0000711175 cik0000711175:C000005728Member cik0000711175:SpecialtyRetailMember 2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-03623 |

| |

| Exact name of registrant as specified in charter: | | The Prudential Series Fund |

| |

| Address of principal executive offices: | | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | |

| |

| Date of fiscal year end: | | 12/31/2024 |

| |

| Date of reporting period: | | 12/31/2024 |

Item 1 – Reports to Stockholders

(a) Report transmitted to stockholders pursuant to Rule

30e-1

under the Act (17 CFR

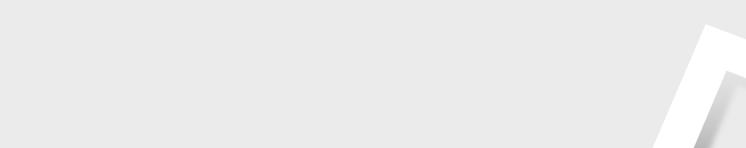

270.30e-1).

The Prudential Series Fund

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class I shares of PSF Global Portfolio (the “Portfolio”) for the period of

January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE

P

ORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF Global Portfolio—Class I | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

US equities registered impressive returns in 2024, with the S&P 500 Index gaining 25% against the backdrop of robust economic growth,

disinflation progress, and US Federal Reserve interest rate cuts. It was the second straight year of 20% returns for the S&P 500 Index, the first

time that has occurred since 1999. Mega-cap growth stocks drove the S&P 500 Index’s outsized returns, underpinned by ongoing optimism

over the earnings potential of artificial intelligence.

■

International equities, as measured by the MSCI EAFE Index, delivered a modest gain of 3.82% in 2024, underperforming US equities by a

rather wide margin. Slowing economic momentum contributed to low-single-digit equity returns in Europe, while an end to deflation and

corporate governance reforms led to more impressive gains in Japan. Emerging market equities were up 7.5% despite economic struggles in

China, which were offset by optimism over the potential policy response such as monetary easing.

■

Top-level allocation between segments positively contributed to the Portfolio’s performance relative the MSCI World Index during the period. A

small overweight allocation to US large-cap growth was the main positive driver of Portfolio performance. A small underweight allocation to

international growth was also a positive, as it lagged both the international and growth segments.

■

Exposure to US value stocks was a drag on performance relative to US growth stocks in the domestic space but outperformed both

international growth and value stocks. Subadvisor performance struggled throughout the period. For the Portfolio’s domestic equity

subadvisors, the dominance of the “Magnificent Seven” mega-cap technology stocks detracted from performance, as subadvisers maintained

consistently underweight allocations to these stocks. The Portfolio’s international equity subadvisors struggled due to underweight allocations in

China, as well as underweight allocations to high-growth names within the growth style. Stock selection detracted from relative performance

across subadvisors.

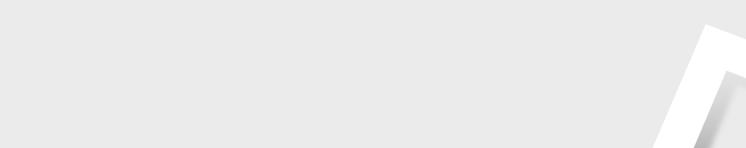

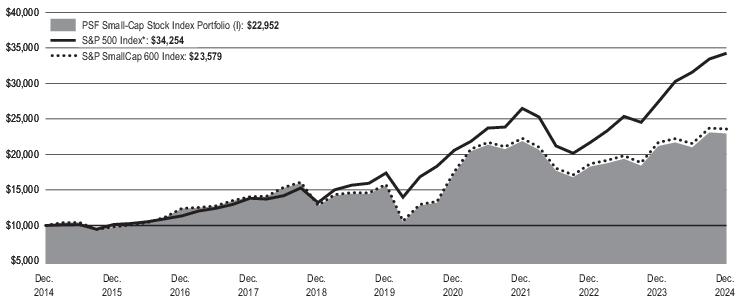

HOW HAS THE PORTFOLIO PERFORMED OVER THE PAST 10 YEARS?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

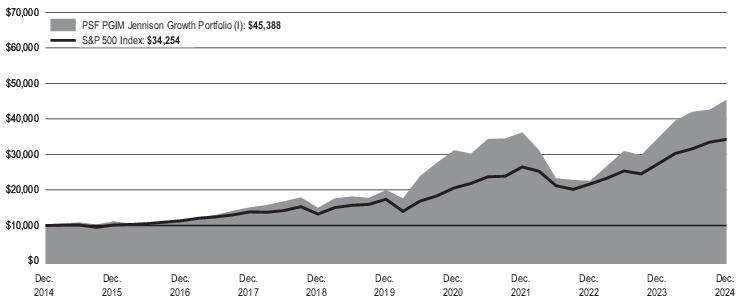

The line graph reflects a hypothetical $10,000 investment in Class I shares and assumes that all recurring fees (including management fees) were

deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have

been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown would

have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | | |

| Portfolio | | | |

| MSCI World Index (GD) | | | |

WHAT ARE SOME KEY PORTFOLIO STATISTICS

AS

OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

| |

Semiconductors & Semiconductor Equipment | |

| |

Affiliated Mutual Fund - Short-Term Investment (4.1% represents investments purchased with collateral from securities on loan) | |

Interactive Media & Services | |

| |

| |

Oil, Gas & Consumable Fuels | |

| |

| |

| |

| |

Health Care Equipment & Supplies | |

Technology Hardware, Storage & Peripherals | |

| |

| |

Hotels, Restaurants & Leisure | |

| |

| |

Health Care Providers & Services | |

| |

| |

Life Sciences Tools & Services | |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

| |

| |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Textiles, Apparel & Luxury Goods | |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY SIGNIFICANT CHANGES TO THE PORTFOLIO THIS YEAR?

The following is a summary of certain changes to the Portfolio since January 1, 2024.

■

Effective April 4, 2024, the Manager agreed to voluntarily waive 0.04% of its investment management fee through April 9, 2024.

For more complete information, you should review the Portfolio’s current prospectus and any applicable supplements and the Portfolio’s next

prospectus, which we expect to be available by May 1, 2025 at

www.prudential.com/variableinsuranceportfolios

or by request at

(800) 346-3778.

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class III shares of PSF Global Portfolio (the “Portfolio”) for the period of

January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF Global Portfolio—Class III | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

US equities registered impressive returns in 2024, with the S&P 500 Index gaining 25% against the backdrop of robust economic growth,

disinflation progress, and US Federal Reserve interest rate cuts. It was the second straight year of 20% returns for the S&P 500 Index, the first

time that has occurred since 1999. Mega-cap growth stocks drove the S&P 500 Index’s outsized returns, underpinned by ongoing optimism

over the earnings potential of artificial intelligence.

■

International equities, as measured by the MSCI EAFE Index, delivered a modest gain of 3.82% in 2024, underperforming US equities by a

rather wide margin. Slowing economic momentum contributed to low-single-digit equity returns in Europe, while an end to deflation and

corporate governance reforms led to more impressive gains in Japan. Emerging market equities were up 7.5% despite economic struggles in

China, which were offset by optimism over the potential policy response such as monetary easing.

■

Top-level allocation between segments positively contributed to the Portfolio’s performance relative the MSCI World Index during the period. A

small overweight allocation to US large-cap growth was the main positive driver of Portfolio performance. A small underweight allocation to

international growth was also a positive, as it lagged both the international and growth segments.

■

Exposure to US value stocks was a drag on performance relative to US growth stocks in the domestic space but outperformed both

international growth and value stocks. Subadvisor performance struggled throughout the period. For the Portfolio’s domestic equity

subadvisors, the dominance of the “Magnificent Seven” mega-cap technology stocks detracted from performance, as subadvisers maintained

consistently underweight allocations to these stocks. The Portfolio’s international equity subadvisors struggled due to underweight allocations in

China, as well as underweight allocations to high-growth names within the growth style. Stock selection detracted from relative performance

across subadvisors.

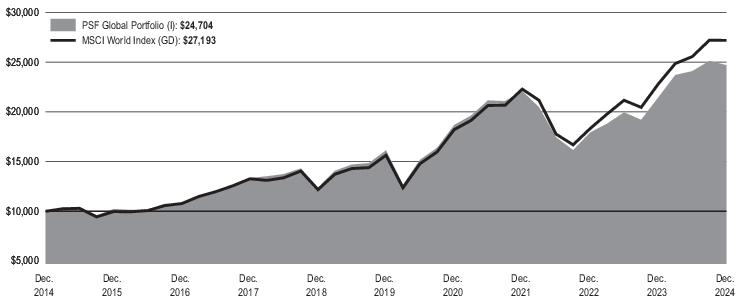

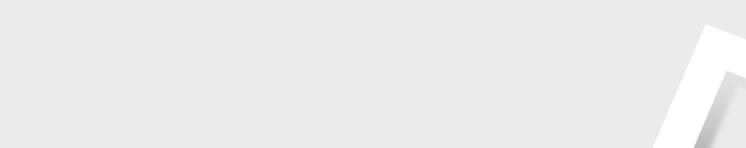

HOW HAS THE PORTFOLIO PERFORMED SINCE INCEPTION?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class III shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown

would have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: April 26, 2021 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | |

| Portfolio | | |

| MSCI World Index (GD) | | |

Portfolio Inception: 04/26/2021.

Since Inception returns are provided because the Portfolio has less than 10 fiscal years of returns. Since Inception returns for the Indexes are

measured from the closest month-end to the Portfolio’s inception date.

WHAT ARE SOME KEY PORTFOLIO STATISTICS

AS

OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

| |

Semiconductors & Semiconductor Equipment | |

| |

Affiliated Mutual Fund - Short-Term Investment (4.1% represents investments purchased with collateral from securities on loan) | |

Interactive Media & Services | |

| |

| |

Oil, Gas & Consumable Fuels | |

| |

| |

| |

| |

Health Care Equipment & Supplies | |

Technology Hardware, Storage & Peripherals | |

| |

| |

Hotels, Restaurants & Leisure | |

| |

| |

Health Care Providers & Services | |

| |

| |

Life Sciences Tools & Services | |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

| |

| |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Textiles, Apparel & Luxury Goods | |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY SIGNIFICANT CHANGES TO THE PORTFOLIO THIS YEAR?

The following is a summary of certain changes to the Portfolio since January 1, 2024.

■

Effective April 4, 2024, the Manager agreed to voluntarily waive 0.04% of its investment management fee through April 9, 2024.

For more complete information, you should review the Portfolio’s current prospectus and any applicable supplements and the Portfolio’s next

prospectus, which we expect to be available by May 1, 2025 at

www.prudential.com/variableinsuranceportfolios

or by request at

(800) 346-3778.

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

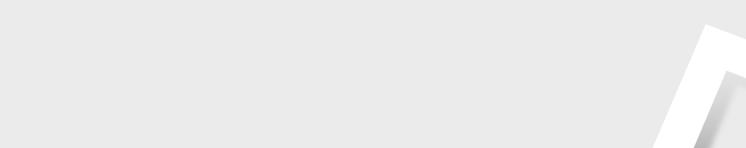

PSF Mid-Cap Growth Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class I shares of PSF Mid-Cap Growth Portfolio (the “Portfolio”) for the

period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF Mid-Cap Growth Portfolio—Class I | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

In the year ended December 31, 2024, the S&P 500 Index achieved its second consecutive year of returns exceeding 20.0%, marking the S&P

500 Index’s best back-to-back performance since 1997-1998. While there were short periods where market breadth appeared to broaden, a

narrow subset of mega-cap stocks led the way during the reporting period, much like they did in 2023.

■

While large-cap equities led returns across the market spectrum, growth equities as a style continued to outperform value equities, with the

Russell Midcap Growth Index and Russell Midcap Value Index returning 22.10% and 13.07%, respectively, during the year. Within the Russell

Midcap Growth Index, the utilities and technology sectors led returns while the telecommunications and health care sectors lagged.

■

The Portfolio underperformed the Russell Midcap Growth Index during the year. As concentration within the Index became historically high, the

Portfolio’s underexposure to large benchmark names detracted from its relative performance. Seven of the top-10-performing securities in the

Russell Midcap Growth Index were unowned or underweight in the Portfolio for most of the reporting period. Stock selection in the technology

and industrials sectors was the top detractor from Portfolio performance, with underweight positions in

. and

representing the most significant detraction from Portfolio performance on an individual stock basis.

■

Conversely, stock selection within the financials and telecommunications sectors contributed positively to the Portfolio’s performance relative to

the Russell Midcap Growth Index, with overweight positions in

and

leading the way.

■

The portfolio managers aimed to strategically position the Portfolio to capitalize on a potential broadening of benchmark leadership with

exposure across enduring growth franchises and areas with lower expectations, such as certain segments of consumer, housing, and software.

HOW HAS THE PORTFOLIO PERFORMED OVER THE PAST 10 YEARS?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class I shares and assumes that all recurring fees (including management fees) were

deducted and dividends and distributions were reinvested. Without waiver of

fees and/or expense reimbursements,

if any, the returns would have

been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown would

have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | | |

| Portfolio | | | |

| | | |

| Russell Midcap Growth Index | | | |

| S&P MidCap 400 Index | | | |

*The Portfolio has added this broad-based index in response to new regulatory requirements.

WHAT ARE SOME KEY PORTFOLIO STATISTICS AS OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S

HOLDINGS AS OF 12/31/2024

?

| |

Affiliated Mutual Fund - Short-Term Investment (17.6% represents investments purchased with collateral from securities on loan) | |

| |

| |

Hotels, Restaurants & Leisure | |

Semiconductors & Semiconductor Equipment | |

| |

| |

| |

| |

| |

| |

Life Sciences Tools & Services | |

| |

Oil, Gas & Consumable Fuels | |

Health Care Equipment & Supplies | |

Construction & Engineering | |

| |

| |

Commercial Services & Supplies | |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

Consumer Staples Distribution & Retail | |

Diversified Consumer Services | |

| |

| |

Health Care Providers & Services | |

Energy Equipment & Services | |

| |

Independent Power & Renewable Electricity | |

| |

| |

| |

| |

| |

Textiles, Apparel & Luxury Goods | |

Trading Companies & Distributors | |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY SIGNIFICANT CHANGES TO THE PORTFOLIO THIS YEAR?

The following is a summary of certain changes to the Portfolio since January 1, 2024.

■

On November 20, 2024, the Board of Trustees of The Prudential Series Fund (the “Trust”) approved the reorganization (the “Reorganization”)

of PSF Mid-Cap Growth Portfolio (the “Target Portfolio”) into the PSF PGIM Jennison Growth Portfolio (the “Acquiring Portfolio”), each a series

of the Trust. The Reorganization is subject to approval by the shareholders of the Target Portfolio. A special meeting of the Target Portfolio’s

shareholders to vote on the proposed Reorganization will be held on or about March 25, 2025. If approved by shareholders of the Target

Portfolio, it is expected that the Reorganization will be completed on or about April 14, 2025.

For more complete information, you should review the Portfolio’s current prospectus and any applicable supplements and the Portfolio’s next

prospectus, which we expect to be available by May 1, 2025 at

www.prudential.com/variableinsuranceportfolios

or by request at

(800) 346-3778.

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

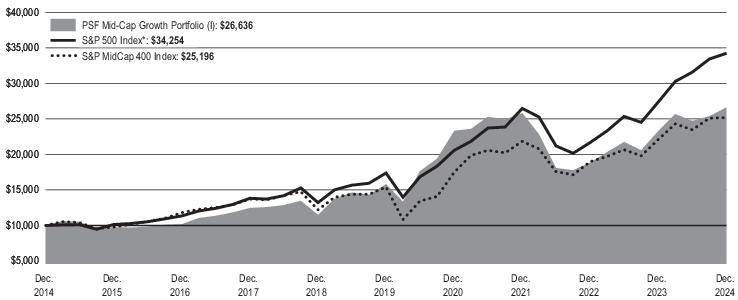

The Prudential Series Fund

PSF Mid-Cap Growth Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class II shares of PSF Mid-Cap Growth Portfolio (the “Portfolio”) for the

period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF Mid-Cap Growth Portfolio—Class II | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

In the year ended December 31, 2024, the S&P 500 Index achieved its second consecutive year of returns exceeding 20.0%, marking the S&P

500 Index’s best back-to-back performance since 1997-1998. While there were short periods where market breadth appeared to broaden, a

narrow subset of mega-cap stocks led the way during the reporting period, much like they did in 2023.

■

While large-cap equities led returns across the market spectrum, growth equities as a style continued to outperform value equities, with the

Russell Midcap Growth Index and Russell Midcap Value Index returning 22.10% and 13.07%, respectively, during the year. Within the Russell

Midcap Growth Index, the utilities and technology sectors led returns while the telecommunications and health care sectors lagged.

■

The Portfolio underperformed the Russell Midcap Growth Index during the year. As concentration within the Index became historically high, the

Portfolio’s underexposure to large benchmark names detracted from its relative performance. Seven of the top-10-performing securities in the

Russell Midcap Growth Index were unowned or underweight in the Portfolio for most of the reporting period. Stock selection in the technology

and industrials sectors was the top detractor from Portfolio performance, with underweight positions in

. and

representing the most significant detraction from Portfolio performance on an individual stock basis.

■

Conversely, stock selection within the financials and telecommunications sectors contributed positively to the Portfolio’s performance relative to

the Russell Midcap Growth Index, with overweight positions in

and

leading the way.

■

The portfolio managers aimed to strategically position the Portfolio to capitalize on a potential broadening of benchmark leadership with

exposure across enduring growth franchises and areas with lower expectations, such as certain segments of consumer, housing, and software.

HOW HAS THE PORTFOLIO PERFORMED OVER THE PAST 10 YEARS?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class II shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or ex

pense reimbursement

s, if any, the returns would

have been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown

would have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | | |

| Portfolio | | | |

| | | |

| Russell Midcap Growth Index | | | |

| S&P MidCap 400 Index | | | |

*The Portfolio has added this broad-based index in response to new regulatory requirements.

WHAT ARE SOME KEY PORTFOLIO STATISTICS AS OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

Affiliated Mutual Fund - Short-Term Investment (17.6% represents investments purchased with collateral from securities on loan) | |

| |

| |

Hotels, Restaurants & Leisure | |

Semiconductors & Semiconductor Equipment | |

| |

| |

| |

| |

| |

| |

Life Sciences Tools & Services | |

| |

Oil, Gas & Consumable Fuels | |

Health Care Equipment & Supplies | |

Construction & Engineering | |

| |

| |

Commercial Services & Supplies | |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

Consumer Staples Distribution & Retail | |

Diversified Consumer Services | |

| |

| |

Health Care Providers & Services | |

Energy Equipment & Services | |

| |

Independent Power & Renewable Electricity | |

| |

| |

| |

| |

| |

Textiles, Apparel & Luxury Goods | |

Trading Companies & Distributors | |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY SIGNIFICANT CHANGES TO THE PORTFOLIO THIS YEAR?

The following is a summary of certain changes to the Portfolio since January 1, 2024.

■

On November 20, 2024, the Board of Trustees of The Prudential Series Fund (the “Trust”) approved the reorganization (the “Reorganization”)

of PSF Mid-Cap Growth Portfolio (the “Target Portfolio”) into the PSF PGIM Jennison Growth Portfolio (the “Acquiring Portfolio”), each a series

of the Trust. The Reorganization is subject to approval by the shareholders of the Target Portfolio. A special meeting of the Target Portfolio’s

shareholders to vote on the proposed Reorganization will be held on or about March 25, 2025. If approved by shareholders of the Target

Portfolio, it is expected that the Reorganization will be completed on or about April 14, 2025.

For more complete information, you should review the Portfolio’s current prospectus and any applicable supplements and the Portfolio’s next

prospectus, which we expect to be available by May 1, 2025 at

www.prudential.com/variableinsuranceportfolios

or by request at

(800) 346-3778.

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

PSF Mid-Cap Growth Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class III shares of PSF Mid-Cap Growth Portfolio (the “Portfolio”) for the

period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF Mid-Cap Growth Portfolio—Class III | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

In the year ended December 31, 2024, the S&P 500 Index achieved its second consecutive year of returns exceeding 20.0%, marking the S&P

500 Index’s best back-to-back performance since 1997-1998. While there were short periods where market breadth appeared to broaden, a

narrow subset of mega-cap stocks led the way during the reporting period, much like they did in 2023.

■

While large-cap equities led returns across the market spectrum, growth equities as a style continued to outperform value equities, with the

Russell Midcap Growth Index and Russell Midcap Value Index returning 22.10% and 13.07%, respectively, during the year. Within the Russell

Midcap Growth Index, the utilities and technology sectors led returns while the telecommunications and health care sectors lagged.

■

The Portfolio underperformed the Russell Midcap Growth Index during the year. As concentration within the Index became historically high, the

Portfolio’s underexposure to large benchmark names detracted from its relative performance. Seven of the top-10-performing securities in the

Russell Midcap Growth Index were unowned or underweight in the Portfolio for most of the reporting period. Stock selection in the technology

and industrials sectors was the top detractor from Portfolio performance, with underweight positions in

. and

representing the most significant detraction from Portfolio performance on an individual stock basis.

■

Conversely, stock selection within the financials and telecommunications sectors contributed positively to the Portfolio’s performance relative to

the Russell Midcap Growth Index, with overweight positions in

and

leading the way.

■

The portfolio managers aimed to strategically position the Portfolio to capitalize on a potential broadening of benchmark leadership with

exposure across enduring growth franchises and areas with lower expectations, such as certain segments of consumer, housing, and software.

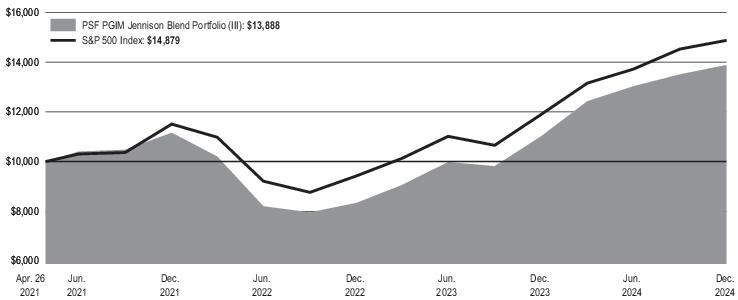

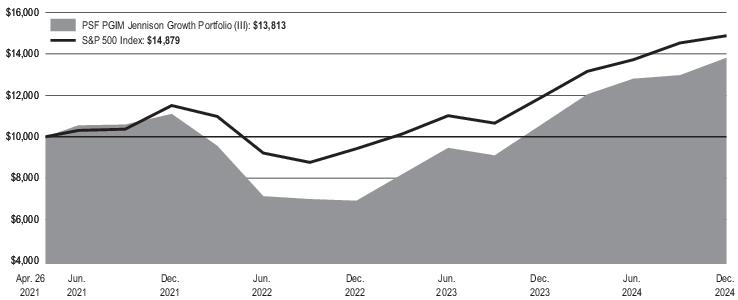

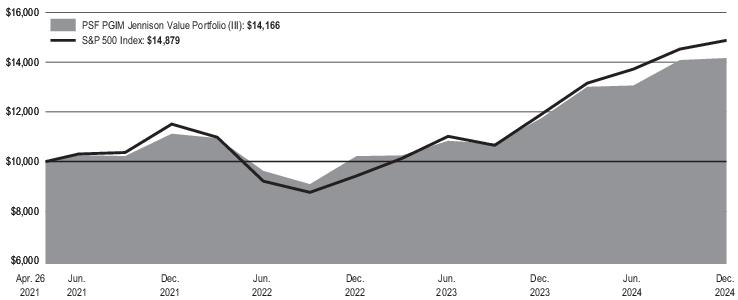

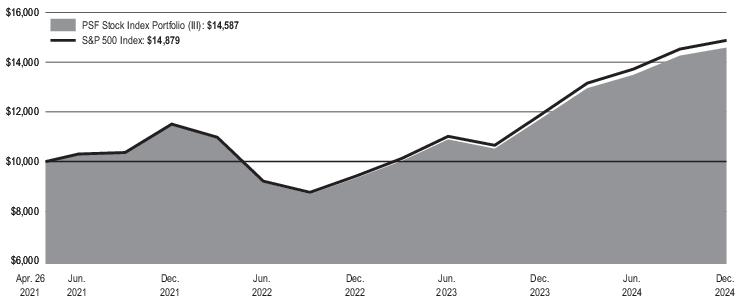

HOW HAS THE PORTFOLIO PERFORMED SINCE INCEPTION?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class III shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown

would have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: April 26, 2021 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | |

| Portfolio | | |

| | |

| Russell Midcap Growth Index | | |

| S&P MidCap 400 Index | | |

Portfolio Inception: 04/26/2021.

Since Inception returns are provided because the

Portfolio has less than

10 fiscal years of returns. Since Inception returns for the Indexes are

measured from the closest month-end to the Portfolio’s inception date.

*The Portfolio has added this broad-based index in response to new regulatory requirements.

WHAT ARE SOME KEY PORTFOLIO STATISTICS AS OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

Affiliated Mutual Fund - Short-Term Investment (17.6% represents investments purchased with collateral from securities on loan) | |

| |

| |

Hotels, Restaurants & Leisure | |

Semiconductors & Semiconductor Equipment | |

| |

| |

| |

| |

| |

| |

Life Sciences Tools & Services | |

| |

Oil, Gas & Consumable Fuels | |

Health Care Equipment & Supplies | |

Construction & Engineering | |

| |

| |

Commercial Services & Supplies | |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

Consumer Staples Distribution & Retail | |

Diversified Consumer Services | |

| |

| |

Health Care Providers & Services | |

Energy Equipment & Services | |

| |

Independent Power & Renewable Electricity | |

| |

| |

| |

| |

| |

Textiles, Apparel & Luxury Goods | |

Trading Companies & Distributors | |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY SIGNIFICANT CHANGES TO THE PORTFOLIO THIS YEAR?

The following is a summary of certain changes to the Portfolio since January 1, 2024.

■

On November 20, 2024, the Board of Trustees of The Prudential Series Fund (the “Trust”) approved the reorganization (the “Reorganization”)

of PSF Mid-Cap Growth Portfolio (the “Target Portfolio”) into the PSF PGIM Jennison Growth Portfolio (the “Acquiring Portfolio”), each a series

of the Trust. The Reorganization is subject to approval by the shareholders of the Target Portfolio. A special meeting of the Target Portfolio’s

shareholders to vote on the proposed Reorganization will be held on or about March 25, 2025. If approved by shareholders of the Target

Portfolio, it is expected that the Reorganization will be completed on or about April 14, 2025.

For more complete information, you should review the Portfolio’s current prospectus and any applicable supplements and the Portfolio’s next

prospectus, which we expect to be available by May 1, 2025 at

www.prudential.com/variableinsuranceportfolios

or by request at

(800) 346-3778.

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

PSF Natural Resources Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class I shares of PSF Natural Resources Portfolio (the “Portfolio”) for the

period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF Natural Resources Portfolio—Class I | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Natural resources equities had strong results during the reporting period. While oil prices finished lower due to concerns over reduced demand,

particularly in China, natural gas prices rose. Gold prices reached all-time highs in October 2024 due to safe-haven demand, while base metals

prices were mixed.

■

Stock selection in the electrical components and equipment sector, where holdings benefited from increased demand given the critical ties

between artificial intelligence and electrification, and in the paper and forest products sector, where Portfolio holdings benefited from favorable

housing sentiment, contributed positively to performance relative to the Custom Blended Index (the Index) during the period. Stock selection in

precious metals and minerals sector also contributed positively.

■

Stock selection in the commodity chemicals sector and an underweight allocation to the oil and gas storage and transportation sector detracted

the most from performance during the reporting period.

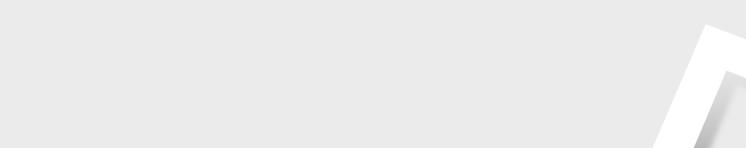

HOW HAS THE PORTFOLIO PERFORMED OVER THE PAST 10 YEARS?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance

.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class I shares and assumes that all recurring fees (including management fees) were

deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have

been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown would

have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | | |

| | | |

| | | |

Lipper Global Natural Resources Funds Index | | | |

| | | |

*The Portfolio has added this broad-based index in response to new regulatory requirements.

WHAT ARE SOME KEY PORTFOLIO STATISTICS AS OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

United States (13.2% represents investments purchased with collateral from securities on loan) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

WERE THERE ANY SIGNIFICANT CHANGES TO THE PORTFOLIO THIS YEAR?

The following is a summary of certain changes to the Portfolio since January 1, 2024.

■

On November 20, 2024, the Board of Trustees of The Prudential Series Fund (the “Trust”) approved the reorganization (the “Reorganization”)

of PSF Natural Resources Portfolio (the “Target Portfolio”) into the PSF PGIM Jennison Blend Portfolio (the “Acquiring Portfolio”), each a series

of the Trust. The Reorganization is subject to approval by the shareholders of the Target Portfolio. A special meeting of the Target Portfolio’s

shareholders to vote on the proposed Reorganization will be held on March 25, 2025. If approved by shareholders of the Target Portfolio, it is

expected that the Reorganization will be completed on or about April 14, 2025.

For more complete information, you should review the Portfolio’s current prospectus and any applicable supplements and the Portfolio’s next

prospectus, which we expect to be available by May 1, 2025 at

www.prudential.com/variableinsuranceportfolios

or by request at

(800) 346-3778.

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

PSF Natural Resources Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class II shares of PSF Natural Resources Portfolio (the “Portfolio”) for

the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF Natural Resources Portfolio—Class II | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Natural resources equities had strong results during the reporting period. While oil prices finished lower due to concerns over reduced demand,

particularly in China, natural gas prices rose. Gold prices reached all-time highs in October 2024 due to safe-haven demand, while base metals

prices were mixed.

■

Stock selection in the electrical components and equipment sector, where holdings benefited from increased demand given the critical ties

between artificial intelligence and electrification, and in the paper and forest products sector, where Portfolio holdings benefited from favorable

housing sentiment, contributed positively to performance relative to the Custom Blended Index (the Index) during the period. Stock selection in

precious metals and minerals sector also contributed positively.

■

Stock selection in the commodity chemicals sector and an underweight allocation to the oil and gas storage and transportation sector detracted

the most from performance during the reporting period.

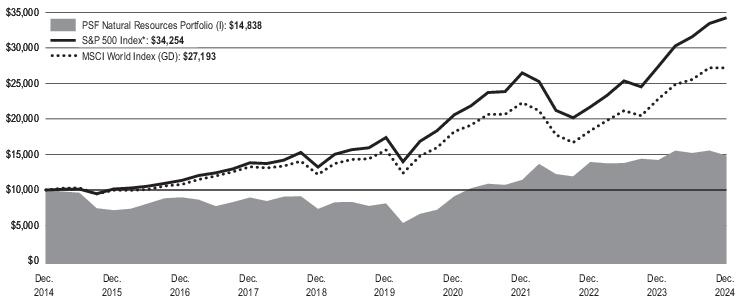

HOW HAS THE PORTFOLIO PERFORMED OVER THE PAST 10 YEARS?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance

.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class II shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges

were included

, the returns shown

would have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | | |

| | | |

| | | |

Lipper Global Natural Resources Funds Index | | | |

| | | |

*The Portfolio has added this broad-based index in response to new regulatory requirements.

WHAT ARE SOME KEY PORTFOLIO STATISTICS AS OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE

PORTFOLIO’S HOLDINGS

AS OF 12/31/2024?

| |

United States (13.2% represents investments purchased with collateral from securities on loan) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

WERE THERE ANY SIGNIFICANT CHANGES TO THE PORTFOLIO THIS YEAR?

The following is a summary of certain changes to the Portfolio since January 1, 2024.

■

On November 20, 2024, the Board of Trustees of The Prudential Series Fund (the “Trust”) approved the reorganization (the “Reorganization”)

of PSF Natural Resources Portfolio (the “Target Portfolio”) into the PSF PGIM Jennison Blend Portfolio (the “Acquiring Portfolio”), each a series

of the Trust. The Reorganization is subject to approval by the shareholders of the Target Portfolio. A special meeting of the Target Portfolio’s

shareholders to vote on the proposed Reorganization will be held on March 25, 2025. If approved by shareholders of the Target Portfolio, it is

expected that the Reorganization will be completed on or about April 14, 2025.

For more complete information, you should review the Portfolio’s current prospectus and any applicable supplements and the Portfolio’s next

prospectus, which we expect to be available by May 1, 2025 at

www.prudential.com/variableinsuranceportfolios

or by request at

(800) 346-3778.

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

PSF Natural Resources Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class III shares of PSF Natural Resources Portfolio (the “Portfolio”) for

the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF Natural Resources Portfolio—Class III | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Natural resources equities had strong results during the reporting period. While oil prices finished lower due to concerns over reduced demand,

particularly in China, natural gas prices rose. Gold prices reached all-time highs in October 2024 due to safe-haven demand, while base metals

prices were mixed.

■

Stock selection in the electrical components and equipment sector, where holdings benefited from increased demand given the critical ties

between artificial intelligence and electrification, and in the paper and forest products sector, where Portfolio holdings benefited from favorable

housing sentiment, contributed positively to performance relative to the Custom Blended Index (the Index) during the period. Stock selection in

precious metals and minerals sector also contributed positively.

■

Stock selection in the commodity chemicals sector and an underweight allocation to the oil and gas storage and transportation sector detracted

the most from performance during the reporting period.

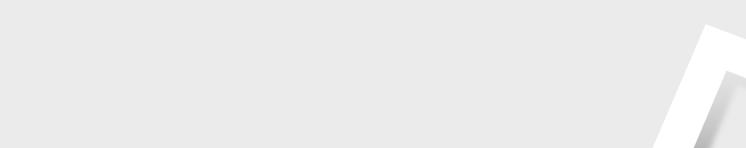

HOW HAS THE PORTFOLIO PERFORMED SINCE INCEPTION?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class III shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown

would have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: April 26, 2021 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | |

| | |

| | |

Lipper Global Natural Resources Funds Index | | |

| | |

Portfolio Inception: 04/26/2021.

Since Inception returns are provided because the Portfolio has less than 10 fiscal years of returns. Since Inception returns for the Indexes are

measured from the closest month-end to the Portfolio’s inception date.

*The Portfolio has added this broad-based index in response to new regulatory requirements.

WHAT ARE SOME KEY PORTFOLIO STATISTICS AS OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

United States (13.2% represents investments purchased with collateral from securities on loan) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

WERE THERE ANY SIGNIFICANT CHANGES TO THE

PORTFOLIO THIS YEAR

?

The following is a summary of certain changes to the Portfolio since January 1, 2024.

■

On November 20, 2024, the Board of Trustees of The Prudential Series Fund (the “Trust”) approved the reorganization (the “Reorganization”)

of PSF Natural Resources Portfolio (the “Target Portfolio”) into the PSF PGIM Jennison Blend Portfolio (the “Acquiring Portfolio”), each a series

of the Trust. The Reorganization is subject to approval by the shareholders of the Target Portfolio. A special meeting of the Target Portfolio’s

shareholders to vote on the proposed Reorganization will be held on March 25, 2025. If approved by shareholders of the Target Portfolio, it is

expected that the Reorganization will be completed on or about April 14, 2025.

For more complete information, you should review the Portfolio’s current prospectus and any applicable supplements and the Portfolio’s next

prospectus, which we expect to be available by May 1, 2025 at

www.prudential.com/variableinsuranceportfolios

or by request at

(800) 346-3778.

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

PSF PGIM 50/50 Balanced Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class I shares of PSF PGIM 50/50 Balanced Portfolio (the “Portfolio”) for

the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF PGIM 50/50 Balanced Portfolio—Class I | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

US stocks had a volatile end to 2024 but ultimately saw positive performance and finished the reporting period with strong gains. While the

Bloomberg US Aggregate Bond Index experienced late-term volatility, it still closed the year ended December 31, 2024 with positive

total returns.

■

The Portfolio’s overweight allocation to equities positively contributed to the Portfolio’s performance relative to its Custom Blended Index during

the reporting period. The Portfolio increased its equity exposure in the first quarter of 2024 and retained the overweight allocation over the year,

while also reducing its exposure to fixed income. The underweight allocation to fixed income was a steady contributor to performance,

notwithstanding a temporary pullback in equities during the summer.

■

The Portfolio’s off-benchmark position in international equities was generally flat for most of the reporting period before turning negative in the

final months of 2024. Non-US stocks underperformed US equities in the run-up to, and following, the US presidential election.

■

The Portfolio held a very modest position in S&P 500 Index futures, which provided flexibility to manage the equity exposure and had a slightly

positive impact on performance.

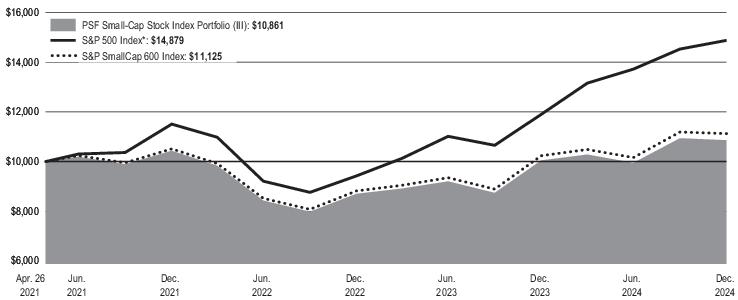

HOW HAS THE PORTFOLIO PERFORMED OVER THE PAST 10 YEARS?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class I shares and assumes that all recurring fees (including management fees) were

deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have

been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown would

have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | | |

| | | |

| | | |

| | | |

*The Portfolio’s Custom Blended Index is a model portfolio consisting of the S&P 500 Index (50%), Bloomberg US Aggregate Bond Index (40%), and FTSE 3-Month US Treasury Bill

Index (10%).

WHAT ARE SOME KEY

PORTFOLIO

STATISTICS

AS OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

Affiliated Mutual Fund - Short-Term Investment (1.4% represents investments purchased with collateral from securities on loan) | |

U.S. Government Agency Obligations | |

Semiconductors & Semiconductor Equipment | |

Collateralized Loan Obligations | |

Commercial Mortgage-Backed Securities | |

| |

| |

Technology Hardware, Storage & Peripherals | |

Interactive Media & Services | |

| |

| |

| |

| |

| |

U.S. Treasury Obligations | |

Oil, Gas & Consumable Fuels | |

| |

| |

Health Care Equipment & Supplies | |

| |

Health Care Providers & Services | |

Consumer Staples Distribution & Retail | |

Hotels, Restaurants & Leisure | |

| |

| |

Residential Mortgage-Backed Securities | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Real Estate Investment Trusts (REITs) | |

Life Sciences Tools & Services | |

| |

| |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

PSF PGIM 50/50 Balanced Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class III shares of PSF PGIM 50/50 Balanced Portfolio (the “Portfolio”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF PGIM 50/50 Balanced Portfolio—Class III | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

US stocks had a volatile end to 2024 but ultimately saw positive performance and finished the reporting period with strong gains. While the

Bloomberg US Aggregate Bond Index experienced late-term volatility, it still closed the year ended December 31, 2024 with positive

total returns.

■

The Portfolio’s overweight allocation to equities positively contributed to the Portfolio’s performance relative to its Custom Blended Index during

the reporting period. The Portfolio increased its equity exposure in the first quarter of 2024 and retained the overweight allocation over the year,

while also reducing its exposure to fixed income. The underweight allocation to fixed income was a steady contributor to performance,

notwithstanding a temporary pullback in equities during the summer.

■

The Portfolio’s off-benchmark position in international equities was generally flat for most of the reporting period before turning negative in the

final months of 2024. Non-US stocks underperformed US equities in the run-up to, and following, the US presidential election.

■

The Portfolio held a very modest position in S&P 500 Index futures, which provided flexibility to manage the equity exposure and had a slightly

positive impact on performance.

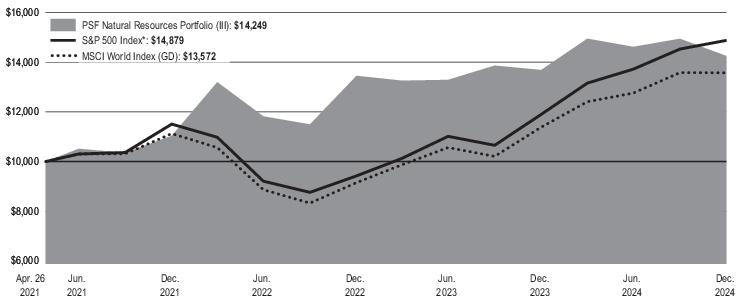

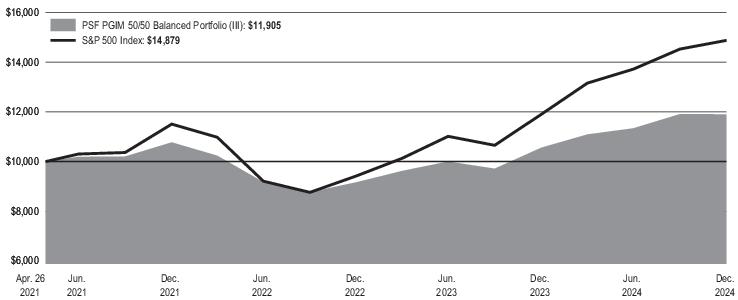

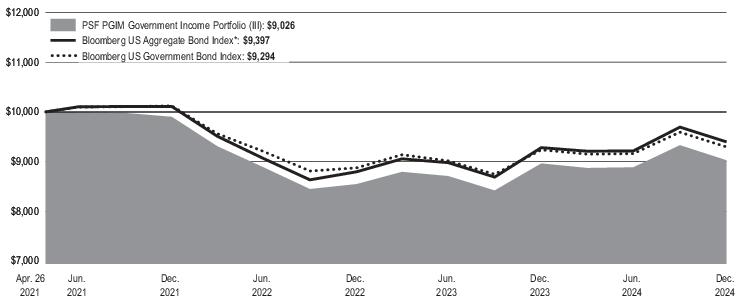

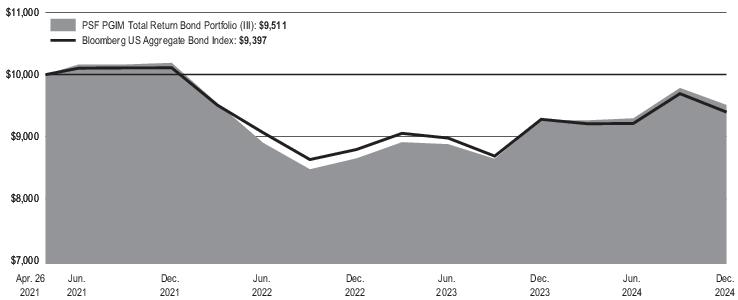

HOW HAS THE PORTFOLIO PERFORMED SINCE INCEPTION?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class III shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown

would have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: April 26, 2021 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | |

| | |

| | |

| | |

Portfolio Inception: 04/26/2021.

Since Inception returns are provided because the Portfolio has less than 10 fiscal years of returns. Since Inception returns for the Indexes are

measured from the closest month-end to the Portfolio’s inception date.

*The Portfolio’s Custom Blended Index is a model portfolio consisting of the S&P 500 Index (50%), Bloomberg US Aggregate Bond Index (40%), and FTSE 3-Month US Treasury Bill

Index (10%).

WHAT ARE SOME KEY PORTFOLIO STATISTICS AS OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

Affiliated Mutual Fund - Short-Term Investment (1.4% represents investments purchased with collateral from securities on loan) | |

U.S. Government Agency Obligations | |

Semiconductors & Semiconductor Equipment | |

Collateralized Loan Obligations | |

Commercial Mortgage-Backed Securities | |

| |

| |

Technology Hardware, Storage & Peripherals | |

Interactive Media & Services | |

| |

| |

| |

| |

| |

U.S. Treasury Obligations | |

Oil, Gas & Consumable Fuels | |

| |

| |

Health Care Equipment & Supplies | |

| |

Health Care Providers & Services | |

Consumer Staples Distribution & Retail | |

Hotels, Restaurants & Leisure | |

| |

| |

Residential Mortgage-Backed Securities | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Real Estate Investment Trusts (REITs) | |

Life Sciences Tools & Services | |

| |

| |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

PSF PGIM Flexible Managed Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class I shares of PSF PGIM Flexible Managed Portfolio (the “Portfolio”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF PGIM Flexible Managed Portfolio—Class I | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

US stocks had a volatile end to 2024 but ultimately finished the reporting period with strong gains. While the Bloomberg US Aggregate Bond

Index experienced late-term volatility, it still closed the year ended December 31, 2024 with positive total returns.

■

The Portfolio’s overweight allocation to equities positively contributed to the Portfolio’s performance relative to its Custom Blended Index during

the reporting period. The Portfolio increased its equity exposure in the first quarter of 2024 and retained the overweight allocation over the year,

while also reducing its exposure to fixed income. The underweight allocation in fixed income was a steady contributor to performance,

notwithstanding a temporary pullback in equities during the summer.

■

An off-benchmark position in international equities was generally flat for most of the reporting period before turning negative in the final months

of 2024. Non-US stocks underperformed US equities in the run-up to, and following, the US presidential election.

■

The Portfolio held a very modest position in S&P 500 Index futures, which provided flexibility to manage the equity exposure and had a slightly

positive impact on performance.

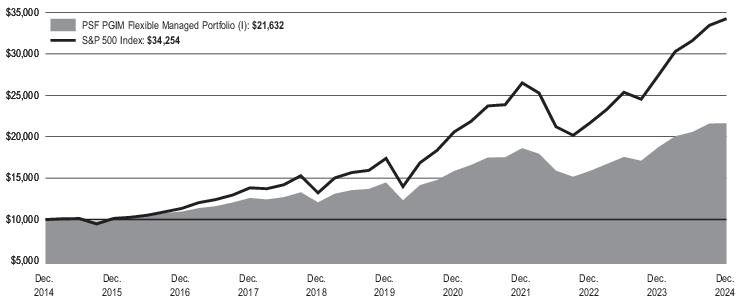

HOW HAS THE PORTFOLIO PERFORMED OVER THE PAST 10 YEARS?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class I shares and assumes that all recurring fees (including management fees) were

deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have

been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown would

have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | | |

| | | |

| | | |

| | | |

*The Portfolio’s Custom Blended Index is a model portfolio consisting of the S&P 500 Index (60%), Bloomberg US Aggregate Bond Index (35%), and FTSE 3-Month US Treasury Bill

Index (5%).

WHAT ARE SOME KEY PORTFOLIO STATISTICS AS OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

U.S. Government Agency Obligations | |

Affiliated Mutual Fund - Short-Term Investment (1.9% represents investments purchased with collateral from securities on loan) | |

Semiconductors & Semiconductor Equipment | |

| |

| |

Commercial Mortgage-Backed Securities | |

Technology Hardware, Storage & Peripherals | |

Collateralized Loan Obligations | |

Interactive Media & Services | |

| |

| |

| |

| |

| |

Oil, Gas & Consumable Fuels | |

Health Care Equipment & Supplies | |

| |

| |

Consumer Staples Distribution & Retail | |

Health Care Providers & Services | |

Hotels, Restaurants & Leisure | |

| |

| |

| |

| |

| |

| |

| |

U.S. Treasury Obligations | |

| |

| |

Life Sciences Tools & Services | |

Residential Mortgage-Backed Securities | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Real Estate Investment Trusts (REITs) | |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY SIGNIFICANT CHANGES TO THE PORTFOLIO THIS YEAR?

The following is a summary of certain changes to the Portfolio since January 1, 2024.

■

The Manager has agreed to contractually limit expenses to 0.61% through June 30, 2024 and; effective July 1, 2024, contractually limit

expenses to 0.62% through June 30, 2025.

For more complete information, you should review the Portfolio’s current prospectus and any applicable supplements and the Portfolio’s next

prospectus, which we expect to be available by May 1, 2025 at

www.prudential.com/variableinsuranceportfolios

or by request at

(800) 346-3778.

You can find additional information at

www.prudential.com/variableinsuranceportfolios

, including the Portfolio’s prospectus, financial

information, portfolio holdings, and proxy voting information. You can also request this information by contacting us at (800) 346-3778.

The Prudential Series Fund

PSF PGIM Flexible Managed Portfolio

ANNUAL SHAREHOLDER REPORT – DECEMBER 31, 2024

This annual shareholder report contains important information about the Class III shares of PSF PGIM Flexible Managed Portfolio (the “Portfolio”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Portfolio at

www.prudential.com/variableinsuranceportfolios

. You can also request this

information by contacting us at (800) 346-3778.

This report describes changes to the Portfolio that occurred during the reporting period.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PSF PGIM Flexible Managed Portfolio—Class III | | |

The table does not include charges charged under your variable annuity contract or variable life insurance policies (each, a Contract). Because Contract charges are not included, the

total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

WHAT AFFECTED THE PORTFOLIO’S PERFORMANCE DURING THE REPORTING PERIOD?

■

US stocks had a volatile end to 2024 but ultimately finished the reporting period with strong gains. While the Bloomberg US Aggregate Bond

Index experienced late-term volatility, it still closed the year ended December 31, 2024 with positive total returns.

■

The Portfolio’s overweight allocation to equities positively contributed to the Portfolio’s performance relative to its Custom Blended Index during

the reporting period. The Portfolio increased its equity exposure in the first quarter of 2024 and retained the overweight allocation over the year,

while also reducing its exposure to fixed income. The underweight allocation in fixed income was a steady contributor to performance,

notwithstanding a temporary pullback in equities during the summer.

■

An off-benchmark position in international equities was generally flat for most of the reporting period before turning negative in the final months

of 2024. Non-US stocks underperformed US equities in the run-up to, and following, the US presidential election.

■

The Portfolio held a very modest position in S&P 500 Index futures, which provided flexibility to manage the equity exposure and had a slightly

positive impact on performance.

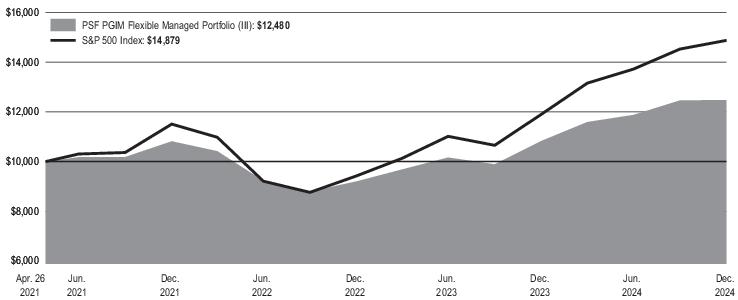

HOW HAS THE PORTFOLIO PERFORMED SINCE INCEPTION?

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The returns do not reflect the deduction

of applicable taxes, if any, that a shareholder would pay on Portfolio distributions or redemption of Portfolio shares.

The line graph reflects a hypothetical $10,000 investment in Class III shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower. The returns shown in the chart and table do not include Contract charges. If Contract charges were included, the returns shown

would have been lower than those shown. Consult your Contract prospectus for information about Contract charges. Performance for other share

classes will vary.

Cumulative Performance: April 26, 2021 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of December 31, 2024 |

| | |

| | |

| | |

| | |

Portfolio Inception: 04/26/2021.

Since Inception returns are provided because the Portfolio has less than 10 fiscal years of returns. Since Inception returns for the Indexes are

measured from the closest month-end to the Portfolio’s inception date.

*The Portfolio’s Custom Blended Index is a model portfolio consisting of the S&P 500 Index (60%), Bloomberg US Aggregate Bond Index (35%), and FTSE 3-Month US Treasury Bill

Index (5%).

WHAT ARE SOME KEY PORTFOLIO STATISTICS

AS

OF 12/31/2024?

| |

Number of portfolio holdings | |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE PORTFOLIO’S HOLDINGS AS OF 12/31/2024?

| |

U.S. Government Agency Obligations | |

Affiliated Mutual Fund - Short-Term Investment (1.9% represents investments purchased with collateral from securities on loan) | |

Semiconductors & Semiconductor Equipment | |

| |

| |

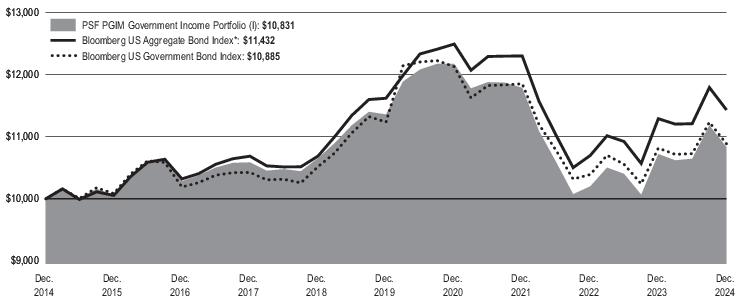

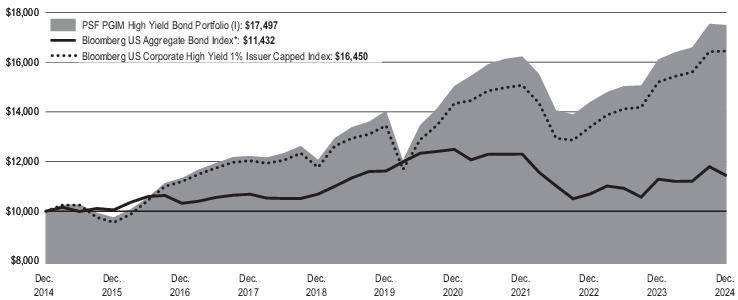

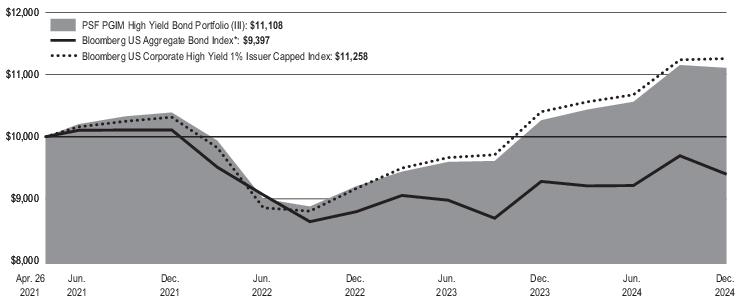

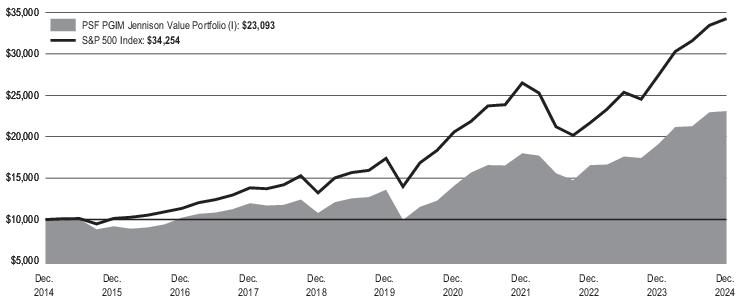

Commercial Mortgage-Backed Securities | |