ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those financial statements appearing elsewhere in this Form 10-K. This discussion contains forward-looking statements that involve significant risks and uncertainties. As a result of many factors, such as those set forth under “Forward Looking Statements” and “Item 1A. Risk Factors” and elsewhere in this Form 10-K, our actual results may differ materially from those anticipated in these forward-looking statements.

Overview

We believe we are one of the world’s largest producer, based on manufacturing capacity, and a leading innovator of bimetallic wire products, principally copper-clad aluminum (CCA) and copper-clad steel (CCS) products. Our products are primarily used within the telecommunications, electrical utility, and transportation industries, and are sold as conductor components within the broadband wire and cable market, and finished products in the electrical utility and transportation markets. Our products significantly reduce the amount of copper required to manufacture a conductor, and since copper is expensive; we significantly reduce conductor cost through the addition of an aluminum or steel core. CCA and CCS conductors are generally used in substitution of solid copper conductors where either cost savings or specific electrical and/or physical attributes are either required or desired. In the fiscal year of 2008, our products were sold to over 300 customers in 38 countries. We market our products under the trademarked names of “Copperweld®” and “Fushi™,” and sell either directly to cable manufacturers or through distributors or sales agents to end-users.

Although we are engaged in one line of business, as a result of the differing markets primarily served by each of our manufacturing facilities and significant differences in the operating results among each of our facilities as a result of the acquisition of Copperweld we now analyze our worldwide operations based on two geographic reportable segments: 1) “PRC” which consists of our facility located in Dalian, Liaoning, the People’s Republic of China (PRC) and 2) “US” which consists of our Fayetteville, Tennessee, (USA), and Telford, England, (UK) facilities. We have combined our U.S. and U.K. operations as one segment since the UK is a subsidiary of the US operating company and is under the direction of our U.S. segment manager. Further, the nature of our products, services and production processes at our U.S. and U.K. facilities, along with the customer base, methods to distribute products and services are nearly identical.

We believe we have a strong market position in all markets in which we compete due to product, geographic, customer diversity and our ability to deliver superior products while operating as a low cost provider. As a result, we are now the leading producer of bimetallic wire products in the world and are the market leaders in North America, Europe, North Africa the Middle East, and the People’s Republic of China. We strive to continue expansion within current and evolving markets, and to create shareholder value by:

| | · | Investing in organic and inorganic growth in both infrastructure-based and fast-growing markets; |

| | · | Focusing on expansion within and into new, higher-margin products, applications and markets through investment into new machinery and research and development; |

| | · | Continuously improving business processes throughout the Company by focusing on key performance indicators and operational excellence; |

| | · | Hiring and developing strategic talent thus improving the effectiveness of our performance management processes; and |

| | · | Protecting and enhancing shareholder value of the Fushi Copperweld brand. |

To accomplish these goals, we are focused on continuously improving operational efficiency in areas we view to be vital: quality, delivery, cost, and innovation. We also take an opportunistic approach to achieving our goals, and thus, we seek acquisitions of businesses which facilitate overall growth and cash flows of the Company.

Typically using 70% less copper than conventional copper wire, but offering materially the same utility and functionality, our bimetallic wire is used in applications such as distribution products for telecommunication networks, cables for the wireless industry, automotive and consumer products, video and data applications, electrical power cables, wire components for electronic devices, as well as other industrial conductors. In many applications, the value of bimetallic wire is based on advantages other than the economies of bimetallic versus solid copper. Weight considerations strongly favor CCA because the end user can expect approximately 2.6 times the length with the same weight as solid copper. Wire is sold by weight but used by length. The additional length increases the value of CCA. Weight is a major concern in some applications where the end product is portable, such as cell phones, music players, etc. and in automotive applications. We believe that the use of much lighter bimetallic products will continue to offer opportunities for these applications. Other advantages include RF resistance factor. RF signals travel over the surface of the wire. With bimetallic wire, the RF resistance characteristics of the copper cladding offers identical high frequency characteristics as solid copper, but with much less weight and lower end-product stiffness.

CCS combines the functionality of copper with the strength of steel to provide a higher value, stronger alternative to solid copper for use in coaxial drop cables for cable television, electrical utility applications including ground cables and tracer wire, automotive wiring harnesses, catenary cable for electrified railroads and other applications requiring specific levels of conductivity and higher levels of tensile strength. Copperweld CCS is synonymous with copper-clad steel and is registered as Copperweld®.

Our products are effectively “engineered composite conductors”. We do not produce commodity products and are not subject to the same pricing effects of pure commodity metals. Our customers purchase and use our products for their physical and/or conductive qualities, which have their respective application advantages, with cost savings being an added incentive. While the pricing volatility of our raw materials, especially copper, is a primary cause of cost variations in our products, changes in raw material costs do not materially affect our earnings per share. Although an increase in the price of raw materials may serve to reduce our gross margins as a percentage of net sales, likewise, a decline in raw material prices will increase our gross margin as a percentage of net sales. We generally pass the cost of price changes in our raw materials to our customers rather than the percentage changes. We establish prices for our products based on market factors and our cost to produce our products. Typically, we set a base price for our products for our customers with an understanding that as prices of raw materials change, primarily for copper but also for aluminum and steel, we will pass the change through to our customers. Therefore, when prices of raw material increase, our prices to our customers increase and the amount of our total net sales increases while the dollar amount of our gross margin remains relatively stable. As a result, the impact on earnings per share from volatile raw material prices is minimal, although there are timing delays of varying lengths depending upon volatility of metals prices, the type of product, competitive conditions and particular customer arrangements.

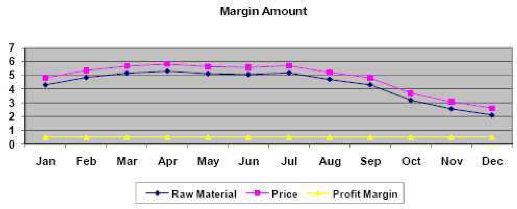

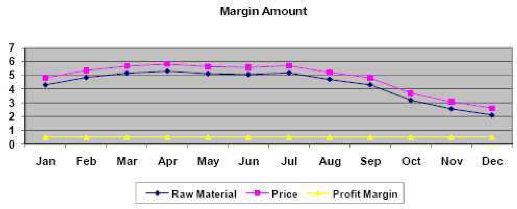

The above chart demonstrates how changes in the 2008 Comex monthly average copper and aluminum prices can hypothetically affect our margins. The combined cost of copper and aluminum changed from approximately $4.25 at month one to a high of $5.33 in month four and then trended generally down during the remainder of the year to a low of $2.11 in month twelve. In this example, we have a gross margin per pound of $0.50 for illustrative purposes. Passing the changing costs through to our customers’ prices allows us to maintain a level amount of dollar gross margin. Considering gross margin as a percentage of net sales can be misleading when raw materials costs are increasing even though the dollar amount of gross margin remains the same. Although the gross margin would have fluctuated between from 8.6% and 19.2% in our example, the dollar amount of gross margin and resulting net income flowing to earnings per share remained the same.

Factors driving and affecting operations results include raw material prices, product and price competition, economic conditions in various geographic regions, foreign currency exchange rates, interest rates, changes in technology, fluctuations in customer demand, variations in the mix of products, production capacity and utilization, working capital sufficiency, availability of credit and general market liquidity, patent and intellectual property issues, litigation results and legal and regulatory developments, and our ability to accurately forecast sales demand and calibrate manufacturing to such demand, manage volatile raw material costs, develop, manufacture and successfully market new and enhanced products and product lines, control operating costs, and attract, motivate and retain key personnel to manage our operational, financial and management information systems.

Current Business Environment and 2009 Outlook

With respect to the overall business trends in 2009 and forward, management recognizes that the current condition of the global economy may present us with significant challenges to our financial condition and results of operations. Statistics showed that the global economy decelerated quickly and severely in the second half of 2008. China, a market that has generated most of our revenue and growth, saw its GDP growth in the fourth quarter of 2008 drop to 6.8%, the slowest the country has experienced in seven years. The figure was more than 10% in the first half of 2008, and 13% rate for 2007. Global economic turmoil, uncertainties in capital markets, currency fluctuations and commodity cost volatility have substantially reduced the visibility for our industry and our business.

However, we think the following macro-level trends will positively impact our business and offer us opportunity to capture new business despite global economic conditions and preserve profitability:

| | · | Continued growth in demand for CCA-based telecommunication products; |

| | · | Government stimulus packages focused on infrastructure: high-speed railways, T&D and power grid build out; |

| | · | Continued strength of grounding wire market; |

| | · | Worldwide underlying long-term growth trends in electric utility and infrastructure markets; |

| | · | Continuing demand for cost effective, energy saving alternatives. |

In addition to these macro-level trends, the Company is presented with tremendous opportunities brought by the increasing capital expenditures of major telecommunications operators in China subsequent to the restructuring and the recent issuance of 3G licenses. In order to capture the growth opportunities, we will focus on driving profitability by streamlining our organizational structure and business procedures, increasing operational efficiency and optimizing operating processes, while managing production costs and operating expenses.

In addition, we are seeking to continue to develop the high potential utility and electrical appliance markets, to enhance productivity and to expand our sales of higher margin products. Meanwhile, we are also working to strengthen sales management and customer relations. We will seek to consolidate our relationships with our best customers, stop or suspend selling to customers that pose significant credit risk, and develop new customers cautiously. In addition, as part of our ongoing efforts to reduce total operating costs, we continuously improve our ability to efficiently utilize existing and new manufacturing capacity to manage expansion and growth. Investment in new capacity will pay dividends. Effectively utilized manufacturing assets, economy of scale generated, will help offset high raw material prices and dilute overhead over time. Despite worsening economic conditions, we expect to operate our facilities at relatively high combined utilization rates.

We actively seek to identify and promptly respond to key economic and industry trends in order to capitalize on expanding niche markets for our products, and possibly entering into new markets both down and up stream, in order to achieve better returns. We have the resources, technology, working capital and capacity to meet growing market demands. Over the long-term, we believe that we are well positioned to benefit from the growth opportunities in China and throughout the world.

Financial Performance Highlights:

Results of Operations

The following table shows, for the periods indicated, information derived from our consolidated statements of income in thousands of dollars and as a percentage of net sales (net sales and expenses for the Fayetteville and Telford (Copperweld) are included for the 2007 fiscal year beginning October 29, 2007 through December 31, 2007). Percentages may not add due to rounding.

| | | Year Ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | |

| | | Amount | | | % | | | Amount | | | % | | | Amount | | | % | |

| Net Sales | | $ | 221,435 | | | | 100 | % | | $ | 128,222 | | | | 100 | % | | $ | 67,596 | | | | 100 | % |

| Cost of Sales | | | 164,182 | | | | 74 | % | | | 85,774 | | | | 67 | % | | | 42,782 | | | | 63 | % |

| Gross Profit | | | 57,253 | | | | 26 | % | | | 42,448 | | | | 33 | % | | | 24,814 | | | | 37 | % |

| Selling, general and administrative expenses | | | 20,163 | | | | 9 | % | | | 11,803 | | | | 9 | % | | | 4,428 | | | | 7 | % |

| Operating income | | | 37,090 | | | | 17 | % | | | 30,645 | | | | 24 | % | | | 20,386 | | | | 30 | % |

| Income before taxes | | | 28,970 | | | | 13 | % | | | 26,654 | | | | 21 | % | | | 18,208 | | | | 27 | % |

| Net income | | $ | 28,475 | | | | 13 | % | | $ | 29,506 | | | | 23 | % | | $ | 17,810 | | | | 26 | % |

Year ended December 31, 2008 compared to year ended December 31, 2007

Net Sales

The following tables set forth net sales in millions by each of our reporting segments and metric tons (MT) sold on a combined basis:

| | | Net Sales | | | | | | | |

| | | Year ended December 31 | | | | | | | |

| | | 2008 | | | 2007 | | | | | | | |

| | | | | | % of Net | | | | | | % of Net | | | Dollar | | | | |

| | | Amount | | | Sales | | | Amount | | | Sales | | | Change | | | % Change | |

| PRC | | $ | 159.5 | | | | 72.0 | % | | $ | 118.1 | | | | 92.1 | % | | $ | 41.4 | | | | 35.1 | % |

| US | | $ | 62.0 | | | | 28.0 | % | | $ | 10.1 | | | | 7.9 | % | | $ | 51.9 | | | | 513.9 | % |

| Total Net sales | | $ | 221.5 | | | | 100.0 | % | | $ | 128.2 | | | | 100.0 | % | | $ | 93.3 | | | | 72.8 | % |

| | | Metric Tons Sold | | | | | | | |

| | | Year ended December 31 | | | | | | | |

| | | 2008 | | | 2007 | | | | | | | |

| | | | | | % of MT | | | | | | % of MT | | | Tonnage | | | | |

| | | MT | | | Sold | | | MT | | | Sold | | | Change | | | % Change | |

| PRC | | | 26,261 | | | | 70.4 | % | | | 19,416 | | | | 91.1 | % | | | 6,845 | | | | 35.3 | % |

| US | | | 11,030 | | | | 29.6 | % | | | 1,906 | | | | 8.9 | % | | | 9,124 | | | | 478.7 | % |

| Total MT sold | | | 37,291 | | | | 100.0 | % | | | 21,322 | | | | 100.0 | % | | | 15,969 | | | | 74.9 | % |

Net sales were $221.4 million in 2008, compared to $128.2 million in 2007. The 73% increase in sales in the fiscal year ended December, 2008 was primarily attributable to the full year inclusion of the Copperweld acquisition and an increase in sales from our Dalian facility. Substantially all organic growth was due to increases in sales volumes.

The PRC segment experienced an increase of 35.1% in net sales for the fiscal year ended December 31, 2008 relative to the comparable 2007 period. The majority of the increase in PRC net sales is primarily due to a 35.3% increase in metric tons sold.

Prior to the acquisition of Copperweld in October of 2007 we did not engage in operations within our US segment. We began to realize contributions from our operations within the US segment beginning October 29, 2007. As a result, our US segment experienced a significant increase in net sales of 513.9% for the fiscal year ended December 31, 2008. This was primarily due to the full-year inclusion of Copperweld into our operations

Net Sales by Industry

The following table breaks down sales by categories for both Dalian and Fayetteville for the year ended December 31, 2008 and 2007. Telford’s production is reflected in Fayetteville’s production.

| | | FY2008 | | | FY 2007* | |

| | | Dalian | | | Fayetteville | | | Dalian | | | Fayetteville | |

| | | sales (tons) | | | % of total sales | | | sales (tons) | | | % of total sales | | | sales (tons) | | | % of total sales | | | sales (tons) | | | % of total sales | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Telecom | | | 13,918 | | | | 53 | % | | | 4,631 | | | | 42.0 | % | | | 12,928 | | | | 66.6 | % | | | 7,564 | | | | 56.9 | % |

| Utility | | | 11,674 | | | | 44 | % | | | 4,304 | | | | 39 | % | | | 6,139 | | | | 31.6 | % | | | 2,560 | | | | 19.3 | % |

| Automotive | | | - | | | | - | | | | 532 | | | | 4.8 | % | | | - | | | | - | | | | 2,593 | | | | 19.5 | % |

| Other | | | 669 | | | | 3 | % | | | 1,563 | | | | 14.2 | % | | | 349 | | | | 1.8 | % | | | 579 | | | | 4.4 | % |

| Total | | | 26,261 | | | | 100.0 | % | | | 11,030 | | | | 100.0 | % | | | 19,416 | | | | 100.0 | % | | | 13,296 | | | | 100.0 | % |

*Fiscal year 2007 volumes are shown on a pro forma basis assuming that sales from Fayetteville and Telford were included for the full fiscal year for illustrative purposes.

The following table summarizes installed capacities and outputs by product type for both Dalian and Fayetteville for the year ended December 31, 2008. Telford’s production is reflected in Fayetteville’s numbers.

| | | Dalian | | | Fayetteville | |

| | | Installed Capacity | | | Output | | | Installed Capacity | | | Output | |

| Product line | | (Metric Tons) | | | (Metric Tons) | | | (Metric Tons) | | | (Metric Tons) | |

| CCA | | | 34,000 | | | | 25,358 | | | | 12,400 | | | | 2,771 | |

| CCS | | | 800 | | | | 25 | | | | 16,300 | | | | 7,896 | |

Capacity in Transit: CCA 6,000 M Tons and CCS 8,200 M Tons

At December 31, 2008, we had combined production capacity for CCA of 46,400 metric tons and CCS capacity of 17,100 metric tons. We had an additional 6,000 metric tons of CCA capacity and 4,100 metric tons of CCS capacity in transit to Dalian. We expect to have the additional CCA capacity installed in Dalian by the end of second quarter 2009 and the CCS capacity installed in the third quarter 2009. We also expect to install a further 4,100 metric tons of CCs at our Fayetteville facility over the course of 2009. During 2008, the average price of CCA produced in Dalian and sold primarily in the PRC was $6,188 per ton while the average price of CCA produced and sold from Fayetteville was $6,654 per ton, and CCS produced in Fayetteville sold for an average of $5,086. Both Dalian and Fayetteville sell a variety of CCA products and the price for each variety may vary based on the amount of manufacturing required and the ratio of copper to aluminum. Dalian did not sell a significant amount of CCS during 2008. The average selling price of CCS sold by Fayetteville varies by product type primarily based on the amount of copper (conductivity) in the product and the amount of manufacturing required. Sales referred to as Fayetteville include the sales from Telford also.

Customers

We significantly expanded and diversified our customer base in 2008 both through our acquisition of Copperweld and through organic growth. Our five largest customers accounted for 18.2% of total sales in 2008, down from 24.6% in 2007 and 29% in 2006. (Copperweld’s sales for the full year of 2007 are included for comparison purposes.) Furthermore, our ten largest customers in 2008 accounted for only 29.6% of net sales, down from 37.8% in 2007 on a pro forma basis including full year sales for Fayetteville facility. We believe this increased diversification significantly limits our market risk and gives us a stronger base on which to expand. We further believe our overall customer composition and the concentration of our top customers will change as we expand our business and seek to shift our product sales portfolio to higher margin products. We are continuing to expand and consolidate the direction of our combined sales and marketing group in order to focus our resources towards diversification of our customer base, product mix and geographic presence to mitigate customer concentration risk. Our objective is to focus on expanding our existing business relationships by offering a wider range of products and building new sales relationships throughout the world with our expanded sales organization.

The following table sets forth our ten largest customers in fiscal 2008:

| Originating Office | | 2008 Sales in USD | | | Percentage of Total Sales | |

| Dalian | | | 10,077,574 | | | | 4.55 | % |

| Fayetteville | | | 8,682,315 | | | | 3.92 | % |

| Fayetteville | | | 8,545,835 | | | | 3.86 | % |

| Dalian | | | 6,713,586 | | | | 3.03 | % |

| Dalian | | | 6,270,735 | | | | 2.83 | % |

| Dalian | | | 6,133,967 | | | | 2.77 | % |

| Dalian | | | 5,275,169 | | | | 2.38 | % |

| Fayetteville | | | 4,858,052 | | | | 2.19 | % |

| Dalian | | | 4,784,115 | | | | 2.16 | % |

| Dalian | | | 4,294,241 | | | | 1.94 | % |

| Total | | | 65,635,589 | | | | 29.63 | % |

Our manufacturing activities are determined and scheduled upon both firm orders and projected sales information gathered by our sales personnel from direct contact with our customers. Customers typically submit purchase orders seven to thirty days prior to the requested delivery date. However, depending on the product and the available equipment run schedules, the lead time can be as short as three days. The sales price is determined at the time of purchase based on a formula or a unit price for each product. In either case, the purchase price is a function of the market price of our raw materials at the time of purchase, subject to adjustment at the time of delivery. For some customers, we adjust our prices based on the average cost of raw materials for the previous month.

Geographically, a substantial portion of our customers served by our Dalian sales force is based in the PRC. Some of our customers are US based corporations that have established subsidiaries operating inside the PRC. Several of these corporations were former customers of our Fayetteville facility but now place orders through their subsidiaries located in the PRC. We categorize these orders as domestic orders. On the other hand, most of our customers served by our Fayetteville and Telford based sales group are located in the Americas, Europe, Africa, Asia, excluding the PRC and the Middle East. We are transferring all of our Asian customers to our PRC based sales group in order to provide more efficient customer service. As a result, we anticipate that most of our net sales will continue to be derived from sales to our Asian customers. Combined, we expect our sales growth to continue worldwide because of our working capital base, our combined sales force, our production capacity and our commitment to innovative research and development of our existing products and for developing new products.

Cost of Goods Sold

Cost of goods sold increased to $164.2 million in 2008, from $85.8 million in 2007. As measured by percentage of net sales, our cost of goods sold was 74.1% in 2008 compared with 66.9% in 2007. Cost of goods sold principally consists of the cost of raw materials, labor, utilities, manufacturing costs, manufacturing related depreciation, machinery maintenance costs, purchasing and receiving costs, inspection costs, shipping and handling costs, and other fixed costs associated with the manufacturing process. The increase in Cost of Goods Sold as a percentage of net sales was principally due to the acquisition of Copperweld in October 2007, which has labor and overhead costs that historically have been greater than our legacy operations in Dalian.

Raw material costs accounted for 84.8% of total costs in 2008. Copper composed 55.6% of our raw material costs, aluminum 38.7% and steel 5.7%. Other variable costs included manufacturing labor, maintenance, shipping and handling, and utility expenses. Depreciation and overhead costs as a percentage of COGS were 7.4% in 2008. The manufacturing related depreciation for 2008 was $4,843,153.

Suppliers

In Dalian we have historically relied on two key suppliers for the procurement of copper strip and aluminum. These two suppliers combined to account for approximately 37% of our total raw material purchases for the fiscal years to 2008. Our strategically located facilities worldwide provide us with the opportunity to pursue global sourcing and we plan to increase the number of raw material suppliers further spreading our supply risk over a larger number of suppliers. We will continue our strategy of expanding our sources of supply to overcome supply and price issues that can develop with only one or two suppliers, particularly for copper.

42

The following table sets forth our ten largest raw material suppliers for fiscal 2008:

Ten Largest Raw Material Suppliers 2008 | | Purchases in USD | | | % of Raw Material Purchases | |

| Copper—Dalian | | | 34,758,156 | | | | 25.2 | % |

| Aluminum—Dalian | | | 16,172,714 | | | | 11.8 | % |

| Aluminum—Dalian | | | 14,987,557 | | | | 10.9 | % |

| Copper—Dalian | | | 14,087,237 | | | | 10.3 | % |

| Aluminum—Dalian | | | 9,092,174 | | | | 6.6 | % |

| Copper—Fayetteville | | | 7,177,355 | | | | 5.2 | % |

| Aluminum—Fayetteville | | | 5,251,721 | | | | 3.8 | % |

| Copper—Fayetteville | | | 5,191,525 | | | | 3.8 | % |

| Steel—Fayetteville | | | 4,204,542 | | | | 3.1 | % |

Steel-Fayetteville | | | 3,802,794 | | | | 2.8 | % |

| Total—Top Ten | | | 114,725,775 | | | | 83.5 | % |

Gross margin

Gross profit was $57.3 million in 2008, increased 34.9% from approximately $42.4 million in 2007. As a percentage of net sales, gross profit decreased from 33.1% to 25.9%. This was primarily due to the lower margins contributed by the Fayetteville and Telford facilities acquired in October 2007, as well as a slight decline in gross margins in Dalian.

Selling, General and Administrative Expenses

Selling expenses, which principally includes sales related staff salary and benefits, travel expenses, and sales commissions, were $4.6 million in 2008, compared to $1.8 in 2007, a 161.4% increase. This increase is primarily due to the inclusion of a full year of Fayetteville and Telford salaries, as well as a ramp up in sales efforts to penetrate new markets and industries. As a percentage of net sales, selling expenses increased by 0.7% in 2008 compared to 2007. General and administrative expenses, as a percentage of net sales, decreased to 7% of net sales in 2008, compared to 7.8% in 2007. The decrease is primarily due to benefits realized from integrating our global sales team following the acquisition of Copperweld in October 2007 and economies of scale resulting from increased revenues. On a dollar for dollar basis, general and administrative expenses increased to $15.6 million in 2008 compared to $10.0 million in 2007. As with selling expenses, the increase in gross amount of general and administrative expenses primarily is attributed to a full year of expenses associated with the acquisition of Copperweld in October 2007.

Operating Income

The following table sets forth operating income by segment, in millions of dollars:

| | | Year ended December 31 | | | | | | | |

| | | 2008 | | | 2007 | | | | | | | |

| | | | | | % of | | | | | | % of | | | | | | | |

| | | | | | operating | | | | | | operating | | | Dollar | | | | |

| | | Amount | | | income | | | Amount | | | income | | | Change | | | % Change | |

| PRC | | $ | 43.1 | | | | 116 | % | | $ | 34.7 | | | | 113 | % | | $ | 8.4 | | | | 24.2 | % |

| US | | $ | (0.6 | ) | | | -2 | % | | $ | (0.6 | ) | | | -2 | % | | $ | - | | | | 0.0 | % |

| Corporate | | $ | (5.4 | ) | | | -15 | % | | $ | (3.5 | ) | | | -11 | % | | $ | (1.9 | ) | | | 54.3 | % |

| Total operating income | | $ | 37.1 | | | | 100 | % | | $ | 30.6 | | | | 100 | % | | $ | 6.5 | | | | 21.2 | % |

* Percentages may not equal 100% due to rounding

Operating income for the fiscal year ended December 31, 2008, increased approximately $6.5 million, or 21.2%, compared to the same period in 2007, which was primarily due to higher net sales from our PRC segment and partially offset by lower gross margins associated with the full-year consolidation of Copperweld and macroeconomic conditions which had significant effect on fourth quarter operations in our US segment.

The increase in operating income for the PRC segment of $8.4 million , or 24.2%, compared to the same period in 2007, is largely the result of increased volume due to continued strong demand for the segment’s telecommunication and utility products as a result of a strong economy and growing infrastructure demand.

Operating income in the US segment remained flat year over year despite an increase of 513.9% in total net sales from the full-year consolidation of Copperweld in fiscal 2008. Our US segment obtained profitability through the first three quarters of fiscal year 2008; however, as the global economy eroded in the fourth quarter of 2008 our gross margins were impacted in a negative manner due to significant declines in copper prices and decreased net sales associated with macroeconomic conditions which affected all products and markets within the segment.

Interest Expense

Interest expense increased to $8.8 million in 2008 from $7.5 million in 2007, while as a percentage of net sales, interest expense decreased to 4% in 2008 from 5.9% in 2007. This increase is primarily the result of interest on the $40 million High Yield notes and amortized loan commission, interest accrual and amortization of costs relating to the Kuhns Brothers litigation, as well as inclusion of the Dalian working capital line and increases in Dalian’s short term bank loans.

Taxation

U.S. income tax

Fushi Copperweld, Inc. (formerly Fushi International, Inc.) is a company incorporated in the State of Nevada, Fushi Holdings is a company incorporated in the State of Delaware, Copperweld Bimetallics, LLC is chartered in the State of Delaware and Copperweld UK, LLC is registered in the United Kingdom. Prior to the acquisition of Copperweld, we conducted substantially all our operations through our PRC operating subsidiaries. With the acquisition of Copperweld, we have a manufacturing facility and administrative offices located in Fayetteville, Tennessee, USA and in Telford, England, UK.

We are subject to United States taxation; however, we do not anticipate incurring significant United States income tax liability during fiscal year 2009 due to the following factors:

- We anticipate that Copperweld has sufficient tax loss carry forwards to offset any taxable income earned during the coming years.

- Earnings generated from our non-U.S. operating companies are generally eligible for a deferral from United States taxation until such earnings are repatriated to the United States, and

- We believe that we will not generate any significant amount of income inclusions under the income imputation rules applicable to a United States company that owns "controlled foreign corporations" for United States federal income tax purposes.

Therefore, no provision for U.S. federal income taxes or tax benefits on the undistributed earnings and/or losses of our company has been made.

A valuation allowance is required against deferred tax assets if, based on the weight of available evidence, it is more-likely-than-not that some or all of the deferred tax assets will not be realized. Management believes that the realization of the benefits can be used by their US operating subsidiary in future periods because expectations are that Copperweld U.S. will have taxable income in future periods. US companies must generate a total of $22,953,021 of taxable net income by years 2025 to 2028 in order to recover the deferred tax asset balance. Profits of Fayetteville in each of the first three quarters of 2008 were $1,036,996, $244,546 and $102,198 respectively. Through cost savings initiatives implemented beginning in the fourth quarter of 2008; the Company has lowered total labor overhead by approximately $100,000 per month. The Company is also in the process of refining and improving their manufacturing processes that may further realize cost savings of approximately $300,000 per month. With these cost saving measures in place, the Company believes that it is possible to realize profit at current sales levels at the Fayetteville facility and that Fayetteville will be well positioned to experience increased profitability when the global economic crisis subsides and sales begin to rebound to historical levels. The Company projects the Fayetteville facility to start generating positive annual pre-tax income in fiscal year 2010. Based on its review and taking into consideration the foregoing, the Company believes that, as of December 31, 2008, it was not necessary to provide a valuation allowance for deferred tax assets.

PRC enterprise income tax

In the fiscal year ended December 31, 2008, our business operations were principally conducted by our subsidiaries incorporated in the PRC. PRC enterprise income tax is calculated based on taxable income determined under PRC accounting principles. In accordance with “Income Tax Law of China for Enterprises with Foreign Investment and Foreign Enterprises,” or the Income Tax Law, “Foreign Invested Enterprises”, or FIEs, established in the PRC are generally subject to an “Enterprise Income Tax”, or EIT, rate of 33%. PRC domestic companies are governed by the Enterprise Income Tax Laws of the PRC and are also generally subject to an EIT rate of 33%. However, the Income Tax Laws provide certain favorable tax treatment to a company that qualifies as a "New or High-technology Enterprise" or a “Foreign Invested Enterprise” located in the old town of an inshore open city. Additionally, the governments at the provincial, municipal and local levels can provide many tax incentives and abatements based on a number of programs at each level.

The Dalian Municipal Government issued a notice in 2000 providing for a series of tax preferential treatments to companies that qualify as "New or High-tech Enterprise” or companies that are registered and operate in a specified development zone in Dalian City.

Dalian Fushi, a 100% variable interest, non-operating subsidiary, was incorporated in the PRC and is subject to PRC income tax which is computed according to the relevant laws and regulations in the PRC. Dalian Fushi's bimetallic composite conductor wire product was approved by Dalian Cit as a "high-tech" project. As a result, Dalian Fushi is a business entity that is qualified as a "new or high-technology enterprise," and is entitled to a two-year full exemption from the PRC enterprise income tax starting from its first year of operation, which expired on December 31, 2003, followed by a 50% reduction and other favorable tax treatment for the succeeding three years, which expired on December 31, 2006. The provision for income taxes for the twelve months ended December 31, 2008 was zero as we didn’t have any operation under Dalian Fushi from the beginning of 2007.

Fushi International (Dalian) (“FID”), a wholly owned subsidiary of Fushi Holdings, Inc., was incorporated in the PRC as an FIE and is subject to PRC income tax which is computed according to the relevant laws and regulations in the PRC. FID has located its factories in a special economic region in Dalian and is granted certain preferential treatments including a corporate income tax rate of 24%. In September 2005, FID was approved as a wholly foreign owned enterprise. This economic region allows FID a two-year income tax exemption for the years ended December 31, 2006 and 2007, and a 50% income tax reduction for the following three years ended December 31, 2008, 2009, and 2010.

Effective January 1, 2008, the new EIT Law in PRC imposes a unified income tax rate of 25.0% on all domestic-invested enterprises and FIEs, such as our PRC operating subsidiaries, unless they qualify under certain limited exceptions. But the EIT Law permits companies to continue to enjoy their existing preferential tax treatments until such treatments expire in accordance with their current terms. Any increase in our effective tax rate as a result of the above may adversely affect our operating results

Net Income

Pre-tax income increased 17.5% to $31.3 million from $26.6 million, excluding litigation accrual expense. Net income decreased to approximately $28.5 million, or 13% of net sales for the year ended December 31, 2008, from approximately $29.5 million, or 23% of net sales for the year ended December 31, 2007, representing a decrease of $1.03 million or 3.5%. The bottom line decrease is primarily due to a 7.2% decline in gross margin, slight increase in other expense and increase in the provision for income tax. As more fully described in the section “Taxation” above, we became liable for PRC income taxes on our Dalian operations during 2008.

Basic and diluted earnings per share (EPS) for the fiscal year ended December 31, 2008 were $1.04 and $1.00, compared to $1.33 and $1.19 for the prior year. The weighted average number of shares outstanding to calculate basic EPS was 27.3 million and 22.2 million for 2008 and 2007, respectively. The weighted average number of shares outstanding to calculate diluted EPS was 28.3 million and 25.2 million for 2008 and 2007, respectively.

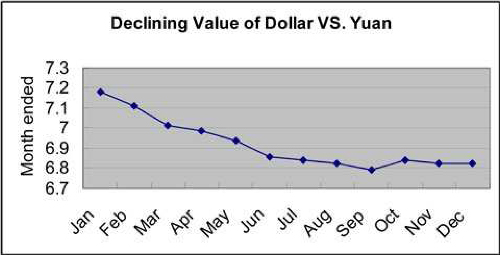

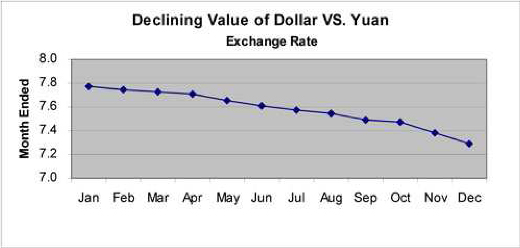

Foreign Currency Translation Gains

In the year ended December 31, 2008, the RMB steadily rose against the US dollar for the first and second quarter’s months and then partially stabilized for the third and fourth quarters. As a result of the appreciation of the RMB, we recognized a foreign currency translation gain of $12.5 million. Given the uncertainty of exchange rate fluctuations, we cannot estimate the effect of these fluctuations on our future business, product pricing, and results of operations or financial condition. See “Risk Factors- Risks Related to Doing Business in the PRC. - The fluctuation of the Renminbi may materially and adversely affect your investment.”

Prior to acquiring Copperweld in October 2007, materially all of our revenues and a majority of our expenses were denominated in RMB Yuan. For our operations in the PRC, the income statement accounts and balance sheet amounts with the exception of equity at December 31, 2008 were translated at 1 RMB Yuan to 0.14657 USD, or 1 USD to 6.8225 RMB Yuan. The equity accounts were stated at their historical rate.

Year ended December 31, 2007 compared to year ended December 31, 2006

Net Sales

The following tables set forth net sales in millions by each of our reporting segments and metric tons (MT) sold on a combined basis:

| | | Net Sales | | | | | | | |

| | | Year ended December 31 | | | | | | | |

| | | 2007 | | | 2006 | | | | | | | |

| | | | | | % of Net | | | | | | % of Net | | | Dollar | | | | |

| | | Amount | | | Sales | | | Amount | | | Sales | | | Change | | | % Change | |

| PRC | | $ | 118.0 | | | | 92.0 | % | | $ | 67.6 | | | | 100.0 | % | | $ | 50.4 | | | | 74.6 | % |

| US | | $ | 10.2 | | | | 8.0 | % | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

| Total Net sales | | $ | 128.2 | | | | 100.0 | % | | $ | 67.6 | * | | | 100.0 | % | | $ | 60.6 | | | | 89.6 | % |

| | | Metric Tons Sold | | | | | | | |

| | | Year ended December 31 | | | | | | | |

| | | 2007 | | | 2006 | | | | | | | |

| | | | | | % of MT | | | | | | % of MT | | | Tonnage | | | | |

| | | MT | | | Sold | | | MT | | | Sold | | | Change | | | % Change | |

| PRC | | | 19,416 | | | | 91.1 | % | | | 11,701 | | | | 100.0 | % | | | 7,715 | | | | 65.9 | % |

| US | | | 1,906 | | | | 8.9 | % | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

| Total MT sold | | | 21,322 | | | | 100.0 | % | | | 11,701 | * | | | 100.0 | % | | | 9,621 | | | | 82.2 | % |

* We did not have any operations outside of China during the fiscal year 2006.

Net sales were $128.2 million in 2007 including sales from Fayetteville and Telford facilities for the period October 29 through the end of the period, compared to $67.6 million in 2006. Of the 89.6% sales growth in the fiscal year ended December 31, 2007, 74.8% was due to organic growth and 14.8% was attributable to sales from Fayetteville and Telford for November and December of 2007.

The PRC segment experienced an increase of 74.6% in net sales for the fiscal year ended December 31, 2007 relative to the comparable 2006 period. The majority of the increase in PRC net sales is due to a 65.9% increase in metric tons sold and a 7.4% increase in the average selling price as a result of higher metal prices relative to 2007 levels. The increase in average selling price in 2007 was primarily due to the increase in raw material prices, particularly copper prices, and the increased sales volume primarily reflects expanded production capacity as a result of our capital investment.

We did not have any operations outside of China during the fiscal year 2006. We began to realize contributions from our operations within the US segment beginning October 29, 2007 upon the completion of the acquisition of the Fayetteville and Telford facilities. As a result there is no comparable segment data to report for 2006.

Customers

We significantly expanded and diversified our customer base in 2007 both through our acquisition of Copperweld and through organic growth. Our five largest customers accounted for 24.6% of total sales in 2007, down from 29% in 2006 and 41% in 2005. Our largest customer accounted for 10.8% of sales in 2007. In fact, our ten largest customers in 2007 accounted for only 37.75% of net sales, on a pro forma basis including full year sales for Fayetteville facility. We believe this increased diversification significantly limits our market risk and gives us a stronger base on which to expand. We further believe our overall customer composition and the concentration of our top customers will change as we expand our business and seek to shift our product sales portfolio to higher margin products. However, the loss of, or significant reduction in orders from any of our largest customers may have a material adverse impact on our financial condition and operating results. We are continuing to expand and consolidate the direction of our combined sales and marketing group in order to focus our resources towards diversification of our customer base, product mix and geographic presence to mitigate customer concentration risk. Our objective is to focus on expanding our existing business relationships by offering a wider range of products and building new sales relationships throughout the world with our expanded sales organization.

The following table (which considers Fayetteville’s sales for the full year of 2007) sets forth our ten largest customers in fiscal 2007:

| Originating Office | | 2007 Sales in USD | | | Percentage of Total Sales | |

| Fayetteville | | | 21,215,885 | | | | 10.80 | % |

| Dalian | | | 8,027,451 | | | | 4.09 | % |

| Dalian | | | 6,798,765 | | | | 3.46 | % |

| Fayetteville | | | 6,638,111 | | | | 3.38 | % |

| Dalian | | | 5,636,408 | | | | 2.87 | % |

| Dalian | | | 5,518,656 | | | | 2.81 | % |

| Dalian | | | 5,476,410 | | | | 2.79 | % |

| Dalian | | | 5,222,391 | | | | 2.66 | % |

| Dalian | | | 4,977,456 | | | | 2.53 | % |

| Dalian | | | 4,624,811 | | | | 2.35 | % |

| Total | | | 74,136,344 | | | | 37.74 | % |

Cost of Goods Sold

Cost of goods sold increased to $85.8 million in 2007, from $42.8 million in 2006. As measured by percentage of net sales, our cost of goods sold was 66.9% in 2007 compared with 63.3% in 2006. Cost of goods sold principally consists of the cost of raw materials, labor, utilities, manufacturing costs, manufacturing related depreciation, machinery maintenance costs, purchasing and receiving costs, inspection costs, shipping and handling costs, and other fixed costs associated with the manufacturing process. The increase in Cost of Goods Sold as a percentage of net sales was principally due to the cost of adding capacity in Dalian and labor and overhead costs in Fayetteville that historically have been greater than in Dalian.

Suppliers

We also significantly diversified our sources of supply. In Dalian we have historically relied on two key suppliers for the procurement of copper strip and aluminum. These two suppliers combined to account for approximately 41% of our total raw material purchases during the fiscal years prior to 2007. During 2007, four suppliers provided 43.0% of our raw material for us. With the addition of Fayetteville and Telford, we will increase the number of raw material suppliers further spreading our supply risk over a larger number of suppliers. We will continue our strategy of expanding our sources of supply to overcome supply and price issues that can develop with only one or two suppliers, particularly for copper.

The following table sets forth our ten largest raw material suppliers for fiscal 2007:

Ten Largest Raw Material Suppliers 2007 | | Purchases in USD | | | % of Raw Material Purchases | |

| Copper—Dalian | | | 26,122,785 | | | | 12.5 | % |

| Aluminum—Dalian | | | 13,462,792 | | | | 11.0 | % |

| Aluminum—Dalian | | | 13,220,800 | | | | 10.8 | % |

| Copper—Dalian | | | 10,895,561 | | | | 8.9 | % |

| Aluminum—Dalian | | | 10,334,099 | | | | 8.4 | % |

| Copper—Fayetteville | | | 9,222,531 | | | | 7.5 | % |

| Aluminum—Fayetteville | | | 7,693,142 | | | | 6.3 | % |

| Copper—Fayetteville | | | 5,894,133 | | | | 4.8 | % |

| Copper—Fayetteville | | | 4,758,723 | | | | 3.9 | % |

| Steel—Fayetteville | | | 4,274,291 | | | | 3.5 | % |

| Total—Top Ten | | | 105,878,857 | | | | 77.6 | % |

The information in the preceding chart includes Fayetteville’s purchases for the full year of 2007.

Gross margin

Gross profit was $42.4 million in 2007, increased 71.1% from approximately $24.8 million in 2006. As a percentage of net sales, gross profit decreased from 36.7% to 33.1%. This was primarily driven by higher raw material costs that affected the selling price but not the dollar amount of margin. As we discussed in the overview, we pass increases in raw material costs to our customers rather than the percentage changes in our raw material costs. Therefore, when raw material increases are passed through to our customers, the sales price will increase and the net margin as a percentage of net sales will decline. However, the dollar amount of gross margin remains stable.

Selling, General and Administrative Expenses

Selling expenses, which principally include sales related staff salary and benefits, travel expenses, and sales commissions, were $1.8 million in 2007, compared to $613,119 in 2006, a 187.5% increase. As a percentage of net sales, selling expenses increased by 0.47% in 2007 compared to 2006. General and administrative expenses, as a percentage of net sales, increased to 7.8% of net sales in 2007, compared to 5.6% in 2006. The increase was primarily due to increased depreciation associated with expanded asset base amounting to $2.2 million, $1.9 million share based compensation, $1.6 million professional fee and costs associated with expanding our staff in Dalian to accommodate the increasing demand for our products and the inclusion of Copperweld operating expenses for the period October 29, 2007 through December 31, 2007.

Operating Income

The following table sets forth operating income by segment, in millions of dollars:

| | | Year ended December 31 | | | | | | | |

| | | 2007 | | | 2006 | | | | | | | |

| | | | | | % of | | | | | | % of | | | | | | | |

| | | | | | operating | | | | | | operating | | | Dollar | | | | |

| | | Amount | | | income | | | Amount | | | income | | | Change | | | % Change | |

| PRC | | $ | 34.7 | | | | 113 | % | | $ | 21.4 | | | | 105 | % | | $ | 13.3 | | | | 62.1 | % |

| US | | $ | (0.6 | ) | | | -2 | % | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

| Corporate | | $ | (3.5 | ) | | | -11 | % | | $ | (1.0 | ) | | | -5 | % | | $ | (2.5 | ) | | | 250.0 | % |

| Total operating income | | $ | 30.6 | | | | 100 | % | | $ | 20.4 | * | | | 100 | % | | $ | 10.2 | | | | 50.0 | % |

* We did not have any operations outside of China during the fiscal year 2006.

Operating income for the fiscal year ended December 31, 2007, increased approximately $10.2 million, or 50.0%, compared to the same period in 2006, which was primarily due to higher net sales and partially offset by lower gross margins associated with the full-year consolidation of Copperweld.

Operating income in the PRC segment increased approximately $13.3 million, or 62.1%, compared to the same period in 2007, primarily due to an increase in total net sales and by $17 million in gross margins.

We did not have any operations outside of China during the fiscal year 2006. We began to realize contributions from our operations within the US segment beginning October 29, 2007 upon the completion of the acquisition of the Fayetteville and Telford facilities. As a result there is no comparable segment data to report for 2006.

Interest Expense

Interest expense increased to $7.5 million in 2007 from $1.07 million in 2006, while as a percentage of net sales, interest expense increased to 5.9% in 2007 from 1.6% in 2006. We issued $40 million in HY notes and $20 million in convertible notes that were purchased by Citadel Equity Fund Ltd. on January 24, 2007. Interest expense related to those notes during 2007 was approximately $5.2 million.

Taxation

Income tax

Fushi Copperweld, Inc. (formerly Fushi International, Inc.) is a company incorporated in the State of Nevada, Fushi Holdings is a company incorporated in the State of Delaware, Copperweld Bimetallics, LLC is chartered in the State of Delaware and Copperweld UK, LLC is registered in the United Kingdom. Prior to the acquisition of Copperweld, we conducted substantially all our operations through our PRC operating subsidiaries. With the acquisition of Copperweld, we have a manufacturing facility and administrative offices located in Fayetteville, Tennessee, USA and in Telford, England, UK.

PRC enterprise income tax

In the fiscal year ended December 31, 2007, our business operations were principally conducted by our subsidiaries incorporated in the PRC. PRC enterprise income tax is calculated based on taxable income determined under PRC accounting principles. In accordance with “Income Tax Law of China for Enterprises with Foreign Investment and Foreign Enterprises,” or the Income Tax Law, “Foreign Invested Enterprises”, or FIEs, established in the PRC are generally subject to an “Enterprise Income Tax”, or EIT, rate of 33%. PRC domestic companies are governed by the Enterprise Income Tax Laws of the PRC and are also generally subject to an EIT rate of 33%. However, the Income Tax Laws provide certain favorable tax treatment to a company that qualifies as a "New or High-technology Enterprise" or a “Foreign Invested Enterprise” located in the old town of an inshore open city. Additionally, the governments at the provincial, municipal and local levels can provide many tax incentives and abatements based on a number of programs at each level.

The Dalian Municipal Government issued a notice in 2000 providing for a series of tax preferential treatments to companies that qualify as "New or High-tech Enterprise” or companies that are registered and operate in a specified development zone in Dalian City.

Dalian Fushi, a 100% variable interest, non-operating subsidiary, was incorporated in the PRC and is subject to PRC income tax which is computed according to the relevant laws and regulations in the PRC. Dalian Fushi's bimetallic composite conductor wire product was approved by Dalian Cit as a "high-tech" project. As a result, Dalian Fushi is a business entity that is qualified as a "new or high-technology enterprise," and is entitled to a two-year full exemption from the PRC enterprise income tax starting from its first year of operation, which expired on December 31, 2003, followed by a 50% reduction and other favorable tax treatment for the succeeding three years, which expires on December 31, 2006. The provision for income taxes for the twelve months ended December 31 was zero as we didn’t have any operation under Dalian Fushi from the beginning of 2007.

Fushi International (Dalian) (“FID”), a wholly owned subsidiary of Fushi Holdings, Inc., was incorporated in the PRC as an FIE and is subject to PRC income tax which is computed according to the relevant laws and regulations in the PRC. FID has located its factories in a special economic region in Dalian and is granted certain preferential treatments including a corporate income tax rate of 24%. In September 2005, FID was approved as a wholly foreign owned enterprise. This economic region allows FID a two-year income tax exemption for the years ended December 31, 2006 and 2007, and a 50% income tax reduction for the following three years ended December 31, 2008, 2009, and 2010.

Effective January 1, 2008, the new EIT Law in PRC imposes a unified income tax rate of 25.0% on all domestic-invested enterprises and FIEs, such as our PRC operating subsidiaries, unless they qualify under certain limited exceptions. But the EIT Law permits companies to continue to enjoy their existing preferential tax treatments until such treatments expire in accordance with their current terms. Any increase in our effective tax rate as a result of the above may adversely affect our operating results

Net Income

Net income increased to approximately $29.5 million, or 23.0% of net sales for the year ended December 31, 2007, from approximately $17.8 million, or 26.4% of net sales for the year ended December 31, 2006, representing an increase of $11.7 million or 65.7% with a net margin of 26%. The bottom line increase is primarily due to substantial revenue increases while the decrease as a percentage of the net sales was primarily due to lower gross margin and higher SG&A.

Basic and diluted earnings per share (EPS) for the fiscal year ended December 31, 2007 were $1.33 and $1.19, compared to $0.89 and $0.84 for the prior year. The weighted average number of shares outstanding to calculate basic EPS was 22.2 million and 19.9 million for 2007 and 2006, respectively. The weighted average number of shares outstanding to calculate diluted EPS was 25.2 million and 21.3 million for 2007 and 2006, respectively.

Foreign Currency Translation Gains

In the year ended December 31, 2007, the RMB steadily rose against the US dollar. As a result of the appreciation of the RMB, we recognized a foreign currency translation gain of $9.9 million. Given the uncertainty of exchange rate fluctuations, we cannot estimate the effect of these fluctuations on our future business, product pricing, and results of operations or financial condition. See “Risk Factors- Risks Related to Doing Business in the PRC. - The fluctuation of the Renminbi may materially and adversely affect your investment.”

Prior to acquiring Copperweld, materially all of our revenues and a majority of our expenses in 2007 were denominated in RMB Yuan. For our operations in the PRC, the income statement accounts and balance sheet amounts with the exception of equity at December 31, 2007 were translated at 1 RMB Yuan to 0.1371 USD, or 1 USD to 7.2941 RMB Yuan. The equity accounts were stated at their historical rate.

LIQUIDITY AND CAPITAL RESOURCES

We have historically financed our operations and capital expenditures principally through private placements of debt and equity offerings, bank loans, and cash provided by operations. Significant factors affecting our cash liquidity include (1) cash provided by operating activities, (2) cash used for capital expenditures, and (3) our available credit facilities and other borrowing arrangements.

The transfer of operating funds from Dalian to our non-PRC subsidiaries and parent company during 2008 and 2007 was $6.1 million and $2.0 million, respectively.

As is customary in the industry, we provide payment terms to most of our customers that exceed terms that we receive from our suppliers. Therefore, the Company’s liquidity needs have generally consisted of working capital necessary to finance receivables and raw material inventory. Capital expenditures have historically been necessary to expand the production capacity of the Company’s manufacturing operations.

In summary, our cash flows were:

| | | December 31, 2008 | | | December 31, 2007 | |

| Net cash (used in) provided by operating activities | | $ | (368,212 | ) | | $ | 26,152,846 | |

| Net cash (used in) investing activities | | | (17,089,985 | ) | | | (51,182,872 | ) |

| Net cash (used in) provided by financing activities | | | (1,666,360 | ) | | | 80,257,602 | |

| Effect of exchange rate on cash and cash equivalents | | | 4,821,569 | | | | 4,193,631 | |

| Cash and cash equivalents at beginning | | | 79,914,758 | | | | 20,493,551 | |

| Cash and cash equivalents at ending | | $ | 65,611,770 | | | $ | 79,914,758 | |

For the fiscal year ended December 31, 2008, net cash used by operating activities was $368,212. This was primarily attributable to our net income of $28.5 million, $33.4 million increase in working capital from $7.9 million in 2007 to $41.3 million in 2008, adjusted by an add-back of non-cash expenses mainly consisting of depreciation and amortization of $9.7 million and share-based compensation expense of $1.9 million. The change in working capital for the year ended December 31, 2008 was primarily related to i) a $24.8 million increase in accounts receivable; ii) a $17.4 million increase in advance to raw material suppliers, partially offset by $5.1 million decrease in inventory; iii) a $5.0 million increase in deferred tax assets and a $1.8 million decrease in taxes payable; iv) a $1.1 million decrease in other payables and accrued liabilities, partially offset by a $4.1 million increase in accounts payables. Increase in accounts receivables was primarily driven by revenue growth, and extended credit term to certain customers as well as longer collection cycle as a result of challenging economic condition. We maintain an allowance for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments. Allowance for doubtful accounts is based on our assessment of the collectability of specific customer accounts, the aging of accounts receivable, our history of bad debts, and the general condition of the industry. We have not experienced any significant amount of bad debt since the inception of our operation and have established appropriate procedures to facilitate collection. Increase in advance to raw material suppliers was due to significant purchase commitments of copper supplies incurred towards the end of the third quarter and the purchase commitments were subsequently renegotiated and amended with the suppliers to reflect prevailing market price for future delivery. The repairs and maintenance expense recognized in 2007 and 2008 are $227,248 and $819,283, respectively. The increase in repairs and maintenance expense for the fiscal year ended December 31, 2008 was primarily due to the additional cost on PP&E that were acquired through the acquisition of Copperweld in October 2007.

For the fiscal year ended December 31, 2008, net cash used in investing activities was $17.1 million, and was primarily attributable to i) a $1.7 million purchase of land use rights; ii) a $15.2 million capital expenditure on improvement of property and purchase of new equipment and machinery, and (iii) a $3.1 million advances for purchase of equipment

For the fiscal year ended December 31, 2008, net cash used in financing activities was $1.7million as a result of repayment of maturing, long term and short term working capital loan in the amount of $17.3 million and payment in the amount of $2.4 million on our existing credit line facilities, partially offset by proceeds from short term borrowing of $16.9 million. As of December 31, 2008, we had outstanding short-term working capital loans with banks in an aggregate amount of $17.6 million with terms ranging from three months to one year and maturity dates ranging from February to March, 2009. The weighted average annual interest rate on the loan was 8.96%

Our Fayetteville facility (Copperweld) maintains a revolving line of credit with Wells Fargo Bank. Availability on the credit line is the lower of $12.8 million or the collateral balances. The outstanding balance was $4,712,075 at December 31, 2008. The Company deposits the cash collections from its customers against the outstanding account balance of the line of credit on a daily basis. The line of credit matures in 2010. If we are unable to renew or replace our Fayetteville revolving line of credit, our Fayetteville results of operations would be adversely affected. See “Risk Factors – Risks Related to Our Business – Our Fayetteville, Tennessee operation is dependent upon a line of credit to fund working capital needs and, if we are unable to renew or replace the line of credit, our Fayetteville results of operations would be adversely affected.” Our Telford facility (Copperweld UK) maintains a revolving line of credit with a limit of approximately $1,096,000 (or ₤750,000) but had no balance outstanding at December 31, 2008. Both lines of credit expire in 2010.

As of December 31, 2008, we had cash and cash equivalents of $65.6 million, down $14.3 million from $79.9 million at December 31, 2007.

On January 24, 2007, we and Citadel Equity Fund Ltd. ("Citadel") entered a Notes Purchase Agreement (the “Notes Purchase Agreement”) pursuant to indicative financing term sheets dated December 19, 2006. Pursuant to the terms of the Notes Purchase Agreement, the Company offered and sold and Citadel purchased (a) $40,000,000 of the Company’s Guaranteed Senior Secured Floating Rate Notes due 2012 (the “HY Notes”) and (b) $20,000,000 of the Company’s 3.0% Senior Secured Convertible Notes due 2012 (the “Convertible Notes” and collectively with the HY Notes, the "Notes"). The details of the indentures are available in previous filing. The indenture for the Convertible Notes, among other provisions, allows the holder to convert the debt to common stock at a conversion rate of $7.00 for each share. On January 8, 2008, Citadel converted $15.0 million in debt to 2,142,857 shares of our common stock.

The HY Notes and Convertible Notes contain customary affirmative and negative covenants and other provisions, including restrictions on the incurrence of additional debt, creation of liens, making restricted payments, paying dividends, maintenance of a maximum leverage ratio, maintenance of a minimum fixed charge coverage ratio, and minimum net worth. We were in compliance with all of these requirements as of December 31, 2008.

Under the terms of the Indentures governing the Notes, we are required to make payments of interest on the Notes on the same day such payments are due and payable. We have experienced payment delays in January 2009 due to recent tightening of SAFE restrictions on the conversion of RMB to USD. We have since paid the interest amounts in full and have no current issues with respect to payment.

If there is a default, or we do not maintain certain financial covenants or we do not maintain borrowing availability in excess of certain pre-determined levels, we may be unable to incur additional indebtedness, make restricted payments or redeem or repurchase our capital stock. To the extent the Noteholders demand accelerated payment of maturity in entire or partial principal of the Notes as a result of declared default, our liquidity will be adversely affected. Without sufficient liquidity to fund our debt obligations, we may be forced to curtail our operations, including reducing or depleting our working capital, reducing or delaying capital expenditures, and limiting out ability to obtain additional financing for future working capital, capital expenditures, acquisitions and other business opportunities we want to pursue. Especially given the current adverse economic condition and the extreme volatility, disruption and dislocation the capital and credit markets have been experiencing in recent months, there can be no assurance that our ability to utilize our current credit facilities or our ability to access credit and capital markets and finance our operations will not be impaired. (See risk factors related to business referencing foreign exchange control and Fayetteville, and risks related to notes.)

In addition, if we are unable to stay enforcement of the judgment in the Kuhns litigation pending our appeal, we will be forced to pay the approximately $7 million judgment immediately. Any payment of the judgment would have a material adverse effect on our liquidity. The Company allocate the contingent liability of $7,197,794 to the following: (a) $710,544 was expensed immediately in second quarter of 2008; (b) $3,000,000 was recorded as deferred commissions on long term notes and is being amortized over the remainder of the long term note’s life, $1,650,000 was amortized for the year ended December 31, 2008, $1,350,000 was outstanding as deferred commissions on long term notes as of December 31, 2008; (c) $3,487,250 was allocated to Additional Paid in Capital. See “Item 3. Legal Proceedings.”

Days sales outstanding (DSO) was 82 days and 67 days at December 31, 2008 and 2007 respectively, while days payable outstanding was16 days and 13 days at December 31, 2008 and 2007 respectively.

Standard Customer and Supplier Payment Terms (days) as below:

| | | Year ended December 31, 2008 |

| Customer Payment Term | | Payment in advance to 90 days |

| Supplier Payment Term | | Payment in advance to 30 days |

The increase in DSO was because we extended credit terms for our P.R.C. segment in late 2008 to certain credible customers that have long-standing business relationships with us in order to capture increased market share. We believe that our ability to extend credit terms puts pressure on our smaller competitors whose limited capital resources have become further strained due to the global economic crisis and who are unable to make such adjustments for customers. Prior to this adjustment in customer credit policies, the standard number of days we gave our customers to pay was 90 days. We write off receivables specifically based on the facts we obtain about the customers’ ability to pay. The Company has established appropriate procedures to facilitate collection.

Aging Analysis of accounts receivable:

| | | 31-Dec-08 | |

| 1-30 days | | | 7,967,993 | |

| 31-60 days | | | 14,981,574 | |

| 61-90 days | | | 17,033,521 | |

| 91-180 days | | | 9,394,900 | |

| 181-365 days | | | 723,089 | |

| Bad debt | | | -318,529 | |

| Total | | | 49,782,548 | |

Inventory turnover days increased slightly from 13 days at December 31, 2007 to 16 days at December 31, 2008. The Company’s principal raw materials consist of aluminum and steel rods and copper strips. Changes in the price of copper, which has an established history of volatility, directly affect the prices of the Company’s products and influence the demand for products. The Company’s decision to make advanced purchases of raw materials is mainly based upon (1) the current and projected future market price of raw materials, (2) the demand and supply situation in the raw materials market, and (3) the forecasted demand of products.

Advance to supplier’s turnover days has increased from 10 days at December 31, 2007, to 45 days at December 31, 2008. The primary reason for the increased investments in inventory and advances is due to increased demand forecasts of our products within the P.R.C. market as a result of increased government spending related to infrastructure projects. Furthermore, due to globally depressed commodity prices, the Company believed there was an opportunity to secure lower purchase prices through increased investments in deposit (advance) to suppliers which in turn lowered the average purchase price of raw materials and minimized the loss resulting from the significant decline in spot prices in the fourth quarter of 2008.

We believe that our current cash flow and capital resources will be sufficient to meet our anticipated cash needs, including our cash needs for working capital, capital expenditures, and our other short-term operating strategies for the next 12 months. We may, however, require additional cash resources due to changing business conditions or other future developments, including any investments or acquisitions we may decide to pursue. Customer demand, competitive market forces, commodities pricing, customer acceptance of our product mix and economic conditions worldwide could affect our ability to continue to fund our future needs from business operations. The Company’s contractual obligations and commercial commitments as of December 31, 2008 are summarized below:

| Contractual obligations | | Total | | | Payment due by less than 1 year | | | 2–3 years | | | 4-5 years | | | More than 5 years | |

| Estimated variable rate interest payment related to High Yield notes(semi-annual) | | | 7,428,471 | | | | 3,277,267 | | | | 3,714,236 | | | | 436,968 | | | | - | |

| Estimated fixed rate interest payment related to Convertible notes(semi-annual) | | | 525,000 | | | | 150,000 | | | | 300,000 | | | | 75,000 | | | | - | |

| Long-Term Debt Obligations-High Yield note principal | | | 40,000,000 | | | | 5,000,000 | | | | 25,000,000 | | | | 10,000,000 | | | | - | |

| Long-Term Debt Obligations-Convertible note principal | | | 5,000,000 | | | | - | | | | - | | | | 5,000,000 | | | | - | |

| Long-Term Debt Obligations-Estimated interest upon | | | | | | | | | | | | | | | | | | | | |

| redemption of Convertible Notes at Mature | | | 5,305,158 | | | | - | | | | - | | | | 5,305,158 | | | | - | |

| Long-Term Debt Obligations-SWAP settlement | | | 6,177,304 | | | | 964,617 | | | | 3,784,729 | | | | 1,427,958 | | | | - | |

| Total | | | 64,435,933 | | | | 9,391,884 | | | | 32,798,965 | | | | 22,245,084 | | | | - | |

| (1) | This table assumes we will repay our outstanding High Yield Notes strictly to the mandatory redemption schedule defined in the High Yield note indentures. Calculations are based on 6 month LIBOR rate as of July 22, 2008 of 3.14% as reported by the British Bankers’ Associations (BBA). |

| (2) | This table assumes that our outstanding Convertible Notes will not be converted and will need to be redeemed by their maturity date of January 24, 2012. |

The fair market value of our derivative hedge is mainly determined based upon the changes in forward market six month USD LIBOR rates and changes in forward market exchange rate between USD and Chinese RMB, and the LIBOR yield curve. A decline in forward market LIBOR rates and accelerated depreciation in Chinese RMB against USD as well as a change from an upward to a flat or an inverted LIBOR yield curve can generate material losses on our derivative hedge.

The fair market values of our warrant and conversion option derivatives are determined by the market price of our stock, strike price, volatility, risk free interest rate, expected life and dividend yield. An increase in our stock price can generate material losses on our warrant and conversion option derivatives.

Management's discussion and analysis of its financial condition and results of operations are based upon the Company's consolidated financial statements, which have been prepared in accordance with United States generally accepted accounting principles. The Company's financial statements reflect the selection and application of accounting policies which require management to make significant estimates and judgments. See note 1 to the Company's consolidated financial statements, "Summary of Significant Accounting Policies and Organization". Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. The Company believes that the following reflect the more critical accounting policies that currently affect the Company's financial condition and results of operations:

Revenue recognition

Revenue is recognized when product is shipped and title passes to the customer and collectability is reasonably assured. Sales revenue represents the invoiced value of goods, net of a VAT. All of the Company's products that are sold in the PRC are subject to a Chinese value-added tax at a rate of 17% of the gross sales price. All of the Company’s products that are manufactured and sold in the UK are subject to a UK value-added tax at a rate of 15% of the gross sales price. This VAT may be offset by VAT paid by the Company on raw materials and other materials included in the cost of producing its finished products.

Although most of our products are covered by our warranty programs, the terms and conditions of which vary depending on the customers and the product sold. Because we have not experienced any significant warranty claims in the past, we have not established any reserve fund for warranty claims or defective products.

Segment reporting

The Company uses a “management approach” model for segment reporting. The management approach model is based on the way a company’s management organizes segments within the company for making operating decisions and assessing performance. For the years ended December 31, 2008 and 2007, the Company has two reportable segments: China and US. The China segment, through the Dalian manufacturing facility, is engaged in developing, designing, manufacturing, marketing and distributing copper-cladded bi-metallic engineered conductor products, principally copper-clad aluminum (CCA) and primarily services the Asia-Pacific region, and specifically the PRC market. The US segment, consisting of two manufacturing facilities, one in Fayetteville, Tennessee, USD and a second in Telford, England, are engaged in developing, designing, manufacturing, marketing and distributing copper-cladded bimetallic engineered conductor products, principally CCA and copper-clad steel (CCS) and primarily service the North and South America, European, Middle Eastern and North African markets.

Property, Plant and Equipment

Building, plant and equipment are recorded at cost less accumulated depreciation and amortization. Depreciation and amortization are recorded utilizing the straight-line method over the estimated original useful lives of the assets. Amortization of leasehold improvements is calculated on a straight-line basis over the life of the asset or the term of the lease, whichever is shorter. Major renewals and betterments are capitalized and depreciated; maintenance and repairs that do not extend the life of the respective assets are charged to expense as incurred. Upon disposal of assets, the cost and related accumulated depreciation are removed from the accounts and any gain or loss is included in income. Depreciation related to property and equipment used in production is reported in cost of sales.

Long-term assets of the Company are reviewed annually as to whether their carrying value has become impaired.

If a cost does not extend an asset’s useful life, increase its productivity, improve its operating efficiency, or add additional production capacity, the cost is regarded as repairs and maintenance and recognized as an expense as incurred, if it does, the cost is regarded as major renewals and betterments and capitalized.

The repairs and maintenance expense recognized in 2006, 2007 and 2008 are $59,330, $227,248 and $819,283, respectively. The increase in repairs and maintenance expense for the fiscal year ended December 31, 2008 was primarily due to the additional cost on PP&E that were acquired through the acquisition of Copperweld in October 2007.

For the years ended December 31, 2006, 2007 and 2008, there were no amounts expended for major renewals and betterments that were capitalized.

Bad debts

The Company's business operations are conducted in the PRC and in the US. The Company extends unsecured credit to customers with good credit history. Management reviews its accounts receivable on a regular basis to determine if the bad debt allowance is adequate at each year-end. Because we only extend trade credits too many of our customers, who tend to be well-established and large sized businesses, and we have not experienced any write-offs in our PRC operations and no material write-off of accounts receivable in our US operations. At December 31, 2008 we had an allowance of bad debts in the amount of $318,529.