UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3737

Fidelity Advisor Series IV

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | November 30 |

Date of reporting period: | November 30, 2005 |

Item 1. Reports to Stockholders

| Fidelity® Institutional Short-Intermediate Government Fund |

| Annual Report November 30, 2005 |

| Contents | ||||

| Chairman’s Message | 4 | Ned Johnson’s message to shareholders. | ||

| Performance | 5 | How the fund has done over time. | ||

| Management’s Discussion | 6 | The manager’s review of fund | ||

| performance, strategy and outlook. | ||||

| Shareholder Expense | 7 | An example of shareholder expenses. | ||

| Example | ||||

| Investment Changes | 8 | A summary of major shifts in the fund’s | ||

| investments over the past six months. | ||||

| Investments | 9 | A complete list of the fund’s investments | ||

| with their market values. | ||||

| Financial Statements | 17 | Statements of assets and liabilities, | ||

| operations, and changes in net assets, | ||||

| as well as financial highlights. | ||||

| Notes | 21 | Notes to the financial statements. | ||

| Report of Independent | 26 | |||

| Registered Public | ||||

| Accounting Firm | ||||

| Trustees and Officers | 27 | |||

| Distributions | 38 | |||

| Board Approval of | 39 | |||

| Investment Advisory | ||||

| Contracts and | ||||

| Management Fees | ||||

| To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) website at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines. Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation. Other third party marks appearing herein are the property of their respective owners. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company. |

Annual Report 2

| This report and the financial statements contained herein are submitted for the general infor- mation of the shareholders of the fund. This report is not authorized for distribution to prospec- tive investors in the fund unless preceded or accompanied by an effective prospectus. A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio hold ings, view the most recent quarterly report, semiannual report, or annual report on Fidelity’s web site at http://fidelity.com/holdings. NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE Neither the fund nor Fidelity Distributors Corporation is a bank. |

3 Annual Report

Chairman’s Message

(photograph of Edward C. Johnson 3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind every one where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission’s forward pricing rules or were involved in so called “market timing” activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that some one could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner and in every other. But I underscore again that Fidelity has no so called “agreements” that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee which is returned to the fund and, therefore, to investors to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors’ holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report 4

Performance: The Bottom Line

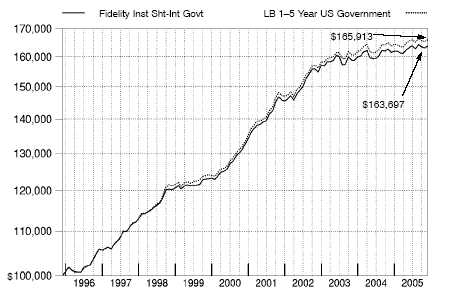

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund’s dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of perfor mance each year. The $100,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns | ||||||

| Periods ended November 30, 2005 | Past 1 | Past 5 | Past 10 | |||

| year | years | years | ||||

| Fidelity® Inst Sht Int Govt Fund | 1.39% | 4.31% | 5.05% | |||

| $100,000 Over 10 Years | ||||||

Let’s say hypothetically that $100,000 was invested in Fidelity® Institutional Short Intermediate Government Fund on November 30, 1995. The chart shows how the value of your investment would have changed, and also shows how the Lehman Brothers® 1-5 Year US Government Bond Index performed over the same period.

| 5 Annual Report 5 |

Management’s Discussion of Fund Performance

Comments from George Fischer, Portfolio Manager of Fidelity® Institutional Short Intermediate Government Fund

Investment grade bond performance reflected the good news/bad news dichotomy regard ing the economy’s direction during the year ending November 30, 2005, as index returns were positive, but well below their historical averages. On the downside, inflation levels accelerated along with record high prices for natural gas and oil, the latter of which reached $70 per barrel after Hurricane Katrina devastated the Gulf Coast’s production and refining facilities. Investors were further troubled by the Federal Reserve Board’s eight interest rate hikes. On the upside, core inflation — which excludes volatile energy and food prices — remained relatively tame and quarterly gross domestic product growth (GDP) showed the economy was solid, but not overheated. Still, investors leaned more toward the cautious side, as suggested by the modest 2.40% gain of the Lehman Brothers® Aggregate Bond Index. Treasuries outperformed corporate, agency and mortgage backed bonds, but not to a great extent, as each of these investment grade debt categories re turned more than 2.00% but less than 3.00%, according to their respective Lehman Broth ers benchmarks.

For the 12 months ending November 30, 2005, the fund returned 1.39%, outpacing both the LipperSM Short Intermediate Government Funds Average and the Lehman Brothers

1-5 Year U.S. Government Bond Index, which returned 0.99% and 1.36%, respectively. The biggest boost to the fund’s performance relative to the index was effective yield curve positioning, which refers to how the fund’s assets were distributed across a range of maturities. Early in the period, the fund’s larger than index stake in longer term securities and in cash benefited performance as the yield curve flattened and longer term securities and cash outpaced short term securities. A large weighting relative to the index in agency securities and a significant underweighting in Treasuries also boosted returns because agencies outpaced comparable duration Treasuries. My decision to maintain an out of index stake in mortgage pass through securities worked against the fund, given that they trailed comparable duration Treasuries, due largely to heavy mortgage supply. However, my positioning elsewhere within the mortgage sector was a plus, with holdings in collateralized mortgage obligations making a positive contribution.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

| Annual Report |

| 6 6 |

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2005 to November 30, 2005).

| Actual Expenses |

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the share holder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Expenses Paid | ||||||||||

| During Period* | ||||||||||

| Beginning | Ending | June 1, 2005 | ||||||||

| Account Value | Account Value | to November 30, | ||||||||

| June 1, 2005 | November 30, 2005 | 2005 | ||||||||

| Actual | $ | 1,000.00 | $ | 1,002.70 | $ | 2.26 | ||||

| Hypothetical (5% return per year | ||||||||||

| before expenses) | $ | 1,000.00 | $ | 1,022.81 | $ | 2.28 | ||||

* Expenses are equal to the Fund’s annualized expense ratio of .45%; multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one half year period).

7 Annual Report

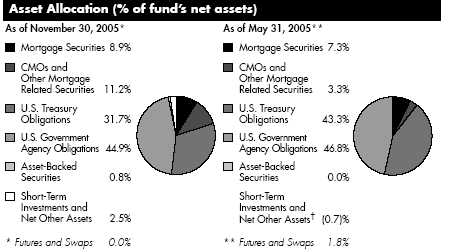

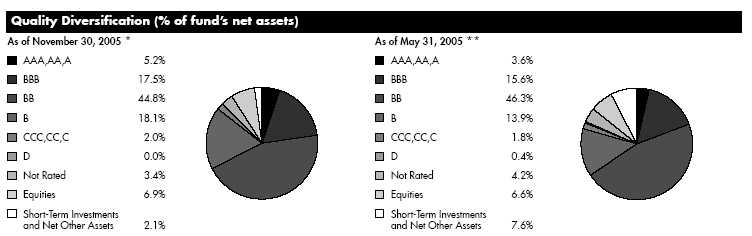

| Investment Changes | ||||

| Coupon Distribution as of November 30, 2005 | ||||

| % of fund’s | % of fund’s investments | |||

| investments | 6 months ago | |||

| 0.01 – 0.99% | 10.0 | 5.2 | ||

| 2 – 2.99% | 26.7 | 50.7 | ||

| 3 – 3.99% | 17.9 | 15.7 | ||

| 4 – 4.99% | 24.4 | 11.7 | ||

| 5 – 5.99% | 9.6 | 7.7 | ||

| 6 – 6.99% | 7.4 | 6.1 | ||

| 7% and over | 1.5 | 1.6 | ||

Coupon distribution shows the range of stated interest rates on the fund’s investments, excluding short term investments.

| Average Years to Maturity as of November 30, 2005 | ||||||

| 6 months ago | ||||||

| Years | 3.2 | 2.8 | ||||

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund’s bonds, weighted by dollar amount.

| Duration as of November 30, 2005 | ||||||

| 6 months ago | ||||||

| Years | 2.3 | 2.2 | ||||

Duration shows how much a bond fund’s price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund’s performance and share price. Accordingly, a bond fund’s actual performance may differ from this example.

(dagger) Short-Term Investments and Net Other Assets are not included in the pie chart.

Annual Report 8

| Investments November 30, 2005 | ||||

| Showing Percentage of Net Assets | ||||

| U.S. Government and Government Agency Obligations 76.6% | ||||

| Principal | Value (Note 1) | |||

| Amount | ||||

| U.S. Government Agency Obligations 44.9% | ||||

| Fannie Mae: | ||||

| 2.625% 11/15/06 | $ 5,585,000 | $ 5,479,393 | ||

| 3.25% 1/15/08 | 1,710,000 | 1,660,160 | ||

| 3.875% 5/15/07 | 5,170,000 | 5,111,352 | ||

| 4.5% 10/15/08 | 8,587,000 | 8,534,087 | ||

| 4.625% 10/15/14 | 6,700,000 | 6,586,663 | ||

| 5.5% 3/15/11 | 5,095,000 | 5,252,593 | ||

| 6.25% 2/1/11 | 575,000 | 605,849 | ||

| 6.375% 6/15/09 | 14,370,000 | 15,150,780 | ||

| Federal Home Loan Bank: | ||||

| 3.75% 9/28/06 | 13,960,000 | 13,860,060 | ||

| 3.8% 12/22/06 | 2,970,000 | 2,943,178 | ||

| 5.8% 9/2/08 | 11,605,000 | 11,914,993 | ||

| Freddie Mac: | ||||

| 2.375% 4/15/06 | 79,750,000 | 79,192,464 | ||

| 2.75% 8/15/06 | 2,670,000 | 2,635,816 | ||

| 2.875% 12/15/06 | 18,490,000 | 18,155,017 | ||

| 4% 8/17/07 | 1,052,000 | 1,040,066 | ||

| 4.125% 4/2/07 | 4,501,000 | 4,468,498 | ||

| 4.25% 7/15/09 | 5,183,000 | 5,099,139 | ||

| 5.875% 3/21/11 | 475,000 | 493,848 | ||

| Government Loan Trusts (assets of Trust guaranteed by | ||||

| U.S. Government through Agency for International | ||||

| Development) Series 1-B, 8.5% 4/1/06 | 255,854 | 261,214 | ||

| Israeli State (guaranteed by U.S. Government through | ||||

| Agency for International Development) 6.8% 2/15/12 | 2,500,000 | 2,694,970 | ||

| Overseas Private Investment Corp. U.S. Government | ||||

| guaranteed participation certificates 6.77% 11/15/13 | 1,046,154 | 1,119,384 | ||

| TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | 192,259,524 | |||

| U.S. Treasury Inflation Protected Obligations 10.0% | ||||

| U.S. Treasury Inflation-Indexed Notes 0.875% 4/15/10 | 45,105,280 | 42,871,000 | ||

| U.S. Treasury Obligations – 21.7% | ||||

| U.S. Treasury Notes: | ||||

| 2.375% 8/31/06 | 9,143,000 | 9,007,638 | ||

| 3.375% 9/15/09 | 23,964,000 | 23,098,109 | ||

| 3.75% 5/15/08 | 23,614,000 | 23,253,343 | ||

| See accompanying notes which are an integral part of the financial statements. | ||||

| 9 | Annual Report | |||

| Investments continued | ||||||

| U.S. Government and Government Agency Obligations continued | ||||||

| Principal | Value (Note 1) | |||||

| Amount | ||||||

| U.S. Treasury Obligations continued | ||||||

| U.S. Treasury Notes: – continued | ||||||

| 4% 2/15/15 | $ | 4,000,000 | $ 3,839,532 | |||

| 4.75% 5/15/14 | 33,400,000 | 33,910,118 | ||||

| TOTAL U.S. TREASURY OBLIGATIONS | 93,108,740 | |||||

| TOTAL U.S. GOVERNMENT AND GOVERNMENT | ||||||

| AGENCY OBLIGATIONS | ||||||

| (Cost $332,836,717) | 328,239,264 | |||||

| U.S. Government Agency Mortgage Securities 8.9% | ||||||

| Fannie Mae – 6.7% | ||||||

| 3.477% 4/1/34 (b) | 153,191 | 152,653 | ||||

| 3.739% 1/1/35 (b) | 116,331 | 114,839 | ||||

| 3.752% 10/1/33 (b) | 70,810 | 69,224 | ||||

| 3.766% 12/1/34 (b) | 77,078 | 76,068 | ||||

| 3.788% 12/1/34 (b) | 17,868 | 17,663 | ||||

| 3.793% 6/1/34 (b) | 316,246 | 305,298 | ||||

| 3.819% 6/1/33 (b) | 57,083 | 56,105 | ||||

| 3.824% 1/1/35 (b) | 76,649 | 75,821 | ||||

| 3.847% 1/1/35 (b) | 206,330 | 204,082 | ||||

| 3.869% 1/1/35 (b) | 125,654 | 125,196 | ||||

| 3.877% 6/1/33 (b) | 307,044 | 302,491 | ||||

| 3.889% 12/1/34 (b) | 61,606 | 61,477 | ||||

| 3.907% 10/1/34 (b) | 89,655 | 88,711 | ||||

| 3.952% 5/1/34 (b) | 22,276 | 22,626 | ||||

| 3.955% 11/1/34 (b) | 149,579 | 148,434 | ||||

| 3.963% 1/1/35 (b) | 97,043 | 96,075 | ||||

| 3.968% 5/1/33 (b) | 29,919 | 29,510 | ||||

| 3.983% 12/1/34 (b) | 494,270 | 492,786 | ||||

| 3.984% 12/1/34 (b) | 102,275 | 101,572 | ||||

| 3.993% 1/1/35 (b) | 56,363 | 55,877 | ||||

| 3.996% 12/1/34 (b) | 77,699 | 77,146 | ||||

| 4% 8/1/18 | 1,076,504 | 1,022,929 | ||||

| 4.01% 2/1/35 (b) | 65,200 | 64,470 | ||||

| 4.021% 12/1/34 (b) | 37,767 | 37,450 | ||||

| 4.023% 1/1/35 (b) | 134,365 | 133,257 | ||||

| 4.028% 2/1/35 (b) | 60,823 | 60,106 | ||||

| 4.037% 1/1/35 (b) | 42,883 | 42,591 | ||||

| 4.044% 10/1/18 (b) | 66,248 | 65,040 | ||||

| 4.06% 1/1/35 (b) | 60,420 | 59,646 | ||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 10 |

| U.S. Government Agency Mortgage Securities continued | ||||||||

| Principal | Value (Note 1) | |||||||

| Amount | ||||||||

| Fannie Mae – continued | ||||||||

| 4.064% 4/1/33 (b) | $ | 26,316 | $ | 26,083 | ||||

| 4.064% 12/1/34 (b) | 127,663 | 126,844 | ||||||

| 4.087% 1/1/35 (b) | 133,943 | 132,737 | ||||||

| 4.094% 2/1/35 (b) | 41,855 | 41,436 | ||||||

| 4.098% 2/1/35 (b) | 122,150 | 120,904 | ||||||

| 4.103% 2/1/35 (b) | 42,980 | 42,664 | ||||||

| 4.109% 2/1/35 (b) | 258,101 | 255,863 | ||||||

| 4.111% 1/1/35 (b) | 136,046 | 134,518 | ||||||

| 4.124% 1/1/35 (b) | 244,171 | 241,687 | ||||||

| 4.126% 11/1/34 (b) | 105,405 | 104,655 | ||||||

| 4.129% 1/1/35 (b) | 134,221 | 134,113 | ||||||

| 4.129% 2/1/35 (b) | 158,064 | 157,892 | ||||||

| 4.144% 1/1/35 (b) | 195,390 | 194,711 | ||||||

| 4.159% 2/1/35 (b) | 124,354 | 123,291 | ||||||

| 4.168% 1/1/35 (b) | 116,679 | 115,652 | ||||||

| 4.174% 1/1/35 (b) | 258,035 | 255,981 | ||||||

| 4.182% 11/1/34 (b) | 30,005 | 29,804 | ||||||

| 4.187% 1/1/35 (b) | 154,730 | 152,126 | ||||||

| 4.204% 3/1/34 (b) | 68,380 | 67,431 | ||||||

| 4.214% 10/1/34 (b) | 188,614 | 187,788 | ||||||

| 4.25% 2/1/35 (b) | 67,384 | 66,148 | ||||||

| 4.282% 2/1/35 (b) | 38,653 | 38,265 | ||||||

| 4.287% 8/1/33 (b) | 152,632 | 151,578 | ||||||

| 4.293% 7/1/34 (b) | 62,749 | 62,992 | ||||||

| 4.297% 3/1/33 (b) | 77,497 | 76,870 | ||||||

| 4.298% 3/1/35 (b) | 64,449 | 64,215 | ||||||

| 4.305% 5/1/35 (b) | 105,092 | 103,889 | ||||||

| 4.307% 1/1/35 (b) | 63,033 | 62,068 | ||||||

| 4.313% 3/1/33 (b) | 44,859 | 44,103 | ||||||

| 4.318% 1/1/35 (b) | 78,577 | 78,582 | ||||||

| 4.325% 10/1/33 (b) | 30,860 | 30,484 | ||||||

| 4.328% 12/1/34 (b) | 42,606 | 42,500 | ||||||

| 4.348% 1/1/35 (b) | 67,402 | 66,331 | ||||||

| 4.351% 6/1/33 (b) | 33,758 | 33,337 | ||||||

| 4.356% 9/1/34 (b) | 584,269 | 580,212 | ||||||

| 4.365% 4/1/35 (b) | 41,685 | 41,174 | ||||||

| 4.367% 2/1/34 (b) | 181,596 | 179,304 | ||||||

| 4.403% 2/1/35 (b) | 110,339 | 108,622 | ||||||

| 4.41% 5/1/35 (b) | 213,605 | 212,983 | ||||||

| 4.419% 11/1/34 (b) | 1,123,580 | 1,123,109 | ||||||

| 4.428% 7/1/36 (b) | 465,399 | 467,409 | ||||||

| 4.444% 4/1/34 (b) | 109,452 | 108,847 | ||||||

See accompanying notes which are an integral part of the financial statements.

11 Annual Report

| Investments continued | ||||||

| U.S. Government Agency Mortgage Securities continued | ||||||

| Principal | Value (Note 1) | |||||

| Amount | ||||||

| Fannie Mae – continued | ||||||

| 4.445% 10/1/34 (b) | $ | 396,330 | $ 395,982 | |||

| 4.449% 3/1/35 (b) | 115,984 | 114,471 | ||||

| 4.48% 8/1/34 (b) | 231,632 | 229,216 | ||||

| 4.481% 1/1/35 (b) | 106,924 | 106,809 | ||||

| 4.501% 5/1/35 (b) | 84,891 | 83,776 | ||||

| 4.523% 8/1/34 (b) | 137,414 | 137,784 | ||||

| 4.545% 7/1/35 (b) | 250,572 | 248,870 | ||||

| 4.548% 2/1/35 (b) | 498,123 | 497,909 | ||||

| 4.56% 2/1/35 (b) | 74,379 | 73,601 | ||||

| 4.561% 1/1/35 (b) | 146,126 | 146,231 | ||||

| 4.564% 4/1/33 (b) | 823,703 | 820,293 | ||||

| 4.577% 9/1/34 (b) | 277,462 | 277,834 | ||||

| 4.589% 2/1/35 (b) | 49,904 | 50,030 | ||||

| 4.605% 8/1/34 (b) | 92,359 | 91,895 | ||||

| 4.646% 1/1/33 (b) | 49,414 | 49,193 | ||||

| 4.653% 3/1/35 (b) | 32,976 | 33,050 | ||||

| 4.658% 9/1/34 (b) | 18,795 | 18,680 | ||||

| 4.702% 3/1/35 (b) | 631,370 | 632,069 | ||||

| 4.708% 2/1/33 (b) | 12,658 | 12,647 | ||||

| 4.712% 10/1/32 (b) | 16,724 | 16,688 | ||||

| 4.725% 3/1/35 (b) | 127,966 | 126,838 | ||||

| 4.732% 10/1/32 (b) | 17,899 | 17,908 | ||||

| 4.732% 7/1/34 (b) | 223,792 | 224,633 | ||||

| 4.819% 12/1/32 (b) | 98,540 | 98,511 | ||||

| 4.834% 8/1/34 (b) | 72,560 | 72,179 | ||||

| 4.842% 12/1/34 (b) | 81,630 | 81,357 | ||||

| 4.857% 1/1/35 (b) | 18,249 | 18,363 | ||||

| 4.925% 12/1/32 (b) | 7,596 | 7,606 | ||||

| 4.986% 11/1/32 (b) | 49,076 | 49,475 | ||||

| 5.031% 2/1/35 (b) | 34,303 | 34,407 | ||||

| 5.042% 7/1/34 (b) | 42,201 | 42,349 | ||||

| 5.064% 11/1/34 (b) | 16,150 | 16,178 | ||||

| 5.112% 5/1/35 (b) | 506,894 | 508,855 | ||||

| 5.2% 6/1/35 (b) | 368,009 | 370,422 | ||||

| 5.229% 8/1/33 (b) | 98,590 | 98,750 | ||||

| 5.344% 7/1/35 (b) | 44,772 | 44,963 | ||||

| 5.5% 1/1/09 to 6/1/20 | 6,812,995 | 6,849,143 | ||||

| 6% 5/1/16 to 10/1/16 | 998,573 | 1,020,334 | ||||

| 6.5% 6/1/15 to 3/1/35 | 2,701,011 | 2,771,193 | ||||

| 7% 6/1/12 to 6/1/31 | 386,736 | 403,002 | ||||

| 7% 12/1/20 (a) | 230,244 | 237,151 | ||||

| 8% 8/1/09 | 19,274 | 19,669 | ||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 12 |

| U.S. Government Agency Mortgage Securities continued | ||||||

| Principal | Value (Note 1) | |||||

| Amount | ||||||

| Fannie Mae – continued | ||||||

| 9% 2/1/13 to 8/1/21 | $ | 239,976 | $ 257,508 | |||

| 9.5% 5/1/09 to 11/1/21 | 17,091 | 18,038 | ||||

| 10.5% 5/1/10 to 8/1/20 | 46,965 | 51,296 | ||||

| 11% 11/1/10 to 9/1/14 | 287,735 | 311,683 | ||||

| 11.5% 11/1/15 to 7/15/19 | 200,458 | 220,685 | ||||

| 12% 4/1/15 | 14,889 | 16,658 | ||||

| 12.5% 3/1/16 | 11,719 | 12,959 | ||||

| 28,587,486 | ||||||

| Freddie Mac – 1.9% | ||||||

| 4.056% 12/1/34 (b) | 73,329 | 72,440 | ||||

| 4.11% 12/1/34 (b) | 114,221 | 112,499 | ||||

| 4.187% 1/1/35 (b) | 371,181 | 366,024 | ||||

| 4.274% 3/1/35 (b) | 103,439 | 102,383 | ||||

| 4.299% 5/1/35 (b) | 170,241 | 168,643 | ||||

| 4.307% 12/1/34 (b) | 86,965 | 85,615 | ||||

| 4.387% 2/1/35 (b) | 227,664 | 225,730 | ||||

| 4.444% 3/1/35 (b) | 95,208 | 93,263 | ||||

| 4.448% 2/1/34 (b) | 116,133 | 114,566 | ||||

| 4.474% 6/1/35 (b) | 179,984 | 177,783 | ||||

| 4.489% 3/1/35 (b) | 115,585 | 113,387 | ||||

| 4.491% 3/1/35 (b) | 699,537 | 689,345 | ||||

| 4.559% 2/1/35 (b) | 174,948 | 172,825 | ||||

| 4.819% 10/1/32 (b) | 14,373 | 14,377 | ||||

| 4.889% 3/1/33 (b) | 34,496 | 34,403 | ||||

| 5% 7/1/35 to 9/1/35 | 910,762 | 876,138 | ||||

| 5.023% 4/1/35 (b) | 580,668 | 579,671 | ||||

| 5.085% 9/1/32 (b) | 267,563 | 268,499 | ||||

| 5.292% 8/1/33 (b) | 50,271 | 50,868 | ||||

| 5.5% 11/1/20 | 2,776,598 | 2,789,272 | ||||

| 5.676% 4/1/32 (b) | 22,713 | 22,930 | ||||

| 6.5% 5/1/08 | 35,304 | 35,947 | ||||

| 7.5% 11/1/12 | 180,190 | 187,215 | ||||

| 8% 9/1/07 to 12/1/09 | 78,024 | 79,329 | ||||

| 8.5% 7/1/06 to 6/1/14 | 101,968 | 104,511 | ||||

| 9% 12/1/07 to 12/1/18 | 81,502 | 86,379 | ||||

| 9.5% 2/1/17 to 12/1/22 | 330,352 | 358,283 | ||||

| 10% 1/1/09 to 6/1/20 | 89,567 | 96,613 | ||||

| 10.5% 9/1/20 to 5/1/21 | 24,743 | 26,373 | ||||

| 11% 12/1/11 | 1,966 | 2,117 | ||||

| 11.5% 10/1/15 | 5,081 | 5,564 | ||||

| 12% 9/1/11 to 11/1/19 | 23,197 | 25,437 | ||||

See accompanying notes which are an integral part of the financial statements.

13 Annual Report

| Investments continued | ||||||||

| U.S. Government Agency Mortgage Securities continued | ||||||||

| Principal | Value (Note 1) | |||||||

| Amount | ||||||||

| Freddie Mac – continued | ||||||||

| 12.25% 11/1/14 | $ | 25,015 | $ | 27,511 | ||||

| 12.5% 8/1/10 to 6/1/19 | 229,015 | 252,200 | ||||||

| 8,418,140 | ||||||||

| Government National Mortgage Association – 0.3% | ||||||||

| 8% 11/15/09 to 12/15/23 | 966,642 | 1,017,007 | ||||||

| 8.5% 5/15/16 to 3/15/17 | 50,332 | 54,390 | ||||||

| 10.5% 1/15/16 to 1/15/18 | 166,427 | 185,318 | ||||||

| 11% 10/20/13 | 3,293 | 3,559 | ||||||

| 12.5% 11/15/14 | 60,952 | 67,866 | ||||||

| 13.5% 7/15/11 | 10,244 | 11,477 | ||||||

| 1,339,617 | ||||||||

| TOTAL U.S. GOVERNMENT AGENCY MORTGAGE SECURITIES | ||||||||

| (Cost $38,553,324) | 38,345,243 | |||||||

| Asset Backed Securities 0.8% | ||||||||

| Fannie Mae Grantor Trust Series 2005-T4 Class A1C, | ||||||||

| 4.3413% 9/25/35 (b) | ||||||||

| (Cost $3,350,000) | 3,350,000 | 3,349,734 | ||||||

| Collateralized Mortgage Obligations 11.0% | ||||||||

| U.S. Government Agency 11.0% | ||||||||

| Fannie Mae: | ||||||||

| floater: | ||||||||

| Series 1994-42 Class FK, 3.73% 4/25/24 (b) | 2,176,326 | 2,107,325 | ||||||

| Series 2003-25 Class CF, 4.5413% 3/25/17 (b) | 1,519,162 | 1,524,529 | ||||||

| planned amortization class Series 2003-39 Class PV, | ||||||||

| 5.5% 9/25/22 | 1,010,000 | 1,010,434 | ||||||

| sequential pay: | ||||||||

| Series 1993-238 Class C, 6.5% 12/25/08 | 3,001,178 | 3,032,316 | ||||||

| Series 1999-25 Class Z, 6% 6/25/29 | 3,824,968 | 3,887,551 | ||||||

| Fannie Mae guaranteed REMIC pass thru certificates: | ||||||||

| floater: | ||||||||

| Series 2001-38 Class QF, 5.1713% 8/25/31 (b) | 596,811 | 611,229 | ||||||

| Series 2002-49 Class FB, 4.74% 11/18/31 (b) | 841,365 | 847,303 | ||||||

| Series 2002-60 Class FV, 5.1913% 4/25/32 (b) | 178,787 | 184,495 | ||||||

| Series 2002-68 Class FH, 4.64% 10/18/32 (b) | 704,126 | 713,829 | ||||||

| Series 2002-74 Class FV, 4.6413% 11/25/32 (b) | 2,121,847 | 2,138,894 | ||||||

| Series 2002-75 Class FA, 5.1913% 11/25/32 (b) | . | 366,244 | 378,304 | |||||

| Series 2003-122 Class FL, 4.5413% 7/25/29 (b) | 311,858 | 311,658 | ||||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 14 |

| Collateralized Mortgage Obligations continued | ||||||

| Principal | Value (Note 1) | |||||

| Amount | ||||||

| U.S. Government Agency continued | ||||||

| Fannie Mae guaranteed REMIC pass thru certificates: - | ||||||

| continued | ||||||

| floater: | ||||||

| Series 2003-131 Class FM, 4.5913% 12/25/29 (b) | $ | 215,591 | $ 216,457 | |||

| Series 2003-15 Class WF, 4.5413% 8/25/17 (b) | 367,810 | 369,338 | ||||

| Series 2004-31 Class F, 4.4913% 6/25/30 (b) | 541,738 | 542,355 | ||||

| Series 2004-33 Class FW, 4.5913% 8/25/25 (b) | 526,748 | 529,438 | ||||

| planned amortization class: | ||||||

| Series 2002-11 Class QB, 5.5% 3/25/15 | 323,160 | 323,992 | ||||

| Series 2002-16 Class PG, 6% 4/25/17 | 670,000 | 689,854 | ||||

| Series 2002-8 Class PD, 6.5% 7/25/30 | 135,842 | 136,012 | ||||

| Series 2003-91 Class HA, 4.5% 11/25/16 | 1,000,000 | 984,620 | ||||

| sequential pay Series 2005-4 Class ED, 5% 6/25/27 . | 3,433,333 | 3,414,572 | ||||

| Series 2002-50 Class LE, 7% 12/25/29 | 86,518 | 87,507 | ||||

| Series 2005-69 Class ZL, 4.5% 8/25/25 | 833,748 | 830,026 | ||||

| Freddie Mac floater Series 3028 Class FM, 4.365% | ||||||

| 9/15/35 (b) | 1,512,026 | 1,491,591 | ||||

| Freddie Mac Multi class participation certificates guaranteed: | ||||||

| floater: | ||||||

| Series 2406: | ||||||

| Class FP, 5.1% 1/15/32 (b) | 706,841 | 724,048 | ||||

| Class PF, 5.1% 12/15/31 (b) | 585,000 | 602,086 | ||||

| Series 2410 Class PF, 5.1% 2/15/32 (b) | 1,340,000 | 1,378,405 | ||||

| Series 2526 Class FC, 4.52% 11/15/32 (b) | 655,145 | 657,789 | ||||

| Series 2530 Class FE, 4.72% 2/15/32 (b) | 471,309 | 478,358 | ||||

| Series 2553 Class FB, 4.62% 3/15/29 (b) | 1,440,000 | 1,444,099 | ||||

| Series 2577 Class FW, 4.62% 1/15/30 (b) | 1,116,706 | 1,123,464 | ||||

| Series 2625 Class FJ, 4.42% 7/15/17 (b) | 891,161 | 892,428 | ||||

| Series 2770 Class FP, 4.565% 12/15/25 (b) | 525,747 | 526,822 | ||||

| Series 2861: | ||||||

| Class GF, 4.42% 1/15/21 (b) | 293,691 | 294,041 | ||||

| Class JF, 4.42% 4/15/17 (b) | 475,789 | 477,346 | ||||

| Series 2994 Class FB, 4.27% 6/15/20 (b) | 455,429 | 454,050 | ||||

| planned amortization class: | ||||||

| Series 1543 Class VK, 6.7% 1/15/23 | 651,758 | 656,200 | ||||

| Series 2461 Class PG, 6.5% 1/15/31 | 120,246 | 120,424 | ||||

| Series 2640 Class GR, 3% 3/15/10 | 646,162 | 642,300 | ||||

| sequential pay: | ||||||

| Series 1929 Class EZ, 7.5% 2/17/27 | 1,801,130 | 1,899,649 | ||||

| Series 2617 Class GW, 3.5% 6/15/16 | 1,273,337 | 1,240,682 | ||||

| Series 2630 Class MB, 4.5% 6/15/18 | 3,475,000 | 3,281,326 | ||||

| Series 2866 Class N, 4.5% 12/15/18 | 680,000 | 668,738 | ||||

See accompanying notes which are an integral part of the financial statements.

15 Annual Report

| Investments continued | ||||

| Collateralized Mortgage Obligations continued | ||||

| Principal | Value (Note 1) | |||

| Amount | ||||

| U.S. Government Agency continued | ||||

| Freddie Mac Multi-class participation certificates | ||||

| guaranteed: – continued | ||||

| sequential pay: | ||||

| Series 3013 Class VJ, 5% 1/15/14 | $ 1,278,477 | $ 1,271,766 | ||

| Series 2931 Class ZK, 4.5% 2/15/20 | 309,788 | 309,408 | ||

| Series 3018 Class ZA, 5.5% 8/15/35 | 344,016 | 343,579 | ||

| Ginnie Mae guaranteed REMIC pass thru securities | ||||

| planned amortization class: | ||||

| Series 2001-53 Class TA, 6% 12/20/30 | 18,352 | 18,314 | ||

| Series 2005-58 Class NJ, 4.5% 8/20/35 | 1,465,000 | 1,433,001 | ||

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | ||||

| (Cost $47,754,218) | 47,301,952 | |||

| Commercial Mortgage Securities 0.2% | ||||

| Freddie Mac Multi-class participation certificates | ||||

| guaranteed floater Series 2448 Class FT, 5.12% | ||||

| 3/15/32 (b) | ||||

| (Cost $915,053) | 897,720 | 922,152 | ||

| Cash Equivalents 2.5% | ||||

| Maturity | ||||

| Amount | ||||

| Investments in repurchase agreements (Collateralized by U.S. | ||||

| Government Obligations, in a joint trading account at | ||||

| 4.04%, dated 11/30/05 due 12/1/05) | ||||

| (Cost $10,679,000) | $10,680,198 | 10,679,000 | ||

| TOTAL INVESTMENT PORTFOLIO 100.0% | ||||

| (Cost $434,088,312) | 428,837,345 | |||

| NET OTHER ASSETS – 0.0% | (151,153) | |||

| NET ASSETS 100% | $ 428,686,192 | |||

| Legend (a) Security or a portion of the security purchased on a delayed delivery or when-issued basis. (b) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

Income Tax Information

At November 30, 2005, the fund had a capital loss carryforward of approximately $16,269,036 of which $5,799,739, $4,168,919, $1,483,869 and $4,816,509 will expire on November 30, 2007, 2008, 2012 and 2013, respectively.

See accompanying notes which are an integral part of the financial statements.

Annual Report 16

| Financial Statements | ||||||||

| Statement of Assets and Liabilities | ||||||||

| November 30, 2005 | ||||||||

| Assets | ||||||||

| Investment in securities, at value (including repurchase | ||||||||

| agreements of $10,679,000) See accompanying | ||||||||

| schedule: | ||||||||

| Unaffiliated issuers (cost $434,088,312) | $ | 428,837,345 | ||||||

| Cash | 769 | |||||||

| Receivable for investments sold | 107,291 | |||||||

| Receivable for fund shares sold | 422,395 | |||||||

| Interest receivable | 2,385,280 | |||||||

| Total assets | 431,753,080 | |||||||

| Liabilities | ||||||||

| Payable for investments purchased | ||||||||

| Regular delivery | $ | 1,957,987 | ||||||

| Delayed delivery | 240,009 | |||||||

| Payable for fund shares redeemed | 652,021 | |||||||

| Distributions payable | 53,642 | |||||||

| Accrued management fee | 162,106 | |||||||

| Other affiliated payables | 1,123 | |||||||

| Total liabilities | 3,066,888 | |||||||

| Net Assets | $ | 428,686,192 | ||||||

| Net Assets consist of: | ||||||||

| Paid in capital | $ | 448,599,113 | ||||||

| Undistributed net investment income | 1,636,305 | |||||||

| Accumulated undistributed net realized gain (loss) on | ||||||||

| investments | (16,298,259) | |||||||

| Net unrealized appreciation (depreciation) on | ||||||||

| investments | (5,250,967) | |||||||

| Net Assets, for 45,032,806 shares outstanding | $ | 428,686,192 | ||||||

| Net Asset Value, offering price and redemption price per | ||||||||

| share ($428,686,192 ÷ 45,032,806 shares) | $ | 9.52 | ||||||

See accompanying notes which are an integral part of the financial statements.

17 Annual Report

| Financial Statements continued | ||||||

| Statement of Operations | ||||||

| Year ended November 30, 2005 | ||||||

| Investment Income | ||||||

| Interest | $ | 16,358,059 | ||||

| Expenses | ||||||

| Management fee | $ | 2,100,865 | ||||

| Independent trustees’ compensation | 2,185 | |||||

| Miscellaneous | 931 | |||||

| Total expenses before reductions | 2,103,981 | |||||

| Expense reductions | (24,470) | 2,079,511 | ||||

| Net investment income | 14,278,548 | |||||

| Realized and Unrealized Gain (Loss) | ||||||

| Net realized gain (loss) on: | ||||||

| Investment securities: | ||||||

| Unaffiliated issuers | (4,694,556) | |||||

| Swap agreements | (116,916) | |||||

| Total net realized gain (loss) | (4,811,472) | |||||

| Change in net unrealized appreciation (depreciation) on: | ||||||

| Investment securities | (3,371,529) | |||||

| Swap agreements | 73,963 | |||||

| Total change in net unrealized appreciation | ||||||

| (depreciation) | (3,297,566) | |||||

| Net gain (loss) | (8,109,038) | |||||

| Net increase (decrease) in net assets resulting from | ||||||

| operations | $ | 6,169,510 | ||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 18 |

| Statement of Changes in Net Assets | ||||||||

| Year ended | Year ended | |||||||

| November 30, | November 30, | |||||||

| 2005 | 2004 | |||||||

| Increase (Decrease) in Net Assets | ||||||||

| Operations | ||||||||

| Net investment income | $ | 14,278,548 | $ | 11,804,720 | ||||

| Net realized gain (loss) | (4,811,472) | (794,916) | ||||||

| Change in net unrealized appreciation (depreciation) . | (3,297,566) | (2,312,320) | ||||||

| Net increase (decrease) in net assets resulting from | ||||||||

| operations | 6,169,510 | 8,697,484 | ||||||

| Distributions to shareholders from net investment income . | (12,781,978) | (11,835,110) | ||||||

| Share transactions | ||||||||

| Proceeds from sales of shares | 89,442,606 | 153,915,985 | ||||||

| Reinvestment of distributions | 12,059,991 | 11,219,970 | ||||||

| Cost of shares redeemed | (151,985,452) | (203,279,531) | ||||||

| Net increase (decrease) in net assets resulting from | ||||||||

| share transactions | (50,482,855) | (38,143,576) | ||||||

| Total increase (decrease) in net assets | (57,095,323) | (41,281,202) | ||||||

| Net Assets | ||||||||

| Beginning of period | 485,781,515 | 527,062,717 | ||||||

| End of period (including undistributed net investment | ||||||||

| income of $1,636,305 and undistributed net invest- | ||||||||

| ment income of $278,410, respectively) | $ | 428,686,192 | $ | 485,781,515 | ||||

| Other Information | ||||||||

| Shares | ||||||||

| Sold | 9,316,942 | 15,811,309 | ||||||

| Issued in reinvestment of distributions | 1,257,918 | 1,153,927 | ||||||

| Redeemed | (15,856,373) | (20,915,238) | ||||||

| Net increase (decrease) | (5,281,513) | (3,950,002) | ||||||

See accompanying notes which are an integral part of the financial statements.

19 Annual Report

| Financial Highlights | ||||||||||||||||||||

| Years ended November 30, | 2005 | 2004 | 2003 | 2002 | 2001 | |||||||||||||||

| Selected Per Share Data | ||||||||||||||||||||

| Net asset value, beginning of period | $ | 9.65 | $ | 9.71 | $ | 9.71 | $ | 9.51 | $ | 9.19 | ||||||||||

| Income from Investment Operations | ||||||||||||||||||||

| Net investment incomeB | 293 | .225 | .236 | .376D | .562 | |||||||||||||||

| Net realized and unrealized gain | ||||||||||||||||||||

| (loss) | (.160) | (.060) | .004 | .206D | .329 | |||||||||||||||

| Total from investment operations | 133 | .165 | .240 | .582 | .891 | |||||||||||||||

| Distributions from net investment | ||||||||||||||||||||

| income | (.263) | (.225) | (.240) | (.382) | (.571) | |||||||||||||||

| Net asset value, end of period | $ | 9.52 | $ | 9.65 | $ | 9.71 | $ | 9.71 | $ | 9.51 | ||||||||||

| Total ReturnA | 1.39% | 1.71% | 2.48% | 6.25% | 9.96% | |||||||||||||||

| Ratios to Average Net AssetsC | ||||||||||||||||||||

| Expenses before reductions | 45% | .45% | .45% | .45% | .45% | |||||||||||||||

| Expenses net of fee waivers, if any | .45% | .45% | .45% | .45% | .45% | |||||||||||||||

| Expenses net of all reductions | 44% | .45% | .44% | .45% | .44% | |||||||||||||||

| Net investment income | 3.05% | 2.31% | 2.42% | 3.92%D | 5.98% | |||||||||||||||

| Supplemental Data | ||||||||||||||||||||

| Net assets, end of period | ||||||||||||||||||||

| (000 omitted) | $ | 428,686 | $ | 485,782 | $ | 527,063 | $ | 501,942 | $ | 406,591 | ||||||||||

| Portfolio turnover rate | 96% | 165% | 289% | 219% | 173% |

| A Total returns would have been lower had certain expenses not been reduced during the periods shown. B Calculated based on average shares outstanding during the period. C Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund. D Effective December 1, 2001, the fund adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies and began amortizing premium and discount on all debt securities. Per share data and ratios for periods prior to adoption have not been restated to reflect this change. |

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 20 |

Notes to Financial Statements

For the period ended November 30, 2005

1. Significant Accounting Policies.

Fidelity Institutional Short Intermediate Government Fund (the fund) is a fund of Fidelity Advisor Series IV (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open end management investment company organized as a Massa chusetts business trust. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Investments are valued and net asset value per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Wherever possible, the fund uses independent pricing services approved by the Board of Trustees to value its investments. Debt securities, including restricted securities, for which quotes are readily available, are valued by independent pricing services or by dealers who make markets in such securities. Pricing services consider yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices. When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accor dance with procedures adopted by the Board of Trustees. The frequency of when fair value pricing is used is unpredictable. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities. Invest ments in open end mutual funds are valued at their closing net asset value each business day. Short term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements.

21 Annual Report

Notes to Financial Statements continued

| 1. Significant Accounting Policies continued Income Tax Information and Distributions to Shareholders continued |

Dividends are declared daily and paid monthly from net investment income. Distribu tions from realized gains, if any, are recorded on the ex dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book tax differences will reverse in a subsequent period.

Book tax differences are primarily due to swap agreements, prior period premium and discount on debt securities, market discount, deferred trustees compensation, financing transactions, and capital loss carryforwards.

The tax basis components of distributable earnings and the federal tax cost as of period end were as follows:

| Unrealized appreciation | $ | 557,137 | ||

| Unrealized depreciation | (5,334,876) | |||

| Net unrealized appreciation (depreciation) | (4,777,739) | |||

| Undistributed ordinary income | 1,134,976 | |||

| Capital loss carryforward | 16,269,036 | |||

| Cost for federal income tax purposes | $ | 433,615,084 | ||

The tax character of distributions paid was as follows:

| November 30, 2005 | November 30, 2004 | |||||||

| Ordinary Income | $ | 12,781,978 | $ | 11,835,110 |

2. Operating Policies.

Repurchase Agreements. Fidelity Management & Research Company (FMR) has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The fund may also invest directly with institutions in repurchase agreements. Repur chase agreements are collateralized by government or non government securities. Collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Annual Report 22

2. Operating Policies continued

Delayed Delivery Transactions and When Issued Securities. The fund may purchase or sell securities on a delayed delivery or when issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. During the time a delayed delivery sell is outstanding, the contract is marked to market daily and equivalent deliverable securities are held for the transaction. The value of the securities purchased on a delayed delivery or when issued basis are identified as such in the fund’s Schedule of Investments. The fund may receive compensation for interest forgone in the purchase of a delayed delivery or when issued security. With respect to purchase commitments, the fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the value of the underly ing securities or if the counterparty does not perform under the contract’s terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Swap Agreements. The fund may invest in swaps for the purpose of managing its exposure to interest rate, credit or market risk.

Interest rate swaps are agreements to exchange cash flows periodically based on a notional principal amount, for example, the exchange of fixed rate interest payments for floating rate interest payments. Periodic payments received or made by the fund are recorded in the accompanying Statement of Operations as realized gains or losses, respectively. The primary risk associated with interest rate swaps is that unfavorable changes in the fluctuation of interest rates could adversely impact a fund.

Swaps are marked to market daily based on dealer supplied valuations and changes in value are recorded as unrealized appreciation (depreciation). Gains or losses are realized upon early termination of the swap agreement. Collateral, in the form of cash or securities, may be required to be held in segregated accounts with a fund’s custodian in compliance with swap contracts.

Mortgage Dollar Rolls. To earn additional income, the fund may employ trading strategies which involve the sale and simultaneous agreement to repurchase similar securities (“mortgage dollar rolls”) or the purchase and simultaneous agreement to sell similar securities (“reverse mortgage dollar rolls”). The securities traded are mortgage securities and bear the same interest rate but may be collateralized by different pools of mortgages. During the period between the sale and repurchase in a mortgage dollar roll transaction, a fund will not be entitled to receive interest and principal payments on the securities sold but will invest the proceeds of the sale in other securities which may enhance the yield and total return. In addition, the difference between the sale price and the future purchase price is recorded as an adjustment to investment income. During the period between the purchase and subsequent sale in a reverse mortgage dollar roll

23 Annual Report

| Notes to Financial Statements continued 2. Operating Policies continued Mortgage Dollar Rolls continued |

transaction a fund is entitled to interest and principal payments on the securities purchased. The price differential between the purchase and sale is recorded as an adjustment to investment income. Losses may arise due to changes in the value of the securities or if the counterparty does not perform under the terms of the agreement. If the counterparty files for bankruptcy or becomes insolvent, a fund’s right to repurchase or sell securities may be limited.

3. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the fund with investment manage ment related services for which the fund pays a monthly management fee that is based on an annual rate of .45% of the fund’s average net assets. FMR pays all other expenses, except the compensation of the independent Trustees and certain exceptions such as interest expense. The management fee paid to FMR by the fund is reduced by an amount equal to the fees and expenses paid by the fund to the independent Trustees.

| 4. Committed Line of Credit. |

The fund participates with other funds managed by FMR in a $4.2 billion credit facility (the “line of credit”) to be utilized for temporary or emergency purposes to fund share holder redemptions or for other short term liquidity purposes. The fund has agreed to pay commitment fees on its pro rata portion of the line of credit, which is included in Miscellaneous Expense on the Statement of Operations. During the period, there were no borrowings on this line of credit.

| 5. Security Lending. |

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insol vency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Cash collateral is invested in cash equivalents. At period end there were no security loans outstanding. Security lending income represents the income earned on investing cash collateral, less fees and ex penses associated with the loan, plus any premium payments that may be received on the loan of certain types of securities. Net income from lending portfolio securities during the period amounted to $7,171.

| Annual Report |

| 24 |

| 6. Expense Reductions. |

Through arrangements with the fund’s custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce the fund’s management fee. During the period, these credits reduced the fund’s management fee by $24,470.

| 7. Other. |

The fund’s organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the perfor mance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund’s maximum expo sure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

25 Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Advisor Series IV and the Shareholders of Fidelity Institutional Short Intermediate Government Fund:

In our opinion, the accompanying statement of assets and liabilities, including the sched ule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Institutional Short Intermediate Government Fund (a fund of Fidelity Advisor Series IV) at November 30, 2005 and the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsi bility of the Fidelity Institutional Short Intermediate Government Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant esti mates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at November 30, 2005 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

| /s/ PricewaterhouseCoopers LLP PricewaterhouseCoopers LLP Boston, Massachusetts January 13, 2006 |

| Annual Report |

| 26 |

Trustees and Officers

The Trustees, Member of the Advisory Board, and executive officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund’s activities, review contractual arrangements with companies that provide services to the fund, and review the fund’s performance. Except for William O. McCoy and Albert R. Gamper, Jr., each of the Trustees oversees 326 funds advised by FMR or an affiliate. Mr. McCoy oversees 328 funds advised by FMR or an affiliate. Mr. Gamper oversees 235 funds advised by FMR or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instru ment signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 72nd birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. The executive officers and Advisory Board Member hold office without limit in time, except that any officer and Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund’s Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-8544.

| Interested Trustees*: |

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

| Name, Age; Principal Occupation Edward C. Johnson 3d (75) |

Year of Election or Appointment: 1983

Mr. Johnson is Chairman of the Board of Trustees. Mr. Johnson serves as Chief Executive Officer, Chairman, and a Director of FMR Corp.; a Director and Chairman of the Board and of the Executive Committee of FMR; Chairman and a Director of Fidelity Management & Research (Far East) Inc.; Chairman and a Director of Fidelity Investments Money Man agement, Inc.; and Chairman (2001 present) and a Director (2000 present) of FMR Co., Inc.

27 Annual Report

Trustees and Officers - continued

| Name, Age; Principal Occupation Stephen P. Jonas (52) |

Year of Election or Appointment: 2005

Mr. Jonas is Senior Vice President of Institutional Short Intermediate Government. He also serves as Senior Vice President of other Fidelity funds (2005 present). Mr. Jonas is Executive Director of FMR (2005 present). Previously, Mr. Jonas served as President of Fidelity Enterprise Operations and Risk Services (2004 2005), Chief Administrative Officer (2002 2004), and Chief Financial Officer of FMR Co. (1998 2000). Mr. Jonas has been with Fidelity Investments since 1987 and has held various financial and management positions includ ing Chief Financial Officer of FMR. In addition, he serves on the Boards of Boston Ballet (2003 present) and Simmons College (2003 present).

| Robert L. Reynolds (53) |

Year of Election or Appointment: 2003

Mr. Reynolds is a Director (2003 present) and Chief Operating Officer (2002 present) of FMR Corp. He also serves on the Board at Fidelity Investments Canada, Ltd. (2000 present). Previously, Mr. Reynolds served as President of Fidelity Investments Institutional Retirement Group (1996 2000).

* Trustees have been determined to be “Interested Trustees” by virtue of, among other things, their affiliation with the trust or various entities under common control with FMR.

| Annual Report |

| 28 |

| Independent Trustees: |

Correspondence intended for each Independent Trustee (that is, the Trustees other than the Interested Trustees) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205 5235.

| Name, Age; Principal Occupation Dennis J. Dirks (57) |

Year of Election or Appointment: 2005

Prior to his retirement in May 2003, Mr. Dirks was Chief Operating Officer and a member of the Board of The Depository Trust & Clearing Corporation (DTCC) (1999 2003). He also served as President, Chief Operating Officer, and Board member of The Depository Trust Company (DTC) (1999 2003) and President and Board member of the National Securities Clearing Corporation (NSCC) (1999 2003). In addi tion, Mr. Dirks served as Chief Executive Officer and Board member of the Government Securities Clearing Corporation (2001 2003) and Chief Executive Officer and Board member of the Mortgage Backed Securities Clearing Corporation (2001 2003). Mr. Dirks also serves as a Trustee of Manhattan College (2005 present).

| Albert R. Gamper, Jr. (63) |

Year of Election or Appointment: 2006

Mr. Gamper also serves as a Trustee (2006 present) or Member of the Advisory Board (2005 present) of other investment companies advised by FMR. Prior to his retirement in December 2004, Mr. Gamper served as Chairman of the Board of CIT Group Inc. (commercial finance). Dur ing his tenure with CIT Group Inc. Mr. Gamper served in numerous senior management positions, including Chairman (1987 1989; 1999 2001; 2002 2004), Chief Executive Officer (1987 2004), and President (1989 2002). He currently serves as a member of the Board of Directors of Public Service Enterprise Group (utilities, 2001 present), Chairman of the Board of Governors, Rutgers University (2004 present), and Chairman of the Board of Saint Barnabas Health Care System.

29 Annual Report

Trustees and Officers - continued

| Name, Age; Principal Occupation Robert M. Gates (62) |

Year of Election or Appointment: 1997

Dr. Gates is Chairman of the Independent Trustees (2006 present). Dr. Gates is President of Texas A&M University (2002 present). He was Director of the Central Intelligence Agency (CIA) from 1991 to 1993. From 1989 to 1991, Dr. Gates served as Assistant to the President of the United States and Deputy National Security Advisor. Dr. Gates is a Director of NACCO Industries, Inc. (mining and manufacturing), Parker Drilling Co., Inc. (drilling and rental tools for the energy industry, 2001 present), and Brinker International (restaurant management, 2003 present). Previously, Dr. Gates served as a Director of LucasVarity PLC (automotive components and diesel engines), a Director of TRW Inc. (automotive, space, defense, and information technology), and Dean of the George Bush School of Government and Public Service at Texas A&M University (1999 2001). Dr. Gates also is a Trustee of the Forum for International Policy.

| George H. Heilmeier (69) |

Year of Election or Appointment: 2004

Dr. Heilmeier is Chairman Emeritus of Telcordia Technologies (commu nication software and systems), where prior to his retirement, he served as company Chairman and Chief Executive Officer. He currently serves on the Boards of Directors of The Mitre Corporation (systems engineer ing and information technology support for the government), and HRL Laboratories (private research and development, 2004 present). He is Chairman of the General Motors Science & Technology Advisory Board and a Life Fellow of the Institute of Electrical and Electronics Engineers (IEEE) (2000 present). Dr. Heilmeier is a member of the Defense Science Board and the National Security Agency Advisory Board. He is also a member of the National Academy of Engineering, the American Acad emy of Arts and Sciences, and the Board of Overseers of the School of Engineering and Applied Science of the University of Pennsylvania. Pre viously, Dr. Heilmeier served as a Director of TRW Inc. (automotive, space, defense, and information technology, 1992 2002), Compaq (1994 2002), Automatic Data Processing, Inc. (ADP) (technology based business outsourcing, 1995 2002), INET Technologies Inc. (telecommu nications network surveillance, 2001 2004), and Teletech Holdings (cus tomer management services). He is the recipient of the 2005 Kyoto Prize in Advanced Technology for his invention of the liquid display.

| Annual Report |

| 30 |

| Name, Age; Principal Occupation Marie L. Knowles (59) |

Year of Election or Appointment: 2001

Prior to Ms. Knowles’ retirement in June 2000, she served as Executive Vice President and Chief Financial Officer of Atlantic Richfield Company (ARCO) (diversified energy, 1996 2000). From 1993 to 1996, she was a Senior Vice President of ARCO and President of ARCO Transportation Company. She served as a Director of ARCO from 1996 to 1998. She currently serves as a Director of Phelps Dodge Corporation (copper mining and manufacturing) and McKesson Corporation (healthcare ser vice, 2002 present). Ms. Knowles is a Trustee of the Brookings Institution and the Catalina Island Conservancy and also serves as a member of the Advisory Board for the School of Engineering of the University of Southern California.

| Ned C. Lautenbach (61) |

Year of Election or Appointment: 2000

Mr. Lautenbach has been a partner of Clayton, Dubilier & Rice, Inc. (private equity investment firm) since September 1998. Previously, Mr. Lautenbach was with the International Business Machines Corpora tion (IBM) from 1968 until his retirement in 1998. Mr. Lautenbach serves as a Director of Italtel Holding S.p.A. (telecommunications (Milan, Italy), 2004 present) and Eaton Corporation (diversified industrial) as well as the Philharmonic Center for the Arts in Naples, Florida. He also is a member of the Board of Trustees of Fairfield University (2005 present), as well as a member of the Council on Foreign Relations.

| William O. McCoy (72) |

Year of Election or Appointment: 1997

Prior to his retirement in December 1994, Mr. McCoy was Vice Chair man of the Board of BellSouth Corporation (telecommunications) and President of BellSouth Enterprises. He is currently a Director of Liberty Corporation (holding company), Duke Realty Corporation (real estate), and Progress Energy, Inc. (electric utility). He is also a partner of Frank lin Street Partners (private investment management firm) and a member of the Research Triangle Foundation Board. In addition, Mr. McCoy served as the Interim Chancellor (1999 2000) and a member of the Board of Visitors for the University of North Carolina at Chapel Hill and currently serves on the Board of Directors of the University of North Carolina Health Care System and the Board of Visitors of the Kenan Flagler Business School (University of North Carolina at Chapel Hill). He also served as Vice President of Finance for the University of North Car olina (16 school system).

31 Annual Report

Trustees and Officers - continued

| Name, Age; Principal Occupation Cornelia M. Small (61) |

Year of Election or Appointment: 2005

Ms. Small is a member (2000 present) and Chairperson (2002 present) of the Investment Committee, and a member (2002 present) of the Board of Trustees of Smith College. Previously, she served as Chief In vestment Officer (1999 2000), Director of Global Equity Investments (1996 1999), and a member of the Board of Directors of Scudder, Ste vens & Clark (1990 1997) and Scudder Kemper Investments (1997 1998). In addition, Ms. Small served as Co Chair (2000 2003) of the Annual Fund for the Fletcher School of Law and Diplomacy.

| William S. Stavropoulos (66) |

Year of Election or Appointment: 2002

Mr. Stavropoulos is Chairman of the Board (2000 present) and a Mem ber of the Board of Directors of The Dow Chemical Company. Since joining The Dow Chemical Company in 1967, Mr. Stavropoulos served in numerous senior management positions, including President (1993 2000; 2002 2003), CEO (1995 2000; 2002 2004), and Chair man of the Executive Committee (2000 2004). Currently, he is a Direc tor of NCR Corporation (data warehousing and technology solutions), BellSouth Corporation (telecommunications), Chemical Financial Corpo ration, Maersk Inc. (industrial conglomerate, 2002 present), and Metal mark Capital (private equity investment firm, 2005 present). He also serves as a member of the Board of Trustees of the American Enterprise Institute for Public Policy Research. In addition, Mr. Stavropoulos is a member of The Business Council, J.P. Morgan International Council and the University of Notre Dame Advisory Council for the College of Science.

| Kenneth L. Wolfe (66) |

Year of Election or Appointment: 2005

Prior to his retirement in 2001, Mr. Wolfe was Chairman and Chief Executive Officer of Hershey Foods Corporation (1993 2001). He cur rently serves as a member of the boards of Adelphia Communications Corporation (2003 present), Bausch & Lomb, Inc., and Revlon Inc. (2004 present).

| Annual Report |

| 32 |

Advisory Board Member and Executive Officers:

Correspondence intended for each executive officer and Mr. Lynch may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

| Name, Age; Principal Occupation Peter S. Lynch (61) |

Year of Election or Appointment: 2003

Member of the Advisory Board of Fidelity Advisor Series IV. Vice Chair man and a Director of FMR, and Vice Chairman (2001 present) and a Director (2000 present) of FMR Co., Inc. Previously, Mr. Lynch served as a Trustee of the Fidelity funds (1990 2003). In addition, he serves as a Trustee of Boston College, Massachusetts Eye & Ear Infirmary, Historic Deerfield, John F. Kennedy Library, and the Museum of Fine Arts of Boston.

| Walter C. Donovan (43) |

Year of Election or Appointment: 2005

Vice President of Institutional Short Intermediate Government. Mr. Donovan also serves as Vice President of Fidelity’s High Income Funds (2005 present), Fidelity’s Fixed Income Funds (2005 present), certain Asset Allocation Funds (2005 present), and certain Balanced Funds (2005 present). Mr. Donovan also serves as Executive Vice Presi dent of FMR (2005 present) and FMRC (2005 present). Previously, Mr. Donovan served as Vice President and Director of Fidelity’s Interna tional Equity Trading group (1998 2005).

| David L. Murphy (57) |

Year of Election or Appointment: 2005

Vice President of Institutional Short Intermediate Government. Mr. Murphy also serves as Vice President of Fidelity’s Money Market Funds (2002 present), certain Asset Allocation Funds (2003 present), Fidelity’s Investment Grade Bond Funds (2005 present), and Fidelity’s Balanced Funds (2005 present). He serves as Senior Vice President (2000 present) and Head (2004 present) of the Fidelity Investments Fixed Income Division. Mr. Murphy is also a Senior Vice President of FIMM (2003 present) and a Vice President of FMR (2000 present). Previously, Mr. Murphy served as Money Market Group Leader (2002 2004), Bond Group Leader (2000 2002), and Vice President of Fidelity’s Taxable Bond Funds (2000 2002) and Fidelity’s Municipal Bond Funds (2001 2002). Mr. Murphy joined Fidelity Investments in 1989 as a portfolio manager in the Bond Group.

33 Annual Report

Trustees and Officers - continued

| Name, Age; Principal Occupation Thomas J. Silvia (44) |

Year of Election or Appointment: 2005

Vice President of Institutional Short Intermediate Government. Mr. Silvia also serves as Vice President of Fidelity’s Bond Funds (2005 present) and Senior Vice President and Bond Group Leader of the Fidelity Invest ments Fixed Income Division (2005 present). Previously, Mr. Silvia served as Director of Fidelity’s Taxable Bond portfolio managers (2002 2004) and a portfolio manager in the Bond Group (1997 2004).

| George Fischer (44) |

Year of Election or Appointment: 2002

Vice President of Institutional Short Intermediate Government, which he has managed since June 2002. He also manages other Fidelity funds. Since joining Fidelity Investments in 1989, Mr. Fischer has worked as a research analyst and manager.

| Eric D. Roiter (57) |

Year of Election or Appointment: 1998

Secretary of Institutional Short Intermediate Government. He also serves as Secretary of other Fidelity funds; Vice President, General Counsel, and Secretary of FMR Co., Inc. (2001 present) and FMR; Assistant Sec retary of Fidelity Management & Research (U.K.) Inc. (2001 present), Fidelity Management & Research (Far East) Inc. (2001 present), and Fidelity Investments Money Management, Inc. (2001 present). Mr. Roiter is an Adjunct Member, Faculty of Law, at Boston College Law School (2003 present). Previously, Mr. Roiter served as Vice President and Sec retary of Fidelity Distributors Corporation (FDC) (1998 2005).

| Stuart Fross (46) |

Year of Election or Appointment: 2003

Assistant Secretary of Institutional Short Intermediate Government. Mr. Fross also serves as Assistant Secretary of other Fidelity funds (2003 present), Vice President and Secretary of FDC (2005 present), and is an employee of FMR.

| Christine Reynolds (47) |

Year of Election or Appointment: 2004

President, Treasurer, and Anti Money Laundering (AML) officer of Institu tional Short Intermediate Government. Ms. Reynolds also serves as Pres ident, Treasurer, and AML officer of other Fidelity funds (2004) and is a Vice President (2003) and an employee (2002) of FMR. Before joining Fidelity Investments, Ms. Reynolds worked at PricewaterhouseCoopers LLP (PwC) (1980 2002), where she was most recently an audit partner with PwC’s investment management practice.

| Annual Report |

| 34 |

| Name, Age; Principal Occupation Paul M. Murphy (58) |

Year of Election or Appointment: 2005

Chief Financial Officer of Institutional Short Intermediate Government. Mr. Murphy also serves as Chief Financial Officer of other Fidelity funds (2005 present). He also serves as Senior Vice President of Fidelity Pric ing and Cash Management Services Group (FPCMS).

| Kenneth A. Rathgeber (58) |

Year of Election or Appointment: 2004

Chief Compliance Officer of Institutional Short Intermediate Govern ment. Mr. Rathgeber also serves as Chief Compliance Officer of other Fidelity funds (2004) and Executive Vice President of Risk Oversight for Fidelity Investments (2002). Previously, he served as Executive Vice Pres ident and Chief Operating Officer for Fidelity Investments Institutional Services Company, Inc. (1998 2002).

| John R. Hebble (47) |

Year of Election or Appointment: 2003

Deputy Treasurer of Institutional Short Intermediate Government. Mr. Hebble also serves as Deputy Treasurer of other Fidelity funds (2003), and is an employee of FMR. Before joining Fidelity Investments, Mr. Hebble worked at Deutsche Asset Management where he served as Director of Fund Accounting (2002 2003) and Assistant Treasurer of the Scudder Funds (1998 2003).

| Bryan A. Mehrmann (44) |

Year of Election or Appointment: 2005

Deputy Treasurer of Institutional Short Intermediate Government. Mr. Mehrmann also serves as Deputy Treasurer of other Fidelity funds (2005 present) and is an employee of FMR. Previously, Mr. Mehrmann served as Vice President of Fidelity Investments Institutional Services Group (FIIS)/Fidelity Investments Institutional Operations Corporation, Inc. (FIIOC) Client Services (1998 2004).

| Kimberley H. Monasterio (41) |

Year of Election or Appointment: 2004

Deputy Treasurer of Institutional Short Intermediate Government. Ms. Monasterio also serves as Deputy Treasurer of other Fidelity funds (2004) and is an employee of FMR (2004). Before joining Fidelity Investments, Ms. Monasterio served as Treasurer (2000 2004) and Chief Financial Officer (2002 2004) of the Franklin Templeton Funds and Senior Vice President of Franklin Templeton Services, LLC (2000 2004).

35 Annual Report

Trustees and Officers - continued

| Name, Age; Principal Occupation Kenneth B. Robins (36) |

Year of Election or Appointment: 2005