UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2005

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-11663

COMMUNITY BANKS, INC.

(Exact name of registrant as specified in its charter)

Pennsylvania | | 23-2251762 |

(State of Incorporation) | | (I.R.S. Employer Identification No.) |

| | | |

750 East Park Drive, Harrisburg, PA | | 17111 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (717) 920-1698

Securities registered pursuant to Section 12 (b) of the Act: None

Securities registered pursuant to Section 12 (g) of the Act: Common Stock, par value $5 per share

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes | | | No | X |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes | | | No | X |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant was required to file such reports), and (2) has been subject to

| such filing requirements for the past 90 days. | Yes | X | | No | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendments to this Form 10-K. [ ]

| Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). | Yes | X | | No | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | Yes | | | No | X |

Aggregate market value of the Common Stock, $5 par value, held by non-affiliates, computed by reference to the closing price on June 30, 2005: $ 287,000,000

Number of shares of the Common Stock, $5 par value, outstanding as of the close of business on February 28, 2006: 23,300,000 shares.

Documents Incorporated by Reference:

Portions of the Proxy Statement for the 2006 Annual Meeting of Shareholders of Community Banks, Inc., have been incorporated by reference into Part III.

(This page intentionally blank)

COMMUNITY BANKS, INC.

FORM 10-K

INDEX

PART I | | Page |

| | | |

| Item 1 | | 4 - 7 |

| Item 1A | | 7 - 8 |

| Item 1B | | 9 |

| Item 2 | | 9 |

| Item 3 | | 9 |

| Item 4 | | 9 |

| | | |

| | | |

PART II | | |

| | | |

| Item 5 | | 10 |

| Item 6 | | 11 |

| Item 7 | | 12 - 50 |

| Item 7A | | 51 - 53 |

| Item 8 | | 54 - 84 |

| Item 9 | | 85 |

| Item 9A | | 85 |

| Item 9B | | 85 |

| | | |

| | | |

PART III | | |

| | | |

| Item 10 | | 88 |

| Item 11 | | 88 |

| Item 12 | | 88 |

| Item 13 | | 88 |

| Item 14 | | 88 |

| | | |

| | | |

PART IV | | |

| | | |

| Item 15 | | 89 - 90 |

| | | |

| | | |

| | 91 |

| | | |

| | | |

PART I

Community Banks, Inc., referred to in this report as the “Corporation” or “Community,” is a financial holding company that was formed as a Pennsylvania corporation in 1982. The executive offices of Community are located at 750 East Park Drive, Harrisburg, Pennsylvania 17111.

The common stock of Community is listed on the National Market System of the National Association of Securities Dealers Automated Quotation System under the symbol CMTY. Community’s internet address is www.communitybanks.com. Electronic copies of Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are available through the “Investor Relations” section of Community’s website as soon as reasonably practicable after filing such material with, or furnishing it to, the Securities and Exchange Commission. Copies of such reports are also available at no charge.

Community’s wholly-owned banking subsidiary is CommunityBanks, referred to in this report as the “Bank” or “CommunityBanks.”

Acquisition of PennRock Financial Services Corp.

On July 1, 2005, Community completed the acquisition of PennRock Financial Services Corp. (PennRock), a bank holding company headquartered in Blue Ball, Pennsylvania. PennRock had approximately $1.2 billion in assets, $835 million in net loans, $250 million in investments, $880 million in deposits, $220 million in borrowings and $100 million of stockholders’ equity at the acquisition date. PennRock’s subsidiary bank was Blue Ball National Bank (Blue Ball), which operated in Lancaster, Berks, and Chester Counties, Pennsylvania.

Each PennRock shareholder received 1.4 shares of Community in exchange for each share of PennRock common stock. Community issued approximately 10.9 million shares and stock options (to convert outstanding PennRock options into Community stock options).

PennRock merged with and into Community, with Community being the surviving company. Blue Ball merged with and into CommunityBanks and operates as a division of the Bank.

Community’s non-banking subsidiaries are CommunityBanks Investments, Inc. (CBII) and Community Banks Life Insurance Company, Inc. (CBLIC). The subsidiaries of the Bank are UDNB Investments, Inc. (UDNB); PSB Realty Co., Inc.; The Sentinel Agency LLC; Community Banks Insurance Services LLC; CB Services LLC; and Community Mortgage Services LLC. At December 31, 2005, no non-bank subsidiaries have total assets that exceed 1% of consolidated total assets. CBII’s net income was approximately 1.5% of consolidated income for 2005 and UDNB’s net income was approximately 3.5% of consolidated income for 2005. Otherwise no non-bank subsidiary has net income exceeding 1% of consolidated net income.

On January 1, 2002, Community consolidated the charters of its then two banking subsidiaries pursuant to regulatory approvals. Prior to that time, Community’s separate banking organizations operated as Peoples State Bank (PSB), a state chartered bank with offices throughout York and Adams Counties; and Community Banks, N.A. (CBNA), a federally chartered bank headquartered in Dauphin County with offices in central and northeastern Pennsylvania. The consolidation was designed to facilitate a regional operational focus that would ease regulatory burdens while, at the same time, maintain a philosophy of local decision-making.

Community conducts a full service commercial and retail banking business and provides trust services through 72 banking offices in Pennsylvania and Maryland: 3 offices in Adams County, 6 offices in Berks County, 2 offices in Chester County, 5 offices in Cumberland County, 10 offices in Dauphin County, 12 offices in Lancaster County, 3 offices in Luzerne County, 2 offices in Northumberland County, 7 offices in Schuylkill County, 1 office in Snyder County, and 19 offices in York County, Pennsylvania and 2 offices in Carroll County, Maryland. At December 31,

2005, there were three additional offices in varying stages of completion including 1 each in Dauphin, Lancaster, and York counties. There are approximately 1,250 offices of commercial banks and savings and loan associations within the market area in which Community competes. Community currently has a 7% share of the deposit market in the primary metropolitan statistical areas (MSA) in which it conducts business. In addition to traditional banking business, Community conducts business through various direct or indirect, non-bank subsidiaries. These subsidiaries are engaged in activities related to the business of banking.

Over the years, Community has formed special purpose wholly-owned subsidiaries. In 1985, Community formed CBII to make investments primarily in equity securities of other banks. In 1986, Community formed CBLIC to provide credit life insurance to its consumer credit borrowers. Subsidiary trusts, which are not consolidated in the financial statements in accordance with provisions of Financial Accounting Standards Board (FASB) Interpretation No. 46, “Consolidation of Variable Interest Entities, An Interpretation of ARB No. 51,” have been formed to execute trust preferred issuances: CMTY Capital Trust I in December, 2002, for a pooled issuance of $15 million and CMTY Statutory Capital Trust II in December, 2003, for an issuance of $15 million. In January, 2006, Community formed CMTY Statutory Capital Trust III and CMTY Statutory Capital Trust IV for pooled issuances of $10 million each.

Community and its subsidiaries have approximately 933 full-time equivalent employees as of December, 2005, and Community considers its employee relations to be satisfactory.

Like other banking companies, Community has been subjected to competition from credit unions, brokerage firms, money market funds, consumer finance and credit card companies and other companies providing financial services and credit to consumers. The competition is especially fierce with the credit union industry, particularly in certain segments of Community’s markets. The expansion of credit union activity, now permitted by so-called “community-based” charters, continues to create mounting competitive pressure. The expansion of “fields of membership” and credit union activity is thought by most banks to be contributing to an increasingly unfair competitive situation, largely because of the tax-exempt status afforded credit unions. Initiatives to further expand the powers of credit unions to conduct business in areas that go far beyond the original intent of credit union charters continue to be pressed at both the state and federal levels.

Supervision and Regulation of Community

The banking industry is subject to extensive state and federal regulation. Proposals to change laws and regulations governing the banking industry are frequently raised in Congress, in state legislatures, and in various bank regulatory agencies. The likelihood and timing that any such changes may have on Community are difficult to determine with any certainty. Changes in laws or regulations, or changes in the interpretation of laws or regulations, may have a material impact on the business, operations and earnings of Community.

Community Banks, Inc. is registered as a financial holding company with the Federal Reserve Board in accordance with the requirements of the Gramm-Leach-Bliley Act. The Gramm-Leach-Bliley Act enables broad-scale consolidation among banks, securities firms and insurance companies for eligible bank holding companies that have elected and maintain “financial holding company” status. Financial holding companies can offer virtually any type of financial service, including banking, securities underwriting, insurance (both agency and underwriting) and merchant banking. If a bank holding company does not become a financial holding company, it will be limited to those activities previously determined by the Federal Reserve Board to be permissible; i.e., “closely related to banking” under the standard set forth in the Bank Holding Company Act. In order to become a financial holding company, all of a bank holding company’s bank subsidiaries must be well capitalized and well managed and have a rating under the Community Reinvestment Act of at least “satisfactory.”

Community is subject to regulation by the Federal Reserve Board. The Federal Reserve Board requires regular reports from Community and is authorized to make regular examinations of Community and its subsidiaries. The Bank is subject to supervision and regulation, and is examined regularly, by the Federal Deposit Insurance Corporation and the state banking departments in the states in which it operates. To the extent that the Bank’s subsidiaries are licensed to engage in the sale of insurance or the mortgage brokerage business, the subsidiaries are subject to examination by the respective licensing authorities. Community and its direct non-banking subsidiaries are affiliates, within the meaning of applicable banking laws and regulations of the Bank and its subsidiaries. As a result, the Bank and its subsidiaries are subject to restrictions on loans or extensions of credit to, purchase of assets from, investments in, and transactions

with Community and its direct non-banking subsidiaries and on certain other transactions with them or involving their securities.

Capital Adequacy

The Federal Reserve Board and the FDIC have adopted risk-based capital adequacy guidelines for financial holding companies and banks under their supervision. Under these guidelines, “Tier 1 capital” and “Total capital” as a percentage of risk-weighted assets and certain off-balance sheet instruments must be at least 4% and 8%, respectively. The regulators have also imposed a leverage standard, which focuses on the institution’s ratio of Tier 1 capital to average total assets, adjusted for goodwill and certain other items, to supplement their risk-based ratios. This minimum leverage ratio was set at 3% and would apply only to those banking organizations receiving a regulatory composite 1 rating. Most banking organizations will be required to maintain a leverage ratio ranging from 1 to 2 percentage points above the minimum standard.

Community and the Bank are subject to various regulatory capital requirements administered by federal and state banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators that, if undertaken, could have a direct material effect on Community’s financial statements. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, each subsidiary bank must meet specific capital guidelines that involve quantitative measures of assets, liabilities, and certain off-balance sheet items as calculated under regulatory accounting practices. The capital amounts and classification are also subject to qualitative judgments by the regulators about the risk weightings of components, and other factors.

Quantitative measures established by regulation to ensure capital adequacy require Community to maintain minimum amounts and ratios of total and Tier 1 capital to risk-weighted assets and of Tier 1 capital to average assets. Management believes, as of December 31, 2005, that Community and the Bank have met all capital adequacy requirements to which they are subject. For tables presenting Community’s capital ratios, see “Notes to Consolidated Financial Statements - Regulatory Matters” included in Part II, Item 8.

USA Patriot Act

The United and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the USA Patriot Act) imposed additional obligations on financial institutions, including the Bank, to implement and maintain polices, procedures and controls which are reasonably designed to detect and report instances of money laundering and the financing of terrorism. Failure to comply with the Patriot Act’s requirements could have serious legal, financial, and reputational consequences for Community. Community has approved policies and procedures that are believed to be compliant with the Patriot Act and will continue to revise and update policies, procedures, and controls to reflect changes required, as necessary.

Sarbanes-Oxley Act of 2002

The Sarbanes-Oxley Act of 2002 (Sarbanes-Oxley) implemented a broad range of corporate governance, accounting, and reporting measures for companies that have securities registered under the Securities Exchange Act of 1934, including Community. Sarbanes-Oxley and the various regulations promulgated thereunder, established, among other things: (i) increased responsibility for Chief Executive Officers and Chief Financial Officers with respect to the content of filings with the SEC; (ii) enhanced requirements for audit committees, including independence and disclosure of expertise; (iii) enhanced requirements for auditor independence and the types of non-audit services that auditors can provide; (iv) accelerated filing requirements for SEC reports; (v) increased disclosure and reporting obligations for companies, their directors and their executive officers; and (vi) new and increased civil and criminal penalties for violation of securities laws.

Section 404 of Sarbanes-Oxley requires management to issue a report on the effectiveness of its internal controls over financial reporting. In addition, a reporting company’s independent registered public accountants are required to issue an opinion on management’s assessment and an opinion on the effectiveness of the reporting company’s internal control over financial reporting as of the end of the year. These reports for Community for 2005 can be found in Item 8, “Financial Statements and Supplementary Information.” Certifications of the Chief Executive Officer and the Chief Financial Officer as required by Sarbanes-Oxley and the resulting SEC rules can be found in the “Exhibits” section of this report.

Monetary and Fiscal Policy

Community and the Bank are significantly affected by the monetary and fiscal policies of government authorities, including the Federal Reserve Board (FRB), which regulates the national money supply in order to manage recessionary and inflationary pressures. Among the instruments of monetary policy used by the FRB are open-market operations in U.S. Government securities and federal funds, changes in the discount rate on member bank borrowings, and changes in reserve requirements against member bank deposits. These techniques are used in varying combinations to influence the overall level of bank loans, investments and deposits, and the interest rates charged on loans and paid for deposits. The monetary policies of the FRB have had a significant effect on the operating results of banking institutions in the past and are expected to continue to do so in the future. The nature of future changes in monetary and fiscal policies, or the effect which they may have on Community’s business and earnings, cannot be predicted.

Other Merger Activity

On March 30, 2001, Community completed a merger of the Glen Rock State Bank into Community’s bank subsidiary (then known as Peoples State Bank). As a result of the Glen Rock merger, Community acquired an additional 5 branch offices located in York and Adams Counties, Pennsylvania and assets of approximately $190 million.

Operating Segments

All of the operations of Community operate and are reported under its one reportable segment, community banking.

Concentrations, Seasonality

No portions of Community’s businesses are dependent on a single or limited number of customers, the loss of which would have a material adverse effect on our business. No substantial portions of loans or investments are concentrated within a single industry or group of related industries, although a significant amount of loans are secured by real estate located in south central Pennsylvania. Community’s businesses are not seasonal in nature.

Environmental Compliance

Community’s compliance with federal, state and local environmental protection laws had no material effect on capital expenditures, earnings or competitive position in 2005, and is not expected to have a material effect on such expenditures, earnings or competitive position in 2006.

Community’s financial results are subject to a number of risks. The factors discussed below will highlight risks that management believes are most relevant to Community’s current operating environment. The list does not capture all risks associated with Community’s business. Additional risks, including those generally affecting the banking industry and those that management currently deems immaterial may also negatively impact Community’s liquidity, financial position or results of operations.

When reviewing Community’s financial results, you should consider the following risk factors along with the other information contained in this document. You should keep these risk factors in mind when you read forward-looking statements in this document. Please refer to the section entitled “Forward-Looking Statements” included in Part I, Item 7.

Community may not fully realize the anticipated benefits of the PennRock merger.

Management’s anticipated expense savings to be realized from the merger, expected to be derived from the reconfiguration of duplicate internal operations and administrative functions, the elimination of redundant external contractual services and from the convergence and standardization of various retirement, bonus, and incentive programs in the first full year of operations after the merger, may not be fully realized or may take longer than estimated to be realized and have a significant effect on Community’s operations and its financial results.

Future loan losses may exceed Community’s allowance for loan losses.

Community is subject to credit risk, which is the risk of losing principal or interest due to borrowers’ failure to repay loans in accordance with their terms. A downturn in the economy or the real estate market in our market areas or a rapid change in interest rates could have a negative effect on collateral values and borrowers’ ability to repay. This deterioration in economic conditions could result in losses to Community in excess of loan loss allowances. To the extent loans are not paid timely, the loans are placed on non-accrual, thereby reducing interest income. To the extent loan charge-offs exceed our estimates, increased amounts charged to the provision for loan losses would reduce income.

Rapidly changing interest rate environments could reduce Community’s net interest margin, net interest income, fee income and net income.

Interest and fees on loans and securities, net of interest paid on deposits and borrowings, are a large part of Community’s net income. Interest rates are key drivers of net interest margin and subject to many factors beyond the control of management. As interest rates change, net interest income is affected. Rapid increases in interest rates in the future could result in interest expense increasing faster than interest income because of mismatches in financial instrument maturities. Further, substantially higher interest rates generally reduce loan demand and may result in slower loan growth. Decreases or increases in interest rates could have a negative effect on the spreads between the interest rates earned on assets and the rates of interest paid on liabilities, and therefore decrease net interest income.

Although management believes it has implemented effective asset and liability management strategies to reduce the potential effects of changes in interest rates on Community’s results of operations, any substantial, unexpected, prolonged change in market interest rates could have a significant effect on Community’s operations and its financial results.

Community’s profitability depends significantly on economic conditions in its local markets.

Community’s success depends primarily on the general economic conditions in its local markets in central Pennsylvania and northern Maryland. The local economic conditions in these areas have a significant impact on the demand for Community’s products and services as well as the ability of Community’s customers to repay loans, the value of the collateral securing loans and the stability of Community’s deposit funding sources. A significant decline in general economic conditions, caused by inflation, recession, acts of terrorism, outbreak of hostilities or other international or domestic occurrences, unemployment, changes in securities markets or other factors could impact these local economic conditions and, in turn, have a significant effect on Community’s operations and its financial results.

The financial services industry is very competitive.

We face competition in attracting and retaining deposits, making loans, and providing other financial services throughout our market area. Our competitors include other community banks, larger banking institutions, and a wide range of other financial institutions such as credit unions, government-sponsored enterprises, mutual fund companies, insurance companies and other non-bank businesses. Many of these competitors have substantially greater resources than us.

Supervision and Regulation

Community is subject to extensive state and federal laws and regulations governing the banking industry, in particular, and public companies, in general. Changes in those laws and regulations, or the degree of Community’s compliance with those laws and regulations as judged by any of several regulators that oversee Community, could have a significant effect on Community’s operations and its financial results.

Community’s stock price can be volatile.

The market price of Community common stock may fluctuate significantly in response to a number of other factors, including changes in securities analysts’ estimates of financial performance, volatility of stock market prices and volumes, rumors or erroneous information, changes in market valuations of similar companies and changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies.

None.

Community does not own or lease any property. As of December 31, 2005, the Bank owns 44 properties free and clear of encumbrances and leases 36 other properties. Community’s other direct and indirect subsidiaries own 5 properties free and clear of encumbrances and lease 5 properties. Five properties owned by Community’s indirect subsidiary, PSB Realty, are leased to the Bank.

The principal office of Community is located at 750 East Park Drive, Harrisburg Pennsylvania 17111. The principal office of the Bank is owned and located at 150 Market Square, Millersburg Pennsylvania 17061, with executive and administrative offices at 750 East Park Drive, Harrisburg PA 17111.

The Bank currently has 72 branch offices located in Adams, Berks, Chester, Cumberland, Dauphin, Lancaster, Luzerne, Northumberland, Schuylkill, Snyder, and York counties, Pennsylvania, and in Carroll County, Maryland. The Bank owns or leases 120 automated teller machines located throughout these counties.

In February, 2006, Community announced the signing of a lease for a new principal office at 777 East Park Drive, Harrisburg PA 17111. The new facility will provide additional space for administrative management of the Corporation and a state-of-the-art training facility.

From time to time, the Bank also acquires real estate by virtue of foreclosure proceedings, and such real estate is disposed of in the usual and ordinary course of business as expeditiously as is prudently possible.

Various actions and proceedings are presently pending to which Community and/or one or more of its subsidiaries is a party. These actions and proceedings arise out of routine operations and, in management’s opinion, will not have a material adverse effect on Community’s consolidated financial position or results of operations. Community has not been required to pay a penalty to the Internal Revenue Service for failing to make required disclosures with respect to certain transactions identified by the IRS as abusive or that have a significant tax avoidance purpose.

No matters were submitted to a vote of security holders during the fourth quarter of 2005.

PART II

Market Information

The shares of Community are traded on the NASDAQ National Market under the symbol CMTY and are transferred through local and regional brokerage houses. Community had approximately 5,203 shareholders of record as of December 31, 2005. The following table sets forth dividends declared per share and the high and low closing prices for Community common stock as reported by NASDAQ during the periods indicated.

| | 2005 | | 2004 |

| | Price Per Share | Dividends | | Price Per Share | Dividends |

| | Low | High | Declared | | Low | High | Declared |

| | | | | | | | |

| First Quarter | $23.70 | $28.51 | $0.17 | | $28.41 | $34.52 | $0.16 |

| Second Quarter | $23.04 | $26.50 | $0.19 | | $27.02 | $31.58 | $0.17 |

| Third Quarter | $26.66 | $28.85 | $0.19 | | $25.35 | $29.73 | $0.17 |

| Fourth Quarter | $25.09 | $29.84 | $0.20 | | $27.77 | $31.47 | $0.17 |

Holders of the common stock of Community are entitled to such dividends as may be declared from time to time by the Board of Directors out of funds legally available therefore. Community currently expects that it will continue to pay comparable dividends in the future, subject to regulatory requirements, Community’s financial condition and requirements, future prospects, business conditions and other factors deemed relevant by the Board of Directors. As noted in “Capital Adequacy” in Part I, Item 1, Community is subject to various regulatory capital requirements that limit the amount of capital available for dividends.

The market prices listed above are based on historical market quotations and have been restated to reflect stock dividends and splits.

Issuer Purchases of Equity Securities

During the fourth quarter of 2005, the following shares were purchased as part of Community’s Share Repurchase Program and Community did not sell any unregistered securities.

| | | Shares Purchased | | Average Price Paid Per Share | | Shares Purchased as part of Repurchase Program | | Capacity to Purchase More Shares | |

| | | | | | | | | | | | | | |

| 10/1/05-10/31/05 | | | 209,400 | | $ | 27.37 | | | 209,400 | | | 734,700 | |

| 11/1/05-11/30/05 | | | 50,000 | | $ | 28.06 | | | 50,000 | | | 684,700 | |

| 12/1/05-12/31/05 | | | --- | | | --- | | | --- | | | 684,700 | |

| | | At or for the Year Ended December 31, | |

| | | 2005 * | | 2004 | | 2003 | | 2002 | | 2001 | |

| | | (dollars in thousands except for per share data) | |

BALANCE SHEET DATA | | | | | | | | | | | | | | | | |

| At Period End: | | | | | | | | | | | | | | | | |

Investment securities | | $ | 628,585 | | $ | 619,110 | | $ | 646,961 | | $ | 667,801 | | $ | 543,901 | |

Total loans | | | 2,234,497 | | | 1,215,951 | | | 1,078,611 | | | 904,568 | | | 857,278 | |

Total assets | | | 3,332,430 | | | 1,954,799 | | | 1,861,063 | | | 1,680,362 | | | 1,509,734 | |

Total deposits | | | 2,294,367 | | | 1,305,537 | | | 1,230,685 | | | 1,132,913 | | | 1,003,225 | |

Long-term debt | | | 430,719 | | | 404,662 | | | 411,422 | | | 320,533 | | | 322,155 | |

Stockholders’ equity | | | 476,673 | | | 152,341 | | | 143,406 | | | 129,162 | | | 111,249 | |

| Average: | | | | | | | | | | | | | | | | |

Total assets | | | 2,668,605 | | | 1,941,096 | | | 1,780,679 | | | 1,580,046 | | | 1,398,521 | |

Total stockholders’ equity | | | 318,768 | | | 145,750 | | | 135,773 | | | 119,352 | | | 111,381 | |

| | | | | | | | | | | | | | | | | |

EARNINGS DATA: | | | | | | | | | | | | | | | | |

| Net interest income | | | 82,645 | | | 56,557 | | | 52,514 | | | 50,488 | | | 45,935 | |

| Provision for loan losses | | | 2,300 | | | 3,100 | | | 2,500 | | | 3,350 | | | 5,080 | |

| Net interest income after provision for loan losses | | | 80,345 | | | 53,457 | | | 50,014 | | | 47,138 | | | 40,855 | |

| Other income | | | 26,437 | | | 23,213 | | | 20,463 | | | 13,975 | | | 12,141 | |

| Other expense | | | 75,069 | | | 49,993 | | | 45,718 | | | 39,300 | | | 36,521 | |

| Provision for income taxes | | | 6,072 | | | 4,879 | | | 4,359 | | | 3,367 | | | 2,879 | |

| Net income | | | 25,641 | | | 21,798 | | | 20,400 | | | 18,446 | | | 13,596 | |

| | | | | | | | | | | | | | | | | |

PER SHARE DATA: | | | | | | | | | | | | | | | | |

| Basic earnings per share | | | 1.44 | | | 1.78 | | | 1.68 | | | 1.51 | | | 1.11 | |

| Diluted earnings per share | | | 1.42 | | | 1.73 | | | 1.63 | | | 1.48 | | | 1.09 | |

| Cash dividends declared | | | 0.75 | | | 0.67 | | | 0.63 | | | 0.54 | | | 0.48 | |

| Book value | | | 20.80 | | | 12.45 | | | 11.73 | | | 10.67 | | | 9.05 | |

| Average diluted shares outstanding | | | 18,071,833 | | | 12,574,908 | | | 12,497,372 | | | 12,491,320 | | | 12,461,996 | |

| | | | | | | | | | | | | | | | | |

PROFITABILITY RATIOS: | | | | | | | | | | | | | | | | |

| Return on average assets | | | 0.96 | % | | 1.12 | % | | 1.15 | % | | 1.17 | % | | 0.97 | % |

| Return on average stockholders’ equity | | | 8.04 | % | | 14.96 | % | | 15.03 | % | | 15.46 | % | | 12.21 | % |

| Net interest margin (FTE) | | | 3.76 | % | | 3.44 | % | | 3.50 | % | | 3.78 | % | | 3.83 | % |

| Efficiency ratio | | | 57.51 | % | | 60.42 | % | | 60.59 | % | | 56.92 | % | | 60.21 | % |

| | | | | | | | | | | | | | | | | |

CAPITAL AND LIQUIDITY RATIOS: | | | | | | | | | | | | | | | | |

| Stockholders’ equity to total assets | | | 14.30 | % | | 7.79 | % | | 7.71 | % | | 7.69 | % | | 7.37 | % |

| Average equity to average assets | | | 11.95 | % | | 7.51 | % | | 7.62 | % | | 7.55 | % | | 7.96 | % |

| Dividend payout ratio | | | 52.42 | % | | 37.69 | % | | 37.35 | % | | 36.07 | % | | 43.25 | % |

| Net loans to assets | | | 66.36 | % | | 61.47 | % | | 57.25 | % | | 53.10 | % | | 55.98 | % |

| | | | | | | | | | | | | | | | | |

ASSET QUALITY RATIOS: | | | | | | | | | | | | | | | | |

| Allowance for loan losses to total loans outstanding | | | 1.03 | % | | 1.19 | % | | 1.22 | % | | 1.36 | % | | 1.42 | % |

| Allowance for loan losses to non-accrual loans | | | 253 | % | | 266 | % | | 162 | % | | 131 | % | | 109 | % |

| Non-accrual loans to total loans outstanding | | | 0.41 | % | | 0.45 | % | | 0.76 | % | | 1.04 | % | | 1.29 | % |

| Non-performing assets to total assets | | | 0.32 | % | | 0.38 | % | | 0.70 | % | | 0.63 | % | | 0.78 | % |

| Net charge-offs to average loans outstanding | | | 0.05 | % | | 0.16 | % | | 0.17 | % | | 0.35 | % | | 0.39 | % |

* 2005 amounts include the impact of the July 1, 2005 merger with PennRock Financial Services Corp.

INTRODUCTION

Purpose of this Presentation

This presentation has been designed to provide a narrative explanation of the financial statements of Community Banks, Inc. (“Community” or “the Corporation”). The purpose of this presentation is to enhance the 2005 financial disclosures and to provide a framework for evaluating the extent to which historical performance can be relied upon to assess prospects for future performance.

Presentation Format

Throughout this presentation, net interest income and yields on earning assets have been presented on a fully-tax equivalent basis. Balances represent average daily balances, earnings per share are diluted, and all dollar amounts are presented in thousands, unless otherwise indicated.

2005 OVERVIEW

2005 Expansion

If the central theme of Community’s 2005 performance were to be condensed into one word, that word would be “expansion”. Although expansion and growth have occurred on a variety of fronts, the most impressive expansion centered on the acquisition and merger of PennRock Financial Services Corp. (PennRock), the former parent of Blue Ball National Bank (“Blue Ball”). Now operating as a division within the CommunityBanks franchise, Blue Ball has added assets totaling more than $1 billion, including 19 office locations, to Community’s current total of over $3.3 billion in consolidated assets and 71 office locations at the end of the year. More importantly, Blue Ball and its enthusiastic and exceedingly talented team of employees helped to complete Community’s dramatic entree into the highly desirable Berks, Chester, and Lancaster County regions of south-central and southeastern Pennsylvania. Community is now the eighth-largest financial services holding company headquartered in Pennsylvania, with a market capitalization well in excess of $600 million at the end of 2005.

At the beginning of business on July 1, 2005, Community completed its merger with PennRock, thus beginning an exciting chapter in the history of the growing Community franchise. PennRock’s primary subsidiary, Blue Ball, was integrated as a division of CommunityBanks, which is the sole banking subsidiary of the financial services holding company known as Community Banks, Inc. Under the terms of the merger announced on November 16, 2004, former shareholders of PennRock received more than 10,854,000 of common shares of Community in exchange for all of their outstanding shares in PennRock. This transaction was valued at an amount in excess of $325 million at the time of the announcement.

As required under generally accepted accounting principles (GAAP), the merger was accounted for under the purchase method of accounting for business combinations (“purchase accounting”). Consequently, Blue Ball results have been included in consolidated operating results of Community for only the second half of the year. The full year 2005 income statement offers a hybrid presentation of annual operating results consisting of pre-merger Community results for the first half of the year followed by post-merger combined results in the second half. Unfortunately, comparisons of the hybrid 2005 operating performance to prior periods (2004 and 2003) are noticeably distorted, owing to the fact that presentations of pre-2005 results exclude Blue Ball activity.

Throughout this presentation, certain pro forma financial information will be provided in order to make comparative results more meaningful to the reader. Such information will be clearly defined and labeled so as to provide presentations that, to the extent possible, are prepared on a consistent and comparable basis.

| · | Assets Acquired / “De-leverage” Strategy |

In the timeframe leading up to the merger, Community conducted an extensive review and analysis of the balance sheet posture of both Blue Ball and pre-merger Community. In connection with this review, management considered various alternative strategies designed to maximize the net interest margin and net interest income performance of the post-merger, combined entity. Pursuant to the review, Community executed a “de-leveraging strategy” that focused on three primary objectives:

| o | Reduce the combined company’s exposure to high cost, long-term wholesale funding. |

| o | Construct a post-merger balance sheet posture that would reduce interest rate risk associated with certain short-term wholesale funding sources. |

| o | Maximize combined investment portfolio performance in the post-merger environment. |

Concurrent with the periods immediately before and after the merger, Community executed its three-pronged “de-leveraging” strategy, which was timed to coincide with its acquisition of the net identifiable assets of Blue Ball. The first stage commenced with the late second quarter prepayment of $60 million of FHLB term advances, which resulted in a prepayment penalty of $6 million. These advances had a weighted average cost of 6.29%, well in excess of the Corporation’s incremental wholesale borrowing rate. Additionally, such borrowings contained conversion features and terms not necessarily expected to be favorable to Community in future periods. The second and third phases involved the retirement of certain variable-rate, short-term wholesale funding of Blue Ball, accompanied by the disposition of the acquired investment portfolio. These two phases were designed to: (1) reduce Community’s post-merger exposure to potential future increases in the cost of short-term funding sources and, (2) to improve the overall yields on the post-merger, combined investment portfolio.

As a result of the merger with Blue Ball, Community acquired assets of $1.2 billion. Pursuant to the guidance for applying the purchase method of accounting, these acquired assets and assumed liabilities were required to be restated at their fair market values at the date of the merger. Both the merger and “de-leverage” strategies, like all balance sheet management efforts, occurred in a dynamic environment. The synchronized execution of (1) the merger consummation, (2) the fair value restatement of acquired net assets, and (3) the “de-leverage” strategy, made it difficult to precisely isolate and quantify the impact of the individual components of those efforts on the post-merger combination. Management believes, however, that the following summary portrays a reasonable depiction of the strategies that were executed concurrently with the merger of Blue Ball, and provides an appropriate benchmark from which to isolate the level of “acquired” growth attributable to the merger.

| | | Net Assets Acquired in Merger | | Purchase Accounting Adjustments | | De-leverage Strategy | | “Pro Forma” Opening PennRock Balances | |

| | | | | | | | | | | | | | |

| Investment securities | | $ | 250,272 | | $ | --- | | $ | (100,000 | ) | $ | 150,272 | |

| Loans | | | 843,923 | | | (1,757 | ) | | --- | | | 842,166 | |

| Other assets | | | 106,515 | | | 7,976 | | | --- | | | 114,491 | |

| | | | | | | | | | | | | | |

| Total Deposits | | | 879,965 | | | 2,110 | | | --- | | | 882,075 | |

| Short-term borrowings | | | 91,010 | | | --- | | | (75,000 | ) | | 16,010 | |

| Long-term debt | | | 127,000 | | | 1,515 | | | (25,000 | ) | | 103,515 | |

| Other liabilities | | | 13,196 | | | --- | | | --- | | | 13,196 | |

This summary will be helpful in understanding additional analyses that are provided later in this presentation. These results help to draw a distinction between “acquired” growth (from the merger) versus growth attributable to “organic” sources. “Organic” growth has two elements: (1) growth from the underlying economic vitality of the geographic operating market and; (2) growth achieved by capturing existing market share from competitors. By isolating the “acquired” growth from the merger, trends regarding “organic” growth become more apparent and provide more meaningful comparisons to prior year reference points.

| · | Merger, Conversion, and Restructuring Issues |

In addition to the aforementioned expenses associated with the prepayment of FHLB advances, Community incurred certain other expenses associated with both the merger and with the adoption of a common operating platform for the newly-combined company. Including the $6 million FHLB prepayment expense, the aggregate expenses associated with the merger, the system conversion, and the balance sheet restructuring totaled $8.2 million, and were reflected primarily in results for the second quarter of 2005.

The merger of Blue Ball (the “target”) into Community (the “acquirer”) had characteristics that were atypical of other bank-related mergers that have occurred since the advent of mandatory purchase accounting. Blue Ball, with over $1 billion in assets, represented an immense increase of more than 60% over pre-combination assets of Community. In most transactions, it is common for the target to be substantially smaller than the acquirer. Accordingly, this merger transaction had specific terms and conditions that presented unique challenges.

In more conventional merger transactions, the employees of the target company who perform duplicative tasks are frequently identified for displacement, and are normally offered severance and/or retention payments following consummation. These payments are often a function of years of service, the need to ensure a smooth post-merger transition, or other relevant factors. Under purchase accounting, payments to the target bank’s employees are considered to be a component of the purchase price of the target and, by definition, do not affect near-term operating results. This same treatment is also afforded other incremental costs incurred by the target, including items such as contract cancellation fees or the cost of closing duplicative facilities In more conventional transactions, the workforce and facilities of the acquiring company are substantially unaffected by displacement issues because those employees and facilities are expected to remain in place following the merger.

The Community/PennRock transaction was distinctive in that both the acquirer and the target were affected by workforce displacement issues, duplicative contracts, and facility reconfiguration. As required, the costs incurred for severance and retention for displaced employees of Blue Ball were added to the purchase price, a treatment consistent with most mergers. Unlike many mergers, however, Community, the acquiring company, incurred certain incremental costs of the merger, including severance, retention and contract cancellation costs, which were required to be reported as an expense when incurred. During the second and third quarters, Community recorded expenses totaling $1.3 million, which reduced operating results in those periods, as follows: severance and retention payments to Community employees being displaced in the merger, $570,000; contract cancellations and closing of duplicate facilities, $555,000; other, $210,000.

Finally, Community incurred incremental costs totaling $800,000 related to the implementation of its Silverlake core processing platform in the second quarter of 2005. The implementation of this new core platform paved the way for a third quarter 2005 integration of the Blue Ball’s pre-existing Silverlake platform, which had been installed a number of years earlier. The fortuitous decision to migrate Community’s platform to Silverlake, a decision reached well in advance of merger discussions with PennRock, was a primary factor in ensuring a smooth transition in the combination of the two banks.

Aggregate merger, conversion and restructuring expenses totaled $8.2 million ($5.3 million on an after-tax basis) and reduced net income, primarily in the second quarter, by $0.29 of annual earnings per share. As noted throughout this presentation, “core” and “tangible” income, both of which are defined as non-GAAP measurements, have excluded the impact of these items.

2005 Performance: Executive Summary

Excluding the $5.3 million of after-tax merger, conversion and restructuring charges (“special charges”), Community recorded “core” net income of nearly $31.0 million, an increase of $9.2 million over the net income of $21.8 million achieved in 2004. This was an increase of 42% in year-over-year earnings. Even after reducing income for the aforementioned special charges, reported net income reached $25.6 million and reflected a 17% increase over 2004.

“Core” net income was comprised of $10.7 million in the first half of the year and $20.3 million in the second half. As previously noted, Blue Ball operating activity was included only in the second half of the year and was the primary driver of the increase in net income between the first and second halves of 2005.

On a per share basis, “core” net income reached $1.71 compared to $1.73 in 2004. Actual reported earnings per share were $1.42 and included $0.29 of earnings dilution directly attributable to the merger, conversion and restructuring expenses. Improvement in the second half performance was partially constrained as Community undertook deliberate strategies designed to achieve phased-in savings and efficiencies by the beginning of 2006.

The year 2005 was dominated by the preparations and efforts to absorb and integrate the operations of Community and its new Blue Ball division. The influence of internal, merger-related distractions required deft management of core operating activities to minimize the merger’s impact on existing customers. At the same time, dynamic changes in economic conditions, including changes in the interest rate environment, presented additional challenges to preserving and improving the earnings stream.

While plans with respect to the Blue Ball merger were completed, contemporaneous plans were also put into place to create a leveragable infrastructure for future expansion. The first component of those efforts was the replacement of the core processing system, which was completed in two phases to accommodate the Blue Ball integration. Capital levels and capital management plans related thereto, both of which are essential prerequisites for growth, are not expected to be a constraint on acquired or organic growth opportunities for the foreseeable future. Credit quality metrics continued to be sustained at historically low levels. Human capital, another essential precondition for growth, was bolstered by the staff additions and depth of experience provided by personnel from the Blue Ball franchise. And finally, both Blue Ball and Community continued to execute on their respective “de novo” expansion strategies.

All of these factors contributed to an elevated awareness of Community as an “acquirer of choice” in both core and contiguous markets of the franchise. Furthermore, these efforts also served to demonstrate the franchise’s ability to absorb and integrate merger partners in an effective and efficient manner.

GAAP REPORTING ISSUES

There remains a profusion of issues affecting the presentation of financial information in financial statements. In recent years, a strong emphasis has been placed on the adequacy, comparability, and transparency of financial information, particularly for publicly-traded companies that are subjected to recurring financial reporting requirements. The increased complexity associated with the measurement and presentation of financial information has been aggravated by the seemingly endless array of innovative and diverse financial transactions and structures. This has led to a regulatory environment predisposed to mandating enhancements to summarize, simplify, and analyze the vital information contained in financial reports.

In the aftermath of the corporate scandals of recent years, Congress and its designated oversight bodies have passed a wave of new legislation and regulations. These new regulations, and the related disclosure requirements, have been designed to be responsive to the intense scrutiny being applied to financial presentations by investors, creditors, and other users.

This section of the presentation will summarize the salient Generally Accepted Accounting Principals (GAAP) reporting issues associated with presentations of financial information for Community Banks, Inc., including: forward-looking statements; critical accounting policies; and GAAP versus non-GAAP presentations.

Forward-Looking Statements

Periodically, Community has made, and will continue to make statements that may include forward-looking information. The Corporation cautions that forward-looking information disseminated through financial presentations should not be construed as guarantees of future performance. Furthermore, actual results may differ from expectations contained in such forward-looking information as a result of factors that are not predictable. Financial performance can be affected by any number of factors that are not predictable or are out of management’s direct control. Examples include: the effect of prevailing economic conditions; unforeseen or dramatic changes in the general interest rate environment; actions or changes in policies of the Federal Reserve Board and other government agencies; business risk associated with the management of the credit extension function and fiduciary activities. Each of these factors could affect estimates, assumptions, uncertainties and risk used to develop forward-looking information, and could cause actual results to differ materially from management’s expectations regarding future performance.

Critical Accounting Policies

The identification of those accounting policies which are deemed to be critical to the application of GAAP on reported results of Community Banks, Inc. is an important facet of this presentation. Management has identified the applicable promulgations of GAAP that have particular relevance in connection with reporting results for 2005, as follows:

| o | Allowance for Loan Losses: Adequacy of Allowance |

| o | Allowance for Loan Losses: Accounting for Loans Acquired in a Transfer |

| o | Purchase Accounting for Business Combinations |

| o | “Other than Temporary” Impairment of Investment Securities |

Management believes that the application of its accounting policies and procedures for each of the above items should be considered to be a critical accounting policy to ensure the fair presentation of the Corporation’s 2005 financial statements.

The determination of the adequacy of the allowance for loan losses, and the related provision for loan losses is one major area affected by critical accounting policies and procedures. Community applies a systemic methodology in order to estimate the allowance for loan losses. This methodology incorporates management’s judgments about the credit quality of the loan portfolio through a disciplined, regimented methodology that is consistently applied. This process requires that a detailed analysis of the loan portfolio be performed on a quarterly basis. This analysis includes a specific individual loan review for any and all loans that meet specific materiality criteria. Such loans are evaluated for impairment under the provisions of Statement of Financial Accounting Standards (SFAS) No. 114, “Accounting by Creditors for Impairment of a Loan”. The portfolio is further stratified to analyze groups of homogenous loans with similar risk characteristics. Such loans are evaluated under the provisions of SFAS No. 5 “Accounting for Contingencies”.

Management considers all known relevant internal and external factors that may affect loan collectibility, as well as particular risks indigenous to specific types of lending. The process is further designed to consolidate the aggregate loss estimates and to ensure that the allowance for loan losses is recorded in accordance with generally accepted accounting principles. The final results are reviewed and approved by executive management. Results are regularly validated by a review of trends associated with loan volume, delinquencies, potential concentrations, or other factors that may influence the methodology used to estimate the allowance for loan losses.

| · | Accounting for Loans Acquired in a Transfer |

The merger of PennRock on July 1, 2005 required the application of the specific provisions of American Institute of Certified Public Accountants’ (AICPA) Statement of Position (SOP) 03-3, “Accounting for Certain Loans or Debt Securities Acquired in a Transfer”. This pronouncement addresses the accounting for differences between contractual cash flows and cash flows expected to be collected from loans acquired in a transfer where differences are due, at least in part, to credit quality. This SOP prohibits carrying over valuation allowances in the initial accounting of all loans acquired in a purchase business combination and was effective for years beginning after December 15, 2004. Community has given appropriate consideration to this guidance in establishing the accounting for the loans acquired as a result of the PennRock merger.

| · | Purchase Accounting for Business Combinations |

In June of 2001, the Financial Accounting Standards Board (FASB) issued Financial Accounting Standards No. 141, “Business Combinations”, and No. 142, “Goodwill and Other Intangible Assets”. These standards eliminated the pooling-of-interests method of accounting (“pooling”) in favor of purchase accounting. Further, these new standards were promulgated to ensure that post-merger financial statements of combined entities are prepared in a manner that best represents the underlying economics of a business combination.

These standards necessitate the application of accounting policies and procedures that entail the use of assumptions, estimates, and judgments that are critical to the presentation of financial information, including the ongoing valuation of intangibles. Where necessary and appropriate, Community has engaged independent outside consultants to provide objective and verifiable support for the use of certain estimates and assumptions in the application of those policies and procedures. The ultimate responsibility for the application of these standards and the adequacy of disclosures related thereto rests with management. While Community has applied these new standards to other business combinations completed since 2001, the magnitude of the PennRock merger on Community’s consolidated results suggests that the application of these standards is substantially more critical to the 2005 presentation of financial information.

| · | “Other than Temporary” Impairment of Investment Securities |

Investment securities are written down to their net realizable value when there is impairment in value that is considered to be “other than temporary”. The determination of whether or not an “other than temporary” impairment exists is a matter of judgment. Management reviews its investment securities portfolio regularly for possible impairment that is “other than temporary” by analyzing the facts and circumstances of each investment and the expectations for that investment’s performance.

Each of these critical accounting policies and procedures are highlighted later in this presentation and in the notes to the audited financial statements, as appropriate.

GAAP versus Non-GAAP

Like many financial institutions, Community had accounted for virtually all of its business combinations using the pooling-of-interests method of accounting (“pooling”) prior to 2002. Under pooling, historical pre-merger financial information of the combined companies was restated ‘as if’ the combination had occurred prior to the earliest period presented. This approach was advantageous in that it allowed for year-over-year financial performance comparisons that were prepared on a consistent basis. Under purchase accounting, financial statements for any periods prior to the date of the merger are not restated, creating the potential for comparisons that, in some respects, are inherently inconsistent. This contrast was especially apparent in presentations of Community financial performance in 2005, which included six months of Blue Ball activity, compared to 2004 and 2003, which excluded all historical Blue Ball results.

Like most other financial institutions that have made large acquisitions since the mandate of purchase accounting, Community is now providing certain “non-GAAP” information to assist investors in their understanding of the effect of acquisition activity on reported results. Many of these disclosures have been designed to overcome comparability issues related to the influence of intangibles (principally goodwill) created in mergers. The inherent “shortcomings” of purchase accounting, owing primarily to these comparability issues, has lead to an evolving practice of presenting non-GAAP financial information that utilizes terms such as “tangible income”, “tangible assets”, “operating return on average tangible equity”, and other relevant measures. Such information is not presented as a substitute for traditional GAAP measurements, but is provided as a supplemental enhancement to improve comparability and investor understanding.

Community has augmented its traditional GAAP presentation by providing an extensive reconciliation of relevant GAAP and non-GAAP measures to enhance its disclosures of comparative financial performance. The reconciliation appears on page 50. Below is a summary of critical GAAP measurements along with a brief description of the adjustments necessary to produce comparable non-GAAP measurements.

Traditional GAAP Measures | | Adjustments | | Comparable Non-GAAP Measures |

| | | | | |

Balance Sheet: | | | | |

| Average Assets | | Excludes Intangible Assets from Assets | | Average “Tangible” Assets |

| Average Equity | | Excludes Intangible Assets from Equity | | Average “Tangible” Equity |

| Equity to Assets | | Excludes Intangible Assets from Equity and Assets | | “Tangible” Equity to Assets |

| Book Value per Share | | Excludes Intangible Assets from Equity | | “Tangible” Book Value per Share |

| | | | | |

Performance: | | | | |

| Net Income / EPS | | Excludes After-Tax Effect of M&A and Other Special Charges | | “Core” Net Income / EPS |

| Net Income / EPS | | Excludes After-Tax Effect of CDI Amortization, M&A, and Other Special Charges | | “Tangible” or “Operating” Income / EPS |

| Return on Average Assets (ROA) | | “Tangible” Net Income divided by Average “Tangible” Assets | | Operating Return on Average “Tangible” Assets (ROTA) |

| Return on Average Equity (ROE) | | “Tangible” Net Income divided by Average “Tangible” Equity | | Operating Return on Average “Tangible” Equity (ROTE) |

Quarterly Presentation of GAAP / Non-GAAP

The timing of the merger of Community and Blue Ball provided one additional frame of reference that was useful in understanding the hybrid financial performance in 2005. Because the merger was consummated on July 1, 2005, operating results for the first and second quarters of the year consisted exclusively of “pre-merger” Community performance. The second half included the combined performance of Community and Blue Ball for the third and fourth quarters. The existence of these discrete periods provided an opportunity to compare “pre-merger” and “post-merger” operating performance within 2005.

Concurrent with the announcement of the merger in late 2004, Community indicated that the two companies would be combined in a manner that would facilitate realization of expense savings that would be fully operational by the onset of 2006. In this presentation, Community has provided certain comparative analyses designed to provide an indication of the relative effectiveness of those initiatives during the last half of 2005. Analysis of these results will be critical to any evaluation of the extent to which past performance can be used to evaluate the prospects for future performance beyond 2005.

2005 PERFORMANCE ANALYSIS

2005 Economic Conditions

During 2005, the United States and its leaders continued to be preoccupied with issues concerning domestic terror, the situation in Iraq, national and international natural disasters, and spiraling energy costs. At the same time, the domestic landscape continued to reflect the benefits of an economic policy steadfastly focused on controlling inflation and mitigating the prospects for a recession. This policy had been formulated in the wake of the year 2000 stock market bubble, the terrorist attacks of September, 2001, and the war in Iraq. For the last several years, the fiscal climate in the United States has been influenced by a monetary policy that was formulated to help sustain economic growth in the face of an abundance of adverse economic and political circumstances. This “policy accommodation” had been crafted to ensure accessibility to credit, funding, and liquidity, including credit vehicles for commercial and consumer borrowers. Ultimately, this policy accommodation led to the lowest fed funds rate in 46 years.

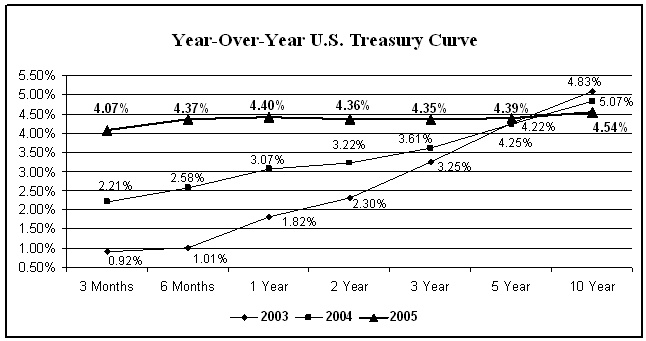

The fed funds rate, a key benchmark interest rate, reached its most recent trough of 1.0% near the beginning of 2004 and was followed by steady increases for the remainder of that year. By the end of 2004, the benchmark target for fed funds had risen steadily to 2.25%. During 2005, the Federal Reserve Board (the “Fed”) continued to reverse its previous policy accommodation through a more “neutral” interest rate policy that neither impeded nor over-stimulated growth. Throughout 2005, the Fed continued to hike the funds target, which resulted in thirteen straight increases, before it reached 4.25% on December 13 of 2005. These increases reflected a policy change based on continued concerns about upside risks of inflationary pressures, the impact of the national budget deficit, and domestic industrial production that appeared to be growing closer to full capacity. At the same time, mid- and short-term interest rates remained relatively constant and produced an increasingly “flat” yield curve. This “flattening” sustained affordable credit terms for commercial and consumer borrowers throughout most of the year.

Because of these favorable borrowing conditions, commercial and consumer loan demand remained robust throughout this period of low interest rates. At the same time, credit quality steadily improved as underlying growth and consumer confidence supported economic vitality and stability for most of 2005. This convergence of circumstances produced a period of sustained credit expansion accompanied by unprecedented improvement in credit quality conditions throughout the year.

Yield Curve Dynamics and Banking

The primary source of revenue for most financial institutions, particularly community banks, is derived from intermediation activities. Intermediation activities are defined as the net revenues generated from the process of gathering deposits, combined with the facilitation of credit extension to retail and commercial customers. Changing interest rates affect the pricing of amounts received on loans and investments as well as the amounts paid to acquire deposits and other funding sources. Banks must maintain a constant vigilance on monitoring and managing the effects of interest rate changes on this essential source of revenue production.

The “yield curve” for the various maturities of U. S. Treasury securities provides a fundamental barometer that gauges the prevailing interest rate profile and, simultaneously, acts as a guidepost for current loan and deposit pricing constraints. The yield curve also offers a reliable frame of reference from which to formulate cognitive assessments about future interest rate changes and their impact on intermediation-based revenue production. The slope of the yield curve is driven primarily by expectations for future interest rate increases and inflationary trends. A “normal” yield curve has a slope that reflects lower costs for shorter term financial instruments, accompanied by symmetrical increases in costs for longer term instruments all along the maturity continuum.

Short-term interest rates are highly influenced by the monetary policy of the Fed. The Federal Open Market Committee, a committee of the Fed, targets the “fed funds” rate, the overnight rate at which banks borrow or lend excess funds between financial institutions. This rate serves as a benchmark for the “overnight” money costs, and correspondingly influences the pricing of a significant portion of a bank’s deposit funding sources. Intermediate and longer term interest rates, unlike the fed funds rate, are more directly influenced by external “market” forces, including perceptions about future interest rates and inflation. These trends, in turn, influence the pricing on mid- and long-term loan commitments as well as deposits and bank borrowings that have scheduled maturities.

Generally speaking, a yield curve with a higher degree of slope provides more opportunity to increase the spread between earning asset yields and funding costs. A steeper yield curve, when combined with growth in earning assets and deposits, can be expected to yield expanded revenue performance. It should be emphasized that while the yield curve is a critical benchmark in setting prices for various monetary assets and liabilities in banks, its influence is not exerted in a vacuum. Credit risk, market risk, competitive issues, and other factors must all be considered, along with interest rate risk, in the pricing of financial instruments.

| · | Banking and the Yield Curve |

During 2005, the overall level of interest rates was considered very low by historical standards. During such a period, a “steep” or highly-sloped yield curve may be a precursor of higher interest rates or elevated inflation in the future. In that same low interest rate environment, a “flat” yield curve may be characteristic of a Fed policy designed to calm an overheated economy by tightening credit availability via increases in short term rates. If other rates along the maturity spectrum do not rise correspondingly, the yield curve can be expected to “flatten”. This scenario may reflect an economic outlook that has little or no expectation of higher future interest rates or higher rates of inflation.

The slope of the yield curve, whether “steep” or “flat”, exists in a highly dynamic environment and does not precisely predict the extent, velocity or direction of future interest rate changes or inflationary trends. The shape of the yield curve, however, remains a crucial barometer for financial institutions as they construct a strategic approach to pricing and revenue maximization in a variety of interest rate environments.

Interest rate risk, or the potential impact that interest rate changes may have on intermediation-based revenue production, is similar to other forms of risk in that it is inherently unpredictable. And while the impact of rate changes on revenue performance can be estimated, managed, and moderated, it can never be fully hedged or ameliorated. The ability to sustain or improve revenue streams from intermediation activities is vulnerable to unexpected or nontraditional shifts in interest rate dynamics. These shifts sometimes manifest themselves in variations from the “normal” slope of the yield curve.

To manage monetary assets and liabilities in a dynamic environment, banks utilize financial simulation models that are designed to quantify the effects of parallel shifts in the yield curve and measure their effect on the spread between earning asset yields and the cost of funding. These models serve to quantify the amount of intermediation-based revenue that is “at risk” if interest rates rise or fall. A parallel shift occurs when all of the interest rates along the yield curve move in the same direction and by the same order of magnitude. Unfortunately, these models are less capable of predicting the effects of interest rate changes when interest rate dynamics venture outside customary parameters. As an example, these models provide less predictable results in situations where benchmark rates change asymmetrically, or if changes occur at one end of the curve without directionally similar changes at the other. Furthermore, these models are also less proficient at forming assumptions about customer tendencies and product preferences during periods of dynamic interest rate change.

Late in 2005, many economists began assessing the potential fallout from an “inverted” yield curve. An inverted yield curve is the opposite of a “normal” yield curve and is characterized by short term rates that are higher than longer term rates. The presence of an inverted yield curve is considered to be an anomaly that is almost counterintuitive to the core business of banking. Inverted yield curves do not typically exist for more than a short period of time. In past economic cycles, the presence of an inverted yield curve has frequently foreshadowed a national recession. However, while virtually all recessions have been presaged by an inverted yield curve, the presence of an inverted curve in previous cycles has not guaranteed the onset of a recession.

A “flat” yield curve, such as the one in place at the end of 2005, has the potential to be sustained for a longer period of time. In addition, the U.S. economy has recently been confronted by the potential for a cooler post-2005 housing market and by higher energy and home-heating prices. To add further uncertainty, the economy is now confronted by a yield curve profile that has often been predictive of recessionary pressures. This combination of circumstances could exacerbate the anxiety currently felt by commercial and retail customers about the prospects for economic difficulties, higher inflation, or a possible recession beyond 2005.

For banks, the presence of a “flat” yield curve for a prolonged or sustained period could measurably lower expectations for expanding revenue from intermediation activities. More importantly, the possibility of recession may suppress future asset growth trends and/or increase the influence of other forms of risk, such as credit risk, which could hamper opportunities for revenue expansion and earnings growth in the near term.

2005 Performance Summary and Review

Against a backdrop of its landmark merger transaction and a multitude of other exogenous economic factors and trends, Community reported its performance results for 2005. That performance reflected the combination of results for a “pre-merger” Community for the first half of 2005, followed by a “post-merger” Community for the second half. This hybrid performance, which provided tangible signs of potential performance enhancements beyond 2005, was limited by the recognition of the special charges. Including these expenses, net income and earnings per share results for 2005 were $25.6 million and $1.42, respectively. This compared to net income of $21.8 million and earnings per share of $1.73 in 2004.

Important traditional measures of relative financial performance include return on average assets (ROA) and return on average equity (ROE), which declined to 0.96% and 8.04%, respectively, for 2005. Comparable measures in 2004 were 1.12% and 14.96%. The decline in these measures was dramatically influenced by the impact of the merger, conversion, and restructuring expenses, and by the impact of the application of purchase accounting in the merger of PennRock. As noted previously, comparable “non-GAAP” measures were cited as “return on tangible assets” (ROTA) and “return on tangible equity” (ROTE), which actually increased to 1.27% and 17.09%, respectively, compared to 1.13% and 15.55% a year ago.

Similar trends were noted with respect to earnings per share (EPS) trends. Excluding the impact of the special charges in the second and third quarter, “core” EPS reached $1.71 and was nearly equal to the 2004 performance of $1.73. While annual EPS performance was flat, quarterly trends in the third and fourth quarters provided indications of the accretive benefits of the merger. For example, while pre-merger first quarter results were $0.44 per share, the post-merger fourth quarter results rose to a record $0.47 per share as anticipated expense savings began to emerge from the combination of the two franchises. The fourth quarter results were the highest quarterly net income and EPS performance in the history of Community.

Growth in the various balance sheet categories was dramatically influenced by net assets added in the merger. Total loans grew 84% from one year ago, while total assets and deposits grew 70% and 76%, respectively. Loans are now at $2.2 billion at the end of 2005, while deposits stand at almost $2.3 billion.

The impressive growth rates achieved in 2005 included the “acquired” growth added through the Blue Ball merger. In order to quantify the extent of “organic” growth, it was necessary to isolate this “acquired” growth from the period-end balances at December 31, 2005. This analysis yielded pro forma balances that provided an indication of the extent of “acquired” growth achieved through expansion of market share or through the underlying vitality of Community’s marketplace. The following table serves to illustrate the impact of both the various balance sheet strategies discussed earlier and the influence of organic growth on overall growth levels.

| | | 2005 Year End Balances | | Less: “Pro Forma” Opening PennRock Balances | | Equals: “Pro Forma” 2005 Year End Balances | | 2004 Year End Balances | | Change | | | % | |

| | | | | | | | | | | | | | | | | | | | |

| Investment securities | | $ | 628,585 | | $ | 150,272 | | $ | 478,313 | | $ | 619,110 | | $ | (140,797 | ) | | (22.7 | )% |

| Loans | | | 2,234,497 | | | 842,166 | | | 1,392,331 | | | 1,215,951 | | | 176,380 | | | 14.5 | % |

| Other assets | | | 469,348 | | | 114,491 | | | 354,857 | | | 119,738 | | | 235,119 | | | 196.4 | % |

| Total Assets | | $ | 3,332,430 | | $ | 1,106,929 | | $ | 2,225,501 | | $ | 1,954,799 | | $ | 270,702 | | | 13.8 | % |

| | | | | | | | | | | | | | | | | | | | |

| Total Deposits | | $ | 2,294,367 | | $ | 882,075 | | $ | 1,412,292 | | $ | 1,305,537 | | $ | 106,755 | | | 8.2 | % |

| Short-term borrowings | | | 87,253 | | | 16,010 | | | 71,243 | | | 47,116 | | | 24,127 | | | 51.2 | % |

| Long-term debt | | | 461,647 | | | 103,515 | | | 358,132 | | | 435,590 | | | (77,458 | ) | | (17.8 | )% |

| Other liabilities | | | 12,490 | | | 13,196 | | | (706 | ) | | 14,215 | | | (14,921 | ) | | 105.0 | % |

| Total Liabilities | | $ | 2,855,757 | | $ | 1,014,796 | | $ | 1,840,961 | | $ | 1,802,458 | | $ | 38,503 | | | 2.1 | % |

| | | | | | | | | | | | | | | | | | | | |

Changes shown above serve to summarize the effect of the following balance sheet dynamics:

| o | Reductions in investment balances were influenced by both the de-leveraging strategy and the utilization of scheduled investment portfolio runoff to fund loan growth. |

| o | Organic loan growth reflected strong loan demand, which was affected by favorable pricing conditions throughout the year. |

| o | Growth in other assets was driven almost exclusively by the effect of intangibles added from the merger of Blue Ball. |

| o | Deposit growth, though steady, was not sufficient to fully fund loan demand. Interest rate conditions favored the utilization of scheduled investment runoff to fund excess loan demand. |

| o | While short term borrowings increased, such borrowings were reduced from the combination of pre-merger balances at Community and Blue Ball. |

| o | Long-term debt reductions were primarily effected by the prepayment of $60 million of FHLB advances from pre-merger Community. |