Our current business strategy is to focus our financial and human resources in the following areas:

| | · | Operating our properties cost-effectively. |

| | · | Expanding our proven and probable reserves and production capacity at our operating properties. |

| | · | Maintaining and investing in exploration projects at our four mining district land packages, which we believe to be under-explored and under-invested: North Idaho’s Silver Valley in the historic Coeur d’Alene Mining District; our Greens Creek unit on Alaska’s Admiralty Island, located near Juneau; the silver producing district near Durango, Mexico; and the Creede district of Southwestern Colorado. |

| | · | Continuing to seek opportunities to acquire and invest in other mining properties and companies (see the Results of Operations and Financial Liquidity and Capital Resources sections below). |

Below is a summary of net income (loss) for each of the last five years (in thousands):

| | | Year Ended December 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Net income (loss) | | $ | 48,983 | | | $ | 67,826 | | | $ | (66,563 | ) | | $ | 53,197 | | | $ | 69,122 | |

Our financial results over the last five years have been impacted by:

| | · | Fluctuations in prices of the metals we produce. The high and low daily closing market prices for silver, gold, lead and zinc for each of the last five years are as follows: |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Silver (per oz.): | | | | | | | | | | | | | | | |

| High | | $ | 30.70 | | | $ | 19.18 | | | $ | 20.92 | | | $ | 15.82 | | | $ | 14.94 | |

| Low | | $ | 15.14 | | | $ | 10.51 | | | $ | 8.88 | | | $ | 11.67 | | | $ | 8.83 | |

| Gold (per oz.): | | | | | | | | | | | | | | | | | | | | |

| High | | $ | 1,421.00 | | | $ | 1,212.50 | | | $ | 1,011.25 | | | $ | 841.10 | | | $ | 725.00 | |

| Low | | $ | 1,058.00 | | | $ | 810.00 | | | $ | 712.50 | | | $ | 608.40 | | | $ | 524.75 | |

| Lead (per lb.): | | | | | | | | | | | | | | | | | | | | |

| High | | $ | 1.18 | | | $ | 1.11 | | | $ | 1.57 | | | $ | 1.81 | | | $ | 0.82 | |

| Low | | $ | 0.71 | | | $ | 0.45 | | | $ | 0.40 | | | $ | 0.71 | | | $ | 0.41 | |

| Zinc (per lb.): | | | | | | | | | | | | | | | | | | | | |

| High | | $ | 1.20 | | | $ | 1.17 | | | $ | 1.28 | | | $ | 1.93 | | | $ | 2.10 | |

| Low | | $ | 0.72 | | | $ | 0.48 | | | $ | 0.47 | | | $ | 1.00 | | | $ | 0.87 | |

See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations for a summary of average market and realized prices for each of the three years ended December 31, 2010, 2009 and 2008. Hecla’s average realized prices for all four metals increased in 2010 compared to 2009, and our realized prices for silver and gold in 2010 were higher than average market prices for those metals in 2010, due in part to the timing of concentrate shipments and their final settlement in comparison to fluctuating prices. However, we believe that market metal price trends are a significant factor in our operating and financial perf ormance. Because we are unable to predict fluctuations in prices for metals and have limited control over the timing of our concentrate shipments, there can be no assurance that our realized prices for silver and gold will exceed or even meet average market metals prices for any future period. In April 2010, we began utilizing forward contracts for lead and zinc with the objective of managing the exposure to changes in prices of lead and zinc contained in our concentrate shipments between the time of sale and final settlement. See Note 10 of Notes to Consolidated Financial Statements for more information on our base metal forward contract programs. Our results of operations are significantly impacted by fluctuations in the prices of silver, gold, lead and zinc, which are affected by numerous factors beyond our control. See Item 1A. Risk Factors – Financial Risks – A substantial or extended decline in metals prices would have a material adverse effect on us for information on the various factors that can impact prices of the metals we produce.

| | · | Exploration and pre-production development expenditures totaling $21.6 million, $9.2 million, $22.5 million, $17.0 million and $22.8 million, respectively, for the years ended December 31, 2010, 2009, 2008, 2007 and 2006. These amounts include expenditures for the now-divested Hollister Development Block, as its development progressed until the sale of our interest in the project in April 2007, of $2.2 million and $14.4 million, respectively, for the years ended December 31, 2007 and 2006. In addition to the amounts above, we also incurred exploration expenditures of $1.2 million, $3.9 million and $5.6 million, respectively, for the years ended December 31, 2008, 2007 and 2006 at our now divested Venezuelan operations. These amounts have been reported in income (loss) from discontinued operations for each period. |

| | · | Provision for closed operations and environmental matters of $201.1 million, $7.7 million, $4.3 million, $49.2 million and $3.5 million, respectively, for the years ended December 31, 2010, 2009, 2008, 2007, and 2006. The 2010 provision includes a $193.2 million adjustment to increase our accrued liability for environmental obligations in Idaho’s Coeur d’Alene Basin as a result of the negotiators representing Hecla, the United States, the Coeur d’Alene Indian Tribe, and the State of Idaho reaching an understanding on proposed financial terms to be incorporated into a comprehensive settlement of the Coeur d’Alene Basin environmental litigation and related claims, including any remaining obligations of Hecla Limited under the 1994 Box Consent Decree. Such compr ehensive settlement would contain additional terms yet to be negotiated, and certain other conditions must be satisfied before a settlement is finalized. The increase in our accrual from prior periods results from several factors impacting the Basin liability, all of which would be addressed in the potential settlement. These factors include: (i) as a result of work completed, and information learned by us, in the fourth quarter of 2010, we expect the cost of future remediation and past response costs in the upper Basin to increase from previous estimates; (ii) any potential settlement of the Basin litigation would address the entire Basin, including the lower Basin, for which we do not know the extent of any future remediation plans, other than the EPA has announced that it plans to issue a ROD amendment for the lower Basin in the future, which would include a lower Basin remediation plan for which Hecla Limited may have had some liability; and (iii) inclusion of natural resource damag es in any potential settlement, for which we are unable to estimate any range of liability, however, as stated in their own filings, the United States’ and the Tribe’s claims for natural resource damages may range in the billions of dollars. The 2007 amount includes an increase of $44.7 million to our then-estimated liabilities for the Coeur d’Alene Basin and the Bunker Hill Superfund Site. See Note 7 and Note 19 of Notes to Consolidated Financial Statements for further discussion. |

| | · | Variability in prices for diesel fuel and amounts of fuel used, and variability in prices for other consumables, which have impacted production costs at our operations. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – The Greens Creek Segment for information on the variability in diesel fuel prices and consumption on production costs for the last three years. |

| | · | Our acquisition of the remaining 70.3% of the Greens Creek mine for $758.5 million in April 2008, a portion of which was funded by a $140 million term loan and $220 million bridge loan. We recorded interest expense related to these credit facilities, including amortization of loan fees and interest rate swap adjustments, of $10.1 million and $19.1 million, respectively in 2009 and 2008. The amount of interest expense in 2009 is net of $1.9 million in capitalized interest. We also recorded approximately $6.0 million in expense in 2009 for additional debt-related fees. We completed repayment of the bridge loan balance in February 2009 and repayment of the term loan balance in October 2009. |

| | · | The 2008-2010 global financial crisis and recession, which impacted metals prices, production costs, and our access to capital markets. |

| | · | An increase in the number of shares of our common stock outstanding, which impacts our income per common share. |

| | · | Losses from discontinued operations, net of tax, for the years ended December 31, 2008 and 2007 of $17.4 million and $15.0 million, respectively, and income from discontinued operations, net of tax, for the year ended December 31, 2006 of $4.3 million. |

A comprehensive discussion of our financial results for the years ended December 31, 2010, 2009 and 2008, individual operating unit performance, general corporate expenses and other significant items can be found in Item 7. — Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations, as well as the Consolidated Financial Statements and Notes thereto.

Products and Segments

Our segments are differentiated by geographic region. We produce zinc, lead and bulk concentrates at our Greens Creek unit and lead and zinc concentrates at our Lucky Friday unit, which we sell to custom smelters on contract, and unrefined gold and silver bullion bars (doré) at Greens Creek, which are sold directly to customers or further refined before sale to precious metals traders. The concentrates produced at our Greens Creek and Lucky Friday units contain payable silver, zinc and lead, and the concentrates produced at Greens Creek also contain payable gold. Our segments as of December 31, 2010 included:

| | · | The Greens Creek unit, a joint venture arrangement which is 100%-owned by us through our subsidiaries Hecla Alaska LLC, Hecla Greens Creek Mining Company and Hecla Juneau Mining Company. We acquired 70.3% of our ownership of Greens Creek in April 2008 from indirect subsidiaries of Rio Tinto, plc. Greens Creek is located on Admiralty Island, near Juneau, Alaska, and has been in production since 1989, with a temporary care and maintenance period from April 1993 through July 1996. During 2010, Greens Creek contributed $313.3 million, or 75%, of our consolidated sales. |

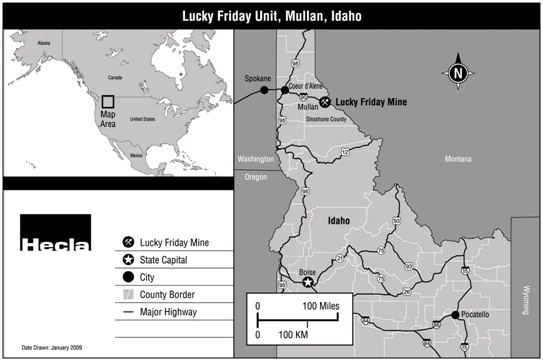

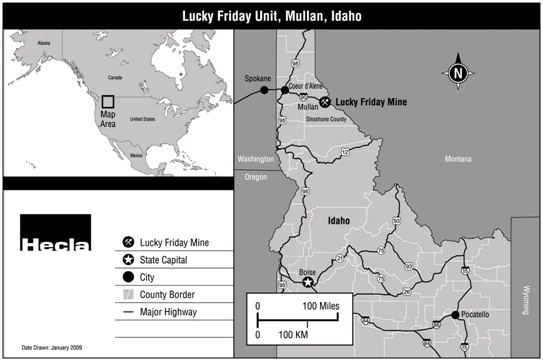

| | · | The Lucky Friday unit located in northern Idaho. Lucky Friday is, through our subsidiaries Hecla Limited and Silver Hunter Mining Company, 100%-owned and has been a producing mine for us since 1958. During 2010, Lucky Friday contributed $105.5 million, or 25%, of our consolidated sales. |

The table below summarizes our production for the years ended December 31, 2010, 2009 and 2008, which reflects our previous 29.7% ownership of Greens Creek until April 16, 2008, and our 100% ownership thereafter. Zinc and lead production quantities are presented in short tons (“tons”).

| | | Year | |

| | | 2010 | | | 2009 | | | 2008 | |

| Silver (ounces) | | | 10,566,352 | | | | 10,989,660 | | | | 8,709,517 | |

| Gold (ounces) | | | 68,838 | | | | 67,278 | | | | 76,810 | |

| Lead (tons) | | | 46,955 | | | | 44,263 | | | | 35,023 | |

| Zinc (tons) | | | 83,782 | | | | 80,995 | | | | 61,441 | |

The gold production amount above for the year ended December 31, 2008 includes 22,160 ounces produced at our discontinued Venezuelan operations sold in July 2008.

Licenses, Permits and Concessions

We are required to obtain various licenses and permits to operate our mines and conduct exploration and reclamation activities. See Item 1A. Risk Factors - Legal, Market and Regulatory Risks - We are required to obtain governmental and lessor approvals and permits in order to conduct mining operations. In addition, we conduct our exploration activities in Mexico pursuant to concessions granted by the Mexican government, which are subject to certain political risks associated with foreign operations. See Item 1A. Risk Factors - Operation, Development, Exploration and Acquisition Risks - Our foreign activities are subject to additional inherent risks.

Physical Assets

Our business is capital intensive and requires ongoing capital investment for the replacement, modernization or expansion of equipment and facilities. At December 31, 2010, the book value of our property, plant, equipment and mineral interests, net of accumulated depreciation, was approximately $833.3 million. We maintain insurance policies against property loss and business interruption. However, such insurance contains exclusions and limitations on coverage, and there can be no assurance that claims would be paid under such insurance policies in connection with a particular event. See Item 1A. Risk Factors - Operation, Development, Exploration and Acquisition Risks - -Our operations may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance.

Employees

As of December 31, 2010, we employed 686 people, and we believe relations with our employees are generally good.

Many of the employees at our Lucky Friday unit are represented by a union. The current collective bargaining agreement with workers at our Lucky Friday unit, which was signed in 2010, expires on April 30, 2016.

Available Information

Hecla Mining Company is a Delaware corporation. Our current holding company structure dates from the incorporation of Hecla Mining Company in 2006 and the renaming of its subsidiary (previously Hecla Mining Company) as Hecla Limited. Our principal executive offices are located at 6500 N. Mineral Drive, Suite 200, Coeur d’Alene, Idaho 83815-9408. Our telephone number is (208) 769-4100. Our web site address is www.hecla-mining.com. We file our annual, quarterly and current reports and any amendments to these reports with the SEC, copies of which are available on our website or from the SEC free of charge (www.sec.gov or 800-SEC-0330 or the SEC’s Public Reference Room, 100 F Stre et, N.E., Washington, D.C. 20549). Charters of our audit, compensation, corporate governance, and directors’ nominating committees, as well as our Code of Ethics for the Chief Executive Officer and Senior Financial Officers and our Code of Business Conduct and Ethics for Directors, Officers and Employees, are also available on our website. We will provide copies of these materials to shareholders upon request using the above-listed contact information, directed to the attention of Investor Relations, or via e-mail request sent to www.info@hecla-mining.com.

We have included the Chief Executive Officer (CEO) and Chief Financial Officer (CFO) certifications regarding our public disclosure required by Section 302 of the Sarbanes-Oxley Act of 2002 as Exhibits 31.1 and 31.2 to this report. Additionally, we filed with the New York Stock Exchange (“NYSE”) the CEO’s certification regarding our compliance with the NYSE’s Corporate Governance Listing Standards (“Listing Standards”) pursuant to Section 303A.12(a) of the Listing Standards, which certification was dated May 28, 2010, and indicated that the CEO was not aware of any violations of the Listing Standards.

Item 1A. Risk Factors

The following risks and uncertainties, together with the other information set forth in this Form 10-K, should be carefully considered by those who invest in our securities. Any of the following risks could materially adversely affect our business, financial condition or operating results and could decrease the value of our common and/or preferred stock.

FINANCIAL RISKS

A global financial crisis may have an impact on our business and financial condition in ways that we currently cannot predict.

The recent credit crisis and related turmoil in the global financial system had an impact on our business and financial position, and a similar financial crisis in the future may also impact us. The continuation or re-emergence of the financial crisis may limit our ability to raise capital through credit and equity markets. As discussed further below, the prices of the metals that we produce are affected by a number of factors, and it is unknown how these factors may be impacted by a global financial crisis.

We have had losses that could reoccur in the future.

Although we reported net income for the years ended December 31, 2010, 2009 and 2007 of $49.0 million, $67.8 million and $53.2 million, respectively, we reported a net loss for the year ended December 31, 2008 of $66.6 million. A comparison of operating results over the past three years can be found in Results of Operations in Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Many of the factors affecting our operating results are beyond our control, including the volatility of metals prices; smelter terms; diesel fuel prices; interest rates; global or regional political or economic policies; inflation; availability and cost of labor; economic developments and crises; governmental regulations; continuity of orebodies; ore grades; recoveries; and speculation, aggregation and sales by central banks and other holders and producers of gold and silver in response to these factors. We cannot foresee whether our operations will continue to generate sufficient revenue in order for us to generate net cash from operating activities. There can be no assurance that we will not experience net losses in the future.

Commodity risk management activities could expose us to losses.

We periodically enter into risk management activities, such as forward sales contracts and commodity put and call option contracts, to manage the prices received on the metals we produce. Such activities are utilized to attempt to insulate our operating results from changes in prices for those metals. However, such activities may prevent us from realizing possible revenues in the event that the market price of a metal exceeds the price stated in a forward sale or call option contract. In addition, we may experience losses if a counterparty fails to purchase under a contract when the contract price exceeds the spot price of a commodity.

During the second quarter of 2010, we initiated financially settled forward contract programs to manage the exposure to changes in lead and zinc prices contained in our concentrate shipments between the time of sale and final settlement, and to manage the exposure of changes in the prices of lead and zinc contained in our forecasted future concentrate shipments. See Note 10 of Notes to Consolidated Financial Statements for more information on these base metals forward contract programs.

If we are able to settle the Coeur d’Alene Basin environmental litigation and other claims, the financial terms of settlement will materially impact our cash resources and our access to additional financing.

The negotiators representing Hecla and the United States and the Coeur d’Alene Indian Tribe (“Plaintiffs”), and the State of Idaho, have reached an understanding on proposed financial terms to be incorporated into a comprehensive settlement of the Coeur d’Alene Basin environmental litigation and related claims, including any remaining obligations of Hecla Limited under the 1994 Box Consent Decree. Such a comprehensive settlement would contain additional terms yet to be negotiated, and certain other conditions must be satisfied before a settlement is finalized. If such settlement is finalized and a Consent Decree entered, substantial cash payment obligations by us would be required, including:

| | · | $102 million within 30 days after entry of the Consent Decree. |

| | · | $55.5 million in cash or shares of Hecla Mining Company common stock, at our election, within 30 days after entry of the Consent Decree. |

| | · | $25 million within 30 days after the first anniversary of entry of the Consent Decree. |

| | · | $15 million within 30 days after the second anniversary of entry of the Consent Decree. |

| | · | $65.9 million by August 2014, in the form of quarterly payments of the proceeds from exercises of any outstanding Series 1 and Series 3 warrants (which have an exercise price of between $2.45 and $2.50 per share) during the quarter with the balance of the $65.9 million due in August 2014 (regardless of the amount of warrants that have been exercised). We have received proceeds of approximately $9.5 million for the exercise of Series 1 and Series 3 warrants as of the date of this report, which we anticipate would be paid to the Plaintiffs within 30 days after entry of the Consent Decree. |

More information about the proposed financial terms of settlement is set forth in Note 19 of Notes to Consolidated Financial Statements.

The requirement to pay $102 million plus proceeds from exercised warrants (which totaled approximately $5.2 million as of December 31, 2010) in cash in 2011 would cause us to use a significant portion of our cash on hand, which, as of December 31, 2010, was $283.6 million (including cash equivalents). Our cash on hand could be further reduced in the near term if we elect to pay the $55.5 million in cash, instead of shares of our common stock. Also, if additional warrants are not exercised, the requirement to pay up to $96.4 million (excluding interest) in cash over the next approximately three years will cause us to use a significant portion of either our cash currently on hand, or future cash resources. There can be no assurance that we will have the cash on hand to meet these oblig ations.

Financial terms of settlement would also require that Hecla Mining Company or Hecla Limited post third party surety in some form to secure the $25 million, $15 million, and $65.9 million payments. Obtaining surety will cause us to incur costs, and will also cause us to utilize credit capacity which could otherwise be used to fund other areas of our business, including operations and capital expenditures. Moreover, there is no guarantee that we will be able to obtain or maintain such surety, in which case we could be in default of the Consent Decree, which could have a material adverse effect on Hecla Limited’s or our results from operations or financial position.

The financial terms summarized above would be part of any final and complete settlement reflected in a Consent Decree. However, no assurance can be given that final settlement will be reached and a Consent Decree entered. See Item 1A. Risk Factors – Legal, Market and Regulatory Risks – The financial terms of proposed settlement that we negotiated with the Plaintiffs’ and the State of Idaho’s negotiators regarding the Coeur d’Alene Basin environmental litigation and related claims are non-binding and are not final, and complete settlement of the litigation and other claims may not be reached and We are required to obtain governmental and lessor approvals and permits in or der to conduct mining operations.

Our profitability could be affected by the prices of other commodities and services.

Our business activities are highly dependent on the costs of commodities and services such as fuel, steel, cement and electricity. The recent prices for such commodities have been volatile and may increase our costs of production and development. A material increase in costs at any of our operating properties could have a significant effect on our profitability. For additional discussion, see Results of Operations in Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Our accounting and other estimates may be imprecise.

Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts and related disclosure of assets, liabilities, revenue and expenses at the date of the consolidated financial statements and reporting periods. The more significant areas requiring the use of management assumptions and estimates relate to:

| | · | mineral reserves and other mineralized material that are the basis for future income and cash flow estimates and units-of-production depreciation, depletion and amortization calculations; |

| | · | environmental, reclamation and closure obligations; |

| | · | reserves for contingencies and litigation; and |

| | · | deferred tax asset valuation allowance. |

Actual results may differ materially from these estimates using different assumptions or conditions. For additional information, see Critical Accounting Estimates in Management’s Discussion and Analysis of Financial Condition and Results of Operations, Note 1 — Significant Accounting Policies of Notes to Consolidated Financial Statements and the risk factors: “Our development of new orebodies and other capital costs may cost more and provide less return than we estimated,” “Our ore reserve estimates may be impreci se” and “Our environmental obligations may exceed the provisions we have made.”

A substantial or extended decline in metals prices would have a material adverse effect on us.

Our revenue is derived from the sale of silver, gold, lead and zinc and, as a result, our earnings are directly related to the prices of these metals. Silver, gold, lead and zinc prices fluctuate widely and are affected by numerous factors, including:

| | · | relative exchange rates of the U.S. dollar; |

| | · | global and regional demand and production; |

| | · | inflation, recession or increased or reduced economic activity; and |

| | · | other political, regulatory and economic conditions. |

These factors are largely beyond our control and are difficult to predict. If the market prices for these metals fall below our production or development costs for a sustained period of time, we will experience losses and may have to discontinue exploration, development or operations, or incur asset write-downs at one or more of our properties.

The following table sets forth the average daily closing prices of the following metals for the year ended December 31, 2006 and each year thereafter through 2010.

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Silver (1) (per oz.) | | $ | 20.16 | | | $ | 14.65 | | | $ | 15.02 | | | $ | 13.39 | | | $ | 11.57 | |

Gold (2) (per oz.) | | $ | 1,224.66 | | | $ | 972.98 | | | $ | 871.71 | | | $ | 696.66 | | | $ | 604.34 | |

Lead (3) (per lb.) | | $ | 0.97 | | | $ | 0.78 | | | $ | 0.95 | | | $ | 1.17 | | | $ | 0.58 | |

Zinc (4) (per lb.) | | $ | 0.98 | | | $ | 0.75 | | | $ | 0.85 | | | $ | 1.47 | | | $ | 1.49 | |

______________

| (3) | London Metals Exchange — Cash |

| (4) | London Metals Exchange — Special High Grade — Cash |

On February 22, 2011, the closing prices for silver, gold, lead and zinc were $32.89 per ounce, $1,401 per ounce, $1.16 per pound and $1.13 per pound, respectively.

An extended decline in metals prices, an increase in operating or capital costs, or our inability to convert exploration potential to reserves may cause us to record write-downs, which could negatively impact our results of operations.

We review the recoverability of the cost of our long-lived assets by estimating the future undiscounted cash flows expected to result from the use and eventual disposition of the asset. Impairment, measured by comparing an asset’s carrying value to its fair value, must be recognized when the carrying value of the asset exceeds these cash flows, and recognizing impairment write-downs could negatively impact our results of operations. Metal price estimates are a key component used in the analysis of the carrying values of our assets. We evaluated the December 31, 2010 carrying values of long-lived assets at our Greens Creek and Lucky Friday segments by comparing them to the average estimated undiscounted cash flows resulting from operatin g plans using various metals price scenarios. Our estimates of undiscounted cash flows for each of our properties also include an estimate of the market value of the exploration potential beyond the current operating plans. Because the average estimated undiscounted cash flows exceeded the asset carrying values, we did not record impairments as of December 31, 2010. However, if the prices of silver, gold, zinc and lead decline for an extended period of time or we fail to control production costs or realize the mineable ore reserves or exploration potential at our mining properties, we may be required to recognize asset write-downs in the future. In addition, the perceived market value of the exploration potential of our properties is dependent upon prevailing metals prices as well as our ability to discover economic ore. A decline in metals prices for an extended period of time or our inability to convert exploration potential to reserves could signific antly reduce our estimations of the value of the exploration potential at our properties and result in asset write-downs.

Our ability to recognize the benefits of deferred tax assets is dependent on future cash flows and taxable income

We recognize the expected future tax benefit from deferred tax assets when the tax benefit is considered to be more likely than not of being realized. Otherwise, a valuation allowance is applied against deferred tax assets. Assessing the recoverability of deferred tax assets requires management to make significant estimates related to expectations of future taxable income. Estimates of future taxable income are based on forecasted income from operations and the application of existing tax laws in each jurisdiction. Metal price estimates are a key component used in the determination of our ability to realize the expected future benefit of our deferred tax assets. To the extent that future taxable income differs significan tly from estimates as a result of a decline in metals prices or other factors, our ability to realize the deferred tax assets could be impacted. Additionally, significant future issuances of common stock or common stock equivalents could limit our ability to utilize our net operating loss carryforwards pursuant to Section 382 of the Internal Revenue Code. Future changes in tax law or changes in ownership structure could limit our ability to utilize our recorded tax assets. As of December 31, 2010, we lifted substantially all deferred tax valuation allowances and our current and non-current deferred tax asset balances were $87.3 million and $100.1 million, respectively. See Note 5 of Notes to Consolidated Financial Statements for further discussion of our deferred tax assets.

Returns for Investments in Pension Plans and Pension Plan Funding Requirements Are Uncertain

We maintain defined benefit pension plans for employees, which provide for specified payments after retirement for most employees. The ability of the pension plans to provide the specified benefits depends on our funding of the plans and returns on investments made by the plans. Returns, if any, on investments are subject to fluctuations based on investment choices and market conditions. A sustained period of low returns or losses on investments could require us to fund the pension plans to a greater extent than anticipated. See Note 8 of Notes to Consolidated Financial Statements for more information on our pension plans.

OPERATION, DEVELOPMENT, EXPLORATION AND ACQUISITION RISKS

We may be subject to a number of unanticipated risks related to inadequate infrastructure.

Mining, processing, development and exploration activities depend on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect our mining operations.

Our development of new orebodies and other capital costs may be higher and provide less return than we estimated.

Capitalized development projects may cost more and provide less return than we estimate. If we are unable to realize a return on these investments, we may incur a related asset write-down that could adversely affect our financial results or condition.

Our ability to sustain or increase our current level of metals production partly depends on our ability to develop new orebodies and/or expand existing mining operations. Before we can begin a development project, we must first determine whether it is economically feasible to do so. This determination is based on estimates of several factors, including:

| | · | expected recovery rates of metals from the ore; |

| | · | facility and equipment costs; |

| | · | availability of adequate manpower; |

| | · | availability of affordable sources of power and adequacy of water supply; |

| | · | exploration and drilling success; |

| | · | capital and operating costs of a development project; |

| | · | environmental considerations and permitting; |

| | · | adequate access to the site, including competing land uses (such as agriculture); |

| | · | foreign currency fluctuation and inflation rates; and |

| | · | availability of financing. |

These estimates are based on geological and other interpretive data, which may be imprecise. As a result, actual operating and capital costs and returns from a development project may differ substantially from our estimates, and, as such, it may not be economically feasible to continue with a development project.

Our ore reserve estimates may be imprecise.

Our ore reserve figures and costs are primarily estimates and are not guarantees that we will recover the indicated quantities of these metals. You are strongly cautioned not to place undue reliance on estimates of reserves. Reserves are estimates made by our professional technical personnel, and no assurance can be given that the estimated amount of metal or the indicated level of recovery of these metals will be realized. Reserve estimation is an interpretive process based upon available data and various assumptions. Our reserve estimates may change based on actual production experience. Further, reserves are valued based on estimates of costs and metals prices, which may not be consistent among our properties. The economic value of ore reserves may be adversely affected by:

| | · | declines in the market price of the various metals we mine; |

| | · | increased production or capital costs; |

| | · | reduction in the grade or tonnage of the deposit; |

| | · | increase in the dilution of the ore; and |

Short-term operating factors relating to our ore reserves, such as the need to sequentially develop orebodies and the processing of new or different ore grades, may adversely affect our cash flow. If the prices of metals that we produce decline substantially below the levels used to calculate reserves for an extended period, we could experience:

| | · | delays in new project development; |

| | · | write-downs of asset values; and |

Efforts to expand the finite lives of our mines may not be successful or could result in significant demands on our liquidity, which could hinder our growth and decrease the value of our stock.

One of the risks we face is that our mines are a depleting asset. Thus, we must continually replace depleted ore reserves. Our ability to expand or replace ore reserves primarily depends on the success of our exploration programs. Mineral exploration, particularly for silver and gold, is highly speculative and expensive. It involves many risks and is often non-productive. Even if we believe we have found a valuable mineral deposit, it may be several years before production from that deposit is possible. During that time, it may become no longer feasible to produce those minerals for economic, regulatory, political or other reasons. As a result of high costs and other uncertainties, we may not be able to expand or replace our existing ore reserves as they are depleted, which would adversely affect our business and fi nancial position in the future.

Over the past years we have evaluated alternatives for deeper access at the Lucky Friday mine in order to expand its operational life. As a result, we initiated work on an internal shaft at Lucky Friday (“#4 Shaft”), including: detailed shaft design, excavation of the hoist room and off shaft development access to shaft facilities, placement and receipt of orders for major equipment purchases, and other construction activities. Upon completion, #4 Shaft would allow us to mine mineralized material below our current workings and provide deeper platforms for exploration. Construction of #4 Shaft would take approximately four more years to complete, and capital expenditures for the project would total approximately $200 million, including approximately $50 million spent on the project through December 31, 2010. Our management currently expects to seek final approval of the project by the Board of Directors in the first half of 2011. We believe that our current capital resources will allow us to proceed. However, there are a number of factors that could affect final approval of the project, including: a significant decline in metals prices, a significant increase in operating or capital costs, or our inability to successfully settle or otherwise manage our existing and potential environmental liabilities relating to historical mining activities in the Coeur d’Alene Basin. An increase in the capital cost could potentially require us to suspend the project or access additional capital though debt financing, the sale of securities, or other external sources. This additional financing could be costly or unavailable.

Our joint development and operating arrangements may not be successful.

We have in the past entered into, and may in the future enter into joint venture arrangements in order to share the risks and costs of developing and operating properties. In a typical joint venture arrangement, the partners own a proportionate share of the assets, are entitled to indemnification from each other and are only responsible for any future liabilities in proportion to their interest in the joint venture. If a party fails to perform its obligations under a joint venture agreement, we could incur liabilities and losses in excess of our pro-rata share of the joint venture. We make investments in exploration and development projects that may have to be written off in the event we do not proceed to a commercially viable mining operation.

On February 21, 2008, we announced that our wholly-owned subsidiary, Rio Grande Silver Inc., acquired the right to earn into a 70% joint venture interest in an approximately 25-square-mile consolidated land package in the Creede Mining District of Colorado. For more information on the terms of the agreement, see Note 17 of Notes to Consolidated Financial Statements.

Our ability to market our metals production may be affected by disruptions or closures of custom smelters and/or refining facilities.

We sell substantially all of our metallic concentrates to custom smelters, with our doré bars sent to refiners for further processing before being sold to metal traders. If our ability to sell concentrates to our contracted smelters becomes unavailable to us, it is possible our operations could be adversely affected. See Note 11 of Notes to Consolidated Financial Statements for more information on the distribution of our sales and our significant customers.

We face inherent risks in acquisitions of other mining companies or properties that may adversely impact our growth strategy.

Mines have limited lives, which is an inherent risk in acquiring mining properties. We are actively seeking to expand our mineral reserves by acquiring other mining companies or properties. Although we are pursuing opportunities that we feel are in the best interest of our investors, these pursuits are costly and often unproductive. Inherent risks in acquisitions we may undertake in the future could adversely affect our current business and financial condition and our growth.

There is a limited supply of desirable mineral lands available in the United States and foreign countries where we would consider conducting exploration and/or production activities, and any acquisition we may undertake is subject to inherent risks. In addition to the risk associated with limited mine lives, we may not realize the value of the companies or properties that are acquired due to a possible decline in metals prices, failure to obtain permits, labor problems, changes in regulatory environment, failure to achieve anticipated synergies, an inability to obtain financing and other factors previously described. Acquisitions of other mining companies or properties may also expose us to new geographic, political, operating, and geological risks. In addition, we face strong competition for companies and propertie s from other mining companies, some of which have greater financial resources than we do, and we may be unable to acquire attractive companies and mining properties on terms that we consider acceptable.

Our business depends on good relations with our employees.

We are dependent upon the ability and experience of our executive officers, managers, employees and other personnel, and there can be no assurance that we will be able to retain all of such employees. We compete with other companies both within and outside the mining industry in connection with the recruiting and retention of qualified employees knowledgeable of the mining business. The loss of these persons or our inability to attract and retain additional highly skilled employees could have an adverse effect on our business and future operations. The Lucky Friday mine is our only operation subject to a collective bargaining agreement, and that agreement expires on April 30, 2016.

Competition from other mining companies may harm our business.

We compete with other mining companies to attract and retain key executives, skilled labor, contractors and other employees. We compete with other mining companies for the services of skilled personnel and contractors and their specialized equipment, components and supplies, such as drill rigs, necessary for exploration and development. We also compete with other mining companies for rights to mine properties. We may be unable to continue to obtain the services of skilled personnel and contractors or specialized equipment or supplies, or to acquire additional rights to mine properties.

Mining accidents or other adverse events at an operation could decrease our anticipated production.

Production may be reduced below our historical or estimated levels as a result of mining accidents; unfavorable ground conditions; work stoppages or slow-downs; lower than expected ore grades; the metallurgical characteristics of the ore that are less economic than anticipated; or our equipment or facilities fail to operate properly or as expected. For example, in the second quarter of 2010, mining activities at the Lucky Friday mine stopped for approximately two weeks due to some deterioration of shaft infrastructure at the #2 Shaft, which is the mine’s secondary escape way. That stoppage adversely impacted production in the second quarter of 2010. Upon completion of repairs to #2 Shaft, the mine returned to normal production.

Our operations may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance.

Our business is capital intensive, requiring ongoing capital investment for the replacement, modernization or expansion of equipment and facility. The Company maintains insurance policies against property loss and business interruption and insures against risks that are typical in the operation of our business, in amounts we believe to be reasonable. Such insurance, however, contains exclusions and limitations on coverage, particularly with respect to environmental liability and political risk. There can be no assurance that claims would be paid under such insurance policies in connection with a particular event. Our business is subject to a number of risks and hazards including:

| | · | political and country risks; |

| | · | civil unrest or terrorism; |

| | · | labor disputes or strikes; |

| | · | unusual or unexpected geologic formations; |

| | · | underground fires or floods; |

| | · | explosive rock failures; and |

| | · | unanticipated hydrologic conditions, including flooding and periodic interruptions due to inclement or hazardous weather conditions. |

Such risks could result in:

| | · | personal injury or fatalities; |

| | · | damage to or destruction of mineral properties or producing facilities; |

| | · | delays in exploration, development or mining; |

| | · | temporary or permanent closure of facilities. |

We maintain insurance to protect against losses that may result from some of these risks at levels consistent with our historical experience, industry practice and circumstances surrounding each identified risk. Insurance against environmental risks is generally either unavailable or, we believe, too expensive for us, and we therefore do not maintain environmental insurance. Occurrence of events for which we are not insured may have an adverse effect on our business.

Our foreign activities are subject to additional inherent risks.

We sold our mining operations and assets in Venezuela in July 2008, but still currently conduct exploration projects in Mexico and continue to own assets, real estate and mineral interests there. We anticipate that we will continue to conduct operations in Mexico and possibly other international locations in the future. Because we conduct operations internationally, we are subject to political and economic risks such as:

| | · | the effects of local political, labor and economic developments and unrest; |

| | · | significant or abrupt changes in the applicable regulatory or legal climate; |

| | · | exchange controls and export restrictions; |

| | · | expropriation or nationalization of assets with inadequate compensation; |

| | · | currency fluctuations and repatriation restrictions; |

| | · | invalidation of governmental orders, permits or agreements; |

| | · | renegotiation or nullification of existing concessions, licenses, permits and contracts; |

| | · | corruption, demands for improper payments, expropriation, and uncertain legal enforcement and physical security; |

| | · | disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations; |

| | · | fuel or other commodity shortages; |

| | · | laws or policies of foreign countries and the United States affecting trade, investment and taxation; |

| | · | civil disturbances, war and terrorist actions; and |

Consequently, our exploration, development and production activities outside of the United States may be substantially affected by factors beyond our control, any of which could materially adversely affect our financial condition or results of operations.

LEGAL, MARKET AND REGULATORY RISKS

We are currently involved in ongoing legal disputes that may materially adversely affect us.

There are several ongoing legal disputes in which we are involved. If any of these disputes result in a substantial monetary judgment against us, are settled on terms in excess of our current accruals, or otherwise impact our operations, our financial results or condition could be materially adversely affected. For example, we may ultimately incur environmental remediation costs or the plaintiffs in environmental proceedings may be awarded damages substantially in excess of the amounts we have accrued. In particular, we face this risk in connection with the Coeur d’Alene Basin environmental lawsuit in which the Plaintiffs have alleged damages totaling in the billions of dollars and in which Hecla Limited is the sole remaining defendant. In February 2011, the negotiators representing Hecla , the Plaintiffs, and the State of Idaho reached an understanding on proposed financial terms to be incorporated into a comprehensive settlement of the Coeur d’Alene Basin environmental litigation and related claims. Those financial terms of potential settlement are set forth in Note 19 of Notes to Consolidated Financial Statements. See risk titled “The financial terms of proposed settlement that we negotiated with the Plaintiffs’ and the State of Idaho’s negotiators regarding the Coeur d’Alene Basin environmental litigation and related claims are non-binding and are not final, and complete settlement of the litigation and other claims may not be reached.” For a description of the lawsuits in which we are involved, see Note 7 a nd Note 19 of Notes to Consolidated Financial Statements.

The financial terms of proposed settlement that we negotiated with the Plaintiffs’ and the State of Idaho’s negotiators regarding the Coeur d’Alene Basin environmental litigation and related claims are non-binding and are not final, and complete settlement of the litigation and other claims may not be reached.

In February 2011, the negotiators representing Hecla, the Plaintiffs, and the State of Idaho reached an understanding on proposed financial terms to be incorporated into a comprehensive settlement of the Coeur d’Alene Basin environmental litigation and related claims. The proposed financial terms would require that we pay in the aggregate $263.4 million to the Plaintiffs and the State of Idaho over approximately three years, and provide a limited amount of land to be used as a repository waste site, as part of settling the litigation and other claims. The proposed financial terms of settlement are set forth in Note 19 of Notes to Consolidated Financial Statements.

Any comprehensive settlement would contain additional material terms yet to be negotiated. While the negotiators have reached an understanding on proposed financial terms, no party has agreed to any of these terms. Thus, these terms are not, at this point, binding on us, the Plaintiffs, or the State of Idaho until an agreement on all of the other terms of settlement is reached and a Consent Decree is entered by the Court. On February 18, 2011, the Court issued an order giving the parties until April 15, 2011 to file a joint status report regarding settlement efforts and stated no extensions will be given absent a showing of extraordinary cause.

If the negotiators for Hecla, the Plaintiffs, and the State of Idaho do reach a final settlement in the form of a proposed Consent Decree that they are prepared to recommend to their respective managements and clients, that Consent Decree will be subject to (i) approval by the parties’ management and clients, (ii) a 30-day public comment period and a period for responses to those public comments and (iii) approval by the United States District Court in Idaho. There can be no assurance that the parties will be successful in negotiating and agreeing on the final terms of the Consent Decree, or that the Consent Decree will be entered by the Court and thereby become final and binding. If we are unable to successfully settle the litigation and other claims and have the Consent Decree entered, it is possible that Hecla Limited’s liability for environmental remediation and other damages in the Coeur d’Alene Basin will exceed the amounts we have accrued for such liabilities. See risk titled “Our environmental obligations may exceed the provisions we have made.”

We are required to obtain governmental and lessor approvals and permits in order to conduct mining operations.

In the ordinary course of business, mining companies are required to seek governmental and lessor approvals and permits for expansion of existing operations or for the commencement of new operations. Obtaining the necessary governmental permits is a complex, time-consuming and costly process. The duration and success of our efforts to obtain permits are contingent upon many variables not within our control. Obtaining environmental permits, including the approval of reclamation plans, may increase costs and cause delays depending on the nature of the activity to be permitted and the interpretation of applicable requirements implemented by the permitting authority. There can be no assurance that all necessary approvals and permits will be obtained and, if obtained, that the costs involved will not exceed those that we previously estimated. It is possible that the costs and delays associated with the compliance with such standards and regulations could become such that we would not proceed with the development or operation. We are required to post surety bonds or cash collateral to secure our reclamation obligations and we may be unable to obtain the required surety bonds or may not have the resources to provide cash collateral.

We face substantial governmental regulation and environmental risk.

Our business is subject to extensive U.S. and foreign, federal, state and local laws and regulations governing development, production, labor standards, occupational health, waste disposal, use of toxic substances, environmental regulations, mine safety and other matters. For example, in 2010 both of our operating mines received several citations under the Mine Safety and Health Act of 1977, as administered by the Federal Mine Safety and Health Administration. Further, we have been and are currently involved in lawsuits or disputes in which we have been accused of causing environmental damage, violating environmental laws, or violating environmental permits, and we may be subject to similar lawsuits or disputes in the future. See risk titled � 220;Our environmental obligations may exceed the provisions we have made.” For example, in late 2008 and during 2009, Hecla Limited experienced a number of alleged water permit exceedances for water discharges at its Lucky Friday unit. The 2008 alleged violations resulted in Hecla Limited entering into a Consent Agreement and Final Order (“CAFO”) and a Compliance Order with the EPA in April 2009, which included an extended compliance timeline. In connection with the CAFO, Hecla Limited agreed to pay an administrative penalty to the EPA of $177,500 to settle any liability for such exceedances. The 2009 alleged violations were the subject of a December 2010 letter from the EPA informing Hecla Limited that EPA is prepared to seek civil penalties for these alleged violations, as well as for alleged unpermitted discharges of waste water in 2009 at the Lucky Friday unit. In the same letter, EPA invited Hecla Limited to discuss these ma tters with them prior to filing a complaint. Hecla Limited disputes EPA’s assertions, but has begun negotiations with EPA in an attempt to resolve these matters.

Hecla Limited has undertaken efforts to bring its water discharges at the Lucky Friday unit into compliance with the permit, but cannot provide assurances that it will be able to fully comply with the permit limits in the future. Any future non-compliance with the permit limits or other regulatory or environmental requirements could lead to future penalties, regulatory or other legal action, damages, or otherwise impact our operations and financial results.

In addition to existing regulatory requirements, legislation and regulations may be adopted or permit limits reduced at any time that result in additional operating expense, capital expenditures or restrictions and delays in the mining, production or development of our properties. In addition, enforcement or regulatory tools and methods available to governmental regulators such as the U.S. Environmental Protection Agency which have not been used or seldomly used against us, could in the future be used against us.

Legislative and regulatory measures to address climate change and green house gas emissions are in various phases of consideration. If adopted, such measures could increase our cost of environmental compliance and also delay or otherwise negatively affect efforts to obtain permits and other regulatory approvals with regard to existing and new facilities. Proposed measures could also result in increased cost of fuel and other consumables used at our operations, including the diesel generation of electricity at our Greens Creek operation if we are unable to access utility power. Climate change legislation may also affect our smelter customers who burn fossil fuels, resulting in increased costs to us, and may affect the market for the metals we produce with effects on prices that are not possible for us to predict.

From time to time, the U.S. Congress considers proposed amendments to the General Mining Law of 1872, as amended, which governs mining claims and related activities on federal lands. The extent of any future changes is not known and the potential impact on us as a result of U.S. Congressional action is difficult to predict. Changes to the General Mining Law, if adopted, could adversely affect our ability to economically develop mineral reserves on federal lands. Although we are not currently mining on federal land, exploration and future mining could occur on federal land.

Our environmental obligations may exceed the provisions we have made.

We are subject to significant environmental obligations, particularly in northern Idaho through our subsidiary Hecla Limited. At December 31, 2010, we had accrued $318.8 million as a provision for environmental obligations, including $278.1 million accrued for Hecla Limited’s various liabilities in Idaho. As of the date of this report, these accrual balances included a total of $262.2 million for environmental claims with respect to the entire Coeur d’Alene Basin (“Basin”), including the Box, in northern Idaho. These accrual balances include an increase of $193.2 million in the fourth quarter of 2010 as a result of negotiators representing Hecla, the Plaintiffs, and the State of Idaho with respect to the Coeur d’Alene Basin environmental litigation an d related claims reaching an understanding on proposed financial terms to be incorporated into a comprehensive settlement that would contain additional terms yet to be negotiated. Despite reaching such an understanding, there is no guarantee that final settlement terms will be reached and a Consent Decree entered. If we are unable to successfully settle the litigation and have a Consent Decree entered, it is possible that Hecla Limited’s liability for environmental remediation and other damages in the Coeur d’Alene Basin will exceed the amounts we have accrued for such liabilities.

For an overview of our potential environmental liabilities, see Note 7 and Note 19 of Notes to Consolidated Financial Statements.

The titles to some of our properties may be defective or challenged.

Unpatented mining claims constitute a significant portion of our undeveloped property holdings, the validity of which could be uncertain and may be contested. Although we have conducted title reviews of our property holdings, title review does not necessarily preclude third parties from challenging our title. In accordance with mining industry practice, we do not generally obtain title opinions until we decide to develop a property. Therefore, while we have attempted to acquire satisfactory title to our undeveloped properties, some titles may be defective.

The price of our stock has a history of volatility and could decline in the future.

Our common and preferred stocks are listed on the New York Stock Exchange. The market price for our stock has been volatile, often based on:

| | · | changes in metals prices, particularly silver; |

| | · | our results of operations and financial condition as reflected in our public news releases or periodic filings with the Securities and Exchange Commission; |

| | · | fluctuating proven and probable reserves; |

| | · | factors unrelated to our financial performance or future prospects, such as global economic developments, market perceptions of the attractiveness of particular industries, or the reliability of metals markets,; |

| | · | political and regulatory risk; |

| | · | the success of our exploration programs; |

| | · | ability to meet production estimates; |

| | · | environmental and legal risk; |

| | · | the extent of analytical coverage concerning our business; and |

| | · | the trading volume and general market interest in our securities. |

The market price of our stock at any given point in time may not accurately reflect our value, and may prevent shareholders from realizing a profit on their investment.

Our Series B Preferred Stock has a liquidation preference of $50 per share or $7.9 million.

If we were liquidated, holders of our preferred stock would be entitled to receive approximately $7.9 million (plus any accrued and unpaid dividends) from any liquidation proceeds before holders of our common stock would be entitled to receive any proceeds.

We may not be able to pay preferred stock dividends in the future.

Since July 2005, we paid regular quarterly dividends on our Series B Preferred Stock through the third quarter of 2008. The annual dividend payable on the Series B Preferred Stock is currently $0.6 million. Prior to the fourth quarter of 2004, we had not declared preferred dividends on Series B Preferred Stock since the second quarter of 2000. Series B Preferred Stock dividends due on January 1, 2009, for the fourth quarter of 2008 and dividends due for the three quarters thereafter were deferred. In January 2010 we paid all dividends in arrears and dividends due for the fourth quarter of 2009 for the Series B Preferred Stock, and we paid all regular quarterly dividends for 2010. However, there can be no assurance that we will continue to pay dividends in the future.

Additional issuances of equity securities by us would dilute the ownership of our existing stockholders and could reduce our earnings per share.

We may issue equity in the future in connection with acquisitions, strategic transactions or for other purposes, including funding our obligations under any settlement of litigation of other claims. Any such acquisition could be material to us and could significantly increase the size and scope of our business, including our market capitalization. To the extent we issue any additional equity securities, the ownership of our existing stockholders would be diluted and our earnings per share could be reduced. As of December 31, 2010, there were warrants outstanding for purchase of 24,479,513 shares of our common stock. The warrants give the holders the right to purchase our common stock at the following prices: $2.45 (6,328,793 shares), $2.56 (460,976 shares), and $2.50 (17,6 89,744 shares). The remaining warrants expire in June and August 2014. See Note 9 of Notes to Consolidated Financial Statements.

The issuance of additional shares of our preferred stock or common stock in the future could adversely affect holders of common stock.

The market price of our common stock is likely to be influenced by our preferred stock. For example, the market price of our Common Stock could become more volatile and could be depressed by our failure to pay dividends on our currently outstanding Series B Preferred Stock, which would prevent us from paying dividends to holders of our common stock.

In addition, our board of directors is authorized to issue additional classes or series of preferred stock without any action on the part of our stockholders. This includes the power to set the terms of any such classes or series of preferred stock that may be issued, including voting rights, dividend rights and preferences over common stock with respect to dividends or upon the liquidation, dissolution or winding up of the business and other terms. If we issue preferred stock in the future that has preference over our common stock with respect to the payment of dividends or upon liquidation, dissolution or winding up, or if we issue preferred stock with voting rights that dilute the voting power of our common stock, the rights of holders of the common stock or the market price of the common st ock could be adversely affected.

We may issue substantial additional shares of common stock or other securities in connection with acquisitions, strategic transactions or for other purposes, including funding of our obligations under any settlement of litigation or other claims, to the extent permitted by our credit facility. Any such acquisition could be material to us and could significantly increase the size and scope of our business. Issuances or sales of substantial amounts of additional common stock or the perception that such issuances or sales could occur may cause prevailing market prices for our common stock to decline and could result in dilution to our stockholders.

As noted above, as of December 31, 2010, there were warrants outstanding to purchase a total of 24,479,513 shares of our common stock.

As described in Note 19 to Notes to Consolidated Financial Statements, we issued 18.9 million shares of our common stock in January of 2011 in connection with conversion of our 6.5% Mandatory Convertible Preferred Stock.

If a large number of shares of our common stock are sold in the public market, the sales could reduce the trading price of our common stock, impede our ability to raise future capital.

We cannot predict what effect, if any, future issuances by us of our common stock or other equity will have on the market price of our common stock. In addition, shares of our common stock that we issue in connection with an acquisition may not be subject to resale restrictions. We may issue substantial additional shares of common stock or other securities in connection with material acquisition transactions or for other purposes, including funding of our obligations under any settlement of litigation or other claims. The market price of our common stock could decline if certain large holders of our common stock, or recipients of our common stock, sell all or a significant portion of their shares of common stock or are perceived by the market as intending to sell these shares other than in an orderly manner. In addi tion, these sales could also impair our ability to raise capital through the sale of additional common stock in the capital markets.

The provisions in our certificate of incorporation, our by-laws and Delaware law could delay or deter tender offers or takeover attempts that may offer a premium for our common stock.

The provisions in our certificate of incorporation, our by-laws and Delaware law could make it more difficult for a third party to acquire control of us, even if that transaction would be beneficial to stockholders. These impediments include:

| | · | the classification of our board of directors into three classes serving staggered three-year terms, which makes it more difficult to quickly replace board members; |

| | · | the ability of our board of directors to issue shares of preferred stock with rights as it deems appropriate without stockholder approval; |

| | · | a provision that special meetings of our board of directors may be called only by our chief executive officer or a majority of our board of directors; |

| | · | a provision that special meetings of stockholders may only be called pursuant to a resolution approved by a majority of our entire board of directors; |

| | · | a prohibition against action by written consent of our stockholders; |

| | · | a provision that our board members may only be removed for cause and by an affirmative vote of at least 80% of the outstanding voting stock; |

| | · | a provision that our stockholders comply with advance-notice provisions to bring director nominations or other matters before meetings of our stockholders; |

| | · | a prohibition against certain business combinations with an acquirer of 15% or more of our common stock for three years after such acquisition unless the stock acquisition or the business combination is approved by our board prior to the acquisition of the 15% interest, or after such acquisition our board and the holders of two-thirds of the other common stock approve the business combination; and |

| | · | a prohibition against our entering into certain business combinations with interested stockholders without the affirmative vote of the holders of at least 80% of the voting power of the then outstanding shares of voting stock. |

The existence of these provisions may deprive stockholders of an opportunity to sell our stock at a premium over prevailing prices. The potential inability of our stockholders to obtain a control premium could adversely affect the market price for our common stock.

If we cannot meet the New York Stock Exchange continued listing requirements, the NYSE may delist our common stock.

Our common stock is currently listed on the NYSE. In the future, if we are not be able to meet the continued listing requirements of the NYSE, which require, among other things, that the average closing price of our common stock be above $1.00 over 30 consecutive trading days, our common stock may be delisted. Our closing stock price on February 22, 2011 was $10.40. The closing price of our common stock was last below $1.00 for over 30 consecutive trading days was during the second quarter of 2001.

If we are unable to satisfy the NYSE criteria for continued listing, our common stock would be subject to delisting. A delisting of our common stock could negatively impact us by, among other things, reducing the liquidity and market price of our common stock; reducing the number of investors willing to hold or acquire our common stock, which could negatively impact our ability to raise equity financing; decreasing the amount of news and analyst coverage for the Company; and limiting our ability to issue additional securities or obtain additional financing in the future. In addition, delisting from the NYSE might negatively impact our reputation and, as a consequence, our business.

Item 1B. Unresolved Staff Comments

None.

Item 2. Property Descriptions

OPERATING PROPERTIES

The Greens Creek Unit

Our various subsidiaries own 100% of the Greens Creek Mine, located in Southeast Alaska, which has been in production since 1989, with a temporary care and maintenance period from April 1993 through July 1996. Since the start of production, Greens Creek has been owned and operated through various joint venture arrangements involving a variety of partners, including us. For approximately 15 years prior to April 16, 2008, our wholly-owned subsidiary, Hecla Alaska LLC, owned an undivided 29.7% joint venture interest in the assets of Greens Creek. On April 16, 2008, we completed the acquisition of all of the equity of two Rio Tinto subsidiaries holding a 70.3% interest in the Greens Creek mine for approximately $758.5 million. The acquisition gives our various subsidiaries con trol of 100% of the Greens Creek mine.

The Greens Creek orebody contains silver, zinc, gold and lead, and lies adjacent to the Admiralty Island National Monument, an environmentally sensitive area. The Greens Creek property includes 17 patented lode claims and one patented mill site claim, in addition to property leased from the U.S. Forest Service. Greens Creek also has title to mineral rights on 7,500 acres of federal land adjacent to the properties. The entire project is accessed by boat and served by 13 miles of road and consists of the mine, an ore concentrating mill, a tailings impoundment area, a ship-loading facility, camp facilities and a ferry dock. The map below illustrates the location and access to Greens Creek:

The Greens Creek deposit is a polymetallic, stratiform, massive sulfide deposit. The host rock consists of predominantly marine sedimentary, and mafic to ultramafic volcanic and plutonic rocks, which have been subjected to multiple periods of deformation. These deformational episodes have imposed intense tectonic fabrics on the rocks. Mineralization occurs discontinuously along the contact between a structural hanging wall of quartz mica carbonate phyllites and a structural footwall of graphitic and calcareous argillite. Major sulfide minerals are pyrite, sphalerite, galena, and tetrahedrite/tennanite.

Pursuant to a 1996 land exchange agreement, the joint venture transferred private property equal to a value of $1.0 million to the U.S. Forest Service and received exploration and mining rights to approximately 7,500 acres of land with mining potential surrounding the existing mine. Production from new ore discoveries on the exchanged lands will be subject to federal royalties included in the land exchange agreement. The royalty is only due on production from reserves that are not part of Greens Creek’s extralateral rights. Thus far, there has been no production triggering payment of the royalty. The royalty is 3% if the average value of the ore during a year is greater than $120 per ton of ore, and 0.75% if the value is $120 per ton or less. The benchmark of $120 per ton is adjusted annually according to the Gross Domestic Product (GDP) Implicit Price Deflator until the year 2016, and at December 31, 2010, was at approximately $160 per ton when applying the latest GDP Implicit Price Deflator observation.

Greens Creek is an underground mine which produces approximately 2,200 tons of ore per day. The primary mining methods are cut and fill and longhole stoping. The ore is processed on site at a mill, which produces lead, zinc and bulk concentrates, as well as gold doré. In 2010, ore was processed at an average rate of approximately 2,193 tons per day. During 2010, mill recovery totaled approximately 73% silver, 78% zinc, 68% lead and 64% gold. The doré is further refined by precious metal refiners and sold to banks, and the three concentrate products are sold to a number of major smelters worldwide. See Note 11 of Notes to Consolidated Financial Statements for information on the significant customers for Greens Creek’s products. Concentrates are shipped from a marine terminal located on Admiralty Island about nine miles from the mine site.

Electricity for the Greens Creek unit has historically been provided by diesel generators located on site. However, an agreement was reached during 2005 to purchase excess hydroelectric power from the local power company, Alaska Electric Light and Power Company (“AEL&P”). Installation of the necessary infrastructure was completed in 2006, and use of hydroelectric power commenced during the third quarter of 2006. The infrastructure is also used to provide power to surrounding communities. This project has reduced production costs at Greens Creek to the extent power has been available. Low lake levels and increased demand in the Juneau area combined to restrict the amount of power available to Greens Creek prior to 2009. In 2009 and 2010, the mine received an increased proportion of its power needs from AEL&P. However, when weather conditions are not favorable to maintain lake water levels, the mine relies on diesel generated power.

The employees at Greens Creek are employees of Hecla Greens Creek Mining Company, our wholly-owned subsidiary, and are not represented by a bargaining agent. There were 343 employees at the Greens Creek unit at December 31, 2010.

As of December 31, 2010, we have recorded a $35.3 million asset retirement obligation for reclamation and closure costs. We maintain a $30 million reclamation bond secured by the restricted cash balance of $7.6 million for Greens Creek. The net book value of the Greens Creek unit property and its associated plant, equipment and mineral interests was approximately $670 million as of December 31, 2010.

Information with respect to production, average costs per ounce of silver produced and proven and probable ore reserves is set forth in the following table, and represents our 100% ownership of Greens Creek after April 16, 2008, and our previous 29.7% ownership prior to that date.

| | | Years Ended December 31, | |

| Production | | 2010 | | | 2009 | | | 2008 | |

| Ore milled (tons) | | | 800,397 | | | | 790,871 | | | | 598,931 | |

| Silver (ounces) | | | 7,206,973 | | | | 7,459,170 | | | | 5,829,253 | |

| Gold (ounces) | | | 68,838 | | | | 67,278 | | | | 54,650 | |

| Zinc (tons) | | | 74,496 | | | | 70,379 | | | | 52,055 | |

| Lead (tons) | | | 25,336 | | | | 22,253 | | | | 16,630 | |

| | | | | | | | | | | | | |

Average Cost per Ounce of Silver Produced (1) | | | | | | | | | | | | |

| Total cash costs | | $ | (3.90 | ) | | $ | 0.35 | | | $ | 3.29 | |

| Total production costs | | $ | 3.36 | | | $ | 7.65 | | | $ | 8.52 | |

| | | | | | | | | | | | | |

Probable Ore Reserves (2,3,4,5,6,7) | | | | | | | | | | | | |

| Total tons | | | 8,243,100 | | | | 8,314,700 | | | | 8,064,700 | |

| Silver (ounces per ton) | | | 12.1 | | | | 12.1 | | | | 13.7 | |

| Gold (ounces per ton) | | | 0.09 | | | | 0.10 | | | | 0.11 | |

| Zinc (percent) | | | 9.3 | | | | 10.3 | | | | 10.5 | |

| Lead (percent) | | | 3.5 | | | | 3.6 | | | | 3.8 | |

| Contained silver (ounces) | | | 99,730,000 | | | | 100,973,300 | | | | 110,583,200 | |

| Contained gold (ounces) | | | 757,000 | | | | 847,400 | | | | 870,100 | |

| Contained zinc (tons) | | | 766,500 | | | | 852,900 | | | | 850,700 | |

| Contained lead (tons) | | | 291,300 | | | | 303,300 | | | | 308,700 | |

| (1) | Includes by-product credits from gold, lead and zinc production. Cash costs per ounce of silver represent measurements that are not in accordance with GAAP that management uses to monitor and evaluate the performance of our mining operations. We believe cash costs per ounce of silver provide an indicator of economic performance and efficiency at each location and on a consolidated basis, as well as providing a meaningful basis to compare our results to those of other mining companies and other mining operating properties. A reconciliation of this non-GAAP measure to cost of sales and other direct production costs and depreciation, depletion and amortization, the most comparable GAAP measure, can be found in Item 7. — MD&A, under Reconciliation of Total Cash Costs (non-GAAP) to Costs of Sales and O ther Direct Production Costs and Depreciation, Depletion and Amortization (GAAP). |