UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | Filed by a party other than the registrant | o |

| | Check the appropriate box: |

| | o | | Preliminary Proxy Statement |

| | o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | x | | Definitive Proxy Statement |

| | o | | Definitive Additional Materials |

| | o | | Soliciting Material Under Section 240.14a-12 |

ARCTIC CAT INC.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | o | | Fee paid previously with preliminary materials. |

| | o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

Table of Contents

ARCTIC CAT INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held August 8, 2007

Notice is hereby given that the Annual Meeting of Shareholders of Arctic Cat Inc. will be held at 601 Brooks Avenue South, Thief River Falls, Minnesota 56701, on Wednesday, August 8, 2007 at 4:00 p.m. for the following purposes:

| | 1. | To elect three directors to serve a three-year term; |

| | 2. | To approve the Arctic Cat Inc. 2007 Omnibus Stock and Incentive Plan; |

| | 3. | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the current fiscal year; and |

| | 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or adjournments thereof. |

The Board of Directors has fixed the close of business on June 11, 2007 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Since it is important that your shares be represented at the Annual Meeting, whether or not you personally plan to attend, you are requested to sign, date and promptly return your proxy card in the enclosed envelope. If you are a record holder, you may also submit your proxy by telephone or through the Internet by following the instructions on the proxy card. If you own shares in “street name,” i.e., through a broker, you should follow the instructions provided by the broker. Returning your signed proxy or submitting your proxy by telephone or through the Internet will not prevent you from voting in person at the Annual Meeting, should you desire to do so.

By Order of the Board of Directors,

Timothy C. Delmore,

Secretary

Thief River Falls, Minnesota

July 2, 2007

TO ASSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, PLEASE SIGN, DATE AND RETURN YOUR PROXY ON THE ENCLOSED PROXY CARD WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON. SHAREHOLDERS WHO ATTEND THE ANNUAL MEETING MAY REVOKE THEIR PROXIES AND VOTE IN PERSON IF THEY SO DESIRE.

TABLE OF CONTENTS

i

ii

Table of Contents

ARCTIC CAT INC.

601 Brooks Avenue South

Thief River Falls, MN 56701

PROXY STATEMENT

Annual Meeting of Shareholders

August 8, 2007

This Proxy Statement is furnished in connection with the solicitation on behalf of the Board of Directors (the “Board”) of Arctic Cat Inc., a Minnesota corporation (the “Company” or “we” or “us”), of proxies for the Annual Meeting of Shareholders of the Company to be held at 601 Brooks Avenue South, Thief River Falls, MN 56701, on Wednesday, August 8, 2007 at 4:00 p.m., Central Daylight Time, or any adjournment or adjournments thereof (the “Annual Meeting”). This Proxy Statement and the enclosed proxy card are being mailed to shareholders on or about July 2, 2007.

The Company’s Annual Report for the fiscal year ended March 31, 2007 (“fiscal 2007”), including audited financial statements, is being mailed to shareholders concurrently with this Proxy Statement.

ABOUT THE MEETING

What is the purpose of the Annual Meeting?

At our Annual Meeting, shareholders will act upon the matters described in the accompanying notice of annual meeting of shareholders. This includes (1) the election of three directors; (2) the approval of the Arctic Cat Inc. 2007 Omnibus Stock and Incentive Plan; and (3) the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the current fiscal year. In addition, our management will report on the performance of the Company and respond to questions from shareholders.

Who is entitled to vote?

Only shareholders of record of our outstanding Common Stock at the close of business on the record date, June 11, 2007, are entitled to receive notice of and to vote at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. Each outstanding share of Common Stock entitles its holder to cast one vote on each matter to be voted upon and there is no cumulative voting.

Who can attend the Meeting?

All shareholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of a majority of the voting power of shares entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business.

1

Table of Contents

A quorum is required for business to be conducted at the Annual Meeting. As of the record date, 12,353,571 shares of Common Stock of the Company were outstanding (excluding 6,102,000 shares of Class B Common Stock which do not vote with the Common Stock in the general election of directors (see “Election of Directors” in this Proxy Statement), but do vote for the other proposals at the Annual Meeting). If you submit a properly executed proxy card or vote your proxy electronically through the Internet or by telephone as described on the proxy card, even if you abstain from voting, then you will be considered part of the quorum. Abstentions and broker non-votes will be treated as shares present for purposes of determining the existence of a quorum.

How do I vote?

Sign and date each proxy card you receive and return it in the prepaid envelope or vote electronically through the Internet or by telephone by following the instructions on the proxy card. If you return a properly executed proxy card without specific voting instructions, your shares will be voted FOR all directors in Proposal 1, FOR Proposal 2, FOR Proposal 3 and at the discretion of the proxy holders as to any other matters which may properly come before the Annual Meeting.

If you wish to vote by Internet or telephone, you must do so before 12:00 p.m. Central Daylight Time on Tuesday, August 7, 2007. After that time, Internet and telephone voting will not be permitted and a shareholder wishing to vote, or revoke an earlier proxy, after such time must submit a signed proxy card or vote in person.

Can I change my vote after I return my proxy card or vote electronically?

Yes. Even after you have submitted your proxy or voted electronically through the Internet or by telephone, you may change your vote at any time before the proxy is exercised at the Annual Meeting. You may change it by:

| | 1) | Returning a later-dated proxy (by mail, Internet or telephone); |

| | 2) | Delivering a written notice of revocation to our Secretary at our principal executive office at 601 Brooks Avenue South, Thief River Falls, MN 56701; or |

| | 3) | Attending the Annual Meeting and voting in person at the Annual Meeting (although attendance at the Annual Meeting without voting at the Annual Meeting will not, in and of itself, constitute a revocation of your proxy). |

What are the Board’s recommendations?

The Board’s recommendations are set forth after the description of the proposals in this Proxy Statement. In summary, the Board recommends a vote:

| | • | FOR the election of each of the nominated directors (See Proposal 1). |

| | • | FOR the approval of Arctic Cat Inc.’s 2007 Omnibus Stock and Incentive Plan as described in this Proxy Statement (See Proposal 2). |

| | • | FOR the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the current fiscal year (See Proposal 3). |

If you return a properly executed proxy card without specific voting instructions, the Proxy Agents will vote in accordance with the recommendations of the Board.

With respect to any other matter that properly comes before the Annual Meeting, the Proxy Agents will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

2

Table of Contents

What vote is required to approve each Proposal?

For Proposal 1, the election of directors, each shareholder of Common Stock will be entitled to vote for three nominees and the three nominees with the greatest number of FOR votes will be elected. The holder of Class B Common Stock does not vote in the general election of directors. See “Election of Directors” in this Proxy Statement.

For Proposal 2, the approval of Arctic Cat Inc.’s 2007 Omnibus Stock and Incentive Plan, each shareholder will be entitled to one vote for each share held, and the affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal will be required for approval.

For Proposal 3, the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the current fiscal year, each shareholder will be entitled to one vote for each share held, and the affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal will be required for approval.

With respect to any other matter that properly comes before the Annual Meeting, the affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal will be required for approval.

A properly executed proxy marked “ABSTAIN” with respect to Proposals 2 and 3, and any other matter that properly comes before the Annual Meeting, will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, abstentions will have the same effect as a negative vote.

A “WITHHELD” vote will be counted for purposes of determining whether there is a quorum, but will not be considered to have been voted in favor of the director nominee with respect to whom authority has been withheld.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to the proposal to be acted upon. If you do not give your broker instructions as to how to vote your shares, your broker has authority under New York Stock Exchange rules to vote those shares for or against “routine” matters, such as the election of directors. Brokers cannot vote on their customers’ behalf on “non-routine” proposals. These rules apply to us notwithstanding the fact that shares of our Common Stock are traded on The NASDAQ Stock Market. If your brokerage firm votes your shares on “routine” matters because you do not provide voting instructions, your shares will be counted for purposes of establishing a quorum to conduct business at the Annual Meeting and in determining the number of shares voted for or against the routine matter. If your brokerage firm lacks discretionary voting power with respect to an item that is not a routine matter and you do not provide voting instructions (a “broker non-vote”), your shares will be counted for purposes of establishing a quorum to conduct business at the Annual Meeting, but will not be counted in determining the number of shares voted for or against the non-routine matter.

Who will count the vote?

An Inspector of Elections will be appointed for the Annual Meeting and will work with a representative of Wells Fargo Shareowner Services, our independent stock transfer agent, to count the votes.

What does it mean if I receive more than one proxy card?

If your shares are registered differently and are in more than one account, you will receive more than one proxy card. To ensure that all your shares are voted, sign and return all proxy cards or vote

3

Table of Contents

electronically through the Internet or by telephone for each proxy card. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our stock transfer agent, Wells Fargo Shareowner Services, at 1-800-468-9716.

How will voting on any other business be conducted?

Although we do not know of any business to be considered at the Annual Meeting other than the matters described in this Proxy Statement, if any other business is presented at the Annual Meeting, your proxy gives authority to each of Christopher A. Twomey and William G. Ness (the “Proxy Agents”) to vote on such matters at their discretion.

How are proxies solicited?

In addition to use of the mail, proxies may be solicited by officers, directors, and other regular employees of Arctic Cat by telephone, through electronic transmission or facsimile transmission, or personal solicitation, and no additional compensation will be paid to such individuals. We will request that banks, brokerage houses, other custodians, nominees and certain fiduciaries forward proxy materials and annual reports to the beneficial owners of our Common Stock.

Who pays for the cost of this proxy solicitation?

The entire cost of preparing, assembling, printing and mailing the Notice of Annual Meeting of Shareholders, this Proxy Statement, the proxy itself, and the cost of soliciting proxies relating to the Annual Meeting will be borne by us. We will, if requested, reimburse banks, brokerage houses, and other custodians, nominees and certain fiduciaries for their reasonable expenses incurred in mailing proxy material to their principals.

PROPOSAL 1

ELECTION OF DIRECTORS

Pursuant to the Company’s Restated Articles of Incorporation, the Board is divided into three classes of directors, each director serving a three-year term. Each year only one class of directors is subject to a shareholder vote, and generally, one-third of the directors belong to each class. This year, upon the recommendation of the Governance Committee, the Board, including a majority of the independent directors, has nominated three directors: Susan E. Lester, David A. Roberts and Christopher A. Twomey. Ms. Lester and Mr. Twomey are incumbent directs whose terms expire this year. Mr. Roberts was appointed by the Board as a director on August 28, 2006. Mr. Roberts was identified and recommended to the Board by an independent third-party search firm. If elected, Ms. Lester’s and Messrs. Roberts’ and Twomey’s terms will expire in 2010. It is intended that proxies will be voted for such nominees. The Company believes that the nominees will be able to serve; but should any of them be unable to serve as a director, the Proxy Agents have advised that they will vote for the election of such substitute nominee(s) as the Board may propose.

In addition, in accordance with a Stock Purchase Agreement dated July 18, 1988 between Suzuki Motor Corporation (“Suzuki”) and the Company, pursuant to which Suzuki purchased 7,560,000 shares (as adjusted for subsequent stock splits) of the Company’s Class B Common Stock (constituting all outstanding shares of Class B Common Stock), Suzuki is entitled to elect one member of the Board and does not vote with the holders of Common Stock in the general election of directors. Consequently, Suzuki will not be voting on the nominees at this Annual Meeting. In August 2004, Masayoshi Ito was elected to the Board of Directors by Suzuki.

4

Table of Contents

The name and age of the nominees and the other directors and their principal occupations are set forth below, based upon information furnished to the Company by the nominees and directors. Unless otherwise indicated, each of the nominees and directors has held their respective identified positions for more than the past five years. Each of the directors, except Messrs. Twomey and Ness, have been determined by the Governance Committee to qualify as an “independent director” as defined by the rules of the National Association of Securities Dealers for companies listed on The NASDAQ Stock Market.

| Name, Age and Principal Occupation | | Director Since | |

|---|

| |

| |

| Nominated for a term ending in 2010: | | | |

| | Susan E. Lester, 50, Private investor; Chief Financial Officer, Homeside Lending, Inc. (a mortgage bank) from October 2001 to May 2002; Chief Financial Officer, U.S. Bancorporation (a commercial bank) from February 1996 to May 2000; Director of First Community Bancorporation. | | 2004 |

| | Christopher A. Twomey, 59, Chairman of the Board of Directors of the Company; President and Chief Executive Officer of the Company since January 1986; Director of The Toro Company. | | 1987 |

| | David A. Roberts, 59, Chairman, President and Chief Executive Officer of Carlisle Companies, Incorporated since June 2007; President and Chief Executive Officer of Graco, Inc. from June 2001 to June 2007; Group Vice President of Marmon Group from 1996 to 2001; Director of Franklin Electric Co., Inc. | | 2006 |

5

Table of Contents

| Name, Age and Principal Occupation | | Director Since | |

|---|

| |

| |

Other directors whose terms of office will continue after the Annual Meeting and

whose terms expire in 2008: | | | |

| | Robert J. Dondelinger, 71, Co-owner and Chairman of the Board of Northern Motors (a General Motors dealership) since 1965. | | 1983 |

| | Kenneth J. Roering, 65, Currently a Professor of Marketing at the Carlson School of Management at the University of Minnesota; Executive Vice President, Strategic Management at the Marshall Financial Group; served as Department Chair for ten years and occupied the Pillsbury Company Chair in Marketing for 20 years; has published more than 70 articles in professional journals, written two books, and edited three collections of scholarly writings in the areas of marketing strategy and new product development; has received various teaching and research awards for his work, including AMA Distinguished Faculty and University of Minnesota Outstanding Graduate Teacher; has consulted with more than 50 companies including, American Express, Motorola, Ecolab, 3M, Cargill, Carlson Companies, Pillsbury, and Medtronic; has been a director of several companies and currently serves on the Board of Innovex Inc. and uBid.com, Inc.; has directed and participated in management development programs throughout the world. | | 1996 |

Other directors whose terms of office will continue after the Annual Meeting and

whose terms expire in 2009: | | | |

| | William G. Ness, 69, Vice Chairman of the Board of Directors of the Company; Chairman of the Board of Directors of the Company from 1982 to 2003; Chief Executive Officer of the Company from 1982 to 1986; Director of Itasca Bemidji, Inc. from 1986 to 2005; Director of Mesaba Aviation, Inc. from 1981 to 1995. | | 1982 |

6

Table of Contents

| Name, Age and Principal Occupation | | Director Since | |

|---|

| |

| |

| | Gregg A. Ostrander, 54, Chairman of the Board of Directors and Chief Executive Officer of Michael Foods, Inc. (a food processing manufacturer) since 1993; Director of Birds Eye Foods, Inc. | | 1995 |

| Director elected by Class B Common Stock: | | | |

| | Masayoshi Ito, 53, General Manager America/Europe Motorcycle Marketing Department, Suzuki Motor Corporation since April 2004; President Suzuki France S.A.S. from May 2003 to March 2004; General Manager Europe Motorcycle Marketing Department from September 2002 to April 2003; Group Leader North America & Oceania Marketing Group and America/Europe Motorcycle Marketing Department from April 2002 to August 2002; General Manager of Suzuki Manufacturing of America Corporation (SMAC) from January 2001 to March 2002; Group Leader Europe Motorcycle Marketing Department from January 2000 to December 2000. | | 2004 |

Vote Required. Each shareholder of Common Stock will be entitled to vote for three nominees and the three nominees with the greatest number of votes will be elected. As indicated above, the holder of Class B Common Stock does not vote in the general election of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES.

Director Emeritus. Mr. Lowell T. Swenson retired as a director in 1998. Recognizing Mr. Swenson’s long-standing contributions to the Company and exemplary service throughout his 15-year term as a director, as well as his service in the snowmobile industry for more than thirty years, the Board determined that the Company would benefit from a continued association with Mr. Swenson and appointed him a Director Emeritus upon his retirement. As a Director Emeritus, Mr. Swenson is invited to attend all Board meetings, but he is not entitled to vote at such meetings and does not have responsibility for the Board’s actions. He is not entitled to compensation paid to outside directors of the Company but is entitled to reimbursement of out-of-pocket expenses incurred in attending Board meetings and is entitled to indemnification in his role as a Director Emeritus.

Meetings. During fiscal 2007, the Board met six times. Each director, except the director elected by the holder of the Class B Common Stock, attended more than 75% of the meetings of the Board and any committee on which such director served. It is the Company’s policy that all directors, except the director elected by the holder of the Class B Common Stock, should attend the Annual Meeting of Shareholders. All directors elected by the holders of Common Stock attended the 2006 Annual Meeting of Shareholders.

7

Table of Contents

Board Committees. The Board has established a Compensation and Human Resources Committee, an Audit Committee and a Governance Committee. The Compensation and Human Resources Committee, which currently consists of Messrs. Dondelinger (Chair), Ostrander and Roberts, met three times during fiscal 2007. Mr. Roberts, who was appointed to the Committee in February 2007, did not participate in the determination of base salary and incentive compensation formulas for executive officers in fiscal 2007. All members are independent directors as defined under the rules of The NASDAQ Stock Market. The Compensation and Human Resources Committee assists in defining the Company’s total executive compensation philosophy and administering its compensation plans, reviews management’s recommendations and makes its own recommendations to the Board with respect to Company executives’ salaries, bonuses and stock option grants, and reviews the Company’s retirement plans and employee benefits. For fiscal 2007, the independent director members of the full Board of Directors voted on compensation for all executive officers. Beginning with fiscal 2008 executive compensation, the Compensation and Human Resources Committee will determine compensation of all executive officers, except the Chief Executive Officer which will be determined by the independent director members of the full Board of Directors following receipt of a recommendation by the Committee. In the performance of its duties, the Compensation and Human Resources Committee may select independent compensation consultants to advise the Committee when appropriate. In addition, the Compensation and Human Resources Committee may delegate authority to subcommittees where appropriate. The Board has established a Stock Grant Subcommittee of the Compensation and Human Resources Committee, currently composed of Messrs. Ostrander and Roberts, for the purpose of granting awards under the Company’s stock option plans. The Compensation and Human Resources Committee Charter is available to shareholders on the Company’s website located atwww.arcticcat.com.

The Audit Committee, which currently consists of Messrs. Ostrander (Chair) and Roering and Ms. Lester, met seven times during fiscal 2007. All members of the Company’s Audit Committee are independent directors as defined by under the rules of The NASDAQ Stock Market. The Board has determined that Susan E. Lester, a member of the Company’s Audit Committee, is an “audit committee financial expert” as that term is defined in rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”). The Audit Committee has sole authority and direct responsibility for the appointment, compensation, retention and oversight of the independent registered public accounting firm, meets with the Company’s independent registered public accounting firm and representatives of management to review the internal and external financial reporting of the Company, reviews the scope of the independent registered public accounting firm’s examination and audit procedures to be utilized, considers comments by the registered public accounting firm regarding internal controls and accounting procedures and management’s response to those comments and pre-approves any audit and non-audit services to be provided by the Company’s independent registered public accounting firm. The Audit Committee operates under a written charter adopted by the Board of Directors, which is available to shareholders on the Company’s website located atwww.arcticcat.com.

The Governance Committee, which currently consists of Messrs. Roering (Chair), Dondelinger and Roberts and Ms. Lester, met two times during fiscal 2007. All members are independent directors as defined under the rules of The NASDAQ Stock Market and the Chair of the Governance Committee also serves as the Board’s Lead Director. The primary purpose of the Governance Committee is to ensure an appropriate and effective role for the Board in the governance of the Company. The primary recurring duties and responsibilities of the Governance Committee include (1) reviewing and recommending to the Board corporate governance polices and procedures; (2) reviewing the Company’s Code of Conduct and compliance thereof; (3) identifying and educating the Company’s directors; (4) evaluating the Board; and (5) recommending to the Board of Directors compensation policies, practices and levels

8

Table of Contents

of compensation for the Board. The independent director members of the full Board then vote on all director nominations. The Governance Committee Charter is available to shareholders on the Company’s website located atwww.arcticcat.com.

In identifying prospective director candidates, the Governance Committee considers its personal contacts, recommendations from shareholders and recommendations from business and professional sources, including executive search firms. An executive search firm has been used in the past to identify director candidates. The Governance Committee’s policy is to consider qualified candidates for positions on the Board recommended in writing by shareholders. Shareholders wishing to recommend candidates for Board membership, rather than directly nominate an individual, should submit the recommendations in writing to the Secretary of the Company at least ninety (90) days prior to the meeting date corresponding to the previous year’s annual meeting, with the submitting shareholder’s name and address and pertinent information about the proposed nominee similar to that set forth for the nominees named herein. When evaluating the qualifications of potential new director candidates, or the continued service of existing directors, the Governance Committee will consider a variety of criteria, including the individual’s integrity, inquisitiveness, experience dealing with complex problems, specialized skills or expertise, diversity of background, independence, financial expertise, freedom from conflicts of interest, ability to understand the role of a director and ability to fully perform the duties of a director. While candidates recommended by shareholders will generally be considered in the same manner as any other candidate, special consideration will be given to existing directors desiring to stand for re-election given their history of service and their knowledge of the Company, as well as the Board’s knowledge of their level of contribution, resulting from such service.

A shareholder intending to independently nominate an individual as a director at an annual meeting, rather than recommend the individual to the Governance Committee for consideration as a nominee, must comply with the advance notice requirements set forth in the Company’s Bylaws. The Company’s Bylaws provide that any shareholder entitled to vote generally in the election of directors may nominate one or more persons for election as directors provided that such shareholder has provided written notice of such intention to the Secretary of the Company. Such notice must be given not less than sixty (60) days nor more than ninety (90) days prior to the meeting date corresponding to the previous year’s annual meeting.

Shareholders wishing to recommend for nomination or to nominate a director should contact the Company’s Secretary for a copy of the relevant procedure for submitting recommendations and nominations and a full delineation of the criteria considered by the Governance Committee when evaluating potential new directors or the continued service of existing directors.

Communications with the Board of Directors. The Company’s Board provides a process for shareholders to send communications to the Board. The manner in which shareholders can send communications to the Board is set forth on the Company’s website located atwww.arcticcat.com.

Director Independence. There are no family relationships between any of the nominees, directors or executive officers of the Company. In addition, David A. Roberts, Gregg A. Ostrander, Susan E. Lester, Robert J. Dondelinger and Kenneth J. Roering, the non-management directors on the Board, are “independent” directors as defined under the rules of The NASDAQ Stock Market. Mr. William I. Hagen, who retired from the Board as of February 14, 2007, was also an “independent” director as defined under the rules of The NASDAQ Stock Market.

Code of Conduct. The Company’s Board has adopted a code of ethics known as the “Arctic Cat Inc. Code of Conduct,” which applies to the Chief Executive Officer, Chief Financial Officer, Controller

9

Table of Contents

and persons performing similar functions, as well as the other officers, directors, employees, consultants, agents and representatives of the Company. The Company believes that the Code of Conduct not only documents its historic good business practices, but sets forth guidelines for ensuring that all Company personnel act with the highest standards of integrity. The Arctic Cat Inc. Code of Conduct is posted on the Company’s web site atwww.arcticcat.com.

COMPENSATION DISCUSSION AND ANALYSIS (“CD&A”)

Compensation of the Company’s executives is annually reviewed by the Compensation and Human Resources Committee of the Board (the “Committee”), currently composed of Messrs. Dondelinger (Chair), Ostrander and Roberts. Mr. Roberts was appointed to the Committee on February 15, 2007 and did not participate in the determination of base salary or incentive compensation formulas for executive officers in fiscal 2007. Mr. Hagen retired from the Company’s Board as of February 14, 2007, and until then, also served on the Committee. During fiscal 2007, the Committee made recommendations to the independent director members of the Board regarding proposed compensation for the Company’s executives and the independent directors then discussed and approved all compensation matters for the Company’s executives, with Mr. Twomey absent during the discussion and approval of his compensation. Beginning with fiscal 2008 executive compensation, the Committee will determine compensation of all executive officers, except the Chief Executive Officer which will be determined by the independent director members of the full Board of Directors following receipt of a recommendation by the Committee.

Compensation Philosophy. The Company’s basic objectives for its executive compensation program are:

| | • | attraction and retention of executives who contribute to the long-term success of the Company; |

| | • | payment for performance; |

| | • | alignment of the interests of management with those of the shareholders; and |

| | • | to provide internal equity. |

The Company’s executive compensation program is designed to accomplish these objectives and still remain cost effective.

Compensation Consultant and Benchmarking. The Committee periodically uses the service of a compensation consultant to analyze benchmarking information, including general industry as well as industry specific and other peer company data, to establish compensation market targets which have been generally in line with median market levels and are competitive for the Company’s industry, geographic location as well as companies of similar revenue size. If a compensation consultant is not used, data and analysis from other survey sources is provided by the Vice President of Human Resources. There was no compensation consultant that was used to set executive compensation levels for fiscal 2007.

The Committee is responsible for hiring the compensation consultant and has recently hired Towers Perrin, a nationally recognized compensation consulting firm. Beginning in fiscal 2008, our peer group of companies will include: Aftermarket Technology, Brunswick, Donaldson Company, ESCO Technologies Inc., Harley Davidson, K2, Modine Manufacturing, Polaris Industries Inc., Robbins & Myers, Tennant Company, Thor Industries, Toro Company and Winnebago. Our peer group of companies may change from time to time based on the current competitive environment.

10

Table of Contents

Role of Management. In addition to reviewing executive officers’ compensation against the benchmarking information, the Committee also considers recommendations from the Chairman and CEO regarding total compensation for those executives reporting directly to him. The CEO and the Vice President of Human Resources meet with the Committee on an annual basis to review competitive market data and analysis provided by the compensation consultant. Except when no data is provided, data and analysis from other survey sources is provided by the Vice President of Human Resources.

Executive Compensation Programs

The components of our executive officer compensation, which are subject to the discretion of the Committee on an individual basis, include base pay, annual incentive awards, long-term incentives, broad-based employee benefits, miscellaneous perquisites and severance arrangements. We believe the sum of these components provides a total compensation package that is comparable to that provided at our peer group of companies, and at other comparable companies.

Base Pay. In order to assure the Company’s ability to attract and retain qualified executives, the Committee believes that base pay should generally be 85% to 115% of the median market level of peer companies. Base pay for the Named Executives is also influenced by level of responsibility, years of experience generally, individual performance and tenure with the Company.

All of the Named Executives were given a 3% increase in base pay for 2007 except Mr. Tweet whose base salary was increased 20% due to his assuming increased responsibilities for Marketing and Product Development for the ATV product line during the fiscal year.

Mr. Twomey’s base pay for fiscal 2007 of $533,000 was determined in a similar manner as the other Named Executives. Mr. Delmore’s base pay for fiscal 2007 was $249,000. Mr. Ray’s base pay for fiscal 2007 was $239,000. Mr. Tweet’s base pay for fiscal 2007 was $250,000 and includes additional compensation in connection with a promotion for assuming increased responsibility for Marketing and Product Development, for the ATV product line during the fiscal year. Mr. Skime’s base pay for fiscal 2007 was $195,000.

Annual Incentive Awards. The Committee believes that placing a meaningful portion of an executive’s overall compensation at total risk, based on the Company’s earnings and the individual’s performance, is the best way to focus attention on the short and intermediate-term goals of the Company and encourage high levels of performance from each executive. The Committee also believes that a greater percentage of total compensation should be at risk as an individual’s responsibility increases. The Committee believes the annual incentive should generally be 85% to 115% of the competitive market.

Each executive is eligible to receive annual cash incentive awards based on corporate and individual performance. The annual incentive program awards each Named Executive, with the exception of Mr. Twomey, a percentage of base pay with 80% of the award tied to the Company’s earnings and 20% tied to the individual’s performance, except that no individual performance awards will be granted if the Company is not profitable. Mr. Twomey’s award is tied 100% to Company earnings. The Board establishes an earnings target each fiscal year. The maximum incentive payout based on earnings for each executive is reached if earnings exceed 20% of the target and no award is paid if earnings are less than 80% of target.

11

Table of Contents

The following table sets forth the potential incentive award for fiscal 2007 for the Named Executives if certain fiscal 2007 earnings targets were met:

| | | Incentive Award as a Percent of Base Pay | | |

|---|

| | |

| | |

| | | Exceed Earnings

Target by 20% | | | Meet Earnings

Target | | | Meet 80% of

Earnings Target | | | Meet Less Than

80% of Earnings

Target | |

|---|

| | |

| | |

| | |

| | |

| |

| Christopher A. Twomey | | | | | 100 | % | | | 60 | % | | | 12 | % | | | -0- | |

| Timothy C. Delmore | | | | | 72 | % | | | 36 | % | | | 7.2 | % | | | -0- | |

| Ronald G. Ray | | | | | 72 | % | | | 36 | % | | | 7.2 | % | | | -0- | |

| Ole E. Tweet | | | | | 72 | % | | | 36 | % | | | 7.2 | % | | | -0- | |

| Roger H. Skime | | | | | 56 | % | | | 28 | % | | | 5.6 | % | | | -0- | |

In assessing performance against the individual performance objectives, the Committee annually receives a report from the CEO outlining the individual performance objectives of each Named Executive and their specific performance against the objectives. The individual performance objectives generally consist of any one or more of the following business criteria, which are intended to focus the Named Executive on specific areas where they can individually have a direct impact on the Company’s business performance: New Product Development; New Technology Development; Customer Satisfaction; Quality Improvement; Process Development; Cost Reduction; Margin Improvement; EBIT Improvement; Sales Growth; Market Share; Strengthen Employee Base; Distribution Channel Improvement; and Succession. In assessing the level of individual achievement against the individual performance objectives, factors such as whether unforeseen occurrences altered the expected difficulty of the objective, as well as whether the objective was a stretch goal for the individual Named Executive are considered. After reviewing the performance against the objective, the Committee reviewed and approved annual individual incentive awards for each of the executive officers except Mr. Twomey, whose award is based 100% on the Company’s earnings.

The following table sets forth the potential incentive payout for fiscal 2007 for the Named Executives under the individual objectives portion of the Annual Incentive Award:

| | | Incentive as a Percent of Base Pay | | |

|---|

| | |

| | |

| | | Target | | | Maximum | |

|---|

| | |

| | |

| |

| Christopher A. Twomey | | | | | -0- | | | | -0- | |

| Timothy C. Delmore | | | | | 9 | % | | | 18 | % |

| Ronald G. Ray | | | | | 9 | % | | | 18 | % |

| Ole E. Tweet | | | | | 9 | % | | | 18 | % |

| Roger H. Skime | | | | | 7 | % | | | 14 | % |

Mr. Twomey’s annual incentive award, 100% of which was tied to the Company’s earnings, was $304,587, or 57% of his base salary. Mr. Twomey’s total cash compensation, including base pay plus incentive, for fiscal 2007 was $838,000. Mr. Twomey’s total compensation in fiscal 2007 of $1,543,000 represented a 13% increase over his total compensation in fiscal 2006 of $1,318,000. Of this increase, 100% derived from cash-based compensation and 0% from equity-based compensation. Mr. Delmore received an incentive award of $85,391, or 34% of his base pay, for the 80% portion of his award based on Company earnings and $22,424, or 9% of his base pay, for the 20% based on individual performance objectives. Mr. Delmore’s total annual cash compensation, including base pay plus incentive, for fiscal 2007 was $356,975. Mr. Ray received an incentive award of $81,823, or 34% of his base pay, for the 80% portion of his award based on Company earnings and $25,069, or 10.5% of his base pay, for the 20%

12

Table of Contents

based on individual performance objectives. Mr. Ray’s total annual cash compensation, including base pay plus incentive, for fiscal 2007 was $345,642. Mr. Tweet received an incentive award of $85,679, or 34% of his base pay for the 80% portion of his award based on Company earnings, and $26,250, or 10.5% of his base pay, for the 20% based on individual performance objectives. Mr. Tweet’s total annual cash compensation, including base pay plus incentive, for fiscal 2007 was $361,929. Mr. Skime received an incentive award of $52,056, or 27% of his base pay, for the 80% portion of his award based on Company earnings, and $13,670, or 7% of his base pay, for the 20% based on individual performance objectives. Mr. Skime’s total annual cash compensation, including base pay plus incentive, for fiscal 2007 was $261,016.

It is the Board’s policy that the Committee will, to the extent permitted by governing law, have the sole and absolute authority to make retroactive adjustments to any cash or equity based incentive compensation paid to executive officers and certain other officers where the payment was predicated upon the achievement of certain financial results that were subsequently the subject of a restatement of the Company’s financial statements. Where applicable, the Company will seek to recover any amount determined to have been inappropriately received by the individual executive.

Long-Term Incentives. Aligning the interests of management with those of shareholders is accomplished through longer term incentives directly related to the improvement in long-term shareholder value. The Committee believes this is accomplished with the award of stock options to the Named Executives and other key personnel. For the Named Executives, stock options valued at amounts designed to bring total executive compensation generally in line with median market levels are awarded annually and vest over three years. In determining the size of stock option grants to executive officers, the Committee considers similar awards to individuals holding comparable positions in our comparative groups.

The Company does not backdate options or grant options retroactively. In addition, the Company does not plan to coordinate grants of options so that they are made before announcement of favorable information, or after announcement of unfavorable information. The Company’s options are granted at fair market value, historically on the date of the annual meeting of shareholders in August of each year, with all required approvals obtained in advance or on the actual grant date. The executive officers are awarded stock options with an exercise price equal to the fair market value of the Company’s Common Stock on the date of grant. The Company’s general practice is to grant options only on the annual grant date. Generally, newly hired or promoted executives who are eligible to receive options, receive their award of stock options on the date of their hire or promotion. The stock options granted to executive officers, including the Named Executives, generally vest in equal installments on the first, second and third anniversaries of the grant date and expire ten years from the grant date. Stock options for other employees have the same vesting schedule as those for executive officers but expire 5 years from the grant date.

Grants were made to the Named Executives as part of an annual process that encompasses six Company employees. In fiscal 2007, annual grants of options described in the Summary Compensation Table were made by the Stock Grant Subcommittee of the Committee of the Board to the Named Executives at the regularly scheduled August meeting. The Stock Grant Subcommittee is comprised of Messrs. Ostrander and Roberts, independent members of the Board, who are also outside directors under applicable rules of the Internal Revenue Code of 1986, as amended (the “Code”).

Stock options have value for the executive officers only if the price of the Company’s stock appreciates in value from the date of grant. Shareholders also benefit from such stock price appreciation.

13

Table of Contents

The Committee believes that stock options encourage and reward effective management which, in turn, results in the long-term corporate financial success as measured by stock price appreciation. In addition, the Committee believes that equity-based compensation ensures that the Company’s executive officers have a continuing stake in the long-term success of the Company.

The Committee believes that significant long-term incentives are key in assuring that executive and shareholder interests are aligned and expects executives to acquire ownership over time. The Committee also believes that ownership should increase as responsibility level increases within the Company. When considering the magnitude of long-term incentives (equity awards), the Compensation and Human Resources Committee also takes into account the percent of Company ownership of executive officers in comparison to executive officer stock ownership levels at peer companies as it relates to total compensation. However, the Company does not have stock ownership guidelines for its executive officers or directors. Long-term compensation accounted for between 33% and 43% of total compensation in fiscal 2007.

Broad Based Employee Benefit Plans. The Company maintains certain broad based employee benefit plans in which its executive officers, including the Named Executives, have been permitted to participate, including retirement, life, and health insurance plans. The Company’s retirement plan is a 401(k) plan which allows all eligible employees to make pre-tax contributions and in which the Company matches employee contributions in an amount equal to the employee’s contribution up to a maximum of 3% of the employee’s cash compensation.

Perquisites. Executive officers are provided annual use of two ATV’s and two snowmobiles. The products are for personal and business use and are returned each year. The Company sells the returned products to dealers and employees for an amount greater than the Company’s cost. Income for the executive is grossed up to pay for the associated taxes on the value of the products. The Committee believes it is important for Company executives, as part of their job, to be familiar with Company products.

Executive officers also receive supplemental life and disability insurance to provide a competitive death and disability benefit. Incomes for executives are grossed up to pay for the associated tax liability.

Severance Arrangements. The Company and its executive officers have in place severance agreements which are designed to retain the executive officer and provide for continuity of management in the event of an actual or threatened change in control of the Company. The agreements provide that, in the event of a change in control, each executive officer would have specific rights and receive specified benefits if the executive officer is terminated without “cause��� or the executive officer voluntarily terminates his or her employment for “good reason.” In addition, upon certain types of terminations of employment (other than a termination following a change in control of the Company), severance benefits may be paid to the Named Executives. Additional information regarding the severance arrangements is provided in the section of this Proxy Statement entitled, “Potential Payments Upon Termination or Change-in-Control.”

Tax Deductibility of Pay. Section 162(m) of the Code imposes a $1 million limit on the amount that a public company may deduct for compensation paid to the Company’s CEO or any of the Company’s four other most highly compensated executive officers who are employed as of the end of the year. This limitation does not apply to compensation that meets the requirements under Section 162(m) for “qualifying performance-based” compensation. “Qualifying performance-based” compensation is compensation paid only if the individual’s performance meets pre-established objective goals based on

14

Table of Contents

performance criteria approved by the shareholders. The Company believes that all compensation paid under the management incentive plans for fiscal 2007 will be fully deductible for federal income tax purposes.

Compensation Committee Report

The Compensation and Human Resources Committee of the Board of Directors has reviewed and discussed with management the Compensation Discussion and Analysis (“CD&A”). Based on the review and discussions, the Compensation and Human Resources Committee recommended that the Board of Directors include the CD&A in this Proxy Statement.

SUBMITTED BY THE COMPENSATION AND HUMAN RESOURCES COMMITTEE

OF THE COMPANY’S BOARD OF DIRECTORS

Robert J. Dondelinger (Chair) Gregg A. Ostrander David A. Roberts

15

Table of Contents

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash and Certain Other Compensation

The following table shows, for fiscal 2007, the cash compensation paid by the Company, as well as certain other compensation paid or accrued for those years, to Christopher A. Twomey, the Company’s Chief Executive Officer, Timothy C. Delmore, the Company’s Chief Financial Officer and to each of the three other most highly compensated executive officers of the Company whose compensation exceeded $100,000 (collectively with Mr. Twomey and Mr. Delmore, the “Named Executives”). For a discussion of the amount of salary and bonus in proportion to total compensation, as well as other material factors related to summary compensation, please see the “Compensation Discussion and Analysis” section of this Proxy Statement.

SUMMARY COMPENSATION TABLE FOR FISCAL YEAR ENDED MARCH 31, 2007

| Name and Principal Position | | | Year | | | Salary

($) | | | Option

Awards(1)

($) | | | Non-Equity

Incentive Plan

Compensation(2)

($) | | | All Other

Compensation

($) | | | Total ($) | |

|---|

| | |

| | |

| | |

| | |

| | |

| | |

| |

Christopher A. Twomey

President and Chief Executive Officer | | | | | 2007 | | | $ | 533,250 | | | $ | 684,632 | | | $ | 304,587 | | | $ | 20,229 | (3) | | $ | 1,542,698 | |

Timothy C. Delmore

Chief Financial Officer and

Secretary | | | | | 2007 | | | | 249,160 | | | | 315,951 | | | | 107,815 | | | | 8,695 | (3) | | | 681,621 | |

Ronald G. Ray

Vice President — Operations | | | | | 2007 | | | | 238,750 | | | | 208,567 | | | | 106,892 | | | | 8,768 | (3) | | | 562,977 | |

Ole E. Tweet

Vice President — General Manager, ATV | | | | | 2007 | | | | 250,000 | | | | 154,573 | | | | 111,929 | | | | 6,147 | (3) | | | 522,649 | |

Roger H. Skime

Vice President — Snowmobile Engineering | | | | | 2007 | | | | 195,290 | | | | 146,019 | | | | 65,726 | | | | 6,733 | (3) | | | 413,768 | |

| (1) | These amounts reflect the expense recognized for financial statement reporting purposes for fiscal 2007 in accordance with SFAS No. 123(R), unreduced by the estimated service-based forfeitures. The other assumptions used in calculating these amounts are set forth in Note A to the Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2007. |

| (2) | Amounts reflect annual cash incentive awards based on corporate and individual performance. The awards are further described in the “Compensation Discussion and Analysis” section of this Proxy Statement. |

| (3) | Includes contributions by the Company to the individual’s 401(k) retirement plan account. |

16

Table of Contents

SUPPLEMENTAL TABLE TO THE OPTION AWARDS COLUMN

FOR FISCAL YEAR ENDED MARCH 31, 2007

| Name and Principal Position | | | Grant Date | | | Shares

Granted

# | | | Expense

Recorded

in 2007 ($) | |

|---|

| | |

| | |

| | |

| |

Christopher A. Twomey

President and Chief Executive Officer | | | | | 08/02/2006 | | | | 100,000 | | | | 122,206 | |

| | 08/03/2005 | | | | 90,000 | | | | 205,046 | |

| | | | | 08/04/2004 | | | | 80,000 | | | | 256,188 | |

| | | | | 08/07/2003 | | | | 100,000 | | | | 101,192 | |

| | | | | | | | |

| |

| Total | | | | | | | | | | | | $ | 684,632 | |

| | | | | | | | |

| |

Timothy C. Delmore

Chief Financial Officer and Secretary | | | | | 08/02/2006 | | | | 50,000 | | | | 61,103 | |

| | 08/03/2005 | | | | 40,000 | | | | 91,131 | |

| | 08/04/2004 | | | | 35,000 | | | | 113,121 | |

| | | | | 08/07/2003 | | | | 50,000 | | | | 50,596 | |

| | | | | | | | |

| |

| Total | | | | | | | | | | | | $ | 315,951 | |

| | | | | | | | |

| |

Ronald G. Ray

Vice President — Operations | | | | | 08/02/2006 | | | | 32,000 | | | | 39,106 | |

| | 08/03/2005 | | | | 25,000 | | | | 56,957 | |

| | | | | 08/04/2004 | | | | 25,000 | | | | 92,265 | |

| | | | | 08/07/2003 | | | | 20,000 | | | | 20,238 | |

| | | | | | | | |

| |

| Total | | | | | | | | | | | | $ | 208,566 | |

| | | | | | | | |

| |

Ole E. Tweet

Vice President — General Manager, ATV | | | | | 08/02/2006 | | | | 32,000 | | | | 39,106 | |

| | 08/03/2005 | | | | 17,500 | | | | 39,870 | |

| | | | | 08/04/2004 | | | | 15,000 | | | | 55,359 | |

| | | | | 08/07/2003 | | | | 20,000 | | | | 20,238 | |

| | | | | | | | |

| |

| Total | | | | | | | | | | | | $ | 154,573 | |

| | | | | | | | |

| |

Roger H. Skime

Vice President — Snowmobile Engineering | | | | | 08/02/2006 | | | | 25,000 | | | | 30,552 | |

| | 08/03/2005 | | | | 17,500 | | | | 39,870 | |

| | | | | 08/04/2004 | | | | 15,000 | | | | 55,359 | |

| | | | | 08/07/2003 | | | | 20,000 | | | | 20,238 | |

| | | | | | | | |

| |

| Total | | | | | | | | | | | | $ | 146,019 | |

| | | | | | | | |

| |

Grants of Plan-Based Awards for Fiscal Year Ended March 31, 2007

All stock options granted to each of the Named Executives were made under the 2002 Stock Plan. The stock options have an exercise price equal to the closing market price of the underlying security on the date of grant. In addition, the grant date is the date the grant was approved by the Compensation and Human Resources Committee. The stock options granted to the Named Executives in fiscal 2007 vest in equal installments on the first, second and third anniversaries of the grant date and expire ten years from the grant date. There has been no repricing or other material modification of the stock options granted to each of the Named Executives during the last fiscal year.

For a discussion of the amount of salary and bonus in proportion to total compensation, as well as other material factors related to summary compensation, please see the “Compensation Disclosure and Analysis” section of this Proxy Statement.

17

Table of Contents

The following table summarizes grants of equity awards to each of the Named Executives during fiscal 2007:

| Name | | | Grant Date | | | All Other

Option Awards:

Number of Securities

Underlying Options (#) | | | Exercise or

Base Price

of Option Awards

($/Sh)(2) | | | Grant Date Fair

Value of Stock and

Option Awards(1) | |

|---|

| | |

| | |

| | |

| | |

| |

Christopher A. Twomey

President and

Chief Executive Officer | | | | | 08/02/2006 | | | | 100,000 | | | $ | 17.84 | | | $ | 555,760 | |

Timothy C. Delmore

Chief Financial Officer | | | | | 08/02/2006 | | | | 50,000 | | | $ | 17.84 | | | | 277,880 | |

Ronald G. Ray

Vice President — Operations | | | | | 08/02/2006 | | | | 32,000 | | | $ | 17.84 | | | | 177,843 | |

Ole E. Tweet

Vice President — General Manager ATV | | | | | 08/02/2006 | | | | 32,000 | | | $ | 17.84 | | | | 177,843 | |

Roger H. Skime

Vice President — Snowmobile Engineering | | | | | 08/02/2006 | | | | 25,000 | | | $ | 17.84 | | | | 138,940 | |

| (1) | The grant date present value was $5.56 per share. Fair value was determined by multiplying the number of shares by grant date present value. |

| (2) | Closing market price on 08/02/2006. |

18

Table of Contents

Outstanding Equity Awards at March 31, 2007

The following table provides a summary of equity awards outstanding for each of the Named Executives as of the end of fiscal 2007:

| | | Option Awards | | |

|---|

| | |

| | |

| Name | | | Number of Securities Underlying

Unexercised Options | | | Option

Exercise

Price

($) | | | Option

Expiration

Date | | |

|---|

| | |

(#)

Exercisable | | | (#)

Unexercisable | | |

|---|

| | |

| | |

| | |

| | |

| | |

Christopher A. Twomey

President and

Chief Executive Officer | | | | | | | | | 100,000 | (1) | | | 17.84 | | | | 08/02/2016 | |

| | 30,000 | | | | 60,000 | (1) | | | 21.96 | | | | 08/03/2015 | |

| | 53,334 | | | | 26,666 | (1) | | | 27.69 | | | | 08/04/2014 | |

| | | | | 100,000 | | | | | | | | 21.03 | | | | 08/07/2013 | |

| | | | | 100,000 | | | | | | | | 15.50 | | | | 08/08/2012 | |

| | | | | 80,000 | | | | | | | | 15.33 | | | | 08/09/2011 | |

| | | | | 71,709 | | | | | | | | 12.06 | | | | 08/03/2010 | |

| | | | | 34,340 | | | | | | | | 9.38 | | | | 08/05/2009 | |

Timothy C. Delmore

Chief Financial Officer | | | | | | | | | 50,000 | (1) | | | 17.84 | | | | 08/02/2016 | |

| | 13,334 | | | | 26,666 | (1) | | | 21.96 | | | | 08/03/2015 | |

| | 23,334 | | | | 11,666 | (1) | | | 27.69 | | | | 08/04/2014 | |

| | | | | 50,000 | | | | | | | | 21.03 | | | | 08/07/2013 | |

| | | | | 33,333 | | | | | | | | 15.50 | | | | 08/08/2012 | |

| | | | | 11,666 | | | | | | | | 15.33 | | | | 08/09/2011 | |

Ronald G. Ray

Vice President — Operations | | | | | | | | | 32,000 | (1) | | | 17.84 | | | | 08/02/2016 | |

| | 8,334 | | | | 16,666 | (1) | | | 21.96 | | | | 08/03/2015 | |

| | 16,667 | | | | 8,333 | (1) | | | 27.69 | | | | 08/04/2014 | |

| | | | | 20,000 | | | | | | | | 21.03 | | | | 08/07/2013 | |

Roger H. Skime

VP Snowmobile Engineering | | | | | | | | | 25,000 | (1) | | | 17.84 | | | | 08/02/2016 | |

| | 5,834 | | | | 11,666 | (1) | | | 21.96 | | | | 08/03/2015 | |

| | 10,000 | | | | 5,000 | (1) | | | 27.69 | | | | 08/04/2014 | |

| | | | | 20,000 | | | | | | | | 21.03 | | | | 08/07/2013 | |

| | | | | 20,000 | | | | | | | | 15.50 | | | | 08/08/2012 | |

| | | | | 15,000 | | | | | | | | 15.33 | | | | 08/09/2011 | |

Ole E. Tweet

Vice President /General Manager ATV | | | | | | | | | 32,000 | (1) | | | 17.84 | | | | 08/02/2016 | |

| | 5,834 | | | | 11,666 | (1) | | | 21.96 | | | | 08/03/2015 | |

| | 10,000 | | | | 5,000 | (1) | | | 27.69 | | | | 08/04/2014 | |

| | | | | 6,666 | | | | | | | | 21.03 | | | | 08/07/2013 | |

| (1) | Becomes exercisable with respect to one-third of the shares of Common Stock subject to the option on each annual anniversary of the grant date, beginning one year from the date of grant. |

Option Exercises and Stock Vested for Fiscal Year Ended March 31, 2007

None of the Named Executives exercised any stock options during the fiscal year ended March 31, 2007.

19

Table of Contents

Potential Payments Upon Termination or Change-in-Control

The Company has entered into employment agreements with each of its executive officers which provide, among other things, for a lump-sum cash severance payment to each such executive equal to approximately three times the executive’s average annual compensation over the preceding five years plus certain fringe benefits under certain circumstances following a “change in control” of the Company. In general, a “change in control” would occur when there has been any change in the controlling persons reported in the Company’s proxy statement, when 20% or more of the Company’s outstanding voting stock is acquired by any person, when current members of the Board of Directors or their successors elected or nominated by such members cease to constitute at least 75% of the Board of Directors, when the Company merges or consolidates with or sells substantially all its assets to any person or entity or when the Company’s shareholders approve a plan of liquidation or dissolution of the Company. The employment agreements also prohibit disclosure of confidential information concerning the Company and require disclosure and assignment of inventions, discoveries and other works relating to the executive’s employment. If a “change in control” had occurred at the end of fiscal 2007 and the executive’s employment was terminated by the executive for “good reason” or by the Company for other than “cause” or disability, the Named Executives would have received the amounts indicated, which includes deemed compensation during the preceding five years from the exercise of stock options and a reasonable estimate of the cost of life, disability, accident and health insurance benefits required to be provided by the Company for the 36-month period following such termination: Mr. Twomey, $2,898,317; Mr. Delmore, $752,490; Mr. Ray, $968,996; Mr. Skime, $553,718; and Mr. Tweet, $699,148.

If the Named Executive fails to perform his or her duties due to disability, then the Company shall pay the executive his or her base salary at the rate in effect at the commencement of the period of such disability plus a pro rata portion of an amount equal to the year-end bonus paid to the executive for the fiscal year immediately preceding the change in control, until such time as the executive is determined to be eligible for long-term disability benefits in accordance with the Company’s insurance programs.

The Company has also entered into employment agreements with each of its executive officers, including the Named Executives, pursuant to which they will receive upon termination of employment (and with respect to Mr. Twomey upon his voluntary termination), by the Company for other than “cause,” for a twelve-month period, (i) with respect to Mr. Twomey, an amount equal to his average annual cash compensation over the five-year period immediately preceding the date of termination and with respect to the other executive officers, an amount equal to their average annual salary over the three-year period immediately preceding the date of termination, and (ii) the employee benefits received prior to termination. The employment agreements also restrict each executive officer from certain competitive employment following termination and prohibit disclosure of confidential information concerning the Company. Mr. Twomey, upon termination of his employment for any reason, will also receive $175,000 of deferred compensation. If the following Named Executives had been terminated at the end of the last fiscal year for a reason other than cause, they would have received the following amounts pursuant to the employment agreements: Mr. Twomey, $737,171 (in addition to the deferred compensation); Mr. Delmore, $242,053; Mr. Ray, $231,850; Mr. Skime, $189,333; and Mr. Tweet, $216,667.

20

Table of Contents

The following table summarizes the amounts payable to the Named Executives following a termination of employment:

| Name | | | Involuntary (Not for

“Cause” or “Disability”)

or for Good Reason

Following Change in Control | | | Involuntary (Not for “Cause”) | |

|---|

| | |

| | |

| |

| Christopher A. Twomey | | | | $ | 2,898,317 | | | $ | 737,171 | |

| Timothy C. Delmore | | | | | 752,490 | | | | 242,053 | |

| Ronald G. Ray | | | | | 968,996 | | | | 231,850 | |

| Ole E. Tweet | | | | | 699,148 | | | | 216,667 | |

| Roger H. Skime | | | | | 553,718 | | | | 189,333 | |

Compensation of Non-Management Directors

The Company uses a combination of cash and stock-based incentive compensation to attract and retain qualified candidates to serve on the Board of Directors. In setting director compensation, the Company considers the significant amount of time that directors expend in fulfilling their duties to the Company as well as the skill-level required by the Company of members of the Board.

Management directors do not receive compensation for their service as directors. All non-employee directors other than the representative of Class B Common Stock currently receive $5,000 per quarter, $1,000 per meeting attended, $750 per committee meeting and $3,500 additional compensation per year if they serve as a committee chair, in addition to reimbursement of out-of-pocket expenses incurred on behalf of the Company. In addition, pursuant to the Company’s 2002 Stock Plan, each non-employee director automatically receives on the date of election or re-election as a director, or appointment as a director by action of the Board during the period between shareholder meetings, and on the date of each subsequent annual or special shareholder meeting at which action is taken to elect any director if the non-employee director’s term is not up for election that year and the non-employee director is serving an unexpired term (provided that the non-employee director has served for at least six months), an option to purchase 6,000 shares of the Company’s Common Stock at an option price equal to the fair market value of the Company’s Common Stock on the date the option is granted. These options have terms expiring five years following termination of service as a director and are exercisable at any time following the date of grant. The 2002 Stock Plan also permits granting of additional or alternative options to directors at the discretion of the Board. Upon shareholder approval of the Arctic Cat Inc. 2007 Omnibus Stock and Incentive Plan (the “2007 Omnibus Plan”), no further awards will be made under the Company’s 2002 Stock Plan and non-employee directors will receive the awards described in the description of the 2007 Omnibus Plan in this Proxy Statement. The director elected by the holder of Class B Common Stock is reimbursed for out-of-pocket expenses incurred on behalf of the Company and does not receive the remuneration described above.

In addition, non-employee directors are provided annual use of an ATV and a snowmobile. The products are for personal use and are returned each year except in the year of a director’s retirement, in which case the director is permitted to keep the vehicles. The Company sells the returned products to dealers and employees for an amount greater than the Company’s cost. The Company believes it is important for its directors to be familiar with Company products.

21

Table of Contents

Non-Management Director Compensation for Fiscal Year Ended March 31, 2007

The following table summarizes the compensation paid to non-management directors during fiscal 2007:

| Name | | | Fees Earned or

Paid in Cash

($) | | | Option

Awards

($) | | | All Other

Compensation

($) | | | Total

($) | |

|---|

| | |

| | |

| | |

| | |

| |

| Robert J. Dondelinger | | | | | 30,000 | | | | 40,183 | (1) | | | -0- | | | | 70,183 | |

| William I. Hagen(2) | | | | | 27,000 | | | | 40,183 | (1) | | | 12,632 | (3) | | | 79,815 | |

| Masayoshi Ito | | | | | -0- | | | | -0- | | | | -0- | | | | -0- | |

| Susan E. Lester | | | | | 33,750 | | | | 40,183 | (1) | | | -0- | | | | 73,933 | |

| William G. Ness | | | | | 30,000 | | | | 40,183 | (1) | | | -0- | | | | 70,183 | |

| Gregg A. Ostrander | | | | | 34,250 | | | | 40,183 | (1) | | | -0- | | | | 74,433 | |

| David A. Roberts(4) | | | | | 12,000 | | | | 36,962 | (1) | | | -0- | | | | 48,962 | |

| Kenneth J. Roering | | | | | 31,250 | | | | 40,183 | (1) | | | -0- | | | | 71,433 | |

| (1) | These amounts reflect the expense recognized for financial statement reporting purposes for fiscal 2007 in accordance with SFAS No. 123(R), unreduced by the estimated service-based forfeitures. The other assumptions used in calculating these amounts are set forth in Note A to the Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2007. Except for Mr. Roberts, the grant date fair value of each option award computed in accordance with FAS 123R was $40,183, or $6.70 per share. The grant date fair value of Mr. Roberts’ option award computed in accordance with FAS 123R was $36,962, or $6.16 per share At fiscal-year end, Mr. Dondelinger and Mr. Hagen held options to purchase 89,721 shares of Common Stock; Ms. Lester held options to purchase 18,000 shares of Common Stock; Mr. Ness held options to purchase 24,000 shares of Common Stock; Mr. Ostrander held options to purchase 54,000 shares of Common Stock; Mr. Roberts held options to purchase 6,000 shares of Common Stock and; Mr. Roering held options to purchase 54,000 shares of Common Stock. |

| (2) | Mr. Hagen retired from the Company’s Board as of February 14, 2007. |

| (3) | The amount reflects the aggregate incremental cost to the Company for an ATV and a snowmobile that Mr. Hagen was permitted to keep upon his retirement from the Company’s Board. |

| (4) | Mr. Roberts was appointed a director on August 28, 2006. |

Supplemental Table to the Non-Management Director Option Awards Column for

Fiscal Year Ended March 31, 2007

| Name | | | Grant Date | | | Shares

Granted # | | | Expense Recorded

in 2007 ($) | |

|---|

| | |

| | |

| | |

| |

| Robert J. Dondelinger | | | | | 08/02/2006 | | | | 6,000 | | | | 40,183 | |

| William I. Hagen | | | | | 08/02/2006 | | | | 6,000 | | | | 40,183 | |

| Masayoshi Ito | | | | | — | | | | — | | | | — | |

| Susan E. Lester | | | | | 08/02/2006 | | | | 6,000 | | | | 40,183 | |

| William G. Ness | | | | | 08/02/2006 | | | | 6,000 | | | | 40,183 | |

| Gregg A. Ostrander | | | | | 08/02/2006 | | | | 6,000 | | | | 40,183 | |

| David A. Roberts | | | | | 08/28/2006 | | | | 6,000 | | | | 36,962 | |

| Kenneth J. Roering | | | | | 08/02/2006 | | | | 6,000 | | | | 40,183 | |

Compensation Committee Interlocks and Insider Participation

As described below, Mr. Dondelinger, a director and member of the Compensation and Human Resources Committee of the Board, has a relationship with an entity which engages in certain

22

Table of Contents

transactions with the Company which require disclosure. See “Certain Transactions.” Mr. Ness, a director and former member of the Compensation and Human Resources Committee of the Board, was formerly an officer of the Company.

Certain Transactions

Since the Company first began production in August 1983, it has purchased engines for its products from Suzuki pursuant to contracts which are renewed annually and which stipulate price and general terms of delivery of engines. During the last fiscal year, the Company paid Suzuki $111,931,208 for engines, service parts and tooling. Terms of the agreement were, and renewal rates are, the subject of arms-length negotiation on terms no less favorable to the Company than the Company could otherwise obtain.

During the last fiscal year, the Company purchased certain vehicles from Northern Motors, a General Motors dealership in which Mr. Dondelinger, a director of the Company, is Co-Owner and Chairman of the Board. During the last fiscal year, the Company paid Northern Motors $126,581 for vehicles, repairs and other miscellaneous items. The prices paid by the Company were, and will continue to be, the subject of arms-length negotiation on terms no less favorable to the Company than the Company could otherwise obtain.

On May 1, 2003, Miller & Hagen Investments, LLP of which Mr. Hagen, a former director of the Company, is a partner entered into a five year lease with the Company. The lease is for approximately 14,350 square feet consisting of warehouse, machine shop and office space located in Thief River Falls, Minnesota. The rent is $55,000 annually, a rate which was the subject of arms-length negotiation and is no less favorable to the Company than the Company could otherwise obtain.

Notwithstanding these transactions, Mr. Dondelinger is considered an “independent director” under the rules of The NASDAQ Stock Market and has been so determined by the Board given the relatively small size of the transactions. Mr. Hagen, who retired from the Board as of February 14, 2007, was also considered an “independent director” under the rules of The NASDAQ Stock Market and had been so determined by the Board given the relatively small size of the transaction.

Review, Approval or Ratification of Transactions with Related Persons

The Audit Committee, currently comprised of Messrs. Ostrander (Chair) and Roering and Ms. Lester, is responsible for the review and approval of all related-party transactions between the Company and any executive officer, director or director nominee of the Company, or any immediate family member of any such person. In addition, all related-party transactions that come within the disclosures required by Item 404 of the SEC’s Regulation S-K must also be approved by the Audit Committee. The policies and procedures regarding the approval of all such related-party transactions have been approved at a meeting of the Audit Committee and are evidenced in the corporate records of the Company.

23

Table of Contents

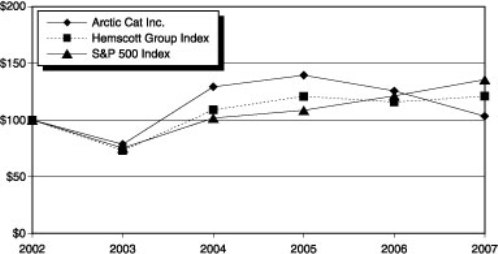

Performance Graph

In accordance with the rules of the SEC, the following performance graph compares performance of the Company’s Common Stock on The NASDAQ Stock Market to the Standard & Poor’s 500 Index and to the Recreational Vehicles Index prepared by Hemscott, Inc.. The graph compares on an annual basis the cumulative total shareholder return on $100 invested on March 31, 2002, and assumes reinvestment of all dividends and has been adjusted to reflect stock splits. The performance graph is not necessarily indicative of future investment performance.

COMPARE 5-YEAR CUMULATIVE TOTAL RETURN

AMONG ARCTIC CAT INC.,

S&P 500 INDEX AND HEMSCOTT GROUP INDEX

ASSUMES $100 INVESTED ON APR. 1, 2002

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING MAR. 31, 2007

| | | MARCH 31, | | |

|---|

| | |

| | |

| | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | |

|---|

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Arctic Cat Inc. | | | | $ | 100.00 | | | $ | 78.66 | | | $ | 129.38 | | | $ | 139.50 | | | $ | 125.68 | | | $ | 103.40 | |

| Recreational Vehicles Index | | | | | 100.00 | | | | 73.11 | | | | 108.92 | | | | 120.92 | | | | 115.85 | | | | 121.11 | |

| S&P 500 Index | | | | | 100.00 | | | | 75.24 | | | | 101.66 | | | | 108.47 | | | | 121.18 | | | | 135.52 | |

24

Table of Contents

BENEFICIAL OWNERSHIP OF CAPITAL STOCK

The following table presents information provided to the Company as to the beneficial ownership of the Company’s capital stock as of June 15, 2007 by (i) the only shareholders known to the Company to hold 5% or more of such stock, (ii) each of the nominees, directors and Named Executives of the Company and (iii) all directors and officers as a group. Unless otherwise indicated, all shares represent sole voting and investment power.

Beneficial Owners | | | Capital Stock

Beneficially Owned(1) | | | Percent of

Outstanding Shares

of Common Stock | | | Percent of

Outstanding Shares

of Capital Stock | |

|---|

| | |

| | |

| | |

| |

Suzuki Motor Corporation

300 Takatsuki-cho

Hamamatsu-shi

Shizuoka-ken, Japan 432-8611 | | | | | 6,102,000 | (2) | | | 0 | % | | | 33.1 | % |

Royce & Associates, LLC

1414 Avenue of the Americas

New York, NY 10019 | | | | | 1,518,034 | (3) | | | 12.3 | % | | | 8.2 | % |

| Barclays Global Investors Ltd. | | | | | | | | | | | | | | |