- WEBNF Dashboard

- Financials

- Filings

- Holdings

- Transcripts

-

ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Westpac Banking (WEBNF) 6-KCurrent report (foreign)

Filed: 4 May 20, 10:13am

Exhibit 3

| ASX Release 4 MAY 2020 Westpac 2020 Half Year Result - Media Release Level 18, 275 Kent Street Sydney, NSW, 2000 Westpac Banking Corporation (“Westpac”) today provides the attached Media Release – Westpac 2020 Half Year Result. For further information: David LordingAndrew Bowden Group Head of Media RelationsHead of Investor Relations 0419 683 411T. (02) 8253 4008 (ext. 24008) M. 0438 284 863 This document has been authorised for release by Tim Hartin, Group Company Secretary. |

| `Lhghgl,k.mnbvcxdghjkl; Media Release 4 May 2020 Financial results snapshot First Half 2020 compared to First Half 20191 •Statutory net profit $1,190 million, down 62% •Cash earnings $993 million, down 70% (excluding notable items2, $2,278 million, down 44%) •Impairment charge of $2,238 million, up $1,905 including potential impacts of COVID-19 •Cash earnings per share 28 cents, down 71% (excluding notable items,2 64 cents, down 46%) •Net interest margin 2.13%, up 1 bps •Return on equity (ROE) 2.9% (excluding notable items2, 6.7%) •Common equity Tier 1 (CET1) capital ratio of 10.8% •Interim dividend decision deferred Key points •Supporting our people and customers -105,000 Australian mortgage accounts put on hold, total loan value of $39 billion -31,000 Australian business loans put on hold, total loan value of $8.2 billion -22,000 Australian employees working from home •Simplifying Westpac and how it is run -Greater focus on banking businesses to create a simpler and more efficient bank -Establish Specialist Businesses division with a strategic review of Superannuation, Wealth Platforms, Investments, Insurance, Auto Finance and Westpac Pacific businesses -Lines of business sharpening individual accountability and end-to-end management •Improving risk management -Respond to AUSTRAC matter -Update CGA implementation plan and improve non-financial risk management -Customer remediation program, $107 million in payments to customers during the half •Building for the long term -Support customers, improve performance disciplines and transform the business using digital -Reset the cost base for a simpler organisation 1 Reported on a cash earnings basis unless otherwise stated. For an explanation of cash earnings and reconciliation to reported results, refer to Section 5, Note 8 of Westpac Group’s 2020 Interim Financial Results. 2 References to notable items in this release include (after tax) provisions for: estimated customer refunds, payments, associated costs and litigation ($258m) and costs associated with AUSTRAC proceedings including a provision for a potential penalty ($1,027m). |

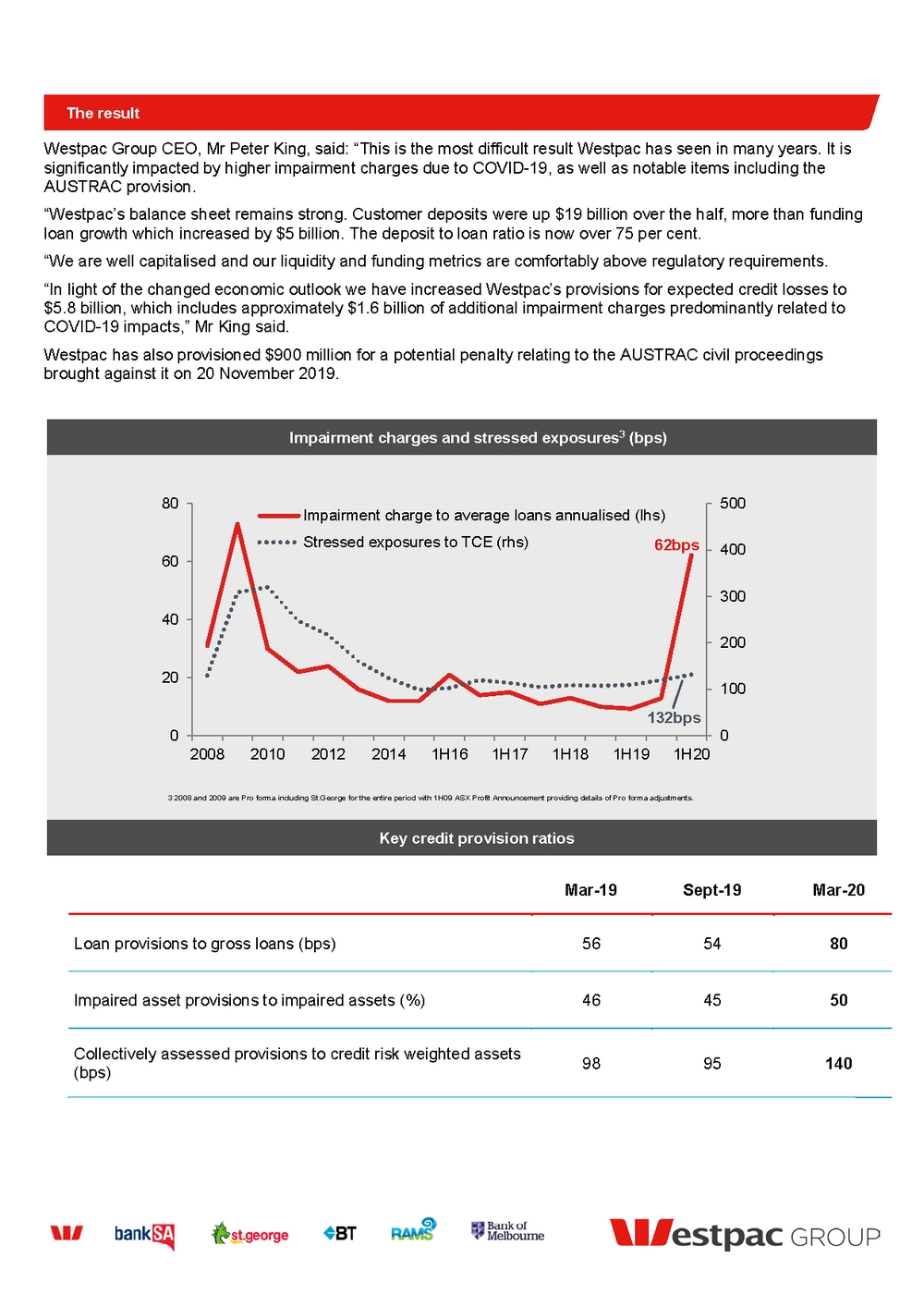

| The result Westpac Group CEO, Mr Peter King, said: “This is the most difficult result Westpac has seen in many years. It is significantly impacted by higher impairment charges due to COVID-19, as well as notable items including the AUSTRAC provision. “Westpac’s balance sheet remains strong. Customer deposits were up $19 billion over the half, more than funding loan growth which increased by $5 billion. The deposit to loan ratio is now over 75 per cent. “We are well capitalised and our liquidity and funding metrics are comfortably above regulatory requirements. “In light of the changed economic outlook we have increased Westpac’s provisions for expected credit losses to $5.8 billion, which includes approximately $1.6 billion of additional impairment charges predominantly related to COVID-19 impacts,” Mr King said. Westpac has also provisioned $900 million for a potential penalty relating to the AUSTRAC civil proceedings brought against it on 20 November 2019. Impairment charges and stressed exposures3 (bps) 80 Impairment charge to average loans annualised (lhs) 500 Stressed exposures to TCE (rhs) 60 62bps 400 300 40 200 20 132bps 0 20082010201220141H161H171H181H191H20 100 0 3 2008 and 2009 are Pro forma including St.George for the entire period with 1H09 ASX Profit Announcement providing details of Pro forma adjustments. Key credit provision ratios Mar-19Sept-19Mar-20 Loan provisions to gross loans (bps)565480 Impaired asset provisions to impaired assets (%)464550 Collectively assessed provisions to credit risk weighted assets (bps)9895140 |

| Supporting our people and customers Mr King said Westpac was using its scale, strength and experience to support its people and customers through the unprecedented COVID-19 crisis. “We are continuing to lend to keep credit flowing in the economy and we have tailored relief packages to help consumers and businesses. “It is vital that when we get to the recovery phase businesses are ready to re-open and support as many Australians back into work as possible.” Mr King said he was incredibly proud of the way employees had responded to COVID-19. “Despite the significant disruption to their home and working lives, our people have remained committed to assisting customers through these challenging times. “Our significant investment in IT has allowed us to increase from an average of 1,000 to 22,000 Australian employees working from home, many in customer facing roles. “We have been particularly focused on making it easier and faster for customers to sign up digitally and do their banking from home,” he said. “This includes introducing new measures such as increasing the value of a cheque that can be deposited from our mobile banking app from $1,000 to $20,000, and increasing the tap and go payment limit from $100 to $200.” Simplifying what we do – focusing on banking businesses In determining immediate priorities, Mr King said it was clear that Westpac needed to simplify and focus on its Australian and New Zealand banking businesses. “We have several businesses where we don’t have sufficient scale or where the returns are insufficient for the risk. These include wealth platforms, superannuation and retirement products, investments, general and life insurance and auto finance. “These businesses will be moved into a new Specialist Businesses division. Jason Yetton has been appointed Chief Executive, Specialist Businesses, and will commence the new role on 18 May 2020. “Our Westpac Pacific business will also be managed in this division to simplify the Institutional bank portfolio. “Jason is a proven executive who held senior positions at Westpac for many years, including Group Executive, Westpac Retail & Business Banking and General Manager, BT Customer Solutions, and was most recently an executive at CBA. “These are good businesses with strong franchises and will benefit from being in their own division under the leadership of Jason who will bring his considerable energy and skills to the role. Over the coming months we will conduct a detailed strategic review on the best options for these businesses. This will include considering whether they would ultimately be more successful under different ownership. “The changes today are a significant step to reducing the complexity of our portfolio and will allow the Group Executives to focus on improving performance in our Australian and New Zealand banking businesses.” Background on Mr Yetton is attached. Improving risk management Mr King said it was clear that Westpac’s non-financial risk management needed to improve, and this was one of the Group’s highest priorities. “Working with the Board, we are implementing changes which will have a strong, positive impact on Westpac’s management of non-financial risk and performance,” he said. “We’ve made a number of leadership and structural changes and are implementing the recommendations from our Culture, Governance and Accountability self-assessment. “The Board and Executive team are committed to delivering the required uplift in non-financial risk management.” |

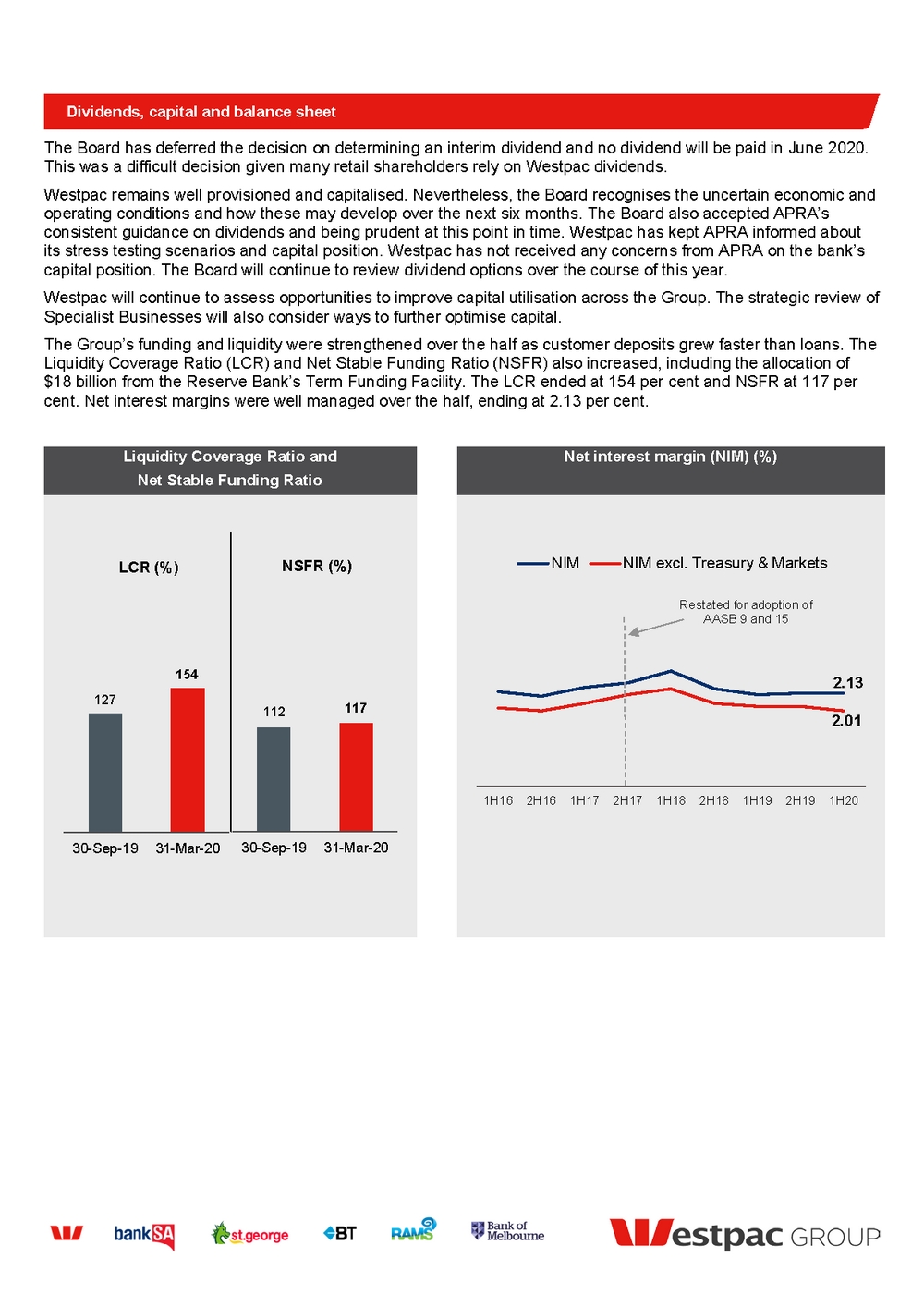

| Dividends, capital and balance sheet The Board has deferred the decision on determining an interim dividend and no dividend will be paid in June 2020. This was a difficult decision given many retail shareholders rely on Westpac dividends. Westpac remains well provisioned and capitalised. Nevertheless, the Board recognises the uncertain economic and operating conditions and how these may develop over the next six months. The Board also accepted APRA’s consistent guidance on dividends and being prudent at this point in time. Westpac has kept APRA informed about its stress testing scenarios and capital position. Westpac has not received any concerns from APRA on the bank’s capital position. The Board will continue to review dividend options over the course of this year. Westpac will continue to assess opportunities to improve capital utilisation across the Group. The strategic review of Specialist Businesses will also consider ways to further optimise capital. The Group’s funding and liquidity were strengthened over the half as customer deposits grew faster than loans. The Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) also increased, including the allocation of $18 billion from the Reserve Bank’s Term Funding Facility. The LCR ended at 154 per cent and NSFR at 117 per cent. Net interest margins were well managed over the half, ending at 2.13 per cent. Liquidity Coverage Ratio and Net Stable Funding Ratio Net interest margin (NIM) (%) LCR (%) NSFR (%) NIMNIM excl. Treasury & Markets Restated for adoption of AASB 9 and 15 127 154 112 117 2.13 2.01 1H16 2H16 1H17 2H17 1H18 2H18 1H19 2H19 1H20 30-Sep-1931-Mar-20 30-Sep-1931-Mar-20 |

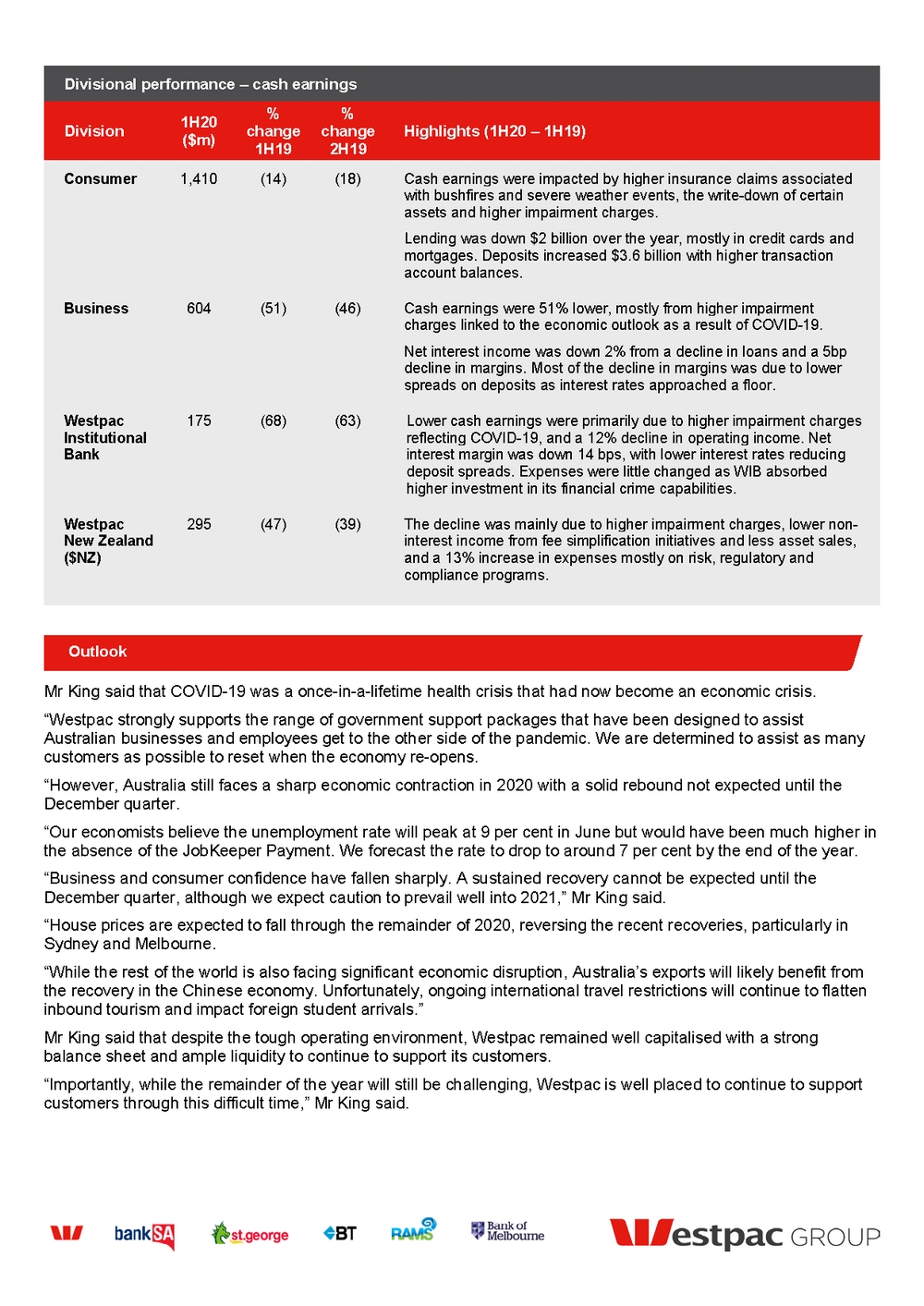

| Divisional performance – cash earnings Division1H20 ($m) % change 1H19 % change 2H19 Highlights (1H20 – 1H19) Consumer1,410(14)(18)Cash earnings were impacted by higher insurance claims associated with bushfires and severe weather events, the write-down of certain assets and higher impairment charges. Lending was down $2 billion over the year, mostly in credit cards and mortgages. Deposits increased $3.6 billion with higher transaction account balances. Business604(51)(46)Cash earnings were 51% lower, mostly from higher impairment charges linked to the economic outlook as a result of COVID-19. Net interest income was down 2% from a decline in loans and a 5bp decline in margins. Most of the decline in margins was due to lower spreads on deposits as interest rates approached a floor. Westpac Institutional Bank 175(68)(63)Lower cash earnings were primarily due to higher impairment charges reflecting COVID-19, and a 12% decline in operating income. Net interest margin was down 14 bps, with lower interest rates reducing deposit spreads. Expenses were little changed as WIB absorbed higher investment in its financial crime capabilities. Westpac New Zealand ($NZ) 295(47)(39)The decline was mainly due to higher impairment charges, lower non-interest income from fee simplification initiatives and less asset sales, and a 13% increase in expenses mostly on risk, regulatory and compliance programs. Outlook Mr King said that COVID-19 was a once-in-a-lifetime health crisis that had now become an economic crisis. “Westpac strongly supports the range of government support packages that have been designed to assist Australian businesses and employees get to the other side of the pandemic. We are determined to assist as many customers as possible to reset when the economy re-opens. “However, Australia still faces a sharp economic contraction in 2020 with a solid rebound not expected until the December quarter. “Our economists believe the unemployment rate will peak at 9 per cent in June but would have been much higher in the absence of the JobKeeper Payment. We forecast the rate to drop to around 7 per cent by the end of the year. “Business and consumer confidence have fallen sharply. A sustained recovery cannot be expected until the December quarter, although we expect caution to prevail well into 2021,” Mr King said. “House prices are expected to fall through the remainder of 2020, reversing the recent recoveries, particularly in Sydney and Melbourne. “While the rest of the world is also facing significant economic disruption, Australia’s exports will likely benefit from the recovery in the Chinese economy. Unfortunately, ongoing international travel restrictions will continue to flatten inbound tourism and impact foreign student arrivals.” Mr King said that despite the tough operating environment, Westpac remained well capitalised with a strong balance sheet and ample liquidity to continue to support its customers. “Importantly, while the remainder of the year will still be challenging, Westpac is well placed to continue to support customers through this difficult time,” Mr King said. |

| To view Mr King’s 1H20 results video on Westpac Wire, please visit our website. For further information David LordingAndrew Bowden Head of Media RelationsHead of Investor Relations M. 0419 683 411T. 02 8253 4008 M. 0438 284 863 Jason Yetton Biography Jason Yetton is a proven financial services executive with a consistent track record of success, transformation and achievement across banking, funds management and wealth management. Most recently Jason was Chief Executive Officer NewCo, CBA, where he was appointed to lead the demerger of its wealth management and mortgage broking businesses. Prior to that he was Chief Executive Officer & Managing Director, SocietyOne, an early financial services disrupter and consumer finance marketplace lender. Jason was previously with the Westpac Group for more than 20 years, holding a number of senior positions including Group Executive, Westpac Retail & Business Banking, and a range of senior executive positions in BT Financial Group, including General Manager, BT Customer Solutions and Head of Product. Jason is married with three sons and lives in Sydney. |