Fiscal 2Q23 Results April 26, 2023

Forward-looking statements Certain statements made in this presentation and the associated conference call may constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning future strategic objectives, business prospects, anticipated savings, financial results (including expenses, earnings, liquidity, cash flow and capital expenditures), industry or market conditions, demand for and pricing of our products, acquisitions, divestitures, anticipated results of litigation, regulatory developments, and general economic conditions. In addition, words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “forecasts,” and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” as well as any other statement that necessarily depends on future events, is intended to identify forward-looking statements. Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements and urge you to carefully consider the risks described in our filings with the Securities and Exchange Commission (the “SEC”) from time to time, including our most recent Annual Report on Form 10-K, and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which are available at www.raymondjames.com and the SEC’s website at www.sec.gov. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events, or otherwise. 2

Overview of Results Paul Reilly Chair & CEO, Raymond James Financial 3

4 *These are non-GAAP measures. See the schedules in the Appendix of this presentation for a reconciliation of our non-GAAP measures to the most directly comparable GAAP measures and for more information on these measures. Certain non-GAAP financial measures have been adjusted for additional expenses directly related to our acquisitions that we believe are not indicative of our core operating results, such as those related to amortization of identifiable intangible assets arising from acquisitions and acquisition-related retention. Prior periods have been conformed to the current period presentation. $ in millions, except per share amounts 2Q23 vs. 2Q22 vs. 1Q23 As reported: Net revenues RECORD $ 2,873 7% 3% Net income available to common shareholders $ 425 32% (16)% Earnings per common share - diluted $ 1.93 27% (16)% 2Q22 1Q23 Return on common equity 17.3 % 15.0% 21.3% vs. 2Q22 vs. 1Q23 Non-GAAP measures*: Adjusted net income available to common shareholders $ 446 29% (12)% Adjusted earnings per common share - diluted $ 2.03 25% (11)% 2Q22 1Q23 Adjusted return on common equity 18.2 % 16.1% 21.2% Adjusted return on tangible common equity 22.3 % 18.0% 26.1% Fiscal 2Q23 highlights

Fiscal 2Q23 key metrics 5 $ in billions 2Q23 vs. 2Q22 vs. 1Q23 Client assets under administration $ 1,224.4 (3)% 5% Private Client Group (PCG) assets under administration $ 1,171.1 (2)% 5% PCG assets in fee-based accounts $ 666.3 (2)% 5% Financial assets under management $ 194.4 —% 5% Domestic PCG net new assets* $ 21.5 (11)% (7)% Total clients’ domestic cash sweep and ESP balances** $ 52.2 (32)% (14)% PCG financial advisors*** 8,726 —% —% Bank loans, net: Raymond James Bank $ 31.4 13% (1)% TriState Capital Bank**** $ 12.3 NM (1)% Total bank loans, net $ 43.7 57% (1)% *Domestic Private Client Group net new assets represents domestic Private Client Group client inflows, including dividends and interest, less domestic Private Client Group client outflows, including commissions, advisory fees and other fees. **In March 2023, we launched our Enhanced Savings Program, in which Private Client Group clients may deposit cash in a high-yield Raymond James Bank account. ***This metric includes the impact of the transfer of one firm with 166 financial advisors previously affiliated as independent contractors to our Registered Investment Advisor & Custody Services (“RCS”) division during our fiscal third quarter of 2022. Advisors in RCS are not included in the financial advisor count, although their assets are still included in client assets under administration.****Acquired on June 1, 2022.

Note: Segments do not total consolidated results because of the Other segment and intersegment eliminations not shown. Starting in 3Q22, the Bank Segment results include Raymond James Bank and TriState Capital Bank. Fiscal 2Q23 segment results 6 $ in millions 2Q23 vs. 2Q22 vs. 1Q23 Net revenues: Private Client Group RECORD $ 2,144 12% 4% Capital Markets $ 302 (27)% 2% Asset Management $ 216 (8)% 4% Bank RECORD $ 540 174% 6% Consolidated net revenues $ 2,873 7% 3% Pre-tax income/(loss): Private Client Group RECORD $ 441 107% 2% Capital Markets $ (34) NM (113)% Asset Management $ 82 (20)% 3% Bank $ 91 10% (33)% Consolidated pre-tax income $ 557 29% (15)%

FYTD 2023 highlights (6 months) 7 * These are non-GAAP measures. See the schedules in the Appendix of this presentation for a reconciliation of our non-GAAP measures to the most directly comparable GAAP measures and for more information on these measures. Certain non-GAAP financial measures have been adjusted for additional expenses directly related to our acquisitions that we believe are not indicative of our core operating results, such as those related to amortization of identifiable intangible assets arising from acquisitions and acquisition-related retention. Prior periods have been conformed to the current period presentation. $ in millions, except per share amounts FYTD 2023 vs. FYTD 2022 As reported: Net revenues RECORD $ 5,659 4% Net income available to common shareholders RECORD $ 932 21% Earnings per common share - diluted RECORD $ 4.23 17% FYTD 2022 Return on common equity 19.3 % 18.1% vs. FYTD 2022 Non-GAAP measures*: Adjusted net income available to common shareholders RECORD $ 951 18% Adjusted earnings per common share - diluted RECORD $ 4.31 13% FYTD 2022 Adjusted return on common equity 19.7 % 19.0% Adjusted return on tangible common equity 24.2 % 21.2%

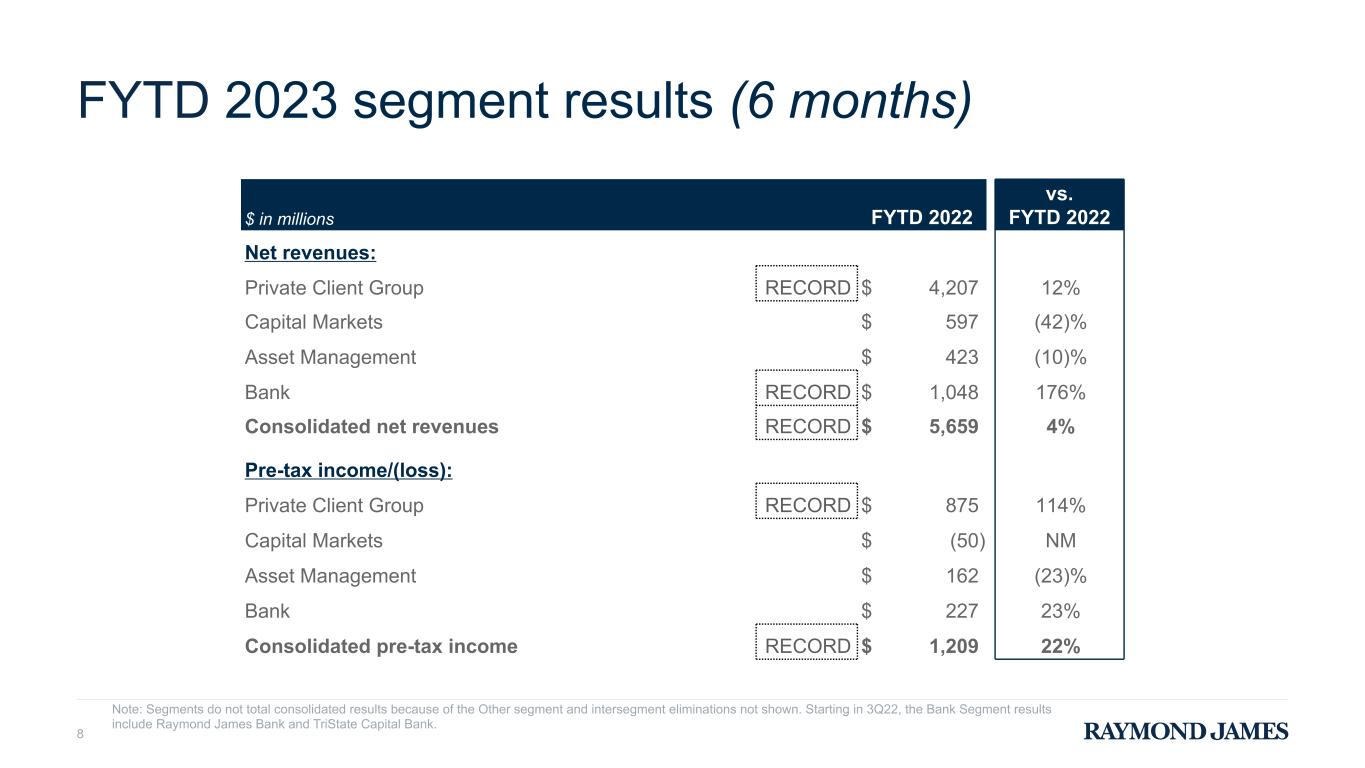

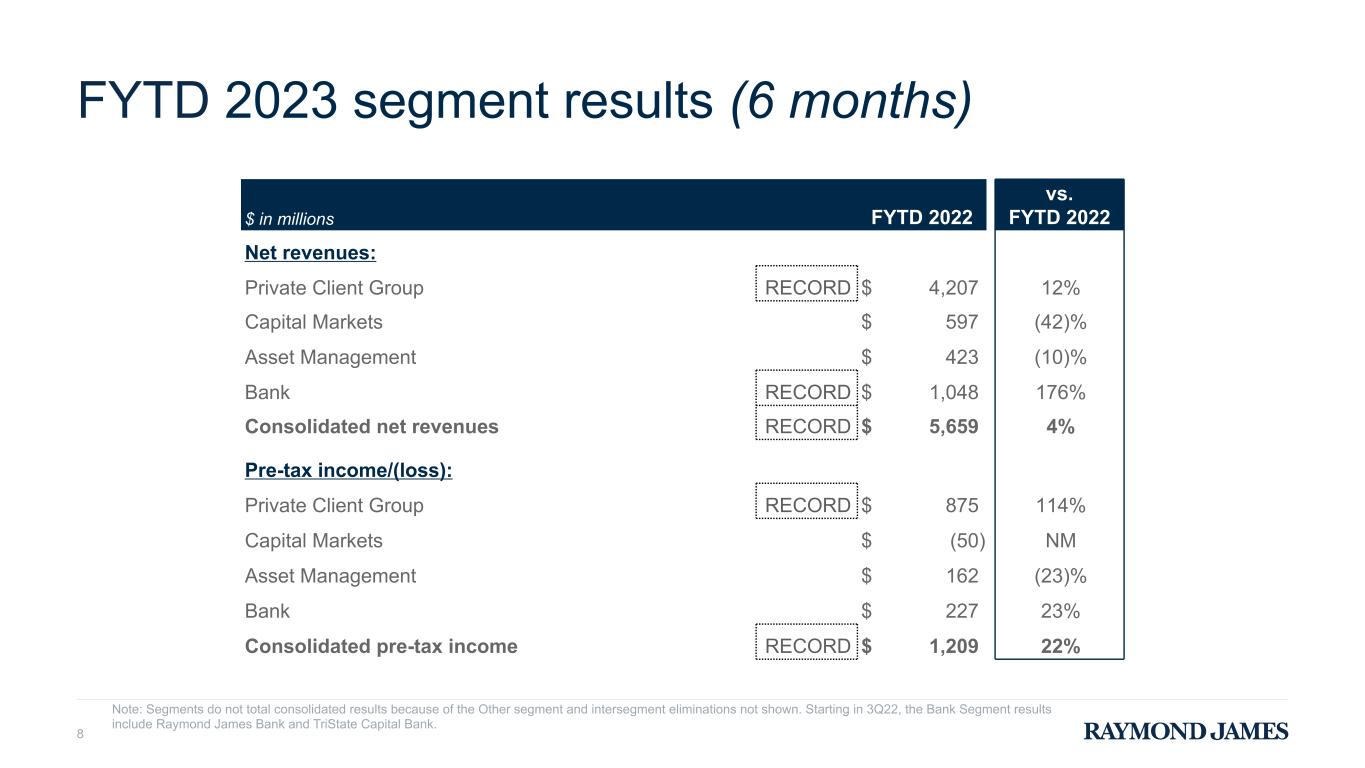

FYTD 2023 segment results (6 months) 8 $ in millions FYTD 2022 vs. FYTD 2022 Net revenues: Private Client Group RECORD $ 4,207 12% Capital Markets $ 597 (42)% Asset Management $ 423 (10)% Bank RECORD $ 1,048 176% Consolidated net revenues RECORD $ 5,659 4% Pre-tax income/(loss): Private Client Group RECORD $ 875 114% Capital Markets $ (50) NM Asset Management $ 162 (23)% Bank $ 227 23% Consolidated pre-tax income RECORD $ 1,209 22% Note: Segments do not total consolidated results because of the Other segment and intersegment eliminations not shown. Starting in 3Q22, the Bank Segment results include Raymond James Bank and TriState Capital Bank.

Financial Review Paul Shoukry Chief Financial Officer, Raymond James Financial 9

Consolidated net revenues 10 $ in millions 2Q23 vs. 2Q22 vs. 1Q23 Asset management and related administrative fees $ 1,302 (11)% 5% Brokerage revenues 496 (12)% 2% Account and service fees 258 44% (11)% Investment banking 154 (34)% 9% Interest income 915 278% 11% Other 32 19% (27)% Total revenues 3,157 16% 4% Interest expense (284) 647% 18% Net revenues $ 2,873 7% 3%

Domestic cash sweep and ESP balances 11 C lie nt s' D om es tic C as h S w ee p & E S P B al an ce s ($ B ) C ash S w eep & E S P B alances as a % of D om estic P C G A U A CLIENTS' DOMESTIC CASH SWEEP & ENHANCED SAVINGS PROGRAM (ESP)* BALANCES AS A % OF DOMESTIC PCG ASSETS UNDER ADMINISTRATION (AUA) 33.6 36.6 38.7 39.1 37.7 25.9 25.5 22.0 18.2 9.4 17.0 13.7 6.4 3.1 2.4 76.5 75.8 67.1 60.4 52.2 7.0% 7.8% 7.0% 5.9% 4.9% RJBDP - Bank Segment** RJBDP - Third-Party Banks** Client Interest Program ESP* 2Q22 3Q22 4Q22 1Q23 2Q23 Note: May not total due to rounding. *In March 2023, we launched our Enhanced Savings Program, in which Private Client Group clients may deposit cash in a high- yield Raymond James Bank account. **Raymond James Bank Deposit Program (RJBDP) is a multi-bank sweep program in which clients' cash deposits in their brokerage accounts are swept into interest-bearing deposit accounts at our Bank segment, which includes Raymond James Bank and TriState Capital Bank, as well as various third-party banks. Year-over-year change: (32)% Sequential change: (14)% 2.7

Net interest income & RJBDP fees (third-party banks) 12 Note: Starting in 3Q22, the Bank Segment results include Raymond James Bank and TriState Capital Bank. *As reported in Account and Service Fees in the PCG segment. **Computed by dividing annualized RJBDP Fees (Third-Party Banks), which are net of the interest expense paid to clients by the third-party banks, by the average daily RJBDP balances at third-party banks. $ IN MILLIONS 224 370 606 723 731 204 314 497 586 631 Firmwide Net Interest Income RJBDP Fees (Third-Party Banks)* 2Q22 3Q22 4Q22 1Q23 2Q23 NET INTEREST MARGIN (NIM) 2.01% 2.41% 2.91% 3.36% 3.63% 1.25% 1.77% 2.53% 3.19% 3.59% Firmwide NIM Bank Segment NIM 2Q22 3Q22 4Q22 1Q23 2Q23 AVERAGE YIELD ON RJBDP (THIRD-PARTY BANKS)** 0.32% 0.88% 1.85% 2.72% 3.25% 2Q22 3Q22 4Q22 1Q23 2Q23 Year-over-year change: 226% Sequential change: 1% 20 100 56 109 137

Consolidated expenses 13 $ in millions 2Q23 vs. 2Q22 vs. 1Q23 Compensation, commissions and benefits $ 1,820 (2)% 5% Non-compensation expenses: Communications and information processing 153 20% 10% Occupancy and equipment 68 10% 3% Business development 54 59% (4)% Investment sub-advisory fees 36 (10)% 6% Professional fees 38 41% 19% Bank loan provision for credit losses 28 33% 100% Other* 119 55% 109% Total non-compensation expenses 496 28% 25% Total non-interest expenses $ 2,316 3% 9% *2Q23 included unfavorable impact of an adverse arbitration ruling in Private Client Group business. 1Q23 included a favorable impact of a $32 million insurance settlement received during the period related to a previously settled litigation matter. **Total compensation ratio is computed by dividing compensation, commissions and benefits expense by net revenues for each respective period. Adjusted total compensation ratio is computed by dividing adjusted compensation, commissions and benefits expense by net revenues for each respective period. ***This is a non-GAAP financial measure. See the schedules in the Appendix of this presentation for a reconciliation of our non-GAAP measures to the most directly comparable GAAP measures and for more information on these measures. TOTAL NON-COMPENSATION EXPENSES $ IN MILLIONS 388 469 456 398 496 2Q22 3Q22 4Q22 1Q23 2Q23 TOTAL COMPENSATION RATIO** 69.3% 67.5% 62.1% 62.3% 63.3%68.8% 66.8% 61.5% 61.7% 62.8% Adjusted Total Compensation Ratio*** Total Compensation Ratio 2Q22 3Q22 4Q22 1Q23 2Q23 * *

* This is a non-GAAP measure. See the schedules in the Appendix of this presentation for a reconciliation of our non-GAAP measures to the most directly comparable GAAP measures and for more information on these measures. Consolidated pre-tax margin 14 16.2% 15.3% 23.4% 19.4%17.4% 17.7% 22.8% 23.3% 20.4% Pre-Tax Margin (GAAP) Pre-Tax Margin (Adjusted)* 2Q22 3Q22 4Q22 1Q23 2Q23 21.8%

Other financial information 15 *This amount includes cash on hand at the parent, as well as parent cash loaned to Raymond James & Associates ("RJ&A"), which RJ&A has invested on behalf of RJF in cash and cash equivalents or otherwise deployed in its normal business activities. **This is a non-GAAP measure. See the schedules in the Appendix of this presentation for a reconciliation of our non- GAAP measures to the most directly comparable GAAP measures and for more information on these measures. ***Estimated. The capital ratio calculations does not include the effect of our April 3, 2023 redemption of Series A preferred stock at a redemption amount of $40 million, which will be reflected in our fiscal third quarter. $ in millions, except per share amounts 2Q23 vs. 2Q22 vs. 1Q23 Total assets $ 79,180 8% 3% RJF corporate cash* $ 1,833 (18)% (9)% Total common equity attributable to RJF $ 9,875 15% 1% Book value per share $ 46.67 13% 3% Tangible book value per share** $ 38.14 5% 3% Weighted-average common and common equivalent shares outstanding – diluted 219.2 3% (1)% 2Q22 1Q23 Tier 1 leverage ratio*** 11.5 % 11.1% 11.3% Tier 1 capital ratio*** 20.1 % 23.9% 20.3% Common equity tier 1 ratio*** 19.9 % 23.9% 20.0% Total capital ratio*** 21.4 % 25.0% 21.6% Effective tax rate 23.3 % 25.4% 21.9%

$1B of dividends paid and share repurchases over the past 5 quarters Capital management 16 DIVIDENDS PAID AND SHARE REPURCHASES $ IN MILLIONS 71 171 135 217 441 — 100 62 138 350 71 71 73 79 91 Share Repurchases* Dividends Paid** 2Q22 3Q22 4Q22 1Q23 2Q23 Number of Shares Repurchased* (thousands) — 1,136 600 1,292 3,745 Average Share Price of Shares Repurchased* — $87.98 $104.07 $106.46 $93.45 *Under the Board of Director's common stock repurchase authorization. **Reflects dividends paid to holders of common shares. ***Indicates amount remaining as of 3/31/23 under the Board of Director's $1.5 billion common stock repurchase authorization approved on December 1, 2022. $1.1B remains under current common stock repurchase authorization***

Bank segment key credit trends 17 $ in millions 2Q23 vs. 2Q22 vs. 1Q23 Bank loan provision for credit losses $ 28 33% 100% Net charge-offs $ 20 1,900% 900% 2Q22 1Q23 Nonperforming assets as a % of total assets 0.16 % 0.27% 0.11% Bank loan allowance for credit losses as a % of loans held for investment 0.94 % 1.17% 0.92% Bank loan allowance for credit losses on corporate loans as a % of corporate loans held for investment* 1.67 % 2.11% 1.64% Criticized loans as a % of loans held for investment 0.92 % 2.63% 1.01% Note: Our Bank segment includes Raymond James Bank and TriState Capital Bank. *Corporate loans include commercial and industrial loans, commercial real estate loans, and real estate investment trust loans.

Outlook 18

Appendix 19

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 20 We utilize certain non-GAAP financial measures as additional measures to aid in, and enhance, the understanding of our financial results and related measures. These non- GAAP financial measures have been separately identified in this document. We believe certain of these non-GAAP financial measures provide useful information to management and investors by excluding certain material items that may not be indicative of our core operating results. We utilize these non-GAAP financial measures in assessing the financial performance of the business, as they facilitate a comparison of current- and prior-period results. Beginning with our fiscal third quarter of 2022, certain of our non-GAAP financial measures have been adjusted for additional expenses directly related to our acquisitions that we believe are not indicative of our core operating results, such as those related to amortization of identifiable intangible assets arising from acquisitions and acquisition-related retention. Prior periods have been conformed to the current period presentation. We believe that return on tangible common equity and tangible book value per share are meaningful to investors as they facilitate comparisons of our results to the results of other companies. In the following tables, the tax effect of non-GAAP adjustments reflects the statutory rate associated with each non-GAAP item. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. In addition, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures of other companies. The following tables provide a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures for those periods which include non-GAAP adjustments. Note: Please refer to the footnotes on slide 29 for additional information. continued on next slide

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) Note: Please refer to the footnotes on slide 29 for additional information. continued on next slide21 Three months ended Six months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Net income available to common shareholders $ 323 $ 299 $ 437 $ 507 $ 425 $ 769 $ 932 Non-GAAP adjustments: Expenses directly related to acquisitions included in the following financial statement line items: Compensation, commissions and benefits — Acquisition-related retention (1) 14 18 17 18 17 25 35 Professional fees 5 4 1 — — 7 — Bank loan provision/(benefit) for credit losses — Initial provision for credit losses on acquired loans — 26 — — — — — Other Amortization of identifiable intangible assets (2) 6 8 11 11 11 14 22 Initial provision for credit losses on acquired lending commitments — 5 — — — — — All other acquisition-related expenses 6 4 1 — — 6 — Total “Other” expense 12 17 12 11 11 20 22 Total expenses related to acquisitions 31 65 30 29 28 52 57 Other — Insurance settlement received (3) — — — (32) — — (32) Pre-tax impact of non-GAAP adjustments 31 65 30 (3) 28 52 25 Tax effect of non-GAAP adjustments (8) (16) (8) 1 (7) (13) (6) Total non-GAAP adjustments, net of tax 23 49 22 (2) 21 39 19 Adjusted net income available to common shareholders (4) $ 346 $ 348 $ 459 $ 505 $ 446 $ 808 $ 951 Pre-tax income $ 433 $ 415 $ 616 $ 652 $ 557 $ 991 $ 1,209 Pre-tax impact of non-GAAP adjustments (as detailed above) 31 65 30 (3) 28 52 25 Adjusted pre-tax income (4) $ 464 $ 480 $ 646 $ 649 $ 585 $ 1,043 $ 1,234

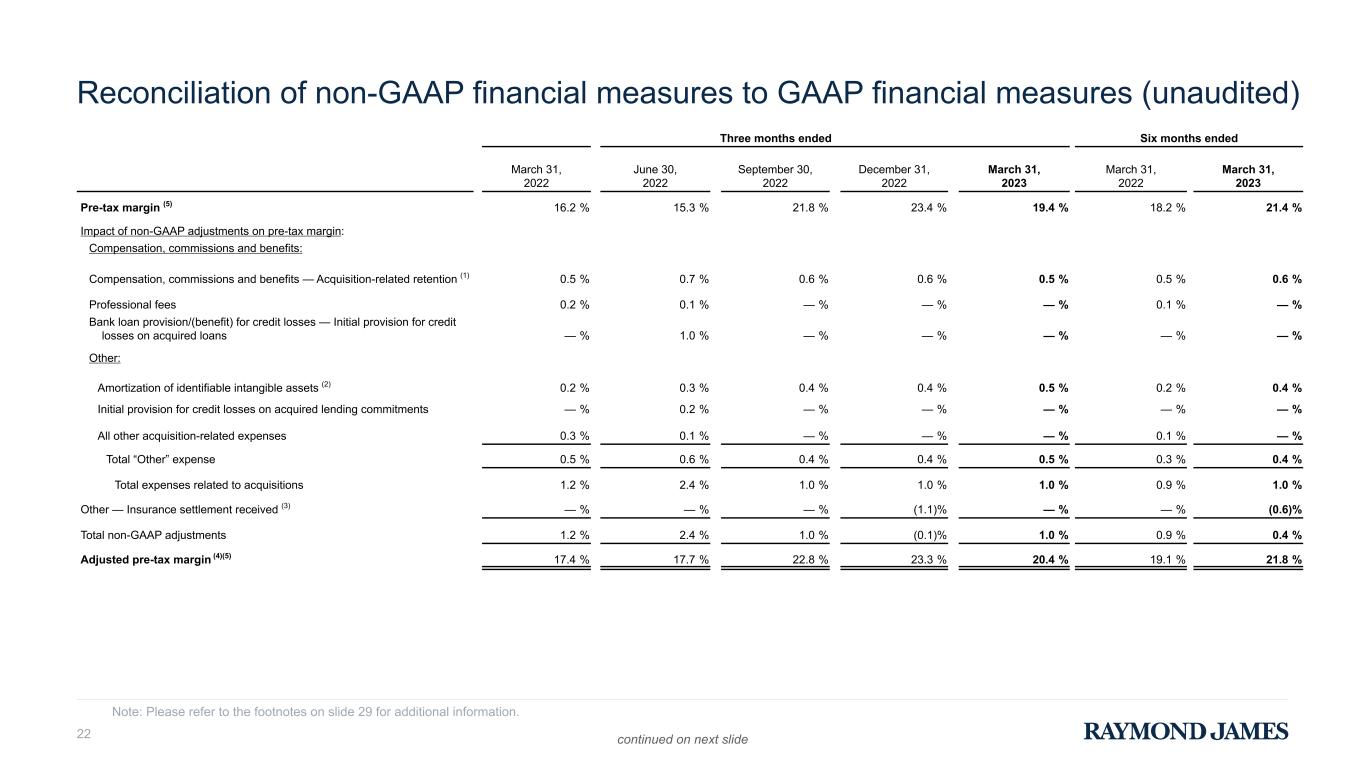

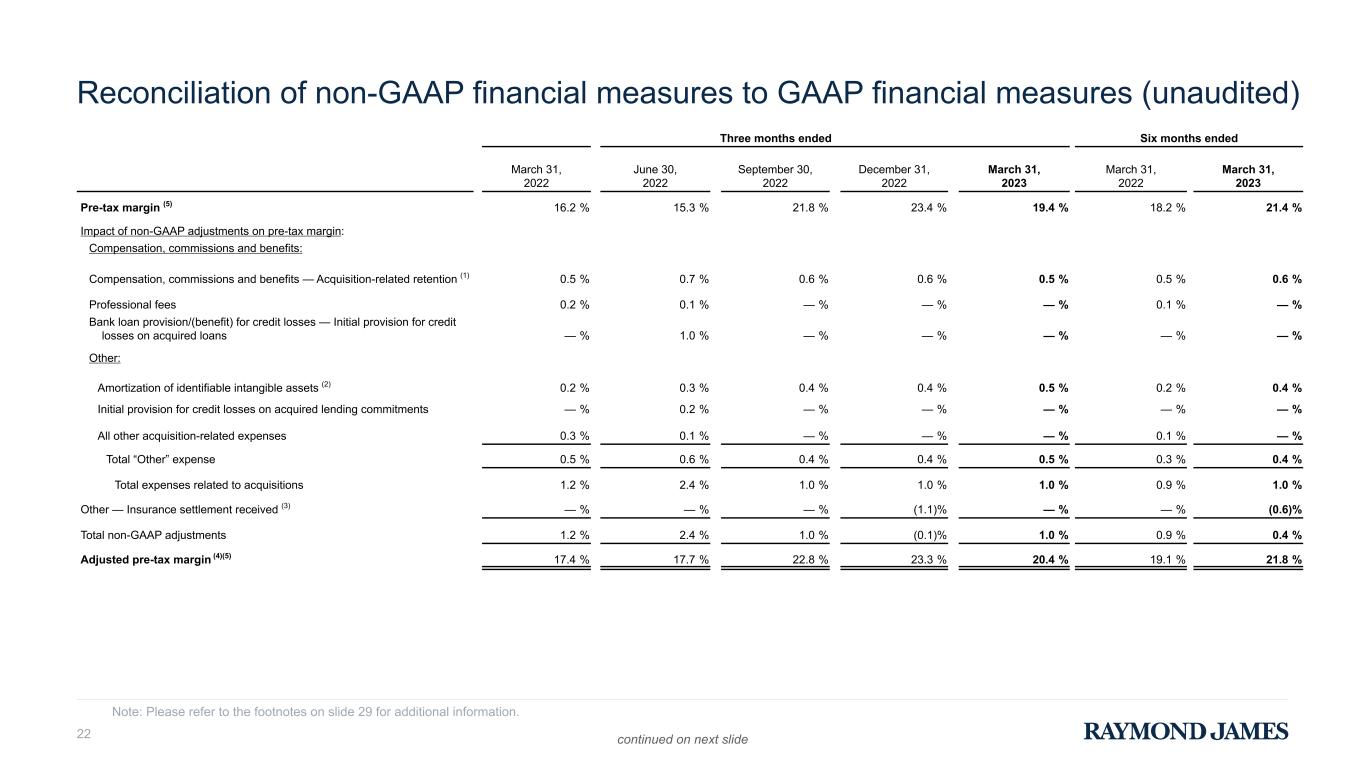

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) Three months ended Six months ended March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Pre-tax margin (5) 16.2 % 15.3 % 21.8 % 23.4 % 19.4 % 18.2 % 21.4 % Impact of non-GAAP adjustments on pre-tax margin: Compensation, commissions and benefits: Compensation, commissions and benefits — Acquisition-related retention (1) 0.5 % 0.7 % 0.6 % 0.6 % 0.5 % 0.5 % 0.6 % Professional fees 0.2 % 0.1 % — % — % — % 0.1 % — % Bank loan provision/(benefit) for credit losses — Initial provision for credit losses on acquired loans — % 1.0 % — % — % — % — % — % Other: Amortization of identifiable intangible assets (2) 0.2 % 0.3 % 0.4 % 0.4 % 0.5 % 0.2 % 0.4 % Initial provision for credit losses on acquired lending commitments — % 0.2 % — % — % — % — % — % All other acquisition-related expenses 0.3 % 0.1 % — % — % — % 0.1 % — % Total “Other” expense 0.5 % 0.6 % 0.4 % 0.4 % 0.5 % 0.3 % 0.4 % Total expenses related to acquisitions 1.2 % 2.4 % 1.0 % 1.0 % 1.0 % 0.9 % 1.0 % Other — Insurance settlement received (3) — % — % — % (1.1) % — % — % (0.6) % Total non-GAAP adjustments 1.2 % 2.4 % 1.0 % (0.1) % 1.0 % 0.9 % 0.4 % Adjusted pre-tax margin (4)(5) 17.4 % 17.7 % 22.8 % 23.3 % 20.4 % 19.1 % 21.8 % Note: Please refer to the footnotes on slide 29 for additional information. continued on next slide22

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 23 Note: Please refer to the footnotes on slide 29 for additional information. continued on next slide Three months ended March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 Total compensation ratio (6) 69.3 % 67.5 % 62.1 % 62.3 % 63.3 % Less the impact of non-GAAP adjustments on compensation ratio: Acquisition-related retention (1) 0.5 % 0.7 % 0.6 % 0.6 % 0.5 % Adjusted total compensation ratio (4) (6) 68.8 % 66.8 % 61.5 % 61.7 % 62.8 % Three months ended $ in millions March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 Compensation, commissions and benefits expense 1,852 $ 1,834 $ 1,759 1,736 1,820 Acquisition-related retention (1) 14 18 17 18 17 Adjusted compensation, commissions and benefits expense (4) $ 1,838 $ 1,816 $ 1,742 $ 1,718 $ 1,803

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 24 Note: Please refer to the footnotes on slide 29 for additional information. Three months ended Six months ended Earnings per common share (7) March 31, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Basic $ 1.56 $ 2.36 $ 1.97 $ 3.71 $ 4.33 Impact of non-GAAP adjustments on basic earnings per common share: Compensation, commissions and benefits: Compensation, commissions and benefits — Acquisition-related retention (1) 0.07 0.08 0.08 0.12 0.16 Professional fees 0.02 — — 0.03 — Bank loan provision/(benefit) for credit losses — Initial provision for credit losses on acquired loans — — — — — Other: Amortization of identifiable intangible assets (2) 0.03 0.06 0.05 0.07 0.11 Initial provision for credit losses on acquired lending commitments — — — — — All other acquisition-related expenses 0.03 — — 0.03 — Total “Other” expense 0.06 0.06 0.05 0.10 0.11 Total expenses related to acquisitions 0.15 0.14 0.13 0.25 0.27 Other — Insurance settlement received (3) — (0.15) — — (0.15) Tax effect of non-GAAP adjustments (0.04) — (0.03) (0.06) (0.03) Total non-GAAP adjustments, net of tax 0.11 (0.01) 0.10 0.19 0.09 Adjusted basic (4) $ 1.67 $ 2.35 $ 2.07 $ 3.90 $ 4.42 continued on next slide

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 25 Note: Please refer to the footnotes on slide 29 for additional information. continued on next slide Three months ended Six months ended Earnings per common share (7) March 31, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Diluted $ 1.52 $ 2.30 $ 1.93 $ 3.61 $ 4.23 Impact of non-GAAP adjustments on diluted earnings per common share: Compensation, commissions and benefits: Compensation, commissions and benefits — Acquisition-related retention (1) 0.06 0.08 0.08 0.12 0.16 Professional fees 0.02 — — 0.03 — Bank loan provision/(benefit) for credit losses — Initial provision for credit losses on acquired loans — — — — — Other: Amortization of identifiable intangible assets (2) 0.03 0.06 0.05 0.07 0.10 Initial provision for credit losses on acquired lending commitments — — — — — All other acquisition-related expenses 0.03 — — 0.03 — Total “Other” expense 0.06 0.06 0.05 0.10 0.10 Total expenses related to acquisitions 0.14 0.14 0.13 0.25 0.26 Other — Insurance settlement received (3) — (0.15) — — (0.15) Tax effect of non-GAAP adjustments (0.04) — (0.03) (0.06) (0.03) Total non-GAAP adjustments, net of tax 0.10 (0.01) 0.10 0.19 0.08 Adjusted diluted (4) $ 1.62 $ 2.29 $ 2.03 $ 3.80 $ 4.31

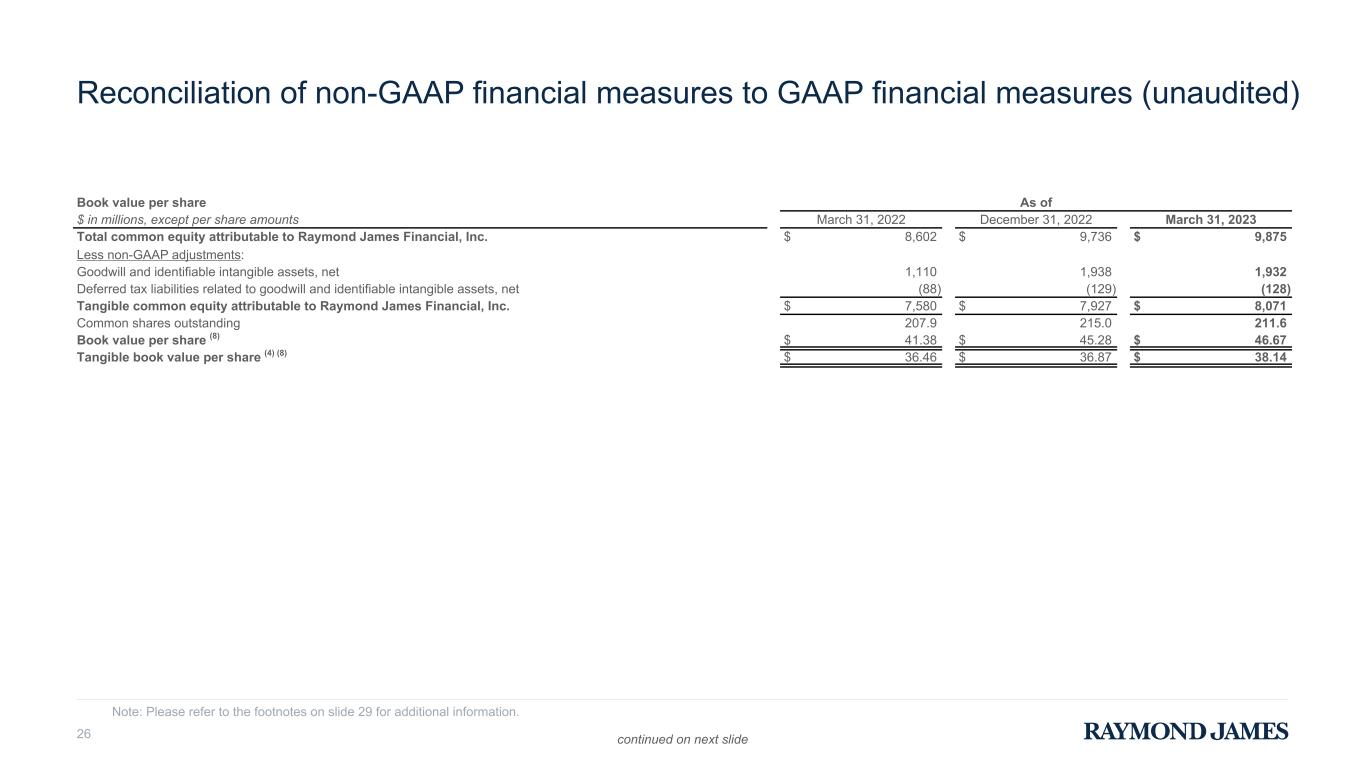

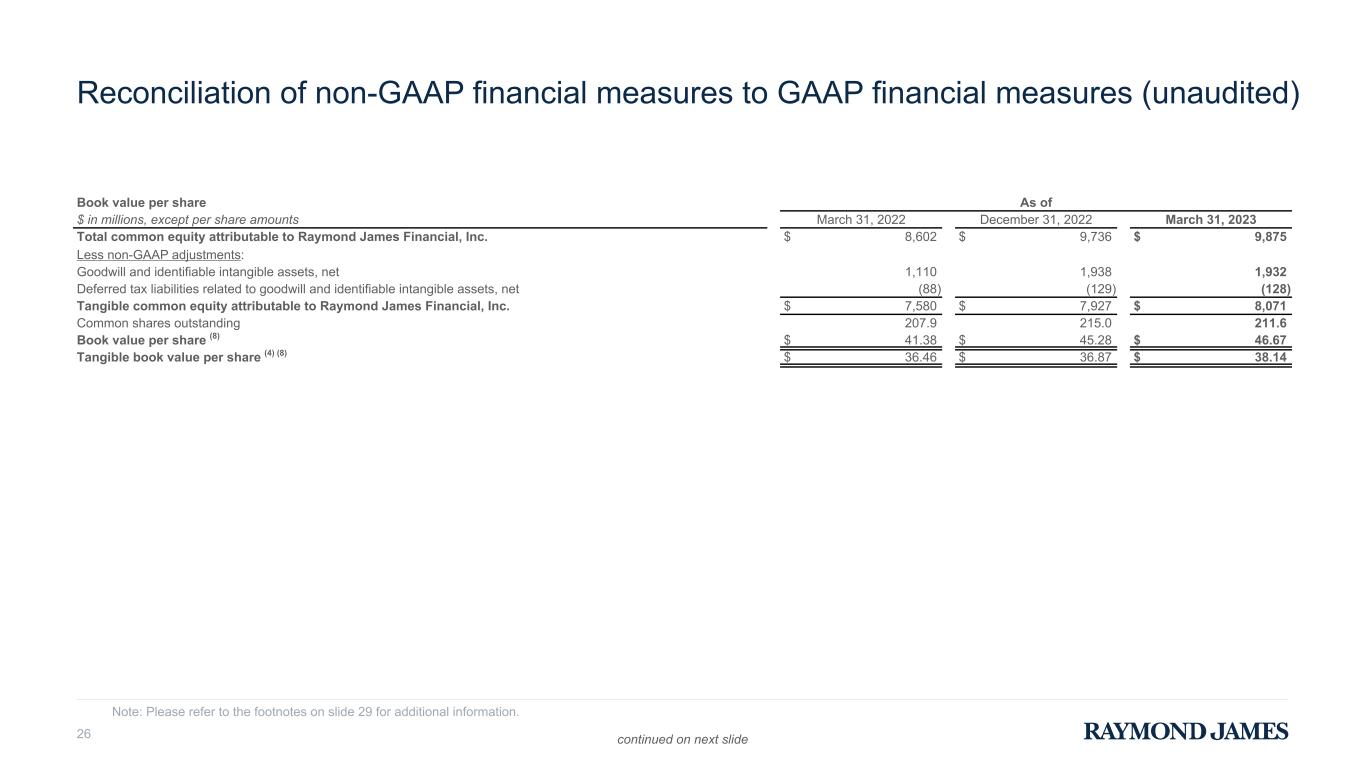

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 26 Note: Please refer to the footnotes on slide 29 for additional information. continued on next slide Book value per share As of $ in millions, except per share amounts March 31, 2022 December 31, 2022 March 31, 2023 Total common equity attributable to Raymond James Financial, Inc. $ 8,602 $ 9,736 $ 9,875 Less non-GAAP adjustments: Goodwill and identifiable intangible assets, net 1,110 1,938 1,932 Deferred tax liabilities related to goodwill and identifiable intangible assets, net (88) (129) (128) Tangible common equity attributable to Raymond James Financial, Inc. $ 7,580 $ 7,927 $ 8,071 Common shares outstanding 207.9 215.0 211.6 Book value per share (8) $ 41.38 $ 45.28 $ 46.67 Tangible book value per share (4) (8) $ 36.46 $ 36.87 $ 38.14

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 27 Note: Please refer to the footnotes on slide 29 for additional information. Return on common equity Three months ended Six months ended $ in millions March 31, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Average common equity (9) $ 8,601 $ 9,537 $ 9,806 $ 8,482 $ 9,650 Impact of non-GAAP adjustments on average common equity: Compensation, commissions and benefits: Compensation, commissions and benefits — Acquisition-related retention (1) 7 9 9 12 18 Professional fees 3 — — 3 — Bank loan provision/(benefit) for credit losses — Initial provision for credit losses on acquired loans — — — — — Other: Amortization of identifiable intangible assets (2) 3 5 6 7 11 Initial provision for credit losses on acquired lending commitments — — — — — All other acquisition-related expenses 3 — — 2 — Total “Other” expense 6 5 6 9 11 Total expenses related to acquisitions 16 14 15 24 29 Other — Insurance settlement received (3) — (16) — — (21) Tax effect of non-GAAP adjustments (4) 1 (4) (6) (2) Total non-GAAP adjustments, net of tax 12 (1) 11 18 6 Adjusted average common equity (4) (9) $ 8,613 $ 9,536 $ 9,817 $ 8,500 $ 9,656 continued on next slide

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 28 Note: Please refer to the footnotes on slide 29 for additional information. Return on tangible common equity Three months ended Six months ended $ in millions March 31, 2022 December 31, 2022 March 31, 2023 March 31, 2022 March 31, 2023 Average common equity (9) $ 8,601 $ 9,537 $ 9,806 $ 8,482 $ 9,650 Less: Average goodwill and identifiable intangible assets, net 992 1,935 1,936 955 1,934 Average deferred tax liabilities related to goodwill and identifiable intangible assets, net (77) (128) (129) (72) (128) Average tangible common equity (4) (9) $ 7,686 $ 7,730 $ 7,999 $ 7,599 $ 7,844 Impact of non-GAAP adjustments on average tangible common equity: Compensation, commissions and benefits: Compensation, commissions and benefits — Acquisition-related retention (1) 7 9 9 12 18 Professional fees 3 — — 3 — Bank loan provision/(benefit) for credit losses — Initial provision for credit losses on acquired loans — — — — — Other: Amortization of identifiable intangible assets (2) 3 5 6 7 11 Initial provision for credit losses on acquired lending commitments — — — — — All other acquisition-related expenses 3 — — 2 — Total “Other” expense 6 5 6 9 11 Total expenses related to acquisitions 16 14 15 24 29 Other — Insurance settlement received (3) — (16) — — (21) Tax effect of non-GAAP adjustments (4) 1 (4) (6) (2) Total non-GAAP adjustments, net of tax 12 (1) 11 18 6 Adjusted average tangible common equity (4) (9) $ 7,698 $ 7,729 $ 8,010 $ 7,617 $ 7,850 Return on equity (10) 15.0 % 21.3 % 17.3 % 18.1 % 19.3 % Adjusted return on equity (4) (10) 16.1 % 21.2 % 18.2 % 19.0 % 19.7 % Return on tangible common equity (4) (10) 16.8 % 26.2 % 21.3 % 20.2 % 23.8 % Adjusted return on tangible common equity (4) (10) 18.0 % 26.1 % 22.3 % 21.2 % 24.2 %

Footnotes 29 (1) Includes acquisition-related compensation expenses arising from equity and cash-based retention awards issued in conjunction with acquisitions in prior years. Such retention awards are generally contingent upon the post-closing continuation of service of certain associates who joined the firm as part of such acquisitions and are expensed over the requisite service period. (2) Amortization of identifiable intangible assets, which was included in “Other” expense, includes amortization of identifiable intangible assets arising from our acquisitions. (3) The three months ended December 31, 2022 and six months ended March 31, 2023 included the favorable impact of a $32 million insurance settlement received during the period related to a previously settled litigation matter. This item has been reflected as an offset to Other expenses within our Other segment. In the computation of our non-GAAP financial measures, we have reversed the favorable impact of this item on adjusted pre-tax income and adjusted net income available to common shareholders. See the schedules on the previous pages for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures and for more information on these measures. (4) These are non-GAAP financial measures. See the schedules on the previous pages for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures and for more information on these measures. (5) Pre-tax margin is computed by dividing pre-tax income by net revenues for each respective period or, in the case of adjusted pre-tax margin, computed by dividing adjusted pre-tax income by net revenues for each respective period. (6) Total compensation ratio is computed by dividing compensation, commissions and benefits expense by net revenues for each respective period. Adjusted total compensation ratio is computed by dividing adjusted compensation, commissions and benefits expense by net revenues for each respective period. (7) Earnings per common share is computed by dividing net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period or, in the case of adjusted earnings per common share, computed by dividing adjusted net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period. The allocations of earnings and dividends to participating securities were $0 million for the three months ended March 31, 2022, $1 million for each of the three months ended June 30, 2022, September 30, 2022, and December 31, 2022, $2 million for the three months ended March 31, 2023, $1 million for the six months ended March 31, 2022, and $3 million for the six months ended March 31, 2023. (8) Book value per share is computed by dividing total common equity attributable to Raymond James Financial, Inc. by the number of common shares outstanding at the end of each respective period or, in the case of tangible book value per share, computed by dividing tangible common equity by the number of common shares outstanding at the end of each respective period. (9) Average common equity for the quarter-to-date period is computed by adding the total common equity attributable to Raymond James Financial, Inc. as of the date indicated to the prior quarter-end total, and dividing by two, or in the case of average tangible common equity, computed by adding tangible common equity as of the date indicated to the prior quarter-end total, and dividing by two. For the year-to-date period, average common equity is computed by adding the total common equity attributable to Raymond James Financial, Inc. as of each quarter-end date during the indicated period to the beginning of year total, and dividing by three, or in the case of average tangible common equity, computed by adding tangible common equity as of each quarter-end date during the indicated period to the beginning of year (10) Return on common equity is computed by dividing annualized net income available to common shareholders by average common equity for each respective period or, in the case of return on tangible common equity, computed by dividing annualized net income available to common shareholders by average tangible common equity for each respective period. Adjusted return on common equity is computed by dividing annualized adjusted net income available to common shareholders by adjusted average common equity for each respective period, or in the case of adjusted return on tangible common equity, computed by dividing annualized adjusted net income available to common shareholders by adjusted average tangible common equity for each respective period. Tangible common equity is defined as total common equity attributable to Raymond James Financial, Inc. less goodwill and intangible assets, net of related deferred taxes.