- HMC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Honda Motor (HMC) 6-KCurrent report (foreign)

Filed: 10 Feb 21, 6:07am

No.1-7628

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF FEBRUARY 2021

COMMISSION FILE NUMBER: 1-07628

HONDA GIKEN KOGYO KABUSHIKI KAISHA

(Name of registrant)

HONDA MOTOR CO., LTD.

(Translation of registrant’s name into English)

1-1, Minami-Aoyama 2-chome, Minato-ku, Tokyo 107-8556, Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Exhibit 1:

Exhibit 2:

Exhibit 3:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

HONDA GIKEN KOGYO KABUSHIKI KAISHA (HONDA MOTOR CO., LTD.) |

/s/ Masao Kawaguchi |

| Masao Kawaguchi |

| General Manager |

| Finance Division |

| Honda Motor Co., Ltd. |

Date: February 10, 2021

HONDA MOTOR CO., LTD. REPORTS

CONSOLIDATED FINANCIAL RESULTS

FOR THE FISCAL THIRD QUARTER AND

THE FISCAL NINE-MONTH PERIOD ENDED DECEMBER 31, 2020

Tokyo, February 9, 2021 — Honda Motor Co., Ltd. today announced its consolidated financial results for the fiscal third quarter and the fiscal nine-month period ended December 31, 2020.

Nine Months Results

While the global economy which had slowed down due to the spread of coronavirus disease 2019 (COVID-19) has been on a recovery track, it has still affected Honda’s consolidated financial results for the nine months ended December 31, 2020.

Resulting from travel restriction measures by government, Honda’s production bases in Japan and overseas were also affected by suspended or reduced production mainly due to restrictions on employees’ commute to the workplaces and delays in the supply of parts within the supply chain. Some dealers in Japan and overseas were obliged to suspend business, shorten business hours, or reduce services such as inspections and repairs. As of the date of this report, Honda has been largely resuming its business activities and there is no significant impact on its businesses in major countries or regions.

Honda’s consolidated sales revenue for the nine months ended December 31, 2020 decreased by 16.8%, to JPY 9,546.7 billion from the same period last year, due mainly to decreased sales revenue in all business operations. Operating profit decreased by 30.1%, to JPY 447.0 billion from the same period last year, due mainly to a decrease in profit attributable to decreased sales revenue and model mix, which was partially offset by decreased selling, general and administrative expenses as well as continuing cost reduction. Profit before income taxes decreased by 16.2%, to JPY 658.7 billion from the same period last year. Profit for the period attributable to owners of the parent decreased by 8.5%, to JPY 444.1 billion from the same period last year.

Earnings per share attributable to owners of the parent for the period amounted to JPY 257.21, a decrease of JPY 18.92 from the corresponding period last year. One Honda American Depository Share represents one common share.

Third Quarter Results

Consolidated sales revenue for the three months ended December 31, 2020 increased by 0.6%, to JPY 3,771.5 billion from the same period last year, due mainly to increased sales revenue in Automobile business and Financial services business operations, which was partially offset by decreased sales revenue in Motorcycle business operations as well as negative foreign currency translation effects. Operating profit increased by 66.7%, to JPY 277.7 billion from the same period last year, due mainly to decreased R&D expenses as well as continuing cost reduction, which was partially offset by increased selling, general and administrative expenses as well as negative foreign currency effects. Profit before income taxes increased by 86.9%, to JPY 386.4 billion from the same period last year. Profit for the period attributable to owners of the parent increased by 144.0%, to JPY 284.0 billion from the same period last year.

Earnings per share attributable to owners of the parent for the period amounted to JPY 164.51, an increase of JPY 98.14 from the corresponding period last year.

—1—

Consolidated Statements of Financial Position for the Fiscal Nine Months Ended December 31, 2020

Total assets increased by JPY 318.7 billion, to JPY 20,780.2 billion from March 31, 2020 due mainly to an increase in cash and cash equivalents, equipment on operating leases as well as other financial assets, which was partially offset by negative foreign currency translation effects. Total liabilities increased by JPY 28.7 billion, to JPY 12,204.1 billion from March 31, 2020 due mainly to increased financing liabilities, which was partially offset by negative foreign currency translation effects. Total equity increased by JPY 290.0 billion, to JPY 8,576.0 billion from March 31, 2020 due mainly to increased retained earnings attributable to profit for the period, which was partially offset by negative foreign currency translation effects.

Consolidated Statements of Cash Flows for the Fiscal Nine Months Ended December 31, 2020

Consolidated cash and cash equivalents on December 31, 2020 increased by JPY 200.9 billion from March 31, 2020, to JPY 2,873.2 billion. The reasons for the increases or decreases for each cash flow activity, when compared with the same period last year, are as follows:

Net cash provided by operating activities amounted to JPY 826.1 billion of cash inflows. Cash inflows from operating activities increased by JPY 220.7 billion from the same period last year, due mainly to decreased payments for parts and raw materials, which was partially offset by decreased cash received from customers.

Net cash used in investing activities amounted to JPY 663.6 billion of cash outflows. Cash outflows from investing activities increased by JPY 227.6 billion from the same period last year, due mainly to increased payments for acquisitions of investments accounted for using the equity method as well as decreased proceeds from sales and redemptions of other financial assets.

Net cash provided by financing activities amounted to JPY 81.5 billion of cash inflows. Cash inflows from financing activities increased by JPY 281.6 billion from the same period last year, due mainly to increased proceeds from financing liabilities.

—2—

Forecasts for the Fiscal Year Ending March 31, 2021

In regard to the forecasts of the financial results for the fiscal year ending March 31, 2021, Honda projects consolidated results to be as shown below:

Fiscal year ending March 31, 2021

| Yen (billions) | Changes from FY 2020 | |||||||

Sales revenue | 12,950.0 | - 13.3 | % | |||||

Operating profit | 520.0 | - 17.9 | % | |||||

Profit before income taxes | 745.0 | - 5.7 | % | |||||

Profit for the year | 500.0 | - 1.9 | % | |||||

Profit for the year attributable to owners of the parent | 465.0 | + 2.0 | % | |||||

| Yen | ||||||||

Earnings per share attributable to owners of the parent | ||||||||

Basic and diluted | 269.31 | |||||||

Note: The forecasts are based on the assumption that the average exchange rates for the Japanese yen to the U.S. dollar will be JPY 105 for the full year ending March 31, 2021.

The reasons for the increases or decreases in the forecasts of the operating profit, and profit before income taxes for the fiscal year ending March 31, 2021 from the previous year are as follows.

| Yen (billions) | ||||

Revenue, model mix, etc. | - 418.6 | |||

Cost reduction, the effect of raw material cost fluctuations, etc. | + 117.0 | |||

SG&A expenses | + 211.0 | |||

R&D expenses | + 46.0 | |||

Currency effect | - 69.0 | |||

|

| |||

Operating profit compared with fiscal year ended March 31, 2020 | - 113.6 | |||

|

| |||

Share of profit of investments accounted for using the equity method | + 70.7 | |||

Finance income and finance costs | - 2.0 | |||

|

| |||

Profit before income taxes compared with fiscal year ended March 31, 2020 | - 44.9 | |||

|

| |||

Dividend per Share of Common Stock

Fiscal third quarter dividend is JPY 26 per share of common stock. The total expected annual dividend per share of common stock for the fiscal year ending March 31, 2021, is JPY 82 per share.

This announcement contains “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are based on management’s assumptions and beliefs taking into account information currently available to it. Therefore, please be advised that the actual results of the Company could differ materially from those described in these forward-looking statements as a result of numerous factors, including general economic conditions in the principal markets of the Company, its consolidated subsidiaries and its affiliates accounted for by the equity-method, and fluctuation of foreign exchange rates, as well as other factors detailed from time to time. The various factors for increases and decreases in profit have been classified in accordance with a method that Honda considers reasonable.

—3—

[1] Condensed Consolidated Statements of Financial Position

March 31, 2020 and December 31, 2020

| Yen (millions) | ||||||||

| Mar. 31, 2020 | Dec. 31, 2020 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | 2,672,353 | 2,873,289 | ||||||

Trade receivables | 633,909 | 639,755 | ||||||

Receivables from financial services | 1,878,358 | 1,684,526 | ||||||

Other financial assets | 190,053 | 352,123 | ||||||

Inventories | 1,560,568 | 1,448,639 | ||||||

Other current assets | 365,769 | 361,229 | ||||||

|

|

|

| |||||

Total current assets | 7,301,010 | 7,359,561 | ||||||

|

|

|

| |||||

Non-current assets: | ||||||||

Investments accounted for using the equity method | 655,475 | 804,181 | ||||||

Receivables from financial services | 3,282,807 | 3,340,466 | ||||||

Other financial assets | 441,724 | 626,746 | ||||||

Equipment on operating leases | 4,626,063 | 4,603,672 | ||||||

Property, plant and equipment | 3,051,704 | 2,921,098 | ||||||

Intangible assets | 760,434 | 807,739 | ||||||

Deferred tax assets | 132,553 | 86,318 | ||||||

Other non-current assets | 209,695 | 230,422 | ||||||

|

|

|

| |||||

Total non-current assets | 13,160,455 | 13,420,642 | ||||||

|

|

|

| |||||

Total assets | 20,461,465 | 20,780,203 | ||||||

|

|

|

| |||||

Liabilities and Equity | ||||||||

Current liabilities: | ||||||||

Trade payables | 958,469 | 959,136 | ||||||

Financing liabilities | 3,248,457 | 3,323,459 | ||||||

Accrued expenses | 449,716 | 369,960 | ||||||

Other financial liabilities | 209,065 | 169,775 | ||||||

Income taxes payable | 43,759 | 45,945 | ||||||

Provisions | 287,175 | 311,461 | ||||||

Other current liabilities | 593,447 | 545,940 | ||||||

|

|

|

| |||||

Total current liabilities | 5,790,088 | 5,725,676 | ||||||

|

|

|

| |||||

Non-current liabilities: | ||||||||

Financing liabilities | 4,221,229 | 4,305,653 | ||||||

Other financial liabilities | 303,570 | 286,330 | ||||||

Retirement benefit liabilities | 578,909 | 570,174 | ||||||

Provisions | 238,439 | 264,109 | ||||||

Deferred tax liabilities | 698,868 | 712,612 | ||||||

Other non-current liabilities | 344,339 | 339,597 | ||||||

|

|

|

| |||||

Total non-current liabilities | 6,385,354 | 6,478,475 | ||||||

|

|

|

| |||||

Total liabilities | 12,175,442 | 12,204,151 | ||||||

|

|

|

| |||||

Equity: | ||||||||

Common stock | 86,067 | 86,067 | ||||||

Capital surplus | 171,823 | 172,026 | ||||||

Treasury stock | (273,940 | ) | (273,820 | ) | ||||

Retained earnings | 8,142,948 | 8,487,222 | ||||||

Other components of equity | (114,639 | ) | (164,892 | ) | ||||

|

|

|

| |||||

Equity attributable to owners of the parent | 8,012,259 | 8,306,603 | ||||||

Non-controlling interests | 273,764 | 269,449 | ||||||

|

|

|

| |||||

Total equity | 8,286,023 | 8,576,052 | ||||||

|

|

|

| |||||

Total liabilities and equity | 20,461,465 | 20,780,203 | ||||||

|

|

|

| |||||

—4—

[2] Condensed Consolidated Statements of Income and Condensed Consolidated Statements of Comprehensive Income

Condensed Consolidated Statements of Income

For the nine months ended December 31, 2019 and 2020

| Yen (millions) | ||||||||

| Nine months ended Dec. 31, 2019 | Nine months ended Dec. 31, 2020 | |||||||

Sales revenue | 11,472,949 | 9,546,713 | ||||||

Operating costs and expenses: | ||||||||

Cost of sales | (9,090,126 | ) | (7,594,521 | ) | ||||

Selling, general and administrative | (1,163,591 | ) | (1,004,211 | ) | ||||

Research and development | (579,978 | ) | (500,981 | ) | ||||

|

|

|

| |||||

Total operating costs and expenses | (10,833,695 | ) | (9,099,713 | ) | ||||

|

|

|

| |||||

Operating profit | 639,254 | 447,000 | ||||||

|

|

|

| |||||

Share of profit of investments accounted for using the equity method | 149,731 | 204,570 | ||||||

Finance income and finance costs: | ||||||||

Interest income | 38,565 | 13,572 | ||||||

Interest expense | (15,125 | ) | (8,563 | ) | ||||

Other, net | (26,257 | ) | 2,128 | |||||

|

|

|

| |||||

Total finance income and finance costs | (2,817 | ) | 7,137 | |||||

|

|

|

| |||||

Profit before income taxes | 786,168 | 658,707 | ||||||

Income tax expense | (254,713 | ) | (186,809 | ) | ||||

|

|

|

| |||||

Profit for the period | 531,455 | 471,898 | ||||||

|

|

|

| |||||

Profit for the period attributable to: | ||||||||

Owners of the parent | 485,288 | 444,102 | ||||||

Non-controlling interests | 46,167 | 27,796 | ||||||

| Yen | ||||||||

Earnings per share attributable to owners of the parent | ||||||||

Basic and diluted | 276.13 | 257.21 | ||||||

—5—

Condensed Consolidated Statements of Comprehensive Income

For the nine months ended December 31, 2019 and 2020

| Yen (millions) | ||||||||

| Nine months ended Dec. 31, 2019 | Nine months ended Dec. 31, 2020 | |||||||

Profit for the period | 531,455 | 471,898 | ||||||

Other comprehensive income, net of tax: | ||||||||

Items that will not be reclassified to profit or loss | ||||||||

Remeasurements of defined benefit plans | — | — | ||||||

Net changes in revaluation of financial assets measured at fair value through other comprehensive income | 3,337 | 64,000 | ||||||

Share of other comprehensive income of investments accounted for using the equity method | 704 | 613 | ||||||

Items that may be reclassified subsequently to profit or loss | ||||||||

Net changes in revaluation of financial assets measured at fair value through other comprehensive income | 99 | 127 | ||||||

Exchange differences on translating foreign operations | (90,608 | ) | (114,008 | ) | ||||

Share of other comprehensive income of investments accounted for using the equity method | (23,331 | ) | 5,772 | |||||

|

|

|

| |||||

Total other comprehensive income, net of tax | (109,799 | ) | (43,496 | ) | ||||

|

|

|

| |||||

Comprehensive income for the period | 421,656 | 428,402 | ||||||

|

|

|

| |||||

Comprehensive income for the period attributable to: | ||||||||

Owners of the parent | 378,667 | 394,202 | ||||||

Non-controlling interests | 42,989 | 34,200 | ||||||

—6—

Condensed Consolidated Statements of Income

For the three months ended December 31, 2019 and 2020

| Yen (millions) | ||||||||

| Three months ended Dec. 31, 2019 | Three months ended Dec. 31, 2020 | |||||||

Sales revenue | 3,747,593 | 3,771,569 | ||||||

Operating costs and expenses: | ||||||||

Cost of sales | (2,966,552 | ) | (2,940,964 | ) | ||||

Selling, general and administrative | (379,648 | ) | (381,019 | ) | ||||

Research and development | (234,744 | ) | (171,851 | ) | ||||

|

|

|

| |||||

Total operating costs and expenses | (3,580,944 | ) | (3,493,834 | ) | ||||

|

|

|

| |||||

Operating profit | 166,649 | 277,735 | ||||||

|

|

|

| |||||

Share of profit of investments accounted for using the equity method | 41,552 | 102,274 | ||||||

Finance income and finance costs: | ||||||||

Interest income | 12,305 | 4,695 | ||||||

Interest expense | (7,530 | ) | (2,014 | ) | ||||

Other, net | (6,243 | ) | 3,733 | |||||

|

|

|

| |||||

Total finance income and finance costs | (1,468 | ) | 6,414 | |||||

|

|

|

| |||||

Profit before income taxes | 206,733 | 386,423 | ||||||

Income tax expense | (75,043 | ) | (87,094 | ) | ||||

|

|

|

| |||||

Profit for the period | 131,690 | 299,329 | ||||||

|

|

|

| |||||

Profit for the period attributable to: | ||||||||

Owners of the parent | 116,432 | 284,051 | ||||||

Non-controlling interests | 15,258 | 15,278 | ||||||

| Yen | ||||||||

Earnings per share attributable to owners of the parent | ||||||||

Basic and diluted | 66.37 | 164.51 | ||||||

—7—

Condensed Consolidated Statements of Comprehensive Income

For the three months ended December 31, 2019 and 2020

| Yen (millions) | ||||||||

| Three months ended Dec. 31, 2019 | Three months ended Dec. 31, 2020 | |||||||

Profit for the period | 131,690 | 299,329 | ||||||

Other comprehensive income, net of tax: | ||||||||

Items that will not be reclassified to profit or loss | ||||||||

Remeasurements of defined benefit plans | — | — | ||||||

Net changes in revaluation of financial assets measured at fair value through other comprehensive income | 8,030 | 45,754 | ||||||

Share of other comprehensive income of investments accounted for using the equity method | 1,308 | 1,040 | ||||||

Items that may be reclassified subsequently to profit or loss | ||||||||

Net changes in revaluation of financial assets measured at fair value through other comprehensive income | (65 | ) | 13 | |||||

Exchange differences on translating foreign operations | 77,102 | (36,418 | ) | |||||

Share of other comprehensive income of investments accounted for using the equity method | 8,240 | 5,297 | ||||||

|

|

|

| |||||

Total other comprehensive income, net of tax | 94,615 | 15,686 | ||||||

|

|

|

| |||||

Comprehensive income for the period | 226,305 | 315,015 | ||||||

|

|

|

| |||||

Comprehensive income for the period attributable to: | ||||||||

Owners of the parent | 205,575 | 296,866 | ||||||

Non-controlling interests | 20,730 | 18,149 | ||||||

—8—

[3] Condensed Consolidated Statements of Changes in Equity

For the nine months ended December 31, 2019

| Yen (millions) | ||||||||||||||||||||||||||||||||

| Equity attributable to owners of the parent | Non-controlling interests | Total equity | ||||||||||||||||||||||||||||||

| Common stock | Capital surplus | Treasury stock | Retained earnings | Other components of equity | Total | |||||||||||||||||||||||||||

Balance as of April 1, 2019 | 86,067 | 171,460 | (177,827 | ) | 7,973,637 | 214,383 | 8,267,720 | 298,070 | 8,565,790 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Comprehensive income for the period | ||||||||||||||||||||||||||||||||

Profit for the period | 485,288 | 485,288 | 46,167 | 531,455 | ||||||||||||||||||||||||||||

Other comprehensive income, net of tax | (106,621 | ) | (106,621 | ) | (3,178 | ) | (109,799 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income for the period | 485,288 | (106,621 | ) | 378,667 | 42,989 | 421,656 | ||||||||||||||||||||||||||

Reclassification to retained earnings | (40 | ) | 40 | — | — | |||||||||||||||||||||||||||

Transactions with owners and other | ||||||||||||||||||||||||||||||||

Dividends paid | (147,863 | ) | (147,863 | ) | (54,987 | ) | (202,850 | ) | ||||||||||||||||||||||||

Purchases of treasury stock | (39,475 | ) | (39,475 | ) | (39,475 | ) | ||||||||||||||||||||||||||

Disposal of treasury stock | 79 | 79 | 79 | |||||||||||||||||||||||||||||

Share-based payment transactions | 330 | 330 | 330 | |||||||||||||||||||||||||||||

Equity transactions and others | (3,049 | ) | (3,049 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total transactions with owners and other | 330 | (39,396 | ) | (147,863 | ) | (186,929 | ) | (58,036 | ) | (244,965 | ) | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Other changes | 1,775 | 1,775 | 1,775 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Balance as of December 31, 2019 | 86,067 | 171,790 | (217,223 | ) | 8,312,797 | 107,802 | 8,461,233 | 283,023 | 8,744,256 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

| For the nine months ended December 31, 2020 |

| |||||||||||||||||||||||||||||||

| Yen (millions) | ||||||||||||||||||||||||||||||||

| Equity attributable to owners of the parent | Non-controlling interests | Total equity | ||||||||||||||||||||||||||||||

| Common stock | Capital surplus | Treasury stock | Retained earnings | Other components of equity | Total | |||||||||||||||||||||||||||

Balance as of April 1, 2020 | 86,067 | 171,823 | (273,940 | ) | 8,142,948 | (114,639 | ) | 8,012,259 | 273,764 | 8,286,023 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Comprehensive income for the period | ||||||||||||||||||||||||||||||||

Profit for the period | 444,102 | 444,102 | 27,796 | 471,898 | ||||||||||||||||||||||||||||

Other comprehensive income, net of tax | (49,900 | ) | (49,900 | ) | 6,404 | (43,496 | ) | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income for the period | 444,102 | (49,900 | ) | 394,202 | 34,200 | 428,402 | ||||||||||||||||||||||||||

Reclassification to retained earnings | 353 | (353 | ) | — | — | |||||||||||||||||||||||||||

Transactions with owners and other | ||||||||||||||||||||||||||||||||

Dividends paid | (100,181 | ) | (100,181 | ) | (40,766 | ) | (140,947 | ) | ||||||||||||||||||||||||

Purchases of treasury stock | (4 | ) | (4 | ) | (4 | ) | ||||||||||||||||||||||||||

Disposal of treasury stock | 124 | 124 | 124 | |||||||||||||||||||||||||||||

Share-based payment transactions | 203 | 203 | 203 | |||||||||||||||||||||||||||||

Equity transactions and others | 2,251 | 2,251 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total transactions with owners and other | 203 | 120 | (100,181 | ) | (99,858 | ) | (38,515 | ) | (138,373 | ) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Balance as of December 31, 2020 | 86,067 | 172,026 | (273,820 | ) | 8,487,222 | (164,892 | ) | 8,306,603 | 269,449 | 8,576,052 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

—9—

[4] Condensed Consolidated Statements of Cash Flows

For the nine months ended December 31, 2019 and 2020

| Yen (millions) | ||||||||

| Nine months ended Dec. 31, 2019 | Nine months ended Dec. 31, 2020 | |||||||

Cash flows from operating activities: | ||||||||

Profit before income taxes | 786,168 | 658,707 | ||||||

Depreciation, amortization and impairment losses excluding equipment on operating leases | 529,727 | 444,545 | ||||||

Share of profit of investments accounted for using the equity method | (149,731 | ) | (204,570 | ) | ||||

Finance income and finance costs, net | (36,878 | ) | 52,741 | |||||

Interest income and interest costs from financial services, net | (98,250 | ) | (99,425 | ) | ||||

Changes in assets and liabilities | ||||||||

Trade receivables | 144,006 | 6,927 | ||||||

Inventories | (14,088 | ) | 88,067 | |||||

Trade payables | (208,556 | ) | 78,928 | |||||

Accrued expenses | (56,143 | ) | (72,394 | ) | ||||

Provisions and retirement benefit liabilities | (34,155 | ) | 86,077 | |||||

Receivables from financial services | 30,472 | (11,553 | ) | |||||

Equipment on operating leases | (248,773 | ) | (118,989 | ) | ||||

Other assets and liabilities | (104,211 | ) | (151,391 | ) | ||||

Other, net | 3,782 | (608 | ) | |||||

Dividends received | 104,657 | 119,642 | ||||||

Interest received | 218,353 | 177,097 | ||||||

Interest paid | (113,631 | ) | (83,502 | ) | ||||

Income taxes paid, net of refunds | (147,350 | ) | (144,107 | ) | ||||

|

|

|

| |||||

Net cash provided by operating activities | 605,399 | 826,192 | ||||||

Cash flows from investing activities: | ||||||||

Payments for additions to property, plant and equipment | (250,995 | ) | (227,151 | ) | ||||

Payments for additions to and internally developed intangible assets | (159,851 | ) | (165,830 | ) | ||||

Proceeds from sales of property, plant and equipment and intangible assets | 10,307 | 4,680 | ||||||

Payments for acquisitions of subsidiaries, net of cash and cash equivalents acquired | (3,047 | ) | 2,230 | |||||

Payments for acquisitions of investments accounted for using the equity method | (4,802 | ) | (110,747 | ) | ||||

Proceeds from sales of investments accounted for using the equity method | — | 10,376 | ||||||

Payments for acquisitions of other financial assets | (240,295 | ) | (311,873 | ) | ||||

Proceeds from sales and redemptions of other financial assets | 214,102 | 134,639 | ||||||

Other, net | (1,404 | ) | — | |||||

|

|

|

| |||||

Net cash used in investing activities | (435,985 | ) | (663,676 | ) | ||||

Cash flows from financing activities: | ||||||||

Proceeds from short-term financing liabilities | 6,226,745 | 6,992,681 | ||||||

Repayments of short-term financing liabilities | (6,348,745 | ) | (6,781,179 | ) | ||||

Proceeds from long-term financing liabilities | 1,398,797 | 1,356,619 | ||||||

Repayments of long-term financing liabilities | (1,182,699 | ) | (1,304,276 | ) | ||||

Dividends paid to owners of the parent | (147,863 | ) | (100,181 | ) | ||||

Dividends paid to non-controlling interests | (47,043 | ) | (34,134 | ) | ||||

Purchases and sales of treasury stock, net | (39,396 | ) | 120 | |||||

Repayments of lease liabilities | (55,689 | ) | (47,584 | ) | ||||

Other, net | (4,237 | ) | (555 | ) | ||||

|

|

|

| |||||

Net cash provided by (used in) financing activities | (200,130 | ) | 81,511 | |||||

Effect of exchange rate changes on cash and cash equivalents | (21,581 | ) | (43,091 | ) | ||||

|

|

|

| |||||

Net change in cash and cash equivalents | (52,297 | ) | 200,936 | |||||

Cash and cash equivalents at beginning of year | 2,494,121 | 2,672,353 | ||||||

|

|

|

| |||||

Cash and cash equivalents at end of period | 2,441,824 | 2,873,289 | ||||||

|

|

|

| |||||

—10—

[5] Assumptions for Going Concern

None

[6] Notes to Consolidated Financial Statements

[A] Segment Information

Honda has four reportable segments: Motorcycle business, Automobile business, Financial services business and Life creation and other businesses, which are based on Honda’s organizational structure and characteristics of products and services. Operating segments are defined as the components of Honda for which separate financial information is available that is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performance. The accounting policies used for these reportable segments are consistent with the accounting policies used in the Company’s condensed consolidated interim financial statements.

Principal products and services, and functions of each segment are as follows:

Segment | Principal products and services | Functions | ||

Motorcycle Business | Motorcycles, all-terrain vehicles (ATVs), side-by-sides (SxS) and relevant parts | Research and development Manufacturing Sales and related services | ||

Automobile Business | Automobiles and relevant parts | Research and development Manufacturing Sales and related services | ||

Financial Services Business | Financial services | Retail loan and lease related to Honda products Others | ||

Life Creation and Other Businesses | Power products and relevant parts, and others | Research and development Manufacturing Sales and related services Others | ||

Segment information based on products and services

As of and for the nine months ended December 31, 2019

| Yen (millions) | ||||||||||||||||||||||||||||

| Motorcycle Business | Automobile Business | Financial Services Business | Life Creation and Other Businesses | Segment Total | Reconciling Items | Consolidated | ||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||

External customers | 1,585,770 | 7,691,119 | 1,961,952 | 234,108 | 11,472,949 | — | 11,472,949 | |||||||||||||||||||||

Intersegment | — | 164,786 | 10,626 | 19,317 | 194,729 | (194,729 | ) | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 1,585,770 | 7,855,905 | 1,972,578 | 253,425 | 11,667,678 | (194,729 | ) | �� | 11,472,949 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment profit (loss) | 222,182 | 229,000 | 196,761 | (8,689 | ) | 639,254 | — | 639,254 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment assets | 1,519,250 | 7,837,663 | 10,373,083 | 362,483 | 20,092,479 | 396,227 | 20,488,706 | |||||||||||||||||||||

Depreciation and amortization | 50,147 | 417,950 | 615,663 | 10,777 | 1,094,537 | — | 1,094,537 | |||||||||||||||||||||

Capital expenditures | 52,849 | 328,282 | 1,730,700 | 10,574 | 2,122,405 | — | 2,122,405 | |||||||||||||||||||||

As of and for the nine months ended December 31, 2020

|

| |||||||||||||||||||||||||||

| Yen (millions) | ||||||||||||||||||||||||||||

| Motorcycle Business | Automobile Business | Financial Services Business | Life Creation and Other Businesses | Segment Total | Reconciling Items | Consolidated | ||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||

External customers | 1,258,173 | 6,207,728 | 1,853,641 | 227,171 | 9,546,713 | — | 9,546,713 | |||||||||||||||||||||

Intersegment | — | 153,209 | 9,520 | 14,270 | 176,999 | (176,999 | ) | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 1,258,173 | 6,360,937 | 1,863,161 | 241,441 | 9,723,712 | (176,999 | ) | 9,546,713 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment profit (loss) | 152,379 | 52,624 | 250,581 | (8,584 | ) | 447,000 | — | 447,000 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment assets | 1,382,083 | 8,061,407 | 10,280,529 | 360,515 | 20,084,534 | 695,669 | 20,780,203 | |||||||||||||||||||||

Depreciation and amortization | 50,324 | 378,524 | 617,238 | 11,484 | 1,057,570 | — | 1,057,570 | |||||||||||||||||||||

Capital expenditures | 28,358 | 348,446 | 1,485,375 | 7,004 | 1,869,183 | — | 1,869,183 | |||||||||||||||||||||

—11—

For the three months ended December 31, 2019

| Yen (millions) | ||||||||||||||||||||||||||||

| Motorcycle Business | Automobile Business | Financial Services Business | Life Creation and Other Businesses | Segment Total | Reconciling Items | Consolidated | ||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||

External customers | 530,227 | 2,523,149 | 616,318 | 77,899 | 3,747,593 | — | 3,747,593 | |||||||||||||||||||||

Intersegment | — | 51,736 | 3,470 | 8,471 | 63,677 | (63,677 | ) | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 530,227 | 2,574,885 | 619,788 | 86,370 | 3,811,270 | (63,677 | ) | 3,747,593 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment profit (loss) | 74,527 | 33,707 | 64,599 | (6,184 | ) | 166,649 | — | 166,649 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

For the three months ended December 31, 2020

|

| |||||||||||||||||||||||||||

| Yen (millions) | ||||||||||||||||||||||||||||

| Motorcycle Business | Automobile Business | Financial Services Business | Life Creation and Other Businesses | Segment Total | Reconciling Items | Consolidated | ||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||

External customers | 490,857 | 2,585,190 | 614,549 | 80,973 | 3,771,569 | — | 3,771,569 | |||||||||||||||||||||

Intersegment | — | 52,925 | 3,097 | 5,434 | 61,456 | (61,456 | ) | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 490,857 | 2,638,115 | 617,646 | 86,407 | 3,833,025 | (61,456 | ) | 3,771,569 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment profit (loss) | 72,715 | 123,127 | 85,715 | (3,822 | ) | 277,735 | — | 277,735 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Explanatory notes:

| 1. | Intersegment sales revenues are generally made at values that approximate arm’s-length prices. |

| 2. | Reconciling items include elimination of intersegment transactions and balances as well as unallocated corporate assets. Unallocated corporate assets, included in reconciling items as of December 31, 2019 and 2020 amounted to JPY 650,927 million and JPY 931,069 million, respectively, which consist primarily of the Company’s cash and cash equivalents and financial assets measured at fair value through other comprehensive income. |

In addition to the disclosure required by IFRS, Honda provides the following supplemental information for the financial statements users:

Supplemental geographical information based on the location of the Company and its subsidiaries

As of and for the nine months ended December 31, 2019

| Yen (millions) | ||||||||||||||||||||||||||||||||

| Japan | North America | Europe | Asia | Other Regions | Total | Reconciling Items | Consolidated | |||||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||||||

External customers | 1,714,572 | 6,259,055 | 426,596 | 2,532,782 | 539,944 | 11,472,949 | — | 11,472,949 | ||||||||||||||||||||||||

Inter-geographic areas | 1,623,743 | 285,634 | 156,462 | 500,784 | 5,239 | 2,571,862 | (2,571,862 | ) | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total | 3,338,315 | 6,544,689 | 583,058 | 3,033,566 | 545,183 | 14,044,811 | (2,571,862 | ) | 11,472,949 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Operating profit (loss) | 38,066 | 280,736 | 11,004 | 274,911 | 35,555 | 640,272 | (1,018 | ) | 639,254 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Assets | 4,812,390 | 11,366,463 | 652,222 | 2,966,416 | 625,857 | 20,423,348 | 65,358 | 20,488,706 | ||||||||||||||||||||||||

Non-current assets other than financial instruments, deferred tax assets and net defined benefit assets | 2,936,823 | 4,816,100 | 59,005 | 687,869 | 133,830 | 8,633,627 | — | 8,633,627 | ||||||||||||||||||||||||

As of and for the nine months ended December 31, 2020 |

| |||||||||||||||||||||||||||||||

| Yen (millions) | ||||||||||||||||||||||||||||||||

| Japan | North America | Europe | Asia | Other Regions | Total | Reconciling Items | Consolidated | |||||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||||||

External customers | 1,559,844 | 5,200,322 | 350,963 | 2,124,773 | 310,811 | 9,546,713 | — | 9,546,713 | ||||||||||||||||||||||||

Inter-geographic areas | 1,189,865 | 270,594 | 121,711 | 329,638 | 4,509 | 1,916,317 | (1,916,317 | ) | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total | 2,749,709 | 5,470,916 | 472,674 | 2,454,411 | 315,320 | 11,463,030 | (1,916,317 | ) | 9,546,713 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Operating profit (loss) | (31,386 | ) | 269,236 | 18,352 | 170,069 | 421 | 426,692 | 20,308 | 447,000 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Assets | 5,048,475 | 11,271,264 | 666,494 | 2,996,726 | 484,914 | 20,467,873 | 312,330 | 20,780,203 | ||||||||||||||||||||||||

Non-current assets other than financial instruments, deferred tax assets and net defined benefit assets | 3,038,243 | 4,637,887 | 58,660 | 643,185 | 114,368 | 8,492,343 | — | 8,492,343 | ||||||||||||||||||||||||

—12—

For the three months ended December 31, 2019

| Yen (millions) | ||||||||||||||||||||||||||||||||

| Japan | North America | Europe | Asia | Other Regions | Total | Reconciling Items | Consolidated | |||||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||||||

External customers | 502,173 | 2,074,816 | 135,220 | 855,119 | 180,265 | 3,747,593 | — | 3,747,593 | ||||||||||||||||||||||||

Inter-geographic areas | 542,748 | 88,038 | 55,104 | 161,475 | 1,589 | 848,954 | (848,954 | ) | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total | 1,044,921 | 2,162,854 | 190,324 | 1,016,594 | 181,854 | 4,596,547 | (848,954 | ) | 3,747,593 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Operating profit (loss) | (43,134 | ) | 101,755 | 1,201 | 88,633 | 27,130 | 175,585 | (8,936 | ) | 166,649 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

For the three months ended December 31, 2020

|

| |||||||||||||||||||||||||||||||

| Yen (millions) | ||||||||||||||||||||||||||||||||

| Japan | North America | Europe | Asia | Other Regions | Total | Reconciling Items | Consolidated | |||||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||||||

External customers | 559,587 | 2,068,582 | 114,672 | 892,829 | 135,899 | 3,771,569 | — | 3,771,569 | ||||||||||||||||||||||||

Inter-geographic areas | 518,693 | 99,268 | 58,881 | 136,149 | 1,887 | 814,878 | (814,878 | ) | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total | 1,078,280 | 2,167,850 | 173,553 | 1,028,978 | 137,786 | 4,586,447 | (814,878 | ) | 3,771,569 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Operating profit (loss) | 43,691 | 149,920 | 7,114 | 79,132 | (1,653 | ) | 278,204 | (469 | ) | 277,735 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Explanatory notes:

| 1. | Major countries in each geographic area: |

North America | United States, Canada, Mexico | |

Europe | United Kingdom, Germany, Belgium, Italy, France | |

Asia | Thailand, Indonesia, China, India, Vietnam | |

Other Regions | Brazil, Australia |

| 2. | Sales revenues between geographic areas are generally made at values that approximate arm’s-length prices. |

| 3. | Reconciling items include elimination of inter-geographic transactions and balances as well as unallocated corporate assets. Unallocated corporate assets, included in reconciling items as of December 31, 2019 and 2020 amounted to JPY 650,927 million and JPY 931,069 million, respectively, which consist primarily of the Company’s cash and cash equivalents and financial assets measured at fair value through other comprehensive income. |

—13—

[B] Other

Loss related to airbag inflators

Honda has been conducting market-based measures in relation to airbag inflators. Honda recognizes a provision for specific warranty costs when it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation. There is a possibility that Honda will need to recognize additional provisions when new evidence related to the product recalls arise, however, it is not possible for Honda to reasonably estimate the amount and timing of potential future losses as of the date of this report.

—14—

February 9, 2021

| To: | Shareholders of Honda Motor Co., Ltd. |

| From: | Honda Motor Co., Ltd. |

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo, 107-8556

Takahiro Hachigo

President and Representative Director

Notice of Resolution by the Board of Directors

Concerning Distribution of Surplus (Quarterly Dividends)

and Revision of Dividend Forecast for the Fiscal Year Ending March 31, 2021

The Board of Directors of Honda Motor Co., Ltd. (the “Company”), at its meeting held on February 9, 2021, resolved to make a distribution of surplus (quarterly dividends), the record date of which is December 31, 2020, and revised the amount of the projected dividend per share of common stock for the year ending March 31, 2021 as follows:

Particulars

1. Details of Distribution of Surplus (Quarterly Dividends)

| Resolution | Previous Dividends Forecast (Announced on November 6, 2020) | Dividends Paid for the Second Quarter in Fiscal 2020 | ||||

Record Date | December 31, 2020 | December 31, 2020 | December 31, 2019 | |||

Dividends per Share of Common Stock (yen) | 26 | 19 | 28 | |||

Total Amount of Dividends (million yen) | 44,909 | — | 48,932 | |||

Effective Date | March 8, 2021 | — | March 4, 2020 | |||

Source of Funds for Dividends | Retained Earnings | — | Retained Earnings |

2. Details of the Revised Dividend Payments

| Dividends per Share (yen) | ||||||||||

Record Date | End of First Quarter | End of Second Quarter | End of Third Quarter | Fiscal Year-end | Total | |||||

Latest Dividend Forecast (Announced on November 6, 2020) | — | — | — | 19 | 68 | |||||

Projected Dividends | — | — | — | 26 | 82 | |||||

Dividends Paid in Fiscal 2021 | 11 | 19 | 26 | — | — | |||||

Dividends Paid in Fiscal 2020 | 28 | 28 | 28 | 28 | 112 | |||||

3. Basis of the Distribution of Surplus

The Company considers the redistribution of profits to its shareholders to be one of its most important management issues, and makes distributions after taking into account, among others, its retained earnings for future growth and consolidated earnings performance based on a long-term perspective. The Company resolved that a third quarter dividend payment of ¥26 per share of common stock is to be paid considering its forecast for consolidated financial results for the fiscal year ending March 31, 2021. The Company also revised the amount of the projected dividend per share of common stock for the year ending March 31, 2021 that was announced on November 6, 2020.

HONDA MOTOR CO., LTD.

Last updated: February 9, 2021

Honda Motor Co., Ltd.

Takahiro Hachigo

Contact and telephone number: Legal Division

Telephone: 03-3423-1111 (main number)

Securities code number: 7267

https://www.honda.co.jp

The status of corporate governance at Honda Motor Co., Ltd. (hereinafter, “Honda”, the “Company”) is as follows.

| I. | Basic Approach to Corporate Governance, and Capital Composition, Corporate Attributes and Other Basic Information |

| 1. | Basic Approach |

Honda strives to enhance corporate governance as one of the most important tasks for its management, based on the Company’s basic principle, in order to strengthen the trust of our shareholders/investors, customers and society; encourage timely, decisive and risk-considered decision-making; seek sustainable growth and the enhancement of corporate value over the mid- to long-term; and become “a company that society wants to exist”.

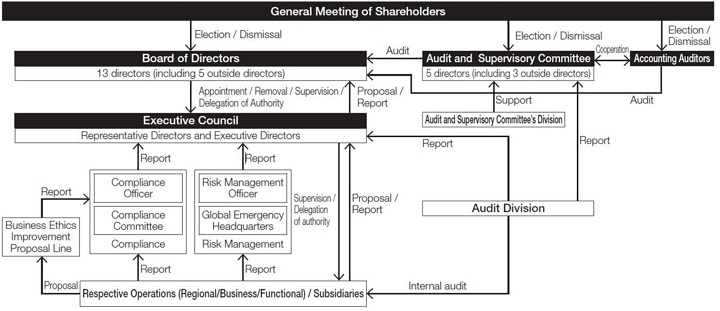

The Company has adopted a “company with an Audit and Supervisory Committee” system with the aim of reinforcing the supervisory function of the Board of Directors and ensuring the prompt decision-making. Under the system, the Company operates the Audit and Supervisory Committee, which consists of directors, to delegate the authority to directors from the Board of Directors and accelerate the separation of the supervisory function and business execution function.

1

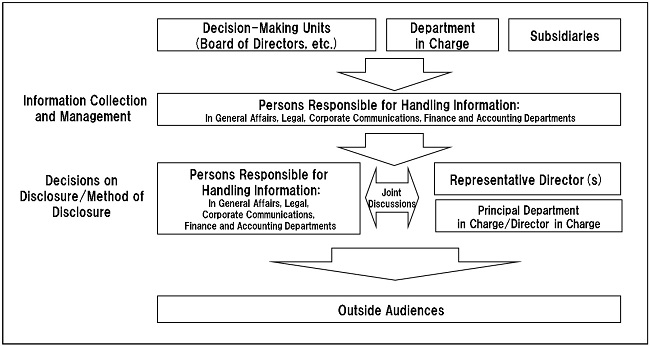

We are making efforts to appropriately disclose corporate information including the release and disclosure of quarterly financial results and management policies in a timely and accurate manner to bolster trust and appreciation from shareholders/investors and society. Going forward, we will continue to strive to ensure the transparency of our management.

Reasons for non-compliance

| • | Supplementary Principle 4.1.2 stating that recognizing that a mid-term business plan is a commitment to shareholders, the board should do their best to achieve the plan. |

In order to make the optimum business judgment promptly and flexibly in today’s constantly changing business environment and at the same time to disclose information in an ideal way for shareholders and investors to help them understand the Company’s business strategies and financial performance correctly, the Company announces the business visions and strategies, as well as business outlook for the single fiscal year.

The Company’s midterm business plans are not announced currently: however, the Executive Council decides on a midterm business plans, checks the progress of such plans, conducts analysis, and revises them as necessary. The Board of Directors deliberates and passes the resolution on a midterm business plans developed by the Executive Council, receives reports on the progress and analysis, and supervises the conditions.

| • | Supplementary Principle 4.10.1 stating that Companies should strengthen the independence, objectivity and accountability of board functions on the matters of nomination and remuneration, by establishing optional advisory committees under the board to which independent directors make significant contributions. |

In making a determination to submit the shareholders’ meeting proposal regarding the election, etc. of a director (excluding directors who are Audit and Supervisory Committee members) and determination or revision of the remuneration structure or the remuneration standards for the directors and officers, the Board of Directors shall discuss the matter after hearing the opinions formed in advance by the Audit and Supervisory Committee to enhance independence, objectivity and accountability of the Board. Thus, the company believes optional advisory committees are not necessary and existing structure is appropriately functioning.

2

Disclosure based on each Corporate Governance Code

Based on the Board of Directors resolutions, “Honda Corporate Governance Basic Policies” showing the company’s basic concept, framework and implementation policy are determined and posted on our website.

URL of “Honda Corporate Governance Basic Policies”:

https://global.honda/content/dam/site/global/investors/cq_img/policy/governance/20210209_governance_policies_e.pdf

[Principle 1.4] Basic policy about cross-shareholdings, verification of appropriateness of the holding, and the voting rights as to the cross-shareholdings

Refer to the Article 16 (Basic Policies for Cross-Shareholdings and Exercise of Voting Rights as to Cross-Shareholdings) of the “Honda Corporate Governance Basic Policies.”

[Principle 1.7] Related Party Transactions

Refer to the Article 10 (Conflicting Interest Transactions) of the “Honda Corporate Governance Basic Policies.”

[Principle 2.6] Effort for company pension fund to function as an asset owner

| • | Pension fund management for the Company is conducted by the Honda Corporate Pension Fund (hereinafter, the “Fund”). |

| • | The Fund avoids conflicts of interests between the fund beneficiaries and the Company by entrusting the management of its reserve fund to multiple investors in and out of Japan, and, the portfolio managers of the entrusted investors make investment decisions and exercise voting rights at their discretion. |

| • | In order for the Fund to enhance its specialist knowledge in fund management and to exercise its function such as monitoring against investors sufficiently, the Company dispatches its officer(s) and/or staff with expertise in finance and human resources to the Fund. Moreover, the Company checks soundness of the overall operation of the Fund through the activities such as deliberations of asset management committee held quarterly. |

3

[Principle 3.1]

| (1) | Business principles, business strategies and business plans |

| Basic principles: | Honda Philosophy is posted on our website. | |

| Business strategies: | “2030 vision” is planned and announced in 2017. | |

| Business plans: | Business forecast for each fiscal year is announced. | |

| (2) | Basic views and guidelines on corporate governance |

Refer to the “Honda Corporate Governance Basic Policies.”

| (3) | Basic policies and procedures in determining the remuneration of the directors and executive officers |

Refer to the Article 12 (Remuneration Policies) of the “Honda Corporate Governance Basic Policies.”

| (4) | Policies and procedures in the nomination and dismissal of directors and operating officers |

Refer to the Article 4 (Policy, etc. for Selection of Candidates for Directors [excluding Directors who are Audit and Supervisory Committee Members]), Article 8 (Policy, etc. for Selection of Candidates for Directors who are Audit and Supervisory Committee Members), and Article 12 (Appointment Policies, Terms, etc. of Office of Executive Officers) of the “Honda Corporate Governance Basic Policies.”

| (5) | Explanations with respect to the individual nominations of candidates for directors |

Refer to the “convening notices for general shareholder meetings” posted on our website.

[Supplementary Principles 4.1.1] Matters to be decided by the Board of Directors and the scope of the matters delegated to the management

Refer to the Article 2 (Roles and Responsibilities of the Board of Directors) of the “Honda Corporate Governance Basic Policies.”

4

[Principle 4.9] Independence Standards and Qualification for Independent Outside Directors

Refer to the Annex 1 (Criteria for Independence of Outside Directors) of the “Honda Corporate Governance Basic Policies” and II-1 of this report (Matters Relating to Independent Directors).

[Supplementary Principles 4.11.1] View on the appropriate balance between knowledge, experience and skills of the board as a whole, and also on diversity and appropriate board size

Refer to the Article 3 (Constitution of the Board of Directors) of the “Honda Corporate Governance Basic Policies.”

[Supplementary Principles 4.11.2] Conditions of the directors also serving as directors at other companies

Refer to the “convening notices for general shareholder meetings” and relevant documents posted on our website.

[Supplementary Principles 4.11.3] Evaluation of effectiveness of the Board of Directors

For each fiscal year, the Company’s Board of Directors carries out an evaluation of the Board as a whole for the purpose of checking the current state of its operational capabilities, subsequently, to enhance effectiveness.

As same as the previous fiscal year, a self-evaluation was conducted by the Company for 2019. Based on the results of a questionnaire and interviews conducted with the Directors, the self-evaluation was deliberated and resolved at the Board of Directors. The self-evaluation questionnaire was prepared under the supervision of outside attorneys. The interviews and the compilation of the results were carried out by outside attorneys as well.

The Board of Directors shared the view that “effectiveness of the Board is ensured appropriately”, by the constitution of the Board of Directors and enhancing provision of useful information to Outside Directors. Further, they also shared the understanding of the needs to provide useful information and to have more thorough discussions over the macroscopic theme and future strategies to further enhance monitoring capabilities of the Board of Directors.

5

The Company will further enhance monitoring capabilities of the Board of Directors to raise effectiveness, by taking measures such as provision of sufficient information to Outside Directors and having thorough discussion over the macroscopic theme and future strategies.

[Supplementary Principles 4.14.2] Training policy for directors

Refer to the Article 9 (Approaches for Improving Board Effectiveness – Director Training) of the “Honda Corporate Governance Basic Policies.”

[Principle 5.1] Policy for Constructive Dialogue with Shareholders

Refer to the Article 17 (Policies for Dialogue with Shareholders) and the Annex 2 (Policies for Promoting Dialogue with Shareholders) of the “Honda Corporate Governance Basic Policies.”

| 2. | Capital Composition |

Percentage of shares held by foreign investors: 30% or more

Principal Shareholders

Name or Designation | Number of Shares Held (thousands) | Percentage of Total Shares Issued (%) | ||||||

The Master Trust Bank of Japan, Ltd. (Trust Account) | 133,949 | 7.75 | ||||||

Japan Trustee Services Bank, Ltd. (Trust Account) | 114,252 | 6.61 | ||||||

SSBTC CLIENT OMNIBUS ACCOUNT | 58,061 | 3.36 | ||||||

Moxley & Co. LLC | 53,915 | 3.12 | ||||||

Meiji Yasuda Life Insurance Company | 51,199 | 2.96 | ||||||

Japan Trustee Services Bank, Ltd. (Trust Account 9) | 46,605 | 2.70 | ||||||

Tokio Marine & Nichido Fire Insurance Co., Ltd. | 35,461 | 2.05 | ||||||

Japan Trustee Services Bank, Ltd. (Trust Account 5) | 32,086 | 1.86 | ||||||

JP Morgan Chase Bank 385151 | 30,145 | 1.75 | ||||||

Nippon Life Insurance Company | 28,666 | 1.66 | ||||||

6

Existence of controlling shareholders (excluding the parent company):

Existence of a parent company: None

Supplementary explanation:

| 3. | Corporate Attributes |

Stock Exchange Listings and market classification: Tokyo Stock Exchange, First Section

Annual closing of accounts: March

Industry classification: Transportation equipment

Number of employees (on a consolidated basis) on the closing date of previous fiscal year: 1,000 or more

Net sales (consolidated) in the previous fiscal year: ¥1 trillion (1,000,000,000,000) or more

Number of consolidated subsidiaries on the closing date of the previous fiscal year: 300 or more

| 4. | Guidelines for Measures for Protection of Minority Shareholders when Conducting Transactions, Etc., with Controlling Shareholders |

7

| 5. | Other Special Situations That Might Have a Major Influence on Corporate Governance |

| (1) | Concept of and policies for group management |

The Company shares Honda philosophy with all group companies, aiming to enhance medium- to long-term corporate values and sustainable growth of entire Honda group. While taking its business characteristic and external environment into consideration, the Company runs the business of the group through maximizing the synergistic effect within the group, making decisions promptly, integrating operation of business, etc., and verifies and reviews the group management when necessary.

| (2) | Reasons for having the listed subsidiaries |

Yachiyo Industry Co., Ltd. (Investment stake: 50.41%)

Yachiyo’s major areas of business are R&D, production, and sales of fuel tanks and sunroofs for automobiles and exhaust system parts for motorcycles. Honda believes that each of their business contributes to competitive advantage of Honda products and to increase the value the Company offers to customers.

Yutaka Giken Co., Ltd. (Investment stake: 69.66%)

Yutaka’s major areas of business are R&D, production, and sales of drive train parts, exhaust system parts, etc. for automobiles. Yutaka also engages in R&D, production, and sales of motor parts for electric vehicles. The Company believes that each of their business contributes to competitive advantage of Honda products and to increase the value the Company offers to customers.

| (3) | Methods to ensure effectiveness of governance system of the listed subsidiaries |

To enhance corporate values of the entire Honda group, the Company shares with its subsidiaries the Company’s Code of Conduct, the basic policy on development of internal control systems, and the risk management policy.

In addition, the Company developed systems for reporting material matters of the management of subsidiaries to the Company, the systems to accept whistle-blowing reports from management and employees of subsidiaries, and others. The Company gives careful consideration of interest of minority shareholders, for example, by supporting the governance system of the listed subsidiary that effectively accepts and utilizes independent outside directors and setting the business terms based on the arm’s length principles with listed subsidiary, and respects the independence of listed subsidiary.

8

| II. | Overview of Management Supervisory Organization Related to Decision Making, Execution and Supervision and Other Corporate Governance Systems |

| 1. | Matters Related to Governance Units and Their Operation, Etc. |

Form of governance organization: Company with audit and supervisory committee

Information on Directors

Number of directors specified in the Articles of Incorporation: 20

Term of directors specified in the Articles of Incorporation: 1 year

Chairperson of the Board of Directors: Chairman

Current number of directors: 13

Appointment of outside directors: Appointed

Number of outside directors: 5

Number of directors specified as independent directors: 5

9

Relationship with the Company (1)

Name | Affiliation | Relationship with the Company | ||||||||||||||||||||||||||||||||||||||||||||

| a | b | c | d | e | f | g | h | i | j | k | ||||||||||||||||||||||||||||||||||||

| Hiroko Koide | From another company | No | No | No | No | No | No | No | No | No | No | No | ||||||||||||||||||||||||||||||||||

| Fumiya Kokubu | From another company | No | No | No | No | No | No | No | No | No | No | No | ||||||||||||||||||||||||||||||||||

| Hideo Takaura | Certified public accountant | No | No | No | No | No | No | No | No | No | No | No | ||||||||||||||||||||||||||||||||||

| Mayumi Tamura | From another company | No | No | No | No | No | No | No | No | No | No | No | ||||||||||||||||||||||||||||||||||

| Kunihiko Sakai | Attorney at law | No | No | No | No | No | No | No | No | No | No | No | ||||||||||||||||||||||||||||||||||

| * | Options for Categories of Relationship with the Company |

| * | If any of the items above apply to the outside directors himself/herself “now or recently”, please mark with a “¡” and, if any of the items above applied to the outside directors himself/herself in the “past”, please mark with a “D”. |

10

| * | If any of the items above apply to a family member or a close relative “now or recently”, please mark with a “🌑” and, if any of the items above applied to any of them in the “past”, please mark with a “p”. |

a. person who executes business of the listed company or its subsidiary;

b. directors who are executive personnel or non-executive personnel of a parent company of the listed company;

c. person who executes business of a fellow subsidiary of the listed company;

d. party for which the listed company is a major customer or a person who executes its business;

e. listed company’s major customer or a person who executes its business;

f. consultant, accounting professional, or legal professional who receives a large amount of money or other financial asset other than remuneration for directorship/auditorship from the listed company;

g. listed company’s major shareholder (where the said major shareholder is a company, a person who executed its business);

h: person who executes the business of a customer of the listed company (where any of items d, e and f do not apply to such customer) (this item only applies to the outside director himself/herself);

i: person who executes the business of an entity whose outside director/outside corporate auditor is also a person who executes the business of the listed company (this item only applies to the outside director himself/herself);

j: person who executes the business of an entity to whom the listed company makes donations (this item only applies to the outside director himself/herself); or

k. Other.

11

Relationship with the Company (2)

Name: Hiroko Koide

Status as directors who are Audit and Supervisory Committee members: No

Status as independent director: Yes

Supplementary explanation of applicable items:

Reasons for the selection of this outside director (In the case a director is specified as an independent director, include information on the reasons for selection as an independent director):

Based on her global perspective as well as abundant experience and deep insight regarding corporate management, she oversees the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

In addition, she is specified as an independent director, because there are not any personal relationship, business relationship and etc. which applies to the matters described in the Criteria for Independence of Outside Directors, and there are no special conflicts of interest between the Company and Hiroko Koide.

Name: Fumiya Kokubu

Status as directors who are Audit and Supervisory Committee members: No

Status as independent director: Yes

Supplementary explanation of applicable items:

Reasons for the selection of this outside director (In the case a director is specified as an independent director, include information on the reasons for selection as an independent director):

Based on his abundant experience and deep insight regarding corporate management, he oversees the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

In addition, he is specified as an independent director, because there are not any personal relationship, business relationship etc. which applies to the matters described in the Criteria for Independence of Outside Directors, and there are no special conflicts of interest between the Company and Fumiya Kokubu.

The Company has a business relationship with Marubeni Corporation, where Fumiya Kokubu currently holds the position of Chairman of the Board. However, the amount of annual transactions between the two companies is less than 1% of the consolidated sales revenue of the Company and of the other party, which fulfills the Criteria for Independence of Outside Directors.

12

Name: Hideo Takaura

Status as directors who are Audit and Supervisory Committee members: Yes

Status as independent director: Yes

Supplementary explanation of applicable items:

Reasons for the selection of this outside director (In the case a director is specified as an independent director, include information on the reasons for selection as an independent director):

Based on his high expertise and abundant experience as a certified public accountant, he audits and oversees the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

In addition, he is specified as an independent director, because there are not any personal relationship, business relationship and etc. which applies to the matters described in the Criteria for Independence of Outside Directors, and there are no special conflicts of interest between the Company and Hideo Takaura.

13

Name: Mayumi Tamura

Status as directors who are Audit and Supervisory Committee members: Yes

Status as independent director: Yes

Supplementary explanation of applicable items:

Reasons for the selection of this outside director (In the case a director is specified as an independent director, include information on the reasons for selection as an independent director):

Based on her abundant experience and deep insight regarding corporate management, she audits and oversees the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

In addition, she is specified as an independent director, because there are not any personal relationship, business relationship and etc. which applies to the matters described in the Criteria for Independence of Outside Directors, and there are no special conflicts of interest between the Company and Mayumi Tamura.

Name: Kunihiko Sakai

Status as directors who are Audit and Supervisory Committee members: Yes

Status as independent director: Yes

Supplementary explanation of applicable items:

Reasons for the selection of this outside director (In the case a director is specified as an independent director, include information on the reasons for selection as an independent director):

Based on his high expertise and abundant experience as a legal affairs specialist, he audits and oversees the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

In addition, he is specified as an independent director, because there are not any personal relationship, business relationship and etc. which applies to the matters described in the Criteria for Independence of Outside Directors, and there are no special conflicts of interest between the Company and Kunihiko Sakai.

14

Existence of any optional committee corresponding to a nominating committee or a compensation committee: None

Information on members of the Audit and Supervisory Committee

Existence of the Audit and Supervisory Committee: Established

Current number of a member of the Audit and Supervisory Committee: 5

Number of full-time member of the Audit and Supervisory Committee: 2

Number of inside director: 2

Number of outside director: 3

Chairman of the Audit and Supervisory Committee: Inside director

Directors and employees to assist with the duties of the Audit and Supervisory Committee: Appointed

Matters relating to independence of subject directors and employees from executive officers

Full-time staff members are employed for the Audit and Supervisory Committee’s Division which is independent from the Company’s chain of command of the directors (excluding directors who are also the members of the Audit and Supervisory Committee) and is under the direct control of the Audit and Supervisory Committee. Under the direct order from the Audit and Supervisory Committee, the Audit and Supervisory Committee’s Division shall support the said Committee so that their duties are executed effectively.

Collaboration among the Audit and Supervisory Committee, Accounting Auditors and the Audit Office

The Audit and Supervisory Committee holds meetings with Accounting Auditors. In this meeting, Accounting Auditors explain and report the auditing plans, results of their auditing activities, etc., and both parties exchange opinions.

15

During this fiscal year, the Audit and Supervisory Committee held 12 meetings with Accounting Auditors.

The Audit Division which is an internal auditing division of the Company periodically reports the auditing policies, auditing plans and the results of audits to the Audit and Supervisory Committee. Moreover, the Division makes additional reports to the Audit and Supervisory Committee as necessary and when requested by the Committee. The Audit and Supervisory Committee and the Audit Division carry out the audit either independently or cooperatively.

Based on the Standards for Audit and Supervisory Committee Reports, the control divisions such as accounting and legal divisions shall periodically provide information necessary for auditing to the Audit and Supervisory Committee or to the committee members appointed by the Committee.

Existence of any optional committee corresponding to a nominating committee or a compensation committee: None

Matters Relating to Independent Directors

Number of independent directors: 5

Other Matters Related to Independent Directors

Criteria for Independence of Outside Directors

The Company’s Board of Directors will determine that an outside director is sufficiently independent from the Company if it determines that the said outside director satisfies the independence criteria stipulated by the Tokyo Stock Exchange and the requirements set forth below:

1. He/She is not, and has never been, any of the following during the last year:

1) a person who executes the business (*1) of a large shareholder (*2) of the Company;

2) a person who executes the business of (i) a major customer (*3) of the Company, or (ii) a company of which the Company is a major customer;

16

3) a person who executes the business of a major lender (*4) of the Company group;

4) a person who executes the business of an audit corporation which conducts statutory audits for the Company or a person who handles the audit functions of the Company;

5) a consultant, an accounting specialist, or a legal expert (or, if the person in question is a corporation, an association, or any other similar organization, then a person who executes the business of that corporation, etc.) who receives a large amount (*5) of money, etc. from the Company, other than remuneration paid to directors of the Company;

2. No family member or close relative (*6) of the outside director currently falls or at any point of time during the last year fell under any of items 1) through 5) in paragraph 1 above.

*1 A “person who executes the business” means an executive director, an executive officer, or an important employee including operating officer.

*2 A “large shareholder” means a shareholder who directly or indirectly holds shares representing 10% or more of the total number of voting rights of the Company as of the end of a fiscal year.

*3 A “major customer” means a customer of the Company where the annual amount of transactions between the customer and the Company exceeds 2% of the consolidated sales revenue of the Company or the said customer.

*4 A “major lender” means a financial institution from which the Company group borrows, where the aggregate amount of outstanding borrowings exceeds 2% of the amount of consolidated total assets of the Company or the financial institution as at the end of a fiscal year.

*5 A person receives a “large amount” if he/she receives consideration from the Company in excess of 10 million yen per year.

*6 A “family member or close relative” means a spouse or first or second degree relative of an outside director.

17

Provision of Incentives

Status of measures to provide incentives to directors: Introduction of a performance-linked remuneration system.

Remuneration for the Executive Directors shall consist of performance-linked remuneration and remuneration, etc. other than performance-linked remuneration. In terms of payment percentage, when performance-linked remuneration is paid on the base amount, the remuneration rate is set at 50% of the total remuneration for executive bonuses and stock-based remuneration that are performance-linked remuneration, and 50% of total remuneration for remuneration, etc. other than performance-linked remuneration.

In addition, regarding performance-linked remuneration indicators, the indicator for executive bonuses includes business performance, dividends to shareholders, employees’ bonus levels, and the like for each fiscal year, and the indicator for stock-based remuneration includes growth rates for financial indicators, such as consolidated operating profit margin, and growth rates for non-financial indicators, such as brand value and ESG.

The reasons for using such indicators are that the Company deems that each indicator stated for executive bonuses is important to consider when measuring the contribution to corporate value in the fiscal year and the degree to which the Company has fulfilled corporate responsibilities for its shareholders and employees, and that each indicator stated for stock-based remuneration is important to consider when measuring the contribution to the sustainable enhancement of corporate value over the mid- to long-term.