UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed | by a Party other than the Registrant ¨ |

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

CARDIODYNAMICS INTERNATIONAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials. |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

CARDIODYNAMICS INTERNATIONAL CORPORATION

6175 Nancy Ridge Drive

San Diego, CA 92121

June 12, 2006

Dear Shareholder:

We cordially invite you to attend the 2006 Annual Meeting of Shareholders of CardioDynamics International Corporation, which will be held at the Company’s headquarters located at 6175 Nancy Ridge Drive, San Diego, California, on Thursday, July 20, 2006 at 9:00 a.m. (PDT).

The Notice of Annual Meeting of Shareholders and the Proxy Statement included with this letter describe the business to be acted upon at the Annual Meeting. Our Annual Report on Form 10-K for fiscal 2005 is also enclosed. To ensure that your shares are represented at the meeting, we urge you to vote in the manner described in this notice.

Thank you for your support and we look forward to seeing you at the Annual Meeting.

|

On behalf of the Board of Directors, |

|

|

Michael K. Perry Chief Executive Officer |

|

|

| |

YOUR VOTE IS IMPORTANT Whether or not you expect to attend the Annual Meeting of Shareholders in person, you are urged to vote as promptly as possible to ensure your representation and presence of a quorum at the Annual Meeting. Your shares may be voted electronically on the internet, by telephone or by signing, dating and returning the enclosed proxy card. We urge you to do so now regardless of whether or not you plan to attend the meeting in person. No postage need be affixed if your proxy is mailed in the United States. |

CARDIODYNAMICS INTERNATIONAL CORPORATION

6175 NANCY RIDGE DRIVE

SAN DIEGO, CA 92121

NOTICEOF ANNUAL MEETINGOF SHAREHOLDERS

To be held July 20, 2006

The Annual Meeting of Shareholders of CardioDynamics International Corporation, a California corporation (“CardioDynamics”), will be held at the Company’s headquarters located at 6175 Nancy Ridge Drive, San Diego, California, on Thursday, July 20, 2006 at 9:00 a.m. (PDT), to consider and act upon the following matters:

1. To elect a Board of Directors for the following year. Management has nominated the following persons for election at the meeting: James C. Gilstrap, Robert W. Keith, Richard O. Martin, B. Lynne Parshall and Michael K. Perry.

2. To ratify the appointment of Mayer Hoffman McCann P.C. as the independent registered public accounting firm for the fiscal year ending November 30, 2006.

3. To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

Shareholders of record at the close of business on June 1, 2006, are entitled to notice of, and to vote at, the Annual Meeting of Shareholders and any adjournments or postponements thereof. Whether or not you plan to attend the meeting in person, please vote your shares in any one of the manners outlined on the proxy card. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the meeting will be counted. The prompt return of your proxy will assist us in preparing for the Annual Meeting.

| | | | |

| | | | | By Order of the Board of Directors, |

| | |

| | | | |

|

Dated: June 12, 2006 | | | | Michael K. Perry Chief Executive Officer |

CardioDynamics International Corporation

TABLE OF CONTENTS

CARDIODYNAMICS INTERNATIONAL CORPORATION

PROXY STATEMENT FOR THE

2006 ANNUAL MEETING OF SHAREHOLDERS

To Be Held July 20, 2006

These proxy materials are being mailed in connection with the solicitation of proxies by the Board of Directors of CardioDynamics International Corporation, a California corporation (“CardioDynamics”), for the Annual Meeting of Shareholders to be held at the Company’s headquarters located at 6175 Nancy Ridge Drive, San Diego, California, at 9:00 a.m. (PDT) on July 20, 2006 and at any adjournment or postponement of the Annual Meeting. Voting materials, which include this Proxy Statement, a Proxy Card and our 2005 Annual Report on Form 10-K, were mailed to our shareholders of record on or about June 12, 2006. Our principal executive offices are located at 6175 Nancy Ridge Drive, San Diego, California 92121. Our telephone number is (858) 535-0202 and our Internet address is www.cdic.com.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Shareholders. Each proposal is described in more detail in this Proxy Statement.

RECORD DATE; OUTSTANDING SHARES

The record date for determining those shareholders who are entitled to notice of, and to vote at, the Annual Meeting is June 1, 2006. At the close of business on the record date, we had 48,817,615 outstanding shares of common stock (the “Common Stock”).

VOTING RIGHTS AND SOLICITATION

Any shareholder executing a proxy has the power to revoke it at any time before it is voted by delivering written notice of such revocation to our Corporate Secretary before the Annual Meeting or by properly executing and delivering a proxy bearing a later date. You may also revoke your proxy at the Annual Meeting by voting your shares in person.

We will pay for the cost of soliciting proxies and may reimburse brokerage firms and others for their expense in forwarding solicitation material. Solicitation will be made primarily through the use of the mail but our regular employees may, without additional compensation, solicit proxies personally by telephone or fax.

Each share of Common Stock is entitled to one vote on matters brought before the Annual Meeting. In voting for directors, each shareholder has the right to cumulate his or her votes and give one nominee a number of votes equal to the number of directors to be elected, multiplied by the number of shares he or she holds, or to distribute his or her votes on the same principle among the nominees to be elected in such manner as he or she may see fit. For example, in the event of cumulative voting a shareholder owning ten shares of Common Stock would have 50 votes (five directors multiplied by ten shares) to allocate among as few as one, or as many as five candidates. A shareholder may cumulate his or her votes, however, only if his or her candidate or candidates have been placed in nomination prior to the voting and if any shareholder has given notice at the Annual Meeting prior to the voting of that shareholder’s intention to cumulate his or her votes.

The shares represented by the proxy will be voted at the Annual Meeting by the proxy holder as specified by the person solicited. Discretionary authority to cumulate votes is, however, being solicited by the Board of Directors.

1

California statutes and case law do not provide specific instructions regarding the treatment of abstentions; therefore, we believe that shares that are voted “WITHHELD” or “ABSTAIN” in person or by proxy should be treated as follows:

| | • | | present for purposes of determining whether or not a quorum is present at the Annual Meeting, and: |

| | • | | entitled to vote on a particular subject matter and the Annual Meeting; therefore, a “WITHHELD” or “ABSTAIN” vote is the same as voting against a proposal that has a required affirmative voting threshold, such as proposal two, but would have no effect on proposal one, the election of directors, who are elected by a plurality of votes. |

If you hold your common stock through a broker, the broker may be prevented from voting shares held in your brokerage account on some proposals unless you have given the broker voting instructions (a “broker non-vote”). Shares that are subject to a broker non-vote are counted for purposes of determining whether a quorum exists but do not count for or against any particular proposal.

QUORUM

A quorum is required for shareholders to conduct business at the Annual Meeting. The presence in person or by proxy of the persons entitled to vote a majority of the voting shares at any meeting shall constitute a quorum for the transaction of business.

VOTE REQUIRED

With respect to Proposal 1, a plurality of the votes cast will be required to elect each nominee to the Board of Directors. With respect to Proposal 2, the affirmative vote of the holders of a majority of the Common Stock present in person or represented by proxy and entitled to vote will be required to ratify the appointment of our independent auditors.

SHAREHOLDER PROPOSALS FOR 2006 PROXY STATEMENT

The deadline for shareholders to submit proposals to be considered for inclusion in our Proxy Statement for the next year’s Annual Meeting of Shareholders is February 14, 2007. Such proposals may be included in the next year’s Proxy Statement if they comply with certain rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”).

If a shareholder wishes to have a proposal considered at the 2007 Annual Meeting but does not seek to have the proposal included in our Proxy Statement and Form of Proxy for that meeting, and if the shareholder does not notify CardioDynamics of the proposal by May 2, 2007, then the persons appointed as proxies by management may use their discretionary voting authority to vote on the proposal when the proposal is considered at the 2007 Annual Meeting, even though there is no discussion of the proposal in the Proxy Statement for that meeting. It is recommended that shareholders submitting proposals or notices of proposal direct them to our Corporate Secretary and utilize certified mail-return receipt requested. Shareholders’ proposals should be submitted to CardioDynamics International Corporation, 6175 Nancy Ridge Drive, San Diego, California 92121.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Board of Directors welcomes the submission of any comments or concerns from shareholders and any interested parties. Communications should be addressed to CardioDynamics International Corporation, 6175 Nancy Ridge Drive, San Diego, CA 92121, Attention: Board of Directors.

2

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of six members. Directors are elected at the annual meeting and serve for a term of one year, unless re-elected.

Connie R. Curran, RN, Ed.D will not seek re-election as a director and her term will automatically expire immediately prior to the Annual Meeting. At that time, the Board of Directors intends to reduce the number of board members from six to five.

The five individuals below have been nominated for election to our Board to serve until the next annual meeting or until their successors are elected and qualified. Unless you specify otherwise, your proxy will be voted for the election for the below listed nominees of the Board of Directors, each of whom is in an incumbent director, and distributed among the nominees as the proxy holders see fit.

If, however, any of the nominees are unable to serve, or for good cause declines to serve at the time of the Annual Meeting, the proxy holders will exercise discretionary authority to vote for a substitute. The Board of Directors is not aware of any circumstances that would render any nominee unavailable for election. Discretionary authority to cumulate votes is being solicited by the Board of Directors, and it is intended that the proxies received by the proxy holders pursuant to the solicitation will be voted in a manner designed to cause the election of the maximum number of the Board of Directors’ nominees.

The following table presents a brief biography, as of May 31, 2006, of each nominee to be elected at the Annual Meeting:

| | | | |

Name

| | Age

| | Principal Occupation and Business Experience

|

James C. Gilstrap | | 70 | | Mr. Gilstrap has served as the Chairman or Co-Chairman of our Board of Directors since May 1995. Mr. Gilstrap is retired from Jefferies & Company, where he served as Senior Executive Vice President, Partner, board member, and a member of the Executive Committee. Mr. Gilstrap serves on the board of Corautus Genetics, Inc. Mr. Gilstrap is a past President of the Dallas Securities Dealers, as well as a past member of the Board of Governors of the National Association of Securities Dealers, Inc. |

| | |

Robert W. Keith | | 48 | | Mr. Keith has served as a Director since July 2005. Mr. Keith is President and Chief Operating Officer of Verus Pharmaceuticals, Inc. and has held various executive management positions since co-founding the company in November 2002. Prior to that, he was a Partner at Advantage Management Solutions, L.L.C., a commercial strategy and operations consulting firm for life science companies. Prior to that, Mr. Keith was a member of the senior management team at Dura Pharmaceuticals, Inc. and Elan Corporation, plc from 1996 to 2001; during his tenure he served in several positions, including Vice President of Sales, Vice President of Commercial Strategies and Marketing and Vice President of Managed Care and National Accounts. Prior to that, he held an executive management position at Abbott Laboratories. Mr. Keith has more than 20 years of experience in the life sciences industry and management consulting. Mr. Keith earned Master’s degrees from both the Wharton School of the University of Pennsylvania and the University of Pennsylvania and a Bachelor’s degree from The George Washington University. |

3

| | | | |

Name

| | Age

| | Principal Occupation and Business Experience

|

Richard O. Martin, Ph.D. | | 66 | | Dr. Martin has served as a Director since July 1997. From 1998 until 2001, Dr. Martin served as President of Medtronic Physio-Control Corporation, a medical device company that designs, manufactures and sells external defibrillators and heart monitors. Prior to its acquisition by Medtronic in 1998, Dr. Martin was Chairman and Chief Executive Officer of Physio-Control Corporation. Prior to that, he was Vice President of cardiovascular business development with Sulzer Medica and has held management positions at Intermedics, Inc. and Medtronic, Inc. Dr. Martin serves on the Boards of Directors of Endographic Solutions, Inc., Cardiac Dimensions, Inc., Encore Medical Corp., Inovise Medical Inc., MDdatacor Inc. and Prescient Medical, Inc. Dr. Martin earned a bachelor’s degree in electrical engineering from Christian Brothers College, a Master’s degree in Electrical Engineering from Notre Dame University and a Doctorate in Electrical/Biomedical Engineering from Duke University. |

| | |

B. Lynne Parshall | | 51 | | Ms. Parshall has served as a Director since July 2005. Ms. Parshall has been Executive Vice President of Isis Pharmaceuticals, Inc. since December 1995 and Chief Financial Officer since June 1994. She has held various positions with Isis Pharmaceuticals, Inc. since 1991. Prior to that, she was a Partner at Cooley Godward, LLP from 1986 to 1991. Ms. Parshall serves on the board for Corautus Genetics, Inc. and is on the Board of Trustees of the Bishop’s School. She is also a member of the American, California and San Diego bar associations. Ms. Parshall earned a Bachelor’s degree in Government and Economics from Harvard University and a J.D. degree from Stanford Law School. |

| | |

Michael K. Perry | | 45 | | Mr. Perry has been the Chief Executive Officer and Director of CardioDynamics since April 1998. From 1994 to 1997, Mr. Perry was Vice President of Operations at Pyxis Corporation, and in 1995 assumed additional responsibility for Research and Development. Pyxis Corporation was a pioneer of healthcare automation and information management services, in addition to pharmacy management services to hospitals and outpatient facilities. Mr. Perry was part of the executive team that successfully acquired and integrated three businesses into Pyxis, and in 1996, sold the company to Cardinal Health, Inc. for $980 million. Prior to joining Pyxis, Mr. Perry served in several increasingly responsible management assignments with Hewlett-Packard Company’s Medical Products Group in manufacturing and finance. Additionally, he was Director of Quality for a division of Hewlett-Packard’s DeskJet Printer Group. In 2003, Mr. Perry was named San Diego Entrepreneur of the Year for Medical Products and Technology. Mr. Perry holds a Master’s degree in Business Administration from Harvard University and a Bachelor’s degree in Mechanical Engineering from General Motors Institute. Mr. Perry serves on the Advisory Board of the University of California San Diego Cardiovascular Center and the Board of Directors for Junior Achievement of San Diego. |

The Company’s Board of Directors recommends a voteFOR the nominees listed herein.

4

CORPORATE GOVERNANCE AND BOARD COMMITTEES

Director Independence

All of the members of our Board of Directors qualify as “independent” as defined by the rules of The Nasdaq National Market, except for Mr. Perry.

Board Meetings and Committees

The Board of Directors held four meetings during the fiscal year ended November 30, 2005. Each incumbent director nominee participated in at least 75% of the meetings of the Board held during the period in which they served as a director.

Audit Committee.The Board of Directors has established a standing Audit Committee currently composed of three non-employee directors, Ms. Parshall, Dr. Martin and Dr. Curran. The Audit Committee is responsible for the appointment, retention and termination of our independent registered public accounting firm, monitoring the effectiveness of the audit effort, the Company’s financial and accounting organization and its system of internal accounting and disclosure controls. The committee also reviews other matters with respect to our accounting, auditing and financial reporting practices and procedures as it may find appropriate or may be brought to their attention. Each member of the Audit Committee is “independent” within the meaning of SEC rules and regulations and the listing standards of the National Association of Securities Dealers, and the Board has determined that Ms. Parshall qualifies as an audit committee financial expert within the meaning of SEC rules and regulations. The Audit Committee held ten meetings during the fiscal year ended November 30, 2005. Each incumbent member nominee participated in at least 75% of the meetings of the Audit Committee held during the period in which they served as a committee member.

The Audit Committee is governed by a charter which is available on our corporate website at www.cdic.com/ir/fr_govern.html.

Compensation Committee.The Board of Directors has established a standing Compensation Committee currently composed of three non-employee directors, Dr. Martin, Mr. Keith and Mr. Gilstrap. The Compensation Committee establishes, monitors and acts on matters relating to performance, compensation levels and benefit plans for executive officers and key employees of the Company. For more information, please see the section captioned “Board Compensation Committee Report on Executive Compensation.” Each member of the Compensation Committee is “independent” under the listing standards of The Nasdaq National Market. The Compensation Committee held four meetings during the fiscal year ended November 30, 2005. Each incumbent member nominee participated in at least 75% of the meetings of the Audit Committee held during the period in which they served as a committee member in fiscal 2005. No interlocking relationships exist between our Board of Directors or Compensation Committee and the Board of Directors or Compensation Committee of any other company.

Nominating/Governance Committee.The Board of Directors has established a Nominating/ Governance Committee, currently composed of three directors, Mr. Gilstrap, Mr. Keith and Ms. Parshall. The Nominating/Governance Committee reviews matters pertaining to Board composition and screens and recommends to the Board potential candidates for election as a director. In addition, the Nominating/Governance Committee develops and recommends to the Board a set of corporate governance principles applicable to the Company and oversees corporate governance matters. Each member of the Nominating/Governance Committee is “independent” under the listing standards of The Nasdaq National Market. The Nominating/Governance Committee held one meeting during the fiscal year ended November 30, 2005. Each incumbent member nominee participated in at least 75% of the meetings of the Nominating/Governance Committee held during the period in which they served as a committee member.

The Nominating/Governance Committee strives to select individuals as director nominees who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment and who

5

will be the most effective, in conjunction with the other director nominees, in collectively serving the long-term interests of the shareholders. To this end, the Nominating/Governance Committee seeks director nominees with the highest professional and personal ethics and values, an understanding of our business and industry, diversity of business experience and expertise, a high level of education and broad-based business acumen. The Nominating/Governance Committee also will consider any other factor which it deems relevant in selecting individuals as director nominees. The Nominating/Governance Committee does not use different standards to evaluate nominees depending on whether they are proposed by our directors and management or by our shareholders.

The Nominating/Governance Committee also will consider recommendations properly submitted by our shareholders. Shareholders may recommend qualified candidates for our Board by writing to our Corporate Secretary at our principal executive offices, 6175 Nancy Ridge Drive, San Diego, California 92121. All shareholder communications that are received in this manner will be submitted to the Nominating/Governance Committee for review and consideration. Nominations of directors by our shareholders will be reviewed by the Nominating/Governance Committee, who will determine whether these nominations should be presented to the Board.

Directors’ Fees

Each non-employee director who has not been employed by us during the preceding two years is granted annually an option to purchase 12,000 shares of the common stock of CardioDynamics at fair market value, for their service as a director. In addition, at their election, they also receive either a cash fee of $2,000 per month or an annual stock option grant at fair market value. In 2006, the elected grant was for 24,000 stock options and in 2005, the elected grant was for 12,000 stock options. The options vest monthly over 12 months and expire upon the earlier of ten years from the date of grant or two years after the director terminates their position on the Board. All directors are reimbursed for out-of-pocket expenses incurred in connection with their service on the Board.

During fiscal 2005, 2004 and 2003, we granted 198,000, 102,000 and 82,000 options, respectively, to the non-employee members of the Board of Directors. During fiscal 2005, the director compensation was as follows:

| | | | | |

| | | Cash Paid

| | Stock Options

|

James C. Gilstrap | | $ | — | | 48,000 |

Connie R. Curran, Ed.D., RN | | | — | | 48,000 |

Peter C. Farrell, Ph. D.(1) | | | 8,000 | | 6,000 |

Robert W. Keith(2) | | | 8,000 | | 12,000 |

Ronald A. Matricaria(1) | | | 16,000 | | — |

Richard O. Martin, Ph. D. | | | — | | 48,000 |

Ronald L. Merriman(1) | | | 17,667 | | — |

B. Lynne Parshall(2) | | | 8,000 | | 36,000 |

| (1) | Director’s Board term concluded at annual shareholder meeting on July 21, 2005. |

| (2) | Director’s Board term commenced at annual shareholder meeting on July 21, 2005. |

Relationships among Directors and Executive Officers

We are not aware of any family relationships among any of our directors or executive officers.

Code of Ethics

We have adopted (and filed as an exhibit on Form 10-K for the fiscal year ended November 30, 2003) a code of business conduct and ethics that applies to our principal executive officer and principal financial and accounting officer. The Code of Ethics is available on our website at www.cdic.com/ir/fr_govern.html.

6

PRINCIPAL SHAREHOLDERS

The following are the only persons known by us to own beneficially, 5% or more of the outstanding shares of our common stock as of May 10, 2006.

| | | | | |

Name and Address of Beneficial Owner

| | Shares Beneficially Owned

| |

| | Number(1)

| | Percentage (2)

| |

J. Michael Paulson(3) P.O. Box 9660 Rancho Santa Fe, CA 92067 | | 2,896,394 | | 5.9 | % |

| | |

Atlas Master Fund, Ltd.(4) c/o Walkers SPV Limited P.O. Box 908 GT George Town, Grand Cayman Cayman Islands, British West Indies | | 5,194,663 | | 9.7 | % |

| | |

Dr. Herbert A. Wertheim 191 Leucadendra Drive Coral Gables, FL 33156 | | 2,825,000 | | 5.8 | % |

| 1) | Except as indicated in the footnotes to this table, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws, where applicable. |

| 2) | Percentage of ownership is calculated pursuant to SEC Rule 13d-3(d)(1). |

| 3) | Includes 2,513,139 shares held in the Allen E. Paulson Living Trust dated December 23, 1986 of which J. Michael Paulson is the Trustee and executor. Also includes 7,000 shares beneficially owned by the Trust, by virtue of its right to acquire such shares from us under stock options now exercisable or exercisable within 60 days. Also includes 376,255 shares held by J. Michael Paulson, by virtue of his right to acquire such shares from us under stock options now exercisable or exercisable within 60 days. Excludes shares of common stock owned by Mr. Paulson’s brothers; Mr. Paulson disclaims beneficial ownership of such shares. |

| 4) | Includes 3,094,665 shares beneficially held by Atlas Global, LLC, Atlas Global Investments, Ltd., Atlas Global Investments II, Ltd., Atlas Master Fund, Visium Balanced Fund, LP, Visium Balanced Offshore Fund, Ltd., Visium Long Bias Fund, LP, Visium Balanced Long Bias Fund, Ltd., Visium Capital Management LLC., Balyasny Asset Management LP, Dmitry Balyasny and 2,099,998 shares beneficially owned by Atlas Master Fund, Visium Balanced Fund, LP, Visium Balanced Offshore Fund, Ltd, Visium Long Bias Fund, LP, Visium Balanced Long Bias Fund, Ltd., by virtue of their right to acquire such shares from us under subordinated convertible notes now convertible or convertible within 60 days. Excludes 2,465,220 shares that are restricted from conversion under subordinated convertible notes by Atlas Master Fund, Visium Balanced Fund, LP, Visium Balanced Offshore Fund, Ltd, Visium Long Bias Fund, LP, Visium Balanced Long Bias Fund, Ltd., until they receive approval from CardioDynamics. |

7

SECURITY OWNERSHIP OF CERTAIN BENEFICAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of common stock of CardioDynamics as of May 10, 2006 by each director and officer of CardioDynamics named in the Summary Compensation Table, and by all directors and executive officers of CardioDynamics as a group. Except as indicated in the footnotes to this table, we believe that the persons named in the table have sole voting and investment power with respect to all the shares of common stock shown as beneficially owned by them, subject to community property laws, where applicable. Share ownership in each case includes shares of common stock that may be acquired pursuant to stock options exercisable currently or exercisable within 60 days after May 10, 2006. The percentage ownership is calculated pursuant to Rule 13d-3(d)(1) promulgated by the SEC under the Securities Exchange Act of 1934.

Unless otherwise indicated, the address for each person listed below is care of CardioDynamics International Corporation, 6175 Nancy Ridge Drive, San Diego, California 92121.

| | | | | |

| | | Shares Beneficially Owned

| |

Name

| | Number (1)

| | Percent (2)

| |

Russell H. Bergen(3) | | 286,056 | | * | |

Connie R. Curran(3) | | 120,000 | | * | |

James C. Gilstrap(4) | | 2,404,427 | | 4.9 | % |

Robert W. Keith(3) | | 11,000 | | * | |

Steve P. Loomis(3) | | 236,159 | | * | |

Richard O. Martin, Ph.D.(3) | | 214,000 | | * | |

B. Lynne Parshall(3) | | 35,000 | | * | |

Michael K. Perry(3) | | 1,021,420 | | 2.1 | % |

Rhonda F. Rhyne(3) | | 540,363 | | 1.1 | % |

Richard E. Trayler(3) | | 245,528 | | * | |

All Directors and executive officers as a group (3)—(11 persons) | | 5,269,287 | | 10.2 | % |

| (1) | Except as indicated in the footnotes to this table, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws, where applicable. Share ownership in each case includes shares issuable on exercise of certain outstanding options as described in the footnotes below. |

| (2) | Percentage of ownership is calculated pursuant to SEC Rule 13d-3(d)(1). |

| (3) | Includes shares of common stock that may be acquired pursuant to stock options exercisable currently or exercisable within 60 days. |

| (4) | Includes 400,000 shares held by the Scripps Medical Charitable Limited Partnership of which Mr. Gilstrap is a general partner with a minority ownership interest. Mr. Gilstrap disclaims any pecuniary interest in 399,752 of the shares. Also includes 103,000 shares of common stock Mr. Gilstrap beneficially owns, by virtue of his right to acquire such shares from us under stock options now exercisable or exercisable within 60 days. Also includes 32,654 shares held by the James C. Gilstrap Trust dated January 16, 1995 and 71,000 shares held in his daughters’ trust’s, Mr. Gilstrap disclaims beneficial ownership of such shares. |

8

EXECUTIVE OFFICERS

Our executive officers, as of May 31, 2006, are as follows:

Michael K. Perry, see description under “Election of Directors.”

Russell H. Bergen,age 59, has served as our Vice President of Operations since joining us in September 1998. From 1971 to 1998, Mr. Bergen held management positions in the Instrument Group, Peripheral Products Group and Inkjet Business Unit of Hewlett Packard Company. Previously, Mr. Bergen was employed at Honeywell, Inc. as a procurement engineer. Mr. Bergen earned Bachelor degrees in Aerospace Engineering and Manpower Management from the University of Colorado at Boulder.

Richard L. Kalich,age 60, is President of our Vermed division where he has served as President since 1999. Between 1993 and 1999 he was President and CEO of Imtec, Inc. and prior to that, from 1983 to 1993, Mr. Kalich held progressively responsible management positions with Matthews International, Inc. leading to Vice President and Division Manager. Between 1978 and 1983, Mr. Kalich held various positions with Sears, Roebuck Inc. leading to National Marketing Manager of the Hardware Department and Craftsman Tools. He holds a Bachelor’s degree in Economics from Penn State University and a Master’s degree in Management from Michigan State University.

Steve P. Loomis, age 46, joined CardioDynamics in September 1996 as Vice President of Finance and has held the positions of Chief Financial Officer and Corporate Secretary since April 1997. From 1993 until 1996, he served as Director of Financial Reporting at Kinko’s Inc. From 1988 to 1993, Mr. Loomis was Chief Financial Officer for Terminal Data Corporation, a publicly traded company. He earned his Bachelor’s degree in Business Administration from California State University at Northridge. Mr. Loomis is a certified public accountant and a member of the American Institute of Certified Public Accountants. He also serves on the Board of Directors of Santa Fe Christian Schools.

Rhonda F. Rhyne, age 45, has been our President since June 1997, previously serving as Chief Operating Officer from 1996 to 1997 and as Vice President of Operations from 1995 to 1996. From 1992 until 1995, Ms. Rhyne was President, Chief Executive Officer and Vice President of Sales and Marketing for Culture Technology, Inc. Ms. Rhyne has also held sales positions at GE Medical Systems and Quinton Instrument Company, both medical device subsidiaries of publicly held companies. Ms. Rhyne holds a Bachelor’s degree in Pharmacy from Washington State University and a Master’s degree in Business Administration, executive program, from University of California Los Angeles, Anderson School of Business.

Richard E. Trayler,age 55, is our Vice President of International Operations and served as our Chief Operating Officer from July 1997 to January 2003. From 1982 to 1997, Mr. Trayler held sales management positions at Quinton Instrument Company. He has also held positions at the Heart Institute for CARE, the University of Washington and the Boeing Company. Mr. Trayler earned a Bachelor’s degree from Texas A&M University and a Master’s degree from the University of Washington.

9

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Our compensation programs and policies applicable to our executive officers are established and administered by the Compensation Committee of our Board of Directors. The Compensation Committee is comprised of three non-employee directors, none of whom have interlocking relationships as defined by the rules and regulations of the Securities and Exchange Commission.

It is the philosophy of the Compensation Committee that executive compensation be aligned with our overall business strategies, values and performance. These policies are designed to set executive compensation, including salary, cash bonus awards and long-term stock-based incentive awards, at a level consistent with amounts paid to executive officers of companies of similar size, industry and geographic location.

Compensation Philosophy and Objectives

The Compensation Committee believes that compensation of our executive officers should:

| | • | | Encourage creation of shareholder value and achievement of strategic corporate objectives; |

| | • | | Integrate compensation with our annual and long-term corporate objectives, values and business strategies, and focus executive actions on the fulfillment of those objectives, values and strategies; |

| | • | | Provide a competitive total compensation package that enables us to attract and retain, on a long-term basis, high caliber personnel; |

| | • | | Provide a compensation opportunity that is competitive with companies in the medical device and biotechnology industries, taking into account relative company size, performance and geographic location as well as individual responsibilities and performance; and |

| | • | | Align the interests of management with the long-term interests of stockholders and enhance shareholder value by providing management with longer-term incentives through equity ownership. |

The Compensation Committee periodically reviews the approach to executive compensation and will make changes as competitive conditions and other circumstances warrant and will seek to ensure our compensation philosophy is consistent with our best interests.

Key Elements of Executive Compensation

The compensation of executive officers is based upon our financial performance as well as the achievement of certain business objectives, including: increased market penetration, broadening of distribution channels through strategic relationships, securing and growing recurring revenue, targeting new market opportunities, furthering ICG technology and developing ICG products for new medical applications, as well as the achievement of individual business objectives by each executive officer.

Executive compensation consists of three elements: (i) base salary, (ii) bonus awards and (iii) long-term stock-based incentive awards. The summary below describes in more detail the factors that the Compensation Committee considers in establishing each of the three primary components of the variable compensation package provided to the executive officers.

Base salary—Salary ranges are largely determined through comparisons with companies of similar revenues, market capitalization, headcount or complexity in the medical device and biotechnology industries. Actual salaries are based on individual performance contributions and other more qualitative and developmental criteria within a competitive salary range for each position that is established through evaluation of responsibilities and competitive, inflationary, internal equity and market considerations. The Compensation Committee, on the basis of its knowledge of executive compensation in the industry, believes that salary levels of

10

our executive officers are at a level that the Compensation Committee considered to be reasonable and necessary, at the time such salary determinations were made, given our financial resources and stage of development. The Compensation Committee reviews executive salaries each October and sets the salaries for the following year.

Bonus awards—The Compensation Committee has established an incentive bonus program providing for the payment to each executive officer of quarterly bonuses that are directly related to the group and individual achievements of executive management and our revenues and earnings. The bonus pool is established based on quarterly revenues and earnings achieved and the pool is allocated to individual executives through a weighting, half of which is based on achievement of our revenue and earnings goals and half of which is based on CEO and Compensation Committee assessment of the executive’s individual quarterly goal achievement and overall contribution to CardioDynamics.

In fiscal 2005, the target bonuses for executive officers ranged from 42% to 53% of annual base salary, however there were no bonuses paid for the year. Incentive award amounts for each participant are based on his or her potential impact on our operating and financial results and on market competitive pay practices. Under the incentive bonus program, incentive awards are paid based on achievement of quarterly performance goals. These performance goals include individual performance goals, which are established by the CEO at the beginning of each quarter, and annual corporate performance goals. The corporate performance goals are based on our achievement of strategic objectives as well as specific revenue and earnings growth targets for each quarter and the fiscal year.

Long-term stock-based incentive awards—Our Stock Option Plan, which was approved by our shareholders in 2004, as well as the executive bonus plan, are structured to permit awards under such plans to qualify as performance-based compensation and to maximize the tax deductibility of such awards. The Committee intends that compensation paid to management, including stock options, be exempt from the limitations on deductibility under Section 162(m) of the Internal Revenue Code. Accordingly, the Compensation Committee administers grants under our Stock Option Plan to members of management.

The Compensation Committee believes that providing incentives that focus attention on managing the Company from the perspective of an owner with an equity stake in the business will closely align the interest of shareholders and executive officers. Therefore, all employees, and particularly those persons who have substantial responsibility for our management and growth, are eligible to receive annual stock option grants, although the Compensation Committee, at its discretion, may grant options at other times in recognition of exceptional achievements.

The number of shares underlying stock options granted to executive officers is based on competitive practices in the industry as determined by independent surveys and the Compensation Committee’s knowledge of industry practice. The Compensation Committee grants options under the Stock Option Plan with an exercise price equal to the fair market value on the date of grant. The grants are intended to be competitive in order to retain and encourage positive future performance and to provide a direct link with the interests of our shareholders.

The Compensation Committee, in making its determination as to grant levels, takes into consideration: (i) the executive’s historical and expected contribution toward our objectives, (ii) prior award levels, (iii) award levels necessary to replace particular executives, (iv) the executive’s direct ownership of our shares, (v) the number of options vested and unvested, (vi) anticipated accounting rule changes, and (vii) the number of options outstanding as a percentage of total shares outstanding. During fiscal 2005, options to purchase 1,428,931 shares of our common stock, net of forfeitures and expirations, were granted to employees, which represented 2.9% of our total outstanding shares. Of those, 539,027 stock options were granted to our executive officers. A grant was made in January of 2005, based on executive achievements in fiscal 2004, and a second grant was made in October of 2005, based on executive achievements thus far in fiscal 2005. Therefore, stock options granted in fiscal 2005 represent option compensation for more than one year. The Stock Option Plan limits the total number of shares subject to options that may be granted to a participant during the lifetime of the plan to 800,000 shares. The Stock Option Plan contains provisions providing for forfeiture of the options in the event the option holder engages in certain intentional misconduct contrary to our interests.

11

Chief Executive Officer Compensation

Michael K. Perry is our Chief Executive Officer. In October 2004, the Compensation Committee set Mr. Perry’s annual base salary for 2005 at $279,000. The salary increase in 2005 was approved by the Compensation Committee in recognition of his achievement of specific corporate objectives in 2004, which included: growing our revenues 35%, growing income from operations 26% and achieving $4,365,000 of positive operating cash flow. Additionally, he was recognized for identifying, acquiring and integrating the Vermed and Medis operations. In October 2005, the Compensation Committee set Mr. Perry’s annual base salary for 2006 at $293,000. The salary increase in 2006 was approved by the Compensation Committee in recognition of his achievement of specific corporate objectives in 2005, which included: FDA clearance and launch of the BioZ DX ICG Diagnostics product, award of Premier multi-source electrode contract, and presentation of the CONTROL study demonstrating that the use of BioZ ICG was more than two times better than standard care for achievement of blood pressure control in mild to moderate hypertensive patients. The Compensation Committee determined that these achievements were important to our future growth and could assist us in enhancing shareholder value. The Compensation Committee also considered Mr. Perry’s compensation relative to medical device and biotechnology industry norms within southern California.

As an incentive for future performance, the Compensation Committee granted Mr. Perry options under our Stock Option Plan, exercisable at the fair market value on the date of grant, to purchase 95,000 shares of our common stock.

Mr. Perry is a member of the Board of Directors, but did not participate in matters involving the evaluation of his own performance or the setting of his own compensation. The foregoing report has been furnished by our Compensation Committee.

|

| Compensation Committee: |

|

Richard O. Martin, Ph.D.—Chairman |

James C. Gilstrap |

Robert W. Keith |

12

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following table provides information regarding the annual and long-term compensation earned for services rendered in all capacities to CardioDynamics for the fiscal years ended November 30, 2005, 2004 and 2003 of those persons who were, at November 30, 2005 (i) the Chief Executive Officer and (ii) the four most highly compensated executive officers of CardioDynamics whose aggregate direct remuneration from the Company during the fiscal year ended November 30, 2005 exceeded $100,000 (collectively, the “Named Officers”).

SUMMARY COMPENSATION TABLE

| | | | | | | | | | |

| | | | | Annual Compensation(1)

| | Long Term

Compensation

Awards

|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other

Annual

Compensation ($)

| | Securities Underlying

Options/

SARs (#)

|

Michael K. Perry Chief Executive Officer | | 2005

2004

2003 | | 279,588

262,237

239,400 | | -0-

103,575

123,575 | | -0-

-0-

-0- | | 95,000

60,000

60,600 |

| | | | | |

Rhonda F. Rhyne President | | 2005

2004

2003 | | 230,504

218,214

211,348 | | -0-

62,425

85,500 | | -0-

-0-

-0- | | 81,200

50,000

50,000 |

| | | | | |

Steve P. Loomis Chief Financial Officer | | 2005

2004

2003 | | 184,712

171,130

163,393 | | -0-

53,925

67,750 | | -0-

-0-

-0- | | 70,000

40,000

40,000 |

| | | | | |

Russell H. Bergen Vice President ofOperations | | 2005

2004

2003 | | 169,116

160,465

155,386 | | -0-

52,200

65,200 | | -0-

-0-

-0- | | 70,000

40,000

40,600 |

| | | | | |

Richard E. Trayler Vice President of International Operations | | 2005

2004

2003 | | 174,032

166,680

161,000 | | -0-

52,950

59,525 | | -0-

-0-

-0- | | 50,000

20,000

20,000 |

| (1) | Employee benefits provided to each of the Named Officers under various Company programs do not exceed the disclosure thresholds established under the SEC rules and are therefore not included. |

13

The following table provides information regarding option grants during the fiscal year ended November 30, 2005 to the Named Officers in fiscal 2005. One grant was made in January of 2005 based on executive achievements in fiscal 2004 and a second grant was made in October of 2005 based on executive achievements thus far in fiscal 2005. Therefore the stock option grant amounts listed below represent option compensation for more than one year. The Company has not granted any stock appreciation rights.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | | |

| | | Individual Grants

| | |

Name

| | Number of

Securities

Underlying

Options

Granted (#)

| | Percent of

Total Options

Granted to

Employees In

Fiscal Year

2005

| | | Exercise

Price Per

Share

($/Sh.)(1)

| | Expiration

Date

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Appreciation for the

Option Term(2) |

| | | | | | 5%($)

| | 10%($)

|

Michael K. Perry | | 45,000 | | 2.2 | % | | $ | 4.89 | | 1/18/2015 | | 138,389 | | 350,703 |

| | | 50,000 | | 2.5 | % | | $ | 1.19 | | 10/20/2015 | | 37,419 | | 94,828 |

| | | | | | |

Rhonda F. Rhyne | | 35,000 | | 1.7 | % | | $ | 4.89 | | 1/18/2015 | | 107,635 | | 272,769 |

| | | 1,200 | | 0.1 | % | | $ | 1.81 | | 8/1/2015 | | 1,366 | | 3,462 |

| | | 45,000 | | 2.2 | % | | $ | 1.19 | | 10/20/2015 | | 33,677 | | 85,345 |

| | | | | | |

Steve P. Loomis | | 30,000 | | 1.5 | % | | $ | 4.89 | | 1/18/2015 | | 92,259 | | 233,802 |

| | | 40,000 | | 2.0 | % | | $ | 1.19 | | 10/20/2015 | | 29,935 | | 75,862 |

| | | | | | |

Russell H. Bergen | | 30,000 | | 1.5 | % | | $ | 4.89 | | 1/18/2015 | | 92,259 | | 233,802 |

| | | 40,000 | | 2.0 | % | | $ | 1.19 | | 10/20/2015 | | 29,935 | | 75,862 |

| | | | | | |

Richard E. Trayler | | 30,000 | | 1.5 | % | | $ | 4.89 | | 1/18/2015 | | 92,259 | | 233,802 |

| | | 20,000 | | 1.0 | % | | $ | 1.19 | | 10/20/2015 | | 14,968 | | 37,931 |

| (1) | All options were granted at fair market value (closing sale price for our common stock on the Nasdaq Stock Market on the date of grant). |

| (2) | The potential realizable value is calculated based on the ten-year term of the options at the time of grant; the assumption that the closing price for the common stock on the grant date appreciates at the indicated annual rate compounded annually for the entire term of the option; and the assumption that the option is exercised and sold on the last day of its term. |

The following table provides further information regarding the Named Officers’ exercises and outstanding stock options as of November 30, 2005. No stock appreciation rights were granted or exercised.

AGGREGATED OPTION/SAR EXERCISES IN LAST

FISCAL YEAR AND FISCAL YEAR END OPTION/SAR VALUES

| | | | | | | | | |

Name

| | Shares Acquired

On Exercise (#)

| | Value Realized ($)

| | Number of

Securities

Underlying

Unexercised

Options/SARs

at FY-End (#)

Exercisable/

Unexercisable

| | Value(1) of Unexercised In-the-Money Options/SARs at FY- End ($) Exercisable/ Unexercisable(2)

|

Michael K. Perry | | 10,000 | | $ | 9,950 | | 944,939/23,961 | | - 0 - |

Rhonda F. Rhyne | | 5,000 | | $ | 8,100 | | 515,535/21,565 | | - 0 - |

Steve P. Loomis | | 2,694 | | $ | 9,389 | | 209,334/19,169 | | - 0 - |

Russell H. Bergen | | 4,000 | | $ | 5,720 | | 259,731/19,169 | | - 0 - |

Richard E. Trayler | | -0- | | | -0- | | 172,316/9,584 | | - 0 - |

14

| (1) | Represents the difference between the closing sale price of our common stock on the Nasdaq Stock Market of $1.04 on November 30, 2005 and the exercise price of the options. |

| (2) | The respective Named Officers as of November 30, 2005 could not exercise these options and future exercisability is subject to certain vesting provisions including specific stock price thresholds and/or remaining in the employ of the Company for up to four additional years. |

Employment Agreements

The Company is not party to any employment agreements.

Long-Term Incentive Plans

The Company does not have any long-term incentive plans(as defined in the SEC rules and regulations).

Equity Compensation Plan Information

The following table sets forth certain information concerning common stock to be issued in connection with our equity compensation plans.

| | | | | | | |

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights (a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights (b)

| | Number of securities

remaining available

for issuance under

equity compensation

plans (excluding

securities reflected in

column (a)) (c)

|

Equity compensation plans approved by security holders | | 5,408,976 | | $ | 3.73 | | 762,716 |

Equity compensation plans not approved by security holders | | 603,000 | | $ | 1.625 | | None |

| | |

| |

|

| |

|

Total | | 6,011,976 | | $ | 3.52 | | 762,716 |

| | |

| | | | |

|

For a discussion of our equity compensation plans, See “Note 12 Stock Options” in the Notes to the Consolidated Financial Statements included in Part II, Item 8 of the Annual Report on Form 10-K for fiscal year ended November 30, 2005.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company receives certain engineering, development and consulting services from Rivertek Medical Systems, Inc., of which Dennis Hepp, former Chief Technology Officer of the Company, is a 100% beneficial owner. The Company paid $230,000, $259,000 and $269,000 to Rivertek for engineering services in fiscal 2005, 2004 and 2003, respectively. Amounts payable to Rivertek at November 30, 2005, 2004 and 2003 were $65,000, $145,000 and $77,000, respectively. Subsequent to fiscal year end, in December 2005, Dennis Hepp retired from service as CardioDynamics’ Chief Technology Officer.

INDEMNIFICATION AGREEMENTS

We have entered into indemnification agreements with each of our directors and officers. Such indemnification agreements require us to indemnify our directors and officers to the fullest extent permitted by California law.

15

PERFORMANCE GRAPH

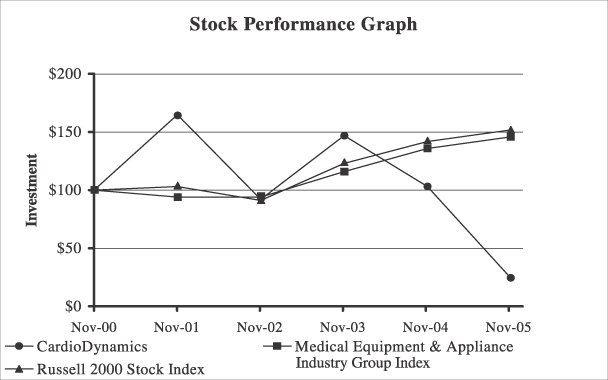

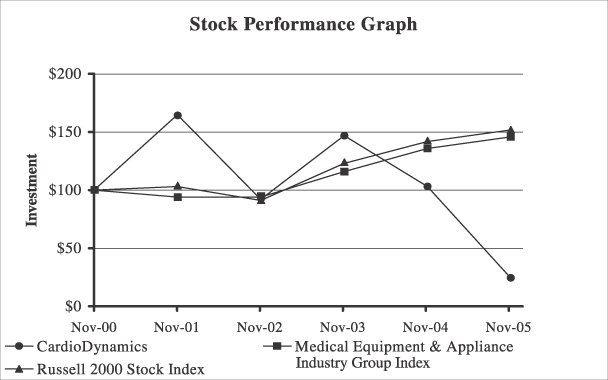

The following graph compares the five-year cumulative total return (assuming reinvestment of dividends) of an investment of $100 from November 30, 2000 to November 30, 2005 for: (i) our common stock, (ii) the Russell 2000 stock index and (iii) the Medical Equipment and Appliance Industry Group index. Our common stock has been included in both of these indices. The Russell 2000 is comprised of the smallest 2,000 companies in the Russell 3000 index, which contains the 3,000 largest United States companies, based on total market capitalization.

| | | | | | | | | | | | |

(In dollars)

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

|

CardioDynamics | | 100 | | 165 | | 92 | | 147 | | 103 | | 24 |

Medical Equipment & Appliance Group | | 100 | | 94 | | 94 | | 116 | | 136 | | 146 |

Russell 2000 Stock Index | | 100 | | 103 | | 91 | | 123 | | 142 | | 152 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file initial reports of ownership and changes in ownership with the SEC. These persons are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such reports furnished to us, we believe that each person who, at any time during the fiscal year ended November 30, 2005, was a director, officer, or beneficial owner of more than 10% of a class of registered equity securities of CardioDynamics, filed on a timely basis all reports required by Section 16(a) of the Securities Exchange Act.

16

AUDIT COMMITTEE REPORT

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to the Company’s financial reporting process, its systems of internal accounting and financial controls, and the independent audit of its financial statements. The Audit Committee consisted of three non-employee members. Each member of the Audit Committee is “independent” within the meaning of SEC rules and regulations and the listing standards of the National Association of Securities Dealers, and the Board has determined that Ms. Parshall qualifies as an audit committee financial expert within the meaning of SEC rules and regulations.

The Audit Committee has reviewed and discussed with management the Company’s audited financial statements for the fiscal year ended November 30, 2005, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. In addition, the Audit Committee has discussed with the Company’s Independent Registered Public Accounting Firm, the auditors’ independence from management and the Audit Committee including the matters in the written disclosures required by the Independence Standards Board and considered the compatibility of non-audit services with the auditors’ independence.

The Audit Committee has reviewed and discussed with Mayer Hoffman McCann P.C., the Company’s Independent Registered Public Accounting Firm who are responsible for expressing an opinion on the conformity of those audited financial statements in accordance with accounting principles generally accepted in the United States of America, their judgment as to the quality, not just the acceptability, of the Company’s accounting practices and such other matters as are required to be discussed by the independent accountants with the Audit Committee under generally accepted auditing standards including the matters required to be discussed by Statement on Auditing Standards No. 61. The Audit Committee has also received the written disclosures from Mayer Hoffman McCann P.C. required by Independence Standards Board Standard No. 1 and the Audit Committee has discussed the independence of Mayer Hoffman McCann P.C. with that firm. Based on the Audit Committee’s review and discussions noted above, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2005, for filing with the Securities and Exchange Commission.

Respectfully Submitted:

The Audit Committee

| | | | |

/s/ B. LYNNE PARSHALL

| | /s/ CONNIE R. CURRAN

| | /s/ RICHARD O. MARTIN

|

| B. Lynne Parshall, Chairman | | Connie R. Curran | | Richard O. Martin |

17

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Mayer Hoffman McCann P.C. to serve as our independent registered public accounting firm for the fiscal year ending November 30, 2005 and 2006. Prior to that, KPMG LLP audited our financial statements for the fiscal year ended November 30, 2004 and prior years.

Mayer Hoffman McCann P.C. has advised our Audit Committee that it is “independent” of us within the rules and guidelines of the SEC, the American Institute of Certified Public Accountants and the Independence Standards Board. A representative of Mayer Hoffman McCann P.C. is expected to be present at the Annual Meeting, will have an opportunity to make a statement if desired, and will be available to respond to appropriate questions.

The Board of Directors recommends a voteFOR the ratification of the appointment of Mayer Hoffman McCann P.C. as our independent registered public accounting firm for the fiscal year ended November 30, 2006.

Fees Billed For Services Rendered By Principal Registered Public Accounting Firm

The following tables present fees billed, or expected to be billed, as of the Form 10-K filing date for professional audit services rendered by both KPMG LLP and Mayer Hoffman McCann P.C. for the audit of the Company’s annual financial statements for the years ended November 30, 2005 and 2004 and fees for other services rendered by KPMG LLP and Mayer Hoffman McCann P.C. during those periods.

| | | | | | |

| | | 2005

| | 2004

|

KPMG LLP: | | | | | | |

Audit Fees | | $ | 17,150 | | $ | 892,031 |

Tax Fees | | | — | | | 7,500 |

All Other Fees | | | 7,424 | | | 77,440 |

| | |

|

| |

|

|

Total | | $ | 24,574 | | $ | 976,971 |

| | |

|

| |

|

|

| | |

| | | 2005

| | 2004

|

Mayer Hoffman McCann P.C.: | | | | | | |

Audit Fees | | $ | 1,140,000 | | | — |

Tax Fees | | | — | | | — |

All Other Fees | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 1,140,000 | | | — |

| | |

|

| |

|

|

Audit fees.Audit fees relate to services rendered in connection with the annual audit of the Company’s financial statements and internal controls, SAS 100 quarterly review of our financial statements, and fees for SEC registration statement services.

Tax Fees.Tax services consisted of fees for tax consultation and tax compliance services.

All Other Fees.Other fees consisted primarily of acquisition related services.

The Audit committee considers whether the provisions of these services is compatible with maintaining our outside auditor’s independence, and has determined such services for fiscal 2005 and 2004 were compatible. All of the services described above were approved by the Audit Committee pursuant to paragraph (c)(7)(ii)(C) of Rule 2-01 of Regulation S-X under the Exchange Act, to the extent that the rule was applicable during 2004 and 2005.

18

ANNUAL REPORT ON FORM 10-K

CardioDynamics will mail without charge, upon written request, to any shareholder a copy of the annual report on Form 10-K, including the financial statements, schedules and list of exhibits. Requests should be sent to CardioDynamics International Corporation, 6175 Nancy Ridge Drive, San Diego, California 92121, Attention: Shareholder Relations.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for shareholders and cost savings for companies.

This year, a number of brokers with account holders who are our shareholders will be “householding” our proxy materials. A single proxy statement will be delivered to multiple shareholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report on Form 10-K, please notify your broker, direct your written request to CardioDynamics International Corporation, Investor Relations, 6175 Nancy Ridge Drive, San Diego, California 92121, or contact Investor Relations at (800) 778-4825, ext. 1031. Shareholders who currently receive multiple copies of the proxy statement and/or annual report on Form 10-K at their address and would like to request “householding” of their communications should contact their broker.

OTHER MATTERS

The Board of Directors is not aware of any matter to be presented for action at the Annual Meeting other than the matters set forth in this Proxy Statement. Should any other matter requiring a vote of the shareholders arise, the persons named as proxy holders on the enclosed proxy card will vote the shares represented thereby in accordance with their best judgment in the interest of the CardioDynamics. Discretionary authority with respect to such other matters is granted by the execution of the enclosed proxy card.

| | | | |

| | | | | By Order of the Board of Directors |

| | |

| | | | |

|

Dated: June 12, 2006 | | | | Michael K. Perry Chief Executive Officer |

| | |

19

CARDIODYNAMICS INTERNATIONAL CORPORATION

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints James C. Gilstrap and Michael K. Perry, jointly and severally, as proxies, with full power of substitution, to vote all shares of stock which the undersigned is entitled to vote at the Annual Meeting of Shareholders of CardioDynamics International Corporation to be held on Thursday, July 20, 2006 or at any postponement or adjournment thereof, as specified below, and to vote in their discretion on such other business as may properly come before the Annual Meeting and any postponement or adjournment thereof.

The Board of Directors recommends a voteFOR Proposals 1 and 2. To vote in accordance with the Board of Directors recommendations just sign below, no boxes need to be checked.

1. Election of Directors:

Nominees:

| | | | |

| James C. Gilstrap | | Robert W. Keith | | Richard O. Martin |

| | |

| B. Lynne Parshall | | Michael K. Perry | | |

¨ VoteFORall nominees above (except as withheld in the space below)

¨ VoteWITHHELDfrom all nominees

Instruction: To withhold authority to vote for any individual nominee, check the box “Vote FOR” and write the nominee’s name for whom you wish to withhold your vote on the line below.

2. To ratify the appointment of Mayer Hoffman McCann P.C. as our independent registered public accounting firm for the fiscal year ending November 30, 2006.

| | | | |

| ¨ Vote FOR | | ¨ VoteAGAINST | | ¨ ABSTAIN |

Unless otherwise specified by the undersigned, this proxy will be voted FOR Proposals 1 and 2 and will be voted by the proxy holders at their discretion as to any other matters properly transacted at the Annual Meeting or any postponement or adjournment thereof. To vote in accordance with the Board of Directors recommendations just sign below, no boxes need to be checked.

|

| Dated: , 2006 |

|

|

| Signature of Shareholder |

|

|

| Printed Name of Shareholder |

|

|

| Title (if appropriate) |

|

Please sign exactly as name appears hereon. If signing as attorney, executor, administrator, trustee or guardian, please give full title as such, and, if signing for a corporation, give your title. When shares are in the names of more than one person, each should sign. |

CHECK HERE IF YOU PLAN TO ATTEND THE ANNUAL MEETING