OMB APPROVAL

OMB Number: 3235-0570

Expires: October 31, 2006

Estimated average burden hours per response...19.3

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3616

Mosaic Income Trust

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

W. Richard Mason

Madison/Mosaic Legal and Compliance Department

8777 N. Gainey Center Drive, Suite 220

Scottsdale, AZ 85258

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: December 31, 2003

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspoection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1. Report to Shareholders.

ANNUAL REPORT

December 31, 2003

Mosaic Income Trust

Government Fund

Intermediate Income Fund

Mosaic Funds

www.mosaicfunds.com

Contents

| Letter to Shareholders | 1 |

| Management's Discussion of Fund Performance | |

| mReview of Period | 2 |

| mOutlook | 2 |

| mFund Overview | 3 |

| mComparison of Changes in the Value of a $10,000 Investment | 4 |

| Independent Auditors' Report | 5 |

| Portfolio of Investments | |

| mGovernment Fund | 6 |

| mIntermediate Income Fund | 7 |

| Statements of Assets and Liabilities | 9 |

| Statements of Operations | 10 |

| Statements of Changes in Net Assets | 11 |

| Financial Highlights | 12 |

| Notes to Financial Statements | 13 |

| Management Information | 16 |

Letter to Shareholders

After three straight years in which bond investments outpaced stocks, 2003 saw modest gains for bonds, while stocks more than doubled their historic averages. This alone would not be upsetting for bond investors--after all, most of us are invested in bonds for relative safety, income and diversification. But this past June interest rates dipped to 45-year lows, and then ramped swiftly upward over the next two months. From low-point to high-point, holders of long-term bonds saw double-digit losses. Looked at in isolation, a move like this can shake the foundation of many bond investors' confidence.

Holders of Mosaic Income Trust funds suffered just a fraction of this volatility. The reason: we actively manage the duration of our bond funds, and recognizing the risk in the market, we were positioned at just about the shortest duration in our firm's 30-year history of bond management.

Going forward, with the economy revving up, we see little diminution in interest rate risk--the loss of value that bonds suffer when rates rise. We believe that holding bonds in today's uncertain world makes just as good as sense as ever--however, not just any bonds will do. Both of our funds in Income Trust are positioned for 2004 with a defensive duration posture and an emphasis on quality holdings. Our goal continues to be "participate and protect." We are pleased to have participated in the three-year bull market in bonds, and will work hard to protect those gains when a period of rising interest rates appears likely.

We appreciate the trust that you have placed in us to make these management decisions, and we believe that we will have cause in future reports to take pride in being decisive in our positioning.

Sincerely,

(signature)

Katherine Frank

President

Management's Discussion of Fund Performance

Review of Period

As the books closed on 2003, the economy and equity markets appeared to have finally turned after a difficult few years. Meanwhile, interest rates worked their way slightly higher from a year previous, after dipping to 45-year lows in June. Rates on the benchmark 10-Year Treasury began the year at 3.82%, dove to 3.11% in mid-June, and ended the year at 4.27% after hitting a high of 4.60%. This relatively modest year-end to year-end movement in rates begs the questions: despite a dramatic improvement in the economic backdrop and less geo-political uncertainty, why have interest rates not moved higher, and what does 2004 hold? Answers can be found by examining current Fed policy and some of the factors impacting the economy.

Fourth-quarter declines in both the Consumer and Producer Price Indices highlight 2003's tame inflation backdrop. Over the course of the year, the Federal Reserve Board shifted its assessment of inflation risks from a deflationary tilt to a more balanced risk, and went on record as desiring a higher rate of inflation. This positive price-pressure backdrop should keep short-term interest rates low and the yield curve steep in the first half of 2004. In other words, short-term rates will likely continue to be considerably lower than longer term rates.

Another important measure of the economy is the employment situation. Despite sharply higher benefit costs, overall unit labor costs continued to shrink in 2003, while hourly earnings growth is at its lowest level in 16 years.

With the benign inflation outlook and declining labor costs, the Fed went on record as desiring to keep monetary policy stimulative until unused productive capacity diminishes and the labor market enters a period of sustained job creation. Manufacturing capacity utilization, which is a measure of how fully industry is using its facilities, ended the year at a low 75.8%, and the unemployment rate was well above the level of full employment.

Outlook

Low employment costs should help corporate profits to continue to improve at a rapid pace until a labor market recovery takes hold and wages begin to rise. We also expect that buoyant economic growth over the next year will close the "capacity gap" and the Fed will be forced to reevaluate its pro-growth stance later in 2004. As much as anything else, the Fed's stance in 2003 allowed rates to remain low despite strengthening economic growth. As we enter 2004, economic activity suggests a strong and sustainable recovery. Record monetary and fiscal stimulus is working, with third quarter real GDP advancing at an 8.2% annual rate and the fourth quarter growing near 5%. Growth is broad-based, with advancing capital spending, improving inventory stockpiles, strong housing, and stable consumption expenditures. Although the 8%+ pace is unlikely to persist, growth in 2004 should be above trend and, if so, will help to shrink the capacity overhang plaguing the economy and concerning the Fed. With global demand picking up, inventories lean, and the manufacturing workweek growing, producers should add jobs in 2004. Increasing global demand has pushed commodities prices higher--a classic precursor to an inflation upswing. By the second half of 2004, the Fed may very well get its wish for inflation.

Fund Overview

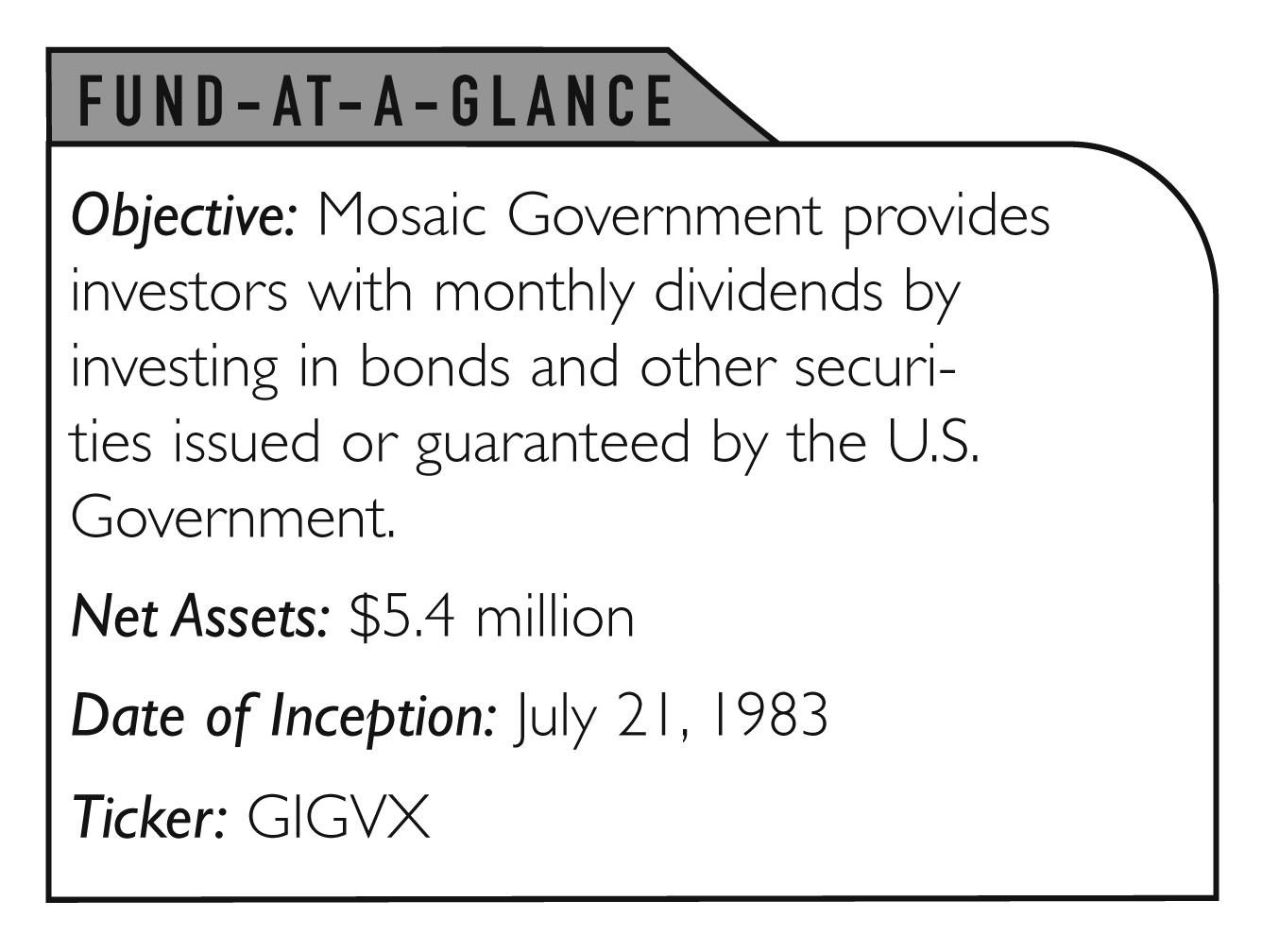

Mosaic Government Fund

Mosaic Government Fund returned 1.24% for the year ended December 31, 2003. This return was lower than the fund's peers, as the Lipper Intermediate U.S. Government Fund Index advanced 2.18%. This performance gap reflects management's defensive positioning of the portfolio at a short duration. While this positioning was not a plus over this period (nor was it a major liability, as results indicate), it does reflect Mosaic's concerns about the prospects of interest rate increases. If interest rates rise over the ensuing months, shareholders will see the benefits, since shorter bonds will retain their value far better than longer bonds.

Mosaic Government was heavily weighted towards government agency notes, whose added yields over Treasuries (spreads) continued to appeal to management. The fund's largest positions during the year were short to intermediate duration bonds issued by Freddie Mac and Fannie Mae.

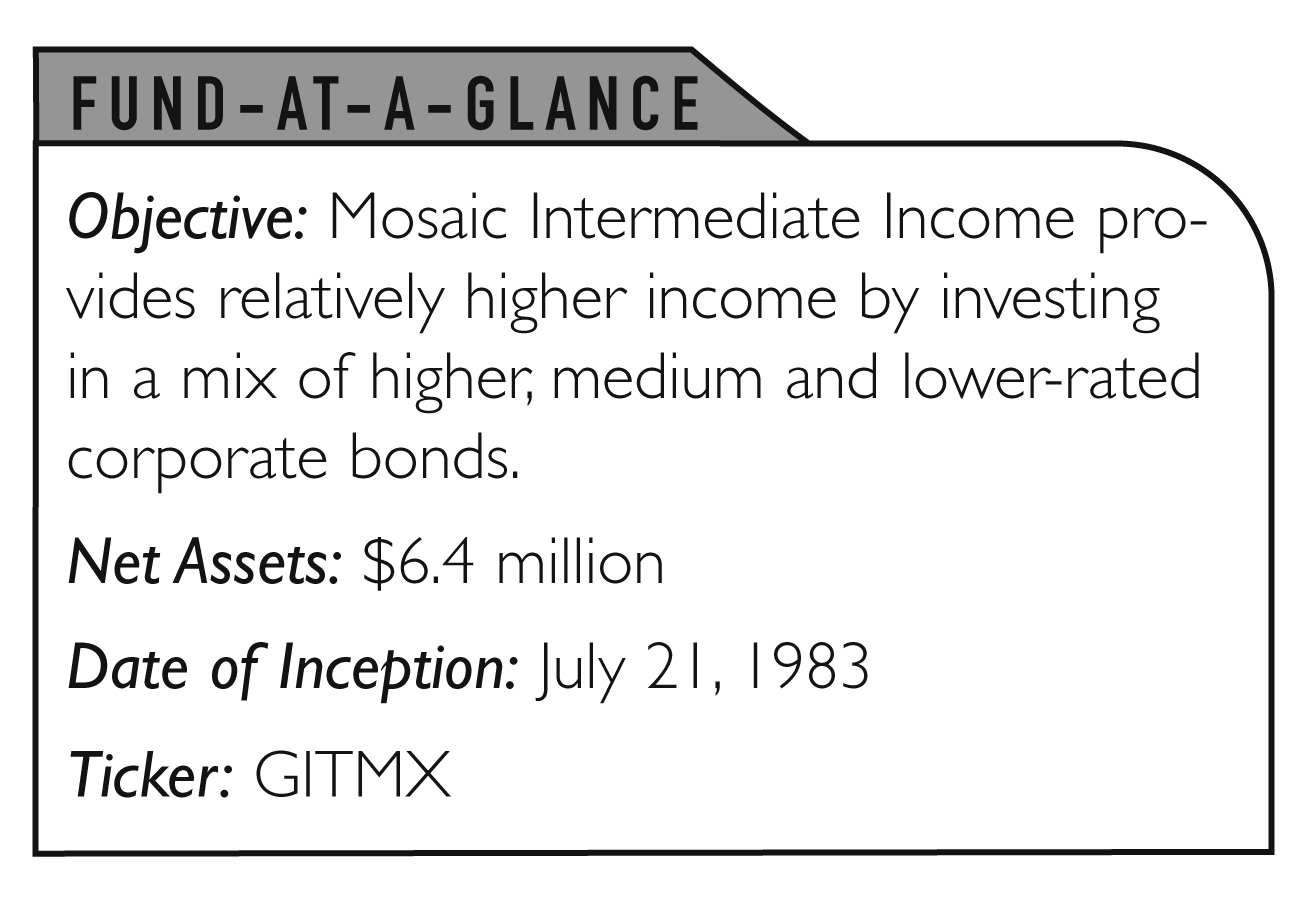

Mosaic Intermediate Income Fund

Mosaic Intermediate Income Fund returned 4.63% for the year ended December 31, 2003. Over the same period, the Lipper Intermediate Investment Grade Index was up 5.41%. The performance gap was largely a duration story, as the fund's shorter maturity was not additive over the year, as interest rates ended the year only slightly higher than where they started, despite a major drop, then rise in rates in the summer which marked the volatility during the year. However, should rates ramp up over the ensuing months, shareholders will benefit, since shorter bonds will outperform longer bonds in such an environment.

The bulk of the fund was invested in high-quality, intermediate corporate bonds throughout the period, with much of the remainder in government agency securities. Intermediate Income can invest as much as 35% in lower-rated securities. Promises of an improved economy and a rising stock market made high-yield bonds one of the hot spots in the market, and the fund benefited from its exposure to Bbb and Bb bonds. However, Bb bonds, the lowest rated bonds in the portfolio, were less than 10% of holdings through the period, reflecting management's continued concern over taking undue risks.

Looking forward, we continue to believe that a recovering economy will be a positive for corporate bonds. Corporate bond yields retain a yield advantage as well, which we expect will help overall returns and mitigate the effect of rising rates on our holdings. A rebounding economy will also buoy the prospects of lower-rated bonds, which we foresee playing a larger role in the fund's portfolio in the future.

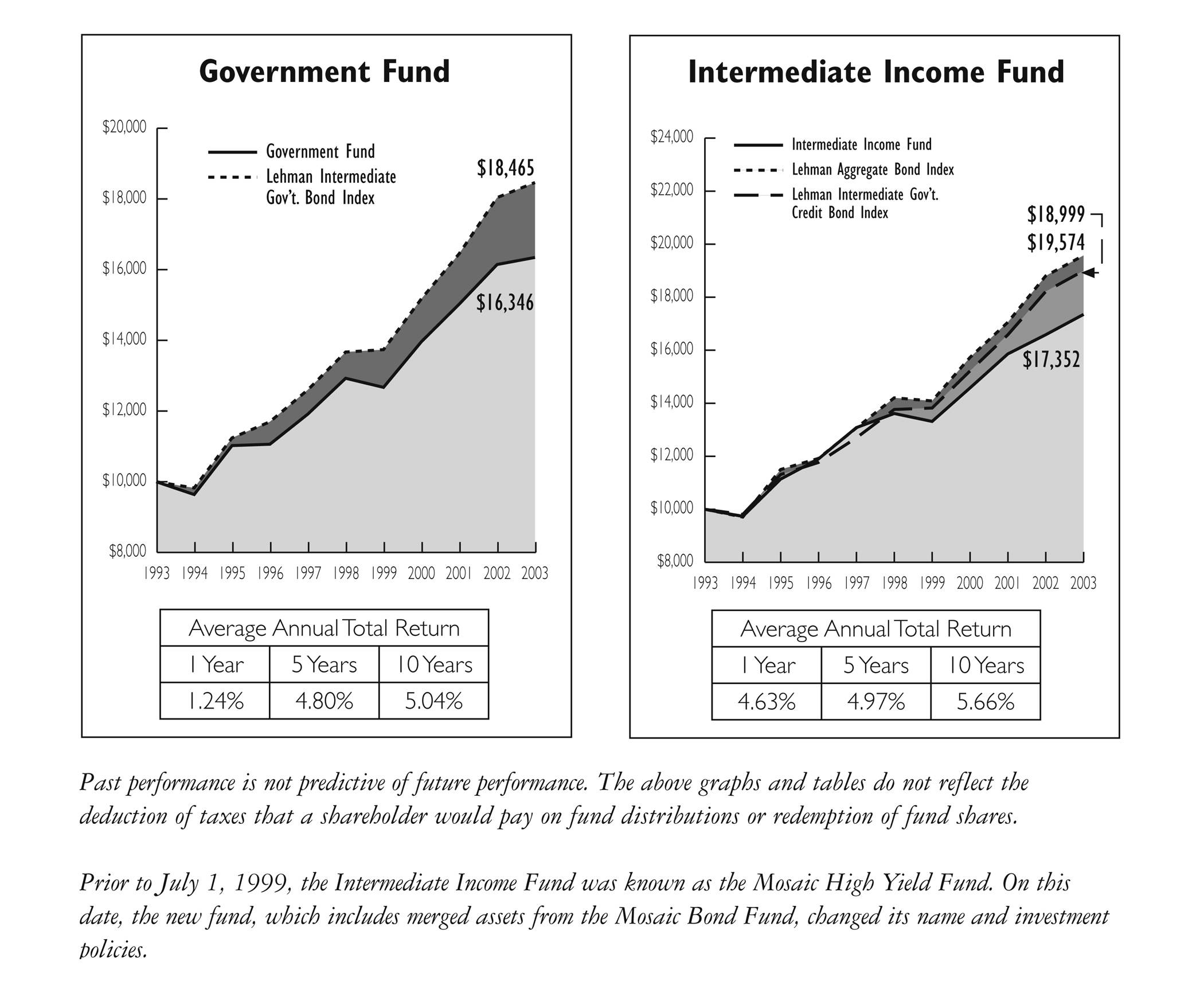

Comparison of Changes in the Value of a $10,000 Investment

To the Board of Trustees and Shareholders of Mosaic Income Trust:

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of Mosaic Government Fund and Mosaic Intermediate Income Fund (collectively, the "Funds"), two series of Mosaic Income Trust, as of December 31, 2003, the related statements of operations for the year then ended, statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds' management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2003, by correspondence with the Funds' custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the Funds as of December 31, 2003, the results of their operations, the changes in their net assets, and the financial highlights for the respective stated periods, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

(signature)

Chicago, Illinois

February 13, 2004

Government Fund - - Portfolio of Investments

Credit Rating* | Principal Amount | Value | ||

| Moody's | S&P | |||

| US GOVERNMENT & AGENCY OBLIGATIONS: 96.0% of net assets | ||||

| US GOVERNMENT AGENCY NOTES: 63.6% | ||||

| Aaa | AAA | Fannie Mae, 6.5%, 8/15/04 | $250,000 | $258,149 |

| Aaa | AAA | Fannie Mae, 7.125%, 2/15/05 | 400,000 | 425,400 |

| Aaa | AAA | Fannie Mae, 5.75%, 6/15/05 | 350,000 | 371,082 |

| Aaa | AAA | Fannie Mae, 6%, 12/15/05 | 300,000 | 323,213 |

| Aaa | AAA | Fannie Mae, 6.42%, 3/9/09 | 300,000 | 302,830 |

| Aaa | AAA | Fannie Mae, 6.375%, 6/15/09 | 175,000 | 198,121 |

| Aaa | AAA | Fannie Mae, 5.5%, 10/18/11 | 200,000 | 203,945 |

| Aaa | AAA | Freddie Mac, 6.875%, 1/15/05 | 230,000 | 243,050 |

| Aaa | AAA | Freddie Mac, 3.5%, 9/15/07 | 350,000 | 356,352 |

| Aaa | AAA | Freddie Mac, 5.125%, 10/15/08 | 250,000 | 268,376 |

| Aaa | AAA | Freddie Mac, 5.5%, 9/15/11 | 425,000 | 457,652 |

| US TREASURY NOTES: 16.0% | ||||

| Aaa | AAA | US Treasury Notes, 5.875%, 11/15/05 | 400,000 | 430,547 |

| Aaa | AAA | US Treasury Notes, 4.625%, 5/15/06 | 400,000 | 424,063 |

| MORTGAGE BACKED SECURITIES: 16.4% | ||||

| Aaa | AAA | Fannie Mae, Mortgage Pool #555345, 5.5%, 2/1/18 | 169,987 | 176,420 |

| Aaa | AAA | Fannie Mae, Mortgage Pool #636758, 6.5%, 5/1/32 | 103,859 | 108,667 |

| Aaa | AAA | Fannie Mae, Mortgage Pool #254346, 6.5%, 6/1/32 | 91,026 | 95,241 |

| Aaa | AAA | Fannie Mae, Mortgage Pool #254405, 6%, 8/1/32 | 135,600 | 140,268 |

| Aaa | AAA | Freddie Mac, Mortgage Pool, Gold Pass Through Certificates #E57247, 6.5%, 3/1/09 | 74,012 | 78,557 |

| Aaa | AAA | Freddie Mac, Mortgage Pool, Gold Pass Through Certificates #E90778, 5.5%, 8/1/17 | 125,795 | 130,517 |

| Aaa | AAA | Freddie Mac, Mortgage Pool, Gold Pass Through Certificates #C01364, 6.5%, 6/1/32 | 90,972 | 95,323 |

| Aaa | AAA | Government National Mortgage Association II, Guaranteed Pass Through Certificates #2483, 7%, 9/20/27 | 50,666 | 53,972 |

| TOTAL US GOVERNMENT & AGENCY OBLIGATIONS (Cost $5,023,298) | $5,141,745 | |||

| REPURCHASE AGREEMENT: 3.2% of net assets With Morgan Stanley and Company issued 12/31/03 at 0.65%, due 1/2/04, collateralized by $172,413 in United States Treasury Notes due 11/15/18. Proceeds at maturity are $169,006 (Cost $169,000). | $169,000 | |||

| TOTAL INVESTMENTS: 99.2% of net assets (Cost $5,192,298) | $5,310,745 | |||

| CASH AND RECEIVABLES LESS LIABILITIES: 0.8% of net assets | 44,772 | |||

| NET ASSETS: 100.0% | $5,355,517 | |||

Intermediate Income Fund - Portfolio of Investments

Credit Rating* | Principal Amount | Value | ||

| Moody's | S&P | |||

| CORPORATE DEBT SECURITIES: 66.1% of net assets | ||||

| CONSUMER STAPLES: 9.0% | ||||

| A2 | A | Coca-Cola Enterprise, 5.25%, 5/15/07 | $150,000 | $161,034 |

| A3 | BBB+ | Kraft Foods Inc., 4.625% 11/1/06 | 200,000 | 208,844 |

| Baa2 | BBB | Safeway, Inc., 4.8%, 7/16/07 | 200,000 | 207,754 |

| ENERGY: 1.7% | ||||

| Baa3 | BBB | Oryx Energy Company, 8.125%, 10/15/05 | 100,000 | 108,924 |

| FINANCIALS: 12.8% | ||||

| A3 | A | Countrywide Home Loan, 5.625% 5/15/07 | 100,000 | 108,043 |

| Baa1 | A- | Equifax, 6.3%, 7/1/05 | 150,000 | 159,363 |

| A1 | A | Household Finance Co., 7.875%, 3/1/07 | 150,000 | 171,538 |

| A1 | AA- | International Lease Finance, 5.75%, 10/15/06 | 200,000 | 215,317 |

| Aa3 | A+ | Morgan Stanley & Company, 6.875%, 3/1/07 | 150,000 | 168,912 |

| HEALTH CARE: 2.2% | ||||

| Ba3 | BB+ | Amerisourcebergen Co., 8.125%, 9/1/08 | 125,000 | 141,563 |

| INDUSTRIAL: 16.5% | ||||

| Ba3 | BB+ | American Standard, 7.375%, 2/1/08 | 175,000 | 194,250 |

| Baa1 | BBB+ | Chevron Phillips, 5.375%, 6/15/07 | 200,000 | 213,101 |

| A3 | BBB | Daimler Chrysler, 6.4%, 5/15/06 | 150,000 | 160,799 |

| BBB- | A3 | Ford Motor Credit, 6.875%, 2/1/06 | 150,000 | 160,174 |

| Ba1 | BBB- | Watson Pharmaceutical, 7.125%, 5/15/08 | 150,000 | 161,149 |

| Ba1 | BB+ | YUM! Brands Inc., 7.65%, 5/15/08 | 150,000 | 171,000 |

| INSURANCE: 8.0% | ||||

| Baa1 | BBB | Harleysville Group, 5.75%, 7/15/13 | 150,000 | 141,697 |

| Baa3 | BBB- | Markel Corp., 6.8%, 2/15/13 | 150,000 | 158,497 |

| A1 | A | MGIC Investment Corp., 6.0%, 3/15/07 | 200,000 | 215,144 |

| RETAILERS-APPAREL: 3.1% | ||||

| A3 | A- | Kohl's Corporation, 6.7%, 2/1/06 | 185,000 | 201,380 |

| TECHNOLOGY: 6.3% | ||||

| A2 | A | Computer Sciences Co., 7.5%, 8/8/05 | 175,000 | 190,191 |

| Baa1 | BBB | Lexmark International, 6.75%, 5/15/08 | 200,000 | 216,833 |

| TELECOMMUNICATIONS: 6.0% | ||||

| Baa3 | BBB | AT&T Broadband, 8.375%, 3/15/13 | $181,000 | $221,908 |

| Baa3 | BBB- | Sprint Capital Corp., 6.125%, 11/15/08 | 150,000 | 160,083 |

| UTILITIES: 0.5% | ||||

| A2 | BBB+ | Wisconsin Power & Light, 7.625%, 3/1/10 | 25,000 | 29,001 |

| TOTAL CORPORATE DEBT SECURITIES (Cost $4,009,662) | $4,246,499 | |||

| COLLATERALIZED MORTGAGE OBLIGATIONS: 2.3% of net assets | ||||

| Aaa | AAA | Federal National Mortgage Association, Mortgage Pool #636758, 6.5%, 5/1/32 | 138,478 | 144,890 |

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $139,712) | $144,890 | |||

| US GOVERNMENT & AGENCY OBLIGATIONS: 27.5% of net assets | ||||

| Aaa | AAA | Fannie Mae, 7.125%, 2/15/05 | 250,000 | 265,875 |

| Aaa | AAA | Fannie Mae, 6.0%, 12/15/05 | 300,000 | 323,213 |

| Aaa | AAA | Fannie Mae, 6.04%, 2/25/09 | 500,000 | 503,456 |

| Aaa | AAA | Freddie Mac, 6.25%, 7/15/04 | 450,000 | 462,267 |

| Aaa | AAA | US Treasury Note, 4.625%, 5/15/06 | 200,000 | 212,032 |

| TOTAL US GOVERNMENT & AGENCY OBLIGATIONS (Cost $1,745,366) | $1,766,843 | |||

| REPURCHASE AGREEMENT: 2.1% of net assets With Morgan Stanley and Company issued 12/31/03 at 0.65%, due 1/2/04, collateralized by $139,767 in United States Treasury Notes due 11/15/18. Proceeds at maturity are $137,005 (Cost $137,000). | 137,000 | |||

| TOTAL INVESTMENTS: 98.0% of net assets (Cost $6,031,740) | $6,295,232 | |||

| CASH AND RECEIVABLES LESS LIABILITIES: 2.0% of net assets | 132,400 | |||

| NET ASSETS: 100.0% | $6,427,632 | |||

Notes to the Portfolio of Investments:

* - Unaudited; Moody's - Moody's Investors Services, Inc.; S&P - Standard & Poor's Corporation

Statements of Assets and Liabilities

Government Fund | Intermediate Income Fund | |

| ASSETS | ||

| Investments, at value (Note 1 and 2) | ||

| mInvestment securities | $5,141,745 | $6,158,232 |

| mRepurchase agreements | 169,000 | 137,000 |

| mTotal investments* | 5,310,745 | 6,295,232 |

| Cash | 662 | 895 |

| Receivables | ||

| mInterest | 57,559 | 104,292 |

| mCapital shares sold | -- | 41,500 |

| Total assets | 5,368,966 | 6,441,919 |

| LIABILITIES | ||

| mCapital shares redeemed | 13,449 | 14,287 |

| Total liabilities | 13,449 | 14,287 |

| NET ASSETS (Note 7) | $5,355,517 | $6,427,632 |

| CAPITAL SHARES OUTSTANDING | 516,952 | 958,365 |

| NET ASSET VALUE PER SHARE | $10.36 | $6.71 |

| *INVESTMENT SECURITIES, AT COST | $5,192,298 | $6,031,740 |

Statements of Operations

For the year ended December 31, 2003

Government Fund | Intermediate Income Fund | |

| INVESTMENT INCOME (Note 1) | ||

| mInterest income | $245,935 | $324,110 |

| EXPENSES (Notes 3 and 5) | ||

| mInvestment advisory fees | 34,428 | 41,899 |

| mOther expenses | 28,644 | 30,167 |

| Total Expenses | 63,072 | 72,066 |

| NET INVESTMENT INCOME | $182,863 | $252,044 |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||

| mNet realized gain on investments | 27,355 | 112,890 |

| mChange in net unrealized appreciation (depreciation) of investments | (148,067) | (63,997) |

| NET GAIN (LOSS) ON INVESTMENTS | $(120,712) | $48,893 |

| TOTAL INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $62,151 | $300,937 |

Statements of Changes in Net Assets

For the year indicated

Government Fund | Intermediate Income Fund | |||

Year Ended Dec. 31, | Year Ended Dec. 31, | |||

2003 | 2002 | 2003 | 2002 | |

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | ||||

| mNet investment income | $182,863 | $218,496 | $252,044 | $309,712 |

| mNet realized gain (loss) on investments | 27,355 | 121,793 | 112,890 | (243,364) |

| mChange in net unrealized appreciation (depreciation) on investments | (148,067) | 57,851 | (63,997) | 234,731 |

| Total increase in net assets resulting from operations | 62,151 | 398,140 | 300,937 | 301,079 |

| DISTRIBUTION TO SHAREHOLDERS | ||||

| mFrom net investment income | (182,863) | (218,496) | (252,044) | (309,712) |

| CAPITAL SHARE TRANSACTIONS (Note 8) | (462,703) | 477,058 | (460,625) | 580,526 |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | (583,415) | 656,702 | (411,732) | 571,893 |

| NET ASSETS | ||||

| Beginning of year | $5,938,932 | $5,282,230 | $6,839,364 | $6,267,471 |

| End of year | $5,355,517 | $5,938,932 | $6,427,632 | $6,839,364 |

| UNDISTRIBUTED NET INVESTMENT INCOME | $-- | $-- | $-- | $-- |

Financial Highlights

(Selected data for a share outstanding throughout each year indicated)

GOVERNMENT FUND

Year Ended December 31, | |||||

2003 | 2002 | 2001 | 2000 | 1999 | |

| Net asset value, beginning of year | $10.58 | $10.24 | $9.97 | $9.54 | $10.22 |

| Investment operations: | |||||

| mNet investment income | 0.35 | 0.41 | 0.48 | 0.51 | 0.48 |

| mNet realized and unrealized gain (loss) on investments | (0.22) | 0.34 | 0.27 | 0.43 | (0.68) |

| Total from investment operations | 0.13 | 0.75 | 0.75 | 0.94 | (0.20) |

| mLess distributions from net investment income | (0.35) | (0.41) | (0.48) | (0.51) | (0.48) |

| Net asset value, end of year | $10.36 | $10.58 | $10.24 | $9.97 | $9.54 |

| Total return (%) | 1.24 | 7.45 | 7.62 | 10.19 | (1.99) |

| Ratios and supplemental data | |||||

| Net assets, end of year (thousands) | $5,356 | $5,939 | $5,282 | $5,149 | $5,206 |

| mRatio of expenses to average net assets (%) | 1.15 | 1.14 | 1.15 | 1.15 | 1.14 |

| mRatio of net investment income to average net assets (%) | 3.32 | 3.92 | 4.67 | 5.31 | 4.86 |

| mPortfolio turnover (%) | 31 | 44 | 34 | 33 | 12 |

INTERMEDIATE INCOME FUND

Year Ended December 31, | |||||

2003 | 2002 | 2001 | 2000 | 1999 | |

| Net asset value, beginning of year | $6.66 | $6.67 | $6.48 | $6.31 | $6.92 |

| Investment operations: | |||||

| mNet investment income | 0.25 | 0.30 | 0.37 | 0.40 | 0.46 |

| mNet realized and unrealized gain (loss) on investments | 0.05 | (0.01) | 0.19 | 0.17 | (0.61) |

| Total from investment operations | 0.30 | 0.29 | 0.56 | 0.57 | (0.15) |

| mLess distributions from net investment income | (0.25) | (0.30) | (0.37) | (0.40) | (0.46) |

| Net asset value, end of year | $6.71 | $6.66 | $6.67 | $6.48 | $6.31 |

| Total return (%) | 4.63 | 4.56 | 8.81 | 9.49 | (2.20) |

| Ratios and supplemental data | |||||

| Net assets, end of year (thousands) | $6,428 | $6,839 | $6,267 | $4,286 | $5,195 |

| mRatio of expenses to average net assets (%) | 1.08 | 1.07 | 1.07 | 1.08 | 1.11 |

| mRatio of net investment income to average net assets (%) | 3.76 | 4.61 | 5.61 | 6.43 | 6.97 |

| mPortfolio turnover (%) | 36 | 54 | 28 | 18 | 63 |

1. Summary of Significant Accounting Policies. Mosaic Income Trust (the "Trust") is registered with the Securities and Exchange Commission under the Investment Company Act of 1940 as an open-end, diversified investment management company. This report contains information about two separate funds (the "Funds") whose objective is to receive and distribute bond income. The Government Fund invests in securities of the U. S. Govern-ment and its agencies. The Intermediate Income Fund invests in investment grade corporate, government and government agency fixed income securities. The Intermediate Income Fund may also invest a portion of its assets in securities rated as low as "B" by Moody's Investors Service, Inc. or Standard & Poor's Corporation. A third Mosaic Income Trust portfolio, available to certain institutional investors (as defined in the fund's prospectus) presents its financial information in a separate report.

Securities Valuation: Repurchase agreements and other securities having maturities of 60 days or less are valued at amortized cost, which approximates market value. Securities having longer maturities, for which market quotations are readily available, are valued at the mean between their closing bid and asked prices. Securities for which current market quotations are not readily available are valued at their fair value as determined in good faith by the Board of Trustees.

Investment Transactions: Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and federal income tax purposes.

Investment Income: Interest income is recorded on an accrual basis. Bond premium is amortized and original issue discount and market discount are accreted over the expected life of each applicable security. Other income is accrued as earned.

Distribution of Income and Gains: Net investment income, determined as gross investment income less total expenses, is declared as a regular dividend and distributed to shareholders monthly. Capital gains distributions, if any, are declared and paid annually at year end.

The tax character of distributions paid during 2003 and 2002 was as follows:

2003 | 2002 | |

| Government Fund: | ||

| Distributions paid from | ||

| mOrdinary Income | $182,863 | $218,496 |

| Intermediate Income Fund: | ||

| Distributions paid from | ||

| mOrdinary Income | $252,044 | $309,712 |

As of December 31, 2003, the components of distributable earnings on a tax basis were as follows:

| Government Fund: | |

| Accumulated net realized losses | $(124,143) |

| Net unrealized appreciation on investments | 117,349 |

$b(6,794) | |

| Intermediate Income Fund: | |

| Accumulated net realized losses | $(1,053,564) |

| Net unrealized appreciation on investments | 263,492 |

$b(790,072) |

Net realized gains or losses may differ for financial and tax reporting purposes as a result of loss deferrals related to wash sales and post-October transactions.

Income Tax: No provision is made for Federal income taxes since it is the intention of the Trust to comply with the provisions of the Internal Revenue Code available to investment companies and to make the requisite distribu-tion to shareholders of taxable income which will be sufficient to relieve it from all or substantially all Federal income taxes. As of December 31, 2003, the Government and Intermediate Income Funds had available for federal income tax purposes the following unused capital loss carryovers:

| Expiration Date | Government Fund | Intermediate Income Fund |

| December 31, 2004 | $44,628 | $b-- |

| December 31, 2005 | 64,210 | -- |

| December 31, 2006 | -- | 221,284 |

| December 31, 2007 | 9,847 | 486,268 |

| December 31, 2008 | 5,458 | 89,747 |

| December 31, 2009 | -- | 12,901 |

| December 31, 2010 | -- | 243,364 |

A portion of the Intermediate Income Fund's capital loss carryovers were acquired through its merger with Mosaic Bond Fund on July 1, 1999, and are subject to certain limitations.

Due to inherent differences in the recognition of income, expenses, and realized gains/losses under generally accepted accounting principles and federal income tax purposes, permanent differences between financial and tax basis reporting for the 2003 fiscal year have been identified and appropriately reclassified. In the Government Fund, permanent differences relating to the expiration of capital loss carryover totaling $59,684 were reclassified from accumulated net realized losses to net paid in capital on shares of beneficial interest.

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. Investments in Repurchase Agreements. When the Trust purchases securities under agreements to resell, the securities are held for safekeeping by the Trust's custodian bank as collateral. Should the market value of the securities purchased under such an agreement decrease below the principal amount to be received at the termination of the agreement plus accrued interest, the counterparty is required to place an equivalent amount of additional securities in safekeeping with the Trust's custodian bank. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the Trust, along with other registered investment companies having Advisory and Services Agreements with the same advisor, transfers uninvested cash balances into a joint trading account. The aggregate balance in this joint trading account is invested in one or more consolidated repurchase agreements whose underlying securities are U.S. Treasury or federal agency obligations. The Government Fund has approximately a 1.2% interest and the Intermediate Income Fund has approximately a 1.0% interest in the consolidated repurchase agreement of $13,978,000 collateralized by $14,260,321 in United States Treasury Notes. Proceeds at maturity are $13,978,505.

3. Investment Advisory Fees and Other Transactions with Affiliates. The investment advisor to the Trust, Madison Mosaic, LLC, a wholly owned subsidiary of Madison Investment Advisors, Inc., (collectively "the Advisor"), earns an advisory fee equal to 0.625% per annum of the average net assets of each of the Funds; the fees are accrued daily and are paid monthly.

4. Investment Transactions. Purchases and sales of securities (excluding short-term securities) for the year ended December 31, 2003 were as follows:

Purchases | Sales | |

| Government Fund: | ||

| U.S. Gov't Securities | $1,612,618 | $2,009,769 |

| Other | -- | -- |

| Intermediate Income Fund: | ||

| U.S. Gov't Securities | $737,192 | $985,104 |

| Other | $1,545,109 | $1,497,501 |

5. Other Expenses. Under a separate Services Agreement, the Advisor will provide or arrange for each Fund to have all other necessary operational and support services for a fee based on a percentage of average net assets. This percentage is 0.52% for the Government Fund and 0.45% for the Intermediate Income Fund. These fees are accrued daily and paid monthly.

The Advisor is also responsible for the fees and expenses of Trustees and for certain promotional expenses.

6. Aggregate Cost and Unrealized Appreciation (Depreciation). The aggregate cost for federal income tax purposes and the net unrealized appreciation (depreciation) are stated as follows as of December 31, 2003:

Government Fund | Intermediate Income Fund | |

| Aggregate Cost | $5,193,396 | $6,031,740 |

| Gross unrealized appreciation | 138,335 | 272,047 |

| Gross unrealized depreciation | (20,986) | (8,555) |

| Net unrealized appreciation | $b117,349 | $b263,492 |

7. Net Assets. At December 31, 2003, net assets include the following:

Government Fund | Intermediate Income Fund | |

| Net paid in capital on shares of beneficial interest | $5,362,311 | $7,217,704 |

| Accumulated net realized losses | (125,241) | (1,053,564) |

| Net unrealized appreciation on investments | 118,447 | 263,492 |

| Total net assets | $5,355,517 | $6,427,632 |

8. Capital Share Transactions. An unlimited number of capital shares, without par value, are authorized. Transactions in capital shares for the following periods were:

Government Fund

Year Ended December 31, | ||

2003 | 2002 | |

| In Dollars | ||

| Shares sold | $563,828 | $742,989 |

| Shares issued in reinvestment of dividends | 170,488 | 203,056 |

| Total shares issued | 734,316 | 946,045 |

| Shares redeemed | (1,197,019) | (468,987) |

| Net increase (decrease) | $(462,703) | $477,058 |

| In Shares | ||

| Shares sold | 53,363 | 71,612 |

| Shares issued in reinvestment of dividends | 16,279 | 19,563 |

| Total shares issued | 69,642 | 91,175 |

| Shares redeemed | (114,189) | (45,294) |

| Net increase (decrease) | (44,547) | 45,881 |

Intermediate Income Fund

Year Ended December 31, | ||

2003 | 2002 | |

| In Dollars | ||

| Shares sold | $988,002 | $1,614,253 |

| Shares issued in reinvestment of dividends | 220,413 | 265,769 |

| Total shares issued | 1,208,415 | 1,880,022 |

| Shares redeemed | (1,669,040) | (1,299,496) |

| Net increase (decrease) | $(460,625) | $580,526 |

| In Shares | ||

| Shares sold | 146,878 | 244,360 |

| Shares issued in reinvestment of dividends | 32,859 | 40,452 |

| Total shares issued | 179,737 | 284,812 |

| Shares redeemed | (248,332) | (197,486) |

| Net increase (decrease) | (68,595) | 87,326 |

Management Information (unaudited)

Independent Trustees

| Name, Address and Age | Position(s) Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen | Other Directorships Held |

| Philip E. Blake 550 Science Drive Madison, WI 53711 Born 11/07/1944 | Trustee | Indefinite Term since May 2001 | Retired investor; formerly publisher of Madison's Wisconsin State Journal newspaper. | All 12 Mosaic Funds | Madison Newspapers, Inc. of Madison, WI |

| James R. Imhoff, Jr. 550 Science Drive Madison, WI 53711 Born 5/20/1944 | Trustee | Indefinite Term since July 1996 | Chairman and CEO of First Weber Group, Inc. (real estate brokers) of Madison, WI. | All 12 Mosaic Funds | None |

| Lorence D. Wheeler550 Science Drive Madison, WI 53711 Born 1/31/1938 | Trustee | Indefinite Term since July 1996 | Retired investor; formerly Pension Specialist for CUNA Mutual Group (insurance) and President of Credit Union Benefits Services, Inc. (a provider of retirement plans and related services for credit union employees nationwide). | All 12 Mosaic Funds | None |

Interested Trustees*

| Frank E. Burgess 550 Science Drive Madison, WI 53711 Born 8/04/1942 | Trustee and Vice President | Indefinite Terms since July 1996 | Founder, President and Director of Madison Investment Advisors, Inc. | All 12 Mosaic Funds | None |

| Katherine L. Frank 550 Science Drive Madison, WI 53711 Born 11/27/1960 | Trustee and President | Indefinite Terms President since July 1996, Trustee since May 2001 | Principal and Vice President of Madison Investment Advisors, Inc. and President of Madison Mosaic, LLC | All 12 Mosaic Funds, but does not serve as Trustee of Mosaic Equity Trust | None |

Officers*

| Jay R. Sekelsky 550 Science Drive Madison, WI 53711 Born 9/14/1959 | Vice President | Indefinite Term since July 1996 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 12 Mosaic Funds | None |

| Christopher Berberet 550 Science Drive Madison, WI 53711 Born 7/31/1959 | Vice President | Indefinite Term since July 1996 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 12 Mosaic Funds | None |

| W. Richard Mason 8777 N. Gainey Center Drive, #220 Scottsdale, AZ 85258Born 5/13/1960 | Secretary and General Counsel | Indefinite Terms since November 1992 | Principal of Mosaic Funds Distributor, LLC; General Counsel for Madison Investment Advisors, Madison Scottsdale, LC and Madison Mosaic, LLC | All 12 Mosaic Funds | None |

| Greg Hoppe 550 Science Drive Madison, WI 53711 Born 4/28/1969 | Chief Financial Officer | Indefinite Term since August 1999 | Vice President of Madison Mosaic, LLC; formerly CFO of Amcore Bank-South Central and auditor for McGladrey & Pullen accounting firm | All 12 Mosaic Funds | None |

*All interested Trustees and Officers of the Trust are employees and/or owners of Madison Investment Advisors, Inc. Since Madison Investment Advisors, Inc. serves as the investment advisor to the Trust, each of these individuals is considered an "interested person" of the Trust as the term is defined in the Investment Company Act of 1940.

The Statement of Additional Information contains more information about the Trustees and is available upon request. To request a free copy, call Mosaic Funds at 1-800-368-3195.

Forward-Looking Statement Disclosure. One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate," "may," "will," "expect," "believe," "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Proxy Voting Information. The Trust adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Fund's portfolios. These policies are available to you upon request and free of charge by writing to Mosaic Funds, 550 Science Drive, Madison, WI 53711 or by calling toll-free at 1-800-368-3195. Beginning next year, the Trust's proxy voting policies may also be obtained by visiting the Securities and Exchange Commission web site at www.sec.gov. The Trust will respond to shareholder requests for copies of our policies within two business days of request by first-class mail or other means designed to ensure prompt delivery.

Change of Independent Auditors. In October 2003, the Board of Trustees decided that, effective for the fiscal year beginning January 1, 2004, for matters relating to such fiscal years, the firm of Grant Thornton, LLP shall serve as the certifying accountant for the Trust, replacing Deloitte & Touche LLP at the conclusion of its engagement certifying the financial statements for the Trust's fiscal year ended December 31, 2003 and attendant matters related to fiscal years ended prior to December 31, 2004. For the Trust's last two fiscal years, Deloitte & Touche LLP has not issued to the Trust an adverse opinion or a disclaimer of opinion, or qualified or modified an opinion as to uncertainty, audit scope, or accounting principles. There has been no disagreement with Deloitte & Touche LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of Deloitte & Touche LLP, would have caused it to make reference to the subject matter of the disagreement in connection with its report. There have been no events listed in paragraphs (a)(1)(v)(A) through (D) of 17 CFR 229.304(a)(1).

The Mosaic Family of Mutual Funds

Mosaic Equity Trust

Mosaic Investors Fund

Mosaic Balanced Fund

Mosaic Mid-Cap Fund

Mosaic Foresight Fund

Mosaic Income Trust

Mosaic Government Fund

Mosaic Intermediate Income Fund

Mosaic Institutional Bond Fund

Mosaic Tax-Free Trust

Mosaic Arizona Tax-Free Fund

Mosaic Missouri Tax-Free Fund

Mosaic Virginia Tax-Free Fund

Mosaic Tax-Free National Fund

Mosaic Government Money Market

For more complete information on any Mosaic fund, including charges and expenses, request a prospectus by calling 1-800-368-3195. Read it carefully before you invest or send money. This document does not constitute an offering by the distributor in any jurisdiction in which such offering may not be lawfully made. Mosaic Funds Distributor, LLC.

TRANSER AGENT

Mosaic Funds

c/o US Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

TELEPHONE NUMBERS

Shareholder Service

Toll-free nationwide: 888-670-3600

Mosaic Tiles (24 hour automated information)

Toll-free nationwide: 800-336-3600

550 Science Drive

Madison, Wisconsin 53711

Mosaic Funds

www.mosaicfunds.com

SEC File Number 811-3616

ANNUAL REPORT

December 31, 2003

Mosaic Income Trust

mmMosaic Institutional Bond Fund

Mosaic Funds

www.mosaicfunds.com

Contents

| Letter to Shareholders | 1 |

| Management's Discussion of Fund Performance | |

| mReview of Period | 2 |

| mOutlook | 2 |

| mFund Overview | 3 |

| Independent Auditors' Report | 5 |

| Portfolio of Investments | 6 |

| Statement of Assets and Liabilities | 7 |

| Statement of Operations | 7 |

| Statements of Changes in Net Assets | 8 |

| Financial Highlights | 9 |

| Notes to Financial Statements | 9 |

| Management Information | 12 |

Letter to Shareholders

After three straight years in which bond investments outpaced stocks, 2003 saw modest gains for bonds, while stocks more than doubled their historic averages. This alone would not be upsetting for bond investors--after all, most of us are invested in bonds for relative safety, income and diversification. But this past June interest rates dipped to 45-year lows, and then ramped swiftly upward over the next two months. From low-point to high-point, holders of long-term bonds saw double-digit losses. Viewed in isolation, such volatility can shake the foundation of any bond investors' confidence.

However, holders of Mosaic Institutional Bond Fund suffered a fraction of this volatility. The reason: we actively manage our bond funds exposure to interest rate changes and recognizing the risk in the market, we positioned the fund near the shortest average maturity in our firm's 30-year history of bond management.

Going forward, with the economy revving up, we continue to see interest rate risk--the potential loss of value that bonds suffer when rates rise. We believe that holding bonds in today's uncertain world makes just as good of sense as ever--however, not just any bonds will do. Institutional Bond Fund is positioned for 2004 with a defensive maturity posture and an emphasis on quality holdings. In other words, we believe that holding onto the gains of the past few years in a tough bond market is just as important as capturing gains in a benign bond market.

We believe that ultimately, rising interest rates will reward our defensive positioning, and set the stage for taking advantage of higher yielding bonds. We appreciate the trust that you have placed in us to make these management decisions.

Sincerely,

(signature)

Katherine Frank

President

Management's Discussion of Fund Performance

As the books closed on 2003, the economy and equity markets appeared to have finally turned after a difficult few years. Meanwhile, interest rates worked their way slightly higher from a year previous, after dipping to 45-year lows in June. Rates on the benchmark 10-Year Treasury began the year at 3.82%, dove to 3.11% in mid-June, and ended the year at 4.27% after hitting a high of 4.60%. This relatively modest year-end to year-end movement in rates begs the questions: despite a dramatic improvement in the economic backdrop and less geo-political uncertainty, why have interest rates not moved higher, and what does 2004 hold? Answers can be found by examining current Fed policy and some of the factors impacting the economy.

Fourth-quarter declines in both the Consumer and Producer Price Indices highlight 2003's tame inflation backdrop. Over the course of the year, the Federal Reserve Board shifted its assessment of inflation risks from a deflationary tilt to a more balanced risk, and went on record as desiring a higher rate of inflation. This positive price-pressure backdrop should keep short-term interest rates low and the yield curve steep in the first half of 2004. In other words, short-term rates will likely continue to be considerably lower than longer term rates.

With the benign inflation outlook and declining labor costs, the Fed went on record as desiring to keep monetary policy stimulative until unused productive capacity diminishes and the labor market enters a period of sustained job creation. Manufacturing capacity utilization, which is a measure of how fully industry is using its facilities, ended the year at a low 75.8%, and the unemployment rate was well above the level of full employment.

Low employment costs should help corporate profits to continue to improve at a rapid pace until a labor market recovery takes hold and wages begin to rise. We also expect that buoyant economic growth over the next year will close the "capacity gap" and the Fed will be forced to reevaluate its pro-growth stance later in 2004. As much as anything else, the Fed's stance in 2003 allowed rates to remain low despite strengthening economic growth.

As we enter 2004, economic activity suggests a strong and sustainable recovery. Record monetary and fiscal stimulus is working, with third quarter real GDP advancing at an 8.2% annual rate and the fourth quarter growing near 5%. Growth is broad-based, with advancing capital spending, improving inventory stockpiles, strong housing, and stable consumption expenditures. Although the 8%+ pace is unlikely to persist, growth in 2004 should be above trend and, if so, will help to shrink the capacity overhang plaguing the economy and concerning the Fed. With global demand picking up, inventories lean, and the manufacturing work week growing, producers should add jobs in 2004. Increasing global demand has pushed commodities prices higher--a classic precursor to an inflation upswing. By the second half of 2004, the Fed may very well get its wish for inflation which should soon lead to higher rates.

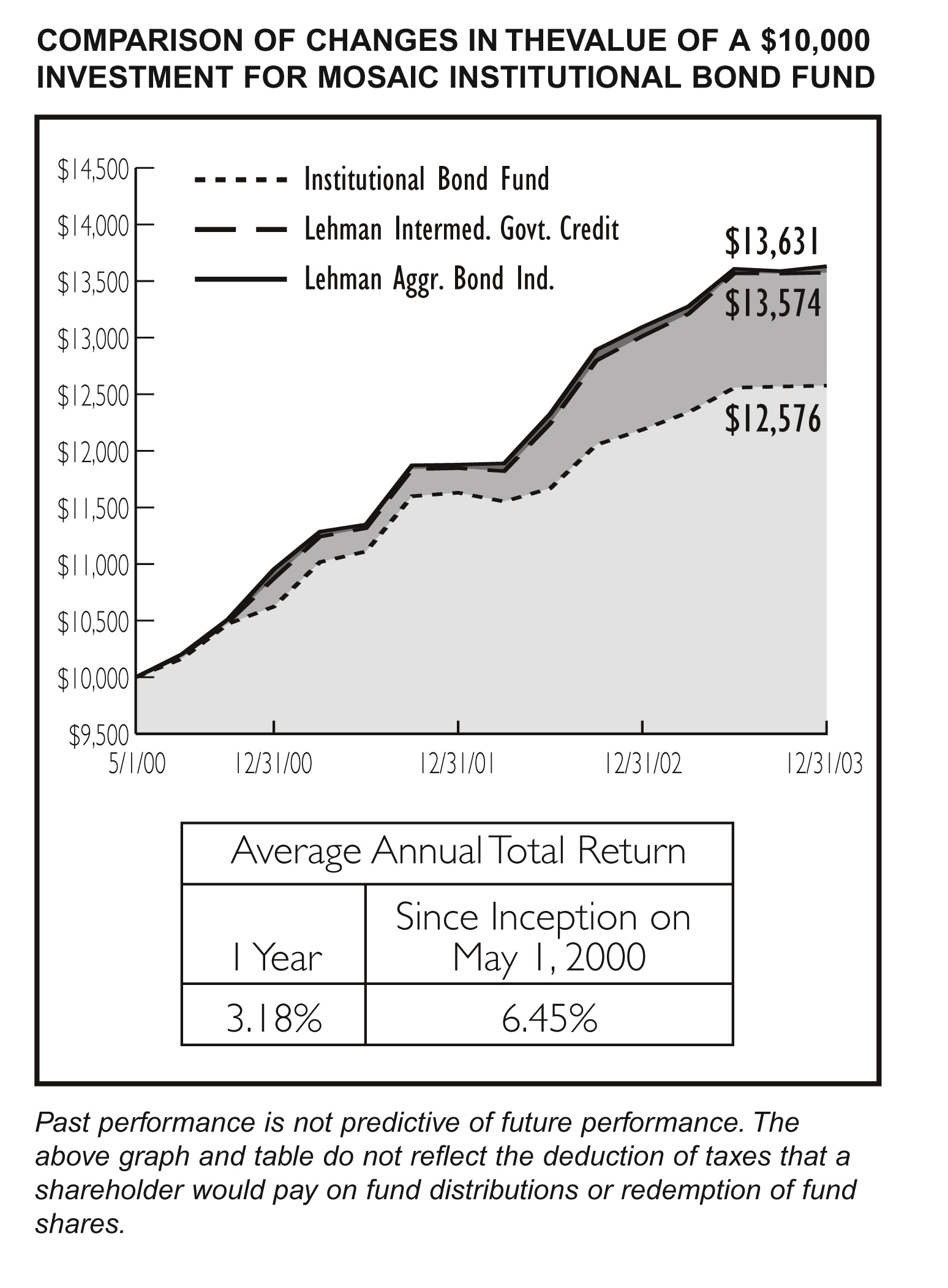

Mosaic Institutional Bond Fund returned 3.18% for the year ended December 31, 2003. This return was lower than the fund's peers, as the Lipper Intermediate Investment Grade Index advanced 5.41%. This performance gap reflects management's defensive positioning of the portfolio at a short duration. While this positioning was not additive during this period, it does demonstrate Mosaic's concerns about the prospects of interest rate increases. If interest rates rise over the ensuing months, shareholders will see the benefits, since shorter bonds will retain their value far better than longer bonds.

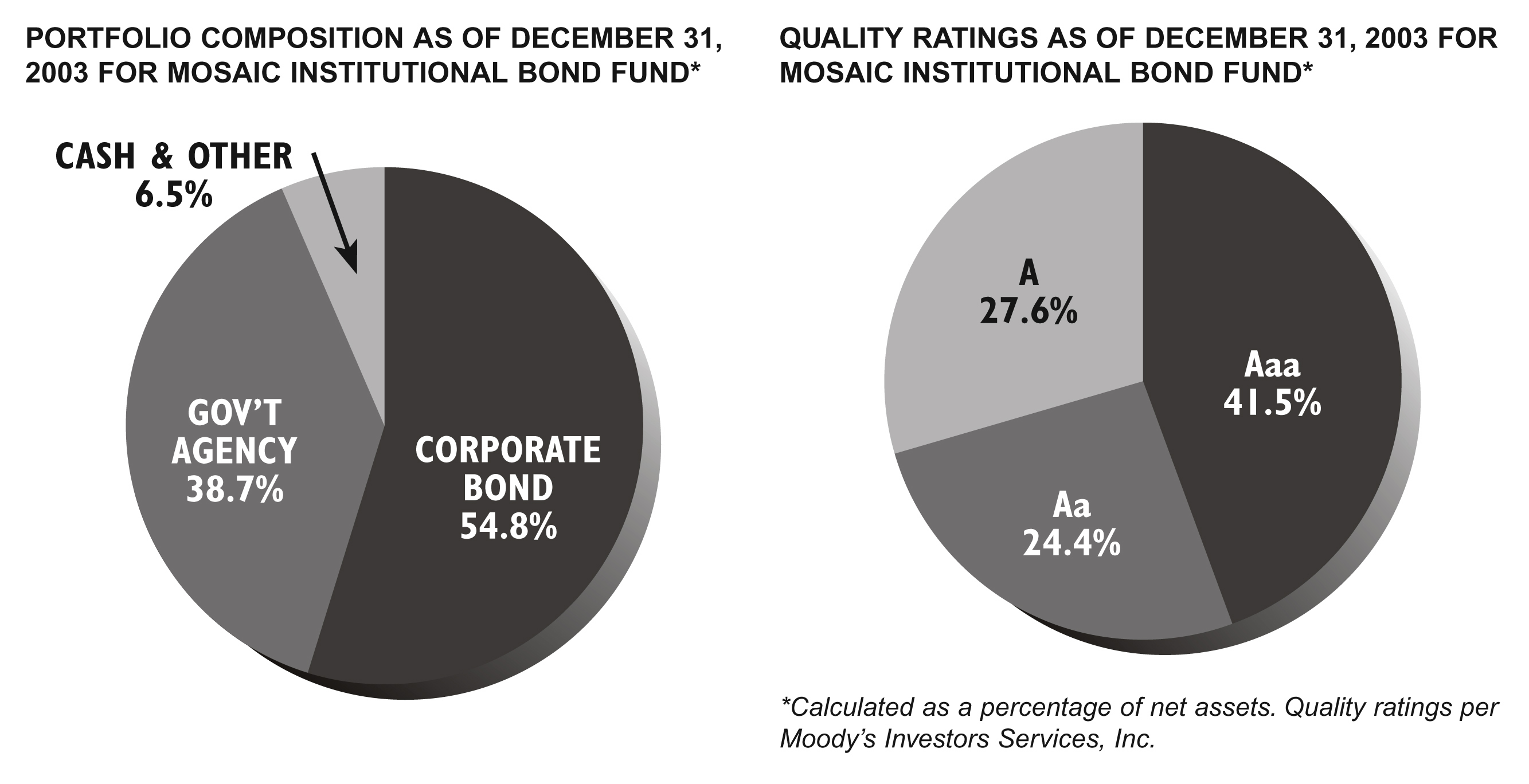

The Fund was similarly positioned throughout the year, with its highest weighting in investment-grade corporate bonds. The Fund began the year with a 59.5% exposure to bonds in this category and finished the year with a 54.8% exposure. The bulk of the rest of the portfolio was invested in government agency bonds.

The duration was kept quite short throughout the year, with the year beginning at 2.21 and ending at 2.32. Average maturity of the holdings started the year at 2.93 and ending at 2.58. The 30-day SEC yield drifted slightly lower through the course of the year, from 2.74% to 2.36% at year end.

By year end the broad signs of economic expansion only increased concerns about rates rising. Preserving capital in these kinds of environments is a high priority for the managers of Institutional Bond. It will take some time for all of these effects of economic expansion to work their way through the economy and eventually cause the Federal Reserve Board to raise rates from their current historic lows. At that point it will become possible to entertain lengthening the duration of the portfolio.

Independent Auditors' Report

To the Board of Trustees and Shareholders of Mosaic Income Trust:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of Mosaic Institutional Bond Fund (the "Fund"), a series of Mosaic Income Trust, as of December 31, 2003, the related statement of operations for the year then ended, statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three years in the period then ended and for the period from May 1, 2000 through December 31, 2000. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2003, by correspondence with the Fund's custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Mosaic Institutional Bond Fund as of December 31, 2003, the results of its operations, the changes in its net assets, and the financial highlights for the respective stated periods, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

(signature)

Chicago, Illinois

February 13, 2004

| Credit Rating* | Principal Amount | Value | ||

| Moody's | S&P | |||

| DEBT INSTRUMENTS: 93.5% of net assets | ||||

| Corporate Obligations: 54.8% | ||||

| A1 | A+ | American Express, 5.5%, 9/12/06 | $155,000 | $166,903 |

| Aa3 | A | Bank One Corp, 6.875%, 8/1/06 | 150,000 | 165,976 |

| Aa1 | AA- | Citigroup Inc, 5.75%, 5/10/06 | 200,000 | 215,364 |

| A2 | A | Coca-Cola Enterprise, 5.25%, 5/15/07 | 200,000 | 214,712 |

| A2 | A | Computer Sciences Co, 7.5%, 8/8/05 | 185,000 | 201,059 |

| A3 | A- | CONOCO Inc, 6.35%, 4/15/09 | 205,000 | 230,237 |

| A3 | BBB- | Ford Motor Credit, 6.875%, 2/1/06 | 150,000 | 160,174 |

| Aaa | AAA | General Electric Corp, 4.625%, 9/15/09 | 200,000 | 208,169 |

| Aa3 | A+ | Goldman Sachs, 6.65%, 5/15/09 | 185,000 | 209,501 |

| A1 | A | Household Finance Co, 7.875%, 3/1/07 | 185,000 | 211,564 |

| A1 | AA- | International Lease Finance, 5.75%, 10/15/06 | 200,000 | 215,317 |

| A3 | A- | Kohl's Corporation, 6.7%, 2/1/06 | 190,000 | 206,823 |

| Aa3 | NA | Merrill Lynch, 7%, 1/15/07 | 200,000 | 220,626 |

| A1 | A | MGIC Investment Corp, 7.5%, 10/15/05 | 175,000 | 190,879 |

| Aa3 | A+ | Morgan Stanley Dean Witter, 6.875%, 3/1/07 | 170,000 | 191,434 |

| Aa3 | A | Nationsbank Corp, 7.5%, 9/15/06 | 200,000 | 224,577 |

| A1 | A+ | SBC Communication, 5.75%, 5/2/06 | 185,000 | 198,640 |

| Aa3 | AA | Texaco Capital Inc, 5.5%, 1/15/09 | 150,000 | 163,860 |

| A2 | A | Texas Instruments, 6.125%, 2/1/06 | 160,000 | 172,149 |

| Aa2 | A+ | Wells Fargo & Co, 6.875%, 4/1/06 | 200,000 | 220,651 |

| A1 | A | WPS Resources Corp, 7%, 11/1/09 | 100,000 | 114,560 |

| US Government & Agency Obligations: 38.7% | ||||

| Aaa | AAA | Federal Home Loan Bank, 5.375%, 1/5/04 | 300,000 | 300,106 |

| Aaa | AAA | Fannie Mae, 7.125%, 2/15/05 | 290,000 | 308,415 |

| Aaa | AAA | Fannie Mae, 5.25%, 4/15/07 | 300,000 | 323,155 |

| Aaa | AAA | Freddie Mac, 6.25%, 7/15/04 | 560,000 | 575,265 |

| Aaa | AAA | Freddie Mac, 3.625%, 9/15/08 | 425,000 | 428,272 |

| Aaa | AAA | US Treasury Notes, 5.875%,11/15/05 | 300,000 | 322,910 |

| Aaa | AAA | US Treasury Notes, 4.625%,5/15/06 | 600,000 | 636,094 |

| TOTAL DEBT INSTRUMENTS (Cost $6,780,540) | $6,997,392 | |||

| REPURCHASE AGREEMENT: 4.3% of net assets With Morgan Stanley and Company issued 12/31/03 at 0.65%, due 1/2/04, collateralized by $332,584 in United States Treasury Notes due 11/15/18.Proceeds at maturity are $326,012 (Cost $326,000). | 326,000 | |||

| TOTAL INVESTMENTS: 97.8% of net assets (Cost $7,106,540) | $7,323,392 | |||

| CASH AND RECEIVABLES LESS LIABILITIES: 2.2% of net assets | 164,262 | |||

| NET ASSETS: 100.00% | $7,487,654 | |||

Notes to the Portfolio of Investments:

* - Unaudited

Moody's - Moody's Investors Services, Inc.;

S&P - Standard & Poor's Corporation

Statement of Assets and Liabilities

| ASSETS | |

| Investments, at value (Note 1 and 2) | |

| mInvestment securities | $6,997,392 |

| mRepurchase agreements | 326,000 |

| mTotal investments* | 7,323,392 |

| Cash | 684 |

| Receivables | |

| mDividends and interest | 116,603 |

| mCapital shares sold | 50,000 |

| Total assets | $7,490,679 |

| LIABILITIES | |

| Payables | |

| mCapital shares redeemed | 3,025 |

| Total liabilities | $3,025 |

| NET ASSETS (Note 7) | $7,487,654 |

| CAPITAL SHARES OUTSTANDING | 713,376 |

| NET ASSET VALUE PER SHARE | $10.50 |

| * INVESTMENT SECURITIES, AT COST | $7,106,540 |

Statement of Operations

For the year ended December 31, 2003

| INVESTMENT INCOME (Note 1) | |

| mInterest income | $290,181 |

| EXPENSES (Notes 3 and 5) | |

| mInvestment advisory fees | 21,890 |

| mOther expenses | 10,945 |

| Total Expenses | 32,835 |

| NET INVESTMENT INCOME | 257,346 |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |

| mNet realized gain on investments | 88,253 |

| mChange in net unrealized appreciation (depreciation) of investments | (123,113) |

| NET LOSS ON INVESTMENTS | (34,860) |

| TOTAL INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $222,486 |

Statements of Changes in Net Assets

For the year indicated

Year Ended December 31, | ||

2003 | 2002 | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | ||

| mNet investment income | $257,346 | $284,094 |

| mNet realized gain (loss) on investments | 88,253 | (116,347) |

| mChange in net unrealized appreciation (depreciation) on investments | (123,113) | 153,718 |

| Total increase in net assets resulting from operations | 222,486 | 321,465 |

| DISTRIBUTIONS TO SHAREHOLDERS | ||

| mFrom net investment income | (257,346) | (284,094) |

| mFrom net capital gains | - | (27,926) |

| Total distributions | (257,346) | (312,020) |

| CAPITAL SHARE TRANSACTIONS (Note 8) | 524,393 | 664,053 |

| TOTAL INCREASE IN NET ASSETS | 489,533 | 673,498 |

| NET ASSETS | ||

| Beginning of year | $6,998,121 | $6,324,623 |

| End of year | $7,487,654 | $6,998,121 |

| UNDISTRIBUTED NET INVESTMENT INCOME | $-- | $-- |

Financial Highlights

Selected data for a share outstanding throughout each period indicated

Year Ended December 31, | Period | |||

2003 | 2002 | 2001 | 2000 | |

| Net asset value, beginning of period | $10.54 | $10.54 | $10.22 | $10.00 |

| Investment operations: | ||||

| mNet investment income | 0.37 | 0.45 | 0.60 | 0.39 |

| mNet realized and unrealized gain (loss) on investments | (0.04) | 0.04 | 0.35 | 0.23 |

| Total from investment operations | 0.33 | 0.49 | 0.95 | 0.62 |

| mLess distributions: | ||||

| mmFrom net investment income | (0.37) | (0.45) | (0.60) | (0.39) |

| mmFrom net capital gains | .-- | (0.04) | (0.03) | (0.01) |

| Total distributions | (0.37) | (0.49) | (0.63) | (0.40) |

| Net asset value, end of period | $10.50 | $10.54 | $10.54 | $10.22 |

| Total return (%) | 3.18 | 4.79 | 9.47 | 6.24 |

| Ratios and supplemental data | ||||

| Net assets, end of period (thousands) | $7,488 | $6,998 | $6,325 | $5,528 |

| mRatio of expenses to average net assets (%) | 0.45 | 0.45 | 0.45 | 0.45 |

| mRatio of net investment income to average net assets (%) | 3.53 | 4.28 | 5.68 | 6.74 |

| mPortfolio turnover (%) | .38 | 30 | 68 | 36 |

Notes to Financial Statements

For the year ended December 31, 2003

1. Summary of Significant Accounting Policies. Mosaic Income Trust (the "Trust") is registered with the Securities and Exchange Commission under the Investment Company Act of 1940 as an open-end, diversified investment manage-ment company. The Trust currently offers three portfolios, each of which is a diversified mutual fund. This report contains information about one of these portfolios, the Mosaic Institutional Bond Fund (the "Fund"), which commenced operations May 1, 2000. Its objectives and strategies are detailed in its prospectus. The remaining two Trust portfolios present their financial information in a separate report.

Securities Valuation: Repurchase agreements and other securities having maturities of 60 days or less are valued at amortized cost, which approximates market value. Securities having longer maturities, for which quotations are readily available, are valued at the mean between their closing bid and asked prices. Securities for which current market quotations are not readily available are valued at their fair value as determined in good faith by the Board of Trustees.

Investment Transactions: Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and federal income tax purposes.

Investment Income: Interest income is recorded on an accrual basis. Bond premium is amortized and original issue discount and market discount are accreted over the expected life of each applicable security. Other income is accrued as earned.

Distribution of Income and Gains: Net invest-ment income, determined as gross investment income less total expenses, is declared as a regular dividend and distributed to shareholders quarterly. Capital gains distributions, if any, are declared and paid annually at year end.

The tax character of distributions paid during 2003 and 2002 was as follows:

2003 | 2002 | |

| Distributions paid from: | ||

| mOrdinary Income | $257,346 | $284,094 |

| mLong-term capital gains | -- | 17,452 |

| mShort-term capital gains | -- | 10,474 |

As of December 31, 2003, the components of distributable earnings on a tax basis were as follows:

| Accumulated net realized losses | $(28,094) |

| Net unrealized appreciation on investments | 216,852 |

$188,758 |

Net realized gains or losses may differ for financial and tax reporting purposes as a result of loss deferrals related to wash sales and post-October transactions.

Income Tax: No provision is made for Federal income taxes since it is the intention of the Fund to comply with the provisions of the Internal Revenue Code available to investment companies and to make the requisite distribu-tion to shareholders of taxable income which will be sufficient to relieve it from all or substantially all Federal income taxes. As of December 31, 2003, the Fund had available for federal income tax purposes an unused capital loss carryover of $28,094 which expires on December 31, 2010.

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. Investments in Repurchase Agreements. When the Fund purchases securities under agreements to resell, the securities are held for safekeeping by the Fund's custodian bank as collateral. Should the market value of the securities purchased under such an agreement decrease below the principal amount to be received at the termination of the agreement plus accrued interest, the counterparty is required to place an equivalent amount of additional securities in safekeeping with the Fund's custodian bank. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the Fund, along with other registered investment companies having Advisory and Services Agreements with the same Advisor, transfers uninvested cash balances into a joint trading account. The aggregate balance in this joint trading account is invested in one or more consolidated repurchase agreements whose underlying securities are U.S. Treasury or federal agency obligations. The Institutional Bond Fund has approximately a 2.3% interest in the consolidated repurchase agreement of $13,978,000 collateralized by $14,260,321 in United States Treasury Notes. Proceeds at maturity are $13,978,505.

3. Investment Advisory Fees and Other Transactions with Affiliates. The investment advisor to the Fund, Madison Mosaic, LLC, a wholly owned subsidiary of Madison Investment Advisors, Inc., (collectively "the Advisor"), earns an advisory fee equal to 0.30% per annum of the average net assets of the Fund. The fees are accrued daily and are paid monthly.

4. Investment Transactions. Purchases and sales of securities (excluding short-term securities) for the year ended December 31, 2003 were as follows:

| Purchases | Sales | |

| U. S. Gov't Securities | $1,734,208 | $941,550 |

| Other | $1,662,253 | $1,620,175 |

5. Other Expenses. Under a separate Services Agreement, the Advisor will provide or arrange for the Fund to have all other necessary operational and support services for a fee based on a percentage (0.15%) of average net assets. These fees are accrued daily and paid monthly.

The Advisor is also responsible for the fees and expenses of Trustees and for certain promotional expenses.

6. Aggregate Cost and Unrealized Appreciation (Depreciation). The aggregate cost for federal income tax purposes and the net unrealized appreciation (depreciation) are as follows as of December 31, 2003:

| Aggregate Cost | $7,106,540 |

| Gross unrealized appreciation | 229,297 |

| Gross unrealized depreciation | (12,445) |

| Net unrealized appreciation | $b216,852 |

7. Net Assets. At December 31, 2003, net assets include the following:

| Net paid in capital on shares of beneficial interest | $7,298,896 |

| Accumulated net realized loss | (28,094) |

| Net unrealized appreciation on investments | 216,852 |

| Total Net Assets | $7,487,654 |

8. Capital Share Transactions. An unlimited number of capital shares, without par value, are authorized. Transactions in capital shares were as follows:

Year Ended Dec. 31, | ||

2003 | 2002 | |

| In Dollars | ||

| Shares sold | $490,627 | $356,576 |

| Shares issued in reinvestment of dividends | 257,346 | 312,020 |

| Total shares issued | 747,973 | 668,596 |

| Shares redeemed | (223,580) | (4,543) |

| Net increase | $524,393 | $664,053 |

| In Shares | ||

| Shares sold | 46,296 | 34,158 |

| Shares issued in reinvestment of dividends | 24,331 | 29,843 |

| Total shares issued | 70,627 | 64,001 |

| Shares redeemed | (21,161) | (431) |

| Net increase | 49,466 | 63,570 |

Management Information (unaudited)

Independent Trustees

| Name, Address and Age | Position(s) Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen | Other Directorships Held |

| Philip E. Blake 550 Science Drive Madison, WI 53711 Born 11/07/1944 | Trustee | Indefinite Term since May 2001 | Retired investor; formerly publisher of Madison's Wisconsin State Journal newspaper. | All 12 Mosaic Funds | Madison Newspapers, Inc. of Madison, WI |

| James R. Imhoff, Jr. 550 Science Drive Madison, WI 53711 Born 5/20/1944 | Trustee | Indefinite Term since July 1996 | Chairman and CEO of First Weber Group, Inc. (real estate brokers) of Madison, WI. | All 12 Mosaic Funds | None |

| Lorence D. Wheeler 550 Science Drive Madison, WI 53711 Born 1/31/1938 | Trustee | Indefinite Term since July 1996 | Retired investor; formerly Pension Specialist for CUNA Mutual Group (insurance) and President of Credit Union Benefits Services, Inc. (a provider of retirement plans and related services for credit union employees nationwide). | All 12 Mosaic Funds | None |

Interested Trustees*

| Frank E. Burgess 550 Science Drive Madison, WI 53711 Born 8/04/1942 | Trustee and Vice President | Indefinite Terms since July 1996 | Founder, President and Director of Madison Investment Advisors, Inc. | All 12 Mosaic Funds | None |

| Katherine L. Frank 550 Science Drive Madison, WI 53711 Born 11/27/1960 | Trustee and President | Indefinite Terms President since July 1996, Trustee since May 2001 | Principal and Vice President of Madison Investment Advisors, Inc. and President of Madison Mosaic, LLC | All 12 Mosaic Funds, but does not serve as Trustee of Mosaic Equity Trust | None |

Officers*

| Jay R. Sekelsky 550 Science Drive Madison, WI 53711 Born 9/14/1959 | Vice President | Indefinite Term since July 1996 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 12 Mosaic Funds | None |

| Christopher Berberet 550 Science Drive Madison, WI 53711 Born 7/31/1959 | Vice President | Indefinite Term since July 1996 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 12 Mosaic Funds | None |

| W. Richard Mason 8777 N. Gainey Center Drive, #220 Scottsdale, AZ 85258 Born 5/13/1960 | Secretary and General Counsel | Indefinite Terms since November 1992 | Principal of Mosaic Funds Distributor, LLC; General Counsel for Madison Investment Advisors, Madison Scottsdale, LC and Madison Mosaic, LLC | All 12 Mosaic Funds | None |

| Greg Hoppe 550 Science Drive Madison, WI 53711 Born 4/28/1969 | Chief Financial Officer | Indefinite Term since August 1999 | Vice President of Madison Mosaic, LLC; formerly CFO of Amcore Bank-South Central and auditor for McGladrey & Pullen accounting firm | All 12 Mosaic Funds | None |

*All interested Trustees and Officers of the Trust are employees and/or owners of Madison Investment Advisors, Inc. Since Madison Investment Advisors, Inc. serves as the investment advisor to the Trust, each of these individuals is considered an "interested person" of the Trust as the term is defined in the Investment Company Act of 1940.

The Statement of Additional Information contains more information about the Trustees and is available upon request. To request a free copy, call Mosaic Funds at 1-800-368-3195.

Forward-Looking Statement Disclosure. One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate," "may," "will," "expect," "believe," "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Proxy Voting Information. The Trust adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Fund's portfolios. These policies are available to you upon request and free of charge by writing to Mosaic Funds, 550 Science Drive, Madison, WI 53711 or by calling toll-free at 1-800-368-3195. Beginning next year, the Trust's proxy voting policies may also be obtained by visiting the Securities and Exchange Commission web site at www.sec.gov. The Trust will respond to shareholder requests for copies of our policies within two business days of request by first-class mail or other means designed to ensure prompt delivery.

Change of Independent Auditors. In October 2003, the Board of Trustees decided that, effective for the fiscal year beginning January 1, 2004, for matters relating to such fiscal years, the firm of Grant Thornton, LLP shall serve as the certifying accountant for the Trust, replacing Deloitte & Touche LLP at the conclusion of its engagement certifying the financial statements for the Trust's fiscal year ended December 31, 2003 and attendant matters related to fiscal years ended prior to December 31, 2004. For the Trust's last two fiscal years, Deloitte & Touche LLP has not issued to the Trust an adverse opinion or a disclaimer of opinion, or qualified or modified an opinion as to uncertainty, audit scope, or accounting principles. There has been no disagreement with Deloitte & Touche LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of Deloitte & Touche LLP, would have caused it to make reference to the subject matter of the disagreement in connection with its report. There have been no events listed in paragraphs (a)(1)(v)(A) through (D) of 17 CFR 229.304(a)(1).

The Mosaic Family of Mutual Funds

Mosaic Equity Trust

Mosaic Investors Fund

Mosaic Balanced Fund

Mosaic Mid-Cap Fund

Mosaic Foresight Fund

Mosaic Income Trust

Mosaic Government Fund

Mosaic Intermediate Income Fund

Mosaic Institutional Bond Fund

Mosaic Tax-Free Trust

Mosaic Arizona Tax-Free Fund

Mosaic Missouri Tax-Free Fund

Mosaic Virginia Tax-Free Fund

Mosaic Tax-Free National Fund

Mosaic Government Money Market

For more complete information on any Mosaic fund, including charges and expenses, request a prospectus by calling 1-800-368-3195. Read it carefully before you invest or send money. This document does not constitute an offering by the distributor in any jurisdiction in which such offering may not be lawfully made. Mosaic Funds Distributor, LLC.

TRANSER AGENT

Mosaic Funds

c/o US Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

TELEPHONE NUMBERS

Shareholder Service

Toll-free nationwide: 888-670-3600

Mosaic Tiles (24 hour automated information)

Toll-free nationwide: 800-336-3600

550 Science Drive

Madison, Wisconsin 53711

Mosaic Funds

www.mosaicfunds.com

SEC File Number 811-3616

Item 2. Code of Ethics.

The Trust has adopted a code of ethics that applies to the Trust’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, regardless of whether these individuals are employed by the Trust or a third party. The code was first adopted during the period covered by this report and was not subsequently amended. The Trust granted no waivers from the code during the period covered by this report. Any person may obtain a complete copy of the code without charge by calling Mosaic Funds at 800-368-3195 and requesting a copy of the Mosaic Funds Sarbanes Oxley Code of Ethics.

Item 3. Audit Committee Financial Expert.

At a meeting held during the period covered by this report, The Trust’s Board of Trustees elected Philip Blake, an “independent” Trustee and a member of the Trust’s audit committee, to serve as the Trust’s audit committee financial expert among the three Mosaic independent Trustees who so qualify to serve in that capacity.

Item 4. Principal Accountant Fees and Services.

(a) Note that audit fees are paid pursuant to the Services Agreement between the Trust and Madison Mosaic, LLC and are not paid directly to the accountants. Total audit fees paid to the registrant's principal accountant for the fiscal years ended December 31, 2002 and 2003, respectively, out of the Services Agreement fees collected from all Mosaic Funds were $98,900 and $92,500. Of these amounts, approximately $23,000 and $23,000, respectively, was attributable to the registrant and the remainder attributable to audit services provided to other Mosaic Funds registrants.

(b) Not applicable.

(c) Not applicable.

(d) Not applicable.

(e) (1) Before any accountant is engaged by the registrant to render audit or non-audit services, the engagement must be approved by the audit committee as contemplated by paragraph (c)(7)(i)(A) of Rule 2-01of Regulation S-X.

(2) Not applicable.

(f) Not applicable.

(g) Not applicable.

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. [Reserved]

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. [Reserved]

Item 9. Controls and Procedures.

Trust’s principal executive officer and principal financial officer determined that the Trust’s disclosure controls and procedures are effective, based on their evaluation of these controls and procedures within 90 days of the date of this report. There were no significant changes in the Trust’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation. The officers identified no significant deficiencies or material weaknesses.

Item 10. Exhibits.

(a)(1) Code of ethics referred to in Item 2.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Mosaic Income Trust

By: (signature)

W. Richard Mason, Secretary

Date: February 24, 2004

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

By: (signature)

Katherine L. Frank, Chief Executive Officer

Date: February 24, 2004

By: (signature)

Greg Hoppe, Chief Financial Officer

Date: February 24, 2004