Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-14549

UNITED SECURITY BANCSHARES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 63-0843362 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

131 West Front Street Post Office Box 249 Thomasville, Alabama | 36784 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code (334) 636-5424

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.01 Per Share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 30, 2005, was $177,756,380.

The number of shares of common stock outstanding as of March 9, 2006, was 6,422,967 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2006 annual meeting of its shareholders are incorporated by reference into Part III.

Table of Contents

United Security Bancshares, Inc.

Annual Report on Form 10-K

for the fiscal year ended

December 31, 2005

TABLE OF CONTENTS

i

Table of Contents

This Annual Report on Form 10-K, other periodic reports filed by United Security Bancshares, Inc. and its subsidiaries (“Bancshares”) under the Securities Exchange Act of 1934, as amended, and any other written or oral statements made by or on behalf of Bancshares may include “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, that reflect Bancshares’ current views with respect to future events and financial performance. Such forward-looking statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to:

1. Possible changes in economic and business conditions that may affect the prevailing interest rates, the prevailing rates of inflation, or the amount of growth, stagnation, or recession in the global, U.S., Alabama and Mississippi economies, the value of investments, the collectibility of loans and the ability to retain and grow deposits;

2. Possible changes in monetary and fiscal policies, laws and regulations, and other activities of governments, agencies and similar organizations;

3. The effects of easing of restrictions on participants in the financial services industry, such as banks, securities brokers and dealers, investment companies and finance companies, other potential regulatory changes, and attendant changes in patterns and effects of competition in the financial services industry; and

4. The ability of Bancshares to achieve its expected operating results including (i) the continued growth of the markets in which Bancshares operates consistent with recent historical experience and (ii) Bancshares’ ability to expand into new markets and to maintain profit margins.

The words, “believe,” “expect,” “anticipate,” “project,” and similar expressions, signify forward-looking statements. Readers are cautioned not to place undue reliance on any forward-looking statements made by or on behalf of Bancshares. Any such statements speak only as of the date such statements were made, and Bancshares undertakes no obligation to update or revise any forward-looking statements.

In addition, Bancshares’ business is subject to a number of general and market risks that would affect any forward-looking statements, including the risks discussed under Item1A herein entitled “Risk Factors.”

1

Table of Contents

PART I

| Item 1. | Business. |

General

United Security Bancshares, Inc. (“Bancshares”) is a Delaware corporation organized in 1999, as a successor by merger with United Security Bancshares, Inc., an Alabama corporation. Bancshares is a bank holding company registered under the Bank Holding Company Act of 1956, as amended (the “Act”), and it operates one banking subsidiary, First United Security Bank (the “Bank”). The Bank owns all of the stock of Acceptance Loan Company, Inc. (“ALC”), a finance company organized for the purpose of making consumer loans and purchasing consumer loans from vendors. Bancshares owns all the stock of First Security Courier Corporation (“First Security”), an Alabama corporation organized for the purpose of providing certain bank courier services. The Bank’s wholly-owned Arizona subsidiary, FUSB Reinsurance, Inc. (“FUSB Reinsurance”), reinsures or “underwrites” credit life and credit accident and health insurance policies sold to the Bank’s consumer loan customers. FUSB Reinsurance is responsible for the first level of risk on these policies up to a specified maximum amount, and a primary third-party insurer retains the remaining risk. The third-party insurer and/or a third-party administrator is responsible for performing most of the administrative functions of FUSB Reinsurance on a contract basis.

The Bank has nineteen banking offices, which are located in Brent, Bucksville, Butler, Calera, Centreville, Coffeeville, Columbiana, Fulton, Gilbertown, Grove Hill, Harpersville, Jackson, Thomasville, Tuscaloosa, and Woodstock, Alabama. Its market area includes portions of Bibb, Chilton, Clarke, Choctaw, Hale, Jefferson, Marengo, Monroe, Perry, Shelby, Sumter, Tuscaloosa, Washington and Wilcox Counties in Alabama, as well as Clarke, Lauderdale and Wayne Counties in Mississippi.

2

Table of Contents

The Bank conducts a general commercial banking business and offers banking services such as the receipt of demand, savings and time deposits, personal and commercial loans, credit card and safe deposit box services and the purchase and sale of government securities.

As of December 31, 2005, the Bank had 186 full-time equivalent employees, ALC had 96 full-time equivalent employees and Bancshares had no employees, other than the executive officers of Bancshares who are referenced in Part III, Item 10 of this report.

Competition

Bancshares and its subsidiaries encounter strong competition in making loans, acquiring deposits and attracting customers for investment services. Competition among financial institutions is based upon interest rates offered on deposit accounts, interest rates charged on loans, other credit and service charges relating to loans, the quality and scope of the services rendered, the convenience of banking facilities and, in the case of loans to commercial borrowers, relative lending limits. The Bank competes with other commercial banks (including at least ten in its service area), credit unions, finance companies, mutual funds, insurance companies, investment banking companies, brokerage firms, and other financial intermediaries operating in Alabama and elsewhere. Many of these competitors, some of which are affiliated with large bank holding companies, have substantially greater resources and lending limits. In addition, many of the Bank’s non-bank competitors are not subject to the same extensive federal regulations that govern bank holding companies and federally-insured banks.

The financial services industry is likely to become more competitive as further technological advances enable more companies to provide financial services. These technological advances may diminish the importance of depository institutions and other financial intermediaries in the transfer of funds among parties.

Supervision and Regulation

Bancshares and the Bank are subject to state and federal banking laws and regulations which impose specific requirements and restrictions on, and provide for general regulatory oversight with respect to, virtually all aspects of operations. These laws and regulations are generally intended to protect depositors,

3

Table of Contents

not shareholders. To the extent that the following summary describes statutory or regulatory provisions, it is qualified in its entirety by reference to the particular statutory and regulatory provisions. Any change in applicable laws or regulations may have a material effect on the business and prospects of Bancshares.

As a bank holding company, Bancshares is subject to regulation under the Act and to inspection, examination and supervision by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). The Bank is subject to supervision, examination and regulation by applicable state and federal banking agencies, including the Federal Reserve and the Federal Deposit Insurance Corporation (the “FDIC”). The Bank also is subject to various requirements and restrictions under federal and state law, including requirements to maintain allowances against deposits, restrictions on the types and amounts of loans that may be granted and the interest that may be charged thereon, and limitations on the types of investments that may be made and the types of services that may be offered. Various consumer laws and regulations affect the operations of the Bank. In addition to the impact of regulation, commercial banks are affected significantly by the actions of the Federal Reserve as it attempts to control the money supply and credit availability in order to influence the economy.

The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 (the “IBBEA”) permits adequately capitalized and adequately managed bank holding companies, as determined by the Federal Reserve, to acquire banks in any state subject to concentration limits and other conditions. The IBBEA also generally authorizes the interstate merger of banks. Under the IBBEA, banks are permitted to establish new branches on an interstate basis, provided that the law of the host state specifically authorizes such action.

The Federal Reserve has authority to prohibit bank holding companies from paying dividends if such payment is deemed to be an unsafe or unsound practice. The Federal Reserve has indicated generally that it may be an unsafe or unsound practice for bank holding companies to pay dividends unless the bank holding company’s net income over the preceding year is sufficient to fund the dividends, and the expected rate of earnings retention is consistent with the organization’s capital needs, asset quality and overall financial condition.

4

Table of Contents

In addition to the limitations placed on the payment of dividends at the holding company level, there are various legal and regulatory limits on the extent to which the Bank may pay dividends or otherwise supply funds to Bancshares. Under Alabama law, a bank may not pay a dividend in excess of 90 percent of its net earnings until the bank’s surplus is equal to at least 20 percent of capital. Also, under Alabama law, a bank is required to obtain approval of the Superintendent of Banking prior to the payment of dividends if the total of all dividends declared by the bank in any calendar year will exceed the total of the bank’s net earnings (as defined by statute) for the year, and its retained net earnings for the preceding two years, less any required transfers to surplus. Also, no dividends may be paid from a bank’s surplus without the prior written approval of the Superintendent of Banking.

In addition, federal and state regulatory agencies have the authority to prevent a bank or bank holding company from paying a dividend or engaging in any other activity that, in the opinion of the agency, would constitute an unsafe or unsound practice. The inability of the Bank to pay dividends may have an adverse effect on Bancshares.

Bancshares and the Bank also are subject to certain restrictions on extensions of credit to executive officers, directors, principal shareholders and their related interests. Such extensions of credit must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with third parties and must not involve more than the normal risk of repayment or present other unfavorable features.

The Gramm-Leach-Bliley Act of 2000 (the “GLB Act”) permits bank holding companies that meet certain management, capital and community reinvestment standards to engage in a substantially broader range of non-banking activities that were previously permitted, including insurance underwriting and merchant banking activities. Under the GLB Act, a bank holding company that elects to become a financial holding company may engage in any activity that the Federal Reserve, in consultation with the Secretary of the Department of the Treasury, determines by regulation or order is: (i) financial in nature; (ii) incidental to such financial activity; or (iii) complementary to such financial activity and does not pose a substantial risk to the safety or soundness of depository institutions or the financial system generally. Bancshares has elected to become a financial holding company.

5

Table of Contents

The GLB Act preserves the role of the Federal Reserve as the umbrella supervisor for holding companies while at the same time incorporating a system of functional regulation designed to take advantage of the strengths of the various federal and state regulators. In particular, the GLB Act replaces the broad exemption from Securities and Exchange Commission regulation that banks previously enjoyed with more limited exemptions, and it reaffirms that states are the regulators for the insurance activities of all persons, including federally-chartered banks.

The GLB Act and the applicable regulations issued by the various federal regulatory agencies require financial institutions (including banks, insurance agencies and broker/dealers) to implement policies and procedures regarding the disclosure of nonpublic personal information about their customers with non-affiliated third parties. In general, financial institutions are required to explain to consumers their policies and procedures regarding the disclosure of such nonpublic personal information, and, unless otherwise required or permitted by law, financial institutions are prohibited from disclosing such information except as provided in their policies and procedures. Specifically, the Information Security Guidelines established by the GLB Act require each financial institution, under the supervision and ongoing oversight of its Board of Directors or an appropriate committee thereof, to develop, implement and maintain a comprehensive written information security program designed to ensure the security and confidentiality of customer information, to protect against anticipated threats or hazards to the security or integrity of such information, and to protect against unauthorized access to or use of such information that could result in substantial harm or inconvenience to any customer.

Subsidiary banks of a bank holding company are subject to certain restrictions on extensions of credit to the bank holding company or any of its non-bank subsidiaries, investments in the stock or other securities thereof, and the acceptance of such stocks or securities as collateral for loans to any borrower. Among other requirements, transactions between a bank and its affiliates must be on an arm’s-length basis.

6

Table of Contents

The Bank is subject to extensive supervision and regulation by the Alabama State Banking Department and the FDIC. Among other things, these agencies have the authority to prohibit the Bank from engaging in any activity (such as paying dividends) that, in the opinion of the agency, would constitute an unsafe or unsound practice. The Bank also is subject to various requirements and restrictions under federal and state law. Areas subject to regulation include dividend payments, reserves, investments, loans (including loans to insiders and significant shareholders), mergers, issuance of securities, establishment of branches and other aspects of operation, including compliance with truth-in-lending laws, usury laws and other consumer protection laws. The GLB Act establishes minimum federal standards of financial privacy pursuant to which financial institutions will be required to institute written privacy policies that must be disclosed to customers at certain required intervals. In addition to the impact of regulation, commercial banks are affected significantly by the actions of the Federal Reserve as it attempts to control the money supply and credit availability in order to influence the economy.

There are a number of obligations and restrictions imposed on bank holding companies and their depository institution subsidiaries by federal law and regulatory policy that are designed to reduce potential loss exposure to the depositors of such depository institutions and to the FDIC insurance fund in the event the depository institution becomes in danger of default or is in default. For example, under a policy of the Federal Reserve with respect to bank holding company operations, a bank holding company is required to serve as a source of financial strength to its subsidiary depository institutions and to commit resources to support such institutions in circumstances where it might not do so absent such policy. In addition, the “cross-guarantee” provisions of federal law require insured depository institutions under common control to reimburse the FDIC for any loss suffered or reasonably anticipated as a result of the default of a commonly controlled insured depository institution or for any assistance provided by the FDIC to a commonly controlled insured depository institution in danger of default. Although the FDIC’s claim is junior to the claims of non-affiliated depositors, holders of secured liabilities, general creditors and subordinated creditors, it is superior to the claims of shareholders. The Bank is a FDIC insured depository institution. Any capital loans by a bank holding company to its subsidiary banks are subordinate in right of payment to deposits and to certain other

7

Table of Contents

indebtedness of such subsidiary banks. In the event of a bank holding company’s bankruptcy, any commitment by the bank holding company to a federal bank regulatory agency to maintain the capital of a subsidiary bank will be assumed by the bankruptcy trustee and entitled to a priority of payment.

The federal banking agencies have broad powers under current federal law to take prompt corrective action to resolve problems of insured depository institutions. The extent of these powers depends upon whether the institutions in question are “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” or “critically undercapitalized” as such terms are defined under regulations issued by each of the federal banking agencies. In general, the agencies measure capital adequacy within a framework that makes capital requirements sensitive to the risk profiles of individual banking companies. The guidelines define capital as either Tier 1 (primarily common shareholders’ equity) or Tier 2 (certain debt instruments and a portion of the allowance for loan losses). Bancshares and the Bank are subject to a minimum Tier 1 capital ratio (Tier 1 capital to risk-weighted assets) of 4%, a total capital ratio (Tier 1 plus Tier 2 to risk-weighted assets) of 8% and a Tier 1 leverage ratio (Tier 1 to average quarterly assets) of 3%. To be considered a “well capitalized” institution, the Tier 1 capital ratio, the total capital ratio and the Tier 1 leverage ratio must equal or exceed 6%, 10% and 5%, respectively.

The Community Reinvestment Act (the “CRA”) requires that, in connection with examinations of a financial institution such as the Bank, the Federal Reserve or the FDIC must evaluate the record of the financial institution in meeting the credit needs of its local communities, including low and moderate income neighborhoods, consistent with the safe and sound operation of those institutions. The CRA does not establish specific lending requirements or programs for financial institutions nor does it limit an institution’s discretion to develop the types of products and services that it believes are best suited to its particular community, consistent with the CRA. These factors are considered in evaluating mergers, acquisitions and applications to open a branch or facility. The CRA also requires all institutions to make public disclosure of their CRA ratings. The Bank received a satisfactory rating in its most recent evaluation.

The Bank Secrecy Act is the centerpiece of the federal government’s efforts to prevent banks and other financial institutions from being used to facilitate the transfer or deposit of money derived from criminal

8

Table of Contents

activity. Under the Bank Secrecy Act, financial institutions are obligated to file Suspicious Activity Reports, or SARs, on suspicious activities involving the institution, including certain attempted or actual violations of law as well as certain transactions that do not appear to have a lawful purpose or are not the sort of transaction in which the particular customer would normally be expected to engage.

The Bank Secrecy Act was amended by the USA Patriot Act of 2001 (the “USA Patriot Act”) expanding the important role the government expects banks to play in detecting and reporting suspicious activity. The USA Patriot Act broadened the application of anti-money laundering regulations to apply to additional types of financial institutions, such as broker-dealers, and strengthened the ability of the U.S. Government to detect and prosecute international money laundering and the financing of terrorism. The principal provisions of Title III of the USA Patriot Act require that regulated financial institutions: (i) establish an anti-money laundering program that includes training and audit components; (ii) comply with regulations regarding the verification of the identity of any person seeking to open an account; (iii) take additional required precautions with non-U.S. owned accounts; and (iv) perform certain verification and certification of money laundering risk for their foreign correspondent banking relationships. The USA Patriot Act also expanded the conditions under which funds in a U.S. interbank account may be subject to forfeiture and increased the penalties for violation of anti-money laundering regulations.

Failure of a financial institution to comply with the Bank Secrecy Act, as amended by the USA Patriot Act, could have serious legal and reputational consequences for the institution. The Bank has adopted policies, procedures and controls to address compliance with these regulations, and the Bank will continue to revise and update its policies, procedures and controls to reflect changes required by the USA Patriot Act and applicable implementing regulations.

From time to time, various bills are introduced in the United States Congress with respect to the regulation of financial institutions. Certain of these proposals, if adopted, could significantly change the regulation of banks and the financial services industry. Bancshares cannot predict whether any of these proposals will be adopted or, if adopted, how these proposals would affect Bancshares.

9

Table of Contents

FDIC regulations require that management report on its responsibility for preparing its institution’s financial statements and for establishing and maintaining an internal control structure and procedures for financial reporting and compliance with designated laws and regulations concerning safety and soundness.

Supervision, regulation and examination of banks by the bank regulatory agencies are intended primarily for the protection of depositors rather than for the shareholders of the banks.

Available Information

The Bank’s website address ishttp://www.firstusbank.com (Bancshares does not maintain a website). Bancshares’ annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 (“Exchange Act”) are not currently available on the Bank’s website; however, Bancshares continues to assess the expense associated with implementing this feature on the Bank’s website. These reports are available on the Securities and Exchange Commission’s website,http://www.sec.gov, and Bancshares will provide paper copies of these reports free of charge upon written request.

Making or continuing an investment in securities issued by Bancshares, including our common stock, involves certain risks that you should carefully consider. The risks and uncertainties described below are not the only risks that may have a material adverse effect on Bancshares. Additional risks and uncertainties also could adversely affect our business and our results. If any of the following risks actually occur, our business, financial condition or results of operations could be negatively affected, the market price for your securities could decline, and you could lose all or a part of your investment. Further, to the extent that any of the information contained in this Annual Report on Form 10-K constitutes forward-looking statements, the risk factors set forth below also are cautionary statements identifying important factors that could cause Bancshares’ actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Bancshares.

10

Table of Contents

Risks Related to Our Business

The banking industry is highly competitive which could result in loss of market share and adversely affect our business.

We encounter strong competition in making loans, acquiring deposits and attracting customers for investment services. We compete with other commercial banks (including at least ten in our service area), credit unions, finance companies, mutual funds, insurance companies, investment banking companies, brokerage firms, and other financial intermediaries operating in Alabama and elsewhere. Many of these competitors, some of which are affiliated with large bank holding companies, have substantially greater resources and lending limits. In addition, many of our non-bank competitors are not subject to the same extensive federal regulations that govern bank holding companies and federally-insured banks.

We are subject to extensive governmental regulation, which could have an adverse impact on our operations.

The banking industry is extensively regulated and supervised under both federal and state law. We are subject to the regulation and supervision of the Federal Reserve Board, the FDIC, and the Superintendent of Banking of the State of Alabama. These regulations are intended primarily to protect depositors, the public, and the FDIC insurance funds, and are not intended to protect shareholders. Additionally, Bancshares, the Bank and certain of its subsidiaries are subject to regulation, supervision and examination by other regulatory authorities, such as the Securities and Exchange Commission, the National Association of Securities Dealers, Inc. and state securities and insurance regulators. We are subject to changes in federal and state law, as well as regulations and governmental policies, income tax laws, and accounting principles. Regulations affecting banks and other financial institutions are undergoing continuous change, and the ultimate effect of such changes cannot be predicted. Regulations and laws may be modified at any time, and new legislation may be enacted that will affect us, the Bank and its subsidiaries. We cannot assure you that such modifications or new laws will not adversely affect us. Our regulatory position is discussed in greater detail under “Item 1. Business—Supervision and Regulation.”

Rapid and significant changes in market interest rates may adversely affect our performance.

Most of our assets and liabilities are monetary in nature and subject us to significant risks from changes in interest rates. Our profitability depends to a large extent on our net interest income, and changes in interest rates can impact our net interest income as well as the valuation of our assets and liabilities.

11

Table of Contents

Our results of operations are affected by changes in interest rates and our ability to manage interest rate risks. Changes in market interest rates, changes in the relationships between short-term and long-term market interest rates, and changes in the relationships between different interest rate indices can affect the interest rates charged on interest-earning assets differently than the interest rates paid on interest-bearing liabilities. These differences could result in an increase in interest expense relative to interest income or a decrease in our interest rate spread. For a more detailed discussion of these risks and our management strategies for these risks, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Item 7A. Quantitative and Qualitative Disclosures about Market Risk.” Our net interest margin depends on many factors that are partly or completely out of our control, including competition, federal economic monetary and fiscal policies, and general economic conditions. Despite our strategies to manage interest rate risks, changes in interest rates can still have a material adverse impact on our profitability.

Changes in the policies of monetary authorities and other government action could adversely affect our profitability.

The results of operations of Bancshares are affected by credit policies of monetary authorities, particularly the Federal Reserve Board. The instruments of monetary policy employed by the Federal Reserve Board include open market operations in U.S. Government securities, changes in the discount rate or the federal funds rate on bank borrowings, and changes in reserve requirements against bank deposits. In view of changing conditions in the national economy and in the money markets, particularly in light of the continuing threat of terrorist attacks and the current military operations in the Middle East, we cannot predict possible future changes in interest rates, deposit levels, loan demand or our business and earnings. Furthermore, the actions of the U.S. Government and other governments in responding to such terrorist attacks or the military operations in the Middle East may result in currency fluctuations, exchange controls, market disruption and other adverse effects.

12

Table of Contents

If we experience greater loan losses than anticipated, our earnings may be adversely affected.

As a lender, we are exposed to the risk that our customers will be unable to repay their loans according to their terms and that any collateral securing the payment of their loans may not be sufficient to assure repayment. Credit losses are inherent in the business of making loans and could have a material adverse effect on our operating results. Our credit risk with respect to our real estate and construction loan portfolio will relate principally to the creditworthiness of individuals and the value of the real estate serving as security for the repayment of loans. Our credit risk with respect to our commercial and consumer loan portfolio will relate principally to the general creditworthiness of businesses and individuals within our local markets.

We make various assumptions and judgments about the collectibility of our loan portfolio and provide an allowance for potential loan losses based on a number of factors. We believe that the allowance for loan losses is adequate. However, if our assumptions or judgments are wrong, the allowance for loan losses may not be sufficient to cover actual loan losses. The actual amount of future provisions for loan losses cannot be determined at this time and may vary from the amounts of past provisions.

Our profitability and liquidity may be affected by changes in economic conditions in the areas where our operations or loans are concentrated.

Bancshares’ success depends to a certain extent on the general economic conditions of the geographic markets served by the Bank and its subsidiaries in the states of Alabama and Mississippi. The local economic conditions in these areas have a significant impact on our commercial, real estate and construction loans, the ability of borrowers to repay these loans, and the value of the collateral securing these loans. Adverse changes in the economic conditions of the southeastern United States in general or any one or more of these local markets could negatively impact the financial results of Bancshares’ banking operations and have a negative effect on its profitability.

Hurricanes could cause a disruption in our operations which could have an adverse impact on the results of operations.

Some of our operations are located in the areas bordering the Gulf of Mexico, a region that is susceptible to hurricanes. Such weather events can cause disruption to our operations and could have a

13

Table of Contents

material adverse effect on our overall results of operations.Further, a hurricane in any of our market areas could adversely impact the ability of borrowers to timely repay their loans and may adversely impact the value of any collateral held by us.

We need to stay current on technological changes in order to compete and meet customer demands.

The financial services market, including banking services, is undergoing rapid changes with frequent introductions of new technology-driven products and services. In addition to better serving customers, the effective use of technology increases efficiency and may enable financial institutions to reduce costs. Our future success may depend, in part, on our ability to use technology to provide products and services that provide convenience to customers and to create additional efficiencies in our operations.

We cannot guarantee that we will pay dividends to shareholders in the future.

Cash available to pay dividends to our shareholders is derived from dividends paid by the Bank. The ability of the Bank to pay dividends, as well as our ability to pay dividends to our shareholders, will continue to be subject to and limited by the results of operations of the Bank and by certain legal and regulatory restrictions. Further, any lenders making loans to us may impose financial covenants that may be more restrictive than regulatory requirements with respect to our payment of dividends to shareholders. There can be no assurance of whether or when we may pay dividends to our shareholders in the future.

The performance of our investment portfolio is subject to fluctuations due to changes in interest rates and market conditions.

Changes in interest rates can negatively affect the performance of most of our investments. Interest rate volatility can reduce unrealized gains or create unrealized losses in our portfolios. Interest rates are highly sensitive to many factors, including governmental monetary policies, domestic and international economic and political conditions and other factors beyond our control. Fluctuations in interest rates affect our returns on, and the market value of, our investment securities.

The fair market value of the securities in our portfolio and the investment income from these securities also fluctuate depending on general economic and market conditions. In addition, actual net investment income and/or cash flows from investments that carry prepayment risk, such as mortgage-backed and other asset-backed securities, may differ from those anticipated at the time of investment as a result of interest rate fluctuations.

Risks Related to the Securities Market

Securities issued by Bancshares, including our common stock, are not FDIC insured.

Securities issued by Bancshares, including our common stock, are not savings or deposit accounts or other obligations of any bank and are not insured by the FDIC, the Bank Insurance Fund, or any other governmental agency or instrumentality, or any private insurer, and are subject to investment risk, including the possible loss of principal.

Future issuances of additional securities could result in dilution of your ownership.

We may determine from time to time to issue additional securities to raise additional capital, support growth, or to make acquisitions. Further, we may issue stock options or other stock grants to retain and motivate our employees. These issuances of our securities will dilute the ownership interests of our shareholders.

Our common stock price is volatile, which could result in substantial losses for individual stockholders.

The market prices of our common stock have been volatile, and we expect that they will continue to be volatile. In particular, our common stock may be subject to significant fluctuations in response to a variety of factors, including but not limited to:

| • | general economic and business conditions; |

| • | actual or anticipated variations in quarterly operating results; |

14

Table of Contents

| • | failure to meet analyst predictions and projections; |

| • | announcements of innovations or new services by us or our competitors; |

| • | changing market conditions in the financial services industry; |

| • | collectibility of loans; |

| • | monetary and fiscal policies, laws and regulations and other activities of the government, agencies and similar organizations; |

| • | cost and other effects of legal and administrative cases and proceedings, claims, settlements and judgments; |

| • | additions or departures of key personnel; |

| • | our sales of common stock or other securities in the future; and |

| • | other events or factors, many of which are beyond our control. |

Due to these factors, you may not be able to sell your stock at or above the price you paid for it, which could result in substantial losses.

Our results of operations depend upon the results of operations of our subsidiaries.

There are various regulatory restrictions on the ability of our subsidiaries to pay dividends or make other payments to us. In addition, our right to participate in any distribution of assets of any of our subsidiaries upon the subsidiary’s liquidation or otherwise, will be subject to the prior claims of creditors of that subsidiary, except to the extent that any of our claims as a creditor of such subsidiary may be recognized.

| Item 1B. | Unresolved Staff Comments. |

None.

| Item 2. | Properties. |

Bancshares owns no property and does not expect to own any property; however, the business of Bancshares is conducted from the nineteen offices of the Bank and the Bank owns all of its offices in fee simple without encumbrances, except the new office in Columbiana, which is leased. The Bank paid $2,150 for an option to lease the Columbiana property in 2005. ALC leases office space throughout Alabama and Southeast Mississippi but owns no property. During 2005, the aggregate annual rental payments for office space for ALC totaled approximately $363,292.

15

Table of Contents

| Item 3. | Legal Proceedings. |

Bancshares and the Bank, because of the nature of their businesses, are subject at various times to numerous legal actions, threatened or pending. In the opinion of Bancshares, based on review and consultation with legal counsel, the outcome of any legal proceedings presently pending against Bancshares or the Bank will not have a material effect on Bancshares’ consolidated financial statements or results of operations.

| Item 4. | Submission of Matters to a Vote of Security Holders. |

Not applicable.

PART II

| Item 5. | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

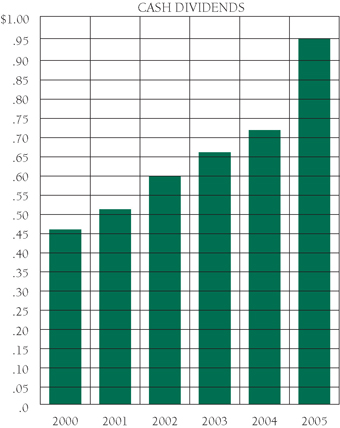

Bancshares’ common stock trades under the symbol “USBI” on The Nasdaq SmallCap Market. The sales price range for Bancshares’ common stock during each calendar quarter of 2004 and 2005 are shown below. The market prices represent sales prices as reported in the Nasdaq Historical Quotes. Additionally, Bancshares has declared dividends on its common stock on a quarterly basis in the past two years, as shown below.

| High | Low | Dividends Declared | |||||||

2004 | |||||||||

First Quarter | $ | 30.86 | $ | 22.31 | $ | 0.18 | |||

Second Quarter | 27.99 | 18.38 | 0.18 | ||||||

Third Quarter | 28.14 | 19.67 | 0.18 | ||||||

Fourth Quarter | 33.41 | 27.01 | 0.18 | ||||||

| 2005 | |||||||||

First Quarter | $ | 33.66 | $ | 27.43 | $ | 0.35 | |||

Second Quarter | 32.50 | 24.02 | 0.20 | ||||||

Third Quarter | 35.47 | 26.00 | 0.20 | ||||||

Fourth Quarter | 32.48 | 24.50 | 0.20 | ||||||

The last reported sales price of Bancshares’ Common Stock as reported in the Nasdaq Historical Quotes on March 9, 2006, was $25.70.

16

Table of Contents

As a holding company, Bancshares, except under extraordinary circumstances, will not generate earnings of its own, but will rely solely on dividends paid to it by the Bank as the source of income to meet its expenses and pay dividends. Under normal circumstances, Bancshares’ ability to pay dividends will depend entirely on the ability of the Bank to pay dividends to Bancshares. The Alabama Banking Code imposes certain restrictions on the Bank regarding the payment of dividends. Under Alabama law, the Bank may not pay a dividend in excess of 90 percent of its net earnings until the Bank’s surplus is equal to at least 20 percent of capital. The Bank is required to obtain approval of the Superintendent of Banking prior to the payment of dividends if the total of all dividends declared by the Bank in any calendar year will exceed the total of (a) the Bank’s net earnings (as defined by statute) for that year plus (b) its retained net earnings for the preceding two years, less any required transfers to surplus. Also, no dividends may be paid from the Bank’s surplus without the prior written approval of the Superintendent of Banking.

Bancshares’ management currently expects that comparable cash dividends will be paid in the future.

Bancshares has one class of common stock. As of March 9, 2006, there were approximately 931 shareholders of Bancshares.

Issuer Purchases of Equity Securities

The following table sets forth purchases made by or on behalf of Bancshares or any “affiliated purchaser,” as defined in Rule 10b-18(a)(3) of the Exchange Act, of shares of common stock.

Period | (a) Total Number of Shares Purchased | (b) Average Price Paid per Share | (c) Total Number of Shares Purchased as Part of Publicly Announced Programs | (d) Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Programs | ||||||||

October 1 – October 31 | 3,400 | (1) | $ | 26.22 | (1) | 0 | 671,918 | |||||

November 1 – November 30 | 0 | $ | 0.00 | 0 | 671,918 | |||||||

December 1 – December 31 | 0 | $ | 0.00 | 0 | 671,918 | |||||||

Total | 3,400 | (1) | $ | 26.22 | (1) | 0 | 671,918 | (2) | ||||

| (1) | The shares were purchased in open-market transactions by an independent trustee for the United Security Bancshares, Inc. Employee Stock Ownership Plan (With 401(k) Provisions). |

| (2) | Under a share repurchase program publicly announced on May 21, 2001, Bancshares was authorized to repurchase up to 1,429,204 shares of common stock, as adjusted for the two-for-one stock split that was effective June 30, 2003. 757,286 shares were repurchased under the program. On January 19, 2006, the Board terminated the repurchase program, which was scheduled to expire on June 30, 2006, and approved a new repurchase program. Under the new repurchase program, Bancshares is authorized to repurchase up to 642,785 shares of common stock before December 31, 2007, the expiration date of the new repurchase program. |

17

Table of Contents

In addition to the repurchased shares reflected in the table, 135 shares were purchased in August 2005, at an average price per share of $29.31 in open-market transactions by a trust established in connection with the United Security Bancshares, Inc. Non-Employee Directors’ Deferred Compensation Plan.

Item 6. Selected Financial Data.

UNITED SECURITY BANCSHARES, INC. AND SUBSIDIARIES

SELECTED FINANCIAL DATA

| Year Ended December 31, | ||||||||||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | ||||||||||||||||

| (In Thousands of Dollars, Except Per Share Amounts) | ||||||||||||||||||||

RESULTS OF OPERATIONS | ||||||||||||||||||||

Interest Income | $ | 52,679 | $ | 49,434 | $ | 46,722 | $ | 45,752 | $ | 47,776 | ||||||||||

Interest Expense | 11,810 | 10,369 | 11,197 | 14,134 | 18,419 | |||||||||||||||

Net Interest Income | 40,869 | 39,065 | 35,525 | 31,618 | 29,357 | |||||||||||||||

Provision for Loan Losses | 3,853 | 3,724 | 3,505 | 3,859 | 5,255 | |||||||||||||||

Non-Interest Income | 5,278 | 5,755 | 5,724 | 5,069 | 4,730 | |||||||||||||||

Non-Interest Expense | 23,059 | 22,045 | 21,306 | 20,032 | 19,493 | |||||||||||||||

Income Before Income Taxes | 19,235 | 19,051 | 16,438 | 12,796 | 9,339 | |||||||||||||||

Income Taxes | 5,579 | 5,920 | 5,023 | 3,621 | 2,552 | |||||||||||||||

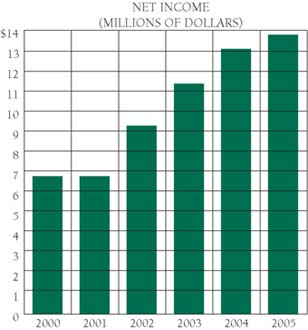

Net Income Before Cumulative Effect of a Change in Accounting Principle | $ | 13,656 | $ | 13,131 | $ | 11,415 | $ | 9,175 | $ | 6,787 | ||||||||||

Cumulative Effect of a Change in Accounting Principle | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | (200 | ) | |||||||||

Net Income After Cumulative Effect of a Change in Accounting Principle | $ | 13,656 | $ | 13,131 | $ | 11,415 | $ | 9,175 | $ | 6,587 | ||||||||||

Net Income Per Share | ||||||||||||||||||||

Basic | $ | 2.12 | $ | 2.04 | $ | 1.77 | $ | 1.41 | $ | 0.95 | ||||||||||

Diluted | $ | 2.12 | $ | 2.04 | $ | 1.77 | $ | 1.41 | $ | 0.94 | ||||||||||

Average Number of Shares Outstanding* | 6,428 | 6,431 | 6,432 | 6,506 | 6,988 | |||||||||||||||

PERIOD END STATEMENT OF CONDITION | ||||||||||||||||||||

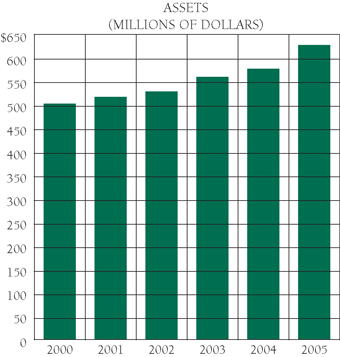

Total Assets | $ | 621,483 | $ | 586,153 | $ | 567,188 | $ | 535,318 | $ | 523,112 | ||||||||||

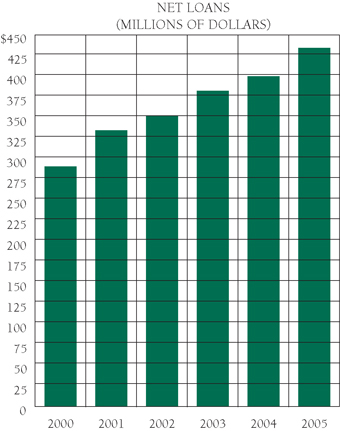

Loans, Net | 431,527 | 396,922 | 379,736 | 351,434 | 332,994 | |||||||||||||||

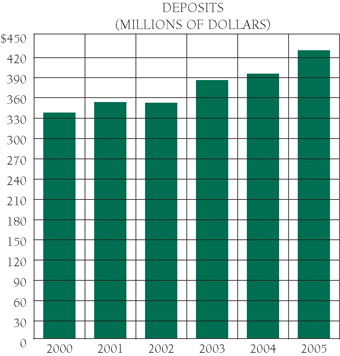

Deposits | 426,231 | 400,451 | 387,680 | 353,100 | 354,815 | |||||||||||||||

Long-Term Debt | 89,588 | 89,637 | 95,755 | 105,874 | 95,992 | |||||||||||||||

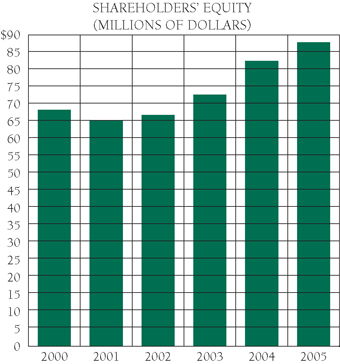

Shareholders’ Equity | 87,709 | 81,913 | 73,329 | 67,032 | 65,206 | |||||||||||||||

AVERAGE BALANCES | ||||||||||||||||||||

Total Assets | $ | 607,837 | $ | 582,048 | $ | 549,705 | $ | 532,409 | $ | 516,305 | ||||||||||

Earning Assets | 552,846 | 533,008 | 511,220 | 498,868 | 486,615 | |||||||||||||||

Loans, Net of Unearned Discount | 418,548 | 391,435 | 365,532 | 345,374 | 318,453 | |||||||||||||||

Deposits | 417,666 | 391,852 | 372,142 | 357,539 | 345,919 | |||||||||||||||

Long-Term Debt | 90,715 | 99,028 | 100,547 | 99,597 | 96,045 | |||||||||||||||

Shareholders’ Equity | 85,154 | 77,623 | 69,421 | 65,309 | 67,736 | |||||||||||||||

PERFORMANCE RATIOS | ||||||||||||||||||||

Net Income to: | ||||||||||||||||||||

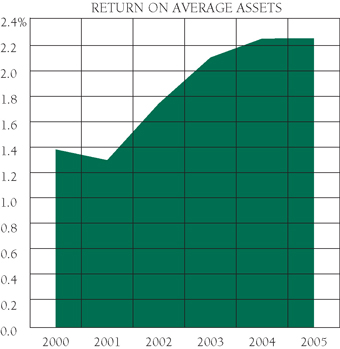

Average Total Assets | 2.25 | % | 2.26 | % | 2.08 | % | 1.72 | % | 1.28 | % | ||||||||||

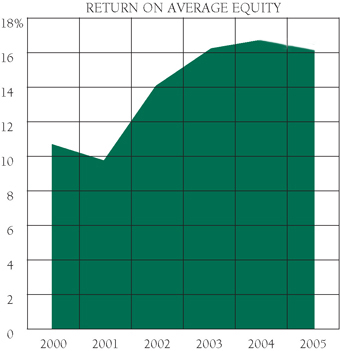

Average Shareholders’ Equity | 16.04 | % | 16.92 | % | 16.44 | % | 14.05 | % | 9.72 | % | ||||||||||

Average Shareholders’ Equity to: | ||||||||||||||||||||

Average Total Assets | 14.01 | % | 13.34 | % | 12.63 | % | 12.27 | % | 13.12 | % | ||||||||||

Dividend Payout Ratio | 44.75 | % | 35.27 | % | 37.75 | % | 42.35 | % | 53.98 | % | ||||||||||

| * | A two-for-one stock split was authorized and implemented in 2003. Accordingly, all shares outstanding in prior years have been adjusted to reflect the stock split. |

18

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

Introduction

United Security Bancshares, Inc., a Delaware corporation (“United Security” or the “Company”), is a bank holding company with its principal offices in Thomasville, Alabama. United Security operates a commercial banking subsidiary, First United Security Bank (the “Bank”). At December 31, 2005, the Bank operated eighteen banking offices located in Thomasville, Coffeeville, Fulton, Gilbertown, Grove Hill, Butler, Jackson, Brent, Centreville, Woodstock, Harpersville, Calera, Bucksville, and Tuscaloosa, Alabama. Its market area includes Clarke, Choctaw, Bibb, Shelby, Tuscaloosa and portions of Marengo, Sumter, Washington, Wilcox, Chilton, Hale, Monroe, Perry and Jefferson Counties in Alabama, as well as Clarke, Lauderdale, and Wayne Counties in Mississippi. United Security is also the parent company of First Security Courier Corporation (“FSCC”), an Alabama corporation. FSCC is a courier service organized to transport items for processing to the Federal Reserve for companies located in Southwest Alabama. The Bank opened its nineteenth banking office in Columbiana, Alabama, during March 2006.

The Bank owns all of the stock of Acceptance Loan Company, Inc. (“ALC”), an Alabama corporation. ALC is a finance company organized for the purpose of making and purchasing consumer loans. ALC has twenty-five offices located in Alabama and Southeast Mississippi. The headquarters of ALC is located in Jackson, Alabama. The Bank represents the funding source for ALC.

The Bank’s sole business is banking; therefore, loans and investments are its principal sources of income. The Bank contributed approximately $10.2 million to consolidated net income in 2005, while ALC contributed approximately $3.3 million. The Bank provides a wide range of commercial banking services to small and medium-sized businesses, real estate developers, property managers, business executives, professionals and other individuals.

FUSB Reinsurance, Inc. (“FUSB Reinsurance”), an Arizona corporation and wholly-owned subsidiary of the Bank, reinsures or “underwrites” credit life and credit accident and health insurance policies sold to the Bank’s and ALC’s consumer loan customers. FUSB Reinsurance is responsible for the first level of risk on these policies up to a specified maximum amount, and the primary third-party insurer retains the remaining risk. The third-party insurer also is responsible for performing most of the administrative functions of FUSB Reinsurance on a contract basis.

At December 31, 2005, United Security had consolidated assets of $621.5 million, deposits of $426.2 million, and shareholders’ equity of $87.7 million. Total assets increased by $35.3 million, or 6%, in 2005. Net income increased from $13.1 million in 2004 to $13.7 million in 2005. Net income per share increased from $2.04 in 2004 to $2.12 in 2005. |  | |

A two-for-one stock split was implemented in July 2003. This stock split increased common stock to an average of 6.4 million shares outstanding; however, total shareholders’ equity was not affected by the split. All shares outstanding and dividend per share numbers for prior years have been adjusted as a result of the stock split. | ||

A high priority continues to be placed on efficiency and uniformity among the Bank’s nineteen offices and ALC’s twenty-five offices in an effort to improve the delivery of services to our customers. The loan review process continues to receive strong emphasis in our quality-control program. Particular emphasis is being directed toward effective loan origination and credit quality control. | ||

Delivery of the best possible services to customers remains an overall operational focus of the Bank. We recognize that attention to details and responsiveness to customers’ desires are critical to customer satisfaction. The Bank continues to employ the most current technology, both in its financial services and in the training of its 282 full-time equivalent employees, to ensure customer satisfaction and convenience. |

The following discussion and financial information are presented to aid in an understanding of the current financial position and results of operations of United Security, and should be read in conjunction with the Audited Consolidated Financial Statements and Notes thereto included herein. The emphasis of this discussion will be on the years 2005, 2004, and 2003. All yields presented and discussed herein are based on the accrual basis and not on the tax-equivalent basis, unless otherwise indicated.

19

Table of Contents

Forward-Looking Statements

This Annual Report, other periodic reports filed by the Company under the Securities Exchange Act of 1934, as amended, and any other written or oral statements made by or on behalf of the Company may include “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, that reflect the Company’s current views with respect to future events and financial performance. Such forward-looking statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to:

| 1. | Possible changes in economic and business conditions that may affect the prevailing interest rates, the prevailing rates of inflation, or the amount of growth, stagnation, or recession in the global, United States, and Alabama and Mississippi economies, the value of investments, the collectibility of loans and the ability to retain and grow deposits; |

| 2. | Possible changes in monetary and fiscal policies, laws and regulations, and other activities of governments, agencies and similar organizations; |

| 3. | The effects of easing of restrictions on participants in the financial services industry, such as banks, securities brokers and dealers, investment companies and finance companies, other potential regulatory changes, and attendant changes in patterns and effects of competition in the financial services industry; and |

| 4. | The ability of the Company to achieve its expected operating results including the continued growth of the markets in which the Company operates consistent with recent historical experience and the Company’s ability to expand into new markets and to maintain profit margins. |

The words, “believe,” “expect,” “anticipate,” “project,” and similar expressions, signify forward-looking statements. Readers are cautioned not to place undue reliance on any forward-looking statements made by or on behalf of the Company. Any such statements speak only as of the date such statements were made, and the Company undertakes no obligation to update or revise any forward-looking statements.

Critical Accounting Policies and Estimates

The preparation of the Company’s financial statements requires management to make subjective judgments associated with estimates. These estimates are necessary to comply with accounting principles generally accepted in the United States and general banking practices. These areas include accounting for allowance for loan loss, derivatives and hedging, and income taxes.

The Company maintains the allowance for loan losses at a level deemed adequate by management to absorb probable losses from loans in the portfolio. In determining the adequacy of the allowance for loan losses, management considers numerous factors, including but not limited to management’s estimate of (a) future economic conditions, (b) the financial condition and liquidity of certain loan customers, and (c) collateral values of property securing certain loans. Because these factors and others involve the use of management’s estimation and judgment, the allowance for loan losses is inherently subject to adjustment at future dates. Unfavorable changes in the factors used by management to determine the adequacy of the allowance, including increased loan delinquencies and subsequent charge-offs, or the availability of new information, could require additional provisions, in excess of normal provisions, to the allowance for loan losses in future periods.

Both fair-value and cash-flow hedges require assumptions related to the impact of changes in interest rates on the fair- value of the derivative and the item being hedged. These assumptions are documented at inception to demonstrate effective hedging of the designated risk. If these assumptions do not accurately reflect future changes in the fair-value, the Company may be required to discontinue the use of hedge accounting for that derivative. This change in accounting treatment could affect current period earnings.

20

Table of Contents

Management’s determination of the realization of the deferred tax asset is based upon management’s judgment of various future events and uncertainties, including the timing and amount of future income earned by subsidiaries and the implementation of various tax planning strategies to maximize realization of the deferred tax asset. Management believes that the subsidiaries will be able to generate sufficient operating earnings to realize the deferred tax benefits. As management periodically evaluates the realizability of the deferred tax asset, subjective judgments are made that may impact the resulting provision for income tax.

Supplemental Compensation Benefits Agreements

The Company and the Bank have entered into supplemental compensation benefits agreements with the directors and certain executive officers. The measurement of the liability under the agreements includes estimates involving life expectancy, length of time before retirement and the expected returns on the Bank-owned life insurance policies used to fund the agreements. Should these estimates prove materially wrong, the cost of the agreements could change accordingly.

Rescission Offer

During a review of the Company’s compliance with the Securities and Exchange Commission (the “SEC”) rules and regulations in October 2003, it was discovered that the United Security Bancshares, Inc. Employee Stock Ownership Plan (With 401(k) Provisions) (the “Plan”), maintained for the benefit of the Company’s employees, had purchased a greater number of shares of common stock than had been initially registered with the SEC under the Plan by the Company. Although all of the purchases under the Plan were made in a manner consistent with the Plan and the investment elections of the Plan participants, the Company determined that the purchases of up to 30,790 shares of common stock by participants in the Plan may not have been properly registered in accordance with the Securities Act of 1933. Since participants who purchased such securities may have had a right to require the Company to rescind the sale of such common stock, the Company offered to rescind the purchase of such stock issued to the Plan participants. The rescission offer expired on March 10, 2004, and no participants elected to accept the rescission offer by the Company.

Operating Results

Summary of Operating Results

| Year Ended December 31, | |||||||||

| 2005 | 2004 | 2003 | |||||||

| (In Thousands of Dollars) | |||||||||

Total Interest Income | $ | 52,679 | $ | 49,434 | $ | 46,722 | |||

Total Interest Expense | 11,810 | 10,369 | 11,197 | ||||||

Net Interest Income | 40,869 | 39,065 | 35,525 | ||||||

Provision for Loan Losses | 3,853 | 3,724 | 3,505 | ||||||

Net Interest Income After Provision for Loan Losses | 37,016 | 35,341 | 32,020 | ||||||

Non-Interest Income | 5,278 | 5,755 | 5,724 | ||||||

Non-Interest Expense | 23,059 | 22,045 | 21,306 | ||||||

Income Before Income Taxes | 19,235 | 19,051 | 16,438 | ||||||

Applicable Income Taxes | 5,579 | 5,920 | 5,023 | ||||||

Net Income | $ | 13,656 | $ | 13,131 | $ | 11,415 | |||

21

Table of Contents

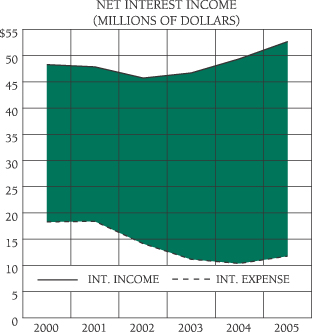

Net Interest Income

Net interest income (interest income less interest expense) is an effective measurement of how well management has matched interest-earning assets and interest-bearing liabilities and is the Bank’s principal source of income. Fluctuations in interest rates materially affect net interest income. The accompanying graph analyzes these changes.

|

Net interest income increased by $1.8 million, or 4.6%, in 2005, compared to an increase of 10.0% and 12.4% in 2004 and 2003, respectively. Volume, rate and yield changes in interest-earning assets and interest-bearing liabilities contributed to the increase in net interest income. Average interest-earning assets increased by $19.8 million, or 3.7%, in 2005, while average interest-bearing liabilities - increased $5.4 million, or 1.2%. Volume changes of equal amounts in interest-earning assets and |

interest-bearing liabilities generally increase net interest income because of the spread between the yield on loans and investments and the rates paid on interest-bearing liabilities. In 2005, average interest-earning assets outgained average interest-bearing liabilities by $14.5 million, and the average increase in interest rates and volume changes increased both interest income and interest expense.

The Bank’s ability to produce net interest income is measured by a ratio called the interest margin. The interest margin is net interest income as a percent of average earning assets. The interest margin was 7.4% in 2005, 7.3% in 2004, and 7.0% in 2003.

Interest margins are affected by several factors, one of which is the relationship of rate-sensitive earning assets to rate-sensitive interest-bearing liabilities. This factor determines the effect that fluctuating interest rates will have on net interest income. Rate-sensitive earning assets and interest-bearing liabilities are those which can be repriced to current market rates within a relatively short time. The Bank’s objective in managing interest rate sensitivity is to achieve reasonable stability in the interest margin throughout interest rate cycles by maintaining the proper balance of rate sensitive assets and liabilities. For further analysis and discussion of interest rate sensitivity, refer to the section entitled “Liquidity and Interest Rate Sensitivity Management” below.

Another factor that affects the interest margin is the interest rate spread. The interest rate spread measures the difference between the average yield on interest-earning assets and the average rate paid on interest-bearing liabilities. This measurement gives a more accurate representation of the effect market interest rate movements have on interest rate-sensitive assets and liabilities. The interest rate spread was 2.1% in 2005, 1.9% in 2004, and 2.2% in 2003. The average amount of the interest-bearing liabilities as noted in the table, “Yields Earned on Average Interest Earning Assets and Rates Paid on Average Interest Bearing Liabilities,” increased 1.2% in 2005, while the average rate of interest paid increased from 2.4% in 2004 to 2.6% in 2005. Average interest-earning assets increased 3.7% in 2005, while the average yield on earning assets increased from 9.3% in 2004 to 9.5% in 2005.

22

Table of Contents

The percentage of earning assets funded by interest-bearing liabilities also affects the Bank’s interest margin. The Bank’s earning assets are funded by interest-bearing liabilities, non-interest bearing demand deposits, and shareholders’ equity. The net return on earning assets funded by non-interest bearing demand deposits and shareholders’ equity exceeds the net return on earning assets funded by interest-bearing liabilities. The Bank maintains a relatively consistent percentage of earning assets funded by interest-bearing liabilities. In 2005, 80.9% of the Bank’s average earning assets were funded by interest-bearing liabilities as opposed to 82.9% in 2004 and 83.9% in 2003.

Yields Earned on Average Interest-Earning Assets and Rates Paid on Average Interest-Bearing Liabilities

| December 31, | |||||||||||||||||||||||||||

| 2005 | 2004 | 2003 | |||||||||||||||||||||||||

Average Balance | Interest | Yield/ Rate % | Average Balance | Interest | Yield/ Rate % | Average Balance | Interest | Yield/ Rate % | |||||||||||||||||||

| (In Thousands of Dollars, Except Percentages) | |||||||||||||||||||||||||||

ASSETS | |||||||||||||||||||||||||||

Interest-Earning Assets: | |||||||||||||||||||||||||||

Loans (Note A) | $ | 418,548 | $ | 46,914 | 11.21 | % | $ | 391,435 | $ | 43,438 | 11.10 | % | $ | 365,532 | $ | 40,577 | 11.10 | % | |||||||||

Taxable Investments | 114,905 | 4,894 | 4.26 | % | 121,503 | 5,066 | 4.17 | % | 129,061 | 5,246 | 4.06 | % | |||||||||||||||

Non-Taxable Investments | 19,393 | 871 | 4.49 | % | 20,055 | 930 | 4.64 | % | 16,627 | 899 | 5.41 | % | |||||||||||||||

Federal Funds Sold | 0 | 0 | 0.00 | % | 15 | 0 | 0.00 | % | 0 | 0 | 0.00 | % | |||||||||||||||

Total Interest-Earning Assets | 552,846 | 52,679 | 9.53 | % | 533,008 | 49,434 | 9.27 | % | 511,220 | 46,722 | 9.14 | % | |||||||||||||||

Non-Interest Earning Assets: | |||||||||||||||||||||||||||

Other Assets | 54,991 | 49,040 | 38,485 | ||||||||||||||||||||||||

Total | $ | 607,837 | $ | 582,048 | $ | 549,705 | |||||||||||||||||||||

LIABILITIES AND SHAREHOLDERS EQUITY | |||||||||||||||||||||||||||

Interest-Bearing Liabilities: | |||||||||||||||||||||||||||

Demand Deposits | $ | 80,295 | $ | 638 | 0.79 | % | $ | 76,045 | $ | 509 | 0.67 | % | $ | 73,023 | $ | 578 | 0.79 | % | |||||||||

Savings Deposits | 57,246 | 539 | 0.94 | % | 52,632 | 442 | 0.84 | % | 47,709 | 469 | 0.98 | % | |||||||||||||||

Time Deposits | 217,888 | 6,985 | 3.21 | % | 212,407 | 5,601 | 2.64 | % | 206,737 | 6,209 | 3.00 | % | |||||||||||||||

Borrowings | 91,959 | 3,648 | 3.97 | % | 100,950 | 3,817 | 3.78 | % | 101,571 | 3,941 | 3.88 | % | |||||||||||||||

Total Interest-Bearing Liabilities | 447,388 | 11,810 | 2.64 | % | 442,034 | 10,369 | 2.35 | % | 429,040 | 11,197 | 2.61 | % | |||||||||||||||

Non-Interest-Bearing Liabilities: | |||||||||||||||||||||||||||

Demand Deposits | 62,237 | 50,768 | 44,673 | ||||||||||||||||||||||||

Other Liabilities | 13,058 | 11,623 | 6,571 | ||||||||||||||||||||||||

Shareholders’ Equity | 85,154 | 77,623 | 69,421 | ||||||||||||||||||||||||

Total | $ | 607,837 | $ | 582,048 | $ | 549,705 | |||||||||||||||||||||

Net Interest Income (Note B) | $ | 40,869 | $ | 39,065 | $ | 35,525 | |||||||||||||||||||||

Net Yield on Interest-Earning Assets | 7.39 | % | 7.33 | % | 6.95 | % | |||||||||||||||||||||

| Note A – | For the purpose of these computations, non-accruing loans are included in the average loan amounts outstanding. These loans amounted to $5,662,303, $1,496,679, and $1,879,007 for 2005, 2004, and 2003, respectively. | |

| Note B – | Loan fees of $3,205,322, $3,270,294, and $3,015,525 for 2005, 2004, and 2003, respectively, are included in interest income amounts above. |

23

Table of Contents

Changes in Interest Earned and Interest Expense Resulting from Changes in Volume and Changes in Rates

2005 Compared to 2004 Increase (Decrease) Due to Change In: | 2004 Compared to 2003 Increase (Decrease) Due to Change In: | 2003 Compared to 2002 Increase (Decrease) Due to Change In: | ||||||||||||||||||||||||||||||||||

| Volume | Average Rate | Net | Volume | Average Rate | Net | Volume | Average Rate | Net | ||||||||||||||||||||||||||||

| (In Thousands of Dollars) | ||||||||||||||||||||||||||||||||||||

Interest Earned On: | ||||||||||||||||||||||||||||||||||||

Loans | $ | 3,009 | $ | 467 | $ | 3,476 | $ | 2,875 | $ | (14 | ) | $ | 2,861 | $ | 2,187 | $ | 912 | $ | 3,099 | |||||||||||||||||

Taxable Investments | (275 | ) | 104 | (171 | ) | (307 | ) | 126 | (181 | ) | (378 | ) | (1,637 | ) | (2,015 | ) | ||||||||||||||||||||

Non-Taxable Investments | (31 | ) | (28 | ) | (59 | ) | 185 | (154 | ) | 31 | (24 | ) | (84 | ) | (108 | ) | ||||||||||||||||||||

Federal Funds | 0 | 0 | 0 | 0 | 0 | 0 | (6 | ) | 0 | (6 | ) | |||||||||||||||||||||||||

Total Interest-Earning Assets | 2,703 | 543 | 3,246 | 2,753 | (42 | ) | 2,711 | 1,779 | (809 | ) | 970 | |||||||||||||||||||||||||

Interest Expense On: | ||||||||||||||||||||||||||||||||||||

Demand Deposits | 28 | 101 | 129 | 24 | (94 | ) | (70 | ) | 63 | (184 | ) | (121 | ) | |||||||||||||||||||||||

Savings Deposits | 39 | 58 | 97 | 48 | (75 | ) | (27 | ) | 60 | (236 | ) | (176 | ) | |||||||||||||||||||||||

Time Deposits | 145 | 1,239 | 1,384 | 170 | (778 | ) | (608 | ) | 66 | (1,919 | ) | (1,853 | ) | |||||||||||||||||||||||

Other Liabilities | (340 | ) | 171 | (169 | ) | (24 | ) | (100 | ) | (124 | ) | (34 | ) | (877 | ) | (911 | ) | |||||||||||||||||||

Total Interest-Bearing Liabilities | (128 | ) | 1,569 | 1,441 | 218 | (1,047 | ) | (829 | ) | 155 | (3,216 | ) | (3,061 | ) | ||||||||||||||||||||||

Increase in Net Interest Income | $ | 2,831 | $ | (1,026 | ) | $ | 1,805 | $ | 2,535 | $ | 1,005 | $ | 3,540 | $ | 1,624 | $ | 2,407 | $ | 4,031 | |||||||||||||||||

Provision for Loan Losses

The provision for loan losses is an expense used to establish the allowance for loan losses. Actual loan losses, net of recoveries, are charged directly to the allowance. The expense recorded each year is a reflection of actual losses experienced during the year and management’s judgment as to the adequacy of the allowance to absorb losses inherent to the portfolio. Charge-offs exceeded recoveries by $3.2 million during the year, and a provision of $3.9 million was expensed for loan losses in 2005, compared to $3.7 million in 2004 and $3.5 million in 2003. The ratio of the allowance to loans net of unearned income at December 31, 2005 and 2004, was 1.75%. Net charge-offs have declined significantly over the past five years from a high of $5.2 million in 2001 to a low of $3.2 million in 2005. Likewise, the ratio of net charge-offs to average loans also has declined. Net charge-offs decreased $285,000 from 2004 to 2005, and the ratio of net charge-offs to average loans declined to 0.77%. For additional information regarding the Company’s allowance for loan losses, see “Loans and Allowance for Loan Loss” below.

Non-Interest Income

The following table presents the major components of non-interest income for the years indicated.

| Year Ended December 31, | |||||||||||

| 2005 | 2004 | 2003 | |||||||||

| (In Thousands of Dollars) | |||||||||||

Service Charges and Other Fees on Deposit Accounts | $ | 2,941 | $ | 3,259 | $ | 3,316 | |||||

Credit Insurance Commissions and Fees | 770 | 937 | 977 | ||||||||

Bank-Owned Life Insurance | 419 | 370 | 370 | ||||||||

Investment Security (Losses) Gains, Net | (37 | ) | (38 | ) | 52 | ||||||

Other Income | 1,185 | 1,227 | 1,009 | ||||||||

Total Non-Interest Income | $ | 5,278 | $ | 5,755 | $ | 5,724 | |||||

Non-interest income consists of revenues generated by a broad range of financial services and activities, including fee-based services and commissions earned through insurance sales and trading activities. In addition, gains and losses from the sale of investment portfolio securities are included in non-interest income.

24

Table of Contents

Total non-interest income decreased $476,639 or 8.3% in 2005. This compares to an increase of 0.5% in 2004, and an increase of 12.9% in 2003. The 2005 decrease can be attributed to a 9.7%, or $317,383, decrease in service and other charges on deposit accounts and a 17.9%, or $167,777, decrease in credit life insurance income. The decrease in service charge income for 2005 is due to a significant reduction in customer overdrafts and accounts with non-sufficient funds. The income generated by overdraft and non-sufficient funds charges decreased by $300,950 in 2005 compared to a decrease of $53,637 in 2004.

The Bank’s subsidiary, FUSB Reinsurance, Inc., which reinsures or “underwrites” credit life and credit accident and health insurance policies sold to the Bank’s consumer loan customers, generated premiums and commissions of $769,648 in 2005, $937,425 in 2004, and $977,183 in 2003. The 2005 premiums and commissions declined due to fewer policies being sold as demand for this product decreased in 2005.

The Company and the Bank entered into supplemental compensation benefit agreements with the directors and certain executive officers in 2002. The Bank purchased Bank-owned life insurance policies to fund those agreements. The income recognized on these Bank-owned policies was $418,576 in 2005, $369,590 in 2004 and $370,318 in 2003.

Non-recurring items of non-interest income include securities gains and losses. Investment securities sold had a net loss of $37,232 in 2005 compared to a $37,716 loss in 2004 and a $51,680 gain in 2003. Income generated in the area of securities gains and losses is dependent on many factors including investment portfolio strategies, interest rate changes, and the short, intermediate, and long-term outlook for the economy.

Other income includes fee income generated from other banking services such as letters of credit, ATMs, debit and credit cards, check cashing and wire transfers. Other income decreased $42,000, or 3.4%, in 2005 compared to a 21.6% increase in 2004 and a 17.5% increase in 2003.

The Bank continues to search for new sources of non-interest income. These sources will come from innovative ways of performing currently provided banking services, as well as providing new services in the future.

Non-Interest Expense

The following table presents the major components of non-interest expense for the years indicated.

| Year Ended December 31, | ||||||||||||

| 2005 | 2004 | 2003 | ||||||||||

| (In Thousands of Dollars) | ||||||||||||

Compensation and Benefits | $ | 14,146 | $ | 12,964 | $ | 12,377 | ||||||

Occupancy | 1,552 | 1,498 | 1,408 | |||||||||

Furniture and Equipment | 1,338 | 1,371 | 1,356 | |||||||||

Impairment on Limited Partnerships | 357 | 345 | 562 | |||||||||

Legal, Accounting and Other Professional Fees | 802 | 1,078 | 539 | |||||||||

Stationary and Supplies | 531 | 506 | 526 | |||||||||

Telephone/Communication | 429 | 435 | 429 | |||||||||

Advertising | 330 | 253 | 350 | |||||||||

Collection and Recovery | 289 | 246 | 326 | |||||||||

Other | 3,285 | 3,349 | 3,433 | |||||||||

Total Non-Interest Expense | $ | 23,059 | $ | 22,045 | $ | 21,306 | ||||||

Efficiency Ratio | 50.0 | % | 49.2 | % | 51.7 | % | ||||||

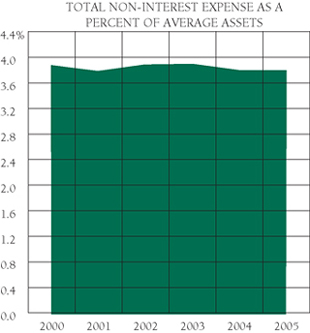

Total Non-Interest Expense to Average Assets | 3.8 | % | 3.8 | % | 3.9 | % | ||||||

Non-interest expense consists primarily of four major categories: salaries and employee benefits, occupancy expense, furniture and equipment expense, and other expense. Most of the expenses in these categories have increased due to the normal course of doing business; however, a full year of operation of the Tuscaloosa office accounted for a substantial portion of the 2004 increase over 2003. The ratio of non-interest expense to average assets remained stable during the period at 3.8%, 3.8% and 3.9% in 2005, 2004, and 2003, respectively.

25

Table of Contents

The efficiency ratio was computed by dividing total non-interest expense by net interest income and non-interest income. An increase in the efficiency ratio indicates that more resources are being utilized to generate the same (or greater) volume of income while a decrease would indicate a more efficient allocation of resources. Our efficiency ratio for 2005 was 50.0%, compared to 49.2% in 2004 and 51.7% during 2003.

Total compensation and benefits increased approximately $1,182,336, or 9.1%, in 2005. This increase is attributable to a combination of normal merit adjustments, incentives, an increase in the costs of the group health care plan, as well as the supplemental compensation benefit plan. Additionally, United Security sponsors an employee stock ownership plan with 401(k) provisions. The Company made matching contributions totaling $430,147, $427,926 and $402,710 in 2005, 2004, and 2003, respectively. The increases in compensation expense of 4.7% in 2004 and 7.7% in 2003 are due in part to the staffing of the new Calera and Tuscaloosa offices. At December 31, 2005, the Bank had 282 full-time equivalent employees compared to 285 in 2004, and 284 in 2003.