5 Quarterly Financial Supplement Second quarter of fiscal 2023 results

TABLE OF CONTENTS PAGE Consolidated Statements of Income (Unaudited) 3 Consolidated Selected Key Metrics (Unaudited) 4 Segment Results Private Client Group (Unaudited) 6 Capital Markets (Unaudited) 7 Asset Management (Unaudited) 8 Bank (Unaudited) 9 Other (Unaudited) 10 Bank Segment Selected Key Metrics (Unaudited) 11 Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) 12 Footnotes 18 RAYMOND JAMES FINANCIAL, INC.

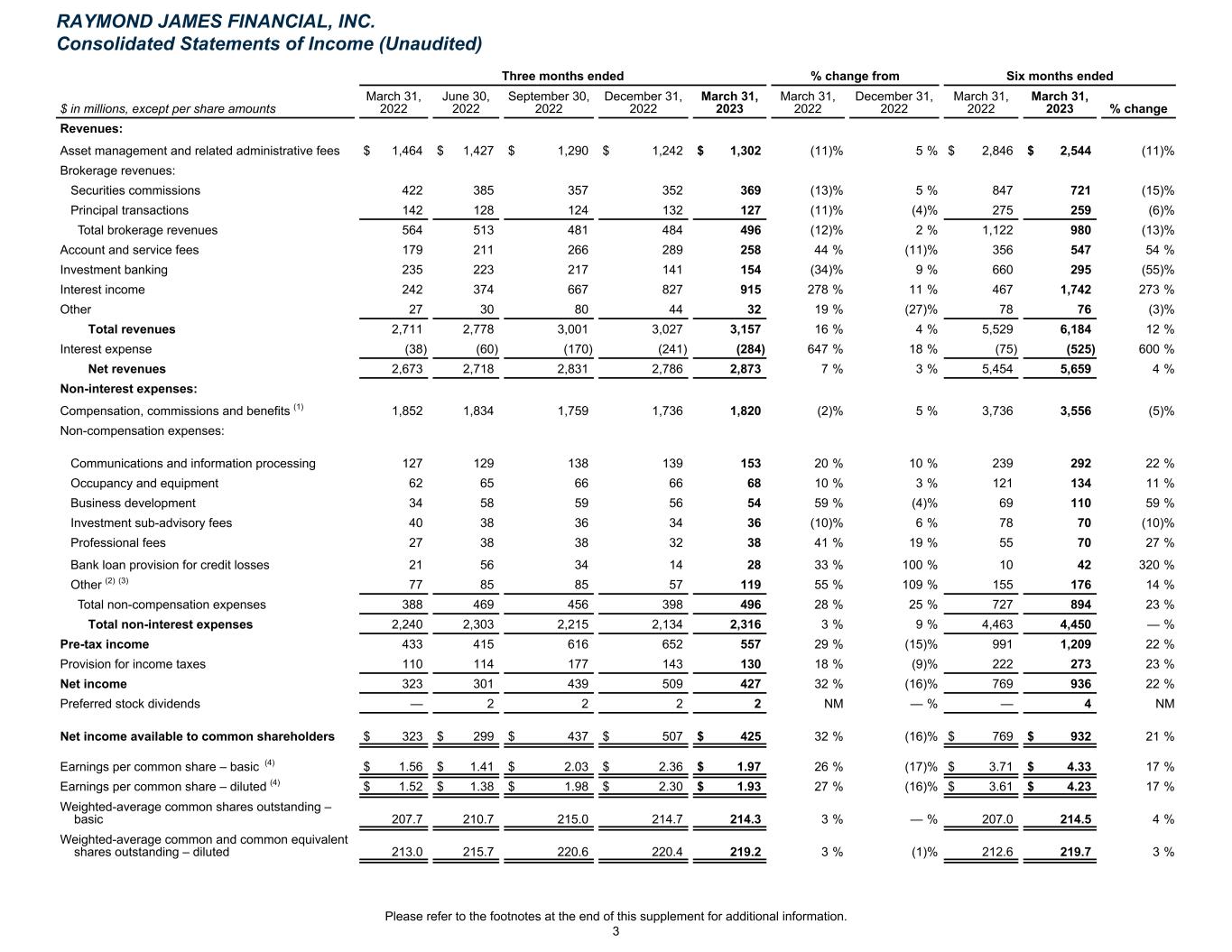

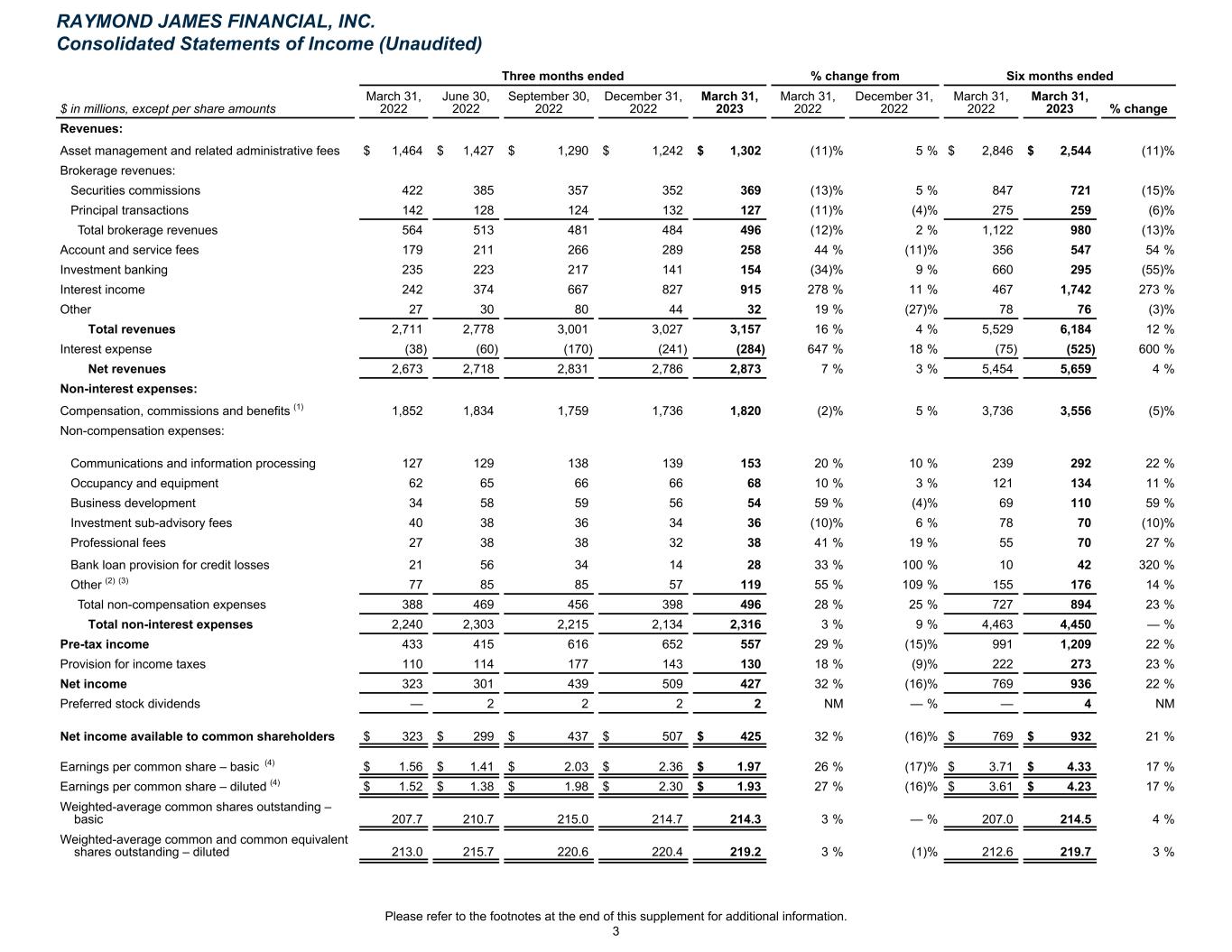

Three months ended % change from Six months ended $ in millions, except per share amounts March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 March 31, 2022 March 31, 2023 % change Revenues: Asset management and related administrative fees $ 1,464 $ 1,427 $ 1,290 $ 1,242 $ 1,302 (11) % 5 % $ 2,846 $ 2,544 (11) % Brokerage revenues: Securities commissions 422 385 357 352 369 (13) % 5 % 847 721 (15) % Principal transactions 142 128 124 132 127 (11) % (4) % 275 259 (6) % Total brokerage revenues 564 513 481 484 496 (12) % 2 % 1,122 980 (13) % Account and service fees 179 211 266 289 258 44 % (11) % 356 547 54 % Investment banking 235 223 217 141 154 (34) % 9 % 660 295 (55) % Interest income 242 374 667 827 915 278 % 11 % 467 1,742 273 % Other 27 30 80 44 32 19 % (27) % 78 76 (3) % Total revenues 2,711 2,778 3,001 3,027 3,157 16 % 4 % 5,529 6,184 12 % Interest expense (38) (60) (170) (241) (284) 647 % 18 % (75) (525) 600 % Net revenues 2,673 2,718 2,831 2,786 2,873 7 % 3 % 5,454 5,659 4 % Non-interest expenses: Compensation, commissions and benefits (1) 1,852 1,834 1,759 1,736 1,820 (2) % 5 % 3,736 3,556 (5) % Non-compensation expenses: Communications and information processing 127 129 138 139 153 20 % 10 % 239 292 22 % Occupancy and equipment 62 65 66 66 68 10 % 3 % 121 134 11 % Business development 34 58 59 56 54 59 % (4) % 69 110 59 % Investment sub-advisory fees 40 38 36 34 36 (10) % 6 % 78 70 (10) % Professional fees 27 38 38 32 38 41 % 19 % 55 70 27 % Bank loan provision for credit losses 21 56 34 14 28 33 % 100 % 10 42 320 % Other (2) (3) 77 85 85 57 119 55 % 109 % 155 176 14 % Total non-compensation expenses 388 469 456 398 496 28 % 25 % 727 894 23 % Total non-interest expenses 2,240 2,303 2,215 2,134 2,316 3 % 9 % 4,463 4,450 — % Pre-tax income 433 415 616 652 557 29 % (15) % 991 1,209 22 % Provision for income taxes 110 114 177 143 130 18 % (9) % 222 273 23 % Net income 323 301 439 509 427 32 % (16) % 769 936 22 % Preferred stock dividends — 2 2 2 2 NM — % — 4 NM Net income available to common shareholders $ 323 $ 299 $ 437 $ 507 $ 425 32 % (16) % $ 769 $ 932 21 % Earnings per common share – basic (4) $ 1.56 $ 1.41 $ 2.03 $ 2.36 $ 1.97 26 % (17) % $ 3.71 $ 4.33 17 % Earnings per common share – diluted (4) $ 1.52 $ 1.38 $ 1.98 $ 2.30 $ 1.93 27 % (16) % $ 3.61 $ 4.23 17 % Weighted-average common shares outstanding – basic 207.7 210.7 215.0 214.7 214.3 3 % — % 207.0 214.5 4 % Weighted-average common and common equivalent shares outstanding – diluted 213.0 215.7 220.6 220.4 219.2 3 % (1) % 212.6 219.7 3 % RAYMOND JAMES FINANCIAL, INC. Consolidated Statements of Income (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 3

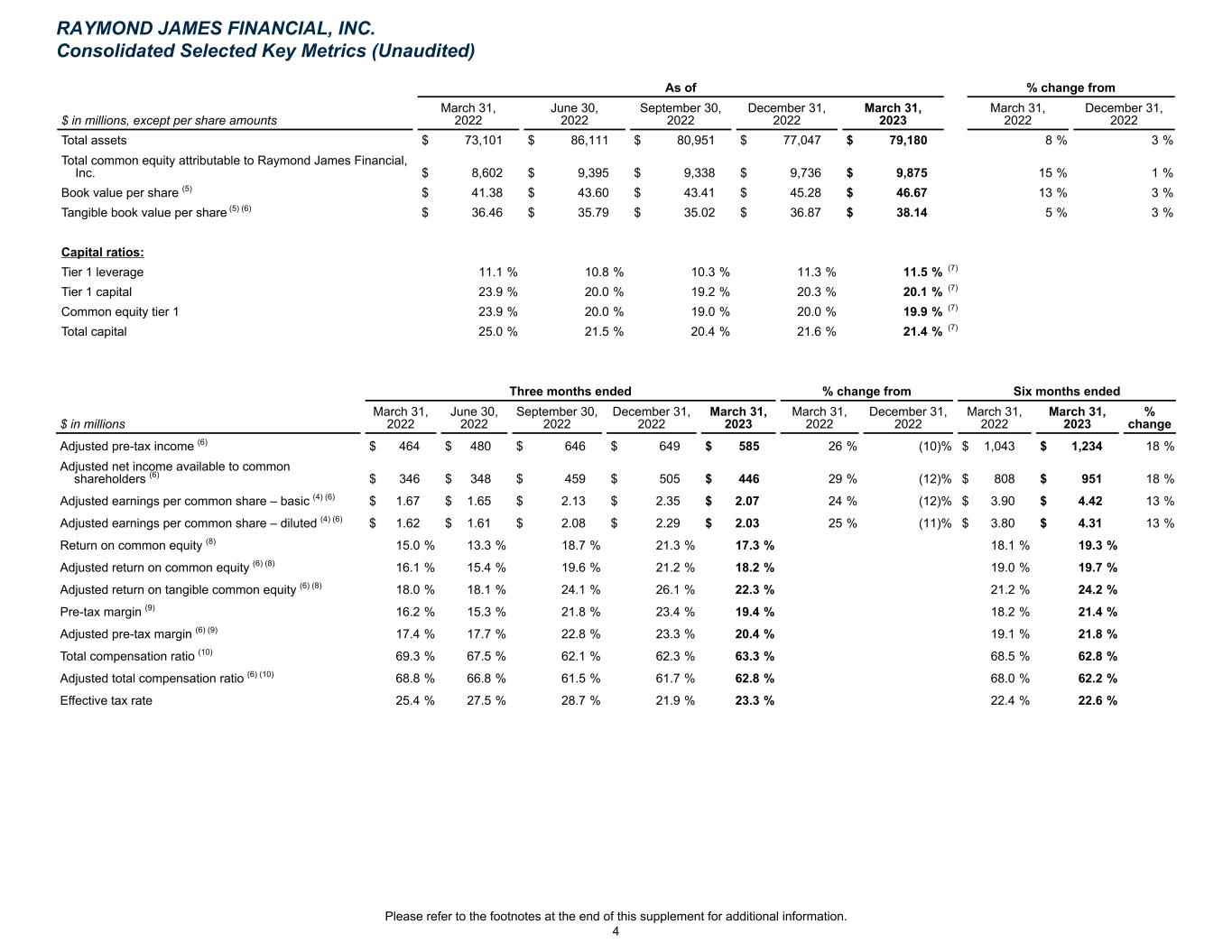

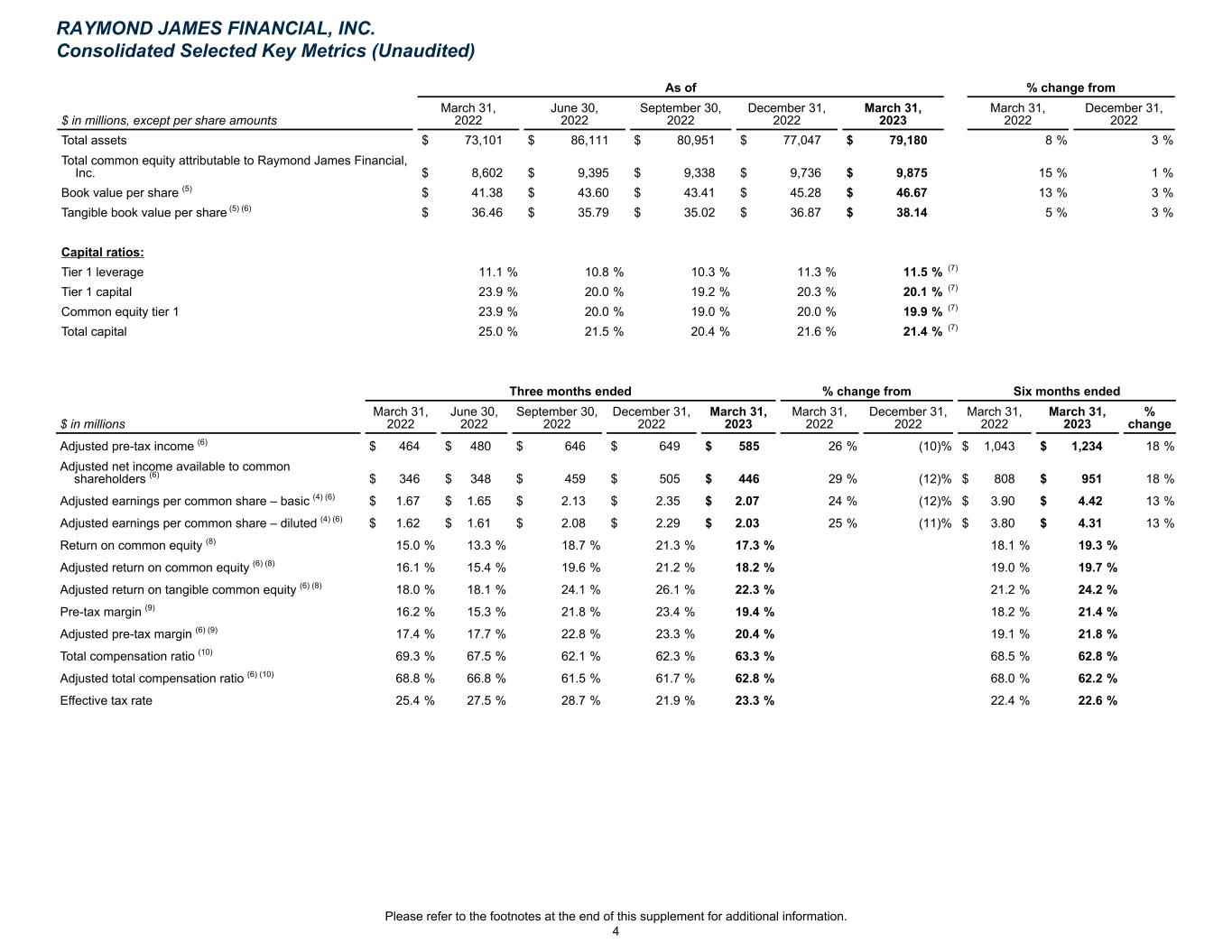

As of % change from $ in millions, except per share amounts March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 Total assets $ 73,101 $ 86,111 $ 80,951 $ 77,047 $ 79,180 8 % 3 % Total common equity attributable to Raymond James Financial, Inc. $ 8,602 $ 9,395 $ 9,338 $ 9,736 $ 9,875 15 % 1 % Book value per share (5) $ 41.38 $ 43.60 $ 43.41 $ 45.28 $ 46.67 13 % 3 % Tangible book value per share (5) (6) $ 36.46 $ 35.79 $ 35.02 $ 36.87 $ 38.14 5 % 3 % Capital ratios: Tier 1 leverage 11.1 % 10.8 % 10.3 % 11.3 % 11.5 % (7) Tier 1 capital 23.9 % 20.0 % 19.2 % 20.3 % 20.1 % (7) Common equity tier 1 23.9 % 20.0 % 19.0 % 20.0 % 19.9 % (7) Total capital 25.0 % 21.5 % 20.4 % 21.6 % 21.4 % (7) Three months ended % change from Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 March 31, 2022 March 31, 2023 % change Adjusted pre-tax income (6) $ 464 $ 480 $ 646 $ 649 $ 585 26 % (10) % $ 1,043 $ 1,234 18 % Adjusted net income available to common shareholders (6) $ 346 $ 348 $ 459 $ 505 $ 446 29 % (12) % $ 808 $ 951 18 % Adjusted earnings per common share – basic (4) (6) $ 1.67 $ 1.65 $ 2.13 $ 2.35 $ 2.07 24 % (12) % $ 3.90 $ 4.42 13 % Adjusted earnings per common share – diluted (4) (6) $ 1.62 $ 1.61 $ 2.08 $ 2.29 $ 2.03 25 % (11) % $ 3.80 $ 4.31 13 % Return on common equity (8) 15.0 % 13.3 % 18.7 % 21.3 % 17.3 % 18.1 % 19.3 % Adjusted return on common equity (6) (8) 16.1 % 15.4 % 19.6 % 21.2 % 18.2 % 19.0 % 19.7 % Adjusted return on tangible common equity (6) (8) 18.0 % 18.1 % 24.1 % 26.1 % 22.3 % 21.2 % 24.2 % Pre-tax margin (9) 16.2 % 15.3 % 21.8 % 23.4 % 19.4 % 18.2 % 21.4 % Adjusted pre-tax margin (6) (9) 17.4 % 17.7 % 22.8 % 23.3 % 20.4 % 19.1 % 21.8 % Total compensation ratio (10) 69.3 % 67.5 % 62.1 % 62.3 % 63.3 % 68.5 % 62.8 % Adjusted total compensation ratio (6) (10) 68.8 % 66.8 % 61.5 % 61.7 % 62.8 % 68.0 % 62.2 % Effective tax rate 25.4 % 27.5 % 28.7 % 21.9 % 23.3 % 22.4 % 22.6 % RAYMOND JAMES FINANCIAL, INC. Consolidated Selected Key Metrics (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 4

As of % change from March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 Client asset metrics ($ in billions): Client assets under administration $ 1,256.1 $ 1,125.3 $ 1,093.1 $ 1,169.7 $ 1,224.4 (3) % 5 % Private Client Group assets under administration $ 1,198.3 $ 1,068.8 $ 1,039.0 $ 1,114.3 $ 1,171.1 (2) % 5 % Private Client Group assets in fee-based accounts $ 678.0 $ 606.7 $ 586.0 $ 633.1 $ 666.3 (2) % 5 % Financial assets under management $ 193.7 $ 182.4 $ 173.8 $ 185.9 $ 194.4 — % 5 % Net new assets metrics (11) ($ in millions) Three months ended Six months ended March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Domestic Private Client Group net new assets $ 24,093 $ 14,663 $ 20,184 $ 23,226 $ 21,473 $ 60,194 $ 44,699 Domestic Private Client Group net new assets growth — annualized 8.6 % 5.4 % 8.3 % 9.8 % 8.4 % 11.4 % 9.4 % Clients' domestic cash sweep and Enhanced Savings Program balances ($ in millions) As of % change from March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 Raymond James Bank Deposit Program (“RJBDP”): (12) Bank segment (12) $ 33,570 $ 36,646 $ 38,705 $ 39,098 $ 37,682 12 % (4) % Third-party banks 25,887 25,478 21,964 18,231 9,408 (64) % (48) % Subtotal RJBDP 59,457 62,124 60,669 57,329 47,090 (21) % (18) % Client Interest Program 17,013 13,717 6,445 3,053 2,385 (86) % (22) % Total clients’ domestic cash sweep balances 76,470 75,841 67,114 60,382 49,475 (35) % (18) % Enhanced Savings Program (13) — — — — 2,746 NM NM Total clients’ domestic cash sweep and Enhanced Savings Program balances $ 76,470 $ 75,841 $ 67,114 $ 60,382 $ 52,221 (32) % (14) % Three months ended Six months ended March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Average yield on RJBDP - third-party banks (14) 0.32 % 0.88 % 1.85 % 2.72 % 3.25 % 0.30 % 2.93 % As of % change from March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 Private Client Group financial advisors: Employees 3,601 3,615 3,638 3,631 3,628 1 % — % Independent contractors (15) 5,129 5,001 5,043 5,068 5,098 (1) % 1 % Total advisors (15) 8,730 8,616 8,681 8,699 8,726 — % — % RAYMOND JAMES FINANCIAL, INC. Consolidated Selected Key Metrics (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 5

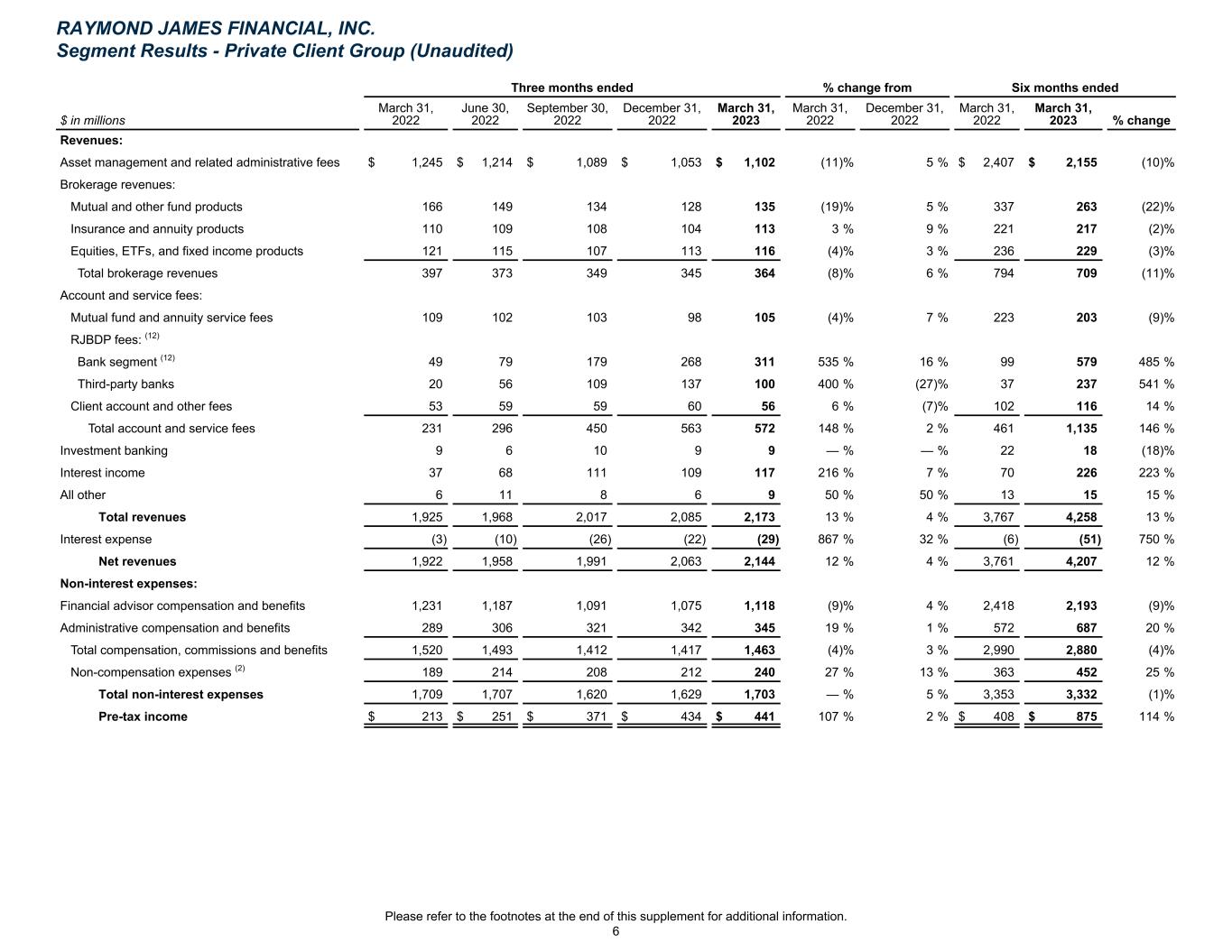

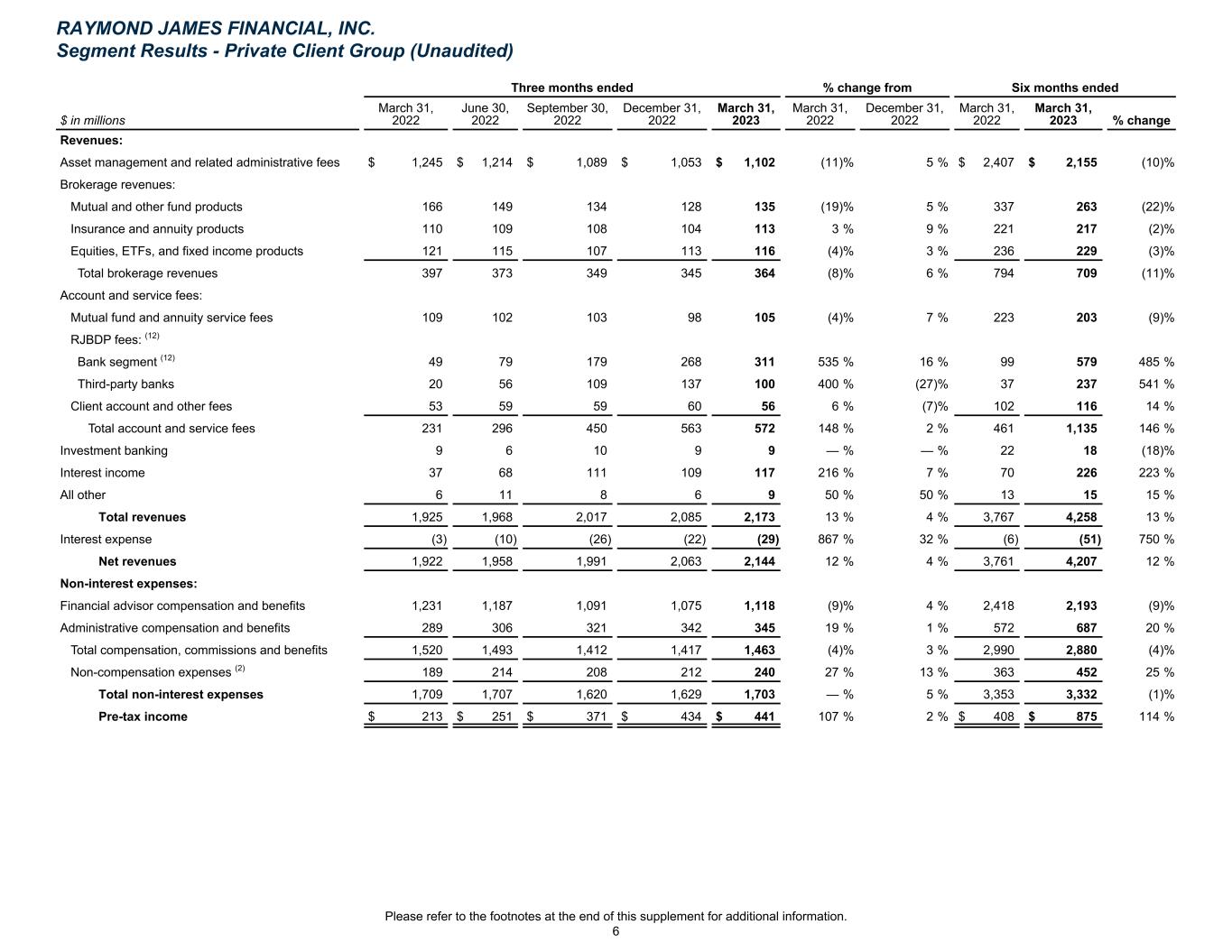

Three months ended % change from Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 March 31, 2022 March 31, 2023 % change Revenues: Asset management and related administrative fees $ 1,245 $ 1,214 $ 1,089 $ 1,053 $ 1,102 (11) % 5 % $ 2,407 $ 2,155 (10) % Brokerage revenues: Mutual and other fund products 166 149 134 128 135 (19) % 5 % 337 263 (22) % Insurance and annuity products 110 109 108 104 113 3 % 9 % 221 217 (2) % Equities, ETFs, and fixed income products 121 115 107 113 116 (4) % 3 % 236 229 (3) % Total brokerage revenues 397 373 349 345 364 (8) % 6 % 794 709 (11) % Account and service fees: Mutual fund and annuity service fees 109 102 103 98 105 (4) % 7 % 223 203 (9) % RJBDP fees: (12) Bank segment (12) 49 79 179 268 311 535 % 16 % 99 579 485 % Third-party banks 20 56 109 137 100 400 % (27) % 37 237 541 % Client account and other fees 53 59 59 60 56 6 % (7) % 102 116 14 % Total account and service fees 231 296 450 563 572 148 % 2 % 461 1,135 146 % Investment banking 9 6 10 9 9 — % — % 22 18 (18) % Interest income 37 68 111 109 117 216 % 7 % 70 226 223 % All other 6 11 8 6 9 50 % 50 % 13 15 15 % Total revenues 1,925 1,968 2,017 2,085 2,173 13 % 4 % 3,767 4,258 13 % Interest expense (3) (10) (26) (22) (29) 867 % 32 % (6) (51) 750 % Net revenues 1,922 1,958 1,991 2,063 2,144 12 % 4 % 3,761 4,207 12 % Non-interest expenses: Financial advisor compensation and benefits 1,231 1,187 1,091 1,075 1,118 (9) % 4 % 2,418 2,193 (9) % Administrative compensation and benefits 289 306 321 342 345 19 % 1 % 572 687 20 % Total compensation, commissions and benefits 1,520 1,493 1,412 1,417 1,463 (4) % 3 % 2,990 2,880 (4) % Non-compensation expenses (2) 189 214 208 212 240 27 % 13 % 363 452 25 % Total non-interest expenses 1,709 1,707 1,620 1,629 1,703 — % 5 % 3,353 3,332 (1) % Pre-tax income $ 213 $ 251 $ 371 $ 434 $ 441 107 % 2 % $ 408 $ 875 114 % RAYMOND JAMES FINANCIAL, INC. Segment Results - Private Client Group (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 6

Three months ended % change from Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 March 31, 2022 March 31, 2023 % change Revenues: Brokerage revenues: Fixed income $ 125 $ 107 $ 96 $ 100 $ 96 (23) % (4) % $ 245 $ 196 (20) % Equity 41 32 30 34 34 (17) % — % 80 68 (15) % Total brokerage revenues 166 139 126 134 130 (22) % (3) % 325 264 (19) % Investment banking: Merger & acquisition and advisory 139 147 152 102 87 (37) % (15) % 410 189 (54) % Equity underwriting 52 36 25 15 29 (44) % 93 % 149 44 (70) % Debt underwriting 35 34 30 16 29 (17) % 81 % 79 45 (43) % Total investment banking 226 217 207 133 145 (36) % 9 % 638 278 (56) % Interest income 5 6 20 23 21 320 % (9) % 10 44 340 % Affordable housing investments business revenues 15 21 56 24 23 53 % (4) % 50 47 (6) % All other 4 3 9 4 3 (25) % (25) % 9 7 (22) % Total revenues 416 386 418 318 322 (23) % 1 % 1,032 640 (38) % Interest expense (3) (3) (19) (23) (20) 567 % (13) % (5) (43) 760 % Net revenues 413 383 399 295 302 (27) % 2 % 1,027 597 (42) % Non-interest expenses: Compensation, commissions and benefits 253 243 238 213 231 (9) % 8 % 584 444 (24) % Non-compensation expenses 73 79 95 98 105 44 % 7 % 155 203 31 % Total non-interest expenses 326 322 333 311 336 3 % 8 % 739 647 (12) % Pre-tax income/(loss) $ 87 $ 61 $ 66 $ (16) $ (34) NM (113) % $ 288 $ (50) NM RAYMOND JAMES FINANCIAL, INC. Segment Results - Capital Markets (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 7

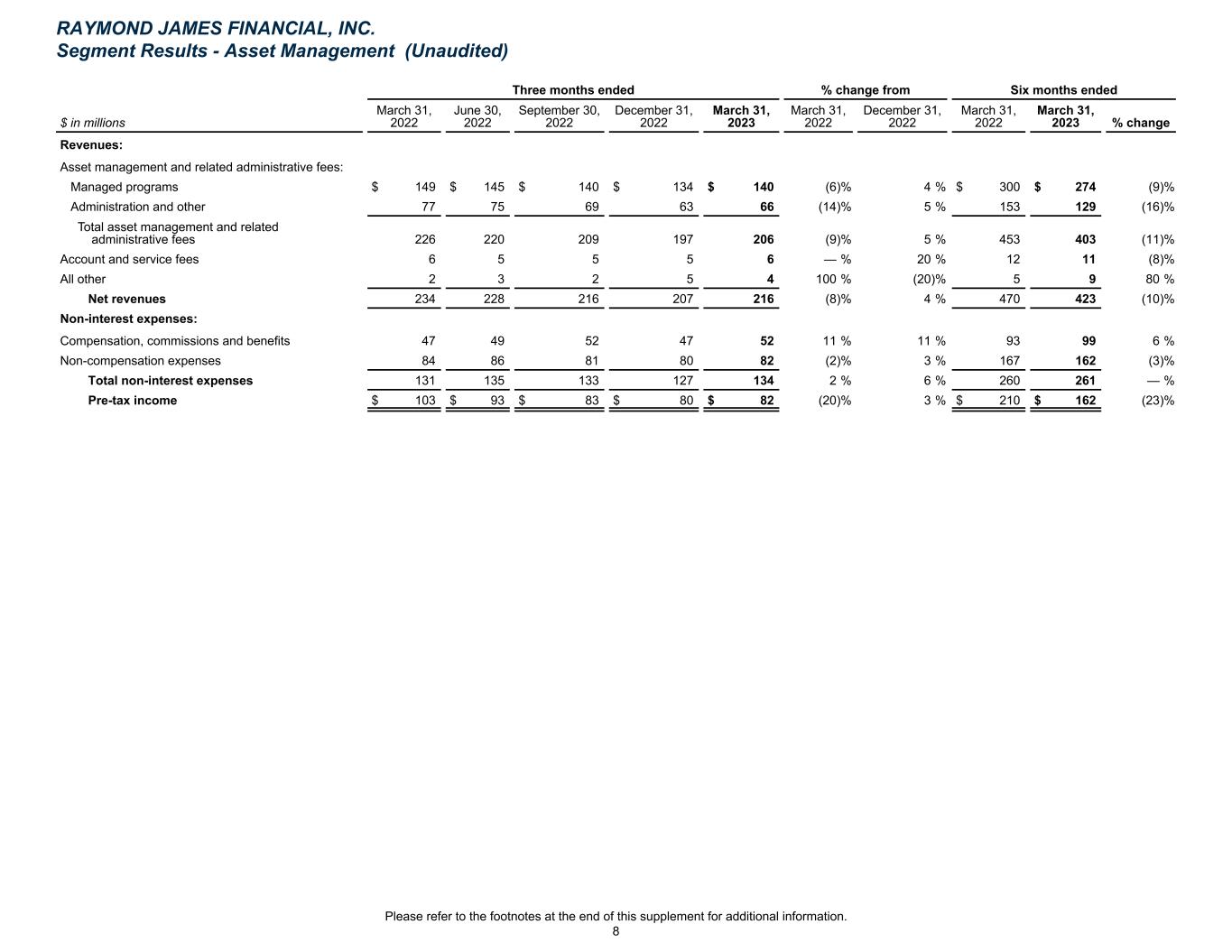

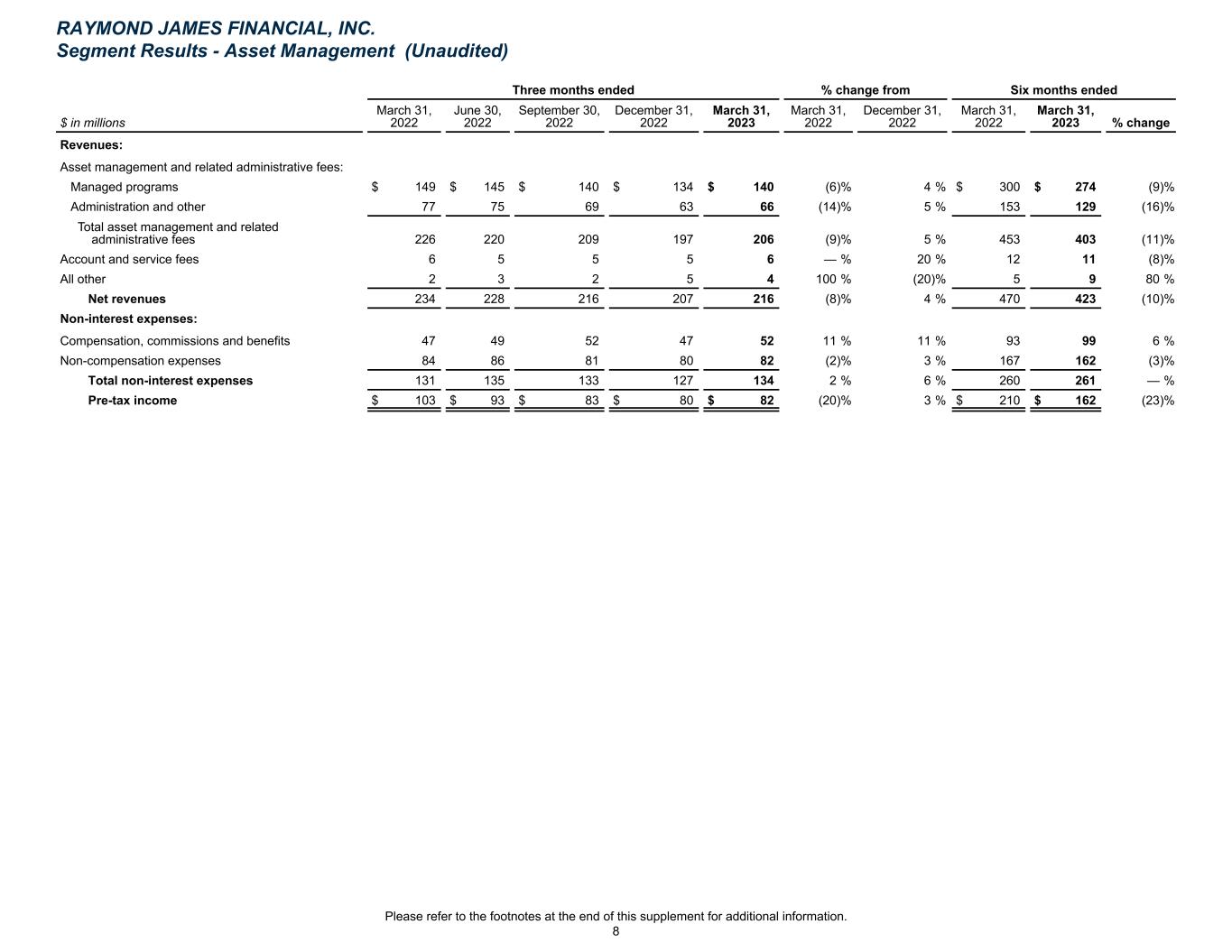

Three months ended % change from Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 March 31, 2022 March 31, 2023 % change Revenues: Asset management and related administrative fees: Managed programs $ 149 $ 145 $ 140 $ 134 $ 140 (6) % 4 % $ 300 $ 274 (9) % Administration and other 77 75 69 63 66 (14) % 5 % 153 129 (16) % Total asset management and related administrative fees 226 220 209 197 206 (9) % 5 % 453 403 (11) % Account and service fees 6 5 5 5 6 — % 20 % 12 11 (8) % All other 2 3 2 5 4 100 % (20) % 5 9 80 % Net revenues 234 228 216 207 216 (8) % 4 % 470 423 (10) % Non-interest expenses: Compensation, commissions and benefits 47 49 52 47 52 11 % 11 % 93 99 6 % Non-compensation expenses 84 86 81 80 82 (2) % 3 % 167 162 (3) % Total non-interest expenses 131 135 133 127 134 2 % 6 % 260 261 — % Pre-tax income $ 103 $ 93 $ 83 $ 80 $ 82 (20) % 3 % $ 210 $ 162 (23) % RAYMOND JAMES FINANCIAL, INC. Segment Results - Asset Management (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 8

Three months ended % change from Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 March 31, 2022 March 31, 2023 % change Revenues: Interest income $ 199 $ 296 $ 527 $ 676 $ 749 276 % 11 % $ 386 $ 1,425 269 % Interest expense (10) (26) (110) (185) (219) 2,090 % 18 % (20) (404) 1,920 % Net interest income 189 270 417 491 530 180 % 8 % 366 1,021 179 % All other 8 6 11 17 10 25 % (41) % 14 27 93 % Net revenues 197 276 428 508 540 174 % 6 % 380 1,048 176 % Non-interest expenses: Compensation and benefits 14 21 36 40 48 243 % 20 % 27 88 226 % Non-compensation expenses: Bank loan provision for credit losses 21 56 34 14 28 33 % 100 % 10 42 320 % RJBDP fees to Private Client Group (12) 49 79 179 268 311 535 % 16 % 99 579 485 % All other 30 46 56 50 62 107 % 24 % 59 112 90 % Total non-compensation expenses 100 181 269 332 401 301 % 21 % 168 733 336 % Total non-interest expenses 114 202 305 372 449 294 % 21 % 195 821 321 % Pre-tax income $ 83 $ 74 $ 123 $ 136 $ 91 10 % (33) % $ 185 $ 227 23 % RAYMOND JAMES FINANCIAL, INC. Segment Results - Bank (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 9

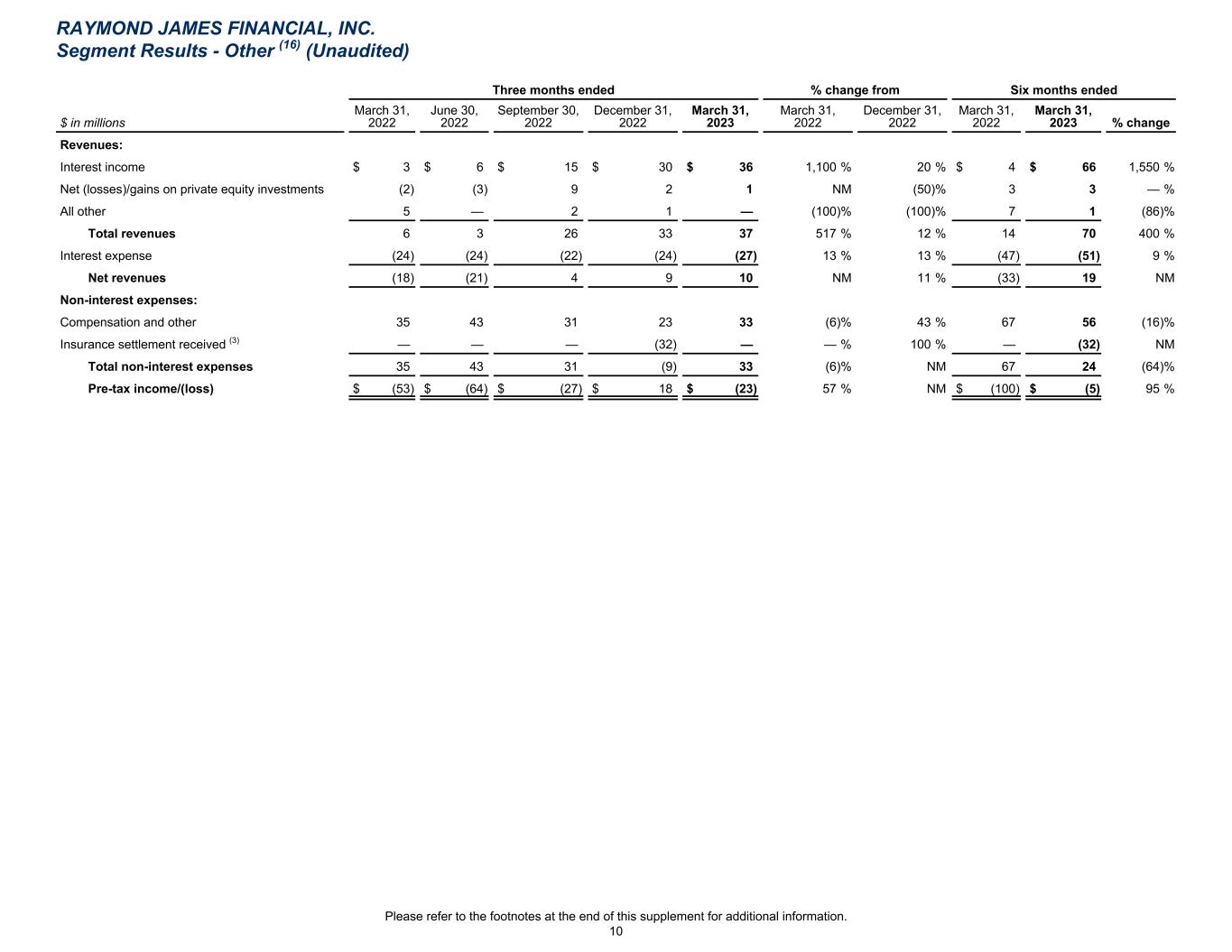

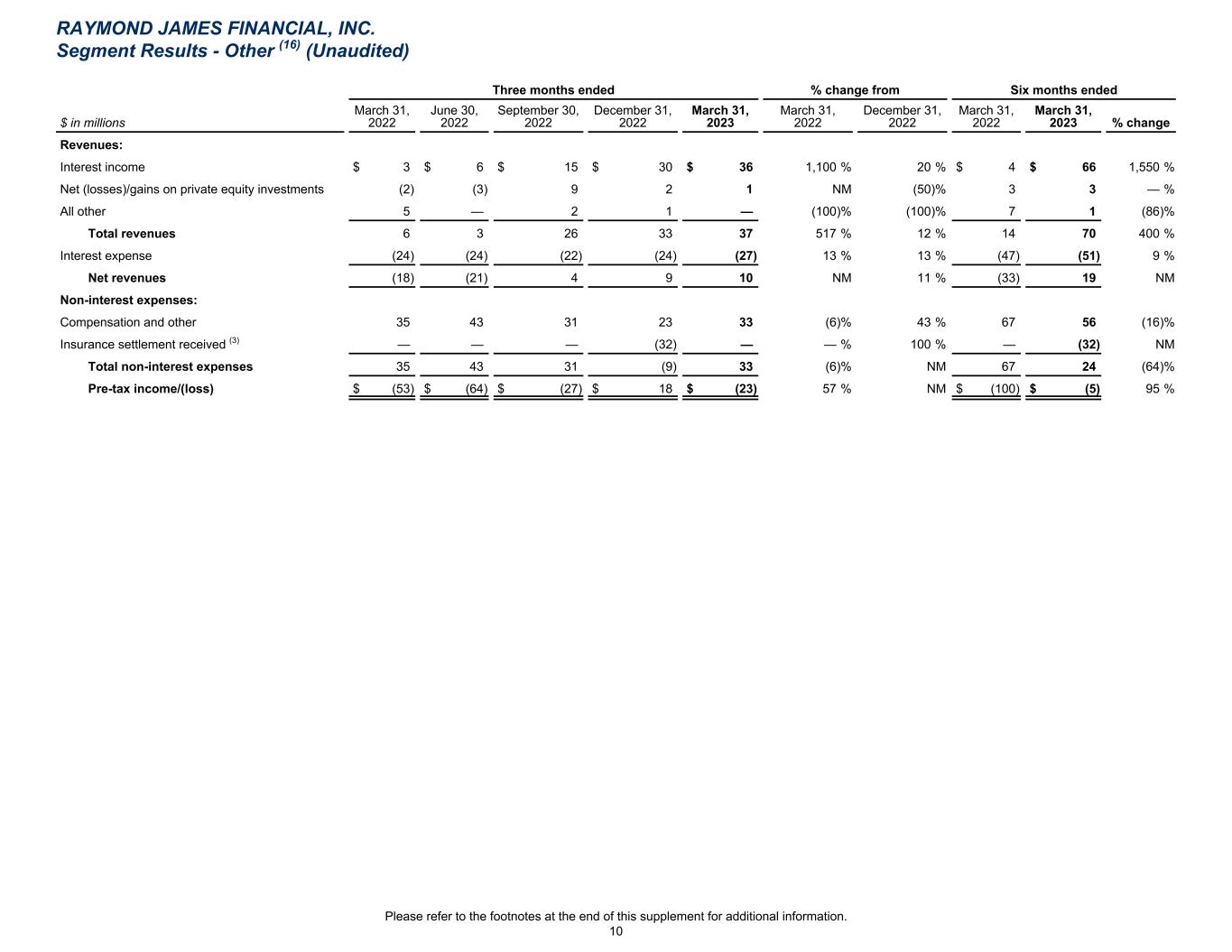

Three months ended % change from Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 March 31, 2022 March 31, 2023 % change Revenues: Interest income $ 3 $ 6 $ 15 $ 30 $ 36 1,100 % 20 % $ 4 $ 66 1,550 % Net (losses)/gains on private equity investments (2) (3) 9 2 1 NM (50) % 3 3 — % All other 5 — 2 1 — (100) % (100) % 7 1 (86) % Total revenues 6 3 26 33 37 517 % 12 % 14 70 400 % Interest expense (24) (24) (22) (24) (27) 13 % 13 % (47) (51) 9 % Net revenues (18) (21) 4 9 10 NM 11 % (33) 19 NM Non-interest expenses: Compensation and other 35 43 31 23 33 (6) % 43 % 67 56 (16) % Insurance settlement received (3) — — — (32) — — % 100 % — (32) NM Total non-interest expenses 35 43 31 (9) 33 (6) % NM 67 24 (64) % Pre-tax income/(loss) $ (53) $ (64) $ (27) $ 18 $ (23) 57 % NM $ (100) $ (5) 95 % RAYMOND JAMES FINANCIAL, INC. Segment Results - Other (16) (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 10

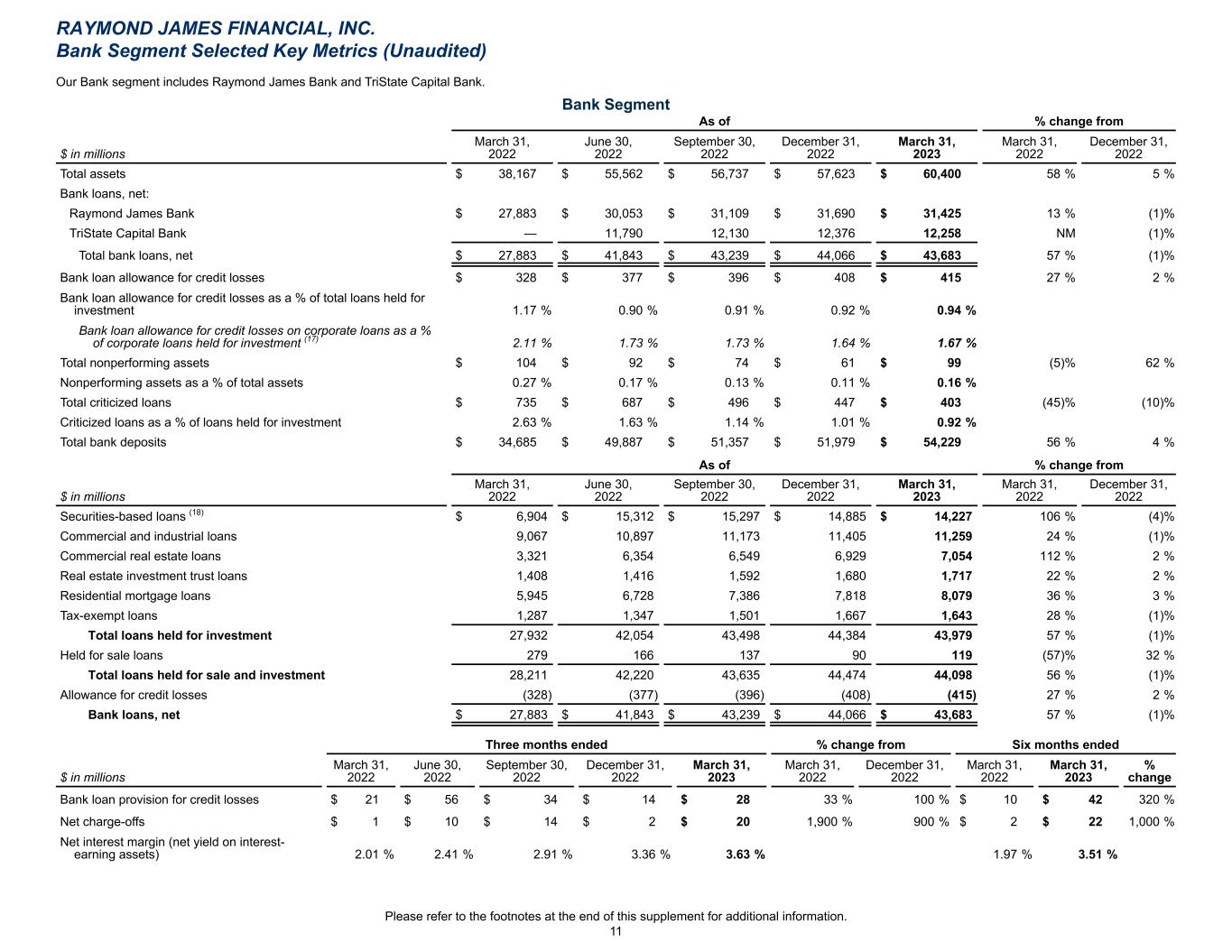

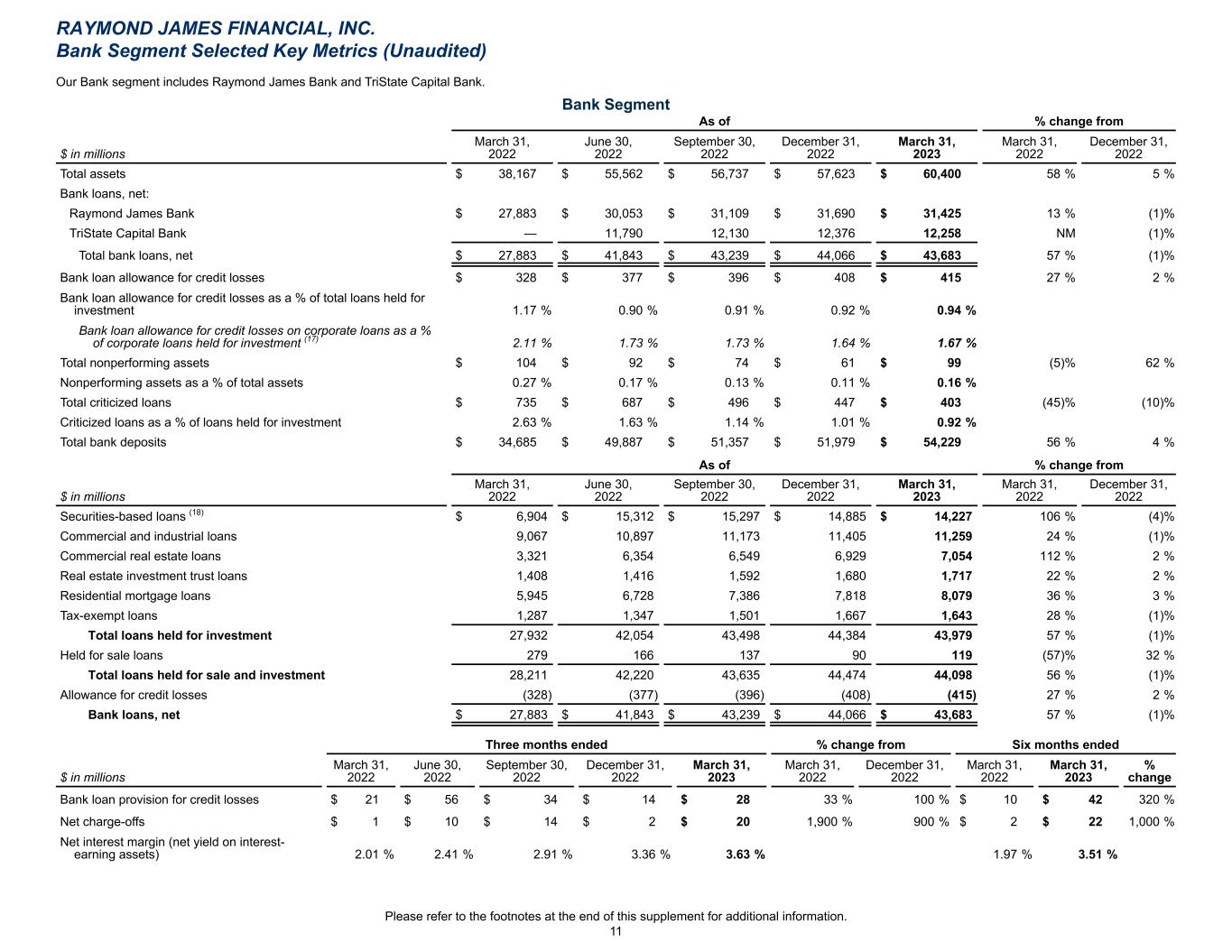

Our Bank segment includes Raymond James Bank and TriState Capital Bank. Bank Segment As of % change from $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 Total assets $ 38,167 $ 55,562 $ 56,737 $ 57,623 $ 60,400 58 % 5 % Bank loans, net: Raymond James Bank $ 27,883 $ 30,053 $ 31,109 $ 31,690 $ 31,425 13 % (1) % TriState Capital Bank — 11,790 12,130 12,376 12,258 NM (1) % Total bank loans, net $ 27,883 $ 41,843 $ 43,239 $ 44,066 $ 43,683 57 % (1) % Bank loan allowance for credit losses $ 328 $ 377 $ 396 $ 408 $ 415 27 % 2 % Bank loan allowance for credit losses as a % of total loans held for investment 1.17 % 0.90 % 0.91 % 0.92 % 0.94 % Bank loan allowance for credit losses on corporate loans as a % of corporate loans held for investment (17) 2.11 % 1.73 % 1.73 % 1.64 % 1.67 % Total nonperforming assets $ 104 $ 92 $ 74 $ 61 $ 99 (5) % 62 % Nonperforming assets as a % of total assets 0.27 % 0.17 % 0.13 % 0.11 % 0.16 % Total criticized loans $ 735 $ 687 $ 496 $ 447 $ 403 (45) % (10) % Criticized loans as a % of loans held for investment 2.63 % 1.63 % 1.14 % 1.01 % 0.92 % Total bank deposits $ 34,685 $ 49,887 $ 51,357 $ 51,979 $ 54,229 56 % 4 % As of % change from $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 Securities-based loans (18) $ 6,904 $ 15,312 $ 15,297 $ 14,885 $ 14,227 106 % (4) % Commercial and industrial loans 9,067 10,897 11,173 11,405 11,259 24 % (1) % Commercial real estate loans 3,321 6,354 6,549 6,929 7,054 112 % 2 % Real estate investment trust loans 1,408 1,416 1,592 1,680 1,717 22 % 2 % Residential mortgage loans 5,945 6,728 7,386 7,818 8,079 36 % 3 % Tax-exempt loans 1,287 1,347 1,501 1,667 1,643 28 % (1) % Total loans held for investment 27,932 42,054 43,498 44,384 43,979 57 % (1) % Held for sale loans 279 166 137 90 119 (57) % 32 % Total loans held for sale and investment 28,211 42,220 43,635 44,474 44,098 56 % (1) % Allowance for credit losses (328) (377) (396) (408) (415) 27 % 2 % Bank loans, net $ 27,883 $ 41,843 $ 43,239 $ 44,066 $ 43,683 57 % (1) % Three months ended % change from Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 December 31, 2022 March 31, 2022 March 31, 2023 % change Bank loan provision for credit losses $ 21 $ 56 $ 34 $ 14 $ 28 33 % 100 % $ 10 $ 42 320 % Net charge-offs $ 1 $ 10 $ 14 $ 2 $ 20 1,900 % 900 % $ 2 $ 22 1,000 % Net interest margin (net yield on interest- earning assets) 2.01 % 2.41 % 2.91 % 3.36 % 3.63 % 1.97 % 3.51 % RAYMOND JAMES FINANCIAL, INC. Bank Segment Selected Key Metrics (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 11

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) We utilize certain non-GAAP financial measures as additional measures to aid in, and enhance, the understanding of our financial results and related measures. These non-GAAP financial measures have been separately identified in this document. We believe certain of these non-GAAP financial measures provide useful information to management and investors by excluding certain material items that may not be indicative of our core operating results. We utilize these non-GAAP financial measures in assessing the financial performance of the business, as they facilitate a comparison of current- and prior-period results. Beginning with our fiscal third quarter of 2022, certain of our non-GAAP financial measures have been adjusted for additional expenses directly related to our acquisitions that we believe are not indicative of our core operating results, such as those related to amortization of identifiable intangible assets arising from acquisitions and acquisition-related retention. Prior periods have been conformed to the current period presentation. We believe that return on tangible common equity and tangible book value per share are meaningful to investors as they facilitate comparisons of our results to the results of other companies. In the following tables, the tax effect of non-GAAP adjustments reflects the statutory rate associated with each non-GAAP item. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. In addition, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures of other companies. The following tables provide a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures for those periods which include non-GAAP adjustments. Three months ended Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Net income available to common shareholders $ 323 $ 299 $ 437 $ 507 $ 425 $ 769 $ 932 Non-GAAP adjustments: Expenses directly related to acquisitions included in the following financial statement line items: Compensation, commissions and benefits — Acquisition-related retention (1) 14 18 17 18 17 25 35 Professional fees 5 4 1 — — 7 — Bank loan provision for credit losses — Initial provision for credit losses on acquired loans — 26 — — — — — Other Amortization of identifiable intangible assets (19) 6 8 11 11 11 14 22 Initial provision for credit losses on acquired lending commitments — 5 — — — — — All other acquisition-related expenses 6 4 1 — — 6 — Total “Other” expense 12 17 12 11 11 20 22 Total expenses related to acquisitions 31 65 30 29 28 52 57 Other — Insurance settlement received (3) — — — (32) — — (32) Pre-tax impact of non-GAAP adjustments 31 65 30 (3) 28 52 25 Tax effect of non-GAAP adjustments (8) (16) (8) 1 (7) (13) (6) Total non-GAAP adjustments, net of tax 23 49 22 (2) 21 39 19 Adjusted net income available to common shareholders (6) $ 346 $ 348 $ 459 $ 505 $ 446 $ 808 $ 951 Pre-tax income $ 433 $ 415 $ 616 $ 652 $ 557 $ 991 $ 1,209 Pre-tax impact of non-GAAP adjustments (as detailed above) 31 65 30 (3) 28 52 25 Adjusted pre-tax income (6) $ 464 $ 480 $ 646 $ 649 $ 585 $ 1,043 $ 1,234 Compensation, commissions and benefits expense $ 1,852 $ 1,834 $ 1,759 $ 1,736 $ 1,820 $ 3,736 $ 3,556 Less: Acquisition-related retention (as detailed above) 14 18 17 18 17 25 35 Adjusted “Compensation, commissions and benefits” expense (6) $ 1,838 $ 1,816 $ 1,742 $ 1,718 $ 1,803 $ 3,711 $ 3,521 RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 12

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Three months ended Six months ended March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Pre-tax margin (9) 16.2 % 15.3 % 21.8 % 23.4 % 19.4 % 18.2 % 21.4 % Impact of non-GAAP adjustments on pre-tax margin: Compensation, commissions and benefits — Acquisition-related retention (1) 0.5 % 0.7 % 0.6 % 0.6 % 0.5 % 0.5 % 0.6 % Professional fees 0.2 % 0.1 % — % — % — % 0.1 % — % Bank loan provision for credit losses — Initial provision for credit losses on acquired loans — % 1.0 % — % — % — % — % — % Other: Amortization of identifiable intangible assets (19) 0.2 % 0.3 % 0.4 % 0.4 % 0.5 % 0.2 % 0.4 % Initial provision for credit losses on acquired lending commitments — % 0.2 % — % — % — % — % — % All other acquisition-related expenses 0.3 % 0.1 % — % — % — % 0.1 % — % Total “Other” expense 0.5 % 0.6 % 0.4 % 0.4 % 0.5 % 0.3 % 0.4 % Total expenses related to acquisitions 1.2 % 2.4 % 1.0 % 1.0 % 1.0 % 0.9 % 1.0 % Other — Insurance settlement received (3) — % — % — % (1.1) % — % — % (0.6) % Total non-GAAP adjustments 1.2 % 2.4 % 1.0 % (0.1) % 1.0 % 0.9 % 0.4 % Adjusted pre-tax margin (6) (9) 17.4 % 17.7 % 22.8 % 23.3 % 20.4 % 19.1 % 21.8 % Total compensation ratio (10) 69.3 % 67.5 % 62.1 % 62.3 % 63.3 % 68.5 % 62.8 % Less the impact of non-GAAP adjustments on compensation ratio: Acquisition-related retention (1) 0.5 % 0.7 % 0.6 % 0.6 % 0.5 % 0.5 % 0.6 % Adjusted total compensation ratio (6) (10) 68.8 % 66.8 % 61.5 % 61.7 % 62.8 % 68.0 % 62.2 % RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 13

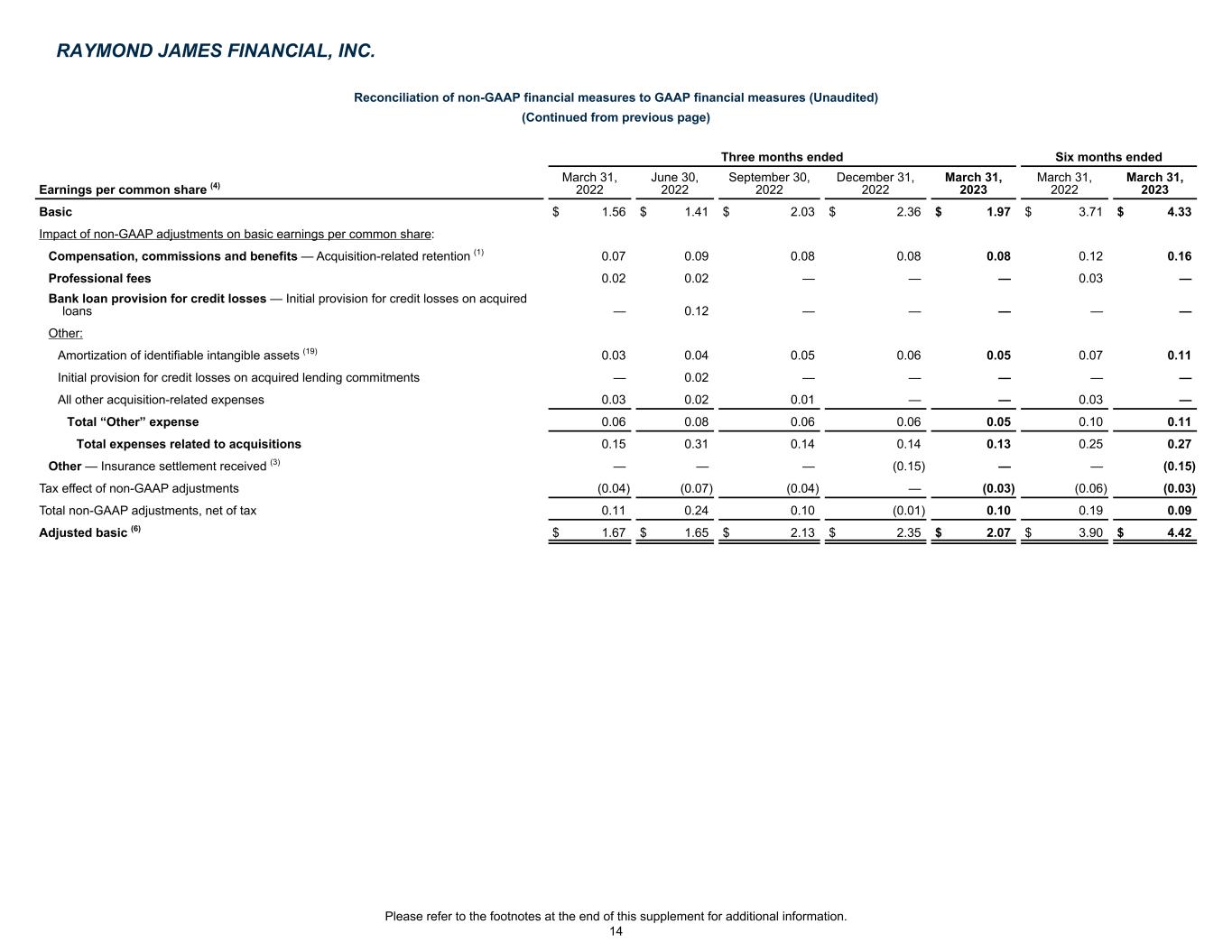

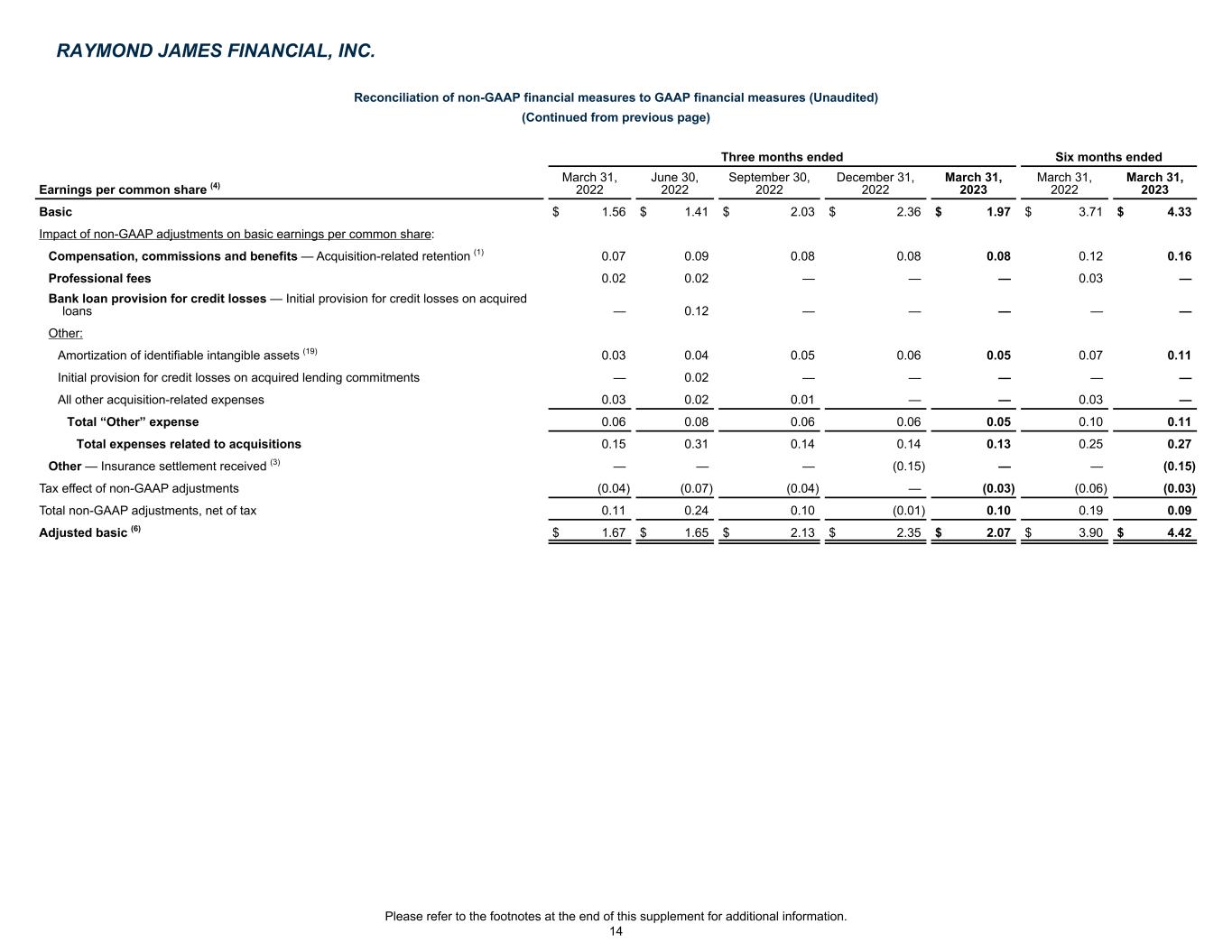

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Three months ended Six months ended Earnings per common share (4) March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Basic $ 1.56 $ 1.41 $ 2.03 $ 2.36 $ 1.97 $ 3.71 $ 4.33 Impact of non-GAAP adjustments on basic earnings per common share: Compensation, commissions and benefits — Acquisition-related retention (1) 0.07 0.09 0.08 0.08 0.08 0.12 0.16 Professional fees 0.02 0.02 — — — 0.03 — Bank loan provision for credit losses — Initial provision for credit losses on acquired loans — 0.12 — — — — — Other: Amortization of identifiable intangible assets (19) 0.03 0.04 0.05 0.06 0.05 0.07 0.11 Initial provision for credit losses on acquired lending commitments — 0.02 — — — — — All other acquisition-related expenses 0.03 0.02 0.01 — — 0.03 — Total “Other” expense 0.06 0.08 0.06 0.06 0.05 0.10 0.11 Total expenses related to acquisitions 0.15 0.31 0.14 0.14 0.13 0.25 0.27 Other — Insurance settlement received (3) — — — (0.15) — — (0.15) Tax effect of non-GAAP adjustments (0.04) (0.07) (0.04) — (0.03) (0.06) (0.03) Total non-GAAP adjustments, net of tax 0.11 0.24 0.10 (0.01) 0.10 0.19 0.09 Adjusted basic (6) $ 1.67 $ 1.65 $ 2.13 $ 2.35 $ 2.07 $ 3.90 $ 4.42 RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 14

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Three months ended Six months ended Earnings per common share (4) March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Diluted $ 1.52 $ 1.38 $ 1.98 $ 2.30 $ 1.93 $ 3.61 $ 4.23 Impact of non-GAAP adjustments on diluted earnings per common share: Compensation, commissions and benefits — Acquisition-related retention (1) 0.06 0.08 0.08 0.08 0.08 0.12 0.16 Professional fees 0.02 0.02 — — — 0.03 — Bank loan provision for credit losses — Initial provision for credit losses on acquired loans — 0.12 — — — — — Other: Amortization of identifiable intangible assets (19) 0.03 0.04 0.05 0.06 0.05 0.07 0.10 Initial provision for credit losses on acquired lending commitments — 0.02 — — — — — All other acquisition-related expenses 0.03 0.02 0.01 — — 0.03 — Total “Other” expense 0.06 0.08 0.06 0.06 0.05 0.10 0.10 Total expenses related to acquisitions 0.14 0.30 0.14 0.14 0.13 0.25 0.26 Other — Insurance settlement received (3) — — — (0.15) — — (0.15) Tax effect of non-GAAP adjustments (0.04) (0.07) (0.04) — (0.03) (0.06) (0.03) Total non-GAAP adjustments, net of tax 0.10 0.23 0.10 (0.01) 0.10 0.19 0.08 Adjusted diluted (6) $ 1.62 $ 1.61 $ 2.08 $ 2.29 $ 2.03 $ 3.80 $ 4.31 Book value per share As of $ in millions, except per share amounts March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 Total common equity attributable to Raymond James Financial, Inc. $ 8,602 $ 9,395 $ 9,338 $ 9,736 $ 9,875 Less non-GAAP adjustments: Goodwill and identifiable intangible assets, net 1,110 1,810 1,931 1,938 1,932 Deferred tax liabilities related to goodwill and identifiable intangible assets, net (88) (128) (126) (129) (128) Tangible common equity attributable to Raymond James Financial, Inc. (6) $ 7,580 $ 7,713 $ 7,533 $ 7,927 $ 8,071 Common shares outstanding 207.9 215.5 215.1 215.0 211.6 Book value per share (5) $ 41.38 $ 43.60 $ 43.41 $ 45.28 $ 46.67 Tangible book value per share (5) (6) $ 36.46 $ 35.79 $ 35.02 $ 36.87 $ 38.14 RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 15

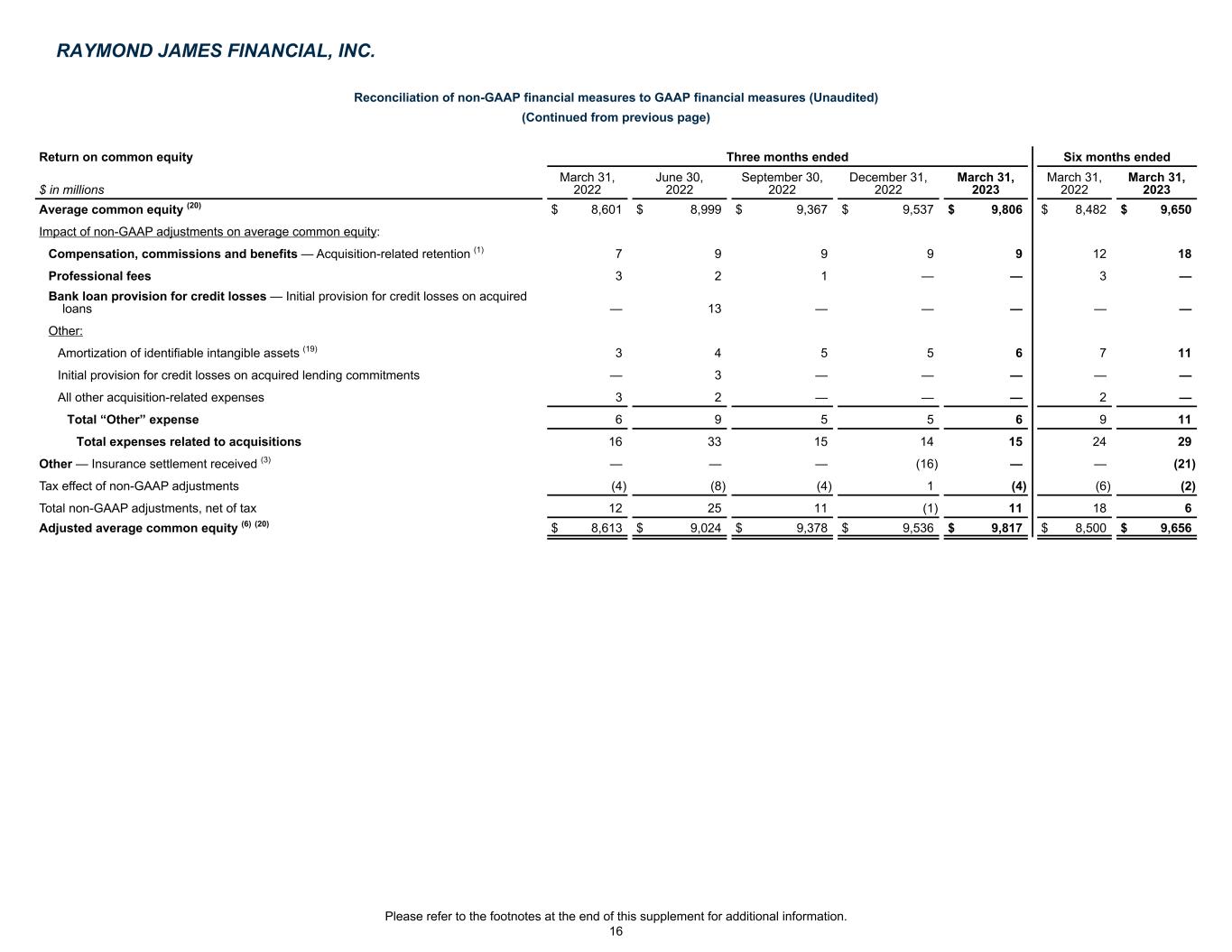

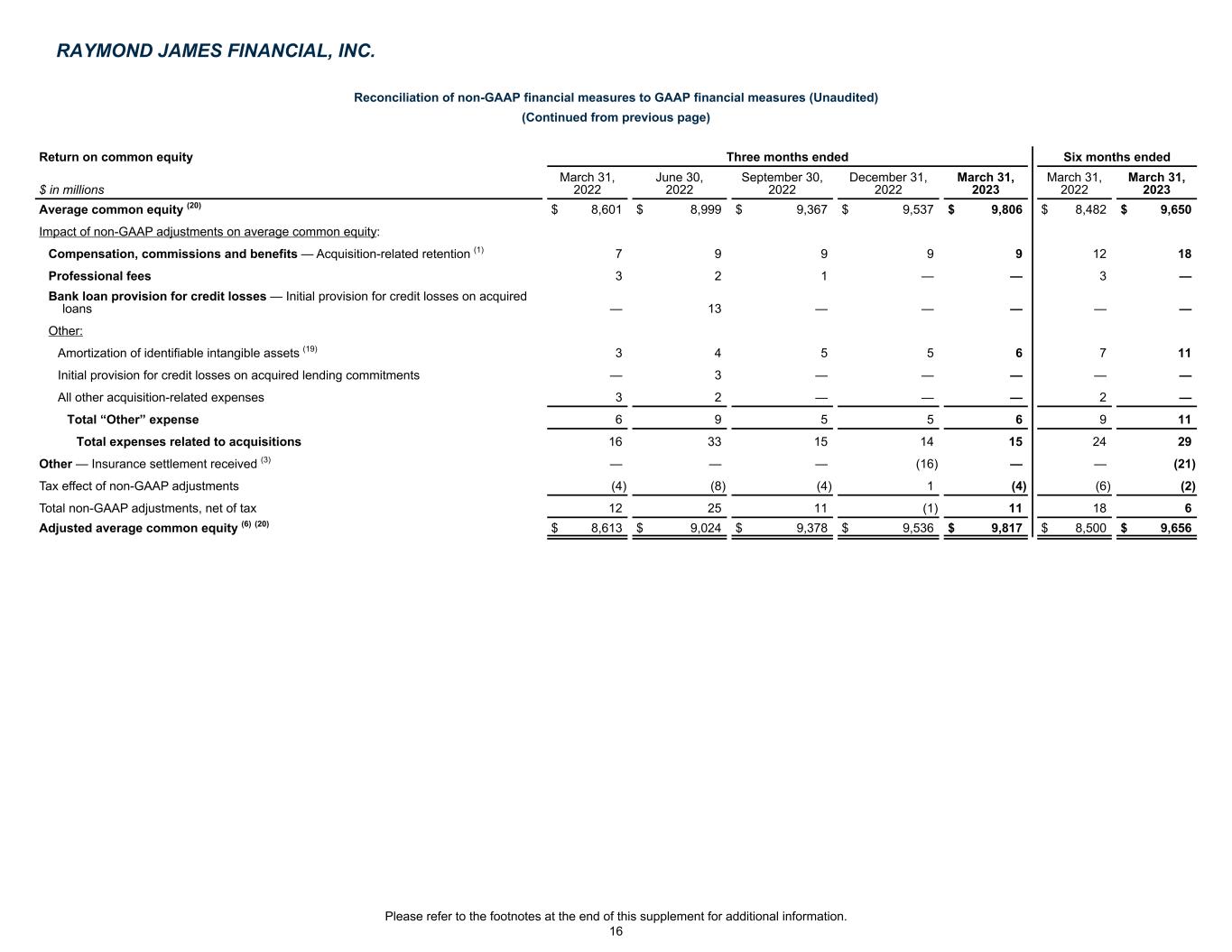

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Return on common equity Three months ended Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Average common equity (20) $ 8,601 $ 8,999 $ 9,367 $ 9,537 $ 9,806 $ 8,482 $ 9,650 Impact of non-GAAP adjustments on average common equity: Compensation, commissions and benefits — Acquisition-related retention (1) 7 9 9 9 9 12 18 Professional fees 3 2 1 — — 3 — Bank loan provision for credit losses — Initial provision for credit losses on acquired loans — 13 — — — — — Other: Amortization of identifiable intangible assets (19) 3 4 5 5 6 7 11 Initial provision for credit losses on acquired lending commitments — 3 — — — — — All other acquisition-related expenses 3 2 — — — 2 — Total “Other” expense 6 9 5 5 6 9 11 Total expenses related to acquisitions 16 33 15 14 15 24 29 Other — Insurance settlement received (3) — — — (16) — — (21) Tax effect of non-GAAP adjustments (4) (8) (4) 1 (4) (6) (2) Total non-GAAP adjustments, net of tax 12 25 11 (1) 11 18 6 Adjusted average common equity (6) (20) $ 8,613 $ 9,024 $ 9,378 $ 9,536 $ 9,817 $ 8,500 $ 9,656 RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 16

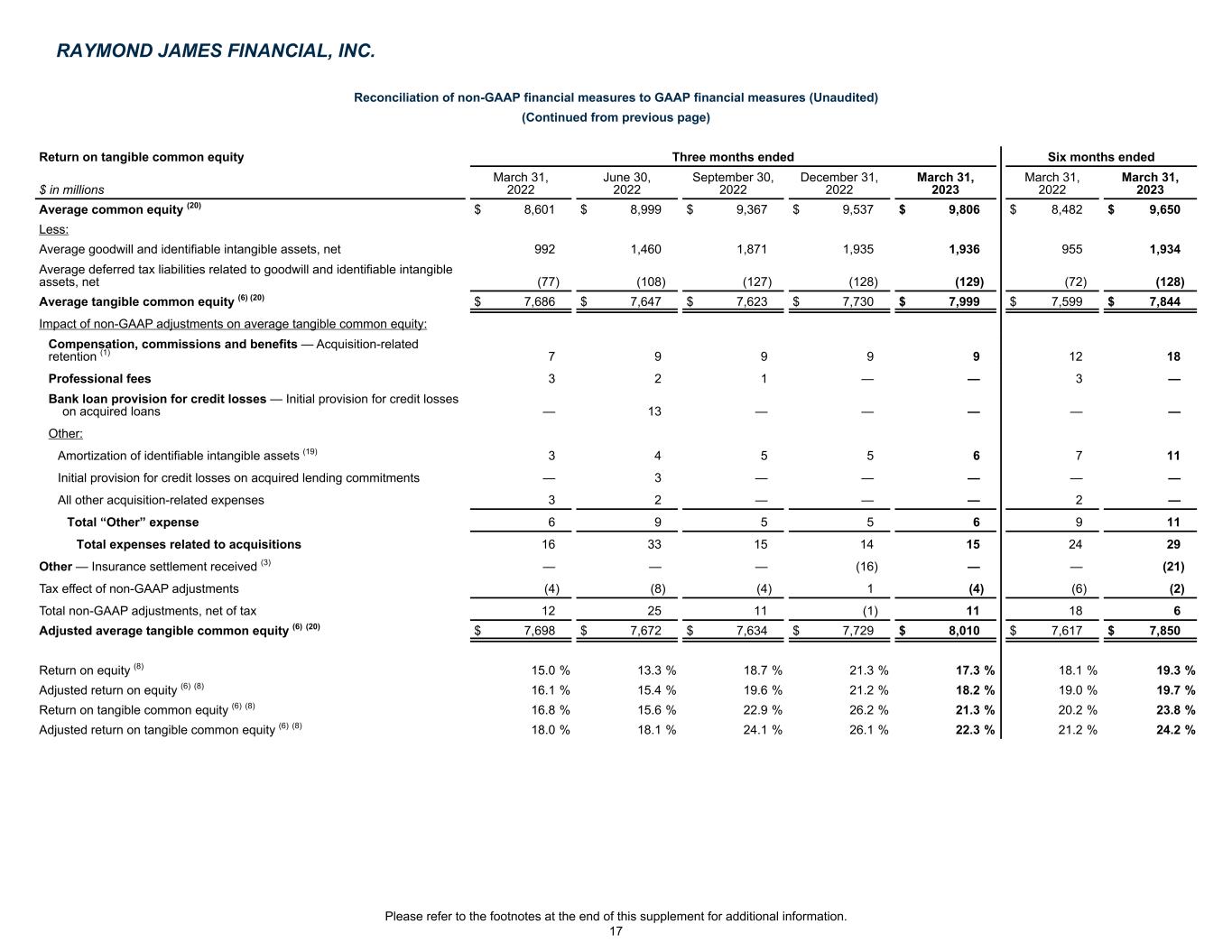

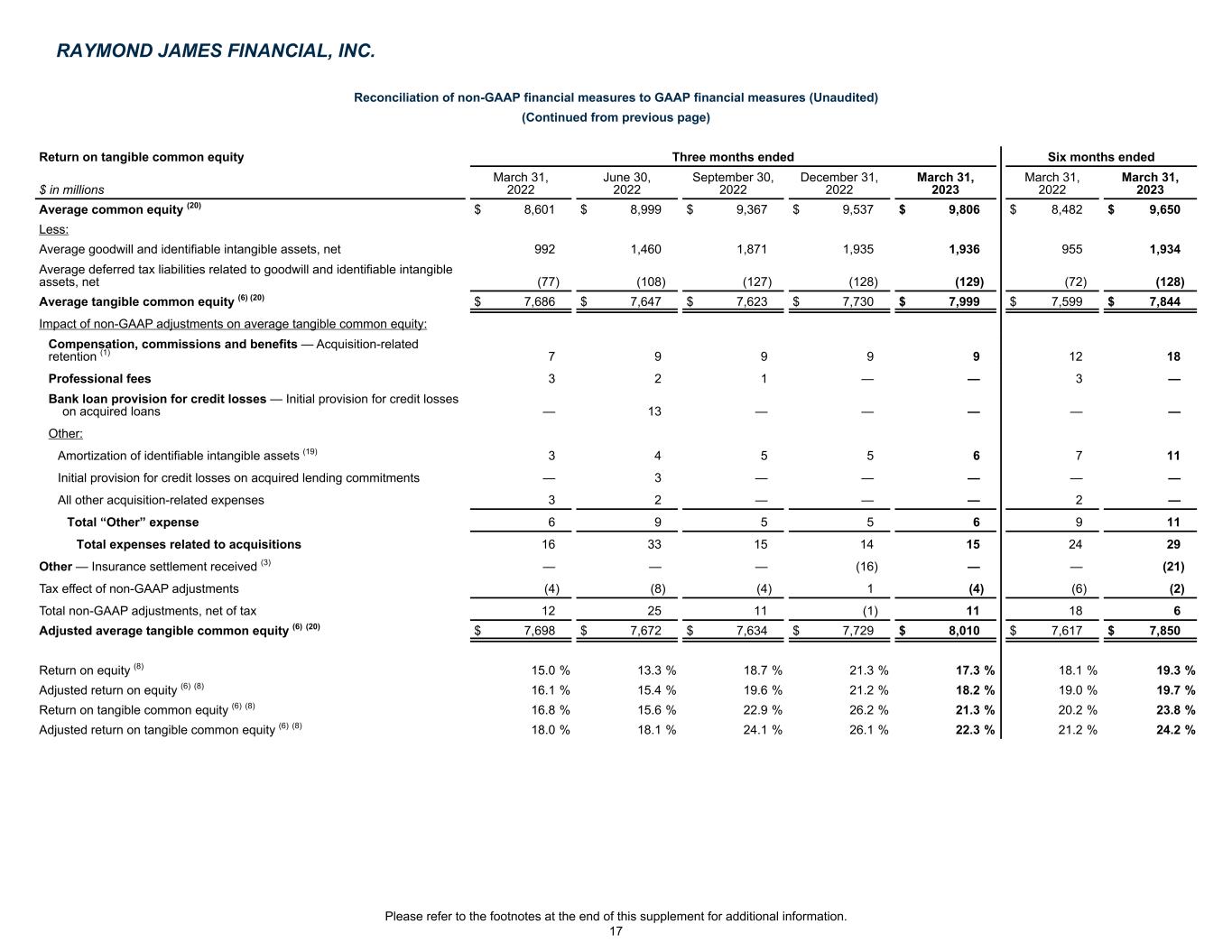

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Return on tangible common equity Three months ended Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Average common equity (20) $ 8,601 $ 8,999 $ 9,367 $ 9,537 $ 9,806 $ 8,482 $ 9,650 Less: Average goodwill and identifiable intangible assets, net 992 1,460 1,871 1,935 1,936 955 1,934 Average deferred tax liabilities related to goodwill and identifiable intangible assets, net (77) (108) (127) (128) (129) (72) (128) Average tangible common equity (6) (20) $ 7,686 $ 7,647 $ 7,623 $ 7,730 $ 7,999 $ 7,599 $ 7,844 Impact of non-GAAP adjustments on average tangible common equity: Compensation, commissions and benefits — Acquisition-related retention (1) 7 9 9 9 9 12 18 Professional fees 3 2 1 — — 3 — Bank loan provision for credit losses — Initial provision for credit losses on acquired loans — 13 — — — — — Other: Amortization of identifiable intangible assets (19) 3 4 5 5 6 7 11 Initial provision for credit losses on acquired lending commitments — 3 — — — — — All other acquisition-related expenses 3 2 — — — 2 — Total “Other” expense 6 9 5 5 6 9 11 Total expenses related to acquisitions 16 33 15 14 15 24 29 Other — Insurance settlement received (3) — — — (16) — — (21) Tax effect of non-GAAP adjustments (4) (8) (4) 1 (4) (6) (2) Total non-GAAP adjustments, net of tax 12 25 11 (1) 11 18 6 Adjusted average tangible common equity (6) (20) $ 7,698 $ 7,672 $ 7,634 $ 7,729 $ 8,010 $ 7,617 $ 7,850 Return on equity (8) 15.0 % 13.3 % 18.7 % 21.3 % 17.3 % 18.1 % 19.3 % Adjusted return on equity (6) (8) 16.1 % 15.4 % 19.6 % 21.2 % 18.2 % 19.0 % 19.7 % Return on tangible common equity (6) (8) 16.8 % 15.6 % 22.9 % 26.2 % 21.3 % 20.2 % 23.8 % Adjusted return on tangible common equity (6) (8) 18.0 % 18.1 % 24.1 % 26.1 % 22.3 % 21.2 % 24.2 % RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 17

Footnotes (1) Includes acquisition-related compensation expenses arising from equity and cash-based retention awards issued in conjunction with acquisitions in prior years. Such retention awards are generally contingent upon the post-closing continuation of service of certain associates who joined the firm as part of such acquisitions and are expensed over the requisite service period. (2) The three and six months ended March 31, 2023 included the unfavorable impact of an adverse arbitration ruling in our Private Client Group business. The impact of this ruling has been reflected in Other expenses within our Private Client Group segment. (3) The three months ended December 31, 2022 and six months ended March 31, 2023 included the favorable impact of a $32 million insurance settlement received during the period related to a previously settled litigation matter. This item has been reflected as an offset to Other expenses within our Other segment. In the computation of our non-GAAP financial measures, we have reversed the favorable impact of this item on adjusted pre-tax income and adjusted net income available to common shareholders. See the schedules on the previous pages for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures and for more information on these measures. (4) Earnings per common share is computed by dividing net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period or, in the case of adjusted earnings per common share, computed by dividing adjusted net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period. The allocations of earnings and dividends to participating securities were $0 million for the three months ended March 31, 2022, $1 million for each of the three months ended June 30, 2022, September 30, 2022, and December 31, 2022, $2 million for the three months ended March 31, 2023, $1 million for the six months ended March 31, 2022, and $3 million for the six months ended March 31, 2023. (5) Book value per share is computed by dividing total common equity attributable to Raymond James Financial, Inc. by the number of common shares outstanding at the end of each respective period or, in the case of tangible book value per share, computed by dividing tangible common equity by the number of common shares outstanding at the end of each respective period. (6) These are non-GAAP financial measures. See the schedules on the previous pages for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures and for more information on these measures. (7) Estimated. The capital ratio calculations do not include the effect of our April 3, 2023 redemption of our 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock at a redemption amount of $40 million, which will be reflected in our fiscal third quarter. (8) Return on common equity is computed by dividing annualized net income available to common shareholders by average common equity for each respective period or, in the case of return on tangible common equity, computed by dividing annualized net income available to common shareholders by average tangible common equity for each respective period. Adjusted return on common equity is computed by dividing annualized adjusted net income available to common shareholders by adjusted average common equity for each respective period, or in the case of adjusted return on tangible common equity, computed by dividing annualized adjusted net income available to common shareholders by adjusted average tangible common equity for each respective period. Tangible common equity is defined as total common equity attributable to Raymond James Financial, Inc. less goodwill and intangible assets, net of related deferred taxes. (9) Pre-tax margin is computed by dividing pre-tax income by net revenues for each respective period or, in the case of adjusted pre-tax margin, computed by dividing adjusted pre-tax income by net revenues for each respective period. (10) Total compensation ratio is computed by dividing compensation, commissions and benefits expense by net revenues for each respective period. Adjusted total compensation ratio is computed by dividing adjusted compensation, commissions and benefits expense by net revenues for each respective period. (11) Domestic Private Client Group net new assets represents domestic Private Client Group client inflows, including dividends and interest, less domestic Private Client Group client outflows, including commissions, advisory fees and other fees. The Domestic Private Client Group net new asset growth — annualized percentage is based on the beginning Domestic Private Client Group assets under administration balance for the indicated period. (12) We earn fees from RJBDP, a multi-bank sweep program in which clients’ cash deposits in their brokerage accounts are swept into interest-bearing deposit accounts at Raymond James Bank and TriState Capital Bank, which are included in our Bank segment, as well as various third-party banks. RJBDP balances swept to our Bank segment are reflected in Bank deposits on our Consolidated Statement of Financial Condition. Fees earned by the Private Client Group segment on deposits held by our Bank segment are eliminated in consolidation. (13) In March 2023, we launched our Enhanced Savings Program, in which Private Client Group clients may deposit cash in a high-yield Raymond James Bank account. These balances are reflected in Bank deposits on our Consolidated Statement of Financial Condition. (14) Average yield on RJBDP - third-party banks is computed by dividing annualized RJBDP fees - third-party banks, which are net of the interest expense paid to clients by the third-party banks, by the average daily RJBDP balances at third-party banks. (15) This metric includes the impact of the transfer of one firm with 166 financial advisors previously affiliated as independent contractors to our Registered Investment Advisor & Custody Services (“RCS”) division during our fiscal third quarter of 2022. Advisors in RCS are not included in the financial advisor count, although their assets are still included in client assets under administration. (16) The Other segment includes the results of our private equity investments, interest income on certain corporate cash balances, certain acquisition-related expenses, and certain corporate overhead costs of RJF, including the interest costs on certain of our public debt. (17) Corporate loans included commercial and industrial loans, commercial real estate loans, and real estate investment trust loans. (18) Securities-based loans included loans collateralized by the borrower’s marketable securities at advance rates consistent with industry standards and, to a lesser extent, the cash surrender value of life insurance policies. (19) Amortization of identifiable intangible assets, which was included in “Other” expense, includes amortization of identifiable intangible assets arising from our acquisitions. RAYMOND JAMES FINANCIAL, INC. 18

(20) Average common equity for the quarter-to-date period is computed by adding the total common equity attributable to Raymond James Financial, Inc. as of the date indicated to the prior quarter-end total, and dividing by two, or in the case of average tangible common equity, computed by adding tangible common equity as of the date indicated to the prior quarter-end total, and dividing by two. For the year-to-date period, average common equity is computed by adding the total common equity attributable to Raymond James Financial, Inc. as of each quarter-end date during the indicated period to the beginning of year total, and dividing by three, or in the case of average tangible common equity, computed by adding tangible common equity as of each quarter-end date during the indicated period to the beginning of year total, and dividing by three. Adjusted average common equity is computed by adjusting for the impact on average common equity of the non-GAAP adjustments, as applicable for each respective period. Adjusted average tangible common equity is computed by adjusting for the impact on average tangible common equity of the non-GAAP adjustments, as applicable for each respective period. RAYMOND JAMES FINANCIAL, INC. 19