AND

A STRATEGIC AFFILIATION

- 1 -

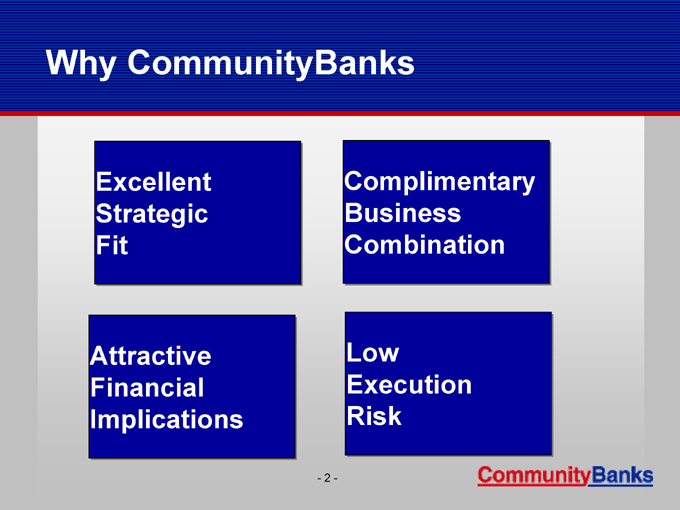

Why CommunityBanks

Excellent Strategic Fit

Complimentary Business Combination

Attractive Financial Implications

Low Execution Risk

- 2 -

Overview of Community Banks, Inc.

Parent Of CommunityBanks 47 Banking Offices Total assets of $2 Billion

Comprehensive Community Banking Services, as well as Trust & Asset Management, P&C Insurance, Retail Investment, and Title Services

- 3 -

The CommunityBanks Network

York/Adams Counties (21 Offices)

York – 2nd fastest growing urban market in PA

Adams – growth in excess of 10%

Dauphin/Cumberland Counties (12 Offices)

Harrisburg/West Shore focus

Strong in N. Dauphin

Schuylkill/Luzerne/Northumberland/Snyder (14 Offices)

Growing market share in stable markets

Northern Maryland (2 Offices)

Carroll County – Exceptional Demographics

- 4 -

Our Vision For CommunityBanks

Build shareholder value by growing our community banking franchise’s market share in existing markets and expanding (de novo or via affiliation) in new growth markets

Management team is young, energetic and motivated to perform for the long term

- 5 -

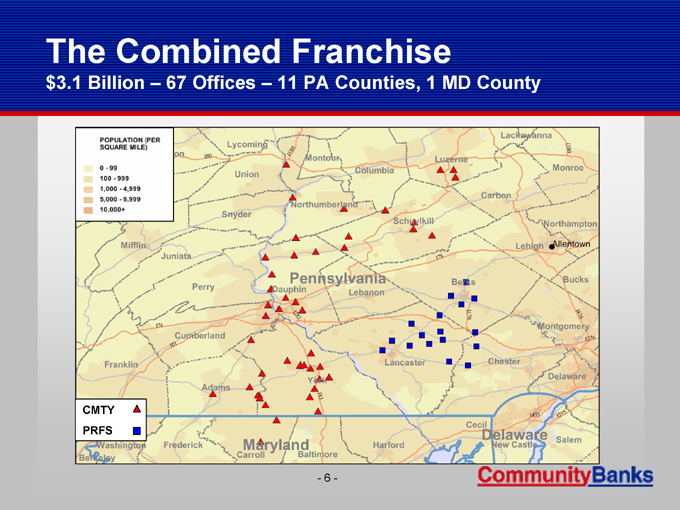

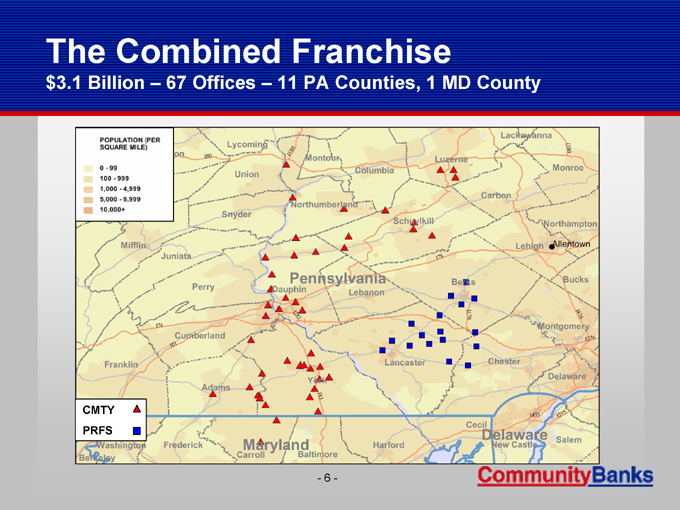

The Combined Franchise $3.1 Billion – 67 Offices – 11 PA Counties, 1 MD County

CMTY PRFS

- 6 -

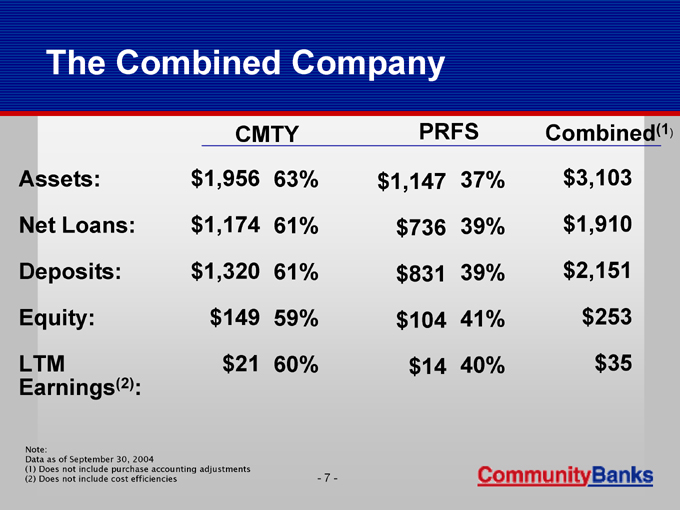

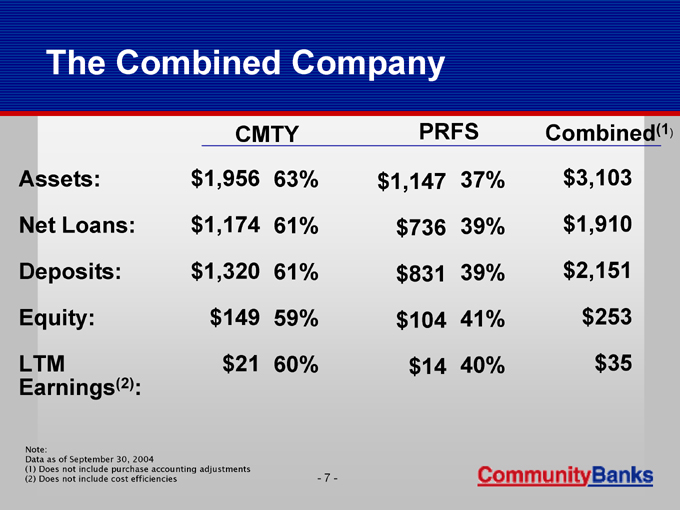

The Combined Company

CMTY PRFS Combined(1)

Assets: $1,956 63% $1,147 37% $3,103

Net Loans: $1,174 61% $736 39% $1,910

Deposits: $1,320 61% $831 39% $2,151

Equity: $149 59% $104 41% $253

LTM Earnings(2): $21 60% $14 40% $35

Note:

Data as of September 30, 2004

(1) Does not include purchase accounting adjustments

(2) Does not include cost efficiencies

- 7 –

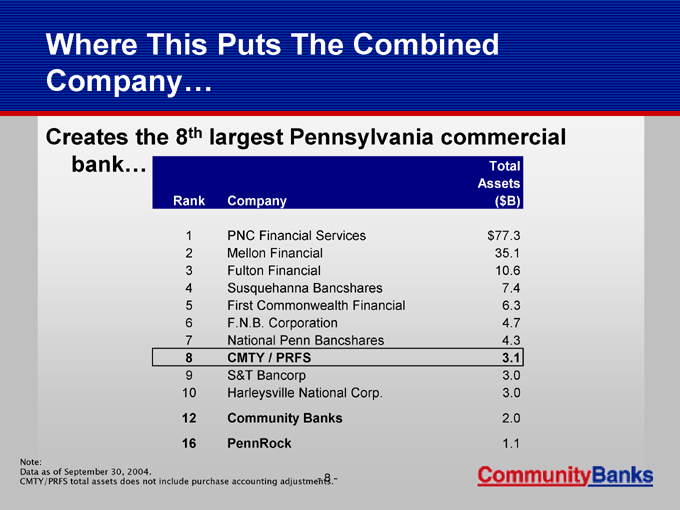

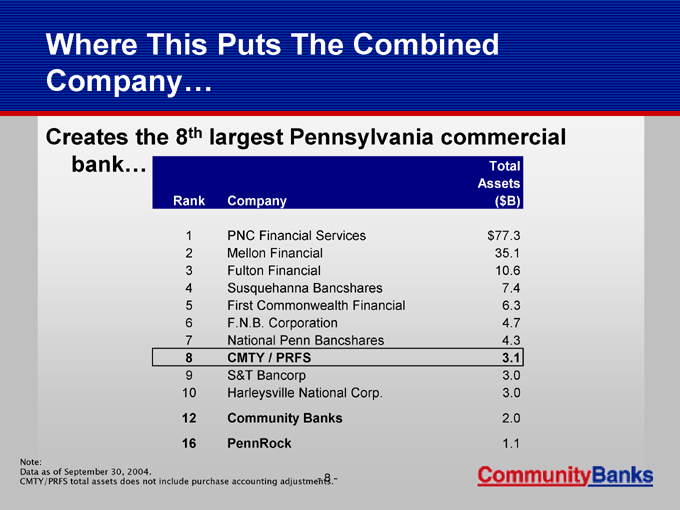

Where This Puts The Combined Company…

Creates the 8th largest Pennsylvania commercial bank…

Total Assets ($B)

Rank Company

1 PNC Financial Services $77.3

2 Mellon Financial 35.1

3 Fulton Financial 10.6

4 Susquehanna Bancshares 7.4

5 First Commonwealth Financial 6.3

6 F.N.B. Corporation 4.7

7 National Penn Bancshares 4.3

8 CMTY / PRFS 3.1

9 S&T Bancorp 3.0

10 Harleysville National Corp. 3.0

12 Community Banks 2.0

16 PennRock 1.1

Note:

Data as of September 30, 2004.

CMTY/PRFS total assets does not include purchase accounting adjustments.—8 -

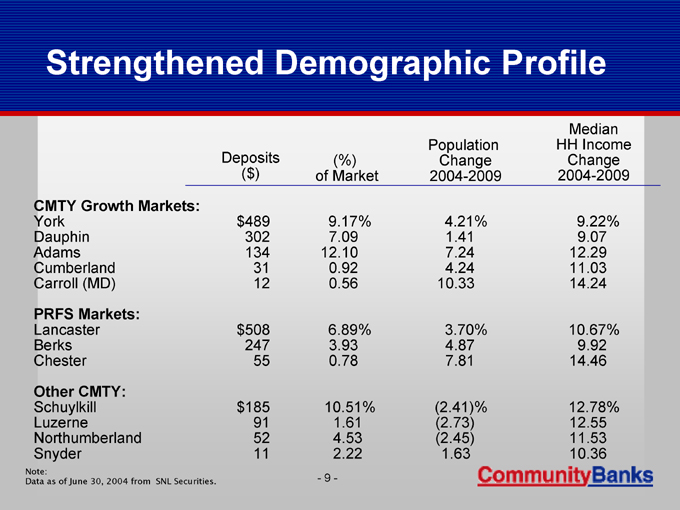

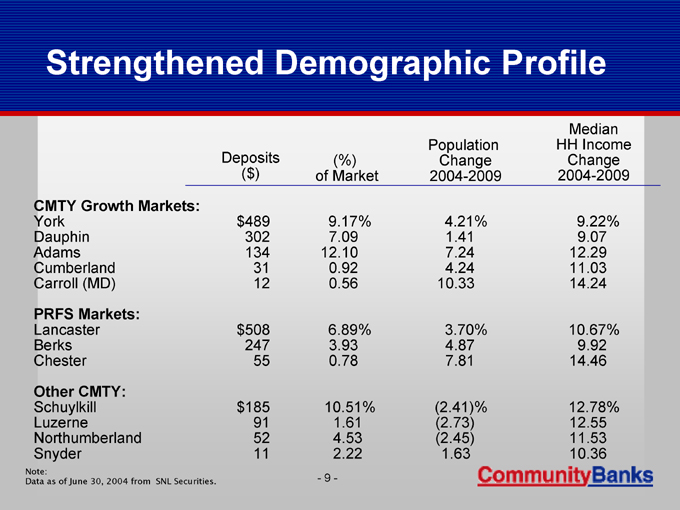

Strengthened Demographic Profile

Deposits ( $) (%) of Market Population Change 2004-2009 Median HH Income Change 2004-2009

CMTY Growth Markets:

York $ 489 9.17% 4.21% 9.22%

Dauphin 302 7.09 1.41 9.07

Adams 134 12.10 7.24 12.29

Cumberland 31 0.92 4.24 11.03

Carroll (MD) 12 0.56 10.33 14.24

PRFS Markets:

Lancaster $ 508 6.89% 3.70% 10.67%

Berks 247 3.93 4.87 9.92

Chester 55 0.78 7.81 14.46

Other CMTY:

Schuylkill $ 185 10.51% (2.41)% 12.78%

Luzerne 91 1.61 (2.73) 12.55

Northumberland 52 4.53 (2.45) 11.53

Snyder 11 2.22 1.63 10.36

Note:

Data as of June 30, 2004 from SNL Securities.

- 9 -

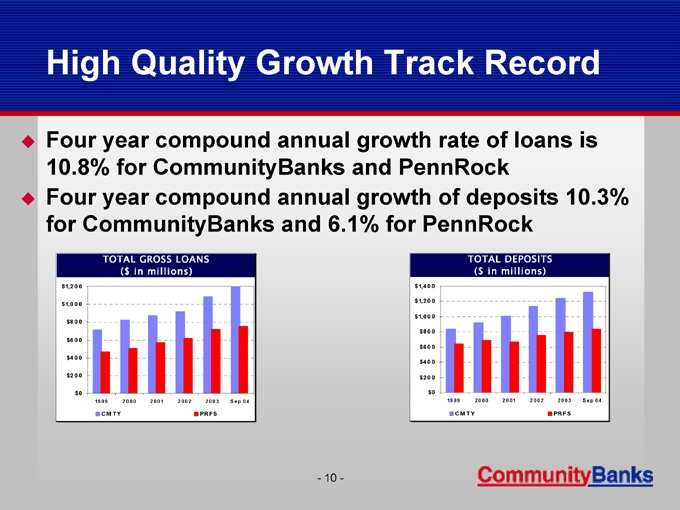

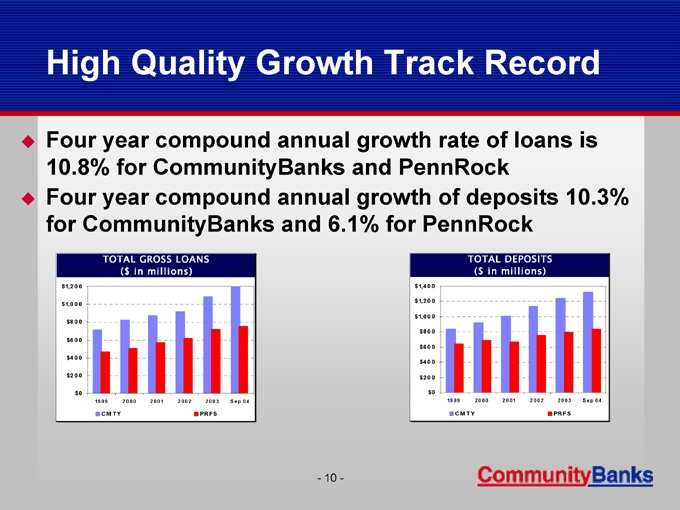

High Quality Growth Track Record

Four year compound annual growth rate of loans is 10.8% for CommunityBanks and PennRock Four year compound annual growth of deposits 10.3% for CommunityBanks and 6.1% for PennRock

TOTAL GROSS LOANS

($ in millions)

TOTAL DEPOSITS

($ in millions) $1,2 0 0 $1,0 0 0 $8 0 0 $6 0 0 $4 0 0 $2 0 0 $0

19 99 20 00 2 00 1 20 02 2 00 3 S ep 04

CM TY PRFS

$1,4 0 0

$1,2 0 0

$1,0 0 0

$8 0 0

$6 0 0

$4 0 0

$2 0 0

$0

19 99 20 00 2 00 1 20 02 2 00 3 S ep 04

CM TY PRFS

- 10 -

Opportunities

Combination of growth markets Higher legal lending limit Leveraging of integrated businesses, e.g. retail investment sales, P&C insurance and title services Alignment of investment portfolio strategies

- 11 -

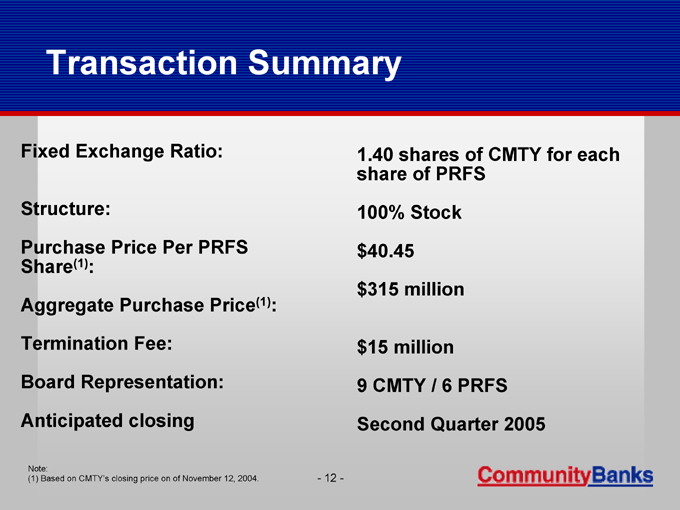

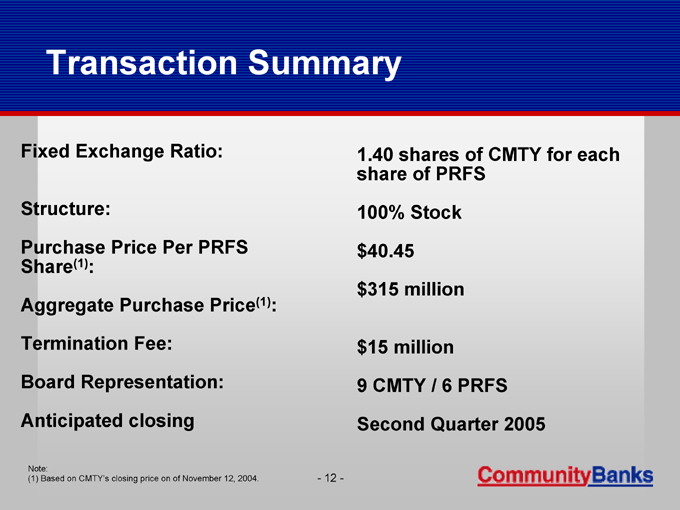

Transaction Summary

Fixed Exchange Ratio: 1.40 shares of CMTY for each share of PRFS

Structure: 100% Stock

Purchase Price Per PRFS Share(1): $ 40.45

Aggregate Purchase Price(1): $ 315 million

Termination Fee: $15 million

Board Representation: 9 CMTY / 6 PRFS

Anticipated closing Second Quarter 2005

Note:

(1) Based on CMTY’s closing price on of November 12, 2004.

- 12 -

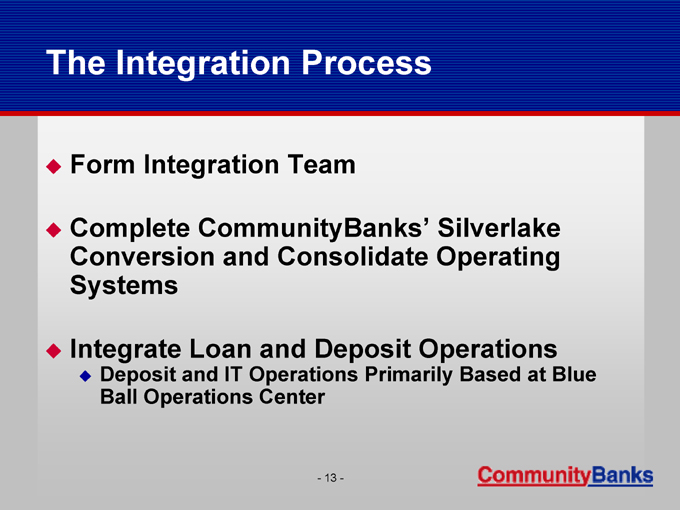

The Integration Process

Form Integration Team

Complete CommunityBanks’ Silverlake Conversion and Consolidate Operating Systems

Integrate Loan and Deposit Operations

Deposit and IT Operations Primarily Based at Blue Ball Operations Center

- 13 -

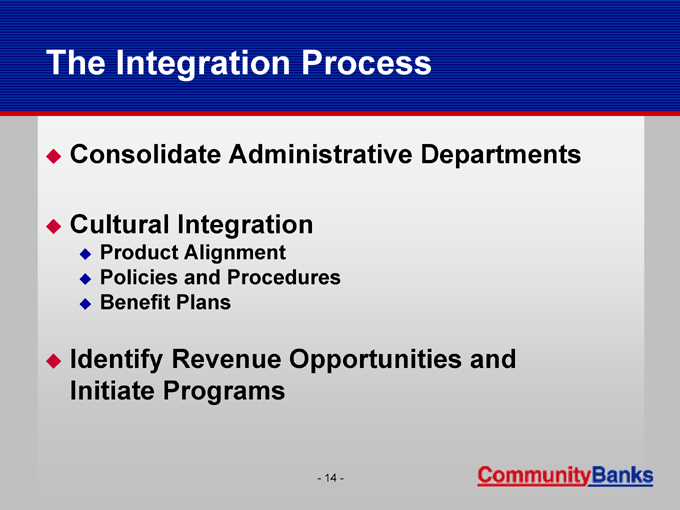

The Integration Process

Consolidate Administrative Departments

Cultural Integration

Product Alignment

Policies and Procedures

Benefit Plans

Identify Revenue Opportunities and Initiate Programs

- 14 -