decrease to noncurrent liabilities of $1.3 million, with a corresponding adjustment to other comprehensive income. The adoption did not affect our results of operations.

FIN 48, “Accounting for Uncertainty in Income Taxes,” requires that uncertain tax positions are evaluated in a two-step process, whereby (1) it is determined whether it is more likely than not that the tax positions will be sustained based on the technical merits of the position and (2) for those tax positions that meet the more-likely-than-not recognition threshold, the largest amount of tax benefit that is greater than fifty percent likely of being realized upon ultimate settlement with the related tax authority would be recognized.

At our non-operating properties, we accrue costs associated with environmental remediation obligations when it is probable that such costs will be incurred and they are reasonably estimable. Estimates for reclamation and other closure costs are prepared in accordance with SFAS No. 5 “Accounting for Contingencies,” or Statement of Position 96-1 “Environmental Remediation Liabilities.” Accruals for estimated losses from environmental remediation obligations have historically been recognized no later than completion of the remedial feasibility study for such facility and are charged to provision for closed operations and environmental matters. Costs of future expenditures for environmental remediation are not discounted to their present value unless subject to a contractually obligated fixed payment schedule. Such costs are based on management’s current estimate of amounts to be incurred when the remediation work is performed, within current laws and regulations.

Future closure, reclamation and environmental-related expenditures are difficult to estimate, in many circumstances, due to the early stage nature of investigations, and uncertainties associated with defining the nature and extent of environmental contamination and the application of laws and regulations by regulatory authorities and changes in reclamation or remediation technology. We periodically review accrued liabilities for such reclamation and remediation costs as evidence becomes available indicating that our liabilities have potentially changed. Changes in estimates at our non-operating properties are reflected in current period net income (loss).

Sales to smelters are recorded net of charges by the smelters for treatment, refining, smelting losses, and other charges negotiated by us with the smelters. Charges are estimated by us upon shipment of concentrates based on contractual terms, and actual charges do not vary materially from our estimates. Costs charged by smelters include fixed treatment and refining costs per ton of concentrate, and also include price escalators which allow the smelters to participate in the increase of lead and zinc prices above a negotiated baseline.

Table of Contents

Changes in metals prices between shipment and final settlement will result in changes to revenues previously recorded upon shipment. Our concentrate sales are based on a provisional sales price containing an embedded derivative that is required to be separated from the host contract for accounting purposes. The host contract is the receivable from the sale of the concentrates at the forward price at the time of the sale. The embedded derivative, which does not qualify for hedge accounting, is adjusted to market through earnings each period prior to final settlement.

At December 31, 2008, metals contained in concentrates and exposed to future price changes totaled 902,248 ounces of silver, 3,730 ounces of gold, 17,283 tons of zinc, and 5,609 tons of lead.

Sales from our Greens Creek and Lucky Friday units include significant value from by-product metals mined along with net values of each unit’s primary metal.

Sales of metals in products tolled by refiners and sold directly by us, rather than sold to smelters, are recorded at contractual amounts when title and risk of loss transfer to the buyer. We sell finished metals after refining, as well as doré produced at our locations. Third-party smelting and refinery costs are recorded as a reduction of revenue.

Changes in the market price of metals significantly affect our revenues, profitability, and cash flow. Metals prices can and often do fluctuate widely and are affected by numerous factors beyond our control, such as political and economic conditions, demand, forward selling by producers, expectations for inflation, central bank sales, custom smelter activities, the relative exchange rate of the U.S. dollar, purchases and lending, investor sentiment, and global mine production levels. The aggregate effect of these factors is impossible to predict. Because our revenue is derived from the sale of silver, gold, lead, and zinc, our earnings are directly related to the prices of these metals.

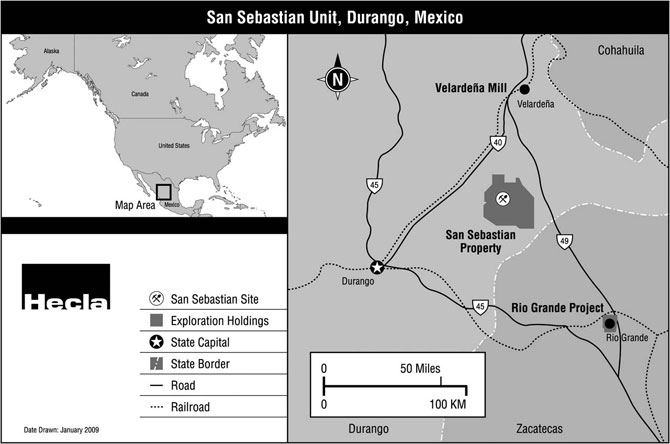

P. Foreign Currency — The functional currency for our operations located in the U.S., Mexico and Canada, as of December 31, 2008, was the U.S. dollar. Accordingly, for the San Sebastian unit in Mexico and our Canadian office, we have translated our monetary assets and liabilities at the period-end exchange rate, and non-monetary assets and liabilities at historical rates, with income and expenses translated at the average exchange rate for the current period. All translation gains and losses have been included in the current period net income (loss).

Effective January 1, 2007, we implemented a change in the functional currency for our discontinued Venezuelan operations from the U.S. dollar to the Bolívar, the local currency in Venezuela. We believe that significant changes in the economic facts and circumstances affecting our discontinued Venezuelan operations indicated that a change in the functional currency was appropriate, under the provisions of FASB Statement No. 52, “Foreign Currency Translation” (SFAS 52). In accordance with SFAS 52, the balance sheet for our discontinued Venezuelan operations has been recalculated, as of January 1, 2007, so that all assets and liabilities are translated at the current exchange rate of 2,150 Bolívar to $1, the fixed, official exchange rate in effect at that time. As a result, the dollar value of non-monetary assets, previously translated at historical exchange rates, has been significantly reduced. The offsetting translation adjustment was recorded to equity as a component of accumulated other comprehensive income, and reclassified to loss on sale of discontinued operations upon the sale of our Venezuelan operations.

For the years ended December 31, 2008, 2007 and 2006, we recognized total net foreign exchange losses of $13.2 million, $12.1 million and $5.0 million, respectively.Of these, $13.3 million, $12.0 million and $4.9 million, respectively, of the net foreign exchange losses for the three years are related to our discontinued Venezuelan operations, and are included inGain (loss) from discontinued operations, net of tax with the remaining balance included inNet foreign exchange gain (loss), on ourConsolidated Statements of Operations and Comprehensive Income (Loss).

Exchange control regulations enacted in Venezuela in 2005 limited our ability to repatriate cash and receive dividends or other distributions without substantial cost. At December 31, 2007, we held the U.S. dollar equivalent of approximately $30.0 million denominated in the Venezuelan Bolívar at the rate of 2,150 Bolivares to $1.00. Additionally, we were required to convert into Venezuelan currency the proceeds of Venezuelan export sales made over the past 180 days, approximately $8.1 million, during the six months following December 31, 2007. Exchanging our cash held in local currency into U.S. dollars could be done through specific governmental programs, or through the use of negotiable instruments at conversion rates that were higher than the official rate (parallel rate) on which we incurred foreign currency losses. During 2008 and 2007, we exchanged the U.S. dollar equivalent of approximately $38.7 and $37.0 million, respectively, valued at the official exchange rate of 2,150 Bolivares to $1.00, for $25.4 and $19.8 million at open market exchange rates, in compliance with applicable regulations, incurring a foreign exchange loss for the difference. Changes to the Venezuelan Criminal Exchange Law enacted in December 2007 prohibit the publication of Bolívar exchange rates other than the official rate.

On July 8, 2008, we completed the sale of our discontinued Venezuelan operations to Rusoro Mining Company (“Rusoro”) (seeNote 13 for further discussion). During the second quarter of 2008, we repatriated substantially all of our remaining Bolivares-denominated cash. Pursuant to the sale agreement, Rusoro paid us $0.9 million for the U.S. dollar equivalent of the residual Bolivares-denominated cash balances held in Venezuela at the close of the sale, converted at official rates.

F-12

Table of Contents

Q. Risk Management Contracts — We use derivative financial instruments as part of an overall risk-management strategy that is used as a means of hedging exposure to base metals prices and interest rates. We do not hold or issue derivative financial instruments for speculative trading purposes.

Derivative contracts qualifying as normal purchases and sales are accounted as such, under the provisions of SFAS No. 133 “Accounting for Derivative Instruments and Hedging Activities.” Gains and losses arising from a change in the fair value of a contract before the contract’s delivery date are not recorded, and the contract price is recognized in sales of products following settlement of the contract by physical delivery of production to the counterparty at contract maturity.

We measure derivative contracts as assets or liabilities based on their fair value. Gains or losses resulting from changes in the fair value of derivatives in each period are recorded either in current earnings or other comprehensive income (“OCI”), depending on the use of the derivative, whether it qualifies for hedge accounting and whether that hedge is effective. Amounts deferred in OCI are reclassified to sales of products (for metals price-related contracts) or interest expense (for interest rate-related contracts) when the hedged transaction has occurred. Ineffective portions of any change in fair value of a derivative are recorded in current period other operating income (expense).

On May 5, 2008, we entered into an interest rate swap agreement that had the economic effect of modifying the LIBOR-based variable interest obligations associated with our term facility. As a result, the interest payable related to $103.3 million of the $121.7 million term facility balance at December 31, 2008 is fixed at a rate of 9.38% until maturity on March 31, 2011, in accordance with the amortization schedule of the amended and restated credit agreement dated April 16, 2008. As a result of an amendment to the facility in December 2008 to defer the $18.3 million principal payment originally due on December 31, 2008 to February 13, 2009, the terms of the interest rate swap agreement and the note that the swap agreement pertains to did not match at December 31, 2008 with regards to the maturity date of the $18.3 million payment, with the hedge being slightly ineffective as a result. The fair value of the swap at December 31, 2008 was a liability of $2.5 million. We have recorded an accumulated unrealized loss of $2.0 million at December 31, 2008, and realized a $0.5 million hedging loss in 2008 related to the ineffective portion of the swap. The unrealized loss is included in accumulated other comprehensive income in our consolidated balance sheet and the realized loss is included in interest expense in our consolidated statement of operations, with the fair value payable included in other non-current liabilities in our consolidated balance sheet. For additional information regarding our credit facilities, seeNote 7andNote 21.

On February 3, 2009, we reached an agreement to amend the terms of our credit facilities to defer all principal payments due on our term facility in 2009, totaling $66.7 million, to 2010 and 2011 (SeeNote 21 for more information). As a result of the amendment, the original hedging relationship was de-designated, and a new hedging relationship was designated. A retrospective hedge effectiveness test was performed on the original hedging relationship at the date of de-designation, and the original hedging relationship was determined to be ineffective. Consequently, the change in fair value of the swap of $0.2 million between December 31, 2008 and February 3, 2009 was recorded as a gain on the income statement. The amount of unrealized loss included in accumulated other comprehensive income relating to the original hedge will be recognized in the income statement when the hedged interest payments occur.

We had no commodity-related derivative positions at December 31, 2008.

R. Stock Based Compensation — In accordance with SFAS No. 123(R), the fair value of the equity instruments granted to employees during 2008 were estimated on the date of grant using the Black-Scholes pricing model, utilizing the same methodologies and assumptions as we have historically used. As of December 31, 2008, the majority of the instruments outstanding were fully vested, and we recognized stock-based compensation expense under SFAS No. 123(R) of approximately $4.1 million during 2008, which was recorded to general and administrative expenses, exploration and cost of sales and other direct production costs. For the years ended December 31, 2007 and 2006, we recognized $3.4 million and $2.5 million, respectively, in compensation expense as required by SFAS No. 123(R).

For additional information on our employee stock option and unit compensation, seeNotes 9 and10 ofNotes to Consolidated Financial Statements.

S. Pre-Development Expense — Costs incurred in the exploration stage that may ultimately benefit production, such as underground ramp development, are expensed due to the lack of proven and probable reserves, which would indicate future recovery of these expenses.

T. Legal Costs –Legal costs incurred in connection with a potential loss contingency are recorded to expense as incurred.

U. Basic and Diluted Income (Loss) Per Common Share — We calculate basic earnings per share on the basis of the weighted average number of common shares outstanding during the period. Diluted earnings per share is calculated using weighted average number of common shares outstanding during the period plus the effect of potential dilutive common shares during the period using the treasury stock method.

F-13

Table of Contents

Potential dilutive common shares include outstanding stock options, restricted stock awards, stock units, warrants and convertible preferred stock for periods in which we have reported net income. For periods in which we reported net losses, potential dilutive common shares are excluded, as their conversion and exercise would be anti-dilutive. SeeNote 15 ofNotes to Consolidated Financial Statements for additional information.

V. Comprehensive Income (Loss) — In addition to net income (loss), comprehensive income (loss) includes all changes in equity during a period, such as adjustments to minimum pension liabilities, adjustments to recognize the overfunded or underfunded status of our defined benefit pension plans pursuant to SFAS No. 158, the effective portion of changes in fair value of derivative instruments, foreign currency translation adjustments and cumulative unrecognized changes in the fair value of available for sale investments, net of tax, if applicable.

W. New Accounting Pronouncements — In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles,” which identifies the sources of accounting principles and provides entities with a framework for selecting the principles used in preparation of financial statements that are presented in conformity with GAAP. SFAS 162 will become effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, The Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles. The adoption of SFAS No. 162 is not expected to have a material impact on our consolidated financial statements.

In March 2008, the FASB issued SFAS No. 161 “Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB Statement No. 133 (SFAS No. 161),” to enhance the current disclosure framework in SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities, as amended.” SFAS No. 161 amends and expands the disclosures required by SFAS No. 133 so that they provide an enhanced understanding of (1) how and why an entity uses derivative instruments, (2) how derivative instruments and related hedged items are accounted for under SFAS No. 133 and its related interpretations, and (3) how derivative instruments affect an entity’s financial position, financial performance, and cash flows. SFAS No. 161 is effective for both interim and annual reporting periods beginning after November 15, 2008. We are currently evaluating the potential impact of this statement on our consolidated financial statements and at this time we do not anticipate a material effect.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements – an amendment of No. ARB 51,” which is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. SFAS No. 160 amends ARB 51 to establish accounting and reporting standards for the noncontrolling ownership interest in a subsidiary and for the deconsolidation of a subsidiary. We are currently evaluating the potential impact of this statement on our consolidated financial statements and at this time we do not anticipate a material effect.

In December 2007, the FASB revised SFAS No. 141 “Business Combinations.” The revised standard is effective for transactions where the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008.SFAS No. 141(R) will change the accounting for the assets acquired and liabilities assumed in a business combination.

| | |

| • | Acquisition costs will be generally expensed as incurred; |

| | |

| • | Noncontrolling interests (formally known as “minority interests”) will be valued at fair value at the acquisition date; |

| | |

| • | Acquired contingent liabilities will be recorded at fair value at the acquisition date and subsequently measured at either the higher of such amount or the amount determined under existing guidance for non-acquired contingencies; |

| | |

| • | In-process research and development will be recorded at fair value as an indefinite-lived intangible asset at the acquisition date |

| | |

| • | Restructuring costs associated with a business combination will be generally expensed subsequent to the acquisition date; and |

| | |

| • | Changes in deferred tax asset valuation allowances and income tax uncertainties after the acquisition date generally will affect income tax expense. |

The adoption of SFAS No. 141(R) does not currently have a material effect on our Consolidated Financial Statements. However, any future business acquisitions occurring on or after the beginning of the first annual reporting period beginning on or after December 15, 2008 will be accounted for in accordance with this statement.

In September 2006, the FASB issued SFAS No. 157 “Fair Value Measurements,” which became effective for fiscal years beginning after November 15, 2007, and for interim periods within those years, for certain financial assets and

F-14

Table of Contents

liabilities. SFAS No. 157 defines fair value, establishes a framework for measuring fair value and expands the related disclosure requirements. In February 2008, FASB Staff Position (FSP) No. FAS 157-2 was issued, which delayed by a year the effective date of SFAS No. 157 for certain nonfinancial assets and liabilities. We adopted SFAS No. 157 for financial assets and liabilities in the first quarter of 2008, and the adoption did not have a material impact on our consolidated financial statements. See Note 14 of Notes to the Consolidated Financial Statements for more information. We are currently evaluating the potential impact of the adoption of SFAS No. 157 as it relates to nonfinancial assets and liabilities on our consolidated financial statements.

Note 2. Short-term Investments and Securities Held for Sale, Investments, and Restricted Cash

Cash

Exchange control regulations in Venezuela limited our ability to repatriate cash and receive dividends or other distributions without substantial cost. Our cash balances denominated in Bolívares that were maintained in Venezuela totaled a U.S. dollar equivalent, at official exchange rates, of approximately $30.0 million at December 31, 2007. On June 19, 2008, we entered into an agreement to sell our wholly owned subsidiaries holding our business and operations in Venezuela to Rusoro, with the transaction closing on July 8, 2008 (seeNote 13 for further discussion of the transaction).

Prior to the sale of our Venezuelan operations, exchanging our cash held in local currency into U.S. dollars was done through specific governmental programs, or through the use of negotiable instruments at conversion rates that were less favorable than the official rate (parallel rate) on which we incurred foreign currency losses. During 2008, prior to the sale of our Venezuelan operations, we exchanged the U.S. dollar equivalent of approximately $38.7 million at the official exchange rate of 2,150 Bolívares to $1.00 for approximately $25.4 million at open market exchange rates and in compliance with applicable regulations, incurring foreign exchange losses for the difference. All of these losses were incurred on repatriations of cash from Venezuela. During 2007, we exchanged the U.S. dollar equivalent of approximately $37.0 million, valued at the official exchange rate of 2,150 Bolívares to $1.00, for approximately $19.8 million at open market exchange rates, in compliance with applicable regulations, incurring foreign exchange losses for the difference. Approximately $13.8 million of the conversion losses for 2007 were incurred on the repatriation of cash from Venezuela, while additional losses of approximately $3.4 million in 2007 were related to conversions of Bolívares for the payment of expatriate payroll and other U.S. dollar-denominated goods and services.

Our cash is maintained in various financial institutions, and the balances are insured up to the Federal Deposit Insurance Corporation limits of $250,000 per institution. Some of our cash balances at December 31, 2008 exceeded the federally insured limits. We have not experienced losses on cash balances exceeding the federally insured limits.

Short-term Investments and Securities Held for Sale

Short-term investments consisted of the following at December 31, 2008 and 2007 (in thousands):

| | | | | | | |

| | 2008 | | 2007 | |

Adjustable rate securities | | $ | — | | $ | 4,000 | |

Marketable equity securities (Cost: 2007 - $18,903) | | | — | | | 21,759 | |

| | $ | — | | $ | 25,759 | |

Adjustable rate securities are carried at amortized cost. However, due to the short-term nature of these investments, the amortized cost approximates fair market value. Marketable equity securities are also carried at fair market value, as they are classified as “available-for-sale” securities under the provisions of SFAS No. 115. The $21.8 million marketable equity securities balance at December 31, 2007 represents 8.2 million shares of Great Basin Gold, Inc. stock, including 7.9 million shares transferred to us upon the sale of the Hollister Development Block gold exploration project interest to Great Basin Gold in April 2007. We sold 8.2 million shares of Great Basin Gold stock during the second quarter of 2008 for total proceeds of $27.0 million and recognized a gain on sale of investment of $8.1 million. In January 2006, we sold our equity shares of Alamos Gold Inc., generating a $36.4 million pre-tax gain and netting $57.4 million of cash proceeds.

Non-current Investments

At December 31, 2008 and 2007, the fair value of our non-current investments was $3.1 million and $8.4 million, respectively. The basis of these investments, representing equity securities, was approximately $5.2 million and $1.1 million, respectively, at December 31, 2008 and 2007. $1.9 million of the $3.1 million non-current investments balance at December 31, 2008 represents 3.6 million shares of Rusoro stock transferred to us upon the sale of El Callao and Drake Bering (seeNote 13 for information on the sale of our discontinued Venezuelan operations). At December 31, 2008, we have recorded a $2.6 million unrealized loss on the Rusoro shares, which have been in a continuous unrealized loss position since August 2008. We considered the following information in concluding that the impairment on the Rusoro shares is temporary:

F-15

Table of Contents

| | |

| • | We believe that we have the intent and ability to hold the investment until its cost basis is recovered, and that it is not probable that we will sell the investment at a loss. |

| | |

| • | Rusoro recently completed the acquisition of a new operating mine and continues to have access to liquidity. We believe that their assets continue to remain sound. |

| | |

| • | Analysts have recently given Rusoro stock a “buy” rating with a target share price greater than our cost, and analyst net asset value calculations have recently exceeded our cost. |

However, the exchange on which Rusoro stock is traded experienced a significant overall loss in value in 2008, there has been a general reduction in investor confidence in junior mining companies in recent months, and Rusoro shares are thinly traded. If our investment in Rusoro stock continues to have a fair value less than its original cost, we will monitor these factors in determining whether it is still appropriate to record an unrealized loss for the impairment in the future.

At December 31, 2008, total unrealized gains of $1.0 million for investments held having a net gain position and total unrealized losses of $3.1 million for investments held having a net loss position were included in accumulated other comprehensive income.

Restricted Cash and Investments

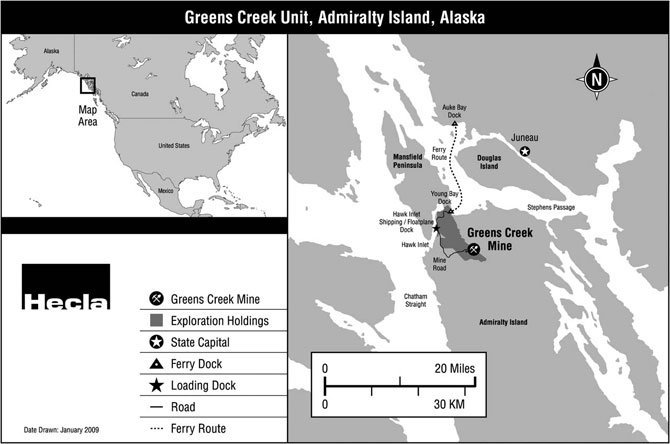

Various laws and permits require that financial assurances be in place for certain environmental and reclamation obligations and other potential liabilities. Restricted investments primarily represent investments in money market funds and certificate of deposit. These investments are restricted primarily for reclamation funding or surety bonds and were $15.2 million at December 31, 2008, and $17.2 million at December 31, 2007, which includes $7.6 million and $8.9 million, respectively, restricted for reclamation funding for the Greens Creek Joint Venture. In April 2008, we completed the acquisition of the companies holding 70.3% of the Greens Creek Joint Venture, resulting in our 100% ownership of Greens Creek through our various subsidiaries (seeNote 19 for further discussion). In August 2008, we obtained release of the restricted cash balance of $30.4 million, replacing it with a letter of credit backed by the restricted cash balance of $7.6 million. Accordingly, the $7.6 million December 31, 2008 balance represents 100% of the Greens Creek restricted balance, while the $8.9 million balance at December 31, 2007 represents our 29.7% share of the $29.9 million total Greens Creek restricted balance held prior to our acquisition of the remaining 70.3% interest.

Our loan covenants required that we maintain an unencumbered cash balance of at least $10 million at December 31, 2008. There was no legal restriction on the funds, therefore, we did not classify them as restricted cash.

Note 3: Inventories

Inventories consist of the following (in thousands):

| | | | | | | |

| | December 31, | |

| | 2008 | | 2007 | |

Concentrates, doré, bullion, metals in transit and in-process inventories | | $ | 12,874 | | $ | 5,465 | |

Materials and supplies | | | 8,457 | | | 10,046 | |

| | $ | 21,331 | | $ | 15,511 | |

The product inventory acquired in connection with the purchase of the companies owning 70.3% of the Greens Creek mine, as discussed further inNote 19, was all sold during the second quarter of 2008.

Note 4: Properties, Plants, Equipment and Mineral Interests, Royalty Obligations and Lease Commitments

Properties, Plants and Equipment and Mineral Interests

Our major components of properties, plants, equipment, and mineral interests are (in thousands):

| | | | | | | |

| | December 31, | |

| | 2008 | | 2007 | |

Mining properties, including asset retirement obligations | | $ | 262,104 | | $ | 14,405 | |

Development costs | | | 88,026 | | | 147,320 | |

Plants and equipment | | | 308,482 | | | 218,791 | |

Land | | | 9,270 | | | 1,007 | |

Mineral interests | | | 369,125 | | | 4,940 | |

Construction in progress | | | 43,941 | | | 23,703 | |

| | | 1,080,948 | | | 410,166 | |

Less accumulated depreciation, depletion and amortization | | | 228,835 | | | 277,858 | |

Net carrying value | | $ | 852,113 | | $ | 132,308 | |

F-16

Table of Contents

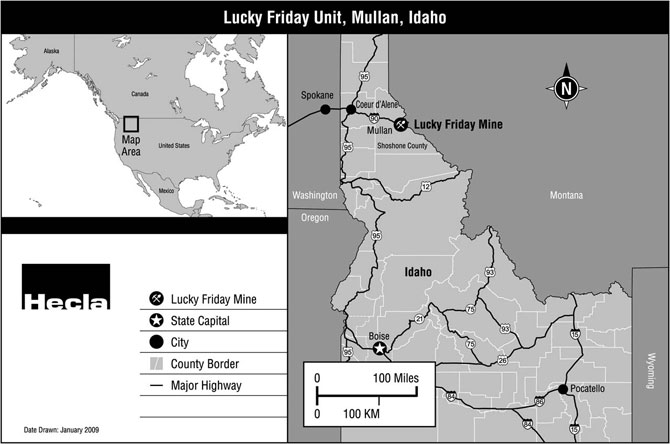

During 2008, we incurred total capital expenditures of approximately $68.7 million that included $44.1 million at the Lucky Friday unit and $24 million at the Greens Creek unit. In addition, on April 16, 2008, we completed the acquisition of the remaining 70.3% interest in the Greens Creek Joint Venture for $758.5 million. A total of $689.7 million of the purchase price was allocated to the net carrying value of property, plants, equipment and mineral interests at the Greens Creek unit, including $5.0 million for the asset retirement obligation, $266.7 million for development costs, $67.2 million for plants and equipment, $7.2 million for land, and $343.6 million for mineral interests. We also acquired substantially all of the assets of Independence Lead Mines (“Independence”) on November 6, 2008 for 6.9 million shares of our common stock. The Independence purchase price of approximately $14.6 million was allocated to mineral interests at the Lucky Friday unit. In addition, we issued approximately 1.6 million shares of our Common Stock in 2008 to acquire the right to earn into a 70% interest in the San Juan Silver Joint Venture with Emerald Mining & Leasing, LLC and Golden 8 Mining, LLC, which holds an approximately 25-square-mile consolidated land package in the Creede Mining District of Colorado, resulting in an $11.4 million increase to mineral interests. SeeNote 19 for further discussion of the acquisitions of 70.3% of Greens Creek, Independence, and San Juan Silver earn-in rights.

On July 8, 2008, we completed the sale of the companies holding 100% of the ownership interest of our discontinued Venezuelan operations, resulting in the disposal of properties, plants, equipment and mineral interests having net carrying value of approximately $32.3 million at the time of sale. SeeNote 13 for more information on the sale.

Leases

We enter into operating leases during the normal course of business. During the years ended December 31, 2008, 2007 and 2006, we incurred expenses of $2.0 million, $1.8 million and $1.2 million, respectively, for these leases. At December 31, 2008, future obligations under our non-cancelable leases were as follows (in thousands):

| | | | |

Year ending December 31, | | | | |

2009 | | $ | 2,511 | |

2010 | | | 853 | |

2011 | | | 853 | |

2012 | | | 220 | |

2013 | | | 9 | |

Total | | $ | 4,446 | |

Note 5: Environmental and Reclamation Activities

The liabilities accrued for our reclamation and closure costs at December 31, 2008 and 2007, were as follows (in thousands):

| | | | | | | |

| | 2008 | | 2007 | |

Operating properties: | | | | | | | |

Greens Creek | | $ | 29,964 | | $ | 5,150 | |

Lucky Friday | | | 879 | | | 807 | |

Nonoperating properties: | | | | | | | |

San Sebastian | | | 1,161 | | | 1,148 | |

Grouse Creek | | | 14,326 | | | 19,061 | |

Coeur d’Alene Basin | | | 65,600 | | | 65,600 | |

Bunker Hill | | | 3,155 | | | 3,459 | |

Republic | | | 3,800 | | | 3,800 | |

All other sites | | | 2,462 | | | 2,640 | |

Discontinued operations – La Camorra | | | — | | | 4,474 | |

Total | | | 121,347 | | | 106,139 | |

Reclamation and closure costs, current | | | (2,227 | ) | | (9,686 | ) |

Reclamation and closure costs, long-term | | $ | 119,120 | | $ | 96,453 | |

The activity in our accrued reclamation and closure cost liability for the years ended December 31, 2008, 2007 and 2006, was as follows (in thousands):

F-17

Table of Contents

| | | | |

Balance at January 1, 2006 | | $ | 69,242 | |

Accruals for estimated costs | | | 643 | |

Revision of estimated cash flows due to changes in reclamation plans | | | 528 | |

Payment of reclamation obligations | | | (4,509 | ) |

Balance at December 31, 2006 | | | 65,904 | |

Accruals for estimated costs | | | 45,623 | |

Revision of estimated cash flows due to changes in reclamation plans | | | 1,293 | |

Payment of reclamation obligations | | | (6,681 | ) |

Balance at December 31, 2007 | | | 106,139 | |

Accruals for estimated costs | | | 811 | |

Liability addition due to the purchase price allocation for the acquisition of 70.3% of Greens Creek | | | 12,145 | |

Revision of estimated cash flows due to changes in reclamation plans | | | 13,114 | |

Liability reduction due to the sale of discontinued operations | | | (4,474 | ) |

Payment of reclamation obligations | | | (6,388 | ) |

Balance at December 31, 2008 | | $ | 121,347 | |

Below is a reconciliation as of December 31, 2008 and 2007 (in thousands), of our asset retirement obligations, which are included in our total accrued reclamation and closure costs of $121.3 million and $106.1 million, respectively, reflected above. The sum of our estimated reclamation and abandonment costs was discounted using a credit adjusted, risk-free interest rate of 7% from the time we incurred the obligation to the time we expect to pay the retirement obligation.

| | | | | | | |

| | 2008 | | 2007 | |

Balance January 1 | | $ | 11,579 | | $ | 9,921 | |

Changes in obligations due to acquisition of 70.3% of Greens Creek | | | 12,145 | | | — | |

Changes in obligations due to changes in reclamation plans | | | 13,114 | | | 1,363 | |

Accretion expense | | | 475 | | | 354 | |

Changes in obligations due to sale of discontinued operations | | | (4,474 | ) | | — | |

Payment of reclamation obligations | | | (835 | ) | | (59 | ) |

Balance at December 31 | | $ | 32,004 | | $ | 11,579 | |

For additional information as it pertains to the acquisition of the remaining 70.3% interest in Greens Creek, seeNote 19. SeeNote 13 for further discussion of the sale of our discontinued Venezuelan operations.

Note 6: Income Taxes

Major components of our income tax provision (benefit) for the years ended December 31, 2008, 2007 and 2006, relating to continuing operations are as follows (in thousands):

| | | | | | | | | | |

| | 2008 | | 2007 | | 2006 | |

Continuing operations: | | | | | | | | | | |

Current: | | | | | | | | | | |

Federal | | $ | 3 | | $ | 811 | | $ | 1,371 | |

State | | | (170 | ) | | 88 | | | 89 | |

Foreign | | | 370 | | | 504 | | | 442 | |

Total current income tax provision | | | 203 | | | 1,403 | | | 1,902 | |

Deferred: | | | | | | | | | | |

Federal | | | 3,604 | | | (9,906 | ) | | (11,594 | ) |

Foreign | | | — | | | — | | | — | |

Total deferred income tax (benefit) provision | | | 3,604 | | | (9,906 | ) | | (11,594 | ) |

Total income tax (benefit) provision from continuing operations | | | 3,807 | | | (8,503 | ) | | (9,692 | ) |

| | | | | | | | | | |

Discontinued operations: | | | | | | | | | | |

Tax provision for loss on sale of discontinued operations | | | 2,944 | | | — | | | — | |

Tax provision (benefit) for loss from discontinued operations | | | — | | | (627 | ) | | 2,391 | |

| | | | | | | | | | |

Total income tax (benefit) provision | | $ | 6,751 | | $ | (9,130 | ) | $ | (7,301 | ) |

F-18

Table of Contents

Domestic and foreign components of income (loss) from operations before income taxes for the years ended December 31, 2008, 2007 and 2006, are as follows (in thousands):

| | | | | | | | | | |

| | 2008 | | 2007 | | 2006 | |

Domestic | | $ | (23,823 | ) | $ | 72,104 | | $ | 61,510 | |

Foreign | | | (9,543 | ) | | (12,450 | ) | | (6,414 | ) |

Discontinued operations | | | (26,446 | ) | | (15,587 | ) | | 6,725 | |

Total | | $ | (59,812 | ) | $ | 44,067 | | $ | 61,821 | |

The annual tax provision (benefit) is different from the amount that would be provided by applying the statutory federal income tax rate to our pretax income (loss). The reasons for the difference are (in thousands):

| | | | | | | | | | | | | | | | | | | |

| | 2008 | | | | | 2007 | | | | | 2006 | | | | |

Computed “statutory” (benefit) provision | | $ | (20,934 | ) | | (35 | )% | $ | 15,423 | | | 35 | % | $ | 21,637 | | | 35 | % |

Percentage depletion | | | (2,594 | ) | | (4 | ) | | (10,416 | ) | | (24 | ) | | (9,126 | ) | | (15 | ) |

Net increase (utilization) of U.S. and foreign tax loss carryforwards | | | 23,528 | | | 39 | | | (3,534 | ) | | (8 | ) | | (23,159 | ) | | (37 | ) |

Change in valuation allowance other than utilization | | | 3,604 | | | 6 | | | (10,481 | ) | | (24 | ) | | (1,219 | ) | | (2 | ) |

Discontinued operations | | | 2,944 | | | 5 | | | — | | | — | | | — | | | — | |

Effect of U.S. AMT, state, foreign taxes and other | | | 203 | | | — | | | (122 | ) | | — | | | 4,566 | | | 7 | |

| | $ | 6,751 | | | 11 | % | $ | (9,130 | ) | | (21 | )% | $ | (7,301 | ) | | (12 | )% |

Pursuant to guidelines contained in SFAS No. 109, Accounting for Income Taxes, we evaluated the positive and negative evidence available to determine whether a valuation allowance is required on our net deferred tax assets for the period ended December 31, 2008. At December 31, 2008 and 2007, the balance of our valuation allowance used to offset our net deferred tax assets was $139 million and $115 million, respectively.

For the period ended December 31, 2008 three significant factors made an impact on our net deferred tax position. The Company acquired control of the Greens Creek Joint Venture in April and added net a deferred tax asset of $23 million related to the purchase price allocation and purchase accounting. In July, the Company sold its Venezuelan business and the deferred tax assets related the Venezuelan business were eliminated, resulting in a net deferred tax reduction of $3.2 million. Lastly, the economic conditions of recent months and the evidence available at year-end reduced the amount of deferred tax assets that the Company can expect to use in the future to $38.6 million which required a net increase to the valuation allowance of $3.6 million for the year. The year 2007 benefited from favorable metal prices resulting in higher taxable income and we utilized significant tax net operating loss carryforwards. We increased our net deferred tax assets by $10.5 million, to a total of $22.3 million at December 31, 2007, to reflect the total net deferred tax asset that we expect to utilize over a 2-year period based on income from operations. Due to our return to profitability in 2007 and 2006, we felt that 24 months was an appropriate period to measure based on all available evidence at that time.

The deferred tax asset will be amortized against taxable income in the U.S. in future periods. We will review available evidence in future periods to determine whether more or less of our deferred tax asset should be realized. Adjustment to the valuation allowance will be made in the period for which the determination is made.

F-19

Table of Contents

The components of the net deferred tax asset were as follows (in thousands):

| | | | | | | |

| | December 31, | |

| | 2008 | | 2007 | |

Deferred tax assets: | | | | | | | |

Accrued reclamation costs | | $ | 44,281 | | $ | 40,709 | |

Deferred exploration | | | 8,523 | | | 4,564 | |

Investment valuation differences | | | — | | | 43 | |

Postretirement benefits other than pensions | | | 1,761 | | | 2,880 | |

Deferred compensation | | | 2,253 | | | 3,158 | |

Foreign net operating losses | | | 8,058 | | | 21,300 | |

Federal net operating losses | | | 85,200 | | | 64,589 | |

State net operating losses | | | 10,578 | | | 4,927 | |

Capital loss carryforward | | | 767 | | | — | |

Tax credit carryforwards | | | 2,809 | | | 3,075 | |

Stock compensation | | | 1,926 | | | 1,618 | |

Other comprehensive income | | | 10,009 | | | — | |

Miscellaneous | | | 2,162 | | | 9,080 | |

Total deferred tax assets | | | 178,327 | | | 155,943 | |

Valuation allowance | | | (138,848 | ) | | (115,413 | ) |

Total deferred tax assets | | | 39,479 | | | 40,530 | |

Deferred tax liabilities: | | | | | | | |

Unrealized gain on marketable securities | | | — | | | (4,074 | ) |

Pension costs | | | — | | | (12,231 | ) |

Properties, plants and equipment | | | (927 | ) | | (1,917 | ) |

Total deferred tax liabilities | | | (927 | ) | | (18,222 | ) |

Net deferred tax asset | | $ | 38,552 | | $ | 22,308 | |

We plan to permanently reinvest earnings from foreign subsidiaries. For the years 2008, 2007 and 2006 we had no unremitted foreign earnings. Foreign net operating losses carried forward are shown above as a deferred tax asset.

We recorded a valuation allowance to reflect the estimated amount of deferred tax assets, which may not be realized principally due to the expiration of net operating losses and tax credit carryforwards. The changes in the valuation allowance for the years ended December 31, 2008, 2007 and 2006, are as follows (in thousands):

| | | | | | | | | | |

| | 2008 | | 2007 | | 2006 | |

Balance at beginning of year | | $ | (115,413 | ) | $ | (133,363 | ) | $ | (160,396 | ) |

Increase related to non-utilization of net operating loss carryforwards and non-recognition of deferred tax assets due to uncertainty of recovery | | | (39,679 | ) | | (38,325 | ) | | (19,569 | ) |

Decrease related to net recognition of deferred tax assets | | | 16,244 | | | 10,486 | | | 11,822 | |

Decrease related to recognition of deferred tax liability on unrealized gain | | | — | | | 5,192 | | | — | |

Decrease related to utilization and expiration of deferred tax assets | | | — | | | 25,967 | | | 34,780 | |

Decrease due to utilization on gain on sale of subsidiary | | | — | | | 14,630 | | | — | |

Balance at end of year | | $ | (138,848 | ) | $ | (115,413 | ) | $ | (133,363 | ) |

As of December 31, 2008, for U.S. income tax purposes, we have net operating loss carryforwards of $243.4 million and $140.6 million, respectively, for regular and alternative minimum tax purposes. These operating loss carryforwards expire over the next 15 to 20 years, the majority of which expire between 2011 and 2024. In addition, we have foreign tax operating loss carryforwards of approximately $25 million, which expire between 2009 and 2017. Our U.S. tax loss carryforwards may also be limited upon a change in control. We have approximately $1 million in alternative minimum tax credit carryforwards which do not expire and are eligible to reduce future regular U.S. tax liabilities.

Uncertain Tax Positions

The Company or one of its subsidiaries files income tax returns in the U.S. federal jurisdiction, various state and foreign jurisdictions. We are no longer subject to income tax examinations by U.S. federal and state tax authorities for years prior to 2005, or examinations by foreign tax authorities for years prior to 2002. We currently have no tax years under examination.

Based on our assessment of FIN 48, “Accounting for Uncertainty in Income Taxes,” we concluded that consistent with 2007, FIN 48 had no significant impact on our results of operations or financial position as of December 31, 2008. We do not have an accrual for uncertain tax positions as of December 31, 2008. As a result, tabular reconciliation of beginning and ending balances would not be meaningful. If interest and penalties were to be assessed, we would charge interest to interest expense, and penalties to other operating expense. It is not anticipated that unrecognized tax benefits would significantly increase or decrease within 12 months of the reporting date.

Note 7: Long-term Debt and Credit Agreement

In September 2005, we entered into a $30.0 million revolving credit agreement for an initial two-year term, with the right to extend the facility for two additional one-year periods, on terms acceptable to us and the lenders. In both September 2006 and September 2007, we amended and extended the agreement one additional year. Amounts borrowed under the credit agreement were to be available for general corporate purposes. Our then 29.7 % interest in the Greens Creek Joint Venture, which is held by Hecla Alaska LLC, our indirect wholly owned subsidiary, was pledged as collateral under the credit agreement. The interest rate on the agreement was either 2.25% above the London InterBank Offered Rate (“LIBOR”) or an

F-20

Table of Contents

alternate base rate plus 1.25%. We made quarterly commitment fee payments equal to 0.75% per annum on the sum of the average unused portion of the credit agreement. There were no outstanding borrowings at December 31, 2007.

On April 16, 2008, the credit agreement was amended and restated in connection with our acquisition of the companies owning 70.3% of the joint venture operating the Greens Creek mine (seeNote 19 for further discussion of the Greens Creek acquisition). The amended and restated agreement involved a $380 million facility, consisting of a $140 million three-year term facility maturing on March 31, 2011, which was fully drawn upon closing of the Greens Creek transaction, and a $240 million bridge facility, which originally was scheduled to mature in October 2008.

We utilized $220 million from the bridge facility at the time of closing the Greens Creek transaction, and used the remaining $20 million balance available for general corporate purposes in September 2008. We applied $162.9 million in proceeds from the public offering of 34.4 million shares of our common stock against the bridge loan principal balance during the third quarter of 2008 (seeNote 10 for more information). On October 16, 2008, the Company repaid an additional $37.1 million of the bridge facility balance, and reached an agreement with its bank syndicate to extend the remaining $40 million outstanding bridge facility balance until February 16, 2009, subject to certain reporting requirements and amendments to the bridge loan and term loan interest rates. The amendment required the Company to provide an updated long-range operating plan for the bank syndicate to review, and the plan was accepted by the banking group in December 2008. An additional amendment to the credit facilities in December 2008 changed the repayment date of the $40 million bridge facility balance to February 13, 2009. All of the $40 million outstanding bridge facility balance was classified as current at December 31, 2008. On February 4, 2009, we entered into an agreement to sell 32 million units comprised of one share of Common Stock and one-half Series 3 Warrant to purchase one share of Common Stock in an underwritten public offering for proceeds of approximately $65.6 million. On February 6, 2009, the underwriters exercised their over-allotment option in connection with the original offering, resulting in the issuance and sale of 4.8 million additional units for additional proceeds of approximately $9.8 million. We applied $40 million of the total proceeds to the payment of our outstanding bridge facility balance on February 10, 2009. In accordance with the credit facilities, we also reduced our term loan by approximately $8 million in February 2009 (seeNote 21 of Notes to Consolidated Financial Statements for more information).

The first term facility principal payment of $18.3 was paid on September 30, 2008. In December 2008, we reached an agreement with the bank syndicate to move the $18.3 million principal payment originally scheduled for December 31, 2008 to February 13, 2009. On February 3, 2009, we again amended the terms of the credit agreement to defer all term facility principal payments due in 2009, totaling $66.7 million, to 2010 and 2011. As discussed above, we reduced our term loan by approximately $8 million in February, 2009. As a result, $8 million of the $121.7 million term facility balance outstanding at December 31, 2008 was classified as current, with the $113.7 million classified as non-current. According to the amended agreement, equal quarterly principal payments totaling $60.0 million are to be made in 2010, with a final payment of $53.7 million due on March 31, 2011. SeeNote 21 ofNotes to Consolidated Financial Statements for further discussion of the amendment. We and all of our material U.S. subsidiaries guarantee the amended and restated credit agreement.

The December 2008 amendment to the agreement to defer the $18.3 million principal payment discussed above also resulted in a change to the interest rate on the term facility from an applicable margin of 2.25% and 3.00% over LIBOR to an applicable margin of 6% over LIBOR, or an alternative base rate plus an applicable margin of 5.00%. However, we have entered into an interest rate swap agreement to manage the effects of interest rate volatility on the term facility (seeNote 11). $103.3 million of the $121.7 million term facility balance outstanding at December 31, 2008 was subject to the interest rate swap and had an interest rate of 9.38% at December 31, 2008. The $18.3 million deferred principal balance had an interest rate of 6.5% at December 31, 2008. The interest rate applicable margins did not change as a result of the February 3, 2009 amendment to the agreement. During 2008, we made interest payments totaling $5.4 million for the term facility, including net amounts paid for interest rate swap spreads.

The bridge facility has an interest rate of either LIBOR plus 6.00% or an alternative base rate plus 5.00%. At December 31, 2008, our interest rate on the bridge facility was 6.5%. During 2008, we made interest payments totaling $6.3 million for the bridge facility. We have also paid a commitment fee equal to 0.50% per annum on the unused portion of the bridge facility.

The amended and restated credit agreement includes various covenants and other limitations related to our indebtedness and investments, as well as other information and reporting requirements. We were not in compliance with certain covenants and other requirements related to the amended and restated credit agreement as of December 31, 2008. However, our non-compliance with these items has subsequently been waived. Additionally, we are required to pay any dividends on our 6.5% Mandatory Convertible Preferred Stock in common stock until the earlier of the date on which the bridge facility is repaid in full and February 13, 2009, to the extent payment of such dividends in common stock is permitted thereby and under applicable law.

F-21

Table of Contents

The February 3, 2009 amendment to the amended and restated credit agreement also requires us to pay an additional fee to our lenders upon effectiveness of the amendment, and on each subsequent July 1st and January 1st, by issuing to the lenders an aggregate amount of a new Series of 12% Convertible Preferred Stock (discussed further inNote 21) equal to 3.75% of the aggregate principal amount of the term facility outstanding on such date until the term facility is paid off in full. Pursuant to this requirement, 42,621 shares of 12% Convertible Preferred Stock were issued to the lenders in February 2009.

If the market prices for the metals we produce decline or we fail to control our production or development costs for a sustained period of time, our ability to service our debt obligations may be adversely affected. Failure to meet the payment obligations of our credit facilities could cause us to be in default. If there were an event of default under our credit facilities, the affected creditors could cause all amounts borrowed under these instruments to be due and payable immediately. Additionally, if we fail to repay indebtedness under the credit facilities when it becomes due, the lenders under the credit facilities could proceed against the assets which we have pledged to them as security.

Note 8: Commitments and Contingencies

Bunker Hill Superfund Site

In 1994, we, as a potentially responsible party under the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”), entered into a Consent Decree with the Environmental Protection Agency (“EPA”) and the State of Idaho concerning environmental remediation obligations at the Bunker Hill Superfund site, a 21-square-mile site located near Kellogg, Idaho (the “Bunker Hill site”). The 1994 Consent Decree (the “Bunker Hill Decree” or “Decree”) settled our response-cost responsibility under CERCLA at the Bunker Hill site. Parties to the Decree included us, Sunshine Mining and Refining Company (“Sunshine”) and ASARCO Incorporated (“ASARCO”). Sunshine subsequently filed bankruptcy and settled all of its obligations under the Bunker Hill Decree.

In 1994, we entered into a cost-sharing agreement with other potentially responsible parties, including ASARCO, relating to required expenditures under the Bunker Hill Decree. ASARCO is in default of its obligations under the cost-sharing agreement and consequently in August 2005, we filed a lawsuit against ASARCO in Idaho State Court seeking amounts due us for work completed under the Decree. Additionally, we have claimed certain amounts due us under a separate agreement related to expert costs incurred to defend both parties with respect to the Coeur d’Alene River Basin litigation in Federal District Court, discussed further below. After we filed suit, ASARCO filed for Chapter 11 bankruptcy protection in United States Bankruptcy Court in Texas in August 2005. As a result of this filing, an automatic stay is in effect for our claims against ASARCO. We are unable to proceed with the Idaho State Court litigation against ASARCO because of the stay, and have asserted our claims in the context of the bankruptcy proceeding.

In late September 2008, we reached an agreement with ASARCO to allow our claim against ASARCO in ASARCO’s bankruptcy proceedings in the amount of approximately $3.3 million. Our claim included approximately $3.0 million in clean up costs incurred by us for ASARCO’s share of such costs under the cost sharing agreement with ASARCO related to the Bunker Hill Decree. The remaining $330,000 is litigation-related costs incurred by us for ASARCO’s share of expert fees in the Basin litigation. The agreement also provides that we and ASARCO release each other from any and all liability under the cost sharing agreement, the Bunker Hill Decree and the Basin CERCLA site (discussed below). The agreement is subject to ASARCO obtaining an order from the Federal District Court in Idaho modifying the existing Consent Decree for the Bunker Hill site. The mutual release of liability provision of the agreement is subject to final bankruptcy court approval of ASARCO’s separate settlement agreement with the United States which, among other things, set and allowed the United States’ claim against ASARCO for ASARCO’s Basin CERCLA liability. We believe the mutual release provision may not become effective due to ASARCO’s separate settlement with the United States not being approved by the Bankruptcy Court or being materially modified. Depending on the resolution of ASARCO’s bankruptcy proceedings, we could receive a portion of or all of our $3.3 million allowed claim against ASARCO in the bankruptcy proceeding. We are unable to predict the outcome and timing of ASARCO’s bankruptcy proceeding.

In December 2005, we received notice that the EPA allegedly incurred $14.6 million in costs relating to the Bunker Hill site from January 2002 to March 2005. The notice was provided so that we and ASARCO might have an opportunity to review and comment on the EPA’s alleged costs prior to the EPA’s submission of a formal demand for reimbursement, which has not occurred as of the date of this filing. We reviewed the costs submitted by the EPA to determine whether we have any obligation to pay any portion of the EPA’s alleged costs relating to the Bunker Hill site. We were unable to determine what costs we will be obligated to pay under the Bunker Hill Decree based on the information submitted by the EPA. We requested that the EPA provide additional documentation relating to these costs. In September 2006, we received from the EPA a certified narrative cost summary, and certain documentation said to support that summary, which revised the EPA’s earlier determination to state that it had incurred $15.2 million in response costs. The September notice stated that it was not a formal demand and invited us to discuss or comment on the matter. In the second quarter of 2007, we were able to identify certain costs submitted by the EPA that we believe it is probable that we may have liability within the context of the Decree, and

F-22

Table of Contents

accordingly, in June of 2007, we estimated the range of our potential liability to be between $2.7 million and $6.8 million, and accrued the minimum of the range as we believed no amount in the range was more likely than any other. We will continue to assess the materials relating to the alleged costs sent to us and to discuss the matter with the EPA. If we are unable to reach a satisfactory resolution, we anticipate exercising our right under the Bunker Hill Decree to challenge reimbursement of the alleged costs. However, an unsuccessful challenge would likely require us to further increase our expenditures and/or accrual relating to the Bunker Hill site.

The accrued liability balance at December 31, 2008 relating to the Bunker Hill site was $3.2 million. The liability balance represents our portion of the remaining remediation activities associated with the site, our estimated portion of a long-term institutional controls program required by the Bunker Hill Decree, and potential reimbursement to the EPA of costs allegedly incurred by the agency as described in a notice to us by the agency. We believe ASARCO’s remaining share of its future obligations will be paid through proceeds from an ASARCO trust created in 2003 for the purpose of funding certain of ASARCO’s environmental obligations, as well as distributions to be determined by the Bankruptcy Court. In the event we are not successful in collecting what is due us from the ASARCO trust or through the bankruptcy proceedings, because the Bunker Hill Decree holds us jointly and severally liable, it is possible our liability balance for the remedial activity at the Bunker Hill site could be $18.3 million, the amount we currently estimate to complete the total remaining obligation under the Decree, as well as potential reimbursement to the EPA of costs allegedly incurred by the agency at the Bunker Hill site. There can be no assurance as to the ultimate disposition of litigation and environmental liability associated with the Bunker Hill Superfund site, and we believe it is possible that a combination of various events, as discussed above, or other events could be materially adverse to our financial results or financial condition.

Coeur d’Alene River Basin Environmental Claims

Coeur d’Alene Indian Tribe Claims

In July 1991, the Coeur d’Alene Indian Tribe (“Tribe”) brought a lawsuit, under CERCLA, in Federal District Court in Idaho against us, ASARCO and a number of other mining companies asserting claims for damages to natural resources downstream from the Bunker Hill site over which the Tribe alleges some ownership or control. The Tribe’s natural resource damage litigation has been consolidated with the United States’ litigation described below. Because of various bankruptcies and settlements of other defendants, we are the only remaining defendant in the Tribe’s Natural Resource Damages case.

U.S. Government Claims

In March 1996, the United States filed a lawsuit in Federal District Court in Idaho against certain mining companies, including us, that conducted historic mining operations in the Silver Valley of northern Idaho. The lawsuit asserts claims under CERCLA and the Clean Water Act, and seeks recovery for alleged damages to, or loss of, natural resources located in the Coeur d’Alene River Basin (“Basin”) in northern Idaho for which the United States asserts it is the trustee under CERCLA. The lawsuit claims that the defendants’ historic mining activity resulted in releases of hazardous substances and damaged natural resources within the Basin. The suit also seeks declaratory relief that we and other defendants are jointly and severally liable for response costs under CERCLA for historic mining impacts in the Basin outside the Bunker Hill site. We have asserted a number of defenses to the United States’ claims.

In May 1998, the EPA announced that it had commenced a Remedial Investigation/ Feasibility Study under CERCLA for the entire Basin, including Lake Coeur d’Alene, as well as the Bunker Hill site, in support of its response cost claims asserted in its March 1996 lawsuit. In October 2001, the EPA issued its proposed clean-up plan for the Basin. The EPA issued the Record of Decision (“ROD”) on the Basin in September 2002, proposing a $359.0 million Basin-wide clean-up plan to be implemented over 30 years and establishing a review process at the end of the 30-year period to determine if further remediation would be appropriate.

During 2000 and 2001, we were involved in settlement negotiations with representatives of the United States, the State of Idaho and the Tribe. These settlement efforts were unsuccessful. However, we have resumed efforts to explore possible settlement of these and other matters, but it is not possible to predict the outcome of these efforts.

Phase I of the trial on the consolidated Tribe’s and the United States’ claims commenced in January 2001, and was concluded in July 2001. Phase I addressed the extent of liability, if any, of the defendants and the allocation of liability among the defendants and others, including the United States. In September 2003, the Court issued its Phase I ruling, holding that we have some liability for Basin environmental conditions. The Court refused to hold the defendants jointly and severally liable for historic tailings releases and instead allocated a 31% share of liability to us for impacts resulting from these releases. The portion of damages, past costs and clean-up costs to which this 31% applies, other cost allocations applicable to us and the Court’s determination of an appropriate clean-up plan is to be addressed in Phase II of the litigation. The Court also left issues on the deference, if any, to be afforded the United States’ clean-up plan, for Phase II.

F-23

Table of Contents

The Court found that while certain Basin natural resources had been injured, “there has been an exaggerated overstatement” by the plaintiffs of Basin environmental conditions and the mining impact. The Court significantly limited the scope of the trustee plaintiffs’ resource trusteeship and will require proof in Phase II of the litigation of the trustees’ percentage of trusteeship in co-managed resources. The United States and the Tribe are re-evaluating their claims for natural resource damages for Phase II; such claims may be in the range of $2.0 billion to $3.4 billion. We believe we have limited liability for natural resource damages because of the actions of the Court described above. Because of a number of factors relating to the quality and uncertainty of the United States’ and Tribe’s natural resources damage claims, we are currently unable to estimate what, if any, liability or range of liability we may have for these claims.

Two of the defendant mining companies, Coeur d’Alene Mines Corporation and Sunshine Mining and Refining Company, settled their liabilities under the litigation during 2001. We and ASARCO (which, as discussed above, filed for bankruptcy in August 2005) are the only defendants remaining in the United States’ litigation. Phase II of the trial was scheduled to commence in January 2006. As a result of ASARCO’s bankruptcy filing, the Idaho Federal Court vacated the January 2006 trial date. We anticipate the Court will schedule a status conference to address rescheduling the Phase II trial date once the Bankruptcy Court rules on a motion brought by the United States to declare the bankruptcy stay inapplicable to the Idaho Federal Court proceedings. The Company does not currently have an opinion as to when the Court might rule.

In 2003, we estimated the range of potential liability for remediation in the Basin to be between $18 million and $58 million and accrued the minimum of the range, as we believed no amount in the range was more likely than any other amount at that time. In the second quarter of 2007, we determined that the cash payment approach to estimating our potential liability used in 2003 was not reasonably likely to be successful, and changed to an approach of estimating our liability through the implementation of actual remediation in portions of the Basin. Accordingly, we finalized an upper Basin cleanup plan, including a cost estimate, and reassessed our potential liability for remediation of other portions of the Basin, which caused us to increase our estimate of potential liability for Basin cleanup to the range of $60.0 million to $80.0 million. Accordingly, in June 2007, we recorded a provision of $42.0 million, which increased our total liability for remediation in the Basin from $18.0 million to $60.0 million, the low end of the estimated range of liability, with no amount in the range being more likely than any other amount. The liability is not discounted, as the timing of the expenditures is uncertain, but is expected to occur over the next 20 to 30 years.

In expert reports exchanged with the defendants in August and September 2004, the United States claimed to have incurred approximately $87.0 million for past environmental study, remediation and legal costs associated with the Basin for which it is alleging it is entitled to reimbursement in Phase II. In a July 2006 Proof of Claim filed in the ASARCO bankruptcy case, the EPA increased this claim to $104.5 million. A portion of these costs is also included in the work to be done under the ROD. With respect to the United States’ past cost claims, as of December 31, 2008, we have determined a potential range of liability for this past response cost to be $5.6 million to $13.6 million, with no amount in the range being more likely than any other amount.

Although the United States has previously issued its ROD proposing a clean-up plan totaling approximately $359.0 million and its past cost claim is $87.0 million, based upon the Court’s prior orders, including its September 2003 order and other factors and issues to be addressed by the Court in Phase II of the trial, we currently estimate the range of our potential liability for both past costs and remediation (but not natural resource damages as discussed above) in the Basin to be $65.6 million to $93.6 million (including the potential range of liabilities of $60.0 million to $80.0 million for Basin cleanup, and $5.6 million to $13.6 million for the United States’ past cost claims as discussed above), with no amount in the range being more likely than any other number at this time. Based upon GAAP, we have accrued the minimum liability within this range, which at December 31, 2008, was $65.6 million. It is possible that our ability to estimate what, if any, additional liability we may have relating to the Basin may change in the future depending on a number of factors, including but not limited to information obtained or developed by us prior to Phase II of the trial and its outcome, and, any interim court determinations. There can be no assurance as to the outcome of the Coeur d’Alene River Basin environmental claims and we believe it is possible that a combination of various events, as discussed above, or other events could be materially adverse to our financial results or financial condition.

Insurance Coverage Litigation

In 1991, we initiated litigation in the Idaho District Court, County of Kootenai, against a number of insurance companies that provided comprehensive general liability insurance coverage to us and our predecessors. We believe the insurance companies have a duty to defend and indemnify us under their policies of insurance for all liabilities and claims asserted against us by the EPA and the Tribe under CERCLA related to the Bunker Hill site and the Basin. In 1992, the Idaho State District Court ruled that the primary insurance companies had a duty to defend us in the Tribe’s lawsuit. During 1995 and 1996, we entered into settlement agreements with a number of the insurance carriers named in the litigation. Prior to 2008, we have received a total of approximately $7.2 million under the terms of the settlement agreements. Thirty percent of these settlements

F-24

Table of Contents

were paid to the EPA to reimburse the U.S. Government for past costs under the Bunker Hill Decree. Litigation is still pending against one insurer with trial suspended until the underlying environmental claims against us are resolved or settled. The remaining insurer in the litigation, along with a second insurer not named in the litigation, is providing us with a partial defense in all Basin environmental litigation. As of December 31, 2008, we have not recorded a receivable or reduced our accrual for reclamation and closure costs to reflect the receipt of any potential insurance proceeds.

Independence Lead Mines Litigation

In March 2002, Independence Lead Mines Company (“Independence”) notified us of certain alleged defaults by us under a 1968 lease agreement relating to the Gold Hunter area (also known as the DIA properties) of our Lucky Friday unit. Independence alleged that we violated the “prudent operator obligations” implied under the lease by undertaking the Gold Hunter project and violated certain other provisions of the Agreement with respect to milling equipment and calculating net profits and losses. Under the lease agreement, we have the exclusive right to manage, control and operate the DIA properties. Independence holds an 18.52% net profits interest under the lease agreement that is payable after we recoup our investments in the DIA properties. In addition, after we recoup our investment, Independence has two years within which to elect to convert its net profits interest into a working interest.

In June 2002, Independence filed a lawsuit in Idaho State District Court seeking termination of the lease agreement and requesting unspecified damages. Trial of the case occurred in late March 2004. In July 2004, the Court issued a decision that found in our favor on all issues and subsequently awarded us approximately $0.1 million in attorneys’ fees and certain costs, which Independence has paid. In August 2004, Independence filed its Notice of Appeal with the Idaho Supreme Court. Oral arguments were heard by the Idaho Supreme Court in February 2006. In April 2006, the Idaho Supreme Court ruled in our favor on all of Independence’s claims.

In December 2006, Independence filed a lawsuit in the United States District Court for the District of Idaho seeking monetary damages and injunctive relief. Independence alleged that the April 2006 decision by the Idaho Supreme Court violated their civil rights and their constitutional right to due process, and also alleged that we engaged in mail fraud and securities fraud during the term of the lease. We moved to dismiss the lawsuit, and in September 2007, the Court granted our motion to dismiss all claims in the complaint, and the case was dismissed in its entirety. In October 2007, Independence filed a Notice of Appeal to the United States Court of Appeals for the Ninth Circuit.

In January 2007, Independence filed an action in Idaho State District Court for Shoshone County seeking rescission of the lease based upon the theory of mutual mistake. We responded to the lawsuit with a motion to dismiss. In May 2007, the court issued a decision that found in our favor and dismissed the plaintiff’s complaint on the merits and with prejudice. In addition, the court awarded us costs and attorney’s fees. Independence has appealed the judgment against it to the Idaho Supreme Court.

On February 12, 2008, we and our wholly owned subsidiary Hecla Merger Company entered into an asset purchase agreement with Independence. Under the terms of the Asset Purchase Agreement, Hecla Merger Company acquired substantially all of the assets of Independence in exchange for 6,936,884 shares of Hecla common stock (the “Independence Acquisition”). The Independence Acquisition closed in November 2008, and as of November 21, 2008, all litigation between us and Independence has been dismissed, and we have acquired all of Independence’s right, title and interest to the DIA properties and the related agreements between us and Independence.

Creede, Colorado, Litigation

In February 2007, Wason Ranch Corporation (“Wason”) filed a complaint in Federal District Court in Denver, Colorado, against us, Homestake Mining Company of California (“Homestake”), and Chevron USA Inc. (successor in interest to Chevron Resources Company) (collectively the “defendants”). The suit alleges violations of the Resource Conservation and Recovery Act (“RCRA”) by each of the defendants. In May 2007, Wason amended its complaint to add state tort law claims against us and defendant Ty Poxon (“Poxon”). The suit alleges damage to Wason’s property by each defendant. The suit also alleges violations of the Clean Water Act (“CWA”) by us and Homestake Mining Company of California. The suit alleges that the defendants are past and present owners and operators of mines and associated facilities located in Mineral County near Creede, Colorado, and such operations have released pollutants into the environment, including the plaintiff’s property, in violation of RCRA and CWA. The lawsuit seeks injunctive relief to abate the alleged harm and an unspecified amount of civil penalties for the alleged violations. We responded to the lawsuit with a motion to dismiss. On March 31, 2008, the Court issued a decision that found in our favor and dismissed the plaintiff’s complaint. In April 2008, Wason appealed the decision to the United States Court of Appeals for the Tenth Circuit.

F-25

Table of Contents

In October 2008, Wason and defendants Hecla, Homestake, and Poxon reached a settlement where Wason agreed to dismiss its appeal, and release and discharge Hecla from all state law claims arising out of environmental conditions due to mining or milling that were brought, or could have been brought, in its 2007 claim.

Mexico Litigation

In Mexico, our wholly owned subsidiary, Minera Hecla, S.A de C.V., currently is involved in two cases in the State of Durango, Mexico, concerning the Velardeña mill. The Velardeña mill processed ore from our now closed San Sebastian mine, and the mill was placed on care and maintenance upon closure of the mine. In the first case we are interveners in a commercial action initiated in April of 2006 by a creditor to the prior owner of the mill. In that litigation, the creditor to the prior mill owner seeks to demonstrate that he has an ownership interest in the mill arising out of an allegedly unpaid prior debt. We are contesting this action, and deny the assertion that the plaintiff has an ownership interest in the mill. We take this position for a number of reasons, including the fact that the mill was sold to us prior to plaintiff’s obtaining his alleged ownership interest. In the second matter, a civil action involving Minera Hecla that is in a different court within the State of Durango, the same creditor as in the first case claims that his ownership of the Velardeña mill relates back to the time he allegedly performed the work on which the debt was based, rather than the time that he filed his lien relating to the debt, which was after the mill was sold to us. We are contesting the position of the creditor.

In February 2009 we received notice that the court in the first matter referenced above ruled in favor of the creditor, and also in February 2009, we filed a timely appeal. We are currently negotiating with the plaintiff who has offered to purchase the mill from Minera Hecla. If such negotiations are successful, the above referenced litigation will be dismissed with prejudice.

The basis for our defense in the above matter is that we have a judicially determined valid bill of sale for the Velardeña mill. Thus, we believe that the claims of the creditor and his successors are without merit, and that Minera Hecla is the sole owner of the Velardeña mill. We intend to zealously defend our ownership interest. Although there can be no assurance as to the outcome of these proceedings, we believe that the proceedings will not have a material adverse effect on our results from operations or on our financial position.

BNSF Railway Company Claim