UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-02333

New Perspective Fund

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: September 30

Date of reporting period: March 31, 2017

Michael W. Stockton

New Perspective Fund

333 South Hope Street

Los Angeles, California 90071

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

| | | New Perspective Fund®

Semi-annual report

for the six months ended

March 31, 2017 |

We believe high-

conviction investing

and diverse

perspectives lead

to better results.

New Perspective Fund seeks to provide you with long-term growth of capital. Future income is a secondary objective.

This fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For more than 85 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 5.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, visit americanfunds.com.

Here are the average annual total returns on a $1,000 investment with all distributions reinvested for periods ended March 31, 2017:

| Class A shares | | 1 year | | 5 years | | 10 years |

| | | | | | | |

| Reflecting 5.75% maximum sales charge | | 7.81% | | 9.01% | | 5.92% |

For other share class results, visit americanfunds.com and americanfundsretirement.com.

The total annual fund operating expense ratio was 0.77% for Class A shares as of the prospectus dated April 7, 2017.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Investing outside the United States may be subject to risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Fellow investors:

For the six months ended March 31, 2017, New Perspective Fund gained 7.41%. This return includes a 29 cents-per-share dividend and a $1.08 per-share capital gain paid in December 2016. The fund’s results lagged the 8.18% increase recorded by the fund’s primary benchmark, the unmanaged MSCI ACWI (All Country World Index), which measures returns for equity markets in 46 countries.

The fund also trailed its peers, as reflected by the Lipper Global Funds Index, which advanced 9.13% for the October-to-March period. Fund results were down 1.92% in the fourth quarter of 2016, significantly lagging the MSCI benchmark. However, the fund recovered in the first quarter of 2017, gaining 9.51% and finishing well ahead of the benchmark for that quarter. Over longer time frames, the fund’s results compare favorably to the benchmark and the Lipper peer group, as shown in the table below.

Global equities rally on brighter economic outlook

World markets rose amid signs of improving economic growth in the U.S., Europe and Japan. Several key indexes hit a series of new highs, fueled by expectations that President Donald Trump would deliver market-supportive policies following his November election. Cyclical stocks rallied as investors cheered the prospects for rising inflation, income tax cuts, regulatory cutbacks and fiscal stimulus under the new administration. The Federal Reserve raised short-term interest rates in December and again in March, citing a healthy economy and a tight labor market. For the six months, U.S. stocks gained 10%*.

| * | Unless otherwise indicated, country and region returns are based on MSCI indexes, expressed in U.S. dollars and assume the reinvestment of dividends. Results reflect dividends net of withholding taxes, except the MSCI USA Index, which reflects dividends gross of withholding taxes. |

Results at a glance

For periods ended March 31, 2017, with all distributions reinvested

| | | Cumulative total returns | | Average annual total returns |

| | | 6 months | | 1 year | | 5 years | | 10 years | | Lifetime

(since 3/13/73) |

| | | | | | | | | | | | | | | | |

| New Perspective Fund (Class A shares) | | | 7.41 | % | | | 14.38 | % | | | 10.31 | % | | | 6.55 | % | | | 12.15 | % |

| MSCI ACWI1,2 | | | 8.18 | | | | 15.04 | | | | 8.37 | | | | 4.00 | | | | — | 3 |

| Standard & Poor’s 500 Composite Index4 | | | 10.12 | | | | 17.17 | | | | 13.30 | | | | 7.51 | | | | 10.38 | |

| Lipper Global Funds Index | | | 9.13 | | | | 16.30 | | | | 8.91 | | | | 4.16 | | | | — | 5 |

| 1 | The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Source: MSCI. |

| 2 | Results reflect dividends net of withholding taxes. |

| 3 | The MSCI ACWI began operations on December 31, 1987. |

| 4 | The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. S&P source: S&P Dow Jones Indices LLC. |

| 5 | The Lipper Global Funds Index began operations on December 31, 1983. Lipper indexes track the largest mutual funds (no more than 30), represented by one share class per fund, in the corresponding Lipper category. Source: Thomson Reuters Lipper. |

Euro-zone equities enjoyed a strong rally as well, gaining more than 10% as economic activity accelerated in the United Kingdom, Germany and France. Stocks moved higher despite concerns over the U.K.’s impending exit from the European Union and the efforts of Euroskeptic candidates to unseat established political parties in the Netherlands, France and Germany. Japanese stocks experienced modest gains, rising 4% amid slow-but-steady growth. In the final quarter of 2016, Japan’s export-oriented economy grew by 1.2%, marking the first time in three years that it has expanded in all four quarters within the same calendar year.

Sector returns broadly positive

Most sectors advanced, led by an 18% gain in the financials sector. Bank stocks, in particular, rose sharply during the fourth quarter on prospects for higher interest rates and a potential regulatory rollback. However, the bank rally faded in the first quarter as long-term interest rates actually declined amid strong demand for U.S. Treasuries. Information technology stocks rallied, supported by robust earnings from bellwether tech companies and the rapidly expanding use of internet-connected devices around the world. Materials also moved higher as a more upbeat global economic outlook and signs of stabilization in China’s economy contributed to a solid rebound in commodities prices.

The real estate sector declined and telecommunication services stocks were essentially flat. Both sectors were impacted by rising interest rates, which tend to hurt high-dividend paying stocks, also known as bond proxies. A number of real estate companies with significant holdings in shopping mall properties were additionally hit by swiftly evolving e-commerce trends, especially the booming popularity of online retailers. Telecom stocks were hurt by fierce competition for new customers, which weighed on the profitability of wireless service providers. Consumer staples on the whole were unchanged for the six-month period amid high valuations and a sector rotation out of defensive stocks.

Specific companies drive results

Select investments in the consumer discretionary sector produced impressive returns. Two travel-related companies — Priceline and Norwegian Cruise Line — were among the largest contributors to returns, gaining 21.0% and 34.6%, respectively. Priceline has seen a considerable increase in hotel bookings, even as a number of its top competitors have slipped in recent years. Norwegian Cruise Line has benefited from rising demand for cruise ship vacations and greater on-board spending by passengers. Elsewhere in the sector, Netflix shares climbed 50.0% as the streaming video company generated better-than-expected subscriber growth and continued to expand its business outside the U.S.

The materials sector provided another area of strength: Brazilian mining giant Vale was the top contributor to results, soaring 90.7%. Shares surged on rising prices for iron ore, improving profitability and aggressive debt reduction measures. In

the information technology sector, several companies that make components for computers, smartphones and other wireless devices were additive. Broadcom advanced 26.9%, while ASML registered a 21.1% gain. AAC Technologies also did well, rising 15.6%. On the other hand, shares of Nintendo slipped 12.3% amid investor concerns about the launch of its new video game console.

Investments in the health care sector disappointed for the six-month period. Novo Nordisk shares declined 17.6% as the world’s largest provider of insulin products struggled with an increasingly difficult environment for future price increases, particularly in the U.S. market. Novo Nordisk has been a successful long-term investment for the fund; however, given the more recent pricing challenges, its position in the portfolio has been significantly reduced. Elsewhere in the sector, shares of Regeneron Pharmaceuticals and Medtronic posted single-digit losses.

Looking ahead

Our outlook for the markets remains generally positive, given steady improvements in the U.S. economy and aggressive stimulus measures in Europe and Japan. While there is some ambiguity over the direction of the new U.S. presidential administration, market-supportive policies including lower taxes and fiscal stimulus should help to boost growth over time. While macroeconomic events are important, we remain primarily focused on our portfolio companies and their prospects going forward. That said, we cannot ignore the political environment, the potential changes to trade relationships around the world and the rising level of concern among investors.

In our view, the shifting economic and trade regimes will provide challenges, but we see them as opportunities to capitalize on short-term distortions in asset prices and to invest in companies that stand to benefit over the long term. Comprehensive research is the key to making those determinations. Strong multinational companies typically have innovative management teams, diverse sources of revenue and the resilience of solid balance sheets. These attributes offer the potential for future success, regardless of any geopolitical headwinds that may emerge in the months and years ahead.

Thank you for your commitment to New Perspective Fund. We look forward to reporting to you again in six months.

Sincerely,

Robert W. Lovelace

President

May 11, 2017

For current information about the fund, visit americanfunds.com.

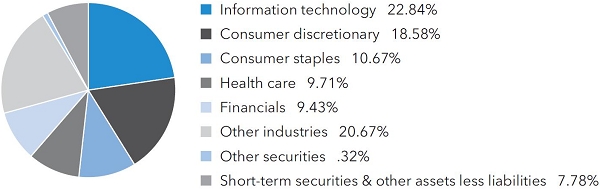

| Summary investment portfolio March 31, 2017 | unaudited |

| | |

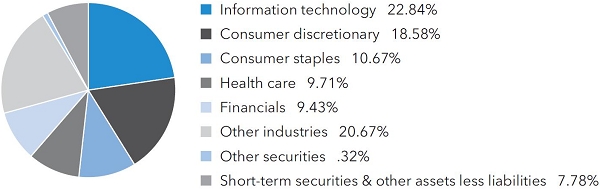

| Industry sector diversification | Percent of net assets |

| Country diversification by domicile | | | Percent of

net assets | |

| United States | | | 50.54 | % |

| Euro zone* | | | 11.87 | |

| Japan | | | 6.43 | |

| United Kingdom | | | 5.63 | |

| Switzerland | | | 2.56 | |

| Taiwan | | | 2.35 | |

| South Africa | | | 2.06 | |

| South Korea | | | 1.81 | |

| Canada | | | 1.62 | |

| Other countries | | | 7.35 | |

| Short-term securities & other assets less liabilities | | | 7.78 | |

| * | Countries using the euro as a common currency; those represented in the fund’s portfolio are Belgium, Finland, France, Germany, Ireland, the Netherlands and Spain. |

| Common stocks 91.90% | | | Shares | | | | Value

(000) | |

| Information technology 22.84% | | | | | | | | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | | 221,552,994 | | | $ | 1,380,029 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. (ADR) | | | 2,954,600 | | | | 97,029 | |

| Facebook, Inc., Class A1 | | | 9,802,000 | | | | 1,392,374 | |

| Microsoft Corp. | | | 18,748,800 | | | | 1,234,796 | |

| ASML Holding NV | | | 6,292,109 | | | | 835,025 | |

| ASML Holding NV (New York registered) | | | 2,759,470 | | | | 366,458 | |

| Alphabet Inc., Class C1 | | | 899,487 | | | | 746,178 | |

| Alphabet Inc., Class A1 | | | 476,000 | | | | 403,553 | |

| Broadcom Ltd. | | | 5,245,300 | | | | 1,148,511 | |

| Murata Manufacturing Co., Ltd. | | | 5,265,241 | | | | 748,900 | |

| Visa Inc., Class A | | | 7,928,300 | | | | 704,588 | |

| Samsung Electronics Co., Ltd. | | | 380,746 | | | | 701,365 | |

| MasterCard Inc., Class A | | | 4,595,900 | | | | 516,901 | |

| Nintendo Co., Ltd. | | | 1,898,900 | | | | 440,655 | |

| Texas Instruments Inc. | | | 5,074,700 | | | | 408,818 | |

| Other securities | | | | | | | 3,646,464 | |

| | | | | | | | 14,771,644 | |

| | | Shares | | | | Value

(000) | |

| Consumer discretionary 18.58% | | | | |

| Amazon.com, Inc.1 | | | 2,867,600 | | | $ | 2,542,243 | |

| Priceline Group Inc.1 | | | 690,080 | | | | 1,228,322 | |

| Naspers Ltd., Class N | | | 6,312,876 | | | | 1,089,299 | |

| Starbucks Corp. | | | 9,596,100 | | | | 560,316 | |

| Norwegian Cruise Line Holdings Ltd.1 | | | 9,254,800 | | | | 469,496 | |

| Netflix, Inc.1 | | | 2,779,000 | | | | 410,764 | |

| Tesla, Inc.1 | | | 1,332,000 | | | | 370,696 | |

| NIKE, Inc., Class B | | | 6,645,000 | | | | 370,326 | |

| Other securities | | | | | | | 4,976,766 | |

| | | | | | | | 12,018,228 | |

| | | | | | | | | |

| Consumer staples 10.67% | | | | | | | | |

| British American Tobacco PLC | | | 14,398,915 | | | | 956,141 | |

| Nestlé SA | | | 10,524,918 | | | | 807,508 | |

| Pernod Ricard SA | | | 6,378,796 | | | | 754,663 | |

| Associated British Foods PLC | | | 12,677,805 | | | | 413,938 | |

| Coca-Cola Co. | | | 8,966,800 | | | | 380,551 | |

| Philip Morris International Inc. | | | 3,296,800 | | | | 372,209 | |

| Other securities | | | | | | | 3,218,069 | |

| | | | | | | | 6,903,079 | |

| | | | | | | | | |

| Health care 9.71% | | | | | | | | |

| Regeneron Pharmaceuticals, Inc.1 | | | 2,270,250 | | | | 879,745 | |

| Incyte Corp.1 | | | 6,057,130 | | | | 809,657 | |

| Bayer AG | | | 4,016,388 | | | | 462,960 | |

| Novo Nordisk A/S, Class B | | | 12,602,803 | | | | 432,828 | |

| Boston Scientific Corp.1 | | | 16,441,100 | | | | 408,890 | |

| Intuitive Surgical, Inc.1 | | | 491,400 | | | | 376,643 | |

| Medtronic PLC | | | 4,535,100 | | | | 365,348 | |

| Other securities | | | | | | | 2,541,767 | |

| | | | | | | | 6,277,838 | |

| | | | | | | | | |

| Financials 9.43% | | | | | | | | |

| JPMorgan Chase & Co. | | | 10,635,200 | | | | 934,196 | |

| CME Group Inc., Class A | | | 6,942,800 | | | | 824,805 | |

| AIA Group Ltd. | | | 111,018,600 | | | | 699,982 | |

| Chubb Ltd. | | | 4,220,800 | | | | 575,084 | |

| Prudential PLC | | | 20,267,222 | | | | 428,123 | |

| Other securities | | | | | | | 2,638,977 | |

| | | | | | | | 6,101,167 | |

| | | | | | | | | |

| Industrials 8.63% | | | | | | | | |

| Airbus SE, non-registered shares | | | 7,000,039 | | | | 532,667 | |

| Ryanair Holdings PLC (ADR)1 | | | 5,248,261 | | | | 435,501 | |

| ASSA ABLOY AB, Class B | | | 19,264,100 | | | | 396,218 | |

| Johnson Controls International PLC | | | 9,940,649 | | | | 372,193 | |

| Other securities | | | | | | | 3,842,876 | |

| | | | | | | | 5,579,455 | |

| Common stocks (continued) | | | Shares | | | | Value

(000) | |

| Materials 4.69% | | | | | | | | |

| Vale SA, Class A, preferred nominative (ADR) | | | 44,009,900 | | | $ | 395,209 | |

| Vale SA, Class A, preferred nominative | | | 11,578,500 | | | | 104,334 | |

| Praxair, Inc. | | | 3,203,100 | | | | 379,888 | |

| Other securities | | | | | | | 2,155,206 | |

| | | | | | | | 3,034,637 | |

| | | | | | | | | |

| Energy 4.65% | | | | | | | | |

| Schlumberger Ltd. | | | 7,222,950 | | | | 564,112 | |

| Enbridge Inc. (CAD denominated) | | | 11,090,423 | | | | 464,599 | |

| Canadian Natural Resources, Ltd. | | | 10,903,500 | | | | 356,987 | |

| Other securities | | | | | | | 1,618,410 | |

| | | | | | | | 3,004,108 | |

| | | | | | | | | |

| Telecommunication services 1.41% | | | | | | | | |

| SoftBank Group Corp. | | | 5,208,434 | | | | 367,814 | |

| Other securities | | | | | | | 546,237 | |

| | | | | | | | 914,051 | |

| | | | | | | | | |

| Other 0.84% | | | | | | | | |

| Other securities | | | | | | | 541,043 | |

| | | | | | | | | |

| Miscellaneous 0.45% | | | | | | | | |

| Other common stocks in initial period of acquisition | | | | | | | 287,372 | |

| | | | | | | | | |

| Total common stocks (cost: $37,875,512,000) | | | | | | | 59,432,622 | |

| | | | | | | | | |

| Convertible bonds 0.25% | | | Principal amount

(000 | ) | | | | |

| Other 0.25% | | | | | | | | |

| Other securities | | | | | | | 160,410 | |

| | | | | | | | | |

| Total convertible bonds (cost: $157,384,000) | | | | | | | 160,410 | |

| | | | | | | | | |

| Bonds, notes & other debt instruments 0.07% | | | | | | | | |

| U.S. Treasury bonds & notes 0.07% | | | | | | | | |

| U.S. Treasury 0.07% | | | | | | | | |

| Other securities | | | | | | | 42,804 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments (cost: $42,805,000) | | | | | | | 42,804 | |

| | | | | | | | | |

| Short-term securities 7.75% | | | | | | | | |

| Federal Home Loan Bank 0.53%–0.79% due 4/11/2017–7/26/2017 | | $ | 1,190,200 | | | | 1,189,230 | |

| Jupiter Securitization Co., LLC 0.73% due 4/11/20172 | | | 11,000 | | | | 10,997 | |

| Other securities | | | | | | | 3,812,934 | |

| | | | | | | | | |

| Total short-term securities (cost: $5,013,254,000) | | | | | | | 5,013,161 | |

| Total investment securities 99.97% (cost: $43,088,955,000) | | | | | | | 64,648,997 | |

| Other assets less liabilities 0.03% | | | | | | | 21,324 | |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 64,670,321 | |

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

As permitted by U.S. Securities and Exchange Commission regulations, “Miscellaneous” securities include holdings in their first year of acquisition that have not previously been publicly disclosed.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio. “Other securities” includes a security which was valued under fair value procedures adopted by authority of the board of trustees. The total value of the security which was valued under fair value procedures was $169,738,000, which represented .26% of the net assets of the fund. “Other securities” also includes a security which was pledged as collateral. The total value of pledged collateral was $6,678,000, which represented .01% of the net assets of the fund.

Forward currency contracts

| | | | | | | | | Unrealized |

| | | | | | | | | (depreciation) |

| Contract amount | | | | | | appreciation |

| Purchases | | Sales | | | | | | at 3/31/2017 |

| (000) | | (000) | | Counterparty | | Settlement date | | (000 | ) |

| USD53,787 | | JPY6,050,000 | | Bank of New York Mellon | | 4/6/2017 | | | $ | (566 | ) |

| USD1,540 | | JPY175,930 | | Bank of America, N.A. | | 4/13/2017 | | | | (41 | ) |

| USD18,552 | | JPY2,100,000 | | Citibank | | 4/27/2017 | | | | (332 | ) |

| USD33,999 | | JPY3,850,000 | | HSBC Bank | | 4/27/2017 | | | | (621 | ) |

| USD33,896 | | JPY3,754,000 | | Bank of America, N.A. | | 5/24/2017 | | | | 107 | |

| USD186,254 | | JPY21,300,000 | | Bank of America, N.A. | | 6/14/2017 | | | | (5,640 | ) |

| | | | | | | | | | $ | (7,093 | ) |

| 1 | Security did not produce income during the last 12 months. |

| 2 | Acquired in a transaction exempt from registration under Section 4(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities, including those in “Other securities,” was $2,949,144,000, which represented 4.56% of the net assets of the fund. |

Key to abbreviations and symbol

ADR = American Depositary Receipts

CAD = Canadian dollars

JPY = Japanese yen

USD/$ = U.S. dollars

See Notes to Financial Statements

Financial statements

| Statement of assets and liabilities | unaudited |

| at March 31, 2017 | (dollars in thousands) |

| Assets: | | | | |

| Investment securities in unaffiliated issuers, at value (cost: $43,088,955) | | | | | | $ | 64,648,997 | |

| Cash | | | | | | | 105,811 | |

| Cash denominated in currencies other than U.S. dollars (cost: $3,199) | | | | | | | 3,199 | |

| Unrealized appreciation on open forward currency contracts | | | | | | | 107 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | $ | 218,673 | | | | | |

| Sales of fund’s shares | | | 487,605 | | | | | |

| Dividends and interest | | | 145,633 | | | | 851,911 | |

| | | | | | | | 65,610,025 | |

| Liabilities: | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | | | | | 7,200 | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 405,658 | | | | | |

| Repurchases of fund’s shares | | | 481,256 | | | | | |

| Investment advisory services | | | 20,715 | | | | | |

| Services provided by related parties | | | 13,956 | | | | | |

| Trustees’ deferred compensation | | | 4,736 | | | | | |

| Other | | | 6,183 | | | | 932,504 | |

| Net assets at March 31, 2017 | | | | | | $ | 64,670,321 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | | | | | $ | 40,715,678 | |

| Distributions in excess of net investment income | | | | | | | (19,331 | ) |

| Undistributed net realized gain | | | | | | | 2,421,458 | |

| Net unrealized appreciation | | | | | | | 21,552,516 | |

| Net assets at March 31, 2017 | | | | | | $ | 64,670,321 | |

See Notes to Financial Statements

(dollars and shares in thousands, except per-share amounts)

Shares of beneficial interest issued and outstanding (no stated par value) —

unlimited shares authorized (1,677,485 total shares outstanding)

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

| Class A | | $ | 37,256,985 | | | | 963,714 | | | $ | 38.69 | |

| Class B | | | 5,137 | | | | 135 | | | | 38.15 | |

| Class C | | | 1,345,150 | | | | 36,075 | | | | 37.32 | |

| Class F-1 | | | 1,570,334 | | | | 40,865 | | | | 38.46 | |

| Class F-2 | | | 5,177,750 | | | | 134,256 | | | | 38.59 | |

| Class F-3 | | | 514,465 | | | | 13,290 | | | | 38.71 | |

| Class 529-A | | | 1,708,860 | | | | 44,689 | | | | 38.27 | |

| Class 529-B | | | 529 | | | | 14 | | | | 37.64 | |

| Class 529-C | | | 362,292 | | | | 9,737 | | | | 37.24 | |

| Class 529-E | | | 76,951 | | | | 2,032 | | | | 37.90 | |

| Class 529-F-1 | | | 84,285 | | | | 2,209 | | | | 38.18 | |

| Class R-1 | | | 81,372 | | | | 2,200 | | | | 37.02 | |

| Class R-2 | | | 524,490 | | | | 14,051 | | | | 37.36 | |

| Class R-2E | | | 38,466 | | | | 1,008 | | | | 38.17 | |

| Class R-3 | | | 1,599,920 | | | | 42,303 | | | | 37.85 | |

| Class R-4 | | | 1,856,267 | | | | 48,648 | | | | 38.19 | |

| Class R-5E | | | 997 | | | | 26 | | | | 38.54 | |

| Class R-5 | | | 1,547,507 | | | | 40,054 | | | | 38.66 | |

| Class R-6 | | | 10,918,564 | | | | 282,179 | | | | 38.72 | |

See Notes to Financial Statements

| Statement of operations | unaudited |

| for the six months ended March 31, 2017 | (dollars in thousands) |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Dividends (net of non-U.S. taxes of $10,551) | | $ | 417,276 | | | | | |

| Interest | | | 20,531 | | | $ | 437,807 | |

| | | | | | | | | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | | 116,216 | | | | | |

| Distribution services | | | 62,587 | | | | | |

| Transfer agent services | | | 29,315 | | | | | |

| Administrative services | | | 8,044 | | | | | |

| Reports to shareholders | | | 1,315 | | | | | |

| Registration statement and prospectus | | | 688 | | | | | |

| Trustees’ compensation | | | 516 | | | | | |

| Auditing and legal | | | 44 | | | | | |

| Custodian | | | 2,062 | | | | | |

| Other | | | 881 | | | | 221,668 | |

| Net investment income | | | | | | | 216,139 | |

| | | | | | | | | |

| Net realized gain and unrealized appreciation: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments in unaffiliated issuers | | | 2,607,067 | | | | | |

| Forward currency contracts | | | 41,104 | | | | | |

| Currency transactions | | | (10,251 | ) | | | 2,637,920 | |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments in unaffiliated issuers (net of non-U.S. taxes of $147) | | | 1,564,752 | | | | | |

| Forward currency contracts | | | (5,930 | ) | | | | |

| Currency translations | | | 481 | | | | 1,559,303 | |

| Net realized gain and unrealized appreciation | | | | | | | 4,197,223 | |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | | | | | $ | 4,413,362 | |

| * | Additional information related to class-specific fees and expenses is included in the Notes to Financial Statements. |

See Notes to Financial Statements

| Statements of changes in net assets | |

| | (dollars in thousands) |

| | | Six months ended | | | Year ended | |

| | | March 31, 2017* | | | September 30, 2016 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 216,139 | | | $ | 563,323 | |

| Net realized gain | | | 2,637,920 | | | | 1,854,195 | |

| Net unrealized appreciation | | | 1,559,303 | | | | 3,648,312 | |

| Net increase in net assets resulting from operations | | | 4,413,362 | | | | 6,065,830 | |

| | | | | | | | | |

| Dividends and distributions paid to shareholders: | | | | | | | | |

| Dividends from net investment income | | | (491,981 | ) | | | (423,068 | ) |

| Distributions from net realized gain on investments | | | (1,749,492 | ) | | | (3,083,008 | ) |

| Total dividends and distributions paid to shareholders | | | (2,241,473 | ) | | | (3,506,076 | ) |

| | | | | | | | | |

| Net capital share transactions | | | 1,437,095 | | | | 2,335,701 | |

| | | | | | | | | |

| Total increase in net assets | | | 3,608,984 | | | | 4,895,455 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of period | | | 61,061,337 | | | | 56,165,882 | |

End of period (including distributions in excess of and undistributed net investment income:

$(19,331) and $256,511, respectively) | | $ | 64,670,321 | | | $ | 61,061,337 | |

See Notes to Financial Statements

| Notes to financial statements | unaudited |

1. Organization

New Perspective Fund (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks to provide long-term growth of capital. Future income is a secondary objective.

The fund has 19 share classes consisting of six retail share classes (Classes A, B and C, as well as three F share classes, F-1, F-2 and F-3), five 529 college savings plan share classes (Classes 529-A, 529-B, 529-C, 529-E and 529-F-1) and eight retirement plan share classes (Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are described further in the following table:

| Share class | | Initial sales charge | | Contingent deferred sales

charge upon redemption | | Conversion feature |

| Classes A and 529-A | | Up to 5.75% | | None (except 1% for certain redemptions within one year of purchase without an initial sales charge) | | None |

| Classes B and 529-B* | | None | | Declines from 5% to 0% for redemptions within six years of purchase | | Classes B and 529-B convert to Classes A and 529-A, respectively, after eight years |

| Class C | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | None |

| Class 529-E | | None | | None | | None |

| Classes F-1, F-2, F-3 and 529-F-1 | | None | | None | | None |

| Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6 | | None | | None | | None |

| * | Class B and 529-B shares of the fund are not available for purchase. |

On January 27, 2017, the fund made an additional retail share class (Class F-3) available for sale pursuant to an amendment to its registration statement filed with the U.S. Securities and Exchange Commission. Refer to the fund’s prospectus for more details.

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Cash — Cash includes amounts held in an interest bearing deposit facility.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

Dividends and distributions to shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | | Examples of standard inputs |

| All | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | | Standard inputs and interest rate volatilities |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most

appropriate by the fund’s investment adviser. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of trustees as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following tables present the fund’s valuation levels as of March 31, 2017 (dollars in thousands):

| | | Investment securities |

| | | | Level 1* | | | | Level 2 | | | | Level 3 | | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Common stocks: | | | | | | | | | | | | | | | | |

| Information technology | | $ | 14,771,644 | | | $ | — | | | $ | — | | | $ | 14,771,644 | |

| Consumer discretionary | | | 12,018,228 | | | | — | | | | — | | | | 12,018,228 | |

| Consumer staples | | | 6,733,341 | | | | 169,738 | | | | — | | | | 6,903,079 | |

| Health care | | | 6,277,838 | | | | — | | | | — | | | | 6,277,838 | |

| Financials | | | 6,101,167 | | | | — | | | | — | | | | 6,101,167 | |

| Industrials | | | 5,579,455 | | | | — | | | | — | | | | 5,579,455 | |

| Materials | | | 3,034,637 | | | | — | | | | — | | | | 3,034,637 | |

| Energy | | | 3,004,108 | | | | — | | | | — | | | | 3,004,108 | |

| Telecommunication services | | | 914,051 | | | | — | | | | — | | | | 914,051 | |

| Other | | | 541,043 | | | | — | | | | — | | | | 541,043 | |

| Miscellaneous | | | 287,372 | | | | — | | | | — | | | | 287,372 | |

| Convertible bonds | | | — | | | | 160,410 | | | | — | | | | 160,410 | |

| Bonds, notes & other debt instruments | | | — | | | | 42,804 | | | | — | | | | 42,804 | |

| Short-term securities | | | — | | | | 5,013,161 | | | | — | | | | 5,013,161 | |

| Total | | $ | 59,262,884 | | | $ | 5,386,113 | | | $ | — | | | $ | 64,648,997 | |

| | | Other investments† |

| | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Unrealized appreciation on open forward currency contracts | | $ | — | | | $ | 107 | | | $ | — | | | $ | 107 | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | — | | | | (7,200 | ) | | | — | | | | (7,200 | ) |

| Total | | $ | — | | | $ | (7,093 | ) | | $ | — | | | $ | (7,093 | ) |

| * | Securities with a value of $22,996,833,000, which represented 35.56% of the net assets of the fund, transferred from Level 2 to Level 1 since the prior fiscal year-end, primarily due to a lack of significant market movements following the close of local trading. |

| † | Forward currency contracts are not included in the investment portfolio. |

4. Risk factors

Investing in the fund may involve certain risks including, but not limited to, those described below.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline — sometimes rapidly or unpredictably — due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may also decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in growth-oriented stocks — Growth-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds) may involve larger price swings and greater potential for loss than other types of investments.

Investing outside the U.S. — Securities of issuers domiciled outside the U.S., or with significant operations or revenues outside the U.S., may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as the imposition of price controls or punitive taxes, that could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the U.S. Investments outside the U.S. may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the U.S. In addition, the value of investments outside the U.S. may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of investing outside the U.S. may be heightened in connection with investments in emerging markets.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

5. Certain investment techniques

Forward currency contracts — The fund has entered into forward currency contracts, which represent agreements to exchange currencies on specific future dates at predetermined rates. The fund’s investment adviser uses forward currency contracts to manage the fund’s exposure to changes in exchange rates. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from possible movements in exchange rates.

On a daily basis, the fund’s investment adviser values forward currency contracts and records unrealized appreciation or depreciation for open forward currency contracts in the fund’s statement of assets and liabilities. Realized gains or losses are recorded at the time the forward currency contract is closed or offset by another contract with the same broker for the same settlement date and currency.

Closed forward currency contracts that have not reached their settlement date are included in the respective receivables or payables for closed forward currency contracts in the fund’s statement of assets and liabilities. Net realized gains or losses from closed forward currency contracts and net unrealized appreciation or depreciation from open forward currency contracts are recorded in the fund’s statement of operations. The average month-end notional amount of open forward currency contracts while held was $358,435,000.

The following tables present the financial statement impacts resulting from the fund’s use of forward currency contracts as of, or for the six months ended, March 31, 2017 (dollars in thousands):

| | | | | Assets | | Liabilities |

| Contract | | Risk type | | Location on statement of

assets and liabilities | | | Value | | | Location on statement of

assets and liabilities | | | Value | |

| Forward currency | | Currency | | Unrealized appreciation on open forward currency contracts | | $ | 107 | | | Unrealized depreciation on open forward currency contracts | | $ | 7,200 | |

| | | | | | | | | | | | | | | |

| | | | | Net realized gain | | | Net unrealized depreciation |

| Contract | | Risk type | | Location on statement of

operations | | | Value | | | Location on statement of

operations | | | Value | |

| Forward currency | | Currency | | Net realized gain on forward currency contracts | | $ | 41,104 | | | Net unrealized depreciation on forward currency contracts | | $ | (5,930 | ) |

Collateral — The fund participates in a collateral program due to its use of forward currency contracts. The program calls for the fund to either receive or pledge highly liquid assets, such as cash or U.S. Treasury bills, as collateral based on the net gain or loss on unsettled forward currency contracts by counterparty. The purpose of the collateral is to cover potential losses that could occur in the event that either party cannot meet its contractual obligations.

Rights of offset — The fund has entered into enforceable master netting agreements with certain counterparties for forward currency contracts, where on any date amounts payable by each party to the other (in the same currency with respect to the same transaction) may be closed or offset by each party’s payment obligation. If an early termination date occurs under these agreements following an event of default or termination event, all obligations of each party to its counterparty are settled net through a single payment in a single currency (“close-out netting”). For financial reporting purposes, the fund does not offset financial assets and financial liabilities that are subject to these master netting arrangements in the statement of assets and liabilities.

The following table presents the fund’s forward currency contracts by counterparty that are subject to master netting agreements but that are not offset in the fund’s statement of assets and liabilities. The net amount column shows the impact of offsetting on the fund’s statement of assets and liabilities as of March 31, 2017, if close-out netting was exercised (dollars in thousands):

| | | Gross amounts

recognized in the | | Gross amounts not offset in the

statement of assets and liabilities and

subject to a master netting agreement | | | |

| | | statement of assets | | Available | | Non-cash | | Cash | | | Net |

| Counterparty | | and liabilities | | to offset | | collateral* | | collateral | | | amount |

| Assets: | | | | | | | | | | | | | | | | | | | | |

| Bank of America, N.A. | | $ | 107 | | | $ | (107 | ) | | $ | — | | | $ | — | | | $ | — | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | |

| Bank of America, N.A. | | $ | 5,681 | | | $ | (107 | ) | | $ | (4,879 | ) | | $ | — | | | $ | 695 | |

| Bank of New York Mellon | | | 566 | | | | — | | | | (566 | ) | | | — | | | | — | |

| Citibank | | | 332 | | | | — | | | | (332 | ) | | | — | | | | — | |

| HSBC Bank | | | 621 | | | | — | | | | (621 | ) | | | — | | | | — | |

| Total | | $ | 7,200 | | | $ | (107 | ) | | $ | (6,398 | ) | | $ | — | | | $ | 695 | |

| * | Non-cash collateral is shown on a settlement basis. |

6. Taxation and distributions

Federal income taxation — The fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to mutual funds and intends to distribute substantially all of its net taxable income and net capital gains each year. The fund is not subject to income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.

As of and during the period ended March 31, 2017, the fund did not have a liability for any unrecognized tax benefits. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the fund did not incur any interest or penalties.

The fund is not subject to examination by U.S. federal tax authorities for tax years before 2012, by state tax authorities for tax years before 2011 and by tax authorities outside the U.S. for tax years before 2009.

Non-U.S. taxation — Dividend and interest income are recorded net of non-U.S. taxes paid. The fund may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. As a result of rulings from European courts, the fund filed for additional reclaims related to prior years. These reclaims are recorded when the amount is known and there are no significant uncertainties on collectability. Gains realized by the fund on the sale of securities in certain countries are subject to non-U.S. taxes. The fund records an estimated deferred tax liability based on unrealized gains to provide for potential non-U.S. taxes payable upon the sale of these securities.

Distributions — Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are due primarily to different treatment for items such as currency gains and losses; short-term capital gains and losses; capital losses related to sales of certain securities within 30 days of purchase; unrealized appreciation of certain investments in securities outside the U.S. and cost of investments sold. The fiscal year in which amounts are distributed may differ from the year in which the net investment income and net realized gains are recorded by the fund for financial reporting purposes.

The components of distributable earnings on a tax basis are reported as of the fund’s most recent year-end. As of September 30, 2016, the components of distributable earnings on a tax basis were as follows (dollars in thousands):

| Undistributed ordinary income | | $ | 357,002 | |

| Undistributed long-term capital gains | | | 1,592,546 | |

As of March 31, 2017, the tax basis unrealized appreciation (depreciation) and cost of investment securities were as follows (dollars in thousands):

| Gross unrealized appreciation on investment securities | | $ | 22,175,136 | |

| Gross unrealized depreciation on investment securities | | | (706,726 | ) |

| Net unrealized appreciation on investment securities | | | 21,468,410 | |

| Cost of investment securities | | | 43,180,587 | |

The tax character of distributions paid to shareholders was as follows (dollars in thousands):

| | | Six months ended March 31, 2017 | | Year ended September 30, 2016 | |

| | | | | | | Total | | | | | | Total | |

| | | | | | | dividends and | | | | | | dividends and | |

| | | Ordinary | | Long-term | | distributions | | Ordinary | | Long-term | | distributions | |

| Share class | | income | | capital gains | | paid | | income | | capital gains | | paid | |

| Class A | | $ | 278,042 | | | $ | 1,031,032 | | | $ | 1,309,074 | | | $ | 254,294 | | | $ | 1,906,486 | | | $ | 2,160,780 | |

| Class B | | | — | | | | 590 | | | | 590 | | | | — | | | | 4,904 | | | | 4,904 | |

| Class C | | | — | | | | 39,750 | | | | 39,750 | | | | — | | | | 75,632 | | | | 75,632 | |

| Class F-1 | | | 10,957 | | | | 43,834 | | | | 54,791 | | | | 9,524 | | | | 75,338 | | | | 84,862 | |

| Class F-2 | | | 47,624 | | | | 134,071 | | | | 181,695 | | | | 27,673 | | | | 156,189 | | | | 183,862 | |

| Class F-31 | | | — | | | | — | | | | — | | | | | | | | | | | | | |

| Class 529-A | | | 11,448 | | | | 46,636 | | | | 58,084 | | | | 9,636 | | | | 82,834 | | | | 92,470 | |

| Class 529-B | | | — | | | | 97 | | | | 97 | | | | — | | | | 740 | | | | 740 | |

| Class 529-C | | | — | | | | 10,340 | | | | 10,340 | | | | — | | | | 18,762 | | | | 18,762 | |

| Class 529-E | | | 356 | | | | 2,142 | | | | 2,498 | | | | 272 | | | | 3,905 | | | | 4,177 | |

| Class 529-F-1 | | | 733 | | | | 2,261 | | | | 2,994 | | | | 560 | | | | 3,503 | | | | 4,063 | |

| Class R-1 | | | — | | | | 2,552 | | | | 2,552 | | | | — | | | | 5,298 | | | | 5,298 | |

| Class R-2 | | | 55 | | | | 15,442 | | | | 15,497 | | | | — | | | | 30,183 | | | | 30,183 | |

| Class R-2E | | | 226 | | | | 867 | | | | 1,093 | | | | 11 | | | | 56 | | | | 67 | |

| Class R-3 | | | 7,211 | | | | 46,021 | | | | 53,232 | | | | 5,938 | | | | 86,922 | | | | 92,860 | |

| Class R-4 | | | 13,614 | | | | 52,193 | | | | 65,807 | | | | 11,934 | | | | 95,180 | | | | 107,114 | |

| Class R-5E2 | | | — | 3 | | | — | 3 | | | — | 3 | | | — | 3 | | | — | 3 | | | — | 3 |

| Class R-5 | | | 15,272 | | | | 42,198 | | | | 57,470 | | | | 14,733 | | | | 79,957 | | | | 94,690 | |

| Class R-6 | | | 106,443 | | | | 279,466 | | | | 385,909 | | | | 88,493 | | | | 457,119 | | | | 545,612 | |

| Total | | $ | 491,981 | | | $ | 1,749,492 | | | $ | 2,241,473 | | | $ | 423,068 | | | $ | 3,083,008 | | | $ | 3,506,076 | |

| 1 | Class F-3 shares were offered beginning January 27, 2017. |

| 2 | Class R-5E shares were offered beginning November 20, 2015. |

| 3 | Amount less than one thousand. |

7. Fees and transactions with related parties

CRMC, the fund’s investment adviser, is the parent company of American Funds Distributors,® Inc. (“AFD”), the principal underwriter of the fund’s shares, and American Funds Service Company® (“AFS”), the fund’s transfer agent. CRMC, AFD and AFS are considered related parties to the fund.

Investment advisory services — The fund has an investment advisory and service agreement with CRMC that provides for monthly fees accrued daily. These fees are based on a series of decreasing annual rates beginning with 0.600% on the first $500 million of daily net assets and decreasing to 0.355% on such assets in excess of $71 billion. For the six months ended March 31, 2017, the investment advisory services fee was $116,216,000, which was equivalent to an annualized rate of 0.381% of average daily net assets.

Class-specific fees and expenses — Expenses that are specific to individual share classes are accrued directly to the respective share class. The principal class-specific fees and expenses are further described below:

Distribution services — The fund has plans of distribution for all share classes, except Class F-2, F-3, R-5E, R-5 and R-6 shares. Under the plans, the board of trustees approves certain categories of expenses that are used to finance activities primarily intended to sell fund shares and service existing accounts. The plans provide for payments, based on an annualized percentage of average daily net assets, ranging from 0.25% to 1.00% as noted in this section. In some cases, the board of trustees has limited the amounts that may be paid to less than the maximum allowed by the plans. All share classes with a plan may use up to 0.25% of average daily net assets to pay service fees, or to compensate AFD for paying service fees, to firms that have entered into agreements with AFD to provide certain shareholder services. The remaining amounts available to be paid under each plan are paid to dealers to compensate them for their sales activities.

For Class A and 529-A shares, distribution-related expenses include the reimbursement of dealer and wholesaler commissions paid by AFD for certain shares sold without a sales charge. These share classes reimburse AFD for amounts billed within the prior 15 months but only to the extent that the overall annual expense limit of 0.25% is not exceeded. As of March 31, 2017, there were no unreimbursed expenses subject to reimbursement for Class A or 529-A shares.

| | Share class | | Currently approved limits | | Plan limits |

| | Class A | | | 0.25 | % | | | 0.25 | % |

| | Class 529-A | | | 0.25 | | | | 0.50 | |

| | Classes B and 529-B | | | 1.00 | | | | 1.00 | |

| | Classes C, 529-C and R-1 | | | 1.00 | | | | 1.00 | |

| | Class R-2 | | | 0.75 | | | | 1.00 | |

| | Class R-2E | | | 0.60 | | | | 0.85 | |

| | Classes 529-E and R-3 | | | 0.50 | | | | 0.75 | |

| | Classes F-1, 529-F-1 and R-4 | | | 0.25 | | | | 0.50 | |

Transfer agent services — The fund has a shareholder services agreement with AFS under which the fund compensates AFS for providing transfer agent services to each of the fund’s share classes. These services include recordkeeping, shareholder communications and transaction processing. In addition, the fund reimburses AFS for amounts paid to third parties for performing transfer agent services on behalf of fund shareholders.

Administrative services — The fund has an administrative services agreement with CRMC under which the fund compensates CRMC for providing administrative services to Class A, C, F, 529 and R shares. These services include, but are not limited to, coordinating, monitoring, assisting and overseeing third parties that provide

services to fund shareholders. Under the agreement, Class A shares pay an annual fee of 0.01% and Class C, F, 529 and R shares pay an annual fee of 0.05% of their respective average daily net assets.

529 plan services — Each 529 share class is subject to service fees to compensate the Virginia College Savings Plan (“Virginia529”) for its oversight and administration of the 529 college savings plan. The quarterly fee is based on a series of decreasing annual rates beginning with 0.10% on the first $20 billion of the net assets invested in the Class 529 shares of the American Funds and decreasing to 0.03% on such assets in excess of $100 billion. The fee for any given calendar quarter is accrued and calculated on the basis of the average net assets of Class 529 shares of the American Funds for the last month of the prior calendar quarter. The fee is included in other expenses in the fund’s statement of operations. Virginia529 is not considered a related party to the fund.

For the six months ended March 31, 2017, class-specific expenses under the agreements were as follows (dollars in thousands):

| | | | Distribution | | | Transfer agent | | | Administrative | | | 529 plan |

| | Share class | | services | | | services | | | services | | | services |

| | Class A | | | $41,800 | | | | $20,802 | | | | $1,798 | | | Not applicable |

| | Class B | | | 94 | | | | 15 | | | | Not applicable | | | Not applicable |

| | Class C | | | 6,609 | | | | 780 | | | | 332 | | | Not applicable |

| | Class F-1 | | | 1,895 | | | | 991 | | | | 380 | | | Not applicable |

| | Class F-2 | | | Not applicable | | | | 2,501 | | | | 1,171 | | | Not applicable |

| | Class F-3* | | | Not applicable | | | | — | † | | | 8 | | | Not applicable |

| | Class 529-A | | | 1,751 | | | | 795 | | | | 403 | | | $559 |

| | Class 529-B | | | 15 | | | | 3 | | | | 1 | | | 1 |

| | Class 529-C | | | 1,709 | | | | 185 | | | | 86 | | | 120 |

| | Class 529-E | | | 181 | | | | 21 | | | | 18 | | | 25 |

| | Class 529-F-1 | | | — | | | | 39 | | | | 20 | | | 27 |

| | Class R-1 | | | 416 | | | | 40 | | | | 21 | | | Not applicable |

| | Class R-2 | | | 1,913 | | | | 984 | | | | 129 | | | Not applicable |

| | Class R-2E | | | 91 | | | | 28 | | | | 8 | | | Not applicable |

| | Class R-3 | | | 3,883 | | | | 1,089 | | | | 389 | | | Not applicable |

| | Class R-4 | | | 2,230 | | | | 761 | | | | 447 | | | Not applicable |

| | Class R-5E | | | Not applicable | | | | — | † | | | — | † | | Not applicable |

| | Class R-5 | | | Not applicable | | | | 281 | | | | 366 | | | Not applicable |

| | Class R-6 | | | Not applicable | | | | — | | | | 2,467 | | | Not applicable |

| | Total class-specific expenses | | | $62,587 | | | | $29,315 | | | | $8,044 | | | $732 |

| | * | Class F-3 shares were offered beginning January 27, 2017. |

| | † | Amount less than one thousand. |

Trustees’ deferred compensation — Trustees who are unaffiliated with CRMC may elect to defer the cash payment of part or all of their compensation. These deferred amounts, which remain as liabilities of the fund, are treated as if invested in shares of the fund or other American Funds. These amounts represent general, unsecured liabilities of the fund and vary according to the total returns of the selected funds. Trustees’ compensation of

$516,000 in the fund’s statement of operations reflects $240,000 in current fees (either paid in cash or deferred) and a net increase of $276,000 in the value of the deferred amounts.

Affiliated officers and trustees — Officers and certain trustees of the fund are or may be considered to be affiliated with CRMC, AFD and AFS. No affiliated officers or trustees received any compensation directly from the fund.

Security transactions with related funds — The fund may purchase from, or sell securities to, other funds managed by CRMC (or funds managed by certain affiliates of CRMC) under procedures adopted by the fund’s board of trustees. The funds involved in such transactions are considered related by virtue of having a common investment adviser (or affiliated investment advisers), common trustees and/or common officers. When such transactions occur, each transaction is executed at the current market price of the security and no brokerage commissions or fees are paid in accordance with Rule 17a-7 of the 1940 Act.

Interfund lending — Pursuant to an exemptive order issued by the SEC, the fund, along with other CRMC-managed funds (or funds managed by certain affiliates of CRMC), may participate in an interfund lending program. The program provides an alternate credit facility that permits the funds to lend or borrow cash for temporary purposes directly to or from one another, subject to the conditions of the exemptive order. The fund did not lend or borrow cash through the interfund lending program at any time during the six months ended March 31, 2017.

8. Capital share transactions

Capital share transactions in the fund were as follows (dollars and shares in thousands):

| | | Sales1 | | | Reinvestments of

dividends and

distributions | | | Repurchases1 | | | Net (decrease)

increase | |

| Share class | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | Shares | | | Amount | | | Shares | |

| | | | | | | | | | | | | | | | | | |

| Six months ended March 31, 2017 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Class A | | $ | 1,081,449 | | | | 29,205 | | | $ | 1,274,831 | | | | 35,972 | | | $ | (3,236,196 | ) | | | (87,657 | ) | | $ | (879,916 | ) | | | (22,480 | ) |

| Class B | | | 92 | | | | 3 | | | | 586 | | | | 16 | | | | (31,406 | ) | | | (861 | ) | | | (30,728 | ) | | | (842 | ) |

| Class C | | | 92,856 | | | | 2,600 | | | | 39,182 | | | | 1,144 | | | | (224,203 | ) | | | (6,288 | ) | | | (92,165 | ) | | | (2,544 | ) |

| Class F-1 | | | 191,317 | | | | 5,197 | | | | 53,767 | | | | 1,526 | | | | (274,171 | ) | | | (7,447 | ) | | | (29,087 | ) | | | (724 | ) |

| Class F-2 | | | 1,773,101 | | | | 47,991 | | | | 171,816 | | | | 4,862 | | | | (1,088,031 | ) | | | (29,078 | ) | | | 856,886 | | | | 23,775 | |

| Class F-32 | | | 509,870 | | | | 13,298 | | | | — | | | | — | | | | (310 | ) | | | (8 | ) | | | 509,560 | | | | 13,290 | |

| Class 529-A | | | 83,604 | | | | 2,290 | | | | 58,080 | | | | 1,657 | | | | (108,318 | ) | | | (2,973 | ) | | | 33,366 | | | | 974 | |

| Class 529-B | | | 15 | | | | — | 3 | | | 97 | | | | 3 | | | | (5,645 | ) | | | (157 | ) | | | (5,533 | ) | | | (154 | ) |

| Class 529-C | | | 17,223 | | | | 486 | | | | 10,337 | | | | 302 | | | | (29,113 | ) | | | (822 | ) | | | (1,553 | ) | | | (34 | ) |

| Class 529-E | | | 3,164 | | | | 87 | | | | 2,498 | | | | 72 | | | | (5,544 | ) | | | (154 | ) | | | 118 | | | | 5 | |

| Class 529-F-1 | | | 10,484 | | | | 287 | | | | 2,991 | | | | 86 | | | | (8,312 | ) | | | (228 | ) | | | 5,163 | | | | 145 | |

| Class R-1 | | | 4,905 | | | | 138 | | | | 2,550 | | | | 75 | | | | (18,085 | ) | | | (512 | ) | | | (10,630 | ) | | | (299 | ) |

| Class R-2 | | | 59,966 | | | | 1,678 | | | | 15,486 | | | | 452 | | | | (105,033 | ) | | | (2,944 | ) | | | (29,581 | ) | | | (814 | ) |

| Class R-2E | | | 14,772 | | | | 407 | | | | 1,093 | | | | 31 | | | | (4,037 | ) | | | (111 | ) | | | 11,828 | | | | 327 | |

| Class R-3 | | | 159,608 | | | | 4,415 | | | | 53,195 | | | | 1,533 | | | | (266,886 | ) | | | (7,396 | ) | | | (54,083 | ) | | | (1,448 | ) |

| Class R-4 | | | 198,523 | | | | 5,450 | | | | 65,805 | | | | 1,880 | | | | (282,776 | ) | | | (7,794 | ) | | | (18,448 | ) | | | (464 | ) |

| Class R-5E | | | 1,005 | | | | 28 | | | | — | 3 | | | — | 3 | | | (99 | ) | | | (2 | ) | | | 906 | | | | 26 | |

| Class R-5 | | | 153,188 | | | | 4,134 | | | | 57,411 | | | | 1,622 | | | | (186,483 | ) | | | (5,089 | ) | | | 24,116 | | | | 667 | |

| Class R-6 | | | 1,253,363 | | | | 34,014 | | | | 385,071 | | | | 10,865 | | | | (491,558 | ) | | | (13,268 | ) | | | 1,146,876 | | | | 31,611 | |

| Total net increase (decrease) | | $ | 5,608,505 | | | | 151,708 | | | $ | 2,194,796 | | | | 62,098 | | | $ | (6,366,206 | ) | | | (172,789 | ) | | $ | 1,437,095 | | | | 41,017 | |

See page 26 for footnotes.

| | | Sales1 | | | Reinvestments of

dividends and

distributions | | | Repurchases1 | | | Net increase

(decrease) | |

| Share class | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

| | | | | | | | | | | | | | | | | | |

| Year ended September 30, 2016 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | $ | 2,454,907 | | | | 68,536 | | | $ | 2,107,172 | | | | 58,161 | | | $ | (4,441,754 | ) | | | (123,500 | ) | | $ | 120,325 | | | | 3,197 | |

| Class B | | | 1,176 | | | | 34 | | | | 4,874 | | | | 136 | | | | (75,161 | ) | | | (2,144 | ) | | | (69,111 | ) | | | (1,974 | ) |

| Class C | | | 266,125 | | | | 7,700 | | | | 74,475 | | | | 2,124 | | | | (336,172 | ) | | | (9,750 | ) | | | 4,428 | | | | 74 | |

| Class F-1 | | | 427,971 | | | | 12,035 | | | | 83,423 | | | | 2,315 | | | | (356,922 | ) | | | (10,020 | ) | | | 154,472 | | | | 4,330 | |

| Class F-2 | | | 1,874,879 | | | | 52,130 | | | | 172,645 | | | | 4,777 | | | | (723,745 | ) | | | (20,335 | ) | | | 1,323,779 | | | | 36,572 | |

| Class 529-A | | | 151,746 | | | | 4,273 | | | | 92,452 | | | | 2,578 | | | | (199,064 | ) | | | (5,574 | ) | | | 45,134 | | | | 1,277 | |

| Class 529-B | | | 204 | | | | 6 | | | | 740 | | | | 21 | | | | (10,990 | ) | | | (316 | ) | | | (10,046 | ) | | | (289 | ) |

| Class 529-C | | | 37,853 | | | | 1,097 | | | | 18,759 | | | | 536 | | | | (50,906 | ) | | | (1,467 | ) | | | 5,706 | | | | 166 | |

| Class 529-E | | | 7,026 | | | | 199 | | | | 4,177 | | | | 118 | | | | (10,721 | ) | | | (302 | ) | | | 482 | | | | 15 | |

| Class 529-F-1 | | | 18,438 | | | | 519 | | | | 4,062 | | | | 114 | | | | (11,670 | ) | | | (328 | ) | | | 10,830 | | | | 305 | |

| Class R-1 | | | 11,126 | | | | 324 | | | | 5,294 | | | | 152 | | | | (28,653 | ) | | | (826 | ) | | | (12,233 | ) | | | (350 | ) |

| Class R-2 | | | 111,097 | | | | 3,212 | | | | 30,152 | | | | 859 | | | | (171,471 | ) | | | (4,947 | ) | | | (30,222 | ) | | | (876 | ) |

| Class R-2E | | | 25,531 | | | | 710 | | | | 66 | | | | 2 | | | | (1,158 | ) | | | (32 | ) | | | 24,439 | | | | 680 | |

| Class R-3 | | | 328,761 | | | | 9,384 | | | | 92,809 | | | | 2,614 | | | | (461,634 | ) | | | (13,146 | ) | | | (40,064 | ) | | | (1,148 | ) |

| Class R-4 | | | 370,831 | | | | 10,519 | | | | 107,109 | | | | 2,993 | | | | (478,646 | ) | | | (13,619 | ) | | | (706 | ) | | | (107 | ) |

| Class R-5E4 | | | 12 | | | | — | 3 | | | — | | | | — | | | | — | | | | — | | | | 12 | | | | — | 3 |

| Class R-5 | | | 321,431 | | | | 8,982 | | | | 94,652 | | | | 2,615 | | | | (431,321 | ) | | | (12,261 | ) | | | (15,238 | ) | | | (664 | ) |

| Class R-6 | | | 2,275,215 | | | | 64,231 | | | | 545,611 | | | | 15,060 | | | | (1,997,112 | ) | | | (57,270 | ) | | | 823,714 | | | | 22,021 | |

| Total net increase (decrease) | | $ | 8,684,329 | | | | 243,891 | | | $ | 3,438,472 | | | | 95,175 | | | $ | (9,787,100 | ) | | | (275,837 | ) | | $ | 2,335,701 | | | | 63,229 | |

| 1 | Includes exchanges between share classes of the fund. |

| 2 | Class F-3 shares were offered beginning January 27, 2017. |

| 3 | Amount less than one thousand. |

| 4 | Class R-5E shares were offered beginning November 20, 2015. |

9. Investment transactions

The fund made purchases and sales of investment securities, excluding short-term securities and U.S. government obligations, if any, of $9,020,135,000 and $10,504,973,000, respectively, during the six months ended March 31, 2017.

Financial highlights

| | | | | | | Income (loss) from investment operations1 | |

| | | | | | | | | Net gains | | | | |

| | | Net asset | | | Net | | | (losses) on | | | | |

| | | value, | | | investment | | | securities (both | | | Total from | |

| | | beginning | | | income | | | realized and | | | investment | |

| | | of period | | | (loss)2 | | | unrealized) | | | operations | |

| Class A: | | | | | | | | | | | | | | | | |

| Six months ended 3/31/20175,6 | | $ | 37.41 | | | $ | .12 | | | $ | 2.53 | | | $ | 2.65 | |

| Year ended 9/30/2016 | | | 35.80 | | | | .34 | | | | 3.48 | | | | 3.82 | |

| Year ended 9/30/2015 | | | 38.12 | | | | .32 | | | | (.12 | ) | | | .20 | |

| Year ended 9/30/2014 | | | 36.52 | | | | .37 | | | | 3.28 | | | | 3.65 | |

| Year ended 9/30/2013 | | | 30.34 | | | | .34 | | | | 6.17 | | | | 6.51 | |

| Year ended 9/30/2012 | | | 24.88 | | | | .31 | | | | 5.44 | | | | 5.75 | |

| Class B: | | | | | | | | | | | | | | | | |

| Six months ended 3/31/20175,6 | | | 36.76 | | | | (.05 | ) | | | 2.52 | | | | 2.47 | |

| Year ended 9/30/2016 | | | 35.22 | | | | .03 | | | | 3.46 | | | | 3.49 | |

| Year ended 9/30/2015 | | | 37.58 | | | | .02 | | | | (.09 | ) | | | (.07 | ) |

| Year ended 9/30/2014 | | | 36.02 | | | | .08 | | | | 3.23 | | | | 3.31 | |

| Year ended 9/30/2013 | | | 29.86 | | | | .09 | | | | 6.10 | | | | 6.19 | |

| Year ended 9/30/2012 | | | 24.42 | | | | .08 | | | | 5.37 | | | | 5.45 | |

| Class C: | | | | | | | | | | | | | | | | |

| Six months ended 3/31/20175,6 | | | 35.98 | | | | (.02 | ) | | | 2.44 | | | | 2.42 | |

| Year ended 9/30/2016 | | | 34.53 | | | | .05 | | | | 3.35 | | | | 3.40 | |

| Year ended 9/30/2015 | | | 36.91 | | | | .01 | | | | (.10 | ) | | | (.09 | ) |

| Year ended 9/30/2014 | | | 35.43 | | | | .07 | | | | 3.18 | | | | 3.25 | |

| Year ended 9/30/2013 | | | 29.44 | | | | .08 | | | | 6.00 | | | | 6.08 | |

| Year ended 9/30/2012 | | | 24.12 | | | | .08 | | | | 5.29 | | | | 5.37 | |

| Class F-1: | | | | | | | | | | | | | | | | |

| Six months ended 3/31/20175,6 | | | 37.19 | | | | .11 | | | | 2.51 | | | | 2.62 | |

| Year ended 9/30/2016 | | | 35.60 | | | | .32 | | | | 3.47 | | | | 3.79 | |

| Year ended 9/30/2015 | | | 37.91 | | | | .30 | | | | (.12 | ) | | | .18 | |

| Year ended 9/30/2014 | | | 36.34 | | | | .35 | | | | 3.25 | | | | 3.60 | |

| Year ended 9/30/2013 | | | 30.19 | | | | .33 | | | | 6.14 | | | | 6.47 | |

| Year ended 9/30/2012 | | | 24.76 | | | | .31 | | | | 5.40 | | | | 5.71 | |

| Class F-2: | | | | | | | | | | | | | | | | |

| Six months ended 3/31/20175,6 | | | 37.38 | | | | .17 | | | | 2.50 | | | | 2.67 | |

| Year ended 9/30/2016 | | | 35.77 | | | | .42 | | | | 3.49 | | | | 3.91 | |

| Year ended 9/30/2015 | | | 38.11 | | | | .40 | | | | (.13 | ) | | | .27 | |

| Year ended 9/30/2014 | | | 36.52 | | | | .46 | | | | 3.28 | | | | 3.74 | |

| Year ended 9/30/2013 | | | 30.35 | | | | .44 | | | | 6.15 | | | | 6.59 | |

| Year ended 9/30/2012 | | | 24.90 | | | | .39 | | | | 5.42 | | | | 5.81 | |

| Class F-3: | | | | | | | | | | | | | | | | |

| Period from 1/27/2017 to 3/31/20175,6,9 | | | 37.16 | | | | .12 | | | | 1.43 | | | | 1.55 | |

| Dividends and distributions | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Ratio of | | | Ratio of | | | | |

| | | | | | | | | | | | | | | | Net assets, | | | expenses to | | | expenses to | | | | |

| Dividends | | | | | | Total | | | | | | | | | end of | | | average net | | | average net | | | Ratio of net | |

| (from net | | | Distributions | | | dividends | | | Net asset | | | | | | period | | | assets before | | | assets after | | | income (loss) | |

| investment | | | (from capital | | | and | | | value, end | | | | | | (in | | | reimburse- | | | reimburse- | | | to average | |

| income) | | | gains) | | | distributions | | | of period | | | Total return3,4 | | | millions) | | | ments | | | ments4 | | | net assets2,4 | |

| $ | (.29 | ) | | $ | (1.08 | ) | | $ | (1.37 | ) | | $ | 38.69 | | | | 7.41 | %7 | | $ | 37,257 | | | | .76 | %8 | | | .76 | %8 | | | .68 | %8 |

| | (.26 | ) | | | (1.95 | ) | | | (2.21 | ) | | | 37.41 | | | | 10.91 | | | | 36,897 | | | | .77 | | | | .77 | | | | .94 | |

| | (.23 | ) | | | (2.29 | ) | | | (2.52 | ) | | | 35.80 | | | | .34 | | | | 35,187 | | | | .75 | | | | .75 | | | | .84 | |