UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03752

THE MANAGERS FUNDS

(Exact name of registrant as specified in charter)

| | |

| 800 Connecticut Avenue, Norwalk, Connecticut | | 06854 |

| |

| (Address of principal executive offices) | | (Zip code) |

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2005 - DECEMBER 31, 2005

(Annual Shareholder Report)

Item 1. Reports to Shareholders

ANNUAL REPORT

Managers Funds

December 31, 2005

Table of Contents

Nothing contained herein is to be considered an offer, sale, or solicitation of an offer to buy shares of The Managers Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Fellow Shareholder:

Over the past 12 months the markets have been beset with a number of difficult and unpredictable challenges, including recovery from a massive tsunami in Southeast Asia; continuing strife in the Middle East; numerous terrorist incidents; multiple hurricanes in the Gulf of Mexico; and a significant rise in energy prices. We are fortunate that the financial markets have continued to perform so well under these circumstances.

These events serve to remind us that no one can predict the events that are going to shape the markets in coming months. This reinforces our belief that to invest successfully in an uncertain world you have to diversify your investments and be patient.

Most people think of diversification as holding different types of stocks and bonds, but we believe that there is another type of diversification that receives too little notice, and that is diversification by investment manager and holdings. Simply put, no single approach is going to succeed in every kind of market—some growth stock managers will be successful in a rising market, and some will be more successful in a stagnant market. This can be an issue with some investment firms that adhere to only one method of looking at the markets.

That is a major benefit that we bring you at Managers Funds —since we hire subadvisors (affiliates and non-affiliates) to run our portfolios, we offer you a wide selection of very different investment styles to choose from, sometimes within the same asset class. Invest in multiple Managers Funds, and you can get managers with very different approaches and holdings, helping you reduce the risks created by changing economic conditions and natural and man-made events, such as those of the past 12 months.

We also believe that once you have made your manager selection, you must be patient. On the home page of our Web site at www.managersinvest.com, you will find a short article entitled “Stay Invested for the Long Term” that highlights how important it is to consistently stay in the market rather than trying to time the market. We think the implication is clear: to be successful in the market over the long term, select a wide variety of investments giving you good diversification, invest regularly, and stick with your investment plan no matter what events dominate the news.

We invite you to visit our Web site on an ongoing basis to stay in tune with your Managers Funds holdings. The Web site provides detailed profiles of our subadvisors and their investment styles, as well as quarterly commentary on each Fund. If you have any questions, please do call us at 800.835.3879. Thank you for investing with Managers Funds.

| | | | |

Sincerely, | | | | |

| | |

| | | |  |

Peter M. Lebovitz | | | | Thomas G. Hoffman, CFA |

President | | | | Executive Vice President |

The Managers Funds | | | | Chief Investment Officer |

| | | | Managers Investment Group LLC |

1

About Your Fund’s Expenses

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-l) fees; and other Fund expenses. This Fund incurs only ongoing costs. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | |

Six Months Ended December 31, 2005 | | Beginning Account

Value 7/1/2005 | | Ending Account Value 12/31/2005 | | Expenses Paid

During the

Period* |

Managers Special Equity Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,061 | | $ | 7.16 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,018 | | $ | 7.01 |

Managers Special Equity Fund - Institutional Shares | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,062 | | $ | 6.27 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 6.14 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by the fiscal year (365 days). |

You can find more information about your Fund’s expenses, including annual expense ratios for the past fiscal periods, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

2

Managers Special Equity Fund

Portfolio Manager Comments

The Managers Special Equity Fund’s (the “Fund”) objective is to achieve long-term capital appreciation through a diversified portfolio of equity securities of small- and medium-sized companies.

Managers Special Equity Fund invests at least 80% of its assets in equity securities, i.e., common and preferred stocks of U.S. companies. Although the Fund is permitted to purchase securities of both small- and medium-capitalization companies, the Fund has historically invested substantially all of its assets in the securities of small-capitalization companies, that is, companies with capitalizations that at the time of purchase are less than $2.5 billion. The Fund’s benchmark is the Russell 2000 Index.

The Portfolio Managers

The Fund employs multiple portfolio managers who specialize in distinct investment approaches. This “intelligence diversification” not only serves to manage risk, but also helps us tap the markets’ full potential by focusing different analytical insights on each class of investment. Fund management strives to achieve this performance and diversification while ensuring that the Fund operates within the framework of its investment objective and principal investment strategies.

Donald Smith & Co., Inc.

Donald Smith & Co., Inc. (“Donald Smith”) is a value manager that invests in out-of-favor small-capitalization companies. Donald Smith’s philosophy seeks to identify companies in the bottom decile of price-to-tangible book value ratios, with a strong balance sheet, and a positive outlook for earnings potential over the next 2-4 years. Donald Smith believes that extremely low P/B ratio companies often trade below replacement value, are inherently less risky, and are more likely to be acquired. Furthermore, because only a few investment managers focus on companies in the lowest P/B ratio decile, their stocks may be inefficiently priced and can offer tremendous value.

Donald Smith’s process begins by looking for companies in the lowest 10% of price-to-tangible book value ratios with a strong balance sheet, and a positive outlook for earnings potential over the next 2-4 years. Smith also assesses price-to-earnings, price-to-sales, and debt-to-capital ratios to form a “watch list” of about 300 securities. After valuations are addressed, Smith performs fundamental research, including company visits, to assess the quality of the company’s balance sheet and book value. Smith is looking for a catalyst for an improvement in earnings potential that is not already reflected in the stock price. A concentrated portfolio of 40-50 stocks is the result. Stocks are sold when a target price has been achieved, usually set at less than 2x book value. Positions may also be sold if the stock appreciates rapidly, if a better idea is found, or if fundamentals deteriorate. Portfolio turnover is low at 20-40% annually.

The ideal company exhibits many of the following traits:

| | • | | Low price-to-book value |

| | • | | Positive earnings potential over the next 2-4 years |

Portfolio management:

| | • | | Focuses on lowest decile of price-to-tangible book value stocks |

| | • | | Price-to-earnings, price-to-sales, and debt-to-capital also assessed from valuation standpoint |

| | • | | Concentrates the portfolio in 40-50 stocks |

The Portfolio:

| | • | | Value oriented holdings |

| | • | | Initial stock weightings are generally 3% - 3.5% |

| | • | | Typically holds 40-50 stocks |

| | • | | Average turnover between 20-40% annually |

The following factors influence the sell decision when:

| | • | | Target price is reached, usually less than 2x book value |

| | • | | Stock appreciates rapidly |

| | • | | Fundamentals deteriorate |

3

Managers Special Equity Fund

Portfolio Manager Comments (continuted)

Kern Capital Management LLC

Kern Capital Management LLC (“KCM”) believes the U.S. smaller company stock universe provides the opportunity to invest in innovative companies with exceptional growth prospects. With minimal research coverage by brokerage firms and low institutional ownership, KCM believes small and micro-cap stocks represent the least efficient sector of the market.

KCM’s fundamental research is dedicated to uncovering innovative small companies early in their growth cycle while they are still relatively undiscovered. With a huge universe of investment opportunity, KCM’s investment process focuses on what they believe are the most innovative sectors in the U.S. economy (technology, healthcare, services and consumer sectors). Research specialization by economic sector provides the depth of knowledge necessary to make high quality investment decisions and minimize fundamental investment mistakes.

Kern Capital Management LLC believes that the real attraction of small and micro-cap investing is not the asset class, but the stock selection opportunities within the asset class. KCM defines the small-cap investment universe as the smallest 15% of companies, based on market capitalization, on the U.S. stock markets. KCM’s investment process is designed to capitalize on the inefficiencies in the smaller company market.

KCM builds portfolios one company at a time with investment research focused on the most innovative sectors of the economy (technology, health care, services, and consumer). The team’s hands-on approach to fundamental investment research and financial analysis seeks to answer three basic questions to determine an investment’s attractiveness.

| | • | | How attractive is the business? Companies that are pioneering new markets or revolutionizing existing ones can often sustain rapid growth as they establish leading positions in their targeted markets. |

| | • | | How strong is the management? Successful companies require management capable of capitalizing on attractive growth opportunities. Management’s vision and ability to execute the business plan represent key elements in determining how successful a company will be. |

| | • | | How much is the company worth? The team’s process is valuation sensitive. Depending on the economic sector, different criteria are used to determine a company’s enterprise value, which determines if KCM would buy the entire company at the current market value of its equity. |

Given that KCM is focused on investing in innovative growth companies, the first two questions are answered before determining if the valuation is attractive. In fact, the answers to the first two questions will help determine the appropriate valuation for the company.

The ideal company exhibits many of the following traits:

| | • | | Leading market position in a rapidly growing market with high barriers to entry |

| | • | | Entrepreneurial management team with experience managing a growth business |

| | • | | Focused business plan with tight internal controls |

Portfolio management:

| | • | | Invests in between 70 and 90 companies which have market capitalizations that, at the time of initial purchase, place them among the smallest 15% of companies listed in the U.S. stock markets |

| | • | | Builds portfolios from the bottom up and seeks to identify companies early in their growth cycle |

| | • | | Utilizes a team approach to cover approximately 600 stocks through an extensive network of contact and other information sources: |

| | • | | Brokerage firm and industry analysts |

| | • | | Corporate management contacts |

| | • | | Trade shows and trade journals |

| | • | | Focuses on economic sectors where KCM believes the level of innovation is greatest, such as technology, health care, consumer and services |

| | • | | Uses fundamental analysis to identify small, relatively unknown companies that exhibit the potential to become much larger and more successful |

| | • | | Meets with corporate management to discuss business plans and strategies |

4

Managers Special Equity Fund

Portfolio Manager Comments (continuted)

The investment team will make a sell decision when:

| | • | | An investment’s growth prospects deteriorate |

| | • | | Investments achieve excessive valuation relative to the growth opportunities and/or addressable markets |

| | • | | There is a negative change in fundamental confidence and/or investment time horizon |

Skyline Asset Management, L.P.

The investment team from Skyline Asset Management, L.P. (“Skyline”) looks for small-capitalization stocks that have below average valuations with above average growth prospects. Through their intensive in-house research, they find good companies that are overlooked or not widely followed.

Skyline’s research effort focuses on finding good companies that are not widely followed. Typically they invest in firms with market caps of less than $2 billion. The selection process involves using outside research services, computer screens, and internally maintained lists of potential companies/stocks to identify new ideas. These ideas are then screened to determine whether they meet certain basic criteria: relative valuation, capitalization, financial strength, and opportunities for continued growth. This screening process reduces the list from 2000 names to 150-200. This list is then more rigorously analyzed to answer the question, “Why will earnings increase at an above-average rate?” All company documents are analyzed, any available industry or research reports are reviewed and, most importantly, questions are addressed directly to senior company management.

In addition, other companies in the same industry are reviewed to determine relative valuation of the company being investigated. The final portfolio will contain 65-85 stocks and is generally fully invested. The portfolio will tend to be well diversified and the portfolio’s P/E ratio will consistently be below that of the Russell 2000. Skyline sells stocks when they rise to a sell target, which is usually a P/E equal to the overall stock market, or if the company’s fundamentals have changed so that the original investment thesis is no longer valid.

The ideal company exhibits many of the following traits:

| | • | | Market capitalization less than $2 billion |

| | • | | Discounted price/earnings ratio relative to the market |

| | • | | Above average growth prospects |

| | • | | Neglected, under followed, and often out of favor |

Portfolio management:

| | • | | Broad diversification among economic sectors |

| | • | | Keep attentive to earnings |

| | • | | Maintain favorable risk/reward |

The portfolio:

| | • | | Stocks have a maximum weighting of 5% for each holding |

| | • | | Typically holds 65-85 stocks |

| | • | | Cash equivalents averaging less than 5% |

The following factors influence the sell decision when:

| | • | | P/E equals the market/industry P/E |

| | • | | Holding reaches 5.0% of the portfolio |

Westport Asset Management, Inc.

The investment team at Westport Asset Management, Inc., led by Andy Knuth, focuses on small-capitalization companies that are determined to have significant upside potential in earnings and ROE over the next few years. Although investing for growth, Andy will purchase stocks only if they are selling at or below the market’s P/E multiple, or below valuations of other companies in the same industry. Implicit in the strategy is that Andy and his partner Ed Nicklin focus on a small number of issues, and hold them for a long time. The concentration and low turnover enable them to heavily research and monitor each position.

5

Managers Special Equity Fund

Portfolio Manager Comments (continuted)

The portfolio manager at Westport Asset Management, Inc. is focused on future profits only, and, in fact, prefers to find businesses which are inherently good but which have gone through a troubling period. Acquisitions or divestitures, management shake-ups, changes in the business cycle, or the development of a proprietary product in a strong industry are all factors that might improve earnings and investor perceptions. The portfolio manager will typically have a concentrated portfolio, and any industry concentrations are merely an outcome of stock selection. Because some of the companies in which he invests may not have earnings, the price to trailing earnings ratio may be high, although the price to forward earnings will be well below average. The management style is patient, usually turning over less than 20% per year.

The ideal company exhibits many of the following traits:

| | • | | Upside potential in earnings and ROE (Return On Equity) |

| | • | | Low P/E and improving earnings/cash flow |

| | • | | Company driven by entrepreneurial impact |

| | • | | Preference for turnaround story |

Portfolio management:

| | • | | Has a 2-3 year time horizon on initial investments |

| | • | | Concentrates the portfolio and has low turnover |

| | • | | Views any significant industry concentrations are merely an outcome of bottom-up fundamental analysis |

| | • | | May invest in companies that do not have earnings |

The portfolio:

| | • | | Initial stock weightings will vary depending on liquidity |

| | • | | May have trailing P/E ratios that are higher than the market, but generally forward P/E ratios will be well below the average, because some of the companies Westport invests in may not have earnings |

| | • | | Has an average turnover of less than 20% per year |

The portfolio management team will make a sell decision when:

| | • | | A stock reaches pre-determined price objective |

| | • | | There are negative changes in a company’s fundamentals |

Veredus Asset Management, LLC

The investment philosophy at Veredus Asset Management, LLC (“Veredus”) is based on their belief that positive earnings surprise and positive estimate revision are the key drivers of stock price change. In particular, the Veredus investment team, led by founder Tony Weber, is concerned about the sustainability of this earnings momentum. To that end, the team tends to focus more on the economic performance of a particular company as opposed to more traditional accounting measures. Specifically, the analysts and portfolio managers at Veredus look for companies with strong asset growth and accelerating rates of economic return in excess of their cost of capital. This is what they view as the true definition of wealth creation, or cash flow return on investment (CFROI). Finally, the Veredus team also believes that some technical measures, such as relative strength, flows, and trading volume, can be useful indicators of future stock performance.

The investment team at Veredus Asset Management, LLC starts the research process by screening the entire universe of over 8,000 small companies for upward earnings revisions. Companies are also ranked on the basis of recent estimate changes, considering both absolute and percent change in estimates. This model provides not only a shopping list of potential targets, but the qualification work that Veredus feels is essential to market acceptance. The core of the research effort is placed on calculating the true cash flow return on investment (CFROI) potential of companies on the target list and how Veredus’ internally developed work compares with current street expectations. The primary focus is assessing CFROI on a sequential basis as opposed to year over year. This gives the investment team a more detailed picture for possibilities of margin expansion, sales growth, and other sources of CFROI leverage. Contact with company management is also essential in researching companies in the small-cap arena.

6

Managers Special Equity Fund

Portfolio Manager Comments (continuted)

The ideal investment exhibits many of the following traits:

| | • | | Positive earnings surprise and subsequent upward estimate revisions |

| | • | | Attacking large markets with high barriers to entry |

| | • | | Balance sheet commensurate with income statement |

Portfolio management:

| | • | | Screens for companies which rank in the top 20% of all companies based on earnings estimate revisions and quarterly earning surprise |

| | • | | Employs extensive fundamental research |

| | • | | Seeks sustainability of company’s fundamental performance |

The investment team will make a sell decision when:

| | • | | There is an anticipated/ actual earnings disappointment |

| | • | | They see deteriorating market mechanics |

| | • | | There is a change in strategic market outlook or better idea develops |

The Year in Review

Over the 12 months ended December 31, 2005, the Special Equity Managers Class of shares returned 4.00% and the Institutional class of shares returned 4.21% compared to a gain of 4.55% for the Russell 2000 Index and 4.15% for the Russell 2000 Growth Index. Broad markets continued to appreciate with large capitalization stocks outperforming small capitalization stocks for the first time since 1998. From a style perspective, small cap value stocks narrowly outperformed small growth marking five of the past six years in which value has outperformed growth in the small cap universe. Sector analysis reveals that seven out of ten sectors finished in positive territory during 2005 with only consumer discretionary, information technology, and utilities giving up ground. One of the macro themes across the board for the year was the continued strength of energy. The sector finished the year up 48% with points midway through the third quarter whereby the sector was testing 60% gains. Exposure to, or lack thereof in some cases, weighed heavily on the relative performance of fund managers throughout the year.

The year opened in somewhat volatile fashion as the Russell 2000 ultimately ended the first quarter with a 5.3% decline. The Fund, however, managed to outperform on a relative basis during this period behind underexposure to health care and financial stocks along with a strong aggregate total return within these sectors. The consumer sectors also proved to be a fruitful space as several of the value managers within the Fund were able to capitalize on the increased merger & acquisition activity during the year. Specifically, Toys ‘R Us, a Donald Smith holding, was up 26% on news that it had agreed to be acquired by an investment firm.

The second and third quarters in the small capitalization universe are best noted for a sixteen week period spanning from the beginning of May through the end of July in which the Fund was up 15%. All sectors of the Index appreciated 10% or more during this run headlined by a 30% gain in energy related stocks. While the Fund lost ground to the Russell 2000 in mid to late July, it was still buoyed by considerable strength in its consumer discretionary stocks which also happened to be the Fund’s largest overweight. Veredus’ sizable bet on homebuilders such as Meritage Homes (+47%), Beazer Homes (+43%), and Toll Brothers (+48%) paid off nicely. In fact, the performance gap would have been much closer had it not been for a 3.7% underweight to the outperforming energy sector.

The final quarter of 2005 proved to be a good one on a relative basis for the Fund which outperformed the benchmark by over 130 basis points. While returns weren’t spectacular for either the Fund or the benchmark, it was encouraging to see the growth bias of the portfolio able to capitalize in a market where small cap growth outperformed small cap value. Outperformance was spread across a wide variety of areas as six of the Fund’s nine sectors contributed positively to relative performance. Of particular note, all three value style managers in addition to Veredus took the opportunity to establish and/or add to oil and gas dependent companies such as airlines, shipping, or transportation stocks. Veredus in particular was able to capture a 44% gain from its airline exposure through the likes of Continental (121%), AirTran (27%), and JetBlue (31%). Retailing stocks also posted solid numbers coming off strong year-over-year same store sales and capitalizing on the resiliency of the American consumer around the holiday season.

7

Managers Special Equity Fund

Portfolio Manager Comments (continuted)

Looking Forward

Heading into 2006, the Fund’s sector weights have not changed significantly as consumer discretionary, information technology, and industrials remain the three largest allocations. Fund management on the whole is optimistic about prospects for the coming year. Veredus foresees a stoppage in rate hikes by the Fed as a positive for the homebuilders while capital spending related stocks also look attractive given the cash rich balance sheets of so many companies. With the potential for continued pricing pressures on the traditional consumer, such as higher energy costs and rising interest rates, Skyline has mildly shifted some if its retail holdings in favor of the services industry. Donald Smith continues to reallocate away from the oil suppliers to the oil users, such as airlines and transportation stocks, in an effort to try and take advantage of attractive valuations and what he perceives to be overvalued energy prices. Finally, similar to last year, merger and acquisition activity is expected to remain high with perhaps more deals coming to the table in the smaller market cap ranges this year as opposed to the bigger deals of 2005.

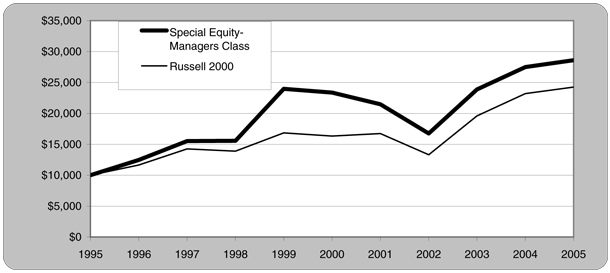

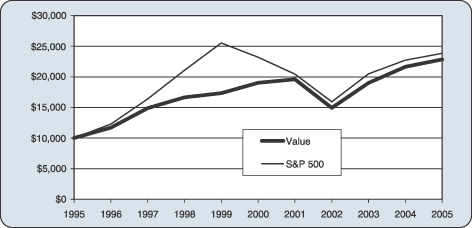

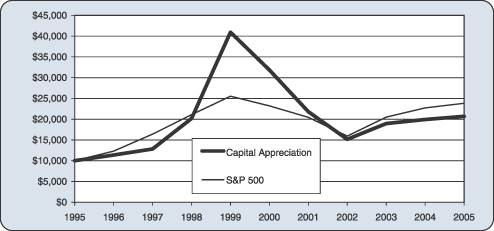

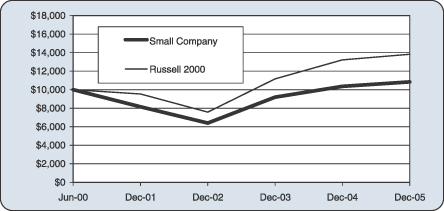

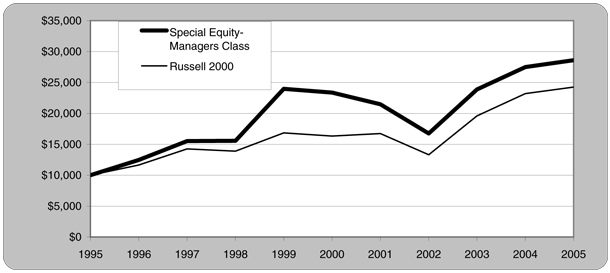

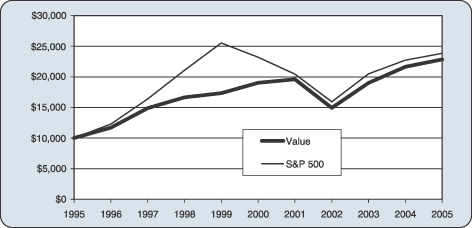

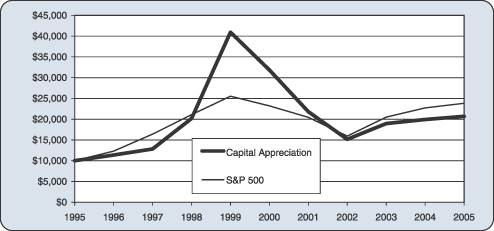

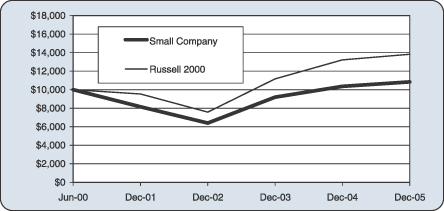

Cumulative Total Return Performance

Special Equity’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index and is widely regarded in the industry as the premier measure of small cap stock performance. The Russell 3000 Index is composed of 3000 of the largest U.S. companies, as determined by market capitalization which represents approximately 98% of the investable U.S. equity market. Unlike the Fund, the Russell 2000 Index is unmanaged, is not available for investment, and does not incur expenses. The first chart compares a hypothetical $10,000 investment made in Special Equity- Managers Class on December 31, 1995, to a $10,000 investment made in the Russell 2000 for the same time period. The second chart compares a hypothetical $10,000 investment made in Special Equity- Institutional Class on May 3, 2004, to a $10,000 investment made in the Russell 2000 for the same time period. The graphs and tables do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Past performance is not indicative of future results.

The table below shows the average annual total returns for Special Equity – Managers Class and the Russell 2000 Index since December 31, 1995 through December 31, 2005.

| | | | | | | | | |

Average Annual Total Returns: | | 1 Year | | | 5 Years | | | 10 Years | |

Special Equity – Managers Class | | 4.00 | % | | 4.13 | % | | 11.08 | % |

Russell 2000 Index | | 4.55 | % | | 8.22 | % | | 9.26 | % |

8

Managers Special Equity Fund

Portfolio Manager Comments (continuted)

The table below shows the average annual total returns for Special Equity – Institutional Class and the Russell 2000 Index since May 3, 2004 through December 31, 2005.

| | | | | | |

Average Annual Total Returns: | | 1 Year | | | Since Inception | |

Special Equity – Institutional Class | | 4.21 | % | | 11.35 | % |

Russell 2000 Index | | 4.55 | % | | 12.39 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

The Fund is subject to risks associated with investments in small capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history, and a reliance on one or a limited number of products.

9

Managers Special Equity Fund

Portfolio Manager Comments (continuted)

The table below displays a full breakdown of the sector allocation of the Fund as well as the top ten positions as of December 31, 2005.

| | | |

Top Ten Holdings (out of 290 securities) | | | |

ITT Educational Services, Inc.* | | 2.0 | % |

MI Developments, Inc., Class A* | | 1.9 | |

Dillard’s, Inc., Class A* | | 1.7 | |

Reliant Resources, Inc.* | | 1.5 | |

FelCor Lodging Trust, Inc.* | | 1.5 | |

Meristar Hospitality Corp. * | | 1.4 | |

AK Steel Holding Corp. * | | 1.2 | |

ATMI, Inc.* | | 0.8 | |

VistCon Corp. | | 0.8 | |

Dana Corp. | | 0.8 | |

| | | |

Top Ten as a Group | | 13.6 | % |

| | | |

| | | | | | |

Portfolio Breakdown | | % of

Net Assets | | | Russell

2000 | |

Information Technology | | 21.9 | % | | 21.7 | % |

Industrials | | 20.4 | | | 17.3 | |

Consumer Discretionary | | 18.7 | | | 20.2 | |

Financials | | 15.3 | | | 14.7 | |

Health Care | | 10.4 | | | 9.9 | |

Materials | | 4.3 | | | 4.1 | |

Energy | | 2.6 | | | 2.5 | |

Utilities | | 2.3 | | | 2.3 | |

Telecommunication Services | | 0.6 | | | 0.6 | |

Other Assets & Liabilities | | 3.5 | | | 6.7 | |

| | | | | | |

| | 100 | % | | 100 | % |

| | | | | | |

| * | Top Ten Holding at June 30, 2005 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Any securities discussed may no longer be held in the account’s portfolio. It should not be assumed that any of the securities transactions discussed were or will prove to be profitable, or that the investment recommendations we make in the future will be profitable.

10

Managers Special Equity Fund

Schedule of Portfolio Investments

December 31, 2005

| | | | | |

Security Description | | Shares | | Value |

Common Stocks - 96.5% | | | | | |

Consumer Discretionary - 18.7% | | | | | |

ADVO, Inc. | | 327,8332 | | $ | 9,238,334 |

Aftermarket Technology Corp.* | | 473,400 | | | 9,202,896 |

AnnTaylor Stores Corp.* | | 639,4502 | | | 22,073,814 |

Applebee’s International, Inc. | | 388,1252 | | | 8,767,744 |

Beasley Broadcasting Group, Inc.* | | 356,7122 | | | 4,819,179 |

Beazer Homes USA, Inc. | | 336,9002 | | | 24,539,796 |

Big 5 Sporting Goods Corp. | | 388,7002 | | | 8,508,643 |

Big Lots, Inc.* | | 907,1522 | | | 10,894,896 |

Borders Group, Inc. | | 345,400 | | | 7,484,818 |

Building Material Holding Corp. | | 82,0002 | | | 5,593,220 |

California Pizza Kitchen, Inc.* | | 214,3752 | | | 6,853,569 |

Carter’s, Inc.* | | 117,450 | | | 6,911,933 |

CBRL Group, Inc. | | 351,0302 | | | 12,338,705 |

Charming Shoppes, Inc.* | | 485,7502 | | | 6,411,900 |

Coldwater Creek, Inc.* | | 383,1502 | | | 11,697,570 |

Comstock Homebuilding Companies, Inc.* | | 207,2502 | | | 2,924,298 |

Cosi, Inc.* | | 714,275 | | | 5,928,483 |

COX Radio, Inc., Class A* | | 368,6002 | | | 5,189,888 |

Dana Corp. | | 3,825,0002 | | | 27,463,499 |

dELiA*s Corp.* | | 256,5002 | | | 2,128,950 |

Dillard’s, Inc., Class A | | 2,296,2002 | | | 56,991,683 |

Drew Industries, Inc.* | | 256,9002 | | | 7,242,011 |

Duckwall-ALCO Stores, Inc.* | | 182,400 | | | 4,166,016 |

Emmis Communications Corp., Class A* | | 703,0682 | | | 13,998,084 |

Gaylord Entertainment Co., Class A* | | 161,2332 | | | 7,028,146 |

Genesco, Inc.* | | 441,6752 | | | 17,132,573 |

Guess?, Inc.* | | 159,8002 | | | 5,688,880 |

Gymboree Corp.* | | 966,100 | | | 22,606,740 |

Hot Topic, Inc.* | | 208,700 | | | 2,973,975 |

Kerzner International, Ltd.* | | 261,0002 | | | 17,943,750 |

La Quinta Corp.* | | 845,0002 | | | 9,413,300 |

Meritage Homes Corp.* | | 331,5002 | | | 20,857,980 |

Mikohn Gaming Corp* | | 1,154,100 | | | 11,390,967 |

Orient-Express Hotels Ltd. | | 341,9002 | | | 10,776,688 |

Pacific Sunwear of California, Inc.* | | 287,900 | | | 7,174,468 |

Proquest Co.* | | 408,7002 | | | 11,406,817 |

Rare Hospitality International, Inc.* | | 256,9002 | | | 7,807,191 |

Ross Stores, Inc. | | 930,0002 | | | 26,876,999 |

Ruby Tuesday, Inc. | | 510,9002 | | | 13,227,201 |

Ryland Group, Inc., The | | 294,2002 | | | 21,220,646 |

Saks, Inc.* | | 1,023,0002 | | | 17,247,780 |

Salem Communications Corp., Class A* | | 448,4222 | | | 7,842,901 |

Scopus Video Neworks, Ltd.* | | 563,3002 | | | 3,379,800 |

Source Interlink Companies, Inc.* | | 235,0002 | | | 2,613,200 |

Sports Authority, Inc.* | | 433,8002 | | | 13,504,194 |

Standard-Pacific Corp. | | 224,5502 | | $ | 8,263,440 |

Steak n Shake Co., The* | | 579,4002 | | | 9,820,830 |

Talbots, Inc. | | 180,400 | | | 5,018,728 |

Texas Roadhouse, Inc., Class A* | | 437,4102 | | | 6,801,726 |

The Wet Seal, Inc., Class A* | | l,721,1002 | | | 7,641,684 |

TJX Companies, Inc. | | 160,000 | | | 3,716,800 |

Toro Co. | | 285,4002 | | | 12,491,958 |

United Rentals, Inc.* | | 231,2002 | | | 5,407,768 |

Visteon Corp. | | 4,395,3002 | | | 27,514,577 |

Total Consumer Discretionary | | | | | 626,161,636 |

Energy - 2.6% | | | | | |

Comstock Resources, Inc.* | | 317,0002 | | | 9,671,670 |

Dresser-Rand Group, Inc.* | | 222,300 | | | 5,375,214 |

Houston Exploration Co.* | | 320,500 | | | 16,922,400 |

Key Energy Services, Inc.* | | 648,300 | | | 8,732,601 |

Newfield Exploration Co.* | | 131,300 | | | 6,574,191 |

OMI Corp. | | 64,0002 | | | 1,161,600 |

Overseas Shipholding Group, Inc. | | 102,0002 | | | 5,139,780 |

Pogo Producing Co. | | 484, 2002 | | | 24,118,002 |

Stone Energy Corp.* | | 184,8002 | | | 8,413,944 |

Total Energy | | | | | 86,109,402 |

Financials - 15.3% | | | | | |

Alabama National Bancorp | | 64,4002 | | | 4,170,544 |

American Financial Group, Inc. | | 155,300 | | | 5,949,543 |

American National Insurance Co. | | 68,950 | | | 8,066,461 |

AmerUs Group | | 204,8002 | | | 11,606,016 |

Aspen Insurance Holdings, Ltd. | | 399,600 | | | 9,458,532 |

BankUnited Financial Corp. | | 601,0882 | | | 15,970,908 |

Banner Corp. | | 217,7402 | | | 6,793,488 |

Brown & Brown, Inc. | | 530,2002 | | | 16,192,308 |

Chicago Mercantile Exchange Holdings, Inc. | | 57,4502 | | | 21,112,301 |

Chittenden Corp. | | 495,6252 | | | 13,783,331 |

Clark, Inc. | | 425,9002 | | | 5,643,175 |

Commercial Capital Bancorp, Inc. | | 497,400 | | | 8,515,488 |

Conseco, Inc.* | | 662,2002 | | | 15,343,174 |

Delphi Financial Group, Inc., Class A | | 298,2002 | | | 13,720,182 |

Downey Financial Corp. | | 393,3802 | | | 26,903,258 |

FelCor Lodging Trust, Inc.* | | 2,900,0002 | | | 49,909,000 |

Harbor Florida Bancshares, Inc. | | 224,9002 | | | 8,332,545 |

Hilb, Rogal & Hamilton Co. | | 305,5002 | | | 11,764,805 |

iStar Financial, Inc. | | 375,6002 | | | 13,390,140 |

Jefferies Group, Inc. | | 290,3502 | | | 13,059,943 |

MCG Capital Corp. | | 693,578 | | | 10,119,303 |

Meristar Hospitality Corp.*4 | | 5,024,600 | | | 47,231,240 |

MI Developments, Inc., Class A | | 1,804,7002 | | | 62,045,586 |

National Western Life Insurance Co., Class A* | | 12,000 | | | 2,482,920 |

Prosperity Bancshares, Inc. | | 330,3002 | | | 9,492,822 |

Provident Bankshares Corp. | | 235,5652 | | | 7,955,030 |

The accompanying notes are an integral part of these financial statements.

11

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | |

Security Description | | Shares | | Value |

Financials (continued) | | | | | |

Reinsurance Group of America, Inc. | | 338,9002 | | $ | 16,185,864 |

Scottish Annuity & Life Holdings, Ltd. | | 516,6002 | | | 12,682,530 |

South Financial Group, Inc. | | 22,011 | | | 606,183 |

St. Joe Co., The | | 111,5002 | | | 7,495,030 |

Sterling Financial Corp. | | 803,1052 | | | 20,061,563 |

Triad Guaranty, Inc.* | | 104,6822 | | | 4,604,961 |

U.S.I. Holdings Corp.* | | 808,4012 | | | 11,131,682 |

United PanAm Financial Corp.* | | 228,200 | | | 5,903,534 |

Webster Financial Corp. | | 279,800 | | | 13,122,620 |

Total Financials | | | | | 510,806,010 |

Health Care - 10.4% | | | | | |

Adams Respiratory Therapeutics, Inc.* | | 276,850 | | | 11,256,721 |

Affymetrix, Inc.* | | 83,300 | | | 3,977,575 |

Amsurg Corp.* | | 258,400 | | | 5,907,024 |

Aspect Medical Systems, Inc.* | | 174,9752 | | | 6,010,391 |

Atherogenics, Inc.* | | 270,1002 | | | 5,404,701 |

Centene Corp.* | | 604,0002 | | | 15,879,160 |

Cepheid, Inc.* | | 464,700 | | | 4,080,066 |

Charles River Laboratories International, Inc.* | | 398,5162 | | | 16,885,122 |

Cyberonics, Inc.* | | 338,4002 | | | 10,930,320 |

DaVita, Inc.* | | 138,4002 | | | 7,008,576 |

DexCom, Inc.* | | 385,000 | | | 5,744,200 |

Eclipsys Corp.* | | 304,200 | | | 5,758,506 |

Fisher Scientific International, Inc.* | | 60,0002 | | | 3,711,600 |

Foxhollow Technologies, Inc.* | | 318,9002 | | | 9,500,031 |

Gen-Probe, Inc.* | | 258,800 | | | 12,626,852 |

Harvard Bioscience, Inc.* | | 595,900 | | | 2,651,755 |

IMS Health, Inc. | | 820,081 | | | 20,436,418 |

Intuitive Surgical, Inc.* | | 195,4002 | | | 22,914,557 |

Kyphon, Inc.* | | 278,1502 | | | 11,356,865 |

LCA-Vision, Inc. | | 192,0502 | | | 9,124,296 |

LifeCell Corp.* | | 253,8252 | | | 4,840,443 |

Lincare Holdings, Inc.* | | 212,1002 | | | 8,889,111 |

Momenta Pharmaceutical, Inc.* | | 220,0002 | | | 4,848,800 |

NeoPharm, Inc.* | | 358,1002 | | | 3,863,899 |

Neurometrix, Inc.* | | 215,6002 | | | 5,881,568 |

NitroMed, Inc.* | | 824,4002 | | | 11,500,380 |

NuVasive, Inc.* | | 396,8752 | | | 7,183,438 |

NxStage Medical, Inc.* | | 239,8002 | | | 2,868,008 |

Omnicell, Inc.* | | 200,500 | | | 2,395,975 |

Owens & Minor, Inc. | | 213,3002 | | | 5,872,149 |

Par Pharmaceutical Co., Inc.* | | 136,900 | | | 4,290,446 |

Resmed, Inc.* | | 148,7252 | | | 5,697,655 |

Sonosite, Inc.* | | 94,300 | | | 3,301,443 |

Syneron Medical Ltd.* | | 416,0502 | | | 13,209,588 |

Telik, Inc.* | | 238,200 | | | 4,047,018 |

Thoratec Corp.* | | 246,200 | | | 5,093,878 |

Triad Hospitals, Inc.* | | 613,264 | | | 24,058,347 |

United Therapeutics Corp.* | | 305,2752 | | | 21,100,608 |

Universal Health Services, Inc., Class B | | 170,0002 | | | 7,945,800 |

VCA Antech, Inc.* | | 284,4502 | | | 8,021,490 |

Total Health Care | | | | | 346,074,780 |

Industrials - 20.4% | | | | | |

AAR Corp.* | | 259,2002 | | | 6,207,840 |

Acuity Brands, Inc. | | 448,9532 | | | 14,276,705 |

Adesa, Inc. | | 546,900 | | | 13,355,298 |

Air France | | 948,178 | | | 20,499,608 |

Airtran Holdings, Inc.* | | 1,542,5502 | | | 24,727,077 |

Alaska Airgroup, Inc.* | | 615,0002 | | | 21,967,800 |

Albany International Corp. | | 312,600 | | | 11,303,616 |

American Commercial Lines, Inc.* | | 147,000 | | | 4,452,630 |

Astec Industries, Inc.* | | 72,775 | | | 2,376,832 |

Axsys Technologies, Inc.*4 | | 680,850 | | | 12,221,258 |

BE Aerospace, Inc.* | | 748,250 | | | 16,461,500 |

Brink’s Co., The | | 420,241 | | | 20,133,746 |

Builders FirstSource, Inc.* | | 427,925 | | | 9,144,757 |

Carlisle Co., Inc. | | 142,700 | | | 9,867,705 |

CNF, Inc. | | 105,600 | | | 5,901,984 |

Continental Airlines, Inc.* | | 529,6002 | | | 11,280,480 |

CoStar Group, Inc.* | | 149,830 | | | 6,468,161 |

Crane Co. | | 502,7002 | | | 17,730,229 |

Curtiss-Wright Corp. | | 131,3002 | | | 7,168,980 |

DeVry, Inc.* | | 658,2002 | | | 13,164,000 |

DRS Technologies, Inc. | | 106,2002 | | | 5,460,804 |

Dycom Industries, Inc.* | | 484,400 | | | 10,656,800 |

Education Management Corp.* | | 112,400 | | | 3,766,524 |

EGL, Inc.* | | 263,500 | | | 9,899,695 |

EnerSys* | | 179,9002 | | | 2,345,896 |

First Advantage Corp.* | | 395,6002 | | | 10,566,476 |

Flowserve Corp.* | | 245,5002 | | | 9,711,980 |

General Cable Corp.* | | 161,775 | | | 3,186,968 |

Global Power Equipment Group, Inc.* | | 746,1002 | | | 3,372,372 |

Granite Construction, Inc. | | 261,7002 | | | 9,397,647 |

Heidrick & Struggles International, Inc.* | | 241,2002 | | | 7,730,460 |

Hudson Highland Group, Inc.* | | 476,400 | | | 8,270,304 |

Insituform Technologies, Inc.* | | 594,800 | | | 11,521,276 |

Interpool, Inc. | | 424,300 | | | 8,010,784 |

ITT Educational Services, Inc.* | | l,131,6002 | | | 66,888,875 |

Jackson Hewitt Tax Service, Inc. | | 214,200 | | | 5,935,482 |

JLG Industries, Inc. | | 366,2002 | | | 16,720,692 |

Laidlaw International, Inc. | | 529,100 | | | 12,290,993 |

Lydall, Inc.* | | 231,500 | | | 1,886,725 |

Mercury Computer Systems, Inc.* | | 494,800 | | | 10,207,724 |

The accompanying notes are an integral part of these financial statements.

12

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | |

Security Description | | Shares | | Value |

Industrials (continued) | | | | | |

NCI Building Systems, Inc.* | | 350,8002 | | $ | 14,901,984 |

Nuco2, Inc.* | | 48,900 | | | 1,363,332 |

Pacer International, Inc.* | | 228,3002 | | | 5,949,498 |

Perini Corp. * | | 195,000 | | | 4,709,250 |

Power-One, Inc.* | | 976,900 | | | 5,880,938 |

Precision Castparts Corp. | | 60,200 | | | 8,299,962 |

Royal Group Technologies Ltd. * | | 1,511,100 | | | 13,599,900 |

Ryder System, Inc. | | 192,8002 | | | 7,908,656 |

Schawk, Inc. | | 73,3002 | | | 1,520,975 |

Sea Containers, Ltd., Class A | | 658,900 | | | 8,262,606 |

Sea Containers, Ltd., Class B | | 13,090 | | | 160,614 |

Sequa Corp., Class A* | | 99,6002 | | | 6,877,380 |

Sequa Corp., Class B* | | 38,300 | | | 2,661,850 |

Shaw Group, Inc., The* | | 779,0502 | | | 22,662,565 |

Steelcase, Inc. | | 826,9002 | | | 13,089,827 |

Swift Transportation Co., Inc.* | | 411,0002 | | | 8,343,300 |

Tecumseh Products Co., Class B | | 175,9932 | | | 3,511,060 |

Thomas & Betts Corp.* | | 653,500 | | | 27,420,860 |

United Stationers, Inc.* | | 232,5002 | | | 11,276,250 |

URS Corp.* | | 511,850 | | | 19,250,679 |

Volt Information Sciences, Inc.* | | 69,350 | | | 1,319,037 |

Walter Industries, Inc. | | 142,5002 | | | 7,085,100 |

Washington Group International, Inc.* | | 197,1002 | | | 10,440,387 |

Watson Wyatt & Co. | | 363,000 | | | 10,127,700 |

Total Industrials | | | | | 683,162,393 |

Information Technology - 21.9% | | | | | |

3Com Corp.* | | 4,638,600 | | | 16,698,960 |

Actel Corp. * | | 669,600 | | | 8,524,008 |

Akamai Technologies, Inc.* | | 846,4002 | | | 16,868,752 |

Aladdin Knowledge Systems, Ltd. * | | 284,400 | | | 4,897,368 |

Anaren Microwave, Inc. *4 | | 1,057,900 | | | 16,534,977 |

Andrew Corp. * | | 632,000 | | | 6,781,360 |

Applied Films Corp.* | | 295,3002 | | | 6,133,381 |

aQuantive, Inc. * | | 991,9002 | | | 25,035,556 |

Artesyn Technologies, Inc. * | | 522,3002 | | | 5,379,690 |

ASM International NV* | | 424,3002 | | | 7,136,726 |

ATMI, Inc.* | | 986,900 | | | 27,603,592 |

AudioCodes, Ltd.* | | 1,268,8002 | | | 14,083,680 |

Avid Technology, Inc.* | | 416,300 | | | 22,796,588 |

Belden CDT, Inc. | | 375,2002 | | | 9,166,136 |

Benchmark Electronics, Inc.* | | 452,7002 | | | 15,224,301 |

Blue Coat Systems, Inc. * | | 315,1502 | | | 14,408,658 |

Centra Software, Inc.* | | 321,400 | | | 642,800 |

CheckFree Corp. * | | 80,700 | | | 3,704,130 |

Checkpoint Systems, Inc. * | | 418,3002 | | | 10,311,095 |

Cognizant Technology Solutions Corp.* | | 188,8802 | | | 9,510,108 |

CommScope, Inc.* | | 662,2002 | | | 13,330,086 |

Comtech Group, Inc.* | | 159,100 | | | 988,011 |

Digitas, Inc.* | | 630,500 | | | 7,893,860 |

ECI Telecommunications, Ltd. * | | 999,400 | | | 7,485,506 |

eFunds Corp.* | | 767,6262 | | | 17,993,153 |

Electronics for Imaging, Inc.* | | 464,7812 | | | 12,367,822 |

Equinix, Inc.* | | 549,600 | | | 22,401,695 |

Exfo Electro-Optical Engineering, Inc.* | | 1,893,1002 | | | 8,526,522 |

F5 Networks, Inc.* | | 225,4502 | | | 12,893,486 |

Fairchild Semiconductor International, Inc.* | | 1,165,6002 | | | 19,710,296 |

Fargo Electronics, Inc.* | | 217,200 | | | 4,181,100 |

FEI Co.* | | 312,300 | | | 5,986,791 |

Foundry Networks, Inc. * | | 850,150 | | | 11,740,572 |

Genesis Microchip, Inc.* | | 377,3002 | | | 6,825,357 |

Global Payments, Inc. | | 175,7002 | | | 8,189,377 |

Identix, Inc. * | | 3,805,6002 | | | 19,066,056 |

Integral Systems, Inc. | | 200,000 | | | 3,772,000 |

Intevac, Inc.* | | 388,200 | | | 5,124,240 |

Keithley Instruments, Inc. | | 570,600 | | | 7,976,988 |

MEMC Electronic Materials, Inc. * | | 331,100 | | | 7,340,487 |

Mentor Graphics Corp.* | | 1,120,600 | | | 11,587,004 |

MRO Software, Inc.* | | 301,400 | | | 4,231,656 |

Multi-Fineline Electronix, Inc.* | | 90,250 | | | 4,347,343 |

NDS Group, PLC* | | 105,700 | | | 4,349,555 |

Netgear, Inc.* | | 265,4002 | | | 5,108,950 |

Netlogic Microsystems, Inc.* | | 196,1752 | | | 5,343,807 |

Parametric Technology Corp.* | | 2,316,100 | | | 14,128,210 |

Park Electrochemical Corp. | | 257,400 | | | 6,687,252 |

Perot Systems Corp.* | | 267,100 | | | 3,776,794 |

Power Integrations, Inc. * | | 585,900 | | | 13,950,279 |

Reynolds & Reynolds Co., The, Class A | | 115,000 | | | 3,228,050 |

RF Micro Devices, Inc.* | | 2,349,550 | | | 12,711,066 |

RightNow Technologies, Inc. * | | 486,3002 | | | 8,977,098 |

Rogers Corp. * | | 370,5002 | | | 14,516,190 |

S1 Corp.* | | 867,700 | | | 3,774,495 |

Salesforce.com, Inc.* | | 599,6002 | | | 19,217,180 |

ScanSource, Inc. * | | 94,3002 | | | 5,156,324 |

SERENA Software, Inc.* | | 269,600 | | | 6,319,424 |

Sierra Wireless, Inc. * | | 557,1002 | | | 6,183,810 |

Symmetricom, Inc.* | | 379,100 | | | 3,210,977 |

SYNNEX Corp.* | | 459,0002 | | | 6,935,490 |

Synopsys, Inc.* | | 356,400 | | | 7,149,384 |

TALX Corp. | | 244,300 | | | 11,166,953 |

Terayon Communication Systems, Inc.* | | 4,565,700 | | | 10,546,767 |

Trident Microsystems, Inc. * | | 1,158,2002 | | | 20,847,600 |

Utstarcom, Inc.* | | 2,080,0002 | | | 16,764,800 |

Vishay Intertechnology, Inc.* | | 713,9002 | | | 9,823,264 |

The accompanying notes are an integral part of these financial statements.

13

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Shares | | Value | |

Information Technology (continued) | | | | | | | |

WebEx Communications, Inc.* | | | 728,800 | | $ | 15,763,944 | |

WebSideStory, Inc. * | | | 304,300 | | | 5,516,959 | |

Witness Systems, Inc.* | | | 562,2502 | | | 11,059,458 | |

Woodhead Industries, Inc. 4 | | | 629,200 | | | 8,727,004 | |

Wright Express Corp. * | | | 319,600 | | | 7,031,200 | |

Total Information Technology | | | | | | 733,373,558 | |

Materials - 4.3% | | | | | | | |

AK Steel Holding Corp.* 4 | | | 4,929,4002 | | | 39,188,730 | |

Albemarle Corp. | | | 308,3002 | | | 11,823,305 | |

Aleris International, Inc.* | | | 267,400 | | | 8,620,976 | |

Cytec Industries, Inc. | | | 336,8002 | | | 16,041,784 | |

Longview Fibre Co. | | | 659,9002 | | | 13,732,519 | |

Lubrizol Corp. | | | 439,000 | | | 19,065,770 | |

Scotts Co., The, Class A | | | 160,8002 | | | 7,274,592 | |

Stillwater Mining Co.* | | | 1,168,9002 | | | 13,524,173 | |

Symyx Technologies, Inc.* | | | 509,600 | | | 13,906,984 | |

Total Materials | | | | | | 143,178,833 | |

Telecommunication Services - 0.6% | | | | | | | |

General Communication, Inc., Class A* | | | 878,100 | | | 9,070,773 | |

Syniverse Holdings, Inc.* | | | 559,5002 | | | 11,693,550 | |

Total Telecommunication Services | | | | | | 20,764,323 | |

Utilities - 2.3% | | | | | | | |

Avista Corp. | | | 1,202,200 | | | 21,290,962 | |

Reliant Resources, Inc. * | | | 4,851,5002 | | | 50,067,480 | |

Sierra Pacific Resources Corp.* | | | 530,800 | | | 6,921,632 | |

Total Utilities | | | | | | 78,280,074 | |

Total Common Stocks

(cost $2,508,166,959) | | | | | | 3,227,911,009 | |

| | |

| | | Principal

Amount | | | |

U.S. Government Obligations - 0.6%5 | | | | | | | |

United States Treasury Bonds - 0.4% | | | | | | | |

U.S. Treasury Bonds, 7.125%, 02/15/23 | | $ | 2,567,549 | | | 3,413,960 | |

U.S. Treasury Bonds, 7.250%, 05/15/16 | | | 614,765 | | | 765,338 | |

U.S. Treasury Bonds, 8.750%, 08/15/20 | | | 1,263,170 | | | 1,871,349 | |

U.S. Treasury Inflation Indexed Bonds, 1.875%, 07/15/13 | | | 6,631,644 | | | 7,142,551 | |

Total United States Treasury Bonds | | | | | | 13,193,198 | |

United States Treasury Notes - 0.2% | | | | | | | |

U.S. Inflation Indexed Notes, 0.875%, 04/15/10 | | | 2,034,149 | | | 2,045,352 | |

U.S. Treasury Notes, 4.000%, 06/15/09 | | | 3,912,636 | | | 3,890,877 | |

Total United States Treasury Notes | | | | | | 5,936,229 | |

Total U.S. Government Obligations

(cost $19,129,427) | | | Shares | | | 19,129,427 | |

Rights - 0.0%# | | | | | | | |

dELiA*s Corp. Rights, Exp. 04/30/06 (cost $0) | | | 25,626 | | $ | 25,626 | |

Warrants - 0.0%# | | | | | | | |

Air France, ADR

(cost $1,361,928) | | | 861,980 | | | 1,336,069 | |

Short-Term Investments - 30.1%1 | | | | | | | |

Other Investment Companies - 26.7% | | | | | | | |

AIM Liquid Assets Portfolio, Institutional Class Shares, 4.21% | | | 65,966,719 | | | 65,966,719 | |

Bank of New York Institutional Cash Reserves Fund, 4.30%3 | | | 682,264,546 | | | 682,264,546 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 4.14% | | | 91,287,934 | | | 91,287,934 | |

Vanguard Prime Money Market Fund, 4.01% | | | 52,356,926 | | | 52,356,926 | |

Total Other Investment Companies | | | | | | 891,876,125 | |

Other Short-Term Investments - 3.4%3 | | | | | | | |

| | |

| | | Principal

Amount | | | |

Goldman Sachs Promissory Notes, 4.33% | | $ | 45,049,088 | | | 45,049,088 | |

Greenwich Capital Holdings, Inc., 4.33% | | | 30,036,083 | | | 30,036,083 | |

Liquid Funding Ltd., 4.35% | | | 40,090,515 | | | 40,090,515 | |

Total Other Short-Term Investments | | | | | | 115,175,686 | |

Total Short-Term Investments

(cost $1,007,051,811) | | | | | | 1,007,051,811 | |

Total Investments -127.2%

(cost $3,535,710,125) | | | | | | 4,255,453,942 | |

Other Assets, less Liabilities - (27.2)% | | | | | | (910,599,131 | ) |

Net Assets - 100.0% | | | | | $ | 3,344,854,811 | |

Based on the approximate cost of investments of $3,551,635,646 for Federal income tax purposes at December 31, 2005, the aggregate gross unrealized appreciation and depreciation were $819,584,598 and $115,766,302, respectively, resulting in net unrealized appreciation of investments of $703,818,296.

| * | Non-income-producing securities. |

| 1 | Yield shown for an investment company represents the December 31, 2005, seven day yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| 2 | Some or all of these shares were out on loan to various brokers as of December 31, 2005, amounting to a market value of $786,568,322, or approximately 23.5% of net assets. |

| 3 | Collateral received from brokers for securities lending was invested in these short-term investments. |

| 4 | Affiliated Company- See Note 6 in the Notes to Financial Statements. |

| 5 | Non-cash collateral received for securities loaned. |

| # | Rounds to less then 0.1%. |

The accompanying notes are an integral part of these financial statements.

14

Statement of Assets and Liabilities

December 31, 2005

| | | |

Assets: | | | |

Investments at value (including securities on loan valued at $786,568,322) | | $ | 4,255,453,942 |

Receivable for investments sold | | | 26,405,034 |

Receivable for Fund shares sold | | | 1,000,821 |

Dividends, interest and other receivables | | | 2,472,078 |

Prepaid expenses | | | 163,830 |

| | | |

Total assets | | | 4,285,495,705 |

| | | |

Liabilities: | | | |

Payable to Custodian | | | 104,340,476 |

Payable for Fund shares repurchased | | | 4,446,811 |

Payable upon return of securities loaned | | | 816,569,658 |

Payable for investments purchased | | | 9,772,829 |

Accrued expenses: | | | |

Investment advisory and management fees | | | 2,709,448 |

Administrative fees | | | 752,625 |

Other | | | 2,049,047 |

| | | |

Total liabilities | | | 940,640,894 |

| | | |

Net Assets | | $ | 3,344,854,811 |

| | | |

Managers Shares: | | | |

| | | |

Net Assets | | $ | 2,834,313,609 |

| | | |

Shares outstanding | | | 32,661,672 |

| | | |

Net asset value, offering and redemption price per share | | $ | 86.78 |

| | | |

Institutional Class Shares: | | | |

| | | |

Net Assets | | $ | 510,540,761 |

| | | |

Shares outstanding | | | 5,862,288 |

| | | |

Net asset value, offering and redemption price per share | | $ | 87.09 |

| | | |

Net Assets Represent: | | | |

Paid-in capital | | $ | 2,580,850,289 |

Undistributed net investment income | | | 1,227,593 |

Accumulated net realized gain from investments | | | 43,033,112 |

Net unrealized appreciation of investments | | | 719,743,817 |

| | | |

Net Assets | | $ | 3,344,854,811 |

| | | |

* Investments at cost | | $ | 3,535,710,125 |

The accompanying notes are an integral part of these financial statements.

15

Statement of Operations

For the year ended December 31, 2005

| | | | |

Investment Income: | | | | |

Dividend income | | $ | 26,605,557 | |

Foreign withholding tax | | | (218,232 | ) |

Securities lending fees | | | 1,719,042 | |

| | | | |

Total investment income | | | 28,106,367 | |

| | | | |

Expenses: | | | | |

Investment management fees | | | 31,662,152 | |

Administrative fees | | | 8,795,043 | |

Transfer agent | | | 7,953,424 | |

Custodian | | | 643,542 | |

Professional fees | | | 452,668 | |

Reports to shareholders | | | 346,006 | |

Trustees fees and expenses | | | 149,864 | |

Registration fees | | | 116,437 | |

Miscellaneous | | | 182,489 | |

| | | | |

Total expenses before offsets | | | 50,301,625 | |

| | | | |

Fee waiver | | | (28,665 | ) |

Expense reductions | | | (1,834,712 | ) |

| | | | |

Net expenses | | | 48,438,248 | |

| | | | |

Net investment loss | | | (20,331,881 | ) |

| | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain on investment transactions | | | 370,099,739 | |

Net unrealized depreciation of investments | | | (216,366,681 | ) |

| | | | |

Net realized and unrealized gain | | | 153,733,058 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 133,401,177 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

16

Statement of Changes in Net Assets

For the year ended December 31,

| | | | | | | | |

| | | Managers Special Equity Fund | |

| | | 2005 | | | 2004 | |

Increase (Decrease) in Net Assets From Operations: | | | | | | | | |

Net investment loss | | $ | (20,331,881 | ) | | $ | (22,980,406 | ) |

Net realized gain on investments | | | 370,099,739 | | | | 347,977,454 | |

Net unrealized appreciation (depreciation) of investments | | | (216,366,681 | ) | | | 156,903,987 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 133,401,177 | | | | 481,901,035 | |

| | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

From net realized gain on investments: | | | | | | | | |

Managers Class | | | (230,875,965 | ) | | | — | |

Institutional Class | | | (39,895,773 | ) | | | — | |

| | | | | | | | |

Total distributions to shareholders | | | (270,771,738 | ) | | | — | |

| | | | | | | | |

From Capital Share Transactions: Managers Class: | | | | | | | | |

Proceeds from sale of shares | | | 698,310,169 | | | | 303,268,419 | |

Reinvestment of distributions | | | 210,983,200 | | | | — | |

Cost of shares repurchased | | | (1,368,795,175 | ) | | | (1,287,267,301 | ) |

| | | | | | | | |

Net decrease from capital share transactions | | | (459,501,806 | ) | | | (983,998,882 | ) |

| | | | | | | | |

Institutional Class: | | | | | | | | |

Proceeds from sale of shares | | | 318,303,171 | | | | 971,313,866 | |

Reinvestment of distributions | | | 34,758,890 | | | | — | |

Cost of shares repurchased | | | (100,347,591 | ) | | | (59,521,580 | ) |

| | | | | | | | |

Net increase from capital share transactions | | | 252,714,470 | | | | 911,792,286 | |

| | | | | | | | |

Net decrease from capital share transactions | | | (206,787,336 | ) | | | (72,206,596 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | (344,157,897 | ) | | | 409,694,439 | |

| | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of year | | | 3,689,012,708 | | | | 3,279,318,270 | |

| | | | | | | | |

End of year | | $ | 3,344,854,811 | | | $ | 3,689,012,708 | |

| | | | | | | | |

End of year undistributed net investment income | | $ | 1,227,593 | | | $ | 658,568 | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Managers Class: | | | | | | | | |

Sale of shares | | | 7,901,047 | | | | 12,009,151 | |

Reinvested shares | | | 2,423,708 | | | | — | |

Shares repurchased | | | (15,430,176 | ) | | | (16,026,228 | ) |

| | | | | | | | |

Net decrease in shares | | | (5,105,421 | ) | | | (4,017,077 | ) |

| | | | | | | | |

Institutional Class: | | | | | | | | |

Sale of shares | | | 3,552,228 | | | | 3,770,486 | |

Reinvested shares | | | 397,790 | | | | — | |

Shares repurchased | | | (1,113,572 | ) | | | (744,644 | ) |

| | | | | | | | |

Net increase in shares | | | 2,836,446 | | | | 3,025,842 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

17

Financial Highlights

For a share outstanding throughout each year ended December 31,

| | | | | | | | | | | | | | | | | | | | |

| | | Managers Class | |

| | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

Net Asset Value, Beginning of Year | | $ | 90.42 | | | $ | 78.48 | | | $ | 55.08 | | | $ | 70.59 | | | $ | 76.82 | |

| | | | | | | | | | | | | | | | | | | | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.54 | ) 5 | | | (0.56 | ) | | | (0.43 | ) | | | (0.34 | ) | | | (0.18 | ) |

Net realized and unrealized gain (loss) on investments | | | 4.18 | | | | 12.50 | | | | 23.83 | | | | (15.17 | ) | | | (6.05 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.64 | | | | 11.94 | | | | 23.40 | | | | (15.51 | ) | | | (6.23 | ) |

| | | | | | | | | | | | | | | | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net realized gain on investments | | | (7.28 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Year | | $ | 86.78 | | | $ | 90.42 | | | $ | 78.48 | | | $ | 55.08 | | | $ | 70.59 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return 1 | | | 4.00 | % | | | 15.18 | % | | | 42.50 | % | | | (21.98 | )% | | | (8.07 | )% |

Ratio of net expenses to average net assets 1 | | | 1.40 | % | | | 1.40 | % | | | 1.43 | % | | | 1.31 | % | | | 1.29 | % |

Ratio of total expenses to average net assets 1 | | | 1.45 | % 4 | | | 1.45 | % 4 | | | 1.46 | % 4 | | | 1.32 | % | | | 1.30 | % |

Ratio of net investment loss to average net assets | | | (0.60 | )% | | | (0.69 | )% | | | (0.72 | )% | | | (0.56 | )% | | | (0.27 | )% |

Portfolio turnover | | | 80 | % | | | 68 | % | | | 64 | % | | | 67 | % | | | 62 | % |

Net assets at end of year (000’s omitted) | | $ | 2,834,314 | | | $ | 3,415,003 | | | $ | 3,279,318 | | | $ | 2,020,821 | | | $ | 2,295,234 | |

| | | | | | | | |

| | | Institutional Class | |

| | | For the year

ended December 31,

2005 | | | For the period*

ended December 31,

2004 | |

Net Asset Value, Beginning of Period | | $ | 90.56 | | | $ | 78.91 | |

Income from Investment Operations: | | | | | | | | |

Net investment loss | | | (0.33 | ) 5 | | | (0.21 | ) |

Net realized and unrealized gain on investments | | | 4.14 | | | | 11.86 | |

| | | | | | | | |

Total from investment operations | | | 3.81 | | | | 11.65 | |

| | | | | | | | |

Less Distributions to Shareholders from: | | | | | | | | |

| | | | | | | | |

Net realized gain on investments | | | (7.28 | ) | | | — | |

| | | | | | | | |

Net Asset Value, End of Period | | $ | 87.09 | | | $ | 90.56 | |

| | | | | | | | |

Total Return1 | | | 4.21 | % | | | 14.75 | % 2 |

Ratio of net expenses to average net assets1 | | | 1.20 | % | | | 1.20 | % 3 |

Ratio of total expenses to average net assets1 | | | 1.25 | % 4 | | | 1.26 | % 3,4 |

Ratio of net investment loss to average net assets | | | (0.56 | )% | | | (0.49 | )% 3 |

Portfolio turnover | | | 80 | % | | | 68 | % 2 |

Net assets at end of period (000’s omitted) | | $ | 510,541 | | | $ | 274,010 | |

| * | Commencement of operations was May 3, 2004. |

| 1 | See Note 1(c) of “Notes to Financial Statements.” |

| 4 | Excludes the impact of fee waivers and expense offsets such as brokerage credits, but includes nonreimbursable expenses such as interest and taxes. (See Note 1c to the Notes to Financial Statements.) |

| 5 | Per share numbers have been calculated using average shares. |

18

Notes to Financial Statements

December 31, 2005

(1) Summary of Significant Accounting Policies

The Managers Funds (the “Trust”) is an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust is comprised of a number of investment series. Included in this report is the Managers Special Equity Fund (“Special Equity”or the “Fund”).

Special Equity offers both Managers Class shares and Institutional Class shares. The Institutional Class shares, which are designed primarily for institutional investors that meet certain administrative and servicing criteria, have a minimum investment of $2,500,000. Managers Class shares are offered to all other investors. Each class represents an interest in the same assets of Special Equity and the classes are identical except for class specific expenses related to shareholder costs. Investment income, realized and unrealized capital gains and losses, the common expenses of Special Equity, and certain Fund level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of Special Equity. Both classes have equal voting privileges except that each class has exclusive voting rights with respect to its services and/or distribution plan.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting periods. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

(a) Valuation of Investments

Equity securities traded on a domestic or international securities exchange are generally valued at the last quoted sale price, or, lacking any sales, at the last quoted bid price. Over-the-counter securities are valued at the Nasdaq Official Closing Price, if one is available. Lacking any sales, over-the-counter securities, are valued at the last quoted bid price. Under certain circumstances, the value of a Fund investment may be based on an evaluation of its fair value, pursuant to procedures established by and under the general supervision of the Board of Trustees of the Fund. A Fund may use the fair value of a portfolio security to calculate its NAV when, for example, (1) market quotations are not readily available because a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the time as of which the Fund calculates its NAV, (3) where a significant event affecting the value of a portfolio security is determined to have occurred between the time of the market quotation provided for a portfolio security and the time as of which the Fund calculates its NAV, (4) a security’s price has remained unchanged over an extended period of time (often referred to as a “stale price”), or (5) the Investment Manager determines that a market quotation is inaccurate. The Investment Manager monitors intervening events that may affect the value of securities held in each Fund’s portfolio and, in accordance with procedures adopted by the Funds’ Trustees, will adjust the prices of securities traded in foreign markets, as appropriate, to reflect the impact of events occurring subsequent to the close of such markets but prior to the time each Fund’s NAV is calculated. Fixed-income securities are valued based on valuations furnished by independent pricing services that utilize matrix systems, which reflect such factors as security prices, yields, maturities and ratings, and are supplemented by dealer and exchange quotations. Short-term investments having a remaining maturity of 60 days or less are valued at amortized cost, which approximates market value. Investments in other regulated investment companies are valued at their end of day net asset value per share except iShares or other ETF’s, which are valued the same as equity securities. Securities (including derivatives) for which market quotations are not readily available are valued at fair value, as determined in good faith, and pursuant to procedures adopted by the Board of Trustees of the Trust.

Investments in certain securities such as preferred stocks are valued on the basis of valuations provided by dealers or by a pricing service which uses information with respect to transactions in such securities, various relationships between securities in determining value.

(b) Security Transactions

Security transactions are accounted for as of the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

The Fund had certain portfolio trades directed to a broker under a brokerage recapture program. For the year ended December 31, 2005, under this arrangement the total amount by which the cost of the Fund’s securities were reduced or proceeds on sales increased was $246,255.

(c) Investment Income and Expenses

Dividend income is recorded on the ex-dividend date except certain dividends from foreign securities where the ex-dividend

19

Notes to Financial Statements (continued)

date may have passed. These dividends are recorded as soon as the Trust is informed of the ex-dividend date. Dividend income on foreign securities is recorded net of any withholding tax. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Non-cash dividends included in dividend income, if any, are reported at the fair value of the securities received. Other income and expenses are recorded on an accrual basis. Expenses that cannot be directly attributed to a fund are apportioned among the Funds in the Trust and in some cases other affiliated funds based upon their relative average net assets or number of shareholders.

The Fund had certain portfolio trades directed to various brokers who paid a portion of the Fund’s expenses. For the year ended December 31, 2005, under this arrangement the Fund’s expenses were reduced and the impact on the expense ratio was $1,828,210 or 0.05%.

The Fund has a “balance credit” arrangement with The Bank of New York (“BNY”), the Fund’s custodian, whereby the Fund is credited with an interest factor equal to 1% below the effective 90-day T-Bill rate for account balances left uninvested overnight. This credit serves to reduce the custody expense that would otherwise be charged to the Fund. For the year ended December 31, 2005, the custodian expense was reduced $6,502 under this arrangement.

Managers Investment Group LLC (formerly The Managers Funds LLC) (the “Investment Manager”) had agreed to waive a portion of its fee or reimburse expenses of Special Equity commensurate with the reduction in the fee paid to Essex Investment Management Company LLC (“Essex”) (subadvisor to Special Equity from December 19, 2003 to January 17, 2005), which was 0.10% of the average daily net assets of the portion of the Fund managed by Essex in excess of $100 million. From January 1, 2005 to January 17, 2005 the amount waived equaled $28,665. On January 18, 2005, Essex was replaced with Veredus Asset Management, and the Investment Manager discontinued waiving a portion of its fee.

Total returns and net investment income for the Fund would have been lower had certain expenses not been offset.

(d) Dividends and Distributions

Dividends resulting from net investment income, if any, normally will be declared and paid annually. Distributions of capital gains, if any, will be made on an annual basis and when required for Federal excise tax purposes. Income and capital gain distributions are determined in accordance with Federal income tax regulations, which may differ from generally accepted accounting principles. These differences are primarily due to differing treatments for losses deferred due to wash sales, equalization accounting for tax purposes, foreign currency and market discount transactions. Permanent book and tax basis differences, if any, relating to shareholder distributions will result in reclassifications to paid-in capital. The tax character of distributions paid during the past two years were as follows:

| | | | | | |

| | | 2005 | | 2004 |

Distributions paid from: | | | | | | |

Ordinary income | | $ | — | | $ | — |

Short-term capital gains | | | — | | | — |

Long-term capital gains | | | 270,771,738 | | | — |

| | | | | | |

| | $ | 270,771,738 | | $ | |

| | | | | | |

As a % of distributions paid: | | | | | | |

Qualified ordinary income | | | — | | | — |

Ordinary income - dividends received deduction | | | — | | | — |

As of December 31, 2005, the components of distributable earnings (excluding unrealized appreciation/depreciation) on a tax basis consisted of:

| | | |

| | | 2005 |

Capital loss carryforward | | $ | — |

Undistributed ordinary income | | | — |

Undistributed short-term capital gains | | | — |

Undistributed long-term capital gains | | $ | 60,186,226 |

| | | |

| | $ | 60,186,226 |

| | | |

(e) Federal Taxes

The Fund intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, to distribute substantially all of its taxable income and gains to its shareholders and to meet certain diversification and income requirements with respect to investment companies. Therefore, no provision for Federal income or excise tax is included in the accompanying financial statements.

20

Notes to Financial Statements (continued)

(f) Capital Loss Carryovers

As of December 31, 2005, the Fund had no accumulated net realized capital loss carryover from securities transactions for Federal income tax purposes.

(g) Capital Stock

The Trust’s Declaration of Trust authorizes for each series the issuance of an unlimited number of shares of beneficial interest, without par value. The Fund records sales and repurchases of its capital stock on the trade date. Dividends and distributions to shareholders are recorded on the ex-dividend date.

At December 31, 2005, certain unaffiliated shareholders, specifically omnibus accounts, individually held greater than 10% of the outstanding shares of the Fund: Special Equity Managers Class shares-two own collectively 34%; Special Equity Institutional Class shares – three own collectively 35%.

(2) Agreements and Transactions with Affiliates