SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

July 17, 2015

LM ERICSSON TELEPHONE COMPANY

(Translation of registrant’s name into English)

Torshamnsgatan 21, Kista

SE-164 83, Stockholm, Sweden

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Announcement of LM Ericsson Telephone Company, dated July17, 2015 regarding “Second Quarter Report 2015”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TELEFONAKTIEBOLAGET LM ERICSSON (publ) | ||

| By: | /S/NINAMACPHERSON | |

| Nina Macpherson | ||

| Senior Vice President and | ||

| General Counsel | ||

| By: | /S/HELENANORRMAN | |

| Helena Norrman | ||

| Senior Vice President | ||

| Corporate Communications |

Date:July 17, 2015

ERICSSON

SECOND QUARTER REPORT 2015

Stockholm, July 17, 2015

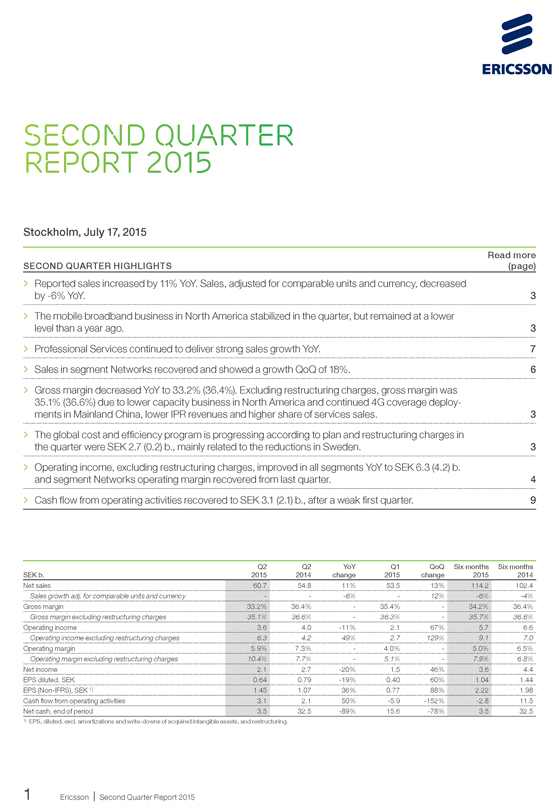

SECOND QUARTER HIGHLIGHTS Read more (page)

> Reported sales increased by 11% YoY. Sales, adjusted for comparable units and currency, decreased by -6% YoY. 3

> The mobile broadband business in North America stabilized in the quarter, but remained at a lower level than a year ago. 3

> Professional Services continued to deliver strong sales growth YoY. 7

> Sales in segment Networks recovered and showed a growth QoQ of 18%. 6

> Gross margin decreased YoY to 33.2% (36.4%). Excluding restructuring charges, gross margin was 35.1% (36.6%) due to lower capacity business in North America and continued 4G coverage deployments in Mainland China, lower IPR revenues and higher share of services sales. 3

> The global cost and efficiency program is progressing according to plan and restructuring charges in the quarter were SEK 2.7 (0.2) b., mainly related to the reductions in Sweden. 3

> Operating income, excluding restructuring charges, improved in all segments YoY to SEK 6.3 (4.2) b. and segment Networks operating margin recovered from last quarter. 4

> Cash flow from operating activities recovered to SEK 3.1 (2.1) b., after a weak first quarter. 9

SEK b. Q2 Q2 YoY Q1 QoQ Six months Six months

2015 2014 change 2015 change 2015 2014

Net sales 60.7 54.8 11% 53.5 13% 114.2 102.4

Sales growth adj. for comparable units and currency - - -6% - 12% -6% -4%

Gross margin 33.2% 36.4% - 35.4% - 34.2% 36.4%

Gross margin excluding restructuring charges 35.1% 36.6% - 36.3% - 35.7% 36.6%

Operating income 3.6 4.0 -11% 2.1 67% 5.7 6.6

Operating income excluding restructuring charges 6.3 4.2 49% 2.7 129% 9.1 7.0

Operating margin 5.9% 7.3% - 4.0% - 5.0% 6.5%

Operating margin excluding restructuring charges 10.4% 7.7% - 5.1% - 7.9% 6.8%

Net income 2.1 2.7 -20% 1.5 46% 3.6 4.4

EPS diluted, SEK 0.64 0.79 -19% 0.40 60% 1.04 1.44

EPS (Non-IFRS), SEK 1) 1.45 1.07 36% 0.77 88% 2.22 1.98

Cash flow from operating activities 3.1 2.1 50% -5.9 -152% -2.8 11.5

Net cash, end of period 3.5 32.5 -89% 15.6 -78% 3.5 32.5

1) EPS, diluted, excl. amortizations and write-downs of acquired intangible assets, and restructuring.

1 Ericsson | Second Quarter Report 2015

CEO COMMENTS

Reported sales increased by 11%. Sales, adjusted for comparable units and currency, decreased by -6% YoY, mainly impacted by less capacity business in North America. Profitability improved sequentially, driven by a strong development in segment Networks.

Business

The mobile broadband business in North America stabilized in the quarter, but remained at a lower level than a year ago. The YoY decline in North America was partly off-set by an increased pace of 4G deployments in Mainland China. Sales growth was strong in the Middle East, India and South East Asia, while it continued to be weak in Japan. Professional Services sales increased YoY with continued strong global demand and growth in all ten regions.

The OSS & BSS business had a favorable development YoY, contributing to sales both in Professional Services and segment Support Solutions.

Segment Networks sales increased by 18% sequentially, supported by the stabilized mobile broadband sales in North America.

Profitability

Operating income, excluding restructuring charges, increased YoY by almost 50%, with improvements in all segments. After a weak first quarter, segment Networks profitability recovered, driven by increased sales and a positive currency hedge effect.

IPR revenues

Reported IPR revenues were slightly down YoY despite a positive currency effect as a majority of the licenses contracts are in USD. The decline was primarily due to the ongoing dispute with a major customer.

Cost and efficiency program

The global cost and efficiency program is progressing according to plan. The target, to achieve savings of approximately SEK 9 b. during 2017 relative to 2014, remains. During the quarter, numerous activities were implemented globally including a reduction of 2,100 positions in Sweden, resulting in higher than normal restructuring charges. Savings related to the activities will start to impact results towards the end of this year.

Cash flow

After a weak first quarter, cash flow from operating activities was positive in the quarter. As cash flow is volatile between quarters it should be viewed on a full-year basis. Our full-year cash conversion target of more than 70% remains.

Targeted growth areas

Our growth strategy builds on a combination of excelling in our core business and establishing leadership in targeted growth areas. We see good progress in the targeted areas and sales continued its strong development from the first quarter. This was mainly driven by a solid sales development in OSS & BSS.

The consolidation in the industry continues, both among vendors and customers, creating opportunities and challenges. Therefore we have, during the first half of 2015, accelerated our transformation journey towards becoming a true ICT company. With our ongoing strategic initiatives we are well positioned to continue to create value for our customers in a transforming market.

Hans Vestberg

President and CEO

2 Ericsson | Second Quarter Report 2015

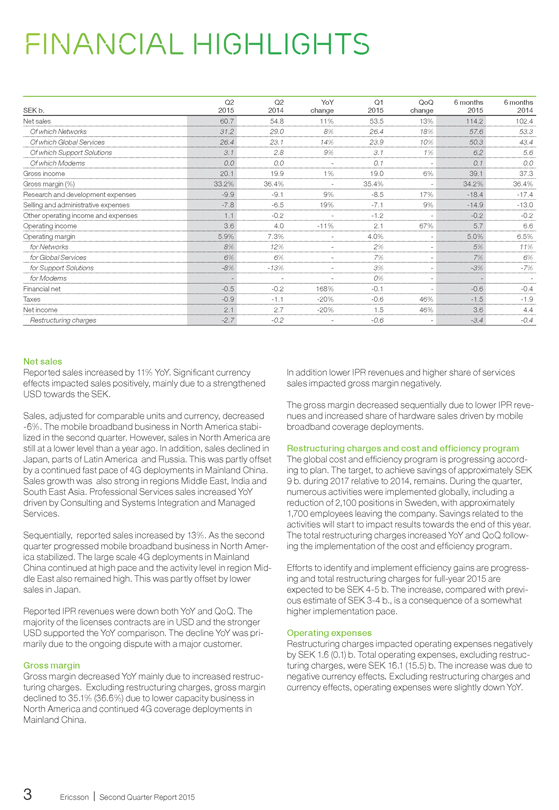

FINANCIAL HIGHLIGHTS

Q2 Q2 YoY Q1 QoQ 6 months 6 months

SEK b. 2015 2014 change 2015 change 2015 2014

Net sales 60.7 54.8 11% 53.5 13% 114.2 102.4

Of which Networks 31.2 29.0 8% 26.4 18% 57.6 53.3

Of which Global Services 26.4 23.1 14% 23.9 10% 50.3 43.4

Of which Support Solutions 3.1 2.8 9% 3.1 1% 6.2 5.6

Of which Modems 0.0 0.0 - 0.1 - 0.1 0.0

Gross income 20.1 19.9 1% 19.0 6% 39.1 37.3

Gross margin (%) 33.2% 36.4% - 35.4% - 34.2% 36.4%

Research and development expenses -9.9 -9.1 9% -8.5 17% -18.4 -17.4

Selling and administrative expenses -7.8 -6.5 19% -7.1 9% -14.9 -13.0

Other operating income and expenses 1.1 -0.2 - -1.2 - -0.2 -0.2

Operating income 3.6 4.0 -11% 2.1 67% 5.7 6.6

Operating margin 5.9% 7.3% - 4.0% - 5.0% 6.5%

for Networks 8% 12% - 2% - 5% 11%

for Global Services 6% 6% - 7% - 7% 6%

for Support Solutions -8% -13% - 3% - -3% -7%

for Modems - - - 0% - - -

Financial net -0.5 -0.2 168% -0.1 - -0.6 -0.4

Taxes -0.9 -1.1 -20% -0.6 46% -1.5 -1.9

Net income 2.1 2.7 -20% 1.5 46% 3.6 4.4

Restructuring charges -2.7 -0.2 - -0.6 - -3.4 -0.4

Net sales

Reported sales increased by 11% YoY. Significant currency effects impacted sales positively, mainly due to a strengthened USD towards the SEK.

Sales, adjusted for comparable units and currency, decreased -6%. The mobile broadband business in North America stabilized in the second quarter. However, sales in North America are still at a lower level than a year ago. In addition, sales declined in Japan, parts of Latin America and Russia. This was partly offset by a continued fast pace of 4G deployments in Mainland China. Sales growth was also strong in regions Middle East, India and South East Asia. Professional Services sales increased YoY driven by Consulting and Systems Integration and Managed Services.

Sequentially, reported sales increased by 13%. As the second quarter progressed mobile broadband business in North America stabilized. The large scale 4G deployments in Mainland China continued at high pace and the activity level in region Middle East also remained high. This was partly offset by lower sales in Japan.

Reported IPR revenues were down both YoY and QoQ. The majority of the licenses contracts are in USD and the stronger USD supported the YoY comparison. The decline YoY was primarily due to the ongoing dispute with a major customer.

Gross margin

Gross margin decreased YoY mainly due to increased restructuring charges. Excluding restructuring charges, gross margin declined to 35.1% (36.6%) due to lower capacity business in North America and continued 4G coverage deployments in Mainland China.

In addition lower IPR revenues and higher share of services sales impacted gross margin negatively.

The gross margin decreased sequentially due to lower IPR revenues and increased share of hardware sales driven by mobile broadband coverage deployments.

Restructuring charges and cost and efficiency program

The global cost and efficiency program is progressing according to plan. The target, to achieve savings of approximately SEK 9 b. during 2017 relative to 2014, remains. During the quarter, numerous activities were implemented globally, including a reduction of 2,100 positions in Sweden, with approximately 1,700 employees leaving the company. Savings related to the activities will start to impact results towards the end of this year. The total restructuring charges increased YoY and QoQ following the implementation of the cost and efficiency program.

Efforts to identify and implement efficiency gains are progressing and total restructuring charges for full-year 2015 are expected to be SEK 4-5 b. The increase, compared with previous estimate of SEK 3-4 b., is a consequence of a somewhat higher implementation pace.

Operating expenses

Restructuring charges impacted operating expenses negatively by SEK 1.6 (0.1) b. Total operating expenses, excluding restructuring charges, were SEK 16.1 (15.5) b. The increase was due to negative currency effects. Excluding restructuring charges and currency effects, operating expenses were slightly down YoY.

3 Ericsson | Second Quarter Report 2015

Quarterly sales and reported sales growth year over year

SEK b. %

80 30

60 60.7 20

40 11% 10

20 0

0 -10

Q2 Q3 Q4 Q1 Q2

2014 2015

Quarterly sales

Reported sales growth

Operating expenses and operating expense, % of sales

SEK b. %

20 40

15 17.7 29% 30

10 20

5 10

0 0

Q2 Q3 Q4 Q1 Q2

2014 2015

Operating expenses

Operating expenses of sales

Operating income and operating margin

SEK b. %

10 10

8 8

6 6% 6

4 3.6 4

2 2

0 0

Q2 Q3 Q4 Q1 Q2

2014 2015

Operating income

Operating margin

Other operating income and expenses

Other operating income and expenses improved YoY following a positive currency hedge contracts effect and a capital gain of SEK 0.3 b. related to a real estate divestment in the US.

The revaluation and realization effects from currency hedge contracts were SEK 0.6 b. This is to be compared with hedge contract effects of SEK -1.4 b. in Q1 2015 and SEK -0.5 b. in Q2 2014.

The positive effect derives mainly from the hedge contract balance in USD. The SEK has strengthened towards the USD between March 31, 2015 (SEK/USD rate 8.64) and June 30, 2015 (SEK/USD rate 8.24).

Operating income

Operating income decreased YoY due to higher restructuring charges of SEK 2.7 (0.2) b. Operating income, excluding restructuring charges, improved to SEK 6.3 (4.2) b. with an operating margin of 10.4% (7.7%). The improvement was driven by higher sales and positive currency hedge effects, partly offset by a lower gross margin.

Despite higher restructuring charges, operating income increased QoQ driven by higher sales and positive other operating income and expenses.

Financial net

The negative financial net increased YoY and QoQ, mainly related to a lower cash position and negative interest revaluation effects.

Net income and EPS

Net income and EPS diluted decreased YoY following the lower operating income. Net income and EPS increased QoQ. EPS (Non-IFRS) was SEK 1.45 (1.07).

Employees

The number of employees on June 30, 2015 was 117,183 compared with 118,706 on March 31, 2015. The decrease is mainly related to implementation of the global cost and efficiency program outside Sweden. Effects from headcount reductions in Sweden will start impacting number of employees during the third quarter. The number of Ericsson services professionals on June 30, 2015 was 65,000 (66,000 March 31, 2015).

MODEMS

Net Sales

The discontinuation of the modems business is now almost completed. Net sales in the quarter was SEK 0.0 b.

Operating income for the modems business was SEK 0.0 b.

4 Ericsson | Second Quarter Report 2015

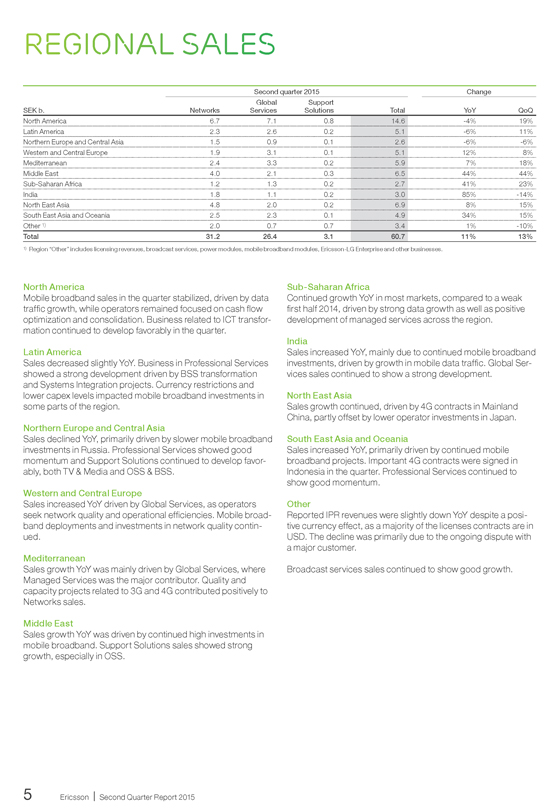

REGIONAL SALES

Second quarter 2015 Change

SEK b. Networks

Global Services Support Solutions

Total

YoY

QoQ

North America

6.7 7.1 0.8 14.6 -4% 19%

Latin America 2.3 2.6 0.2 5.1 -6% 11%

Northern Europe and Central Asia 1.5 0.9 0.1 2.6 -6% -6%

Western and Central Europe 1.9 3.1 0.1 5.1 12% 8%

Mediterranean 2.4 3.3 0.2 5.9 7% 18%

Middle East 4.0 2.1 0.3 6.5 44% 44%

Sub-Saharan Africa 1.2 1.3 0.2 2.7 41% 23%

India 1.8 1.1 0.2 3.0 85% -14%

North East Asia 4.8 2.0 0.2 6.9 8% 15%

South East Asia and Oceania 2.5 2.3 0.1 4.9 34% 15%

Other 1) 2.0 0.7 0.7 3.4 1% -10%

Total 31.2 26.4 3.1 60.7 11% 13%

1) Region “Other” includes licensing revenues, broadcast services, power modules, mobile broadband modules, Ericsson-LG Enterprise and other businesses.

North America

Mobile broadband sales in the quarter stabilized, driven by data traffic growth, while operators remained focused on cash flow optimization and consolidation. Business related to ICT transformation continued to develop favorably in the quarter.

Latin America

Sales decreased slightly YoY. Business in Professional Services showed a strong development driven by BSS transformation and Systems Integration projects. Currency restrictions and lower capex levels impacted mobile broadband investments in some parts of the region.

Northern Europe and Central Asia

Sales declined YoY, primarily driven by slower mobile broadband investments in Russia. Professional Services showed good momentum and Support Solutions continued to develop favorably, both TV & Media and OSS & BSS.

Western and Central Europe

Sales increased YoY driven by Global Services, as operators seek network quality and operational efficiencies. Mobile broadband deployments and investments in network quality continued.

Mediterranean

Sales growth YoY was mainly driven by Global Services, where Managed Services was the major contributor. Quality and capacity projects related to 3G and 4G contributed positively to Networks sales.

Middle East

Sales growth YoY was driven by continued high investments in mobile broadband. Support Solutions sales showed strong growth, especially in OSS.

Sub-Saharan Africa

Continued growth YoY in most markets, compared to a weak first half 2014, driven by strong data growth as well as positive development of managed services across the region.

India

Sales increased YoY, mainly due to continued mobile broadband investments, driven by growth in mobile data traffic. Global Services sales continued to show a strong development.

North East Asia

Sales growth continued, driven by 4G contracts in Mainland China, partly offset by lower operator investments in Japan.

South East Asia and Oceania

Sales increased YoY, primarily driven by continued mobile broadband projects. Important 4G contracts were signed in Indonesia in the quarter. Professional Services continued to show good momentum.

Other

Reported IPR revenues were slightly down YoY despite a positive currency effect, as a majority of the licenses contracts are in USD. The decline was primarily due to the ongoing dispute with a major customer.

Broadcast services sales continued to show good growth.

5 Ericsson | Second Quarter Report 2015

SEGMENT RESULTS

NETWORKS

Segment sales

Networks

Global Services

Support Solutions

Quarterly sales and sales growth year over year

SEK b.%

42 20

35 15

28 8% 31.2 10

21 5

14 0

7 -5

0 -10

Q2 Q3 Q4 Q1 Q2

2014 2015

Quarterly sales

Sales growth

Operating income and operating margin

SEK b.%

6 15

4 10

2 5

0 0

Q2 Q3 Q4 Q1 Q2

2014 2015

Operating income

Operating margin

SEK b. Q2 2015 Q2 2014 YoY change Q1 2015 QoQ change 6 months 2015 6 months 2014

Net sales 31.2 29.0 8% 26.4 18% 57.6 53.3

Sales growth adj. for comparable units and currency - - -9% - 16% -9% -3%

Operating income 2.4 3.6 -32% 0.6 313% 3.0 6.1

Operating income excluding restructuring charges 4.3 3.7 16% 0.8 460% 5.0 6.3

Operating margin 8% 12% - 2% - 5% 11%

Operating margin excluding restructuring charges 14% 13% - 3% - 9% 12%

EBITA margin 10% 14% - 5% - 7% 14%

Restructuring charges -1.8 -0.1 - -0.2 - -2.0 -0.2

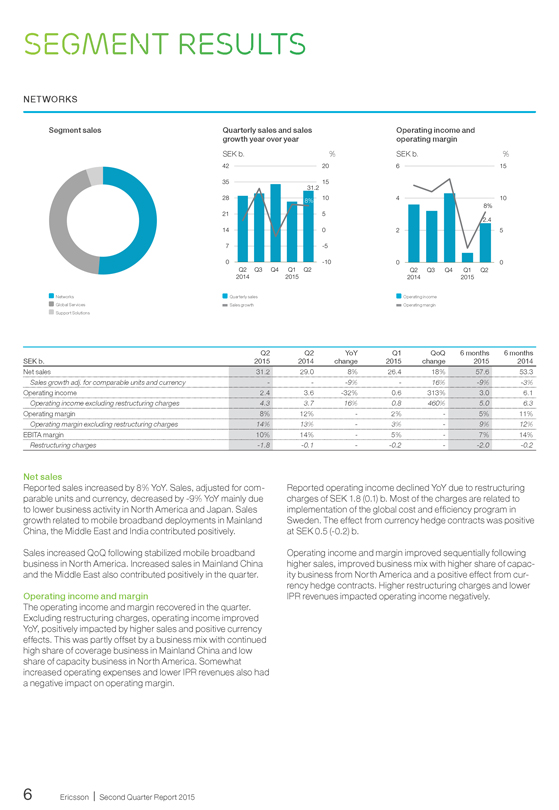

Net sales

Reported sales increased by 8% YoY. Sales, adjusted for comparable units and currency, decreased by -9% YoY mainly due to lower business activity in North America and Japan. Sales growth related to mobile broadband deployments in Mainland China, the Middle East and India contributed positively.

Sales increased QoQ following stabilized mobile broadband business in North America. Increased sales in Mainland China and the Middle East also contributed positively in the quarter.

Operating income and margin

The operating income and margin recovered in the quarter. Excluding restructuring charges, operating income improved YoY, positively impacted by higher sales and positive currency effects. This was partly offset by a business mix with continued high share of coverage business in Mainland China and low share of capacity business in North America. Somewhat increased operating expenses and lower IPR revenues also had a negative impact on operating margin.

Reported operating income declined YoY due to restructuring charges of SEK 1.8 (0.1) b. Most of the charges are related to implementation of the global cost and efficiency program in Sweden. The effect from currency hedge contracts was positive at SEK 0.5 (-0.2) b.

Operating income and margin improved sequentially following higher sales, improved business mix with higher share of capacity business from North America and a positive effect from currency hedge contracts. Higher restructuring charges and lower IPR revenues impacted operating income negatively.

6 Ericsson | Second Quarter Report 2015

GLOBAL SERVICES

Segment sales

Networks

Global Services

Support Solutions

Quarterly sales and sales growth year over year

SEK b. %

45 20

30 14% 10

15 26.4 0

0 -10

Q2 Q3 Q4 Q1 Q2

2014 2015

Quarterly sales

Sales growth

Operating income and operating margin

SEK b. %

3 9

2 6% 6

1 1.6 3

0 0

Q2 Q3 Q4 Q1 Q2

2014 2015

Operating income

Operating margin

Q2 Q2 YoY Q1 QoQ 6 months 6 months

SEK b. 2015 2014 change 2015 change 2015 2014

Net sales 26.4 23.1 14% 23.9 10% 50.3 43.4

Of which Professional Services 20.0 16.6 21% 18.1 10% 38.1 31.7

Of which Managed Services 8.2 6.5 26% 7.5 9% 15.7 12.2

Of which Network Rollout 6.4 6.5 -2% 5.8 11% 12.2 11.8

Sales growth adj. for comparable units and currency - - -2% - 10% -2% -5%

Operating income 1.6 1.5 10% 1.7 -2% 3.3 2.5

Of which Professional Services 2.4 2.1 15% 2.1 14% 4.5 4.0

Of which Network Rollout -0.8 -0.6 25% -0.4 78% -1.2 -1.5

Operating margin 6% 6% - 7% - 7% 6%

for Professional Services 12% 13% - 12% - 12% 13%

for Network Rollout -12% -9% – -7% – -10% -12%

Operating income excluding restructuring charges 2.3 1.6 49% 2.1 11% 4.4 2.6

Operating margin excluding restructuring charges 9% 7% - 9% - 9% 6%

EBITA margin 7% 8% - 8% - 8% 7%

Restructuring charges -0.7 -0.1 – -0.4 - -1.1 -0.1

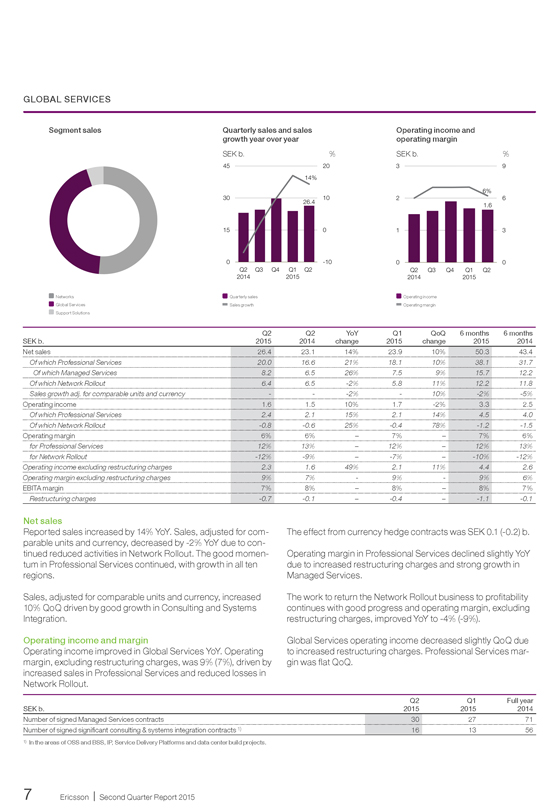

Net sales

Reported sales increased by 14% YoY. Sales, adjusted for comparable units and currency, decreased by -2% YoY due to continued reduced activities in Network Rollout. The good momentum in Professional Services continued, with growth in all ten regions.

Sales, adjusted for comparable units and currency, increased 10% QoQ driven by good growth in Consulting and Systems Integration.

Operating income and margin

Operating income improved in Global Services YoY. Operating margin, excluding restructuring charges, was 9% (7%), driven by increased sales in Professional Services and reduced losses in Network Rollout.

The effect from currency hedge contracts was SEK 0.1 (-0.2) b.

Operating margin in Professional Services declined slightly YoY due to increased restructuring charges and strong growth in Managed Services.

The work to return the Network Rollout business to profitability continues with good progress and operating margin, excluding restructuring charges, improved YoY to -4% (-9%).

Global Services operating income decreased slightly QoQ due to increased restructuring charges. Professional Services margin was flat QoQ.

Q2 Q1 Full year

SEK b. 2015 2015 2014

Number of signed Managed Services contracts 30 27 71

Number of signed significant consulting & systems integration contracts 1) 16 13 56

1) In the areas of OSS and BSS, IP, Service Delivery Platforms and data center build projects.

7

Ericsson | Second Quarter Report 2015

SUPPORT SOLUTIONS

Segment sales

Networks

Global Services

Support Solutions

Quarterly sales and sales growth year over year

SEK b. 6 5 4 3 2 1 0

9% 3.1

% 30 20 10 0 -10 -20 -30 Q2 2014 Q3 Q4 Q1 2015 Q2

Quarterly sales Sales growth

Operating income and operating margin

SEK b.

1,0 0,5 0,0 -0,5

-8% -0.2 Q2 2014 Q3 Q4 Q1 2015 Q2

% 20 10 0 -10 -20

Operating income Operating margin

SEK b. Q2 2015 Q2 2014 YoY change Q1 2015 QoQ change 6 months 2015 6 months 2014

Net sales 3.1 2.8 9% 3.1 1% 6.2 5.6

Sales growth adj. for comparable units and currency - - -13% - -3% -12% 4%

Operating income -0.2 -0.4 -37% 0.1 - -0.2 -0.4

Operating income excluding restructuring charges 0.0 -0.3 -87% 0.1 - 0.1 -0.3

Operating margin -8% -13% - 3% - -3% -7%

Operating margin excluding restructuring charges -2% -12% - 3% - 1% -6%

EBITA margin 0% -7% - 10% - 5% 0%

Restructuring charges -0.2 0.0 - 0.0 - -0.2 0.0

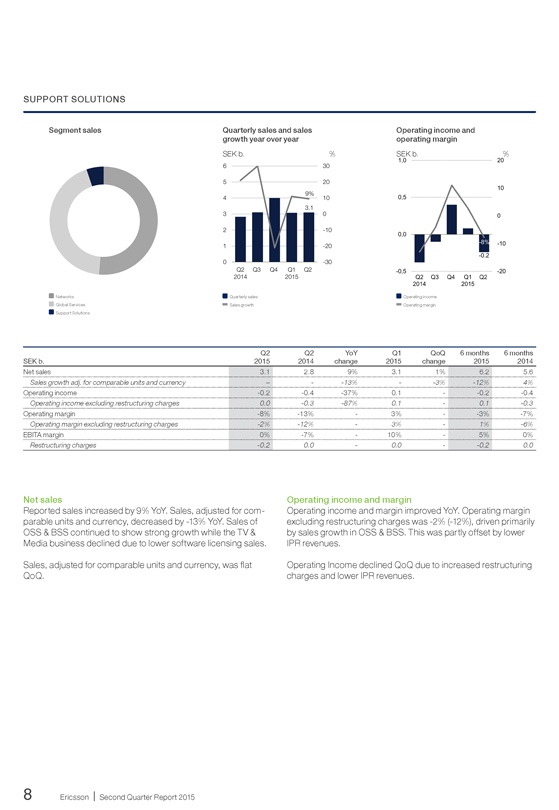

Net sales

Reported sales increased by 9% YoY. Sales, adjusted for comparable units and currency, decreased by -13% YoY. Sales of OSS & BSS continued to show strong growth while the TV & Media business declined due to lower software licensing sales.

Sales, adjusted for comparable units and currency, was flat QoQ.

Operating income and margin

Operating income and margin improved YoY. Operating margin excluding restructuring charges was -2% (-12%), driven primarily by sales growth in OSS & BSS. This was partly offset by lower IPR revenues.

Operating Income declined QoQ due to increased restructuring charges and lower IPR revenues.

8 Ericsson | Second Quarter Report 2015

CASH FLOW

SEK b. Q2 2015 Q2 2014 Q1 2015

Net income reconciled to cash 3.4 5.9 3.1

Changes in operating net assets -0.3 -3.8 -9.0

Cash flow from operating activities 3.1 2.1 -5.9

Cash flow from investing activities 7.0 3.7 -2.1

Cash flow from financing activities -10.6 -12.2 0.9

Net change in cash and cash equivalents -2.3 -5.0 -5.7

Cash conversion (%) 90% 35% -188%

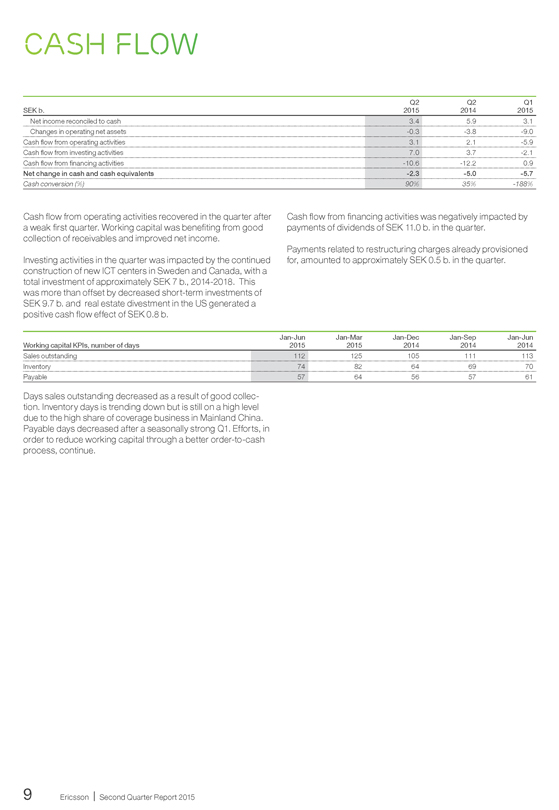

Cash flow from operating activities recovered in the quarter after a weak first quarter. Working capital was benefiting from good collection of receivables and improved net income.

Investing activities in the quarter was impacted by the continued construction of new ICT centers in Sweden and Canada, with a total investment of approximately SEK 7 b., 2014-2018. This was more than offset by decreased short-term investments of SEK 9.7 b. and real estate divestment in the US generated a positive cash flow effect of SEK 0.8 b.

Cash flow from financing activities was negatively impacted by payments of dividends of SEK 11.0 b. in the quarter.

Payments related to restructuring charges already provisioned for, amounted to approximately SEK 0.5 b. in the quarter.

Working capital KPIs, number of days Jan-Jun 2015 Jan-Mar 2015 Jan-Dec 2014 Jan-Sep 2014 Jan-Jun 2014

Sales outstanding 112 125 105 111 113

Inventory 74 82 64 69 70

Payable 57 64 56 57 61

Days sales outstanding decreased as a result of good collection. Inventory days is trending down but is still on a high level due to the high share of coverage business in Mainland China. Payable days decreased after a seasonally strong Q1. Efforts, in order to reduce working capital through a better order-to-cash process, continue.

9 Ericsson | Second Quarter Report 2015

FINANCIAL POSITION

SEK b. Jun 30 2015 Jun 30 2014 Mar 31 2015

+ Short-term investments 20.8 35.3 30.8

+ Cash and cash equivalents 33.0 33.1 35.3

Gross cash 53.8 68.4 66.1

– Interest bearing liabilities and post-employment benefits 50.3 35.9 50.5

Net cash 3.5 32.5 15.6

Equity 136.7 138.0 149.1

Total assets 278.9 265.5 303.0

Capital turnover (times) 1.3 1.2 1.1

Return on capital employed (%) 6.9% 8.2% 5.8%

Equity ratio (%) 49% 52.0% 49.2%

Return on equity (%) 5.9% 6.8% 3.6%

Net cash decreased in the quarter as a result of the dividend payout and capex related to the construction of three global ICT centers in Sweden and Canada. This was partly offset by the positive cash flow from operating activities.

The net cash position, excluding post-employment benefits, was SEK 28.0 b.

The average maturity of long-term borrowings as of June 30, 2015, was 5.3 years, compared to 6.2 years 12 months earlier.

In the quarter a revolving Credit Facility of USD 2.0 b. was renewed. The new facility expires in 2020.

Debt maturity profile, Parent Company

SEK b.

9 6 3 0 2017 2018 2019 2020 2021 2022

Swedish Export Credit Corporation MTN Bond

Nordic Investment Bank

European Investment Bank

Notes and Bonds

10 Ericsson | Second Quarter Report 2015

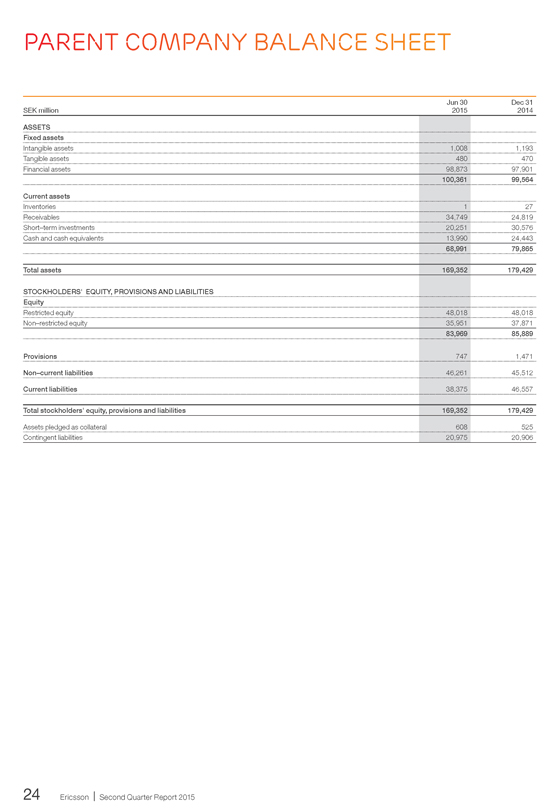

PARENT COMPANY

Income after financial items was SEK 9.0 (2.9) b. The increase was mainly related to received dividends.

Major changes in the Parent Company’s financial position for the year; decreased cash, cash equivalents and short-term investments of SEK 20.8 b and decreased current and non-current liabilities to subsidiaries of SEK 5.9 b. At the end of the quarter, cash, cash equivalents and short-term investments amounted to SEK 34.2 (55.0) b.

During the quarter, the dividend payment of SEK 11.0 b., as decided by the Annual General Meeting, was made.

The Parent Company has during the quarter recognized dividends from subsidiaries of SEK 6.9 b.

In accordance with the conditions of the long-term variable compensation program (LTV) for Ericsson employees, 3.533.643 shares from treasury stock were sold or distributed to employees during the second quarter. The holding of treasury stock at June 30, 2015, was 56.607.183 Class B shares.

11 Ericsson | Second Quarter Report 2015

OTHER INFORMATION

Ericsson’s Nomination Committee appointed

On May 25, 2015, Ericsson announced that the Nomination Committee for the Annual General Meeting (AGM) 2016 has been appointed in accordance with the Instruction for the Nomination Committee, resolved by the Annual General Meeting 2012.

The Nomination Committee consists of: Petra Hedengran, Investor AB; Bengt Kjell, AB Industrivärden and Handelsbankens Pensionsstiftelse; Johan Held, AFA Försäkring; Marianne Nilsson, Swedbank Robur Fonder; and Leif Johansson, the Chairman of the Board of Director. Petra Hedengran is the Chairman of the Nomination Committee.

Apple litigations

A past global patent license agreement between Ericsson and Apple expired in January 2015 and Apple declined to take a new license on offered FRAND terms. Ericsson negotiated a renewal agreement with Apple for more than two years. During the negotiations, the companies were not able to reach an agreement on licensing of Ericsson’s patents that enable Apple’s mobile devices to connect with the world and power many of their applications.

On January 12, 2015, Apple initiated litigation with Ericsson by filing a lawsuit in the United States District Court for the Northern District of California, seeking a ruling that Apple does not infringe seven of Ericsson’s patents. Two days later, on January 14, 2015, Ericsson filed a complaint in the United States District Court for the Eastern District of Texas requesting a ruling that its proposed global licensing terms with Apple were fair and reasonable.

On February 26, 2015, after Apple refused Ericsson’s offer to have a court determine fair licensing terms by which both companies would be bound, Ericsson filed two complaints with the International Trade Commission (ITC) and seven complaints in the United States District Court for the Eastern District of Texas against Apple, asserting infringement of 41 additional Ericsson patents. Ericsson subsequently amended its complaints to assert two additional patents in the US. Ericsson seeks exclusion orders in the ITC proceedings and damages and injunctions in the District Court actions.

On May 8, 2015, Ericsson further announced that it has filed patent infringement suits against Apple in Germany, the United Kingdom and the Netherlands, seeking damages and injunctions. Ericsson has asserted both standard-essential patents related to the 2G and 4G/LTE standards and other patents that are critical to features and functionality of Apple devices, such as the design of semiconductor components, user interface software, location services and applications, as well as the iOS operating system.

Hearings and trials in the various cases are scheduled to begin in December 2015 and continue into 2016. Ericsson expects that the first court rulings will be issued by a German court in the first quarter of 2016.

Implementation of cost and efficiency program in Sweden

On June 24, 2015, Ericsson completed the redundancy process in Sweden, announced on March 11, 2015. The reduction of approximately 2,100 positions in Sweden, with some 1,700 employees leaving the company, is part of the global cost and efficiency program.

Adaptix litigations

In 2013, Adaptix Inc. (“Adaptix”), a US company, filed two lawsuits against Ericsson, AT&T, AT&T Mobility and MetroPCS Communications in the US District Court for Eastern District of Texas alleging that certain Ericsson products infringe five US patents purportedly assigned to Adaptix. Adaptix seeks damages and an injunction. The trial is scheduled for August 2015.

On May 20, 2014, Adaptix filed three patent infringement lawsuits against Ericsson, T-Mobile, Verizon and Sprint in the same court regarding three US patents. One of these lawsuits accuses Ericsson’s LTE products and Sprint’s use thereof of infringement, one accuses Ericsson’s LTE products and Verizon’s use thereof of infringement, and one accuses Ericsson’s LTE products and T-Mobile’s use thereof of infringement. In January 2015, Adaptix filed one more lawsuit in the same court alleging that Ericsson’s LTE products, and Sprint and Verizon’s use thereof, infringe another U.S. Patent.

In addition to a complaint filed in 2013 with the Tokyo District Court, Adaptix filed another lawsuit in Japan in September 2014 alleging that Ericsson’s LTE products infringe another Japanese patent. In the lawsuits in Japan, Adaptix is also seeking damages and an injunction.

WiLAN litigations

In 2012, Wi-LAN Inc., a Canadian patent licensing company, filed a complaint against Ericsson in the US District Court for the Southern District of Florida alleging that Ericsson’s LTE products infringe three of Wi-LAN’s US patents.

In June 2013, Ericsson’s motion for summary judgment was granted and in August 2014, the decision was reversed by the United States Court of Appeals for the Federal Circuit.

On May 22, the Florida Court granted a Motion for Summary Judgment in favor of Ericsson. WiLAN may still file a notice to appeal the decision.

12 Ericsson | Second Quarter Report 2015

RISK FACTORS

Ericsson’s operational and financial risk factors and uncertainties along with our strategies and tactics to mitigate risk exposures or limit unfavorable outcomes are described in our Annual Report 2014. Compared to the risks described in the Annual Report 2014, no material, new or changed risk factors or uncertainties have been identified in the year.

Risk factors and uncertainties in focus short-term for the Parent Company and the Ericsson Group include:

Potential negative effects on operators’ willingness to invest in network development due to uncertainty in the financial markets and a weak economic business environment, or reduced consumer telecom spending, or increased pressure on us to provide financing, or delayed auctions of spectrums;

Uncertainty regarding the financial stability of suppliers, for example due to lack of financing;

Effects on gross margins and/or working capital of the business mix in the Networks segment between capacity sales and new coverage buildouts;

Effects on gross margins of the business mix in the Global Services segment including proportion of new network build- outs and share of new managed services deals with initial transition costs;

Effects of the ongoing industry consolidation among our customers as well as between our largest competitors, e.g. with postponed investments and intensified price competition as a consequence;

Changes in foreign exchange rates, in particular USD;

Political unrest or instability in certain markets;

Effects on production and sales from restrictions with respect to timely and adequate supply of materials, components and production capacity and other vital services on competitive terms;

No guarantees that specific restructuring or cost-savings initiatives will be sufficient, successful or executed in time to deliver any improvements in short-term earnings.

Ericsson stringently monitors the compliance with all relevant trade regulations and trade embargos applicable to dealings with customers operating in countries where there are trade restrictions or trade restrictions are discussed. Moreover, Ericsson operates globally in accordance with Group policies and directives for business ethics and conduct.

This report has not been reviewed by Telefonaktiebolaget LM Ericsson’s auditors.

Date for next report: October 23, 2015

13 Ericsson | Second Quarter Report 2015

BOARD ASSURANCE

The Board of Directors and the CEO certify that the financial report for the six months gives a fair view of the performance of the business, position and profit or loss of the Company and the Group, and describes the principal risks and uncertainties that the Company and the companies in the Group face.

Stockholm, July 17, 2015

Telefonaktiebolaget LM Ericsson (publ)

Org. Nr. 556016-0680

Anders Nyrén

Deputy Chairman

Leif Johansson

Chairman

Jacob Wallenberg

Deputy Chairman

Roxanne S. Austin

Member of the Board

Nora Denzel

Member of the Board

Börje Ekholm

Member of the Board

Alexander Izosimov

Member of the Board

Ulf J. Johansson

Member of the Board

Kristin Skogen Lund

Member of the Board

Sukhinder Singh Cassidy

Member of the Board

Hans Vestberg

President, CEO and member of the Board

Pehr Claesson

Member of the Board

Kristina Davidsson

Member of the Board

Karin Åberg

Member of the Board

14 Ericsson | Second Quarter Report 2015

EDITOR’S NOTE

Ericsson invites media, investors and analysts to a press conference at the Ericsson Studio, Grönlandsgången 4, Stockholm, at 09.00 (CET), July 17, 2015. An analysts, investors and media conference call will begin at 14.00 (CET).

Live webcast of the press conference and conference call as well as supporting slides will be available at www.ericsson.com/press and www.ericsson.com/investors

Video material will be published during the day on www.ericsson.com/press

For further information, please contact:

Helena Norrman, Senior Vice President, Marketing and Communications

Phone: +46 10 719 34 72

E-mail: investor.relations@ericsson.com or media.relations@ericsson.com

Telefonaktiebolaget LM Ericsson

Org. number: 556016-0680

Torshamnsgatan 21

SE-164 83 Stockholm

Phone: +46 10 719 00 00

www.ericsson.com

Investors

Peter Nyquist, Vice President,

Investor Relations

Phone: +46 10 714 64 49, +46 70 575 29 06

E-mail: peter.nyquist@ericsson.com

Stefan Jelvin, Director,

Investor Relations

Phone: +46 10 714 20 39, +46 70 986 02 27

E-mail: stefan.jelvin@ericsson.com

Åsa Konnbjer, Director,

Investor Relations

Phone: +46 10 713 39 28, +46 73 082 59 28

E-mail: asa.konnbjer@ericsson.com

Rikard Tunedal, Director,

Investor Relations

Phone: +46 10 714 54 00, +46 761 005 400

E-mail: rikard.tunedal@ericsson.com

Media

Ola Rembe, Vice President,

Head of External Communications

Phone: +46 10 719 97 27, +46 73 024 48 73

E-mail: media.relations@ericsson.com

Corporate Communications

Phone: +46 10 719 69 92

E-mail: media.relations@ericsson.com

15 Ericsson | Second Quarter Report 2015

SAFE HARBOR STATEMENT

All statements made or incorporated by reference in this release, other than statements or characterizations of historical facts, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Forward-looking statements can often be identified by words such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”, “estimates”, “may”, “will”, “should”, “would”, “potential”, “continue”, and variations or negatives of these words, and include, among others, statements regarding: (i) strategies, outlook and growth prospects; (ii) positioning to deliver future plans and to realize potential for future growth; (iii) liquidity and capital resources and expenditure, and our credit ratings; (iv) growth in demand for our products and services; (v) our joint venture activities; (vi) economic outlook and industry trends; (vii) developments of our markets; (viii) the impact of regulatory initiatives; (ix) research and development expenditures; (x) the strength of our competitors; (xi) future cost savings; (xii) plans to launch new products and services; (xiii) assessments of risks; (xiv) integration of acquired businesses; (xv) compliance with rules and regulations and (xvi) infringements of intellectual property rights of others.

In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These forward-looking statements speak only as of the date hereof and are based upon the information available to us at this time. Such information is subject to change, and we will not necessarily inform you of such changes. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference for Ericsson include, but are not limited to: (i) material adverse changes in the markets in which we operate or in global economic conditions; (ii) increased product and price competition; (iii) reductions in capital expenditure by network operators; (iv) the cost of technological innovation and increased expenditure to improve quality of service; (v) significant changes in market share for our principal products and services; (vi) foreign exchange rate or interest rate fluctuations; and (vii) the successful implementation of our business and operational initiatives.

16 Ericsson | Second Quarter Report 2015

FINANCIAL STATEMENTS AND

ADDITIONAL INFORMATION

Contents

Financial statements

Consolidated income statement 18

Statement of comprehensive income 18

Consolidated balance sheet 19

Consolidated statement of cash flows 20

Consolidated statement of changes in equity 21

Consolidated income statement – isolated quarters 21

Consolidated statement of cash flows – isolated quarters 22

Parent Company income statement 23

Parent Company statement of comprehensive income 23

Parent Company balance sheet 24

Additional information

Accounting policies 25

Net sales by segment by quarter 26

Sales growth adjusted for comparable units and currency 27

Operating income by segment by quarter 28

Operating margin by segment by quarter 28

EBITA by segment by quarter 29

EBITA margin by segment by quarter 29

Net sales by region by quarter 30

Net sales by region by quarter (cont.) 31

Top 5 countries in sales 31

Net sales by region by segment 32

Provisions 33

Information on investments 33

Reconciliation table, non-IFRS measurements 34

Net cash – end of period 34

Other information 35

Number of employees 35

Restructuring charges by function 36

Restructuring charges by segment 36

17 Ericsson | Second Quarter Report 2015

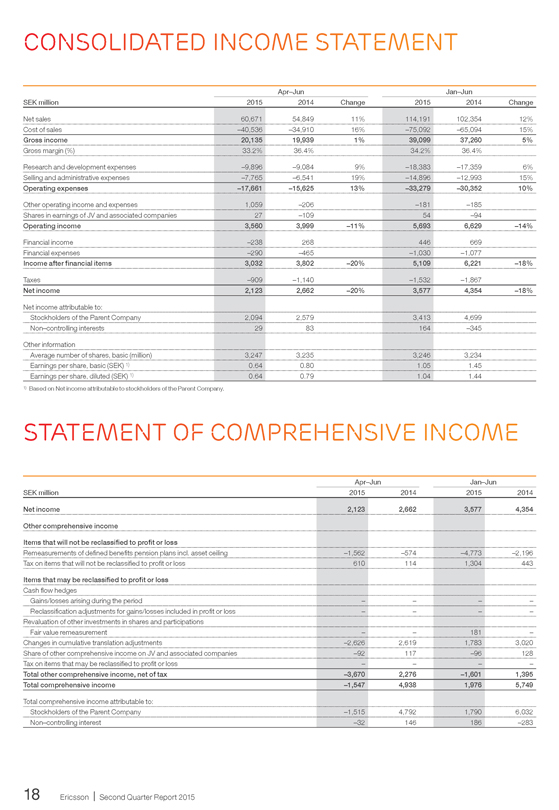

CONSOLIDATED INCOME STATEMENT

Apr–Jun Jan–Jun

SEK million 2015 2014 Change 2015 2014 Change

Net sales 60,671 54,849 11% 114,191 102,354 12%

Cost of sales –40,536 –34,910 16% –75,092 –65,094 15%

Gross income 20,135 19,939 1% 39,099 37,260 5%

Gross margin (%) 33.2% 36.4% 34.2% 36.4%

Research and development expenses –9,896 –9,084 9% –18,383 –17,359 6%

Selling and administrative expenses –7,765 –6,541 19% –14,896 –12,993 15%

Operating expenses –17,661 –15,625 13% –33,279 –30,352 10%

Other operating income and expenses 1,059 –206 –181 –185

Shares in earnings of JV and associated companies 27 –109 54 –94

Operating income 3,560 3,999 –11% 5,693 6,629 –14%

Financial income –238 268 446 669

Financial expenses –290 –465 –1,030 –1,077

Income after financial items 3,032 3,802 –20% 5,109 6,221 –18%

Taxes –909 –1,140 –1,532 –1,867

Net income 2,123 2,662 –20% 3,577 4,354 –18%

Net income attributable to:

Stockholders of the Parent Company 2,094 2,579 3,413 4,699

Non–controlling interests 29 83 164 –345

Other information

Average number of shares, basic (million) 3,247 3,235 3,246 3,234

Earnings per share, basic (SEK) 1) 0.64 0.80 1.05 1.45

Earnings per share, diluted (SEK) 1) 0.64 0.79 1.04 1.44

1) Based on Net income attributable to stockholders of the Parent Company.

STATEMENT OF COMPREHENSIVE INCOME

Apr–Jun Jan–Jun

SEK million 2015 2014 2015 2014

Net income 2,123 2,662 3,577 4,354

Other comprehensive income

Items that will not be reclassified to profit or loss

Remeasurements of defined benefits pension plans incl. asset ceiling –1,562 –574 –4,773 –2,196

Tax on items that will not be reclassified to profit or loss 610 114 1,304 443

Items that may be reclassified to profit or loss

Cash flow hedges

Gains/losses arising during the period – – – –

Reclassification adjustments for gains/losses included in profit or loss – – – –

Revaluation of other investments in shares and participations

Fair value remeasurement – – 181 –

Changes in cumulative translation adjustments –2,626 2,619 1,783 3,020

Share of other comprehensive income on JV and associated companies –92 117 –96 128

Tax on items that may be reclassified to profit or loss – – – –

Total other comprehensive income, net of tax –3,670 2,276 –1,601 1,395

Total comprehensive income –1,547 4,938 1,976 5,749

Total comprehensive income attributable to:

Stockholders of the Parent Company –1,515 4,792 1,790 6,032

Non–controlling interest –32 146 186 –283

18 Ericsson | Second Quarter Report 2015

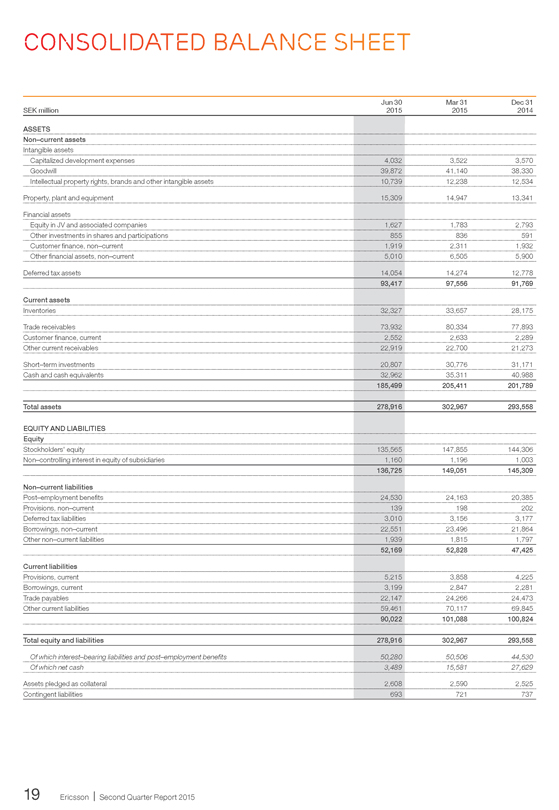

CONSOLIDATED BALANCE SHEET

SEK million Jun 30 2015 Mar 31 2015 Dec 31 2014

ASSETS

Non–current assets

Intangible assets

Capitalized development expenses 4,032 3,522 3,570

Goodwill 39,872 41,140 38,330

Intellectual property rights, brands and other intangible assets 10,739 12,238 12,534

Property, plant and equipment 15,309 14,947 13,341

Financial assets

Equity in JV and associated companies 1,627 1,783 2,793

Other investments in shares and participations 855 836 591

Customer finance, non–current 1,919 2,311 1,932

Other financial assets, non–current 5,010 6,505 5,900

Deferred tax assets 14,054 14,274 12,778 93,417 97,556 91,769

Current assets

Inventories 32,327 33,657 28,175

Trade receivables 73,932 80,334 77,893

Customer finance, current 2,552 2,633 2,289

Other current receivables 22,919 22,700 21,273

Short–term investments 20,807 30,776 31,171

Cash and cash equivalents 32,962 35,311 40,988

185,499 205,411 201,789

Total assets 278,916 302,967 293,558

EQUITY AND LIABILITIES

Equity

Stockholders’ equity 135,565 147,855 144,306

Non–controlling interest in equity of subsidiaries 1,160 1,196 1,003

136,725 149,051 145,309

Non–current liabilities

Post–employment benefits 24,530 24,163 20,385

Provisions, non–current 139 198 202

Deferred tax liabilities 3,010 3,156 3,177

Borrowings, non–current 22,551 23,496 21,864

Other non–current liabilities 1,939 1,815 1,797

52,169 52,828 47,425

Current liabilities

Provisions, current 5,215 3,858 4,225

Borrowings, current 3,199 2,847 2,281

Trade payables 22,147 24,266 24,473

Other current liabilities 59,461 70,117 69,845

90,022 101,088 100,824

Total equity and liabilities 278,916 302,967 293,558

Of which interest–bearing liabilities and post–employment benefits 50,280 50,506 44,530

Of which net cash 3,489 15,581 27,629

Assets pledged as collateral 2,608 2,590 2,525

Contingent liabilities 693 721 737

19 Ericsson | Second Quarter Report 2015

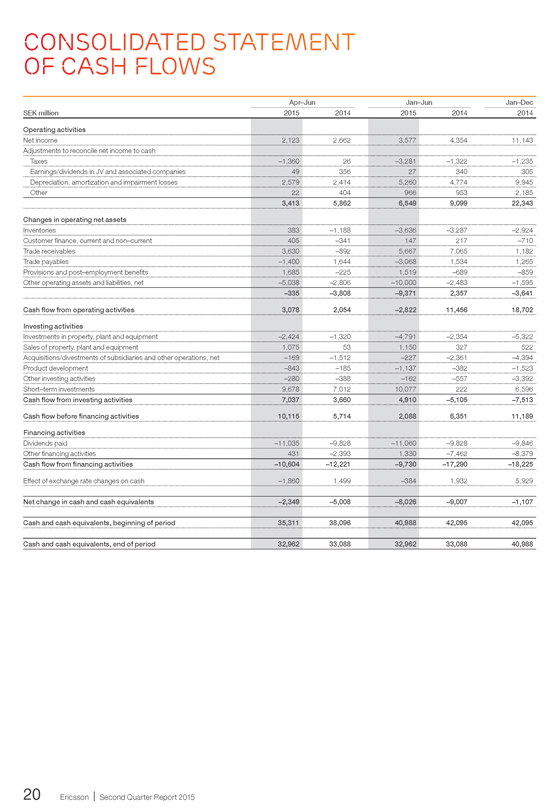

CONSOLIDATED STATEMENT OF CASH FLOWS

Apr–Jun Jan–Jun Jan–Dec

SEK million 2015 2014 2015 2014 2014

Operating activities

Net income 2,123 2,662 3,577 4,354 11,143

Adjustments to reconcile net income to cash

Taxes –1,360 26 –3,281 –1,322 –1,235

Earnings/dividends in JV and associated companies 49 356 27 340 305

Depreciation, amortization and impairment losses 2,579 2,414 5,260 4,774 9,945

Other 22 404 966 953 2,185

3,413 5,862 6,549 9,099 22,343

Changes in operating net assets

Inventories 383 –1,188 –3,636 –3,287 –2,924

Customer finance, current and non–current 405 –341 147 217 –710

Trade receivables 3,630 –892 5,667 7,065 1,182

Trade payables –1,400 1,644 –3,068 1,534 1,265

Provisions and post–employment benefits 1,685 –225 1,519 –689 –859

Other operating assets and liabilities, net –5,038 –2,806 –10,000 –2,483 –1,595

–335 –3,808 –9,371 2,357 –3,641

Cash flow from operating activities 3,078 2,054 –2,822 11,456 18,702

Investing activities

Investments in property, plant and equipment –2,424 –1,320 –4,791 –2,354 –5,322

Sales of property, plant and equipment 1,075 53 1,150 327 522

Acquisitions/divestments of subsidiaries and other operations, net –169 –1,512 –227 –2,361 –4,394

Product development –843 –185 –1,137 –382 –1,523

Other investing activities –280 –388 –162 –557 –3,392

Short–term investments 9,678 7,012 10,077 222 6,596

Cash flow from investing activities 7,037 3,660 4,910 –5,105 –7,513

Cash flow before financing activities 10,115 5,714 2,088 6,351 11,189

Financing activities

Dividends paid –11,035 –9,828 –11,060 –9,828 –9,846

Other financing activities 431 –2,393 1,330 –7,462 –8,379

Cash flow from financing activities –10,604 –12,221 –9,730 –17,290 –18,225

Effect of exchange rate changes on cash –1,860 1,499 –384 1,932 5,929

Net change in cash and cash equivalents –2,349 –5,008 –8,026 –9,007 –1,107

Cash and cash equivalents, beginning of period 35,311 38,096 40,988 42,095 42,095

Cash and cash equivalents, end of period 32,962 33,088 32,962 33,088 40,988

20 Ericsson | Second Quarter Report 2015

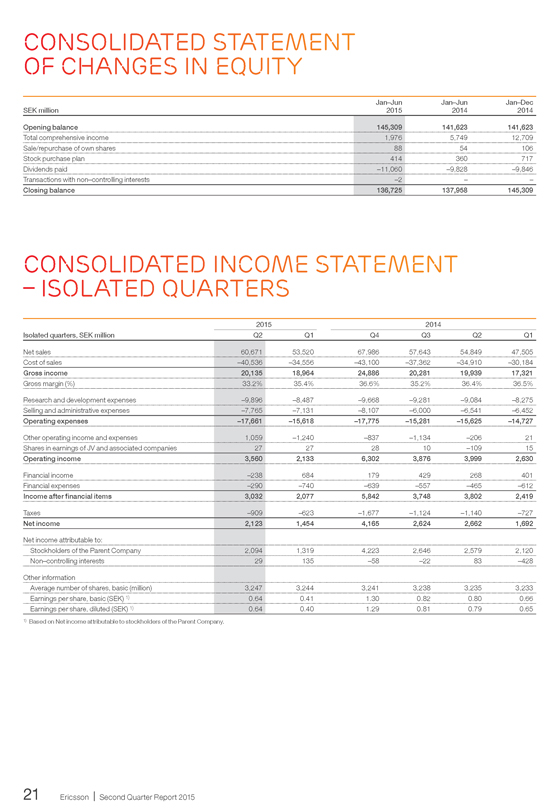

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

SEK million Jan–Jun 2015 Jan–Jun 2014 Jan–Dec 2014

Opening balance 145,309 141,623 141,623

Total comprehensive income 1,976 5,749 12,709

Sale/repurchase of own shares 88 54 106

Stock purchase plan 414 360 717

Dividends paid –11,060 –9,828 –9,846

Transactions with non–controlling interests –2 – –

Closing balance 136,725 137,958 145,309

CONSOLIDATED INCOME STATEMENT - ISOLATED QUARTERS

2015 2014

Isolated quarters, SEK million Q2 Q1 Q4 Q3 Q2 Q1

Net sales 60,671 53,520 67,986 57,643 54,849 47,505

Cost of sales –40,536 –34,556 –43,100 –37,362 –34,910 –30,184

Gross income 20,135 18,964 24,886 20,281 19,939 17,321

Gross margin (%) 33.2% 35.4% 36.6% 35.2% 36.4% 36.5%

Research and development expenses –9,896 –8,487 –9,668 –9,281 –9,084 –8,275

Selling and administrative expenses –7,765 –7,131 –8,107 –6,000 –6,541 –6,452

Operating expenses –17,661 –15,618 –17,775 –15,281 –15,625 –14,727

Other operating income and expenses 1,059 –1,240 –837 –1,134 –206 21

Shares in earnings of JV and associated companies 27 27 28 10 –109 15

Operating income 3,560 2,133 6,302 3,876 3,999 2,630

Financial income –238 684 179 429 268 401

Financial expenses –290 –740 –639 –557 –465 –612

Income after financial items 3,032 2,077 5,842 3,748 3,802 2,419

Taxes –909 –623 –1,677 –1,124 –1,140 –727

Net income 2,123 1,454 4,165 2,624 2,662 1,692

Net income attributable to:

Stockholders of the Parent Company 2,094 1,319 4,223 2,646 2,579 2,120

Non–controlling interests 29 135 –58 –22 83 –428

Other information

Average number of shares, basic (million) 3,247 3,244 3,241 3,238 3,235 3,233

Earnings per share, basic (SEK) 1) 0.64 0.41 1.30 0.82 0.80 0.66

Earnings per share, diluted (SEK) 1) 0.64 0.40 1.29 0.81 0.79 0.65

1) Based on Net income attributable to stockholders of the Parent Company.

21 Ericsson | Second Quarter Report 2015

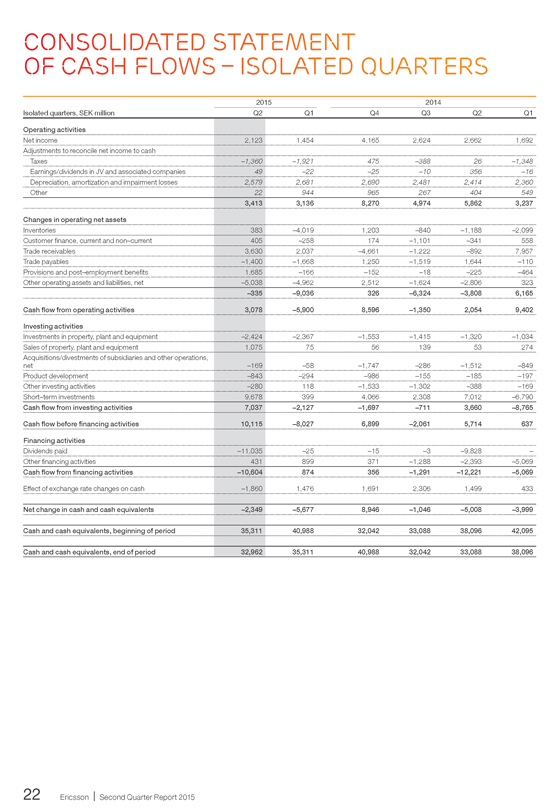

CONSOLIDATED STATEMENT OF CASH FLOWS - ISOLATED QUARTERS

2015 2014

Isolated quarters, SEK million Q2 Q1 Q4 Q3 Q2 Q1

Operating activities

Net income 2,123 1,454 4,165 2,624 2,662 1,692

Adjustments to reconcile net income to cash

Taxes –1,360 –1,921 475 –388 26 –1,348

Earnings/dividends in JV and associated companies 49 –22 –25 –10 356 –16

Depreciation, amortization and impairment losses 2,579 2,681 2,690 2,481 2,414 2,360

Other 22 944 965 267 404 549

3,413 3,136 8,270 4,974 5,862 3,237

Changes in operating net assets

Inventories 383 –4,019 1,203 –840 –1,188 –2,099

Customer finance, current and non–current 405 –258 174 –1,101 –341 558

Trade receivables 3,630 2,037 –4,661 –1,222 –892 7,957

Trade payables –1,400 –1,668 1,250 –1,519 1,644 –110

Provisions and post–employment benefits 1,685 –166 –152 –18 –225 –464

Other operating assets and liabilities, net –5,038 –4,962 2,512 –1,624 –2,806 323

–335 –9,036 326 –6,324 –3,808 6,165

Cash flow from operating activities 3,078 –5,900 8,596 –1,350 2,054 9,402

Investing activities

Investments in property, plant and equipment –2,424 –2,367 –1,553 –1,415 –1,320 –1,034

Sales of property, plant and equipment 1,075 75 56 139 53 274

Acquisitions/divestments of subsidiaries and other operations, net –169 –58 –1,747 –286 –1,512 –849

Product development –843 –294 –986 –155 –185 –197

Other investing activities –280 118 –1,533 –1,302 –388 –169

Short–term investments 9,678 399 4,066 2,308 7,012 –6,790

Cash flow from investing activities 7,037 –2,127 –1,697 –711 3,660 –8,765

Cash flow before financing activities 10,115 –8,027 6,899 –2,061 5,714 637

Financing activities

Dividends paid –11,035 –25 –15 –3 –9,828 –

Other financing activities 431 899 371 –1,288 –2,393 –5,069

Cash flow from financing activities –10,604 874 356 –1,291 –12,221 –5,069

Effect of exchange rate changes on cash –1,860 1,476 1,691 2,306 1,499 433

Net change in cash and cash equivalents –2,349 –5,677 8,946 –1,046 –5,008 –3,999

Cash and cash equivalents, beginning of period 35,311 40,988 32,042 33,088 38,096 42,095

Cash and cash equivalents, end of period 32,962 35,311 40,988 32,042 33,088 38,096

22 Ericsson | Second Quarter Report 2015

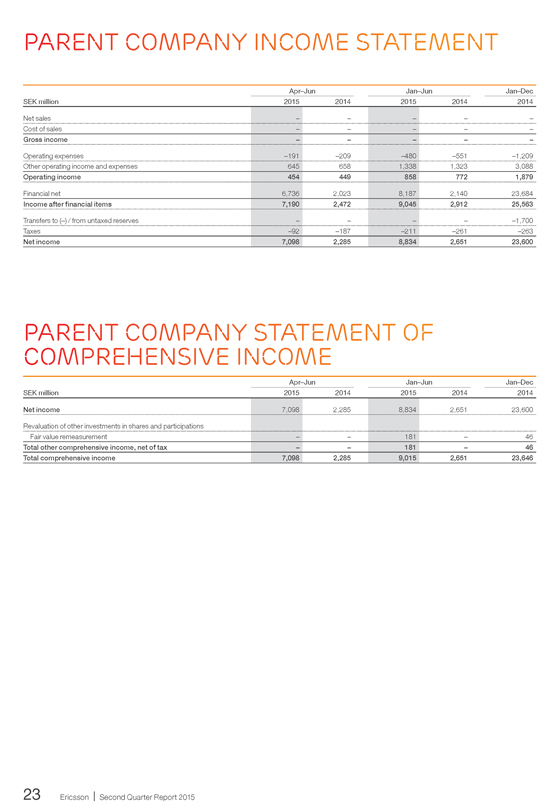

PARENT COMPANY INCOME STATEMENT

Apr–Jun Jan–Jun Jan–Dec

SEK million 2015 2014 2015 2014 2014

Net sales – – – – –

Cost of sales – – – – –

Gross income – – – – –

Operating expenses –191 –209 –480 –551 –1,209

Other operating income and expenses 645 658 1,338 1,323 3,088

Operating income 454 449 858 772 1,879

Financial net 6,736 2,023 8,187 2,140 23,684

Income after financial items 7,190 2,472 9,045 2,912 25,563

Transfers to (–) / from untaxed reserves – – – – –1,700

Taxes –92 –187 –211 –261 –263

Net income 7,098 2,285 8,834 2,651 23,600

PARENT COMPANY STATEMENT OF COMPREHENSIVE INCOME

Apr–Jun Jan–Jun Jan–Dec

SEK million 2015 2014 2015 2014 2014

Net income 7,098 2,285 8,834 2,651 23,600

Revaluation of other investments in shares and participations

Fair value remeasurement – – 181 – 46

Total other comprehensive income, net of tax – – 181 – 46

Total comprehensive income 7,098 2,285 9,015 2,651 23,646

23 Ericsson | Second Quarter Report 2015

PARENT COMPANY BALANCE SHEET

Jun 30 2015 Dec 31 2014

SEK million

ASSETS

Fixed assets

Intangible assets 1,008 1,193

Tangible assets 480 470

Financial assets 98,873 97,901

100,361 99,564

Current assets

Inventories 1 27

Receivables 34,749 24,819

Short–term investments 20,251 30,576

Cash and cash equivalents 13,990 24,443

68,991 79,865

Total assets 169,352 179,429

STOCKHOLDERS’ EQUITY, PROVISIONS AND LIABILITIES

Equity

Restricted equity 48,018 48,018

Non–restricted equity 35,951 37,871

83,969 85,889

Provisions 747 1,471

Non–current liabilities 46,261 45,512

Current liabilities 38,375 46,557

Total stockholders’ equity, provisions and liabilities 169,352 179,429

Assets pledged as collateral 608 525

Contingent liabilities 20,975 20,906

24 Ericsson | Second Quarter Report 2015

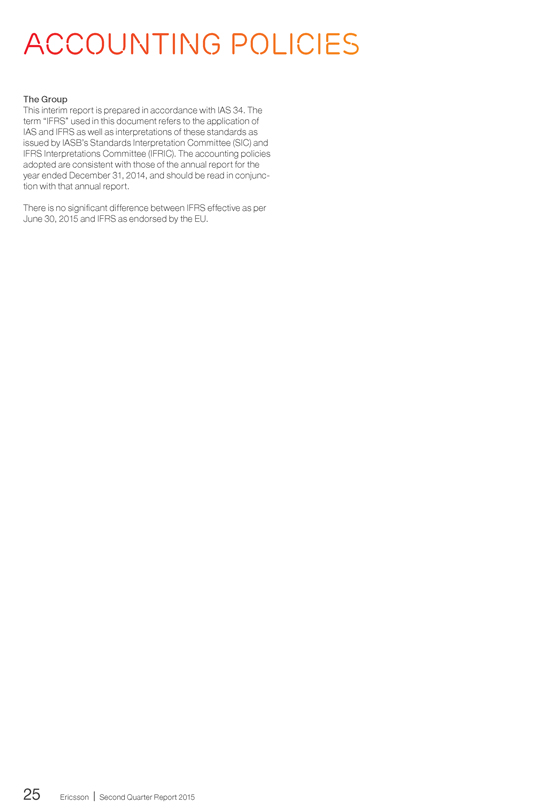

ACCOUNTING POLICIES

The Group

This interim report is prepared in accordance with IAS 34. The term “IFRS” used in this document refers to the application of IAS and IFRS as well as interpretations of these standards as issued by IASB’s Standards Interpretation Committee (SIC) and IFRS Interpretations Committee (IFRIC). The accounting policies adopted are consistent with those of the annual report for the year ended December 31, 2014, and should be read in conjunction with that annual report.

There is no significant difference between IFRS effective as per June 30, 2015 and IFRS as endorsed by the EU.

25 Ericsson | Second Quarter Report 2015

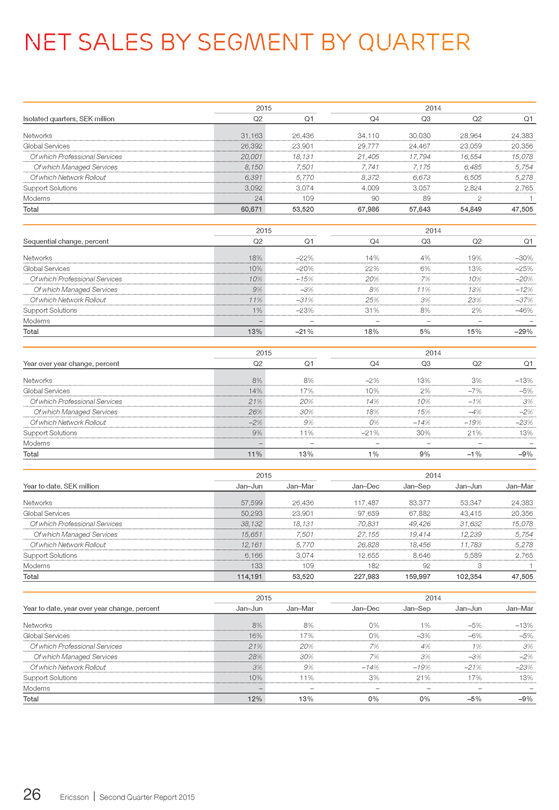

NET SALES BY SEGMENT BY QUARTER

2015 2014

Isolated quarters, SEK million Q2 Q1 Q4 Q3 Q2 Q1

Networks 31,163 26,436 34,110 30,030 28,964 24,383

Global Services 26,392 23,901 29,777 24,467 23,059 20,356

Of which Professional Services 20,001 18,131 21,405 17,794 16,554 15,078

Of which Managed Services 8,150 7,501 7,741 7,175 6,485 5,754

Of which Network Rollout 6,391 5,770 8,372 6,673 6,505 5,278

Support Solutions 3,092 3,074 4,009 3,057 2,824 2,765

Modems 24 109 90 89 2 1

Total 60,671 53,520 67,986 57,643 54,849 47,505

2015 2014

Sequential change, percent Q2 Q1 Q4 Q3 Q2 Q1

Networks 18% –22% 14% 4% 19% –30%

Global Services 10% –20% 22% 6% 13% –25%

Of which Professional Services 10% –15% 20% 7% 10% –20%

Of which Managed Services 9% –3% 8% 11% 13% –12%

Of which Network Rollout 11% –31% 25% 3% 23% –37%

Support Solutions 1% –23% 31% 8% 2% –46%

Modems – – – – – –

Total 13% –21% 18% 5% 15% –29%

2015 2014

Year over year change, percent Q2 Q1 Q4 Q3 Q2 Q1

Networks 8% 8% –2% 13% 3% –13%

Global Services 14% 17% 10% 2% –7% –5%

Of which Professional Services 21% 20% 14% 10% –1% 3%

Of which Managed Services 26% 30% 18% 15% –4% –2%

Of which Network Rollout –2% 9% 0% –14% –19% –23%

Support Solutions 9% 11% –21% 30% 21% 13%

Modems – – – – – –

Total 11% 13% 1% 9% –1% –9%

2015 2014

Year to date, SEK million Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

Networks 57,599 26,436 117,487 83,377 53,347 24,383

Global Services 50,293 23,901 97,659 67,882 43,415 20,356

Of which Professional Services 38,132 18,131 70,831 49,426 31,632 15,078

Of which Managed Services 15,651 7,501 27,155 19,414 12,239 5,754

Of which Network Rollout 12,161 5,770 26,828 18,456 11,783 5,278

Support Solutions 6,166 3,074 12,655 8,646 5,589 2,765

Modems 133 109 182 92 3 1

Total 114,191 53,520 227,983 159,997 102,354 47,505

2015 2014

Year to date, year over year change, percent Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

Networks 8% 8% 0% 1% –5% –13%

Global Services 16% 17% 0% –3% –6% –5%

Of which Professional Services 21% 20% 7% 4% 1% 3%

Of which Managed Services 28% 30% 7% 3% –3% –2%

Of which Network Rollout 3% 9% –14% –19% –21% –23%

Support Solutions 10% 11% 3% 21% 17% 13%

Modems – – – – – –

Total 12% 13% 0% 0% –5% –9%

26 Ericsson | Second Quarter Report 2015

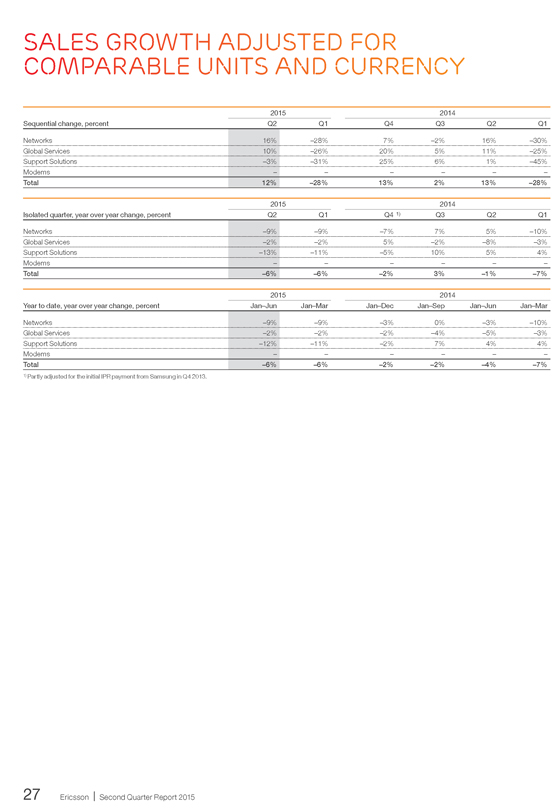

SALES GROWTH ADJUSTED FOR COMPARABLE UNITS AND CURRENCY

2015 2014

Sequential change, percent Q2 Q1 Q4 Q3 Q2 Q1

Networks 16% –28% 7% –2% 16% –30%

Global Services 10% –26% 20% 5% 11% –25%

Support Solutions –3% –31% 25% 6% 1% –45%

Modems – – – – – –

Total 12% –28% 13% 2% 13% –28%

2015 2014

Isolated quarter, year over year change, percent Q2 Q1 Q4 1) Q3 Q2 Q1

Networks –9% –9% –7% 7% 5% –10%

Global Services –2% –2% 5% –2% –8% –3%

Support Solutions –13% –11% –5% 10% 5% 4%

Modems – – – – – –

Total –6% –6% –2% 3% –1% –7%

2015 2014

Year to date, year over year change, percent Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

Networks –9% –9% –3% 0% –3% –10%

Global Services –2% –2% –2% –4% –5% –3%

Support Solutions –12% –11% –2% 7% 4% 4%

Modems – – – – – –

Total –6% –6% –2% –2% –4% –7%

1) Partly adjusted for the initial IPR payment from Samsung in Q4 2013.

27 Ericsson | Second Quarter Report 2015

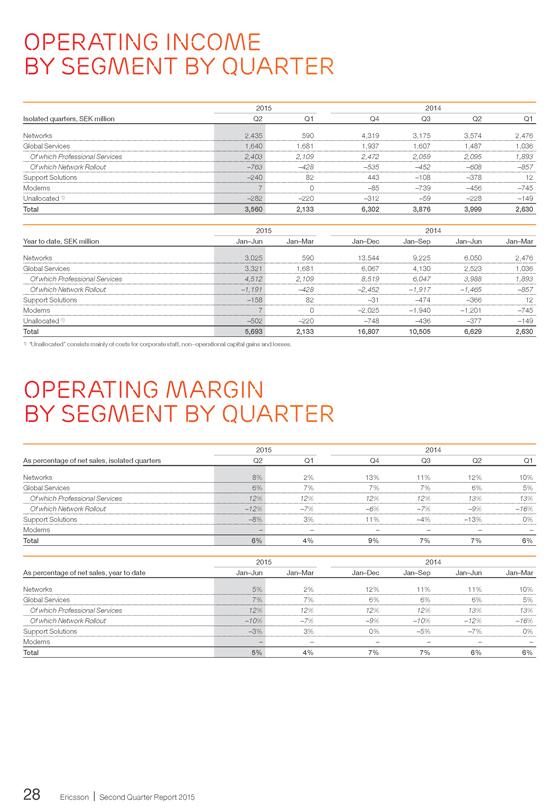

OPERATING INCOME BY SEGMENT BY QUARTER

2015 2014

Isolated quarters, SEK million Q2 Q1 Q4 Q3 Q2 Q1

Networks 2,435 590 4,319 3,175 3,574 2,476

Global Services 1,640 1,681 1,937 1,607 1,487 1,036

Of which Professional Services 2,403 2,109 2,472 2,059 2,095 1,893

Of which Network Rollout –763 –428 –535 –452 –608 –857

Support Solutions –240 82 443 –108 –378 12

Modems 7 0 –85 –739 –456 –745

Unallocated 1) –282 –220 –312 –59 –228 –149

Total 3,560 2,133 6,302 3,876 3,999 2,630

2015 2014

Year to date, SEK million Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

Networks 3,025 590 13,544 9,225 6,050 2,476

Global Services 3,321 1,681 6,067 4,130 2,523 1,036

Of which Professional Services 4,512 2,109 8,519 6,047 3,988 1,893

Of which Network Rollout –1,191 –428 –2,452 –1,917 –1,465 –857

Support Solutions –158 82 –31 –474 –366 12

Modems 7 0 –2,025 –1,940 –1,201 –745

Unallocated 1) –502 –220 –748 –436 –377 –149

Total 5,693 2,133 16,807 10,505 6,629 2,630

1) “Unallocated” consists mainly of costs for corporate staff, non–operational capital gains and losses.

OPERATING MARGIN BY SEGMENT BY QUARTER

2015 2014

As percentage of net sales, isolated quarters Q2 Q1 Q4 Q3 Q2 Q1

Networks 8% 2% 13% 11% 12% 10%

Global Services 6% 7% 7% 7% 6% 5%

Of which Professional Services 12% 12% 12% 12% 13% 13%

Of which Network Rollout –12% –7% –6% –7% –9% –16%

Support Solutions –8% 3% 11% –4% –13% 0%

Modems – – – – – –

Total 6% 4% 9% 7% 7% 6%

2015 2014

As percentage of net sales, year to date Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

Networks 5% 2% 12% 11% 11% 10%

Global Services 7% 7% 6% 6% 6% 5%

Of which Professional Services 12% 12% 12% 12% 13% 13%

Of which Network Rollout –10% –7% –9% –10% –12% –16%

Support Solutions –3% 3% 0% –5% –7% 0%

Modems – – – – – –

Total 5% 4% 7% 7% 6% 6%

28 Ericsson | Second Quarter Report 2015

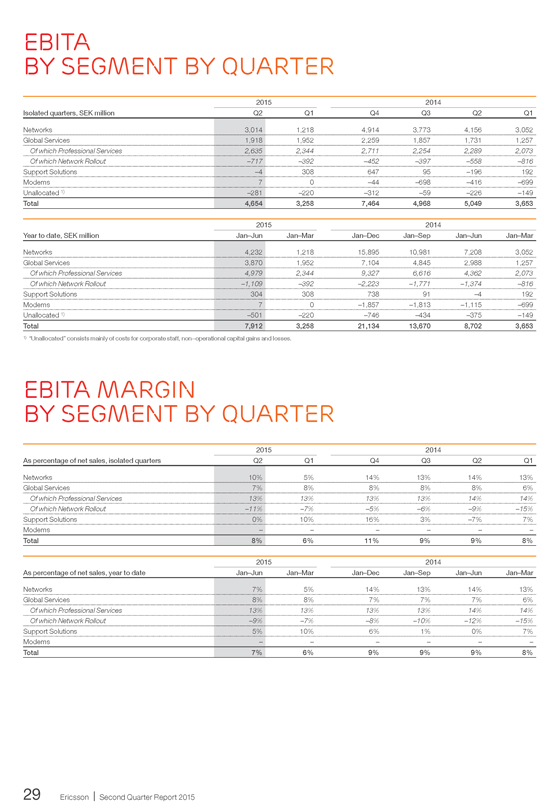

EBITA BY SEGMENT BY QUARTER

2015 2014

Isolated quarters, SEK million Q2 Q1 Q4 Q3 Q2 Q1

Networks 3,014 1,218 4,914 3,773 4,156 3,052

Global Services 1,918 1,952 2,259 1,857 1,731 1,257

Of which Professional Services 2,635 2,344 2,711 2,254 2,289 2,073

Of which Network Rollout –717 –392 –452 –397 –558 –816

Support Solutions –4 308 647 95 –196 192

Modems 7 0 –44 –698 –416 –699

Unallocated 1) –281 –220 –312 –59 –226 –149

Total 4,654 3,258 7,464 4,968 5,049 3,653

2015 2014

Year to date, SEK million Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

Networks 4,232 1,218 15,895 10,981 7,208 3,052

Global Services 3,870 1,952 7,104 4,845 2,988 1,257

Of which Professional Services 4,979 2,344 9,327 6,616 4,362 2,073

Of which Network Rollout –1,109 –392 –2,223 –1,771 –1,374 –816

Support Solutions 304 308 738 91 –4 192

Modems 7 0 –1,857 –1,813 –1,115 –699

Unallocated 1) –501 –220 –746 –434 –375 –149

Total 7,912 3,258 21,134 13,670 8,702 3,653

1) “Unallocated” consists mainly of costs for corporate staff, non–operational capital gains and losses.

EBITA MARGIN BY SEGMENT BY QUARTER

2015 2014

As percentage of net sales, isolated quarters Q2 Q1 Q4 Q3 Q2 Q1

Networks 10% 5% 14% 13% 14% 13%

Global Services 7% 8% 8% 8% 8% 6%

Of which Professional Services 13% 13% 13% 13% 14% 14%

Of which Network Rollout –11% –7% –5% –6% –9% –15%

Support Solutions 0% 10% 16% 3% –7% 7%

Modems – – – – – –

Total 8% 6% 11% 9% 9% 8%

2015 2014

As percentage of net sales, year to date Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

Networks 7% 5% 14% 13% 14% 13%

Global Services 8% 8% 7% 7% 7% 6%

Of which Professional Services 13% 13% 13% 13% 14% 14%

Of which Network Rollout –9% –7% –8% –10% –12% –15%

Support Solutions 5% 10% 6% 1% 0% 7%

Modems – – – – – –

Total 7% 6% 9% 9% 9% 8%

29 Ericsson | Second Quarter Report 2015

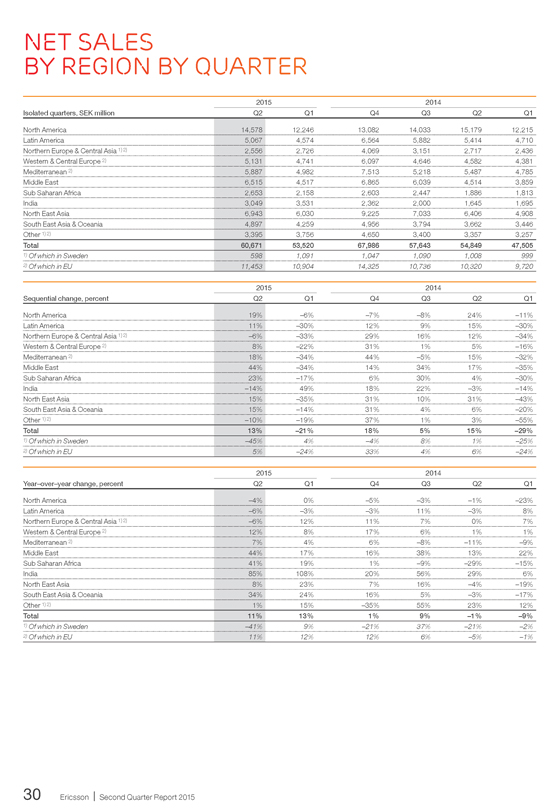

NET SALES BY MARGIN BY QUARTER

2015 2014

Isolated quarters, SEK million Q2 Q1 Q4 Q3 Q2 Q1

North America 14,578 12,246 13,082 14,033 15,179 12,215

Latin America 5,067 4,574 6,564 5,882 5,414 4,710

Northern Europe & Central Asia 1) 2) 2,556 2,726 4,069 3,151 2,717 2,436

Western & Central Europe 2) 5,131 4,741 6,097 4,646 4,582 4,381

Mediterranean 2) 5,887 4,982 7,513 5,218 5,487 4,785

Middle East 6,515 4,517 6,865 6,039 4,514 3,859

Sub Saharan Africa 2,653 2,158 2,603 2,447 1,886 1,813

India 3,049 3,531 2,362 2,000 1,645 1,695

North East Asia 6,943 6,030 9,225 7,033 6,406 4,908

South East Asia & Oceania 4,897 4,259 4,956 3,794 3,662 3,446

Other 1) 2) 3,395 3,756 4,650 3,400 3,357 3,257

Total 60,671 53,520 67,986 57,643 54,849 47,505

1) Of which in Sweden 598 1,091 1,047 1,090 1,008 999

2) Of which in EU 11,453 10,904 14,325 10,736 10,320 9,720

2015 2014

Sequential change, percent Q2 Q1 Q4 Q3 Q2 Q1

North America 19% –6% –7% –8% 24% –11%

Latin America 11% –30% 12% 9% 15% –30%

Northern Europe & Central Asia 1) 2) –6% –33% 29% 16% 12% –34%

Western & Central Europe 2) 8% –22% 31% 1% 5% –16%

Mediterranean 2) 18% –34% 44% –5% 15% –32%

Middle East 44% –34% 14% 34% 17% –35%

Sub Saharan Africa 23% –17% 6% 30% 4% –30%

India –14% 49% 18% 22% –3% –14%

North East Asia 15% –35% 31% 10% 31% –43%

South East Asia & Oceania 15% –14% 31% 4% 6% –20%

Other 1) 2) –10% –19% 37% 1% 3% –55%

Total 13% –21% 18% 5% 15% –29%

1) Of which in Sweden –45% 4% –4% 8% 1% –25%

2) Of which in EU 5% –24% 33% 4% 6% –24%

2015 2014

Year–over–year change, percent Q2 Q1 Q4 Q3 Q2 Q1

North America –4% 0% –5% –3% –1% –23%

Latin America –6% –3% –3% 11% –3% 8%

Northern Europe & Central Asia 1) 2) –6% 12% 11% 7% 0% 7%

Western & Central Europe 2) 12% 8% 17% 6% 1% 1%

Mediterranean 2) 7% 4% 6% –8% –11% –9%

Middle East 44% 17% 16% 38% 13% 22%

Sub Saharan Africa 41% 19% 1% –9% –29% –15%

India 85% 108% 20% 56% 29% 6%

North East Asia 8% 23% 7% 16% –4% –19%

South East Asia & Oceania 34% 24% 16% 5% –3% –17%

Other 1) 2) 1% 15% –35% 55% 23% 12%

Total 11% 13% 1% 9% –1% –9%

1) Of which in Sweden –41% 9% –21% 37% –21% –2%

2) Of which in EU 11% 12% 12% 6% –5% –1%

30 Ericsson | Second Quarter Report 2015

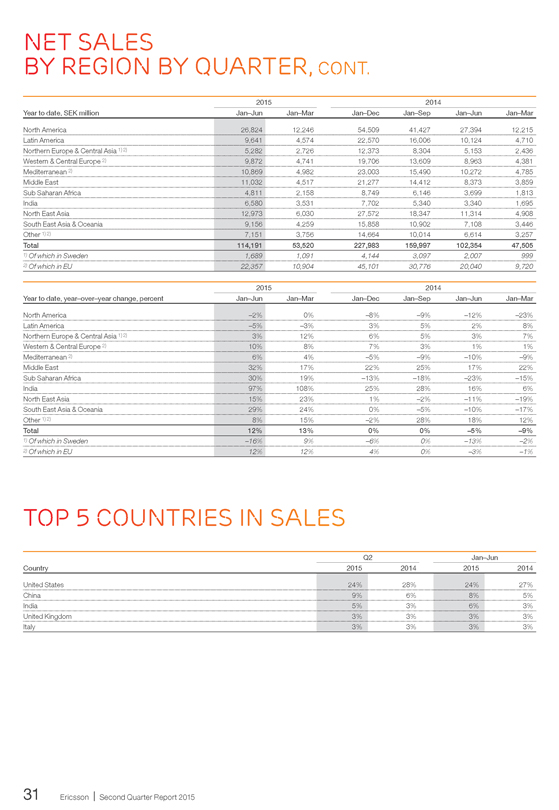

NET SALES BY REGION BY QUARTER, CONT.

2015 2014

Year to date, SEK million Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

North America 26,824 12,246 54,509 41,427 27,394 12,215

Latin America 9,641 4,574 22,570 16,006 10,124 4,710

Northern Europe & Central Asia 1) 2) 5,282 2,726 12,373 8,304 5,153 2,436

Western & Central Europe 2) 9,872 4,741 19,706 13,609 8,963 4,381

Mediterranean 2) 10,869 4,982 23,003 15,490 10,272 4,785

Middle East 11,032 4,517 21,277 14,412 8,373 3,859

Sub Saharan Africa 4,811 2,158 8,749 6,146 3,699 1,813

India 6,580 3,531 7,702 5,340 3,340 1,695

North East Asia 12,973 6,030 27,572 18,347 11,314 4,908

South East Asia & Oceania 9,156 4,259 15,858 10,902 7,108 3,446

Other 1) 2) 7,151 3,756 14,664 10,014 6,614 3,257

Total 114,191 53,520 227,983 159,997 102,354 47,505

1) Of which in Sweden 1,689 1,091 4,144 3,097 2,007 999

2) Of which in EU 22,357 10,904 45,101 30,776 20,040 9,720

2015 2014

Year to date, year–over–year change, percent Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

North America –2% 0% –8% –9% –12% –23%

Latin America –5% –3% 3% 5% 2% 8%

Northern Europe & Central Asia 1) 2) 3% 12% 6% 5% 3% 7%

Western & Central Europe 2) 10% 8% 7% 3% 1% 1%

Mediterranean 2) 6% 4% –5% –9% –10% –9%

Middle East 32% 17% 22% 25% 17% 22%

Sub Saharan Africa 30% 19% –13% –18% –23% –15%

India 97% 108% 25% 28% 16% 6%

North East Asia 15% 23% 1% –2% –11% –19%

South East Asia & Oceania 29% 24% 0% –5% –10% –17%

Other 1) 2) 8% 15% –2% 28% 18% 12%

Total 12% 13% 0% 0% –5% –9%

1) Of which in Sweden –16% 9% –6% 0% –13% –2%

2) Of which in EU 12% 12% 4% 0% –3% –1%

TOP 5 COUNTRIES IN SALES

Q2 Jan–Jun

Country 2015 2014 2015 2014

United States 24% 28% 24% 27%

China 9% 6% 8% 5%

India 5% 3% 6% 3%

United Kingdom 3% 3% 3% 3%

Italy 3% 3% 3% 3%

31 Ericsson | Second Quarter Report 2015

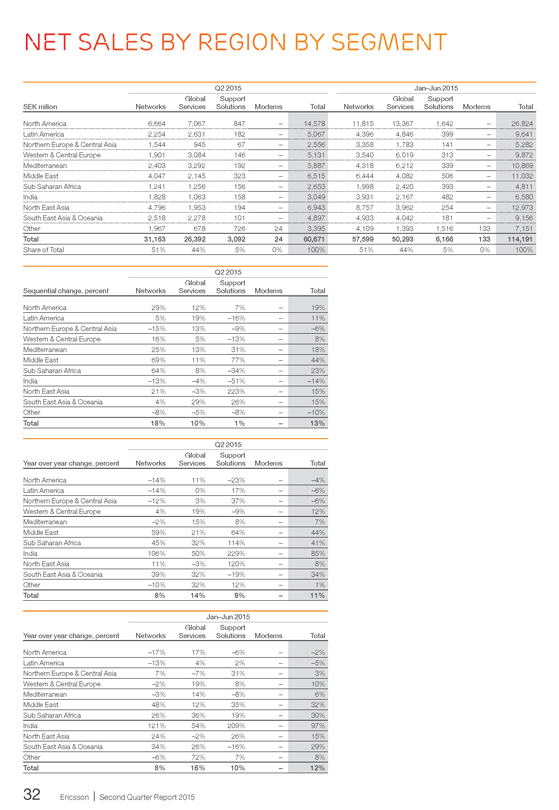

NET SALES BY REGION BY SEGMENT

Q2 2015 Jan–Jun 2015

SEK milion Networks Global Services Support Solutions Modems Total Networks Global Services Support Solutions Modems Total

North America 6,664 7,067 847 – 14,578 11,815 13,367 1,642 – 26,824

Latin America 2,254 2,631 182 – 5,067 4,396 4,846 399 – 9,641

Northern Europe & Central Asia 1,544 945 67 – 2,556 3,358 1,783 141 – 5,282

Western & Central Europe 1,901 3,084 146 – 5,131 3,540 6,019 313 – 9,872

Mediterranean 2,403 3,292 192 – 5,887 4,318 6,212 339 – 10,869

Middle East 4,047 2,145 323 – 6,515 6,444 4,082 506 – 11,032

Sub Saharan Africa 1,241 1,256 156 – 2,653 1,998 2,420 393 – 4,811

India 1,828 1,063 158 – 3,049 3,931 2,167 482 – 6,580

North East Asia 4,796 1,953 194 – 6,943 8,757 3,962 254 – 12,973

South East Asia & Oceania 2,518 2,278 101 – 4,897 4,933 4,042 181 – 9,156

Other 1,967 678 726 24 3,395 4,109 1,393 1,516 133 7,151

Total 31,163 26,392 3,092 24 60,671 57,599 50,293 6,166 133 114,191

Share of Total 51% 44% 5% 0% 100% 51% 44% 5% 0% 100%

Q2 2015

Sequential change, percent Networks Global Services Support Solutions Modems Total

North America 29% 12% 7% – 19%

Latin America 5% 19% –16% – 11%

Northern Europe & Central Asia –15% 13% –9% – –6%

Western & Central Europe 16% 5% –13% – 8%

Mediterranean 25% 13% 31% – 18%

Middle East 69% 11% 77% – 44%

Sub Saharan Africa 64% 8% –34% – 23%

India –13% –4% –51% – –14%

North East Asia 21% –3% 223% – 15%

South East Asia & Oceania 4% 29% 26% – 15%

Other –8% –5% –8% – –10%

Total 18% 10% 1% – 13%

Q2 2015

Year over year change, percent Networks Global Services Support Solutions Modems Total

North America –14% 11% –23% – –4%

Latin America –14% 0% 17% – –6%

Northern Europe & Central Asia –12% 3% 37% – –6%

Western & Central Europe 4% 19% –9% – 12%

Mediterranean –2% 15% 8% – 7%

Middle East 59% 21% 64% – 44%

Sub Saharan Africa 45% 32% 114% – 41%

India 106% 50% 229% – 85%

North East Asia 11% –3% 120% – 8%

South East Asia & Oceania 39% 32% –19% – 34%

Other –10% 32% 12% – 1%

Total 8% 14% 9% – 11%

Jan–Jun 2015

Year over year change, percent Networks Global Services Support Solutions Modems Total

North America –17% 17% –6% – –2%

Latin America –13% 4% 2% – –5%

Northern Europe & Central Asia 7% –7% 31% – 3%

Western & Central Europe –2% 19% 8% – 10%

Mediterranean –3% 14% –8% – 6%

Middle East 48% 12% 35% – 32%

Sub Saharan Africa 26% 36% 19% – 30%

India 121% 54% 209% – 97%

North East Asia 24% –2% 26% – 15%

South East Asia & Oceania 34% 26% –16% – 29%

Other –6% 72% 7% – 8%

Total 8% 16% 10% – 12%

32 Ericsson | Second Quarter Report 2015

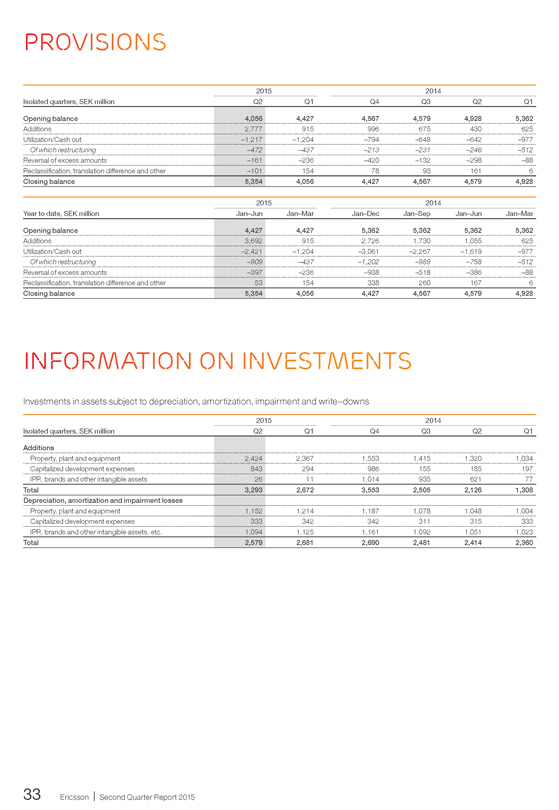

PROVISIONS

2015 2014

Isolated quarters, SEK million Q2 Q1 Q4 Q3 Q2 Q1

Opening balance 4,056 4,427 4,567 4,579 4,928 5,362

Additions 2,777 915 996 675 430 625

Utilization/Cash out –1,217 –1,204 –794 –648 –642 –977

Of which restructuring –472 –437 –213 –231 –246 –512

Reversal of excess amounts –161 –236 –420 –132 –298 –88

Reclassification, translation difference and other –101 154 78 93 161 6

Closing balance 5,354 4,056 4,427 4,567 4,579 4,928

2015 2014

Year to date, SEK million Jan–Jun Jan–Mar Jan–Dec Jan–Sep Jan–Jun Jan–Mar

Opening balance 4,427 4,427 5,362 5,362 5,362 5,362

Additions 3,692 915 2,726 1,730 1,055 625

Utilization/Cash out –2,421 –1,204 –3,061 –2,267 –1,619 –977

Of which restructuring –909 –437 –1,202 –989 –758 –512

Reversal of excess amounts –397 –236 –938 –518 –386 –88

Reclassification, translation difference and other 53 154 338 260 167 6

Closing balance 5,354 4,056 4,427 4,567 4,579 4,928

INFORMATION ON INVESTMENTS

Investments in assets subject to depreciation, amortization, impairment and write–downs

2015 2014

Isolated quarters, SEK million Q2 Q1 Q4 Q3 Q2 Q1

Additions

Property, plant and equipment 2,424 2,367 1,553 1,415 1,320 1,034

Capitalized development expenses 843 294 986 155 185 197

IPR, brands and other intangible assets 26 11 1,014 935 621 77

Total 3,293 2,672 3,553 2,505 2,126 1,308

Depreciation, amortization and impairment losses

Property, plant and equipment 1,152 1,214 1,187 1,078 1,048 1,004

Capitalized development expenses 333 342 342 311 315 333

IPR, brands and other intangible assets, etc. 1,094 1,125 1,161 1,092 1,051 1,023

Total 2,579 2,681 2,690 2,481 2,414 2,360

33 Ericsson | Second Quarter Report 2015

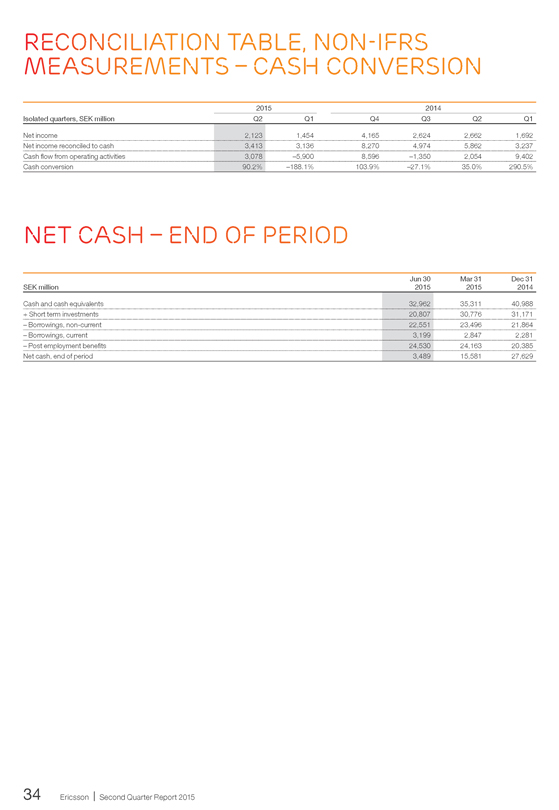

RECONCILIATION TABLE, NON-IFRS MEASUREMENTS – CASH CONVERSION

2015 2014

Isolated quarters, SEK million Q2 Q1 Q4 Q3 Q2 Q1

Net income 2,123 1,454 4,165 2,624 2,662 1,692

Net income reconciled to cash 3,413 3,136 8,270 4,974 5,862 3,237

Cash flow from operating activities 3,078 –5,900 8,596 –1,350 2,054 9,402

Cash conversion 90.2% –188.1% 103.9% –27.1% 35.0% 290.5%

NET CASH – END OF PERIOD

SEK million Jun 30 2015 Mar 31 2015 Dec 31 2014

Cash and cash equivalents 32,962 35,311 40,988

+ Short term investments 20,807 30,776 31,171

– Borrowings, non-current 22,551 23,496 21,864

– Borrowings, current 3,199 2,847 2,281

– Post employment benefits 24,530 24,163 20,385

Net cash, end of period 3,489 15,581 27,629

34 Ericsson | Second Quarter Report 2015

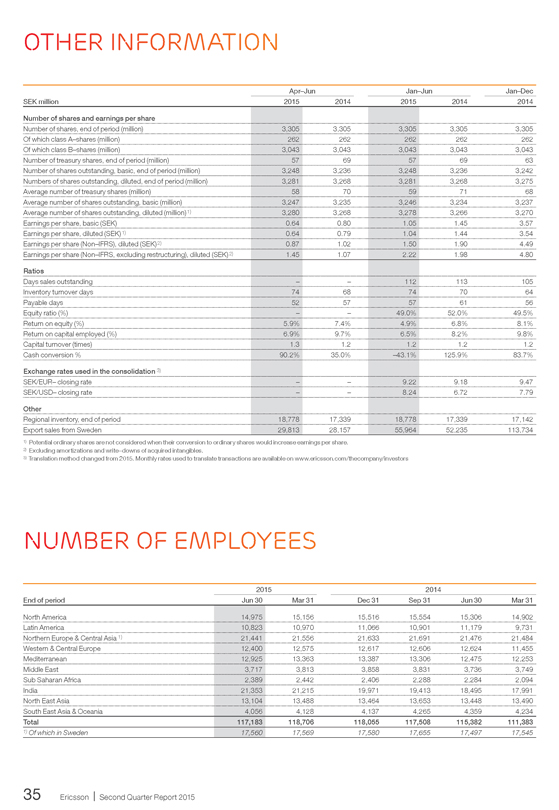

OTHER INFORMATION

SEK million Apr-Jun 2015 2014 Jan-Jun 2015 2014 Jan-Dec 2014

Number of shares and earnings per share

Number of shares, end of period (million) 3,305 3,305 3,305 3,305 3,305

Of which class A-shares (million) 262 262 262 262 262

Of which class B-shares (million) 3,043 3,043 3,043 3,043 3,043

Number of treasury shares, end of period (million) 57 69 57 69 63

Number of shares outstanding, basic, end of period (million) 3,248 3,236 3,248 3,236 3,242

Numbers of shares outstanding, diluted, end of period (million) 3,281 3,268 3,281 3,268 3,275

Average number of treasury shares (million) 58 70 59 71 68

Average number of shares outstanding, basic (million) 3,247 3,235 3,246 3,234 3,237

Average number of shares outstanding, diluted (million) 1) 3,280 3,268 3,278 3,266 3,270

Earnings per share, basic (SEK) 0.64 0.80 1.05 1.45 3.57

Earnings per share, diluted (SEK) 1) 0.64 0.79 1.04 1.44 3.54

Earnings per share (Non-IFRS), diluted (SEK) 2) 0.87 1.02 1.50 1.90 4.49

Earnings per share (Non-IFRS, excluding restructuring), diluted (SEK) 2) 1.45 1.07 2.22 1.98 4.80

Ratios

Days sales outstanding - - 112 113 105

Inventory turnover days 74 68 74 70 64

Payable days 52 57 57 61 56

Equity ratio (%) - - 49.0% 52.0% 49.5%

Return on equity (%) 5.9% 7.4% 4.9% 6.8% 8.1%

Return on capital employed (%) 6.9% 9.7% 6.5% 8.2% 9.8%

Capital turnover (times) 1.3 1.2 1.2 1.2 1.2

Cash conversion % 90.2% 35.0% -43.1% 125.9% 83.7%

Exchange rates used in the consolidation 3)

SEK/EUR-closing rate - - 9.22 9.18 9.47

SEK/USD-closing rate - - 8.24 6.72 7.79

Other

Regional inventory, end of period 18,778 17,339 18,778 17,339 17,142

Export sales from Sweden 29,813 28,157 55,964 52,235 113,734

1) Potential ordinary shares are not considered when their conversion to ordinary shares would increase earnings per share.

2) Excluding amortizations and write–downs of acquired intangibles.

3) Translation method changed from 2015. Monthly rates used to translate transactions are available on

www.ericsson.com/thecompany/investors

NUMBER OF EMPLOYEES

End of period 2015 Jun 30 Mar 31 Dec 31 2014 Sep 31 Jun 30 Mar 31

North America 14,975 15,156 15,516 15,554 15,306 14,902

Latin America 10,823 10,970 11,066 10,901 11,179 9,731

Northern Europe & Central Asia 1) 21,441 21,556 21,633 21,691 21,476 21,484

Western & Central Europe 12,400 12,575 12,617 12,606 12,624 11,455

Mediterranean 12,925 13,363 13,387 13,306 12,475 12,253

Middle East 3,717 3,813 3,858 3,831 3,736 3,749

Sub Saharan Africa 2,389 2,442 2,406 2,288 2,284 2,094

India 21,353 21,215 19,971 19,413 18,495 17,991

North East Asia 13,104 13,488 13,464 13,653 13,448 13,490

South East Asia & Oceania 4,056 4,128 4,137 4,265 4,359 4,234

Total 117,183 118,706 118,055 117,508 115,382 111,383

1) Of which in Sweden 17,560 17,569 17,580 17,655 17,497 17,545

35 Ericsson | Second Quarter Report 2015

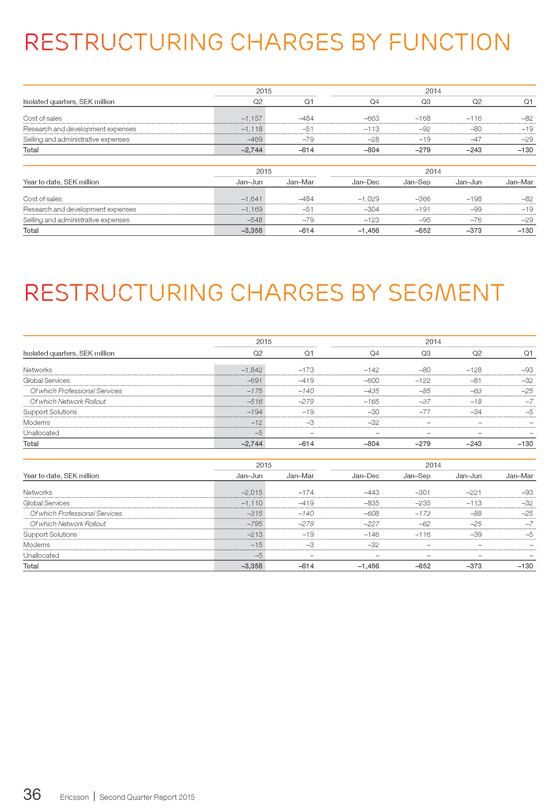

RESTRUCTURING CHARGES BY FUNCTION

Isolated quarters, SEK million 2015 Q2 Q1 Q4 2014 Q3 Q2 Q1

Cost of sales -1,157 -484 -663 -168 -116 -82