UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | | | | | | | | | | | | | | | | | |

| Investment Company Act file number | | 811-03706 | | | | |

| | | | | | |

| AMERICAN CENTURY CALIFORNIA TAX-FREE AND MUNICIPAL FUNDS | | | | | | |

| (Exact name of registrant as specified in charter) | | | | | | |

| | | | | | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | | | | | | 64111 |

| (Address of principal executive offices) | | | | | | (Zip Code) |

| | | | | | |

CHARLES A. ETHERINGTON

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | | | | | | |

| (Name and address of agent for service) | | | | | | |

| | | | | | |

| Registrant’s telephone number, including area code: | | | | | 816-531-5575 | |

| | | | | | |

| Date of fiscal year end: | 08-31 | | | | | |

| | | | | | |

| Date of reporting period: | 08-31-2020 | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

| | | | | |

| |

| Annual Report |

| |

| August 31, 2020 |

| |

| California High-Yield Municipal Fund |

| Investor Class (BCHYX) |

| I Class (BCHIX) |

| Y Class (ACYHX) |

| A Class (CAYAX) |

| C Class (CAYCX) |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the fund or your financial intermediary electronically by calling or sending an email request to your appropriate contacts as listed on the back cover of this report.

You may elect to receive all future reports in paper free of charge. You can inform the fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an email request to your appropriate contacts as listed on the back cover of this report. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| | | | | |

| President’s Letter | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| Approval of Management Agreement | |

| Liquidity Risk Management Program | |

| |

| Additional Information | |

| |

| |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended August 31, 2020. Annual reports help convey important information about fund returns, including market factors that affected performance. For additional investment insights, please visit americancentury.com.

Pandemic Disrupted Economic, Market Courses

Broad market sentiment was generally upbeat through the first half of the reporting period. Dovish central banks, modest inflation, improving economic and corporate earnings data, and progress on U.S.-China trade policy helped boost global growth outlooks. Against this backdrop, risk assets, including municipal bonds (munis), largely remained in favor.

However, beginning in late February, COVID-19 quickly quashed the optimistic tone. The outbreak rapidly spread worldwide, halting most U.S. and global economic activity and triggering a deep worldwide recession. In the U.S., stocks and credit-sensitive assets sold off sharply, while U.S. Treasury yields plunged to record lows amid soaring demand. Quick and aggressive action from the Federal Reserve and Congress helped stabilize financial markets and restore confidence in the muni and credit sectors. Additionally, declining coronavirus infection and death rates in many regions and the reopening of economies were positive influences. By the end of August, manufacturing, employment and other data suggested an economic recovery was underway.

In general, munis bounced back from the early spring sell-off to deliver modest gains for the 12-month period. However, the broad asset class did not keep pace with the rallying Treasury market.

A Slow Return to Normal

The return to pre-pandemic life will take time and patience, but we are confident we will get there. Several drug companies are in final stages of vaccine trials, and medical professionals continue to fine-tune virus treatment protocols. In the meantime, investors likely will face periods of outbreak-related disruptions, economic and political uncertainty, and heightened market volatility. These influences can be unsettling, but they tend to be temporary.

We appreciate your confidence in us during these extraordinary times. Our firm has a long history of helping clients weather unpredictable markets, and we’re confident we will continue to meet today’s challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

| | | | | | | | | | | | | | | | | | | | | |

| Total Returns as of August 31, 2020 | | | | | | | |

| | | | | Average Annual Returns | | | |

| | Ticker

Symbol | | 1

year | 5

years | 10 years | Since

Inception | Inception

Date |

| Investor Class | BCHYX | | 0.96% | 4.56% | 5.12% | — | 12/30/86 |

| S&P Municipal Bond California 50% Investment Grade/50% High Yield Index | — | | 2.80% | 5.48% | — | — | — |

| Bloomberg Barclays Municipal Bond Index | — | | 3.24% | 3.99% | 3.97% | — | — |

| I Class | BCHIX | | 1.17% | 4.77% | 5.33% | — | 3/1/10 |

| Y Class | ACYHX | | 1.21% | — | — | 5.01% | 4/10/17 |

| A Class | CAYAX | | | | | | 1/31/03 |

| No sales charge | | | 0.71% | 4.30% | 4.86% | — | |

| With sales charge | | | -3.79% | 3.34% | 4.37% | — | |

| C Class | CAYCX | | -0.04% | 3.53% | 4.08% | — | 1/31/03 |

Average annual returns since inception are presented when ten years of performance history is not available.

Returns for the Bloomberg Barclays Municipal Bond Index are shown to cover the 10 year period because the S&P Municipal Bond California 50% Investment Grade/50% High Yield Index total return data became available as of December 30, 2011.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 4.50% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

| | |

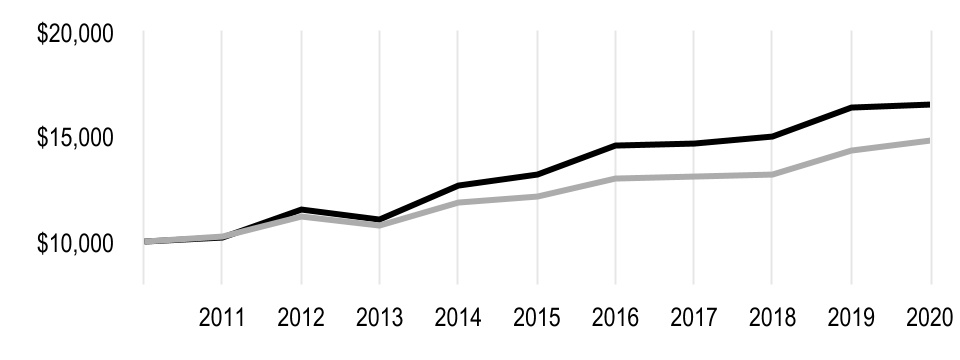

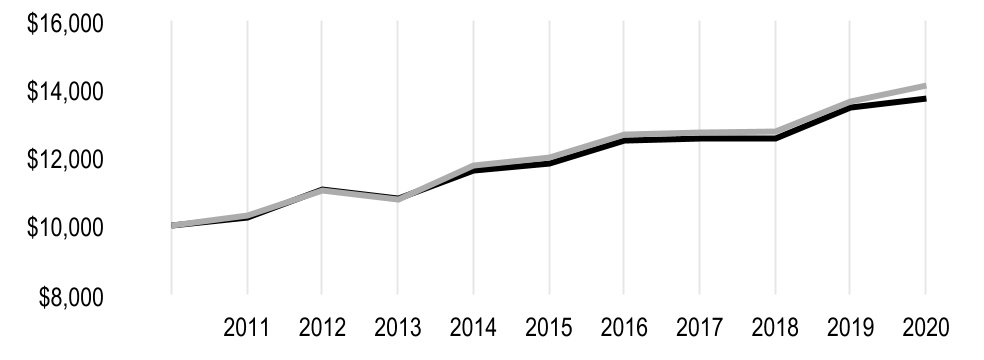

| Growth of $10,000 Over 10 Years |

| $10,000 investment made August 31, 2010 |

| Performance for other share classes will vary due to differences in fee structure. |

| | | | | |

| Value on August 31, 2020 | |

| Investor Class — $16,482 |

| |

| Bloomberg Barclays Municipal Bond Index — $14,768 |

| |

Since S&P Municipal Bond California 50% Investment Grade/50% High Yield Index total return data is only available from December 2011, it is not included in the line chart. .

| | | | | | | | | | | | | | |

| Total Annual Fund Operating Expenses | | | | |

| Investor Class | I Class | Y Class | A Class | C Class |

| 0.50% | 0.30% | 0.27% | 0.75% | 1.50% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Alan Kruss, Joseph Gotelli and Steven Permut

Performance Summary

California High-Yield Municipal returned 0.96%* for the 12 months ended August 31, 2020. By comparison, the S&P Municipal Bond California 50% Investment Grade/50% High Yield Index returned 2.80%. Fund returns reflect operating expenses, while index returns do not.

Like most asset classes during the 12-month period, the municipal bond (muni) market endured extreme volatility as the COVID-19 outbreak prompted a dramatic sell-off in March and April. However, the Federal Reserve (Fed) and the U.S. government quickly responded with monetary and fiscal stimulus. This helped stem losses, restore liquidity and lend stability to fixed-income markets in general, which benefited munis. Within the portfolio, sector allocation and security selection hindered performance, relative to the index, while duration positioning mitigated a portion of the decline.

Fed Moves Bolstered Muni Market

Early in the reporting period, waning trade tensions and an improving global growth outlook fostered risk-on investing, driving muni prices higher. However, as the coronavirus spread across the U.S. in early 2020, economic activity grinded to a halt, and risk assets sold off sharply. Robust demand for safe-haven assets led to considerable muni underperformance versus Treasuries.

Swift action by the Fed, including cutting short-term interest rates to near 0% and launching aggressive lending and asset-purchase plans, aided the market. The Fed’s efforts included the $500 billion Municipal Liquidity Facility (MLF), which restored market confidence that muni issuers would have access to liquidity as needed. Meanwhile, lawmakers passed the Coronavirus Aid, Relief and Economic Security (CARES) Act, which also helped soothe investors’ anxieties. A summer-long risk rally followed, especially as states lifted pandemic-related restrictions.

Demand for munis gradually recovered to nearly pre-COVID-19 levels by the end of the period. New-issue levels similarly whipsawed through 2020, although taxable issuance remained greater than tax-exempt issuance. Overall, muni returns largely trailed Treasuries. Within the broad muni sector, higher-quality securities outperformed lower-quality issues, and general obligation (GO) bonds outperformed revenue bonds. California munis modestly outperformed national munis.

Pandemic Pressured California Finances

State and local finances across the U.S. remained relatively healthy from the start of the reporting period through early 2020. However, costs related to the pandemic stretched California and other state budgets. The CARES Act earmarked funds to offset a large portion of those expenses. Additionally, adjustments by the California government to push select expenditures into 2021-2022 helped smooth the state’s expected drawdown in reserves. At of the end of August, the state’s cash position was strong, with $50.1 billion of available liquidity. This is a key indicator for rating agencies, given the state’s cash liquidity position typically weakens significantly in times of stress (such as from 2009 to 2011).

While California’s employment market has recovered slowly, especially within the hard-hit leisure and hospitality industry, the revenue impact continues to unfold. Yet, the state has several different levers to pull to adjust for any future downturns in revenue, including tax increases, spending to shift funds. The extent of the challenges hinges on the duration of the pandemic-related disruptions and economic downturn.

*All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the index, other share classes may not. See page 3 for returns for all share classes.

Security Selection, Sector Allocation Detracted from Results

Our security selection in the special tax, local GO and hospital sectors weighed on relative returns. While the index holds a blend of high- and low-quality issues in these sectors, we believe lower-quality securities possess a better risk/reward trade-off. Yet, when the market moves as dramatically as it did during the period, lower-quality securities tend to lag. Our security selection in the corporate muni sector helped offset some of these negative effects.

Our overweight allocation, relative to the index, to riskier sectors, including charter schools and student housing, diminished relative returns. An underweight stake in less-risky sectors, such as state GO bonds and water and sewer districts, also detracted. Conversely, avoiding the solid waste/resource recovery sector aided relative performance.

Duration Supplied a Lift

To help offset some of the credit risk in the portfolio, we consistently maintained a longer-than-index duration, which proved beneficial during the period. We also maintained overweight exposure in the 15- to 20-year portion of the yield curve, which supplied a lift.

Portfolio Positioning

Given the prevailing uncertainty related to the pandemic, we’re continually evaluating the broad secular and cyclical repercussions. We’re also monitoring how sectors such as student housing, nursing facilities and airports will manage marketplace changes.

As good as the CARES Act was in addressing the initial expenses of fighting COVID-19, we’re waiting to see what the next round of stimulus looks like. And if no new relief is forthcoming, state and local governments will likely need to implement measures to right-size under a lower-revenue regime. Meanwhile, the upcoming election also looms large due to the potential for higher tax rates, which generally provide a tailwind to the muni market.

Within California, the state’s cash reserves appear healthy enough to buffer the upcoming challenges. Nonetheless, between COVID-19 and the state’s wildfires, we’re weighing the long-term impacts such risks have on broader housing trends. Specifically, we’re considering how a distributed workforce away from coastal areas could affect fundamentals. Ultimately, we’re confident in the market’s resiliency, and we expect credit fundamentals to remain largely stable. Although downgrade levels will likely rise as the impact of the pandemic plays out, we believe defaults will mostly affect the riskiest parts of the market. We believe opportunities will continue to arise across the asset class at all quality levels, and our fundamental credit research will help identify those opportunities.

| | | | | |

| AUGUST 31, 2020 | |

| Portfolio at a Glance | |

| Weighted Average Life to Maturity | 19.7 years |

| Average Duration (Modified) | 5.7 years |

| | |

| Top Five Sectors | % of fund investments |

| Special Tax | 41% |

| Hospital | 15% |

| Tobacco Settlement | 7% |

| Charter School | 7% |

| Multi-Family Housing | 4% |

| | |

| Types of Investments in Portfolio | % of net assets |

| Municipal Securities | 100.4% |

| Other Assets and Liabilities | (0.4)% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from March 1, 2020 to August 31, 2020.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25.00 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25.00 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | Beginning

Account Value

3/1/20 | Ending

Account Value

8/31/20 | Expenses Paid During Period(1) 3/1/20 - 8/31/20 | Annualized Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $971.50 | $2.48 | 0.50% |

| I Class | $1,000 | $973.30 | $1.49 | 0.30% |

| Y Class | $1,000 | $972.60 | $1.34 | 0.27% |

| A Class | $1,000 | $970.30 | $3.71 | 0.75% |

| C Class | $1,000 | $966.60 | $7.42 | 1.50% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,022.62 | $2.54 | 0.50% |

| I Class | $1,000 | $1,023.63 | $1.53 | 0.30% |

| Y Class | $1,000 | $1,023.78 | $1.37 | 0.27% |

| A Class | $1,000 | $1,021.37 | $3.81 | 0.75% |

| C Class | $1,000 | $1,017.60 | $7.61 | 1.50% |

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

AUGUST 31, 2020

| | | | | | | | |

| Principal Amount | Value |

| MUNICIPAL SECURITIES — 100.4% | | |

| California — 99.3% | | |

| 91 Express Lanes Toll Road Rev., 5.00%, 8/15/30 | $ | 2,400,000 | | $ | 2,649,648 | |

| ABAG Finance Authority for Nonprofit Corps. Rev., (Jackson Laboratory), 5.00%, 7/1/37 | 2,000,000 | | 2,110,220 | |

| Alameda Community Facilities District Special Tax, 5.00%, 9/1/42 | 1,250,000 | | 1,381,750 | |

| Alameda Corridor Transportation Authority Rev., 5.00%, 10/1/26 | 2,000,000 | | 2,238,740 | |

| Alameda Corridor Transportation Authority Rev., 5.00%, 10/1/27 (AGM) | 2,000,000 | | 2,236,260 | |

| Alameda Corridor Transportation Authority Rev., 5.00%, 10/1/35 | 2,270,000 | | 2,645,072 | |

| Antelope Valley Healthcare District Rev., 5.00%, 3/1/46 | 5,000,000 | | 5,021,600 | |

| Beaumont Special Tax, 4.00%, 9/1/40 | 1,250,000 | | 1,363,800 | |

| Beaumont Special Tax, 4.00%, 9/1/45 | 1,510,000 | | 1,630,785 | |

| Beaumont Special Tax, 4.00%, 9/1/50 | 1,500,000 | | 1,613,805 | |

| Beaumont Special Tax, (Beaumont Community Facilities District No. 93-1), 5.00%, 9/1/43 | 1,605,000 | | 1,816,956 | |

| Beaumont Special Tax, (Beaumont Community Facilities District No. 93-1), 5.00%, 9/1/48 | 2,855,000 | | 3,217,671 | |

| Beaumont Special Tax, (Beaumont Community Facilities District No. 93-1), 5.00%, 9/1/48 | 2,535,000 | | 2,857,021 | |

| California Community College Financing Authority Rev., (NCCD-Orange Coast Properties LLC), 5.25%, 5/1/43 | 3,200,000 | | 3,309,888 | |

| California Community College Financing Authority Rev., (NCCD-Orange Coast Properties LLC), 5.25%, 5/1/48 | 4,500,000 | | 4,631,175 | |

California Community Housing Agency Rev., 5.00%, 4/1/49(1) | 8,035,000 | | 9,022,743 | |

California Community Housing Agency Rev., 5.00%, 8/1/49(1) | 11,000,000 | | 12,397,440 | |

California Community Housing Agency Rev., 5.00%, 2/1/50(1) | 5,000,000 | | 5,665,550 | |

| California County Tobacco Securitization Agency Rev., 4.00%, 6/1/49 | 750,000 | | 843,308 | |

| California County Tobacco Securitization Agency Rev., 5.00%, 6/1/49 | 650,000 | | 768,177 | |

California County Tobacco Securitization Agency Rev., (Alameda County Tobacco Securitization Corp.), 0.00%, 6/1/50(2) | 22,520,000 | | 3,663,328 | |

| California County Tobacco Securitization Agency Rev., (Gold Country Settlement Funding Corp.), 5.25%, 6/1/46 | 1,000,000 | | 1,000,020 | |

California County Tobacco Securitization Agency Rev., Capital Appreciation, 0.00%, 6/1/55(2) | 2,000,000 | | 358,040 | |

California Enterprise Development Authority Rev., (Academy For Academic Excellence), 5.00%, 7/1/40(1) | 500,000 | | 524,115 | |

California Enterprise Development Authority Rev., (Academy For Academic Excellence), 5.00%, 7/1/50(1) | 500,000 | | 519,000 | |

California Enterprise Development Authority Rev., (Academy For Academic Excellence), 5.00%, 7/1/55(1) | 350,000 | | 361,627 | |

| California Housing Finance Rev., 4.00%, 3/20/33 | 21,284,971 | | 23,519,254 | |

| California Housing Finance Rev., 4.25%, 1/15/35 | 3,278,159 | | 3,696,025 | |

| California Infrastructure & Economic Development Bank Rev., (Academy of Motion Picture Arts and Sciences Obligated Group), 5.00%, 11/1/29 | 5,000,000 | | 6,690,450 | |

| California Municipal Finance Authority Rev., (Azusa Pacific University), 5.00%, 4/1/41 | 1,860,000 | | 1,919,799 | |

| California Municipal Finance Authority Rev., (Bowles Hall Foundation), 5.00%, 6/1/50 | 1,750,000 | | 1,835,925 | |

California Municipal Finance Authority Rev., (California Baptist University), 5.00%, 11/1/46(1) | 2,000,000 | | 2,065,140 | |

| | | | | | | | |

| Principal Amount | Value |

| California Municipal Finance Authority Rev., (Caritas Affordable Housing, Inc.), 5.00%, 8/15/22 | $ | 360,000 | | $ | 386,759 | |

| California Municipal Finance Authority Rev., (CHF-Davis I LLC), 5.00%, 5/15/32 (BAM-TCRS) | 3,000,000 | | 3,632,220 | |

| California Municipal Finance Authority Rev., (CHF-Davis I LLC), 5.00%, 5/15/48 | 6,700,000 | | 7,632,774 | |

| California Municipal Finance Authority Rev., (CHF-Davis I LLC), 5.00%, 5/15/51 | 5,505,000 | | 6,259,350 | |

| California Municipal Finance Authority Rev., (CHF-Riverside I LLC), 5.00%, 5/15/52 | 5,140,000 | | 5,840,325 | |

| California Municipal Finance Authority Rev., (Claremont Graduate University), 5.00%, 10/1/49 | 2,145,000 | | 2,317,758 | |

| California Municipal Finance Authority Rev., (Claremont Graduate University), 5.00%, 10/1/54 | 1,875,000 | | 2,017,950 | |

| California Municipal Finance Authority Rev., (Clinicas del Camino Real Incorporated), 4.00%, 3/1/40 | 2,750,000 | | 3,017,492 | |

| California Municipal Finance Authority Rev., (Clinicas del Camino Real Incorporated), 4.00%, 3/1/50 | 6,785,000 | | 7,309,820 | |

| California Municipal Finance Authority Rev., (Community Hospitals of Central California Obligated Group), 5.00%, 2/1/27 | 1,000,000 | | 1,229,710 | |

| California Municipal Finance Authority Rev., (Community Hospitals of Central California Obligated Group), 5.00%, 2/1/46 | 3,615,000 | | 4,005,095 | |

| California Municipal Finance Authority Rev., (Congregational Home Obligated Group), 5.00%, 11/15/39 | 1,200,000 | | 1,308,744 | |

| California Municipal Finance Authority Rev., (Congregational Home Obligated Group), 5.00%, 11/15/49 | 4,750,000 | | 5,112,425 | |

California Municipal Finance Authority Rev., (Creative Center of Los Altos), 4.00%, 11/1/26(1) | 625,000 | | 636,481 | |

California Municipal Finance Authority Rev., (Creative Center of Los Altos), 4.00%, 11/1/36(1) | 1,400,000 | | 1,364,104 | |

California Municipal Finance Authority Rev., (Creative Center of Los Altos), 4.50%, 11/1/46(1) | 3,100,000 | | 3,071,573 | |

| California Municipal Finance Authority Rev., (Eisenhower Medical Center), 5.00%, 7/1/35 | 3,500,000 | | 4,073,090 | |

| California Municipal Finance Authority Rev., (Eisenhower Medical Center), 5.00%, 7/1/35 | 1,500,000 | | 1,745,610 | |

| California Municipal Finance Authority Rev., (Eisenhower Medical Center), 5.00%, 7/1/36 | 1,580,000 | | 1,832,547 | |

| California Municipal Finance Authority Rev., (Eisenhower Medical Center), 5.00%, 7/1/37 | 1,500,000 | | 1,735,035 | |

| California Municipal Finance Authority Rev., (Eisenhower Medical Center), 5.00%, 7/1/42 | 1,750,000 | | 1,987,352 | |

| California Municipal Finance Authority Rev., (Eisenhower Medical Center), 5.00%, 7/1/47 | 3,000,000 | | 3,368,400 | |

| California Municipal Finance Authority Rev., (Emerson College), 5.00%, 1/1/42 | 5,250,000 | | 5,981,482 | |

California Municipal Finance Authority Rev., (Healthright 360), 5.00%, 11/1/29(1) | 1,670,000 | | 1,885,547 | |

California Municipal Finance Authority Rev., (Healthright 360), 5.00%, 11/1/39(1) | 3,535,000 | | 3,822,643 | |

California Municipal Finance Authority Rev., (Healthright 360), 5.00%, 11/1/49(1) | 4,450,000 | | 4,717,400 | |

| California Municipal Finance Authority Rev., (Northbay Healthcare Group Obligated Group), 5.00%, 11/1/24 | 1,000,000 | | 1,124,480 | |

| California Municipal Finance Authority Rev., (Northbay Healthcare Group Obligated Group), 5.00%, 11/1/25 | 1,000,000 | | 1,145,680 | |

| California Municipal Finance Authority Rev., (Northbay Healthcare Group Obligated Group), 5.00%, 11/1/26 | 500,000 | | 580,315 | |

| California Municipal Finance Authority Rev., (Northbay Healthcare Group Obligated Group), 5.00%, 11/1/35 | 350,000 | | 379,243 | |

| | | | | | | | |

| Principal Amount | Value |

| California Municipal Finance Authority Rev., (Northbay Healthcare Group Obligated Group), 5.00%, 11/1/40 | $ | 500,000 | | $ | 536,410 | |

| California Municipal Finance Authority Rev., (Northbay Healthcare Group Obligated Group), 5.00%, 11/1/44 | 300,000 | | 319,635 | |

| California Municipal Finance Authority Rev., (Northbay Healthcare Group Obligated Group), 5.25%, 11/1/47 | 1,600,000 | | 1,763,152 | |

California Municipal Finance Authority Rev., (P3 Claremont Holdings LLC), 5.00%, 7/1/40(1) | 1,515,000 | | 1,659,743 | |

California Municipal Finance Authority Rev., (P3 Claremont Holdings LLC), 5.00%, 7/1/52(1) | 2,075,000 | | 2,239,195 | |

California Municipal Finance Authority Rev., (Palmdale Aerospace Academy, Inc.), 5.00%, 7/1/49(1) | 5,100,000 | | 5,362,650 | |

California Municipal Finance Authority Rev., (River Charter Schools), 5.50%, 6/1/38(1) | 800,000 | | 844,616 | |

California Municipal Finance Authority Rev., (River Charter Schools), 5.50%, 6/1/48(1) | 1,915,000 | | 2,002,994 | |

California Municipal Finance Authority Rev., (River Charter Schools), 5.50%, 6/1/53(1) | 1,805,000 | | 1,878,698 | |

California Municipal Finance Authority Rev., (Santa Rosa Academy LLC), 5.125%, 7/1/35(1) | 905,000 | | 953,743 | |

California Municipal Finance Authority Rev., (Santa Rosa Academy LLC), 5.375%, 7/1/45(1) | 1,400,000 | | 1,469,286 | |

| California Municipal Finance Authority Rev., (Touro College and University System Obligated Group), 5.25%, 1/1/34 | 950,000 | | 1,017,783 | |

| California Municipal Finance Authority Rev., (Touro College and University System Obligated Group), 5.25%, 1/1/40 | 1,750,000 | | 1,857,275 | |

| California Municipal Finance Authority Rev., (University of San Diego), 5.00%, 10/1/44 | 5,000,000 | | 6,229,500 | |

| California Municipal Finance Authority Rev., (University of San Diego), 5.00%, 10/1/49 | 5,000,000 | | 6,201,600 | |

| California Municipal Finance Authority Rev., (William Jessup University), 5.00%, 8/1/39 | 2,000,000 | | 2,080,700 | |

| California Municipal Finance Authority Rev., (William Jessup University), 5.00%, 8/1/48 | 2,700,000 | | 2,766,231 | |

California Pollution Control Financing Authority Rev., (San Diego County Water Authority), 5.00%, 11/21/45(1) | 2,500,000 | | 2,875,975 | |

| California Public Finance Authority Rev., (Henry Mayo Newhall Memorial Hospital), 5.00%, 10/15/47 | 3,500,000 | | 3,853,430 | |

California Public Finance Authority Rev., (Trinity Classical Academy), 5.00%, 7/1/36(1) | 400,000 | | 420,668 | |

California Public Finance Authority Rev., (Trinity Classical Academy), 5.00%, 7/1/44(1) | 375,000 | | 386,036 | |

California Public Finance Authority Rev., (Trinity Classical Academy), 5.00%, 7/1/54(1) | 1,000,000 | | 1,021,490 | |

| California School Finance Authority Rev., (Alliance for College Ready Public Schools Obligated Group), 5.00%, 7/1/31 | 4,000,000 | | 4,573,880 | |

California School Finance Authority Rev., (Alliance for College Ready Public Schools Obligated Group), 5.00%, 7/1/45(1) | 5,000,000 | | 5,539,700 | |

California School Finance Authority Rev., (Aspire Public Schools Obligated Group), 5.00%, 8/1/27(1) | 985,000 | | 1,151,081 | |

California School Finance Authority Rev., (Aspire Public Schools Obligated Group), 5.00%, 8/1/28(1) | 1,285,000 | | 1,492,887 | |

California School Finance Authority Rev., (Aspire Public Schools Obligated Group), 5.00%, 8/1/29(1) | 795,000 | | 920,181 | |

California School Finance Authority Rev., (Aspire Public Schools Obligated Group), 5.00%, 8/1/30(1) | 400,000 | | 460,376 | |

California School Finance Authority Rev., (Aspire Public Schools Obligated Group), 5.00%, 8/1/31(1) | 500,000 | | 573,185 | |

California School Finance Authority Rev., (Aspire Public Schools Obligated Group), 5.00%, 8/1/36(1) | 1,170,000 | | 1,320,661 | |

| | | | | | | | |

| Principal Amount | Value |

California School Finance Authority Rev., (Aspire Public Schools Obligated Group), 5.00%, 8/1/40(1) | $ | 1,000,000 | | $ | 1,120,310 | |

California School Finance Authority Rev., (Aspire Public Schools Obligated Group), 5.00%, 8/1/46(1) | 1,300,000 | | 1,444,456 | |

California School Finance Authority Rev., (Bright Star Schools Obligated Group), 5.00%, 6/1/37(1) | 1,800,000 | | 1,942,956 | |

California School Finance Authority Rev., (Bright Star Schools Obligated Group), 5.00%, 6/1/47(1) | 3,130,000 | | 3,322,808 | |

California School Finance Authority Rev., (Downtown College Prep Obligated Group), 4.00%, 6/1/26(1) | 2,525,000 | | 2,595,245 | |

California School Finance Authority Rev., (Downtown College Prep Obligated Group), 4.50%, 6/1/31(1) | 1,500,000 | | 1,571,835 | |

California School Finance Authority Rev., (Downtown College Prep Obligated Group), 4.75%, 6/1/36(1) | 1,500,000 | | 1,564,215 | |

California School Finance Authority Rev., (Downtown College Prep Obligated Group), 5.00%, 6/1/46(1) | 4,630,000 | | 4,833,905 | |

California School Finance Authority Rev., (Downtown College Prep Obligated Group), 5.00%, 6/1/51(1) | 2,000,000 | | 2,082,900 | |

California School Finance Authority Rev., (Ednovate Obligated Group), 5.00%, 6/1/30(1) | 1,325,000 | | 1,449,497 | |

California School Finance Authority Rev., (Ednovate Obligated Group), 5.00%, 6/1/37(1) | 430,000 | | 459,902 | |

California School Finance Authority Rev., (Ednovate Obligated Group), 5.00%, 6/1/48(1) | 2,100,000 | | 2,207,772 | |

California School Finance Authority Rev., (Ednovate Obligated Group), 5.00%, 6/1/56(1) | 2,000,000 | | 2,093,040 | |

California School Finance Authority Rev., (Fenton Charter Public Schools), 5.00%, 7/1/50(1) | 785,000 | | 832,916 | |

California School Finance Authority Rev., (Fenton Charter Public Schools), 5.00%, 7/1/58(1) | 770,000 | | 812,288 | |

California School Finance Authority Rev., (Green Dot Public Schools Obligated Group), 5.00%, 8/1/38(1) | 1,130,000 | | 1,324,993 | |

California School Finance Authority Rev., (Green Dot Public Schools Obligated Group), 5.00%, 8/1/45(1) | 3,500,000 | | 3,848,040 | |

California School Finance Authority Rev., (Green Dot Public Schools Obligated Group), 5.00%, 8/1/48(1) | 3,630,000 | | 4,176,823 | |

California School Finance Authority Rev., (Kepler Education, Inc.), 5.75%, 5/1/37(1) | 1,050,000 | | 1,137,339 | |

California School Finance Authority Rev., (Kepler Education, Inc.), 5.875%, 5/1/47(1) | 2,425,000 | | 2,602,001 | |

| California School Finance Authority Rev., (Kipp SoCal Public Schools Obligated Group), 4.125%, 7/1/24 | 300,000 | | 320,730 | |

| California School Finance Authority Rev., (Kipp SoCal Public Schools Obligated Group), 5.00%, 7/1/34 | 500,000 | | 553,425 | |

California School Finance Authority Rev., (Kipp SoCal Public Schools Obligated Group), 5.00%, 7/1/37(1) | 1,180,000 | | 1,378,618 | |

California School Finance Authority Rev., (Kipp SoCal Public Schools Obligated Group), 5.00%, 7/1/39(1) | 1,000,000 | | 1,204,810 | |

| California School Finance Authority Rev., (Kipp SoCal Public Schools Obligated Group), 5.125%, 7/1/44 | 700,000 | | 768,705 | |

California School Finance Authority Rev., (Kipp SoCal Public Schools Obligated Group), 5.00%, 7/1/45(1) | 1,650,000 | | 1,834,437 | |

California School Finance Authority Rev., (Kipp SoCal Public Schools Obligated Group), 5.00%, 7/1/49(1) | 2,000,000 | | 2,371,740 | |

California School Finance Authority Rev., (Kipp SoCal Public Schools Obligated Group), 5.00%, 7/1/54(1) | 1,150,000 | | 1,362,635 | |

California School Finance Authority Rev., (Larchmont Schools), 5.00%, 6/1/33(1) | 500,000 | | 533,240 | |

California School Finance Authority Rev., (Larchmont Schools), 5.00%, 6/1/43(1) | 550,000 | | 573,287 | |

| | | | | | | | |

| Principal Amount | Value |

California School Finance Authority Rev., (Larchmont Schools), 5.00%, 6/1/55(1) | $ | 1,000,000 | | $ | 1,033,450 | |

California School Finance Authority Rev., (Real Journey Academies Obligated Group), 5.00%, 6/1/49(1) | 5,250,000 | | 5,404,035 | |

California School Finance Authority Rev., (Rocketship Education Obligated Group), 5.00%, 6/1/21(1) | 320,000 | | 324,966 | |

California School Finance Authority Rev., (Rocketship Education Obligated Group), 5.00%, 6/1/26(1) | 500,000 | | 536,435 | |

California School Finance Authority Rev., (Rocketship Education Obligated Group), 5.00%, 6/1/31(1) | 870,000 | | 926,968 | |

California School Finance Authority Rev., (Rocketship Education Obligated Group), 5.00%, 6/1/36(1) | 1,000,000 | | 1,051,620 | |

California School Finance Authority Rev., (Rocketship Education Obligated Group), 5.00%, 6/1/37(1) | 360,000 | | 384,595 | |

California School Finance Authority Rev., (Rocketship Education Obligated Group), 5.00%, 6/1/46(1) | 2,100,000 | | 2,178,813 | |

California School Finance Authority Rev., (Rocketship Education Obligated Group), 5.00%, 6/1/53(1) | 2,265,000 | | 2,371,727 | |

California School Finance Authority Rev., (Summit Public Schools Obligated Group), 5.00%, 6/1/37(1) | 1,000,000 | | 1,139,850 | |

California School Finance Authority Rev., (Summit Public Schools Obligated Group), 5.00%, 6/1/47(1) | 1,870,000 | | 2,093,558 | |

California School Finance Authority Rev., (Summit Public Schools Obligated Group), 4.30%, 6/1/53(1) | 2,935,000 | | 2,954,254 | |

California School Finance Authority Rev., (TEACH, Inc. Obligated Group), 5.00%, 6/1/58(1) | 3,600,000 | | 3,745,476 | |

| California State Financial Authority Rev., (Master's University & Seminary), 5.00%, 8/1/34 | 1,400,000 | | 1,500,800 | |

| California State Financial Authority Rev., (Master's University & Seminary), 5.00%, 8/1/39 | 1,640,000 | | 1,730,413 | |

| California State Financial Authority Rev., (Master's University & Seminary), 5.00%, 8/1/48 | 1,000,000 | | 1,037,830 | |

| California State Public Works Board Rev., 5.00%, 11/1/38 | 2,350,000 | | 2,653,079 | |

| California State Public Works Board Rev., (State of California Department of Corrections & Rehabilitation), 5.00%, 9/1/39 | 7,000,000 | | 8,123,010 | |

California Statewide Communities Development Authority Rev., (899 Charleston LLC), 5.25%, 11/1/44(1) | 1,795,000 | | 1,852,368 | |

| California Statewide Communities Development Authority Rev., (Adventist Health System / West Obligated Group), 5.00%, 3/1/35 | 1,785,000 | | 2,123,043 | |

California Statewide Communities Development Authority Rev., (California Baptist University), 3.00%, 11/1/22(1) | 1,300,000 | | 1,301,170 | |

California Statewide Communities Development Authority Rev., (California Baptist University), 3.50%, 11/1/27(1) | 2,630,000 | | 2,596,625 | |

California Statewide Communities Development Authority Rev., (California Baptist University), 5.00%, 11/1/32(1) | 3,090,000 | | 3,314,488 | |

California Statewide Communities Development Authority Rev., (California Baptist University), 5.00%, 11/1/41(1) | 6,325,000 | | 6,607,032 | |

| California Statewide Communities Development Authority Rev., (Collis P and Howard Huntington Memorial Hospital Obligated Group), 5.00%, 7/1/34 | 1,500,000 | | 1,685,010 | |

| California Statewide Communities Development Authority Rev., (Collis P and Howard Huntington Memorial Hospital Obligated Group), 5.00%, 7/1/44 | 2,760,000 | | 3,055,679 | |

| California Statewide Communities Development Authority Rev., (Emanate Health Obligated Group), 4.00%, 4/1/45 | 2,000,000 | | 2,279,440 | |

| California Statewide Communities Development Authority Rev., (Episcopal Communities & Services for Seniors), 5.00%, 5/15/42 | 2,635,000 | | 2,759,451 | |

| California Statewide Communities Development Authority Rev., (Henry Mayo Newhall Memorial Hospital), 5.25%, 10/1/43 (AGM) | 1,000,000 | | 1,121,600 | |

| California Statewide Communities Development Authority Rev., (HumanGood California Obligated Group), 5.00%, 10/1/43 (GA: American Baptist Homes Foundation) | 1,200,000 | | 1,248,984 | |

| | | | | | | | |

| Principal Amount | Value |

| California Statewide Communities Development Authority Rev., (HumanGood California Obligated Group), 5.00%, 10/1/45 | $ | 2,400,000 | | $ | 2,619,720 | |

California Statewide Communities Development Authority Rev., (Independence Support LLC), 7.00%, 6/1/45(3)(4) | 552,144 | | 303,679 | |

| California Statewide Communities Development Authority Rev., (Kaiser Foundation Hospitals), VRN, 5.00%, 4/1/38 | 5,000,000 | | 6,689,200 | |

California Statewide Communities Development Authority Rev., (Lancer Educational Housing LLC), 5.00%, 6/1/46(1) | 3,500,000 | | 3,546,830 | |

California Statewide Communities Development Authority Rev., (Lancer Educational Housing LLC), 5.00%, 6/1/51(1) | 1,450,000 | | 1,473,041 | |

California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.00%, 12/1/26(1) | 2,000,000 | | 2,273,400 | |

California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.00%, 12/1/29(1) | 3,155,000 | | 3,560,386 | |

California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.00%, 12/1/36(1) | 1,000,000 | | 1,101,770 | |

California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.00%, 12/1/41(1) | 1,700,000 | | 1,856,145 | |

California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.00%, 12/1/46(1) | 9,900,000 | | 10,740,807 | |

| California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.50%, 12/1/54 | 4,605,000 | | 4,947,842 | |

California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.50%, 12/1/58(1) | 14,750,000 | | 16,241,225 | |

| California Statewide Communities Development Authority Rev., (Methodist Hospital of Southern California Obligated Group), 5.00%, 1/1/48 | 10,000,000 | | 11,489,100 | |

California Statewide Communities Development Authority Rev., (NCCD-Hooper Street LLC), 5.25%, 7/1/39(1) | 2,550,000 | | 2,567,722 | |

California Statewide Communities Development Authority Rev., (NCCD-Hooper Street LLC), 5.25%, 7/1/49(1) | 3,375,000 | | 3,322,991 | |

| California Statewide Communities Development Authority Rev., (Redlands Community Hospital), 4.00%, 10/1/41 | 6,500,000 | | 6,967,220 | |

| California Statewide Communities Development Authority Special Assessment, 2.70%, 9/2/22 | 345,000 | | 352,424 | |

| California Statewide Communities Development Authority Special Assessment, 3.00%, 9/2/23 | 355,000 | | 369,353 | |

| California Statewide Communities Development Authority Special Assessment, 3.00%, 9/2/24 | 365,000 | | 383,057 | |

| California Statewide Communities Development Authority Special Assessment, 5.00%, 9/2/34 | 1,125,000 | | 1,324,721 | |

| California Statewide Communities Development Authority Special Assessment, 5.00%, 9/2/35 | 1,920,000 | | 2,146,464 | |

| California Statewide Communities Development Authority Special Assessment, 5.00%, 9/2/39 | 1,300,000 | | 1,485,302 | |

| California Statewide Communities Development Authority Special Assessment, 4.00%, 9/2/44 | 900,000 | | 941,535 | |

| California Statewide Communities Development Authority Special Assessment, 5.00%, 9/2/45 | 3,810,000 | | 4,181,780 | |

| California Statewide Communities Development Authority Special Assessment, 5.00%, 9/2/49 | 700,000 | | 789,635 | |

| California Statewide Communities Development Authority Special Tax, 5.00%, 9/1/36 | 1,000,000 | | 1,116,070 | |

| California Statewide Communities Development Authority Special Tax, 5.00%, 9/1/37 | 3,025,000 | | 3,324,777 | |

| | | | | | | | |

| Principal Amount | Value |

| California Statewide Communities Development Authority Special Tax, 5.00%, 9/1/39 | $ | 1,545,000 | | $ | 1,777,816 | |

| California Statewide Communities Development Authority Special Tax, 5.00%, 9/1/45 | 1,500,000 | | 1,651,440 | |

| California Statewide Communities Development Authority Special Tax, 5.00%, 9/1/47 | 1,650,000 | | 1,855,821 | |

| California Statewide Communities Development Authority Special Tax, 5.00%, 9/1/48 | 7,330,000 | | 8,337,508 | |

| California Statewide Communities Development Authority Special Tax, 5.00%, 9/1/48 | 1,750,000 | | 1,969,398 | |

| California Statewide Communities Development Authority Special Tax, (California Statewide Communities Development Authority Cmnty Facs Dist No. 2016-02), 5.00%, 9/1/39 | 1,000,000 | | 1,140,840 | |

| California Statewide Communities Development Authority Special Tax, (California Statewide Communities Development Authority Cmnty Facs Dist No. 2016-02), 5.00%, 9/1/49 | 2,095,000 | | 2,349,375 | |

| California Statewide Communities Development Authority Special Tax, (California Statewide Communities Development Authority Cmnty Facs Dist No. 2018-), 4.00%, 9/1/50 | 1,200,000 | | 1,240,992 | |

Calimesa Special Tax, (Calimesa Community Facilities District No. 2018-1), 4.00%, 9/1/37(5) | 415,000 | | 460,418 | |

Calimesa Special Tax, (Calimesa Community Facilities District No. 2018-1), 4.00%, 9/1/45(5) | 865,000 | | 935,359 | |

Calimesa Special Tax, (Calimesa Community Facilities District No. 2018-1), 4.00%, 9/1/50(5) | 820,000 | | 881,549 | |

| Cathedral City Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 8/1/29 (AGM) | 1,250,000 | | 1,441,938 | |

| Cathedral City Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 8/1/30 (AGM) | 1,315,000 | | 1,512,119 | |

| Cathedral City Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 8/1/31 (AGM) | 1,380,000 | | 1,579,424 | |

| Central Basin Municipal Water District Rev., 5.00%, 8/1/44 | 5,000,000 | | 5,468,150 | |

| Chino Basin Regional Financing Authority Rev., (Inland Empire Utilities Agency), 4.00%, 11/1/25 | 3,000,000 | | 3,553,140 | |

| Chino Community Facilities District Special Tax, 5.00%, 9/1/43 | 3,160,000 | | 3,618,453 | |

| Chino Community Facilities District Special Tax, 4.00%, 9/1/45 | 1,325,000 | | 1,424,494 | |

| Chino Community Facilities District Special Tax, 5.00%, 9/1/48 | 2,500,000 | | 2,834,150 | |

| Chino Community Facilities District Special Tax, 4.00%, 9/1/50 | 2,500,000 | | 2,676,550 | |

| Chula Vista Community Facilities District Special Tax, (Chula Vista Community Facilities District No. 06-1), 5.00%, 9/1/43 | 595,000 | | 670,577 | |

| Chula Vista Community Facilities District Special Tax, (Chula Vista Community Facilities District No. 06-1), 5.00%, 9/1/48 | 1,000,000 | | 1,120,510 | |

| Corona-Norco Unified School District Special Tax, 5.00%, 9/1/43 | 2,430,000 | | 2,744,782 | |

| Corona-Norco Unified School District Special Tax, 4.00%, 9/1/45 | 2,000,000 | | 2,121,460 | |

| Corona-Norco Unified School District Special Tax, 5.00%, 9/1/48 | 1,500,000 | | 1,687,530 | |

| Del Mar Race Track Authority Rev., 5.00%, 10/1/29 | 1,010,000 | | 1,005,586 | |

| Del Mar Race Track Authority Rev., 5.00%, 10/1/35 | 2,000,000 | | 1,950,300 | |

| Dixon Special Tax, 5.00%, 9/1/45 | 4,780,000 | | 5,236,872 | |

| Dixon Special Tax, (Dixon Community Facilities District No. 2013-1 Parklane), 5.00%, 9/1/49 | 2,400,000 | | 2,686,416 | |

| Dublin Community Facilities District Improvement Area No. 1 Special Tax, 5.00%, 9/1/29 | 665,000 | | 796,723 | |

| Dublin Community Facilities District Improvement Area No. 1 Special Tax, 5.00%, 9/1/37 | 1,150,000 | | 1,331,275 | |

| Dublin Community Facilities District Improvement Area No. 1 Special Tax, 5.00%, 9/1/39 | 3,200,000 | | 3,660,288 | |

| Dublin Community Facilities District Improvement Area No. 1 Special Tax, 5.00%, 9/1/47 | 2,840,000 | | 3,232,658 | |

| Dublin Community Facilities District Improvement Area No. 1 Special Tax, 5.00%, 9/1/49 | 7,300,000 | | 8,192,571 | |

| | | | | | | | |

| Principal Amount | Value |

| East Garrison Public Finance Authority Special Tax, 5.00%, 9/1/46 | $ | 1,170,000 | | $ | 1,312,646 | |

| Eastern Municipal Water District Special Tax, 5.00%, 9/1/36 | 3,575,000 | | 4,006,002 | |

| El Dorado County Special Tax, 5.00%, 9/1/27 | 1,050,000 | | 1,294,503 | |

| El Dorado County Special Tax, 5.00%, 9/1/29 | 1,220,000 | | 1,485,338 | |

| El Dorado County Special Tax, 5.00%, 9/1/30 | 1,320,000 | | 1,598,744 | |

| El Dorado County Special Tax, 5.00%, 9/1/31 | 1,275,000 | | 1,536,120 | |

| El Dorado County Special Tax, 5.00%, 9/1/32 | 1,350,000 | | 1,612,211 | |

| El Dorado County Special Tax, 4.00%, 9/1/43 | 1,250,000 | | 1,333,475 | |

| El Dorado County Special Tax, 4.00%, 9/1/46 | 2,350,000 | | 2,482,211 | |

| El Dorado County Special Tax, 5.00%, 9/1/48 | 2,850,000 | | 3,150,561 | |

| El Dorado County Special Tax, (El County Dorado Community Facilities District No. 2018-1 Bass Lake Hills), 5.00%, 9/1/34 | 450,000 | | 515,880 | |

| El Dorado County Special Tax, (El County Dorado Community Facilities District No. 2018-1 Bass Lake Hills), 5.00%, 9/1/39 | 725,000 | | 820,490 | |

| El Dorado County Special Tax, (El County Dorado Community Facilities District No. 2018-1 Bass Lake Hills), 5.00%, 9/1/44 | 1,300,000 | | 1,456,000 | |

| El Dorado County Special Tax, (El County Dorado Community Facilities District No. 2018-1 Bass Lake Hills), 5.00%, 9/1/49 | 1,500,000 | | 1,670,280 | |

| Elk Grove Finance Authority Special Tax, 5.00%, 9/1/43 | 1,040,000 | | 1,170,998 | |

| Elk Grove Finance Authority Special Tax, 5.00%, 9/1/48 | 1,250,000 | | 1,397,188 | |

| Emeryville Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/34 (AGM) | 1,000,000 | | 1,142,880 | |

| Fairfield Community Facilities District Special Tax, 5.00%, 9/1/49 | 1,600,000 | | 1,802,192 | |

| Fairfield Community Facilities District Special Tax, (Fairfield Community Facilities District No. 2016-1), 5.00%, 9/1/39 | 500,000 | | 575,485 | |

Fairfield Community Facilities District Special Tax, (Fairfield Community Facilities District No. 2019-1), 5.00%, 9/1/35(1) | 780,000 | | 906,781 | |

Fairfield Community Facilities District Special Tax, (Fairfield Community Facilities District No. 2019-1), 5.00%, 9/1/50(1) | 3,250,000 | | 3,646,500 | |

| Folsom Ranch Financing Authority Special Tax, 5.00%, 9/1/47 | 4,325,000 | | 4,896,549 | |

| Folsom Ranch Financing Authority Special Tax, (Folsom Community Facilities District No. 19), 5.00%, 9/1/34 | 1,690,000 | | 1,972,957 | |

| Folsom Ranch Financing Authority Special Tax, (Folsom Community Facilities District No. 19), 5.00%, 9/1/39 | 1,255,000 | | 1,440,803 | |

| Folsom Ranch Financing Authority Special Tax, (Folsom Community Facilities District No. 19), 5.00%, 9/1/44 | 2,285,000 | | 2,598,228 | |

| Folsom Ranch Financing Authority Special Tax, (Folsom Community Facilities District No. 20), 5.00%, 9/1/33 | 530,000 | | 609,945 | |

| Folsom Ranch Financing Authority Special Tax, (Folsom Community Facilities District No. 20), 5.00%, 9/1/38 | 845,000 | | 960,072 | |

| Folsom Ranch Financing Authority Special Tax, (Folsom Community Facilities District No. 20), 5.00%, 9/1/48 | 1,675,000 | | 1,879,367 | |

| Folsom Ranch Financing Authority Special Tax, (Folsom Community Facilities District No. 21), 5.00%, 9/1/35 | 1,285,000 | | 1,495,547 | |

| Folsom Ranch Financing Authority Special Tax, (Folsom Community Facilities District No. 21), 5.00%, 9/1/39 | 1,555,000 | | 1,784,285 | |

| Folsom Ranch Financing Authority Special Tax, (Folsom Community Facilities District No. 21), 5.00%, 9/1/44 | 2,540,000 | | 2,886,659 | |

| Fontana Special Tax, (Fontana Community Facilities District No. 31), 5.00%, 9/1/35 | 1,365,000 | | 1,545,480 | |

| Fontana Special Tax, (Fontana Community Facilities District No. 80 Bella Strada), 5.00%, 9/1/46 | 1,000,000 | | 1,135,590 | |

| Foothill-Eastern Transportation Corridor Agency Rev., 6.50%, 1/15/43 | 4,000,000 | | 4,542,840 | |

Foothill-Eastern Transportation Corridor Agency Rev., Capital Appreciation, 0.00%, 1/15/42(2) | 6,000,000 | | 2,963,100 | |

| Foothill-Eastern Transportation Corridor Agency Rev., Capital Appreciation, VRN, 0.00%, 1/15/42 | 2,200,000 | | 2,500,036 | |

| | | | | | | | |

| Principal Amount | Value |

| Foothill-Eastern Transportation Corridor Agency Rev., VRN, 5.50%, 1/15/53 | $ | 3,750,000 | | $ | 4,020,825 | |

| Fremont Community Facilities District No. 1 Special Tax, 5.00%, 9/1/40 | 3,000,000 | | 3,311,250 | |

| Fremont Community Facilities District No. 1 Special Tax, 5.00%, 9/1/45 | 2,000,000 | | 2,191,160 | |

| Fremont Community Facilities District No. 2 Special Tax, 5.00%, 9/1/44 | 1,000,000 | | 1,122,000 | |

| Fremont Community Facilities District No. 2 Special Tax, 5.00%, 9/1/49 | 1,550,000 | | 1,731,335 | |

| Golden State Tobacco Securitization Corp. Rev., 5.00%, 6/1/24 | 1,500,000 | | 1,739,340 | |

| Golden State Tobacco Securitization Corp. Rev., 5.00%, 6/1/25 | 1,000,000 | | 1,191,130 | |

| Golden State Tobacco Securitization Corp. Rev., 5.00%, 6/1/26 | 1,000,000 | | 1,220,970 | |

| Golden State Tobacco Securitization Corp. Rev., 5.00%, 6/1/29 | 1,500,000 | | 1,672,710 | |

| Golden State Tobacco Securitization Corp. Rev., 5.30%, 6/1/37 | 7,000,000 | | 7,255,990 | |

| Golden State Tobacco Securitization Corp. Rev., 5.00%, 6/1/47 | 10,000,000 | | 10,282,200 | |

| Golden State Tobacco Securitization Corp. Rev., 5.00%, 6/1/47 | 4,300,000 | | 4,421,346 | |

| Golden State Tobacco Securitization Corp. Rev., 5.25%, 6/1/47 | 16,500,000 | | 17,018,265 | |

Golden State Tobacco Securitization Corp. Rev., Capital Appreciation, 0.00%, 6/1/47(2) | 45,000,000 | | 9,500,850 | |

Hastings Campus Housing Finance Authority Rev., (University of California Hastings College of the Law), 5.00%, 7/1/61(5) | 5,335,000 | | 5,406,489 | |

Hastings Campus Housing Finance Authority Rev., Capital Appreciation, VRN, (University of California Hastings College of the Law), 0.00%, 7/1/61(1)(5) | 14,365,000 | | 5,417,616 | |

| Hemet Unified School District Financing Authority Special Tax, 5.00%, 9/1/34 | 350,000 | | 390,019 | |

| Hemet Unified School District Financing Authority Special Tax, 5.00%, 9/1/39 | 2,100,000 | | 2,315,691 | |

| Hesperia Special Tax, 5.00%, 9/1/29 | 1,060,000 | | 1,186,023 | |

| Hesperia Special Tax, 5.00%, 9/1/35 | 2,690,000 | | 2,954,319 | |

| Huntington Beach Community Facilities District Special Tax, 5.375%, 9/1/33 | 1,700,000 | | 1,853,544 | |

| Independent Cities Finance Authority Rev., 5.00%, 10/15/47 | 4,000,000 | | 4,182,280 | |

| Independent Cities Finance Authority Rev., (Augusta Communities LLC), 5.00%, 5/15/39 | 2,500,000 | | 2,607,050 | |

| Independent Cities Finance Authority Rev., (Castle Mobile Estates), 6.75%, 8/15/46 | 2,500,000 | | 2,599,175 | |

| Independent Cities Finance Authority Rev., (Palomar Estates East), 5.00%, 9/15/36 | 1,000,000 | | 1,084,550 | |

| Independent Cities Finance Authority Rev., (Palomar Estates West), 5.00%, 9/15/36 | 1,500,000 | | 1,626,825 | |

| Inland Valley Development Agency Tax Allocation, 5.25%, 9/1/37 | 1,110,000 | | 1,240,114 | |

| Irvine Special Assessment, 5.00%, 9/2/42 | 1,500,000 | | 1,673,790 | |

| Irvine Special Assessment, VRDN, 0.02%, 9/1/20 (LOC: State Street Bank & Trust Co.) | 843,000 | | 843,000 | |

| Irvine Special Tax, 5.00%, 9/1/39 | 1,000,000 | | 1,101,460 | |

| Irvine Special Tax, 5.00%, 9/1/44 | 500,000 | | 546,465 | |

| Irvine Special Tax, 5.00%, 9/1/49 | 4,500,000 | | 4,903,785 | |

| Irvine Special Tax, (Irvine Community Facilities District No. 2013-3), 5.00%, 9/1/43 | 2,500,000 | | 2,847,900 | |

| Irvine Special Tax, (Irvine Community Facilities District No. 2013-3), 5.00%, 9/1/48 | 4,250,000 | | 4,815,590 | |

| Irvine Unified School District Special Tax, 5.00%, 9/1/29 | 550,000 | | 677,116 | |

| Irvine Unified School District Special Tax, 5.00%, 9/1/29 | 700,000 | | 861,784 | |

| Irvine Unified School District Special Tax, 5.00%, 9/1/31 | 420,000 | | 511,228 | |

| Irvine Unified School District Special Tax, 5.00%, 9/1/34 | 500,000 | | 599,350 | |

| | | | | | | | |

| Principal Amount | Value |

| Irvine Unified School District Special Tax, 6.70%, 9/1/35 | $ | 515,000 | | $ | 515,000 | |

| Irvine Unified School District Special Tax, 4.00%, 9/1/50 (BAM) | 3,195,000 | | 3,717,862 | |

| Irvine Unified School District Special Tax, 5.00%, 3/1/57 | 3,500,000 | | 4,010,090 | |

| Jurupa Community Services District Special Tax, 5.00%, 9/1/37 | 250,000 | | 262,313 | |

| Jurupa Community Services District Special Tax, 5.00%, 9/1/40 | 1,605,000 | | 1,819,251 | |

| Jurupa Community Services District Special Tax, 5.00%, 9/1/42 | 1,000,000 | | 1,045,440 | |

| Jurupa Public Financing Authority Special Tax, 5.00%, 9/1/42 | 1,000,000 | | 1,117,590 | |

| Jurupa Unified School District Special Tax, 5.00%, 9/1/33 | 1,220,000 | | 1,404,647 | |

| Jurupa Unified School District Special Tax, 5.00%, 9/1/38 | 1,000,000 | | 1,136,690 | |

| Jurupa Unified School District Special Tax, 5.00%, 9/1/43 | 1,255,000 | | 1,414,410 | |

| Jurupa Unified School District Special Tax, 4.00%, 9/1/47 | 1,000,000 | | 1,058,180 | |

La Verne COP, (Brethren Hillcrest Homes), 5.00%, 5/15/22, Prerefunded at 101% of Par(6) | 1,100,000 | | 1,198,879 | |

| Lake Elsinore Special Tax, (Lake Elsinore Community Facilities District No. 2016-2), 5.00%, 9/1/43 | 2,470,000 | | 2,770,130 | |

| Lake Elsinore Special Tax, (Lake Elsinore Community Facilities District No. 2016-2), 5.00%, 9/1/48 | 3,640,000 | | 4,060,529 | |

| Lake Elsinore Facilities Financing Authority Special Tax, 4.00%, 9/1/44 | 535,000 | | 570,727 | |

| Lake Elsinore Public Financing Authority Special Tax, 5.00%, 9/1/40 | 1,925,000 | | 2,138,001 | |

| Lake Elsinore Unified School District Community Facilities District Special Tax, 4.00%, 9/1/42 | 600,000 | | 640,092 | |

| Lake Elsinore Unified School District Community Facilities District Special Tax, 4.00%, 9/1/47 | 900,000 | | 955,863 | |

| Lammersville Joint Unified School District Special Tax, (Lammersville Joint Unified School District Community Facilities Dist No. 2007-1), 6.00%, 9/1/43 | 1,250,000 | | 1,376,338 | |

| Lammersville Joint Unified School District Special Tax, (Lammersville Joint Unified School District Community Facilities Dist No. 2014-1), 5.00%, 9/1/43 | 775,000 | | 863,381 | |

| Lammersville Joint Unified School District Special Tax, (Lammersville Joint Unified School District Community Facilities Dist No. 2014-1), 5.00%, 9/1/47 | 3,750,000 | | 4,207,725 | |

| Lammersville Joint Unified School District Special Tax, (Lammersville Joint Unified School District Community Facilities Dist No. 2014-1), 5.00%, 9/1/48 | 2,500,000 | | 2,773,975 | |

| Lammersville Joint Unified School District Special Tax, (Lammersville Joint Unified School District Community Facilities District No. 200), 5.00%, 9/1/27 | 450,000 | | 548,537 | |

| Lammersville Joint Unified School District Special Tax, (Lammersville Joint Unified School District Community Facilities District No. 200), 5.00%, 9/1/28 | 505,000 | | 612,469 | |

| Lammersville Joint Unified School District Special Tax, (Lammersville Joint Unified School District Community Facilities District No. 200), 5.00%, 9/1/30 | 1,300,000 | | 1,549,223 | |

| Lammersville Joint Unified School District Special Tax, (Lammersville Joint Unified School District Community Facilities District No. 200), 5.00%, 9/1/32 | 1,510,000 | | 1,768,769 | |

| Long Beach Bond Finance Authority Rev., 5.50%, 11/15/37 (GA: Merrill Lynch & Co.) | 1,150,000 | | 1,675,194 | |

| Los Angeles Community Facilities District Special Tax, 6.40%, 9/1/22 | 330,000 | | 334,590 | |

| Los Angeles County Metropolitan Transportation Authority Rev., 4.00%, 6/1/37 | 1,000,000 | | 1,219,130 | |

| Los Angeles County Public Works Financing Authority Rev., 5.00%, 12/1/44 | 7,000,000 | | 8,889,720 | |

| Los Angeles Department of Airports Rev., 5.00%, 5/15/39 | 5,000,000 | | 6,358,050 | |

| Los Angeles Department of Airports Rev., 4.00%, 5/15/40 | 5,000,000 | | 5,895,950 | |

| Los Angeles Department of Water Rev., VRDN, 0.01%, 9/1/20 (SBBPA: Citibank N.A.) | 5,000,000 | | 5,000,000 | |

| | | | | | | | |

| Principal Amount | Value |

| Los Angeles Department of Water & Power System Rev., VRDN, 0.02%, 9/1/20 (SBBPA: Bank of America N.A.) | $ | 6,230,000 | | $ | 6,230,000 | |

| Los Angeles Department of Water & Power System Rev., VRDN, 0.02%, 9/1/20 (SBBPA: Barclays Bank) | 300,000 | | 300,000 | |

| Los Angeles Department of Water & Power System Rev., VRDN, 0.02%, 9/1/20 (SBBPA: TD Bank N.A.) | 2,100,000 | | 2,100,000 | |

| Los Angeles Department of Water & Power System Rev., VRDN, 0.02%, 9/1/20 (SBBPA: Bank of America N.A.) | 585,000 | | 585,000 | |

| M-S-R Energy Authority Rev., 7.00%, 11/1/34 (GA: Citigroup Global Markets) | 1,700,000 | | 2,645,387 | |

| M-S-R Energy Authority Rev., 6.50%, 11/1/39 (GA: Citigroup Global Markets) | 4,000,000 | | 6,372,520 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/21 | 125,000 | | 129,885 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/21 | 215,000 | | 223,359 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/22 | 100,000 | | 107,473 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/22 | 225,000 | | 241,628 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/23 | 100,000 | | 111,205 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/23 | 110,000 | | 121,605 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/24 | 250,000 | | 284,195 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/25 | 175,000 | | 204,540 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/25 | 260,000 | | 302,117 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/26 | 135,000 | | 160,164 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/26 | 115,000 | | 135,701 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/27 | 100,000 | | 117,331 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/28 | 100,000 | | 117,627 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/28 | 100,000 | | 116,681 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/33 | 340,000 | | 391,286 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/33 | 250,000 | | 285,275 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/38 | 400,000 | | 452,852 | |

| Marina Redevelopment Agency Successor Agency Tax Allocation, 5.00%, 9/1/38 | 250,000 | | 281,773 | |

| Menifee Union School District Special Tax, 5.00%, 9/1/43 | 1,000,000 | | 1,123,010 | |

| Menifee Union School District Special Tax, 5.00%, 9/1/44 | 2,245,000 | | 2,522,190 | |

| Menifee Union School District Special Tax, 5.00%, 9/1/48 | 1,500,000 | | 1,677,780 | |

| Menifee Union School District Public Financing Authority Special Tax, 5.00%, 9/1/24 | 1,200,000 | | 1,379,760 | |

| Metropolitan Water District of Southern California Rev., VRDN, 0.02%, 9/1/20 (SBBPA: PNC Bank N.A.) | 2,100,000 | | 2,100,000 | |

| Metropolitan Water District of Southern California Rev., VRDN, 0.02%, 9/1/20 (SBBPA: PNC Bank N.A.) | 2,400,000 | | 2,400,000 | |

| Middle Fork Project Finance Authority Rev., 5.00%, 4/1/32 | 2,285,000 | | 2,762,177 | |

| Middle Fork Project Finance Authority Rev., 5.00%, 4/1/34 | 2,325,000 | | 2,770,819 | |

| Middle Fork Project Finance Authority Rev., 5.00%, 4/1/35 | 2,230,000 | | 2,641,212 | |

| | | | | | | | |

| Principal Amount | Value |

| Middle Fork Project Finance Authority Rev., 5.00%, 4/1/36 | $ | 1,800,000 | | $ | 2,122,398 | |

| Moorpark Rev., (Villa del Arroyo Moorpark LLC), 6.50%, 5/15/41 | 4,000,000 | | 4,133,880 | |

| Murrieta Community Facilities District Special Tax, 5.00%, 9/1/42 | 655,000 | | 745,587 | |

| Murrieta Community Facilities District Special Tax, 5.00%, 9/1/46 | 825,000 | | 933,512 | |

| Murrieta Financing Authority Special Tax, 5.00%, 9/1/31 | 1,735,000 | | 1,855,635 | |

| Murrieta Valley Unified School District Public Financing Authority Special Tax, 5.00%, 9/1/30 | 1,735,000 | | 2,023,999 | |

| Murrieta Valley Unified School District Public Financing Authority Special Tax, 5.00%, 9/1/31 | 1,915,000 | | 2,219,964 | |

| Murrieta Valley Unified School District Public Financing Authority Special Tax, 5.00%, 9/1/32 | 1,155,000 | | 1,332,154 | |

Northern Inyo County Local Hospital District GO, 0.00%, 11/1/34(2) | 1,325,000 | | 854,824 | |

Northern Inyo County Local Hospital District GO, 0.00%, 11/1/36(2) | 2,885,000 | | 1,704,833 | |

| Northern Inyo County Local Hospital District Rev., 3.875%, 12/1/27 | 3,745,000 | | 3,833,045 | |

| Ontario Community Facilities District No. 24 Special Tax, 5.00%, 9/1/26 | 390,000 | | 470,387 | |

| Ontario Community Facilities District No. 24 Special Tax, 5.00%, 9/1/41 | 2,065,000 | | 2,329,175 | |

| Ontario Community Facilities District No. 24 Special Tax, 5.00%, 9/1/46 | 1,500,000 | | 1,680,240 | |

| Ontario Community Facilities District No. 28 Special Tax, 5.00%, 9/1/42 | 1,000,000 | | 1,107,510 | |

| Ontario Community Facilities District No. 28 Special Tax, 5.00%, 9/1/47 | 500,000 | | 552,735 | |

| Ontario Community Facilities District No. 30 Special Tax, 4.00%, 9/1/42 | 1,395,000 | | 1,493,180 | |

| Ontario Community Facilities District No. 30 Special Tax, 4.00%, 9/1/48 | 2,000,000 | | 2,132,780 | |

| Ontario Community Facilities District No. 31 Special Tax, 5.00%, 9/1/42 | 1,050,000 | | 1,199,510 | |

| Ontario Community Facilities District No. 34 Special Tax, 4.00%, 9/1/48 | 1,000,000 | | 1,067,580 | |

| Ontario Community Facilities District No. 40 Special Tax, 4.00%, 9/1/50 | 780,000 | | 865,238 | |

| Ontario Community Facilities District No. 43 Special Tax, 4.00%, 9/1/50 | 1,000,000 | | 1,096,410 | |

| Orange County Community Facilities District Special Tax, 4.00%, 8/15/40 | 1,080,000 | | 1,181,909 | |

| Orange County Community Facilities District Special Tax, 5.25%, 8/15/45 | 3,905,000 | | 4,361,963 | |

| Orange County Community Facilities District Special Tax, 5.00%, 8/15/46 | 10,000,000 | | 11,222,900 | |

| Orange County Community Facilities District Special Tax, 5.00%, 8/15/47 | 2,550,000 | | 2,945,658 | |

| Orange County Community Facilities District Special Tax, 4.00%, 8/15/50 | 1,000,000 | | 1,077,460 | |

| Oroville Rev., (Oroville Hospital), 5.25%, 4/1/39 | 2,350,000 | | 2,580,981 | |

| Oroville Rev., (Oroville Hospital), 5.25%, 4/1/49 | 7,805,000 | | 8,447,273 | |

| Oroville Rev., (Oroville Hospital), 5.25%, 4/1/54 | 3,000,000 | | 3,212,340 | |

| Palomar Health COP, (Palomar Health Obligated Group), 4.00%, 11/1/38 | 1,445,000 | | 1,490,807 | |

| Palomar Health Rev., (Palomar Health Obligated Group), 5.00%, 11/1/27 | 2,005,000 | | 2,433,970 | |

| Palomar Health Rev., (Palomar Health Obligated Group), 5.00%, 11/1/30 | 3,000,000 | | 3,554,040 | |

| Palomar Health Rev., (Palomar Health Obligated Group), 5.00%, 11/1/31 | 2,125,000 | | 2,492,774 | |

| Palomar Health Rev., (Palomar Health Obligated Group), 5.00%, 11/1/36 | 8,465,000 | | 9,686,838 | |

| | | | | | | | |

| Principal Amount | Value |

| Palomar Health Rev., (Palomar Health Obligated Group), 5.00%, 11/1/39 | $ | 8,250,000 | | $ | 9,379,177 | |

| Palomar Health Rev., (Palomar Health Obligated Group), 5.00%, 11/1/42 | 10,000,000 | | 11,353,200 | |

| Perris Joint Powers Authority Special Tax, 5.00%, 9/1/26 | 1,090,000 | | 1,316,764 | |

| Perris Joint Powers Authority Special Tax, 5.00%, 9/1/27 | 1,000,000 | | 1,230,840 | |

| Perris Joint Powers Authority Special Tax, 5.00%, 9/1/30 | 1,325,000 | | 1,583,786 | |

| Perris Joint Powers Authority Special Tax, 5.00%, 9/1/34 | 1,555,000 | | 1,815,245 | |

| Perris Union High School District Special Tax, 5.00%, 9/1/41 | 4,750,000 | | 5,225,190 | |

| Pleasant Valley School District / Ventura County GO, 5.85%, 8/1/31 (NATL) | 4,835,000 | | 6,355,414 | |

| Poway Unified School District Public Financing Authority Special Tax, 5.00%, 9/1/34 | 995,000 | | 1,121,713 | |

| Poway Unified School District Public Financing Authority Special Tax, 5.00%, 9/1/35 | 990,000 | | 1,112,176 | |

| Poway Unified School District Public Financing Authority Special Tax, 5.00%, 9/1/36 | 1,245,000 | | 1,390,740 | |

| Rancho Cordova Special Tax, 4.00%, 9/1/31 | 1,350,000 | | 1,479,074 | |

| Rancho Cordova Special Tax, 4.00%, 9/1/37 | 3,000,000 | | 3,223,560 | |

| Rancho Cordova Special Tax, 5.00%, 9/1/40 | 1,195,000 | | 1,324,861 | |

| Rancho Cordova Special Tax, 4.00%, 9/1/45 | 1,025,000 | | 1,086,613 | |

| Rancho Cordova Special Tax, 5.00%, 9/1/45 | 1,250,000 | | 1,371,913 | |

| Rancho Cordova Special Tax, (Rancho Cordova Grantline 208 Community Facilities District No. 2018-1), 5.00%, 9/1/39 | 690,000 | | 770,475 | |

| Rancho Cordova Special Tax, (Rancho Cordova Grantline 208 Community Facilities District No. 2018-1), 5.00%, 9/1/44 | 410,000 | | 455,358 | |

| Rancho Cordova Special Tax, (Rancho Cordova Grantline 208 Community Facilities District No. 2018-1), 5.00%, 9/1/49 | 530,000 | | 586,169 | |

Redwood City Redevelopment Agency Successor Agency Tax Allocation, Capital Appreciation, 0.00%, 7/15/28 (Ambac)(2) | 3,405,000 | | 3,055,306 | |

| Regents of the University of California Medical Center Pooled Rev., VRDN, 0.01%, 9/1/20 | 1,500,000 | | 1,500,000 | |

| Rio Elementary School District Community Facilities District Special Tax, 5.00%, 9/1/35 | 2,550,000 | | 2,814,894 | |

| Rio Vista Community Facilities District Special Tax, 5.00%, 9/1/38 | 1,070,000 | | 1,216,793 | |

| Rio Vista Community Facilities District Special Tax, 5.00%, 9/1/48 | 1,190,000 | | 1,336,382 | |

| River Islands Public Financing Authority Special Tax, 5.50%, 9/1/45 | 3,500,000 | | 3,737,895 | |

| River Islands Public Financing Authority Special Tax, 5.50%, 9/1/45 | 5,000,000 | | 5,347,950 | |

| Riverside County Community Facilities Districts Special Tax, 5.00%, 9/1/30 | 1,035,000 | | 1,097,473 | |

| Riverside County Community Facilities Districts Special Tax, 5.00%, 9/1/35 | 2,520,000 | | 2,649,704 | |

| Riverside County Community Facilities Districts Special Tax, 5.00%, 9/1/40 | 2,250,000 | | 2,503,417 | |

| Riverside County Community Facilities Districts Special Tax, 5.00%, 9/1/42 | 3,000,000 | | 3,136,920 | |

| Riverside County Community Facilities Districts Special Tax, 5.00%, 9/1/42 | 1,110,000 | | 1,268,808 | |

| Riverside County Community Facilities Districts Special Tax, 5.00%, 9/1/44 | 2,735,000 | | 3,025,840 | |

| Riverside County Community Facilities Districts Special Tax, 5.00%, 9/1/45 | 540,000 | | 612,819 | |

| Riverside County Community Facilities Districts Special Tax, 5.00%, 9/1/48 | 2,500,000 | | 2,807,525 | |

| Riverside County Transportation Commission Rev., 5.75%, 6/1/44 | 500,000 | | 545,610 | |

Riverside County Transportation Commission Rev., Capital Appreciation, 0.00%, 6/1/41(2) | 2,000,000 | | 1,055,180 | |

Riverside County Transportation Commission Rev., Capital Appreciation, 0.00%, 6/1/42(2) | 3,320,000 | | 1,685,697 | |

| | | | | | | | |

| Principal Amount | Value |

Riverside County Transportation Commission Rev., Capital Appreciation, 0.00%, 6/1/43(2) | $ | 5,000,000 | | $ | 2,438,100 | |

| Riverside Unified School District Special Tax, 4.00%, 9/1/40 | 350,000 | | 382,267 | |

| Riverside Unified School District Special Tax, 4.00%, 9/1/45 | 415,000 | | 448,387 | |

| Riverside Unified School District Special Tax, 4.00%, 9/1/50 | 875,000 | | 941,456 | |

| Riverside Unified School District Special Tax, (Riverside Unified School District Community Facilities District No. 32), 4.00%, 9/1/43 | 1,600,000 | | 1,720,544 | |

| Riverside Unified School District Special Tax, (Riverside Unified School District Community Facilities District No. 32), 4.00%, 9/1/48 | 1,850,000 | | 1,980,665 | |

| Romoland School District Special Tax, 5.00%, 9/1/35 | 4,685,000 | | 5,256,101 | |

| Romoland School District Special Tax, 5.00%, 9/1/38 | 2,900,000 | | 3,234,428 | |

| Romoland School District Special Tax, 5.00%, 9/1/41 | 1,250,000 | | 1,433,325 | |

| Romoland School District Special Tax, 5.00%, 9/1/43 | 2,640,000 | | 2,816,035 | |

| Romoland School District Special Tax, (Romoland School District Community Facilities District No. 2004-1 Heritage Lake), 5.00%, 9/1/43 | 3,000,000 | | 3,378,060 | |

| Romoland School District Special Tax, (Romoland School District Community Facilities District No. 2004-1 Heritage Lake), 5.00%, 9/1/48 | 3,250,000 | | 3,633,565 | |

Roseville Special Tax, 5.00%, 9/1/32(1) | 1,265,000 | | 1,473,788 | |

| Roseville Special Tax, 5.00%, 9/1/40 | 1,670,000 | | 1,903,633 | |

| Roseville Special Tax, 5.00%, 9/1/44 | 2,950,000 | | 3,326,390 | |

Roseville Special Tax, 5.00%, 9/1/47(1) | 6,500,000 | | 7,297,745 | |

| Roseville Special Tax, 5.00%, 9/1/49 | 850,000 | | 952,434 | |

Roseville Special Tax, (Roseville Creekview Community Facilities District No. 1), 5.00%, 9/1/45(5) | 1,280,000 | | 1,439,194 | |

Roseville Special Tax, (Roseville Creekview Community Facilities District No. 1), 5.00%, 9/1/50(5) | 250,000 | | 280,250 | |

| Roseville Special Tax, (Roseville Fiddyment Ranch Community Facilities District No. 5), 5.00%, 9/1/49 | 1,000,000 | | 1,109,450 | |

| Roseville Special Tax, (Roseville SVSP Westpark-Federico Community Facilities District No. 1), 5.00%, 9/1/39 | 445,000 | | 499,766 | |

| Roseville Special Tax, (Roseville SVSP Westpark-Federico Community Facilities District No. 1), 5.00%, 9/1/44 | 500,000 | | 556,185 | |

| Roseville Special Tax, (Roseville SVSP Westpark-Federico Community Facilities District No. 1), 5.00%, 9/1/49 | 700,000 | | 776,615 | |

| Roseville Special Tax, (Villages at Sierra Vista Community Facilities District No. 1), 5.00%, 9/1/36 | 685,000 | | 778,345 | |

| Roseville Special Tax, (Villages at Sierra Vista Community Facilities District No. 1), 5.00%, 9/1/39 | 1,390,000 | | 1,567,614 | |

| Roseville Special Tax, (Villages at Sierra Vista Community Facilities District No. 1), 4.00%, 9/1/45 | 495,000 | | 522,581 | |

| Roseville Special Tax, (Villages at Sierra Vista Community Facilities District No. 1), 5.00%, 9/1/49 | 3,870,000 | | 4,304,794 | |

| Roseville Special Tax, (Villages at Sierra Vista Community Facilities District No. 1), 4.00%, 9/1/50 | 650,000 | | 682,806 | |

Roseville Special Tax, (Westbrook Community Facilities District

No. 1), 5.00%, 9/1/37 | 1,250,000 | | 1,401,075 | |