Exhibit 99.2

Exhibit 99.2

ANNOUNCE A STRATEGIC MERGER

November 16, 2004

AND

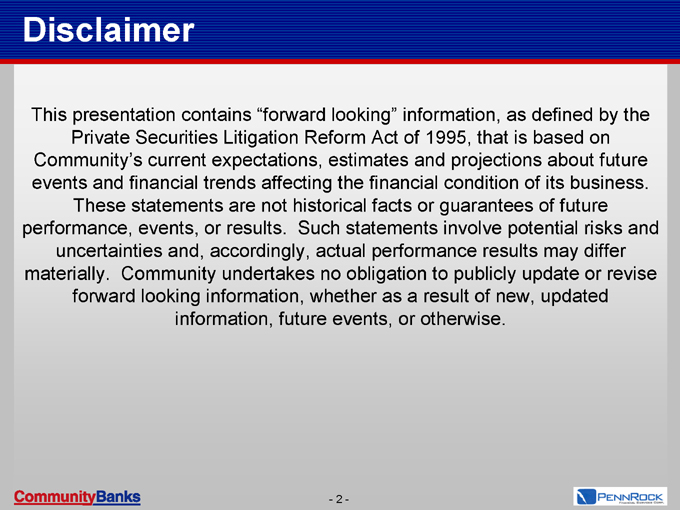

Disclaimer

This presentation contains “forward looking” information, as defined by the Private Securities Litigation Reform Act of 1995, that is based on Community’s current expectations, estimates and projections about future events and financial trends affecting the financial condition of its business. These statements are not historical facts or guarantees of future performance, events, or results. Such statements involve potential risks and uncertainties and, accordingly, actual performance results may differ materially. Community undertakes no obligation to publicly update or revise forward looking information, whether as a result of new, updated information, future events, or otherwise.

- 2 -

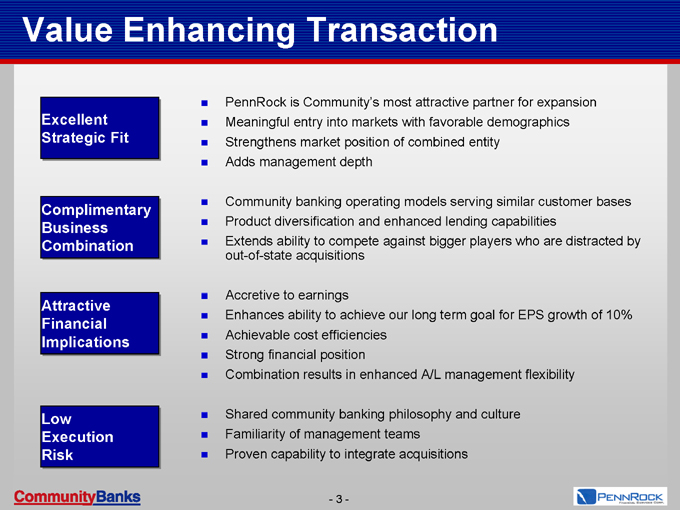

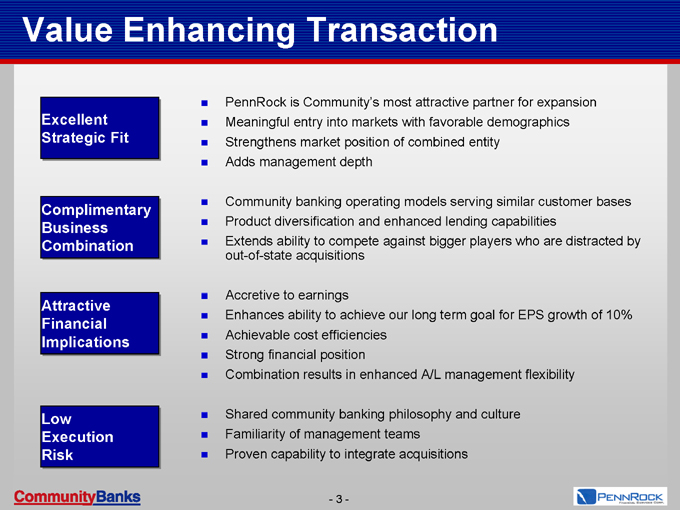

PennRock is Community’s most attractive partner for expansion

Meaningful entry into markets with favorable demographics

Strengthens market position of combined entity

Adds management depth

Community banking operating models serving similar customer bases

Product diversification and enhanced lending capabilities

Extends ability to compete against bigger players who are distracted by out-of-state acquisitions

Accretive to earnings

Enhances ability to achieve our long term goal for EPS growth of 10%

Achievable cost efficiencies

Strong financial position

Combination results in enhanced A/L management flexibility

Shared community banking philosophy and culture

Familiarity of management teams

Proven capability to integrate acquisitions

Excellent Strategic Fit

Complimentary Business Combination

Attractive Financial Implications

Low Execution Risk

Value Enhancing Transaction

- 3 -

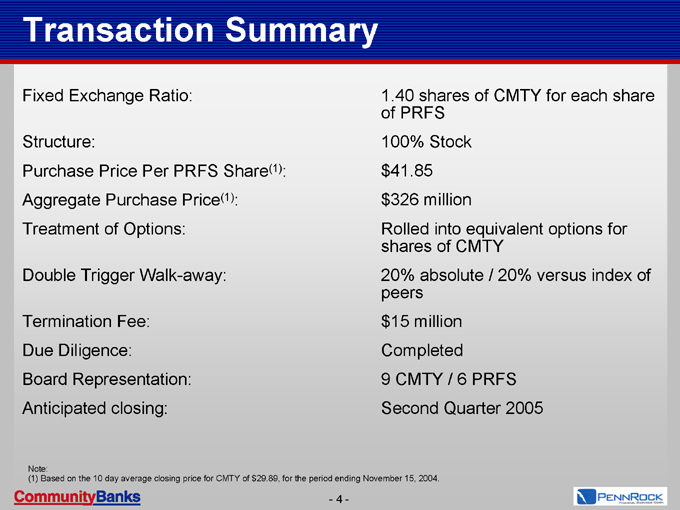

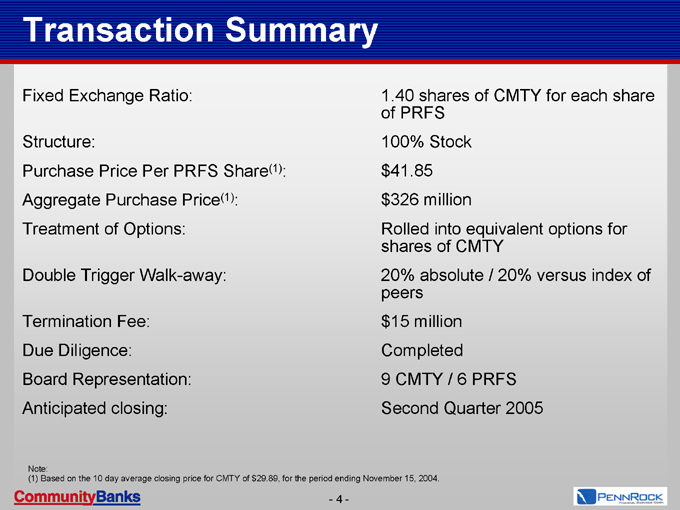

Fixed Exchange Ratio:

Structure:

Purchase Price Per PRFS Share(1):

Aggregate Purchase Price(1):

Treatment of Options:

Double Trigger Walk-away:

Termination Fee:

Due Diligence:

Board Representation:

Anticipated closing:

1.40 shares of CMTY for each share of PRFS

100% Stock

$41.85

$326 million

Rolled into equivalent options for shares of CMTY

20% absolute / 20% versus index of peers

$15 million

Completed

9 CMTY / 6 PRFS

Second Quarter 2005

Note:

(1) Based on the 10 day average closing price for CMTY of $29.89, for the period ending November 15, 2004.

Transaction Summary

- 4—

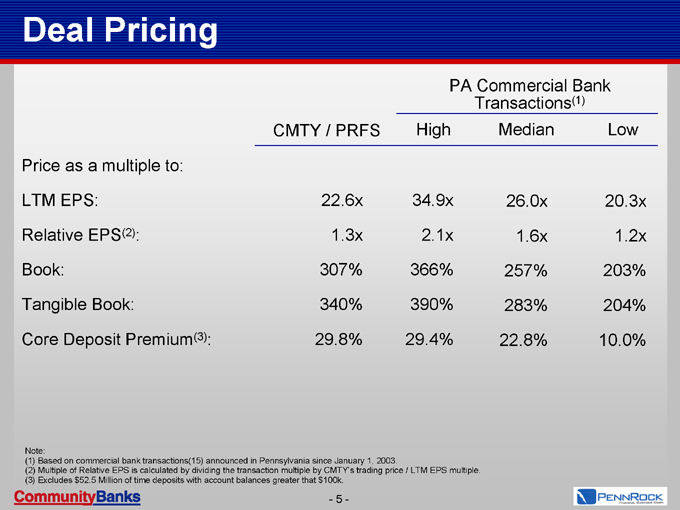

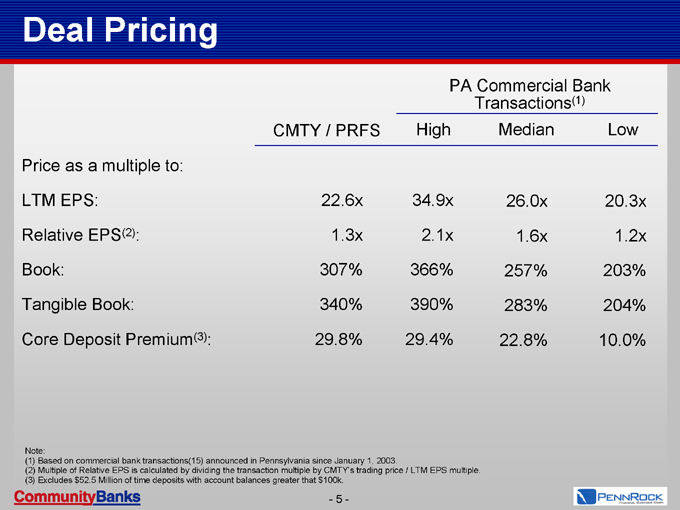

Price as a multiple to:

LTM EPS:

Relative EPS(2):

Book:

Tangible Book:

Core Deposit Premium(3):

CMTY / PRFS

High

Median

Low

PA Commercial Bank Transactions(1)

22.6x

1.3x

307%

340%

29.8%

34.9x

2.1x

366%

390%

29.4%

26.0x

1.6x

257%

283%

22.8%

20.3x

1.2x

203%

204%

10.0%

Deal Pricing

Note:

(1) Based on commercial bank transactions(15) announced in Pennsylvania since January 1, 2003.

(2) Multiple of Relative EPS is calculated by dividing the transaction multiple by CMTY’s trading price / LTM EPS multiple.

(3) Excludes $52.5 Million of time deposits with account balances greater that $100k.

- 5 -

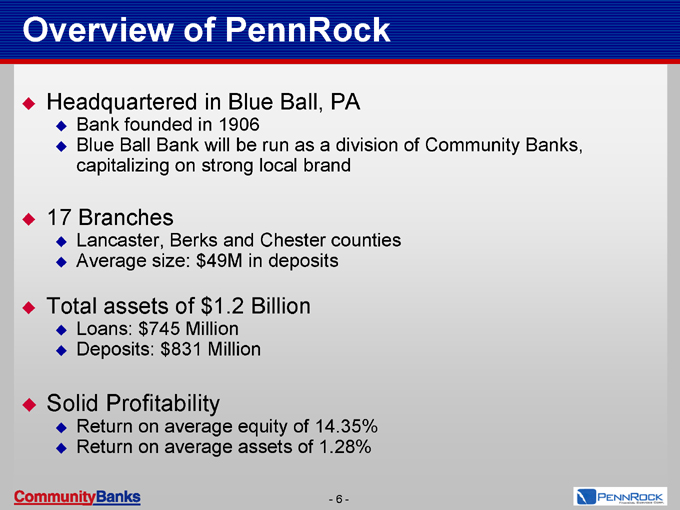

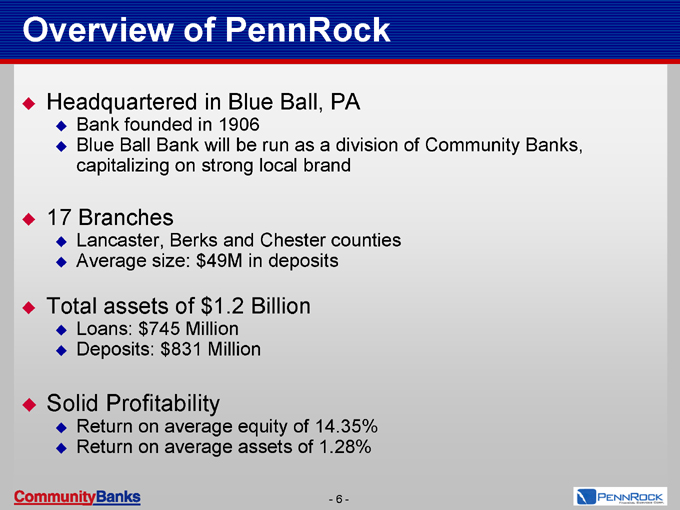

Headquartered in Blue Ball, PA

Bank founded in 1906

Blue Ball Bank will be run as a division of Community Banks, capitalizing on strong local brand

17 Branches

Lancaster, Berks and Chester counties

Average size: $49M in deposits

Total assets of $1.2 Billion

Loans: $745 Million

Deposits: $831 Million

Solid Profitability

Return on average equity of 14.35%

Return on average assets of 1.28%

Overview of PennRock

- 6 -

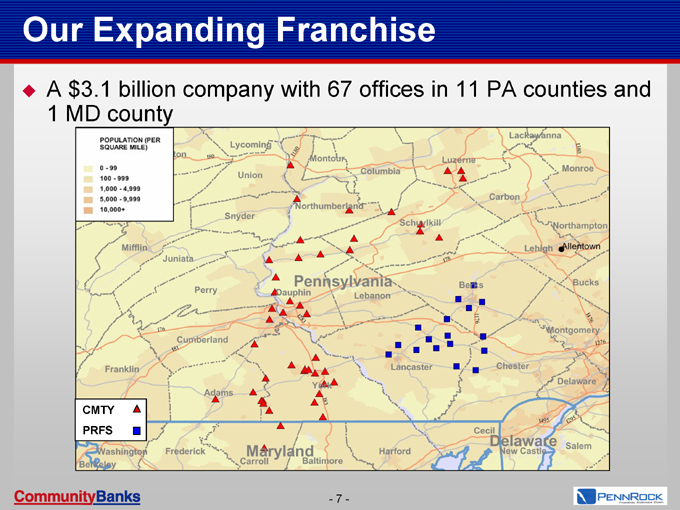

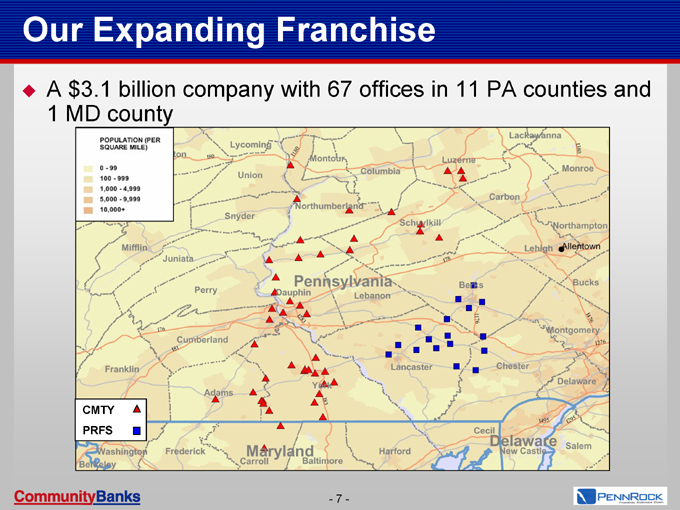

Our Expanding Franchise

CMTY

PRFS

A $3.1 billion company with 67 offices in 11 PA counties and 1 MD county

POPULATION (PER SQUARE MILE)

0 - 99

100 - 999

1,000 - 4,999

5,000 - 9,999

10,000+

- 7 - -

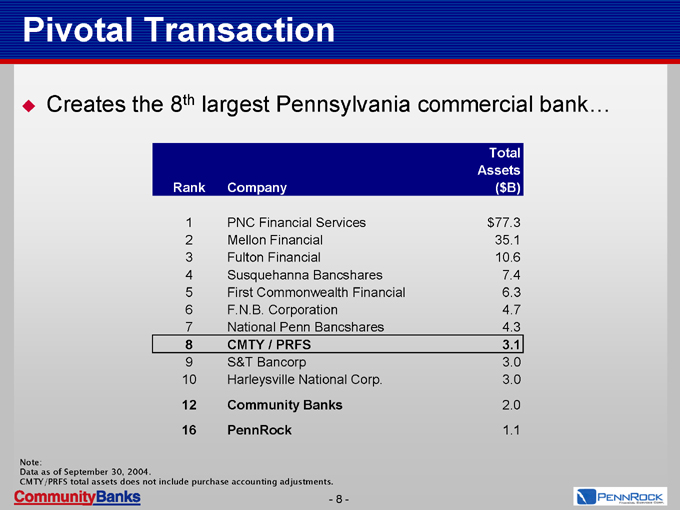

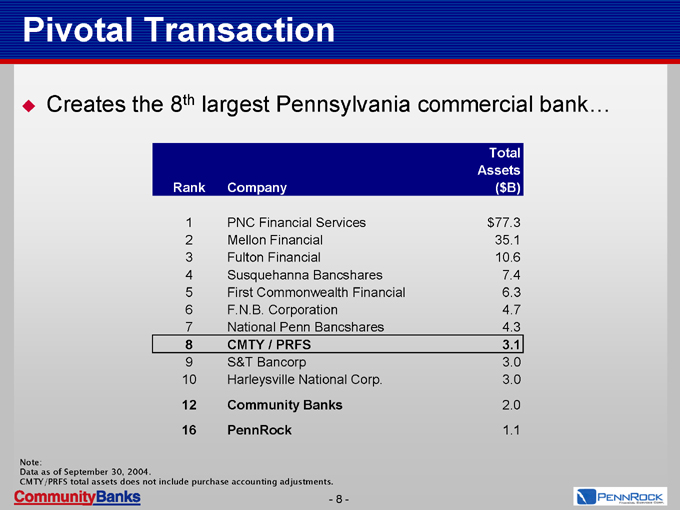

Pivotal Transaction

Creates the 8th largest Pennsylvania commercial bank…

Note:

Data as of September 30, 2004.

CMTY/PRFS total assets does not include purchase accounting adjustments.

Total

Assets

Rank

Company

($B)

1

PNC Financial Services

$77.3

2

Mellon Financial

35.1

3

Fulton Financial

10.6

4

Susquehanna Bancshares

7.4

5

First Commonwealth Financial

6.3

6

F.N.B. Corporation

4.7

7

National Penn Bancshares

4.3

8

CMTY / PRFS

3.1

9

S&T Bancorp

3.0

10

Harleysville National Corp.

3.0

12

Community Banks

2.0

16

PennRock

1.1

- 8 -

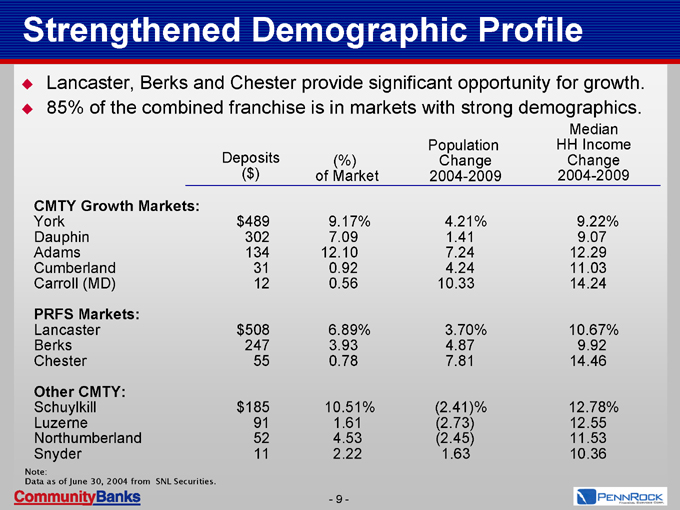

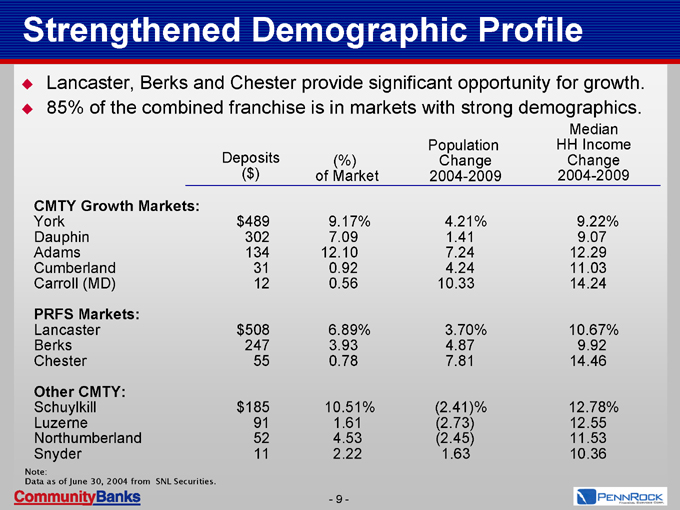

Strengthened Demographic Profile

CMTY Growth Markets:

York

Dauphin

Adams

Cumberland

Carroll (MD)

PRFS Markets:

Lancaster

Berks

Chester

Other CMTY:

Schuylkill

Luzerne

Northumberland

Snyder

Population

Change

2004-2009

Median

HH Income

Change

2004-2009

Note:

Data as of June 30, 2004 from SNL Securities.

4.21%

1.41

7.24

4.24

10.33

3.70%

4.87

7.81

(2.41)%

(2.73)

(2.45)

1.63

9.22%

9.07

12.29

11.03

14.24

10.67%

9.92

14.46

12.78%

12.55

11.53

10.36

Lancaster, Berks and Chester provide significant opportunity for growth.

85% of the combined franchise is in markets with strong demographics.

$489

302

134

31

12

$508

247

55

$185

91

52

11

9.17%

7.09

12.10

0.92

0.56

6.89%

3.93

0.78

10.51%

1.61

4.53

2.22

(%)

of Market

Deposits

($)

- 9 -

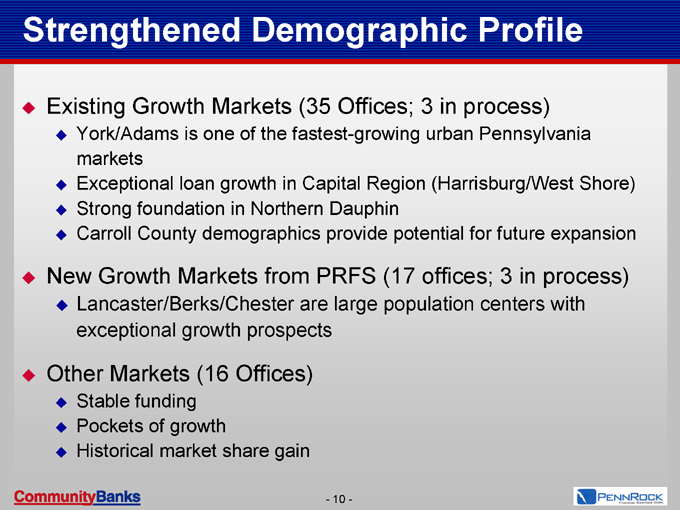

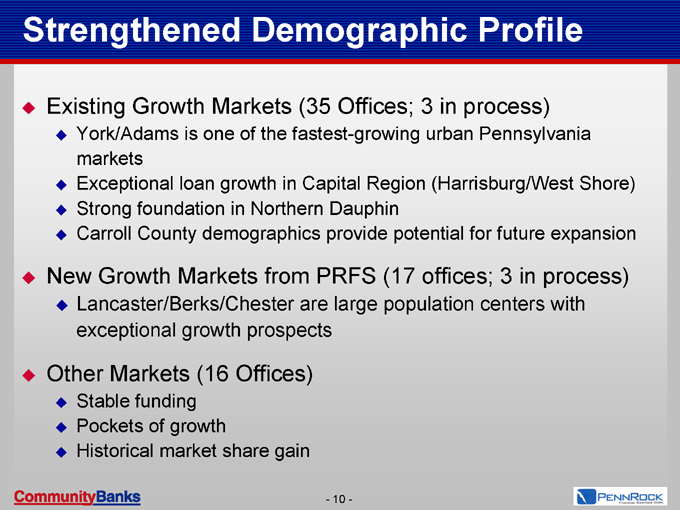

Strengthened Demographic Profile

Existing Growth Markets (35 Offices; 3 in process)

York/Adams is one of the fastest-growing urban Pennsylvania markets

Exceptional loan growth in Capital Region (Harrisburg/West Shore)

Strong foundation in Northern Dauphin

Carroll County demographics provide potential for future expansion

New Growth Markets from PRFS (17 offices; 3 in process)

Lancaster/Berks/Chester are large population centers with exceptional growth prospects

Other Markets (16 Offices)

Stable funding

Pockets of growth

Historical market share gain

- 10 -

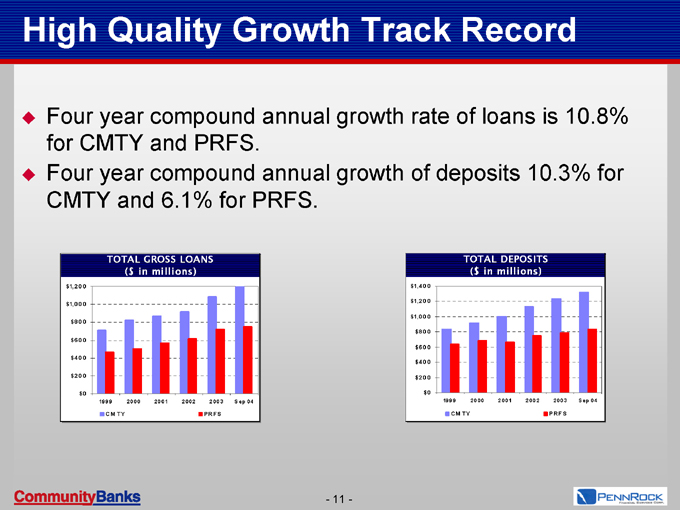

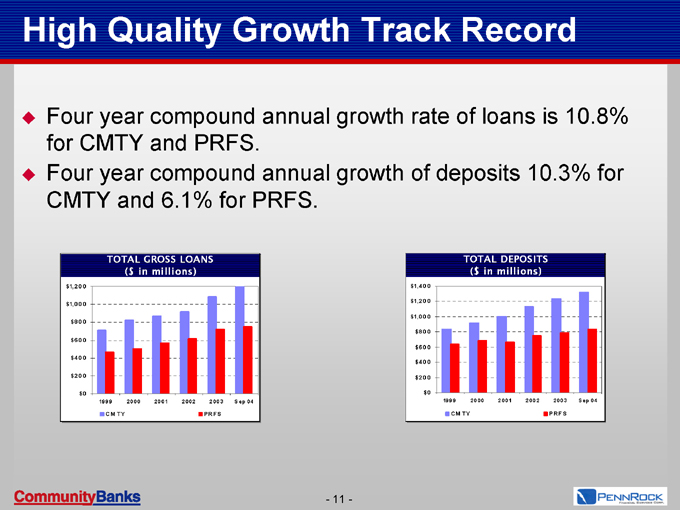

High Quality Growth Track Record

Four year compound annual growth rate of loans is 10.8% for CMTY and PRFS.

Four year compound annual growth of deposits 10.3% for CMTY and 6.1% for PRFS.

($ in millions)

TOTAL GROSS LOANS

$0

$200

$400

$600

$800

$1,000

$1,200

1999

2000

2001

2002

2003

Sep 04

CMTY

PRFS

TOTAL DEPOSITS

($ in millions)

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

1999

2000

2001

2002

2003

2004

- 11 -

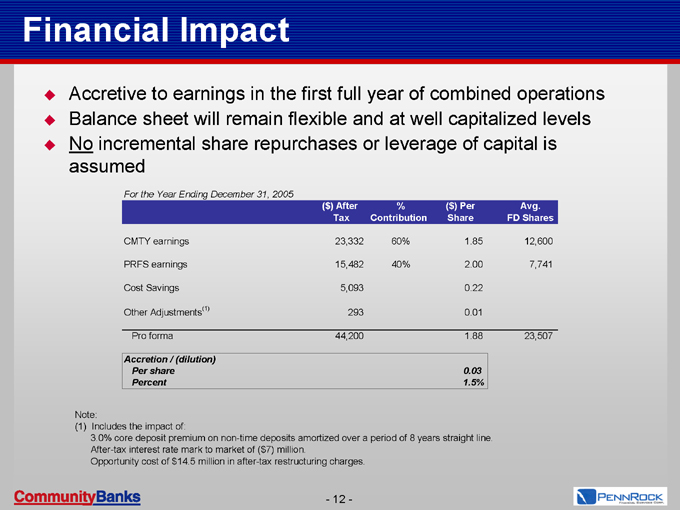

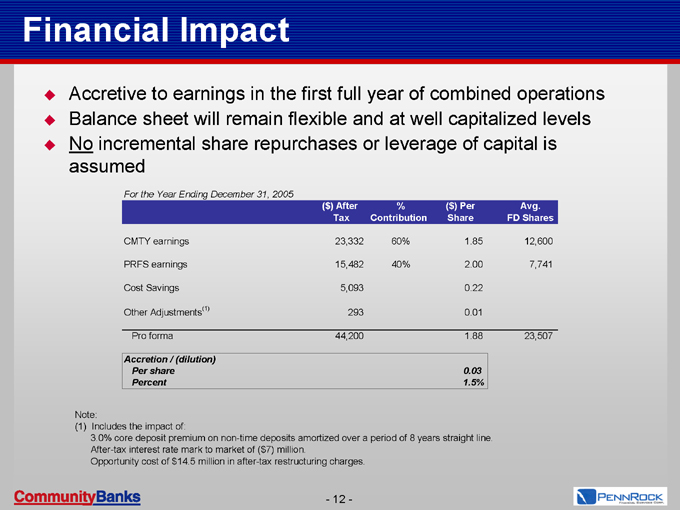

Financial Impact

Accretive to earnings in the first full year of combined operations

Balance sheet will remain flexible and at well capitalized levels

No incremental share repurchases or leverage of capital is assumed

For the Year Ending December 31, 2005

($) After

%

($) Per

Avg.

Tax

Contribution

Share

FD Shares

CMTY earnings

23,332

60%

1.85

12,600

PRFS earnings

15,482

40%

2.00

7,741

Cost Savings

5,093

0.22

Other Adjustments

(1)

293

0.01

Pro forma

44,200

1.88

23,507

Accretion / (dilution)

Per share

0.03

Percent

1.5%

Note:

Includes the impact of:

3.0% core deposit premium on non-time deposits amortized over a period of 8 years straight line.

After-tax interest rate mark to market of ($7) million.

Opportunity cost of $14.5 million in after-tax restructuring charges

- 12 -

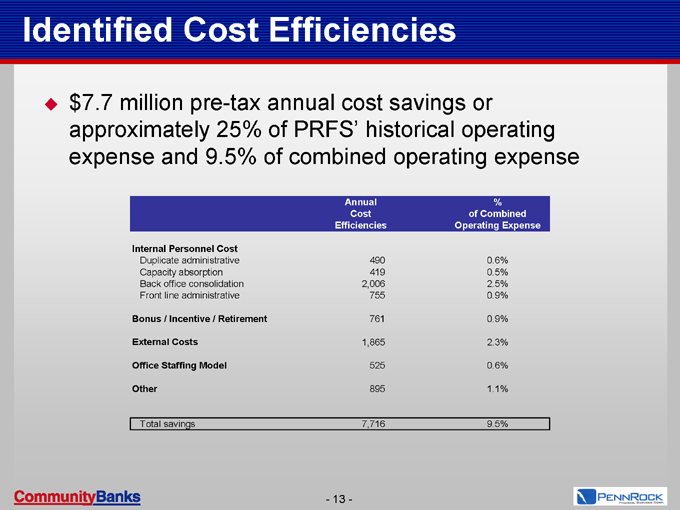

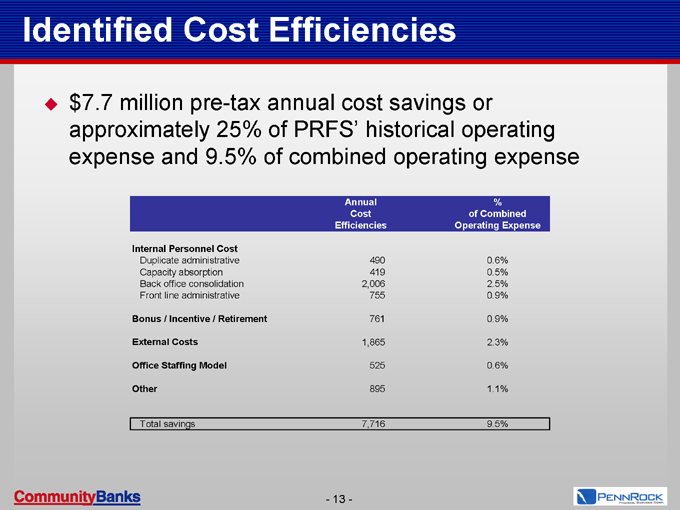

Identified Cost Efficiencies

$7.7 million pre-tax annual cost savings or approximately 25% of PRFS’ historical operating expense and 9.5% of combined operating expense

Annual

%

Cost

of Combined

Efficiencies

Operating Expense

Internal Personnel Cost

Duplicate administrative

490

0.6%

Capacity absorption

419

0.5%

Back office consolidation

2,006

2.5%

Front line administrative

755

0.9%

Bonus / Incentive / Retirement

761

0.9%

External Costs

1,865

2.3%

Office Staffing Model

525

0.6%

Other

895

1.1%

Total savings

7,716

9.5%

- 13 -

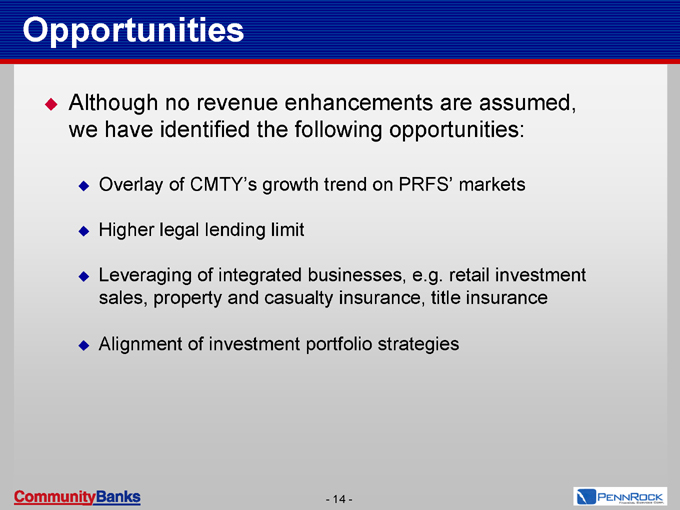

Opportunities

Although no revenue enhancements are assumed, we have identified the following opportunities:

Overlay of CMTY’s growth trend on PRFS’ markets

Higher legal lending limit

Leveraging of integrated businesses, e.g. retail investment sales, property and casualty insurance, title insurance

Alignment of investment portfolio strategies

- 14 -

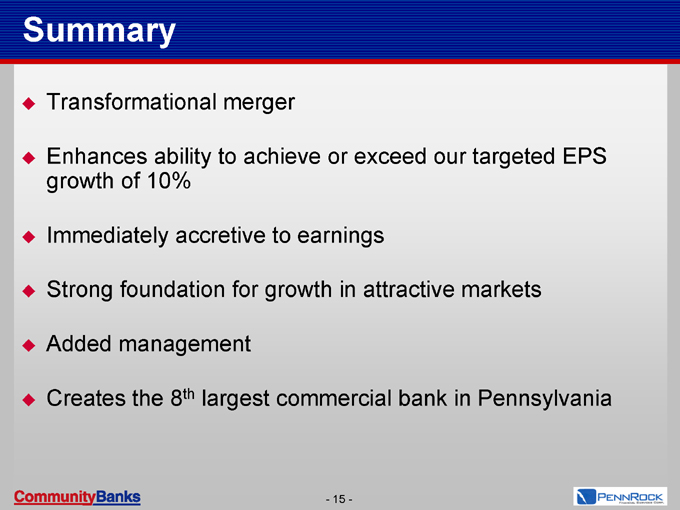

Summary

Transformational merger

Enhances ability to achieve or exceed our targeted EPS growth of 10%

Immediately accretive to earnings

Strong foundation for growth in attractive markets

Added management

Creates the 8th largest commercial bank in Pennsylvania

- 15 -