Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

October 27, 2014

Commission File Number

000-12033

LM ERICSSON TELEPHONE COMPANY

(Translation of registrant’s name into English)

Torshamnsgatan 21, Kista

SE-164 83, Stockholm, Sweden

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENTS ON FORM F-3 (NO. 333-180880) AND ON FORM S-8 (Nos. 333-196453, 333-161683, 333-161684 AND 333-167643) OF TELEFONAKTIEBOLAGET LM ERICSSON (PUBL.) AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED TO THE SECURITIES AND EXCHANGE COMMISSION. TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED WITH OR FURNISHED TO THE SECURITIES AND EXCHANGE COMMISSION.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TELEFONAKTIEBOLAGET LM ERICSSON (publ) | ||

| By: | /S/NINAMACPHERSON | |

| Nina Macpherson | ||

| Senior Vice President and | ||

| General Counsel | ||

| By: | /S/HELENANORRMAN | |

| Helena Norrman | ||

| Senior Vice President | ||

| Corporate Communications |

Date:October 27, 2014

Table of Contents

Third quarter report 2014, Stockholm, October 24, 2014 as adjusted for incorporation by reference.

| THIRD QUARTER HIGHLIGHTS | Read more (page) | |||

• Sales in the quarter were SEK 57.6 (53.0) b., a growth of 9% YoY and 5% QoQ. | 3 | |||

• The sales growth YoY, mainly driven by growth in the Middle East, China, India and Russia was partly offset by sales decline in North America | 2, 9 | |||

• Gross margin increased YoY to 35.2% (32.0%), driven by improved business mix, higher IPR revenues and lower restructuring charges | 3 | |||

• Profitability showed stable improvement across all segments | 4 | |||

• Operating income amounted to SEK 3.9 (4.2) b. The decline was mainly driven by revaluation of unrealized hedge contracts of SEK -1.0 (0.8) b. | 4 | |||

• Cash flow from operating activities was SEK -1.4 (1.5) b. | 10 | |||

SEK b. | Q3 2014 | Q3 2013 | YoY change | Q2 2014 | QoQ change | 9 months 2014 | 9 months 2013 | |||||||||||||||||||||

Net sales | 57.6 | 53.0 | 9 | % | 54.8 | 5 | % | 160.0 | 160.3 | |||||||||||||||||||

Gross margin | 35.2 | % | 32.0 | % | — | 36.4 | % | — | 36.0 | % | 32.1 | % | ||||||||||||||||

Operating income | 3.9 | 4.2 | -8 | % | 4.0 | -3 | % | 10.5 | 8.8 | |||||||||||||||||||

Operating margin | 6.7 | % | 8.0 | % | — | 7.3 | % | — | 6.6 | % | 5.5 | % | ||||||||||||||||

Net income | 2.6 | 3.0 | -13 | % | 2.7 | -1 | % | 7.0 | 5.7 | |||||||||||||||||||

EPS diluted, SEK | 0.81 | 0.90 | -10 | % | 0.79 | 3 | % | 2.25 | 1.72 | |||||||||||||||||||

Cash flow from operating activities | -1.4 | 1.5 | -193 | % | 2.1 | -166 | % | 10.1 | 2.8 | |||||||||||||||||||

Net cash, end of period1) | 29.4 | 24.7 | 19 | % | 32.5 | -9 | % | 29.4 | 24.7 | |||||||||||||||||||

| 1) | Reconciliation of non-IFRS financial measures to the most directly comparable IFRS financial measures can be found on page 30. |

Ericsson Third Quarter Report 2014 | 1 |

Table of Contents

CEO Comments

Reported sales increased by 9% year-over-year with stable operating income.

The sales growth year-over-year was mainly driven by the Middle East, China, India and Russia, but was partly offset by lower sales in North America.

Mobile broadband sales increased both year-over-year and quarter-over-quarter as we have started to deliver on previously communicated key contracts. We are executing on 4G/LTE contracts in Mainland China and Taiwan and improving sales in Japan. Furthermore, the investment climate in India continues to improve. Sales in parts of Europe, mainly UK and Germany, showed growth year-over-year while the development in southern Europe continued to be weak.

Sales in North America continued to be driven by operator investments in capacity and quality enhancements. However, business activity slowed down during the quarter as operators currently focus on cash flow optimization.

The momentum for Professional Services continued and generated organic growth in the quarter driven by managed services sales and systems integration. The acquired Red Bee Media was successfully integrated and fully consolidated in the third quarter.

Political unrest prevails in many parts of the world, especially in the Middle East and Northern Africa. The quarter shows that our global footprint, with customer in 180 countries, gives us the scale and strength to manage regional variations.

Profitability showed stable improvement across all segments. This was primarily driven by favorable

business mix, higher IPR revenues as well as efficiency enhancements. Operating income was negatively impacted by effects from hedge contracts, higher operating expenses related to modems and the acquired Mediaroom business as well as planned ramp up of investments in IP.

We continue to execute on our strategic agenda; to improve our profitability in the core business in order to invest in targeted areas such as IP networks, Cloud, TV & Media and OSS & BSS. Three important acquisitions were made in the quarter:

| • | MetraTech accelerates our cloud and enterprise billing capabilities within BSS |

| • | Fabrix Systems extends our overall leadership position in TV & Media |

| • | Majority stake in Apcera that strengthens our position in enterprise cloud |

During the quarter we took the strategic decision to stop all further development of modems and shift some R&D resources from segment Modems to Networks to pursue growth opportunities in the radio business.

Through our technology and services leadership we are well positioned to continue to be a strategic partner to our customers as they move to capture new market opportunities.

Hans Vestberg

President and CEO

Ericsson Third Quarter Report 2014 | 2 |

Table of Contents

Financial highlights

SEK b. | Q3 2014 | Q3 2013 | YoY change | Q2 2014 | QoQ change | 9 months 2014 | 9 months 2013 | |||||||||||||||||||||

Net sales | 57.6 | 53.0 | 9 | % | 54.8 | 5 | % | 160.0 | 160.3 | |||||||||||||||||||

Of which Networks | 30.0 | 26.7 | 13 | % | 29.0 | 4 | % | 83.4 | 82.9 | |||||||||||||||||||

Of which Global Services | 24.5 | 24.0 | 2 | % | 23.1 | 6 | % | 67.9 | 70.3 | |||||||||||||||||||

Of which Support Solutions | 3.1 | 2.4 | 30 | % | 2.8 | 8 | % | 8.6 | 7.1 | |||||||||||||||||||

Of which Modems | 0.1 | 0.0 | — | 0.0 | — | 0.1 | 0.0 | |||||||||||||||||||||

Gross income | 20.3 | 17.0 | 20 | % | 19.9 | 2 | % | 57.5 | 51.5 | |||||||||||||||||||

Gross margin (%) | 35.2 | % | 32.0 | % | — | 36.4 | % | — | 36.0 | % | 32.1 | % | ||||||||||||||||

Research and development expenses | -9.3 | -7.7 | 20 | % | -9.1 | 2 | % | -26.6 | -23.3 | |||||||||||||||||||

Selling and administrative expenses | -6.0 | -5.8 | 4 | % | -6.5 | -8 | % | -19.0 | -19.1 | |||||||||||||||||||

Other operating income and expenses | -1.1 | 0.8 | -241 | % | -0.2 | 450 | % | -1.3 | -0.2 | |||||||||||||||||||

Operating income | 3.9 | 4.2 | -8 | % | 4.0 | -3 | % | 10.5 | 8.8 | |||||||||||||||||||

Operating margin | 6.7 | % | 8.0 | % | — | 7.3 | % | — | 6.6 | % | 5.5 | % | ||||||||||||||||

for Networks | 11 | % | 10 | % | — | 12 | % | — | 11 | % | 7 | % | ||||||||||||||||

for Global Services | 7 | % | 8 | % | — | 6 | % | — | 6 | % | 6 | % | ||||||||||||||||

for Support Solutions | -4 | % | -5 | % | — | -13 | % | — | -5 | % | -6 | % | ||||||||||||||||

for Modems | — | — | — | — | — | — | — | |||||||||||||||||||||

Financial net | -0.1 | 0.1 | -254 | % | -0.2 | -35 | % | -0.5 | -0.6 | |||||||||||||||||||

Taxes | -1.1 | -1.3 | -13 | % | -1.1 | -1 | % | -3.0 | -2.5 | |||||||||||||||||||

Net income | 2.6 | 3.0 | -13 | % | 2.7 | -1 | % | 7.0 | 5.7 | |||||||||||||||||||

Restructuring charges | -0.3 | -0.7 | -61 | % | -0.2 | 15 | % | -0.7 | -3.5 | |||||||||||||||||||

Net sales

The USD has strengthened towards many currencies, including the SEK, which impacted sales positively in the quarter.

Sales growth YoY was driven by stronger sales in the Middle East, China, India and Russia. This was partly offset by lower sales in North America.

Reported sales for segments Support Solutions and Networks showed good growth YoY. Sales for Global Services grew slightly especially in Professional Services while Network Rollout continued to decline. IPR revenues grew YoY following the Samsung license agreement which was reached in January 2014.

Sales increased sequentially driven by strong mobile broadband sales in the Middle East, Russia, China and India. This offset a decline in capacity sales in North America.

Gross margin

Gross margin increased YoY driven by improved business mix with higher hardware margins, increased IPR revenues, a lower share of Global Services sales and lower restructuring charges.

During the quarter we have executed on previously awarded contracts. This has, in combination with lower capacity business, led to a lower gross margin QoQ.

Restructuring charges

Restructuring charges decreased YoY and remained flat QoQ, however at a low level. The execution on the service delivery strategy, to move local service delivery resources to global centers, continues, but at slower pace compared to last year.

Operating expenses

Total operating expenses increased YoY due to higher R&D expenses. This relates to segment Modems and acquisitions such as the Mediaroom business. As anticipated, the run rate for organic investment in IP and Cloud has also increased compared to the first half of 2014.

Ericsson Third Quarter Report 2014 | 3 |

Table of Contents

Other operating income and expenses

The revaluation and realization effects from hedge contracts were SEK -1.3 b. compared to SEK -0.5 b. in Q2 2014 and SEK 0.8 b. in Q3 2013.

The revaluation effect of SEK -1.0 (0.8) b. derives mainly from our unrealized hedge contract balance in USD, which has decreased in value. The USD has strengthened towards the SEK between June 30 and September 30, 2014. Ericsson’s USD closing rate on September 30, 2014, was SEK 7.27 (6.72 on June 30).

Operating income

Operating income was stable YoY. Improvement was driven by higher sales, favorable business mix, higher IPR revenues, lower restructuring charges and a positive effect from foreign exchange.

The improvement in operating income was more than offset by a negative effect from hedge contracts and increased operating expenses.

Financial net

Financial net decreased YoY mainly due to foreign currency revaluation effects. Financial net improved sequentially as an effect of currency revaluation effects.

Net income and EPS

Net income and EPS diluted decreased following the lower operating income.

Ericsson Third Quarter Report 2014 | 4 |

Table of Contents

Segment results

NETWORKS

SEK b. | Q3 2014 | Q3 2013 | YoY change | Q2 2014 | QoQ change | 9 months 2014 | 9 months 2013 | |||||||||||||||||||||

Net sales | 30.0 | 26.7 | 13 | % | 29.0 | 4 | % | 83.4 | 82.9 | |||||||||||||||||||

Operating income | 3.2 | 2.6 | 24 | % | 3.6 | -11 | % | 9.2 | 5.5 | |||||||||||||||||||

Operating margin | 11 | % | 10 | % | — | 12 | % | — | 11 | % | 7 | % | ||||||||||||||||

Restructuring charges | -0.1 | -0.3 | -73 | % | -0.1 | -38 | % | -0.3 | -1.9 | |||||||||||||||||||

Net sales

Sales showed YoY growth driven by high mobile broadband activities in the Middle East, China and India. In addition, sales in IP Multimedia Subsystem (IMS) solutions continued to grow driven by Voice over LTE (VoLTE).

Sales increased QoQ driven by growth in China, Russia as well as the Middle East. This was partly offset by lower capacity sales in North America. Sales related to Packet Core showed high growth sequentially.

Operating income and margin

The operating margin improved YoY. The increase was supported by improved business mix, IPR revenues and earlier actions to improve commercial and operational effectiveness. This was partly offset by higher operating expenses in IP and Cloud. The revaluation effect from unrealized hedge contracts had a negative impact on the result of SEK -0.8 (0.8) b. YoY. In Q2 the revaluation effect from unrealized hedge contracts was SEK -0.3 b.

Business update

The solid business results were driven by continued mobile broadband demand and operator focus on performance as a differentiator.

Ericsson small cell portfolio is now complete with the launch of new base station RBS 6402, which is intended to address smaller commercial buildings. Ericsson Radio Dot system, for mid to large sized commercial buildings, will start to be commercially deployed in US, Europe and Asia during Q4 2014.

Ericsson Software model was launched with new subscription models and simplified pricing. The new software release, 15A, includes functionality which increases performance and energy saving.

Our position in Cloud business was strengthened with the strategic investment in Apcera (enterprise cloud). The momentum for the multi-application IP router, SSR 8000, continued with 134 contracts signed since the launch in December 2011. During the quarter, 14 new contracts were signed of which 6 were for fixed networks.

Ericsson Third Quarter Report 2014 | 5 |

Table of Contents

GLOBAL SERVICES

SEK b. | Q3 2014 | Q3 2013 | YoY change | Q2 2014 | QoQ change | 9 months 2014 | 9 months 2013 | |||||||||||||||||||||

Net sales | 24.5 | 24.0 | 2 | % | 23.1 | 6 | % | 67.9 | 70.3 | |||||||||||||||||||

Of which Professional Services | 17.8 | 16.2 | 10 | % | 16.6 | 7 | % | 49.4 | 47.6 | |||||||||||||||||||

Of which Managed Services | 7.2 | 6.3 | 15 | % | 6.5 | 11 | % | 19.4 | 18.9 | |||||||||||||||||||

Of which Network Rollout | 6.7 | 7.7 | -14 | % | 6.5 | 3 | % | 18.5 | 22.6 | |||||||||||||||||||

Operating income | 1.6 | 1.8 | -11 | % | 1.5 | 8 | % | 4.1 | 4.1 | |||||||||||||||||||

Of which Professional Services | 2.1 | 2.3 | -10 | % | 2.1 | -2 | % | 6.0 | 6.4 | |||||||||||||||||||

Of which Network Rollout | -0.5 | -0.5 | -4 | % | -0.6 | -26 | % | -1.9 | -2.3 | |||||||||||||||||||

Operating margin | 7 | % | 8 | % | — | 6 | % | — | 6 | % | 6 | % | ||||||||||||||||

for Professional Services | 12 | % | 14 | % | — | 13 | % | — | 12 | % | 13 | % | ||||||||||||||||

for Network Rollout | -7 | % | -6 | % | — | -9 | % | — | -10 | % | -10 | % | ||||||||||||||||

Restructuring charges | -0.1 | -0.4 | -70 | % | -0.1 | 51 | % | -0.2 | -1.4 | |||||||||||||||||||

Net sales

Network Rollout sales declined YoY with lower mobile broadband activities in North America and Japan. Reported sales in Professional Services showed double digit growth driven by Consulting and Systems Integration and Managed Services.

Global Services sales increased QoQ driven by Professional Services sales in Japan and the Middle East. Network rollout sales increased QoQ due to higher project activities in Russia, the Middle East and Germany.

Operating income and margin

Global Services operating margin declined slightly YoY negatively impacted by revaluation of hedge contracts. Network Rollout profitability improved sequentially due to a reduced negative impact from the European modernization projects.

Excluding the negative impact from hedges Professional Services margin remained stable YoY despite a larger share of Managed Services sales.

Business update

Business momentum in Professional Services continues to be good with several new contracts in the quarter for both Managed Services and Consulting and Systems Integration. In Broadcast Services we now serve more than 500 channels.

Other information | Q3 2014 | Q2 2014 | Q1 2014 | Full year 2013 | ||||||||||||

Number of signed Managed Services contracts | 17 | 21 | 16 | 84 | ||||||||||||

Number of signed significant consulting & systems integration contracts1) | 13 | 12 | 9 | 31 | ||||||||||||

Number of Ericsson services professionals, end of period | 65,000 | 64,000 | 61,000 | 64,000 | ||||||||||||

| 1) | In the areas of OSS and BSS, IP, Service Delivery Platforms and data center build projects. |

Ericsson Third Quarter Report 2014 | 6 |

Table of Contents

SUPPORT SOLUTIONS

SEK b. | Q3 2014 | Q3 2013 | YoY change | Q2 2014 | QoQ change | 9 months 2014 | 9 months 2013 | |||||||||||||||||||||

Net sales | 3.1 | 2.4 | 30 | % | 2.8 | 8 | % | 8.6 | 7.1 | |||||||||||||||||||

Operating income | -0.1 | -0.1 | -4 | % | -0.4 | -71 | % | -0.5 | -0.4 | |||||||||||||||||||

Operating margin | -4 | % | -5 | % | — | -13 | % | — | -5 | % | -6 | % | ||||||||||||||||

Restructuring charges | -0.1 | 0.0 | — | 0.0 | — | -0.1 | -0.2 | |||||||||||||||||||||

Net sales

Reported sales increased YoY. Reported sales grew in seven out of ten regions.

Sales increased QoQ with good development in OSS and BSS.

Operating income and margin

Operating income was negative at SEK -0.1 b. and flat YoY. Higher sales were offset by R&D investments in next-generation TV solutions and by a negative revaluation effect from hedges.

Operating income improved QoQ due to a better business mix and higher sales.

Business update

The acquisitions of Fabrix Systems and MetraTech were announced in the quarter. Fabrix Systems adds video cloud storage and computing to Ericsson’s TV & Media offering. Expected closing is in Q4 2014.

The acquisition of MetraTech accelerates cloud and enterprise billing capabilities within BSS. The deal was closed in Q3 2014.

Ericsson’s MediaFirst TV Platform was announced in September. The cloud-based TV platform will be commercially available on the market in Q2 2015.

The overall transition from traditional telecom software license business models to recurrent license revenue deals continues.

Ericsson Third Quarter Report 2014 | 7 |

Table of Contents

MODEMS

SEK b. | Q3 2014 | Q2 2014 | QoQ change | Q1 2014 | ||||||||||||

Net sales | 0.1 | 0.0 | — | 0.0 | ||||||||||||

Operating income | -0.7 | -0.5 | 62 | % | -0.7 | |||||||||||

Operating margin | — | — | — | — | ||||||||||||

Restructuring charges | 0.0 | 0.0 | — | 0.0 | ||||||||||||

Background

Ericsson took over the LTE thin modem operations as part of the breakup of the joint venture with STMicroelectronics in August 2013. Since integration, the modems market has developed in a direction that has reduced the addressable market for thin modems. In addition, there is strong competition, price erosion and an accelerating pace of technology innovation. Success in this evolved market requires significant R&D investments. As a consequence, Ericsson announced, on September 18 2014, the discontinuation of further development of modems and shift some R&D resources to Networks to better pursue growth opportunities in the radio business.

The change is in line with previously communicated statement to evaluate success of Modems within 18-24 months from integration.

Operating income

Operating income was SEK -0.7 b. in the quarter and SEK -1.9 b. year to date 2014. Total operating expenses for the modems business in 2014 are estimated to SEK -2.6 b. Modems continue to support key M7450 customer engagements.

The discontinuation of the modems business will lead to a significant reduction in costs related to the modems business in the first half of 2015. Modems will have no impact on Group P&L from the second half of 2015.

Ericsson Third Quarter Report 2014 | 8 |

Table of Contents

Regional Sales

| Third quarter 2014 | Change | |||||||||||||||||||||||||||

SEK b. | Networks | Global Services | Support Solutions | Modems | Total | YoY | QoQ | |||||||||||||||||||||

North America | 6.8 | 6.5 | 0.8 | — | 14.0 | -3 | % | -8 | % | |||||||||||||||||||

Latin America | 2.7 | 2.9 | 0.3 | — | 5.9 | 11 | % | 9 | % | |||||||||||||||||||

Northern Europe and Central Asia | 2.1 | 0.9 | 0.1 | — | 3.2 | 7 | % | 16 | % | |||||||||||||||||||

Western and Central Europe | 1.8 | 2.7 | 0.2 | — | 4.6 | 6 | % | 1 | % | |||||||||||||||||||

Mediterranean | 2.1 | 2.9 | 0.2 | — | 5.2 | -8 | % | -5 | % | |||||||||||||||||||

Middle East | 3.7 | 2.0 | 0.3 | — | 6.0 | 38 | % | 34 | % | |||||||||||||||||||

Sub-Saharan Africa | 1.2 | 1.1 | 0.1 | — | 2.4 | -9 | % | 30 | % | |||||||||||||||||||

India | 1.1 | 0.7 | 0.2 | — | 2.0 | 56 | % | 22 | % | |||||||||||||||||||

North East Asia | 4.5 | 2.3 | 0.3 | — | 7.0 | 16 | % | 10 | % | |||||||||||||||||||

South East Asia and Oceania | 2.0 | 1.7 | 0.1 | — | 3.8 | 5 | % | 4 | % | |||||||||||||||||||

Other1) | 1.9 | 0.7 | 0.7 | 0.1 | 3.4 | 55 | % | 1 | % | |||||||||||||||||||

Total | 30.0 | 24.5 | 3.1 | 0.1 | 57.6 | 9 | % | 5 | % | |||||||||||||||||||

| 1) | Region “Other” includes licensing revenues, broadcast services, power modules, mobile broadband modules, Ericsson-LG Enterprise and other businesses. |

North America

Sales during the quarter continued to be driven by network quality and capacity expansion business, although at lower levels than previous quarters as operators currently focus on cash-flow optimization. Recent network ICT transformation contracts, including the modernization of OSS and BSS, drove the Professional Services business.

Latin America

Growth continues to be driven by mobile broadband and related services. Currency restrictions impacts investments in parts of the region.

Northern Europe and Central Asia

Sales grew predominantly driven by mobile broadband infrastructure investments in Russia. Professional Services sales increased in the quarter mainly due to operator focus on network quality. TV & Media developed favorably in the quarter, contributing to growth in Support Solutions.

Western and Central Europe

Sales increased YoY mainly driven by Network Rollout. Investments in network quality and capacity, together with managed services, continue to be the main drivers for the business.

Mediterranean

Sales in the region declined YoY due to modernization projects that peaked during 2013. Managed services continue to be an important driver of growth.

Middle East

Sales continued to show good growth YoY mainly driven by 3G deployments. Overall demand for network infrastructure is driven by the rapid increase in data traffic as well as coverage requirements for new mobile licenses.

Sub-Saharan Africa

In certain markets across the region operators are starting to increase their network investments as they focus on network performance. There is a continued demand for managed services.

India

Since end of last year, sales in the region has recovered, mainly driven by an increase in operator capex spending in response to greater data uptake. The YoY growth in Support Solutions is driven by OSS and BSS and TV & Media.

North East Asia

Sales increased YoY as a result of execution on previously awarded 4G/LTE contracts in Mainland China and Taiwan. This was partly offset by reduced network investment levels in Japan and Korea. Sales in Japan improved QoQ

South East Asia and Oceania

Sales increased YoY mainly driven by mobile broadband investments in the region, compensating for a further decline in Indonesia as major 3G projects peaked in 2013. Several markets have commenced LTE trials.

Other

Licensing revenues showed good development YoY, following the Samsung agreement. Broadcast services continued to grow as the acquired Red Bee Media business was fully consolidated in the quarter.

Ericsson Third Quarter Report 2014 | 9 |

Table of Contents

Cash flow

SEK b. | Q3 2014 | Q3 2013 | Q2 2014 | |||||||||

Net income reconciled to cash | 5.0 | 4.4 | 5.9 | |||||||||

Changes in operating net assets | -6.3 | -2.9 | -3.8 | |||||||||

Cash flow from operating activities | -1.4 | 1.5 | 2.1 | |||||||||

Cash flow from investing activities | -0.7 | -3.1 | 3.7 | |||||||||

Cash flow from financing activities | -1.3 | 0.0 | -12.2 | |||||||||

Net change in cash and cash equivalents | -1.0 | -3.3 | -5.0 | |||||||||

Cash conversion (%)1) | -27 | % | 33 | % | 35 | % | ||||||

| 1) | Reconciliation of non-IFRS financial measures to the most directly comparable IFRS financial measures can be found on page 30. |

The negative cash flow from operating activities was due to increased working capital, mainly as a result of increased sales and seasonal build-up of inventory. Execution on previously awarded contracts impacted working capital negatively during the quarter.

Investing activities were predominantly acquisitions of SEK -0.3 b. and normal capex investments of SEK -1.4 b. mainly related to test equipment.

Short-term investments decreased by SEK 2.3 b.

Cash flow from financing activities was mainly related to repayment of debt of SEK -1.3 b.

Cash outlays regarding restructuring amounted to approximately SEK 0.2 b. in the quarter.

Working capital KPIs, number of days | Jan-Sep 2014 | Jan-Jun 2014 | Jan-Mar 2014 | Jan-Dec 2013 | Jan-Sep 2013 | Jan-Jun 2013 | ||||||||||||||||||

Sales outstanding | 111 | 113 | 112 | 97 | 109 | 103 | ||||||||||||||||||

Inventory | 69 | 70 | 72 | 62 | 72 | 73 | ||||||||||||||||||

Payable | 57 | 61 | 62 | 53 | 53 | 55 | ||||||||||||||||||

Days of sales outstanding and inventory days decreased slightly.

Payable days decreased somewhat due to increased services sales with shorter payments days.

Ericsson Third Quarter Report 2014 | 10 |

Table of Contents

Financial Position

SEK b. | Sep 30 2014 | Jun 30 2014 | Mar 31 2014 | Dec 31 2013 | ||||||||||||

+ Short-term investments | 34.0 | 35.3 | 41.8 | 35.0 | ||||||||||||

+ Cash and cash equivalents | 32.0 | 33.1 | 38.1 | 42.1 | ||||||||||||

Gross cash | 66.1 | 68.4 | 79.9 | 77.1 | ||||||||||||

- Interest bearing liabilities and post-employment benefits | 36.6 | 35.9 | 36.3 | 39.3 | ||||||||||||

Net cash1) | 29.4 | 32.5 | 43.6 | 37.8 | ||||||||||||

Equity | 143.4 | 138.0 | 142.6 | 141.6 | ||||||||||||

Total assets | 274.0 | 265.5 | 267.2 | 269.2 | ||||||||||||

Capital turnover (times) | 1.2 | 1.2 | 1.1 | 1.3 | ||||||||||||

Equity ratio (%) | 52.3 | % | 52.0 | % | 53.4 | % | 52.6 | % | ||||||||

| 1) | Reconciliation of non-IFRS financial measures to the most directly comparable IFRS financial measures can be found on page 30. |

Net cash decreased in the quarter as a result of higher working capital and post-employment benefits. Post-employment benefits increased by SEK 1.1 b., mainly due to lower discount rates.

Current borrowings decreased by SEK 1.5 b. mainly due to repayment of a short-term borrowing.

The average maturity of long-term borrowings as of September 30, 2014, was 6.0 years, compared to 4.9 years 12 months ago.

Ericsson has one unutilized Revolving Credit Facility of USD 2.0 b.

On August 28, Standard and Poor’s revised their outlook on Ericsson from negative to stable. Their present rating is BBB+/Stable/A-2.

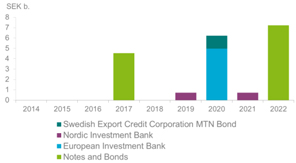

| Debt maturity profile, Parent Company, SEK b. |

Ericsson Third Quarter Report 2014 | 11 |

Table of Contents

Other information

Ericsson acquires a majority stake in Apcera

On September 22, 2014, Ericsson announced it has agreed to acquire a majority stake in Apcera, a US based enterprise services company and creator of the next-generation platform as-a-service called Continuum which works across cloud, in premise and hybrid environments. In addition, Ericsson commits to fund development of next-generation technology as well as sales channel and ecosystem creation.

The acquisition is expected to close during Q4 2014, subject to customary closing conditions. Apcera will operate as a standalone company after the closing and will be consolidated financially under segment Networks.

Ericsson acquires Fabrix Systems

On September 12, 2014, Ericsson announced it has entered into an agreement to acquire Fabrix Systems, a leading provider of cloud storage, computing and network delivery for video applications that today power some of the most advanced cable and telecom cloud Digital Video Recorder (DVR) deployments.

The acquisition enables new services and migration to cloud DVR deployments in all TV platforms including Ericsson MediaFirst and Ericsson Mediaroom. It also adds to Ericsson’s video-centric network and services capabilities to ensure that video can be managed, stored and delivered from the cloud to all TV Anywhere devices efficiently and with assured quality of experience.

The acquisition is expected to close in the fourth quarter, 2014, subject to customary closing conditions. Fabrix Systems will be incorporated into Business Unit Support Solutions.

Ericsson acquires MetraTech

On July 29 Ericsson entered into an agreement to acquire US-based MetraTech Corp. MetraTech accelerates cloud and enterprise billing capabilities within BSS.

The acquisition includes 140 employees and contractors comprising a team of highly-skilled software experts. The acquisition was closed at end of the third quarter 2014.

Antitrust investigations against Ericsson

In March 2013, Ericsson filed a patent infringement lawsuit in the Indian Delhi High Court against Micromax Informatics Limited. As part of its defense, Micromax filed a complaint with the Competition Commission of India (CCI) and in November 2013 the CCI decided to refer the case to the Director General’s Office for an in-depth investigation. In January 2014 the CCI announced they had opened another investigation against Ericsson based on claims made by Intex Technologies (India) Limited. Ericsson has made numerous attempts to sign a license agreement with Micromax and Intex on Fair, Reasonable and Non-discriminatory (FRAND) terms.

Disclosure pursuant to Section 219 of the Iran Threat Reduction and Syria Human Rights Act of 2012 (ITRA)

During the third quarter of 2014, Ericsson made sales of telecommunications infrastructure related products and services in Iran to MTNIrancell and to Mobile Communication Company of Iran, which generated gross revenues (reported as net sales) of approximately SEK 1,236 million. Ericsson does not normally allocate quarterly net profit (reported as net income) on a country-by-country or activity-by-activity basis, other than as set forth in Ericsson’s consolidated financial statements prepared in accordance with IFRS as issued by the IASB. However, Ericsson has estimated that its net profit from such sales, after internal cost allocation, during the third quarter of 2014 would be substantially lower than such gross revenues. Ericsson intends to continue to engage with existing customers and explore opportunities with new customers in Iran while continuously monitoring international developments as they relate to Iran and its government.

Ericsson Third Quarter Report 2014 | 12 |

Table of Contents

Risk factors

Ericsson’s operational and financial risk factors and uncertainties along with our strategies and tactics to mitigate risk exposures or limit unfavorable outcomes are described in our Annual Report 2013. Compared to the risks described in the Annual Report 2013, no material, new or changed risk factors or uncertainties have been identified in the year.

Risk factors and uncertainties in focus short-term for the Parent Company and the Ericsson Group include:

| • | Potential negative effects on operators’ willingness to invest in network development due to uncertainty in the financial markets and a weak economic business environment, or reduced consumer telecom spending, or increased pressure on us to provide financing; |

| • | Uncertainty regarding the financial stability of suppliers, for example due to lack of financing; |

| • | Effects on gross margins and/or working capital of the product mix in the Networks segment between sales of upgrades and expansions (mainly software) and new build outs of coverage (mainly hardware); |

| • | Effects on gross margins of the product mix in the Global Services segment including proportion of new network build outs and share of new managed services deals with initial transition costs; |

| • | A continued volatile sales pattern in the Support Solutions segment or variability in our overall sales seasonality could make it more difficult to forecast future sales; |

| • | Effects of the ongoing industry consolidation among our customers as well as between our largest competitors, e.g. with postponed investments and intensified price competition as a consequence; |

| • | Changes in foreign exchange rates, in particular USD, JPY and EUR; |

| • | Political unrest or instability in certain markets; |

| • | Effects on production and sales from restrictions with respect to timely and adequate supply of materials, components and production capacity and other vital services on competitive terms; |

| • | Natural disasters and other events, affecting business, production, supply and transportation. |

Ericsson stringently monitors the compliance with all relevant trade regulations and trade embargos applicable to dealings with customers operating in countries where there are trade restrictions or trade restrictions are discussed. Moreover, Ericsson operates globally in accordance with Group policies and directives for business ethics and conduct.

Stockholm, October 24, 2014

Telefonaktiebolaget LM Ericsson

Hans Vestberg, President and CEO

Org. Nr. 556016-0680

Date for next report: January 27, 2015

Ericsson Third Quarter Report 2014 | 13 |

Table of Contents

Auditors’ review report

Introduction

We have reviewed the condensed interim financial information (interim report) of Telefonaktiebolaget LM Ericsson (publ.) as of September 30, 2014, and the nine months period then ended. The board of directors and the CEO are responsible for the preparation and presentation of this interim report in accordance with IAS 34 and the Swedish Annual Accounts Act. Our responsibility is to express a conclusion on this interim report based on our review.

Scope of review

We conducted our review in accordance with the International Standard on Review Engagements ISRE 2410,Review of Interim Report Performed by the Independent Auditor of the Entity.A review consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing (ISA) andother generally accepted auditing standards in Sweden. The procedures performed in a review do not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the interim report is not prepared, in all material respects, in accordance with IAS 34 and the Swedish Annual Accounts Act, regarding the Group, and with the Swedish Annual Accounts Act, regarding the Parent Company.

Stockholm, October 24, 2014

PricewaterhouseCoopers AB

Peter Nyllinge

Authorized Public Accountant

Auditor in Charge

Bo Hjalmarsson

Authorized Public Accountant

Ericsson Third Quarter Report 2014 | 14 |

Table of Contents

Editor’s note

For further information, please contact:

Helena Norrman, Senior Vice President,

Communications Phone: +46 10 719 34 72

E-mail: investor.relations@ericsson.com or

media.relations@ericsson.com

Telefonaktiebolaget LM Ericsson (publ.)

Org. number: 556016-0680

Torshamnsgatan 21

SE-164 83 Stockholm

Phone: +46 10 719 00 00

Investors

Peter Nyquist, Vice President,

Investor Relations

Phone: +46 10 714 64 49, +46 70 575 29 06

E-mail: peter.nyquist@ericsson.com

Stefan Jelvin, Director,

Investor Relations

Phone: +46 10 714 20 39, +46 70 986 02 27

E-mail: stefan.jelvin@ericsson.com

Åsa Konnbjer, Director,

Investor Relations

Phone: +46 10 713 39 28, +46 73 082 59 28

E-mail: asa.konnbjer@ericsson.com

Rikard Tunedal, Director,

Investor Relations

Phone: +46 10 714 54 00, +46 761 005 400

E-mail: rikard.tunedal@ericsson.com

Media

Ola Rembe, Vice President,

Head of External Communications

Phone: +46 10 719 97 27, +46 73 024 48 73

E-mail: media.relations@ericsson.com

Corporate Communications

Phone: +46 10 719 69 92

E-mail: media.relations@ericsson.com

Ericsson Third Quarter Report 2014 | 15 |

Table of Contents

Safe harbor statement

All statements made or incorporated by reference in this release, other than statements or characterizations of historical facts, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Forward-looking statements can often be identified by words such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”, “estimates”, “may”, “will”, “should”, “would”, “potential”, “continue”, and variations or negatives of these words, and include, among others, statements regarding: (i) strategies, outlook and growth prospects; (ii) positioning to deliver future plans and to realize potential for future growth; (iii) liquidity and capital resources and expenditure, and our credit ratings; (iv) growth in demand for our products and services; (v) our joint venture activities; (vi) economic outlook and industry trends; (vii) developments of our markets; (viii) the impact of regulatory initiatives; (ix) research and development expenditures; (x) the strength of our competitors; (xi) future cost savings; (xii) plans to launch new products and services; (xiii) assessments of risks; (xiv) integration of acquired businesses; (xv) compliance with rules and regulations and (xvi) infringements of intellectual property rights of others.

In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These forward-looking statements speak only as of the date hereof and are based upon the information available to us at this time. Such information is subject to change, and we will not necessarily inform you of such changes. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference for Ericsson include, but are not limited to: (i) material adverse changes in the markets in which we operate or in global economic conditions; (ii) increased product and price competition; (iii) reductions in capital expenditure by network operators; (iv) the cost of technological innovation and increased expenditure to improve quality of service; (v) significant changes in market share for our principal products and services; (vi) foreign exchange rate or interest rate fluctuations; and (vii) the successful implementation of our business and operational initiatives.

Ericsson Third Quarter Report 2014 | 16 |

Table of Contents

Financial statements and additional information

Ericsson Third Quarter Report 2014 | 17 |

Table of Contents

| Jul - Sep | Jan - Sep | |||||||||||||||||||||||

SEK million | 2013 | 2014 | Change | 2013 | 2014 | Change | ||||||||||||||||||

Net sales | 52,981 | 57,643 | 9 | % | 160,344 | 159,997 | 0 | % | ||||||||||||||||

Cost of sales | -36,028 | -37,362 | 4 | % | -108,834 | -102,456 | -6 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Gross income | 16,953 | 20,281 | 20 | % | 51,510 | 57,541 | 12 | % | ||||||||||||||||

Gross margin (%) | 32.0 | % | 35.2 | % | 32.1 | % | 36.0 | % | ||||||||||||||||

Research and development expenses | -7,710 | -9,281 | 20 | % | -23,334 | -26,640 | 14 | % | ||||||||||||||||

Selling and administrative expenses | -5,778 | -6,000 | 4 | % | -19,050 | -18,993 | 0 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating expenses | -13,488 | -15,281 | 13 | % | -42,384 | -45,633 | 8 | % | ||||||||||||||||

Other operating income and expenses | 805 | -1,134 | -215 | -1,319 | ||||||||||||||||||||

Shares in earnings of JV and associated companies | -51 | 10 | -121 | -84 | -31 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating income | 4,219 | 3,876 | -8 | % | 8,790 | 10,505 | 20 | % | ||||||||||||||||

Financial income | 678 | 429 | 1,162 | 1,098 | ||||||||||||||||||||

Financial expenses | -595 | -557 | -1,766 | -1,634 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income after financial items | 4,302 | 3,748 | -13 | % | 8,186 | 9,969 | 22 | % | ||||||||||||||||

Taxes | -1,292 | -1,124 | -2,456 | -2,991 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income | 3,010 | 2,624 | -13 | % | 5,730 | 6,978 | 22 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income attributable to: | ||||||||||||||||||||||||

- Stockholders of the Parent Company | 2,921 | 2,646 | 5,595 | 7,345 | ||||||||||||||||||||

- Non-controlling interests | 89 | -22 | 135 | -367 | ||||||||||||||||||||

Other information | ||||||||||||||||||||||||

Average number of shares, basic (million) | 3,227 | 3,238 | 3,225 | 3,235 | ||||||||||||||||||||

Earnings per share, basic (SEK)1) | 0.91 | 0.82 | 1.74 | 2.27 | ||||||||||||||||||||

Earnings per share, diluted (SEK)1) | 0.90 | 0.81 | 1.72 | 2.25 | ||||||||||||||||||||

| Jul - Sep | Jan - Sep | |||||||||||||||||||||||

SEK million | 2013 | 2014 | 2013 | 2014 | ||||||||||||||||||||

Net income | 3,010 | 2,624 | 5,730 | 6,978 | ||||||||||||||||||||

Other comprehensive income | ||||||||||||||||||||||||

Items that will not be reclassified to profit or loss | ||||||||||||||||||||||||

Remeasurements of defined benefits pension plans incl. asset ceiling | 458 | -441 | 2,231 | -2,637 | ||||||||||||||||||||

Tax on items that will not be reclassified to profit or loss | -152 | 96 | -858 | 539 | ||||||||||||||||||||

Items that may be reclassified to profit or loss | ||||||||||||||||||||||||

Cash flow hedges | ||||||||||||||||||||||||

Gains/losses arising during the period | 127 | 0 | 265 | 0 | ||||||||||||||||||||

Reclassification adjustments for gains/losses included in profit or loss | -185 | 0 | -948 | 0 | ||||||||||||||||||||

Adjustments for amounts transferred to initial carrying amount of hedged items | ||||||||||||||||||||||||

Revaulation of other investments in shares and participations | ||||||||||||||||||||||||

Fair value remeasurement | 1 | 39 | 70 | 39 | ||||||||||||||||||||

Changes in cumulative translation adjustments | -3,150 | 2,656 | -2,464 | 5,676 | ||||||||||||||||||||

Share of other comprehensive income on JV and associated companies | -150 | 234 | -46 | 362 | ||||||||||||||||||||

Tax on items that may be reclassified to profit or loss | 11 | 0 | 138 | 0 | ||||||||||||||||||||

Total other comprehensive income, net of tax | -3,040 | 2,584 | -1,612 | 3,979 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income | -30 | 5,208 | 4,118 | 10,957 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income attributable to: | ||||||||||||||||||||||||

Stockholders of the Parent Company | -79 | 5,180 | 4,008 | 11,212 | ||||||||||||||||||||

Non-controlling interest | 49 | 28 | 110 | -255 | ||||||||||||||||||||

| 1) | Based on Net income attributable to stockholders of the Parent Company |

Ericsson Third Quarter Report 2014 | 18 |

Table of Contents

| Dec 31 | Jun 30 | Sep 30 | ||||||||||

SEK million | 2013 | 2014 | 2014 | |||||||||

ASSETS | ||||||||||||

Non-current assets | ||||||||||||

Intangible assets | ||||||||||||

Capitalized development expenses | 3,348 | 3,082 | 2,925 | |||||||||

Goodwill | 31,544 | 34,243 | 35,179 | |||||||||

Intellectual property rights, brands and other intangible assets | 12,815 | 11,765 | 12,149 | |||||||||

Property, plant and equipment | 11,433 | 11,924 | 12,674 | |||||||||

Financial assets | ||||||||||||

Equity in JV and associated companies | 2,568 | 2,324 | 2,566 | |||||||||

Other investments in shares and participations | 505 | 510 | 567 | |||||||||

Customer finance, non-current | 1,294 | 1,240 | 1,940 | |||||||||

Other financial assets, non-current | 5,684 | 6,303 | 7,085 | |||||||||

Deferred tax assets | 9,103 | 10,880 | 11,325 | |||||||||

|

|

|

|

|

| |||||||

| 78,294 | 82,271 | 86,410 | ||||||||||

Current assets | ||||||||||||

Inventories | 22,759 | 26,915 | 28,529 | |||||||||

Trade receivables | 71,013 | 66,763 | 70,624 | |||||||||

Customer finance, current | 2,094 | 1,994 | 2,452 | |||||||||

Other current receivables | 17,941 | 19,208 | 19,953 | |||||||||

Short-term investments | 34,994 | 35,310 | 34,011 | |||||||||

Cash and cash equivalents | 42,095 | 33,088 | 32,042 | |||||||||

|

|

|

|

|

| |||||||

| 190,896 | 183,278 | 187,611 | ||||||||||

Total assets | 269,190 | 265,549 | 274,021 | |||||||||

|

|

|

|

|

| |||||||

EQUITY AND LIABILITIES | ||||||||||||

Equity | ||||||||||||

Stockholders’ equity | 140,204 | 136,948 | 142,339 | |||||||||

Non-controlling interest in equity of subsidiaries | 1,419 | 1,010 | 1,035 | |||||||||

|

|

|

|

|

| |||||||

| 141,623 | 137,958 | 143,374 | ||||||||||

Non-current liabilities | ||||||||||||

Post-employment benefits | 9,825 | 12,884 | 13,972 | |||||||||

Provisions, non-current | 222 | 202 | 187 | |||||||||

Deferred tax liabilities | 2,650 | 2,624 | 2,846 | |||||||||

Borrowings, non-current | 22,067 | 19,504 | 20,647 | |||||||||

Other non-current liabilities | 1,459 | 1,699 | 1,809 | |||||||||

|

|

|

|

|

| |||||||

| 36,223 | 36,913 | 39,461 | ||||||||||

Current liabilities | ||||||||||||

Provisions, current | 5,140 | 4,377 | 4,380 | |||||||||

Borrowings, current | 7,388 | 3,525 | 1,997 | |||||||||

Trade payables | 20,502 | 22,795 | 22,067 | |||||||||

Other current liabilities | 58,314 | 59,981 | 62,742 | |||||||||

|

|

|

|

|

| |||||||

| 91,344 | 90,678 | 91,186 | ||||||||||

Total equity and liabilities | 269,190 | 265,549 | 274,021 | |||||||||

|

|

|

|

|

| |||||||

Of which interest-bearing liabilities and post-employment benefits | 39,280 | 35,913 | 36,616 | |||||||||

Of which net cash1) | 37,809 | 32,485 | 29,437 | |||||||||

Assets pledged as collateral | 2,556 | 2,522 | 2,499 | |||||||||

Contingent liabilities | 657 | 664 | 666 | |||||||||

| 1) | Reconciliation of non-IFRS financial measures to the most directly comparable IFRS financial measures can be found on page 30. |

Ericsson Third Quarter Report 2014 | 19 |

Table of Contents

CONSOLIDATED STATEMENT OF CASH FLOWS

| Jul-Sep | Jan-Sep | Jan - Dec | ||||||||||||||||||

SEK million | 2013 | 2014 | 2013 | 2014 | 2013 | |||||||||||||||

Operating activities | ||||||||||||||||||||

Net income | 3,010 | 2,624 | 5,730 | 6,978 | 12,174 | |||||||||||||||

Adjustments to reconcile net income to cash | ||||||||||||||||||||

Taxes | -881 | -388 | -3,419 | -1,710 | -1,323 | |||||||||||||||

Earnings/dividends in JV and associated companies | 50 | -10 | 120 | 330 | 258 | |||||||||||||||

Depreciation, amortization and impairment losses | 2,546 | 2,481 | 7,393 | 7,255 | 10,137 | |||||||||||||||

Other | -327 | 267 | -345 | 1,220 | 756 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 4,398 | 4,974 | 9,479 | 14,073 | 22,002 | ||||||||||||||||

Changes in operating net assets | ||||||||||||||||||||

Inventories | 357 | -840 | -469 | -4,127 | 4,868 | |||||||||||||||

Customer finance, current and non-current | 800 | -1,101 | 1,972 | -884 | 1,809 | |||||||||||||||

Trade receivables | -4,744 | -1,222 | -3,594 | 5,843 | -8,504 | |||||||||||||||

Trade payables | -588 | -1,519 | -3,018 | 15 | -2,158 | |||||||||||||||

Provisions and post-employment benefits | -970 | -18 | -1,567 | -707 | -3,298 | |||||||||||||||

Other operating assets and liabilities, net | 2,206 | -1,624 | -23 | -4,107 | 2,670 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| -2,939 | -6,324 | -6,699 | -3,967 | -4,613 | ||||||||||||||||

Cash flow from operating activities | 1,459 | -1,350 | 2,780 | 10,106 | 17,389 | |||||||||||||||

Investing activities | ||||||||||||||||||||

Investments in property, plant and equipment | -778 | -1,415 | -3,252 | -3,769 | -4,503 | |||||||||||||||

Sales of property, plant and equipment | 97 | 139 | 199 | 466 | 378 | |||||||||||||||

Acquisitions/divestments of subsidiaries and other operations, net | -1,794 | -286 | -1,969 | -2,647 | -2,682 | |||||||||||||||

Product development | -237 | -155 | -733 | -537 | -915 | |||||||||||||||

Other investing activities | -230 | -1,302 | -135 | -1,859 | -1,330 | |||||||||||||||

Short-term investments | -144 | 2,308 | 6,205 | 2,530 | -2,057 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash flow from investing activities | -3,086 | -711 | 315 | -5,816 | -11,109 | |||||||||||||||

Cash flow before financing activities | -1,627 | -2,061 | 3,095 | 4,290 | 6,280 | |||||||||||||||

Financing activities | ||||||||||||||||||||

Dividends paid | -21 | -3 | -8,945 | -9,831 | -9,153 | |||||||||||||||

Other financing activities | 43 | -1,288 | -4,101 | -8,750 | -355 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash flow from financing activities | 22 | -1,291 | -13,046 | -18,581 | -9,508 | |||||||||||||||

Effect of exchange rate changes on cash | -1,711 | 2,306 | 432 | 4,238 | 641 | |||||||||||||||

Net change in cash and cash equivalents | -3,316 | -1,046 | -9,519 | -10,053 | -2,587 | |||||||||||||||

Cash and cash equivalents, beginning of period | 38,479 | 33,088 | 44,682 | 42,095 | 44,682 | |||||||||||||||

Cash and cash equivalents, end of period | 35,163 | 32,042 | 35,163 | 32,042 | 42,095 | |||||||||||||||

Ericsson Third Quarter Report 2014 | 20 |

Table of Contents

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| Jan - Sep | Jan - Sep | Jan - Dec | ||||||||||

SEK million | 2013 | 2014 | 2013 | |||||||||

Opening balance | 138,483 | 141,623 | 138,483 | |||||||||

Total comprehensive income | 4,118 | 10,957 | 11,881 | |||||||||

Sale/repurchase of own shares | 63 | 78 | 90 | |||||||||

Stock purchase plan | 297 | 547 | 388 | |||||||||

Dividends paid | -8,945 | -9,831 | -9,153 | |||||||||

Transactions with non-controlling interests | -66 | 0 | -66 | |||||||||

|

|

|

|

|

| |||||||

Closing balance | 133,950 | 143,374 | 141,623 | |||||||||

|

|

|

|

|

| |||||||

Ericsson Third Quarter Report 2014 | 21 |

Table of Contents

CONSOLIDATED INCOME STATEMENT – ISOLATED QUARTERS

| 2013 | 2014 | |||||||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||

Net sales | 52,032 | 55,331 | 52,981 | 67,032 | 47,505 | 54,849 | 57,643 | |||||||||||||||||||||

Cost of sales | -35,394 | -37,412 | -36,028 | -42,171 | -30,184 | -34,910 | -37,362 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Gross income | 16,638 | 17,919 | 16,953 | 24,861 | 17,321 | 19,939 | 20,281 | |||||||||||||||||||||

Gross margin (%) | 32.0 | % | 32.4 | % | 32.0 | % | 37.1 | % | 36.5 | % | 36.4 | % | 35.2 | % | ||||||||||||||

Research and development expenses | -7,877 | -7,747 | -7,710 | -8,902 | -8,275 | -9,084 | -9,281 | |||||||||||||||||||||

Selling and administrative expenses | -6,643 | -6,629 | -5,778 | -7,223 | -6,452 | -6,541 | -6,000 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Operating expenses | -14,520 | -14,376 | -13,488 | -16,125 | -14,727 | -15,625 | -15,281 | |||||||||||||||||||||

Other operating income and expenses | 20 | -1,040 | 805 | 328 | 21 | -206 | -1,134 | |||||||||||||||||||||

Shares in earnings of JV and associated companies | -32 | -38 | -51 | -9 | 15 | -109 | 10 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Operating income | 2,106 | 2,465 | 4,219 | 9,055 | 2,630 | 3,999 | 3,876 | |||||||||||||||||||||

Financial income | 180 | 304 | 678 | 184 | 401 | 268 | 429 | |||||||||||||||||||||

Financial expenses | -565 | -606 | -595 | -327 | -612 | -465 | -557 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Income after financial items | 1,721 | 2,163 | 4,302 | 8,912 | 2,419 | 3,802 | 3,748 | |||||||||||||||||||||

Taxes | -517 | -647 | -1,292 | -2,468 | -727 | -1,140 | -1,124 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income | 1,204 | 1,516 | 3,010 | 6,444 | 1,692 | 2,662 | 2,624 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income attributable to: | ||||||||||||||||||||||||||||

- Stockholders of the Parent Company | 1,205 | 1,469 | 2,921 | 6,410 | 2,120 | 2,579 | 2,646 | |||||||||||||||||||||

- Non-controlling interests | -1 | 47 | 89 | 34 | -428 | 83 | -22 | |||||||||||||||||||||

Other information | ||||||||||||||||||||||||||||

Average number of shares, basic (million) | 3,222 | 3,224 | 3,227 | 3,230 | 3,233 | 3,235 | 3,238 | |||||||||||||||||||||

Earnings per share, basic (SEK)1) | 0.37 | 0.46 | 0.91 | 1.98 | 0.66 | 0.80 | 0.82 | |||||||||||||||||||||

Earnings per share, diluted (SEK) 1) | 0.37 | 0.45 | 0.90 | 1.97 | 0.65 | 0.79 | 0.81 | |||||||||||||||||||||

| 1) | Based on Net income attributable to stockholders of the Parent Company |

Ericsson Third Quarter Report 2014 | 22 |

Table of Contents

CONSOLIDATED STATEMENT OF CASH FLOWS - ISOLATED QUARTERS

| 2013 | 2014 | |||||||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||

Operating activities | ||||||||||||||||||||||||||||

Net income | 1,204 | 1,516 | 3,010 | 6,444 | 1,692 | 2,662 | 2,624 | |||||||||||||||||||||

Adjustments to reconcile net income to cash | ||||||||||||||||||||||||||||

Taxes | -1,849 | -689 | -881 | 2,096 | -1,348 | 26 | -388 | |||||||||||||||||||||

Earnings/dividends in JV and associated companies | 33 | 37 | 50 | 138 | -16 | 356 | -10 | |||||||||||||||||||||

Depreciation, amortization and impairment losses | 2,411 | 2,436 | 2,546 | 2,744 | 2,360 | 2,414 | 2,481 | |||||||||||||||||||||

Other | -201 | 183 | -327 | 1,101 | 549 | 404 | 267 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| 1,598 | 3,483 | 4,398 | 12,523 | 3,237 | 5,862 | 4,974 | ||||||||||||||||||||||

Changes in operating net assets | ||||||||||||||||||||||||||||

Inventories | -1,426 | 600 | 357 | 5,337 | -2,099 | -1,188 | -840 | |||||||||||||||||||||

Customer finance, current and non-current | 260 | 912 | 800 | -163 | 558 | -341 | -1,101 | |||||||||||||||||||||

Trade receivables | -1,934 | 3,084 | -4,744 | -4,910 | 7,957 | -892 | -1,222 | |||||||||||||||||||||

Trade payables | -2,948 | 518 | -588 | 860 | -110 | 1,644 | -1,519 | |||||||||||||||||||||

Provisions and post-employment benefits | 1,155 | -1,752 | -970 | -1,731 | -464 | -225 | -18 | |||||||||||||||||||||

Other operating assets and liabilities, net | 325 | -2,554 | 2,206 | 2,693 | 323 | -2,806 | -1,624 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| -4,568 | 808 | -2,939 | 2,086 | 6,165 | -3,808 | -6,324 | ||||||||||||||||||||||

Cash flow from operating activities | -2,970 | 4,291 | 1,459 | 14,609 | 9,402 | 2,054 | -1,350 | |||||||||||||||||||||

Investing activities | ||||||||||||||||||||||||||||

Investments in property, plant and equipment | -1,196 | -1,278 | -778 | -1,251 | -1,034 | -1,320 | -1,415 | |||||||||||||||||||||

Sales of property, plant and equipment | 91 | 11 | 97 | 179 | 274 | 53 | 139 | |||||||||||||||||||||

Acquisitions/divestments of subsidiaries and other operations, net | -136 | -39 | -1,794 | -713 | -849 | -1,512 | -286 | |||||||||||||||||||||

Product development | -282 | -214 | -237 | -182 | -197 | -185 | -155 | |||||||||||||||||||||

Other investing activities | 298 | -203 | -230 | -1,195 | -169 | -388 | -1,302 | |||||||||||||||||||||

Short-term investments | -2,860 | 9,209 | -144 | -8,262 | -6,790 | 7,012 | 2,308 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Cash flow from investing activities | -4,085 | 7,486 | -3,086 | -11,424 | -8,765 | 3,660 | -711 | |||||||||||||||||||||

Cash flow before financing activities | -7,055 | 11,777 | -1,627 | 3,185 | 637 | 5,714 | -2,061 | |||||||||||||||||||||

Financing activities | ||||||||||||||||||||||||||||

Dividends paid | -61 | -8,863 | -21 | -208 | — | -9,828 | -3 | |||||||||||||||||||||

Other financing activities | 92 | -4,236 | 43 | 3,746 | -5,069 | -2,393 | -1,288 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Cash flow from financing activities | 31 | -13,099 | 22 | 3,538 | -5,069 | -12,221 | -1,291 | |||||||||||||||||||||

Effect of exchange rate changes on cash | -214 | 2,357 | -1,711 | 209 | 433 | 1,499 | 2,306 | |||||||||||||||||||||

Net change in cash and cash equivalents | -7,238 | 1,035 | -3,316 | 6,932 | -3,999 | -5,008 | -1,046 | |||||||||||||||||||||

Cash and cash equivalents, beginning of period | 44,682 | 37,444 | 38,479 | 35,163 | 42,095 | 38,096 | 33,088 | |||||||||||||||||||||

Cash and cash equivalents, end of period | 37,444 | 38,479 | 35,163 | 42,095 | 38,096 | 33,088 | 32,042 | |||||||||||||||||||||

Ericsson Third Quarter Report 2014 | 23 |

Table of Contents

The Group

This interim report is prepared in accordance with IAS 34. The term “IFRS” used in this document refers to the application of IAS and IFRS as well as interpretations of these standards as issued by IASB’s Standards Interpretation Committee (SIC) and IFRS Interpretations Committee (IFRIC). The accounting policies adopted are consistent with those of the annual report for the year ended December 31, 2013, and should be read in conjunction with that annual report.

As from January 1, 2014, the Company has applied the following new or amended IFRSs and IFRICs:

Amendment to IAS 32, “Financial instruments: Presentation,” Offsetting Financial Assets and Financial Liabilities. This amendment is related to the application guidance in IAS 32, ‘Financial instruments: Presentation,’ and clarifies some of the requirements for offsetting financial assets and financial liabilities on the balance sheet.

IFRIC 21, “Levies.” This interpretation of IAS 37 “Provisions, contingent liabilities and contingent assets” sets out the accounting for an obligation to pay a levy that is not income tax. The interpretation addresses what the obligating event is that gives rise to the need to pay a levy and when a liability should be recognized.

None of the new or amended standards and interpretations has had any significant impact on the financial result or position of the Company. There is no significant difference between IFRS effective as per September 30, 2014 and IFRS as endorsed by the EU.

In the interim reports of 2013 disclosure was given in relation to IFRS 7 about fair valuation of financial instruments. Due to that the amounts are not considered material this disclosure will not be given in the interim reports as from the first quarter of 2014. Should amounts become material quarterly disclosure will be given as from then.

Ericsson Third Quarter Report 2014 | 24 |

Table of Contents

NET SALES BY SEGMENT BY QUARTER

Segment Modems was consolidated as of October 1, 2013.

| 2013 | 2014 | |||||||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||

Networks | 28,133 | 28,142 | 26,655 | 34,769 | 24,383 | 28,964 | 30,030 | |||||||||||||||||||||

Global Services | 21,452 | 24,851 | 23,974 | 27,166 | 20,356 | 23,059 | 24,467 | |||||||||||||||||||||

Of which Professional Services | 14,626 | 16,773 | 16,229 | 18,767 | 15,078 | 16,554 | 17,794 | |||||||||||||||||||||

Of which Managed Services | 5,888 | 6,754 | 6,264 | 6,574 | 5,754 | 6,485 | 7,175 | |||||||||||||||||||||

Of which Network Rollout | 6,826 | 8,078 | 7,745 | 8,399 | 5,278 | 6,505 | 6,673 | |||||||||||||||||||||

Support Solutions | 2,447 | 2,338 | 2,352 | 5,097 | 2,765 | 2,824 | 3,057 | |||||||||||||||||||||

Modems | — | — | — | — | 1 | 2 | 89 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 52,032 | 55,331 | 52,981 | 67,032 | 47,505 | 54,849 | 57,643 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| 2013 | 2014 | |||||||||||||||||||||||||||

Sequential change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||

Networks | -20 | % | 0 | % | -5 | % | 30 | % | -30 | % | 19 | % | 4 | % | ||||||||||||||

Global Services | -24 | % | 16 | % | -4 | % | 13 | % | -25 | % | 13 | % | 6 | % | ||||||||||||||

Of which Professional Services | -23 | % | 15 | % | -3 | % | 16 | % | -20 | % | 10 | % | 7 | % | ||||||||||||||

Of which Managed Services | -13 | % | 15 | % | -7 | % | 5 | % | -12 | % | 13 | % | 11 | % | ||||||||||||||

Of which Network Rollout | -26 | % | 18 | % | -4 | % | 8 | % | -37 | % | 23 | % | 3 | % | ||||||||||||||

Support Solutions | -33 | % | -4 | % | 1 | % | 117 | % | -46 | % | 2 | % | 8 | % | ||||||||||||||

Modems | — | — | — | — | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | -22 | % | 6 | % | -4 | % | 27 | % | -29 | % | 15 | % | 5 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| 2013 | 2014 | |||||||||||||||||||||||||||

Year over year change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||

Networks | 3 | % | 1 | % | -1 | % | -1 | % | -13 | % | 3 | % | 13 | % | ||||||||||||||

Global Services | 4 | % | 3 | % | -1 | % | -3 | % | -5 | % | -7 | % | 2 | % | ||||||||||||||

Of which Professional Services | -2 | % | -1 | % | -1 | % | -1 | % | 3 | % | -1 | % | 10 | % | ||||||||||||||

Of which Managed Services | 3 | % | 4 | % | -1 | % | -3 | % | -2 | % | -4 | % | 15 | % | ||||||||||||||

Of which Network Rollout | 19 | % | 13 | % | -2 | % | -8 | % | -23 | % | -19 | % | -14 | % | ||||||||||||||

Support Solutions | -19 | % | -33 | % | -29 | % | 40 | % | 13 | % | 21 | % | 30 | % | ||||||||||||||

Modems | — | — | — | — | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 2 | % | 0 | % | -3 | % | 0 | % | -9 | % | -1 | % | 9 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| 2013 | 2014 | |||||||||||||||||||||||||||

Year to date, SEK million | Jan - Mar | Jan - Jun | Jan - Sep | Jan - Dec | Jan - Mar | Jan - Jun | Jan - Sep | |||||||||||||||||||||

Networks | 28,133 | 56,275 | 82,930 | 117,699 | 24,383 | 53,347 | 83,377 | |||||||||||||||||||||

Global Services | 21,452 | 46,303 | 70,277 | 97,443 | 20,356 | 43,415 | 67,882 | |||||||||||||||||||||

Of which Professional Services | 14,626 | 31,399 | 47,628 | 66,395 | 15,078 | 31,632 | 49,426 | |||||||||||||||||||||

Of which Managed Services | 5,888 | 12,642 | 18,906 | 25,480 | 5,754 | 12,239 | 19,414 | |||||||||||||||||||||

Of which Network Rollout | 6,826 | 14,904 | 22,649 | 31,048 | 5,278 | 11,783 | 18,456 | |||||||||||||||||||||

Support Solutions | 2,447 | 4,785 | 7,137 | 12,234 | 2,765 | 5,589 | 8,646 | |||||||||||||||||||||

Modems | — | — | — | — | 1 | 3 | 92 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 52,032 | 107,363 | 160,344 | 227,376 | 47,505 | 102,354 | 159,997 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| Year to date, | 2013 | 2014 | ||||||||||||||||||||||||||

year over year change, percent | Jan - Mar | Jan - Jun | Jan - Sep | Jan - Dec | Jan - Mar | Jan - Jun | Jan - Sep | |||||||||||||||||||||

Networks | 3 | % | 2 | % | 1 | % | 0 | % | -13 | % | -5 | % | 1 | % | ||||||||||||||

Global Services | 4 | % | 4 | % | 2 | % | 0 | % | -5 | % | -6 | % | -3 | % | ||||||||||||||

Of which Professional Services | -2 | % | -1 | % | -1 | % | -1 | % | 3 | % | 1 | % | 4 | % | ||||||||||||||

Of which Managed Services | 3 | % | 4 | % | 2 | % | 1 | % | -2 | % | -3 | % | 3 | % | ||||||||||||||

Of which Network Rollout | 19 | % | 16 | % | 9 | % | 4 | % | -23 | % | -21 | % | -19 | % | ||||||||||||||

Support Solutions | -19 | % | -26 | % | -27 | % | -9 | % | 13 | % | 17 | % | 21 | % | ||||||||||||||

Modems | — | — | — | — | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 2 | % | 1 | % | 0 | % | 0 | % | -9 | % | -5 | % | 0 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ericsson Third Quarter Report 2014 | 25 |

Table of Contents

OPERATING INCOME BY SEGMENT BY QUARTER

| 1) | “Unallocated” consists mainly of costs for corporate staff, non-operational capital gains and losses |

Ericsson Third Quarter Report 2014 | 26 |

Table of Contents

NET SALES BY REGION BY QUARTER

| 2013 | 2014 | |||||||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||

North America | 15,773 | 15,341 | 14,453 | 13,772 | 12,215 | 15,179 | 14,033 | |||||||||||||||||||||

Latin America | 4,374 | 5,565 | 5,294 | 6,749 | 4,710 | 5,414 | 5,882 | |||||||||||||||||||||

Northern Europe & Central Asia1) 2) | 2,283 | 2,708 | 2,949 | 3,678 | 2,436 | 2,717 | 3,151 | |||||||||||||||||||||

Western & Central Europe2) | 4,349 | 4,522 | 4,399 | 5,215 | 4,381 | 4,582 | 4,646 | |||||||||||||||||||||

Mediterranean2) | 5,271 | 6,159 | 5,659 | 7,067 | 4,785 | 5,487 | 5,218 | |||||||||||||||||||||

Middle East | 3,160 | 3,978 | 4,386 | 5,914 | 3,859 | 4,514 | 6,039 | |||||||||||||||||||||

Sub Saharan Africa | 2,131 | 2,653 | 2,693 | 2,572 | 1,813 | 1,886 | 2,447 | |||||||||||||||||||||

India | 1,606 | 1,279 | 1,280 | 1,973 | 1,695 | 1,645 | 2,000 | |||||||||||||||||||||

North East Asia | 6,054 | 6,642 | 6,053 | 8,649 | 4,908 | 6,406 | 7,033 | |||||||||||||||||||||

South East Asia & Oceania | 4,129 | 3,758 | 3,617 | 4,283 | 3,446 | 3,662 | 3,794 | |||||||||||||||||||||

Other1) 2) | 2,902 | 2,726 | 2,198 | 7,160 | 3,257 | 3,357 | 3,400 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 52,032 | 55,331 | 52,981 | 67,032 | 47,505 | 54,849 | 57,643 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

1) Of which in Sweden | 1,020 | 1,276 | 798 | 1,333 | 999 | 1,008 | 1,090 | |||||||||||||||||||||

2) Of which in EU | 9,782 | 10,816 | 10,111 | 12,835 | 9,720 | 10,320 | 10,736 | |||||||||||||||||||||

| 2013 | 2014 | |||||||||||||||||||||||||||

Sequential change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||

North America | -7 | % | -3 | % | -6 | % | -5 | % | -11 | % | 24 | % | -8 | % | ||||||||||||||

Latin America | -33 | % | 27 | % | -5 | % | 27 | % | -30 | % | 15 | % | 9 | % | ||||||||||||||

Northern Europe & Central Asia1) 2) | -24 | % | 19 | % | 9 | % | 25 | % | -34 | % | 12 | % | 16 | % | ||||||||||||||

Western & Central Europe2) | -20 | % | 4 | % | -3 | % | 19 | % | -16 | % | 5 | % | 1 | % | ||||||||||||||

Mediterranean2) | -25 | % | 17 | % | -8 | % | 25 | % | -32 | % | 15 | % | -5 | % | ||||||||||||||

Middle East | -38 | % | 26 | % | 10 | % | 35 | % | -35 | % | 17 | % | 34 | % | ||||||||||||||

Sub Saharan Africa | -40 | % | 24 | % | 2 | % | -4 | % | -30 | % | 4 | % | 30 | % | ||||||||||||||

India | 0 | % | -20 | % | 0 | % | 54 | % | -14 | % | -3 | % | 22 | % | ||||||||||||||

North East Asia | -41 | % | 10 | % | -9 | % | 43 | % | -43 | % | 31 | % | 10 | % | ||||||||||||||

South East Asia & Oceania | -9 | % | -9 | % | -4 | % | 18 | % | -20 | % | 6 | % | 4 | % | ||||||||||||||

Other1) 2) | -3 | % | -6 | % | -19 | % | 226 | % | -55 | % | 3 | % | 1 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | -22 | % | 6 | % | -4 | % | 27 | % | -29 | % | 15 | % | 5 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

1) Of which in Sweden | -20 | % | 25 | % | -37 | % | 67 | % | -25 | % | 1 | % | 8 | % | ||||||||||||||

2) Of which in EU | -24 | % | 11 | % | -7 | % | 27 | % | -24 | % | 6 | % | 4 | % | ||||||||||||||

| 2013 | 2014 | |||||||||||||||||||||||||||

Year-over-year change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||

North America | 23 | % | 18 | % | 3 | % | -19 | % | -23 | % | -1 | % | -3 | % | ||||||||||||||

Latin America | -9 | % | 6 | % | -2 | % | 4 | % | 8 | % | -3 | % | 11 | % | ||||||||||||||

Northern Europe & Central Asia1) 2) | 0 | % | -19 | % | 9 | % | 23 | % | 7 | % | 0 | % | 7 | % | ||||||||||||||

Western & Central Europe2) | 1 | % | 10 | % | 21 | % | -4 | % | 1 | % | 1 | % | 6 | % | ||||||||||||||

Mediterranean2) | 14 | % | -1 | % | 5 | % | 0 | % | -9 | % | -11 | % | -8 | % | ||||||||||||||

Middle East | 0 | % | 7 | % | 21 | % | 17 | % | 22 | % | 13 | % | 38 | % | ||||||||||||||

Sub Saharan Africa | -3 | % | -5 | % | -4 | % | -28 | % | -15 | % | -29 | % | -9 | % | ||||||||||||||

India | 13 | % | -25 | % | -26 | % | 23 | % | 6 | % | 29 | % | 56 | % | ||||||||||||||

North East Asia | -34 | % | -21 | % | -28 | % | -16 | % | -19 | % | -4 | % | 16 | % | ||||||||||||||

South East Asia & Oceania | 22 | % | 2 | % | 3 | % | -5 | % | -17 | % | -3 | % | 5 | % | ||||||||||||||

Other1) 2) | 2 | % | -13 | % | -34 | % | 141 | % | 12 | % | 23 | % | 55 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 2 | % | 0 | % | -3 | % | 0 | % | -9 | % | -1 | % | 9 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

1) Of which in Sweden | 22 | % | 0 | % | -52 | % | 5 | % | -2 | % | -21 | % | 37 | % | ||||||||||||||

2) Of which in EU | 3 | % | -3 | % | -5 | % | -1 | % | -1 | % | -5 | % | 6 | % | ||||||||||||||

Ericsson Third Quarter Report 2014 | 27 |

Table of Contents

NET SALES BY REGION BY QUARTER (continued)

Ericsson Third Quarter Report 2014 | 28 |

Table of Contents

NET SALES BY REGION BY SEGMENT

Revenue from Telcordia is reported 50/50 between segments Global Services and Support Solutions.

| Q3 2014 | Jan - Sep 2014 | |||||||||||||||||||||||||||||||||||||||

SEK milion | Net- works | Global Services | Support Solutions | Modems | Total | Net- works | Global Services | Support Solutions | Modems | Total | ||||||||||||||||||||||||||||||

North America | 6,829 | 6,452 | 752 | — | 14,033 | 21,082 | 17,855 | 2,490 | 0 | 41,427 | ||||||||||||||||||||||||||||||

Latin America | 2,691 | 2,860 | 331 | — | 5,882 | 7,741 | 7,541 | 724 | 0 | 16,006 | ||||||||||||||||||||||||||||||

Northern Europe & Central Asia | 2,143 | 937 | 71 | — | 3,151 | 5,270 | 2,855 | 179 | 0 | 8,304 | ||||||||||||||||||||||||||||||

Western & Central Europe | 1,773 | 2,720 | 153 | — | 4,646 | 5,397 | 7,770 | 442 | 0 | 13,609 | ||||||||||||||||||||||||||||||

Mediterranean | 2,088 | 2,943 | 187 | — | 5,218 | 6,526 | 8,409 | 555 | 0 | 15,490 | ||||||||||||||||||||||||||||||

Middle East | 3,705 | 2,028 | 306 | — | 6,039 | 8,054 | 5,676 | 682 | 0 | 14,412 | ||||||||||||||||||||||||||||||

Sub Saharan Africa | 1,237 | 1,126 | 84 | — | 2,447 | 2,820 | 2,911 | 415 | 0 | 6,146 | ||||||||||||||||||||||||||||||

India | 1,106 | 743 | 151 | — | 2,000 | 2,881 | 2,152 | 307 | 0 | 5,340 | ||||||||||||||||||||||||||||||

North East Asia | 4,463 | 2,293 | 277 | — | 7,033 | 11,545 | 6,324 | 478 | 0 | 18,347 | ||||||||||||||||||||||||||||||

South East Asia & Oceania | 2,048 | 1,677 | 69 | — | 3,794 | 5,724 | 4,893 | 285 | 0 | 10,902 | ||||||||||||||||||||||||||||||

Other | 1,947 | 688 | 676 | 89 | 3,400 | 6,337 | 1,496 | 2,089 | 92 | 10,014 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total | 30,030 | 24,467 | 3,057 | 89 | 57,643 | 83,377 | 67,882 | 8,646 | 92 | 159,997 | ||||||||||||||||||||||||||||||

Share of Total | 52 | % | 43 | % | 5 | % | 0 | % | 100 | % | 52 | % | 43 | % | 5 | % | 0 | % | 100 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

| Q3 2014 | ||||||||||||||||||||||||||||||||||||||||

Sequential change, percent | Net- works | Global Services | Support Solutions | Modems | Total | |||||||||||||||||||||||||||||||||||

North America | -11 | % | 1 | % | -32 | % | — | -8 | % | |||||||||||||||||||||||||||||||

Latin America | 3 | % | 8 | % | 112 | % | — | 9 | % | |||||||||||||||||||||||||||||||