UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-3752

THE MANAGERS FUNDS

(Exact name of registrant as specified in charter)

| | |

| 800 Connecticut Avenue, Norwalk, Connecticut | | 06854 |

| (Address of principal executive offices) | | (Zip code) |

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

| | |

| Date of fiscal year end: | | DECEMBER 31 |

| |

| Date of reporting period: | | JANUARY 1, 2004 – DECEMBER 31, 2004 (Annual Shareholder Report) |

| Item 1. | REPORTS TO STOCK HOLDERS. |

ANNUAL REPORT

Managers Funds

| • | | Capital Appreciation Fund |

| • | | International Equity Fund |

| • | | Emerging Markets Equity Fund |

December 31, 2004

Table of Contents

Nothing contained herein is to be considered an offer, sale, or solicitation of an offer to buy shares of The Managers Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Fellow Shareholder:

The U.S. economy grew steadily this past year, providing a generally healthy backdrop for the financial markets. In addition, inflation remained moderately positive despite a sharp rise in energy prices that could have put pressure on all prices or stalled growth completely. The latest evidence is that the economy was growing at an annualized rate of 4% through the third quarter. Importantly, consumer spending did not show the deterioration that many had predicted. Rather, the consumer showed impressive resilience in the face of higher costs for energy and select other necessities. Also, nonresidential fixed investment continued to rebound. Capital spending had declined between 10% and 15% annually during the heart of the 2001 recession, but increased at a comparable pace in recent quarters. This spending also translated into improving balance sheets and earnings for a good number of companies. Meanwhile, energy and other raw material prices eased in late 2004. While long-term interest rates moderated over the course of the year, short-term rates rose, due primarily to the five one-quarter-point (0.25%) interest rate hikes instituted by the Federal Open Market Committee (FOMC) during the period.

Despite the generally positive economic backdrop, the equity markets were mired in somewhat of a trading range throughout most of 2004, but jumped out of it immediately following the November presidential election. Small capitalization stocks again outpaced large cap stocks and value style benchmarks performed significantly better than growth benchmarks. This was driven by strong gains in the energy and materials sectors while traditional growth sectors such as technology and healthcare struggled for most of the year. Developed and emerging foreign markets also posted healthy gains, enhanced for U.S. investors by a weakening U.S. dollar. The surprise for many investors was the strength of longer term bonds. Despite the steady rise of short-term rates as a result of the FOMC tightening program, long-term rates were steady to lower for the year.

We are pleased to report that the Funds within the Managers Funds family performed well within expectations for the year. It was also a very active year from an organizational perspective. Notably, the Managers family of funds celebrated its 20th anniversary in June as Managers Capital Appreciation, Managers Special Equity and Managers Bond Funds each eclipsed their 20th year since inception.

In addition to taking over the management and administration of several Funds formerly managed by Conseco Funds Group, we were, at year end, in the process of seeking shareholder approval to integrate the Fremont family of mutual funds within our group. Shareholder approval was received in mid-January. These Funds also utilize a subadvisor structure. We believe that a key advantage to shareholders of both Fund families will be a broader array of asset classes, investment styles and “intelligence diversification” available within one group of Funds.

Beginning in May we instituted expense caps on several of our Funds which effectively lowered their respective costs to shareholders. These include Managers Value, now capped at 1.19% per year, Managers Capital Appreciation, now capped at 1.29% per year, Managers International Equity, now capped at 1.55% per year, Managers Emerging Markets Equity, now capped at 1.79% per year, and Managers Global Bond, now capped at 1.19% per year. In a similar effort to reduce costs, we commenced operation of a new share class of Managers Special Equity (I Class) which, by virtue of a high minimum investment ($250,000), will be of lower cost than the original share class.

Finally, throughout the latter half of the year, Managers made preparations to partner with several of our AMG Affiliates to create Managers Investment Group, which we formed on January 1, 2005. The new organization has expanded resources and a broad variety of investment management and distribution services.

As always, we post any news or other pertinent information about the Funds as soon as applicable on our new Web site at www.managersinvest.com. Should you have any questions about any of our Funds or this report, please feel free to contact us at 1-800-835-3879, or visit the Web site. We thank you for your investment in The Managers Funds.

| | | | |

Sincerely, | | | | |

| | |

| | | |  |

Peter M. Lebovitz | | | | Thomas G. Hoffman, CFA |

President | | | | Executive Vice President |

The Managers Funds | | | | Chief Investment Officer |

| | | | | Managers Investment Group LLC |

1

About Your Fund’s Expenses

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from the Fund’s gross income, directly reduce the investment return of the Fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund, so you can compare these costs with those of other mutual funds. The examples are based on an investment in the Fund of $1,000 made at the beginning of the most recent fiscal period and held for the entire period.

The table below illustrates your Fund’s costs in two ways:

Actual Fund return: This helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% annual return: This helps you compare the Fund’s costs with those of other mutual funds because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% annual return less expenses. It assumes that the Fund had a return of 5% per year and that the expense ratio is unchanged. You can assess the Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

| | | | | | | | | | | | |

Six Months Ended December 31, 2004

| | Expense Ratio

| | | Beginning Account

Value 6/30/2004

| | Ending Account

Value

12/31/2004

| | Expenses Paid

During the

Period*

|

Managers Value Fund | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.19 | % | | $ | 1,000 | | $ | 1,087 | | $ | 6.26 |

Based on Hypothetical 5% Annual Return | | 1.19 | % | | $ | 1,000 | | $ | 1,019 | | $ | 6.06 |

Managers Capital Appreciation Fund | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.29 | % | | $ | 1,000 | | $ | 1,047 | | $ | 6.66 |

Based on Hypothetical 5% Annual Return | | 1.29 | % | | $ | 1,000 | | $ | 1,019 | | $ | 6.56 |

Managers Small Company Fund | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.45 | % | | $ | 1,000 | | $ | 1,063 | | $ | 7.52 |

Based on Hypothetical 5% Annual Return | | 1.45 | % | | $ | 1,000 | | $ | 1,018 | | $ | 7.35 |

Managers Special Equity Fund | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.39 | % | | $ | 1,000 | | $ | 1,098 | | $ | 7.34 |

Based on Hypothetical 5% Annual Return | | 1.39 | % | | $ | 1,000 | | $ | 1,018 | | $ | 7.06 |

Managers Special Equity Fund - I Shares | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.17 | % | | $ | 1,000 | | $ | 1,099 | | $ | 6.19 |

Based on Hypothetical 5% Annual Return | | 1.17 | % | | $ | 1,000 | | $ | 1,019 | | $ | 5.96 |

Managers International Equity Fund | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.55 | % | | $ | 1,000 | | $ | 1,135 | | $ | 8.34 |

Based on Hypothetical 5% Annual Return | | 1.55 | % | | $ | 1,000 | | $ | 1,017 | | $ | 7.88 |

Managers Emerging Markets | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.79 | % | | $ | 1,000 | | $ | 1,275 | | $ | 10.26 |

Based on Hypothetical 5% Annual Return | | 1.79 | % | | $ | 1,000 | | $ | 1,016 | | $ | 9.10 |

Managers Bond Fund | | | | | | | | | | | | |

Based on Actual Fund Return | | 0.99 | % | | $ | 1,000 | | $ | 1,059 | | $ | 5.12 |

Based on Hypothetical 5% Annual Return | | 0.99 | % | | $ | 1,000 | | $ | 1,020 | | $ | 5.03 |

Managers Global Bond Fund | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.19 | % | | $ | 1,000 | | $ | 1,110 | | $ | 6.33 |

Based on Hypothetical 5% Annual Return | | 1.19 | % | | $ | 1,000 | | $ | 1,019 | | $ | 6.06 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

You can find more information about each Fund’s expenses, including annual expense ratios for the past fiscal periods, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

2

| | |

| Managers Value Fund | | Value |

Managers Value Fund (“Value”) is a value oriented stock Fund seeking long-term capital appreciation through a diversified portfolio of medium and large capitalization companies. In line with our belief in “intelligence diversification,” Managers currently utilizes two independent subadvisors who each manage approximately half of the total portfolio: a team led by Jeffrey Shaw of Armstrong Shaw Associates Inc. (“Armstrong Shaw”), hired in March 2000, and a team led by John Liang of Osprey Partners Investment Management (“Osprey”), hired in September 2001.

The Portfolio Managers

Armstrong Shaw Associates Inc.

Jeff and the investment management team at Armstrong Shaw take a disciplined absolute value approach to investing in the equity market. Their goal is to purchase companies that are selling at a substantial discount to intrinsic value. Shaw defines intrinsic value as an estimate of what a company would be worth if it were sold as a continuing operation to a knowledgeable buyer. This approach permits price appreciation, if the stock grows into its intrinsic value, while limiting the risk of significant price depreciation.

Shaw begins by screening the universe of domestic stocks for those with market caps more than $2.5 billion, P/E ratios below the market average, EPS growth better than 10% and return on equity better than 15%. Shaw might also search for certain events or special situations such as restructurings, industry events, or legislative changes. After narrowing the universe to about 200 mid- and large-cap names, the investment team analyzes the companies by speaking with management, suppliers and customers and examining financial statements. Qualitatively, Shaw prefers companies with discernable business franchises and a management team with a successful track record. The importance of a strong business model and management team in Shaw’s approach cannot be overemphasized. Unlike a deep value manager where price is the main concern, Shaw is willing to pay a bit more for a company with a strong business plan as long as the price is still below what he estimates as the intrinsic value. Quantitatively, the team compares the stock prices to cash flows, EPS, sales, etc. Shaw will estimate the stock’s intrinsic value and purchase stocks only when they are selling for less than 70% of the estimated intrinsic value.

This results in a portfolio of 30-40 of the team’s best ideas. Another 100 stocks or so remain on a watch list for future consideration. Shaw sets target prices on these stocks that reflect his expectation of 30-50% price appreciation over the next 2-3 years. Thus, turnover tends to be low. The portfolio’s performance is driven by each stock’s appreciation toward its intrinsic value along with rising intrinsic value in response to improved business or industry outlooks. Armstrong Shaw will sell a position when a price target is reached, the company’s fundamentals deteriorate, or if it reports below-expectation financial results. Additionally, a drop in price of 25% from average cost triggers an automatic review process for potential sale.

Osprey Partners Investment Management, LLC

As traditional value investors, John Liang and the investment team at Osprey Partners Investment Management seek to identify undervalued stocks with low price to earnings (P/E) and price to cash flow (P/CF) ratios. At the same time, Osprey’s investment team focuses its in-depth bottom-up analysis to identify fundamentally strong, well-managed companies.

The initial step is to screen the investment universe for companies with a market cap above $1.5 billion and a P/E ratio at least 20% less than the P/E ratio of the S&P 500. The analysts will also review other metrics to determine which companies warrant further investigation, favoring companies with low debt to capital, low price to cash flow, and low price to book ratios. The next step of the process is to determine the strength and risks of each company’s business. Each idea is presented to the Research Committee, which determines which securities warrant further analysis and which should be considered for inclusion in the portfolio. The analysts focus on each company’s balance sheet and income statement, earnings quality and sustainability, and profit margin trends. An in-depth assessment of management’s capability and reputation is crucial because many of the companies that Osprey considers have either fallen in price or have not risen as much as some of their peers. Thus, Osprey analysts meet management to review the company’s business models, use of cash, competitiveness, and any acquisition strategies. John and the analysts also monitor the macroeconomic backdrop to determine how industry-level factors could affect a company’s competitiveness or business plan. All of this is intended to identify well-managed companies that are strong competitors. After all research is completed, purchase ideas are considered by the firm’s Investment Committee. This group is responsible for all portfolio management decisions, most importantly what stocks to buy or sell and when to add to or trim a position. In order to purchase a stock, the group must reach a consensus, and an initial position is typically 2%. Industry exposure is monitored to ensure diversification; no industry can comprise more than 15% of the portfolio.

The portfolio will typically consist of 35-45 stocks spread among 15-20 industry groups. A position is sold when the P/E ratio exceeds the P/E ratio of the market, when it appreciates to a predetermined price target, if fundamentals change, or if a better idea should present itself. Additionally, a 20% drop relative to the market prompts a review and positions exceeding 6% of the portfolio are scaled back. The investment team tends to have an investment time horizon of 2 years or more; and the portfolio turnover has been 25% to 40% annually.

The Year in Review

For the year 2004, the Managers Value Fund gained 13.87% compared with a gain of 10.88% for the S&P 500. In the U.S., the broad market (using, for example, the Russell 3000, Wilshire 5000, and S&P 500 indices) rose about 12% for the year and, by most measures, it was the first consecutive positive year since 1998-1999.

3

The equity markets opened the year continuing the rally of 2003 before falling in March amid security concerns following the terrorist attacks in Madrid. The economy took center stage in the middle of the year as the Federal Open Market Committee began to raise the Federal funds rate 0.25%, the first of many such increases. While corporate earnings were strong, the market was soft as a result of concerns about a slowing economy and constrained consumer spending due to rising energy costs. The market began to rally in September only to be slowed down by Merck, which announced the recall of its successful arthritis drug Vioxx.

Throughout most of 2004 the market had been locked into a trading zone, but jumped out immediately after the presidential election. A decisive election boosted markets to their best performance since the fourth quarter of 2003. This strong performance was led by the IT and consumer sectors. Both sectors had been negative all year and posted strong returns of about 13% in the fourth quarter. As corporate profits continued to grow, capital spending increased, helping the IT sector. The consumer was helped by a decrease in energy and materials prices. While price indices rose over all, the fourth quarter saw a decrease in oil prices from a high of over $55 per barrel to about $43 per barrel. This decrease did not stop the energy sector from posting strong returns for the year. Global demand for oil and other materials helped the energy (+31%) and materials (+13%) sectors throughout the year. Industrials (18%) had a strong year despite the poor performance of the airline industry which continues to struggle.

From a style standpoint, the S&P Barra/Value Index outperformed its growth counterpart by over 900 basis points (bps). Low price-to-sales and price-to earnings stocks were the leaders early in the year. The resurgence of the information technology and consumer discretionary sectors in the fourth quarter evened out the distribution as all price-to-earnings quintiles performed well.

The Fund started the year again with a large overweight in the financials sector. However, the results were not as beneficial as in 2003 as an investigation into illegal sales practices within the insurance industry hurt returns and Fannie Mae (-5%) was involved in its own accounting scandal. An overweight in energy was additive to the Fund due to strong performance amid rising energy costs and increased demand. Examples include ConocoPhillips (+32%), Transocean (+77%) and Devon Energy (+36%).

Despite strong performance from the consumer discretionary sector the Fund did not fair as well. Retail in particular lagged due to the performance of Dollar Tree Stores (-4%), Gap (-9%) and Rent-A-Center (-12%). The healthcare sector did not subtract from the Fund as much as it might have thanks to some good stock selection. The poor performance of Merck (-30%) and Pfizer (-24%) was offset by positions in WellPoint (+53%) and Lab Corp. of America (35%). While Merck was liquidated from the Fund, Pfizer remains a significant holding.

Looking Forward

Looking forward, the portfolio managers continue to find value in financials, healthcare and consumer sectors.

The Fund’s subadvisors had the following comments as we progress into 2005:

Armstrong Shaw - With signs that the profit cycle is decelerating, the “quality trade” seems poised to work in 2005. During past periods of decelerating earnings growth, higher quality, large cap stocks have outperformed. Large cap valuations are attractive vs. small cap stocks and have higher dividend support. The weaker dollar should also favor EPS growth for large cap stocks. More than half of all large cap stocks have a cash flow yield greater than the 10 Year Treasury, twice the norm. The last time we were at these levels was in the late 70’s.

Finally, we feel 2005 will be marked by the aggressive use of corporate capital, or put another way, corporations will find more productive uses for all the cash that is sitting on their balance sheets. Corporate cash as a percentage of total assets is at 40 year highs, and totals over $1 trillion dollars. Our portfolio companies have more than their fair share of cash to reinvest and we expect our management teams to make astute capital allocation decisions to deploy this excess cash in ways that increase shareholder value.

Our portfolio is valued at a very reasonable 14.2x 2005 expected earnings which compares favorably to the Russell 1000 Value at 14.5x, the S&P 500 at 17.4x. We are optimistic that the inexpensive valuation level of our portfolio will produce attractive returns going forward.

Osprey - Corporate earnings have been nothing short of spectacular growing in the neighborhood of 20% for all of 2004 - the highest rate in over a decade - after an 18% gain in 2003. Unfortunately, all good things must come to an end, as earnings growth for the S&P 500 Index is projected to slow to 10.5% in 2005. The reason? Corporate after-tax profit margins are the highest on record due to the enormous gains in productivity that U.S. corporations have achieved over the past several years without a corresponding increase in wages and benefits. With productivity gains slowing, raw material and labor costs rising, and little or no pricing power, U.S. companies will have a hard time growing their bottom line much in excess of the projected 3.5% economic growth rate. This dramatic slowing of profits in the U.S. supports our thesis that investors will begin to prize companies with certain and stable earnings more and more as the year progresses.

In conclusion, we see the market as pretty fairly valued at today’s P/E of 17X consensus earnings estimates for 2005. With short-term interest rates rising we don’t expect to see multiple expansion. Therefore, market appreciation in 2005 will most likely be less than 10% with individual companies in the aforementioned defensive and stable earnings growth categories doing much better.

4

With our portfolio deeply undervalued and in excellent position to capitalize on the changing market environment described above, we look forward to what the coming year holds in store.

Cumulative Total Return Performance

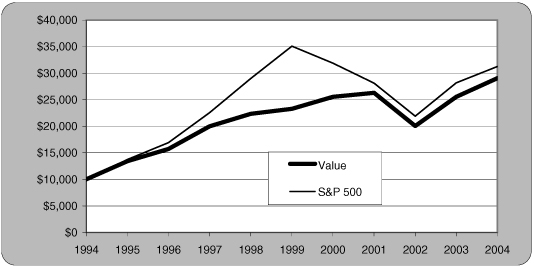

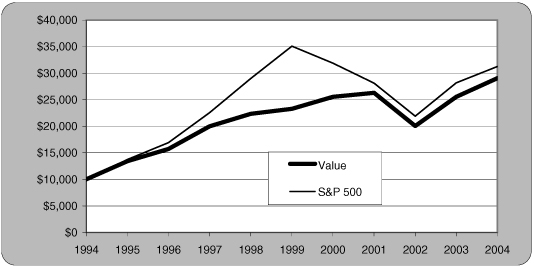

Value Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The S&P 500 Index is an unmanaged capitalization weighted index of 500 commonly traded stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of those stocks. The Index assumes reinvestment of dividends. This chart compares a hypothetical $10,000 investment made in Value Fund on December 31,1994, to a $10,000 investment made in the S&P 500 for the same time period. The chart is not intended to imply any future performance of the Fund. The graph and chart do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Total Returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the Value Fund and the S&P 500 Index since December 31,1994 through December 31, 2004.

| | | | | | | | | |

Average Annual Total Returns:

| | 1 Year

| | | 5 Years

| | | 10 Years

| |

Value Fund | | 13.87 | % | | 4.55 | % | | 11.27 | % |

S&P 500 Index | | 10.88 | % | | (2.30 | )% | | 12.07 | % |

The table below displays a full breakdown of the sector allocation of the Fund as well as the top ten positions as of December 31, 2004.

| | | |

Top Ten Holdings (out of 71 securities)

| | % Fund

| |

Citigroup, Inc.* | | 3.8 | % |

WellPoint Health Networks, Inc.* | | 3.8 | |

Fannie Mae Co. | | 3.6 | |

Bank of America Corp. | | 2.7 | |

ChevronTexaco Corp.* | | 2.6 | |

Comcast Corp., Special Class A | | 2.4 | |

Merrill Lynch & Co., Inc. | | 2.4 | |

Cendant Corp. | | 2.0 | |

Pfizer, Inc. | | 1.9 | |

GlaxoSmithKline PLC, Sponsored ADR | | 1.9 | |

| | |

|

|

Top Ten as a Group | | 27.1 | % |

| | |

|

|

| * | Top Ten Holding at December 31, 2003 |

| | | |

| |

Industry Weightings

| | | |

| Financials | | 31.6 | % |

| Consumer Discretionary | | 20.5 | |

| Health Care | | 14.0 | |

| Industrials | | 9.4 | |

| Energy | | 8.6 | |

| Consumer Staples | | 3.6 | |

| Telecommunication Services | | 2.8 | |

| Information Technology | | 2.7 | |

| Utilities | | 2.6 | |

| Materials | | 1.5 | |

5

Managers Value Fund

December 31, 2004

| | |

| Schedule of Portfolio Investments | | Value |

| | | | | | | |

Security Description

| | Shares

| | | Value

| |

Common Stocks - 97.3% | | | | | | | |

Consumer Discretionary - 20.5% | | | | | | | |

Brinker International, Inc.* | | 26,200 | 2 | | $ | 918,834 | |

Claire’s Stores, Inc. | | 29,600 | | | | 629,000 | |

Clear Channel Communications, Inc. | | 36,600 | | | | 1,225,734 | |

Comcast Corp., Special Class A* | | 87,000 | 2 | | | 2,857,080 | |

Darden Restaurants, Inc. | | 32,000 | | | | 887,680 | |

Dollar Tree Stores, Inc.* | | 56,100 | | | | 1,608,948 | |

Gannett Co., Inc. | | 18,050 | | | | 1,474,685 | |

Gap, Inc., The | | 43,200 | | | | 912,384 | |

Jones Apparel Group, Inc. | | 41,300 | | | | 1,510,341 | |

Lear Corp. | | 10,300 | | | | 628,403 | |

Liberty Media Corp. | | 145,400 | | | | 1,596,492 | |

Mattel, Inc. | | 79,700 | | | | 1,553,353 | |

Office Depot, Inc.* | | 96,000 | | | | 1,666,560 | |

Pulte Homes, Inc. | | 20,950 | | | | 1,336,610 | |

Rent-A-Center, Inc.* | | 40,000 | | | | 1,060,000 | |

Ruby Tuesday, Inc. | | 35,700 | 2 | | | 931,056 | |

Time Warner Co., Inc.* | | 92,000 | | | | 1,788,480 | |

Yum! Brands, Inc. | | 40,500 | | | | 1,910,790 | |

Total Consumer Discretionary | | | | | | 24,496,430 | |

Consumer Staples - 3.6% | | | | | | | |

CVS Corp. | | 36,700 | | | | 1,654,069 | |

SUPERVALU, Inc. | | 38,500 | | | | 1,329,020 | |

Unilever NV | | 20,400 | | | | 1,360,884 | |

Total Consumer Staples | | | | | | 4,343,973 | |

Energy - 8.6% | | | | | | | |

BP, PLC., Sponsored ADR, | | 18,400 | | | | 1,074,560 | |

ChevronTexaco Corp. | | 60,300 | | | | 3,166,353 | |

ConocoPhillips Co. | | 24,698 | | | | 2,144,527 | |

Devon Energy Corp. | | 37,800 | | | | 1,471,176 | |

Kerr-McGee Corp. | | 19,700 | 2 | | | 1,138,463 | |

Transocean, Inc.* | | 29,000 | | | | 1,229,310 | |

Total Energy | | | | | | 10,224,389 | |

Financials - 31.6% | | | | | | | |

ACE, Ltd. | | 36,400 | | | | 1,556,100 | |

Allstate Corp., The | | 34,200 | | | | 1,768,824 | |

American Express Co. | | 19,150 | | | | 1,079,486 | |

American International Group, Inc. | | 28,900 | | | | 1,897,863 | |

Bank of America Corp. | | 68,900 | | | | 3,237,611 | |

Chubb Corp. | | 23,200 | | | | 1,784,080 | |

Citigroup, Inc. | | 95,241 | 2 | | | 4,588,712 | |

Fannie Mae Co. | | 60,900 | | | | 4,336,689 | |

Goldman Sachs Group, Inc. | | 14,400 | | | | 1,498,176 | |

Hartford Financial Services Group, Inc. | | 26,800 | 2 | | | 1,857,508 | |

Jefferson-Pilot Corp. | | 11,700 | | | | 607,932 | |

MBIA, Inc. | | 29,800 | | | | 1,885,744 | |

MBNA Corp. | | 64,407 | | | | 1,815,633 | |

Merrill Lynch & Co., Inc. | | 47,600 | | | | 2,845,052 | |

Morgan Stanley Co. | | 26,500 | | | | 1,471,280 | |

Regions Financial Corp. | | 22,726 | 2 | | | 808,818 | |

St. Paul Travelers Companies, Inc., The | | 32,930 | | | | 1,220,715 | |

Washington Mutual, Inc. | | 33,800 | | | $ | 1,429,064 | |

Wells Fargo & Co. | | 23,949 | | | | 1,488,430 | |

XL Capital, Ltd. | | 7,600 | | | | 590,140 | |

Total Financials | | | | | | 37,767,857 | |

Health Care - 14.0% | | | | | | | |

Abbott Laboratories Co. | | 40,300 | | | | 1,879,995 | |

AmerisourceBergen Corp. | | 9,900 | 2 | | | 580,932 | |

Cardinal Health, Inc. | | 26,100 | 2 | | | 1,517,715 | |

GlaxoSmithKline PLC, ADR | | 47,100 | 2 | | | 2,232,069 | |

HCA, Inc. | | 33,300 | 2 | | | 1,330,668 | |

Health Management Associates, Inc. | | 54,600 | 2 | | | 1,240,512 | |

McKesson Corp. | | 39,400 | | | | 1,239,524 | |

Pfizer, Inc. | | 84,800 | | | | 2,280,272 | |

WellPoint, Inc.* | | 39,000 | | | | 4,485,000 | |

Total Health Care | | | | | | 16,786,687 | |

Industrials - 9.4% | | | | | | | |

Cendant Corp. | | 101,490 | | | | 2,372,836 | |

Emerson Electric Co. | | 24,900 | | | | 1,745,490 | |

General Dynamics Corp. | | 12,200 | 2 | | | 1,276,120 | |

General Electric Co. | | 47,000 | | | | 1,715,500 | |

Honeywell International, Inc. | | 27,800 | | | | 984,397 | |

Pitney Bowes, Inc. | | 37,200 | | | | 1,721,616 | |

United Technologies Corp. | | 13,900 | | | | 1,436,565 | |

Total Industrials | | | | | | 11,252,524 | |

Information Technology - 2.7% | | | | | | | |

Hewlett-Packard Co. | | 96,526 | | | | 2,024,150 | |

Xerox Corp.* | | 73,100 | | | | 1,243,431 | |

Total Information Technology | | | | | | 3,267,581 | |

Materials - 1.5% | | | | | | | |

E.I. du Pont de Nemours & Co., Inc. | | 36,150 | | | | 1,773,158 | |

Telecommunication Services - 2.8% | | | | | | | |

Centurytel, Inc. | | 10,500 | | | | 372,435 | |

Nextel Communications, Inc.* | | 61,000 | | | | 1,830,000 | |

Verizon Communications, Inc. | | 27,245 | | | | 1,103,695 | |

Total Telecommunication Services | | | | | | 3,306,130 | |

Utilities - 2.6% | | | | | | | |

Exelon Corp. | | 44,100 | | | | 1,943,487 | |

FirstEnergy Corp. | | 29,760 | | | | 1,175,818 | |

Total Utilities | | | | | | 3,119,305 | |

Total Common Stocks

(cost $92,295,763) | | | | | | 116,338,034 | |

Other Investment Companies - 12.6%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 2.35%3 | | 11,038,721 | | | | 11,038,721 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 2.12% | | 4,052,302 | | | | 4,052,302 | |

Total Other Investment Companies

(cost $15,091,023) | | | | | | 15,091,023 | |

Total Investments -109.9%

(cost $107,386,786) | | | | | | 131,429,057 | |

Other Assets, less Liabilities – (9.9)% | | | | | | (11,881,851 | ) |

Net Assets - 100.0% | | | | | $ | 119,547,206 | |

The accompanying notes are an integral part of these financial statements.

6

| | |

| Managers Capital Appreciation Fund | | Capital Appreciation |

Managers Capital Appreciation Fund (“Capital Appreciation”) is a growth oriented stock Fund seeking long-term capital appreciation through a diversified portfolio of equity securities. In line with our belief in “Intelligence Diversification,” Managers currently utilizes two independent subadvisors who each manage approximately half of the total portfolio: Elizabeth Bramwell at Bramwell Capital Management, Inc., hired in June 2003, and Steve Cutler and Malcolm MacColl at Essex Investment Management Company, LLC, hired in March 1997.

The Portfolio Managers

Bramwell Capital Management, Inc.

Bramwell Capital Management, Inc. (“BramCap”), led by Chief Investment Officer Elizabeth R. Bramwell, CFA, seeks long-term capital growth through investment in companies that are positioned to realize above-average long-term unit and earnings growth. Bramwell’s focus is on companies that have new products and services and that are positioned to benefit from the long-term payoff on research, as well as plant and market development and expansion.

Bramwell is an active equity manager who builds portfolios stock by stock. She makes investment decisions based on fundamental research, bottom-up earnings forecasts within a macroeconomic and political framework, and company valuations relative to their respective industries, projected future growth rates and the overall equity market.

Among the variables considered are the leadership position of the company, new products and markets, sensitivity to macroeconomic factors, e.g., inflation, interest, currency and tax rates, potential for accelerating earnings growth and improving returns on sales and equity. Within this context, BramCap looks for companies where valuations are attractive relative to projected future growth rates, multiples paid for the S&P 500 and other companies in the industry, and historical valuations.

Stock selection is based on internal research. BramCap’s three securities analysts are dedicated to the research process and with the direction of Ms. Bramwell, monitor current portfolio positions, as well as identify and evaluate potential additions or deletions to the portfolio.

Investment ideas are generated from awareness and synthesis of varying news events and trends, historical experience, industry conferences, company meetings and conference calls. Additionally, information from primary materials such as annual and quarterly reports, and the brokerage community are utilized. The portfolio typically holds 30-60 securities.

BramCap sell stocks when company fundamentals deteriorate, for example, when profitability declines or sales and earnings growth decelerates. Changes in the macroeconomic outlook, such as changes in interest and inflation rates, may also result in reducing or eliminating positions. Additionally, positions may be sold when market valuations are believed to be excessive relative to projected future growth or to make room for better opportunities. Finally, BramCap will typically trim positions that grow to more than 5% of the portfolio. Portfolio turnover is expected to be in the 50-75% range.

Essex Investment Management Company, LLC.

The investment managers at Essex Investment Management Company, LLC (“Essex”) focus on the principle that a company’s earnings growth and profitability will drive its future price performance. Essex attempts to identify companies that have accelerating, sustainable earnings growth and the potential for superior revenue growth and margin expansion. Ideally, Essex searches for companies that have a dominant product or service and a strong management team. Essex seeks investments that are under-owned or attractively priced relative to Essex’s growth projections. Companies that meet all these criteria are defined as “franchise opportunities.”

The research and portfolio management teams at Essex generate ideas by visiting companies and attending conferences and trade shows, as well as through database screening. They then develop earnings models and projections, evaluate balance sheet strengths and weaknesses, and speak with company managements.

Upon initiating a position, Essex applies risk controls to limit negative effects. These consist of price targets, individual position limits of 5% of the portfolio, and a maximum industry exposure limit of 20% of the portfolio. Companies are sold for several reasons: a perceived loss of dominant position, an earnings disappointment, excess value versus forecasted growth, or if there is a better opportunity elsewhere.

The result is that Essex’s portfolio is comprised of a blend of large multinationals with dynamic medium to large industry leaders. The portfolio’s market cap ranges from $1 billion to $100 billion with 50 to 60 companies that display sustainable, high quality earnings growth at reasonable valuations.

The Year in Review

For the twelve months ended December 31, 2004, the Fund posted a total return (including distributions) of 5.14% compared to a total return of 10.88% for the S&P 500. On the heels of a very profitable 2003, U.S. stock prices struggled for most of 2004. There were concerns about terrorism, continued war and political turmoil in the Middle East, rising interest rates, rising raw material costs, and the sustainability of the economic recovery. Thus, the broad equity indices traded in a fairly narrow range during the first ten months of the year. An orderly conclusion to the U.S. presidential election and an easing of energy prices later in the year, however, seemed to release the market from its doldrums. Stock prices shot up during the fourth quarter, and the broad markets concluded 2004 with a second consecutive double-digit calendar year gain. Within the market, there

7

was a slight bias favoring smaller companies over larger ones. For instance, the Russell 2000 (a commonly used small cap index) returned over 18% during 2004 compared with a return of a bit over 10% for the S&P 500. Also, within the S&P 500, those companies with the largest market capitalizations (a common measure of company size) underperformed those companies with the smallest market capitalizations by 12 percentage points.

There was also a strong bias favoring value-style stocks over growth-style stocks during 2004. As an example, S&P and BARRA split the S&P 500 into two categories, the S&P 500/BARRA Growth Index and its Value counterpart. For 2004, the Value Index rose 15.7% while the Growth Index rose 6.1%. A comparable trend can be found in a variety of reports that distinguish between growth and value investing. Consistent with this style bias, energy (+31%) and utilities (+24%) were the best performing sectors of the market, while health care (+2%) and information technology (+3%) were the worst.

All of these broad market trends worked against the Fund during 2004, which nevertheless did post a moderate gain. The Fund’s primary focus is on large-cap growth stocks, which, as noted above, lagged other segments of the stock market during 2004. Also, both of the subadvisors to the Fund have historically held relatively large allocations to the IT and health care sectors. For the year, the Fund’s IT allocation averaged over 23% compared with an average weight of less than 17% for the IT stocks in the S&P 500. Similarly, the Fund’s health care weight averaged almost 18% compared to just over 13% for the health care stocks in the S&P 500 Index. The “allocation effect” of these exposures was a tough hill to climb during the year. In fact, the Fund’s performance for the year was in line with large-cap growth-specific benchmarks, such as the S&P 500\BARRA Growth Index.

One of the areas that worked well for the Fund was energy. The investment team at Essex, in particular, had increased their portfolio’s energy exposure to over 10% early in the first quarter. Portfolio manager Steve Cutler noted in the 2003 Annual Report that his team was having success identifying dynamic growth companies among the oil service and producers. Additionally, the Fund’s industrial holdings rose almost 23% compared with a gain of 18% for the industrial stocks in the S&P 500 Index. Portfolio manager Elizabeth Bramwell bought aggressively into the industrial sector during 2004, particularly in the industrial conglomerate and machinery industries. Her expectation was that capital spending trends looked strong, and would only be enhanced by the continued economic emergence of China.

Looking Forward

Heading into 2005, Bramwell remains constructive about her outlook for the U.S. economy. BramCap’s portfolio continues to emphasize some of the more economically sensitive areas of the market, including infrastructure development and global manufacturers. In addition, Bramwell anticipates continued demand for and innovation within the IT segment. In that regard, she has looked for investments in VoIP, medical technology, and digitalized consumer products.

The IT and consumer sectors remain Essex’s largest sector weights. In IT, they have focused mostly on the hardware and wireless industries. Meanwhile, the Essex consumer analysts continue to see good consumer sentiment and spending trends, which gives them confidence on their outlook for certain retailers. Also, they selectively added some investments in the leisure and travel industry.

The Fund as a whole remains focused on the more traditional growth sectors within the stock market. Almost 25% of the Fund’s assets are invested in IT stocks, followed by 18% in consumer discretionary, 17% in industrials, and 14% in health care. The Fund continues to be positioned, in aggregate, for a continuation of the global economic recovery that we saw in 2003 and 2004.

8

Cumulative Total Return Performance

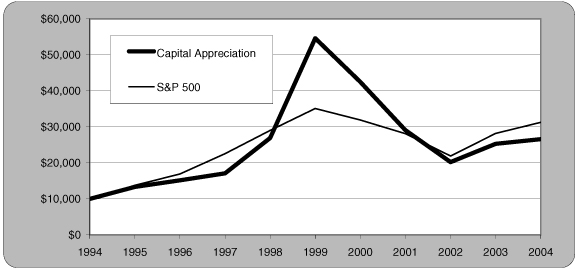

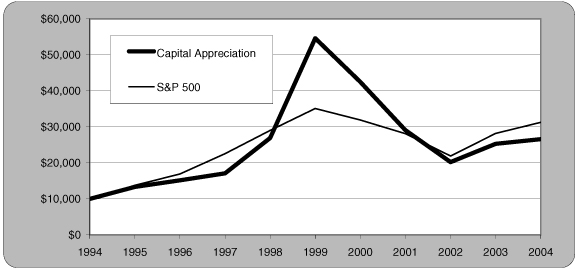

Capital Appreciation’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The S&P 500 Index is an unmanaged capitalization weighted index of 500 commonly traded stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of those stocks. The Index assumes reinvestment of dividends. This chart compares a hypothetical $10,000 investment made in Capital Appreciation on December 31,1994, to a $10,000 investment made in the S&P 500 for the same time period. The chart is not intended to imply any future performance of the Fund. The graph and chart do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Total Returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the Capital Appreciation and the S&P 500 Index since December 31, 1994 through December 31, 2004.

| | | | | | | | | |

Average Annual Total Returns:

| | 1 Year

| | | 5 Years

| | | 10 Years

| |

Capital Appreciation Fund | | 5.14 | % | | (13.41 | )% | | 10.27 | % |

S&P 500 Index | | 10.88 | % | | (2.30 | )% | | 12.07 | % |

The table below displays a full breakdown of the sector allocation of the Fund as well as the top ten positions as of December 31, 2004.

| | | |

Top Ten Holdings (out of 95 securities)

| | % Fund

| |

Dell, Inc.* | | 3.1 | % |

Shlumberger, Ltd.* | | 2.6 | |

3M Co.* | | 2.6 | |

United Parcel Service, Inc., Class B | | 2.5 | |

Best Buy Co., Inc. | | 2.4 | |

Gilead Sciences, Inc. | | 2.3 | |

Microsoft Corp.* | | 2.3 | |

EMC Corp.* | | 2.1 | |

Cisco Systems, Inc. | | 2.1 | |

Norvartis AG | | 1.9 | |

| | |

|

|

Top Ten as a Group | | 23.9 | % |

| | |

|

|

| * | Top Ten Holding at December 31, 2003 |

| | | |

Industry Weightings

| | | |

Information Technology | | 24.8 | % |

Consumer Discretionary | | 17.7 | |

Industrials | | 17.0 | |

Health Care | | 14.5 | |

Energy | | 9.6 | |

Consumer Staples | | 8.0 | |

Financials | | 7.1 | |

Materials | | 1.4 | |

9

Managers Capital Appreciation Fund

December 31, 2004

| | |

| Schedule of Portfolio Investments | | Capital Appreciation |

| | | | | | |

Security Description

| | Shares

| | | Value

|

Common Stocks - 100.1% | | | | | | |

Consumer Discretionary - 17.7% | | | | | | |

Bed Bath & Beyond, Inc.* | | 26,500 | | | $ | 1,055,495 |

Best Buy Co., Inc. | | 39,000 | | | | 2,317,380 |

Brunswick Corp. | | 19,800 | | | | 980,100 |

Carnival Corp. | | 14,700 | | | | 847,161 |

Cheesecake Factory, Inc., The* | | 13,500 | 2 | | | 438,345 |

Coach, Inc.* | | 22,000 | | | | 1,240,800 |

D.R. Horton, Inc. | | 18,700 | | | | 753,797 |

eBay, Inc.* | | 10,800 | | | | 1,255,824 |

Home Depot, Inc. | | 14,500 | | | | 619,730 |

J.C. Penney Co., Inc., Holding Co. | | 30,000 | 2 | | | 1,242,000 |

Las Vegas Sands Corp.* | | 8,790 | 2 | | | 421,920 |

McDonald’s Corp. | | 17,000 | | | | 545,020 |

Nike, Inc., Class B | | 7,900 | | | | 716,451 |

PETsMART, Inc. | | 14,500 | 2 | | | 515,185 |

Pulte Homes, Inc. | | 11,900 | | | | 759,220 |

Royal Caribbean Cruises, Ltd. | | 11,100 | 2 | | | 604,284 |

Staples, Inc. | | 20,000 | | | | 674,200 |

Walt Disney Co., The | | 51,900 | | | | 1,442,820 |

Yum! Brands, Inc. | | 20,000 | | | | 943,600 |

Total Consumer Discretionary | | | | | | 17,373,332 |

Consumer Staples - 8.0% | | | | | | |

Archer-Daniels-Midland Co. | | 33,000 | | | | 736,230 |

Bunge, Ltd. | | 15,000 | 2 | | | 855,150 |

Estee Lauder Co., Class A | | 12,000 | | | | 549,240 |

Hershey Foods Corp. | | 10,000 | | | | 555,400 |

Kellogg Co. | | 12,000 | | | | 535,920 |

Procter & Gamble Co. | | 20,000 | | | | 1,101,600 |

Walgreen Co. | | 20,000 | | | | 767,400 |

Wal-Mart Stores, Inc. | | 34,700 | | | | 1,832,854 |

Wm. Wrigley Jr. Co. | | 13,600 | | | | 940,984 |

Total Consumer Staples | | | | | | 7,874,778 |

Energy - 9.6% | | | | | | |

Apache Corp. | | 20,190 | | | | 1,021,008 |

BJ Services Co. | | 21,900 | 2 | | | 1,019,226 |

Devon Energy Corp. | | 14,000 | | | | 544,880 |

EOG Resources, Inc. | | 19,400 | 2 | | | 1,384,384 |

Nabors Industries, Ltd.* | | 26,400 | | | | 1,354,056 |

Noble Corp* | | 17,000 | | | | 845,580 |

Patterson-UTI Energy, Inc. | | 35,000 | | | | 680,750 |

Schlumberger, Ltd. | | 38,200 | 2 | | | 2,557,490 |

Total Energy | | | | | | 9,407,374 |

Financials - 7.1% | | | | | | |

American Express Co. | | 14,000 | | | | 789,180 |

American International Group, Inc. | | 22,700 | | | | 1,490,709 |

Citigroup, Inc. | | 21,500 | 2 | | | 1,035,870 |

Goldman Sachs Group, Inc. | | 9,600 | | | | 998,784 |

HSBC Holdings, PLC | | 6,000 | 2 | | | 510,840 |

Merrill Lynch & Co., Inc. | | 16,700 | | | | 998,159 |

Wells Fargo & Co. | | 19,400 | | | $ | 1,205,710 |

Total Financials | | | | | | 7,029,252 |

Health Care - 14.5% | | | | | | |

Amgen, Inc.* | | 9,000 | | | | 577,350 |

Beckman Coulter, Inc. | | 7,300 | | | | 489,027 |

Biogen Idec, Inc.* | | 7,300 | | | | 486,253 |

Boston Scientific Corp.* | | 20,400 | | | | 725,220 |

Caremark Rx, Inc.* | | 15,800 | | | | 622,994 |

Genentech, Inc.* | | 24,800 | | | | 1,350,112 |

Gilead Sciences, Inc.* | | 65,200 | | | | 2,281,348 |

Kyphon, Inc.* | | 25,000 | 2 | | | 644,000 |

Medtronic, Inc. | | 25,700 | | | | 1,276,519 |

Novartis AG | | 37,900 | | | | 1,915,466 |

Pfizer, Inc. | | 10,000 | 2 | | | 268,900 |

Stryker Corp. | | 17,000 | | | | 820,250 |

Teva Pharmaceutical Industries, Ltd., Sponsored ADR | | 44,500 | | | | 1,328,770 |

UnitedHealth Group, Inc. | | 10,000 | | | | 880,300 |

Zimmer Holdings, Inc.* | | 7,000 | | | | 560,840 |

Total Health Care | | | | | | 14,227,349 |

Industrials - 17.0% | | | | | | |

3M Co. | | 30,900 | | | | 2,535,963 |

Caterpillar, Inc. | | 8,000 | | | | 780,080 |

Cummins, Inc. | | 17,900 | 2 | | | 1,499,841 |

Emerson Electric Co. | | 17,000 | | | | 1,191,700 |

FedEx Corp. | | 17,700 | | | | 1,743,273 |

General Electric Co. | | 45,000 | | | | 1,642,500 |

Illinois Tool Works | | 13,200 | | | | 1,223,376 |

Ingersoll-Rand Co., Class A | | 8,000 | | | | 642,400 |

J.B. Hunt Transport Services, Inc. | | 19,000 | | | | 852,150 |

PACCAR, Inc. | | 10,000 | | | | 804,800 |

Parker Hannifin Corp. | | 10,000 | 2 | | | 757,400 |

Robert Half International, Inc. | | 18,000 | | | | 529,740 |

United Parcel Service, Inc., Class B | | 29,300 | | | | 2,503,978 |

Total Industrials | | | | | | 16,707,201 |

Information Technology - 24.8% | | | | | | |

Applied Materials, Inc.* | | 26,900 | | | | 459,990 |

Avaya, Inc.* | | 40,000 | | | | 688,000 |

Cisco Systems, Inc.* | | 108,700 | | | | 2,097,910 |

Computer Sciences Corp.* | | 28,000 | | | | 1,578,360 |

Dell, Inc.* | | 73,100 | | | | 3,080,434 |

Diebold, Inc. | | 15,000 | 2 | | | 835,950 |

Electronic Arts, Inc.* | | 9,800 | | | | 604,464 |

EMC Corp.* | | 142,100 | | | | 2,113,027 |

Intel Corp. | | 34,900 | | | | 816,311 |

International Business Machines Corp. | | 10,600 | 2 | | | 1,044,948 |

Linear Technology Corp. | | 15,000 | | | | 581,400 |

Marvell Technology Group Ltd.* | | 25,600 | | | | 908,032 |

Microsoft Corp. | | 83,100 | | | | 2,219,601 |

Molex, Inc. | | 28,000 | | | | 746,200 |

The accompanying notes are an integral part of these financial statements.

10

Managers Capital Appreciation Fund

December 31, 2004

| | |

| Schedule of Portfolio Investments (continued) | | Capital Appreciation |

| | | | | | | |

Security Description

| | Shares

| | | Value

| |

Information Technology (continued) | | | | | | | |

Nokia Corp., Sponsored ADR | | 83,900 | | | $ | 1,314,713 | |

Novell, Inc.* | | 142,300 | | | | 960,525 | |

Oracle Corp.* | | 42,000 | | | | 576,240 | |

Qualcomm, Inc. | | 11,000 | | | | 466,400 | |

SAP Aktiengesellschaft Systems, Sponsored ADR | | 25,000 | | | | 1,105,250 | |

Texas Instruments, Inc. | | 9,000 | | | | 221,580 | |

Veritas Software Corp.* | | 29,600 | | | | 845,080 | |

Yahoo!, Inc.* | | 30,700 | | | | 1,156,776 | |

Total Information Technology | | | | | | 24,421,191 | |

Materials - 1.4% | | | | | | | |

Freeport McMoran Copper & Gold, Inc., Class B | | 8,000 | 2 | | | 305,840 | |

Praxair, Inc. | | 25,000 | | | | 1,103,750 | |

Total Materials | | | | | | 1,409,590 | |

Total Common Stocks

(cost $83,784,129) | | | | | | 98,450,067 | |

Other Investment Company - 8.2%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 2.35%3

(cost $8,061,527) | | 8,061,527 | | | | 8,061,527 | |

Total Investments - 108.3%

(cost $91,845,656) | | | | | | 106,511,594 | |

Other Assets, less Liabilities - (8.3)% | | | | | | (8,164,224 | ) |

Net Assets - 100.0% | | | | | $ | 98,347,370 | |

The accompanying notes are an integral part of these financial statements.

11

| | |

| Managers Small Company Fund | | Small Company |

Managers Small Company Equity Fund (“Small Company”) is an equity Fund that primarily invests in the stocks of small capitalization companies. Managers currently utilizes a single independent subadvisor, Kalmar Investment Advisers, Inc. (“Kalmar”), which has been managing a portion of the Fund since its inception in June 2000. The Fund utilized a dual investment manager structure prior to May 2002.

The Portfolio Manager

Kalmar, located in Wilmington, Delaware, uses a team of portfolio managers led by Ford Draper, Jr., who founded the firm in 1982. Kalmar practices a “Growth with Value” approach to small company investing whereby it seeks to identify high quality growing businesses before they are widely discovered by institutional investors. Kalmar’s team believes there is a low risk/high reward anomaly offered by the equity market in stocks of well managed, rapidly growing smaller companies that for a variety of reasons have not made the radar screen of most typical growth investors. Because these companies are relatively “invisible” institutionally, they can be inefficiently valued and offer strong growth potential. This is the crux of their “Growth with Value” investment style.

The investment team at Kalmar generates investment ideas from several sources: industry reports, discussions with company management teams, quantitative screens, and trade organizations. Thus, there are elements of both “top-down” and “bottom-up” analysis in the initial identification process. Top down thinking is used to identify strategic themes and growth areas to prospect for “Growth with Value” candidates. The most intensive research, however, is dedicated to bottom-up fundamental analysis. The members of the investment management team all come from strong research backgrounds and are committed to disciplined, in-depth fundamental analysis. Fundamentally, Kalmar looks for such criteria as proven and sustainable double-digit growth in revenue and EPS as well as a stock that is reasonably or cheaply priced relative to EPS, book value, and/or cash flow. Additionally, Kalmar looks for dynamic businesses that they can understand, are run by equity owners they can count on, and are buyable at valuations that should rise. Kalmar expects that an idea included in the portfolio will generate a return of 50% inside of two years. This appreciation would come from two sources: compounding growth in business value plus upward revaluation.

The portfolio typically consists of 75-85 securities selected on an individual basis, specifically keyed to the observations and conclusions of their research. Kalmar will tend to avoid concentrated sector bets and will diversify by the size of company, ranging from as small as $50 million up to $2.0 billion at time of purchase. Kalmar also attempts to diversify the portfolio by the “growth character” of its holdings, including both proven “Steady Eddies,” emerging growth opportunities, and growth companies experiencing significant positive transformation. Kalmar is a long-term investor, with annual turnover averaging 48% in recent years. Kalmar’s sell discipline is judgmental, not mechanical. It is based on the team’s assessment of the changing risk/reward fundamentals of a company, the qualifications of a more rewarding replacement, or whether price/fundamental expectations have been met.

The Year in Review

During 2004, the Fund returned 12.73% compared to a gain of 18.33% for the Russell 2000 Index and 14.31% for the Russell 2000 Growth Index. Broad markets continued to rise with small capitalization stocks outperforming large capitalization stocks for the sixth consecutive year. From a stylistic standpoint, small cap value stocks outperformed small cap growth stocks by over 800 basis points. With the exception of technology and telecom, all sectors of the Russell 2000 Index recorded double digit returns. In fact, technology was the lone decliner for the year falling a little over 1% despite a strong rally late in the fourth quarter. The “quality issue” of 2003 that saw some of the more speculative issues post the best returns for the year was largely reversed in 2004. A return to value-oriented companies demonstrating clear revenues and earnings growth largely dominated returns within the small cap universe.

The year opened in rather volatile fashion as a deterioration in the Middle East, rising oil prices, and the pending presidential election all weighed heavily on investor’s minds. Energy sector gains were broad based as both oil & gas companies and energy equipment manufactures benefited from rising oil prices. Conversely, technology shares struggled to regain the growth exhibited in the fourth quarter of 2003. The Fund’s underperformance during the first half of the year came from a combination of factors. Consumer discretionary holdings within the portfolio began the year trailing those of the benchmark which were up over 10% through March. However, the consumer sector cooled off considerably in the second quarter whereby the Fund’s excess exposure hindered returns. An overweight to the struggling technology sector also contributed to underperformance.

After wallowing into negative territory for the first seven months of the year, small cap companies began to rally in mid-August. Much of the rally however was driven by deeper value stocks, a segment of the market that Kalmar’s philosophy and process hasn’t traditionally targeted. Nevertheless, one of the notable bright spots in the portfolio continued to be the active overweight to the energy sector, consisting mainly of oil & gas holdings. Ultra Petroleum, for example, gained on discoveries in offshore China and increased reserves from deeper drilling programs in the U.S. Despite easing somewhat in the fourth quarter, the oil & gas concern was up nearly 29% in the second half of 2004 and 95% for the year. Bucking the positive trend of the small cap universe, Pep Boys managed to do little right for the portfolio from about May onward. The automotive parts and services chain is a transformation play for Kalmar whose recovery has stalled and the company is struggling to regain its past formula for success. Ford and his team continue to monitor the position closely and remain confident that the proper management

12

is in place to correct the turnaround efforts. They are also attracted to the deep discount to book value the company is currently trading at.

All told, contributing influences for the year were attributable to security selection and exposure in both the energy and industrial sectors as Kalmar was able to find value through their strong bottom-up fundamental analysis. Conversely, over exposure to the lagging tech sector and an underweight to the outperforming financial sector was compounded by the Fund’s consumer holdings which trailed those of the Russell 2000 Index.

Looking Forward

Heading into 2005, the Fund’s emphasis remains on the IT, consumer discretionary and industrial sectors, and continues to reflect Kalmar’s strategy of pursuing more aggressive ideas by initiating smaller positions in companies with predictable businesses. Kalmar’s considerable underweight to financials is, and has been, most directly a function of simply not finding as many exciting “Growth with Value” ideas in this sector relative to better risk/reward opportunities found elsewhere. Kalmar’s comments as we progress into the New Year:

In 2005 it seems logical to expect: Several percent early year sustainable economic growth, that likely moderates during the year. Gradually rising interest rates and more slowly increasing inflation, with the Fed continuing to squeeze until real rates clearly go positive and cause a deceleration in inexpensive lending. Better corporate investment and hiring, combined with only modest consumer spending growth. Maintenance of high, volatile energy prices and on-going trended dollar weakness with volatile interludes. Ongoing violence and frustration in Iraq and continuation of over-optimistic, over-simplistic policy initiatives at home and abroad from the Bush administration. Continuation of relatively uninteresting returns for large cap stocks, and if the year is up, another year of better small cap returns – despite near universal prediction of the opposite by market pundits. Likely fairly modest returns for both classes, but better than bonds.

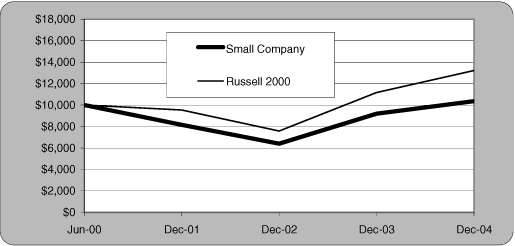

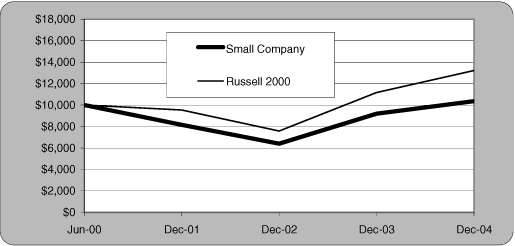

Cumulative Total Return Performance

Small Company’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index. The Russell 3000 Index is composed of 3000 of the largest U.S. companies, as determined by market capitalization which represents approximately 98% of the investable U.S. equity market. This chart compares a hypothetical $10,000 investment made in Small Company on June 19, 2000, to a $10,000 investment made in the Russell 2000 for the same time period. The chart is not intended to imply any future performance of the Fund. The graph and chart do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Total Returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for Small Company and the Russell 2000 Index since inception through December 31, 2004.

| | | | | | |

Average Annual Total Returns:

| | 1 Year

| | | Since Inception *

| |

Small Company Fund | | 12.73 | % | | 0.78 | % |

Russell 2000 Index | | 18.33 | % | | 7.23 | % |

| * | Commencement of operations was June 19, 2000. |

13

The table below displays a full breakdown of the sector allocation of the Fund as well as the top ten positions as of December 31, 2004.

| | | |

Top Ten Holdings (out of 84 securities)

| | % Fund

| |

Pentair, Inc.* | | 3.4 | % |

Acxiom Corp. | | 2.4 | |

Insight Enterprises, Inc.* | | 2.3 | |

Avocent Corp.* | | 2.2 | |

Barr Laboratories, Inc. | | 2.1 | |

Laureate Education, Inc. | | 2.0 | |

PETsMART, Inc.* | | 2.0 | |

Covance, Inc. | | 1.9 | |

Ultra Petroleum Corp. | | 1.9 | |

MSC Industrial Direct Co., Class A* | | 1.8 | |

| | |

|

|

Top Ten as a Group | | 22.0 | % |

| | |

|

|

| * | Top Ten Holding at December 31, 2003 |

| | | |

Industry Weightings

| | | |

Industrials | | 26.1 | % |

Information Technology | | 23.2 | |

Consumer Discretionary | | 22.4 | |

Health Care | | 13.2 | |

Energy | | 6.7 | |

Materials | | 1.6 | |

Consumer Staples | | 1.5 | |

Financials | | 0.4 | |

Other | | 4.9 | |

14

Managers Small Company Fund

December 31, 2004

| | |

| Schedule of Portfolio Investments | | Small Company |

| | | | | | |

Security Description

| | Shares

| | | Value

|

Common Stocks - 95.1% | | | | | | |

| | |

Consumer Discretionary - 22.4% | | | | | | |

Coldwater Creek, Inc.* | | 12,725 | | | $ | 392,821 |

Cost Plus, Inc.* | | 8,175 | 2 | | | 262,663 |

Fred’s, Inc. | | 10,645 | 2 | | | 185,223 |

GameStop Corp.* | | 21,700 | 2 | | | 485,212 |

Gentex Corp. | | 10,000 | | | | 370,200 |

Getty Images, Inc.* | | 3,050 | | | | 209,993 |

Harman International Industries, Inc. | | 2,525 | | | | 320,675 |

Insight Enterprises, Inc.* | | 31,575 | 2 | | | 647,918 |

McCormick & Schmick’s Seafood | | | | | | |

Restaurants, Inc.* | | 5,300 | | | | 89,305 |

Michaels Stores, Inc. | | 9,900 | | | | 296,703 |

O’Reilly Automotive, Inc.* | | 3,700 | 2 | | | 166,685 |

Penn National Gaming, Inc.* | | 5,575 | | | | 337,566 |

PEP Boys-Manny Moe & Jack, Inc. | | 19,650 | | | | 335,426 |

PETsMART, Inc. | | 15,800 | 2 | | | 561,373 |

Red Robin Gourmet Burgers, Inc.* | | 8,150 | | | | 435,781 |

Ruby Tuesday, Inc. | | 13,025 | | | | 339,692 |

TBC Corp.* | | 13,825 | | | | 384,335 |

Tractor Supply Co.* | | 9,650 | | | | 359,077 |

Total Consumer Discretionary | | | | | | 6,180,648 |

| | |

Consumer Staples - 1.5% | | | | | | |

Performance Food Group Co.* | | 15,575 | | | | 419,123 |

| | |

Energy - 6.7% | | | | | | |

Core Laboratories N.V.* | | 6,775 | | | | 158,196 |

Delta Petroleum Corp.* | | 13,250 | 2 | | | 207,760 |

Niko Resources, Ltd.* | | 6,350 | | | | 267,462 |

Tidewater, Inc. | | 8,025 | | | | 285,770 |

Ultra Petroleum Corp.* | | 10,850 | | | | 522,211 |

Whiting Petroleum Corp.* | | 9,100 | | | | 275,275 |

XTO Energy, Inc. | | 3,470 | | | | 122,769 |

Total Energy | | | | | | 1,839,443 |

| | |

Financials - 0.4% | | | | | | |

Boston Private Financial | | | | | | |

Holdings, Inc. | | 4,475 | 2 | | | 126,061 |

| | |

Health Care - 13.2% | | | | | | |

America Service Group, Inc.* | | 5,925 | | | | 158,612 |

Barr Laboratories, Inc.* | | 12,487 | | | | 568,657 |

Covance, Inc.* | | 13,550 | | | | 525,063 |

Luminex Corp.* | | 11,450 | 2 | | | 101,676 |

PSS World Medical, Inc.* | | 28,975 | 2 | | | 362,622 |

Resmed, Inc.* | | 6,825 | 2 | | | 348,758 |

Respironics, Inc.* | | 8,875 | | | | 482,445 |

Salix Pharmaceuticals, Ltd.* | | 12,625 | | | | 222,074 |

Select Medical Corp. | | 11,700 | | | | 205,920 |

Sonosite, Inc.* | | 8,550 | | | | 290,273 |

United Surgical Partners | | | | | | |

International, Inc.* | | 9,300 | | | | 387,810 |

Total Health Care | | | | | | 3,653,910 |

| | |

Industrials - 26.1% | | | | | | |

Actuant Corp., Class A* | | 8,160 | | | $ | 425,544 |

Aeroflex, Inc.* | | 34,100 | | | | 413,292 |

Carlisle Co., Inc. | | 6,100 | | | | 396,012 |

Chicago Bridge & Iron Co. N.V. | | 8,325 | | | | 333,000 |

ChoicePoint, Inc. 6,* | | 10,050 | | | | 462,200 |

DeVry, Inc.* | | 15,075 | | | | 261,702 |

Donaldson Co., Inc. | | 7,150 | | | | 232,947 |

ElkCorp. | | 11,975 | | | | 409,785 |

Hewitt Associates, Inc., Class A* | | 11,900 | | | | 380,919 |

Intermagnetics General Corp.* | | 8,300 | | | | 210,903 |

Laureate Education, Inc.* | | 12,825 | | | | 565,454 |

Mobile Mini, Inc.* | | 10,750 | 2 | | | 355,180 |

MSC Industrial Direct Co., Class A | | 13,750 | | | | 494,725 |

Navigant Consulting, Inc.* | | 16,150 | 2 | | | 429,590 |

NCI Building Systems, Inc.* | | 9,700 | | | | 363,750 |

Pentair, Inc. | | 21,325 | | | | 928,916 |

Providence Service Corp.* | | 3,775 | | | | 79,162 |

Si International, Inc.* | | 6,825 | | | | 209,937 |

UTI Worldwide, Inc. | | 3,625 | 2 | | | 246,573 |

Total Industrials | | | | | | 7,199,591 |

| | |

Information Technology - 23.2% | | | | | | |

Acxiom Corp. | | 24,900 | 2 | | | 654,869 |

Alliance Data Systems Corp.* | | 8,350 | | | | 396,458 |

ATMI, Inc.* | | 9,200 | | | | 207,276 |

Avocent Corp.* | | 14,725 | | | | 596,656 |

Benchmark Electronics, Inc.* | | 14,025 | | | | 478,252 |

Ceridian Corp.* | | 18,650 | | | | 340,922 |

Digitas, Inc.* | | 20,425 | | | | 195,059 |

Emulex Corp.* | | 10,600 | | | | 178,504 |

Excel Technology, Inc.* | | 5,400 | | | | 140,400 |

Fair Isaac Corp. | | 6,293 | 2 | | | 230,827 |

FARO Technologies, Inc.* | | 2,200 | 2 | | | 68,596 |

FEI Co.* | | 11,050 | | | | 232,050 |

International Rectifier Corp.* | | 7,425 | | | | 330,932 |

Lionbridge Technologies, Inc.* | | 15,150 | | | | 101,808 |

MAXIMUS, Inc.* | | 5,150 | | | | 160,268 |

MPS Group, Inc.* | | 20,475 | | | | 251,024 |

OPNET Technologies, Inc.* | | 9,050 | | | | 76,201 |

Polycom, Inc.* | | 8,150 | | | | 190,058 |

Progress Software Corp.* | | 11,500 | | | | 268,525 |

Radisys Corp.* | | 5,350 | | | | 104,593 |

Richardson Electronics, Ltd. | | 10,475 | | | | 111,140 |

Rogers Corp.* | | 8,625 | | | | 371,738 |

StarTek, Inc. | | 3,450 | | | | 98,153 |

Technitrol, Inc.* | | 8,250 | | | | 150,150 |

Tekelec* | | 17,200 | | | | 351,568 |

Tollgrade Communications, Inc.* | | 10,300 | | | | 126,072 |

Total Information Technology | | | | | | 6,412,099 |

| | |

Materials - 1.6% | | | | | | |

MacDermid, Inc. | | 12,100 | | | | 436,809 |

| | |

Total Common Stocks

(cost $18,974,792) | | | | | | 26,267,684 |

The accompanying notes are an integral part of these financial statements.

15

Managers Small Company Fund

December 31, 2004

| | |

| Schedule of Portfolio Investments (continued) | | Small Company |

| | | | | | |

Security Description

| | Shares

| | Value

| |

Other Investment Companies - 19.4%1 | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 2.35%3 | | 3,972,260 | | $ | 3,972,260 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 2.12% | | 1,391,714 | | | 1,391,714 | |

| | |

Total Other Investment Companies

(cost $5,363,974) | | | | | 5,363,974 | |

| | |

Total Investments - 114.5%

(cost $24,338,766) | | | | | 31,631,658 | |

| | |

Other Assets, less Liabilities - (14.5%) | | | | | (4,002,858 | ) |

| | |

Net Assets -100.0% | | | | $ | 27,628,800 | |

The accompanying notes are an integral part of these financial statements.

16

| | |

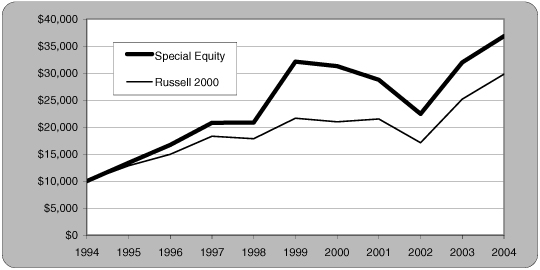

| Managers Special Equity Fund | | Special Equity |

Managers Special Equity Fund (“Special Equity”) is a domestic equity Fund that primarily invests in the stocks of small capitalization companies. In line with our belief in “Intelligence Diversification,” Managers currently utilizes five independent subadvisors who each manage separate portions of the portfolio. For the calendar year 2004 the subadvisors were Donald Smith, of Donald Smith & Co., Inc (“Smith”), who has been managing a portion of the Fund since September 2002, Mike Maloney, of Skyline Asset Management, L.P. (“Skyline”), who has been managing a portion of the Fund since December 2000; Andrew Knuth of Westport Asset Management, Inc. (“Westport”), who has been managing a portion of the Fund since December 1985; Bob Kern, of Kern Capital Management LLC (“Kern Capital”), who has been managing a portion of the Fund since September 1997; and Craig Lewis of Essex Investment Management Company, LLC (“Essex”), who had been managing a portion of the Fund since December 2003.

The Portfolio Managers

Donald Smith & Co., Inc.

Donald Smith is a value manager that invests in out-of-favor small capitalization companies. Smith’s philosophy seeks to identify companies in the bottom decile of price-to-tangible book ratios, with a strong balance sheet, and a positive outlook for earnings potential over the next 2-4 years. Smith believes that extremely low P/B ratio companies often trade below replacement value, are inherently less risky, and are more likely to be acquired. Furthermore, because only a few investment managers focus on companies in the lowest P/B ratio decile, their stocks may be inefficiently priced and can offer tremendous value. Smith limits purchases to companies in the lowest 10% of price-to-tangible book ratios. Smith also assesses price-to-earnings, price-to-sales, and debt-to-capital ratios to form a “watch list” of about 300 securities.

After valuations are addressed, Smith performs fundamental research, including company visits, to assess the quality of the company’s balance sheet and book value. Smith is looking for a catalyst for an improvement in earnings that is not already reflected in the stock price. A concentrated portfolio of 40-50 stocks is the result of his investment process. Stocks are sold when a target price has been achieved, usually set at less than 2x book value. Positions may also be sold if the stock appreciates rapidly, if a better idea is found, or if fundamentals deteriorate. Portfolio turnover is low at 20-40% annually.

Skyline Asset Management, L.P.

Mike Maloney and the investment team at Skyline look for small capitalization stocks that have below average valuations with strong growth prospects. Through their intensive in-house research, they find good companies that are overlooked or not widely followed. Typically, they invest in firms with market capitalizations of less than $2 billion. Skyline believes that this value focus combined with identifying attractive growth prospects and a defined sell discipline can capture inefficiencies in the market.

The investment team’s selection process involves quantitatively and qualitatively screening the universe of small-capitalization stocks for factors such as low price/earnings (P/E) ratio or price/book, attractive earnings prospects, applicable market caps (typically below $2 billion), and lack of institutional coverage. Outside research services, computer screens, and internally maintained lists of potential companies/stocks are the primary sources used to identify new ideas. These ideas are then evaluated to determine whether they meet Skyline’s four basic criteria: relative valuation, capitalization, financial strength, and opportunities for continued growth. In addition, the investment team led by Mike Maloney determines whether the stock provides needed diversification to the portfolio. This multi-step screening process reduces the list from 2000 to 150-200 stocks. Then, one or more of the portfolio manager/analysts perform a rigorous fundamental analysis in an attempt to answer the question, “Why will earnings increase at an above-average rate?” All company documents are analyzed, any available industry or research reports are reviewed and, most importantly, questions are addressed directly with company senior management. In addition, the analysts will review other companies in the same industry to determine competitive threats and the relative valuation of the company being investigated. In so doing, they develop an internal research report that is distributed to the entire investment team and discussed at regular meetings. Input is received from the investment team, and if additional information is required, research is done. The final portfolio will contain approximately 65-85 stocks and is generally fully invested (less than 5% cash) at all times. The portfolio will tend to be well diversified with a price/earnings ratio consistently below the Russell 2000 P/E. Skyline sells stocks when they rise to a sell target, which is usually a price/earnings ratio equal to the overall stock market. In the case of a stock that declines, Skyline will only sell the stock if fundamentals have changed so that the original investment thesis is no longer valid.

Westport Asset Management, Inc.

Andy Knuth’s investment philosophy entails investing in small capitalization companies which he perceives as having significant upside potential in earnings and return on equity over the next 12-18 months. Although he is investing for growth, Andy will purchase stocks only if they are selling at or below the market’s price/earnings multiple, or below valuations of other companies in the same industry. Thus, he must discover and invest in companies very early in their growth cycle.

Implicit in the strategy is that Andy and his investment team focus on a small number of issues, and tend to hold them for a long time. The concentration and low turnover enable Andy to heavily research and monitor each position. He is focused on future profits only, and, in fact, prefers to find businesses which are inherently good but which have gone through a difficult period. Factors that may improve earnings and investor perceptions include acquisitions or divestitures, management shake-ups, changes

17

in the business cycle, or the development of a proprietary product in a strong industry. He searches, in particular, for companies with good managers who are finding ways to substantially improve the company.

The result is that Andy will typically have a concentrated portfolio, and any significant industry concentrations are merely an outcome of bottom-up stock selection. Because some of the companies in which he invests may not yet have earnings, the price to trailing earnings ratio may be high, although the price to forward earnings will be well below average. Andy is a patient investor, usually turning over less than 20% of his portfolio per year.

Kern Capital Management LLC

Bob Kern is one of the pioneers of small-cap and micro-cap investing. While focusing his attention on small companies, Bob directs his efforts toward finding companies that are succeeding through innovation of new products or services. Thus, Bob’s portfolio tends to be concentrated in technology, healthcare, consumer goods and service sectors. Bob seeks to earn returns from the appreciation of stocks as the companies’ products develop and penetrate new markets.

In most cases, the analysis of the product and judgments as to its potential are the most important aspects of the decision to own stock. In all cases, however, the operational and financial health of the company must be verified. Bob and the investment team at Kern Capital like to find companies in which margins will increase with revenue growth, and which can finance much of their growth from operating cash flow. Although valuation is clearly important, Bob is often willing to pay relatively high multiples where he sees enough growth potential. Bob will typically hold a portfolio of 70 to 80 stocks with a median market capitalization of around $500 million.

Essex Investment Management Company, LLC

The investment philosophy at Essex is that a company’s revenue growth, future profitability and cash flow drive share price performance. In particular, the investment professionals at Essex look for dynamic growth opportunities characterized by new or emerging technologies or services, superior and accelerating growth, and improving margins and returns. The focus, therefore, is on fundamental research and the study of macroeconomic/industry trends in order to identify potential growth opportunities.

The investment process at Essex combines bottom-up stock selection with top-down secular trend analysis. The firm’s research analysts are charged with identifying companies with high quality, sustainable growth. Each analyst focuses on understanding the sources of long-term growth within his or her respective industries, and the specific outlook of each stock within those industries in terms of sustainable revenue growth, margin trends, and return trends. In addition, analysts are responsible for considering any potential investment’s attractiveness relative to its stock price (valuation).