- ACCO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ACCO Brands (ACCO) DEF 14ADefinitive proxy

Filed: 30 Mar 15, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | ☒ | |

| Filed by a Party other than the Registrant | ☐ | |

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

ACCO BRANDS CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box) | ||

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

March 30, 2015

Dear Fellow Stockholder:

ACCO Brands delivered better-than-expected results in 2014. In spite of currency pressures and a consolidating customer base, our ACCO Brands team grew earnings, significantly reduced debt, initiated a stock buy-back program, and improved most operating ratios. ACCO Brands stock price was up 34% in 2014, significantly outperforming both the S&P 500 and Russell 2000 stock indices. We are proud of the team’s accomplishments in this difficult environment.

In 2015, the Company will continue to focus on improving profitability and managing channel transition in mature markets, and growing sales and profitability in emerging markets. With a stronger balance sheet, the Company will also continue to evaluate share buy-backs and acquisitions as ways to further enhance shareholder value. We remain confident that we have the right strategy and management team to increase the long-term value of our Company.

We invite you to join the Board of Directors and our management team at the ACCO Brands Corporation 2015 Annual Meeting of Stockholders, which will be held at 10:30 a.m. (Central Time) on Tuesday, May 12, 2015 at the Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois. A map with directions to the Kemper Lakes Business Center can be found at the end of the attached Proxy Statement. The sole purpose of the meeting is to consider the matters described in the following Notice of 2015 Annual Meeting and Proxy Statement.

It is important that your shares are represented at the meeting, whether or not you plan to personally attend. You can submit your proxy by using a toll-free telephone number, by mail or through the Internet, or you can vote in person at the meeting. Instructions for using these services are provided on the accompanying proxy form. If you decide to vote your shares using the accompanying proxy form, we urge you to complete, sign, date and return it promptly.

Sincerely,

|  |

| Robert J. Keller | Robert H. Jenkins |

| Chairman of the Board | Presiding Independent Director |

NOTICE OF 2015 ANNUAL MEETING

AND PROXY STATEMENT

The Annual Meeting of Stockholders of ACCO Brands Corporation (“ACCO Brands” or the “Company”) will be held at the Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois, 60047, at 10:30 a.m. Central Time on Tuesday, May 12, 2015, for the following purposes:

| Item 1: | To elect ten directors identified in this Proxy Statement for a term expiring at the 2016 Annual Meeting; | |

| Item 2: | To ratify the selection of KPMG LLP as our independent registered public accounting firm for 2015; | |

| Item 3: | To approve, by non-binding advisory vote, the compensation of our named executive officers; | |

| Item 4: | To approve the ACCO Brands Corporation Incentive Plan; and | |

| Item 5: | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

We currently are not aware of any other business to be brought before the 2015 Annual Meeting (the “Annual Meeting”). Only holders of record of common stock at the close of business on March 13, 2015 will be entitled to vote at the Annual Meeting or at any adjournment or postponement thereof.

Please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) by telephone, (2) through the Internet or (3) by mail. For specific instructions, please refer to the accompanying proxy card. If you attend the Annual Meeting, you may revoke your proxy and vote in person.

This year we are again taking advantage of Securities and Exchange Commission (“SEC”) rules that allow us to furnish proxy materials to our stockholders via the Internet. We will send a Notice of Internet Availability of Proxy Materials (the “Notice”) to holders of our common stock as of the record date on or about March 30, 2015. The Notice describes how you can access our proxy materials, including this Proxy Statement, beginning on March 30, 2015.

We also are soliciting voting instructions from participants in the ACCO Brands Corporation 401(k) plan who hold shares of our common stock under the plan. We ask each plan participant to sign, date and return the accompanying voting instruction card or provide voting instructions by telephone or through the Internet as described on the voting instruction card.

| By order of the Board of Directors |

|

| Pamela R. Schneider |

| Senior Vice President, General Counsel and Corporate Secretary |

This Proxy Statement and accompanying proxy are first being made available or distributed to our stockholders on or about March 30, 2015.

PROXY STATEMENT - HIGHLIGHTS This summary highlights certain information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider. You should read the entire Proxy Statement carefully before voting.

ACCO Brands Corporation Annual Meeting of Stockholders | |||||||||||

| Time and Date: | 10:30 a.m. Central Time on Tuesday, May 12, 2015 | ||||||||||

| Place: | Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois 60047 | ||||||||||

| Record Date: | March 13, 2015 | ||||||||||

| Proposals to be Voted on and Board Voting Recommendations | |||||||||||

| Proposals | Board Recommendations | Page No. | |||||||||

| Item 1 | Election of ten directors | FOR each nominee | 4 | ||||||||

| Item 2 | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal 2015 | FOR | 17 | ||||||||

| Item 3 | “Say-on-pay” advisory vote on the compensation of our named executive officers | FOR | 51 | ||||||||

| Item 4 | Approval of the ACCO Brands Corporation Incentive Plan | FOR | 52 | ||||||||

| Corporate Governance | ||||

| Board of Directors and Committees | ||||

| • | Declassified Board of Directors - all directors elected annually | |||

| • | Separate Chairman, Chief Executive Officer (“CEO”) and Presiding Independent Director roles | |||

| • | 80% of our directors are independent | |||

| • | Fully independent Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee | |||

| • | Executive sessions of independent directors held at each regularly scheduled board meeting | |||

| • | All directors attended over 75% of Board and committee meetings held in 2014 | |||

| • | All Audit Committee members are “audit committee financial experts” | |||

| Stockholder Interests | ||||

| • | All directors and executive officers have met or are on track to meet stock ownership guidelines | |||

| • | Annual advisory vote to ratify independent auditors | |||

| • | Hedging, pledging and short sales of company stock are prohibited | |||

| Executive Compensation | ||||

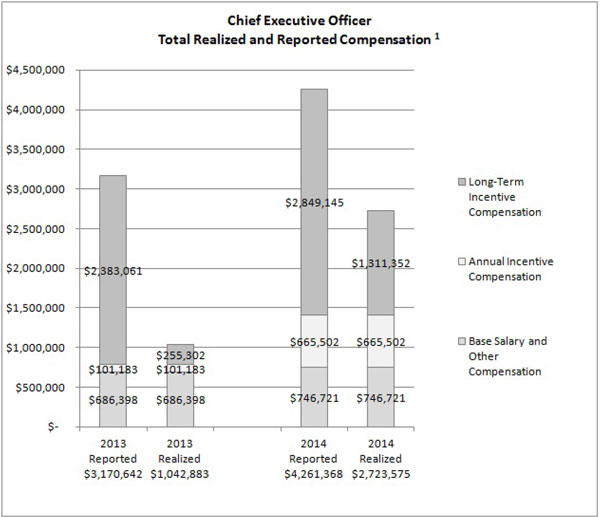

| Boris Elisman, CEO | ||||

| Fiscal 2014 Total Realized Compensation | ||||

| • | 2014 Base Salary - $746,721 | |||

| • | 2014 Annual Incentive Plan Payout - $665,502 | |||

| • | Long-Term Incentive Payout from 2012-2014 Performance Stock Unit Award - $1,311,352 | |||

| Compensation Highlights | ||||

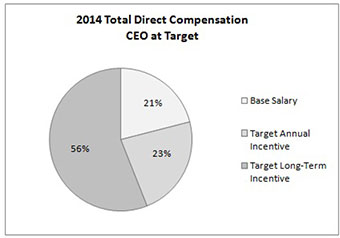

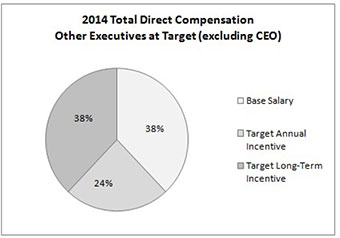

| • | 79% of CEO target compensation is at-risk based on financial performance measures or stock price appreciation | |||

| • | No executive employment agreements or individual change-in-control agreements | |||

| • | Clawback and recoupment policy | |||

| • | Say-on-pay proposal in 2014 was approved by 94.5% of the stockholders voting at the meeting | |||

| • | Independent compensation consultant | |||

| • | Annual compensation risk assessment | ||

| • | Three-year performance period for performance stock units | ||

| • | Double-trigger change-in-control provisions in executive severance plan | ||

| • | Double-trigger change-in-control vesting for long-term equity awards | ||

VOTING AND PROXIES

Why is ACCO Brands distributing this Proxy Statement?

Our Board of Directors is soliciting proxies for use at the Annual Meeting to be held on Tuesday, May 12, 2015, beginning at 10:30 a.m. Central Time, at the Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois. In order to solicit your proxy, we must furnish you with this Proxy Statement, which contains information about the matters to be voted upon at the Annual Meeting.

What is the purpose of the Annual Meeting?

The purpose of the Annual Meeting is for stockholders to act upon the matters outlined in the Notice of the Annual Meeting and described in this Proxy Statement, including: (1) the election of ten directors, (2) the ratification of KPMG LLP as our independent registered public accounting firm for 2015, (3) a non-binding advisory vote on the compensation of our named executive officers, (4) the approval of the ACCO Brands Corporation Incentive Plan (the “Restated Plan”), and (5) such other business as may properly come before the meeting or any adjournment or postponement thereof. In addition, management will be available to respond to questions from stockholders.

Why did I receive a Notice in the mail regarding the availability of proxy materials on the Internet instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we are providing access to our proxy materials via the Internet. The Notice we sent to our stockholders provides instructions on how to access and review this Proxy Statement and our Annual Report online, as well as how to vote online. Providing proxy materials electronically significantly reduces the printing and mailing costs associated with the distribution of printed copies of our proxy materials to our stockholders.

If you receive a Notice, you will not receive a printed copy of the proxy materials by mail unless you request one. All stockholders have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request printed copies may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail on an ongoing basis.

Who is entitled to vote?

Only stockholders who own ACCO Brands common stock of record at the close of business on March 13, 2015 are entitled to vote. Each holder of common stock is entitled to one vote per share. There were 112,285,889 shares of common stock outstanding on March 13, 2015.

What is the difference between being a record holder and holding shares in street name?

A record holder holds shares in his or her own name. Shares held in “street name” are shares that are held in the name of a bank, broker or other nominee on a person’s behalf. If the shares you own are held in “street name” by a bank, broker or other nominee, the bank, broker or other nominee is required to vote your shares according to your instructions. Under the rules of the New York Stock Exchange (“NYSE”), if you do not give instructions to your bank, broker or other nominee, it will still be able to vote your shares with respect to certain “discretionary” items, but will not be allowed to vote your shares with respect to certain “non-discretionary” items. Only the ratification of KPMG LLP as our independent registered public accounting firm (proxy Item 2) is considered to be a discretionary item under the NYSE rules, and your bank, broker or other nominee will be able to vote on that item even if it does not receive voting instructions from you, so long as it holds your shares in its name.

The election of directors (proxy Item 1), the advisory vote on the compensation of our named executive officers (proxy Item 3), and the approval of the Restated Plan (proxy Item 4) are “non-discretionary” items. Therefore, if you hold your shares in street name, your bank, broker or other nominee may not vote your shares with respect to these items unless it receives your voting instructions, and if it does not, those votes will be counted as “broker non-votes.” “Broker non-votes” are shares that are held in “street name” by a bank, broker or other nominee that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

| 1 |

How do I vote?

Stockholders of record can vote by filling out the accompanying proxy card and returning it as instructed on the proxy card. You can also vote by telephone or through the Internet by following the instructions printed on the proxy card or the Notice. You may also vote in person at the meeting.

Stockholders that hold shares in “street name” can vote by following the voting instructions in the materials received from your bank, broker or other nominee. The availability of telephone and Internet voting for stockholders that hold shares in “street name” will depend on the voting processes of your bank, broker or other nominee. Therefore, we recommend that you follow the voting instructions in the materials you receive from your bank, broker or other nominee. In addition, you may only vote in person if you obtain a signed proxy from your bank, broker or other nominee, who is the holder of record.

How will my proxy be voted?

Your proxy, when properly signed and returned, or processed by telephone or through the Internet, and not revoked, will be voted in accordance with your instructions. We are not aware of any other matter that may be properly presented other than the election of directors, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2015, the advisory vote on the compensation of our named executive officers, and the approval of the Restated Plan. If any other matter is properly presented at the meeting, the persons named in the enclosed form of proxy will have the authority to vote on such matters at their discretion.

What constitutes a quorum?

The holders of a majority of the issued and outstanding common stock of the Company present either in person or by proxy at the Annual Meeting will constitute a quorum. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the Annual Meeting. If less than a majority of the outstanding shares of common stock are represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting to another date, time or place.

What if I don’t mark the boxes on my proxy or voting instruction?

If you hold shares in your name, unless you give other instructions on your form of proxy or when you cast your proxy by telephone or through the Internet, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. In summary, the Board of Directors recommends a vote:

| • | FOR the election of each director nominee (proxy Item 1); | |

| • | FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2015 (proxy Item 2); | |

| • | FOR the approval, on an advisory non-binding basis, of the compensation of our named executive officers (proxy Item 3); and | |

| • | FOR the approval of the Restated Plan (proxy Item 4). | |

If you hold shares in “street name,” your bank, broker or other nominee may vote your shares on discretionary matters without receiving voting instructions from you, but cannot vote your shares on non-discretionary matters. As a result, if you do not provide instructions, your bank, broker or other nominee will not have the authority to vote on proxy Item 1 (election of directors), proxy Item 3 (advisory vote on the compensation of our named executive officers) and proxy Item 4 (approval of the Restated Plan), but will have the authority to vote on proxy Item 2 (ratification of independent auditors).

Can I go to the Annual Meeting if I vote by proxy?

Yes. Attending the meeting does not revoke your proxy unless you vote in person at the meeting.

Please note that attendance at the Annual Meeting is limited to stockholders of record as of the close of business on March 13, 2015, the record date, and to those who hold a valid proxy from a stockholder of record. Each stockholder and proxyholder may be asked to present valid picture identification, such as a driver’s license or passport, and proof of stock ownership as of the record date. Proof of ownership can be the Notice, your proxy card or a proxy or voting instruction card provided by your broker, bank or other nominee, or a brokerage statement or letter from your bank or broker evidencing your ownership of ACCO Brands stock

| 2 |

as of March 13, 2015. Stockholders and proxyholders also may be asked to present a form of photo identification such as a driver’s license or passport. The use of cell phones, smartphones, electronic tablets, laptops and recording and photographic equipment is not permitted in the meeting room at the Annual Meeting. Failure to follow the meeting rules will be grounds for exclusion from the Annual Meeting.

How can I revoke my proxy?

You may revoke your proxy at any time before it is actually voted by giving written notice to the secretary of the Annual Meeting (if you attend the Annual Meeting) or by delivering a later-dated proxy, which automatically revokes your earlier proxy, either by mail, by telephone or through the Internet, if one of those methods was used for your initial proxy submission. If shares are held in a stock brokerage account or by a bank, broker or other nominee, then you are not the record holder of your shares, and while you are welcome to attend the Annual Meeting you will not be permitted to vote unless you obtain a signed proxy from your bank, broker or other nominee (who is the holder of record).

Will my vote be public?

No. As a matter of policy, stockholder proxies, ballots and tabulations that identify individual stockholders are kept secret and are only available to the independent Inspectors of Election and certain employees who have an obligation to keep your votes secret.

How many votes are needed to elect the director nominees and approve the other matters to be voted upon at the Annual Meeting?

Directors are elected by a plurality of all votes cast for the election of directors at the Annual Meeting. A proxy marked to withhold authority for the election of one or more directors will not be voted with respect to the director or directors indicated. The affirmative vote of the holders of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote is necessary for approval of proxy Items 2, 3 and 4. Proxy cards marked as abstentions on proxy Items 2, 3 and 4 will not be voted and will have the effect of a negative vote. Please note that if you hold your shares in street name, your bank, broker or other nominee will not be permitted to vote your shares on proxy Item 1 (election of directors), proxy Item 3 (advisory vote on the compensation of our named executive officers ) or proxy Item 4 (approval of the Restated Plan) absent specific instructions from you. Therefore, it is important that you follow the voting instructions on the form that you receive from your bank, broker or other nominee.

What if I participate in the ACCO Brands 401(k) plan?

We also are making this Proxy Statement available to and seeking voting instructions from participants in the ACCO Brands 401(k) plan who hold shares of our common stock under such plan. The trustees of the plan, as record holders of ACCO Brands common stock held in the plan, will vote whole shares attributable to you in accordance with your directions given on your voting instruction card, by telephone or through the Internet. If you hold shares of our common stock under the plan, please complete, sign and return your voting instruction card or provide voting instructions by telephone or through the Internet, as described on the voting instruction card, prior to May 7, 2015. The voting instruction card will serve as instructions to the plan trustees to vote the shares attributable to your interest in the manner you indicate on the card.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

Our Proxy Statement and 2014 Annual Report on Form 10-K are available at: www.proxyvote.com.

| 3 |

ELECTION OFDIRECTORS

(Proxy Item 1)

Our By-laws currently provide that the Board of Directors may consist of not less than nine nor more than thirteen members. Currently, there are ten members serving on our Board of Directors. The Board of Directors, upon recommendation from the Corporate Governance and Nominating Committee (the “Governance Committee”), has selected all of the currently serving directors as nominees for election as directors at the Annual Meeting.

Directors are responsible for overseeing the Company’s business consistent with their fiduciary duties to stockholders. The Board of Directors believes that there are general requirements applicable to all directors as well as other skills and experience that should be represented on our Board as a whole, but not necessarily in each director. The Board of Directors and the Governance Committee consider the entirety of the qualifications of directors and director nominees individually, as well as in the broader context of the Board’s overall composition and the Company’s current and future needs.

Qualifications Required for All Directors

In assessing potential directors, including those recommended by stockholders, the Board of Directors and the Governance Committee consider a variety of factors, including the evolving needs of the Board of Directors and the Company as well as other criteria established by the Board of Directors. These include the potential director’s judgment, independence, business and educational background, stature, public service, conflicts of interest, integrity, ethics and ownership of Company stock, as well as his or her level of commitment to the goal of maximizing stockholder value and his or her ability and willingness to devote sufficient time to serve on the Board of Directors and to the affairs of the Company. The Board of Directors and the Governance Committee require that each director be a recognized person of high integrity with a proven record of success in his or her field. The Board of Directors does not have a specific policy regarding diversity, but considers race, ethnicity, gender, age, cultural background and professional experience in evaluating director candidates.

Experience, Qualifications and Skills Represented on Our Board of Directors

In addition to the general qualifications highlighted above, in light of the Company’s current needs and its business strategy, our Board of Directors has identified particular expertise, qualifications and skills that are important to be represented on our Board as a whole. The Board of Directors believes it is valuable to have a mix of individuals with expertise as senior executives in the areas of operations, finance, marketing and sales, human resources, compensation and talent management; individuals with enterprise-level information technology expertise; and individuals with expertise in emerging market development, corporate strategy, corporate governance and risk management. The Board also believes it is important that a significant number of our Board members have operating knowledge of the industry in which the Company operates and experience serving as a public company director.

2015 Board of Director Nominees

The Board of Directors proposes that each of the ten nominees named and described below be elected for a one-year term expiring at the 2016 annual meeting of stockholders or until his or her respective successor is duly elected and qualified. Proxies cannot be voted for more than the number of nominees proposed for election.

Each of our directors and director nominees possesses the judgment and business and educational background required and has a proven track record of success in his or her field as well as a reputation for integrity, honesty and adherence to high ethical standards. They each have business acumen and an ability to exercise sound judgment and a commitment of service to our Company, its stockholders and the Board of Directors. In addition, our Board of Directors is comprised of individuals who collectively possess the particular experiences we consider important to be represented on our Board of Directors as a whole as discussed under the heading “--Experience, Qualifications and Skills Represented on Our Board of Directors.”

The following paragraphs provide information about each director nominee’s age, positions held, principal occupation and business experience for the past five years, the year first elected as a director of ACCO Brands and the names of other publicly traded companies of which he or she currently serves as a director or has served as a director during the past five years.

Each of the nominees below has consented to serve a one-year term if elected. If any nominee should become unavailable to serve as a director, the Board of Directors may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board of Directors.

| 4 |

For information about the number of shares of common stock beneficially owned by each director see “Certain Information Regarding Security Holders.” There are no family relationships among any of the directors and executive officers of ACCO Brands.

The Board of Directors recommends that you vote FOR the election of all the nominees.

Boris Elisman, President and Chief Executive Officer, Director since 2013.Mr. Elisman, age 52, is the Company’s President and CEO. Prior to becoming our President and Chief Executive Officer (“CEO”) in March 2013, Mr. Elisman served as President and Chief Operating Officer of the Company from 2010 and was President, ACCO Brands Americas from 2008 to 2010. In 2008, he served as President of the Company’s Global Office Products Group and from 2004 to 2008, he served as President of the Company’s Computer Products Group. Prior to that time, Mr. Elisman held Vice President and General Manager positions in marketing and sales for the Hewlett-Packard Company from 2001 to 2004.

Robert J. Keller, Chairman of the Board, Director since 2005.Mr. Keller, age 61, has served as Chairman of the Board of Directors of the Company since October 2008. He served as Chief Executive Officer of the Company from October 2008 to March 2013 and as Executive Chairman from March 2013 to March 2015, when he retired as an executive officer of the Company and transitioned to his current role as non-executive Chairman of our Board. Prior to joining the Company, Mr. Keller served as President and Chief Executive Officer and as a director of APAC Customer Services, Inc. from March 2004 until February 2008 and served in various capacities at Office Depot, Inc., most recently as its President, Business Services Group.

George V. Bayly, Director since 2005.Mr. Bayly, age 72, is a private investor. Since August 2008, Mr. Bayly has served as Principal of Whitehall Investors LLC, a consulting and venture capital firm. Prior to that time, he served as Chairman and interim Chief Executive Officer of Altivity Packaging LLC, interim Chief Executive Officer of U.S. Can Corporation, and Chairman, President and Chief Executive Officer of Ivex Packaging Corporation, a specialty packaging company. Mr. Bayly was a director of General Binding Corporation from 1998 until August 2005, when it was acquired by the Company. He is currently a director of TreeHouse Foods, Inc., and was a director of CCL Industries, Inc. from 2009 to 2013 and a director of Graphic Packaging Holding Company from 2008 until February 2014.

James A.Buzzard, Director since 2012.Mr. Buzzard, age 60, served as President of MeadWestvaco Corporation (“MWV”) from 2003 until his retirement in March 2014 and was responsible for global operations, including Packaging, Specialty Chemicals, Technology and Supply Chain. Mr. Buzzard began his career with Westvaco in 1978 and held positions of increasing responsibility over many years.

Kathleen S. Dvorak, Director since 2010. Ms. Dvorak, age 58, is Executive Vice President and Chief Financial Officer of Richardson Electronics, Ltd., a global provider of engineered solutions and a leading distributor of electronic components to the electron device marketplace. Ms. Dvorak has responsibility for Finance, Information Technology, Human Resources and Legal. Previously, she was Senior Vice President and Chief Financial Officer of United Stationers Inc., an office products wholesaler and distributor from 2001 until 2007.

Robert H. Jenkins, Director since 2007.Mr. Jenkins, age 72, is our Presiding Independent Director. Mr. Jenkins is retired. He served as Chairman, President and Chief Executive Officer of Sundstrand Corporation from 1997 to 1999 and as its President and Chief Executive Officer from 1995 to 1997. Sundstrand is an aerospace and industrial company that merged with United Technologies Corporation in June 1999, forming Hamilton Sundstrand Corporation. Mr. Jenkins is currently a director of AK Steel Holding Corporation, Clarcor, Inc. and Jason Industrial, Inc.

Pradeep Jotwani, Director since 2014.Mr. Jotwani, age 60, is a Senior Vice President at Hewlett-Packard Company, where he has worked since 1982, except for the period between 2007 and 2012. From 2010 until 2012, he served as Senior Vice President at Eastman Kodak Company, which filed for bankruptcy in 2012. Mr. Jotwani served on the board of RealNetworks from 2007 to 2010 and from 2009 until 2010 he served on the boards of Westinghouse Solar and two private firms and worked as an operating executive at Vector Capital, a private equity firm.

Thomas Kroeger, Director since 2009.Mr. Kroeger, age 66, is President of Spencer Alexander Associates, which provides management consulting and executive recruiting services. Spencer Alexander Associates is affiliated with Howard & O’Brien Associates, a retained executive search firm. He is also a member of the Operating Council of Kirtland Capital Partners, a private equity firm and currently serves as a director of Precision Dialog Holdings LLC. Previously, Mr. Kroeger served as chief human resources officer for each of Invacare Corporation, Office Depot, Inc. and The Sherwin-Williams Company. In each of these positions he was also a member of the executive committee.

| 5 |

Michael Norkus, Director since 2009.Mr. Norkus, age 68, is President of Alliance Consulting Group, a business strategy consulting firm. Prior to founding Alliance Consulting Group in 1986, Mr. Norkus was Vice President and director of The Boston Consulting Group, where he served for 11 years. Mr. Norkus also currently serves as a director of Genesee & Wyoming, Inc. and served as a director of Overland Storage, Inc. from 2004 to 2011.

E. Mark Rajkowski, Director since 2012.Mr. Rajkowski, age 56, has been Senior Vice President and Chief Financial Officer of MWV since 2004. He began his career with PricewaterhouseCoopers LLP in 1981, last serving as the managing partner for the Upstate New York Technology Industry Group, and held financial and operating positions of increasing responsibility at Eastman Kodak Company prior to joining MWV.

The table below highlights the primary reasons each individual was selected as a director nominee relative to our desired criteria for a diverse, well-balanced Board of Directors and the particular expertise, qualifications and skills we believe should be represented on our Board of Directors. Many of our directors have experience and expertise beyond those noted below. The table is intended to highlight the specific, unique characteristics which led to each individual’s selection.

| Boris Elisman | Robert J. Keller | George V. Bayly | James A. Buzzard | Kathleen S. Dvorak | Robert H. Jenkins | Pradeep Jotwani | Thomas Kroeger | Michael Norkus | E. Mark Rajkowski | |

| Senior Operating Executive Expertise | √ | √ | √ | √ | √ | √ | ||||

| Senior Financial Executive Expertise | √ | √ | ||||||||

| Senior Marketing/Sales Executive Expertise | √ | √ | √ | √ | ||||||

| Senior HR/Compensation/Talent Development | √ | |||||||||

| Operating Knowledge of Company’s Industry | √ | √ | √ | √ | √ | √ | √ | |||

| Public Company Directorship Experience | √ | √ | √ | |||||||

| Enterprise Level Information Technology Expertise | √ | |||||||||

| International Market Development Expertise | √ | √ | √ | √ | √ | |||||

| Corporate Strategy Development Expertise | √ | √ | √ | |||||||

| Corporate Governance Expertise | √ | √ | √ | √ | ||||||

| Risk Management Expertise | √ | √ | √ | √ |

During 2014, there were six meetings of the Board of Directors. Each director attended at least 75% of the total meetings of the Board of Directors and committees of the Board of Directors of which the director was a member. In addition to participation at Board of Directors and committee meetings, our directors discharge their responsibilities throughout the year through personal meetings and other communications, including considerable telephone contact with our Chairman, our CEO and others regarding matters of interest and concern to ACCO Brands.

| 6 |

CORPORATE GOVERNANCE

The Board of Directors has adopted Corporate Governance Principles to assist it in the exercise of its responsibility to oversee the performance of the Company’s management for the benefit of the Company’s stockholders and the maximization of stockholder value. These principles, along with the charters of the Board of Directors’ committees and other key policies and practices of the Board of Directors, are intended to provide a framework for the governance of the Company.

Director Independence

The Corporate Governance Principles provide that a majority of the members of the Board of Directors, and each member of the Audit, Compensation and Governance Committees, must meet certain criteria for independence. Based on the NYSE independence requirements, the Corporate Governance Principles (which are available on our website,www.accobrands.com) set forth certain standards to assist the Board of Directors in determining director independence. The Corporate Governance Principles provide that a director will be considered independent only if the Board of Directors affirmatively determines that the director has no material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company. In addition, the Corporate Governance Principles provide that under no circumstances will a director be considered independent if:

| (a) | the director is a current employee of the Company or any of its subsidiaries, or has an immediate family member who is a current executive officer of the Company or any of its subsidiaries; | |

| (b) | the director is a former employee, or any immediate family member is a former executive officer, of the Company or its subsidiaries, until three years after the employment has ended; | |

| (c) | the director (1) is a current partner or employee of the firm that is the Company’s internal or external auditor; (2) has been within the last three years, or has an immediate family member that has been within the last three years, a partner or employee of such firm and worked on the Company’s audit during that time; or (3) has an immediate family member who is currently, or within the last three years has been, an employee of such firm and participates in the audit, assurance or tax compliance (but not tax planning) practice; | |

| (d) | the director or an immediate family member has been within the last three years employed as an executive officer of another company where any of the Company’s present executive officers serves or has served at the same time on that company’s compensation committee; | |

| (e) | each year, the director or any immediate family member receives, or in any twelve-month period within the last three years has received, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on future service); and | |

| (f) | the director is a current employee, or any immediate family member is a current executive officer, of a company that makes payments to, or receives payments from, the Company for property or services in an amount that exceeds, in any of the last three fiscal years, the greater of $1 million or 2% of the other company’s consolidated gross revenues. |

Each member of the Board of Directors, other than Messrs. Elisman and Keller, has been affirmatively determined by the Board of Directors to be independent as defined in the Corporate Governance Principles and in accordance with NYSE independence requirements. Sheila G. Talton, who served as a member of the Board of Directors during 2014 and resigned as a director on March 16, 2015, was also affirmatively determined by the Board of Directors to be independent.

In reaching this conclusion as it relates to Messrs. Buzzard and Rajkowski, the Board considered the fact that during 2014, the Company purchased coated paper products from MWV. See “Transactions with Related Persons.” Mr. Rajkowski is, and until March 31, 2014 Mr. Buzzard was, an executive officer of MWV. After considering all the facts and circumstances related to this transaction, the Board of Directors concluded that its existence did not impair Messrs. Buzzard’s and Rajkowski’s independence.

Mr. Norman H. Wesley served as our Presiding Independent Director until May 2014, when he retired and Mr. Jenkins became our Presiding Independent Director. Mr. Jenkins also served as our Presiding Independent Director from September 2008 to May 2013. The Presiding Independent Director presides at all executive sessions of the independent directors. Executive sessions of independent directors are held at every regularly scheduled meeting of the Board of Directors. In 2014, each regularly scheduled Board meeting included an independent director executive session.

| 7 |

Stockholder Communication

The Board of Directors and management encourage communication from our stockholders. Stockholders who wish to communicate with our management should direct their communication to the Chairman or the Office of the Corporate Secretary, Four Corporate Drive, Lake Zurich, Illinois 60047. Stockholders and other interested parties who wish to communicate with the non-employee or independent directors, any individual director or the Presiding Independent Director should direct their communication c/o the Office of the Corporate Secretary at the address above. The Corporate Secretary will forward to our Presiding Independent Director any communications intended for the full Board of Directors, for the non-employee or independent directors as a group, or for the Presiding Independent Director. Communications intended for an individual director will be forwarded directly to that director. If multiple communications are received on a similar topic, the Corporate Secretary may, in her discretion, forward only representative correspondence. Any communications that are unrelated to the Company or Board business or that are abusive, inappropriate or in bad taste or present safety, security or privacy concerns may be handled differently.

Annual Meeting Attendance

We do not have a formal policy requiring members of the Board of Directors to attend stockholders’ annual meetings, although all directors are expected to attend. All of the directors serving on the Board of Directors at the time of the 2014 annual meeting of stockholders (other than Mr. Norman H. Wesley and Mr. G. Thomas Hargrove, both of whom retired following the meeting) were in attendance.

Board of Directors’ Leadership Structure

The Board of Directors regularly evaluates whether it is in the best interests of the Company for the positions of Chairman and CEO to be separate or combined. In March 2013, upon the appointment of Mr. Elisman as our CEO, we separated the role of Chairman and CEO, with Mr. Keller being appointed as the Company’s Chairman.

Separating the roles of Chairman and CEO enables Mr. Elisman to focus his attention on his responsibilities as CEO while Mr. Keller’s role as Chairman provides continuity in leadership of the Board of Directors. The Board believes Mr. Keller’s continued service as a director is valuable to the Company given his familiarity with the Company’s overall business and its short- and long-term strategies. As CEO, Mr. Elisman reports directly to the Board of Directors.

Although the roles of Chairman and CEO have been separated, Mr. Keller is not independent. Accordingly, we continue to have a Presiding Independent Director who presides at meetings of all independent directors in executive session. This allows directors to speak candidly on any matter of interest, without the Chairman, the CEO or other members of management present. Mr. Jenkins, our Presiding Independent Director, works closely with Messrs. Keller and Elisman in establishing the agenda for each meeting of the Board of Directors and acts as a conduit for contact between Messrs. Keller and Elisman and the other directors. The Presiding Independent Director, although not required to do so, also endeavors to attend as many Board committee meetings as possible.

Further, it is our view that the independent members of our Board of Directors and the four standing Board committees provide appropriate oversight and an effective balance to our Chairman and our CEO roles. For additional information regarding the roles and responsibilities of our Audit Committee, Compensation Committee, Governance Committee and Finance and Planning Committee (the “Finance Committee”), see “--Committees.” The Chairman and the CEO do not serve on any of our standing committees and, as discussed in more detail below, the entire Board of Directors is actively involved in overseeing our risk management. We believe the independent composition of our principal Board committees, together with the Presiding Independent Director function, provides balanced leadership and consistent, effective oversight of our management and our company.

Risk Oversight

Our entire Board of Directors is actively involved in risk management. Operational and strategic presentations by management to the Board of Directors include consideration of the challenges and risks to our business, and the Board of Directors and management actively engage in discussions on these topics. At least annually, the Board of Directors reviews management’s long-term strategic plans and the risks associated with carrying out those plans. The presentation for that strategic review is compiled by senior management and approved by the CEO.

In addition, our Governance Committee oversees our enterprise risk management activities and management’s administration of the Company’s corporate social responsibility and sustainability programs. Each of our other Board of Directors’ committees also considers risk within its area of responsibility. Our Audit Committee oversees financial risk and reviews legal and compliance matters and the adequacy of our internal controls over financial reporting and disclosure controls and procedures, including our

| 8 |

information technology general controls. The Audit Committee also periodically requests management to address specific risk issues, including data security, at its meetings. The Finance Committee assists in monitoring and overseeing financial risk with respect to the Company’s capital structure, investments, use of derivatives and hedging instruments, business and financing plans and policies, as well as financing requirements. Likewise, our Compensation Committee considers risk and structures our executive compensation programs with an eye to providing incentives to appropriately reward executives for growing stockholder value without undue risk taking. See “Compensation Discussion and Analysis--Discussion and Analysis--Role of Our Compensation Consultant and Management.” Our Governance Committee periodically reviews the structure of our Board’s committees and charters to ensure appropriate oversight of risk.

Committees

The Board of Directors has established an Audit Committee, a Compensation Committee, a Governance Committee and a Finance Committee, each of which operates pursuant to a written charter that is available on our website (www.accobrands.com). The Company also has an Executive Committee that consists of Messrs. Keller (Chairperson), Elisman and Jenkins. The Executive Committee has all the power and authority of the Board of Directors except for specific powers that by law must be exercised by the entire Board of Directors. Although Messrs. Buzzard and Rajkowski are independent under our Corporate Governance Principles and the NYSE standards, the Board of Directors decided that neither of them should serve on the Compensation Committee, Governance Committee or Audit Committee, respectively, as an acknowledgment that some third parties may not consider them independent for a period of time due to their employment with MWV prior to the merger of a subsidiary of the Company with the consumer office products division of MWV in May 2012 (the “Mead C&OP Merger”).

| Audit Committee | ||||

| Members | The members of the Audit Committee are Ms. Dvorak (Chairperson), Mr. Jotwani and Mr. Jenkins, who joined the Audit Committee following Ms. Talton’s resignation as a director in March 2015. Each member meets, and during her tenure Ms. Talton met, the independence standards of our Corporate Governance Principles and the NYSE and the independence standards under Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). Each member meets, and during her tenure Ms. Talton met, the financial literacy requirements of the NYSE and has been determined by the Board of Directors to be an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K under the Exchange Act. | |||

| Number of Meetings Last Year | Nine | |||

| Primary Functions | Oversees (1) the integrity of our financial statements and our accounting and financial reporting processes, (2) the independence and qualifications of our independent auditors, (3) the performance of the independent auditors and our internal audit function, and (4) our compliance with legal and regulatory requirements. As part of its responsibilities, the Audit Committee, among other things: | |||

| • | retains and oversees an independent, registered public accounting firm to serve as the Company’s independent auditors to audit our financial statements and monitors the independence and performance of our independent auditors; | |||

| • | approves the scope of audit work and reviews reports and recommendations of our independent auditors; | |||

| • | meets separately with our independent auditors on a quarterly basis; | |||

| • | reviews the annual internal audit plan, summaries of key reports and updates on the results of internal audit work; | |||

| • | reviews internal audit staffing levels, qualifications and annual expense budgets; | |||

| 9 |

| • | pre-approves all audit and permissible non-audit services to be provided by our independent auditors in accordance with policies and procedures established and maintained by the Audit Committee; | |||

| • | reviews and discusses with management our financial statements and quarterly and annual reports to be filed with the SEC, our earnings announcements and related materials; | |||

| • | reviews and discusses with management the adequacy and effectiveness of our disclosure controls and procedures and our internal control over financial reporting, including any material weaknesses, significant deficiencies or changes in internal controls; | |||

| • | discusses with our independent auditors our annual and quarterly financial statements; | |||

| • | reviews our policies regarding financial risk assessment and risk management and discusses with management financial risk exposure and controls; | |||

| • | establishes and oversees procedures for receiving and responding to concerns regarding accounting, internal accounting controls and auditing matters; and | |||

| • | reviews and approves (or ratifies where appropriate) certain categories of related-party transactions. | |||

| Compensation Committee | ||||

| Members | The members of the Compensation Committee are Messrs. Kroeger (Chairperson), Bayly and Norkus. Each member meets the independence standards of our Corporate Governance Principles and the NYSE, as well as qualifies as a “non-employee director” within the meaning of Rule 16b-3 promulgated under the Exchange Act and as an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code, as amended (the “Code”). | |||

| Number of Meetings Last Year | Seven | |||

| Primary Functions | Oversees compensation and benefit programs for our executive officers and other members of senior management with a view towards attracting, motivating, and retaining high-quality leadership and compensating those individuals in a manner that is aligned with stockholders’ interests, consistent with competitive practices, commensurate with performance and in compliance with the requirements of appropriate regulatory bodies. As part of its responsibility the Compensation Committee, among other things: | |||

| • | establishes the Company’s compensation philosophy; | |||

| • | annually reviews and recommends to the Board of Directors the compensation of our CEO and evaluates his performance against incentive goals established by the Compensation Committee; | |||

| • | establishes and approves the compensation for our other executive officers; | |||

| • | administers, reviews and exercises the Board of Directors’ authority with respect to equity-based, and annual and long-term incentive compensation plans of the Company; determines and approves, or recommends for approval, grants of awards under such plans to executive officers; and | |||

| 10 |

| delegates, at its discretion, to the CEO the authority to grant equity-based and incentive awards to non-executive employees; | ||||

| • | exercises the Board of Directors’ authority with respect to the oversight and, where applicable, administration of the Company’s health and benefit and defined benefit, retirement and supplemental retirement plans, including the Company’s 401(k) plan; | |||

| • | exercises the Board of Directors’ authority with respect to employment, compensation, severance and change-in-control arrangements or agreements with executive officers, and, if applicable, other key employees as it may determine, and oversees management’s administration of such agreements or arrangements; |

| • | oversees the succession planning processes for executive officers and assists the Board of Directors in establishing such processes for our CEO; | |||

| • | oversees risk management with respect to the Company’s compensation policies and practices; and | |||

| • | establishes and reviews guidelines requiring our executives and other officers to maintain certain levels of stock ownership in the Company. | |||

| Corporate Governance and Nominating Committee | ||||

| Members | The members of the Governance Committee are Messrs. Norkus (Chairperson), Bayly, Jotwani and Kroeger. Each member meets the independence standards of our Corporate Governance Principles and the NYSE. | |||

| Number of Meetings Last Year | Seven | |||

| Primary Functions | Develops and oversees the Company’s corporate governance policies and provides advice with respect to corporate governance, the rights and interests of stockholders and the organization, evaluation and functioning of the Board of Directors and its committees. The Governance Committee also identifies, reviews and recommends candidates for election to the Board of Directors and its committees. As part of its responsibility, the Governance Committee, among other things: | |||

| • | annually reviews and recommends changes to the Company’s corporate governance principles; | |||

| • | reviews and provides recommendations with respect to the composition and structure of the Board of Directors and the duties, powers, composition and structure of the Board’s committees; | |||

| • | establishes and reviews criteria relating to the qualifications, candidacy, service and tenure of directors and the procedures for the consideration of director candidates recommended by the Company’s stockholders; | |||

| • | identifies and evaluates potential director candidates and recommends nominees for election or re-election as members of the Board of Directors; | |||

| • | establishes and reviews criteria and qualifications for membership on Board’s committees and recommends directors for membership on such committees; | |||

| • | manages the annual performance review process of the Board of Directors and the Board’s committees; | |||

| 11 |

| • | annually reviews and makes recommendations regarding compensation arrangements for non-employee directors, and administers the Company’s non-employee director deferred compensation plan; | |||

| • | develops, recommends and periodically reviews the non-employee director stock ownership guidelines; and | |||

| • | oversees management’s administration of the Company’s enterprise risk management, corporate social responsibility and sustainability programs. | |||

| Finance and Planning Committee | ||||

| Members | The members of the Finance Committee are Mr. Rajkowski (Chairperson), Ms. Dvorak and Mr. Jenkins, who joined the Finance Committee following Ms. Talton’s resignation as a director in March 2015. Each member meets, and during her tenure Ms. Talton met, the independence standards of our Corporate Governance Principles and the NYSE. | |||

| Number of Meetings Last Year | Five | |||

| Primary Functions | Assists the Board of Directors in fulfilling its responsibilities to monitor and oversee the Company’s financial affairs with respect to the Company’s capital structure, investments, business and financing plans and policies, as well as financing requirements. The Finance Committee also evaluates specific financial proposals, plans, strategies, transactions and other initiatives. As part of its responsibility the Finance Committee, among other things: | |||

| • | reviews the capital structure and financing requirements of the Company, as well as the Company’s debt ratings and bank credit facility arrangements, and makes recommendations to management concerning the Company’s liquidity needs; | |||

| • | reviews and approves the Company’s policies related to use of hedging and derivative instruments, including, among other things, approving any future authorizations for the Company and its subsidiaries to enter into swaps; | |||

| • | reviews and makes recommendations to management regarding the annual business plan; | |||

| • | reviews and makes recommendations to management on any proposals for equity and debt transactions under consideration, including, but not limited to, issuances, repurchases, redemptions, retirements and recapitalizations; | |||

| • | reviews and makes recommendations to management on any strategic actions under consideration, including any proposed acquisitions, divestitures, mergers, strategic alliances, investments or other actions to maintain or enhance stockholder value; | |||

| • | reviews and makes recommendations to management regarding the Company’s dividend policy; and | |||

| • | annually reviews the funding and investment performance of the Company’s defined benefit, retirement and supplemental retirement plans, including the Company’s 401(k) plans. | |||

| 12 |

Board and Committee Self-Evaluation

Under the direction of the Governance Committee and our Presiding Independent Director, the Board of Directors and each Committee conducts an annual review of its performance and effectiveness.

Director Nomination Process

In identifying and evaluating director candidates for recommendation as nominees to the Board of Directors, the Governance Committee will determine, among other things, whether there are any evolving needs of the Board of Directors and the Company that require a director with particular expertise or experience to fill that need. The Governance Committee may retain a third-party search firm to locate and provide information on candidates that meet the needs of the Board of Directors at that time. The Chairperson of the Governance Committee and some or all of the members of the Governance Committee will interview potential candidates that are deemed appropriate. If the Governance Committee determines that a potential candidate meets the needs of the Board of Directors, has the qualifications, and meets the standards set forth in the Company’s Corporate Governance Principles and as further described under the headings “Election of Directors--Qualifications Required for all Directors” and “--Experience, Qualifications and Skills to Be Represented on Our Board of Directors”, it will vote to recommend to the Board of Directors the nomination of the candidate.

The policy of the Governance Committee is to consider director candidates recommended by stockholders if properly submitted to the Governance Committee. Stockholders wishing to recommend persons for consideration by the Governance Committee as nominees for election to the Board of Directors can do so by writing to the Office of the Corporate Secretary of ACCO Brands Corporation at Four Corporate Drive, Lake Zurich, Illinois 60047. Recommendations must include the proposed nominee’s name, biographical data and qualifications as well as a written statement from the proposed nominee consenting to be named as a nominee and, if nominated and elected, to serve as a director. The Governance Committee will then consider the candidate and the candidate’s qualifications. The Governance Committee may contact the stockholder making the nomination to discuss the qualifications of the candidate and the reasons for making the nomination and may interview the candidate if the Governance Committee deems the candidate to be appropriate. The Governance Committee may use the services of a third-party search firm to provide additional information about the candidate in determining whether to make a recommendation to the Board of Directors.

The Governance Committee’s nomination process for stockholder-recommended candidates and all other candidates is designed to ensure that the Governance Committee fulfills its responsibility to recommend candidates that are properly qualified to serve the Company for the benefit of all of its stockholders, consistent with the standards established by the Governance Committee under our Corporate Governance Principles. Stockholders seeking to nominate persons for election to our Board of Directors must comply with our procedures for stockholder nominations described under the heading “Submission of Stockholder Proposals and Nominations.”

Compensation Committee Interlocks and Insider Participation

All current members of the Compensation Committee are considered independent under our Corporate Governance Principles. No interlocking relationships exist between the Board of Directors or the Compensation Committee and the board of directors or compensation committee of any other company.

Section 16(a) Beneficial Ownership Reporting Compliance

Our directors and executive officers are subject to Section 16 of the Exchange Act, which requires them to file with the SEC reports regarding their ownership and changes in beneficial ownership of our equity securities. Reports received by the Company indicate that all directors and executive officers have filed all requisite reports with the SEC on a timely basis during 2014.

| 13 |

TRANSACTIONS WITH RELATED PERSONS

The Company recognizes that transactions between the Company and any of its directors or executive officers can present potential or actual conflicts of interest and create the appearance that Company decisions are based on considerations other than the best interests of the Company and its stockholders. Therefore, as a general matter and in accordance with the Company’s Code of Business Conduct and Ethics, it is the Company’s preference to avoid such transactions. Nevertheless, the Company recognizes that there are situations where such transactions may be in, or may not be inconsistent with, the best interests of the Company. Therefore, the Company has adopted a formal written policy which requires the Audit Committee to review and, if appropriate, to approve or ratify any such transactions. Pursuant to the policy, the Audit Committee will review any transaction in which the Company is, or will be, a participant and the amount involved exceeds $120,000, and in which any of the Company’s directors or executive officers or any of their immediate family members had, has or will have a direct or indirect material interest. After its review, the Audit Committee will only approve or ratify those transactions that are in, or are not inconsistent with, the best interests of the Company and its stockholders, as the Audit Committee determines in good faith. The Audit Committee has also directed the Company’s General Counsel and internal audit department to review the Company’s compliance with this policy on at least an annual basis.

During 2014, the Company purchased approximately $1.2 million of coated paper products from MWV in a series of transactions. This amount represents significantly less than one percent of either party’s reported annual revenues. Management has determined that such transactions were on terms at least as favorable to the Company as terms otherwise available in the marketplace. Management has also been advised by MWV that Messrs. Buzzard’s and Rajkowski’s compensation was not impacted by these transactions.

| 14 |

2014 DIRECTOR COMPENSATION

The following table sets forth the compensation paid to members of our Board of Directors in 2014 other than Mr. Elisman, whose compensation is included in the 2014 Summary Compensation Table since he is a named executive officer of the Company.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards(1) ($) | All Other Compensation(2) ($) | Total ($) | |||||||||

| George V. Bayly | 90,000 | 90,000 | — | 180,000 | |||||||||

| James A. Buzzard | 90,000 | 90,000 | — | 180,000 | |||||||||

| Kathleen S. Dvorak | 110,000 | 90,000 | — | 200,000 | |||||||||

| Robert H. Jenkins | 105,743 | 90,000 | 5,000 | 200,743 | |||||||||

| Pradeep Jotwani(3) | 71,000 | 104,055 | — | 175,055 | |||||||||

| Robert J. Keller | 380,000 | (4) | — | 36,453 | 416,453 | ||||||||

| Thomas Kroeger | 105,000 | 90,000 | 5,000 | 200,000 | |||||||||

| Michael Norkus | 100,000 | 90,000 | 1,000 | 191,000 | |||||||||

| E. Mark Rajkowski | 100,000 | 90,000 | 2,500 | 192,500 | |||||||||

| Sheila G. Talton(5) | 90,000 | 90,000 | 5,000 | 185,000 | |||||||||

| (1) | The amounts represent the grant date fair value of equity awards determined in accordance with FASB ASC Topic 718. Assumptions used in determining the grant date fair value of these awards are set forth in Note 6 to the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC. The aggregate number of outstanding stock awards and options or stock -settled stock appreciation rights held by each director at December 31, 2014 is set forth in the table below: |

| Name | Restricted Stock Units (RSUs) | Performance Stock Units (PSUs)(a) | Stock Options/SSARs | |||||||

| George V. Bayly | 8,746 | — | — | |||||||

| James A. Buzzard | 8,746 | — | — | |||||||

| Kathleen S. Dvorak | 36,566 | — | — | |||||||

| Robert H. Jenkins | 8,746 | — | — | |||||||

| Pradeep Jotwani | 17,215 | — | — | |||||||

| Robert J. Keller | 601,755 | 125,931 | 549,975 | |||||||

| Thomas Kroeger | 8,746 | — | — | |||||||

| Michael Norkus | 23,598 | — | — | |||||||

| E. Mark Rajkowski | 23,598 | — | — | |||||||

| Sheila G. Talton | 36,566 | — | — | |||||||

| (a) Represents total number of PSUs at target level of achievement. | ||||||||||

| (2) | For Messrs. Jenkins, Kroeger, Norkus, Rajkowski and Ms. Talton, amounts under “All Other Compensation” represent matching charitable donations made by the Company on behalf of such directors. See “--Director Charitable Matching Gift Program.” For Mr. Keller, the amount consists of (a) an automobile allowance of $15,996; (b) $11,700 representing the Company’s 2014 contributions to his tax-qualified 401(k) savings plan account; and (c) $8,757 in group term life and long-term disability insurance premiums paid on his behalf. |

| (3) | Mr. Jotwani was appointed to the Board of Directors effective March 18, 2014 and, as such, received a pro-rated annual cash retainer and a pro-rated annual equity award in addition to his regular annual equity award in May 2014. |

| (4) | Represents Mr. Keller’s salary earned in 2014 as Executive Chairman. |

| (5) | Resigned from the Board of Directors on March 16, 2015. |

Cash Compensation for Non-Employee Directors. Each non-employee director is paid a cash retainer of $90,000. There are no separate meeting fees paid. The $90,000 retainer was benchmarked against director compensation of companies in the Company’s Peer Group, as described under the heading “Compensation Discussion and Analysis--Discussion and Analysis--Peer Group.”

| 15 |

In addition to the annual retainer paid to all non-employee directors, committee chairpersons receive additional annual retainers totaling $20,000 for the Audit Committee, $15,000 for the Compensation Committee and $10,000 for the Governance Committee and Finance Committee or any other committees established by the Board of Directors. In addition, the Presiding Independent Director is paid an additional annual retainer of $25,000.

Upon filing a timely election, a director may elect to defer the cash portion of his or her compensation under our Deferred Compensation Plan for Directors (the “Deferred Plan”). In such an event the director may choose to have his or her deferral account credited in either or both of a phantom fixed income or phantom stock unit account. The phantom stock unit account would correspond to the value of, and the dividend rights associated with, an equivalent number of shares of the Company’s common stock. The balance in a phantom stock unit account, upon the conclusion of service as a director, will be paid to the director in either a lump-sum cash distribution or a lump-sum distribution of shares of ACCO Brands’ common stock, as the director may elect. The balance in a phantom fixed income account, upon the conclusion of service as a director, would be paid to the director in a lump-sum cash distribution. Our obligation to redeem a phantom account is unsecured and is subject to the claims of our general creditors. For the year 2014, one director elected to defer a portion of his cash compensation. As of December 31, 2014, one director had a balance in the phantom stock unit account under the Deferred Plan and none of our directors had a balance in the phantom fixed income unit account.

Equity-Based Compensation for Non-Employee Directors. Each non-employee director receives an annual equity grant either in the form of restricted stock units (“RSUs”) or common stock under our 2011 Amended and Restated ACCO Brands Corporation Incentive Plan, as amended (the “2011 Incentive Plan”) with a fair market value as defined in the 2011 Incentive Plan of $90,000. Non-employee directors are required to receive their equity grants in the form of deferred RSUs if they have not attained the minimum stock ownership required under the Director Stock Ownership Guidelines of three times their annual cash compensation. After achieving the minimum stock ownership guideline, directors are entitled to elect each year whether to receive an outright stock grant or deferred RSUs under the Deferred Plan. Non-employee directors elected to the Board of Directors other than at an annual meeting receive a pro-rata portion of such amount based on the time between their date of appointment and the date of the next annual stockholders’ meeting.

Under the terms of the 2011 Incentive Plan and each individual director’s RSU award agreement, each RSU represents the right to receive one share of our common stock and is fully vested and non-forfeitable on the date of grant. However, the payment of all RSUs to non-employee directors is deferred under the Deferred Plan. The Deferred Plan provides that such awards are payable within 30 days after the conclusion of service as a director. Directors holding deferred RSUs are credited with additional RSUs based on the amount of any dividend that may be paid by the Company.

Compensation for Mr. Keller.During 2014, Mr. Keller served as Executive Chairman of the Board and was paid a salary of $380,000. Effective March 13, 2015, Mr. Keller retired as an executive officer of the Company, and transitioned to his current role as non-executive Chairman. As a non-employee director, Mr. Keller will be compensated in the same manner as all other non-employee directors. In addition to his annual cash retainer and equity-based compensation, Mr. Keller will be paid an additional annual retainer of $100,000 for serving as Chairman of our Board of Directors.

Director Charitable Matching Gift Program.The Company has established a program under which it will make matching charitable gifts of up to $5,000 annually on behalf of each of its non-employee directors. During 2014, five non-employee directors participated in this program.

| 16 |

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

(Proxy Item 2)

The Audit Committee has appointed KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2015. During 2014, KPMG served as the Company’s independent registered public accounting firm and also provided certain other services to the Company. The Audit Committee and the Board of Directors recommend that you ratify this appointment. In line with this recommendation, the Board of Directors intends to introduce the following resolution at the Annual Meeting:

| “RESOLVED, that the appointment of KPMG LLP as the independent registered public accounting firm for the Company for the year 2015 is ratified.” |

A member of KPMG is expected to attend the Annual Meeting to make a statement if he or she desires, and will respond to appropriate questions that may be asked by stockholders.

The Board of Directors recommends that you vote FOR Proxy Item 2.

Report of the Audit Committee

The Audit Committee is composed of directors that are “independent” as defined under the NYSE corporate governance listing standards and Rule 10A-3 of the Exchange Act. The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management is responsible for the Company’s financial statements and the financial reporting process, including implementing and maintaining effective internal control over financial reporting and for the assessment of, and reporting on, the effectiveness of internal control over financial reporting. The Company’s independent registered public accounting firm for 2014, KPMG, is responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States and for expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed with management and KPMG the Company’s audited financial statements for the year ended December 31, 2014 and reports on the effectiveness of internal controls over financial reporting as of December 31, 2014 contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, including a discussion of the reasonableness of significant judgments and clarity of disclosures in the financial statements. The Audit Committee also reviewed and discussed with management the disclosures made in “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014.

The Audit Committee has reviewed and discussed with KPMG the matters required to be discussed by PCAOB Auditing Standard No. 16,Communication with Audit Committees, as amended (AICPA, Professional Standards, Vol. 1. AU Section 380). In addition, the Audit Committee has discussed with KPMG the firm’s independence from the Company, including the matters in the letter provided to the Audit Committee by KPMG regarding the firm’s communications with the Audit Committee concerning independence as required by the Public Company Accounting Oversight Board and has considered the compatibility of non-audit services with the auditor’s independence.

The Audit Committee discussed with KPMG the overall scope and plans for their integrated audit. The Audit Committee meets with KPMG, with and without management present, to discuss the results of the firm’s examinations, its evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

| 17 |

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 for filing with the SEC.

Members of the Audit Committee:

Kathleen Dvorak (Chairperson)

Pradeep Jotwani

Sheila G. Talton (through March 16, 2015)

(Robert H. Jenkins joined the Audit Committee on March 17, 2015, but did not take part in the review and discussion referred to in this Audit Committee Report.) |

This report shall not be deemed to be incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed under such acts.

Audit and Non-Audit Fees

Our independent registered public accounting firm for the 2013 and 2014 fiscal years was KPMG. The following table summarizes the fees paid or payable by the Company to KPMG for services rendered during 2013 and 2014, respectively:

| 2013 | 2014 | ||||||

| Audit fees | $ | 2,999,000 | $ | 2,325,000 | |||

| Audit-related fees | 60,000 | — | |||||

| Tax fees | 340,000 | 204,000 | |||||

| All other fees | 95,000 | 12,000 | |||||

| Total | $ | 3,494,000 | $ | 2,541,000 | |||