Ron Brown

Chairman, President & CEO

INVESTOR PRESENTATION

MAY 2005

Beginning of Plastics Industry Recovery in U.S.

Capacity is being stretched in certain end markets.

Average utilization rates now approaching 84-85%.

U.S. dollar is very low in relation to euro and yen.

Plastics processors’ earnings and cash flow continue to improve,

enabling new investment.

Average age of existing plastics machinery estimated at 10+ years.

Pent up demand growing since 2001.

Today’s machines are more energy efficient and productive.

Plastics manufacturers need to improve efficiency and competitiveness.

2

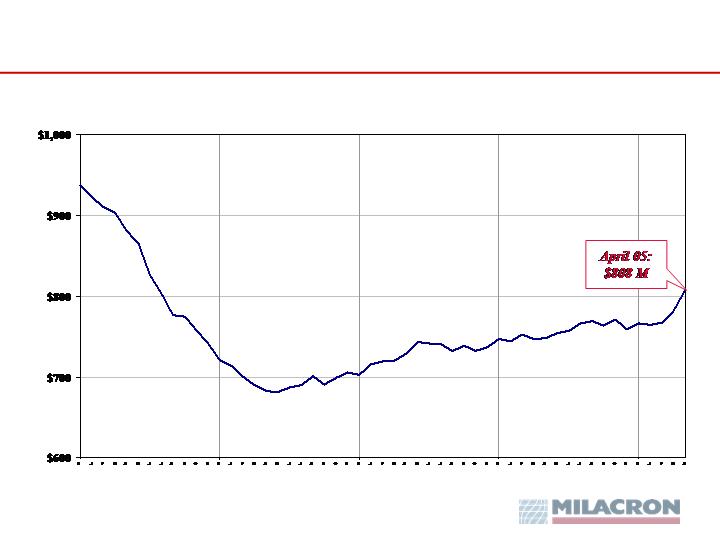

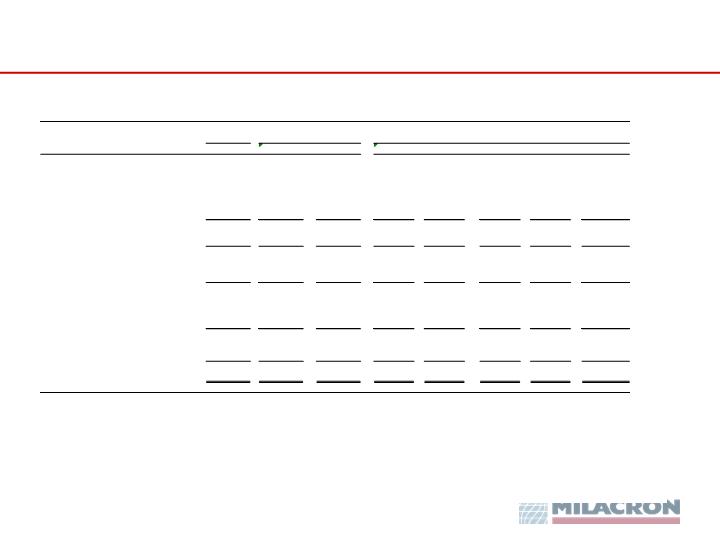

Milacron Consolidated New Orders

12-Month Moving Total

(In millions)

2001

2002

2003

2004

2005

3

Milacron: A Leader in Two Major Technologies

Plastics Processing

Industrial Fluids

Broadest line supplier of equipment

and supplies - all 3 top processing

methods: injection molding, blow

molding and extrusion

#1 in North America; #2 or #3

worldwide

Global reputation for advanced

technology and excellent service

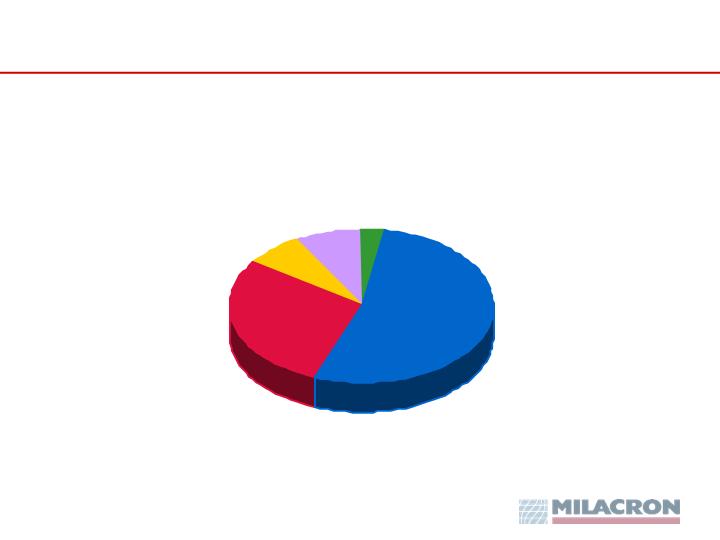

2004 sales: $665 M - 86%

2004 total segment earnings: $22 M*

Coolants, lubricants and process

cleaners used in metalcutting and

metalforming

#1 in North America in water-based

fluids; #3 or #4 worldwide

Global reputation for advanced

technology and excellent service

2004 sales: $109 M - 14%

2004 segment earnings : $9 M

* Sum of three plastics technologies segments’ earnings

4

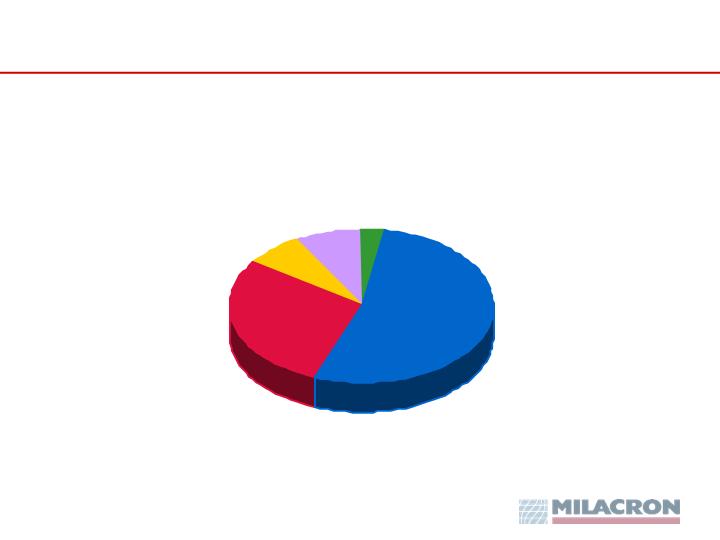

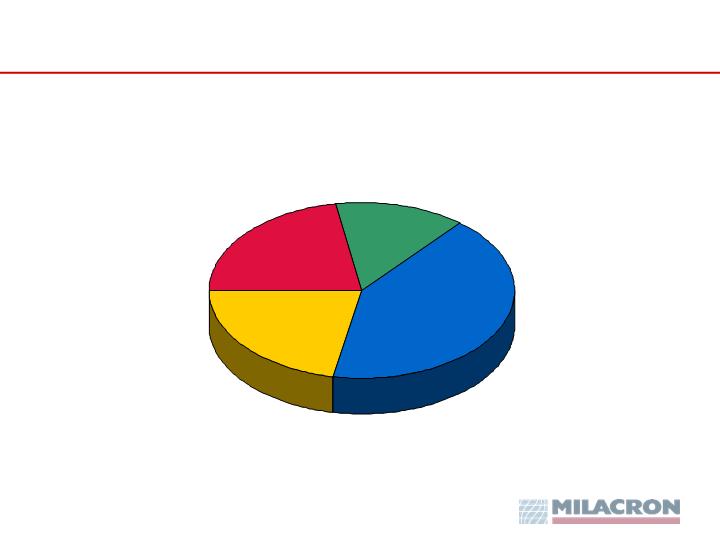

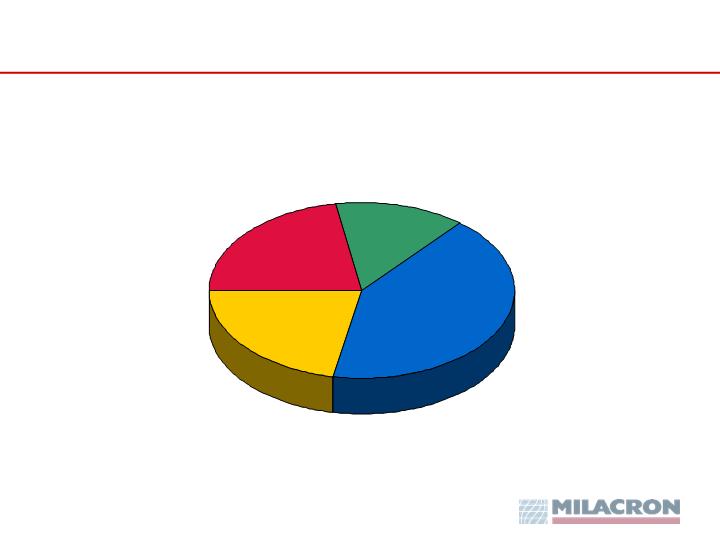

2004 Consolidated Sales - $774 Million

5

Geographic Diversity

United States

53%

Europe

29%

Canada & Mexico

7%

Asia

8%

ROW

3%

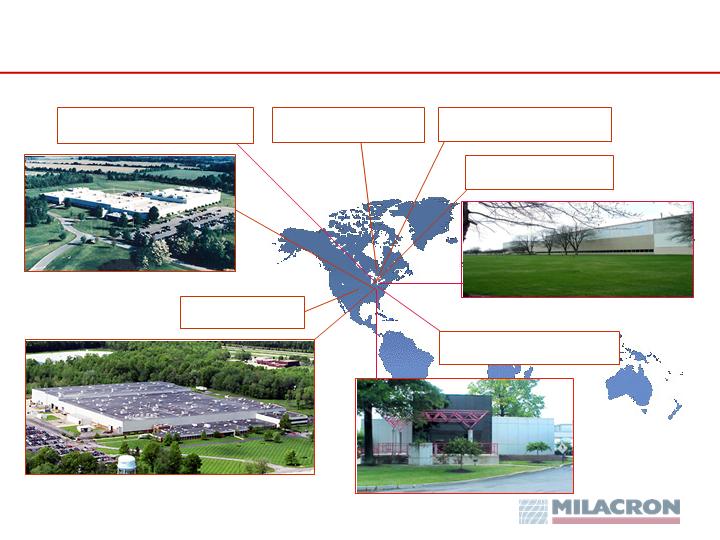

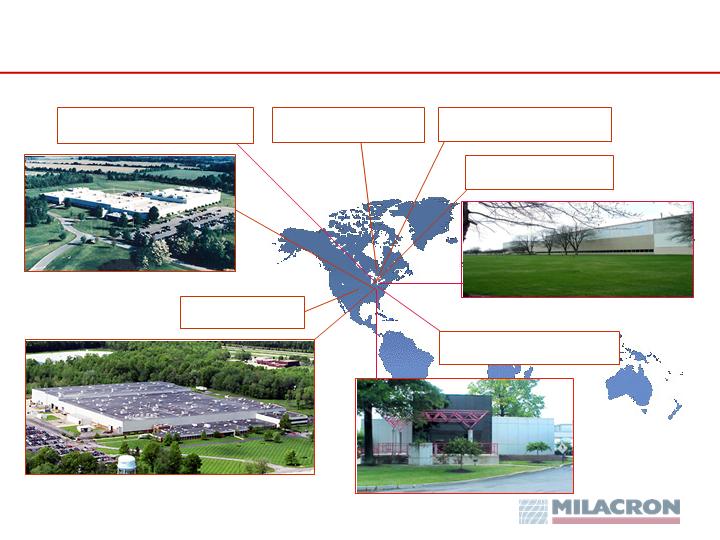

Global Presence: North America - 2,050 Employees

North American Machinery Manufacturing Center

Batavia, OH, USA

Cincinnati Milacron Parts Manufacturing

Mt. Orab, OH, USA

Tecumseh, MI, USA

Uniloy Milacron North America

Madison Heights, MI, USA

D-M-E North America

Wear Technology

McPherson, KS, USA

D-M-E & Master Unit Die

Charlevoix & Greenville, MI, USA

Progress Precision

Mississauga, ONT, Canada

Cimcool Industrial Fluids

Oak Int’l & Producto Chemicals

Sturgis & Livonia, MI, USA

D-M-E North America

Youngwood & Lewistown, PA, USA

Cincinnati, OH, USA

6

Global Presence: Europe - 1,100 Employees

Expulsores Girona

Barcelona, Spain

Ferromatik Milacron Europe

Malterdingen, Germany

D-M-E Europe

Mechelen, Belgium

Magenta, Italy

Uniloy Milacron Europe

Policka, Czech Republic

Uniloy Milacron Europe

Uniloy Milacron B&W

Berlin, Germany

D-M-E Normalien

Fulda, Germany

Cimcool Europe

Vlaardingen, Holland

Oak Int’l & Plastic Moulding Supplies

Corby, England

Cimcool Europe

Freiburg, Gemany

7

Global Presence: Asia - 350 Employees

Milacron Plastics Machinery

Jiangyin, China

Ferromatik Milacron India

Ahmedabad

(Jiangyin) Company

D-M-E China

Hong Kong, Dongguan City

D-M-E Japan

Tokyo

D-M-E India

Belgaum

Cimcool Asia

Ulsan, South Korea

8

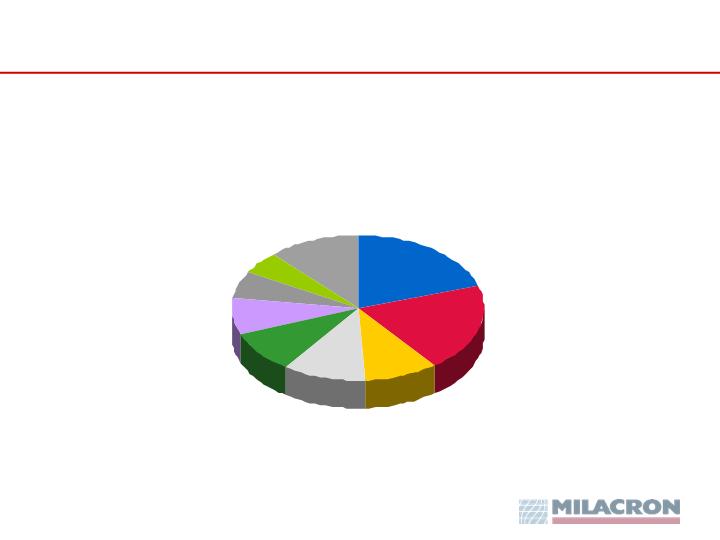

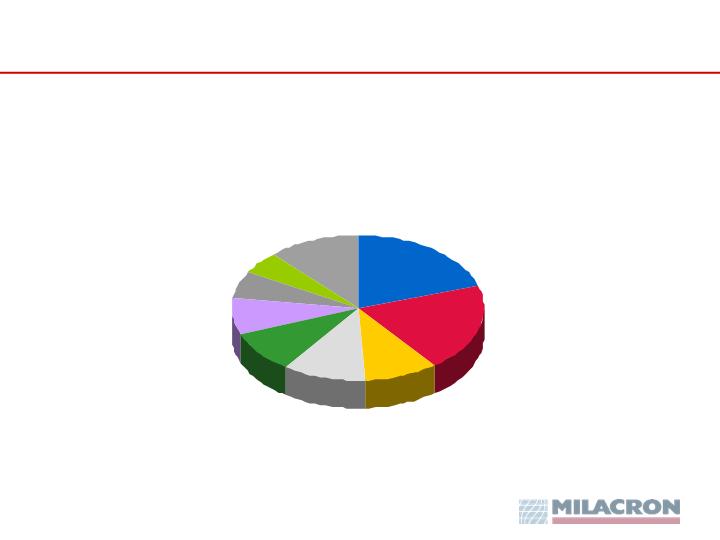

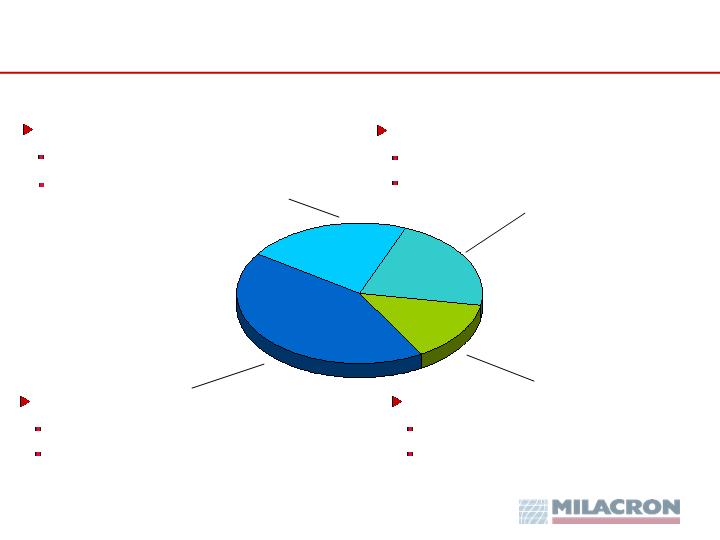

2004 Consolidated Sales - $774 Million

9

End Market Diversity

Packaging

20%

Automotive

20%

Components

9%

Consumer

Goods

11%

Building

Materials

9%

Custom

Molders

8%

Medical

6%

Appliances

5%

Other

12%

Partial Customer List

Abbott Labs

Alcoa/Alpine

Allen Bradley

American Plastic Toys

Bausch & Lomb

Baxter Healthcare

Becton Dickinson

Bemis Manufacturing

Bic Group

Black & Decker

Bosch

Boston Scientific

Braun

Briggs & Stratton

Brown Medical

Burpee

Cascade Engineering/

CK Technologies

Charlotte Pipe

Clorox

Colgate-Palmolive

Consolidated

Container

Crane Plastics

Crown Group

Daimler-Chrysler

Keytronics

Kohler

Kroger Company

Lancer

Lear

Louisiana Pacific

Lucent Technologies

Mattel/Fisher-Price

Maytag/Amana

Mercury Marine

Merle Norman

Cosmetics

Mobil Chemical

Motorola

Mountain Pure Water

Newell/Rubbermaid

Nike

Nummi

Nypro

Oracle Lens

Osram/Sylvania

Owens-Illinois

Papermate

Parket Hannifin

Pitney Bowes

Playtex

Dean Foods

Delphi

Deutsch ECD

Diamond Plastic

Dow/Union Carbide

Dupont

Electrolux Home

Products

Emerson Elec./ Mallory

Evenflo

Fiat

General Electric

General Motors

Gillette

Graco

Harley Davidson

Hasbro

Honda

Honeywell

Hoover

IPEX Inc.

ITW Delpro

Johnson & Johnson

Johnson Controls

KW Plastics

Keter (Resin Partners)

PlayMobil

Polaris Industries

Procter & Gamble

Rayovac

Shop Vac

Siegel Robert

Siemens

Spalding Sports

Stanley Electric

Sunoco/Crellin

Tenneco Packaging

Timken

Toro

Toyota

Tupperware

Tyco / AMP

U.S. Fence

Valeo

VisionTech

Volvo

West Pharmaceuticals/

The Tech Group

Whirlpool

10

Product Type Diversity

2004 Mix of Sales

Durables

Services

&

Aftermarket

Industrial

Fluids

Machinery

42%

22%

14%

22%

11

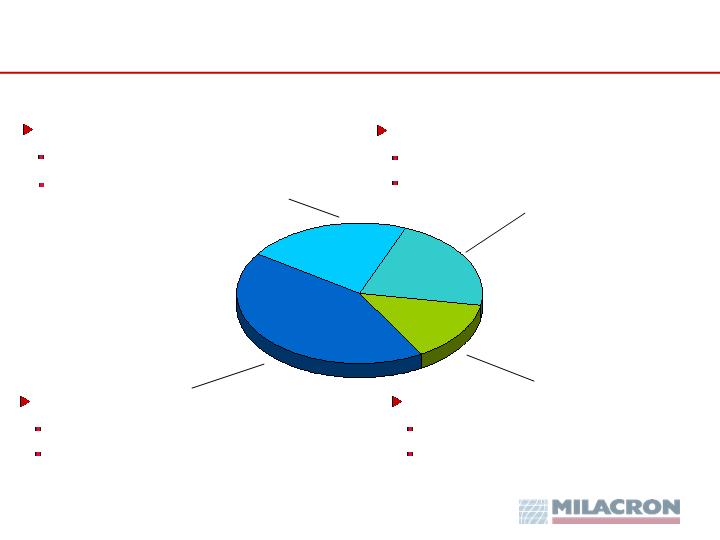

Milacron Segments

Industrial Fluids - Global

2004: sales $109 M; segment earnings $9 M

Metalworking fluids, solvents

and process cleaners

Mold Technologies - Global

2004: sales $167 M; segment earnings $4 M

Mold bases, hot-runner systems, mold

components, MRO supplies

Machinery Technologies - N.A.

2004: sales $334 M; segment earnings $16 M

Injection molding, blow molding

and extrusion

Machinery Technologies - Europe

2004: sales $167 M; segment earnings $2 M

Injection molding and blow molding

14%

43%

21%

22%

12

Plastics Technologies – Injection Molding

Most common, versatile process

Accounts for over half of the market

Used in wide variety of applications

Customer categories

Automotive

Consumer goods

Packaging

Electrical/Electronic

Medical/Scientific

Milacron’s rank

#1 in North America

#3 in Europe

#3 worldwide

Milacron’s technology leadership

All-electric designs

Multi-material, multi-component molding

High-speed, thin-wall molding

Insert molding

13

Plastics Technologies – Blow Molding

For hollow, semi-hollow shapes

Containers of all sorts

Industrial and commercial parts

Customer categories

Packaging

Automotive

Housewares/furniture

Building products

Medical/scientific

Milacron’s rank

#1 in North America

#3 in Europe

#3 worldwide

Milacron’s technology leadership

HDPE (non-PET) containers

Industrial applications

Structural foam molding

14

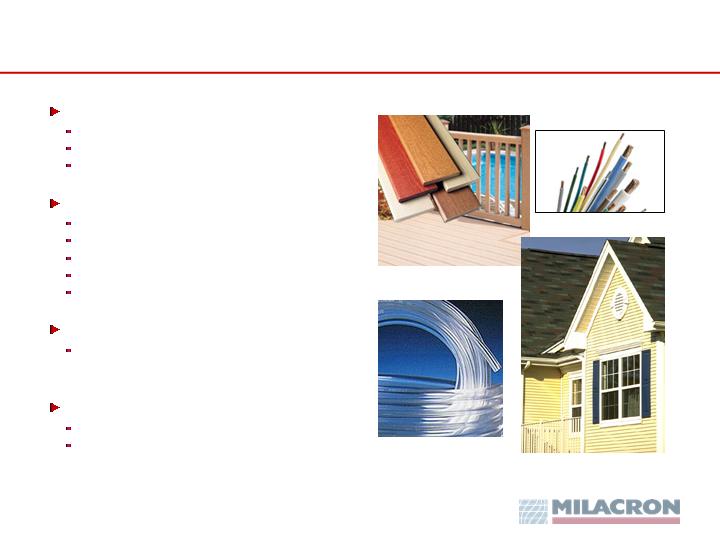

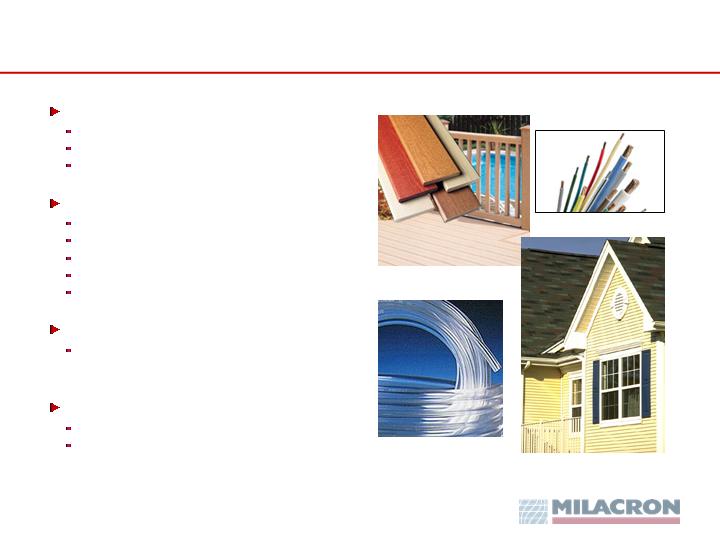

Plastics Technologies – Extrusion

For continuous profiles

Building materials: pipe, siding, decking

Tubing, conduit

Cylindrical parts

Customer categories

Building products

Electrical cable

Medical

Packaging

Appliances

Milacron’s rank

#1 in twin-screw extrusion

in North America

Milacron’s technology leadership

PVC pipe, siding, door and window frames

Wood flour, plastic lumber

15

Plastics Technologies – Mold Tooling

Mold tooling and supplies for injection

molding, the most common, versatile

process

Accounts for over half of the market

Used in wide variety of applications

Customer categories

Automotive

Consumer goods

Packaging

Electrical/Electronic

Medical/Scientific

Milacron’s rank

#1 in North America

#2 in Europe

#2 worldwide

Milacron’s technology leadership

Mold components

Mold making equipment and supplies

Hot runner systems

Mold control systems

16

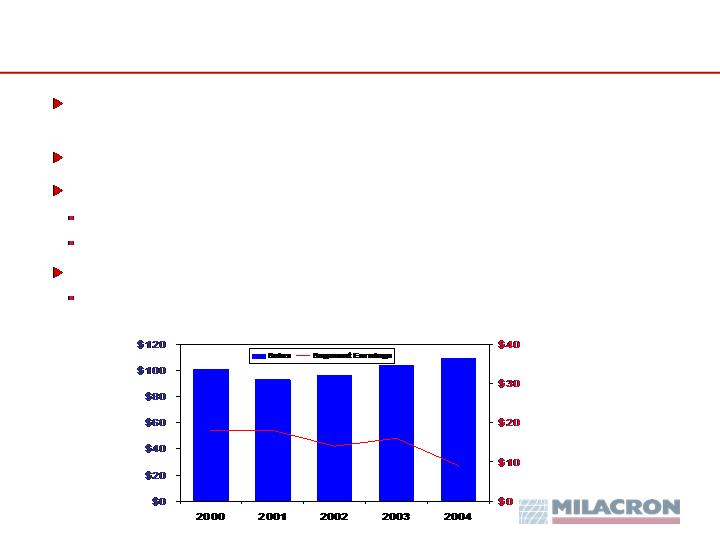

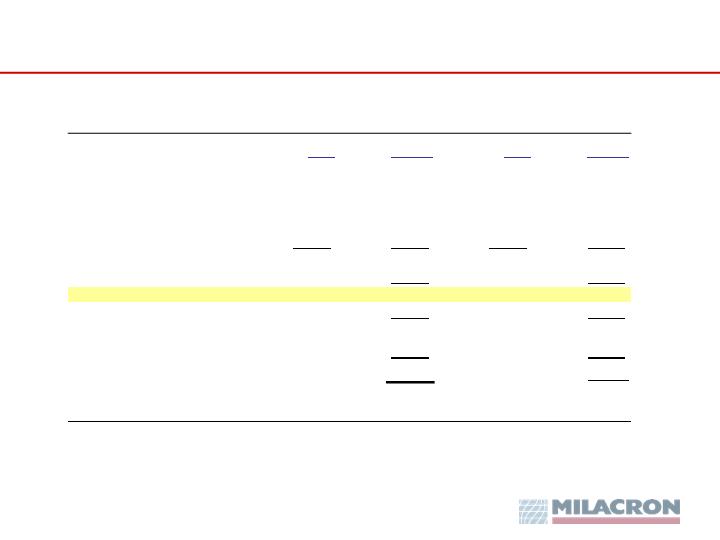

Plastics Businesses – Global Breadth and Depth

Plastics Technologies

($ in millions)

Broadest line supplier of equipment and supplies - all three top

processing methods: injection molding, blow molding and extrusion

#1 in North America; #2 or #3 worldwide

Broad customer base

Packaging, automotive, consumer, construction, electric/electronic, medical, etc.

No customer = more than 2% of sales; top ten customers = less than 10% of sales

Global reputation for advanced technology and excellent service

* Total of three plastics technologies segments’ earnings

17

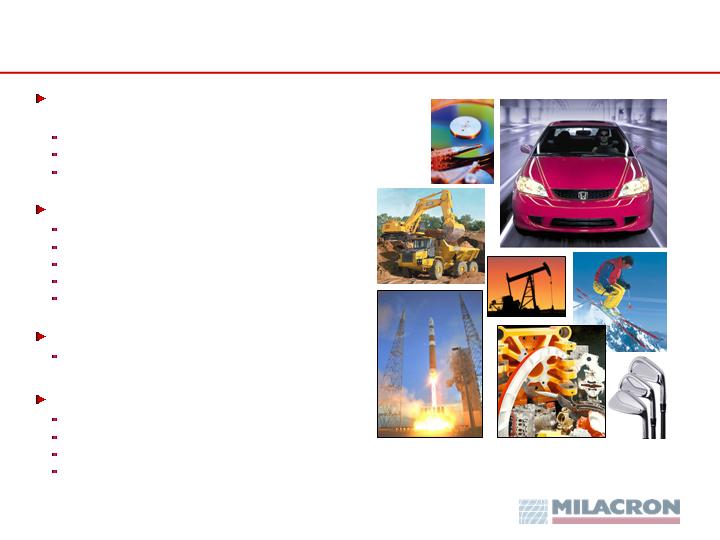

Industrial Fluids for Metalworking

Coolants, lubricants and process cleaners

for a variety of metalworking applications

Metalcutting: milling, drilling, turning, sawing, etc.

Metalforming: stamping

Grinding

Customer categories

Automotive

Agricultural and industrial equipment

Industrial components

Appliances

Medical

Milacron’s rank

#1 in North America in water-based fluids

Milacron’s technology leadership

Premium, high-performance fluids

Fluids for machining aluminum, titanium, etc.

Synthetic and semi-synthetics fluids

Green (vegetable oil-based) fluids

18

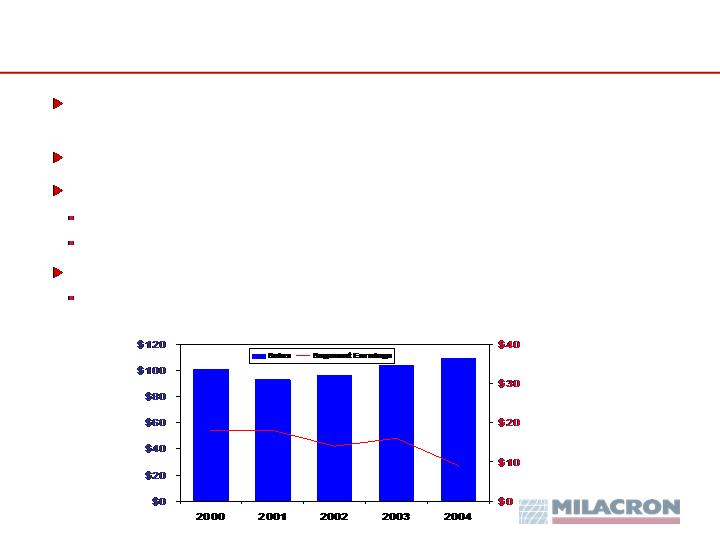

Industrial Fluids Business Consistent

Industrial Fluids

($ in millions)

Coolants, lubricants and process cleaners used in metalcutting (e.g.

machining, grinding) and metalforming (e.g. stamping)

Segment operates as an independent, stand-alone business

In pronounced downturn, maintained its revenue stream

Broad use and consumable nature of fluids result in steady sales

Fluids required to manufacture products

In 2004, margins impacted by higher material costs

Price increase taking hold in 2005

18

18

14

16

9

19

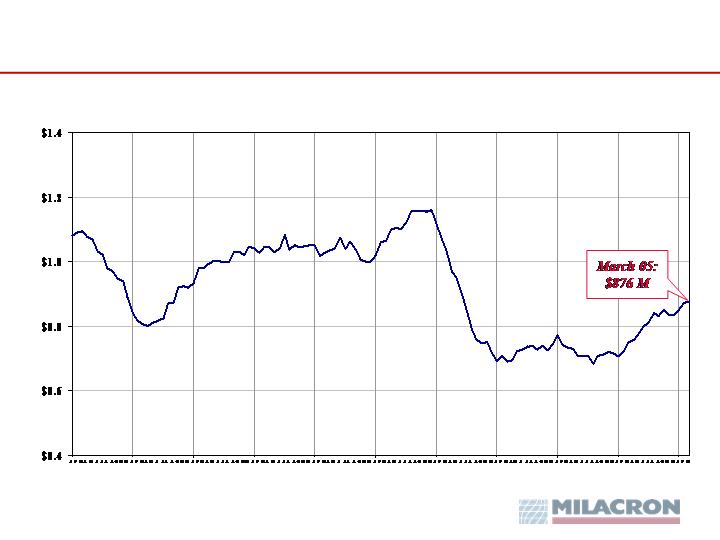

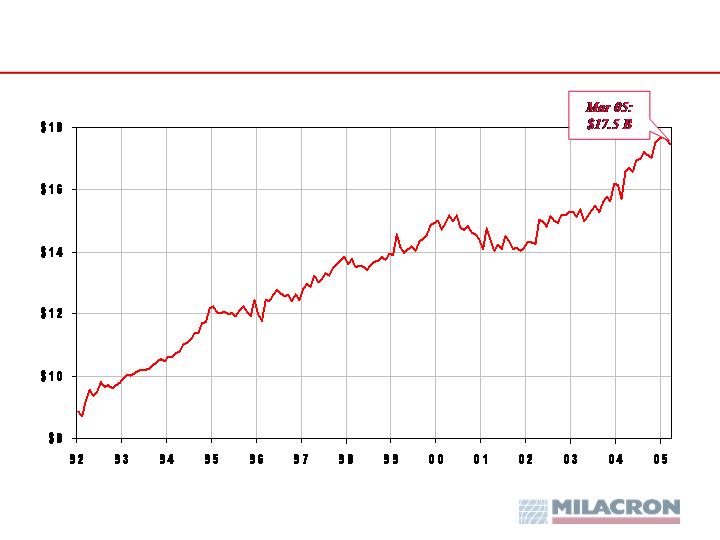

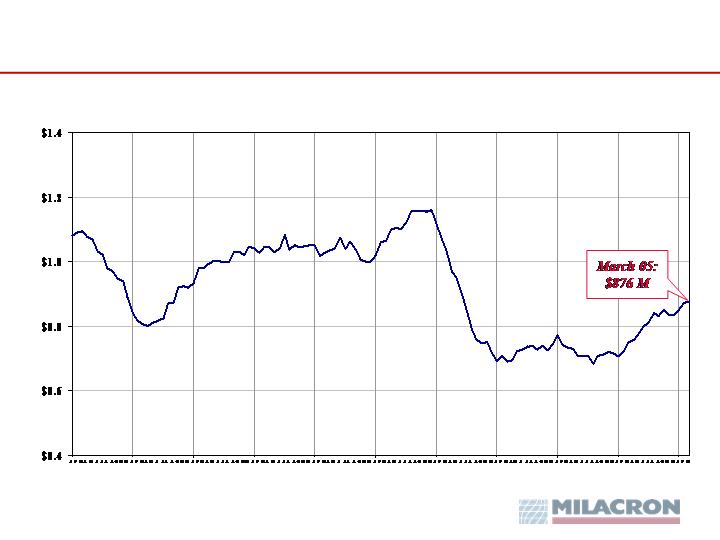

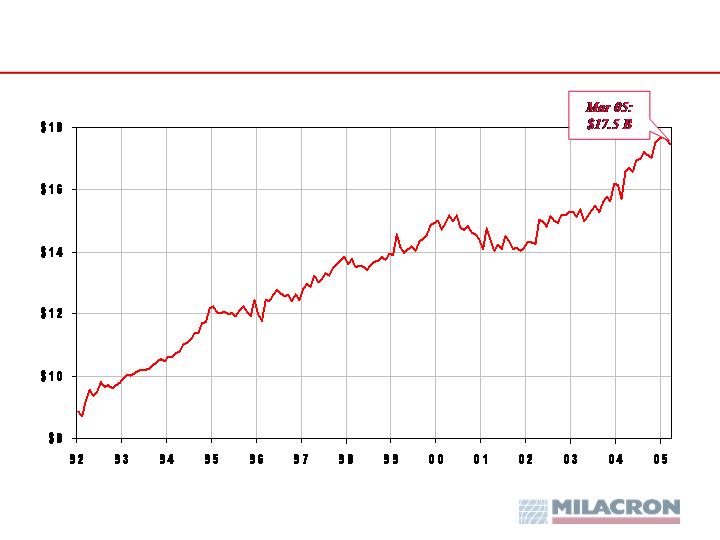

U.S. Injection Machinery Industry New Orders

12-Month Moving Total

(In billions)

Source: The Society of the Plastics Industry

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

20

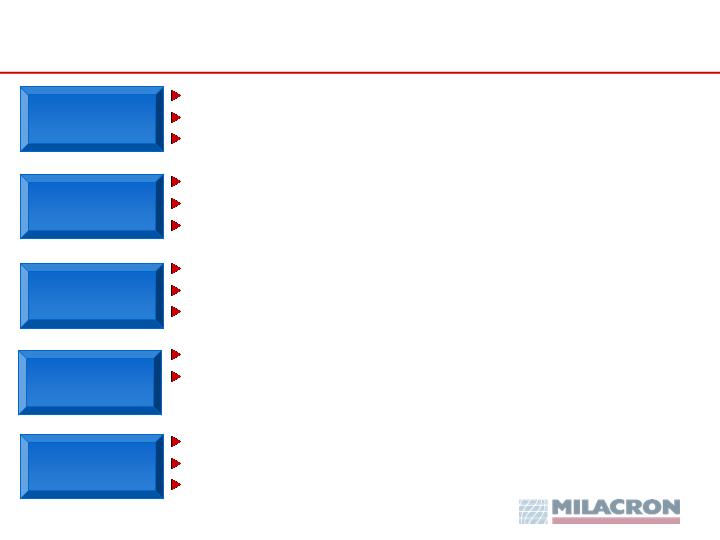

Closed 9 manufacturing facilities from ongoing operations

Divested non-core assets: cutting tools, grinding wheels

Generated $75 M of annual restructuring cost benefits

Drove Lean and Six Sigma throughout the organization

Cut primary working capital from 40% to 25% of sales

Lowered inventory by $119 M

Reduced debt by $350 million

Secured $100 million new equity infusion

Refinanced long-term debt: Notes & revolver

Continued steady flow of new product introductions

Half our machinery sales in 2004 were products

introduced since 2001

Grew aftermarket sales by 14%

Expanded new service organization

Improved our industry-leading response times

Actions Taken Since 2001

Restructured

Operations

Improved

Capital

Structure

Maintained

Technological

Leadership

Increased

Operating

Efficiency

Expanded

Aftermarket

& Service

21

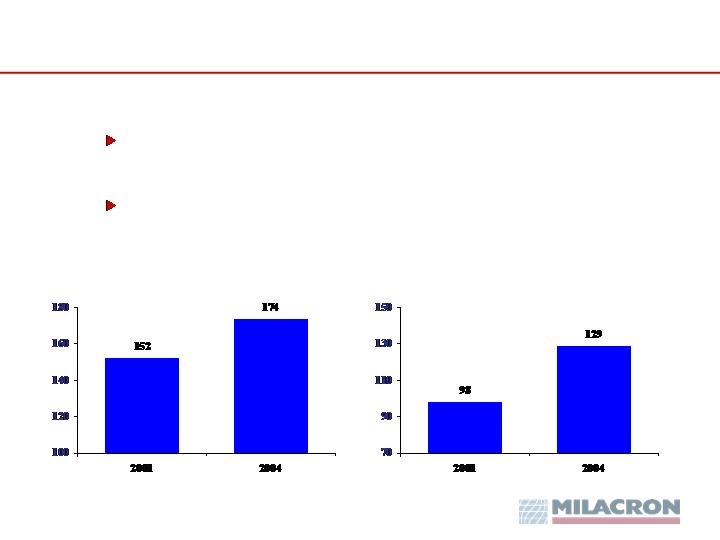

Provide needed technology and aftermarket support

for traditional markets

Expand presence in developing markets, such as

Eastern Europe and Asia

Maximize Value through Growth in Key Markets

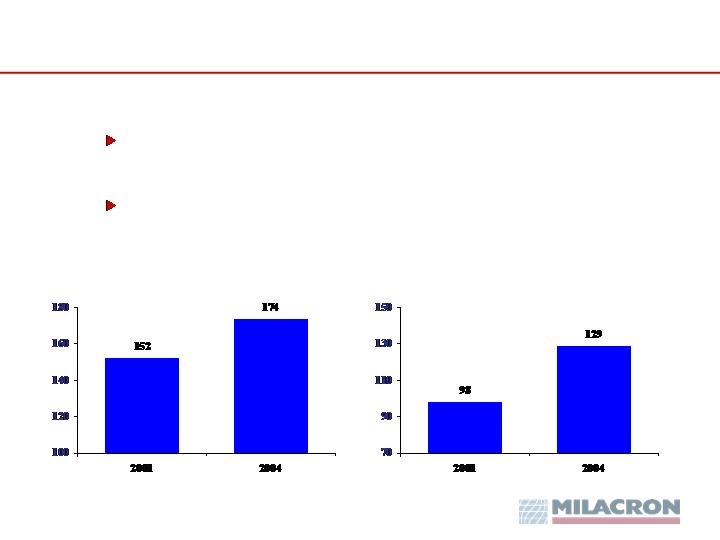

Machinery Aftermarket Sales

($ in millions)

Sales to Non-Traditional Markets*

($ in millions)

Continuing to Execute Long-Term Strategy

* All markets excluding U.S., Canada and Western Europe.

22

Continuing to Execute Long-Term Strategy

Profitable Growth through Operational Excellence

Continue to improve efficiencies and optimize working capital

through implementation of Lean and Six Sigma

Reduce product costs through standardization and strategic

sourcing

Earn technology- and service-based pricing

($ in millions)

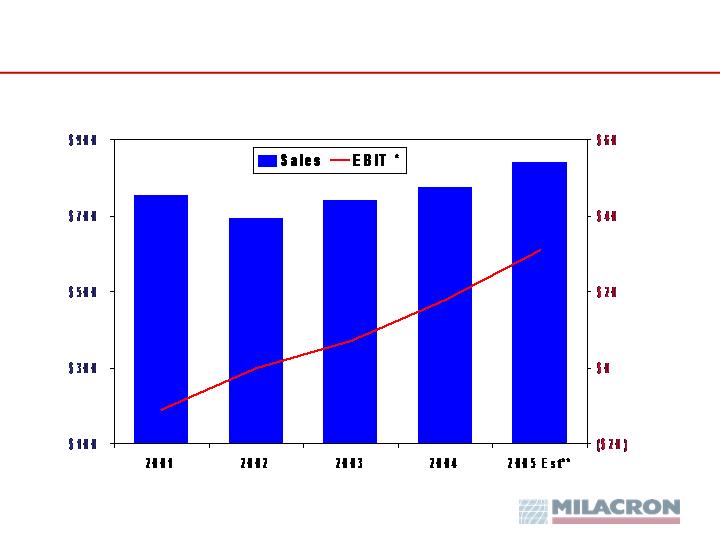

* Ex certain items (see page 30). ** Mid-point of guidance issued 5/5/05.

($ in millions)

23

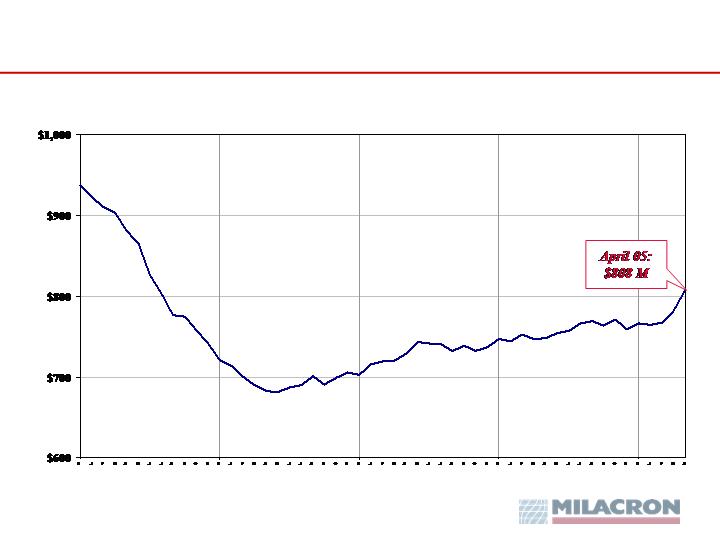

Sources: U.S. Federal Reserve Board

(Utilization)

U.S. Plastics Processors’ Capacity Utilization

April 05:

83.5%

24

U.S. Plastics & Rubber Shipments

(In Billions - Seasonally Adjusted)

Source: U.S. Census Bureau

25

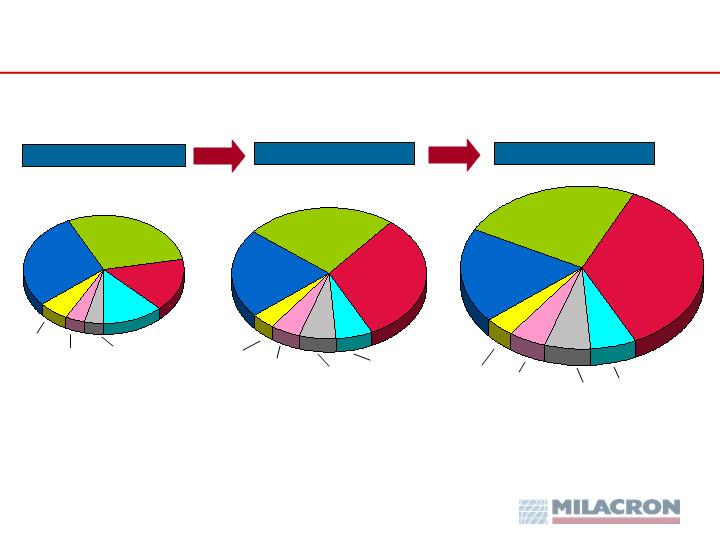

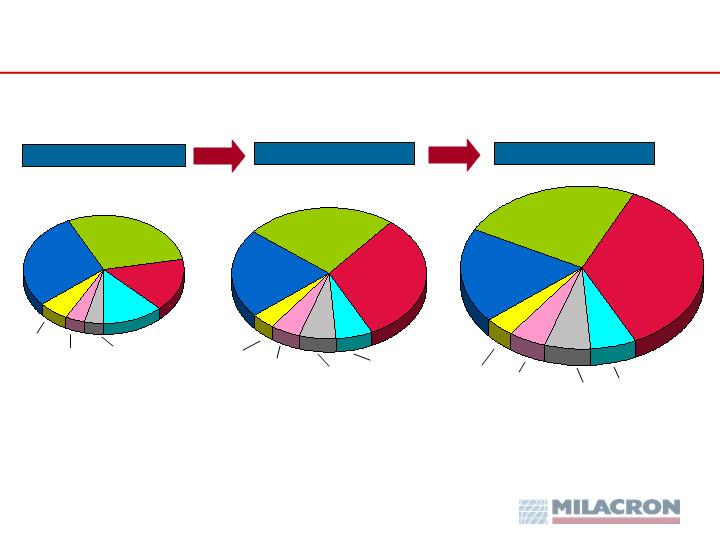

Global Plastics Consumption - Projected Growth

2003 – 176 M Tons

1990 – 86 M Tons

Western

Europe

29%

North

America

29%

Southeast

Asia 16%

Japan

12%

North

America

25%

Western

Europe

22%

Southeast

Asia 32%

Southeast

Asia 36%

North

America

24%

Western

Europe

19%

Eastern

Europe

6%

Latin

America

4%

Africa/

Middle

East

4%

Eastern

Europe

4%

Latin

America

5%

Africa/

Middle

East

6%

Japan

6%

Eastern

Europe

4%

Latin

America

5%

Africa/

Middle

East

6%

Japan

6%

2010 – 250 M Tons

Source: VKE, June 2004

5.7%

5.1%

26

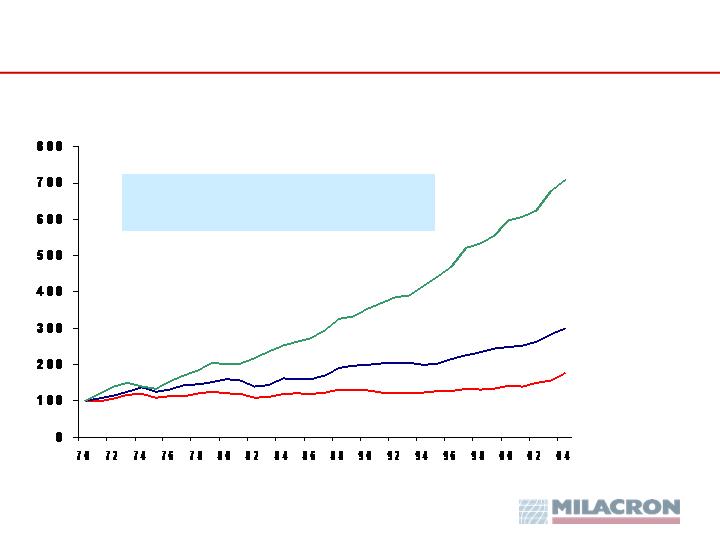

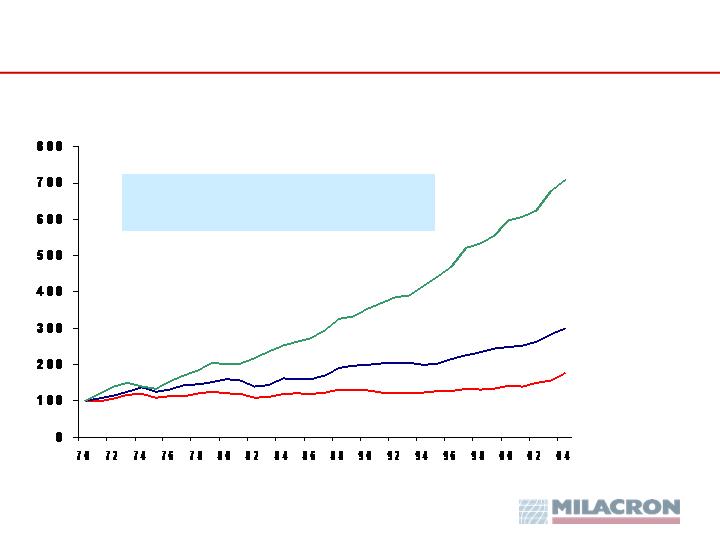

Plastics

Aluminum

Steel

Plastics: The Global Material of Choice

Indexed Production in Weight

(1970 = 100)

Compound Annual Growth Rates 1970-2004

Steel: 2% Aluminum: 3% Plastics: 6%

Source: SPI, Milacron

27

FINANCIAL REVIEW

Bob Lienesch

Senior Vice President - Finance

Controller & CFO

Forward-Looking Statements

Any forward-looking statements made at this meeting by their

nature involve risks, assumptions and uncertainties that could

significantly impact operations, markets, products and

expected and actual results.

For further information, please refer to the Cautionary

Statement included in our most recent Form 10-Q on file with

the Securities and Exchange Commission.

29

Five-Year Financial Summary

From Continuing Operations

* Ex items: Excludes restructuring and refinancing costs as well as

the writedown of goodwill and deferred tax assets.

30

(Dollars in millions)

2004

2003

2002

2001

2000

Sales

774

$

740

$

693

$

755

$

975

$

EBIT*

18

7

0

(11)

90

* Excludes restructuring and refinancing costs as well as

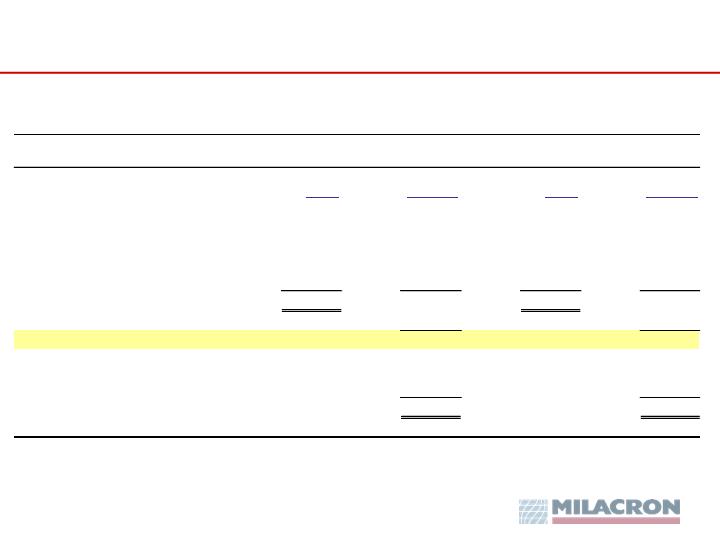

First Quarter Comparison

From Continuing Operations

* Excludes restructuring and refinancing costs

31

(Dollars in millions)

Sales

Earnings

Sales

Earnings

Machinery Technologies - N. America

87

$

1.9

$

77

$

(0.6)

$

Machinery Technologies - Europe

34

(2.2)

43

1.1

Mold Technologies

44

2.3

43

1.4

Industrial Fluids

27

1.4

26

2.5

Segment Totals

192

3.4

189

4.4

Corporate and Unallocated

(3.7)

(3.9)

EBIT *

(0.3)

0.5

Restructuring and Refinancing

(0.4)

(7.5)

Interest

(8.2)

(7.9)

Loss before Tax

(8.9)

(14.9)

Q1 - 2005

Q1 - 2004

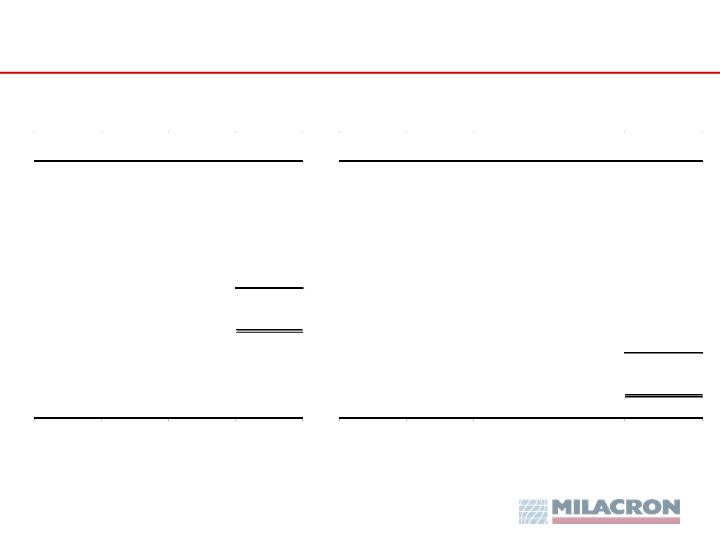

Q1-05 vs. Q1-04 Sales and EBIT* Bridges

* Ex certain items (see page 30).

From Continuing Operations

32

(Dollars in millions)

(Dollars in millions)

Q1-04 SALES

189

$

Q1-04 EBIT

0.5

$

Volume

(2)

Volume/Mix/Price

2.5

Price

1

Material Cost Increases

(5.4)

Currency

4

Cost Reduction Benefits

3.6

Pension & Insurance

(1.2)

Q1-05 SALES

192

$

Sarbanes Oxley Compliance

(1.5)

Other

1.2

Q1-05 EBIT

(0.3)

$

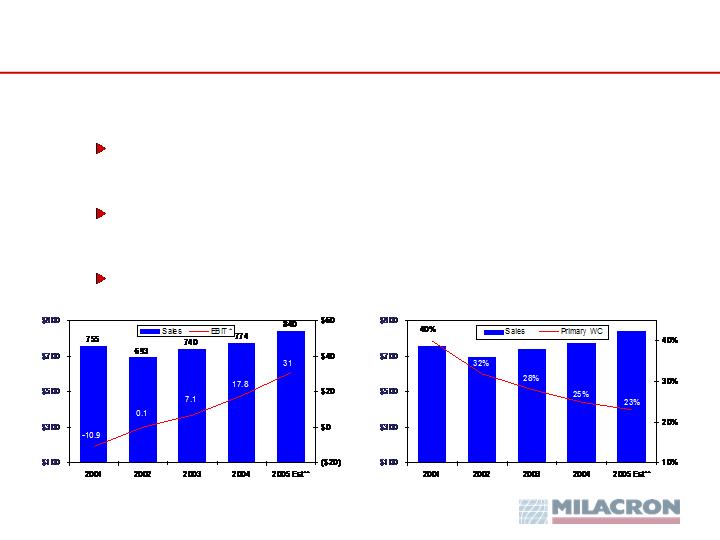

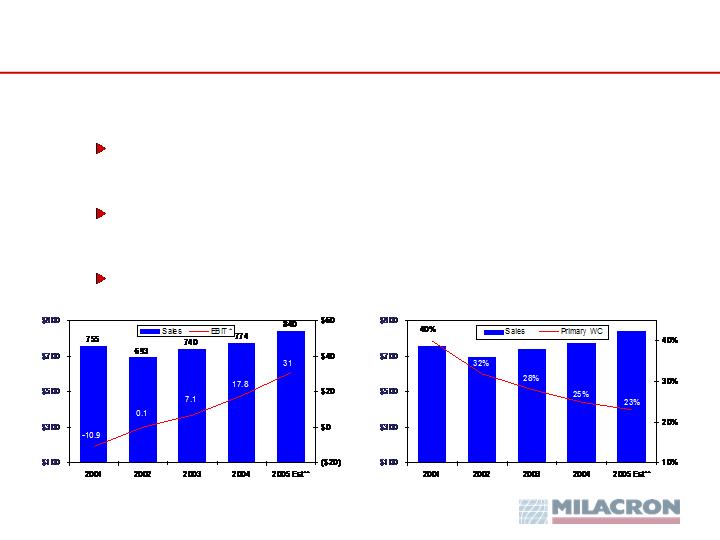

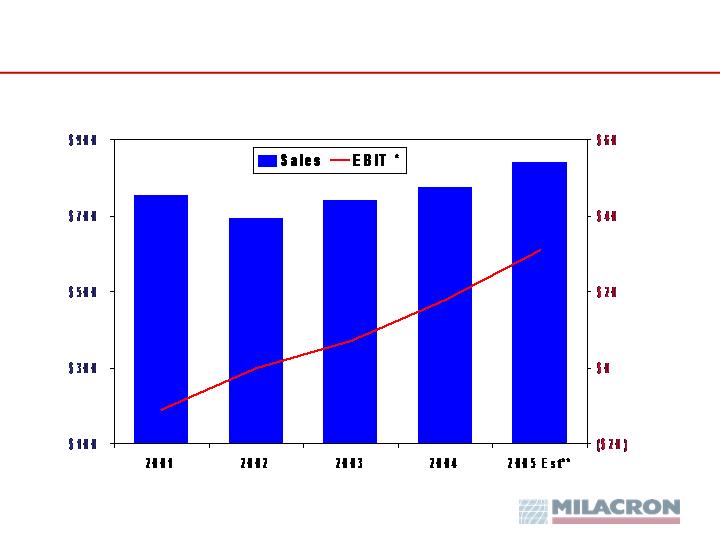

Sales and EBIT Trend

($ in millions)

From Continuing Operations

* Ex certain items (see page 30). ** Mid-point of guidance issued 5/5/05.

33

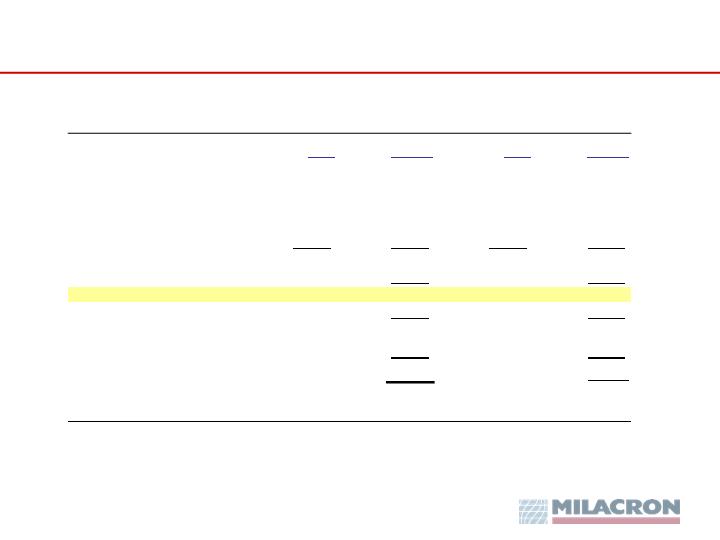

2004 - 2005 Sales and EBIT* Bridges

34

From Continuing Operations

* Ex certain items (see page 30). ** Mid-point of guidance issued 5/5/05.

(Dollars in millions)

(Dollars in millions)

2004 SALES

774

$

2004 EBIT

17.8

$

Volume

40

Volume/Price/Mix

30.3

Price

12

Material Cost Increases

(16.8)

Currency

14

Cost Reduction Benefits

15.7

Pension & Insurance

(6.4)

2005 SALES

840

$

Sarbanes Oxley Compliance

(4.0)

ERP Implementation

(2.0)

Other

(4.1)

2005 EBIT **

30.5

$

Sales and Working Capital Trend

($ in millions)

From Continuing Operations

* Mid-point of guidance issued 5/5/05.

** Primary working capital = inventory + accounts receivable

less accounts payable - advance payments.

35

Capitalization – as of March 31, 2005

36

($ in millions)

Cash

44

$

Debt

Asset-Based Loan (~$40 M borrowing capactiy)

-

Senior Secured Notes 11.5% due 2011

(1)

220

Capital Leases and Other

19

Total Debt

239

Net Debt

195

Equity

4% Preferred Stock

6

6% Series B Convertible Preferred Stock

(2)

113

Common Shares and Capital in Excess of Par

348

Contingent Warrants

1

Accumulated Deficit

(324)

Accumulated Comprehensive Loss

(3)

(109)

Total Equity

35

Total Capitalization

274

$

(1)

Net of original issue discount

(2)

Mandatory conversion into common shares in 2011; represents 51% of outstanding shares on as-converted basis

(3)

Includes pension liability adjustment of $86 M

Note: Diluted shares outstanding on an as-converted basis were approximately 100 M at 3/31/05

and are projected to be approximately 107 M at 6/30/05.

Financial Summary

New order pattern in U.S. improving

Major cost reductions complete;

break-even point lowered

Material costs stabilizing; pricing improving

Balance sheet and liquidity improved

Outlook positive

37

APPENDIX

Detailed Five-Year Financial Summary

From Continuing Operations

* Ex certain items: Excludes restructuring and refinancing costs

as well as the writedown of goodwill and deferred tax assets.

39

(Dollars in millions except per-share data)

2004

2003

2002

2001

2000

Sales

774.2

$

739.7

$

693.2

$

755.2

$

974.5

$

A/T Earnings (Loss) from Continuing

Operations before Restructuring,

Refinancing and Goodwill Charges

(16.9)

(20.0)

(8.9)

(17.6)

49.1

Restructuring Costs

(13.0)

(25.5)

(8.8)

(11.0)

(0.9)

Refinancing Costs

(21.4)

(1.8)

-

-

-

Goodwill Impairment Charge

-

(65.6)

(188.7)

-

-

Writedown of Deferred Tax Assets

-

(70.8)

-

-

-

Earnings (Loss) from

Discontinued Operations

(0.5)

(7.2)

(16.8)

(7.0)

22.8

Net Earnings (Loss)

(51.8)

(190.9)

(223.2)

(35.6)

71.0

Per Share

(1.34)

(5.21)

(6.13)

(0.99)

1.85

EBIT*

17.8

7.1

0.0

(10.9)

89.5

EBITDA*

38.1

$

28.8

$

23.1

$

24.0

$

124.8

$

2004 vs. 2003

* Ex certain items (see page 30).

From Continuing Operations

40

Sales

Earnings

Sales

Earnings

Machinery Technologies - N. America

334

$

16.0

$

321

$

8.1

$

Machinery Technologies - Europe

167

1.9

151

(1.4)

Mold Technologies

167

4.3

169

1.8

Industrial Fluids

109

9.2

104

15.7

Eliminations

(3)

-

(5)

-

Segment Totals

774

31.4

740

24.2

Unallocated and Corporate

(13.6)

(17.1)

EBIT *

17.8

7.1

Interest

(37.3)

(23.0)

Loss before Tax

(19.5)

(15.9)

Provision (benefit) for income taxes

(2.6)

4.1

Loss after Tax

(16.9)

(20.0)

* From continuing operations before one-time items

2004

2003

2003 - 2004 Sales and EBIT* Bridges

41

From Continuing Operations

* Ex certain items (see page 30).

(Dollars in millions)

(Dollars in millions)

2003 SALES

740

$

2003 EBIT

7.1

$

Volume

4

Volume/Mix/Price

9.6

Currency

25

Material Cost Increases

(10.3)

Price

5

Cost Reduction Benefits

29.8

Pension & Insurance

(10.7)

2004 SALES

774

$

Sarbanes Oxley

(1.9)

Other

(5.8)

2004 EBIT

17.8

$

Guidance: Profit & Loss Items

Issued on May 5

42

and year ended Dec. 31, 2004, respectively).

2005 and year ended Dec. 31, 2005, respectively (versus $0.1 million and $2.0 million in quarter ended Jun. 30, 2004

Includes $1.9 million and $6.0 million of expenses related to Sarbanes-Oxley compliance in quarter ended Jun. 30,

quarter ended Jun. 30, 2004 and year ended Dec. 31 2004, respectively).

in quarter ended Jun. 30, 2005 and year ended Dec. 31, 2005, respectively (versus $1.6 million and $6.4 million in

Includes $2.8 million and $11.3 million of expenses related to the U.S defined benefit plan

Earnings (loss) after tax

2

$5 million and $14 million in quarter ended Jun. 30, 2005, and year ended Dec. 31, 2005, respectively.

Includes increased sales over the same periods a year ago due to the strengthening of the Euro of approximately

Sales

1

Quarter Ended

Year Ended

(In millions)

June 30, 2005

Dec. 31, 2005

Projected profit & loss items

Sales (1)

$198 - 212

$825 - 855

Total plastics technologies

170 - 180

710 - 730

Industrial fluids

28 - 32

115 - 125

Segment earnings

Total plastics technologies

3 - 5

25 - 32

Industrial fluids

3 - 5

13 - 16

Corporate expenses

3 - 4

12 - 13

Interest expense - net

7 - 8

31 - 32

Provision for income taxes

< 1

4 - 5

Restructuring charges

< 1

1

Earnings (loss) after tax from continuing operations (2)

(6) - 0

(13) - 0

Guidance: Cash Flow & Balance

Sheet Items

Issued on May 5

43

3 Working capital = inventory + receivables – trade payables –advance billings

Dec. 31, 2005

June 30, 2005

(In millions)

Year Ended

Quarter Ended

Projected cash flow & balance sheet items

Depreciation

4 - 5

20 - 21

Working capital - increase (decrease)

(3)

(6) - (2)

0 - 10

Cash pension contribution

< 1

2 - 3

Capital expenditures

4 - 5

14 - 16

Cash interest

13 - 14

27 - 28

Cash dividends

1.5

6

Cash taxes

-

< 1

Cash restructuring

-

< 1

Average shares outstanding - basic

47 - 48

47 - 48

Average shares outstanding - diluted

97 - 98

100 - 102

44

Reconciliation of Net Earnings (Loss) to EBIT and EBITDA

Reconciliation of Consolidated Earnings to Internal Reporting Measures

Milacron Inc. and Subsidiaries

($ in millions)

Year Ended

December 31,

2005 (a)

2005

2004 (b)

2004

2003 (b)

2002 (b)

2001 (b)

2000

Net loss

(6.5)

$

(9.1)

$

(16.6)

$

(51.8)

$

(190.9)

$

(223.2)

$

(35.6)

$

71.0

$

Cumulative effect of change

in method of accounting (c)

-

-

-

-

-

187.7

-

-

Discontinued operations-

net of income taxes (d)

-

-

0.6

0.5

7.2

16.8

7.0

(22.8)

Loss from continuing operations

(6.5)

(9.1)

(16.0)

(51.3)

(183.7)

(18.7)

(28.6)

48.2

Benefit (provision) for income taxes (e)

(4.5)

(0.2)

(1.1)

2.6

(73.3)

18.4

22.3

19.0

��

Loss from continuing operations before

income taxes

(2.0)

(8.9)

(14.9)

(53.9)

(110.4)

(37.1)

(50.9)

67.2

Interest expense - net (f)

31.5

8.2

7.9

37.3

23.0

23.3

22.5

20.9

Operating earnings (loss)

29.5

(0.7)

(7.0)

(16.6)

(87.4)

(13.8)

(28.4)

88.1

Goodwill impairment charge (g)

-

-

-

-

65.6

-

-

-

Refinancing costs (h)

-

-

6.4

21.4

1.8

-

-

-

Restructuring costs

1.0

0.4

1.1

13.0

27.1

13.9

17.5

1.4

EBIT*

30.5

(0.3)

0.5

17.8

7.1

0.1

(10.9)

89.5

Depreciation and amortization

20.5

4.5

5.3

20.3

21.7

23.0

34.9

35.3

EBITDA*

51.0

$

4.2

$

5.8

$

38.1

$

28.8

$

23.1

$

24.0

$

124.8

$

* Ex certain items: Excludes restructuring and refinancing costs as well as the writedown of goodwill and deferred tax assets.

(a) Based on midpoint of guidance issued May 5, 2005. See pages 42-43.

(b) In 2004, certain operations changed from LIFO to FIFO inventory accounting, so prior results have been restated to conform to FIFO presentation.

(c) Represents goodwill impairment charge related to the adoption of a new accounting standard.

(d) Discontinued operations include Grinding Wheels in 2001-2004 and Round Tools in 2001-2003.

(e) 2003 includes a charge of $70.8 M to establish valuation allowances for deferred tax assets.

(f) 2004 includes a charge of $6.4 million to write-off beneficial conversion for holders of convertible debt.

(g) Represents adjustment of carrying value of goodwill in the mold technologies segment.

(h) Represents costs of refinancing and recapitalizing the company including pursuit of various alternatives.

Three Months Ended

Year Ended

March 31,

December 31,

THANK YOU!