our global presence. These acquisitions have meaningfully expanded our portfolio of well-known brands, enhanced our competitive position from both a product and channel perspective, and added scale to our operations. Today ACCO Brands is a global enterprise focused on developing innovative branded consumer products for use in businesses, schools, and homes.

Our 2019 Results. ACCO Brands had a very good year in 2019 as we delivered record net sales and adjusted earning per share. We also generated $204 million in operating cash flow and used that cash in a balanced way to invest in the business, reduce leverage and reward our stockholders. Great back-to-school sales and shares gains in North America, outstanding productivity savings and inventory reduction, incremental sales from the recent international acquisition, and our nimble response to multiple rounds of U.S. tariffs on Chinese goods all contributed to our results. We paid $24 million in dividends to stockholders, increased the dividend 8 percent during the year, repurchased 8.3 million shares for $65 million, and repaid $71 million of bank debt. We delivered these results despite a slowing global economy, increasing trade barriers, weakening international currencies, and continuing challenges in some of our channels of distribution.

Aligned with our strategy, in August 2019 we purchased Foroni, a leading consumer, school and office products company in Brazil. Foroni is our fourth international acquisition in the last four years. Like previous acquisitions, it gave us a well-known end-user brand and stronger channels of distribution, while presenting opportunities for leverage and cost synergies with our existing business in Brazil.

We also introduced several breakthrough products including a Kensington® SD7000 docking station, a line of Rexel® and Leitz® manual shredders, a GBC® Foton 30 automatic laminator, and our first entry into the wellness category with a line of TruSens® air purifiers. These award-winning products are examples of end-user driven innovation that our marketers and engineers develop every year to grow sales and improve margins. Complementing these innovations, we continued to generate cost savings from our productivity improvement programs. In 2019, we achieved $40 million in cost reduction, much of which we reinvested into our business.

While the overall company performance was very good, the results were uneven across our segments. ACCO Brands North America, with 49 percent of our global sales, had an excellent year and met or exceeded many of its financial objectives. Net sales increased 2.8 percent to $966.8 million. Strong back-to-school success was led by our Five Star® brand which took share in a flat market. North America operating income increased 12.3 percent to $131.0 million due to higher sales and cost savings, partially offset by higher incentive accruals.

ACCO Brands EMEA, with 29 percent of our sales, had a good year, but compared with a very strong 2018, it did not meet many of its objectives. Net sales declined 6 percent to $569.3 million due to the adverse impact of foreign exchange translation. Excluding foreign exchange, sales were essentially flat. Operating income decreased 1.3 percent to $58.6 million due to higher input costs, partially offset by lower restructuring charges and cost savings.

Our International segment had uneven results, as trade tensions took a toll on many global economies and industry-specific issues affected Australia. International sales grew 6.1 percent due to acquisitions, but net of acquisitions and foreign exchange, sales declined 2.8 percent. Strong performance in Brazil was offset by lost placements in Australia and the exit of low margin product lines in Asia. International segment operating income of $48.5 million decreased 1.4 percent due to lower sales, higher restructuring charges and adverse foreign exchange, partially offset by acquisitions. As a result, the International segment also missed most of its financial objectives for the year.

For more information about our business, please see “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2019, which can be found at the Investor Relations section of our website at www.accobrands.com.

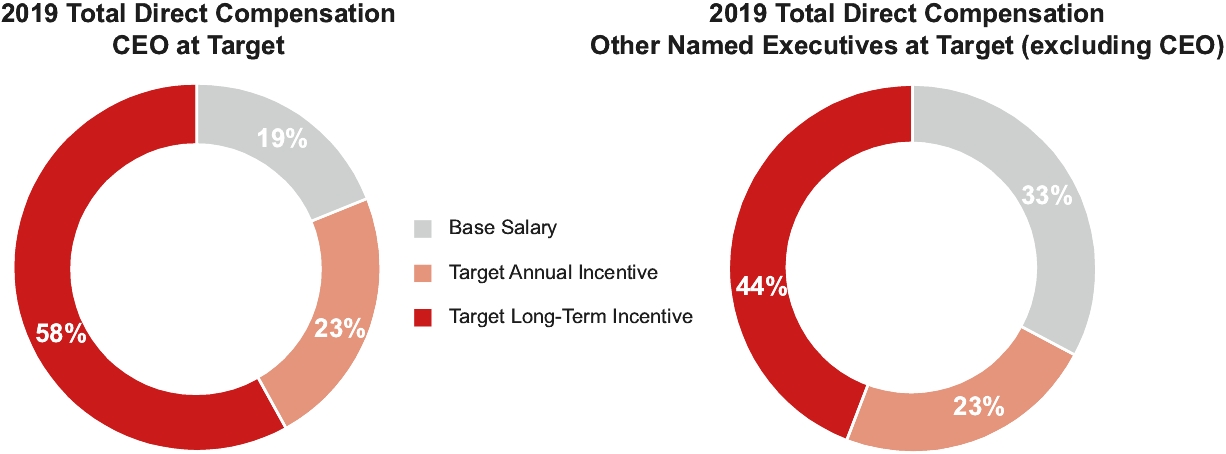

Impact of 2019 Company Performance on Incentive Payouts

We believe the incentive compensation earned in 2019 by our executive officers, including our named executive officers, properly reflected the performance of the Company.