- ACCO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ACCO Brands (ACCO) DEF 14ADefinitive proxy

Filed: 3 Apr 09, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only |

| (as permitted by Rule 14c-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

ACCO BRANDS CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined.): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 3, 2009

Dear Stockholder:

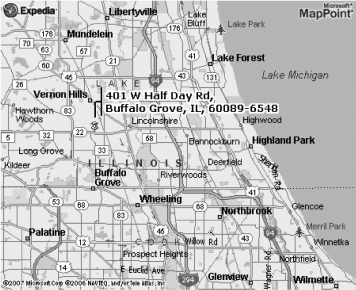

The ACCO Brands Corporation 2009 Annual Meeting of Stockholders will be held at 10:30 a.m. (Central time) on Tuesday, May 19, 2009, at the Arboretum Golf Club, 401 W. Half Day Road, Buffalo Grove, Illinois. A map with directions to the Arboretum Golf Club can be found following this letter. The sole purpose of the meeting is to consider the matters described in the following Notice of 2009 Annual Meeting and Proxy Statement.

It is important that your shares are represented at the meeting, whether or not you personally plan to attend. You can submit your proxy by using a toll-free telephone number, by mail or via the Internet, or you can vote in person at the meeting. Instructions for using these services are provided on the accompanying proxy form. If you decide to vote your shares using the accompanying proxy form, we urge you to complete, sign, date, and return it promptly.

Sincerely,

Robert J. Keller

Chairman of the Board

and Chief Executive Officer

NOTICE OF 2009 ANNUAL MEETING

AND PROXY STATEMENT

The Annual Meeting of Stockholders of ACCO Brands Corporation (“ACCO Brands” or the “Company”) will be held at the Arboretum Golf Club, 401 W. Half Day Road, Buffalo Grove, Illinois, at 10:30 a.m. (Central time) on Tuesday, May 19, 2009, to consider and vote upon the following matters:

| Item 1: | The election of five directors identified in this Proxy Statement for a term expiring at the 2010 Annual Meeting; and |

| Item 2: | To transact such other business as may properly come before the meeting or any adjournment thereof. |

If you hold common stock at the close of business on March 23, 2009, you will be entitled to vote at the Annual Meeting. Please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) by telephone, (2) through the Internet, or (3) by mail. For specific instructions, please refer to the accompanying proxy card. If you attend the Annual Meeting, you may revoke your proxy and vote in person.

This year we are again taking advantage of Securities and Exchange Commission (“SEC”) rules that allow issuers to furnish proxy materials to stockholders via the Internet. We sent Notices of Internet Availability of Proxy Materials to holders of our common stock as of the record date on or about April 3, 2009. The Notice describes how you can access our proxy materials, including this Proxy Statement, beginning on April 3, 2009.

We also are soliciting voting instructions from participants in the ACCO Brands Corporation 401(k) plan who have invested in the ACCO Brands Stock Fund or hold shares of our common stock under the plan. We ask each plan participant to sign, date and return the accompanying voting instruction card, or provide voting instructions by telephone or through the Internet as described on the voting instruction card.

By order of the Board of Directors

Steven Rubin

Senior Vice President, Secretary

and General Counsel

This Proxy Statement and accompanying proxy are first being made available or distributed to our stockholders on or about April 3, 2009.

VOTING AND PROXIES

Why is ACCO Brands distributing this Proxy Statement?

Our Board of Directors is soliciting proxies for use at our 2009 Annual Meeting of Stockholders to be held on Tuesday, May 19, 2009, beginning at 10:30 a.m. (Central time), at the Arboretum Golf Club, 401 W. Half Day Road, Buffalo Grove, Illinois. In order to solicit your proxy, we must furnish you with this Proxy Statement, which contains information that we are required to provide you by law.

What is the purpose of the annual meeting?

The purpose of the Annual Meeting is for stockholders to act upon the matters outlined in the Notice of 2009 Annual Meeting and described in this Proxy Statement, including: (1) the election of five directors, and (2) such other business as may properly come before the meeting. In addition, management will respond to questions from stockholders.

Why did I receive a notice in the mail regarding the availability of proxy materials on the Internet instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy materials via the Internet. Accordingly, we sent a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders. The Notice provides stockholders with instructions on how to access and review this Proxy Statement and our annual report online, as well as vote online. We believe that providing proxy materials electronically will significantly reduce printing and mailing costs associated with the distribution of printed copies of our proxy materials to our stockholders.

If you receive a Notice, you will not receive a printed copy of the proxy materials by mail unless you request one. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request printed copies may be found within the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Who is entitled to vote?

Only stockholders who own ACCO Brands common stock of record at the close of business on March 23, 2009 are entitled to vote. Each holder of common stock is entitled to one vote per share. There were 54,417,698 shares of common stock outstanding on March 23, 2009.

What is the difference between being a record holder and holding shares in street name?

A record holder holds shares in his or her own name. Shares held in “street name” means shares that are held in the name of a bank, broker or other nominee on a person’s behalf.

How do I vote?

Record holders can vote by filling out the accompanying proxy card and returning it as instructed on the proxy card. You can also vote by telephone or the Internet by following the instructions printed on the proxy card or the Notice. If you hold shares in street name, you must vote by giving instructions to your broker or nominee. You should follow the voting instructions that you receive from them. The availability of telephone and Internet voting will depend on the bank’s or broker’s voting process. You may also vote in person at the meeting.

1

How will my proxy be voted?

Your proxy, when properly signed and returned to us, or processed by telephone or via the Internet, and not revoked, will be voted in accordance with your instructions. We are not aware of any other matter that may be properly presented other than the election of directors. If any other matter is properly presented, the persons named in the enclosed form of proxy will have discretionary authority to vote in their best judgment.

What if I don’t mark the boxes on my proxy?

Unless you give other instructions on your form of proxy or when you cast your proxy by telephone or the Internet, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. The Board’s recommendation is set forth together with the description of each Item in this Proxy Statement. In summary, the Board recommends a vote FOR the election of each director nominee.

Can I go to the annual meeting if I vote by proxy?

Yes. Attending the meeting does not revoke your proxy unless you vote in person at the meeting.

How can I revoke my proxy?

You may revoke your proxy at any time before it is actually voted by giving written notice to the secretary of the meeting or by delivering a later-dated proxy, which automatically revokes your earlier proxy, either by mail, by telephone or the Internet if one of those methods was used for your initial proxy submission. If shares are held in a stock brokerage account or by a bank or other broker nominee, then you are not the record holder of your shares, and while you are welcome to attend the Annual Meeting you would not be permitted to vote unless you obtained a signed proxy from your broker nominee (who is the holder of record).

Will my vote be public?

No. As a matter of policy, stockholder proxies, ballots and tabulations that identify individual stockholders are kept secret and are only available to the independent Inspectors of Election and certain employees who have an obligation to keep your votes secret.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the issued and outstanding shares of common stock entitled to vote will constitute a quorum. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting. If less than a majority of the outstanding shares of common stock are represented at the meeting, a majority of the shares so represented may adjourn the meeting to another date, time or place.

How many votes are needed to elect the director nominees?

Directors are elected by a plurality of the votes cast for the election of directors at the meeting. A proxy marked to withhold authority for the election of one or more directors will not be voted with respect to the director or directors indicated.

What if I participate in the ACCO Brands 401(k) plan?

We also are making this Proxy Statement available to and seeking voting instructions from participants in the ACCO Brands 401(k) plan who invest in the ACCO Brands Stock Fund or hold shares of our common stock under such plan. The trustees of the plan, as record holders of ACCO Brands common stock held in the plan,

2

will vote whole shares attributable to you or your interest in the ACCO Brands Stock Fund in accordance with your directions given on your voting instruction card, by telephone or the Internet. If you hold shares of our common stock or invest in the ACCO Brands Stock Fund under the plan, please complete, sign and return your voting instruction card, or provide voting instructions by telephone or through the Internet as described on the voting instruction card prior toMay 15, 2009. The voting instruction card will serve as instructions to the plan trustees to vote the whole shares attributable to your interest in the manner you indicate on the card.

ELECTION OF DIRECTORS

(Proxy Item 1)

During 2008, three directors resigned from the Board of Directors and, accordingly, our Board of Directors currently consists of seven members. At the 2008 Annual Meeting, the stockholders approved an amendment to our Restated Certificate of Incorporation that eliminated the classification of our Board of Directors on a progressive basis. As a result of that action, four of the five nominees listed below are serving terms of office as directors that expire at the 2009 Annual Meeting. The terms of the remaining currently serving directors (Dr. Ewers and Mr. Bayly) continue until the 2010 Annual Meeting.

Pierre E. Leroy has advised the Board of Directors that he has decided to not stand for re-election upon the completion of his term at the 2009 Annual Meeting. In his place, the Board of Directors, upon recommendation from the Corporate Governance and Nominating Committee, has selected Michael Norkus as a nominee for election as a director at the 2009 Annual Meeting.

The Board of Directors proposes that each of the five nominees named and described below, four of whom currently serve as directors, be elected for a one-year term expiring at the 2010 Annual Meeting and until his respective successor is duly elected and qualified. Proxies cannot be voted for more than the number of nominees proposed for re-election.

Nominees.The names of the five director nominees, along with biographical and other information, their ages and, if applicable, the year first elected as a director of ACCO Brands, are set forth below. Each of the nominees has consented to serve a one-year term if elected. If any of them should become unavailable to serve as a director (which is not currently expected), the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

Name | Present positions and offices with ACCO Brands, | Age | Director of | |||

G. Thomas Hargrove | Mr. Hargrove is a private investor. He served as the non-executive Chairman of AGA Creative, a catalog creative agency, from 1999 until 2001, and as a director of General Binding Corporation from 2001 until August, 2005. | 69 | August, 2005 | |||

Robert H. Jenkins | Mr. Jenkins is retired. He served as Chairman, President and Chief Executive Officer of Sundstrand Corporation from 1997 to 1999 and as President and Chief Executive Officer from 1995 to 1997. Sundstrand is an aerospace and industrial company which merged with United Technologies Corporation in June, 1999 forming Hamilton Sundstrand Corporation. Mr. Jenkins is a director of AK Steel Holding Corporation and Clarcor, Inc. | 66 | March, 2007 |

3

Robert J. Keller | Mr. Keller has served as Chairman and Chief Executive Officer of the Company since October 22, 2008. He had previously been named the Company’s Chairman on September 18, 2008. Previously, Mr. Keller served as President and Chief Executive Officer of APAC Customer Services, Inc. from March, 2004 until February, 2008. Mr. Keller served in various capacities at Office Depot, Inc. from February, 1998 through September, 2003, most recently as President, Business Services Group. | 55 | August, 2005 | |||

Michael Norkus | Mr. Norkus is President of Alliance Consulting Group, a strategy consulting firm he founded in 1986. Prior to founding Alliance, Mr. Norkus spent 11 years with the Boston Consulting Group where he was a partner and a director. Mr. Norkus currently is a director of Overland Storage, Inc., where he chairs its nominating and governance committee and serves on the audit committee. | 62 | Not applicable | |||

Norman H. Wesley | Mr. Wesley is retired. He served as Chairman of the Board of Fortune Brands, Inc. from January, 2008 until September, 2008 and was Chairman of the Board and Chief Executive Officer of Fortune Brands from December, 1999 until January, 2008. Mr. Wesley currently serves as a director of Fortune Brands, Inc., and Pactiv Corporation. | 59 | August, 2005 |

The Board of Directors recommends that you vote FOR the election of each nominee.

Continuing Directors.The names of the continuing directors, along with biographical and other information, their ages and the year first elected as a director of ACCO Brands, are set forth below.

Name | Present positions and offices with ACCO Brands, | Age | Director of | |||

Dr. Patricia O. Ewers | Dr. Ewers has been retired since July, 2000. Prior to her retirement she had served as President of Pace University. | 73 | August, 2005 | |||

George V. Bayly | Mr. Bayly is a private investor. He served as interim Chief Executive Officer of U.S. Can Corporation from April, 2004 to January, 2005, and Chairman, President and CEO of Ivex Packaging Corporation, a specialty packaging company until June, 2002. Mr. Bayly was a director of General Binding Corporation from 1998 until August, 2005. He currently is a director of Huhtämaki Oyj, TreeHouse Foods, Inc. and Graphic Packaging Holding Company. | 66 | August, 2005 |

During 2008, there were eight meetings of the Board of Directors. Each director attended at least 75% of the total meetings of the Board of Directors and committees of the Board of Directors of which the director was a member. In addition to participation at Board and committee meetings, our directors discharge their responsibilities throughout the year through personal meetings and other communications, including considerable telephone contact with the Chairman and others regarding matters of interest and concern to ACCO Brands.

4

For information on the beneficial ownership of securities of ACCO Brands by directors and executive officers, see “Certain Information Regarding Security Holdings.”

Director Independence

The Board of Directors has adopted Corporate Governance Principles to address significant issues of corporate governance, such as Board composition and responsibilities, director compensation, and executive succession planning. The Corporate Governance Principles provide that a majority of the members of the Board of Directors, and each member of the Audit, Compensation and Corporate Governance and Nominating Committees, must meet certain criteria for independence. Based on the New York Stock Exchange independence requirements, the Corporate Governance Principles (which are available on our website,www.accobrands.com)set forth certain guidelines to assist in determining director independence. Section A.3 of the Corporate Governance Principles states:

A director shall be considered independent only if the Board of Directors affirmatively determines that the director has no material relationship with ACCO Brands, either directly or as a partner, stockholder, director or officer of an organization that has a material relationship with ACCO Brands.

Under no circumstances shall any of the following persons be considered an independent director for purposes of this guideline:

(a) any current employee of ACCO Brands, its subsidiaries, or ACCO Brands’ independent auditors;

(b) any former employee of ACCO Brands or its subsidiaries until three years after the employment has ended;

(c) any person who (1) is a current partner or employee of the firm that is ACCO Brands’ internal or external auditor; (2) has been within the last three years or has an immediate family member that has been within the last three years a partner or employee of such firm and worked on ACCO Brands’ audit during that time; or (3) has an immediate family member who is currently or within the last three years has been an employee of such firm and participates in the audit, assurance, or tax compliance (but not tax planning) practice;

(d) any person who is employed as an executive officer by another company on whose compensation committee one of ACCO Brands’ executive officers serves or has served during the prior three years;

(e) any person who receives, or who in any twelve month period within the last three years has received, more than $120,000 per year in direct compensation from ACCO Brands, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on future service);

(f) any person who is an executive officer or an employee of a company that makes payments to, or receives payments from, ACCO Brands for property or services in an amount that exceeds, in any of the last three fiscal years, the greater of $1 million or 2% of the other company’s consolidated gross revenues; and

(g) any person who has an immediate family member (as defined by the New York Stock Exchange Listed Company Manual) who falls into one of the previous six categories.

Mr. Norkus and each member of the Board of Directors, other than Mr. Keller, has been determined by the Board to be independent as defined in the New York Stock Exchange Listed Company Manual and to meet the independence criteria set forth in ACCO Brands’ Corporate Governance Principles. All members of the Audit Committee, Corporate Governance and Nominating Committee, and Compensation Committee are independent.

5

Robert H. Jenkins currently serves as the Presiding Independent Director to preside at all executive sessions of the non-employee directors of the Board. Executive sessions of non-employee directors are held at every regularly scheduled meeting of the Board of Directors.

Stockholder Communication

The Board of Directors and management encourage communication from our stockholders. Stockholders who wish to communicate with our management should direct their communication to the Chairman and Chief Executive Officer or the Office of the Corporate Secretary, 300 Tower Parkway, Lincolnshire, Illinois 60069. Stockholders and other interested parties who wish to communicate with the non-employee directors, any individual director or the Presiding Independent Director should direct their communication c/o the Office of the Corporate Secretary at the address above. The Secretary will forward any communications intended for the full Board, for the non-employee directors as a group, or for the Presiding Independent Director to Mr. Jenkins. Communications intended for an individual director will be forwarded directly to that director. If multiple communications are received on a similar topic, the Secretary may, in his discretion, forward only representative correspondence. Any communications that are abusive, in bad taste or present safety or security concerns may be handled differently.

Annual Meeting Attendance

We do not have a formal policy requiring members of the Board to attend stockholder annual meetings, although all directors are strongly encouraged to attend. All of the current directors attended the 2008 Annual Meeting.

Committees

The Board of Directors has established an Audit Committee, a Compensation Committee, a Corporate Governance and Nominating Committee and an Executive Committee.

Audit Committee | ||

| Members | The members of the Audit Committee are Messrs. G. Thomas Hargrove (Chairperson), George V. Bayly and Robert H. Jenkins. Each member meets the independence standards set forth in our Corporate Governance Principles and those set forth in the New York Stock Exchange Listed Company Manual. In addition, each member meets the independence standard under Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). Each member has been determined by the Board of Directors to be an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K under the Exchange Act. | |

| Number of Meetings Last Year | Eight | |

| Primary Functions | To assist our Board of Directors in overseeing (i) the integrity of our financial statements and the financial reporting process; (ii) our compliance with legal and regulatory requirements; (iii) the independence and qualifications of our external auditors; and (iv) the performance of our external and internal auditors. As part of their responsibility the committee: | |

1. Retains a firm of independent auditors to audit our financial statements and approves the scope of the firm’s audit; | ||

2. Approves the scope of audit work and reviews reports and recommendations of our independent auditors; | ||

3. Approves the annual internal audit plan and reviews reports and updates on the results of internal audit work; | ||

6

4. Pre-approves all audit and non-audit services provided by our independent auditors; | ||

5. Assists the Board in overseeing the integrity of our financial statements and financial reporting process; | ||

6. Monitors the independence and performance of our independent auditors and the performance of our internal auditors; | ||

7. Discusses with management our earnings announcements, financial statements and quarterly and annual reports to be filed with the SEC; | ||

8. Discusses with our independent auditors our annual and quarterly financial statements; | ||

9. Reviews our policies regarding risk assessment and risk management; and | ||

10. Establishes procedures for receiving and responding to concerns regarding accounting, internal accounting controls and auditing matters. | ||

| Compensation Committee | ||

| Members | The members of the Compensation Committee are Messrs. Wesley (Chairperson), Bayly, Hargrove, Leroy (until the date of the 2009 Annual Meeting) and Dr. Ewers. Each member meets the independence standards set forth in our Corporate Governance Principles and those set forth in the New York Stock Exchange Listed Company Manual. | |

| Number of Meetings Last Year | Five | |

| Primary Functions | To assure that our senior executives are compensated appropriately and in a manner consistent with competitive practices, performance and the requirements of the appropriate regulatory bodies. As part of this overall responsibility the committee: | |

1. Administers our Amended and Restated 2005 Incentive Plan and exercises the authority of the Board relating to employee benefit plans; | ||

2. Designates executive officers who may be granted stock options, performance awards and other stock-based awards; | ||

3. Allocates the total amount of stock options, performance awards and other stock-based awards to be awarded to all other key employees and delegates to an executive officer the authority to designate those key employees; | ||

4. Reviews and recommends to the Board target compensation and goals for the chief executive officer and evaluates his or her performance in achieving established goals; | ||

5. Sets salary and determines incentive compensation for our executive officers; | ||

6. Recommends terms and conditions of incentive compensation plans and equity-based plans for approval by the Board of Directors; | ||

7. Retains any compensation consultants to assist in the evaluation of senior executive compensation and benefits; and | ||

8. Oversees management’s administration of retirement and other benefit arrangements and plans, compensation agreements and severance plans and agreements for executive officers. | ||

7

| Corporate Governance and Nominating Committee | ||

| Members | The members of the Corporate Governance and Nominating Committee, Messrs. Jenkins (Chairperson), Leroy (until the date of the 2009 Annual Meeting), and Dr. Ewers all meet the independence standards set forth in our Corporate Governance Principles and those set forth in the New York Stock Exchange Listed Company Manual. | |

| Number of Meetings Last Year | Four | |

| Primary Functions | 1. Develops and recommends a set of corporate governance principles designed to foster an effective corporate governance environment; | |

2. Reviews the charters, duties, powers and composition of Board committees and recommends changes; | ||

3. Manages the performance review process of the Board, its committees and management; | ||

4. Identifies and evaluates potential director candidates and recommends nominees for election or re-election as members of the Board of Directors; | ||

5. Recommends independent directors for membership on the Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee, including their Chairpersons; | ||

6. Recommends directors and executive officers for membership on other committees that may be established by the Board of Directors; | ||

7. Recommends compensation arrangements for non-employee directors; and | ||

8. Oversees management’s administration of non-employee director stock plans. | ||

| Executive Committee | ||

| Members | The members of the Executive Committee are Messrs. Keller (Chairperson), Jenkins and Wesley. | |

| Number of Meetings Last Year | None | |

| Primary Functions | Has all the power and authority of the full Board except for specific powers that by law must be exercised by the full Board. | |

Nomination Process

The primary functions of the Corporate Governance and Nominating Committee and a list of the Committee members (all of whom have been determined by the Board to be independent as defined by the New York Stock Exchange independence standards) are provided above. The Corporate Governance and Nominating Committee establishes the process by which the Board of Directors exercises its fiduciary duties for overseeing the performance of ACCO Brands’ management for the benefit of its stockholders and the maximization of stockholder value. Specific duties and responsibilities of the Corporate Governance and Nominating Committee include defining director qualifications as well as criteria for director independence and the selection of director candidates to be recommended to the Board.

The Committee, when identifying and evaluating candidates, first determines whether there are any evolving needs of the Board that require an expert in a particular field to fill that need. The Committee then may retain a

8

third-party search firm to locate and provide information on candidates that meet the needs of the Board at that time. The Committee chair and some or all of the members of the Committee will interview potential candidates that are deemed appropriate. If the Committee determines that a potential candidate meets the needs of the Board, has the qualifications, and meets the standards set forth in ACCO Brands’ Corporate Governance Principles, it will vote to recommend to the Board of Directors the nomination of the candidate.

The policy of the Corporate Governance and Nominating Committee is to consider director candidates recommended by stockholders if properly submitted to the Corporate Governance and Nominating Committee. Stockholders wishing to recommend persons for consideration by the Corporate Governance and Nominating Committee as nominees for election to the Board of Directors can do so by writing to the Office of the Secretary of ACCO Brands Corporation at 300 Tower Parkway, Lincolnshire, Illinois 60069. Recommendations must include the proposed nominee’s name, biographical data and qualifications as well as a written statement from the proposed nominee consenting to be named as a nominee and, if nominated and elected, to serve as a director. The Corporate Governance and Nominating Committee will then consider the candidate and the candidate’s qualifications. The Committee may contact the stockholder making the nomination to discuss the qualifications of the candidate and the reasons for making the nomination. The Committee may then interview the candidate if the Committee deems the candidate to be appropriate. The Committee may use the services of a third-party search firm to provide additional information about the candidate prior to making a recommendation to the Board.

The Corporate Governance and Nominating Committee believes that it is necessary for our directors to possess many qualities and skills. The Committee believes that all directors must possess a considerable amount of business management and educational experience as well as meet the standards established by the Committee pursuant to ACCO Brands’ Corporate Governance Principles. In developing these standards, the Committee considers issues of judgment, diversity, background, stature, conflicts of interest, integrity, ethics and commitment to the goal of maximizing stockholder value. In considering candidates for the Board, the Corporate Governance and Nominating Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the Board are also considered.

The Committee’s nomination process for stockholder-recommended candidates and all other candidates is designed to ensure that the Committee fulfills its responsibility to recommend candidates that are properly qualified to serve ACCO Brands for the benefit of all of its stockholders, consistent with the standards established by the Committee under the ACCO Brands’ Corporate Governance Principles.

Compensation Committee Interlocks and Insider Participation

All current members of the Compensation Committee are considered independent under our Corporate Governance Principles. No interlocking relationships exist between the Board of Directors or the Compensation Committee and the Board of Directors or compensation committee of any other company.

9

Section 16(a) Beneficial Ownership Reporting Compliance

Each director and executive officer of ACCO Brands who is subject to Section 16 of the Exchange Act is required to file with the SEC reports regarding their ownership and changes in beneficial ownership of our equity securities. Reports received by ACCO Brands indicate that all these directors and executive officers have filed all requisite reports with the SEC on a timely basis during or for 2008.

EXECUTIVE OFFICERS OF ACCO BRANDS CORPORATION

Name and age | Title | |

Robert J. Keller, 55 | Chairman and Chief Executive Officer | |

Boris Elisman, 46 | Executive Vice President; President, ACCO Brands Americas | |

Neal V. Fenwick, 47 | Executive Vice President and Chief Financial Officer | |

Kriss A. Kirchhoff, 53 | Executive Vice President; President, Product Generation Organization | |

Peter Munk, 45 | Executive Vice President; President, ACCO Brands International | |

Mark C. Anderson, 47 | Senior Vice President, Corporate Development | |

David L. Kaput, 49 | Senior Vice President and Chief Human Resources Officer | |

Gregory J. McCormack, 45 | Senior Vice President, Operations (Americas) | |

Thomas P. O’Neill, Jr., 55 | Senior Vice President, Finance and Accounting | |

Steven Rubin, 61 | Senior Vice President, Secretary and General Counsel | |

Christopher M. Franey, 53 | Senior Vice President; President, Computer Products Group | |

John M. Turner, 59 | President, Commercial Print Finishing Group | |

All of the above-named officers have been actively engaged in the business of the Company and its predecessor as employees (or in the case of Messrs. Turner and Rubin, as employees of General Binding Corporation (“GBC”) prior to its merger with the predecessor of the Company in August 2005) for the past five years in the capacity indicated above or in a substantially similar capacity except:

| · | Robert J. Keller, who has served in this position since October 22, 2008. Mr. Keller had previously been named the Company’s Chairman on September 18, 2008. He had been President and Chief Executive Officer of APAC Customer Services, Inc. from March, 2004 until February, 2008. Prior to that time Mr. Keller served in various capacities at Office Depot, Inc. from February, 1998 through September, 2003, most recently as President, Business Services Group; |

| · | Boris Elisman, who before being appointed to this position in October, 2008 was President of the Company’s Global Office Products Group since April, 2008 and President of the Company’s Computer Products Group since joining the Company in 2005. Prior to that time he held Vice President and General Manager positions in marketing and sales for the Hewlett-Packard Company from 2001 to 2004; |

| · | Kriss A. Kirchhoff, who before being appointed to this position in October, 2008 was President of the Company’s Document Finishing Group since joining the Company in December, 2006. Prior to that |

10

time he had been the President of TreeTop Technologies, a software engineering firm, for one year and for more than five years prior to that held various general management positions in the printing and imaging group of the Hewlett-Packard Company; |

| · | Peter Munk, who before being appointed to this position in October, 2008 was President of the Company’s Europe Group since joining the Company in February, 2006. Prior to that time he held various general management positions in the consumer products group of Black and Decker, Inc.; |

| · | Mark C. Anderson, who before joining the Company in October, 2007 was the Director, Corporate Development for Pitney Bowes, Inc. since February, 2003 and a Vice President of Business Development for Pitney Bowes from August, 2001 to February, 2003; |

| · | David L. Kaput, who before joining the Company in October, 2007 had been the Senior Vice President, Global HR Practices and Governance of SAP, AG since August, 2005 and Senior Vice President, Global Human Resources and Corporate Officer of SAP Global Marketing, Inc. from October, 2001 to August, 2005; |

| · | Gregory J. McCormack, who has held various senior operations and management positions with the Company prior to his assuming this position in April, 2008; |

| · | Thomas P. O’Neill, who before joining the Company in 2005 had been the Group Vice President, Global Finance for Teleflex, Inc. from 2003 to 2005 and had been Senior Vice President and Chief Financial Officer for Philip Services Corporation from 2001 to 2002; and |

| · | Christopher M. Franey, who before joining the Company in December, 2008 had been a marketing and sales Vice President for Samsung Electronics Information Technology Division since 2006 and prior to that time had been the President of ViewSonic Corporation, a global provider of visual display technology products since 2004. |

There is no family relationship between any of the above named officers. All officers are appointed for one-year terms by the Board of Directors or until such time each is re-appointed.

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

The year 2008 was a difficult one for the Company and the office products industry generally. The Company’s weak operating performance and declining global economic conditions forced the Company and the Compensation Committee of the Board of Directors to make some very difficult decisions aimed at preserving the Company’s liquidity and mitigating declining operating results. Among the actions taken with respect to the Company’s officers in 2008 and early 2009 in this regard, all of which are discussed in more detail in the following discussion and analysis, were:

| · | significant base salary reductions, |

| · | no payment of annual cash bonuses for the year 2008, except in the case of one officer pursuant to a pre-existing agreement, |

| · | the curtailment of certain retirement benefit plans, and |

| · | deferral of the establishment of a 2009 annual cash bonus plan. |

11

Overview and Objectives of the Compensation Program

The Compensation Committee (the “Committee”) of the Board of Directors has the responsibility for establishing, implementing and monitoring the compensation and benefit programs of the Company and ensuring adherence with the Company’s compensation objectives. The principal purpose of the Committee is to oversee an executive compensation program that aligns an executive’s interests with those of our stockholders by rewarding performance against established goals, with the ultimate objective of improving stockholder value. Further, the Committee seeks to structure its executive compensation arrangements so that the Company can attract and retain quality management leadership.

Among other things, the Committee:

| · | approves the compensation levels for the Company’s executive officers including the officers named in the 2008 Summary Compensation Table (the “named executive officers”); |

| · | approves long-term incentive awards for the Company’s executive officers under the Company’s Amended and Restated 2005 Incentive Plan (the “LTIP”); |

| · | makes a final determination with respect to annual performance measures, establishes individual incentive opportunities, and determines the actual awards under the cash award annual incentives portion of the LTIP; and |

| · | assesses the competitiveness and effectiveness of the Company’s other executive compensation and benefit plans. |

Further, the Committee annually reviews and approves the target compensation and goals for the Chief Executive Officer (the “CEO”), evaluates, along with the other non-employee members of the Board of Directors, the CEO’s performance in light of these goals, and determines the CEO’s total cash and long-term incentive compensation program based on this evaluation. The actions of the Committee with respect to the CEO are then reported on and discussed with the non-employee members of the Board of Directors for final approval.

At the direction of the Committee and to assist it in its review and approval process, management prepares a presentation of total compensation, a “tally sheet,” and/or other supporting data for the Committee’s use when considering and determining executive compensation for all of the Company’s executive officers.

The tally sheets summarize each officer’s total compensation and provide information on the:

| · | value of each component of current compensation, including benefits and perquisites; |

| · | potential value of all equity-based long-term incentive awards held by the officer, both vested and unvested, at then-current market prices; and |

| · | value of lump-sum payments and benefits that would be payable should the officer’s employment terminate under various scenarios such as retirement, voluntary termination, involuntary termination or following a change-in-control. Details on potential excise tax gross-up payments on excess parachute payments related to termination following a change-in-control of the Company also are included. |

The tally sheets provide a succinct summary of all elements of each officer’s compensation so that the Committee can analyze both the individual elements of compensation as well as the aggregate amount of actual and projected compensation and the impact of Company performance on the value of equity awards. The tally sheets assist the Committee in comparing an executive officer’s compensation against benchmark information for our peer group companies, as reviewed and approved by the Committee in conjunction with advice provided by the Committee’s compensation consultant.

12

The Committee has retained Compensation Strategies, Inc. (“CSI”) as its consultant and advisor on executive officer compensation matters. During 2008, CSI provided advice and benchmarking data, made recommendations on matters pertaining to compensation of our CEO and advised the Committee on compensation matters for all other executive officers as requested by the Committee. While CSI has acted primarily as an advisor to the Committee, CSI also has provided, on a limited basis and with the knowledge and consent of the Committee, compensation data to management and assisted management in valuing equity awards. Management continues to use other consultants and publicly available survey data and information for compensation-related matters and in making recommendations to the Committee. During 2008, representatives of CSI attended four of the five Committee meetings.

Our executive management can and does make recommendations to the Committee. These recommendations have historically focused on the Company’s broad-based compensation and benefit plans; award pools for long-term incentive grants; and employment and compensation matters related to the Company’s executive officers. However, the Committee has final approval on all compensation actions, plans, and programs as they relate to executive officers. Our CEO, other members of our management and the Committee’s outside advisors may be invited to attend all, or a portion of the Committee meetings. At these meetings, the Committee solicits the views of the CEO on compensation matters as they relate to him and the other executive officers. However, decisions relating to compensation matters for the CEO are made by the Committee with final approval by the Board, in each case without the CEO being present.

Design of the Compensation Program

The executive compensation program seeks to align an executive’s interests with those of our stockholders by rewarding performance against established goals at the corporate and, where appropriate, business unit and regional levels, as well as attract and retain high-caliber management leadership. In particular, our compensation program seeks to:

| · | link management and stockholder interests by creating incentive awards that balance both short-term and long-term goals; |

| · | drive achievement of the Company’s business objectives and calibrate compensation to those achievements by delivering a mix of fixed and at-risk compensation; |

| · | attract, retain, and motivate talented individuals; and |

| · | provide flexibility that enables the development and deployment of talent to support the current and future needs of the Company’s businesses worldwide |

As part of its analytical process in setting executive compensation, the Committee reviews the compensation of its executive officers in relation to compensation to executives at comparable companies. At the request of the Committee, CSI has created a list of comparable companies to assist the Committee in comparing pay levels and practices. The Committee believes that this peer group reflects a group of companies that is comparable to the business of the Company in terms of industry and customer similarities. In particular, the peer group consists of companies with business-to-business sales models and retailers and distributors in similar markets as the Company with revenues between $100 million and $20 billion. Companies with historically poor performance as reflected by years of consecutive losses, as well as companies in bankruptcy were excluded. In reviewing executive compensation information for its meeting in the first quarter of 2008, the peer group consisted of the following companies:

| Avery Dennison Corporation | Nashua Corporation | |

| A.T. Cross Company | Newell Rubbermaid, Inc. | |

| Herman Miller, Inc. | Office Depot, Inc. |

13

| HNI Corporation | OfficeMax, Inc. | |

| IKON Office Solutions, Inc. | Pitney Bowes, Inc. | |

| Imation Corporation | SanDisk Corporation | |

| Knoll, Inc. | Staples, Inc. | |

| Lexmark International, Inc. | United Stationers, Inc. | |

| Logitech International S.A. | Zebra Technologies Corporation | |

| MeadWestvaco Corporation |

The Committee was provided with historical total compensation data, as well as available data for each material component of total compensation for the senior executive officers of each company in the peer group. This information, as well as a review and comparison of the Company’s internal data, provides a means by which the Committee can compare pay levels and practices and assists the Committee and executive management in developing the Company’s compensation programs and in developing management’s recommendations to the Committee. In May 2008, CSI recommended to and the Committee agreed to exclude Staples, Inc. and Office Depot, Inc. from the peer group due to their size, and Logitech International S.A. as it is not headquartered in the United States.

We believe that linking pay and performance contributes to the creation of stockholder value. The Committee believes that, for the pay-and-performance link to be effective, high-performing, experienced individuals that have proven to be strong contributors to the Company’s performance, or have shown the potential to be strong contributors, should be rewarded with total compensation that falls within the 50th and 75th percentile of compensation paid to similarly situated executives of the companies comprising the relevant peer group. The Committee may exercise discretion to vary these objectives as dictated by additional considerations such as individual performance, the experience level, future potential and specific job assignment of the executive, pay equity, as well as market conditions and the Company’s recent and anticipated future performance.

Executive Compensation Mix

Our executive compensation components are weighted toward performance-based incentives, encouraging the creation of sustainable stockholder value through the achievement of the Company’s long-term profitability and growth goals. However, the Committee has not pre-established any weightings for the various components of either cash or long-term compensation. A substantial portion of executive compensation is at risk and differentiated as follows:

Annual Compensation

| · | Base salaries — fixed annual income that is typically reviewed and adjusted annually based on the Committee’s assessment of the individual’s performance and competitive market data and information as provided to the Committee |

| · | Annual incentives — performance-based cash bonus compensation with annual objectives established by the Committee and based on operating (business) plans prepared by senior management and as approved by the Board of Directors during the first quarter of each fiscal year |

Long-term Compensation

| · | Long-term incentives — equity-based and/or cash-based incentives earned by achieving sustained long-term performance which would be expected to correlate into increasing stockholder value |

Event-driven Rewards

| · | Equity or cash-based incentives — occasionally “one-time” award opportunities may be granted based on reaching significant business milestones in addition to achieving stated annual and long-term business objectives |

14

Retirement Plans

| · | Tax qualified and nonqualified defined contribution plans |

| · | Tax qualified and nonqualified defined benefit plans |

Benefits and Perquisites

| · | Employee health and welfare plans |

| · | Supplemental and executive life and long-term disability insurance |

| · | Certain executive perquisites |

The Committee reviews the cash and long-term incentive compensation mix for executive officers at least annually to ensure alignment with the objectives of the Company’s compensation philosophy.

Elements of Compensation

Base Salaries

The Company uses base salaries to recognize individual experience, knowledge, job performance and skills. Providing executives with competitive base salaries allows the Company to attract high-caliber management leaders and retain their on-going services by providing them with a level of financial certainty. The base salaries for the executive officers are reviewed annually by the Committee and adjusted as necessary based on market conditions and the job performance of the individual over the course of the most recent performance period. The Committee utilizes performance assessments by the CEO, considers Company or applicable business unit performance, and competitive market data and information as provided to the Committee by its compensation consultant and management to determine the degree of any adjustment to base salary. In determining any salary adjustment for the CEO and other executive officers, the Committee typically seeks to establish salary levels that are at or near the 50th percentile for comparable positions at companies within the relevant peer group and at levels consistent with its compensation philosophy but may exercise discretion in adjusting off this benchmark when it deems that circumstances warrant such action.

The salaries of the named executive officers other than Mr. Keller were reviewed at the March 2008 meeting of the Committee. The Committee shortly thereafter approved salary increases effective April 1, 2008 for David D. Campbell, who was the Company’s Chief Executive Officer at that time, and the named executive officers other than Mr. Kaput, who was a newly hired executive. Mr. Campbell’s 2008 salary increase represented an annualized increase of 5.0% over his annualized 2007 base salary while the 2008 salary increases for the named executive officers other than Mr. Elisman represented increases that ranged from 4.6% to 3.1% over their respective 2007 base salaries. Mr. Elisman’s salary was increased by 14.3% to reflect the additional duties he assumed in April, 2008 as President of the Company’s Office Products Group. The Committee believed the increases were consistent with the Company’s broad-based annual merit increase practices. Based on benchmarking information provided by CSI, the 2008 salaries were near the median of the peer group comparables for Messrs. Campbell and Fenwick and just above the 25th percentile for Messrs. Elisman and Kirchhoff at the time the salary increases were implemented.

On November 4, 2008, the Board of Directors approved an annual base salary of $720,000 for Mr. Keller, who became the Company’s Chief Executive Officer on October 22, 2008. Mr. Keller’s initial base salary represented an 8.6% decrease from Mr. Campbell’s 2008 base salary. Mr. Keller’s salary is below the median of our peer group comparables and is reflective of the challenging business environment in which the Company was and continues to operate in.

15

The year 2008, and in particular the second half of the year, was a very difficult period for the Company and the office products industry generally. The global economy, particularly in North America and Europe, rapidly deteriorated as the year progressed and has continued to be unfavorable in 2009. The difficult economic environment has placed significant pressure on our customers, which in turn has translated into destocking of their inventories and softer demand for our products. As a result, we have experienced significant decreases to our sales and profits.

Recognizing our increasingly deteriorating sales projections as the fourth quarter of 2008 progressed and in an effort to reduce our expense base to be more in line with then-current and forecasted sales trends, we took extensive cost-cutting measures beginning in the fourth quarter of 2008. Included in those measures, and affecting all non-union U.S. based employees, were a ten-day unpaid furlough for hourly employees, and for salaried employees, including the current and former Chief Executive Officer and the other named executive officers, a salary reduction equivalent to eliminating ten days of base salary over the period October 6, 2008 through January 10, 2009. On an annualized basis this salary reduction would have equaled 14.3% of base salary at the time it was implemented. These actions were discussed with and approved by the Committee and by the Board of Directors as a whole. When wage and salary rates were restored on January 11, 2009, certain of the Company’s executive officers, including Mr. Keller and the other named executive officers, voluntarily agreed to take base salary reductions retroactive to January 11, 2009 which are to be continued through June 30, 2009. As of January 11, 2009 these voluntary base salary reductions amounted to five percent and two and one-half percent on an annualized basis for Mr. Keller and the other named executive officers respectively.

Anticipating that the rate of sales deterioration seen in the second half of 2008 was likely to continue, the Company refined its 2009 business plan to incorporate a further reduction in sales and announced additional cost-cutting measures intended to benefit 2009’s operating results and to help mitigate the anticipated effect of lower sales volumes. These additional measures included some reductions in force, the suspension of 401(k) plan contributions by the Company and the freezing of pension and other retirement plan benefits for U.S. based employees. In considering the refined 2009 business plan and in an effort to protect the Company’s available liquidity and in considering the continued negative sales trends, the Company, with approval of the Committee and the Board of Directors, took additional salary reduction actions in the first quarter of 2009 that negatively impacted all U.S. based non-union employees. For those affected employees, including Mr. Keller and the other named executive officers, salaries and wage rates were reduced by twenty percent (20%) as of February 22, 2009 to be effective until at least June 30, 2009. To further provide immediate impact to the Company’s liquidity and operating results, an additional short-term reduction in pay for these affected employees was implemented equating to an additional approximately thirty-three percent (33%) reduction for the period February 22, 2009 through April 4, 2009. The effect of the foregoing described base salary reductions for Mr. Keller and the other named executive officers (except for Mr. Campbell) is reflected in the following table:

Name | Annualized 2008 base salary1 | Annualized base salary effective as of | ||||||||||

| Jan. 11, 2009 | Feb. 22, 2009 | April 5, 2009 | ||||||||||

Robert J. Keller, Chairman & CEO | $ | 720,000 | $ | 648,000 | $ | 347,328 | $ | 518,400 | ||||

Neal V. Fenwick, EVP & CFO2 | $ | 415,000 | $ | 394,250 | $ | 211,318 | $ | 315,400 | ||||

Boris Elisman, EVP & President, Americas2 | $ | 400,000 | $ | 380,000 | $ | 203,680 | $ | 304,000 | ||||

Kriss A. Kirchhoff, EVP & President, Product Generation2 | $ | 375,000 | $ | 356,250 | $ | 190,950 | $ | 285,000 | ||||

David L. Kaput, SVP & Chief Human Resources Officer | $ | 300,000 | $ | 285,000 | $ | 152,760 | $ | 228,000 | ||||

| 1 | Base salaries before temporary fourth quarter 2008 reductions. |

| 2 | Base salaries had been increased as part of the Committee’s annual salary review in the first quarter of 2008 by $15,000 for Mr. Fenwick, $50,000 for Mr. Elisman and $50,000 for Mr. Kirchhoff. |

16

In agreeing to implement the foregoing base salary reductions, the Committee considered the fact that the base salary rates for the Chief Executive Officer and the other named executive officers would temporarily put them well below the median of the Company’s Peer Group for comparable positions. The Committee considered the potential key executive retention issues resulting from base salary reductions in making these decisions; however the Committee and management believed this action was necessary in light of liquidity considerations and then-current economic and business conditions and was a better alternative than implementing extensive reductions in force.

The following discussion contains statements regarding future individual and company performance targets and goals. These targets and goals are disclosed in the limited context of ACCO Brands’ compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply these statements to other contexts.

Annual Incentives

We believe that annual cash-based incentives focus management on key operational performance objectives that, if achieved, can contribute to the creation of stockholder value. The Company’s annual cash-based Management Incentive Program (the “MIP”) for our executive officers is organized under and governed by the cash bonus provisions of the LTIP. The MIP is designed to reward actual performance during the fiscal year against pre-established measures and target objectives. In accordance with plan provisions, the MIP performance measures, as recommended by management, and target objectives, as set by the Committee for 2008 based on the operating (business) plans approved by the Board, were set and approved by the Committee in the first quarter of 2008. The MIP structure used for the executive officers is similarly used across the Company for salaried incentive-eligible employees.

The Committee believes that a mix of objectives is appropriate for ensuring that management focuses on what it considers to be key areas of operational performance. The 2008 MIP performance measures were derived from stockholder value-drivers that are within the control and influence of management and can be measured comparably from year to year. These measures focused on a mix of three independently achievable objectives:

| · | Company and business unit earnings |

| · | Company and business unit revenue |

| · | Asset management |

Company and business unit earnings,measured as adjusted operating income, was the single largest element of the MIP as this directly drives stockholder value through impacting earnings per share and is the element of the MIP program over which management can exert the greatest degree of short-term control. Adjusted operating income is determined by adjusting reported earnings to eliminate restructuring and restructuring related expenses.

Company and business unit revenueis measured as revenue, excluding the impact of foreign exchange, acquisitions, and dispositions. In 2008, the Committee decided to replace gross margin dollar growth with total revenue in order to further emphasize the Board’s desire to focus management on future revenue growth as a key driver of stockholder value. The Committee believed that management should be more focused on revenue growth than improving growth in gross margin dollars as much of the synergistic benefits of the Company’s merger with General Binding Corporation in August, 2005 had already been achieved.

Asset managementtargets focused on improving working capital efficiency resulting from a reduction in trade cycle days. Reduction in trade cycle days is determined by taking the number of days of accounts receivable, adding the days of inventory and deducting the days of accounts payable. Favorable results are

17

typically achieved by any combination of reducing accounts receivable or inventory levels or extending accounts payable which results in more efficient management of cash. Improvement in trade cycle is a critical building block for building stockholder value, as this is a leading indicator of how effectively the Company is conducting its day-to-day business. It is important to stockholders as it determines the amount of cash generation from earnings that must be re-invested to support growth. Improvement in trade cycle typically results in improved cash flow, affording the Company the ability to accelerate debt repayments, as well as having cash generated for both restructuring and for other general corporate purposes.

Each executive officer’s target award percentage was determined based on competitive market data from the Peer Group, relative internal pay equity and position responsibilities. Generally, incentive targets are set at or between the 50th and 60th percentile levels relative to the relevant Peer Group. The Committee may vary from these targets when it deems that circumstances may warrant such action. Consistent with the Committee’s philosophy of creating incentive and rewarding outstanding performance, the Committee set the “target payouts” for the 2008 MIP at levels that were in excess of targets for comparable measures in 2007. In doing so, and based on recommendations made to the Committee by CSI, the “threshold” payout level for plan achievement was set at 50% which the Committee believes consistent with competitive market and industry practice. An individual’s award opportunity under the MIP is calculated by multiplying the individual’s base salary for the performance period by the target percentage. The actual award is calculated by multiplying the individual’s award opportunity by the actual achieved percentage of target performance. The Committee has the discretion to adjust the annual incentive awards upward or downward based on factors outside of the pre-established performance targets.

For the 2008 fiscal year, the MIP bonus structure, performance targets, performance results, and value of each component as a percentage of the target opportunity for Messrs. Keller, Fenwick and Kaput were as follows (with any actual award for Mr. Keller to be prorated to his October 22, 2008 hire date):

Performance Measure | Component Weighting (as % of Overall Payment) | Threshold (50% Payout) | Target (100% Payout) | Maximum (200% Payout) | Actual Achievement in 2008 | Calculated Payout as a Percent of Target Opportunity | ||||||||

ACCO Brands Adjusted Operating Income | 50 | % | $175.0 million | $191.0 million | $215.0 million | $106.0 million | 0 | % | ||||||

ACCO Brands Trade Cycle | 15 | % | 86 days | 83 days | 78 days | 104 days | 0 | % | ||||||

ACCO Brands Revenue | 35 | % | $1,900.0 million | $1,945.0 million | $2,025.0 million | $1,676.0 million | 0 | % |

Based on the “Calculated Payout as a Percent of Target Opportunity” there were no MIP payments for either of Messrs. Keller or Fenwick. Based on the “Calculated Payout as a Percent of Target Opportunity” Mr. Kaput would not have received a payment; however, in connection with his hiring in October, 2007, the Company guaranteed Mr. Kaput a 2008 MIP award of not less than $150,000 as an incentive that the Committee believed was necessary to have Mr. Kaput accept an offer of employment. Mr. Campbell was not eligible for a MIP award under the terms of the Company’s Executive Severance Plan.

18

During 2008, Mr. Elisman was promoted to the role of EVP and President, ACCO Brands Americas; therefore, he participated under two separate MIP plans during the year. Mr. Elisman participated under the following plan, on a pro rata basis, during his time as the former President, Global Computer Products Group with the MIP bonus structure, performance targets, performance results, and value of each component as a percentage of the target opportunity as follows:

Performance Measure | Component Weighting (as % of Overall Payment) | Threshold (50% Payout) | Target (100% Payout) | Maximum (200% Payout) | Actual Achievement in 2008 | Calculated Payout as a Percent of Target Opportunity | ||||||||

ACCO Brands Adjusted Operating Income Operating Income | 25 | % | $175.0 million | $191.0 million | $215.0 million | $106.0 million | 0 | % | ||||||

Global Computer Products Group Operating Income | 25 | % | $52.0 million | $55.0 million | $59.0 million | $35.8 million | 0 | % | ||||||

Global Computer Products Group Trade Cycle | 12.5 | % | 80 days | 77 days | 72 days | 100 days | 0 | % | ||||||

Global Computer Products Group Revenue | 37.5 | % | $240.0 million | $250.0 million | $270.0 million | $205.0 million | 0 | % |

Based on the “Calculated Payout as a Percent of Target Opportunity”, upon his time in his former role as President, Global Computer Products Group, no MIP payment was earned by Mr. Elisman.

For the remainder of 2008, Mr. Elisman as President, Global Office Products Group and then as EVP and President, ACCO Brands Americas participated under the following plan, on a pro rata basis with the MIP bonus structure, performance targets, performance results, and value of each component as a percentage of the target opportunity as follows:

Performance Measure | Component Weighting (as % of Overall Payment) | Threshold (50% Payout) | Target (100% Payout) | Maximum (200% Payout) | Actual Achievement in 2008 | Calculated Payout as a Percent of Target Opportunity | ||||||||||||

ACCO Brands Adjusted Operating Income Operating Income | 25 | % | $ | 175.0 million | $ | 191.0 million | $ | 215.0 million | $ | 106.0 million | 0 | % | ||||||

Global Office Products Group Operating Income | 25 | % | $ | 99.0 million | $ | 105.5 million | $ | 120.0 million | $ | 58.8 million | 0 | % | ||||||

Global Office Products Group Trade Cycle | 12.5 | % | 76.5 days | 72.5 days | 65.5 days | 96.6 days | 0 | % | ||||||||||

Global Office Products Group Revenue | 37.5 | % | $ | 900.0 million | $ | 915.0 million | $ | 940.0 million | $ | 791.0 million | 0 | % | ||||||

Based on the “Calculated Payout as a Percent of Target Opportunity”, while serving in this capacity, no payment was earned by Mr. Elisman.

For the 2008 fiscal year, the MIP bonus structure, performance targets, performance results, and value of each component as a percentage of the target opportunity for Mr. Kirchhoff were as follows:

Performance Measure | Component Weighting (as % of Overall Payment) | Threshold (50% Payout) | Target (100% Payout) | Maximum (200% Payout) | Actual Achievement in 2008 | Calculated Payout as a Percent of Target Opportunity | ||||||||||||

ACCO Brands Adjusted Operating Income | 25 | % | $ | 175.0 million | $ | 191.0 million | $ | 215.0 million | $ | 106.0 million | 0 | % | ||||||

Global Document Finishing Group Operating Income | 25 | % | $ | 52.5 million | $ | 57.0 million | $ | 65.0 million | $ | 34.9 million | 0 | % | ||||||

Global Document Finishing Group Trade Cycle | 12.5 | % | 102 days | 97 days | 88 days | 120.9 days | 0 | % | ||||||||||

Global Document Finishing Group Growth in Gross Margin Dollars | 37.5 | % | $ | 580.0 million | $ | 595.0 million | $ | 610.0 million | $ | 520.0 million | 0 | % | ||||||

19

Based on the “Calculated Payout as a Percent of Target Opportunity”, no MIP payment was earned by Mr. Kirchhoff.

In order to satisfy the Internal Revenue Code (“Code”) requirements for “performance-based compensation”, the Committee has established maximum annual incentives or incentive bonus amounts that can be paid to any executive officer. Currently, the established maximum amount of an individual award under the MIP may not exceed (i) 50% of any incentive pool established by the Committee, or (ii) $3,000,000.

For the year 2009 the Committee has decided to defer the implementation of the MIP program until at least the second half of the 2009 year. This decision was primarily driven by the uncertainty of worldwide economic conditions and the inability to forecast near-term sales and profitability results with any degree of certainty. The Committee will consider implementation of an MIP program for senior management and other salaried employees at a time it considers to be appropriate.

Long-Term Incentives

We believe that long-term incentives must serve as a significant portion of an executive officer’s overall compensation package. Stock-based awards are provided to motivate executive officers and other eligible employee participants to focus their efforts on activities that will enhance stockholder value over the long-term, thus aligning their interests with those of the Company’s stockholders. Long-term incentives are structured so that rewards are earned in line with performance: above-market rewards for superior performance and below-market or no rewards for inferior performance.

Currently, awards are granted under the LTIP. Pursuant to this plan, the Company may award to key employees of the Company, including all of the named executive officers, a variety of long-term incentives, including nonqualified stock options, incentive stock options, cash or stock-settled stock appreciation rights, restricted stock units, performance share units, and other stock-based incentives, as well as the cash bonus awards described in the Annual Incentives section above.

Consistent with the recommendations of CSI, the Committee determined that equity awards under the LTIP to be made in 2008 for the named executive officers and other senior Company leaders would be made in the following proportions, based on the economic value of each reward type at the date of grant:

Award Type | Proportion | ||

Performance Share Units | 50 | % | |

Stock Options | 25 | % | |

Restricted Stock Units | 25 | % |

The award mix was constructed to provide executives with a long-term incentive package that rewards successful performance, aligns management and stockholder interests, and provides a retention element. The Committee believes that placing a greater level of incentives around the achievement of performance metrics correlates more to its philosophy of rewarding and compensating for performance as described in the description of the Performance Share Units below.

With the exception of Messrs. Keller and Elisman, stock-based awards were granted to the named executive officers and other Company employees participating in the LTIP on March 19, 2008. Stock-based awards were granted to Mr. Elisman on April 7, 2008 in connection with his acceptance of the Company’s offer to promote him to President of the Company’s Office Products Group. The Committee determined that the exercise price of his option awards would equal the exercise price of the awards granted to other officers on March 19, 2008, as that price was greater than the closing price and the average of the high and low sales prices of the Company’s common stock on April 7, 2008. Mr. Keller’s awards were granted on November 17, 2008, following his appointment as Chief Executive Officer in October 2008. At the time of each of the forgoing award grants and

20

assuming target level performance, long-term incentives were intended to represent from 30% to 50% of an executive’s overall targeted compensation package. See“Executive Compensation — 2008 Stock-Based Awards” and related footnotes as well as the following discussion for additional information concerning stock-based awards made in 2008.

Performance Share Units.Performance Share Units (“PSUs”) were granted for the 2008 — 2010 performance period consistent with the above described mix. For this performance period, the Committee, working with CSI and management, established a performance matrix measuring revenue growth and return-on-assets to determine the level of award payout. The Committee approved this structure as it measures two primary drivers of stockholder value. As approved, the actual number of PSUs earned was made contingent upon the Company achieving the threshold entry levels for both measures. The number of units granted will be awarded as shares of the Company’s common stock at the 100% level, if the performance target is achieved. The Committee established targets of 3.0% total revenue growth and average return on assets of 12.5% over the three-year performance period. As originally awarded, up to 150% of the number of units granted could be earned if superior performance is achieved. If threshold performance is met, 75% of the number of units granted will be earned. If threshold performance is not met, awards will be forfeited. In determining any final awards, the Committee retains the discretion to make adjustments it may deem proper to either the pre-established targets or the final award level.

The Committee believed at the time it granted the PSUs in 2008 that the performance targets it established were challenging but fair as they somewhat exceeded forecasted performance at the time the awards were granted but appeared to be attainable, with considerable effort, over the three-year performance period.

In connection with their hiring by the Company, the Committee during 2008 also awarded PSUs to Mr. Keller for the 2007-2009 and 2008-2010 performance periods and Mr. Kaput for the 2007-2009 performance period. These awards were prorated to reflect the grants being made during the applicable performance periods. As key executives and leaders of the business, the Committee determined that providing them with an immediate incentive to focus on the performance criteria established for those periods would benefit the Company. See“Executive Compensation — Grants of Plan Based Awards.”

The PSUs granted to executive officers cliff-vest upon the completion of the three-year performance period and after the Committee has made a final determination upon the level of performance achievement, including any discretion it may elect to exercise, pursuant to both the executive officer’s continued employment with the Company through the end of the performance period and other events which could result in partial or full acceleration of vesting. Recipients of performance awards will receive any cash dividend equivalents at the time of payment equal to the cash dividends that would have been paid on the shares had the recipient owned the shares during the performance period. Currently the Company does not pay any cash dividends on its common stock.

Stock Options. Stock options are granted to focus executive interests on share price appreciation. Executive officers and other LTIP participants only realize benefits from stock options if the price of the Company’s common stock increases over time above the price at which the options were granted. The options become exercisable in three annual installments beginning one year after the grant date, and expire seven years after the grant date. Stock options granted under the LTIP have an exercise price not less than the average of the high and low market price of the stock on the grant date. The Company has adopted this pricing practice in an attempt to “neutralize” any irregular or wide range of movement in the stock price over the course of the trading day.