Schroders’ analysis of various factors and the mix of asset classes that results from such analysis, which may prove incorrect. The particular asset allocation selected for the Portfolio may not perform as well as other asset allocations that could have been selected for the Portfolio. The Portfolio may experience losses or poor relative performance if Schroders allocates a significant portion of the Portfolio’s assets to an asset class that does not perform relative to other asset classes or other subsets of asset classes. The Portfolio may underperform funds that allocate their assets differently than the Portfolio.

-9-

Derivatives Risk. The Portfolio may invest in derivatives to obtain investment exposure, enhance return or “hedge” or protect its assets from an unfavorable shift in the value or rate of a reference instrument. Derivatives can significantly increase the Portfolio’s exposure to market risk, credit and counterparty risk and other risks. Derivatives may be illiquid and difficult to value. Because of their complex nature, some derivatives may not perform as intended. As a result, the Portfolio may not realize the anticipated benefits from a derivative it holds or it may realize losses. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Derivative transactions may create investment leverage, which increases the Portfolio’s volatility and may require the Portfolio to liquidate portfolio securities when it may not be advantageous to do so. Government regulation of derivative instruments may limit or prevent the Portfolio from using such instruments as part of its investment strategies, which could adversely affect the Portfolio.

Market Risk. The Portfolio’s share price can fall because of, among other things, a decline in the market as a whole, deterioration in the prospects for a particular industry or company, or changes in general economic conditions, such as prevailing interest rates or investor sentiment. Significant disruptions to the financial markets could adversely affect the liquidity and volatility of securities held by the Portfolio.

Foreign Investment Risk. Investments in foreign securities, whether direct or indirect, tend to be more volatile and less liquid than investments in U.S. securities because, among other things, they involve risks relating to political, social and economic developments abroad, as well as risks resulting from differences between the regulations and reporting standards and practices to which U.S. and foreign issuers are subject. To the extent foreign securities are denominated in foreign currencies, their values may be adversely affected by changes in currency exchange rates. To the extent the Portfolio invests in foreign sovereign debt securities, it may be subject to additional risks.

Emerging Markets Risk. In addition to all of the risks of investing in foreign developed markets, emerging market securities involve risks attendant to less mature and stable governments and economies, lower trading volume, trading suspension, security price volatility, proceeds repatriation restrictions, withholding and other taxes, some of which may be confiscatory, inflation, deflation, currency devaluation and adverse government regulations of industries or markets. As a result of these risks, the prices of emerging market securities tend to be more volatile than the securities of issuers located in developed markets.

Interest Rate Risk. The value of the Portfolio’s investments in fixed income securities may decline when prevailing interest rates rise or increase when interest rates fall. The longer a security’s maturity or duration, the greater its value will change in response to changes in interest rates. The interest earned on the Portfolio’s investments in fixed income securities may decline when prevailing interest rates fall. Changes in prevailing interest rates, particularly sudden changes, may also increase the level of volatility in fixed income and other markets, increase redemptions in the Portfolio’s shares and reduce the liquidity of the Portfolio’s debt securities and other income-producing holdings. Changes in interest rate levels are caused by a variety of factors, such as central bank monetary policies, inflation rates, and general economic and market conditions.

Interest Rate Swap Risk. The risk of interest rate swaps includes changes in market conditions that may affect the value of the contract or the cash flows, and the possible inability of the counterparty to fulfill its obligations under the agreement. Certain interest rate swap arrangements also may involve the risk that they do not fully offset adverse changes in interest rates. Interest rate swaps may in some cases be illiquid and may be difficult to trade or value, especially in the event of market disruptions. Under certain market conditions, the use of interest rate swaps may result in less favorable performance than if such swap arrangements had not been used.

Credit and Counterparty Risk. The value of the Portfolio’s investments may be adversely affected if a security’s credit rating is downgraded or an issuer of an investment held by the Portfolio fails to pay an obligation on a timely basis, otherwise defaults or is perceived by other investors to be less creditworthy. If a counterparty to a derivatives or other transaction with the Portfolio files for bankruptcy, becomes insolvent, or

-10-

otherwise becomes unable or unwilling to honor its obligation to the Portfolio, the Portfolio may experience significant losses or delays in realizing income on or recovering collateral and may lose all or a part of the income from the transaction.

Commodities Risk. Exposure to the commodities markets may subject the Portfolio to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity. The Portfolio’s ability to invest in commodity-linked derivative instruments may be limited by the Portfolio’s intention to qualify as a regulated investment company, and could adversely affect the Portfolio’s ability to so qualify.

Investment Company and Exchange-Traded Fund Risk. An investment in an investment company or ETF involves substantially the same risks as investing directly in the underlying securities. An investment company or ETF may not achieve its investment objective or execute its investment strategy effectively, which may adversely affect the Portfolio’s performance. The Portfolio must pay its pro rata portion of an investment company’s or ETF’s fees and expenses. Shares of a closed-end investment company or ETF may trade at a premium or discount to the net asset value of its portfolio securities.

Real Estate Investment Risk. Investments in real estate investment trusts and other real estate related securities may be adversely impacted by the performance of the real estate market generally or that of a particular sub-sector or geographic region.

Mortgage-Backed and Asset-Backed Securities Risk. The value of investments in mortgage-backed and asset-backed securities is subject to interest rate risk and credit and counterparty risk. These securities are also subject to the risk that issuers will prepay the principal more quickly or more slowly than expected, which could cause the Portfolio to invest the proceeds in less attractive investments or increase the volatility of their prices. To the extent mortgage-backed and asset-backed securities held by the Portfolio are backed by lower rated securities, such as sub-prime obligations, or are subordinated to other interests in the same mortgage or asset pool, the likelihood of the Portfolio receiving payments of principal or interest may be substantially limited.

TIPS and Inflation-Linked Bonds Risk. The value of inflation-protected securities generally fluctuates in response to changes in real interest rates, which are in turn tied to the relationship between nominal interest rates and the rate of inflation. Therefore, if inflation were to rise at a faster rate than nominal interest rates, real interest rates might decline, leading to an increase in the value of inflation-protected securities. In contrast, if nominal interest rates increased at a faster rate than inflation, real interest rates might rise, leading to a decrease in the value of inflation-protected securities. When real interest rates are rising faster than nominal interest rates, inflation-indexed bonds, including TIPS, may experience greater losses than other fixed income securities with similar durations. The inflation-protected securities markets are generally much smaller and less liquid than the markets for nominal bonds from the same issuers and as such can suffer losses during times of economic stress or illiquidity.

High Yield Debt Security Risk. High yield debt securities, or “junk” bonds, may be more susceptible to market risk and credit and counterparty risk than investment grade debt securities because issuers of high yield debt securities are less secure financially and their securities are more sensitive to downturns in the economy. In addition, the secondary market for high yield debt securities may not be as liquid as that for higher rated debt securities. High-yield debt securities range from those for which the prospect for repayment of principal and interest is predominantly speculative to those which are currently in default on principal or interest payments or whose issuers are in bankruptcy.

Subsidiary Risk. By investing in the Subsidiary, the Portfolio is indirectly exposed to the commodities risks associated with the Subsidiary’s investments in commodity-related instruments. There can be no assurance that the Subsidiary’s investments will contribute to the Portfolio’s returns. The Subsidiary is not registered under the

-11-

1940 Act and is not subject to all the investor protections of the 1940 Act. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the Portfolio and/or the Subsidiary to operate as described in this Prospectus and could adversely affect the Portfolio, such as by reducing the Portfolio’s investment returns. The Portfolio’s ability to invest in the Subsidiary will potentially be limited by the Portfolio’s intention to qualify as a regulated investment company, and might adversely affect the Portfolio’s ability to so qualify.

Tax Risk. In order to qualify for the special tax treatment accorded a regulated investment company (“RIC”) and its shareholders, the Portfolio must derive at least 90% of its gross income for each taxable year from “qualifying income,” meet certain asset diversification tests at the end of each taxable quarter, and meet annual distribution requirements. The Portfolio’s pursuit of its investment strategies will potentially be limited by the Portfolio’s intention to qualify for such treatment and could adversely affect the Portfolio’s ability to so qualify. The Portfolio can make certain investments, the treatment of which for these purposes is unclear. If, in any year, the Portfolio were to fail to qualify for the special tax treatment accorded a RIC and its shareholders, and were ineligible to or were not to cure such failure, the Portfolio would be taxed in the same manner as an ordinary corporation subject to U.S. federal income tax on all its income at the fund level. The resulting taxes could substantially reduce the Portfolio’s net assets and the amount of income available for distribution. In addition, in order to requalify for taxation as a RIC, the Portfolio could be required to recognize unrealized gains, pay substantial taxes and interest, and make certain distributions. Please see the Statement of Additional Information for more information.

Convertible Securities Risk. Investments in convertible securities may be subject to market risk, credit and counterparty risk, interest rate risk and other risks associated with investments in equity and fixed income securities, depending on the price of the underlying security and the conversion price. In addition, a convertible security may be bought back by the issuer, or the Portfolio may be forced to convert a convertible security, at a time and a price that is disadvantageous to the Portfolio.

Portfolio Turnover Risk. The investment techniques and strategies utilized by the Portfolio might result in a high degree of portfolio turnover. High portfolio turnover rates will increase the Portfolio’s transaction costs, which can adversely affect the Portfolio’s performance.

Forward and Futures Contract Risk. The successful use of forward and futures contracts will depend upon the Subadviser’s skill and experience with respect to such instruments and are subject to special risk considerations. The primary risks associated with the use of forward and futures contracts include (i) the imperfect correlation between the change in market value of the instruments held by the Portfolio and the price of the forward or futures contract; (ii) possible lack of a liquid secondary market for a forward or futures contract and the resulting inability to close a forward or futures contract when desired; (iii) losses caused by unanticipated market movements, which are potentially unlimited; (iv) the Subadviser’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (v) the possibility that the counterparty will default in the performance of its obligations; (vi) if the Portfolio has insufficient cash, it may have to sell securities to meet daily variation margin requirements, and the Portfolio may have to sell securities at a time when it may be disadvantageous to do so; (vii) the possibility that the Portfolio may be delayed or prevented from recovering margin or other amounts deposited with a futures commission merchant or futures clearinghouse; (viii) the possibility that position or trading limits will preclude the Subadviser from taking positions in certain futures contracts on behalf of the Portfolio; and (ix) the risks typically associated with foreign investments to the extent the Portfolio invests in futures contracts traded on markets outside the United States.

Credit Default Swap Risk. Credit default swaps may increase credit and counterparty risk (depending on whether the Portfolio is the buyer or seller of the swaps), and they may in some cases be illiquid. Credit default swaps also may be difficult to value, especially in the event of market disruptions. Credit default swap transactions in which the Portfolio is the seller may require that the Portfolio sell portfolio securities when it may not be advantageous to do so in order to satisfy its obligations or to meet segregation requirements.

-12-

Short Position Risk. The Portfolio will incur a loss from a short position if the value of the reference instrument increases after the time the Portfolio entered into the short position. Short positions generally involve a form of leverage, which can exaggerate the Portfolio’s losses, and also may involve credit and counterparty risk. A portfolio that enters into a short position may lose more money than the actual cost of the short position and its potential losses may be unlimited if the portfolio does not own the reference instrument and it is unable to close out of the short position. Any gain from a short position will be offset in whole or in part by the transaction costs associated with the short position.

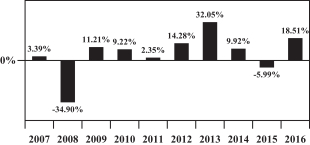

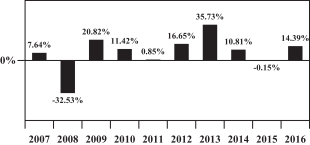

Comparison of Performance

The information below provides some indication of the risks of investing in each Portfolio by showing changes in the Portfolio’s performance from year to year and how the Portfolio’s average annual returns over time compare with those of a broad-based securities market index. Note that the results in the bar chart and table do not include the effect of Contract charges. If these Contract charges had been included, performance would have been lower. As with all mutual funds, past returns are not a prediction of future returns.

Performance results may include the effects of previous expense reduction arrangements or fee waivers in effect during previous periods. The performance results shown would have been lower absent the effect of the expense reduction arrangements and fee waivers.

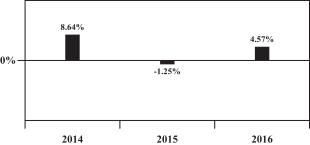

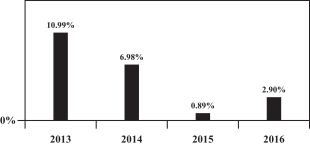

Bar Charts. Class B share information for each Portfolio is shown in the bar charts.

Tables. The tables below show total returns from investments in Class B shares of each Portfolio. The returns shown are compared to broad measures of market performance shown for the same periods.

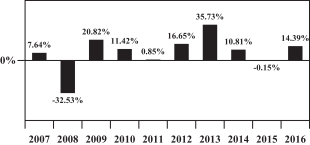

Schroders Global Multi-Asset Portfolio II (Selling Portfolio)

Effective [December 15], 2017, Schroders became the subadviser to the Selling Portfolio. Investment performance prior to that date is attributable to the former investment subadviser to the Portfolio, using principal investment strategies that differ from those described above.

Year-by-Year Total Return for Class B Shares as of December 31 of Each Year

During the periods shown in the bar chart, the highest return for a calendar quarter was +4.01% (quarter-ended June 30, 2014) and the lowest return for a calendar quarter was -5.00% (quarter-ended September 30, 2015).

-13-

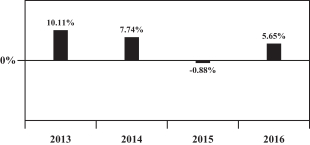

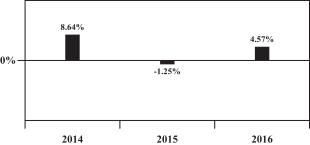

Schroders Global Multi-Asset Portfolio (Buying Portfolio)

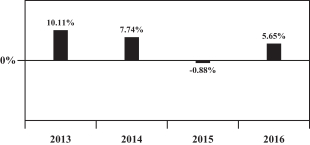

Year-by-Year Total Return for Class B Shares as of December 31 of Each Year

During the periods shown in the bar chart, the highest return for a calendar quarter was +4.80% (quarter-ended December 31, 2013) and the lowest return for a calendar quarter was -3.22% (quarter-ended September 30, 2015).

Schroders Global Multi-Asset Portfolio II (Selling Portfolio)

Average Annual Total Returns as of December 31, 2016

| | | | | | | | | | | | |

| | | 1 year | | | Since

Inception | | | Inception

Date | |

Class B | | | 4.57 | % | | | 5.47 | % | | | 4-19-13 | |

Dow Jones Moderate Index (reflects no deduction for mutual fund fees or expenses) | | | 7.67 | % | | | 5.92 | % | | | — | |

Schroders Global Multi-Asset Portfolio (Buying Portfolio)

Average Annual Total Returns as of December 31, 2016

| | | | | | | | | | | | |

| | | 1 year | | | Since

Inception | | | Inception

Date | |

Class B | | | 5.65 | % | | | 6.48 | % | | | 4-23-12 | |