UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

CARDIODYNAMICS INTERNATIONAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

PRELIMINARY COPY

CARDIODYNAMICS INTERNATIONAL CORPORATION

6175 Nancy Ridge Drive, Suite 300

San Diego, CA 92121

Dear Shareholder:

We cordially invite you to attend the 2007 Annual Meeting of Shareholders of CardioDynamics International Corporation, which will be held at our corporate headquarters located at 6175 Nancy Ridge Drive, Suite 300, San Diego, California 92121, on [ ], August [ ], 2007 at 9:00 a.m. local time.

The Notice of Annual Meeting of Shareholders and the Proxy Statement that follow describe the business to be conducted at the meeting. Our Annual Report on Form 10-K for fiscal 2006 is also enclosed.

The 2007 Annual Meeting of Shareholders will include a proposal regarding the sale of our wholly owned subsidiary, Vermed, Inc., to Medical Device Partners, Inc., a Vermont corporation recently organized by existing management of Vermed to facilitate the acquisition, as well as the election of directors, the ratification of the appointment of our independent registered public accounting firm and the postponement or adjournment of the Annual Meeting, if necessary. If the sale of Vermed is approved and completed, we will receive cash consideration at closing of approximately $8,000,000, subject to adjustment.

The Board of Directors has unanimously recommended that CardioDynamics’ shareholders vote “FOR” the sale of Vermed to Medical Device Partners and “FOR” each of the other proposals. The Board urges you to read this Proxy Statement carefully.

Thank you for your support and we look forward to seeing you at the Annual Meeting.

|

On behalf of the Board of Directors, |

|

| Michael K. Perry |

| Chief Executive Officer |

This proxy statement is dated July [ ], 2007 and is first being mailed to shareholders on or about July [ ], 2007.

YOUR VOTE IS IMPORTANT

Whether or not you expect to attend the Annual Meeting of Shareholders in person, you are urged to vote as promptly as possible to ensure your representation and presence of a quorum at the Annual Meeting. Your shares may be voted electronically on the internet, by telephone or by signing, dating and returning the enclosed proxy card. We urge you to do so now regardless of whether or not you plan to attend the meeting in person. No postage need be affixed if your proxy is mailed in the United States.

CARDIODYNAMICS INTERNATIONAL CORPORATION

6175 Nancy Ridge Drive, Suite 300

SAN DIEGO, CA 92121

NOTICEOF ANNUAL MEETINGOF SHAREHOLDERS

To be held August [ ], 2007

The 2007 Annual Meeting of Shareholders of CardioDynamics International Corporation, a California corporation (“CardioDynamics”), will be held at our corporate headquarters located at 6175 Nancy Ridge Drive, Suite 300, San Diego, California 92121, on [ ], August [ ], 2007 at 9:00 a.m. local time, to consider and act upon the following matters:

1. To approve the sale of all of the capital stock of our Vermed subsidiary to the management of that subsidiary, pursuant to a Stock Purchase Agreement dated June 25, 2007, all as more fully described in the accompanying Proxy Statement.

2. To elect a Board of Directors for the following year. The following persons have been nominated: James C. Gilstrap, Robert W. Keith, Richard O. Martin, B. Lynne Parshall, Michael K. Perry and Jay A. Warren.

3. To ratify the appointment of BDO Seidman, LLP as our independent registered public accounting firm for the fiscal year ending November 30, 2007.

4. To approve the postponement or adjournment of the Annual Meeting, if necessary, for the purpose, among others, of soliciting additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting to approve the proposed sale of Vermed.

5. To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

Shareholders of record at the close of business on July [ ], 2007 are entitled to notice of, and to vote at, the Annual Meeting of Shareholders and any adjournments or postponements thereof.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the meeting in person, please vote your shares in any one of the manners outlined on the proxy card. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the meeting will be counted. The prompt return of your proxy will assist us in preparing for the Annual Meeting.

| | |

| | | By Order of the Board of Directors, |

| |

| San Diego, California | | Michael K. Perry |

| Dated: July [ ], 2007 | | Chief Executive Officer |

TABLE OF CONTENTS

(i)

(ii)

SUMMARY

This Summary highlights selected information from this Proxy Statement and may not contain all of the information that is important to you. Accordingly, we encourage you to read carefully this entire Proxy Statement, its appendices and the documents referred to or incorporated by reference in this Proxy Statement. You may obtain the information incorporated by reference into this proxy statement without charge by following the instructions in the section entitled “Where You Can Find More Information.”

In this proxy statement, the terms “we,” “us,” “our,” “CardioDynamics” and “the Company” refer to CardioDynamics International Corporation. We refer to our wholly owned subsidiary Vermed, Inc., as “Vermed.” We refer to Medical Device Partners, Inc. as “Medical Device Partners” or “Buyer.”

The Annual Meeting of Shareholders

Date, Time and Place. The Annual Meeting of shareholders will be held on August [ ], 2007, at 9:00 a.m. local time, at the Company’s headquarters located at 6175 Nancy Ridge Drive, Suite 300, San Diego, California 92121.

Purpose of the Annual Meeting. At the Annual Meeting, we will ask you to approve the sale of all of the capital stock of our Vermed subsidiary to Buyer for cash consideration at Closing of $8,000,000, subject to certain pre-Closing and post-Closing adjustments. We will also ask you to approve a proposal to postpone or adjourn the Annual Meeting, if necessary, for the purpose, among others, of soliciting additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve the sale of Vermed. We will also ask you to elect six directors to our Board of Directors and to ratify the selection of BDO Seidman, LLP as our independent registered public accounting firm for the fiscal year ending November 30, 2007.

Record Date; Stock Entitled to Vote. You are entitled to vote at the Annual Meeting if you owned shares of our common stock at the close of business on July [ ], 2007, the record date for the Annual Meeting. You will have one vote at the Annual Meeting for each share of our common stock you owned at the close of business on the record date. In voting for directors, you may have the right to cumulate your votes, as further described in this Proxy Statement. As of the record date, there were [ ] shares of our common stock entitled to be voted at the Annual Meeting.

Quorum. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our common stock is necessary to establish a quorum for the Annual Meeting. On July [ ], 2007, the record date, there were [ ] shares of the Company’s common stock outstanding. Shares present, in person or by proxy, including shares as to which authority to vote on any proposal is withheld, shares abstaining as to any proposal, and broker non-votes (where a broker submits a properly executed proxy but does not have authority to vote a customer’s shares) on any proposal will be considered present at the meeting for purposes of establishing a quorum for the meeting.

Vote Required. Assuming a quorum is present, the affirmative vote of a majority of the outstanding shares of our common stock is required to approve the sale of all of the capital stock of Vermed. A plurality of the votes cast (the six directors receiving the most votes) is required to elect each director. The affirmative vote of the majority of the votes cast is required to ratify the selection of BDO Seidman, LLP as our independent registered public accounting firm and to postpone or adjourn the Annual Meeting, if necessary, to solicit additional votes to approve the sale of Vermed.

1

Proposal 1 to Approve the Sale of Vermed

The following is a brief summary of Proposal 1, the sale of our Vermed subsidiary to Buyer for cash consideration at Closing of $8,000,000, subject to certain pre-Closing and post-Closing adjustments.

| | • | | The Companies (page 11) |

Seller.The Seller is CardioDynamics, a California corporation. We have three subsidiaries, Vermed and two German companies, CardioDynamics Management, GmbH, and Medis Medizinische Messtechnik, GmbH. We are the innovator and leader of an important medical technology called impedance cardiography (“ICG”). We develop, manufacture and market noninvasive ICG diagnostic and monitoring devices, proprietary ICG sensors and a broad array of medical device electrodes. We were incorporated in June 1980 and our Internet address is www.cdic.com.

Vermed, Inc. We are proposing to sell all of the outstanding capital stock of our wholly owned subsidiary, Vermed, a Delaware corporation. Vermed is a manufacturer of sensors used by physicians using our ICG technology as well as electrodes and related supplies used in electrocardiograms (“ECG”) and other diagnostic procedures for cardiology, electrotherapy, sleep testing, neurology and general purpose diagnostic testing.

Buyer.The Buyer is Medical Device Partners, a Vermont corporation that was formed in June 2007 by the management of Vermed for the purpose of acquiring from us all of the outstanding shares of capital stock of Vermed.

| | • | | The Proposal (pages 11-31). |

We are asking our shareholder to consider and vote to approve the sale of all of the outstanding capital stock of Vermed pursuant to the terms of a Stock Purchase Agreement dated June 25, 2007 between CardioDynamics and Buyer (the “Stock Purchase Agreement”). The full text of the Stock Purchase Agreement is attached asAppendix A to this Proxy Statement.We urge you to read the Stock Purchase Agreement carefully and in its entirety. If the sale of Vermed is approved by our shareholders and the transaction closes as contemplated, we will receive cash consideration at Closing of approximately $8,000,000, subject to certain pre-Closing and post-Closing adjustments as further described in this Proxy Statement.Our Board of Directors unanimously determined that the sale of Vermed to Buyer is in the best interests of CardioDynamics and our shareholders, and recommends that our shareholders vote “FOR” the approval of the sale of Vermed pursuant to the Stock Purchase Agreement.

| | • | | Our Plans Following Completion of the Sale of Vermed (page 15). |

We plan to utilize the cash proceeds from the sale of Vermed of approximately $8,000,000, as may be adjusted, to meet our existing obligations and for working capital to finance the continued development of our core ICG business. Following the sale, we intend to focus on our ICG core business and will no longer operate in the ECG segment. We do not intend to distribute any of the cash proceeds from the sale to our shareholders. The sale of Vermed will not alter the rights, preferences or privileges of our common stock.

| | • | | Opinion of Cain Brothers Relating to the Sale of Vermed (pages 15-21). |

In deciding whether to approve the sale of Vermed, our Board of Directors also obtained and considered the opinion of CardioDynamics’ financial advisor, Cain Brothers & Company LLC (“Cain Brothers”) that, as of the date of the opinion and subject to the assumptions, limitations and

2

qualifications contained in the opinion, the $8,000,000 cash consideration that we would receive in connection with the sale of all of the capital stock of Vermed to Buyer pursuant to the Stock Purchase Agreement (before any adjustments) was fair to CardioDynamics from a financial point of view. The full text of this opinion is attached asAppendix B to this Proxy Statement.We urge you to read the opinion of Cain Brothers carefully and in its entirety. The opinion was provided for the information and assistance of our Board in connection with the Board’s consideration of the sale of Vermed to Buyer pursuant to the Stock Purchase Agreement. The opinion does not constitute a recommendation to any shareholder as to how such shareholder should vote or act with respect to any matter relating to the proposed sale of Vermed.

| | • | | Interests of Certain Persons in the Sale of Vermed (page 21). |

In considering the recommendation of our Board with respect to the sale of Vermed to Buyer, you should be aware that one of our executive officers and certain employees may have interests in the sale of Vermed that are different from, or are in addition to, the interests of CardioDynamics and our shareholders generally. These interests may conflict with the interests of our shareholders. Among other persons, Rich Kalich, President of Vermed and currently an executive officer of CardioDynamics, is a principal owner and manager of Buyer.

| | • | | Material Accounting Treatment of the Sale of Vermed (page 30). |

We expect to account for the sale of Vermed as a sale of an investment in our wholly owned subsidiary, in accordance with accounting principles generally accepted in the United States. We expect to recognize a loss in the amount of the difference between the sale price and the book value of our investment in Vermed in the second quarter ended May 31, 2007.

| | • | | Material Federal Income Tax Consequences (page 30). |

We do not anticipate that the sale of Vermed will cause us to incur any U.S. federal income tax liability. Additionally, our shareholders will not have any taxable gain or loss as a result of the sale of Vermed. For federal income tax purposes, as of November 30, 2006, we had net operating loss carryforwards of approximately $33,600,000 available to offset future taxable income, which begin to expire in 2011. We do not anticipate having to utilize any of our net operating loss carryforwards, or becoming subject to any limitation on our ability to utilize our net operating loss carryforwards, as a result of the sale of Vermed. Our utilization of net operating loss carryforwards will, however, be subject to certain other limitations under the Internal Revenue Code.

| | • | | Guaranty of Break-up Fee (page 30). |

Rich Kalich, President of Vermed and currently an executive officer of CardioDynamics, is also a principal owner and manager of Buyer. Mr. Kalich has agreed to unconditionally guarantee the Buyer’s obligation to timely pay a $125,000 break-up fee to CardioDynamics under the Stock Purchase Agreement if the agreement is terminated under certain circumstances.

| | • | | Regulatory Approvals (page 30). |

Except for providing this Proxy Statement, the sale of Vermed is not subject to any federal or state regulatory requirements that must be complied with or approval that must be obtained. As a condition to Closing, CardioDynamics must obtain from the Vermont Economic Development Authority the termination of that certain Guaranty, dated January 19, 2005, and any other related agreements by or

3

involving CardioDynamics in favor of or for the benefit of the Vermont Economic Development Authority.

| | • | | Dissenters’ Rights in Connection with the Sale of Vermed (page 30). |

Our shareholders will not be entitled to dissenters’ rights in connection with, or as a result of, the proposed sale of all of the capital stock of our Vermed subsidiary.

| | • | | Anticipated Closing of the Sale of Vermed (pages 27-31). |

We intend to complete the sale of all of the capital stock of Vermed after all of the conditions to the Stock Purchase Agreement are satisfied or waived, including approval by our shareholders. We currently expect the transaction to be completed shortly following the Annual Meeting of shareholders and by the end of August 2007.

| | • | | Board of Directors Recommendation (page 31). |

Our Board of Directors believes that the terms of the proposed sale of Vermed to Buyer is fair to and in the best interest of CardioDynamics and our shareholders, and has unanimously voted to approve the terms of the Stock Purchase Agreement and the transactions contemplated thereby.Our Board unanimously recommends that you vote “FOR” the sale of all of the capital stock of Vermed pursuant to the Stock Purchase Agreement.

4

CARDIODYNAMICSINTERNATIONAL CORPORATION

PROXY STATEMENT FORTHE

2007 ANNUAL MEETINGOF SHAREHOLDERS

QUESTIONS AND ANSWERS

ABOUT THE ANNUAL MEETING AND THE SALE OF VERMED

| Q: | Who is soliciting my proxy? |

| A: | The Board of Directors of CardioDynamics. |

| Q: | Where and when is the Annual Meeting of Shareholders? |

| A: | The Annual Meeting of Shareholders of CardioDynamics will be held at our corporate offices located at 6175 Nancy Ridge Drive, Suite 300, San Diego, California 92121, on August [__], 2007 at 9:00 a.m. local time. |

| Q: | Who can vote at the Annual Meeting? |

| A: | All shareholders of record at the close of business on July [ ], 2007, the record date for the Annual Meeting, will be entitled to notice of and to vote at the Annual Meeting. If on that date, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are a shareholder of record. As a shareholder of record, you may vote in person at the meeting or vote by proxy. If on that date, your shares were held in an account at a brokerage firm, bank, dealer or similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent. As of the close of business on the record date, [ ] shares of our common stock were outstanding. |

| Q: | What constitutes a quorum for the meeting? |

| A: | A quorum is required for shareholders to conduct business at the Annual Meeting. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our common stock is necessary to establish a quorum at the meeting. On the record date, July [ ], 2007, there were [ ] shares of our common stock outstanding. Shares present, in person or by proxy, including shares as to which authority to vote on any proposal is withheld, shares abstaining as to any proposal, and broker non-votes (where a broker submits a properly executed proxy but does not have authority to vote a customer’s shares) on any proposal will be considered present at the meeting for purposes of establishing a quorum for the transaction of business at the meeting. Each of these categories will be tabulated separately. |

| A: | You are voting on the following proposals: |

1. To approve the sale of all of the capital stock of our Vermed subsidiary to Buyer, a company newly formed by existing management of that subsidiary, pursuant to the terms of a Stock Purchase Agreement dated June 25, 2007, for a purchase price of $8,000,000, subject to adjustment, to be received by CardioDynamics at the Closing of the transaction.

2. To elect six directors to our Board of Directors for the following year.

5

3. To ratify the appointment of BDO Seidman, LLP as our independent registered public accounting firm for the fiscal year ending November 30, 2007.

4. To approve a postponement or adjournment of the Annual Meeting, if necessary, for the purpose, among others, of soliciting additional proxies if there are not sufficient votes at the Annual meeting to approve the sale of Vermed.

| Q: | How many votes do I have and how are votes counted? |

| A: | Each share of our common stock is entitled to one vote on matters brought before the Annual Meeting. In voting for directors, each shareholder may have the right to cumulate his or her votes and give one nominee a number of votes equal to the number of directors to be elected, multiplied by the number of shares he or she holds, or to distribute his or her votes on the same principle among the nominees to be elected in such manner as he or she may see fit. For example, in the event of cumulative voting a shareholder owning ten shares of common stock would have 60 votes (six directors to be elected multiplied by ten shares) to allocate among as few as one, or as many as six candidates. A shareholder may cumulate his or her votes, however, only if his or her candidate or candidates have been placed in nomination prior to the voting and if any shareholder has given notice at the Annual Meeting prior to the voting of that shareholder’s intention to cumulate his or her votes. |

The shares represented by the proxy will be voted at the Annual Meeting by the proxy holder as specified by the person solicited. Discretionary authority to cumulate votes is, however, being solicited by the Board of Directors.

| Q: | My shares are held in the “street name.” Will my broker vote my shares? |

| A: | If you hold your shares in “street name,” your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. If you do not give your broker or nominee specific instructions on such a matter, your shares may not be voted. Shares of common stock represented by “broker non-votes” will, however, be counted in determining whether there is a quorum. If you do not instruct your broker on how to vote, because the vote required is based upon the total number of shares of our common stock outstanding on the record date, and not just the shares that are voted, this will have the same effect as a vote against Proposal 1 to approve the sale of Vermed. |

| Q: | How are “WITHHELD” and “ABSTAIN” votes counted? |

| A: | California statutes and case law do not provide specific instructions regarding the treatment of abstentions; therefore, we believe that shares that are voted “WITHHELD” or “ABSTAIN” in person or by proxy should be treated as present for purposes of determining whether or not a quorum is present at the Annual Meeting and entitled to vote on a particular matter. A “WITHHELD” or “ABSTAIN” vote is the same as voting against a proposal that has a required affirmative voting threshold, such as Proposal 1, but would have no effect on Proposal 2, the election of directors, who are elected by a plurality of votes, and no effect on Proposals 3 and 4. |

| Q: | What vote is required to approve each item? |

| A: | Sale of Vermed. With respect to Proposal 1, the affirmative vote of holders of a majority of our outstanding shares of common stock as of the close of business on the record date is required to approve the sale of our Vermed subsidiary pursuant to the Stock Purchase Agreement. |

Election of Directors. With respect to Proposal 2, a plurality of the votes cast at the Annual Meeting (which means the six nominees receiving the most votes) will be required to elect each nominee to the Board of Directors.

Ratify Independent Registered Public Accounting Firm. With respect to Proposal 3, the affirmative vote of a majority of the votes cast at the Annual Meeting is required to ratify the appointment of BDO Seidman, LLP as our independent registered public accounting firm.

6

Postpone or adjourn the Annual Meeting. With respect to Proposal 4, the affirmative vote of a majority of the votes cast at the Annual Meeting, even if less than a quorum, is required to approve the proposal to postpone or adjourn the meeting, if necessary, for the purpose, among others, of soliciting additional proxies.

| Q: | What will happen if the sale of Vermed is approved by our shareholders? |

| A: | If the sale of Vermed is approved by our shareholders, we will sell our investment in Vermed to Buyer pursuant to the terms and conditions of the Stock Purchase Agreement, as more fully described in this Proxy Statement. Following the sale of Vermed, we will still retain our core ICG business, and we will have the cash proceeds from the sale of Vermed. |

| Q: | Why is CardioDynamics selling its Vermed subsidiary? |

| A. | As described in greater detail in this Proxy Statement, our Board of Directors believes that it is in the best interests of CardioDynamics and our shareholders to sell Vermed because of its declining gross profit margin, which, coupled with increases to its operating expenses resulting from public company costs, has led to a decline in EBITDA margins. The Board believes it would be better for us to deploy the cash into our ICG business, where the Board considers growth and valuation prospects are more attractive. |

| Q: | Does the Board believe that CardioDynamics is receiving fair value for its investment in Vermed? |

| A: | The purchase price for the proposed sale of Vermed to Buyer was negotiated between representatives of CardioDynamics and representatives of Buyer. Our Board of Directors believes that the consideration to be received from Buyer for the sale of Vermed is in the best interests of CardioDynamics and our shareholders, and that belief is based on a variety of factors that are further described in this Proxy Statement. In addition, in making its determination, our Board received a fairness opinion from Cain Brothers, a full-service investment bank and registered broker-dealer specializing in institutional distribution, that the cash consideration (before adjustments) is fair to CardioDynamics from a financial point of view. Cain Brothers’ opinion was rendered solely to our Board for its consideration in determining to approve the Stock Purchase Agreement. Cain Brothers did not opine on the terms of the transaction apart from the unadjusted purchase price or on the business decision to approve the Stock Purchase Agreement and its opinion does not constitute a recommendation to any shareholder as to how such shareholder should vote or act with respect to any matter relating to the proposed sale of Vermed. A copy of the opinion of Cain Brothers is attached asAppendix B to this Proxy Statement. |

| Q: | How will CardioDynamics use the money received from the sale of Vermed? |

| A: | We intend to use the proceeds from the sale of Vermed for working capital to fund the continued development of our core ICG business, as well as to continue to meet our ongoing obligations incurred in connection with our normal operations such as facilities lease obligations. Additionally, we intend to retire our revolving line of credit and bank term loan. |

| Q: | When is the sale of Vermed expected to be completed? |

| A: | If the sale of Vermed is approved at the Annual Meeting, we expect to complete the sale to Buyer as soon as practicable after all of the conditions in the Stock Purchase Agreement have been satisfied or waived. The parties are working toward satisfying the conditions to Closing and completing the sale of Vermed as soon as reasonably practicable. We expect to be able to complete the sale of Vermed by the end of August 2007. |

| Q: | What will happen to my CardioDynamics shares if the sale of Vermed is approved? |

| A: | The sale of Vermed will not alter the rights, preferences or privileges of our outstanding common stock. A CardioDynamics shareholder who owns shares of our stock immediately prior to the Closing of the sale of Vermed will continue to hold the same number of shares of CardioDynamics common stock immediately |

7

| | following the Closing. We do not intend to distribute to our shareholders any of the cash proceeds we expect to receive from the sale of Vermed. Rather, we intend to use the proceeds from the transaction, along with our existing cash and cash equivalents, in connection with returning our core business to profitability and in our future business plans. |

| Q: | Will shareholders have dissenters’ rights? |

| A: | No. Under California law, which is our state of incorporation, holders of our common stock do not have rights to dissent from the proposed sale of the outstanding capital stock of Vermed and obtain an appraisal of the fair value of their CardioDynamics shares. |

| Q: | How does the Board of Directors recommend that I vote on the proposals? |

| A: | The Board of Directors recommends that you vote “FOR” (1) the proposal to approve the sale of all of the outstanding capital stock of Vermed pursuant to the Stock Purchase Agreement, (2) the election of the six nominees to our Board of Directors, (3) the ratification of the appointment of BDO Seidman, LLP as our independent registered public accounting firm for the fiscal year ending November 30, 2007, and (4) the proposal to approve a postponement or adjournment of the Annual Meeting, if necessary, for the purpose, among others, of soliciting additional proxies if there are not sufficient votes at the Annual meeting to approve the sale of Vermed. |

| A: | Carefully read this document and indicate on the proxy card how you want to vote. Sign, date and mail your proxy card in the enclosed prepaid return envelope as soon as possible, or vote electronically on the internet or by telephone. You should indicate your vote now even if you expect to attend the Annual Meeting and vote in person. Indicating your vote now will not prevent you from later canceling or revoking your proxy, right up to the day of the Annual Meeting, and will ensure that your shares are voted if you later find you cannot attend the Annual Meeting. If you do not vote, this will have the same effect as a vote against the sale of Vermed. |

| Q: | Can I change my vote after I have mailed my signed proxy card? |

| A: | Yes. You can change your vote in one of three ways, at any time before your proxy is voted at the Annual Meeting, by (i) revoking your proxy by written notice to our Corporate Secretary stating that you would like to revoke your proxy, (ii) completing and submitting a new proxy card bearing a later date, or (iii) attending the Annual Meeting and voting in person. |

| Q: | Who will bear the cost of this solicitation? |

| A: | We will pay for the cost of soliciting proxies and may reimburse brokerage firms and others for their expenses in forwarding solicitation material. Solicitation will be made primarily through the use of the mail but our regular employees may, without additional compensation, solicit proxies personally by telephone or fax. We have retained [ ] to assist us in soliciting proxies. We will pay the fees of [ ], which we expect to be approximately $[ ] plus the reimbursement of expenses. |

| Q: | Whom should I contact with questions? |

| A: | If you have any questions regarding the sale of Vermed, you may contact Rhonda Rhyne, the Company’s President, at CardioDynamics International Corporation, 6175 Nancy Ridge Drive, Suite 300, San Diego, CA 92121, or call (858) 535-0202. If you need additional copies of this Proxy Statement or the enclosed proxy card, or if you have other questions about the proposals or how to vote your shares, you may contact our proxy solicitor, [ ], by telephone at [( ) - ] (toll free). |

8

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include statements regarding our plans, goals, strategies, intent, beliefs or current expectations. These statements are expressed in good faith and based upon reasonable assumptions when made, but there can be no assurance that these expectations will be achieved or accomplished. Sentences in this document containing verbs such as “believe”, “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions (“will,” “may,” “could,” “should,” etc.) constitute forward-looking statements that involve risks and uncertainties. Items contemplating or making assumptions about actual or potential future business plans, sales, market size, collaborations, trends or operating results also constitute such forward-looking statements. These statements are only predictions and actual results could differ materially. Certain factors that might cause such a difference are discussed throughout the reports we file with the SEC, including our Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date we made the statement, and we do not undertake to update the disclosures contained in this document or reflect events or circumstances that occur subsequently or the occurrence of unanticipated events.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended. We file reports, proxy statements and other information with the SEC. You may read and copy these reports, proxy statements and other information at the SEC’s Public Reference Section at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website, located at www.sec.gov, that contains reports, proxy statements and other information regarding companies and individuals that file electronically with the SEC.

The information contained in this Proxy Statement speaks only as of the date indicated on the cover of this proxy statement unless the information specifically indicates that another date applies.

The SEC allows us to “incorporate by reference” information into this proxy statement. This means that we can disclose important information by referring to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this proxy statement. This Proxy Statement and the information that we later file with the SEC may update and supersede the information incorporated by reference. Similarly, the information that we later file with the SEC may update and supersede the information in this Proxy Statement. We also incorporate by reference into this Proxy Statement the following documents filed by us with the SEC under the Exchange Act:

| | • | | our Annual Report on Form 10-K for the year ended November 30, 2006; |

| | • | | our Quarterly Reports on Form 10-Q for the quarters ended February 28, 2007; and |

| | • | | our Current Reports on Form 8-K filed on March 6, 13 and 23, April 10 and 23, and June 1, 14 and 26, 2007. |

We undertake to provide without charge to each person to whom a copy of this Proxy Statement has been delivered, upon request, by first class mail or other equally prompt means, within one business day of receipt of the request, a copy of any or all of the documents incorporated by reference into this Proxy Statement, other than the exhibits to these documents, unless the exhibits are specifically incorporated by reference into the information that this Proxy Statement incorporates.

Requests for copies of our filings should be directed to CardioDynamics International Corporation, 6175 Nancy Ridge Drive, Suite 300 San Diego, California 92121, Attention: Corporate Secretary, and should be made by August [ ], 2007 in order to receive them before the special meeting.

9

Shareholders should not rely on information other than that contained or incorporated by reference in this Proxy Statement. We have not authorized anyone to provide information that is different from that contained in this Proxy Statement. This Proxy Statement is dated July [ ], 2007. No assumption should be made that the information contained in this Proxy Statement is accurate as of any date other than that date, and the mailing of this Proxy Statement will not create any implication to the contrary.

If you have questions about after reading this Proxy Statement, you may contact CardioDynamics International Corporation, 6175 Nancy Ridge Drive, Suite 300, San Diego, CA 92121, or call (858) 535-0202. If you need additional copies of this Proxy Statement or the enclosed proxy card, or if you have questions about the proposals or how to vote your shares, you may also contact our proxy solicitor, [ ], by telephone at [( ) - ] (toll free).

10

PROPOSAL 1

APPROVAL OF SALE OF VERMED

The following information describes the material aspects of the proposed sale by CardioDynamics of all of the outstanding shares of capital stock (the “Shares”) of Vermed, our wholly owned subsidiary, to Medical Device Partners, as the Buyer. This description does not purport to be complete and is qualified in its entirety by reference to the appendices to this Proxy Statement, including the Stock Purchase Agreement. You are urged to carefully read the appendices in their entirety.

Pursuant to the Stock Purchase Agreement dated June 25, 2007 between CardioDynamics and the Buyer, CardioDynamics will sell to the Buyer all of the Shares of capital stock of Vermed for eight million dollars ($8,000,000) in cash at Closing, subject to certain pre-Closing and post-Closing adjustments to the purchase price as described below. The Stock Purchase Agreement is attached to this Proxy Statement asAppendix A.We urge you to read the Stock Purchase Agreement carefully and in its entirety.

Rich Kalich, President of Vermed and an executive officer of CardioDynamics, is a principal owner and manager of the Buyer. In addition, other members of Vermed’s management are investors in and/or managers of Buyer. The sale of all of the outstanding capital stock of Vermed will not result in any material change in the rights of holders of common stock of CardioDynamics.

The Board of Directors of CardioDynamics has determined that the sale of Vermed is advisable and in the best interest of CardioDynamics and our shareholders, and the Board approved the sale of Vermed and the Stock Purchase Agreement on June 25, 2007. Our Board of Directors has determined that it would be prudent to seek shareholder approval of the sale of Vermed and it is a condition to Closing under the Stock Purchase Agreement that a majority of the outstanding shares of our common stock shall have approved the sale of Vermed pursuant to the Stock Purchase Agreement.

The Companies

In addition to CardioDynamics, the other parties to the transaction are Vermed and Medical Device Partners.

Vermed, Inc. Vermed, our wholly owned subsidiary located in Bellows Falls, Vermont, is a manufacturer of sensors used by clinicians using our ICG technology as well as electrodes and related supplies used in electrocardiograms (“ECG”) and other diagnostic procedures for cardiology, electrotherapy, sleep testing, neurology and general purpose diagnostic testing. We acquired Vermed in March 2004 from Vermont Medical, Inc.

Medical Device Partners, Inc.The Buyer is a Vermont corporation that was formed in June 2007 by the management of Vermed for the purpose of acquiring from us all of the outstanding shares of capital stock of Vermed. The Buyer does not currently, and has never, engaged in any business or other operations. The Buyer’s principal corporate offices are located at 9 Lovell Drive, Bellows Falls, Vermont 05101-1556, and its telephone number is (802) 463-9976.

Reasons for the Proposed Sale of Vermed

Our Board of Directors considered a number of factors in evaluating the potential sale of Vermed and the Stock Purchase Agreement. In addition, our Board consulted with management, as well as our legal counsel and financial advisor. Discussed below are the primary reasons our Board considered in determining to approve the sale of Vermed pursuant to the Stock Purchase Agreement.

Over the time period from 1998 to 2003, our revenues grew rapidly from $2 million to $30 million and we achieved consistent growth in profitability and operating cash flow from 2001 to 2003. In January, 2004, the Centers for Medicare and Medicaid Services (CMS) issued a policy change for ICG technology which restricted

11

reimbursement for the hypertension (high blood pressure) use of our technology. During the following three years our ICG business performance declined significantly due to reduced instrument sales and sensor utilization resulting from the Medicare policy restriction. We believe proceeds provided from the sale of Vermed will provide funding for necessary strategic investments to return the ICG business to revenue growth and profitability.

Vermed has made solid contributions to CardioDynamics’ overall operations during our ownership of the Vermed business. However, despite the positive contributions, there has also been deterioration in Vermed’s operating results during this time. We have experienced erosion in Vermed’s gross margin from approximately 39.3% in 2004 to an estimated 29.6% in 2007.

This decline is due to two primary factors: First, we have experienced significant increases in several key commodity costs including silver, copper and petroleum based products such as the foam used in our sensors. Each of these commodities has more than doubled during this period of time. Secondly, additional Group Purchasing Organization and OEM business (including Premier, McKesson, Cardinal, and Physician Sales and Service) obtained has been under a great deal of price pressure and has further contributed to the lower gross margins.

These declines in gross profit margin, coupled with increases to operating expenses resulting from Sarbanes-Oxley legislation and other public company costs has led to a decline in Vermed’s EBITDA margins from 23.6% in 2004 to an estimated 9.9% in 2007.

We concluded that these forces will likely continue to face the Vermed business in the years ahead and it would be better for us to deploy the cash into the ICG business where we consider the growth and valuation prospects to be considerably more attractive looking out over the next three to five years.

In evaluating the proposed transaction, our Board of Directors was aware of the following:

| | • | | the book value of Vermed’s assets constitutes 44% and 43% of the consolidated total tangible assets (which excludes the substantial goodwill component of book value attributable to the recently-acquired Vermed assets and operations) of CardioDynamics for the fiscal years ended November 30, 2006 and 2005, respectively; |

| | • | | the book value of Vermed’s assets constitutes 54% and 49% of the consolidated total assets of CardioDynamics for the 2006 and 2005 fiscal years, respectively; |

| | • | | the net external sales of Vermed constitute 35% and 25% of the total consolidated net external sales of CardioDynamics for the 2006 and 2005 fiscal years, respectively; |

| | • | | the gross margin as a percentage of sales for the ECG segment of 35% and 39% for the 2006 and 2005 fiscal years, respectively, is lower than the gross margin for the ICG segment of 62% and 65%; |

| | • | | Vermed was acquired just over three years ago for $16.5 million and we are now selling our investment in Vermed at a significant loss compared to the original purchase price; |

| | • | | CardioDynamics has been since its organization and will continue after the sale of Vermed to be predominantly a company dedicated to developing its ICG technology; |

| | • | | Vermed’s ECG business has been a separate reporting segment from our ICG business; |

| | • | | the disposition of Vermed would not deprive CardioDynamics of its historical and primary business as an ICG company, nor the means by which CardioDynamics may remain a viable entity, and will allow CardioDynamics to focus on returning its core business to profitability. |

12

Background for the Proposed Sale of Vermed

Over the time period from 1998 to 2003, our revenues grew rapidly from $2 million to $30 million and we achieved consistent growth in profitability and operating cash flow from 2001 to 2003. Our business at the time was solely focused and dependant upon sales of ICG instruments and sensors, with 90% of sales occurring in the United States and 88% of those sales made to physician office customers who were heavily reliant upon Medicare and private insurance reimbursement in order to make investments in new technologies such as ours.

Having achieved a market capitalization in excess of $250 million in late 2003, we felt it important to look for businesses that we could acquire to help diversify the revenue sources for the company, improve our technological capabilities, and/or improve the cost structure of our business.

We acquired Vermed in March 2004 to add an additional product line (ECG electrodes) to the company and also to manufacture our proprietary ICG sensors at a price approximately 30% lower than we were paying to our sensor supplier at the time. Additionally, we acquired Medis Medizinische Messtechnik, GmbH in June 2004 to strengthen our European presence and add additional intellectual property as well as technology development capability in our ICG business.

In January 2004, the Centers for Medicare and Medicaid Services (CMS) issued a policy change for ICG technology which restricted reimbursement for the hypertension use of our technology. During the following three years our ICG business performance declined significantly due to reduced instrument sales and sensor utilization resulting from the Medicare policy restriction.

ICG Business Results

| | | | | | | | | | | |

| | | 2004 | | 2005 | | | 2006 | |

Revenue | | $ | 34,260 | | $ | 27,686 | | | $ | 19,783 | |

Gross Profit | | | 26,664 | | | 18,043 | | | | 12,297 | |

Operating Income (loss) | | | 1,655 | | | (5,104 | ) | | | (7,708 | ) |

In an effort to reduce ICG business operating expenses to maintain a balance with the reduced revenue levels, we initiated two employee restructurings (the first in June 2005, and the second in March 2006) which, along with natural attrition, reduced our ICG workforce by 37%, or 65 employees. In order to stem slowing purchases of our products, we lowered prices to enhance customer return on investment to offset some of the CMS reimbursement effect. Additionally, we made changes to our sales and marketing focus, structure and strategies during this time in an effort to return growth to the ICG business. These efforts were not enough to overcome declining customer interest in our technology caused by the reimbursement policy restriction.

In light of the deterioration in ICG business performance and the continued reduction in our cash balances, in late 2005, management and the Board of Directors began exploring various strategic alternatives to maximize shareholder value and enhance market adoption for ICG technology. These included a number of alternatives including a potential sale of the entire company or any of its constituent parts, acquisition of additional sources of debt or equity capital, or acquiring smaller businesses and/or product lines whose products could be readily sold by our existing physician office sales force. None of these alternatives resulted in a strategic transaction.

In February, 2006, CMS opened a reconsideration process for ICG technology to determine if our newly published clinical evidence (the CONTROL clinical trial results) would warrant an expansion of hypertension coverage. In April 2006, we completed the sale of $5.25 million of subordinated convertible debt to our largest institutional shareholder in an effort to help fund the return of the business to profitability, which we anticipated would occur rather quickly once the CMS hypertension reimbursement policy restrictions were reduced.

However, after extensive efforts from our management team, our clinical consultants, reimbursement lobbyists and numerous discussions with congressional staff members, CMS issued its draft decision in August

13

2006 which maintained its current restrictive policy for reimbursement of hypertensive use of ICG technology. Our request for expanded coverage was denied and more clinical evidence requiring future clinical trials was requested from CMS.

We continued strategic discussions amongst management and the Board during the summer of 2006, and at the October 17, 2006 Board meeting, management was instructed to aggressively pursue a strategic transaction. Management met with Cain Brothers following the October 2006 Board meeting to discuss various strategic alternatives and to begin identifying potential parties to contact regarding a possible strategic transaction involving the Company.

During November and December 2006, Cain Brothers and CardioDynamics developed a list of potential buyers for the Company and/or Vermed and prepared a Confidential Information Memorandum and other marketing materials that were disseminated to potential purchasers.

Cain Brothers had discussions with a number of third parties in January and February 2007, which ultimately resulted in two companies providing indications of interest for Vermed in March 2007 at potential prices far greater than the amount ultimately negotiated with Buyer. Both companies participated in one-day due diligence sessions at Vermed’s facility in Bellows Falls, Vermont, in late March. During April, various discussions occurred with both parties and ultimately, neither company chose to move forward with a possible purchase of Vermed. One such interested party advised that they had no continuing interest in a transaction at any price and the other suggested that they would consider a transaction only at a valuation level that would result in net proceeds substantially less than $8,000,000.

On May 1, 2007, we received a letter from the Vermed management team offering to acquire the assets of Vermed for a cash purchase price of $8,000,000. In mid-May, 2007, the Board directed management to explore whether an acceptable transaction with Vermed management could be negotiated, subject to the approval of the CardioDynamics shareholders.

Throughout June 2007, negotiations continued between CardioDynamics and Vermed management and each of their financial and legal advisors to develop a definitive agreement for the sale of Vermed and a multi-year supplier agreement for ICG sensors that was acceptable to both parties. The negotiations involved the cash purchase price, form of transaction (stock versus assets, including tax elections), personal liability to certain principals of Buyer in the event of default, as well as the nature of the representations and warranties to be made by CardioDynamics and limitations on Buyer’s recourse to CardioDynamics in the event of a breach of those representations and warranties.

Negotiations were completed on June 24, 2007, and on June 25, 2007, the proposed transaction was approved by the CardioDynamics Board and the Stock Purchase Agreement was signed by CardioDynamics and the Buyer. Additionally, we agreed with the Buyer on a form of five-year, fixed-price supply agreement that will be signed at the Closing of the transaction, which is anticipated following the approval of shareholders at this Annual Meeting. At that June 25 Board meeting, representatives of Cain Brothers presented its financial analysis of the $8,000,000 cash consideration (before adjustments) provided for in the proposed transaction, after which it delivered to our Board an oral opinion (which opinion was subsequently confirmed in writing) to the effect that, as of the date of the opinion, and subject to the assumptions, limitations and qualifications contained in the opinion, the consideration provided for in the transaction as proposed was fair to CardioDynamics from a financial point of view.

We believe that the proceeds provided from the sale of Vermed will provide funding for necessary strategic investments intended to return the ICG business to revenue growth and profitability. Specifically, we intend to invest in the continued expansion of our sales and clinical application specialist team, in clinical trial research including the PREVENT-HF trail led by Milton Packer which was initiated earlier this year, and in core

14

technology improvement. Our goal through these investments is to establish ICG in the treatment guidelines for heart failure and hypertension over the next five years.

Our Plans Following Completion of the Sale of Vermed

We plan to utilize the approximately $8,000,000 cash proceeds, as may be adjusted, from the sale of Vermed to meet our existing obligations and for working capital, to pay bank debt and to finance the continued development of our core ICG business. Following the sale of Vermed, we intend to focus on our ICG core business and will no longer have operations in the ECG segment. We do not intend to distribute any of the cash proceeds that we receive from the sale of Vermed to our shareholders. The sale of Vermed will not alter the rights, preferences or privileges of our common stock.

Although there can be no assurance that the proceeds from the sale of Vermed will allow us to achieve revenue growth or profitability once again, we believe this transaction is in the best interest of our shareholders. We cannot assure you, however, that we will successfully complete the sale of Vermed or that we will be able to improve revenues or reduce expenses necessary to allow our core business to become profitable again in the near term, or at all.

Opinion of Cain Brothers Relating to the Sale of Vermed

Our Board of Directors retained Cain Brothers to act as our exclusive financial advisor in connection with potential strategic transactions. Cain Brothers was selected by our Board of Directors because of Cain Brothers’ reputation and expertise as an investment banking firm and its familiarity with our company. As part of its investment banking business, Cain Brothers is regularly engaged in the valuation of businesses and securities in connection with mergers and acquisitions and related transactions and valuations for corporate and other purposes in the healthcare services and medical technology markets.

In accordance with the terms of its engagement letter with us, Cain Brothers, at the Board’s request, delivered an oral opinion (which opinion was subsequently confirmed in writing) to the Board of Directors at a meeting of the Board on June 25, 2007. In its letter, Cain Brothers, on the basis of its analyses and review and in reliance on the accuracy and completeness of the information furnished to it and subject to the limitations, qualifications and assumptions noted below and in the full text of its opinion, rendered its opinion to our Board of Directors that, as of June 25, 2007, the $8,000,000 base consideration to be received by us in the transaction (the “Transaction Consideration”) is fair to us from a financial point of view.

The Transaction Consideration was determined in arm’s length negotiations between Buyer and us. Pursuant to Cain Brothers’ engagement letter, Cain Brothers was not retained for the purpose of making a recommendation, nor did it make a recommendation, as to the amount of the Transaction Consideration. We imposed no restrictions or limitations upon Cain Brothers with respect to the investigations made or the procedures followed by Cain Brothers in rendering its opinion.

The full text of Cain Brothers’ opinion, which sets forth, among other things, assumptions made, procedures followed, matters considered and limitations on the scope of the review undertaken by Cain Brothers in rendering its opinion is attached asAppendix B to this Proxy Statement and is incorporated herein by reference in its entirety. You are urged to, and you should, read the Cain Brothers opinion carefully and in its entirety. The summary of the Cain Brothers opinion in this Proxy Statement is qualified in its entirety by reference to the full text of the Cain Brothers opinion.

Cain Brothers’ opinion was provided for the benefit and use of our Board of Directors in connection with its consideration of the transaction. The Cain Brothers opinion addresses only the fairness to us, from a financial point of view, of the Transaction Consideration. Because Cain Brothers’ opinion addresses only the fairness of the Transaction Consideration, it did not express any views on any other terms of the transaction, including

15

without limitation any possible reduction in the consideration received by us in the transaction based upon the adjustments provided for in the Stock Purchase Agreement or otherwise. Cain Brothers also did not express any opinion on the terms of the proposed supply agreement expected to be entered into between us and Vermed in connection with the transaction, nor, with the concurrence of our management, who advised Cain Brothers that it does not detract from the value of the Transaction Consideration, did Cain Brothers take the supply agreement into account in rendering its opinion.

Cain Brothers’ opinion does not address the merits of our entering into the Stock Purchase Agreement as compared to any alternative business transaction or strategy that might have been available to us nor does it address our underlying business decision to effect the transaction, nor does it address the tax consequences to us arising from the transaction and it does not constitute a recommendation to any shareholder as to how such shareholder should vote or act on any matter relating to the transaction. The opinion does not address the value of our company or our viability as a going concern after the consummation of the transaction. In addition, Cain Brothers did not opine as to the market value or the prices at which any of our securities may trade at any time in the future.

Cain Brothers’ opinion spoke only as of the date it was rendered, was based on the economic, market and other conditions as they existed and information with which it was supplied as of such date and was without regard to any market, economic, financial, legal, tax or other circumstances or event of any kind or nature which might exist or occur after such date. Unless otherwise noted, all of Cain Brothers’ analyses were performed based on market information available as of June 22, 2007.

For purposes of its opinion, Cain Brothers, among other things:

| | • | | reviewed a draft Agreement dated as of June 21, 2007 (including the draft disclosure schedules thereto) and participated in certain negotiations with Buyer; |

| | • | | reviewed certain financial, business and other information about Vermed that was publicly available or provided to Cain Brothers by us and/or Vermed; |

| | • | | reviewed certain internal financial and operating information, including financial forecasts and projections for Vermed on a stand-alone basis that were provided to Cain Brothers by us and/or Vermed, taking into account (a) Vermed’s historical and current fiscal year financial performance, (b) Vermed’s five-year forecasts which include certain adjustments post-Closing of the Transaction to reflect Vermed as an independent, stand-alone entity, and (c) the terms of certain of Vermed’s key customer contracts; |

| | • | | held discussions with our and Vermed’s management regarding Vermed’s prospects and financial outlook and the operating plans of Vermed, including without limitation, the risks and uncertainties of Vermed continuing to operate as a subsidiary of the company; |

| | • | | reviewed the valuation in the public market of companies in lines of business that Cain Brothers deemed similar to that of Vermed in market, services offered and/or size; |

| | • | | reviewed public information with respect to recent acquisition transactions that Cain Brothers deemed comparable to the proposed transaction; |

| | • | | performed discounted cash flow analyses based on Vermed’s five-year forecast; |

| | • | | solicited interest from certain prospective candidates to a strategic transaction involving Vermed or CardioDynamics, selected by us in consultation with Cain Brothers, and analyzed their responses; and |

| | • | | reviewed such other financial studies, performed such other analyses and investigations and took into account such other matters as we deemed appropriate. |

In connection with its review, Cain Brothers did not assume any responsibility for independent verification of any of the financial information, forecasts and other information provided to it by us and Vermed or that was

16

publicly available to it and its opinion is expressly conditioned on such information being complete and accurate. With respect to the financial information, financial forecasts and other information with respect to Vermed, including any adjustments thereto, that Cain Brothers reviewed, Cain Brothers was advised, and assumed, that such forecasts and such other information were reasonably prepared on bases reflecting the best currently available estimates and good faith judgments of our and Vermed’s respective management teams as to the future competitive, operating and regulatory environments and related financial performance of Vermed. Cain Brothers was not requested to make, and did not make, an independent evaluation or appraisal of assets or liabilities of Vermed (contingent or otherwise) or conduct a comprehensive physical inspection of any of the assets of Vermed, nor was Cain Brothers furnished with any such evaluations or appraisals or reports of such physical inspections, nor has Cain Brothers assumed any responsibility to obtain any such evaluations, appraisals or reports. Cain Brothers relied on advice of our legal counsel and independent accountants as to all legal and tax matters with respect to us and the transaction and did not make any independent assessment of such matters. The Cain Brothers opinion necessarily is based upon information available to Cain Brothers as of the date of the opinion and upon financial, economic, market and other conditions as they existed and could be evaluated on the date of the opinion. In addition, Cain Brothers assumed that the transaction would be consummated upon the terms set forth in the Stock Purchase Agreement without waiver or modification of any material terms.

In preparing its opinion to our Board of Directors, Cain Brothers performed a variety of financial and comparative analyses. The preparation of a fairness opinion is a complex process and is not necessarily susceptible to partial analysis or summary description. Cain Brothers believes that its analyses must be considered as a whole and that selecting portions of its analyses and of the factors considered by it, without considering all analyses and factors, could create a misleading or incomplete view of the processes underlying its opinion. No company or transaction used in the analysis performed by Cain Brothers as a comparison is identical to Vermed or to the proposed transaction. In addition, Cain Brothers may have given various analyses more or less weight than other analyses, and may have deemed various assumptions more or less probable than other assumptions, so that the range of valuation resulting from any particular analysis described below should not be taken to be Cain Brothers view of the actual value of Vermed. In performing its analyses, Cain Brothers made numerous assumptions with respect to industry performance, general business and economic conditions and other matters, many of which are beyond our control and the control of Vermed. Any estimates contained in analyses performed by Cain Brothers are not necessarily indicative of actual values or actual future results, which may be significantly more or less favorable than that suggested by such analyses. In addition, analyses relating to the value of businesses or assets do not purport to be appraisals or to necessarily reflect the prices at which businesses or assets may actually be sold. The analyses performed were prepared solely as part of Cain Brothers’ analysis of the fairness as of the date of the opinion, from a financial point of view, of the consideration to be received by us in the transaction and were provided for the use of our Board of Directors in connection with the delivery of Cain Brothers’ opinion.

The following is a brief summary of the material analyses performed by Cain Brothers in connection with the preparation of its opinion, and presented to our Board of Directors at its meeting held on June 25, 2007. References to revenue and EBITDA (as defined below) of Vermed refer to such items derived from the historical and projected financial results of Vermed, as adjusted by our and Vermed’s managements to reflect their estimates of the direct and indirect costs of operating Vermed on a stand-alone basis, which we refer to above and which were provided to Cain Brothers by management. Certain of the summaries of the financial analyses include information presented in tabular format. In order to understand fully the material financial analyses used by Cain Brothers, the tables should be read together with the text of each summary. The tables alone do not constitute a complete description of the material financial analyses.

17

Comparable Company Analysis

To provide contextual data and comparative market information, Cain Brothers compared our selected historical operating and financial ratios to certain publicly traded firms with market capitalizations below $350 million that participate predominantly, or in part, in the disposable medical products industry (the “Comparable Company Analysis”). These comparable companies consisted of:

| | • | | CAS Medical Systems, Inc. |

| | • | | Medical Action Industries, Inc. |

| | • | | Merit Medical Systems, Inc. |

| | • | | Retractable Technologies, Inc. |

| | • | | Specialized Health Products International, Inc. |

| | • | | SRI Surgical Express Inc. |

| | • | | Utah Medical Products Inc. |

In conducting its analysis, Cain Brothers compared, among other things, the enterprise value of Vermed implied by the Transaction Consideration expressed as a multiple of Vermed’s last 12 months (“LTM”) ended May 31, 2007 revenue and earnings before interest, taxes, depreciation and amortization (also referred to as “EBITDA”). Cain Brothers then compared these multiples to the respective low, mean, median and high enterprise value multiples of the comparable companies implied by the public trading value of their common stock. Cain Brothers reviewed information as of June 22, 2007 for the LTM ended March 31, 2007 to calculate specified financial and operating information (as adjusted for one time or unusual items that were publicly disclosed), market values and trading multiples (as described below), and then compared the historical projected financial and operating information of Vermed for the LTM ending May 31, 2007 with the corresponding financial and operating information, market values and multiples of the comparable companies. Due to the fact that Vermed operates on a November 30 fiscal year (“FY”) end basis, and we provided projections to Cain Brothers on a fiscal year basis (including fiscal year-based quarters) only, Cain Brothers utilized LTM ended March 31, 2007 financial measures for the comparable companies as the appropriate comparable information for Vermed’s LTM ended May 31, 2007.

Although Cain Brothers used these companies for comparative purposes, no company utilized in the Comparable Company Analysis is identical to Vermed. Accordingly, consideration of the results of the Comparable Company Analysis cannot be limited to a quantitative review of the mathematical analysis, such as determining the average or median, and involves complex considerations and judgments concerning differences in industry performance, general business, economic, market and financial conditions and other matters concerning the companies as well as Vermed.

| | | | | | | | | | | | | |

Enterprise Value as a Multiple of: | | Financial

Metric(1) | | Implied Vermed

Transaction

Multiple | | Low | | Median | | Mean | | High |

| | | | | | |

LTM Revenue | | $ | 11.5 | | 0.7x | | 0.5x | | 1.7x | | 1.9x | | 3.6x |

| | | | | | |

LTM EBITDA | | $ | 1.2 | | 6.7x | | 7.1x | | 11.5x | | 12.5x | | 22.9x |

(1) | Numbers listed opposite the LTM metrics, respectively, represent Vermed’s LTM ended May 31, 2007 figures provided by our and Vermed’s managements. |

Based on this analysis, Cain Brothers compared Vermed’s implied enterprise value multiples at the Transaction Consideration to the implied range of enterprise multiples of the comparable public companies. Cain Brothers noted that Vermed’s implied multiples based on the Transaction Consideration falls within the multiple ranges of the comparable public companies with respect to revenues and approximately a 0.4 multiple below the low end of the range with respect to EBITDA.

18

Precedent Transactions Analysis

Using publicly available information for transactions completed since January 1, 2002, Cain Brothers’ analyses included a review of 15 transactions with transaction values below $110 million involving companies in the medical products industry (the “Precedent Transactions Analysis”). No transaction utilized as a comparison in the Precedent Transactions Analysis is identical to the proposed transaction nor is any target company identical to Vermed. Accordingly, consideration of the results cannot be limited to a quantitative review of the mathematical analysis, such as determining the mean or median, and involves complex considerations and judgments concerning differences in industry performance, general business, economic, market and financial conditions and other matters concerning the companies as well as Vermed. For each of the precedent transactions, Cain Brothers calculated a multiple of LTM revenue and EBITDA to the enterprise value for each transaction in the case of revenues and for the seven transactions for which EBITDA information was available, as of the announced date of each transaction, and compared such multiples to the corresponding multiples implied by this transaction.

| | | | |

Date

Announced | | Acquiror | | Target |

| | |

| 05/11/07 | | Smith & Nephew plc | | BlueSky Medical Group, Inc. |

| | |

| 04/03/07 | | Symmetry Medical, Inc. | | TNCO, Inc |

| | |

| 03/23/07 | | Integra LifeSciences Holdings Corp. | | LXU Healthcare Inc. |

| | |

| 9/11/06 | | Medical Action Industries, Inc. | | Medegen Medical Products LLC |

| | |

| 06/29/06 | | Spacelabs Healthcare, Inc. | | Reynolds Del Mar |

| | |

| 04/18/06 | | Akray, Inc | | Hypoguard USA, Inc. |

| | |

| 11/11/05 | | Encore Medical Group | | Compex Technologies, Inc. |

| | |

| 10/17/05 | | Natus Medical, Inc. | | Bio-Logic Systems, Corp. |

| | |

| 09/07/05 | | Integra LifeSciences Holdings Corp | | Radionics Division of Tyco Healthcare Group |

| | |

| 08/08/05 | | dj Orthopedics, Inc. | | Orthopedics Soft Goods Business (Encore Medical Group) |

| | |

| 06/29/05 | | Huntleigh Technology plc | | Obstetrics & Cardiovascular Products (Oxford Instruments Medical Ltd.) |

| | |

| 5/15/05 | | CAS Medical Systems, Inc. | | Statcorp, Inc. |

| | |

| 2/14/05 | | Fidelity Capital Investors | | Banta Healthcare Group Ltd. |

| | |

| 01/06/03 | | Ferraris Group plc | | Del Mar Medical Systems, LLC |

| | |

9/04/02 | | Medical Action Industries, Inc. | | Maxxim Medical, Inc., Biosafety Division |

| | | | | | | | | | | | | |

Enterprise Value as a Multiple of: | | Financial

Metric(1) | | Implied Vermed

Transaction

Multiple | | Low | | Mean | | Median | | High |

| | | | | | |

LTM Revenue | | $ | 11.5 | | 0.7x | | 0.5x | | 0.9x | | 0.8x | | 1.9x |

| | | | | | |

LTM EBITDA | | $ | 1.2 | | 6.7x | | 3.6x | | 10.1x | | 11.5x | | 18.0x |

(1) | Numbers listed opposite the LTM metrics represent Vermed’s LTM ended May 31, 2007 figures provided by our and Vermed’s managements. |

19

Based on this analysis, Cain Brothers compared Vermed’s implied enterprise value multiples at the Transaction Consideration to the implied range of enterprise multiples of the precedent transactions. Cain Brothers noted that Vermed’s implied multiples at the Transaction Consideration falls within or approximates the multiple ranges of the precedent transactions.

Discounted Cash Flow Analysis Based on Revenue Exit Multiple

Cain Brothers performed a discounted cash flow analysis based on financial projections provided from our and Vermed’s senior management for FY 2007 to FY 2012. The discounted cash flow analysis is based on the projected future unlevered (before financing costs) free cash flows of Vermed, after taking into consideration capital expenditures and working capital requirements. Cain Brothers calculated a range of terminal values as of November 30, 2012 using multiples of total enterprise value to revenues ranging from 0.50x to 1.25x. The resulting cash flows were taxed at 40.0% and discounted back utilizing weighted average costs of capital (“WACC”) ranging from 16.0% to 20.0%. Based upon and subject to the foregoing, Cain Brothers’ discounted cash flow analysis of Vermed yielded a range of implied enterprise values of Vermed of $5.5 million to $11.0 million. Cain Brothers compared the Transaction Consideration to this range of enterprise values and noted that the Transaction Consideration falls within the enterprise value ranges of the discounted cash flow analysis based on a revenue exit multiple. In particular, Cain Brothers noted the following:

| | | | | | | | | | | | |

| | | Implied Enterprise Value of Vermed Assumed Exit Multiple of FY 2012 Projected Revenues |

WACC: | | 0.50x | | 0.75x | | 1.00x | | 1.25x |

16.0% | | $ | 6.2 | | $ | 7.8 | | $ | 9.4 | | $ | 11.0 |

17.0% | | | 6.0 | | | 7.5 | | | 9.1 | | | 10.6 |

18.0% | | | 5.8 | | | 7.3 | | | 8.7 | | | 10.2 |

19.0% | | | 5.6 | | | 7.0 | | | 8.4 | | | 9.8 |

20.0% | | | 5.5 | | | 6.8 | | | 8.1 | | | 9.5 |

Discounted Cash Flow Analysis Based on EBITDA Exit Multiple.

Cain Brothers performed a discounted cash flow analysis based on financial projections provided from our and Vermed’s senior management for FY 2007 to FY 2012. The discounted cash flow analysis is based on the projected future unlevered (before financing costs) free cash flows of Vermed, after taking into consideration capital expenditures and working capital requirements. Cain Brothers calculated a range of terminal values as of November 30, 2012 using multiples of total enterprise value to EBITDA ranging from 6.0x to 10.0x. The resulting cash flows were taxed at 40.0% and discounted back utilizing WACCs ranging from 16.0% to 20.0%. Based upon and subject to the foregoing, Cain Brothers’ discounted cash flow analysis of Vermed yielded a range of implied enterprise values of Vermed of $6.7 million to $10.7 million. Cain Brothers compared the Transaction Consideration to this range of enterprise values and noted that the Transaction Consideration falls within the enterprise value ranges of the discounted cash flow analysis based on an EBITDA exit multiple. In particular, Cain Brothers noted the following:

| | | | | | | | | | | | | | | |

| | | Implied Enterprise Value of Vermed Assumed Exit Multiple of FY 2012 Projected EBITDA |

WACC: | | 6.0x | | 7.0x | | 8.0x | | 9.0x | | 10.0x |

16.0% | | $ | 7.6 | | $ | 8.4 | | $ | 9.2 | | $ | 9.9 | | $ | 10.7 |

17.0% | | | 7.4 | | | 8.1 | | | 8.8 | | | 9.6 | | | 10.3 |

18.0% | | | 7.1 | | | 7.8 | | | 8.5 | | | 9.2 | | | 9.9 |

19.0% | | | 6.9 | | | 7.6 | | | 8.2 | | | 8.9 | | | 9.6 |

20.0% | | | 6.7 | | | 7.3 | | | 8.0 | | | 8.6 | | | 9.2 |

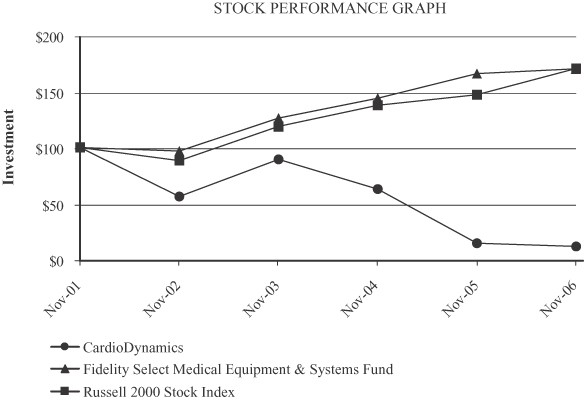

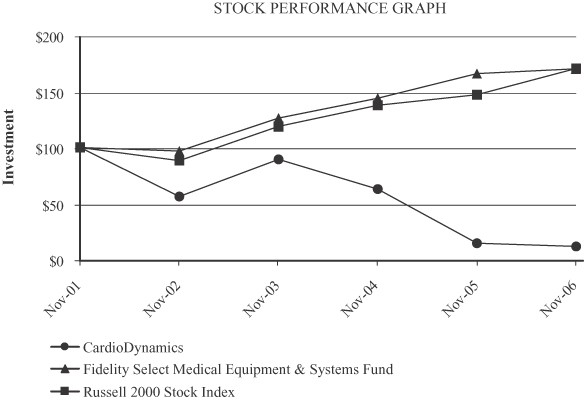

20