SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

April 23, 2015

Commission File Number

000-12033

LM ERICSSON TELEPHONE COMPANY

(Translation of registrant’s name into English)

Torshamnsgatan 21, Kista

SE-164 83, Stockholm, Sweden

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.Form 20-F [x] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): |

Announcement of LM Ericsson Telephone Company, April 23, 2015 regarding “Ericsson reports first quarter results 2015”.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TELEFONAKTIEBOLAGET LM ERICSSON (publ) | ||||||||||

| By: | /s/ NINA MACPHERSON | |||||||||

Nina Macpherson Senior Vice President and General Counsel | ||||||||||

| By: | /s/HELENANORRMAN | |||||||||

Helena Norrman Senior Vice President Corporate Communications | ||||||||||

Date:April 23, 2015

First quarter report 2015

Stockholm, April 23, 2015

FIRST QUARTER HIGHLIGHTS

> Sales in the quarter increased by 13% reaching SEK 53.5 (47.5) b. Significant currency movements impacted sales positively. Sales, adjusted for comparable units and currency decreased by –6% YoY,

Read more

(page)

driven by slower mobile broadband activity in North America. 3

> With current visibility we anticipate the fast pace of 4G deployments in Mainland China to continue and

the North American mobile broadband business to remain slow in the short term. 2

> Professional Services had a strong quarter. 7

> Gross margin decreased YoY to 35.4% (36.5%), due to lower capacity business in North America and continued fast pace of 4G coverage deployments in Mainland China, increased restructuring charges

and a higher share of Global Services sales. 3

> The cost and efficiency program, announced in November 2014, is progressing according to plan.

Savings of SEK 9 b. is expected, with full effect during 2017. 3

> Operating income was SEK 2.1 (2.6) b. Excluding restructuring charges of SEK –0.6 (–0.1) b., the oper-

ating income was flat YoY. 4

> The net currency effect contributed positively to the operating income, despite a negative currency

hedge effect of SEK –1.4 (–0.1) b. 4

> Cash flow from operating activities was SEK –5.9 (9.4) b. mainly due to increased working capital. 9

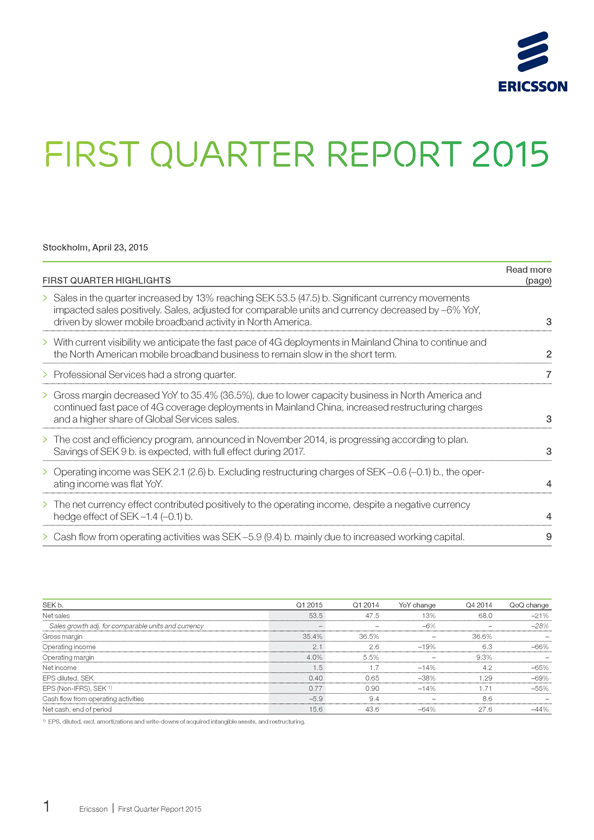

SEK b. Q1 2015 Q1 2014 YoY change Q4 2014 QoQ change

Net sales 53.5 47.5 13% 68.0 –21%

Sales growth adj. for comparable units and currency – – –6% – –28%

Gross margin 35.4% 36.5% – 36.6% –

Operating income 2.1 2.6 –19% 6.3 –66%

Operating margin 4.0% 5.5% – 9.3% –

Net income 1.5 1.7 –14% 4.2 –65%

EPS diluted, SEK 0.40 0.65 –38% 1.29 –69%

EPS (Non-IFRS), SEK 1) 0.77 0.90 –14% 1.71 –55%

Cash flow from operating activities –5.9 9.4 – 8.6 –

Net cash, end of period 15.6 43.6 –64% 27.6 –44%

1) EPS, diluted, excl. amortizations and write-downs of acquired intangible assets, and restructuring.

CEO Comments

Sales increased by 13% in the quarter. Significant currency movements impacted sales positively and Professional Services had a strong quarter. Profit- ability improved in segment Global Services while it declined in segment Networks due to changed busi- ness mix.

Business

In the quarter, sales growth was strong in India and North East

Asia.

Professional Services sales increased YoY with a continued good global demand for our services offering. We signed 27 managed services contracts in the quarter, including a major multi-country contract in Europe.

As anticipated, segment Networks mobile broadband business in North America continued to be slow in the quarter as opera- tors remained focused on cash flow optimization in order to finance major acquisitions and spectrum auctions. The decline in North America was partly offset by a continued fast pace of

4G deployments in Mainland China. As a consequence, the business mix shifted to a higher share of coverage projects in the quarter.

Consumer demand and mobile data traffic growth continued to be strong in North America, creating further need for quality and capacity investments. However, with current visibility, we antici- pate the fast pace of 4G deployments in Mainland China to con- tinue and the North American mobile broadband business to remain slow in the short term.

Profitability

Operating income declined YoY, primarily driven by lower profit- ability in segment Networks due to the above mentioned change in business mix and increased operating expenses. This was partly offset by significantly improved operating income in seg- ment Global Services, mainly driven by Network Rollout. There were no losses related to the modems business in the quarter.

The underlying margin, excluding restructuring charges and hedge losses, improved YoY. The net currency effect contrib- uted positively to the operating income, considering transaction and translation exposure as well as the negative currency hedge effect.

IPR revenues

As a consequence of the ongoing dispute with a major cus- tomer, the IPR licensing revenues declined in constant curren- cies. Reported IPR revenues were stable in the quarter as a majority of these contracts are in USD.

Cost and efficiency program

As part of improving the profitability, we continue to proactively identify efficiency opportunities. The cost and efficiency pro- gram is progressing according to plan. The ambition is to achieve savings of approximately SEK 9 b., with full effect during

2017. The program primarily relates to five key areas: portfolio streamlining and ways of working in R&D; structural enhance- ments in IS/IT; accelerated service delivery transformation; sup- ply chain efficiencies; and structural efficiency gains in G&A.

In the quarter we announced, as part of the program, that 2,200 positions in Sweden, are subject to notice. In addition we will reduce the number of consultants in Sweden by 850.

Cash flow

We ended the quarter with a negative cash flow from operating activities of SEK –5.9 b. mainly due to a change in business mix with less capacity business in North America and a higher share of coverage business in Mainland China. This impacted working capital negatively.

Targeted areas

In line with our strategy, we are investing in our targeted areas; IP networks, Cloud, OSS & BSS, TV & Media and Industry & Soci- ety. Sales in targeted areas continued to show good growth. At the Mobile World Congress (MWC) in Barcelona, in February, we saw an increased interest from non-operator customers, espe- cially within the area of Industry & Society. Most of our key launches at MWC were related to the targeted areas, including the new Router 6000 Series, the Hyperscale Cloud Solution, Expert Analytics 15.0, a new Media Delivery Network solution and Digital Telco Transformation.

In addition to the launches in the targeted areas we announced the new Ericsson Radio System. The system has an innovative modular architecture, delivering three times the capacity density with 50% improvement in energy efficiency. With the launches at the MWC, we have further strengthened our leadership and abil- ity to deliver on our growth ambitions.

Hans Vestberg

President and CEO

Financial highlights

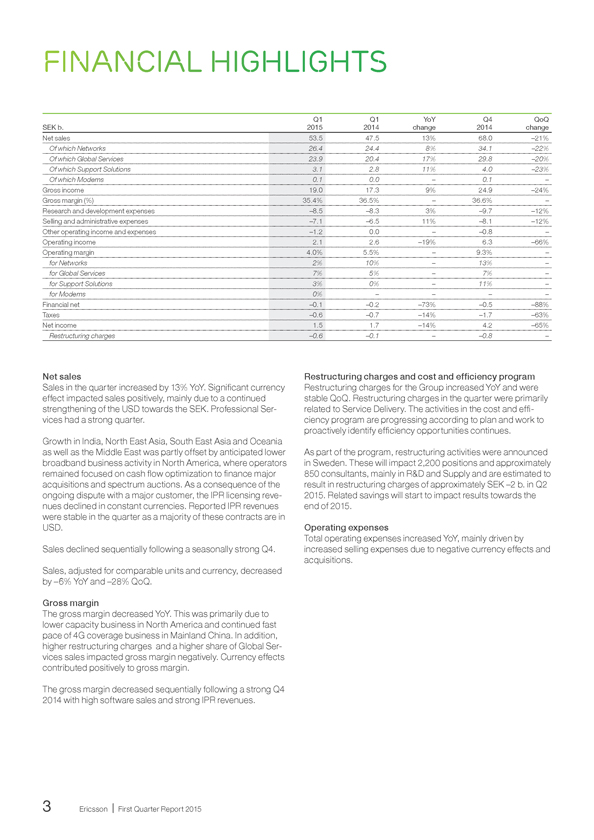

SEK b.

Q1

2015

Q1

2014

YoY

change

Q4

2014

QoQ

change

Net sales 53.5 47.5 13% 68.0 –21%

Of which Networks 26.4 24.4 8% 34.1 –22%

Of which Global Services 23.9 20.4 17% 29.8 –20%

Of which Support Solutions 3.1 2.8 11% 4.0 –23%

Of which Modems 0.1 0.0 – 0.1 –

Gross income 19.0 17.3 9% 24.9 –24%

Gross margin (%) 35.4% 36.5% – 36.6% –

Research and development expenses –8.5 –8.3 3% –9.7 –12%

Selling and administrative expenses –7.1 –6.5 11% –8.1 –12%

Other operating income and expenses –1.2 0.0 – –0.8 –

Operating income 2.1 2.6 –19% 6.3 –66%

Operating margin 4.0% 5.5% – 9.3% –

for Networks 2% 10% – 13% –

for Global Services 7% 5% – 7% –

for Support Solutions 3% 0% – 11% –

for Modems 0% – – – –

Financial net –0.1 –0.2 –73% –0.5 –88%

Taxes –0.6 –0.7 –14% –1.7 –63%

Net income 1.5 1.7 –14% 4.2 –65%

Restructuring charges –0.6 –0.1 – –0.8 –

Net sales

Sales in the quarter increased by 13% YoY. Significant currency effect impacted sales positively, mainly due to a continued strengthening of the USD towards the SEK. Professional Ser- vices had a strong quarter.

Growth in India, North East Asia, South East Asia and Oceania as well as the Middle East was partly offset by anticipated lower broadband business activity in North America, where operators remained focused on cash flow optimization to finance major acquisitions and spectrum auctions. As a consequence of the ongoing dispute with a major customer, the IPR licensing reve- nues declined in constant currencies. Reported IPR revenues were stable in the quarter as a majority of these contracts are in USD.

Sales declined sequentially following a seasonally strong Q4. Sales, adjusted for comparable units and currency, decreased

by –6% YoY and –28% QoQ.

Gross margin

The gross margin decreased YoY. This was primarily due to lower capacity business in North America and continued fast pace of 4G coverage business in Mainland China. In addition, higher restructuring charges and a higher share of Global Ser- vices sales impacted gross margin negatively. Currency effects contributed positively to gross margin.

The gross margin decreased sequentially following a strong Q4

2014 with high software sales and strong IPR revenues.

Restructuring charges and cost and efficiency program Restructuring charges for the Group increased YoY and were stable QoQ. Restructuring charges in the quarter were primarily related to Service Delivery. The activities in the cost and effi- ciency program are progressing according to plan and work to proactively identify efficiency opportunities continues.

As part of the program, restructuring activities were announced in Sweden. These will impact 2,200 positions and approximately

850 consultants, mainly in R&D and Supply and are estimated to result in restructuring charges of approximately SEK –2 b. in Q2

2015. Related savings will start to impact results towards the end of 2015.

Operating expenses

Total operating expenses increased YoY, mainly driven by increased selling expenses due to negative currency effects and acquisitions.

Quarterly sales and reported sales growth year over year

SEK b. %

Quarterly sales

Reported sales growth

Operating expenses and operating expense, % of sales

SEK b. %

Operating expenses

Operating expenses of sales

Operating income and operating margin

SEK b. %

Operating income

Operating margin

Other operating income and expenses

The revaluation and realization effects from currency hedge contracts were SEK –1.4 b., of which SEK –1.1 b. was realized. This is to be compared with the total impact from hedges of SEK

–1.0 b. in Q4 2014 and SEK –0.1 b. in Q1 2014.

The negative effect derives mainly from the hedge contract bal- ance in USD, which has further decreased in value. The SEK has weakened towards the USD between December 31, 2014 (SEK/ USD rate 7.79) and March 31, 2015 (SEK/USD rate 8.64).

Operating income

Operating income decreased YoY due to higher operating expenses and increased restructuring charges. This was partly offset by higher sales. The net currency effect had a positive impact on operating income.

Operating income decreased QoQ primarily due to seasonally weaker sales and a lower gross margin. This was partly offset by lower operating expenses.

Financial net

The financial net improved YoY and QoQ, mainly related to posi- tive foreign currency revaluation effects and positive interest revaluation effects.

Net income and EPS

Net income and EPS diluted decreased following the lower operating income.

Employees

The number of employees on March 31, 2015 is 118,706 com- pared with 118,055 on Dec 31, 2014. The majority of the increase is related to India, following a large new countrywide managed services contract. The number of Ericsson services professionals on March 31, 2015 was 66,000 (65,000 Dec 31,

2014).

MODEMS

Net Sales

The discontinuation of the modems business is now almost completed. Net sales in the quarter of SEK 0.1 b., are related to earlier signed contracts that all have end-of-life agreements.

Operating income

Operating income for the modems business was SEK 0.0 b.

4 |

|

Ericsson | First Quarter Report 2015

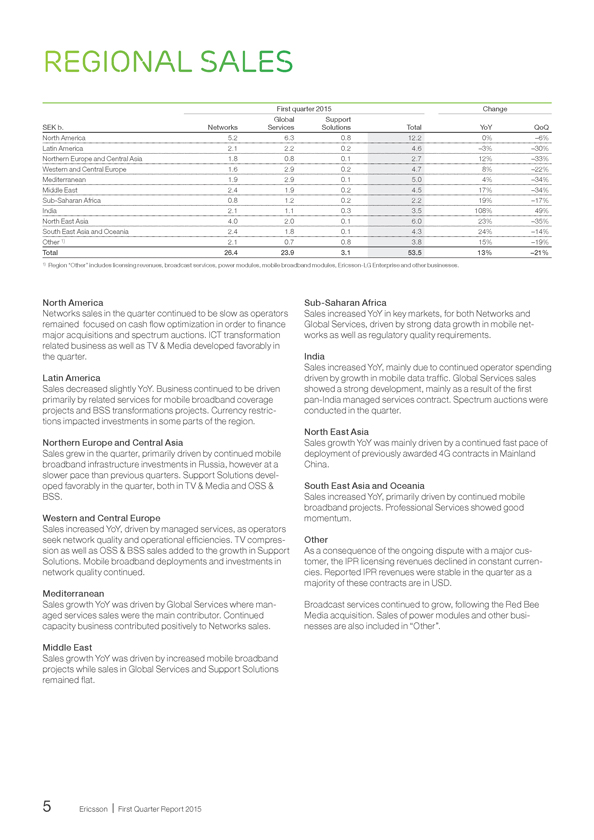

Regional sales

First quarter 2015 Change

SEK b.

North America 5.2 6.3 0.8 12.2 0% –6%

Latin America 2.1 2.2 0.2 4.6 –3% –30%

Northern Europe and Central Asia 1.8 0.8 0.1 2.7 12% –33%

Western and Central Europe 1.6 2.9 0.2 4.7 8% –22%

Mediterranean 1.9 2.9 0.1 5.0 4% –34%

Middle East 2.4 1.9 0.2 4.5 17% –34%

Sub-Saharan Africa 0.8 1.2 0.2 2.2 19% –17%

India 2.1 1.1 0.3 3.5 108% 49%

North East Asia 4.0 2.0 0.1 6.0 23% –35%

South East Asia and Oceania 2.4 1.8 0.1 4.3 24% –14%

Other 1) 2.1 0.7 0.8 3.8 15% –19%

Total 26.4 23.9 3.1 53.5 13% –21%

1) Region “Other” includes licensing revenues, broadcast services, power modules, mobile broadband modules, Ericsson-LG Enterprise and other businesses.

North America

Networks sales in the quarter continued to be slow as operators remained focused on cash flow optimization in order to finance major acquisitions and spectrum auctions. ICT transformation related business as well as TV & Media developed favorably in the quarter.

Latin America

Sales decreased slightly YoY. Business continued to be driven primarily by related services for mobile broadband coverage projects and BSS transformations projects. Currency restric- tions impacted investments in some parts of the region.

Northern Europe and Central Asia

Sales grew in the quarter, primarily driven by continued mobile broadband infrastructure investments in Russia, however at a slower pace than previous quarters. Support Solutions devel- oped favorably in the quarter, both in TV & Media and OSS & BSS.

Western and Central Europe

Sales increased YoY, driven by managed services, as operators seek network quality and operational efficiencies. TV compres- sion as well as OSS & BSS sales added to the growth in Support Solutions. Mobile broadband deployments and investments in network quality continued.

Mediterranean

Sales growth YoY was driven by Global Services where man- aged services sales were the main contributor. Continued capacity business contributed positively to Networks sales.

Middle East

Sales growth YoY was driven by increased mobile broadband projects while sales in Global Services and Support Solutions remained flat.

Sub-Saharan Africa

Sales increased YoY in key markets, for both Networks and Global Services, driven by strong data growth in mobile net- works as well as regulatory quality requirements.

India

Sales increased YoY, mainly due to continued operator spending driven by growth in mobile data traffic. Global Services sales showed a strong development, mainly as a result of the first

pan-India managed services contract. Spectrum auctions were conducted in the quarter.

North East Asia

Sales growth YoY was mainly driven by a continued fast pace of deployment of previously awarded 4G contracts in Mainland China.

South East Asia and Oceania

Sales increased YoY, primarily driven by continued mobile broadband projects. Professional Services showed good momentum.

Other

As a consequence of the ongoing dispute with a major cus- tomer, the IPR licensing revenues declined in constant curren- cies. Reported IPR revenues were stable in the quarter as a majority of these contracts are in USD.

Broadcast services continued to grow, following the Red Bee Media acquisition. Sales of power modules and other busi- nesses are also included in “Other”.

Segment results

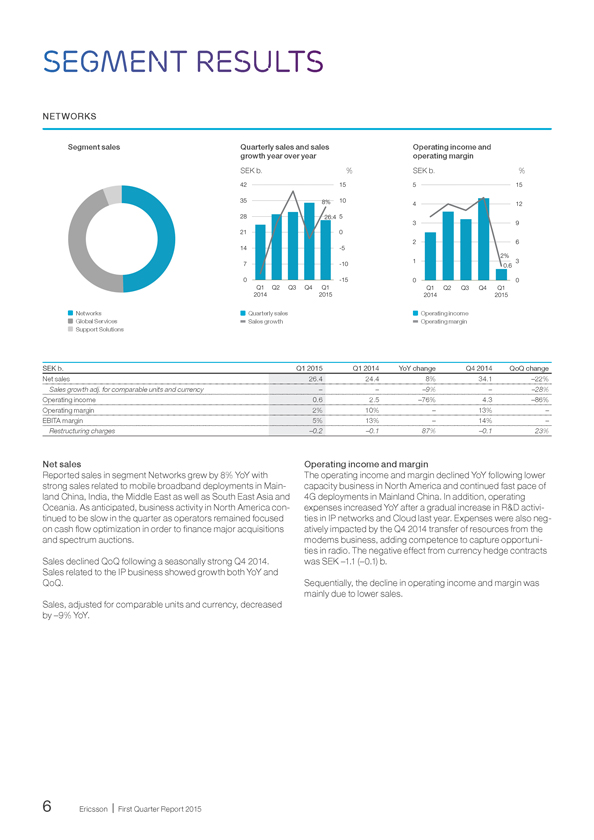

NET WORKS

Segment sales

[GRAPHIC APPEARS HERE]

Networks Global Services Support Solutions

Quarterly sales and sales growth year over year

SEK b. %

[GRAPHIC APPEARS HERE]

Quarterly sales

Sales growth

Operating income and operating margin

SEK b. %

[GRAPHIC APPEARS HERE]

Operating income

Operating margin

SEK b. Q1 2015 Q1 2014 YoY change Q4 2014 QoQ change

Net sales 26.4 24.4 8% 34.1 –22%

Sales growth adj. for comparable units and currency – – –9% – –28%

Operating income 0.6 2.5 –76% 4.3 –86%

Operating margin 2% 10% – 13% –

EBITA margin 5% 13% – 14% –

Restructuring charges –0.2 –0.1 87% –0.1 23%

Net sales

Reported sales in segment Networks grew by 8% YoY with strong sales related to mobile broadband deployments in Main- land China, India, the Middle East as well as South East Asia and Oceania. As anticipated, business activity in North America con- tinued to be slow in the quarter as operators remained focused on cash flow optimization in order to finance major acquisitions and spectrum auctions.

Sales declined QoQ following a seasonally strong Q4 2014. Sales related to the IP business showed growth both YoY and QoQ.

Sales, adjusted for comparable units and currency, decreased by –9% YoY.

Operating income and margin

The operating income and margin declined YoY following lower capacity business in North America and continued fast pace of

4G deployments in Mainland China. In addition, operating expenses increased YoY after a gradual increase in R&D activi- ties in IP networks and Cloud last year. Expenses were also neg- atively impacted by the Q4 2014 transfer of resources from the modems business, adding competence to capture opportuni- ties in radio. The negative effect from currency hedge contracts was SEK –1.1 (–0.1) b.

Sequentially, the decline in operating income and margin was mainly due to lower sales.

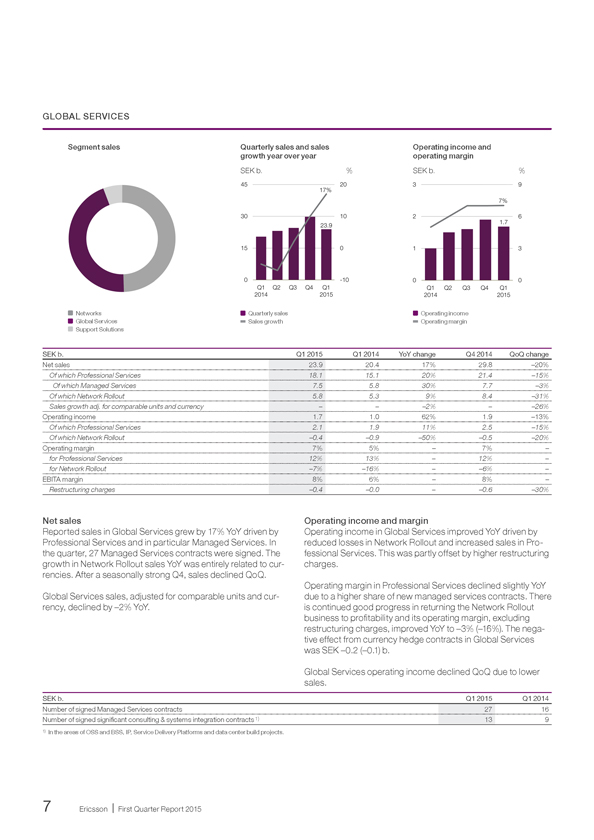

GLOBAL SERVICES

Segment sales

[GRAPHIC APPEARS HERE]

Networks Global Services Support Solutions

Quarterly sales and sales growth year over year

SEK b. %

[GRAPHIC APPEARS HERE]

Quarterly sales

Sales growth

Operating income and operating margin

SEK b. %

[GRAPHIC APPEARS HERE]

Operating income

Operating margin

SEK b. Q1 2015 Q1 2014 YoY change Q4 2014 QoQ change

Net sales 23.9 20.4 17% 29.8 –20%

Of which Professional Services 18.1 15.1 20% 21.4 –15%

Of which Managed Services 7.5 5.8 30% 7.7 –3%

Of which Network Rollout 5.8 5.3 9% 8.4 –31%

Sales growth adj. for comparable units and currency – – –2% – –26%

Operating income 1.7 1.0 62% 1.9 –13%

Of which Professional Services 2.1 1.9 11% 2.5 –15%

Of which Network Rollout –0.4 –0.9 –50% –0.5 –20%

Operating margin 7% 5% – 7% –

for Professional Services 12% 13% – 12% –

for Network Rollout –7% –16% – –6% –

EBITA margin 8% 6% – 8% –

Restructuring charges –0.4 –0.0 – –0.6 –30%

Net sales

Reported sales in Global Services grew by 17% YoY driven by Professional Services and in particular Managed Services. In the quarter, 27 Managed Services contracts were signed. The growth in Network Rollout sales YoY was entirely related to cur- rencies. After a seasonally strong Q4, sales declined QoQ.

Global Services sales, adjusted for comparable units and cur- rency, declined by –2% YoY.

Operating income and margin

Operating income in Global Services improved YoY driven by reduced losses in Network Rollout and increased sales in Pro- fessional Services. This was partly offset by higher restructuring charges.

Operating margin in Professional Services declined slightly YoY due to a higher share of new managed services contracts. There is continued good progress in returning the Network Rollout business to profitability and its operating margin, excluding restructuring charges, improved YoY to –3% (–16%). The nega- tive effect from currency hedge contracts in Global Services

was SEK –0.2 (–0.1) b.

Global Services operating income declined QoQ due to lower sales.

SEK b. Q1 2015 Q1 2014

Number of signed Managed Services contracts 27 16

Number of signed significant consulting & systems integration contracts 1) 13 9

1) In the areas of OSS and BSS, IP, Service Delivery Platforms and data center build projects.

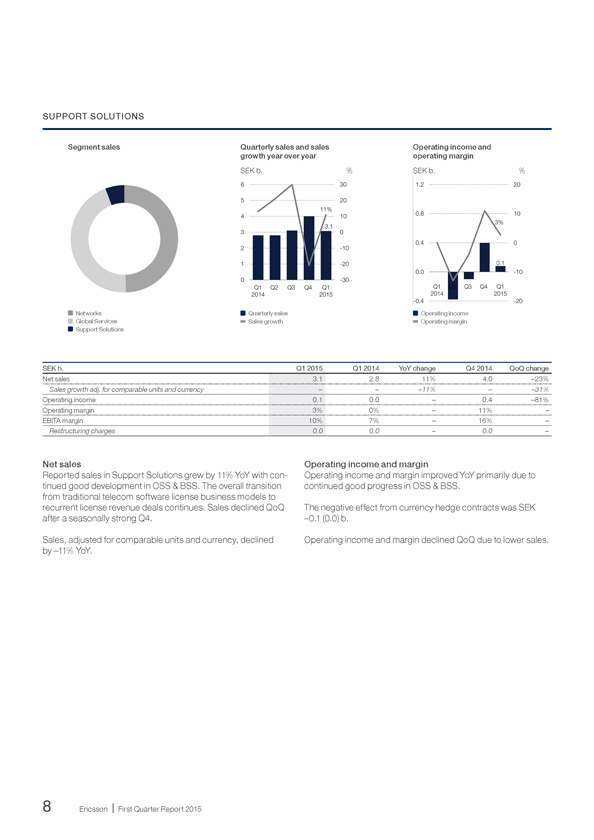

SUPPORT SOLUTIONS

Segment sales

[GRAPHIC APPEARS HERE]

Networks Global Services Support Solutions

Quarterly sales and sales growth year over year

SEK b. %

[GRAPHIC APPEARS HERE]

Quarterly sales

Sales growth

Operating income and operating margin

SEK b. %

[GRAPHIC APPEARS HERE]

Operating income

Operating margin

SEK b. Q1 2015 Q1 2014 YoY change Q4 2014 QoQ change

Net sales 3.1 2.8 11% 4.0 –23%

Sales growth adj. for comparable units and currency – – –11% – –31%

Operating income 0.1 0.0 – 0.4 –81%

Operating margin 3% 0% – 11% –

EBITA margin 10% 7% – 16% –

Restructuring charges 0.0 0.0 – 0.0 –

Net sales

Reported sales in Support Solutions grew by 11% YoY with con- tinued good development in OSS & BSS. The overall transition from traditional telecom software license business models to recurrent license revenue deals continues. Sales declined QoQ after a seasonally strong Q4.

Sales, adjusted for comparable units and currency, declined by –11% YoY.

Operating income and margin

Operating income and margin improved YoY primarily due to continued good progress in OSS & BSS.

The negative effect from currency hedge contracts was SEK

–0.1 (0.0) b.

Operating income and margin declined QoQ due to lower sales.

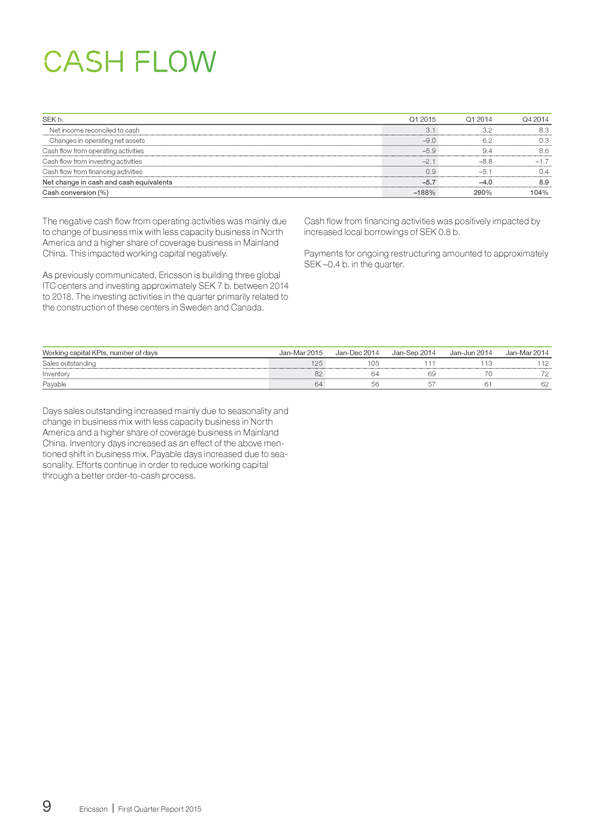

SEK b. Q1 2015 Q1 2014 Q4 2014

Net income reconciled to cash 3.1 3.2 8.3

Changes in operating net assets –9.0 6.2 0.3

Cash flow from operating activities –5.9 9.4 8.6

Cash flow from investing activities –2.1 –8.8 –1.7

Cash flow from financing activities 0.9 –5.1 0.4

Net change in cash and cash equivalents –5.7 –4.0 8.9

Cash conversion (%) –188% 290% 104%

The negative cash flow from operating activities was mainly due to change of business mix with less capacity business in North America and a higher share of coverage business in Mainland China. This impacted working capital negatively.

As previously communicated, Ericsson is building three global ITC centers and investing approximately SEK 7 b. between 2014 to 2018. The investing activities in the quarter primarily related to the construction of these centers in Sweden and Canada.

Cash flow from financing activities was positively impacted by increased local borrowings of SEK 0.8 b.

Payments for ongoing restructuring amounted to approximately

SEK –0.4 b. in the quarter.

Working capital KPIs, number of days Jan-Mar 2015 Jan-Dec 2014 Jan-Sep 2014 Jan-Jun 2014 Jan-Mar 2014

Sales outstanding 125 105 111 113 112

Inventory 82 64 69 70 72

Payable 64 56 57 61 62

Days sales outstanding increased mainly due to seasonality and change in business mix with less capacity business in North America and a higher share of coverage business in Mainland China. Inventory days increased as an effect of the above men- tioned shift in business mix. Payable days increased due to sea- sonality. Efforts continue in order to reduce working capital through a better order-to-cash process.

CASH flow

FINANCIAL POSITION

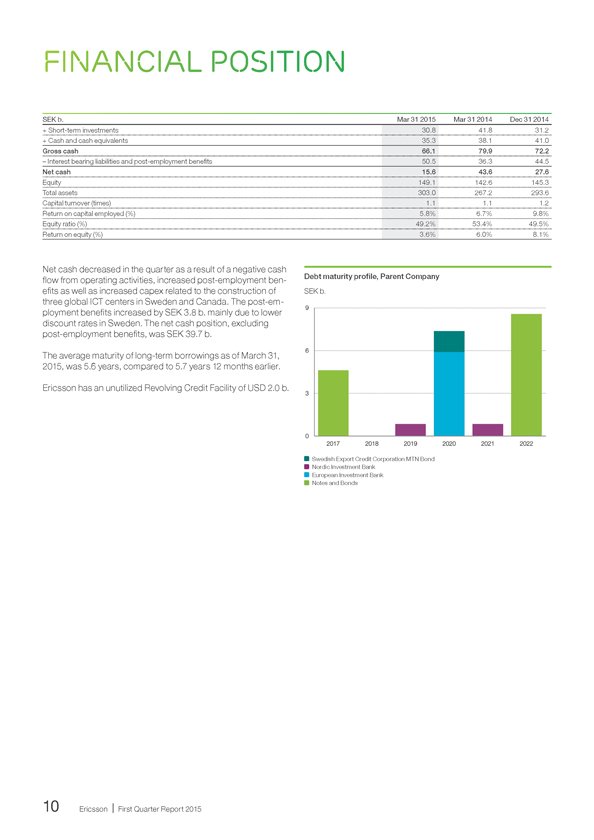

SEK b. Mar 31 2015 Mar 31 2014 Dec 31 2014

+ Short-term investments 30.8 41.8 31.2

+ Cash and cash equivalents 35.3 38.1 41.0

Gross cash 66.1 79.9 72.2

– Interest bearing liabilities and post-employment benefits 50.5 36.3 44.5

Net cash 15.6 43.6 27.6

Equity 149.1 142.6 145.3

Total assets 303.0 267.2 293.6

Capital turnover (times) 1.1 1.1 1.2

Return on capital employed (%) 5.8% 6.7% 9.8%

Equity ratio (%) 49.2% 53.4% 49.5%

Return on equity (%) 3.6% 6.0% 8.1%

Net cash decreased in the quarter as a result of a negative cash flow from operating activities, increased post-employment ben- efits as well as increased capex related to the construction of three global ICT centers in Sweden and Canada. The post-em- ployment benefits increased by SEK 3.8 b. mainly due to lower discount rates in Sweden. The net cash position, excluding

post-employment benefits, was SEK 39.7 b.

The average maturity of long-term borrowings as of March 31,

2015, was 5.6 years, compared to 5.7 years 12 months earlier. Ericsson has an unutilized Revolving Credit Facility of USD 2.0 b.

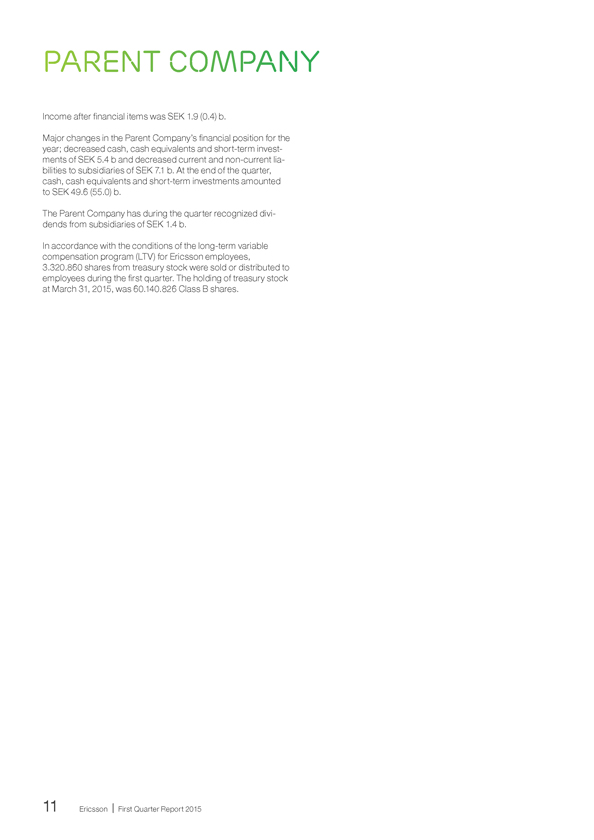

Debt maturity profile, Parent Company

SEK b.

[GRAPHIC APPEARS HERE]

Swedish Export Credit Corporation MTN Bond

Nordic Investment Bank European Investment Bank Notes and Bonds

Parent company

Income after financial items was SEK 1.9 (0.4) b.

Major changes in the Parent Company’s financial position for the year; decreased cash, cash equivalents and short-term invest- ments of SEK 5.4 b and decreased current and non-current lia- bilities to subsidiaries of SEK 7.1 b. At the end of the quarter, cash, cash equivalents and short-term investments amounted

to SEK 49.6 (55.0) b.

The Parent Company has during the quarter recognized divi- dends from subsidiaries of SEK 1.4 b.

In accordance with the conditions of the long-term variable compensation program (LTV) for Ericsson employees,

3.320.860 shares from treasury stock were sold or distributed to employees during the first quarter. The holding of treasury stock at March 31, 2015, was 60.140.826 Class B shares.

Other information

Modems ceased to exist as a Business unit

On January 1, 2015, the Business unit Modems was discontin- ued, following the decision announced on September 18, 2014, that Ericsson would discontinue development of modems and shift part of investment into radio network R&D to better capture growth opportunities in this area. The change in strategy for modems came as the company completed its evaluation of the future of the modems business. Segment Modems will remain as a reporting unit for 2015.

Ericsson took legal action against Apple

On January 12, 2015, Apple filed a lawsuit asking the United States District Court for the Northern District of California to find that it does not infringe a small subset of Ericsson’s patents. On January 14, 2015, following Apple’s legal action, Ericsson filed a complaint in the United States District Court for the Eastern Dis- trict of Texas requesting a ruling on Ericsson’s proposed global licensing fees with Apple. During the past two years of negotia- tions, the companies have not been able to reach an agreement on licensing of Ericsson’s patents that enable Apple’s mobile devices to connect with the world and power many of their appli- cations. Ericsson filed the suit in order to receive an independent assessment on whether Ericsson’s global licensing offer com- plies with Ericsson’s FRAND commitment.

The global license agreement for mobile technology between Ericsson and Apple has expired and Apple has declined to take a new license on offered FRAND terms.

Ericsson announced change in executive leadership team On January 15, 2015, Ericsson announced that Johan Wibergh, Executive Vice President and Head of Segment Networks, will leave his position to take on a role outside of Ericsson. Wibergh joined Ericsson in 1996 and has since held a number of executive positions within the company. Since 2008, Wibergh has also

been part of Ericsson’s Executive Leadership Team. Although stepping down from his position immediately, Wibergh will remain available to Ericsson until April 30, 2015 when he formally leaves the company.

Effective January 15, 2015, Hans Vestberg will, in addition to his role as President and CEO, assume the role as Head of Segment Networks.

Ericsson sued Apple for patent infringement to defend fair licensing system

Ericsson announced on February 27, that it had filed two com- plaints with the International Trade Commission (ITC) and seven complaints in the United States District Court for the Eastern Dis- trict of Texas against Apple asserting 41 patents covering many aspects of Apple’s iPhones and iPads after Apple refused Erics- son’s offer to have a court determine fair licensing terms by which both companies would be bound. The patents include standard essential patents related to the 2G and 4G/LTE standards as well as other patents that are critical to features and functionality of Apple devices. Ericsson seeks exclusion orders in the ITC pro-

ceedings and damages and injunctions in the District Court actions.

The global cost and efficiency program

On March 11, Ericsson announced that 2,200 positions in Swe- den, mainly in R&D and Supply, are subject to notice. This is part of the the cost and efficiency program. The program activities in

2015 will mainly target structural improvements in R&D, Service Delivery and Supply globally.The program includes both head- count reductions and savings in external costs across the com- pany’s operations.

As announced at Ericsson’s Capital Markets Day on November

13, 2014, accelerated efficiency measures will run globally through 2017. The program targets savings of approximately SEK 9 b. with full effect during 2017.

Ericsson announced the intention to acquire telecom IT ser- vices business in Mainland China

On March 16, Ericsson announced that it has signed a definitive agreement to acquire the telecom business of Sunrise Technol- ogy, a provider of IT services in the operations and business sup- port systems (OSS & BSS) domain. Sunrise Technology, which is headquartered in Guangzhou, China, will continue to exist as a separate entity—serving customers in sectors other than telecom. The acquisition of Sunrise Technology strengthens Ericsson’s position in OSS & BSS, which is one of the targeted growth areas where Ericsson aims to establish leadership.

Approximately 1,000 employees—almost all of whom are based in Guangzhou—will join Ericsson by Q2 2015, subject to customary closing conditions. The employees have expertise in IT consult- ing; systems integration for charging and billing systems; cus- tomer relationship management; business intelligence/analytics solutions as well as in application development and maintenance.

POST-CLOSING EVENTS Resolutions at the AGM

On April 14, 2015, Ericsson held its AGM in Stockholm. The pro- posed dividend of SEK 3.40 per share was approved by the AGM.

In accordance with the proposal of the Nomination Committee, Leif Johansson was reelected Chairman of the Board of Direc- tors. Roxanne S. Austin, Nora Denzel, Börje Ekholm, Alexander Izosimov, Ulf J. Johansson, Kristin Skogen Lund, Hans Vestberg and Jacob Wallenberg were re-elected to the Board and Anders Nyrén and Sukhinder Singh Cassidy were elected new Board members. In accordance with the Board of Directors’ proposal, the AGM resolved to approve the Guidelines for remuneration to Group management.

Ericsson’s operational and financial risk factors and uncertain- ties along with our strategies and tactics to mitigate risk expo- sures or limit unfavorable outcomes are described in our Annual Report 2014. Compared to the risks described in the Annual Report 2014, no material, new or changed risk factors or uncer- tainties have been identified in the year.

Risk factors and uncertainties in focus short-term for the Parent

Company and the Ericsson Group include:

> Potential negative effects on operators’ willingness to invest in network development due to uncertainty in the financial markets and a weak economic business environment, or reduced consumer telecom spending, or increased pressure on us to provide financing, or delayed auctions of spectrums;

> Uncertainty regarding the financial stability of suppliers, for example due to lack of financing;

> Effects on gross margins and/or working capital of the busi- ness mix in the Networks segment between capacity sales and new coverage build-outs;

> Effects on gross margins of the business mix in the Global Services segment including proportion of new network build- outs and share of new managed services deals with initial transition costs;

> Effects of the ongoing industry consolidation among our cus- tomers as well as between our largest competitors, e.g. with postponed investments and intensified price competition as

a consequence;

> Changes in foreign exchange rates, in particular USD;

> Political unrest or instability in certain markets;

> Effects on production and sales from restrictions with respect

to timely and adequate supply of materials, components and production capacity and other vital services on competitive terms;

> No guarantees that specific restructuring or cost-savings ini- tiatives will be sufficient, successful or executed in time to deliver any improvements in short-term earnings.

Ericsson stringently monitors the compliance with all relevant trade regulations and trade embargos applicable to dealings with customers operating in countries where there are trade restrictions or trade restrictions are discussed. Moreover, Erics- son operates globally in accordance with Group policies and directives for business ethics and conduct.

Stockholm, April 23, 2015

Telefonaktiebolaget LM Ericsson Hans Vestberg, President and CEO Org. Nr. 556016-0680

This report has not been reviewed by Telefonaktiebolaget LM Ericsson’s auditors.

Date for next report: July 17, 2015

Ericsson invites media, investors and analysts to a press con- ference at the Ericsson Studio, Grönlandsgången 4, Stockholm, at 09.00 (CET), April 23, 2015. An analysts, investors and media conference call will begin at 14.00 (CET).

Live webcast of the press conference and conference call as well as supporting slides will be available at www.ericsson.com/press and

www.ericsson.com/investors

Video material will be published during the day on www.ericsson.com/press

For further information, please contact:

Helena Norrman, Senior Vice President, Marketing and

Communications

Phone: +46 10 719 34 72

E-mail: investor.relations@ericsson.com or media.relations@ericsson.com

Telefonaktiebolaget LM Ericsson

Org. number: 556016-0680

Torshamnsgatan 21

SE-164 83 Stockholm Phone: +46 10 719 00 00 www.ericsson.com

Investors

Peter Nyquist, Vice President, Investor Relations

Phone: +46 10 714 64 49, +46 70 575 29 06

E-mail: peter.nyquist@ericsson.com

Stefan Jelvin, Director, Investor Relations

Phone: +46 10 714 20 39, +46 70 986 02 27

E-mail: stefan.jelvin@ericsson.com

Åsa Konnbjer, Director, Investor Relations

Phone: +46 10 713 39 28, +46 73 082 59 28

E-mail: asa.konnbjer@ericsson.com

Rikard Tunedal, Director, Investor Relations

Phone: +46 10 714 54 00, +46 761 005 400

E-mail: rikard.tunedal@ericsson.com

Media

Ola Rembe, Vice President,

Head of External Communications

Phone: +46 10 719 97 27, +46 73 024 48 73

E-mail: media.relations@ericsson.com

Corporate Communications

Phone: +46 10 719 69 92

E-mail: media.relations@ericsson.com

Safe harbor statement

All statements made or incorporated by reference in this release, other than statements or characterizations of historical facts, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projec- tions about our industry, management’s beliefs and certain assumptions made by us. Forward-looking statements can

often be identified by words such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”, “estimates”, “may”, “will”, “should”, “would”, “potential”, “continue”, and varia- tions or negatives of these words, and include, among others, statements regarding: (i) strategies, outlook and growth pros- pects; (ii) positioning to deliver future plans and to realize poten- tial for future growth; (iii) liquidity and capital resources and expenditure, and our credit ratings; (iv) growth in demand for our products and services; (v) our joint venture activities; (vi) eco- nomic outlook and industry trends; (vii) developments of our markets; (viii) the impact of regulatory initiatives; (ix) research

and development expenditures; (x) the strength of our competi- tors; (xi) future cost savings; (xii) plans to launch new products and services; (xiii) assessments of risks; (xiv) integration of acquired businesses; (xv) compliance with rules and regulations and (xvi) infringements of intellectual property rights of others.

In addition, any statements that refer to expectations, projec- tions or other characterizations of future events or circum- stances, including any underlying assumptions, are for-

ward-looking statements. These forward-looking statements speak only as of the date hereof and are based upon the infor- mation available to us at this time. Such information is subject to change, and we will not necessarily inform you of such changes. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are diffi- cult to predict. Therefore, our actual results could differ materi- ally and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference for Ericsson include, but are not limited to: (i) material adverse changes in the markets in which

we operate or in global economic conditions; (ii) increased prod- uct and price competition; (iii) reductions in capital expenditure by network operators; (iv) the cost of technological innovation and increased expenditure to improve quality of service; (v) sig- nificant changes in market share for our principal products and services; (vi) foreign exchange rate or interest rate fluctuations; and (vii) the successful implementation of our business and operational initiatives.

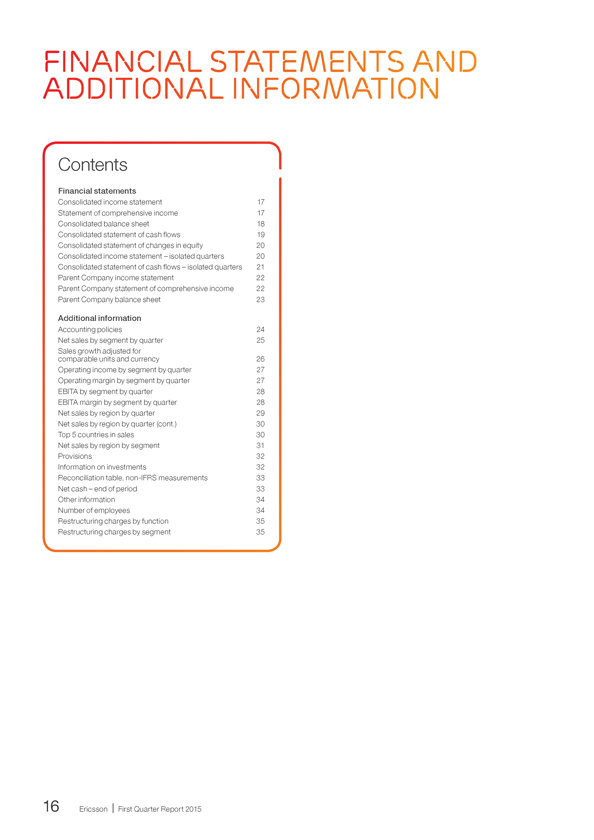

fINANCIAL STATEMENTS AND ADDITIONAL INFORMATION

Contents

Financial statements

Consolidated income statement 17

Statement of comprehensive income 17

Consolidated balance sheet 18

Consolidated statement of cash flows 19

Consolidated statement of changes in equity 20

Consolidated income statement – isolated quarters 20

Consolidated statement of cash flows – isolated quarters 21

Parent Company income statement 22

Parent Company statement of comprehensive income 22

Parent Company balance sheet 23

Additional information

Accounting policies 24

Net sales by segment by quarter 25

Sales growth adjusted for

comparable units and currency 26

Operating income by segment by quarter 27

Operating margin by segment by quarter 27

EBITA by segment by quarter 28

EBITA margin by segment by quarter 28

Net sales by region by quarter 29

Net sales by region by quarter (cont.) 30

Top 5 countries in sales 30

Net sales by region by segment 31

Provisions 32

Information on investments 32

Reconciliation table, non-IFRS measurements 33

Net cash – end of period 33

Other information 34

Number of employees 34

Restructuring charges by function 35

Restructuring charges by segment 35

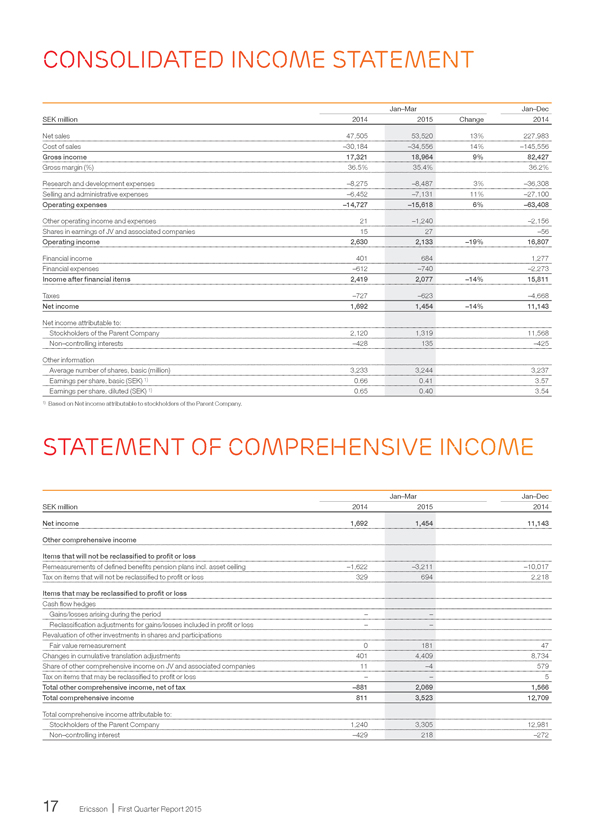

CONSOLIDATED INCOME STATEMENT

Jan–Mar Jan–Dec

SEK million 2014 2015 Change 2014

Net sales 47,505

53,520

13% 227,983

Cost of sales –30,184 –34,556 14% –145,556

Gross income 17,321 18,964 9% 82,427

Gross margin (%) 36.5% 35.4% 36.2%

Research and development expenses –8,275

–8,487

3% –36,308

Selling and administrative expenses –6,452 –7,131 11% –27,100

Operating expenses –14,727 –15,618 6% –63,408

Other operating income and expenses 21

–1,240

–2,156

Shares in earnings of JV and associated companies 15 27 –56

Operating income 2,630 2,133 –19% 16,807

Financial income 401

684

1,277

Financial expenses –612 –740 –2,273

Income after financial items 2,419 2,077 –14% 15,811

Taxes –727

–623

–4,668

Net income 1,692 1,454 –14% 11,143

Net income attributable to:

Stockholders of the Parent Company 2,120 1,319 11,568

Non–controlling interests –428 135 –425

Other information

Average number of shares, basic (million) 3,233 3,244 3,237

Earnings per share, basic (SEK) 1) 0.66 0.41 3.57

Earnings per share, diluted (SEK) 1) 0.65 0.40 3.54

1) Based on Net income attributable to stockholders of the Parent Company.

STATEMENT OF COMPREHENSIVE INCOME

Jan

–Mar Jan–Dec

SEK million 2014 2015 2014

Net income 1,692

1,454

11,143

Other comprehensive income

Items that will not be reclassified to profit or loss

Remeasurements of defined benefits pension plans incl. asset ceiling –1,622 –3,211 –10,017

Tax on items that will not be reclassified to profit or loss 329 694 2,218

Items that may be reclassified to profit or loss

Cash flow hedges

Gains/losses arising during the period – –

Reclassification adjustments for gains/losses included in profit or loss – –

Revaluation of other investments in shares and participations

Fair value remeasurement 0 181 47

Changes in cumulative translation adjustments 401 4,409 8,734

Share of other comprehensive income on JV and associated companies 11 –4 579

Tax on items that may be reclassified to profit or loss – – 5

Total other comprehensive income, net of tax –881 2,069 1,566

Total comprehensive income 811 3,523 12,709

Total comprehensive income attributable to:

Stockholders of the Parent Company 1,240 3,305 12,981

Non–controlling interest –429 218 –272

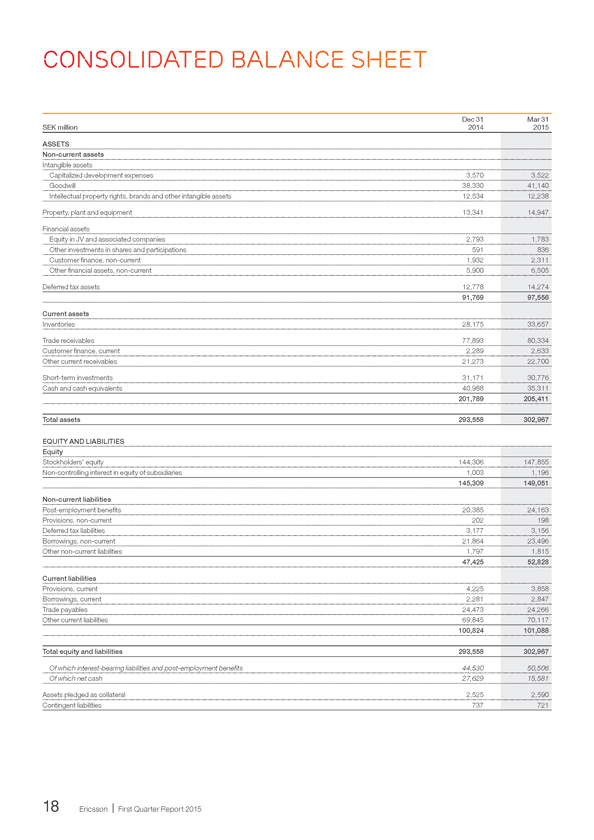

CONSOLIDATED BALANCE SHEET

SEK million

Dec 31

2014

Mar 31

2015

ASSETS

Non-current assets

Intangible assets

Capitalized development expenses 3,570 3,522

Goodwill 38,330 41,140

Intellectual property rights, brands and other intangible assets 12,534 12,238

Property, plant and equipment 13,341

14,947

Financial assets

Equity in JV and associated companies 2,793 1,783

Other investments in shares and participations 591 836

Customer finance, non-current 1,932 2,311

Other financial assets, non-current 5,900 6,505

Deferred tax assets 12,778

14,274

91,769 97,556

Current assets

Inventories 28,175 33,657

Trade receivables 77,893

80,334

Customer finance, current 2,289 2,633

Other current receivables 21,273 22,700

Short-term investments 31,171

30,776

Cash and cash equivalents 40,988 35,311

201,789 205,411

Total assets 293,558 302,967

EQUITY AND LIABILITIES

Consolidated balance sheet

Equity

Stockholders’ equity 144,306

147,855

Non-controlling interest in equity of subsidiaries 1,003

1,196

145,309

149,051

Non-current liabilities

Post-employment benefits 20,385

24,163

Provisions, non-current 202

198

Deferred tax liabilities 3,177

3,156

Borrowings, non-current 21,864

23,496

Other non-current liabilities 1,797

1,815

47,425

52,828

Current liabilities

Provisions, current 4,225

3,858

Borrowings, current 2,281

2,847

Trade payables 24,473

24,266

Other current liabilities 69,845

70,117

100,824

101,088

Total equity and liabilities 293,558

302,967

Of which interest-bearing liabilities and post-employment benefits 44,530

50,506

Of which net cash 27,629

15,581

Assets pledged as collateral 2,525

2,590

Contingent liabilities 737

721

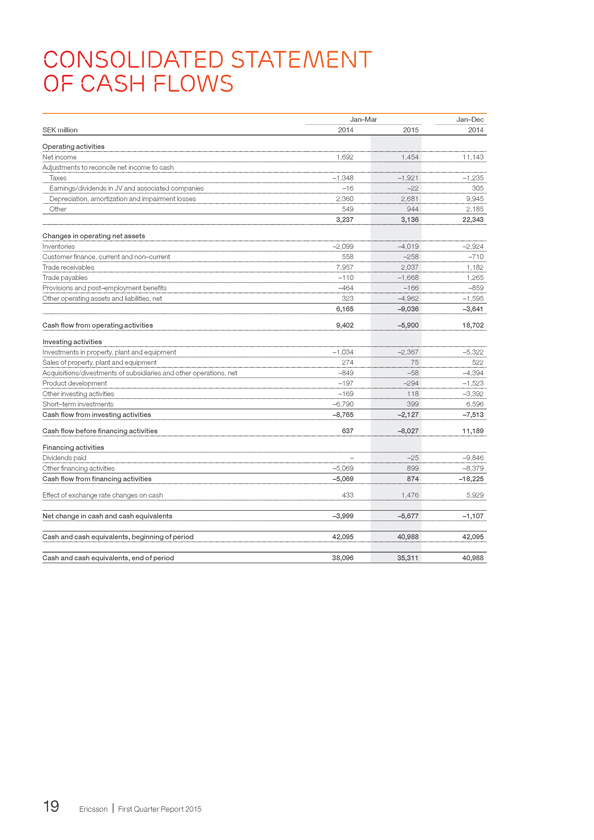

OF CASH FLOWS

Jan–Mar Jan–Dec

2014 2015 2014

SEK million

Operating activities

Net income 1,692 1,454 11,143

Adjustments to reconcile net income to cash

Taxes –1,348 –1,921 –1,235

Earnings/dividends in JV and associated companies –16 –22 305

Depreciation, amortization and impairment losses 2,360 2,681 9,945

Other 549 944 2,185

3,237 3,136 22,343

Changes in operating net assets

Inventories –2,099 –4,019 –2,924

Customer finance, current and non–current 558 –258 –710

Trade receivables 7,957 2,037 1,182

Trade payables –110 –1,668 1,265

Provisions and post–employment benefits –464 –166 –859

Other operating assets and liabilities, net 323 –4,962 –1,595

6,165 –9,036 –3,641

Cash flow from operating activities 9,402

–5,900

18,702

Investing activities

Investments in property, plant and equipment –1,034 –2,367 –5,322

Sales of property, plant and equipment 274 75 522

Acquisitions/divestments of subsidiaries and other operations, net –849 –58 –4,394

Product development –197 –294 –1,523

Other investing activities –169 118 –3,392

Short–term investments –6,790 399 6,596

Cash flow from investing activities –8,765 –2,127 –7,513

Cash flow before financing activities 637

–8,027

11,189

Financing activities

Dividends paid – –25 –9,846

Other financing activities –5,069 899 –8,379

Cash flow from financing activities –5,069 874 –18,225

Effect of exchange rate changes on cash 433

1,476

5,929

Net change in cash and cash equivalents –3,999 –5,677 –1,107

Cash and cash equivalents, beginning of period 42,095 40,988 42,095

Cash and cash equivalents, end of period 38,096 35,311 40,988

CONSOLIDATED STATEMENT

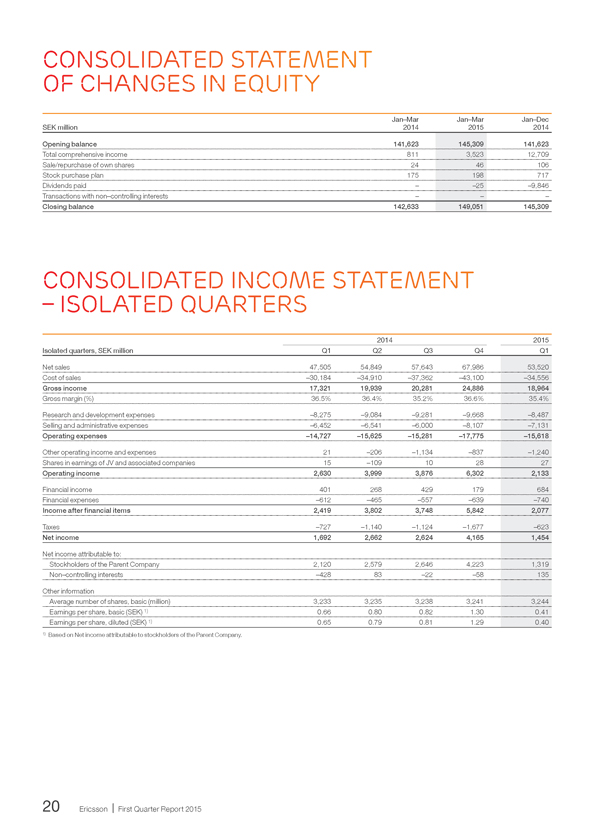

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

SEK million

Jan–Mar

2014

Jan–Mar

2015

Jan–Dec

2014

Opening balance 141,623

145,309

141,623

Total comprehensive income 811 3,523 12,709

Sale/repurchase of own shares 24 46 106

Stock purchase plan 175 198 717

Dividends paid – –25 –9,846

Transactions with non–controlling interests – – –

Closing balance 142,633 149,051 145,309

CONSOLIDATED INCOME STATEMENT

– ISOLATED QUARTERS

Isolated quarters, SEK million

Net sales 47,505 54,849 57,643 67,986

53,520

Cost of sales –30,184 –34,910 –37,362 –43,100 –34,556

Gross income 17,321 19,939 20,281 24,886 18,964

Gross margin (%) 36.5% 36.4% 35.2% 36.6% 35.4%

Research and development expenses –8,275 –9,084 –9,281 –9,668

–8,487

Selling and administrative expenses –6,452 –6,541 –6,000 –8,107 –7,131

Operating expenses –14,727 –15,625 –15,281 –17,775 –15,618

Other operating income and expenses 21 –206 –1,134 –837

–1,240

Shares in earnings of JV and associated companies 15 –109 10 28 27

Operating income 2,630 3,999 3,876 6,302 2,133

Financial income 401 268 429 179

684

Financial expenses –612 –465 –557 –639 –740

Income after financial items 2,419 3,802 3,748 5,842 2,077

Taxes –727 –1,140 –1,124 –1,677

–623

Net income 1,692 2,662 2,624 4,165 1,454

Net income attributable to:

Stockholders of the Parent Company 2,120 2,579 2,646 4,223 1,319

Non–controlling interests –428 83 –22 –58 135

Other information

Average number of shares, basic (million) 3,233 3,235 3,238 3,241 3,244

Earnings per share, basic (SEK) 1) 0.66 0.80 0.82 1.30 0.41

Earnings per share, diluted (SEK) 1) 0.65 0.79 0.81 1.29 0.40

1) Based on Net income attributable to stockholders of the Parent Company.

CONSOLIDATED STATEMENT

20142015

Q1Q2Q3Q4Q1

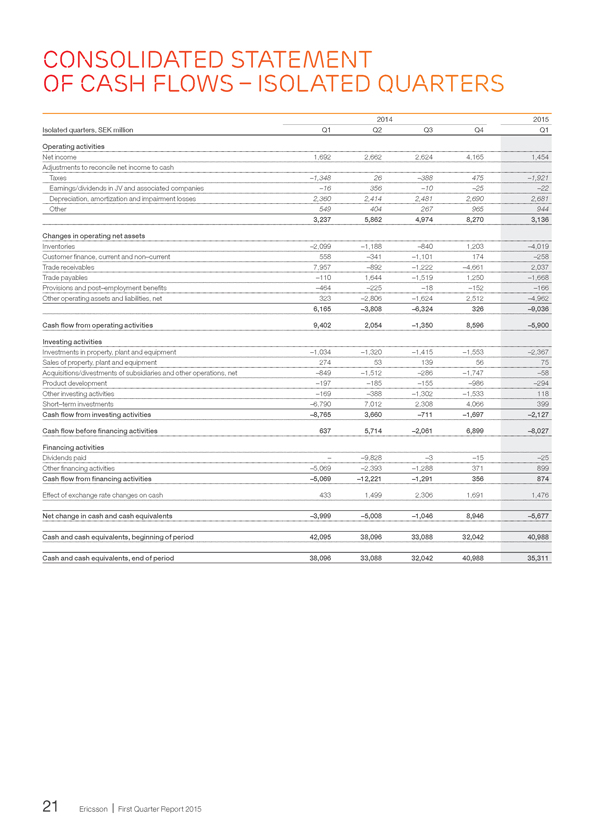

CONSOLIDATED STATEMENT OF CASH FLOWS – ISOLATED QUARTERS

Isolated quarters, SEK million

Operating activities

Net income 1,692 2,662 2,624 4,165 1,454

Adjustments to reconcile net income to cash

Taxes –1,348 26 –388 475 –1,921

Earnings/dividends in JV and associated companies –16 356 –10 –25 –22

Depreciation, amortization and impairment losses 2,360 2,414 2,481 2,690 2,681

Other 549 404 267 965 944

3,237 5,862 4,974 8,270 3,136

Changes in operating net assets

Inventories –2,099 –1,188 –840 1,203 –4,019

Customer finance, current and non–current 558 –341 –1,101 174 –258

Trade receivables 7,957 –892 –1,222 –4,661 2,037

Trade payables –110 1,644 –1,519 1,250 –1,668

Provisions and post–employment benefits –464 –225 –18 –152 –166

Other operating assets and liabilities, net 323 –2,806 –1,624 2,512 –4,962

6,165 –3,808 –6,324 326 –9,036

Cash flow from operating activities 9,402 2,054 –1,350 8,596

–5,900

Investing activities

Investments in property, plant and equipment –1,034 –1,320 –1,415 –1,553 –2,367

Sales of property, plant and equipment 274 53 139 56 75

Acquisitions/divestments of subsidiaries and other operations, net –849 –1,512 –286 –1,747 –58

Product development –197 –185 –155 –986 –294

Other investing activities –169 –388 –1,302 –1,533 118

Short–term investments –6,790 7,012 2,308 4,066 399

Cash flow from investing activities –8,765 3,660 –711 –1,697 –2,127

Cash flow before financing activities 637 5,714 –2,061 6,899

–8,027

Financing activities

Dividends paid – –9,828 –3 –15 –25

Other financing activities –5,069 –2,393 –1,288 371 899

Cash flow from financing activities –5,069 –12,221 –1,291 356 874

Effect of exchange rate changes on cash 433 1,499 2,306 1,691

1,476

Net change in cash and cash equivalents –3,999 –5,008 –1,046 8,946 –5,677

Cash and cash equivalents, beginning of period 42,095 38,096 33,088 32,042 40,988

Cash and cash equivalents, end of period 38,096 33,088 32,042 40,988 35,311

20142015

Q1Q2Q3Q4Q1

CONSOLIDATED STATEMENT

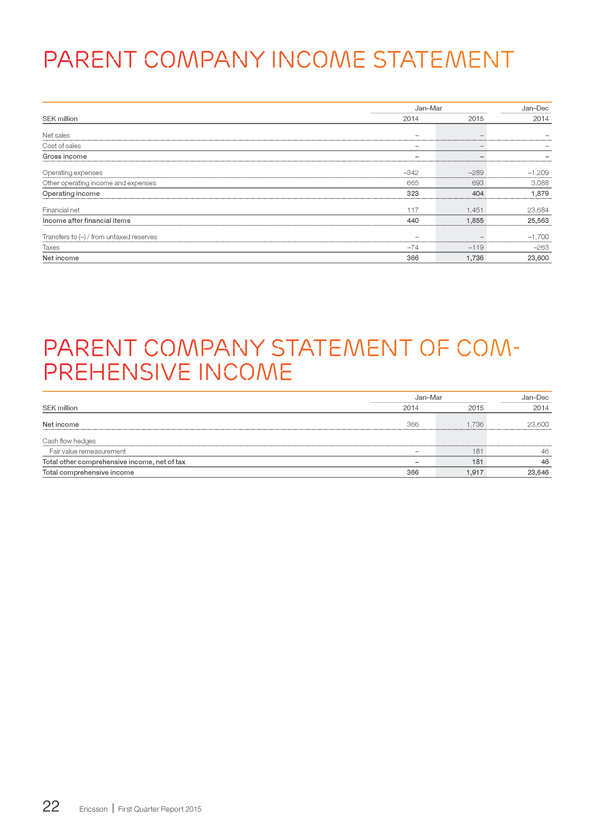

PARENT COMPANY INCOME STATEMENT

SEK million

Net sales –

–

–

Cost of sales – – –

Gross income – – –

Operating expenses –342

–289

–1,209

Other operating income and expenses 665 693 3,088

Operating income 323 404 1,879

Financial net 117

1,451

23,684

Income after financial items 440 1,855 25,563

Transfers to (–) / from untaxed reserves –

–

–1,700

Taxes –74 –119 –263

Net income 366 1,736 23,600

Parent company STATEMENT OF COM- PREHENSIVE INCOME

SEK million

Net income 366

1,736

23,600

Cash flow hedges

Fair value remeasurement – 181 46

Total other comprehensive income, net of tax – 181 46

Total comprehensive income 366 1,917 23,646

Jan–MarJan–Dec

201420152014

Jan–MarJan–Dec

201420152014

PARENT COMPANY INCOME STATEMENT

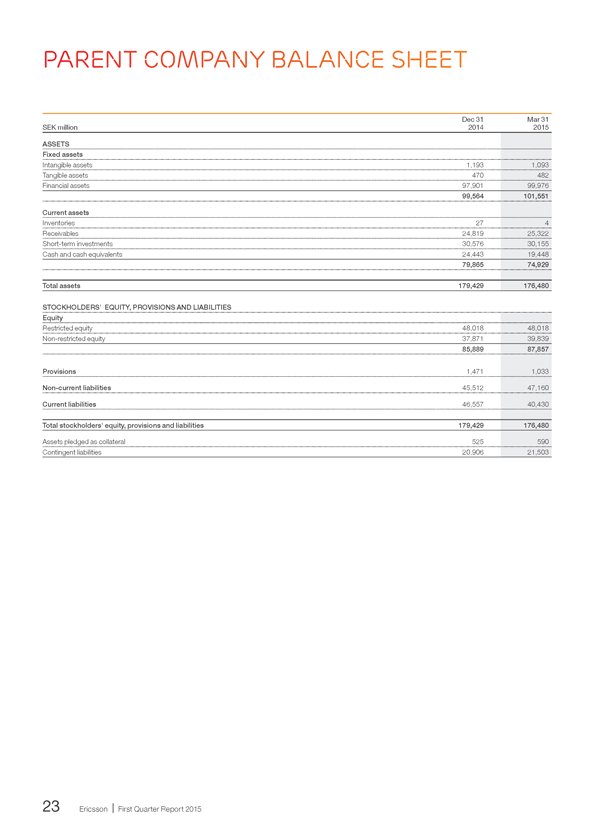

PARENT COMPANY BALANCE SHEET

SEK million

Dec 31

2014

Mar 31

2015

ASSETS

Fixed assets

Intangible assets 1,193 1,093

Tangible assets 470 482

Financial assets 97,901 99,976

99,564 101,551

Current assets

Inventories 27 4

Receivables 24,819 25,322

Short-term investments 30,576 30,155

Cash and cash equivalents 24,443 19,448

79,865 74,929

Total assets 179,429 176,480

STOCKHOLDERS’ EQUITY, PROVISIONS AND LIABILITIES

Equity

Restricted equity 48,018 48,018

Non-restricted equity 37,871 39,839

85,889 87,857

Provisions 1,471

1,033

Non-current liabilities 45,512

47,160

Current liabilities 46,557

40,430

Total stockholders’ equity, provisions and liabilities 179,429 176,480

Assets pledged as collateral 525

590

Contingent liabilities 20,906 21,503

PARENT COMPANY BALANCE SHEET

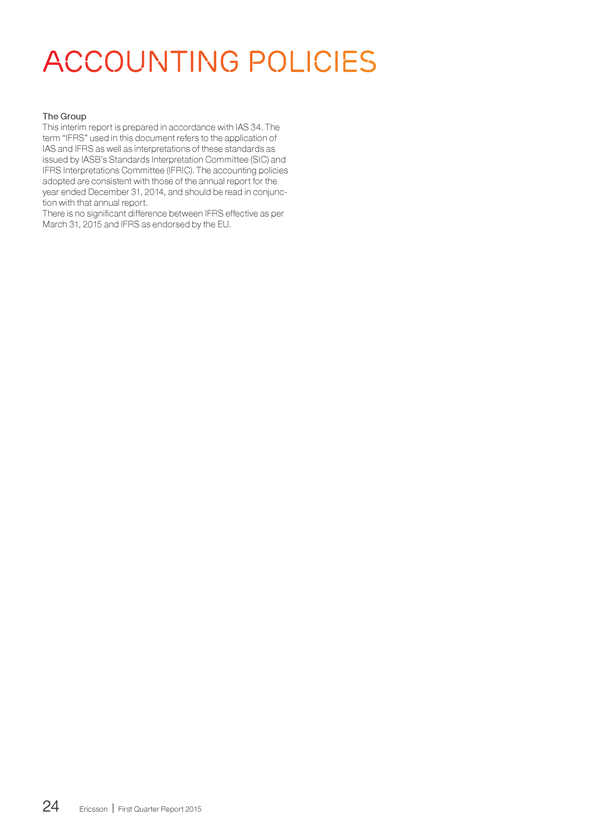

Accounting policies

The Group

This interim report is prepared in accordance with IAS 34. The term “IFRS” used in this document refers to the application of IAS and IFRS as well as interpretations of these standards as issued by IASB’s Standards Interpretation Committee (SIC) and IFRS Interpretations Committee (IFRIC). The accounting policies adopted are consistent with those of the annual report for the year ended December 31, 2014, and should be read in conjunc- tion with that annual report.

There is no significant difference between IFRS effective as per

March 31, 2015 and IFRS as endorsed by the EU.

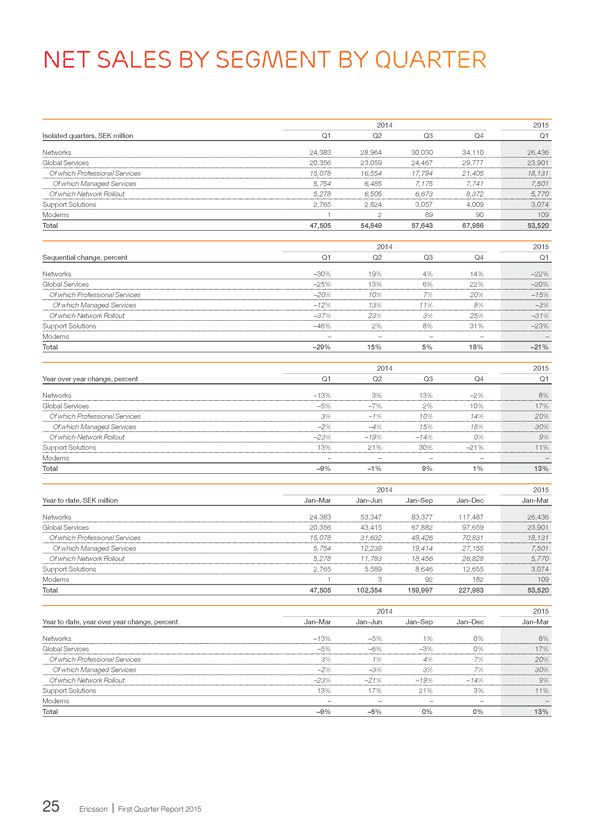

NET SALES BY SEGMENT BY QUARTER

Isolated quarters, SEK million

Networks 24,383 28,964 30,030 34,110

26,436

Global Services 20,356 23,059 24,467 29,777 23,901

Of which Professional Services 15,078 16,554 17,794 21,405 18,131

Of which Managed Services 5,754 6,485 7,175 7,741 7,501

Of which Network Rollout 5,278 6,505 6,673 8,372 5,770

Support Solutions 2,765 2,824 3,057 4,009 3,074

Modems 1 2 89 90 109

Total 47,505 54,849 57,643 67,986 53,520

Sequential change, percent

Networks –30% 19% 4% 14%

–22%

Global Services –25% 13% 6% 22% –20%

Of which Professional Services –20% 10% 7% 20% –15%

Of which Managed Services –12% 13% 11% 8% –3%

Of which Network Rollout –37% 23% 3% 25% –31%

Support Solutions –46% 2% 8% 31% –23%

Modems – – – – –

Total –29% 15% 5% 18% –21%

Year over year change, percent

Networks –13% 3% 13% –2%

8%

Global Services –5% –7% 2% 10% 17%

Of which Professional Services 3% –1% 10% 14% 20%

Of which Managed Services –2% –4% 15% 18% 30%

Of which Network Rollout –23% –19% –14% 0% 9%

Support Solutions 13% 21% 30% –21% 11%

Modems – – – – –

Total –9% –1% 9% 1% 13%

Year to date, SEK million

Networks 24,383 53,347 83,377 117,487

26,436

Global Services 20,356 43,415 67,882 97,659 23,901

Of which Professional Services 15,078 31,632 49,426 70,831 18,131

Of which Managed Services 5,754 12,239 19,414 27,155 7,501

Of which Network Rollout 5,278 11,783 18,456 26,828 5,770

Support Solutions 2,765 5,589 8,646 12,655 3,074

Modems 1 3 92 182 109

Total 47,505 102,354 159,997 227,983 53,520

Year to date, year over year change, percent

Networks –13% –5% 1% 0%

8%

Global Services –5% –6% –3% 0% 17%

Of which Professional Services 3% 1% 4% 7% 20%

Of which Managed Services –2% –3% 3% 7% 30%

Of which Network Rollout –23% –21% –19% –14% 9%

Support Solutions 13% 17% 21% 3% 11%

Modems – – – – –

Total –9% –5% 0% 0% 13%

20142015Q1Q2Q3Q4Q1

20142015

Q1Q2Q3Q4Q1

20142015

Q1Q2Q3Q4Q1

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

26

Ericsson | First Quarter Report 2015

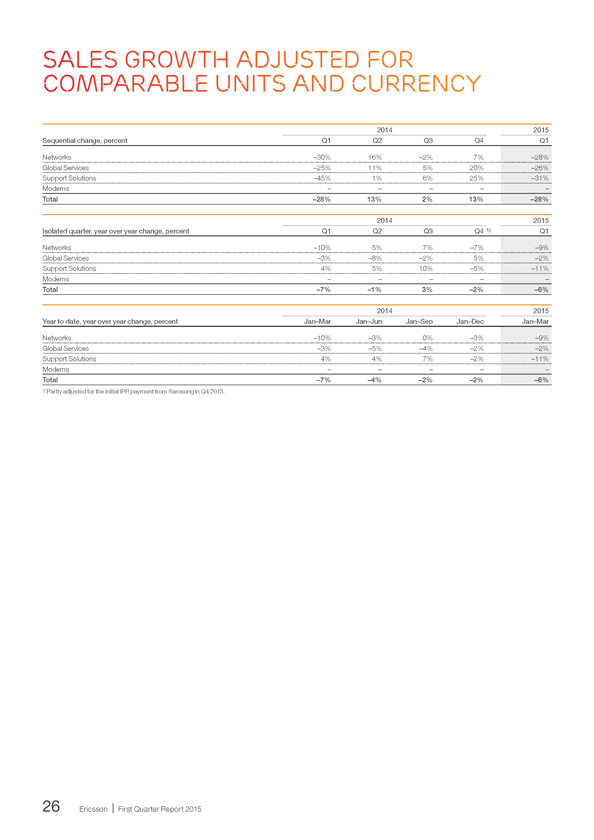

SALES GROWTH ADJUSTED FOR COMPARABLE UNITS AND CURRENCY

Sequential change, percent

Networks –30% 16% –2% 7%

–28%

Global Services –25% 11% 5% 20% –26%

Support Solutions –45% 1% 6% 25% –31%

Modems – – – – –

Total –28% 13% 2% 13% –28%

Isolated quarter, year over year change, percent

Networks –10% 5% 7% –7%

–9%

Global Services –3% –8% –2% 5% –2%

Support Solutions 4% 5% 10% –5% –11%

Modems – – – – –

Total –7% –1% 3% –2% –6%

Year to date, year over year change, percent

Networks –10% –3% 0% –3%

–9%

Global Services –3% –5% –4% –2% –2%

Support Solutions 4% 4% 7% –2% –11%

Modems – – – – –

Total –7% –4% –2% –2% –6%

1) Partly adjusted for the initial IPR payment from Samsung in Q4 2013.

20142015

Q1Q2Q3Q4Q1

20142015

Q1Q2Q3Q4 1)Q1

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

26

Ericsson | First Quarter Report 2015

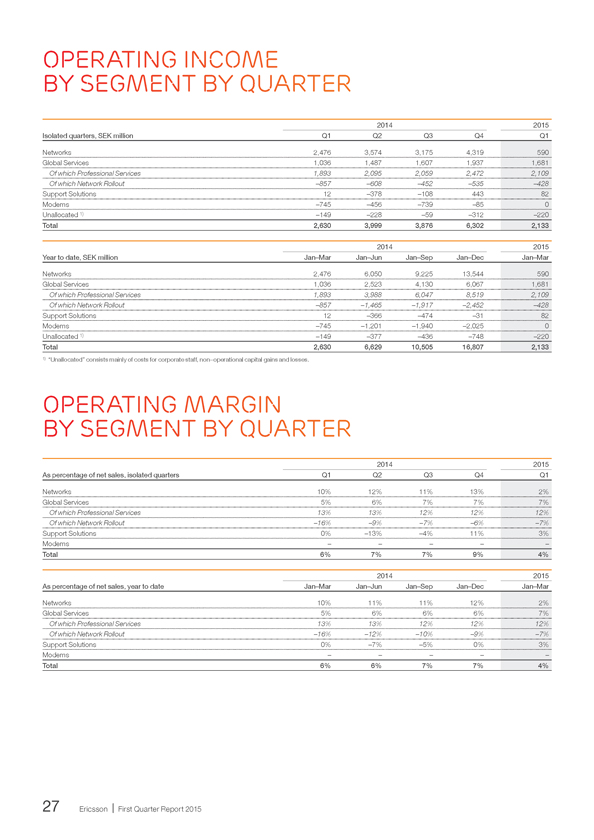

OPERATING INCOME

BY SEGMENT BY QUARTER

2014 2015

Isolated quarters, SEK million Q1 Q2 Q3 Q4 Q1

Networks 2,476 3,574 3,175 4,319

590

Global Services 1,036 1,487 1,607 1,937 1,681

Of which Professional Services 1,893 2,095 2,059 2,472 2,109

Of which Network Rollout –857 –608 –452 –535 –428

Support Solutions 12 –378 –108 443 82

Modems –745 –456 –739 –85 0

Unallocated 1) –149 –228 –59 –312 –220

Total 2,630 3,999 3,876 6,302 2,133

Year to date, SEK million

Networks 2,476 6,050 9,225 13,544

590

Global Services 1,036 2,523 4,130 6,067 1,681

Of which Professional Services 1,893 3,988 6,047 8,519 2,109

Of which Network Rollout –857 –1,465 –1,917 –2,452 –428

Support Solutions 12 –366 –474 –31 82

Modems

–745 –1,201 –1,940 –2,025 0

Unallocated 1) –149 –377 –436 –748 –220

Total 2,630 6,629 10,505 16,807 2,133

1) “Unallocated” consists mainly of costs for corporate staff, non–operational capital gains and losses.

OPERATING margin

BY SEGMENT BY QUARTER

As percentage of net sales, isolated quarters

Networks 10% 12% 11% 13%

2%

Global Services 5% 6% 7% 7% 7%

Of which Professional Services 13% 13% 12% 12% 12%

Of which Network Rollout –16% –9% –7% –6% –7%

Support Solutions 0% –13% –4% 11% 3%

Modems – – – – –

Total 6% 7% 7% 9% 4%

Networks 10% 11% 11% 12%

2%

Global Services 5% 6% 6% 6%

7%

Of which Professional Services 13% 13% 12% 12%

12%

Of which Network Rollout –16% –12% –10% –9%

–7%

Support Solutions 0% –7% –5% 0%

3%

Modems – – – –

–

Total 6% 6% 7% 7%

4%

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

20142015

Q1Q2Q3Q4Q1

2014

2015

Jan–Mar

Jan–Jun

Jan–Sep

Jan–Dec

Jan–Mar

28

Ericsson | First Quarter Report 2015

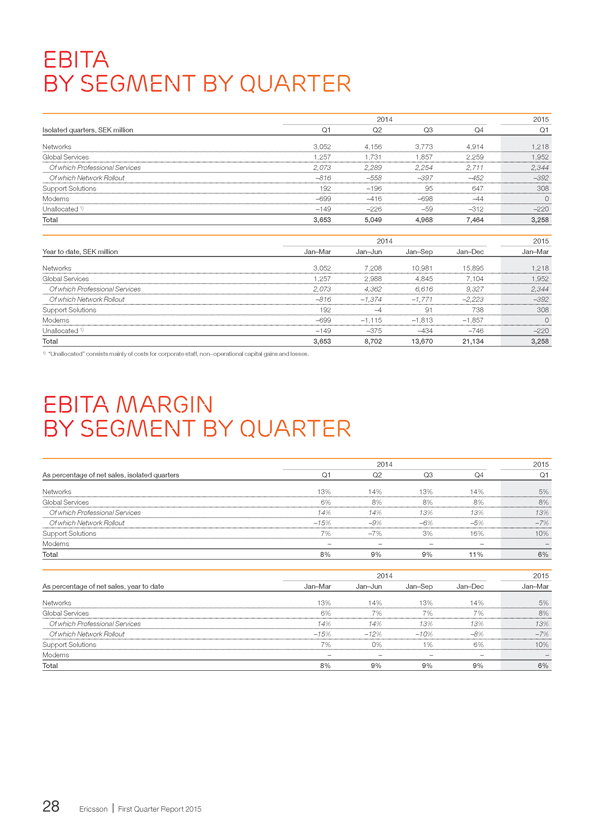

EBITA

BY SEGMENT BY QUARTER

2014 2015

Isolated quarters, SEK million Q1 Q2 Q3 Q4 Q1

Networks 3,052 4,156 3,773 4,914

1,218

Global Services 1,257 1,731 1,857 2,259 1,952

Of which Professional Services 2,073 2,289 2,254 2,711 2,344

Of which Network Rollout –816 –558 –397 –452 –392

Support Solutions 192 –196 95 647 308

Modems –699 –416 –698 –44 0

Unallocated 1) –149 –226 –59 –312 –220

Total 3,653 5,049 4,968 7,464 3,258

Year to date, SEK million

Networks 3,052 7,208 10,981 15,895

1,218

Global Services 1,257 2,988 4,845 7,104 1,952

Of which Professional Services 2,073 4,362 6,616 9,327 2,344

Of which Network Rollout –816 –1,374 –1,771 –2,223 –392

Support Solutions 192 –4 91 738 308

Modems –699 –1,115 –1,813 –1,857 0

Unallocated 1) –149 –375 –434 –746 –220

Total 3,653 8,702 13,670 21,134 3,258

1) “Unallocated” consists mainly of costs for corporate staff, non–operational capital gains and losses.

EBITA MARGIN

BY SEGMENT BY QUARTER

As percentage of net sales, isolated quarters

Networks 13% 14% 13% 14%

5%

Global Services 6% 8% 8% 8% 8%

Of which Professional Services 14% 14% 13% 13% 13%

Of which Network Rollout –15% –9% –6% –5% –7%

Support Solutions 7% –7% 3% 16% 10%

Modems – – – – –

Total 8% 9% 9% 11% 6%

As percentage of net sales, year to date

Networks 13% 14% 13% 14%

5%

Global Services 6% 7% 7% 7% 8%

Of which Professional Services 14% 14% 13% 13% 13%

Of which Network Rollout –15% –12% –10% –8% –7%

Support Solutions 7% 0% 1% 6% 10%

Modems – – – – –

Total 8% 9% 9% 9% 6%

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

20142015

Q1Q2Q3Q4Q1

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

31

Ericsson | First Quarter Report 2015

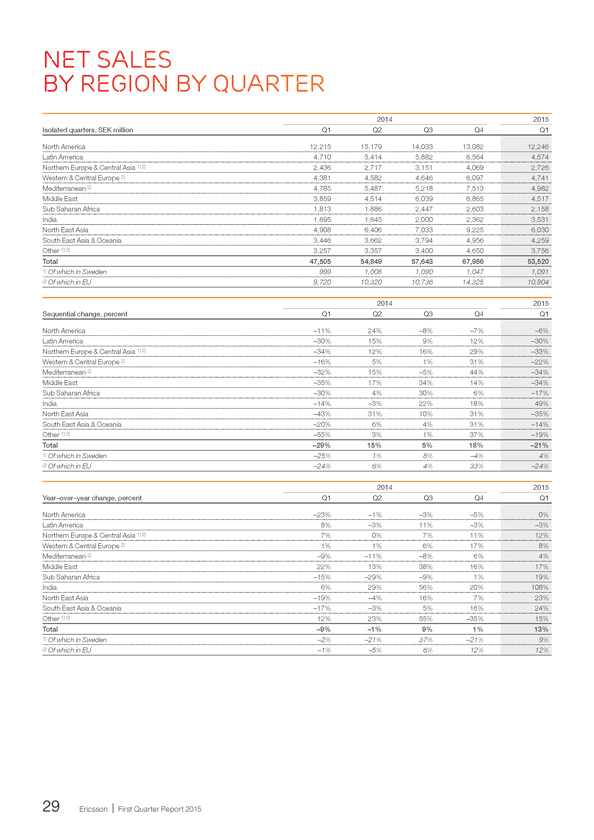

NET SALES BY REGION BY QUARTER

Isolated quarters, SEK million

North America 12,215 15,179 14,033 13,082

12,246

Latin America 4,710 5,414 5,882 6,564 4,574

Northern Europe & Central Asia 1) 2) 2,436 2,717 3,151 4,069 2,726

Western & Central Europe 2) 4,381 4,582 4,646 6,097 4,741

Mediterranean 2) 4,785 5,487 5,218 7,513 4,982

Middle East 3,859 4,514 6,039 6,865 4,517

Sub Saharan Africa 1,813 1,886 2,447 2,603 2,158

India 1,695 1,645 2,000 2,362 3,531

North East Asia 4,908 6,406 7,033 9,225 6,030

South East Asia & Oceania 3,446 3,662 3,794 4,956 4,259

Other 1) 2) 3,257 3,357 3,400 4,650 3,756

Total 47,505 54,849 57,643 67,986 53,520

1) Of which in Sweden 999 1,008 1,090 1,047 1,091

2) Of which in EU 9,720 10,320 10,736 14,325 10,904

Sequential change, percent

North America –11% 24% –8% –7%

–6%

Latin America –30% 15% 9% 12% –30%

Northern Europe & Central Asia 1) 2) –34% 12% 16% 29% –33%

Western & Central Europe 2) –16% 5% 1% 31% –22%

Mediterranean 2) –32% 15% –5% 44% –34%

Middle East –35% 17% 34% 14% –34%

Sub Saharan Africa –30% 4% 30% 6% –17%

India –14% –3% 22% 18% 49%

North East Asia –43% 31% 10% 31% –35%

South East Asia & Oceania –20% 6% 4% 31% –14%

Other 1) 2) –55% 3% 1% 37% –19%

Total –29% 15% 5% 18% –21%

1) Of which in Sweden –25% 1% 8% –4% 4%

2) Of which in EU –24% 6% 4% 33% –24%

Year–over–year change, percent

North America –23% –1% –3% –5%

0%

Latin America 8% –3% 11% –3% –3%

Northern Europe & Central Asia 1) 2) 7% 0% 7% 11% 12%

Western & Central Europe 2) 1% 1% 6% 17% 8%

Mediterranean 2) –9% –11% –8% 6% 4%

Middle East 22% 13% 38% 16% 17%

Sub Saharan Africa –15% –29% –9% 1% 19%

India 6% 29% 56% 20% 108%

North East Asia –19% –4% 16% 7% 23%

South East Asia & Oceania –17% –3% 5% 16% 24%

Other 1) 2) 12% 23% 55% –35% 15%

Total –9% –1% 9% 1% 13%

1) Of which in Sweden –2% –21% 37% –21% 9%

2) Of which in EU –1% –5% 6% 12% 12%

20142015

Q1Q2Q3Q4Q1

20142015

Q1Q2Q3Q4Q1

20142015

Q1Q2Q3Q4Q1

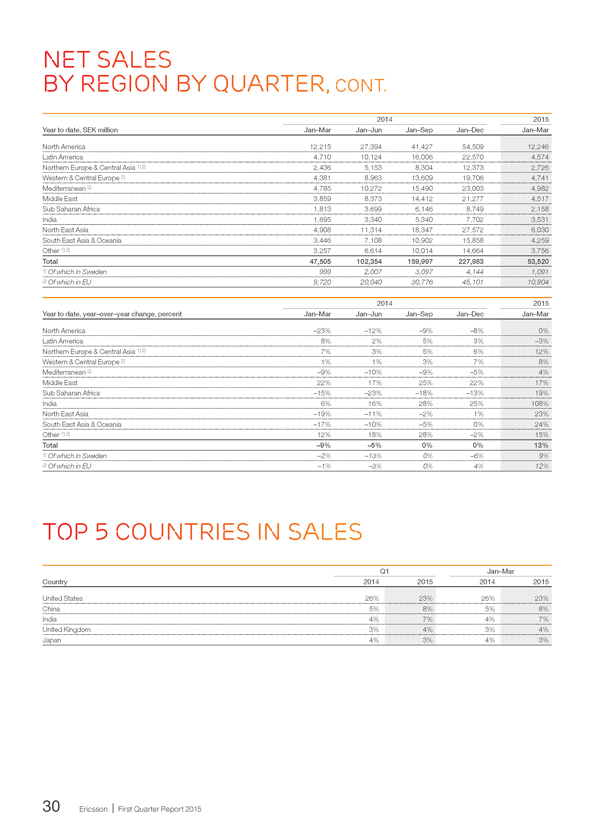

NET SALES

BY REGION BY QUARTER, cont.

Year to date, SEK million

North America 12,215 27,394 41,427 54,509

12,246

Latin America 4,710 10,124 16,006 22,570 4,574

Northern Europe & Central Asia 1) 2) 2,436 5,153 8,304 12,373 2,726

Western & Central Europe 2) 4,381 8,963 13,609 19,706 4,741

Mediterranean 2) 4,785 10,272 15,490 23,003 4,982

Middle East 3,859 8,373 14,412 21,277 4,517

Sub Saharan Africa 1,813 3,699 6,146 8,749 2,158

India 1,695 3,340 5,340 7,702 3,531

North East Asia 4,908 11,314 18,347 27,572 6,030

South East Asia & Oceania 3,446 7,108 10,902 15,858 4,259

Other 1) 2) 3,257 6,614 10,014 14,664 3,756

Total 47,505 102,354 159,997 227,983 53,520

1) Of which in Sweden 999 2,007 3,097 4,144 1,091

2) Of which in EU 9,720 20,040 30,776 45,101 10,904

Year to date, year–over–year change, percent

North America –23% –12% –9% –8%

0%

Latin America 8% 2% 5% 3% –3%

Northern Europe & Central Asia 1) 2) 7% 3% 5% 6% 12%

Western & Central Europe 2) 1% 1% 3% 7% 8%

Mediterranean 2) –9% –10% –9% –5% 4%

Middle East 22% 17% 25% 22% 17%

Sub Saharan Africa –15% –23% –18% –13% 19%

India 6% 16% 28% 25% 108%

North East Asia –19% –11% –2% 1% 23%

South East Asia & Oceania –17% –10% –5% 0% 24%

Other 1) 2) 12% 18% 28% –2% 15%

Total –9% –5% 0% 0% 13%

1) Of which in Sweden –2% –13% 0% –6% 9%

2) Of which in EU –1% –3% 0% 4% 12%

TOP 5 COUNTRIES IN SALES

Q1 Jan–Mar

Country 2014 2015 2014 2015

United States 26%

23%

26%

23%

China 5% 8% 5% 8%

India 4% 7% 4% 7%

United Kingdom 3% 4% 3% 4%

Japan 4% 3% 4% 3%

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

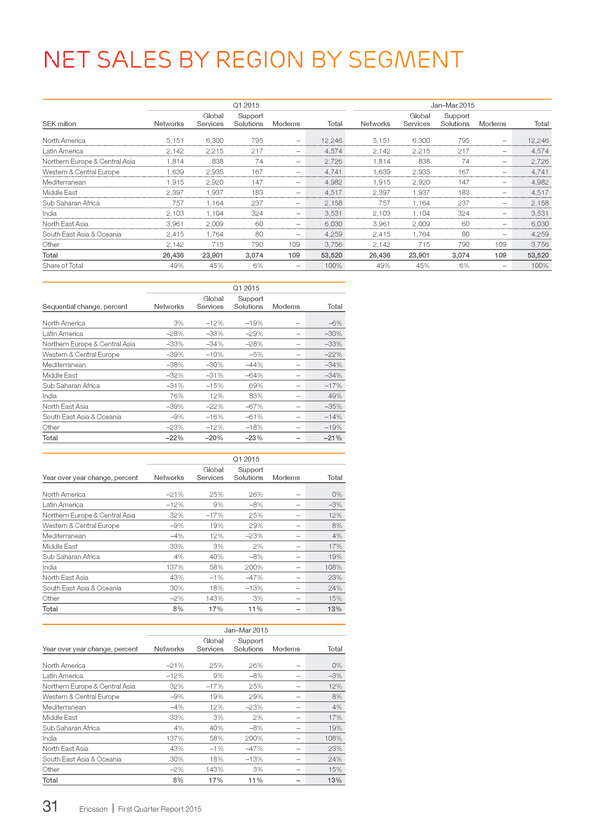

NET SALES

40

Ericsson | First Quarter Report 2015

NET SALES BTY REGION BY SEGMENT

Q1 2015 Jan–Mar 2015

SEK milion Networks

Global

Services

Support

Solutions Modems Total Networks

Global

Services

Support

Solutions Modems Total

North America 5,151 6,300 795 –

12,246

5,151 6,300 795 –

12,246

Latin America 2,142 2,215 217 – 4,574 2,142 2,215 217 – 4,574

Northern Europe & Central Asia 1,814 838 74 – 2,726 1,814 838 74 – 2,726

Western & Central Europe 1,639 2,935 167 – 4,741 1,639 2,935 167 – 4,741

Mediterranean 1,915 2,920 147 – 4,982 1,915 2,920 147 – 4,982

Middle East 2,397 1,937 183 – 4,517 2,397 1,937 183 – 4,517

Sub Saharan Africa 757 1,164 237 – 2,158 757 1,164 237 – 2,158

India 2,103 1,104 324 – 3,531 2,103 1,104 324 – 3,531

North East Asia 3,961 2,009 60 – 6,030 3,961 2,009 60 – 6,030

South East Asia & Oceania 2,415 1,764 80 – 4,259 2,415 1,764 80 – 4,259

Other 2,142 715 790 109 3,756 2,142 715 790 109 3,756

Total 26,436 23,901 3,074 109 53,520 26,436 23,901 3,074 109 53,520

Share of Total 49% 45% 6% – 100% 49% 45% 6% – 100%

Sequential change, percent Networks

Global

Services

Q1 2015

Support

Solutions Modems Total

North America 3% –12% –19% –

–6%

Latin America –28% –33% –29% – –30%

Northern Europe & Central Asia –33% –34% –28% – –33%

Western & Central Europe –39% –10% –5% – –22%

Mediterranean –38% –30% –44% – –34%

Middle East –32% –31% –64% – –34%

Sub Saharan Africa –31% –15% 69% – –17%

India 76% 12% 83% – 49%

North East Asia –39% –22% –67% – –35%

South East Asia & Oceania –9% –16% –61% – –14%

Other –23% –12% –18% – –19%

Total –22% –20% –23% – –21%

Year over year change, percent Networks

Global

Services

Q1 2015

Support

Solutions Modems Total

North America –21% 25% 26% –

0%

Latin America –12% 9% –8% – –3%

Northern Europe & Central Asia 32% –17% 25% – 12%

Western & Central Europe –9% 19% 29% – 8%

Mediterranean –4% 12% –23% – 4%

Middle East 33% 3% 2% – 17%

Sub Saharan Africa 4% 40% –8% – 19%

India 137% 58% 200% – 108%

North East Asia 43% –1% –47% – 23%

South East Asia & Oceania 30% 18% –13% – 24%

Other –2% 143% 3% – 15%

Total 8% 17% 11% – 13%

Year over year change, percent Networks

Global

Services

Jan–Mar 2015

Support

Solutions Modems Total

North America –21% 25% 26% –

0%

Latin America –12% 9% –8% – –3%

Northern Europe & Central Asia 32% –17% 25% – 12%

Western & Central Europe –9% 19% 29% – 8%

Mediterranean –4% 12% –23% – 4%

Middle East 33% 3% 2% – 17%

Sub Saharan Africa 4% 40% –8% – 19%

India 137% 58% 200% – 108%

North East Asia 43% –1% –47% – 23%

South East Asia & Oceania 30% 18% –13% – 24%

Other –2% 143% 3% – 15%

Total 8% 17% 11% – 13%

NET SALES BY REGION BY segment

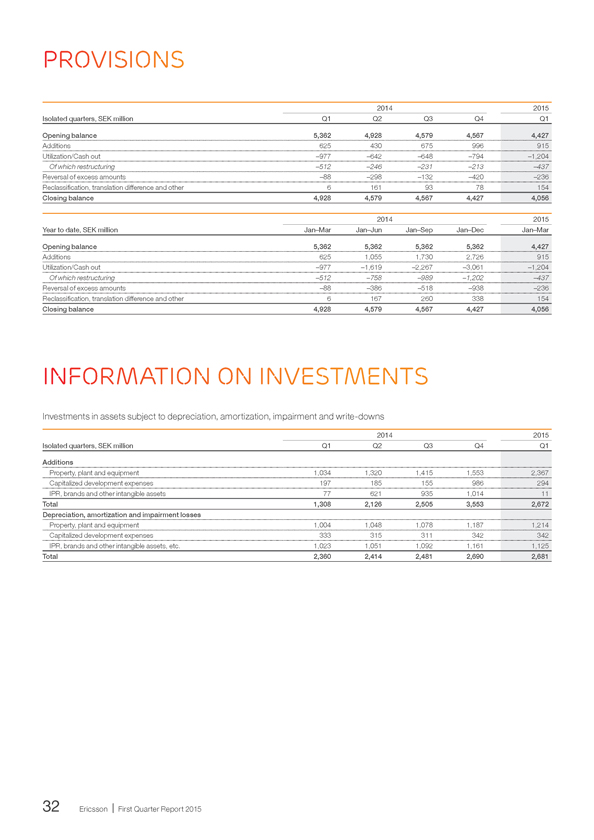

PROVISIONS

Isolated quarters, SEK million

Opening balance 5,362 4,928 4,579 4,567

4,427

Additions 625 430 675 996 915

Utilization/Cash out –977 –642 –648 –794 –1,204

Of which restructuring –512 –246 –231 –213 –437

Reversal of excess amounts –88 –298 –132 –420 –236

Reclassification, translation difference and other 6 161 93 78 154

Closing balance 4,928 4,579 4,567 4,427 4,056

Year to date, SEK million

Opening balance 5,362 5,362 5,362 5,362

4,427

Additions 625 1,055 1,730 2,726 915

Utilization/Cash out –977 –1,619 –2,267 –3,061 –1,204

Of which restructuring –512 –758 –989 –1,202 –437

Reversal of excess amounts –88 –386 –518 –938 –236

Reclassification, translation difference and other 6 167 260 338 154

Closing balance 4,928 4,579 4,567 4,427 4,056

information on INVESTMENTS

Investments in assets subject to depreciation, amortization, impairment and write-downs

Isolated quarters, SEK million

Additions

Property, plant and equipment 1,034 1,320 1,415 1,553 2,367

Capitalized development expenses 197 185 155 986 294

IPR, brands and other intangible assets 77 621 935 1,014 11

Total 1,308 2,126 2,505 3,553 2,672

Depreciation, amortization and impairment losses

Property, plant and equipment 1,004 1,048 1,078 1,187 1,214

Capitalized development expenses 333 315 311 342 342

IPR, brands and other intangible assets, etc. 1,023 1,051 1,092 1,161 1,125

Total 2,360 2,414 2,481 2,690 2,681

20142015

Q1Q2Q3Q4Q1

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

20142015

Q1Q2Q3Q4Q1

PROVISIONS

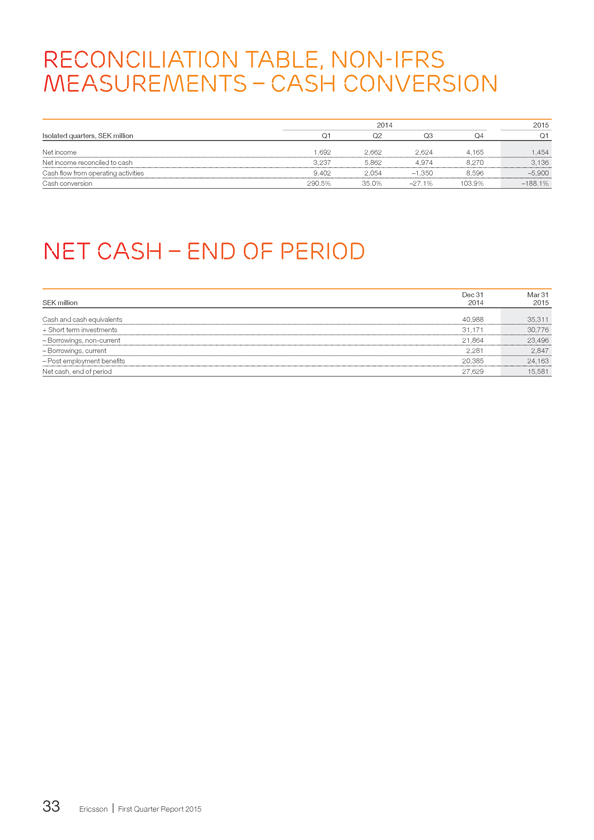

RECONCILIATION TABLE, NON-IFRS MEASUREMENTS – CASH CONVERSION

Isolated quarters, SEK million

Net income 1,692 2,662 2,624 4,165

1,454

Net income reconciled to cash 3,237 5,862 4,974 8,270 3,136

Cash flow from operating activities 9,402 2,054 –1,350 8,596 –5,900

Cash conversion 290.5% 35.0% –27.1% 103.9% –188.1%

net cash – end of period

SEK million

Dec 31

2014

Mar 31

2015

Cash and cash equivalents 40,988

35,311

+ Short term investments 31,171 30,776

– Borrowings, non-current 21,864 23,496

– Borrowings, current

2,281 2,847

– Post employment benefits 20,385 24,163

Net cash, end of period 27,629 15,581

20142015Q1Q2Q3Q4Q1

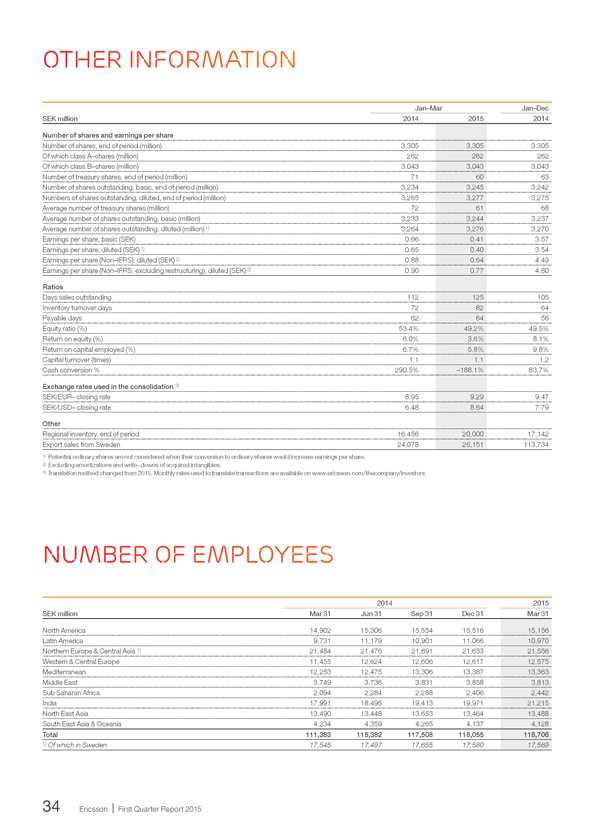

OTHER INFORMATION

SEK million

Number of shares and earnings per share

Number of shares, end of period (million) 3,305 3,305 3,305

Of which class A–shares (million) 262 262 262

Of which class B–shares (million) 3,043 3,043 3,043

Number of treasury shares, end of period (million) 71 60 63

Number of shares outstanding, basic, end of period (million) 3,234 3,245 3,242

Numbers of shares outstanding, diluted, end of period (million) 3,265 3,277 3,275

Average number of treasury shares (million) 72 61 68

Average number of shares outstanding, basic (million) 3,233 3,244 3,237

Average number of shares outstanding, diluted (million) 1) 3,264 3,276 3,270

Earnings per share, basic (SEK) 0.66 0.41 3.57

Earnings per share, diluted (SEK) 1) 0.65 0.40 3.54

Earnings per share (Non–IFRS), diluted (SEK) 2) 0.88 0.64 4.49

Earnings per share (Non–IFRS, excluding restructuring), diluted (SEK) 2) 0.90 0.77 4.80

Ratios

Days sales outstanding 112 125 105

Inventory turnover days 72 82 64

Payable days 62 64 56

Equity ratio (%) 53.4% 49.2% 49.5%

Return on equity (%) 6.0% 3.6% 8.1%

Return on capital employed (%) 6.7% 5.8% 9.8%

Capital turnover (times) 1.1 1.1 1.2

Cash conversion % 290.5% –188.1% 83.7%

Exchange rates used in the consolidation 3)

SEK/EUR– closing rate 8.95 9.29 9.47

SEK/USD– closing rate 6.48 8.64 7.79

Other

Regional inventory, end of period 16,456 20,000 17,142

Export sales from Sweden 24,078 26,151 113,734

1) Potential ordinary shares are not considered when their conversion to ordinary shares would increase earnings per share.

2) Excluding amortizations and write–downs of acquired intangibles.

3) Translation method changed from 2015. Monthly rates used to translate transactions are available on www.ericsson.com/thecompany/investors

NUMBER OF EMPLOYEES

SEK million

North America 14,902 15,306 15,554 15,516

15,156

Latin America 9,731 11,179 10,901 11,066 10,970

Northern Europe & Central Asia 1) 21,484 21,476 21,691 21,633 21,556

Western & Central Europe 11,455 12,624 12,606 12,617 12,575

Mediterranean 12,253 12,475 13,306 13,387 13,363

Middle East 3,749 3,736 3,831 3,858 3,813

Sub Saharan Africa 2,094 2,284 2,288 2,406 2,442

India 17,991 18,495 19,413 19,971 21,215

North East Asia 13,490 13,448 13,653 13,464 13,488

South East Asia & Oceania 4,234 4,359 4,265 4,137 4,128

Total 111,383 115,382 117,508 118,055 118,706

1) Of which in Sweden 17,545 17,497 17,655 17,580 17,569

Jan–MarJan–Dec

201420152014

20142015

Mar 31Jun 31Sep 31Dec 31Mar 31

OTHER INFORMATIOn

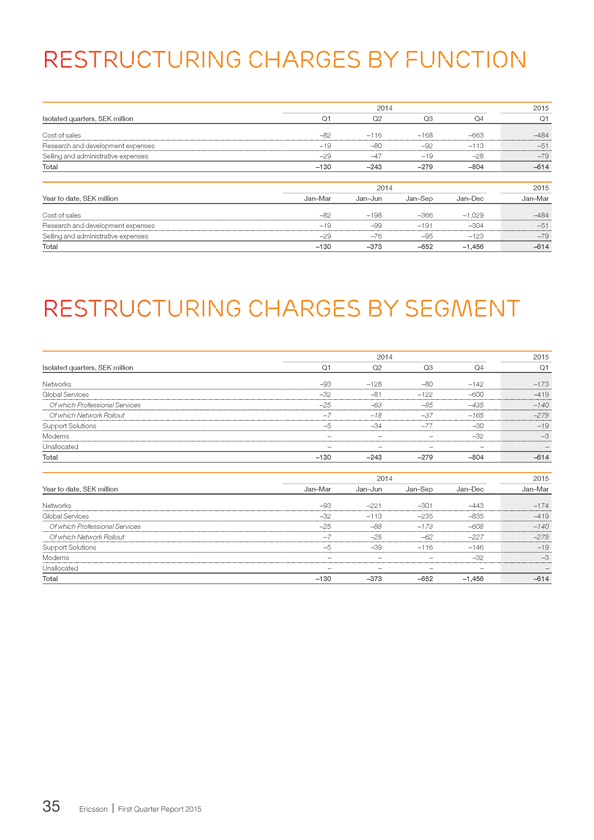

RESTRUCTURING CHAREGES BY FUNCTION

Isolated quarters, SEK million

Cost of sales –82 –116 –168 –663

–484

Research and development expenses –19 –80 –92 –113 –51

Selling and administrative expenses –29 –47 –19 –28 –79

Total –130 –243 –279 –804 –614

Year to date, SEK million

Cost of sales –82 –198 –366 –1,029

–484

Research and development expenses –19 –99 –191 –304 –51

Selling and administrative expenses –29 –76 –95 –123 –79

Total –130 –373 –652 –1,456 –614

RESTRUCTURING CHARGES BY SEGMENt

Isolated quarters, SEK million

Networks –93 –128 –80 –142

–173

Global Services –32 –81 –122 –600 –419

Of which Professional Services –25 –63 –85 –435 –140

Of which Network Rollout –7 –18 –37 –165 –279

Support Solutions –5 –34 –77 –30 –19

Modems – – – –32 –3

Unallocated – – – – –

Total –130 –243 –279 –804 –614

Year to date, SEK million

Networks –93 –221 –301 –443

–174

Global Services –32 –113 –235 –835 –419

Of which Professional Services –25 –88 –173 –608 –140

Of which Network Rollout –7 –25 –62 –227 –279

Support Solutions –5 –39 –116 –146 –19

Modems – – – –32 –3

Unallocated – – – – –

Total –130 –373 –652 –1,456 –614

20142015

Q1Q2Q3Q4Q1

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

20142015

Q1Q2Q3Q4Q1

20142015

Jan–MarJan–JunJan–SepJan–DecJan–Mar

RESTRUCTURING CHARGES BY FUNCTION