Accelerating and Broadening Breakout Growth in Cloud Data Centers John Croteau, President, CEO MACOM November 30, 2016 Filed by Applied Micro Circuits Corporation pursuant to Rule 425 under the Securities Act of 1933, as amended and deemed filed pursuant to Rule 14d-9a of the Securities Exchange Act of 1934, as amended Subject Company: Applied Micro Circuits Corporation Commission File No. 000-23193

Forward-Looking Statement Safe Harbor and Use of Non-GAAP Financial Measures DISCLOSURE NOTICE: This presentation contains forward-looking information related to MACOM, AppliedMicro and the proposed acquisition of AppliedMicro by MACOM that involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Forward-looking statements in this presentation include, among other things, statements about the potential benefits and synergies, strategic plans, divestitures, cost savings, accretion, revenue, margins, market share capture, competitive position, integration and financial and business expectations associated with the acquisition, the price of the transaction, the consideration used in the transaction and the anticipated timing of closing of the acquisition. Risks and uncertainties include, among other things, risks related to the satisfaction of the conditions to closing the acquisition (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all, including uncertainties as to how many of AppliedMicro’s stockholders will tender their shares in the tender offer and the possibility that the acquisition does not close; risks related to the ability to realize the anticipated benefits of the acquisition, including the possibility that the expected benefits from the proposed acquisition will not be realized or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; disruption from the transaction making it more difficult to maintain business, contractual and operational relationships; negative effects of this presentation or the consummation of the proposed acquisition on the market price of MACOM’s common stock and on MACOM’s operating results; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed acquisition; other business effects, including the effects of industry, market, economic, political or regulatory conditions; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies; future business combinations or disposals; the uncertainties inherent in research and development, including the ability to sustain and increase the rate of growth in revenues for AppliedMicro’s products; and competitive developments. A further description of risks and uncertainties relating to MACOM and AppliedMicro can be found in their respective Annual Reports on Form 10-K for the fiscal years ended September 30, 2016 and March 31, 2016, respectively, and in their subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, all of which are filed with the U.S. Securities and Exchange Commission (the “SEC”) and available at www.sec.gov. We make references in this presentation to certain financial information calculated on a basis other than in accordance with accounting principles generally accepted in the United States (GAAP) including non-GAAP gross margin and operating margin, non-GAAP earnings per share, non-GAAP revenue and non-GAAP free cash flow. These non-GAAP measures are provided to enhance the user’s overall understanding of the potential impact of the AppliedMicro transaction. We are unable to provide a quantitative reconciliation of these non-GAAP measures to the most directly comparable GAAP measures because we cannot reliably forecast transaction, integration and other costs related to the AppliedMicro transaction, which are difficult to predict and estimate. The information contained in this presentation is as of November 30, 2016. Neither MACOM nor AppliedMicro assumes any obligation to update forward-looking statements contained in this presentation as the result of new information or future events or developments.

Additional Information and Where to Find it The exchange offer for the outstanding shares of AppliedMicro stock described in this communication has not yet commenced. This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for any materials that MACOM and its offering subsidiary, Montana Merger Sub I, Inc. (“Purchaser”), will file with the SEC. Purchaser plans to file a Tender Offer Statement on Schedule TO, together with other related exchange offer documents, including a letter of transmittal, in connection with the offer; AppliedMicro plans to file a Recommendation Statement on Schedule 14D-9 in connection with the offer; and MACOM plans to file a Registration Statement on Form S-4 that will serve as a prospectus for MACOM stock to be issued as consideration in the offer and the acquisition. These documents will contain important information about MACOM, AppliedMicro and the acquisition. AppliedMicro stockholders are urged to read these documents carefully and in their entirety when they become available before making any decision regarding exchanging their shares. These documents will be made available to AppliedMicro stockholders at no expense to them and will also be available for free at the SEC's website at www.sec.gov. Additional copies may be obtained for free by contacting MACOM’s investor relations department at 949-224-3874 or AppliedMicro’s investor relations department at (415) 217-4962. In addition to the SEC filings made in connection with the transaction, each of MACOM and AppliedMicro files annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other such filed information at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. MACOM’s and AppliedMicro’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

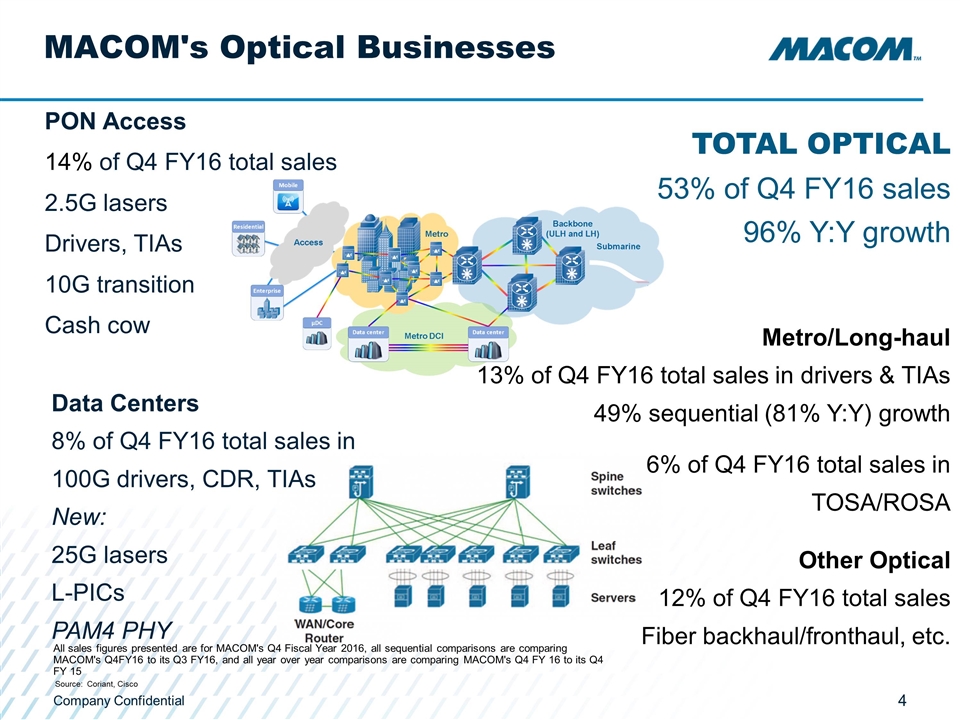

Source: Coriant, Cisco Metro/Long-haul 13% of Q4 FY16 total sales in drivers & TIAs 49% sequential (81% Y:Y) growth 6% of Q4 FY16 total sales in TOSA/ROSA PON Access 14% of Q4 FY16 total sales 2.5G lasers Drivers, TIAs 10G transition Cash cow Data Centers 8% of Q4 FY16 total sales in 100G drivers, CDR, TIAs New: 25G lasers L-PICs PAM4 PHY TOTAL OPTICAL 53% of Q4 FY16 sales 96% Y:Y growth MACOM's Optical Businesses Other Optical 12% of Q4 FY16 total sales Fiber backhaul/fronthaul, etc. All sales figures presented are for MACOM's Q4 Fiscal Year 2016, all sequential comparisons are comparing MACOM's Q4FY16 to its Q3 FY16, and all year over year comparisons are comparing MACOM's Q4 FY 16 to its Q4 FY 15

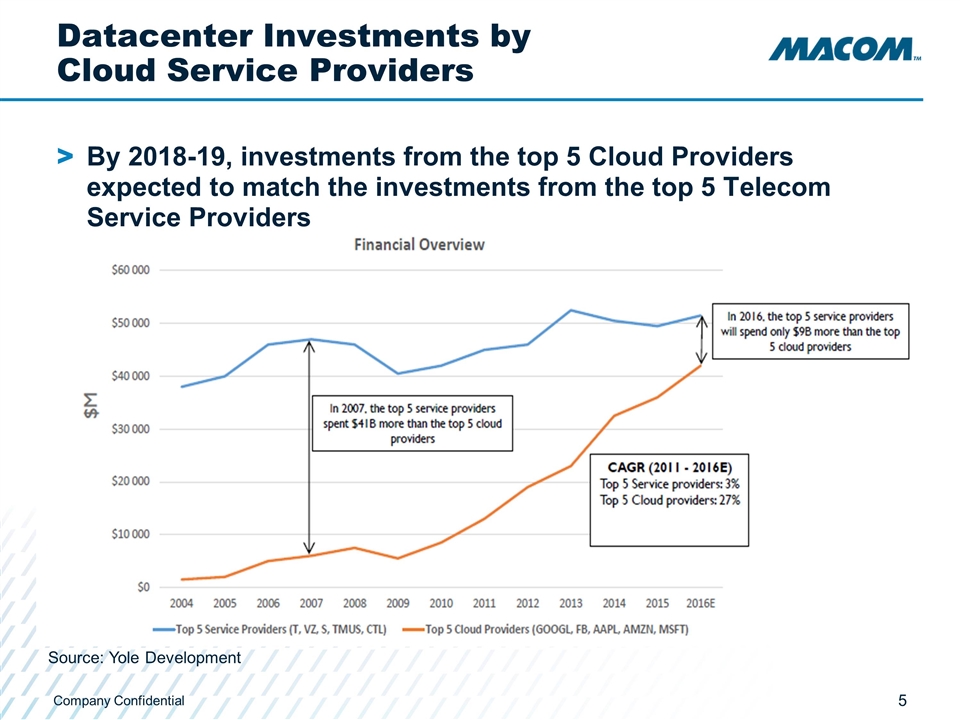

By 2018-19, investments from the top 5 Cloud Providers expected to match the investments from the top 5 Telecom Service Providers Datacenter Investments by Cloud Service Providers Source: Yole Development

Today’s Presenters John Croteau President, CEO MACOM Bob McMullan SVP & CFO MACOM Preet Virk SVP & GM, Networks MACOM Paramesh Gopi President, CEO AppliedMicro Vivek Rajgarhia VP & GM, Lightwave MACOM

Preet Virk SVP & GM, Networks MACOM

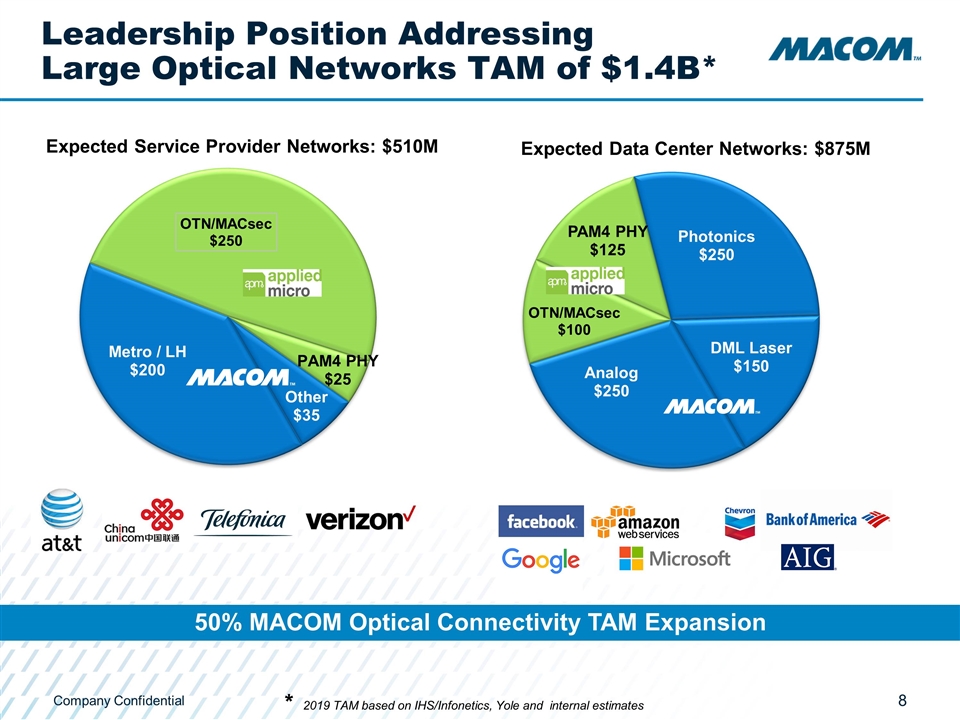

Leadership Position Addressing Large Optical Networks TAM of $1.4B* 50% MACOM Optical Connectivity TAM Expansion * 2019 TAM based on IHS/Infonetics, Yole and internal estimates

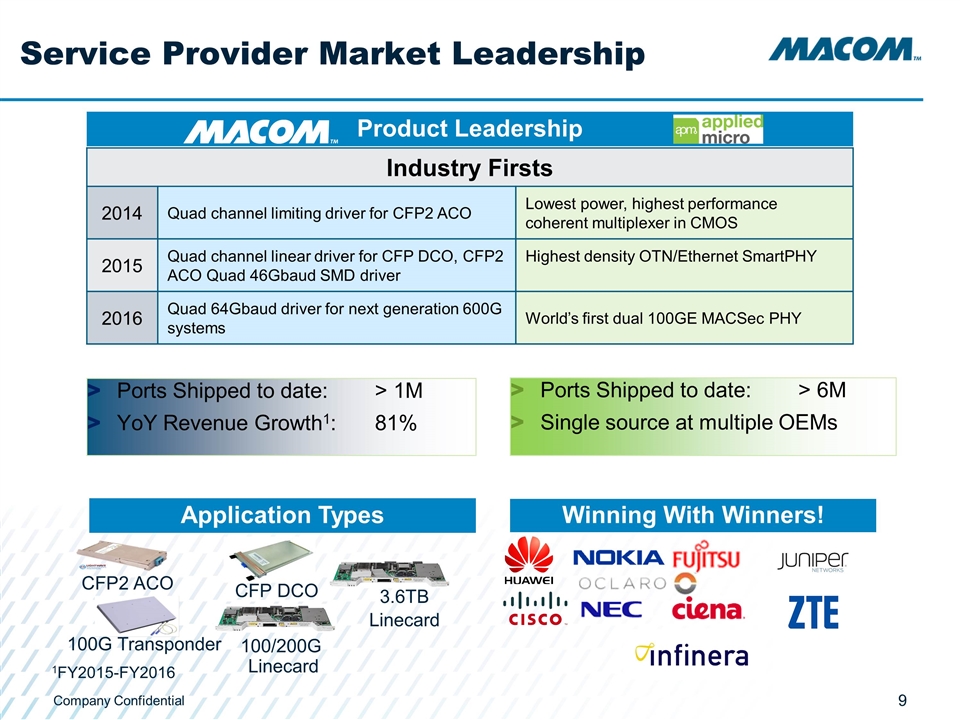

Service Provider Market Leadership Product Leadership Industry Firsts 2014 Quad channel limiting driver for CFP2 ACO Lowest power, highest performance coherent multiplexer in CMOS 2015 Quad channel linear driver for CFP DCO, CFP2 ACO Quad 46Gbaud SMD driver Highest density OTN/Ethernet SmartPHY 2016 Quad 64Gbaud driver for next generation 600G systems World’s first dual 100GE MACSec PHY Winning With Winners! Application Types CFP2 ACO CFP DCO 100G Transponder 100/200G Linecard Ports Shipped to date: > 1M YoY Revenue Growth1: 81% 3.6TB Linecard Ports Shipped to date: > 6M Single source at multiple OEMs 1FY2015-FY2016

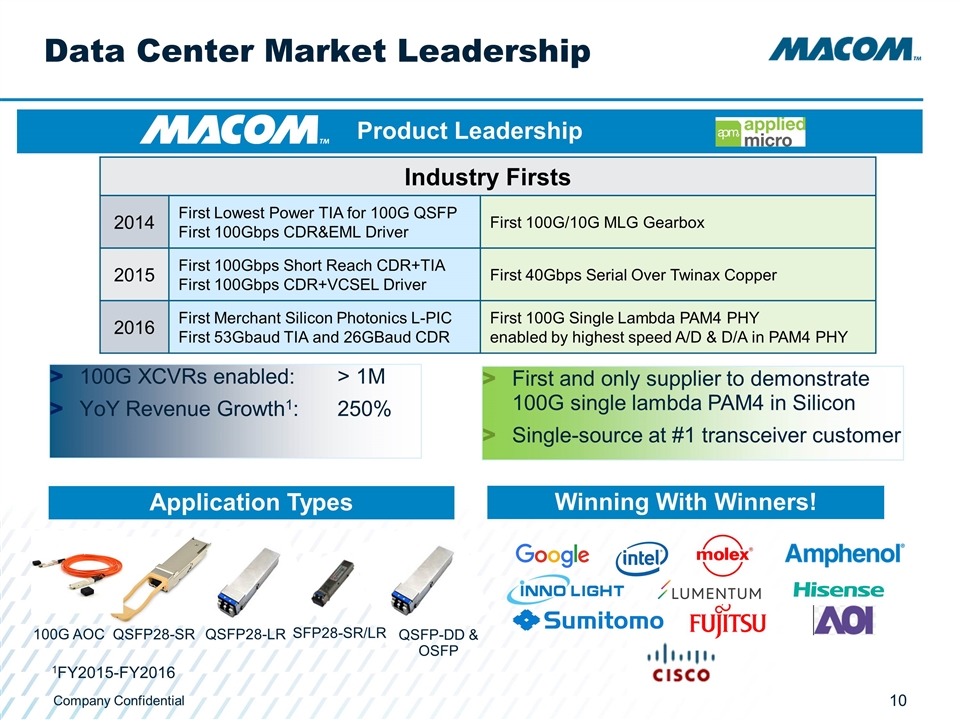

100G XCVRs enabled:> 1M YoY Revenue Growth1:250% Data Center Market Leadership Product Leadership Industry Firsts 2014 First Lowest Power TIA for 100G QSFP First 100Gbps CDR&EML Driver First 100G/10G MLG Gearbox 2015 First 100Gbps Short Reach CDR+TIA First 100Gbps CDR+VCSEL Driver First 40Gbps Serial Over Twinax Copper 2016 First Merchant Silicon Photonics L-PIC First 53Gbaud TIA and 26GBaud CDR First 100G Single Lambda PAM4 PHY enabled by highest speed A/D & D/A in PAM4 PHY Winning With Winners! QSFP28-SR 100G AOC QSFP28-LR QSFP-DD & OSFP First and only supplier to demonstrate 100G single lambda PAM4 in Silicon Single-source at #1 transceiver customer SFP28-SR/LR Application Types 1FY2015-FY2016

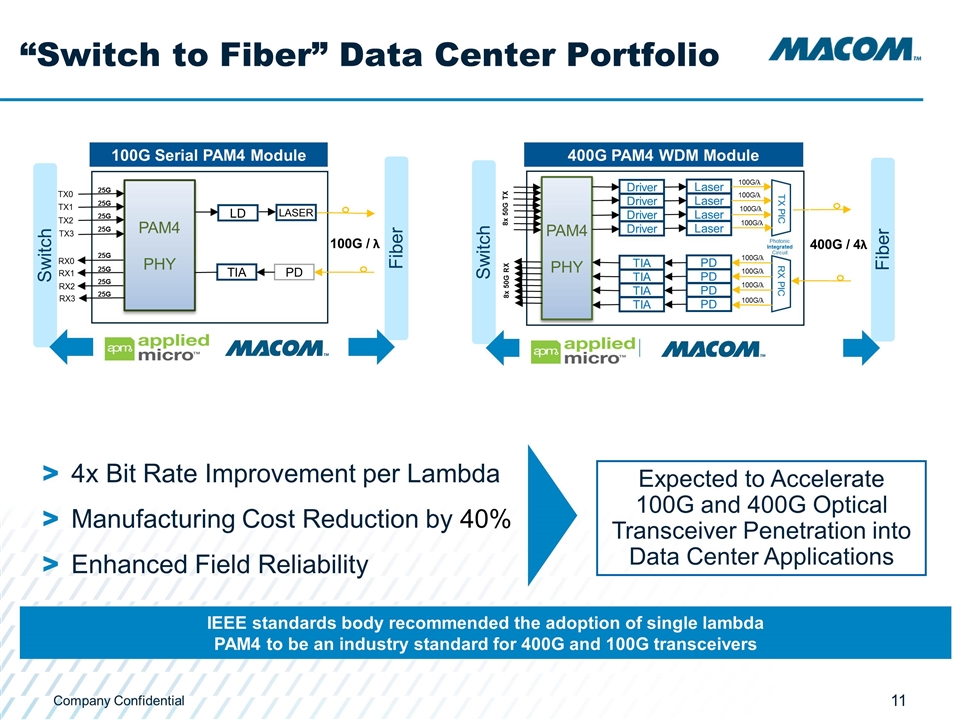

“Switch to Fiber” Data Center Portfolio IEEE standards body recommended the adoption of single lambda PAM4 to be an industry standard for 400G and 100G transceivers Switch Fiber PAM4 PHY 25G 25G 25G 25G 25G 25G 25G 25G TX0 TX1 TX2 TX3 RX0 RX1 RX2 RX3 LD TIA LASER PD 100G / λ 100G Serial PAM4 Module Switch Fiber 400G PAM4 WDM Module PAM4 PHY Driver Driver Driver Driver Laser Laser Laser Laser TIA TIA TIA TIA PD PD PD PD RX PIC 100G/λ 100G/λ 100G/λ 100G/λ 100G/λ 100G/λ 100G/λ 100G/λ 8x 50G TX 8x 50G RX TX PIC Photonic Integrated Circuit 400G / 4λ 4x Bit Rate Improvement per Lambda Manufacturing Cost Reduction by 40% Enhanced Field Reliability Expected to Accelerate 100G and 400G Optical Transceiver Penetration into Data Center Applications

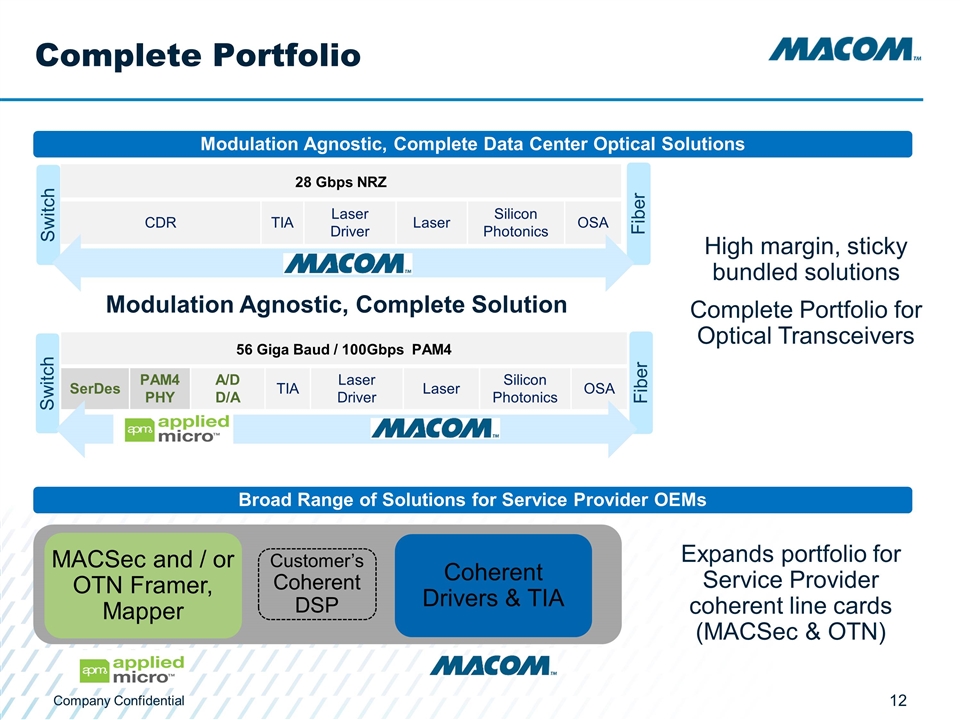

Complete Portfolio Fiber 28 Gbps NRZ CDR TIA Laser Driver Laser Silicon Photonics OSA Switch Fiber 56 Giga Baud / 100Gbps PAM4 SerDes PAM4 PHY A/D D/A TIA Laser Driver Laser Silicon Photonics OSA Switch Modulation Agnostic, Complete Solution High margin, sticky bundled solutions Complete Portfolio for Optical Transceivers Expands portfolio for Service Provider coherent line cards (MACSec & OTN) Modulation Agnostic, Complete Data Center Optical Solutions Broad Range of Solutions for Service Provider OEMs Customer’s Coherent DSP MACSec and / or OTN Framer, Mapper Coherent Drivers & TIA

Paramesh Gopi President, CEO AppliedMicro

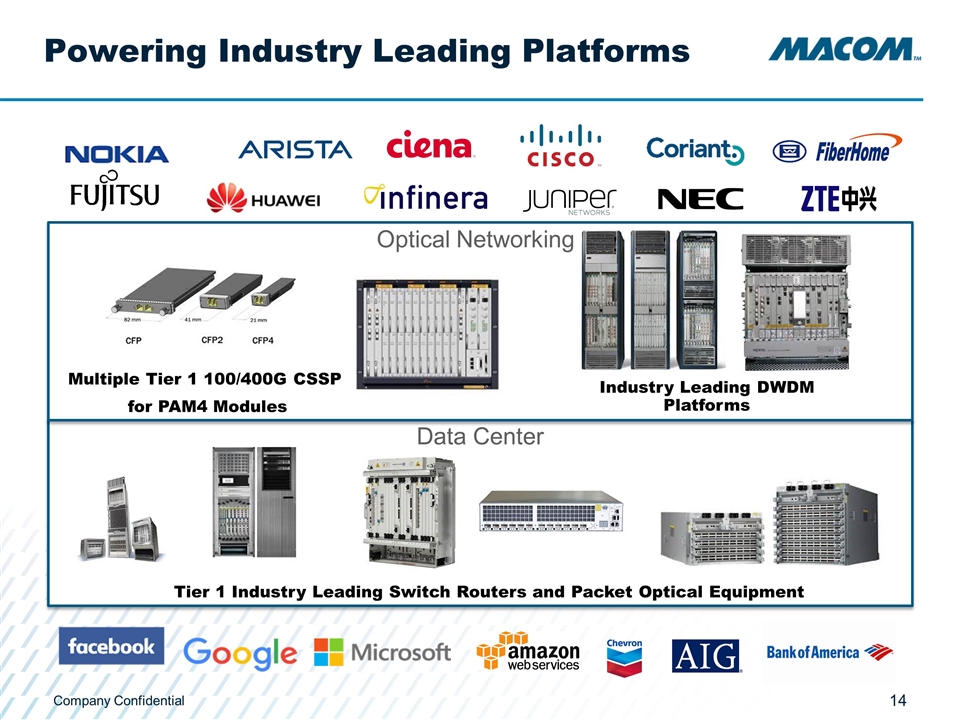

Powering Industry Leading Platforms Data Center Tier 1 Industry Leading Switch Routers and Packet Optical Equipment Optical Networking Industry Leading DWDM Platforms Multiple Tier 1 100/400G CSSP for PAM4 Modules

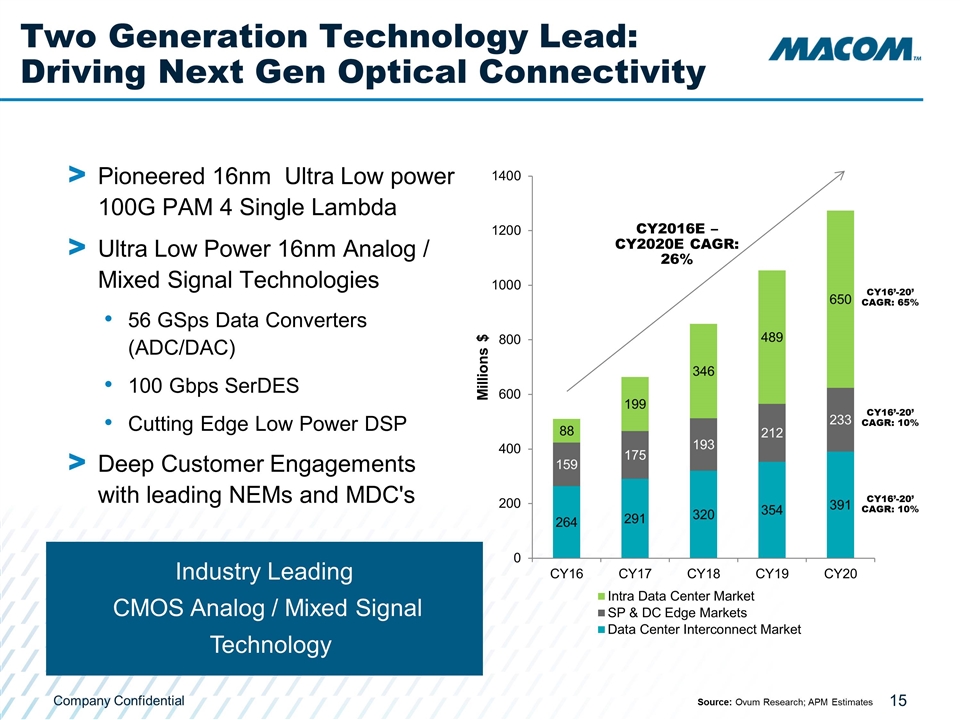

Two Generation Technology Lead: Driving Next Gen Optical Connectivity Pioneered 16nm Ultra Low power 100G PAM 4 Single Lambda Ultra Low Power 16nm Analog / Mixed Signal Technologies 56 GSps Data Converters (ADC/DAC) 100 Gbps SerDES Cutting Edge Low Power DSP Deep Customer Engagements with leading NEMs and MDC's Source: Ovum Research; APM Estimates CY2016E – CY2020E CAGR: 26% CY16’-20’ CAGR: 65% CY16’-20’ CAGR: 10% CY16’-20’ CAGR: 10% Industry Leading CMOS Analog / Mixed Signal Technology

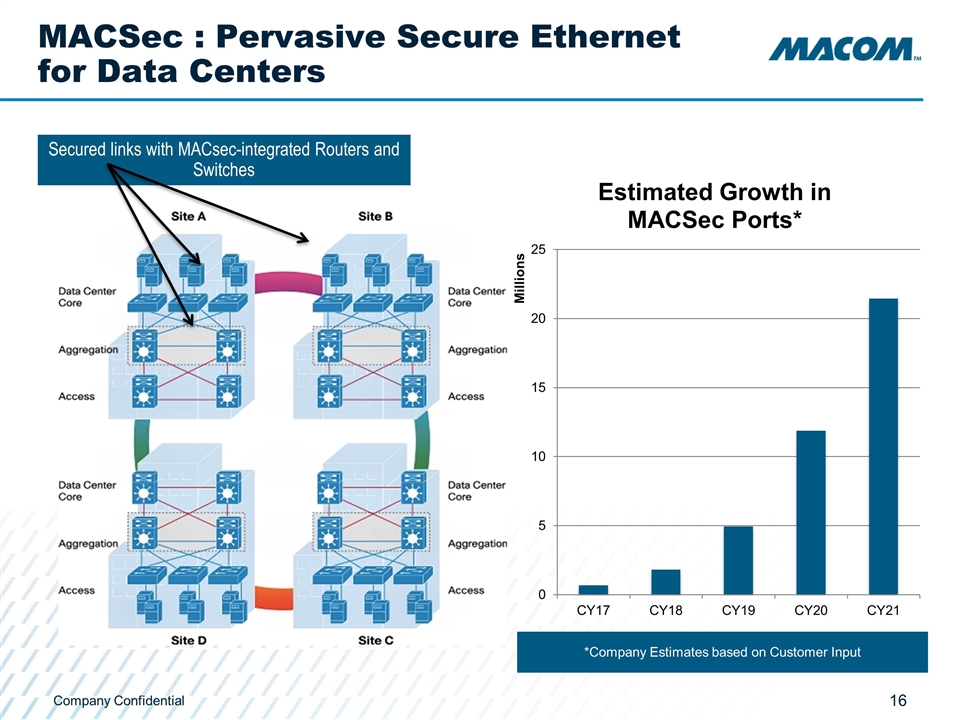

MACSec : Pervasive Secure Ethernet for Data Centers Secured links with MACsec-integrated Routers and Switches *Company Estimates based on Customer Input

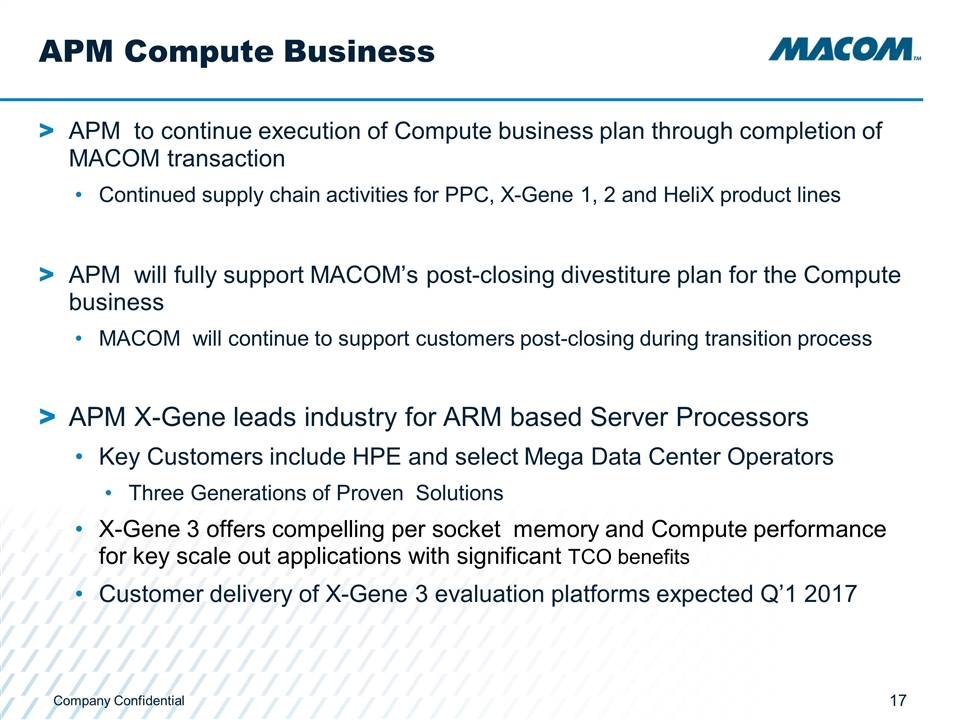

APM to continue execution of Compute business plan through completion of MACOM transaction Continued supply chain activities for PPC, X-Gene 1, 2 and HeliX product lines APM will fully support MACOM’s post-closing divestiture plan for the Compute business MACOM will continue to support customers post-closing during transition process APM X-Gene leads industry for ARM based Server Processors Key Customers include HPE and select Mega Data Center Operators Three Generations of Proven Solutions X-Gene 3 offers compelling per socket memory and Compute performance for key scale out applications with significant TCO benefits Customer delivery of X-Gene 3 evaluation platforms expected Q’1 2017 APM Compute Business

Vivek Rajgarhia VP & GM, Lightwave MACOM

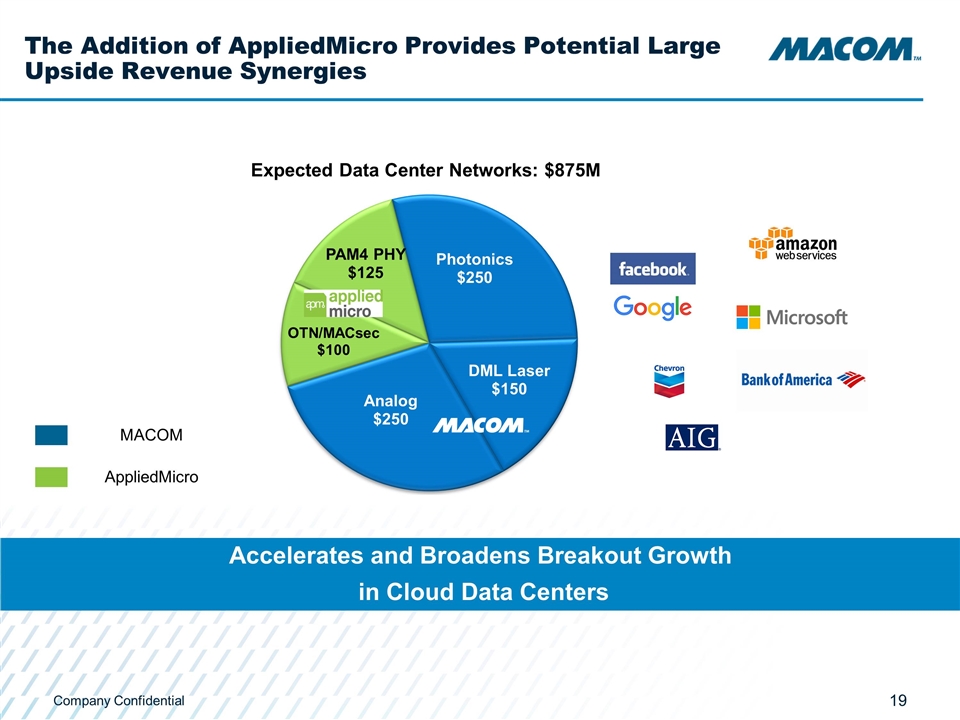

The Addition of AppliedMicro Provides Potential Large Upside Revenue Synergies MACOM AppliedMicro Accelerates and Broadens Breakout Growth in Cloud Data Centers

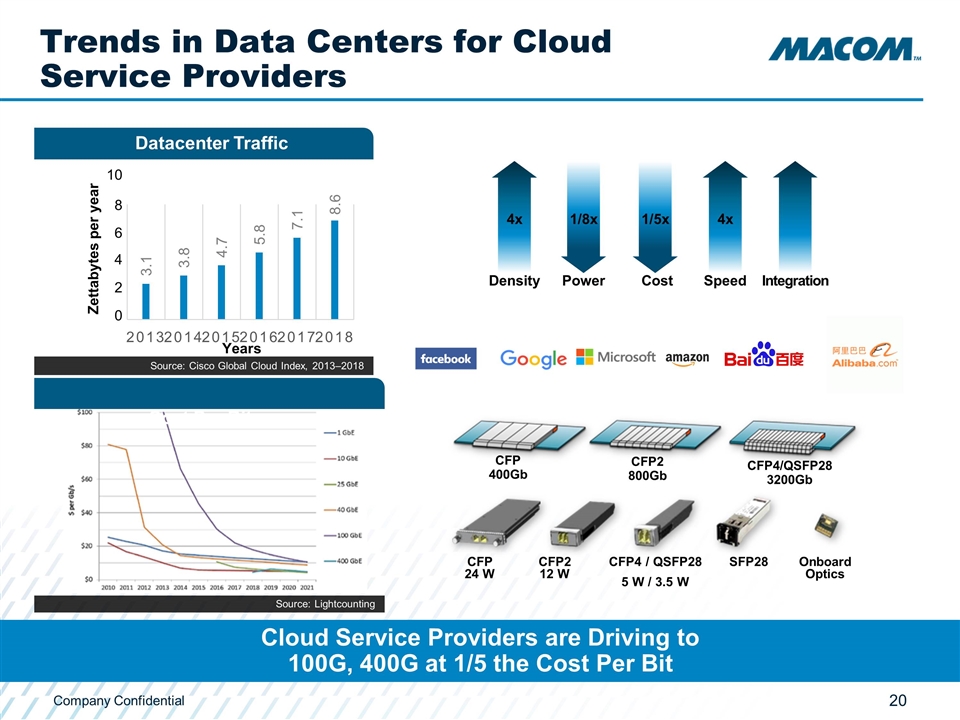

CFP 400Gb CFP2 800Gb CFP4/QSFP28 3200Gb CFP2 12 W CFP4 / QSFP28 5 W / 3.5 W SFP28 Onboard Optics CFP 24 W Power 1/8x Density 4x Cost 1/5x Speed 4x Integration Source: Cisco Global Cloud Index, 2013–2018 Datacenter Traffic Years Zettabytes per year 6 4 2 0 8 10 Trends in Data Centers for Cloud Service Providers Cost Per Bit Source: Lightcounting Cloud Service Providers are Driving to 100G, 400G at 1/5 the Cost Per Bit

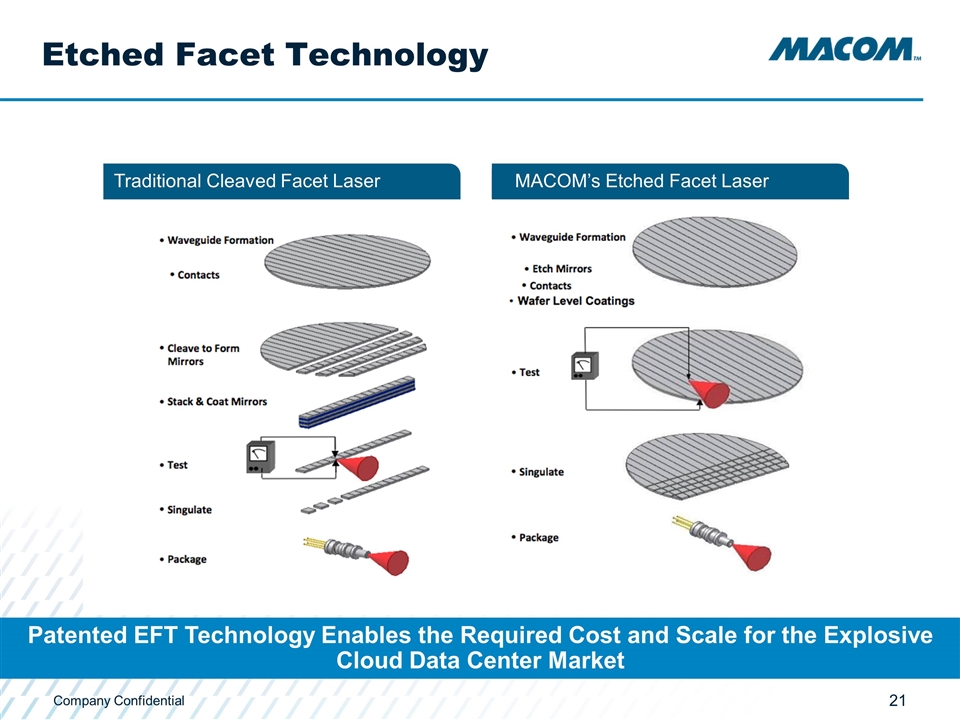

Etched Facet Technology Patented EFT Technology Enables the Required Cost and Scale for the Explosive Cloud Data Center Market Traditional Cleaved Facet Laser MACOM’s Etched Facet Laser

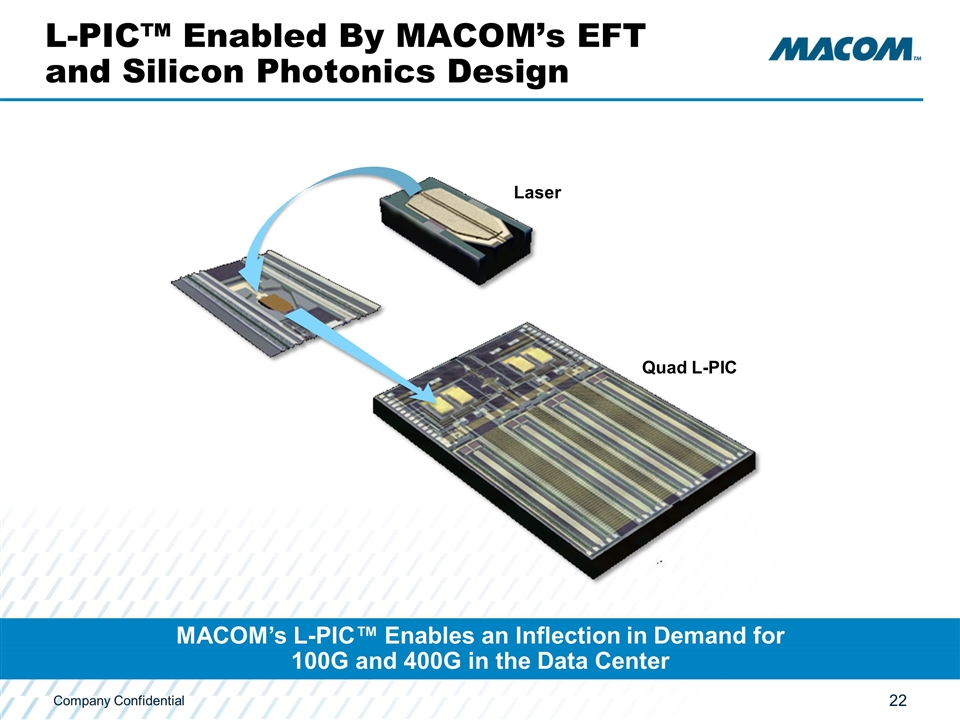

L-PIC™ Enabled By MACOM’s EFT and Silicon Photonics Design Quad L-PIC Laser Laser MACOM’s L-PIC™ Enables an Inflection in Demand for 100G and 400G in the Data Center

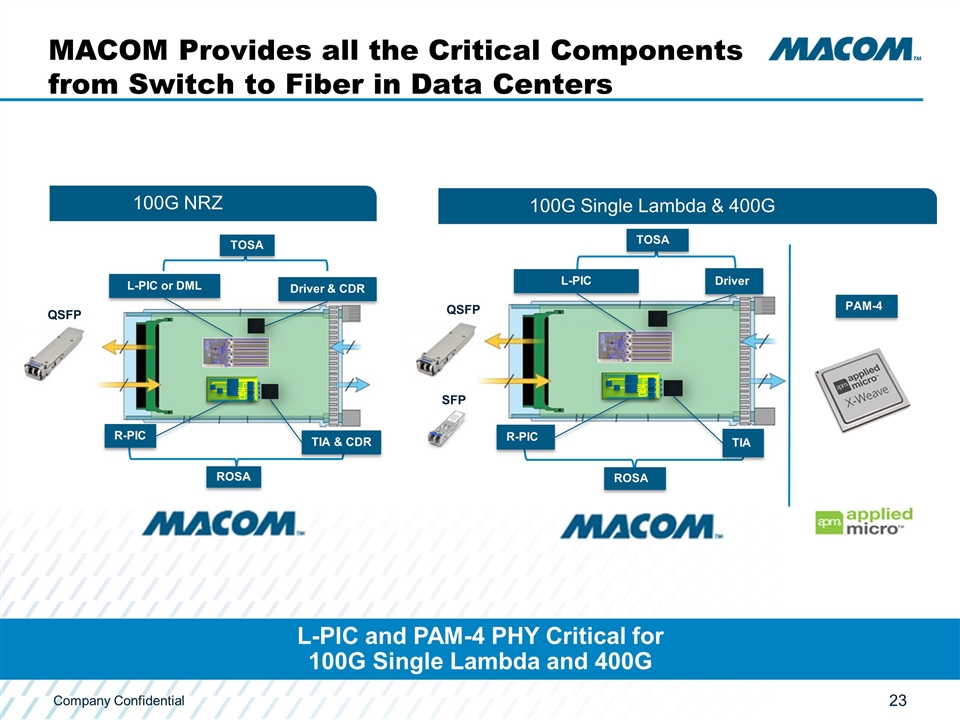

MACOM Provides all the Critical Components from Switch to Fiber in Data Centers L-PIC or DML Driver & CDR TIA & CDR R-PIC TOSA ROSA QSFP L-PIC Driver TIA R-PIC TOSA ROSA QSFP SFP L-PIC and PAM-4 PHY Critical for 100G Single Lambda and 400G 100G NRZ 100G Single Lambda & 400G PAM-4

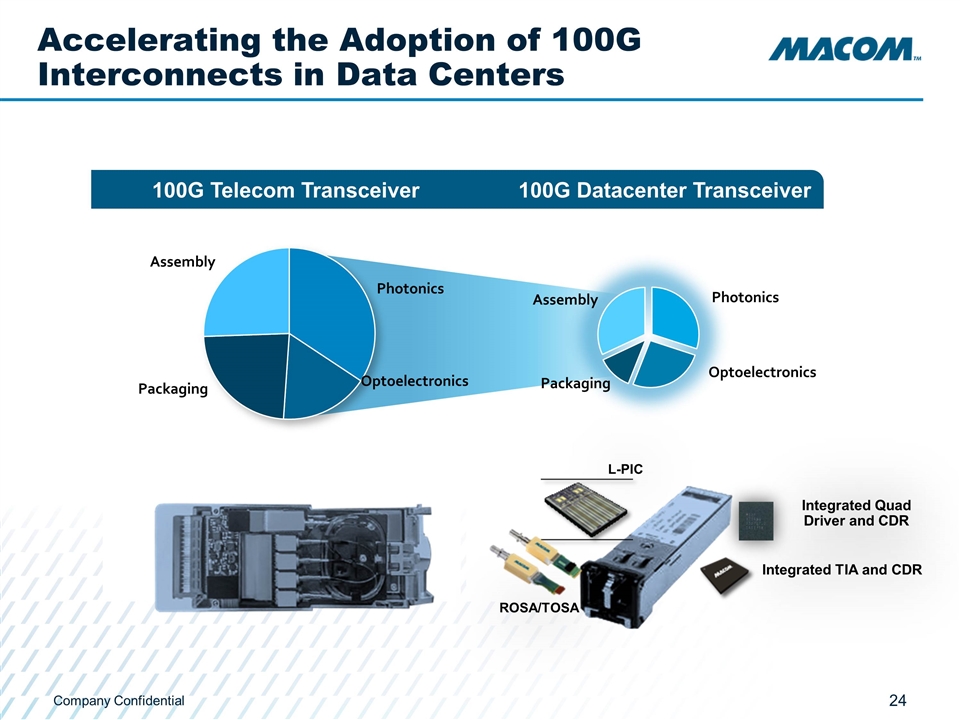

100G Telecom Transceiver 100G Datacenter Transceiver Optoelectronics Photonics Photonics Optoelectronics Packaging Packaging Assembly Assembly ROSA/TOSA Integrated Quad Driver and CDR Integrated TIA and CDR Accelerating the Adoption of 100G Interconnects in Data Centers L-PIC

Bob McMullan SVP & CFO MACOM

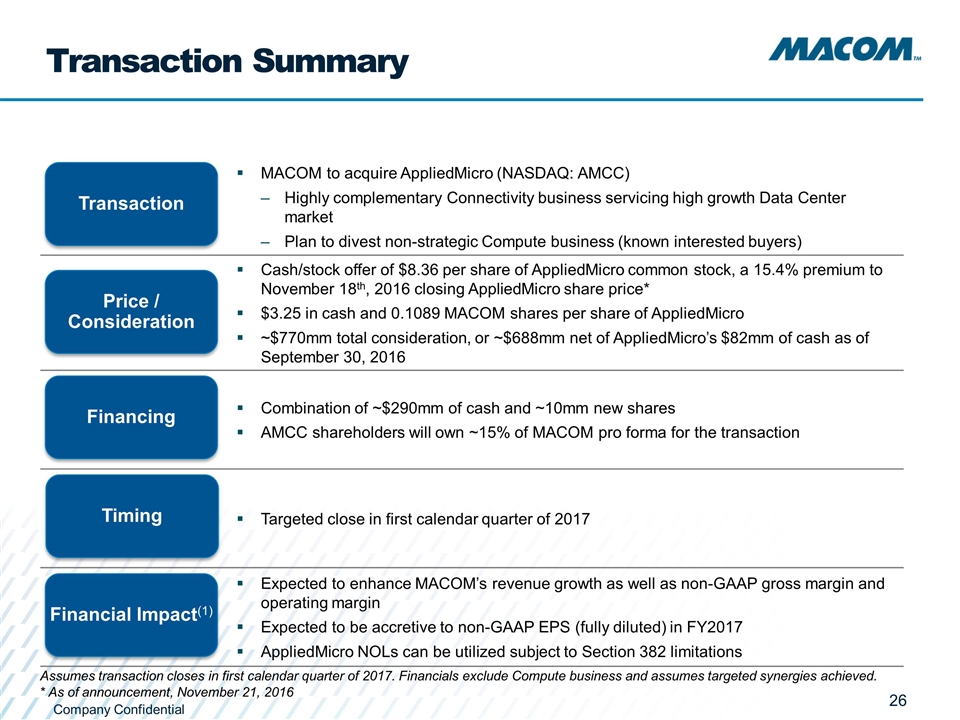

Transaction Summary MACOM to acquire AppliedMicro (NASDAQ: AMCC) Highly complementary Connectivity business servicing high growth Data Center market Plan to divest non-strategic Compute business (known interested buyers) Cash Cash/stock offer of $8.36 per share of AppliedMicro common stock, a 15.4% premium to November 18th, 2016 closing AppliedMicro share price* $3.25 in cash and 0.1089 MACOM shares per share of AppliedMicro ~$770mm total consideration, or ~$688mm net of AppliedMicro’s $82mm of cash as of September 30, 2016 Combination of ~$290mm of cash and ~10mm new shares AMCC shareholders will own ~15% of MACOM pro forma for the transaction Targeted close in first calendar quarter of 2017 Expected to enhance MACOM’s revenue growth as well as non-GAAP gross margin and operating margin Expected to be accretive to non-GAAP EPS (fully diluted) in FY2017 AppliedMicro NOLs can be utilized subject to Section 382 limitations Transaction Price / Consideration Financing Financial Impact(1) Timing Assumes transaction closes in first calendar quarter of 2017. Financials exclude Compute business and assumes targeted synergies achieved. * As of announcement, November 21, 2016

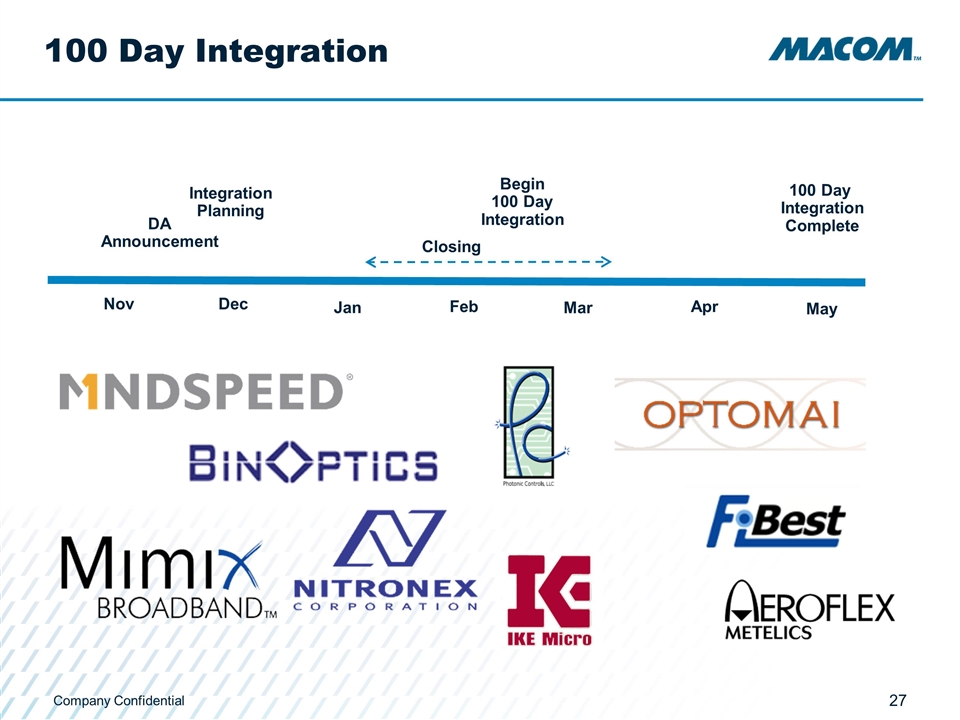

100 Day Integration Jan Nov Dec Apr Feb Mar Closing DA Announcement Integration Planning Begin 100 Day Integration 100 Day Integration Complete May

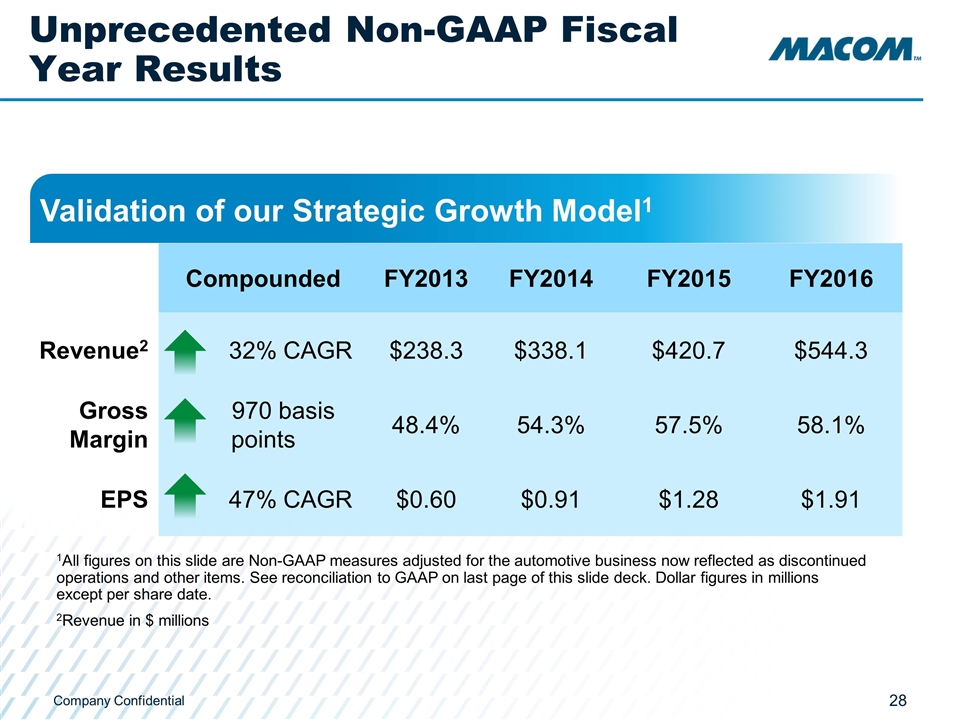

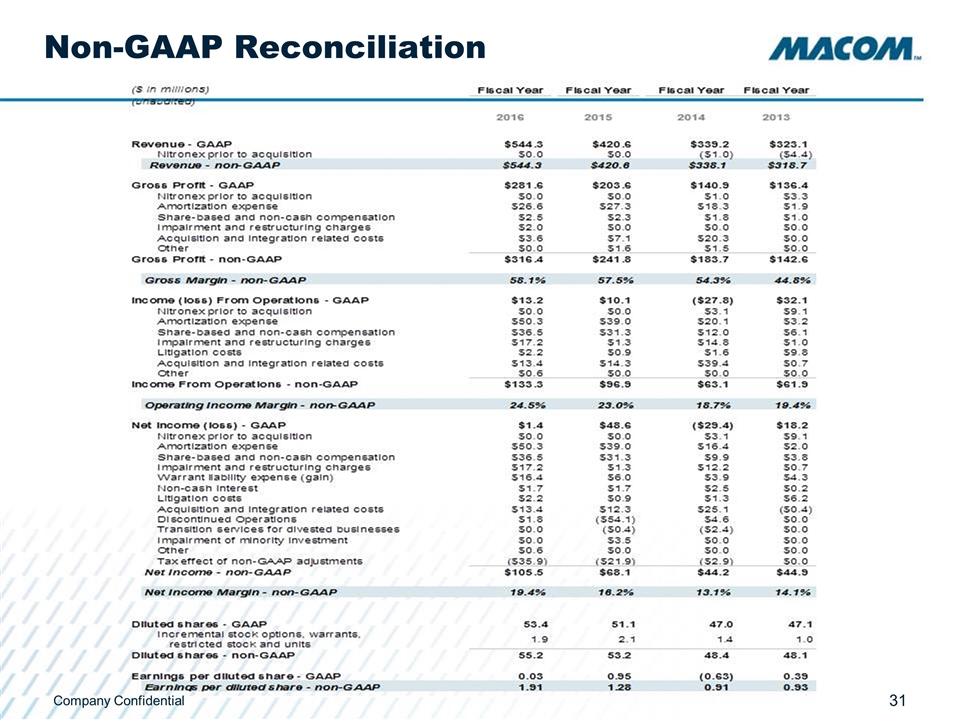

Unprecedented Non-GAAP Fiscal Year Results Validation of our Strategic Growth Model1 Compounded FY2013 FY2014 FY2015 FY2016 Revenue2 32% CAGR $238.3 $338.1 $420.7 $544.3 Gross Margin 970 basis points 48.4% 54.3% 57.5% 58.1% EPS 47% CAGR $0.60 $0.91 $1.28 $1.91 1All figures on this slide are Non-GAAP measures adjusted for the automotive business now reflected as discontinued operations and other items. See reconciliation to GAAP on last page of this slide deck. Dollar figures in millions except per share date. 2Revenue in $ millions

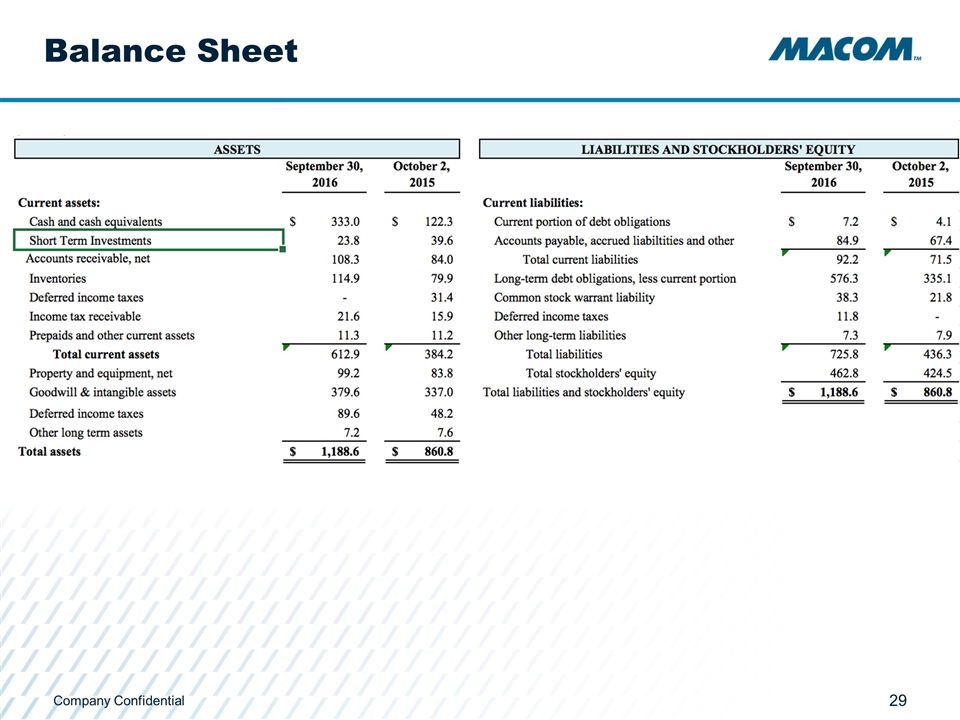

Balance Sheet

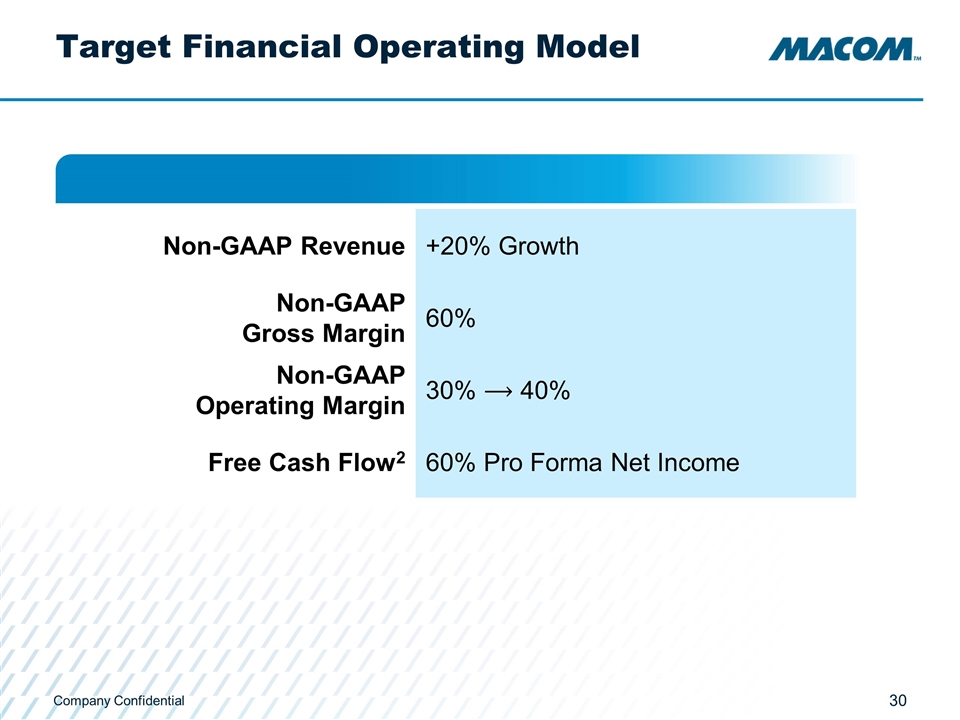

Target Financial Operating Model Non-GAAP Revenue +20% Growth Non-GAAP Gross Margin 60% Non-GAAP Operating Margin 30% ⟶ 40% Free Cash Flow2 60% Pro Forma Net Income

Non-GAAP Reconciliation Company Confidential

Accelerating and Broadening Breakout Growth in Cloud Data Centers Thank You.