- ACCO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ACCO Brands (ACCO) DEF 14ADefinitive proxy

Filed: 30 Mar 12, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only |

| (as permitted by Rule 14c-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

ACCO BRANDS CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined.): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

March 30, 2012

Dear Fellow Stockholder:

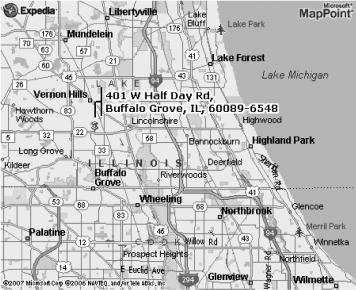

The ACCO Brands Corporation 2012 Annual Meeting of Stockholders will be held at 10:30 a.m. (Central time) on Tuesday, May 15, 2012, at the Kemper Lakes Business Center, Three Corporate Drive, Long Grove, Illinois. A map with directions to the Kemper Lakes Business Center can be found at the end of the attached Proxy Statement. The sole purpose of the meeting is to consider the matters described in the following Notice of 2012 Annual Meeting and Proxy Statement.

It is important that your shares are represented at the meeting, whether or not you personally plan to attend. You can submit your proxy by using a toll-free telephone number, by mail or via the Internet, or you can vote in person at the meeting. Instructions for using these services are provided on the accompanying proxy form. If you decide to vote your shares using the accompanying proxy form, we urge you to complete, sign, date and return it promptly.

| Sincerely, |

|

Robert J. Keller Chairman of the Board and Chief Executive Officer |

NOTICE OF 2012 ANNUAL MEETING

AND PROXY STATEMENT

The Annual Meeting of Stockholders of ACCO Brands Corporation (“ACCO Brands” or the “Company”) will be held at the Kemper Lakes Business Center, Three Corporate Drive, Long Grove, Illinois, at 10:30 a.m. (Central time) on Tuesday, May 15, 2012, to consider and vote upon the following matters:

| Item 1: | The election of nine directors identified in this Proxy Statement for a term expiring at the 2013 Annual Meeting; | |

| Item 2: | The ratification of the selection of KPMG LLP as our independent registered public accounting firm for 2012; | |

| Item 3: | The approval, by non-binding advisory vote, of the compensation of our named executive officers; and | |

| Item 4: | To transact such other business as may properly come before the meeting or any adjournment thereof. | |

We currently are not aware of any other business to be brought before the Annual Meeting. Only holders of record of common stock at the close of business on March 22, 2012, will be entitled to vote at the Annual Meeting or at any adjournment or postponement thereof.

Please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) by telephone, (2) through the Internet, or (3) by mail. For specific instructions, please refer to the accompanying proxy card. If you attend the Annual Meeting, you may revoke your proxy and vote in person.

This year we are again taking advantage of Securities and Exchange Commission (“SEC”) rules that allow issuers to furnish proxy materials to stockholders via the Internet. We sent Notices of Internet Availability of Proxy Materials to holders of our common stock as of the record date on or about March 30, 2012. The Notice describes how you can access our proxy materials, including this Proxy Statement, beginning on March 30, 2012.

We also are soliciting voting instructions from participants in the ACCO Brands Corporation 401(k) plan who hold shares of our common stock under the plan. We ask each plan participant to sign, date and return the accompanying voting instruction card, or provide voting instructions by telephone or through the Internet as described on the voting instruction card.

| By order of the Board of Directors |

|

Steven Rubin Senior Vice President, Secretary and General Counsel |

This Proxy Statement and accompanying proxy are first being made available or distributed to our

stockholders on or about March 30, 2012.

VOTING AND PROXIES

Why is ACCO Brands distributing this Proxy Statement?

Our Board of Directors is soliciting proxies for use at our 2012 Annual Meeting of Stockholders to be held on Tuesday, May 15, 2012, beginning at 10:30 a.m. (Central time), at the Kemper Lakes Business Center, Three Corporate Drive, Long Grove, Illinois. In order to solicit your proxy, we must furnish you with this Proxy Statement, which contains information about the matters to be voted upon at the annual meeting.

What is the purpose of the annual meeting?

The purpose of the Annual Meeting is for stockholders to act upon the matters outlined in the Notice of 2012 Annual Meeting and described in this Proxy Statement, including: (1) the election of nine directors, (2) the ratification of KPMG LLP as our independent registered public accounting firm for 2012, (3) an advisory vote on the compensation of our named executive officers, and (4) such other business as may properly come before the meeting or any adjournment or postponement thereof. In addition, management will be available to respond to questions from stockholders.

Why did I receive a notice in the mail regarding the availability of proxy materials on the Internet instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we are providing access to our proxy materials via the Internet. The Notice of Internet Availability of Proxy Materials (the “Notice”) we sent to our stockholders provides instructions on how to access and review this Proxy Statement and our annual report online, as well as how to vote online. Providing proxy materials electronically significantly reduces the printing and mailing costs associated with the distribution of printed copies of our proxy materials to our stockholders.

If you receive a Notice, you will not receive a printed copy of the proxy materials by mail unless you request one. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request printed copies may be found within the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Who is entitled to vote?

Only stockholders who own ACCO Brands common stock of record at the close of business on March 22, 2012 are entitled to vote. Each holder of common stock is entitled to one vote per share. There were55,555,354 shares of common stock outstanding on March 22, 2012.

What is the difference between being a record holder and holding shares in street name?

A record holder holds shares in his or her own name. Shares held in “street name” means shares that are held in the name of a bank, broker or other nominee on a person’s behalf. If the shares you own are held in “street name” by a brokerage firm, your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokers also offer the option of voting over the Internet or by telephone, instructions for which would be provided by your brokerage firm on

1

your instruction form. Under the current rules of the New York Stock Exchange, or NYSE, if you do not give instructions to your brokerage firm, it will still be able to vote your shares with respect to certain “discretionary” items, but will not be allowed to vote your shares with respect to certain “non-discretionary” items. The ratification of KPMG LLP as our independent registered public accounting firm (proxy Item 2) is considered to be a discretionary item under the NYSE rules and your brokerage firm will be able to vote on that item even if it does not receive instructions from you, so long as it holds your shares in its name.

The election of directors (proxy Item 1) and the other matter to be voted upon (Item 3) are “non-discretionary” items. Therefore, your broker may not vote your shares with respect to these items unless it receives your voting instructions, and if it does not, those votes will be counted as “broker non-votes.” “Broker non-votes” are shares that are held in “street name” by a bank or brokerage firm that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

How do I vote?

Record holders can vote by filling out the accompanying proxy card and returning it as instructed on the proxy card. You can also vote by telephone or the Internet by following the instructions printed on the proxy card or the Notice. If you hold shares in street name, you must vote by giving instructions to your broker or nominee. You should follow the voting instructions that you receive from them. The availability of telephone and Internet voting will depend on the bank’s or broker’s voting process. You may also vote in person at the meeting.

How will my proxy be voted?

Your proxy, when properly signed and returned to us, or processed by telephone or via the Internet, and not revoked, will be voted in accordance with your instructions. We are not aware of any other matter that may be properly presented other than the election of directors, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2012 and the advisory vote on the compensation of our named executive officers. If any other matter is properly presented, the persons named in the enclosed form of proxy will have discretionary authority to vote in their best judgment.

What constitutes a quorum?

The holders of a majority of the issued and outstanding common stock of the Company present either in person or by proxy at the meeting will constitute a quorum. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting. If less than a majority of the outstanding shares of common stock are represented at the meeting, a majority of the shares so represented may adjourn the meeting to another date, time or place.

What if I don’t mark the boxes on my proxy?

Unless you give other instructions on your form of proxy or when you cast your proxy by telephone or the Internet, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. The Board’s recommendation is set forth together with the description of each Item in this Proxy Statement. In summary, the Board recommends a vote:

| — | FOR the election of each director nominee (Item 1); |

2

| — | FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2012 (Item 2); and |

| — | FOR the approval, on an advisory, non-binding basis, of the compensation of our named executive officers (Item 3). |

Can I go to the annual meeting if I vote by proxy?

Yes. Attending the meeting does not revoke your proxy unless you vote in person at the meeting.

How can I revoke my proxy?

You may revoke your proxy at any time before it is actually voted by giving written notice to the secretary of the meeting or by delivering a later-dated proxy, which automatically revokes your earlier proxy, either by mail, by telephone or the Internet if one of those methods was used for your initial proxy submission. If shares are held in a stock brokerage account or by a bank or other broker nominee, then you are not the record holder of your shares, and while you are welcome to attend the Annual Meeting you would not be permitted to vote unless you obtained a signed proxy from your broker nominee (who is the holder of record).

Will my vote be public?

No. As a matter of policy, stockholder proxies, ballots and tabulations that identify individual stockholders are kept secret and are only available to the independent Inspectors of Election and certain employees who have an obligation to keep your votes secret.

How many votes are needed to elect the director nominees and approve the other matters to be voted upon at the annual meeting?

Directors are elected by a plurality of the votes cast for the election of directors at the meeting. A proxy marked to withhold authority for the election of one or more directors will not be voted with respect to the director or directors indicated. The affirmative vote of shares representing a majority in voting power of the Company’s common stock present in person or represented by proxy at the meeting and entitled to vote is necessary for approval of proxy items 2 and 3. Proxy cards marked as abstentions on items 2 and 3 will not be voted and will have the effect of a negative vote.Please note that a broker or other nominee will not be permitted to vote your shares on proxy items 1 (election of directors) or 3 (approval of executive compensation) absent specific instructions from you. Therefore, it is important that you follow the voting instructions on the form that you receive from your brokerage firm.

What if I participate in the ACCO Brands 401(k) plan?

We also are making this Proxy Statement available to and seeking voting instructions from participants in the ACCO Brands 401(k) plan who hold shares of our common stock under such plan. The trustees of the plan, as record holders of ACCO Brands common stock held in the plan, will vote whole shares attributable to you in accordance with your directions given on your voting instruction card, by telephone or the Internet. If you hold shares of our common stock under the plan, please complete, sign and return your voting instruction card, or provide voting instructions by telephone or through the Internet as described on the voting instruction card prior to May 11, 2012. The voting instruction card will serve as instructions to the plan trustees to vote the whole shares attributable to your interest in the manner you indicate on the card.

3

ELECTION OF DIRECTORS

(Proxy Item 1)

Our Board of Directors currently consists of nine members. Our By-laws currently provide that the Board of Directors may consist of not less than eight nor more than eleven members. The Board of Directors, upon recommendation from the Corporate Governance and Nominating Committee, has selected all of the currently serving directors as nominees for election as a director at the 2012 Annual Meeting.

The Board of Directors proposes that each of the nine nominees named and described below, each of whom currently serve as directors, be elected for a one-year term expiring at the 2013 Annual Meeting and until his or her respective successor is duly elected and qualified. Proxies cannot be voted for more than the number of nominees proposed for election.

The following paragraphs provide information as of the date of this proxy statement about each director-nominee. The information presented includes information about each director’s age, positions held, principal occupation and business experience for the past five years, the year first elected as a director of ACCO Brands and the names of other publicly held companies of which he or she currently serves as a director or has served as a director during the past five years. In addition, the information presented below includes details on each director-nominee’s specific experience, qualifications, attributes, and skills that led our Board to the conclusion that he or she should serve as a director in light of our business and structure. We also believe that all of our directors and director-nominees have a reputation for integrity, honesty, and adherence to high ethical standards. They each have business acumen and an ability to exercise sound judgment and a commitment of service to ACCO Brands Corporation and its Board.

The Board of Directors recommends that you vote FOR the election of all the nominees.

Nominees. Each of the nominees below has consented to serve a one-year term if elected. If any of them should become unavailable to serve as a director (which is not currently expected), the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board. Information about the number of shares of common stock beneficially owned by each director appears under the heading “Certain Information Regarding Security Holdings.” There are no family relationships among any of the directors and executive officers of ACCO Brands.

ROBERT J. KELLER, Chairman of the Board and Chief Executive Officer; Director since 2005

Mr. Keller, age 58, has served as Chairman and Chief Executive Officer since October, 2008, was Chairman in September and October of 2008, and served as Presiding Independent Director of the Board from May, 2008 until September, 2008. Previously, Mr. Keller served as President and Chief Executive Officer and as a director of APAC Customer Services, Inc. from March, 2004 until February, 2008. Mr. Keller served in various capacities at Office Depot, Inc. from February, 1998 through September, 2003, most recently as its President, Business Services Group. We believe Mr. Keller’s qualifications to serve on our Board of Directors include his experience in and knowledge of the office products industry, as a public company director and as a business leader at a number of companies in several industries, including one of our principal customers, Office Depot, Inc., as well as his current role as Chief Executive Officer of the Company.

ROBERT H. JENKINS, Presiding Independent Director; Director since 2007

Mr. Jenkins, age 69, has served as Presiding Independent Director since September, 2008. Mr. Jenkins is retired. He served as Chairman, President and Chief Executive Officer of Sundstrand

4

Corporation from 1997 to 1999 and as its President and Chief Executive Officer from 1995 to 1997. Sundstrand is an aerospace and industrial company which merged with United Technologies Corporation in June, 1999, forming Hamilton Sundstrand Corporation. Mr. Jenkins is currently a director of AK Steel Holding Corporation and Clarcor, Inc. He formerly served as a director of Solutia, Inc. from 1997 to 2008. We believe Mr. Jenkins’ qualifications to serve on our Board of Directors include his prior experience as a chief executive officer of a publicly held major industrial firm, his service on other boards of directors of publicly held firms, his extensive corporate governance experience, much of which has been acquired in his role as lead director for AK Steel Holdings Corporation, and his business and operational experience at a number of companies in other industries. His board leadership has been and continues to be invaluable to the Company and the other directors.

GEORGE V. BAYLY, Director since 2005

Mr. Bayly, age 69, is a private investor. Since August, 2008 Mr. Bayly has served as Principal of Whitehall Investors LLC, a consulting and venture capital firm. From September, 2006 to March, 2008 he served as Chairman and interim Chief Executive Officer of Altivity Packaging LLC. He served as interim Chief Executive Officer of U.S. Can Corporation from April, 2004 to January, 2005, and Chairman, President and Chief Executive Officer of Ivex Packaging Corporation, a specialty packaging company, until June, 2002. He was a director of General Binding Corporation (“GBC”) from 1998 until August, 2005. He currently is a director of CCL Industries, Inc., TreeHouse Foods, Inc., and Graphic Packaging Holding Company. He was formerly a director of Huhtämaki Oyj until resigning in 2011. We believe Mr. Bayly’s qualifications to serve on our Board of Directors include his twelve years’ experience as a director of ACCO Brands and GBC and the resultant knowledge he has obtained of the office products industry, his prior experience as chief executive officer at publicly held companies, and his service on other boards of directors of publicly held firms. He also brings an invaluable global business perspective to the Board.

KATHLEEN S. DVORAK, Director since 2010

Ms. Dvorak, age 55, is Executive Vice President and Chief Financial Officer of Richardson Electronics, Ltd., a global provider of engineered solutions and distributor of electronic components serving the RF (radio frequency) and wireless communications, electron device, industrial power conversion and display systems markets. Previously, she had been Senior Vice President and Chief Financial Officer of United Stationers, Inc., an office products wholesaler and distributor, from 2001 until 2007. We believe Ms. Dvorak’s qualifications to serve on our Board of Directors include her extensive experience in the office products industry, including as a former officer of one of our principal customers, and her financial and accounting background and experience as a chief financial officer at two publicly held companies. The Board believes this experience is highly valuable in her service on the Board’s Audit Committee.

G. THOMAS HARGROVE, Director since 2005

Mr. Hargrove, age 72, is a private investor. Mr. Hargrove served as the non-executive Chairman of AGA Creative, a catalog creative agency, from 1999 until 2001, and as a director of General Binding Corporation from 2001 until August, 2005. Early in his career he held various financial management positions and has also served on the Investment Committee of the Washington State University Foundation. We believe Mr. Hargrove’s qualifications to serve on our Board of Directors include his eleven years’ experience as a director and Chairman of the Audit Committee of ACCO Brands and GBC and the resultant knowledge he has obtained of the office products industry. Further enhancing his qualifications are his more than 30 years of operational and financial experience, primarily in the manufacturing and distribution of consumer products, which included serving as president of the At-A-Glance Group, a prominent office products company. The exposure to risk assessment obtained in both

5

his service to GBC’s Audit Committee and in his charitable service has been of great value in chairing the Board’s Audit Committee.

THOMAS KROEGER, Director since 2009

Mr. Kroeger, age 63, is President of Spencer Alexander Associates, which provides management consulting and executive recruiting services. Spencer Alexander Associates is affiliated with Howard & O’Brien Associates, a retained executive search firm. He is also a member of the Operating Council of Kirtland Capital Partners, a private equity firm. Previously, Mr. Kroeger has served as chief human resources officer for each of Invacare Corporation, Office Depot, Inc., and The Sherwin-Williams Company. In each of these positions he also was a member of the executive committee. We believe Mr. Kroeger’s qualifications to serve on our Board of Directors include his extensive background in talent management, which brings an important perspective to board discussions on human resource matters, as well as his prior experience in the office products industry.

MICHAEL NORKUS, Director since 2009

Mr. Norkus, age 65, is President of Alliance Consulting Group, a business strategy consulting firm. Prior to founding Alliance in 1986, Mr. Norkus was Vice President and Director of The Boston Consulting Group, where he served for 11 years. Mr. Norkus also currently serves as a director of Genesee & Wyoming, Inc. and until February, 2011 served as a director of Overland Storage, Inc. since 2004. We believe Mr. Norkus’ qualifications to serve on our Board of Directors include his service as a director of other publicly held companies, his international business experience and his more than three decades of global business consulting experience in the disciplines of corporate strategy, marketing, and new product development.

SHEILA G. TALTON, Director since 2010

Sheila G. Talton, age 59, is President of SGT, Ltd., a firm that provides strategy and technology consulting services in global markets in the financial services, healthcare and technology business sectors. Until July, 2011 she had been the Vice President, Office of Globalization, for Cisco Systems, Inc., a leading global manufacturer, supplier and servicer of Internet Protocol (IP)-based networking and other products related to the communication and information technology (“IT”) industry, and had held that position since 2008. From 2004 to 2008 she also held vice president positions in Cisco’s Advisory Services and China groups following a long career in the IT industry. Prior to joining Cisco Ms. Talton served in multiple roles at EDS including as President of their Business Process Innovation Global Consulting Practice. ACCO believes Ms. Talton’s qualifications to serve on the ACCO Board of Directors include her extensive global operations experience and her further experience as a successful business leader and entrepreneur in the IT industry. Ms. Talton also has extensive experience working on the boards of charitable organizations and is affiliated with several organizations that serve the needs of a diverse population. ACCO believes these experiences will prove highly valuable given the global nature of ACCO’s business and the importance of information technology in ACCO’s operations.

NORMAN H. WESLEY, Director since 2005

Mr. Wesley, age 62, is retired. He served as Chairman of the Board of Fortune Brands, Inc., from December, 1999 until September, 2008, and Chief Executive Officer of Fortune Brands from December, 1999 until January, 2008. Mr. Wesley currently serves as a director of Fortune Brands Home & Security, Inc. and Acuity Brands, Inc. He has formerly served as a director of R.R. Donnelley & Sons Company from 2001 to 2008 and Pactiv Corporation from 2001 to 2010 until its acquisition by Reynolds Group Holdings. We believe Mr. Wesley’s qualifications to serve on our Board of Directors include his extensive experience in the office products industry, including his experience as President of the

6

Company’s predecessor while it was a wholly owned subsidiary of Fortune Brands, Inc., his prior experience as chief executive officer at a publicly held company, and his service on other boards of directors of publicly held firms.

During 2011, there were eleven meetings of the Board of Directors. Each director attended at least 75% of the total meetings of the Board of Directors and committees of the Board of Directors of which the director was a member. In addition to participation at Board and committee meetings, our directors discharge their responsibilities throughout the year through personal meetings and other communications, including considerable telephone contact with the Chairman and others regarding matters of interest and concern to ACCO Brands.

Board Composition Following the 2012 Annual Meeting

In connection with the pending merger of the Consumer & Office Products Business of MeadWestvaco Corporation (“MCOP”) into ACCO Brands, our Board of Directors has agreed to increase the size of the Board of Directors from nine members to eleven members as soon as practicable following the 2012 Annual Meeting. If the MCOP merger is completed before the date of the 2012 Annual Meeting, James A. Buzzard and E. Mark Rajkowski, who have been selected by MeadWestvaco Corporation and approved by our Board of Directors, will be appointed by the Board of Directors to fill the vacancies created. If the MCOP merger is completed after the 2012 Annual Meeting, the two additional directors will be appointed to the Board of Directors as soon as practicable following the consummation of the MCOP merger. Set forth below is biographical and other information for each of Messrs. Buzzard and Rajkowski who have both consented to be named as directors should the MCOP merger be completed.

James A. Buzzard. Mr. Buzzard, age 57, has been President of MeadWestvaco Corporation since 2003. He is responsible for global operations including Packaging, Consumer & Office Products, Specialty Chemicals, Technology and Supply Chain. Mr. Buzzard began his career with Westvaco in 1978 and completed several assignments in the Controller’s department and the former Kraft Division. In 1982, he was named purchasing manager for the Kraft Division. In 1984, he was named administration manager for the former Container Division. He became area sales manager for the Eaton, Ohio, container plant in 1986. He was promoted to corporate marketing manager in marketing services in 1988 and became manager of marketing services in 1990, responsible for corporate market research and the Marketing Personnel Development Program. In 1991, he was named manager of business planning and analysis for the Envelope Division, and in 1992 he was named manager of the Envelope Division and elected vice president of Westvaco. In 1994, he became interim marketing and sales manager of the Fine Papers Division and became sales and marketing manager in 1995. In 1998, he was named assistant division manager of the Fine Papers Division. In 1999, he was elected senior vice president of Westvaco and manager of the Fine Papers Division. In 2000, he assumed responsibility for the Envelope Division, and later that year, he was named executive vice president of Westvaco. He was named executive vice president for MeadWestvaco Corporation in 2002 with responsibility for merger integration and the Consumer & Office Products Group. We believe Mr. Buzzard’s qualifications to serve on our Board of Directors include his extensive experience in the office products industry, his direct knowledge of the Consumer & Office Products Business, and his leadership experience acquired at the helm of MeadWestvaco Corporation. His experience with the Consumer & Office Products Business will bring an invaluable perspective to the Board of Directors.

E. Mark Rajkowski. Mr. Rajkowski, age 53, has been Senior Vice President and Chief Financial Officer of MeadWestvaco Corporation since 2004. He began his career with PricewaterhouseCoopers LLP in 1981, last serving as the managing partner for the Upstate New York Technology Industry Group. In 1998 he joined the Eastman Kodak Company as corporate controller, and in 2001 he became vice president, finance. In 2003, he was named chief operating officer of Kodak’s Consumer Digital Business,

7

and subsequently became vice president and general manager, worldwide operations, Digital & Film Imaging Systems. He joined MeadWestvaco in August 2004. He was a member of the Board of Directors of Performance Technologies, Inc. until May 2011. We believe Mr. Rajkowski’s qualifications to serve on our Board of Directors include his extensive financial and accounting background, his management and executive experience at publicly held firms, and his direct knowledge of the Consumer & Office Products Business.

CORPORATE GOVERNANCE

Director Independence

The Board of Directors has adopted Corporate Governance Principles to address significant issues of corporate governance, such as Board composition and responsibilities, director compensation, and executive succession planning. The Corporate Governance Principles provide that a majority of the members of the Board of Directors, and each member of the Audit, Compensation and Corporate Governance and Nominating Committees, must meet certain criteria for independence. Based on the New York Stock Exchange independence requirements, the Corporate Governance Principles (which are available on our website,www.accobrands.com) set forth certain guidelines to assist in determining director independence. Section A.3 of the Corporate Governance Principles states:

A director shall be considered independent only if the Board of Directors affirmatively determines that the director has no material relationship with ACCO Brands, either directly or as a partner, stockholder, director or officer of an organization that has a material relationship with ACCO Brands.

Under no circumstances shall any of the following persons be considered an independent director for purposes of this guideline:

(a) any current employee of ACCO Brands, its subsidiaries, or ACCO Brands’ independent auditors;

(b) any former employee of ACCO Brands or its subsidiaries until three years after the employment has ended;

(c) any person who (1) is a current partner or employee of the firm that is ACCO Brands’ internal or external auditor; (2) has been within the last three years or has an immediate family member that has been within the last three years a partner or employee of such firm and worked on ACCO Brands’ audit during that time; or (3) has an immediate family member who is currently or within the last three years has been an employee of such firm and participates in the audit, assurance, or tax compliance (but not tax planning) practice;

(d) any person who is employed as an executive officer by another company on whose compensation committee one of ACCO Brands’ executive officers serves or has served during the prior three years;

(e) any person who receives, or who in any twelve month period within the last three years has received, more than $120,000 per year in direct compensation from ACCO Brands, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on future service);

8

(f) any person who is an executive officer or an employee of a company that makes payments to, or receives payments from, ACCO Brands for property or services in an amount that exceeds, in any of the last three fiscal years, the greater of $1 million or 2% of the other company’s consolidated gross revenues; and

(g) any person who has an immediate family member (as defined by the New York Stock Exchange Listed Company Manual) who falls into one of the previous six categories.

Each member of the Board of Directors, other than Mr. Keller, as well as Messrs. Buzzard and Rajkowski, have been determined by the Board to be independent as defined in the New York Stock Exchange Listed Company Manual and to meet the independence criteria set forth in ACCO Brands’ Corporate Governance Principles. All members of the Audit Committee, Corporate Governance and Nominating Committee, and Compensation Committee are independent.

Robert H. Jenkins currently serves as the Presiding Independent Director to preside at all executive sessions of the non-employee directors of the Board. Executive sessions of non-employee directors are held at every regularly scheduled meeting of the Board of Directors.

Stockholder Communication

The Board of Directors and management encourage communication from our stockholders. Stockholders who wish to communicate with our management should direct their communication to the Chairman and Chief Executive Officer or the Office of the Corporate Secretary, 300 Tower Parkway, Lincolnshire, Illinois 60069. Stockholders and other interested parties who wish to communicate with the non-employee directors, any individual director or the Presiding Independent Director should direct their communication c/o the Office of the Corporate Secretary at the address above. The Secretary will forward any communications intended for the full Board, for the non-employee directors as a group, or for the Presiding Independent Director to Mr. Jenkins. Communications intended for an individual director will be forwarded directly to that director. If multiple communications are received on a similar topic, the Secretary may, in his discretion, forward only representative correspondence. Any communications that are abusive, in bad taste or present safety or security concerns may be handled differently.

Annual Meeting Attendance

We do not have a formal policy requiring members of the Board to attend stockholder annual meetings, although all directors are strongly encouraged to attend. All of the current directors attended the 2011 Annual Meeting except for Mr. Wesley who was travelling internationally at the time.

Board Leadership Structure

ACCO Brands is led by Robert J. Keller, who has served as our Chairman and Chief Executive Officer since October, 2008. We believe having the Chief Executive Officer also serve as Chairman of the Board is in the Company’s best interests at this time and is appropriately balanced by the roles of the Presiding Independent Director and the Board’s principal committees as described below.

We believe that having a single leader for the Company in the combined role of Chairman and Chief Executive Officer is seen by our customers, business partners, investors and the other stakeholders as providing strong, unified leadership, notably through the difficult business environment experienced in our industry over the past several years. As Mr. Keller is the director most familiar with the Company’s overall business and its short and long-term strategies, his service on and

9

chairmanship of the Board allows for better communication of those strategies at the Board level, which fosters appropriate discussion that leads to further refining and definition of the Company’s strategies. Additionally, the combined Chairman and Chief Executive Officer role also allows Mr. Keller to serve as an effective link between the Board and management, and facilitates bringing to the Board’s attention key business issues and stakeholder interests as the Board fulfills its duties.

We also have a Presiding Independent Director who presides at meetings of all non-management directors in executive session. Typically, these meetings are held in conjunction with every Board meeting and in 2011 each regularly scheduled Board meeting included a non-management director’s session. This allows directors to speak candidly on any matter of interest, without the Chairman and Chief Executive Officer or other managers present. Robert H. Jenkins has been the Board’s Presiding Independent Director since October, 2008. Mr. Jenkins works closely with Mr. Keller in establishing the agenda for each Board meeting and acts as a conduit for contact between Mr. Keller and the other Board members. The Presiding Independent Director, although not required to do so, also endeavors to attend as many Board committee meetings as possible.

Further, we view the independent members of our Board and the three standing Board committees as providing appropriate oversight and an effective balance to the combined Chairman and Chief Executive Officer role. In this regard, the Audit Committee oversees the accounting and financial reporting processes, as well as most risk, legal and compliance matters. The Compensation Committee oversees the annual performance of our Chairman and Chief Executive Officer, as well as risk surrounding the Company’s compensation plans. The Corporate Governance and Nominating Committee monitors matters such as the composition of the Board and its committees, board performance and “best practices” in corporate governance. The Chairman and Chief Executive Officer does not serve on any of these committees and, as discussed in more detail in this proxy statement, the entire Board of Directors is actively involved in overseeing our risk management. We believe the independent composition of our principal Board committees, together with the Presiding Independent Director function, provides balanced leadership and consistent, effective oversight of our management and our company.

Risk Oversight

Our entire Board is actively involved in overseeing our risk management. Operational and strategic presentations by management to the Board include consideration of the challenges and risks to our business, and the Board and management actively engage in discussion on these topics. At least annually, the Board reviews management’s long term strategic plans and the risks associated with carrying out those plans. The report for that strategic review is compiled by senior management and approved by the Chief Executive Officer.

In addition, each of our Board committees considers risk within its area of responsibility. For instance, our Audit Committee oversees financial risk and reviews at least annually the risk factors enunciated in the Company’s periodic reports that are filed with the SEC. In addition, it discusses legal and compliance matters, and assesses the adequacy of our risk-related internal controls. The Audit Committee also periodically requests management to address specific risk issues at its meetings. Likewise, the Compensation Committee considers risk and structures our executive compensation programs with an eye to providing incentives to appropriately reward executives for growth without undue risk taking. It also annually meets with the Company’s pension plan trust investment advisor to review the investment performance and associated risks with the Company’s U.S. pension plan trust. On an annual basis, the Corporate Governance and Nominating Committee reviews our Board committees’ structure to ensure appropriate oversight of risk.

Our Compensation Committee has reviewed and discussed with management the issues of risk as it relates to our compensation program and practices, and the Committee does not believe our

10

compensation programs and practices encourage excessive or inappropriate risk-taking or are reasonably likely to have a material adverse effect on the Company for, at least, the following reasons:

| • | We structure our pay to consist of both fixed and performance-based compensation. The fixed (or salary) portion of compensation is designed to provide a steady income regardless of the Company’s stock price and financial performance so that executive compensation is not entirely performance based, which could encourage unnecessary or excessive risk taking. The performance-based (cash bonus and equity) portions of compensation are designed to reward both short and long-term corporate performance. For short-term performance, our cash bonus is awarded based on annual performance metrics and targets. For long-term performance our equity awards generally vest over a three year minimum period and only create more value for award recipients if our stock price increases over time. We feel that these variable elements of compensation are a sufficient percentage of overall compensation to motivate executives to produce superior short- and long-term corporate results while the fixed element is also sufficiently high that the executives are not encouraged to take unnecessary or excessive risks in doing so. |

| • | Our operating income and other performance related targets are applicable to our executives and employees alike, regardless of business unit. We believe this encourages consistent behavior across the organization, rather than establishing different performance metrics depending on a person’s position in the Company or their business unit. So, for example, a person in our most profitable business line is not encouraged to take more risk than someone in a less profitable business unit. |

| • | We cap our maximum cash bonus opportunity at two times target, which we believe also mitigates excessive risk taking. Even if the Company dramatically exceeds its operating targets, bonus payouts are limited. Conversely, we have a floor on the bonus target so that profitability below a certain level (as approved by the Compensation Committee) does not permit bonus payouts. |

| • | Our internal control over financial reporting includes controls over the measurement and calculation of earnings that are designed to mitigate the risk of manipulation by any employee, including our executives. In addition, our employees are encouraged to report up to the Company’s director of internal audit and general counsel through a confidential “whistle-blower” hot line in the event they become aware of any internal financial reporting irregularities. |

| • | The members of the Board’s Compensation Committee have extensive experience in executive compensation matters and they are counseled by an independent professional executive compensation consulting firm. Their approval is required before any new executive compensation plan can be amended or implemented. This precludes management’s ability to implement any high risk or excessive compensation program. |

| • | We have adopted a clawback and recoupment policy applicable to all executive officers that is intended to further deter excessive or inappropriate risk taking. |

Committees

The Board of Directors has established an Audit Committee, a Compensation Committee, a Corporate Governance and Nominating Committee and an Executive Committee.

11

Audit Committee

| Members | The members of the Audit Committee are Messrs. Hargrove (Chairperson), Jenkins, Norkus and Mrs. Dvorak. Each member meets the independence standards set forth in our Corporate Governance Principles and those set forth in the New York Stock Exchange Listed Company Manual. In addition, each member meets the independence standard under Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). Each member has been determined by the Board of Directors to be an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K under the Exchange Act. | |||

| Number of Meetings Last Year | Eight | |||

| Primary Functions | To assist our Board of Directors in overseeing (i) the integrity of our financial statements and the financial reporting process; (ii) our compliance with legal and regulatory requirements; (iii) the independence and qualifications of our external auditors; and (iv) the performance of our external and internal auditors. As part of their responsibility the Committee: | |||

| — | Retains a firm of independent auditors to audit our financial statements and approves the scope of the firm’s audit; | |||

| — | Approves the scope of audit work and reviews reports and recommendations of our independent auditors; | |||

| — | Approves the annual internal audit plan and reviews reports and updates on the results of internal audit work; | |||

| — | Pre-approves all audit and non-audit services provided by our independent auditors; | |||

| — | Assists the Board in overseeing the integrity of our financial statements and financial reporting process; | |||

| — | Monitors the independence and performance of our independent auditors and the performance of our internal auditors; | |||

| — | Discusses with management our earnings announcements, financial statements and quarterly and annual reports to be filed with the SEC; | |||

12

— | Discusses with our independent auditors our annual and quarterly financial statements; | |||

| — | Reviews our policies regarding risk assessment and risk management; and | |||

| — | Establishes procedures for receiving and responding to concerns regarding accounting, internal accounting controls and auditing matters. | |||

| Compensation Committee | ||||

| Members | The members of the Compensation Committee are Messrs. Wesley (Chairperson), Bayly, Kroeger and Ms. Talton. Each member meets the independence standards set forth in our Corporate Governance Principles and those set forth in the New York Stock Exchange Listed Company Manual. | |||

| Number of Meetings Last Year | Five | |||

| Primary Functions | To assure that our senior executives are compensated appropriately and in a manner consistent with competitive practices, performance and the requirements of appropriate regulatory bodies. As part of this overall responsibility the Committee: | |||

| — | Administers our Amended and Restated 2011 Incentive Plan and exercises the authority of the Board relating to employee benefit plans; | |||

| — | Designates executive officers who may be granted stock options, performance awards and other stock-based awards; | |||

| — | Allocates the total amount of stock options, performance awards and other stock-based awards to be awarded to all other key employees and delegates to the CEO the authority to designate those key employees; | |||

| — | Reviews and recommends to the Board target compensation and goals for the chief executive officer and evaluates his or her performance in achieving established goals; | |||

| — | Sets salary and determines incentive compensation for our other executive officers; | |||

| — | Recommends terms and conditions of incentive compensation plans and equity-based plans for approval by the Board of Directors; | |||

13

| — | Monitors management’s succession planning processes for executive officers and assists the Board of Directors in establishing such processes for the CEO position. | |||

— | Oversees risk management with respect to the Company’s compensation plans; | |||

— | Retains any compensation consultants to assist in the evaluation of senior executive compensation and benefits; and | |||

— | Oversees management’s administration of retirement and other benefit arrangements and plans, compensation agreements and severance plans and agreements for executive officers. | |||

Corporate Governance and Nominating Committee | ||||

| Members | The members of the Corporate Governance and Nominating Committee, Messrs. Norkus (Chairperson) and Kroeger, Mrs. Dvorak and Ms. Talton, all meet the independence standards set forth in our Corporate Governance Principles and those set forth in the New York Stock Exchange Listed Company Manual. | |||

| Number of Meetings Last Year | Five | |||

| Primary Functions | Develops and recommends a set of corporate governance principles designed to foster an effective corporate governance environment; | |||

| — | Reviews the charters, duties, powers and composition of Board committees and recommends changes; | |||

| — | Manages the performance review process of the Board, its committees and management; | |||

| — | Identifies and evaluates potential director candidates and recommends nominees for election or re-election as members of the Board of Directors; | |||

| — | Recommends independent directors for membership on the Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee, including their Chairpersons; | |||

14

— | Recommends directors and executive officers for membership on other committees that may be established by the Board of Directors; | |||

— | Recommends compensation arrangements for non-employee directors; and | |||

— | Oversees management’s administration of non-employee director stock plans. | |||

Executive Committee | ||||

| Members | The members of the Executive Committee are Messrs. Keller (Chairperson), Jenkins and Wesley. | |||

| Number of Meetings Last Year | None | |||

| Primary Functions | Has all the power and authority of the full Board except for specific powers that by law must be exercised by the full Board. | |||

Nomination Process and Criteria for Nominee Selection

The primary functions of the Corporate Governance and Nominating Committee and a list of the Committee members (all of whom have been determined by the Board to be independent as defined by the New York Stock Exchange independence standards) are provided above. The Corporate Governance and Nominating Committee establishes the process by which the Board of Directors exercises its fiduciary duties for overseeing the performance of ACCO Brands’ management for the benefit of its stockholders and the maximization of stockholder value. Specific duties and responsibilities of the Corporate Governance and Nominating Committee include defining director qualifications as well as criteria for director independence and the selection of director candidates to be recommended to the Board.

The Committee, when identifying and evaluating candidates, first determines whether there are any evolving needs of the Board that require an expert in a particular field to fill that need. The Committee then may retain a third-party search firm to locate and provide information on candidates that meet the needs of the Board at that time. The Committee chair and some or all of the members of the Committee will interview potential candidates that are deemed appropriate. If the Committee determines that a potential candidate meets the needs of the Board, has the qualifications, and meets the standards set forth in ACCO Brands’ Corporate Governance Principles and as further described below, it will vote to recommend to the Board of Directors the nomination of the candidate.

The policy of the Corporate Governance and Nominating Committee is to consider director candidates recommended by stockholders if properly submitted to the Corporate Governance and Nominating Committee. Stockholders wishing to recommend persons for consideration by the Corporate Governance and Nominating Committee as nominees for election to the Board of Directors can do so by writing to the Office of the Secretary of ACCO Brands Corporation at 300 Tower Parkway, Lincolnshire, Illinois 60069. Recommendations must include the proposed nominee’s name, biographical data and qualifications as well as a written statement from the proposed nominee consenting to be named as a nominee and, if nominated and elected, to serve as a director. The Corporate Governance and Nominating Committee will then consider the candidate and the candidate’s qualifications. The Committee may contact the stockholder making the nomination to discuss the qualifications of the

15

candidate and the reasons for making the nomination. The Committee may then interview the candidate if the Committee deems the candidate to be appropriate. The Committee may use the services of a third-party search firm to provide additional information about the candidate prior to making a recommendation to the Board.

The Corporate Governance and Nominating Committee believes that it is necessary for our directors to possess many qualities and skills. The Committee believes that all directors must possess a considerable amount of business management and educational experience as well as meet the standards established by the Committee pursuant to ACCO Brands’ Corporate Governance Principles. In developing these standards, the Committee considers issues of judgment, diversity, background, stature, conflicts of interest, integrity, ethics and commitment to the goal of maximizing stockholder value. In considering candidates for the Board, the Corporate Governance and Nominating Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the Board are also considered.

The Committee’s nomination process for stockholder-recommended candidates and all other candidates is designed to ensure that the Committee fulfills its responsibility to recommend candidates that are properly qualified to serve ACCO Brands for the benefit of all of its stockholders, consistent with the standards established by the Committee under the ACCO Brands’ Corporate Governance Principles.

Compensation Committee Interlocks and Insider Participation

All current members of the Compensation Committee are considered independent under our Corporate Governance Principles. No interlocking relationships exist between the Board of Directors or the Compensation Committee and the Board of Directors or compensation committee of any other company.

Section 16(a) Beneficial Ownership Reporting Compliance

Each director and executive officer of ACCO Brands who is subject to Section 16 of the Exchange Act is required to file with the SEC reports regarding their ownership and changes in beneficial ownership of our equity securities. Reports received by ACCO Brands indicate that all these directors and executive officers have filed all requisite reports with the SEC on a timely basis during or for 2011.

TRANSACTIONS WITH RELATED PERSONS

The Company recognizes that transactions between the Company and any of its directors or executives can present potential or actual conflicts of interest and create the appearance that Company decisions are based on considerations other than the best interests of the Company and its stockholders. Therefore, as a general matter and in accordance with the Company’s Code of Business Conduct and Ethics, it is the Company’s preference to avoid such transactions. Nevertheless, the Company recognizes that there are situations where such transactions may be in, or may not be inconsistent with, the best interests of the Company. Therefore, the Company has adopted a formal written policy which requires the Company’s Audit Committee to review and, if appropriate, to approve or ratify any such transactions. Pursuant to the policy, the Committee will review any transaction in which the Company is or will be a participant and the amount involved exceeds $120,000, and in which any of the Company’s directors or executive officers had, has or will have a direct or indirect material interest. After its review the Committee will only approve or ratify those transactions that are in, or are not inconsistent with, the best interests of the Company and its stockholders, as the Committee determines in good faith. The

16

Committee has also directed the Company’s General Counsel and internal audit department to review the Company’s compliance with this policy on at least an annual basis.

During 2011, the Company was not involved in any transaction of the type the Committee would need to review.

2011 DIRECTOR COMPENSATION

Cash Compensation. Each non-employee director of ACCO Brands is paid an annual retainer of $63,000 for services as a director and receives an attendance fee of $1,500 for each meeting of the Board of Directors attended and for attendance at each meeting of a committee of the Board of Directors on which such director serves. The annual retainer was increased to $63,000 from $60,000 in May, 2011. This was the first increase in the annual retainer since the Company became public in August, 2005. Committee chairpersons receive additional annualized fees totaling $12,000 for each of the Audit and Compensation Committees and $6,000 for the Corporate Governance and Nominating Committee. In addition, the Presiding Independent Director is paid an annual fee of $20,000.

Insurance. Directors traveling on Company business are covered by our business travel accident insurance policy which generally covers all of our employees and directors.

Travel Expenses. We also reimburse our directors for travel and other related expenses incurred in connection with their service as a director.

Equity-based Compensation for Non-employee Directors. Each non-employee director typically receives a $73,500 annual restricted stock unit grant under the 2011 Amended and Restated ACCO Brands Corporation Incentive Plan (“LTIP”). The value of the annual restricted stock unit grant was increased from $70,000 in May, 2011. Non-employee directors appointed to the Board other than at an annual meeting receive a pro-rata portion of such amount based on the time between that date of appointment and the date of the next annual meeting. Under the terms of the LTIP and each individual director’s restricted stock unit award agreement, each restricted stock unit represents the right to receive one share of our common stock and is fully vested and non-forfeitable on the date of grant. The payment of all restricted stock units to non-employee directors are deferred under our Deferred Compensation Plan for Directors (the “Deferred Plan”), which provides that such awards are payable within 30 days after the conclusion of service as a director or immediately upon a change of control of ACCO Brands. Directors holding deferred restricted stock units are credited with additional restricted stock units based on the amount of any dividend that may be paid by ACCO Brands.

Upon filing a timely election, a director may also elect to defer the cash portion of his or her compensation under the Deferred Plan. In such an event the director can choose to have his deferral account credited in either or both of a phantom fixed income or phantom stock unit account. The phantom stock unit account would correspond to the value of, and the dividend rights associated with, an equivalent number of shares of ACCO Brands’ common stock. The balance in a phantom stock unit account, upon the conclusion of service as a director or upon a change in control, would be paid to the director in either a lump-sum cash distribution or a lump-sum distribution of shares of ACCO Brands’ common stock, as the director may elect. The balance in a phantom fixed income account, upon the conclusion of service as a director or upon a change in control, would be paid to the director in a lump-sum cash distribution. Our obligation to redeem a phantom account is unsecured and is subject to the claims of our general creditors. For the year 2011 none of the directors elected to defer any of their cash compensation. As of December 31, 2011 Mr. Hargrove held a total of 33,235 phantom stock units having a total market value of $320,718 and Mr. Jenkins held a total of 16,094 phantom stock units having a total

17

market value of $155,307 based on that day’s closing price of the Company’s common stock on the New York Stock Exchange of $9.65.

The following table sets forth the amount of cash, equity and aggregate compensation paid to non-employee members of our Board of Directors in 2011:

Name | Fees Earned or Paid in Cash | Stock Awards(1) | Total | |||||||||||||||

George V. Bayly | $81,750 | $73,500 | $155,250 | |||||||||||||||

Kathleen S. Dvorak | 98,250 | 73,500 | 171,750 | |||||||||||||||

G. Thomas Hargrove | 102,750 | 73,500 | 176,250 | |||||||||||||||

Robert H. Jenkins | 110,750 | 73,500 | 184,250 | |||||||||||||||

Thomas Kroeger | 93,750 | 73,500 | 167,250 | |||||||||||||||

Michael Norkus | 104,250 | 73,500 | 177,750 | |||||||||||||||

Sheila G. Talton | 93,750 | 73,500 | 167,250 | |||||||||||||||

Norman H. Wesley | 93,750 | 73,500 | 167,250 | |||||||||||||||

| (1) | Represents the proportionate amount of the total grant date fair value of stock awards determined in accordance with FASB ASC Topic 718. The assumptions used in determining the grant date fair values of these awards are set forth in Note 3 to the Company’s consolidated financial statements, which are included in our Annual Report on Form 10-K for the year ended December 31, 2011 filed with the SEC. |

The aggregate number of RSUs held by each non-employee director as of December 31, 2011 was as follows:

Director | Number of RSUs | |||

George V. Bayly | 32,849 | |||

Kathleen S. Dvorak | 18,478 | |||

G. Thomas Hargrove | 32,849 | |||

Robert H. Jenkins | 28,766 | |||

Thomas Kroeger | 20,888 | |||

Michael Norkus | 20,888 | |||

Sheila G. Talton | 18,478 | |||

Norman H. Wesley | 32,849 | |||

18

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

(Proxy Item 2)

The Audit Committee has appointed KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2012. During 2011 KPMG served as the Company’s independent registered public accounting firm and also provided certain other services to the Company. The Audit Committee and the Board of Directors recommend that you ratify this appointment. In line with this recommendation, the Board of Directors intends to introduce the following resolution at the Annual Meeting (designated as Item 2):

“RESOLVED, that the appointment of KPMG LLP as the independent registered public accounting firm for this Company for the year 2012 is ratified.”

A member of KPMG is expected to attend the Annual Meeting to make a statement if he or she desires, and will respond to appropriate questions that may be asked by stockholders.

The Board of Directors recommends that you vote FOR Item 2.

Report of the Audit Committee

The Audit Committee of the Board of Directors is composed of directors that are “independent” as defined under the New York Stock Exchange corporate governance listing standards and Rule 10A-3 of the Exchange Act. The Audit Committee has a written charter that has been approved by the Board of Directors. A copy of the charter is available on our website atwww.accobrands.com. The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management is responsible for the Company’s financial statements and the financial reporting process, including implementing and maintaining effective internal control over financial reporting and for the assessment of, and reporting on, the effectiveness of internal control over financial reporting. The Company’s independent registered public accounting firm for 2011, KPMG, is responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States and for expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed with management and the independent registered public accounting firm, the Company’s audited financial statements for the year ended December 31, 2011 and reports on the effectiveness of internal controls over financial reporting as of December 31, 2011 contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011, including a discussion of the reasonableness of significant judgments and clarity of disclosures in the financial statements. The Audit Committee also reviewed and discussed with management the disclosures made in “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011.

The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees,as amended. In addition, the Audit Committee has discussed with the independent registered accounting firm their independence from the Company, including the matters in the letter provided to the Audit Committee by the independent registered public accounting firm regarding the firm’s communication with the Audit Committee concerning independence as required by the applicable requirements of the Public Company Accounting Oversight Board and has considered the compatibility of non-audit services with the auditor’s independence.

19

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their integrated audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 for filing with the Securities and Exchange Commission.

| Members of the Audit Committee |

| G. Thomas Hargrove (Chairperson) |

| Kathleen Dvorak |

| Robert H. Jenkins |

| Michael Norkus |

This report shall not be deemed to be incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed under such acts.

Audit and Non-Audit Fees

Our independent registered public accounting firm for the 2010 and 2011 fiscal years was KPMG LLP. The following table summarizes the fees paid or payable by ACCO Brands to KPMG for services rendered during 2010 and 2011 respectively:

| 2010 | 2011 | |||||||||||||||

Audit Fees | $ | 2,195,000 | $ | 2,376,000 | ||||||||||||

Audit-related fees | — | — | ||||||||||||||

Tax fees | 243,000 | 237,000 | ||||||||||||||

All other fees | 54,000 | 535,000 | ||||||||||||||

|

|

|

| |||||||||||||

Total | $ | 2,492,000 | $ | 3,148,000 | ||||||||||||

Audit fees include fees for the audit of our annual financial statements, the review of the effectiveness of the Company’s internal control over financial reporting, the review of our financial information included in our Form 10-Q quarterly reports filed with the SEC and services performed in connection with other statutory and regulatory filings or engagements. The tax services provided in both 2010 and 2011 primarily involved domestic and international tax compliance work and tax planning. Other fees for 2011 were related primarily to financial and tax due diligence associated with the Company’s pending merger of the Consumer and Office Products Business of MeadWestvaco Corporation into the Company. Other fees for 2010 were for payroll service reviews in Europe and acquisition due diligence procedures in Australia and New Zealand.

Approval of Audit and Non-Audit Services

All audit and non-audit services provided to the Company by KPMG were approved in advance by the Audit Committee. The Audit Committee has adopted the following policies and procedures for the pre-approval of all audit and permissible non-audit services provided by our independent registered public accounting firm. The Audit Committee annually reviews the audit and non-audit services to be performed

20

by the independent registered public accounting firm during the upcoming year. The Audit Committee considers, among other things, whether the provision of specific non-audit services is permissible under existing law and whether it is consistent with maintaining the registered public accounting firm’s independence. The Audit Committee then approves the audit services and any permissible non-audit services it deems appropriate for the upcoming year. The Audit Committee’s pre-approval of non-audit services is specific as to the services to be provided and includes pre-set spending limits. The provision of any additional non-audit services during the year, or the provision of services in excess of pre-set spending limits, must be pre-approved by either the Audit Committee or by the Chairman of the Audit Committee, who has been delegated authority to pre-approve such services on behalf of the Audit Committee. Any pre-approvals granted by the Chairman of the Audit Committee must be reported to the full Audit Committee at its next regularly scheduled meeting. All of the fees described above for services provided to ACCO Brands under audit fees, audit-related fees, tax fees and all other fees were pre-approved by the Audit Committee pursuant to the Company’s pre-approval policies and procedures.

21

CERTAIN INFORMATION REGARDING SECURITY HOLDERS

The table below sets forth the beneficial ownership of the Company’s common stock as of March 16, 2012. The table sets forth the beneficial ownership by the following individuals or entities:

| • | each person known to us that owns more than 5% of the outstanding shares of the Company’s common stock; |

| • | our executive officers; |

| • | our directors; |

| • | James A. Buzzard and E. Mark Rajkowski; and |

| • | all directors and executive officers of the Company as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. Except as otherwise indicated, each person named in the table has sole voting and investment power with respect to all shares of common stock shown as beneficially owned, subject to applicable community property laws. As of March 16, 2012, 55,530,146 shares of common stock were outstanding. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, shares of Company common stock that are subject to employee stock options or SSARs held by that person that are exercisable on or within 60 days of March 16, 2012 are deemed outstanding. These shares are not, however, deemed outstanding for the purpose of computing the percentage ownership of any other person.

| Beneficial Ownership | ||||||||||||||||||

Name | Number of Shares | Number of Shares Subject to Options and SSARs(1) | Number of Shares Subject to RSUs(2) | Total | Percent | |||||||||||||

Wellington Management Company, | 7,666,990 | — | — | 7,666,990 | 13.8 | % | ||||||||||||

Invesco Ltd. | 5,968,241 | — | — | 5,968,241 | 10.7 | % | ||||||||||||

BlackRock, Inc. | 5,955,364 | — | — | 5,955,364 | 10.7 | % | ||||||||||||

Wells Fargo & Company | 4,771,039 | — | — | 4,771,039 | 8.6 | % | ||||||||||||

JP Morgan Chase & Co. | 2,907,904 | — | — | 2,907,904 | 5.2 | % | ||||||||||||

George V. Bayly | 20,000 | — | 32,849 | 52,849 | * | |||||||||||||

Kathleen S. Dvorak | — | — | 18,478 | 18,478 | * | |||||||||||||

G. Thomas Hargrove | 80,000 | — | 32,849 | 112,849 | * | |||||||||||||

Robert H. Jenkins | 12,000 | — | 28,766 | 40,766 | * | |||||||||||||

22

| Beneficial Ownership | ||||||||||||||||||

Name | Number of Shares | Number of Shares Subject to Options and SSARs(1) | Number of Shares Subject to RSUs(2) | Total | Percent | |||||||||||||

Robert J. Keller | 224,127 | 213,333 | 11,961 | 449,421 | * | |||||||||||||

Thomas Kroeger | — | — | 20,888 | 20,888 | * | |||||||||||||

Michael Norkus | 52,000 | — | 20,888 | 72,888 | * | |||||||||||||

Sheila Talton | — | — | 18,478 | 18,478 | * | |||||||||||||

Norman H. Wesley | 29,671 | — | 32,849 | 62,520 | * | |||||||||||||

Mark C. Anderson | 685 | 62,200 | 5,800 | 68,685 | * | |||||||||||||

Boris Elisman | 8,398 | 258,277 | 11,000 | 277,675 | * | |||||||||||||

Neal V. Fenwick(8) | 76,543 | 427,957 | 11,000 | 515,410 | * | |||||||||||||

Christopher M. Franey(9) | 625 | 109,600 | — | 110,225 | * | |||||||||||||

David L. Kaput(10) | 19,079 | 79,400 | 6,800 | 105,279 | * | |||||||||||||

Thomas P. O’Neill, Jr.(11) | 63,981 | 54,266 | 6,200 | 124,447 | * | |||||||||||||

Steven Rubin(12) | 71,917 | 110,266 | 11,000 | 193,183 | * | |||||||||||||

Thomas H. Shortt(13) | 2,645 | 125,000 | — | 127,645 | * | |||||||||||||

Thomas W. Tedford | — | — | — | — | — | |||||||||||||

James A. Buzzard | — | — | — | — | — | |||||||||||||

E. Mark Rajkowski | — | — | — | — | — | |||||||||||||

All directors and executive officers as a group (18 persons) | 661,671 | 1,440,299 | 269,806 | 2,371,776 | 4.3% | |||||||||||||

| * | Less than 1% |

| (1) | Indicates the number of shares of ACCO Brands common stock issuable upon the exercise of options or SSARs exercisable on or within 60 days of March 16, 2012. |

| (2) | Indicates the number of shares subject to vested restricted stock units (RSUs) and RSUs that vest within 60 days of March 16, 2012. For members of our Board of Directors, these units represent the right to receive one share of ACCO Brands common stock upon cessation of service as a member of the Board of Directors or a change-in-control of ACCO Brands. |

| (3) | Based solely on a Schedule 13G/A filed with the SEC on February 14, 2012 by Wellington Management Company, LLP and affiliated persons. Wellington Management Company, LLP does not have sole dispositive power over any of the shares and has shared voting power over 6,396,040 of the shares. |

| (4) | Based solely on a Schedule 13G/A filed with the SEC by Invesco Ltd. and affiliated persons on February 6, 2012. Of these shares, Invesco Ltd. has sole voting and dispositive power over 5,898,195 shares. |

| (5) | Based solely on a Schedule 13G filed with the SEC on January 24, 2012 by Wells Fargo & Company on its own behalf and on behalf of certain subsidiaries. Of these shares, Wells Fargo & Company has sole voting power over 4,628,100 shares and sole dispositive power over 4,765,568 shares. |

| (6) | Based solely on a Schedule 13G/A filed with the SEC on January 10, 2012 by BlackRock, Inc. which has sole voting and dispositive power over all of the shares. |

| (7) | Based solely on a Schedule 13G/A filed with the SEC on January 25, 2012. Of these shares, JP Morgan Chase & Co. has sole voting power over 2,717,859 shares and sole dispositive power over 2,901,446 shares. |