UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03752

THE MANAGERS FUNDS

(Exact name of registrant as specified in charter)

| | |

| 800 Connecticut Avenue, Norwalk, Connecticut | | 06854 |

| (Address of principal executive offices) | | (Zip code) |

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2006 - DECEMBER 31, 2006

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

ANNUAL REPORT

Managers Funds

December 31, 2006

| | • | | Managers AMG Essex Large Cap Growth Fund |

| | • | | Managers Small Company Fund |

| | • | | Managers International Equity Fund |

| | • | | Managers Emerging Markets Equity Fund |

| | • | | Managers Global Bond Fund |

The Managers Funds

Annual Report – December 31, 2006

TABLE OF CONTENTS

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of The Managers Funds or Managers AMG Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholders and Clients,

We would like to thank you for the opportunity to manage your assets in 2006, and for taking time with us to take a quick glance back at last year’s investment climate.

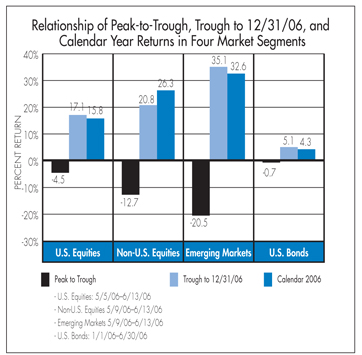

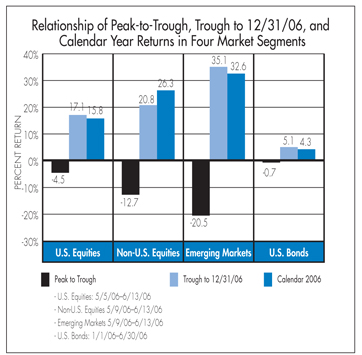

If all we did was focus on the strong, above-average returns generated by most of the asset classes worldwide during 2006—U.S. stocks up 15.8%, non-U.S. stocks up 26.3%, real estate up 36.1%, global bonds up 6.6% (high quality U.S. bonds offered moderately below average returns of 4.3%)—we would be missing one of the most important lessons that 2006 teaches us about investing; for 2006 was a year in which investors needed to endure a period of negative returns in order to reap the benefits the full year had to offer.

Investors with classically diversified portfolios who stuck to their long-term investment plan during the past year should have been pleased with their results. Other investors who were enticed into making asset allocation and investment changes in response to short-term market movements, however, may have experienced below average portfolio results, and certainly took undue risk.

It can be tempting for investors without a solid plan to alter their asset allocations and investment approach. Coming off of three previous years of positive stock market returns, we entered 2006 with the widely reported expectation that the economy was running out of steam. Given the news media’s penchant for pessimism, we were repeatedly told to watch out for: slower economic growth, softer corporate profits, significantly higher oil prices, prospects for higher inflation, expectations for further Federal Reserve interest rate hikes, a collapse in the housing market, the negative impact of a decline in the dollar’s value and of course, a long list of geopolitical concerns. As if that wasn’t enough, the yield curve was borderline inverted, very often a signal of economic weakness.

Investors tried to shrug off this pessimism and through the early part of May the equity markets actually produced positive results. However, the headline risks finally became too much for investors to withstand and the market ran out of steam. From May 5 through June 13, the U.S. equity market declined by 4.5%, while from May 9 through June 13, non-U.S. equities fell by 12.7%, with emerging markets leading the slide down 20.5%. Meanwhile, U.S. bonds had been steadily declining with the Lehman Brothers Aggregate Index down 0.7% through the end of June. Near mid-year, it seemed that the bears were developing a stranglehold on the market. More than a few commentators were wondering what then-new Fed Chairman Dr. Bernanke was trying to accomplish. Cash seemed to be king, commodities were headed higher, and hedge funds were constantly in the news—all very enticing options for investors.

But the whole story was yet to be told. Despite the mixed macro economic news, corporate results were coming through better than many analysts had expected and companies were actually producing positive earnings surprises. In fact, 68% and 76% of S&P 500 companies produced positive earnings surprises in the first and second quarters of 2006, respectively. As the year developed,

1

Letter to Shareholders (continued)

even though economic factors did not dramatically improve, they did not worsen either. The Fed stopped raising rates, oil prices stopped going up (and ultimately finished the year below where they started), inflation concerns tempered, the housing market did not experience the hard landing many had feared, and the mighty consumer did not waver. In retrospect, perhaps it was going to be the soft landing that many had sought.

As more and more positive earnings results came through during the year, even against the backdrop of mixed economic news, the markets staged a broad rally. From the June 13 bottom, the S&P 500 advanced by 17.1%, while the MSCI EAFE increased 20.8%. Meanwhile, the Lehman Aggregate Bond Index advanced 5.1% during the second half of the year.

So what was the lesson to be learned from 2006? Investors who started the year with a reasonably diversified portfolio and simply maintained their long-term perspective had an above-average year and made real progress towards their financial goals. Going into 2006, and for the first part of the year, economic conditions and expectations could easily have compelled an investor to over-think and do something other than stay on plan. The market would have whipsawed these investors, resulting in poor relative returns. Having a well founded long-term plan and sticking with it can improve investors’ odds of reaching their investment goals, and it certainly helped in terms of getting the most out of 2006.

One of our foremost goals at Managers Investment Group (“Managers”) is to structure and manage mutual funds that will help our shareholders and clients become more successful at reaching their investment goals and objectives. Each of our Funds is geared to provide you with exposure to a specific asset class or portion of the market. Investors tend to use our Funds as part of their overall asset allocation in order to structure a well-diversifi ed portfolio intended to meet individual needs. Most of our Funds, therefore, are designed to be building blocks.

Managers International Equity Fund is a great example of how we structure and manage funds for our clients’ benefit. We designed the overall Fund to provide broad exposure to the world’s non-U.S. equity markets, predominately in developed markets. Considering the broad mandate, we believe the best method of accomplishing that goal is by employing a number of investment managers, each with a different focus and approach to investing in the international equity market. As a result, we have built a virtual team of three complimentary institutional investment managers. Each of these three organizations has an experienced team of accomplished professionals and deep resources. Each of them has demonstrated great success in generating attractive investment returns. Yet each has a significantly different outlook and approach to investing. Specifically, the Fund is subadvised by AllianceBernstein, Lazard Asset Management, and Wellington Management Company, whose investment approaches are “bottom-up” value-based, “top-down” thematic, and growth-oriented, respectively. By blending managers with different styles, the portfolio is not held hostage to growth, for example, being out-of-favor. The result is a Fund with expected risk that should be lower than average and that exhibits more stable performance on a relative basis. Though this Fund won’t typically attract performance chasers, it will help investors reach their fi nancial goals without having to zigzag their way through investment styles or fads and give them peace of mind that they have an elegantly diversified portfolio.

At Managers we appreciate the privilege of being part of your investment plan. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit. Thank you again for the opportunity to be of service.

| | | | |

| Respectfully, | | | | |

| | |

| | | |  |

| John Streur | | | | Thomas G. Hoffman, CFA |

| Senior Managing Partner | | | | Executive Vice President |

| Managers Investment Group LLC | | | | Chief Investment Officer |

| | | | Managers Investment Group LLC |

Note: Source for all data referenced in the letter is FactSet and Russell.

2

About Your Fund’s Expenses

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | |

Six Months Ended December 31, 2006 | | Beginning

Account

Value

7/1/2006 | | Ending

Account

Value

12/31/2006 | | Expenses

Paid

During

the

Period* |

Managers Value Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,150 | | $ | 6.40 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 6.01 |

AMG Essex Large Cap Growth Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,083 | | $ | 6.56 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 6.36 |

Managers Small Company Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,073 | | $ | 7.10 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,018 | | $ | 6.92 |

Managers International Equity Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,151 | | $ | 7.92 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,018 | | $ | 7.43 |

Managers Emerging Markets Equity Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,274 | | $ | 10.20 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,016 | | $ | 9.05 |

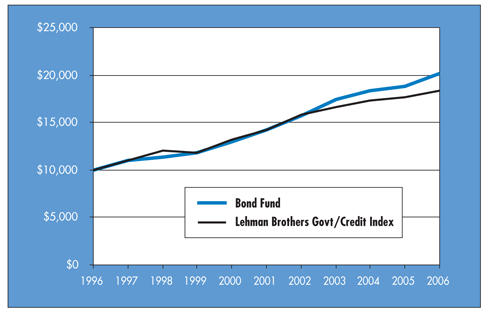

Managers Bond Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,077 | | $ | 5.18 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,020 | | $ | 5.04 |

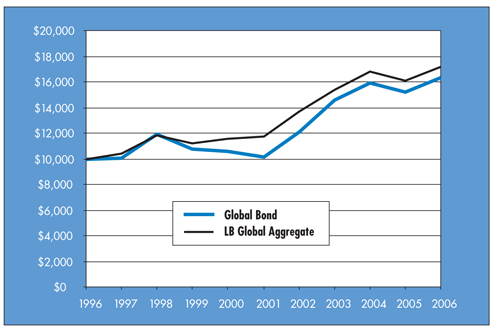

Managers Global Bond Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,046 | | $ | 6.14 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 6.06 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

Managers Value Fund

Portfolio Managers’ Comments

The Managers Value Fund’s (the “Fund”) objective is to achieve long-term capital appreciation through a diversified portfolio of equity securities. Income is the Fund’s secondary objective.

The Fund invests primarily in common and preferred stocks of U.S. companies. The Fund generally invests in medium and large companies, that is, companies with capitalizations that are within the range of capitalizations of companies represented in the S&P 500 Index, the Fund’s benchmark.

THE PORTFOLIO MANAGERS

The Fund employs multiple portfolio managers who specialize in distinct investment approaches. This “intelligence diversifi cation” not only serves to manage risk, but also helps us tap the markets’ full potential by focusing different analytical insights on each class of investment. Fund management strives to achieve this performance and diversifi cation while ensuring that the Fund operates within the framework of its investment objective and principal investment strategies.

Armstrong Shaw Associates

Armstrong Shaw Associates, Inc. (“Armstrong Shaw”) has a disciplined, absolute value approach to the equity market. Valuations are determined using a private purchase test to determine the price that a company could bring in a sale to a sophisticated buyer, discounted cash flow analysis, and market comparables.

Armstrong Shaw invests in securities where a rigid cash fl ow or asset value analysis determines that a company’s stock is selling at a substantial discount to its intrinsic value. While the level of the overall stock market or trends in economic factors may affect the timing in which value is recognized, they are not the basis for investment. Rather, Armstrong Shaw has a classic bottom up, company-by-company view of investing.

Armstrong Shaw’s decision making process includes market screening for potential new ideas, fundamental research including financial modeling and management interviews, an in depth investment committee review, and a strict sell discipline. Idea generation begins with screening the universe for businesses that are growing earnings and generating good returns on capital, but have fallen out of favor in the market. Armstrong Shaw’s fundamental research focuses on forward and backward looking fi nancial modeling, including an analysis of the income statement, the balance sheet, and the cash fl ow statement. The investment team compares each company to its peers, the broader market, and any transactions that may have taken place in its industry. Finally, Armstrong Shaw interviews the management team. During the investment committee review, the investment team challenges the analysis and ultimately decides if the company meets the criteria to be considered for the Portfolio.

The ideal investment exhibits many of the following traits:

| | • | | Defensible business franchise |

| | • | | Ability to generate above average returns |

| | • | | Low risk to technical obsolescence |

| | • | | Low cost provider or niche player |

| | • | | Track record of success |

| | • | | Long-term incentive program aligned with the interest of shareholders |

| | • | | History of being good allocators of capital |

| | • | | Low price to cash fl ow |

| | • | | Low price to asset value |

| | • | | Favorable price versus comparables in the marketplace |

| | • | | Favorable price versus recent transactions |

| | • | | Valuation check: what have buyers paid per hotel room, per subscriber, per a dollar of sales or earnings or cash flow |

Armstrong Shaw’s goal is to buy good businesses, run by proven, capable managers at prices equal to or less than 70% of intrinsic value. They believe that investing in superior businesses at attractive prices will provide superior returns over time.

Portfolio Management:

| | • | | Screens the universe of approximately 5,600 NYSE and AMEX issues and the largest NASDAQ stocks for: |

| | • | | Market caps more than $2.5 billion |

| | • | | EPS growth greater than 10% |

| | • | | Relative Price Earning multiple less than the market |

| | • | | Return on equity of 15% or greater |

| | • | | Conducts quantitative analysis by: |

| | • | | Analyzing income statement, balance sheet, and cash flow statement |

| | • | | Comparing the stock prices to cash flows, EPS, sales, etc. |

| | • | | Interviewing management team to get a better sense of strategic and fi nancial plans for the company |

| | • | | Estimating the stock’s intrinsic value and purchase stocks only when they are selling for less than 70% of the estimated intrinsic value |

The investment team will make a sell decision when:

| | • | | A price target is reached |

| | • | | Company’s fundamentals deteriorate |

| | • | | A better opportunity emerges |

Additionally, a drop in price of 25% from average cost triggers an automatic review process for potential sale.

Osprey Partners Investment Management

As traditional value investors, John Liang and the investment team at Osprey Partners Investment Management, LLC (“Osprey”) seek to identify undervalued stocks with low price-to-earnings and price-to-cash fl ow ratios. At the same time, Osprey’s investment team focuses its in-depth bottom-up analysis to identify fundamentally strong, well-managed companies.

Osprey expects to generate returns from dividend income as well as capital appreciation as a result of improvements to the valuations of the stocks such as, among other things, increases in the price-to-earnings ratio.

The ideal company exhibits many of the following traits:

| | • | | Low debt-to-capital ratios |

4

Managers Value Fund

Portfolio Managers’ Comments

Portfolio Management:

| | • | | Screens the investment universe for companies with a market cap above $1.5 billion and a P/E ratio at least 20% less than the P/E ratio of the S&P 500: |

| | • | | Determines the strength and risks of each company’s business with: |

| | • | | Balance sheet and income statement |

| | • | | Earnings quality and sustainability |

The investment team will make a sell decision when:

| | • | | Stock appreciates to a predetermined price target |

| | • | | A better opportunity emerges |

Additionally, a 20% drop relative to the market prompts an in-depth review and positions exceeding 6% of the portfolio are scaled back. The investment team tends to have an investment time horizon of 2 years or more.

THE YEAR IN REVIEW

For the year 2006, the Managers Value Fund gained 18.08% compared with a gain of 15.79% for the S&P 500.

Except for a brief panic attack in mid-2006, caused partly by fears that the new Federal Reserve Chairman, Ben Bernanke, would tighten the U.S. economy into a recession, the U.S. stock market marched steadily ahead during 2006, finishing higher than all but the most bullish of pundits expected. It wasn’t an expectations expansion, however. Rather, it was the result of a surprisingly resilient economy, continued increases in corporate profitability and a celebration of the eventual end to the Fed’s long campaign of interest rate hikes.

Contrary to most professionals’ expectations at the beginning of the year, including our own, value indexes continued to significantly outpace their growth counterparts, and small-capitalization stock indexes rose more than their large-cap counterparts. The Fund’s value orientation was beneficial throughout the year as a broad range of companies produced solid fundamental growth, but lower expectation, lower valuation stocks appreciated more.

During the generally rising first four months of the year, the Portfolio outperformed with strong contributions from Nokia, and several retailers including Dollar Tree Stores and Rent-a-Center. In addition, the Portfolio’s large financials allocation with signifi cant positions in best of breed banking and capital markets firms such as Goldman Sachs, Merrill Lynch, and Bank of America continued to advance on strong earnings that they extended throughout all of 2006. During a brief but sharp market sell-off in May through mid-July, the Portfolio generally moved with the market. However, as the market rallied off its July trough, the Fund outperformed with its core fi nancials companies again leading along with strong growth from the surprisingly resilient consumer discretionary sector. Media giant, Time Warner, finally broke out of a two and a half year holding pattern with strong results and a 36% price gain. Meanwhile, there were very few negative surprises and no signifi cant price breaks in portfolio holdings during the second half of the year.

LOOKING FORWARD

Even after the strong second half stock rally, the Fund’s subadvisors remain sanguine about their portfolios and had the following comments as we progress into 2007:

Armstrong Shaw

The economic backdrop for 2007 looks favorable as corporate profi t expansion, while moderating, is expected to continue. Real interest rates are low, employment is high and falling energy prices are offsetting a weaker housing market. Valuations are reasonable, and stocks are more attractive than bonds with the S&P 500 trading at a 6.1% earnings yield vs. a 4.7% yield for bonds. We believe that large-cap equities should do better during a decelerating economy and that the trend of large-cap outperformance is likely to persist for a few years. Interestingly, since 1945, the third year of a Presidential term has always been positive, by 18% on average. We feel that 2007 is likely to be a year of P/E expansion and that our Portfolio of high quality, large-capitalization companies with steady earnings power should be a prime beneficiary. Typically, P/E expansion coincides with slow downs in the growth of profits and the economy. Our industrial holdings are weighted toward late cycle businesses such as GE, United Technologies, and Honeywell, which should benefi t from this stage in the economic cycle. Health care and information technology offer above average opportunities and we have added to our exposure in these sectors. We have stayed true to our discipline of buying good companies, run by strong management teams at discounts to their intrinsic value. Many of the companies that we own delivered strong fundamental results but were not rewarded in the market for much of 2006. We have begun to see a change in market leadership which has resulted in better absolute and relative returns in both the fourth quarter and the beginning of 2007. We believe that we are at the beginning of a multi-year trend and that our Portfolio is poised to benefit from this change.

Osprey Partners

The third and fourth quarter rally in stocks that brought the Dow Jones and S&P 500 Indexes to record heights has resulted in stock valuations that are almost squarely in line with historical averages. Corporate profi ts, however, are fi nally beginning to slow after an unprecedented run of above average growth. For 2007, most strategists are looking for growth somewhere in the 7% - 9% range, which would be in line with the long run average of earnings growth. Assuming little or no multiple expansion it is reasonable to expect a similar 7% - 9% increase in stock prices for the year. We only wish that things were so simple.

Clouding the near term picture is the fact that the stock market appears overbought on many short-term indicators. Also, the market has not had a 10% correction in over four years representing one of the longest stretches in U.S. history. Finally, complacency seems to be ruling the day. Volatility, as measured by the VIX Index recently hit the lowest level in over a decade and market economists are nearly in universal agreement about the prospects for a soft landing in 2007. In eerie similarity, not one of the 30 leading economists polled in early 2000 forecasted a slowdown that occurred later that year. The favorite argument of market and economic bulls is that employment is historically low at 4.4% but it was even lower at 3.9% on the eve of the 2001 recession suggesting that this is a lagging

5

Managers Value Fund

Portfolio Managers’ Comments (continued)

rather than leading indicator at best. Finally, the best argument in favor of a bull market in 2007 is the fact that there has never been a down market in the third year of a presidential term in the last fifty years.

While all of these warning signs point to a choppy market in 2007, we nevertheless find ourselves reluctantly siding with the consensus. We continue to believe that the U.S. consumer will remain resilient given the tight labor market and falling energy prices and the current inventory problem in the housing market will ease as the year progresses. We look for a possible near term correction in equity market that will relieve overbought conditions but set the stage for a more sustained advance as the year progresses.

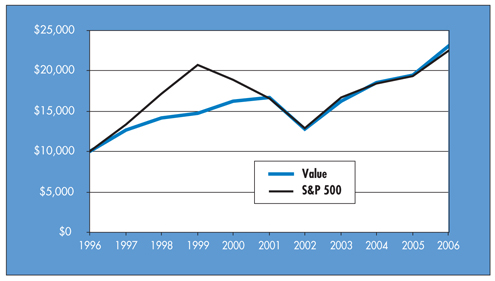

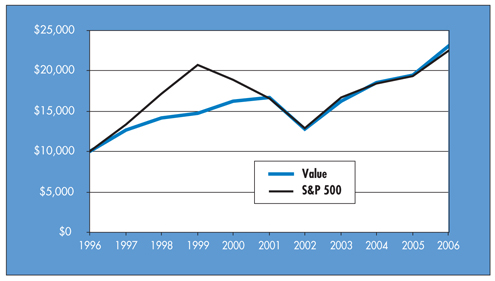

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers Value Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The S&P 500 Index is an unmanaged capitalization weighted index of 500 commonly traded stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of those stocks. Unlike the Fund, the S&P 500 Index is unmanaged, is not available for investment, and does not incur expenses. The Index assumes reinvestment of dividends. This graph compares a hypothetical $10,000 investment made in Managers Value Fund on December 31, 1996 to a $10,000 investment made in the S&P 500 Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the Value Fund and the S&P 500 Index since December 31, 1996 through December 31, 2006.

| | | | | | | | | | | |

Average Annualized Total Returns | | One Year | | | Five Years | | | Ten Years | | | Inception Date |

Value | | 18.08 | % | | 6.62 | % | | 8.71 | % | | 10/31/84 |

S&P 500 Index | | 15.79 | % | | 6.19 | % | | 8.42 | % | | |

6

Managers Value Fund

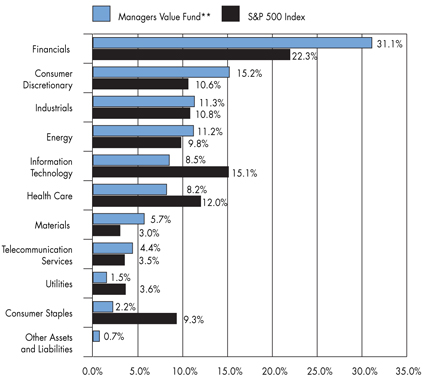

Fund Snapshots

December 31, 2006

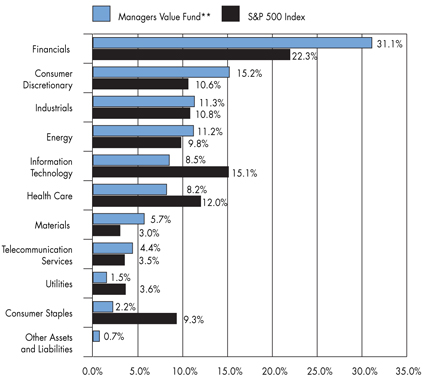

Portfolio Breakdown

| ** | As a percentage of net assets |

| | | | | | |

Industry | | Managers Value Fund** | | | S&P 500 Index | |

Financials | | 31.1 | % | | 22.3 | % |

Consumer Discretionary | | 15.2 | % | | 10.6 | % |

Industrials | | 11.3 | % | | 10.8 | % |

Energy | | 11.2 | % | | 9.8 | % |

Information Technology | | 8.5 | % | | 15.1 | % |

Health Care | | 8.2 | % | | 12.0 | % |

Materials | | 5.7 | % | | 3.0 | % |

Telecommunication Services | | 4.4 | % | | 3.5 | % |

Utilities | | 1.5 | % | | 3.6 | % |

Consumer Staples | | 2.2 | % | | 9.3 | % |

Other Assets and Liabilities | | 0.7 | % | | 0.0 | % |

Top Ten Holdings

| | | |

Security Name | | Percentage of Net Assets | |

American International Group, Inc.* | | 4.7 | % |

Citigroup, Inc.* | | 4.5 | |

Bank of America Corp.* | | 4.4 | |

ChevronTexaco Corp.* | | 4.0 | |

ConocoPhillips Co.* | | 3.3 | |

Capital One Financial Corp. | | 3.2 | |

Merrill Lynch & Co., Inc.* | | 3.1 | |

Verizon Communications, Inc.* | | 2.4 | |

MBIA, Inc. | | 2.3 | |

Nokia Corp., Sponsored ADR* | | 2.2 | |

Top Ten as a Group | | 34.1 | % |

| | | |

| * | Top Ten Holding at June 30, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

7

Managers Value Fund

Schedule of Portfolio Investments

December 31, 2006

| | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 99.3% | | | | | | | |

Consumer Discretionary - 15.2% | | | | | | | |

Abercrombie & Fitch Co. | | 21,000 | 2 | | $ | 1,462,230 | |

Comcast Corp., Special Class A* | | 41,360 | 2 | | | 1,732,157 | |

Gannett Co., Inc. | | 25,200 | 2 | | | 1,523,592 | |

Jarden Corp.* | | 44,900 | 2 | | | 1,562,071 | |

Lowe’s Co., Inc. | | 34,040 | | | | 1,060,346 | |

Mattel, Inc. | | 63,400 | | | | 1,436,644 | |

Rent-A-Center, Inc.* | | 38,900 | 2 | | | 1,147,939 | |

Time Warner Co., Inc. | | 78,700 | | | | 1,714,086 | |

Wyndham Worldwide Corp.* | | 21,602 | | | | 691,696 | |

Total Consumer Discretionary | | | | | | 12,330,761 | |

Consumer Staples - 2.2% | | | | | | | |

CVS Corp. | | 56,440 | 2 | | | 1,744,560 | |

Energy - 11.2% | | | | | | | |

Baker Hughes, Inc. | | 7,910 | 2 | | | 590,561 | |

ChevronTexaco Corp. | | 43,600 | 2 | | | 3,205,908 | |

ConocoPhillips Co. | | 37,130 | | | | 2,671,504 | |

Devon Energy Corp. | | 19,000 | 2 | | | 1,274,520 | |

Transocean, Inc.* | | 16,300 | 2 | | | 1,318,507 | |

Total Energy | | | | | | 9,061,000 | |

Financials - 31.1% | | | | | | | |

ACE, Ltd. | | 28,800 | | | | 1,744,416 | |

Allstate Corp., The | | 10,510 | | | | 684,306 | |

American International Group, Inc. | | 53,620 | | | | 3,842,409 | |

Bank of America Corp. | | 67,000 | | | | 3,577,130 | |

Capital One Financial Corp. | | 33,903 | | | | 2,604,428 | |

Citigroup, Inc. | | 65,541 | | | | 3,650,634 | |

Fannie Mae Co. | | 30,100 | | | | 1,787,639 | |

MBIA, Inc. | | 26,000 | 2 | | | 1,899,560 | |

Merrill Lynch & Co., Inc. | | 27,000 | | | | 2,513,700 | |

Morgan Stanley Co. | | 16,720 | | | | 1,361,510 | |

Washington Mutual, Inc. | | 32,400 | 2 | | | 1,473,876 | |

Total Financials | | | | | | 25,139,608 | |

Health Care - 8.2% | | | | | | | |

Abbott Laboratories Co. | | 24,100 | | | | 1,173,911 | |

Boston Scientific Corp.* | | 44,450 | 2 | | | 763,651 | |

GlaxoSmithKline PLC, Sponsored ADR | | 31,000 | 2 | | | 1,635,560 | |

McKesson Corp. | | 12,250 | 2 | | | 621,075 | |

Pfizer, Inc. | | 68,300 | | | | 1,768,970 | |

UnitedHealth Group, Inc. | | 12,840 | | | | 689,893 | |

Total Health Care | | | | | | 6,653,060 | |

Industrials - 11.3% | | | | | | | |

Emerson Electric Co. | | 13,600 | | | | 599,624 | |

Empresa Brasileira de Aeronautica, S.A. | | 36,600 | | | | 1,516,338 | |

General Electric Co. | | 41,175 | | | | 1,532,122 | |

Honeywell International, Inc. | | 21,100 | 2 | | | 954,564 | |

Ingersoll-Rand Co., Class A | | 31,600 | 2 | | | 1,236,508 | |

Pitney Bowes, Inc. | | 26,700 | 2 | | | 1,233,273 | |

Tyco International, Ltd. | | 37,100 | | | | 1,127,840 | |

United Technologies Corp. | | 15,500 | | | | 969,060 | |

Total Industrials | | | | | | 9,169,329 | |

Information Technology - 8.5% | | | | | | | |

First Data Corp. | | 31,420 | | | | 801,838 | |

Ingram Micro, Inc., Class A* | | 63,700 | | | | 1,300,117 | |

International Business Machines Corp. | | 9,080 | | | | 882,122 | |

Nokia Corp., Sponsored ADR | | 88,000 | | | | 1,788,160 | |

Symantec Corp.* | | 51,900 | 2 | | | 1,082,115 | |

Xerox Corp.* | | 61,010 | | | | 1,034,120 | |

Total Information Technology | | | | | | 6,888,472 | |

Materials - 5.7% | | | | | | | |

Cemex SA de CV* | | 31,190 | | | | 1,056,717 | |

Dow Chemical Co. | | 20,000 | | | | 798,800 | |

E.I. du Pont de Nemours & Co., Inc. | | 31,000 | 2 | | | 1,510,010 | |

PPG Industries, Inc. | | 19,500 | | | | 1,252,095 | |

Total Materials | | | | | | 4,617,622 | |

Telecommunication Services - 4.4% | | | | | | | |

Sprint Corp. | | 82,637 | | | | 1,561,013 | |

Verizon Communications, Inc. | | 53,000 | | | | 1,973,720 | |

Total Telecommunication Services | | | | | | 3,534,733 | |

Utilities - 1.5% | | | | | | | |

Exelon Corp. | | 19,100 | | | | 1,182,099 | |

Total Common Stocks

(cost $ 61,454,223) | | | | | | 80,321,244 | |

Other Investment Companies - 23.2%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.32%3 | | 18,027,521 | | | | 18,027,521 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.18% | | 758,054 | | | | 758,054 | |

Total Other Investment Companies

(cost $18,785,575) | | | | | | 18,785,575 | |

Total Investments - 122.5%

(cost $80,239,798) | | | | | | 99,106,819 | |

Other Assets, less Liabilities - (22.5)% | | | | | | (18,190,510 | ) |

Net Assets - 100% | | | | | $ | 80,916,309 | |

The accompanying notes are an integral part of these financial statements.

8

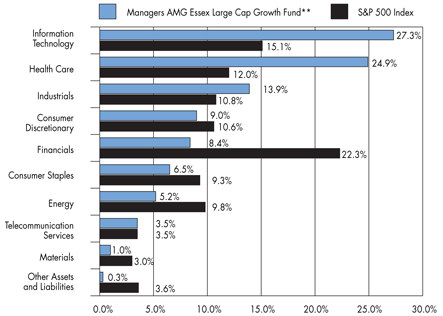

Managers AMG Essex Large Cap Fund

Portfolio Manager’s Comments

For the year ended December 31, 2006, the Managers AMG Essex Large Cap Growth Fund (formerly Managers Capital Appreciation Fund) (the “Fund”) gained 4.96%, underperforming the S&P 500 Index, which returned 15.79%.

Falling oil prices, an explosion in merger activity, and easing bond yields created supportive conditions for most equity types in 2006. Growth stocks of all sizes enjoyed a healthy rebound in the fourth quarter, yet trailed their value counterparts for the year. Overall, 2006 proved to be a difficult year for the Fund. Energy and financial services stocks were the top contributors to Fund performance over the course of the year. However, our most heavily weighted sectors, consumer, health care, and technology, were detractors to performance in the Fund.

Consumer related stocks, including consumer electronics and gaming companies were overall detractors to performance for the year. We maintained a cautious view on the consumer sector throughout the year, as we have maintained for some time the thesis that earnings for companies in this area are vulnerable to a housing slowdown. We reduced our exposure to hotel and gaming companies at the end of the year as we believe earnings are set to slow in 2007. Yahoo! was the primary underperformer in the sector, largely suffering as a result of a deferral of the rollout of its key new search monetization platform. There were a few standout performers in the consumer discretionary sector for the year including Google, DreamWorks Animation, and Staples.

The health care sector experienced a difficult start to 2006 with most segments lagging the broader market. A disappointing fourth quarter contributed to the negative relative performance for the year. However, we continue to look to this industry to offer substantial appreciation potential in the year ahead and further increased our generally overweighted positions. Our primary focus remains on companies in the biotechnology and specialty pharmaceutical areas. The Portfolio had positive contributions by stocks in a variety of areas, notably Gilead Sciences and Shire PLC in drug and pharmaceuticals, and Celgene in biotechnology research and production. Notable underperformers for the year were Teva Pharmaceuticals, UnitedHealth Group, and Omnicare.

The Portfolio maintained a relative underweight to technology throughout the year. However, in the fourth quarter, we increased our overall weighting within technology, believing that capital spending in general should expand further in 2007 with IT spending budgets in particular to benefit. Given the disappointing performance in the middle of the year, the technology sector was a detractor to performance for 2006. Semiconductor companies such as Marvell Technology Group significantly underperformed for the year. In contrast, several of our software and communication equipment investments experienced strong relative returns, including BEA Systems and Brocade Communications. The Fund’s storage related holdings, Network Appliance and Seagate Technology, both performed very well for the year.

Despite a rather volatile start to the year for energy stocks, the sector was a positive contributor to performance for the year. We significantly reduced our energy weight due to our belief that high oil and natural gas prices were vulnerable to a correction. Currently, we retain slightly overweighted positions in energy with an emphasis on the services and equipment companies. We believe these companies will help solve the supply issue through new processes and technologies. While the short- to intermediate-term outlook is uncertain, longer term, we see no let up in the worldwide demand for oil and gas, which coupled with supply constraints, should keep energy prices elevated for several years. ENSCO International, an exploration and production company, and Schlumberger, a services and equipment company were the strongest performers for the year.

Outlook:

The year 2006 was noted for its pronounced sector rotation with few consistent trends or themes. The U.S. economy is entering a phase of slower yet sustainable growth, setting the stage for a further easing of inflation expectations and potentially Federal Reserve policy. We remain confident in our thesis that moderating economic activity will provide a more suitable environment for growth stocks of all sizes. As overall earnings slow to a sustainable pace, we believe investors will become increasingly selective and gravitate towards companies with consistently superior earnings growth. We have not wavered from our philosophy of early identification of growth wherever growth exists and believe that it will be rewarded in the year ahead.

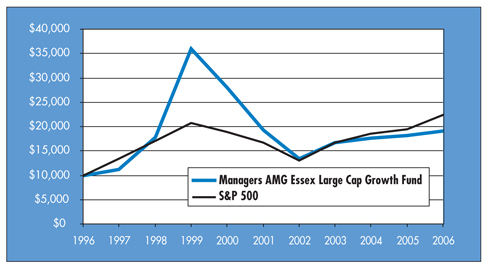

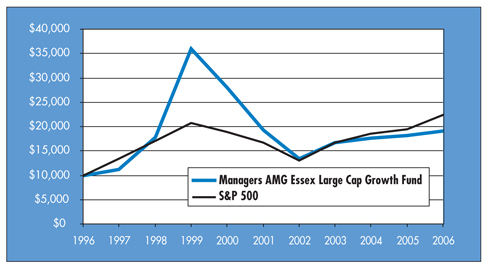

Cumulative Total Return Performance

Managers AMG Essex Large Cap Growth’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The S&P 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of those 500 stocks representing all major industries. Unlike the Fund, the S&P 500 Index is unmanaged, is not available for investment, and does not incur expenses. The Index assumes reinvestment of dividends. This graph compares a hypothetical $10,000 investment made in Managers AMG Essex Large Cap Growth Fund on December 31, 1996, to a $10,000 investment made in the S&P 500 for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of

9

Managers AMG Essex Large Cap Fund

Portfolio Manager’s Comments (continued)

shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for Managers AMG Essex Large Cap Growth Fund and the S&P 500 Index since December 31, 1996 through December 31, 2006.

| | | | | | | | | | | |

Average Annualized Total Returns | | One Year | | | Five Years | | | Ten Years | | | Inception Date |

Managers AMG Essex Large Cap Growth Fund | | 4.96 | % | | -0.08 | % | | 6.69 | % | | 6/1/84 |

S&P 500 Index | | 15.79 | % | | 6.19 | % | | 8.42 | % | | |

10

Managers AMG Essex Large Cap Growth Fund

Fund Snapshots

December 31, 2006

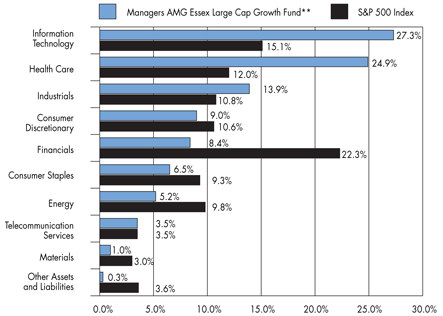

Portfolio Breakdown

| ** | As a percentage of net assets |

| | | | | | |

Industry | | Managers AMG

Essex Large Cap

Growth Fund** | | | S&P 500 Index | |

Information Technology | | 27.3 | % | | 15.1 | % |

Health Care | | 24.9 | % | | 12.0 | % |

Industrials | | 13.9 | % | | 10.8 | % |

Consumer Discretionary | | 9.0 | % | | 10.6 | % |

Financials | | 8.4 | % | | 22.3 | % |

Consumer Staples | | 6.5 | % | | 9.3 | % |

Energy | | 5.2 | % | | 9.8 | % |

Telecommunication Services | | 3.5 | % | | 3.5 | % |

Materials | | 1.0 | % | | 3.0 | % |

Other Assets and Liabilities | | 0.3 | % | | 3.6 | % |

Top Ten Holdings

| | | |

Security Name | | Percentage of Net Assets | |

General Electric Co.* | | 4.3 | % |

Gilead Sciences, Inc.* | | 3.6 | |

Yahoo!, Inc.* | | 3.5 | |

Google, Inc.* | | 3.3 | |

Merrill Lynch & Co., Inc. | | 3.1 | |

Brocade Communication Systems, Inc. | | 3.0 | |

Network Appliance, Inc. | | 2.9 | |

Genentech, Inc.* | | 2.9 | |

Procter & Gamble Co.* | | 2.8 | |

Seagate Technology, Inc. | | 2.8 | |

Top Ten as a Group | | 32.2 | % |

| | | |

| * | Top Ten Holding at June 30, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

11

Managers AMG Essex Large Cap Growth Fund

Schedule of Portfolio Investments

December 31, 2006

| | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 99.7% | | | | | | | |

Consumer Discretionary - 9.0% | | | | | | | |

Comcast Corp., Class A* | | 32,046 | 2 | | $ | 1,356,507 | |

DreamWorks Animation SKG, Inc.* | | 51,911 | 2 | | | 1,530,855 | |

Laureate Education, Inc.* | | 18,996 | 2 | | | 923,775 | |

McGraw-Hill Companies, Inc., The | | 10,999 | 2 | | | 748,152 | |

Staples, Inc. | | 52,588 | | | | 1,404,100 | |

Total Consumer Discretionary | | | | | | 5,963,389 | |

Consumer Staples - 6.5% | | | | | | | |

PepsiCo, Inc. | | 25,132 | | | | 1,572,007 | |

Procter & Gamble Co. | | 28,575 | | | | 1,836,515 | |

Wal-Mart Stores, Inc. | | 18,162 | | | | 838,721 | |

Total Consumer Staples | | | | | | 4,247,243 | |

Energy - 5.2% | | | | | | | |

Schlumberger, Ltd. | | 19,901 | | | | 1,256,947 | |

Southwestern Energy* | | 27,249 | 2 | | | 955,078 | |

Weatherford International, Ltd.* | | 29,221 | 2 | | | 1,221,147 | |

Total Energy | | | | | | 3,433,172 | |

Financials - 8.4% | | | | | | | |

American International Group, Inc. | | 20,546 | | | | 1,472,326 | |

CB Richard Ellis Group, Inc.* | | 38,012 | | | | 1,261,998 | |

Goldman Sachs Group, Inc. | | 3,662 | | | | 730,020 | |

Merrill Lynch & Co., Inc. | | 22,275 | | | | 2,073,802 | |

Total Financials | | | | | | 5,538,146 | |

Health Care - 24.9% | | | | | | | |

Alcon, Inc. | | 13,755 | 2 | | | 1,537,396 | |

Amgen, Inc.* | | 20,534 | | | | 1,402,678 | |

Baxter International, Inc. | | 22,077 | | | | 1,024,152 | |

Celgene Corp.* | | 17,987 | 2 | | | 1,034,792 | |

Genentech, Inc.* | | 23,720 | | | | 1,924,404 | |

Genzyme Corp-Genl Division* | | 23,710 | | | | 1,460,063 | |

Gilead Sciences, Inc.* | | 36,465 | | | | 2,367,672 | |

McKesson Corp. | | 29,522 | | | | 1,496,765 | |

Novartis AG, Sponsored ADR | | 27,545 | | | | 1,582,185 | |

Sepracor, Inc.* | | 12,806 | 2 | | | 788,593 | |

Shire Pharmaceuticals PLC | | 12,177 | 2 | | | 752,052 | |

Vertex Pharmaceuticals, Inc.* | | 28,924 | 2 | | | 1,082,336 | |

Total Health Care | | | | | | 16,453,088 | |

Industrials - 13.9% | | | | | | | |

AMR Corp* | | 60,142 | 2 | | | 1,818,093 | |

Boeing Co., The | | 19,833 | | | | 1,761,964 | |

General Electric Co. | | 76,269 | | | | 2,837,969 | |

Joy Global, Inc. | | 31,266 | 2 | | | 1,511,398 | |

UTI Worldwide, Inc. | | 41,170 | 2 | | | 1,230,983 | |

Total Industrials | | | | | | 9,160,407 | |

Information Technology - 27.3% | | | | | | | |

BEA Systems, Inc.* | | 101,465 | | | | 1,276,430 | |

Broadcom Corp., Class A* | | 38,560 | 2 | | | 1,245,875 | |

Brocade Communications Systems, Inc.* | | 240,526 | 2 | | | 1,974,718 | |

Cisco Systems, Inc.* | | 37,370 | | | | 1,021,322 | |

Ericsson (LM) Tel Co., Sponsored ADR | | 16,493 | | | | 663,513 | |

Google, Inc.* | | 4,705 | | | | 2,166,558 | |

Marvell Technology Group Ltd.* | | 66,688 | 2 | | | 1,279,743 | |

Network Appliance, Inc.* | | 49,245 | 2 | | | 1,934,344 | |

QUALCOMM, Inc. | | 34,096 | | | | 1,288,488 | |

Seagate Technology, Inc. | | 69,205 | 2 | | | 1,833,932 | |

THQ, Inc.* | | 31,868 | 2 | | | 1,036,347 | |

Yahoo!, Inc.* | | 91,062 | 2 | | | 2,325,723 | |

Total Information Technology | | | | | | 18,046,993 | |

Materials - 1.0% | | | | | | | |

E.I. du Pont de Nemours & Co., Inc. | | 13,530 | | | | 659,046 | |

Telecommunication Services - 3.5% | | | | | | | |

American Tower Corp* | | 25,844 | 2 | | | 963,464 | |

NII Holdings, Inc., Class B* | | 20,410 | 2 | | | 1,315,220 | |

Total Telecommunication Services | | | | | | 2,278,684 | |

Total Common Stocks (cost $57,006,316) | | | | | | 65,780,168 | |

Other Investment Companies - 26.9%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.32%3 | | 17,458,431 | | | | 17,458,431 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.18% | | 315,760 | | | | 315,760 | |

Total Other Investment Companies

(cost $17,774,191) | | | | | | 17,774,191 | |

Total Investments - 126.6%

(cost $74,780,507) | | | | | | 83,554,359 | |

Other Assets, less Liabilities - (26.6)% | | | | | | (17,555,154 | ) |

Net Assets - 100% | | | | | $ | 65,999,205 | |

The accompanying notes are an integral part of these financial statements.

12

Managers Small Company Fund

Portfolio Managers’ Comments

The Managers Small Company Fund’s (the “Fund”) objective is to achieve long-term capital appreciation by investing in equity securities of small companies.

THE PORTFOLIO MANAGERS

The Fund employs two portfolio managers who specialize in distinct investment approaches. This “intelligence diversification” not only serves to manage risk, but also helps us tap the markets’ full potential by focusing different analytical insights on each class of investment. Fund management strives to achieve this performance and diversification while ensuring that the Fund operates within the framework of its investment objective and principal investment strategies.

Kalmar Investment Advisers

Kalmar Investment Advisers (“Kalmar”), practices a “Growth-with-Value” approach to small- company investing whereby it seeks to identify high quality growing businesses before they are widely discovered by other institutional investors. Kalmar’s team believes there is a low risk/high reward anomaly offered by the equity market in stocks of such top-notch smaller companies that, for a variety of reasons, have not made the radar screen of most typical growth investors. Because these companies are relatively “invisible” institutionally, they can be purchased at prices which are inefficiently valued to undervalued and yet offer strong growth potential as well. This is the crux of their “Growth-with-Value” investment style.

The investment team at Kalmar generates investment ideas through different screening methodologies and several sources, thus employing elements of both “top-down” and “bottom-up” analysis in the initial identification process. The members of the investment management team all have strong research backgrounds and are committed to disciplined in-depth, hands-on fundamental analysis. Top-down thinking is used to identify strategic themes and growth areas to prospect for individual “Growth-with-Value” candidates.

The most intensive research, however, is dedicated to bottom-up fundamental analysis. Kalmar looks for such criteria as proven and sustainable double-digit growth in revenue and EPS together with a stock that is reasonably to cheaply priced relative to EPS, cash flow, revenues, and enterprise value. Kalmar looks for dynamic businesses that are easily understood, run by equity owners they can count on, and buyable at valuations that they expect to rise. The team’s decision threshold for new holdings is a potential return of 50% in approximately two years. This appreciation is expected to come from two sources: compounding business value plus upward revaluation as greater investor discovery unfolds.

The ideal company exhibits many of the following traits:

| | • | | Market capitalization of $50 million up to $2.5 billion at the time of purchase |

| | • | | Dynamic growth business that Kalmar understands better |

| | • | | Run by committed managements that deliver: |

| | • | | Buyable at inefficient valuations that should rise |

| | • | | Strong improving financials with conservative accounting |

| | • | | Reasonable / cheap valuations, with special positive attributes |

Portfolio Management:

| | • | | Diversified portfolio in terms of sector, security, and market capitalization |

| | • | | Conscious mix of “growth character” companies, from higher growth “Steady Eddies” bought inefficiently valued through to Positive Surprise / Emerging Growth situations |

The investment team will make a sell decision when:

| | • | | They see a change in the fundamentals of a company |

| | • | | A better opportunity emerges |

| | • | | Price or fundamental expectations have been met |

| | • | | A position appreciates beyond an optimal allocation |

Epoch Investment Partners

Epoch Investment Partners (“Epoch Parners”) seeks to create excess return without assuming a high degree of capital risk by creating portfolios of businesses with superior risk/reward profiles. They analyze a business in the same manner a private investor would in looking to purchase the entire company and only invest in those businesses they understand and where they have confidence in their financial statements. They seek businesses that generate “free cash flow” and securities that have unrecognized potential yet possess a combination of above average yield, above average free cash flow growth, and/or below average valuation.

Ideal Investment

The ideal company exhibits many of the following traits:

| | • | | Top quality management that has entrepreneurial drive and experience, a history of success, a strong strategic vision, and that has a reward structure determined by shareholder value creation |

| | • | | Strong financial position as determined by cash flow use, financial transparency, hidden or undervalued assets, and low leverage |

| | • | | Competitive positioning in its marketplace, strong demand characteristics, and sustainable free cash flow |

Portfolio Construction

Portfolio management:

| | • | | Screens the Russell 3000® universe using both quantitative and qualitative criteria |

| | • | | Analyzes each business as if they were to buy the entire company including sustainability of the business, earnings drivers, barriers to entry, and competitive advantages |

| | • | | Evaluates potential companies on basis of management quality, financial strength, nature of the business, and external factors |

| | • | | Develops an investment thesis outlining potential value creating and growth in cash flow |

| | • | | Diversifies the Portfolio across important sectors utilizing inverse risk weighting, a 5% position maximum, and recognizing liquidity considerations |

Sell Discipline

The investment team will make a sell decision when:

| | • | | The security’s price target is reached |

| | • | | There is a change in the investment thesis |

| | • | | Downside risk becomes too great |

THE YEAR IN REVIEW

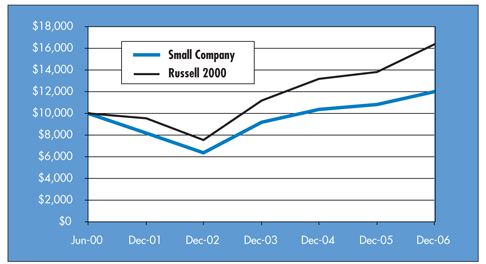

Over the year ended December 31, 2006, the Fund returned 10.42% compared to a gain of 18.37% for the Russell 2000® Index and 13.35% for the Russell 2000® Growth Index. Ultimately, it was a good year to be invested in the equity markets and an even

13

Managers Small Company Fund

Portfolio Managers’ Comments

better year to be invested in small-capitalization stocks. Broad markets posted strong gains with small-cap stocks outperforming large (as measured by the Russell Indexes) and value outperforming growth. For small-cap value stocks, this marked the sixth year out of the past seven they have outperformed their growth counterparts. Sector performance was positive across the board, with materials and telecom services posting 40% gains. Health care was the only sector that failed to reach double digit returns for the year as the pharmaceutical industry turned in lackluster gains. As is generally consistent with a value driven market, those stocks with the lowest quintile of price-to-earnings and price-to-book ratios recorded the strongest returns. It’s also worth noting that investors were hesitant to reward future growth prospects as those stocks in the highest quintile of projected EPS growth performed the worst. This was particularly troublesome for strategies that attempt to take advantage of earnings growth on the basis that it will drive future price appreciation.

Small-cap stocks sprinted out of the blocks in the opening quarter of 2006 with the materials sector providing leadership. The Fund’s near-equal weight to health care related stocks was additive during the quarter as was a sizable allocation to the retail companies. Consumer stocks Coldwater Creek, GameStop, and Tractor Supply all contributed significantly to relative returns in the first quarter. Despite carrying an active overweight position in the technology sector, the Fund wasn’t able to keep pace with the high growth of the Index’s tech holdings. Avid Technology was a particular disappointment, declining 21% over the course of the period. The first quarter also marked the addition of Epoch Investment Partners (“Epoch Partners”) as a second subadvisor to the Fund, which returns the Fund to its original dual subadvised structure and adds both stock and intelligence diversification to the offering.

The U.S. stock market moved sharply lower and showed increased volatility throughout the second quarter and into the third as investors tried to decipher whether the economy was reaching an inflection point. This broad market correction was particularly painful for small-cap stocks which had risen the most leading up to the May 9th peak and struggled to recover as quickly as large-cap stocks which offered greater protection to the downside during the initial sell-off. Given the environment, it was not surprising that the Fund’s large allocation to information technology holdings made for a volatile return stream during the second and third quarters. Ultimately, the Fund’s IT positions performed slightly better than the broad technology sector and proved to be additive to relative returns. Relative returns were buoyed during the two quarter stretch by health care stocks that declined on average approximately 450 basis points (4.5%) less than those of the benchmark. The newly added subadvisor Epoch Partners was particularly instrumental in adding value in this space. The Portfolio’s significantly low weighting within the financials sector was undermining, as these stocks, and particularly those within the Portfolio, held up reasonably well during the decline and consequently had less of a hole to dig out of. The Fund’s industrial holding were disappointing in that they underperformed the Index by over 600 basis points (6.0%). While there were no true “blow-ups,” a duplicate holding in Actuant Corp detracted materially.

Small caps closed out the quarter in strong fashion fully recovering from the mid-year correction and extending gains in a value driven environment. Dissecting the Index further illustrates that the smallest quintile of market capitalization, or micro caps, performed the best, while those stocks with market caps above $1 billion dollars, which make up the majority of the Index, lagged the average return. Also interesting to note—and continuing upon a trend that emerged in the third quarter—the market was still unwilling to reward growth, as the highest quintile of historical and projected EPS growth performed the worst while companies with no historical earnings outpaced the average return. While the Fund lagged on a relative sense, the fundamental performance of the Portfolio holdings continued to be strong, with approximately 70% of the positions reporting earnings in excess of published analysts’ expectations, compared with approximately 60% for the Russell 2000 Index. Given the framework of the investable universe, that did not translate into excess performance during the quarter. Other market-wide trends held true in the Fund as well. The lowest market-cap quintile posted the strongest returns for the Fund, with the same holding true for the lowest quintile of price-to-earnings stocks. Performance leadership by sector was driven by materials stocks.

LOOKING FORWARD

Heading into 2007, the Fund is positioned with a familiar overweight to technology, a somewhat lower underweight in financials, and considerably less exposure to consumer discretionary than this time one year ago. Ford Draper and the Kalmar investment team continue to search for under-the-radar ideas with growth potential that are positioned to perform well or hold up better than most in the face of uncertain economic scenarios. In comparison, David Pearl and the team at Epoch Partners will remain focused on companies that are wisely putting their free cash flow to use or creating high levels of shareholder value.

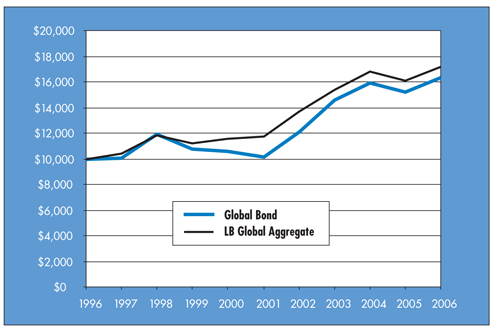

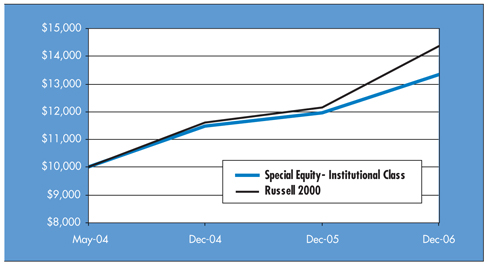

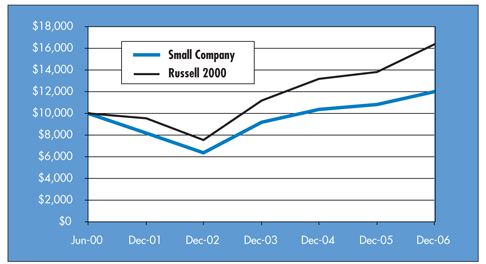

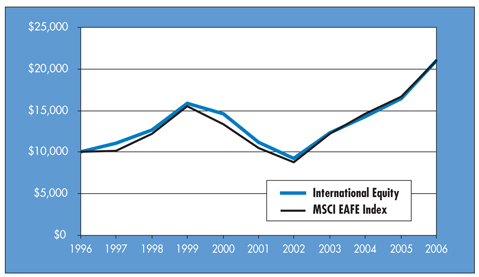

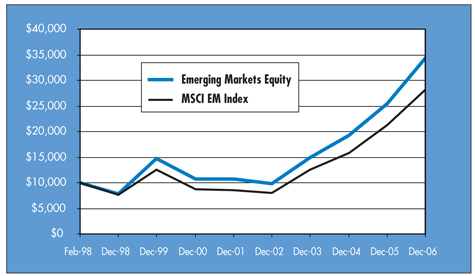

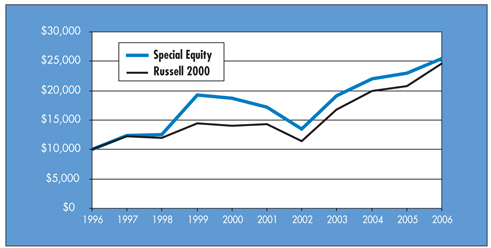

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers Small Company Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000® Index and is widely regarded in the industry as the premier measure of small cap stock performance. The Russell 3000 Index is composed of 3000 of the largest U.S. companies, as determined by market capitalization which represents approximately 98% of the investable U.S. equity market. Unlike the Fund, the Russell 2000 Index is unmanaged, is not available for investment, and does not incur expenses. This graph compares a hypothetical $10,000 investment made in the Managers Small Company Fund on June 19, 2000, to a $10,000 investment made in the Russell 2000 Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes

14

Managers Small Company Fund

Portfolio Managers’ Comments (continued)

that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for Managers Small Company Fund and the Russell 2000 Index since inception through December 31, 2006.

| | | | | | | | | | | |

Average Annualized Total Returns | | One Year | | | Five Year | | | Since Inception* | | | Inception Date |

Small Company | | 10.42 | % | | 7.96 | % | | 2.79 | % | | 6/19/00 |

Russell 2000 | | 18.37 | % | | 11.39 | % | | 7.83 | % | | |

| * | Commencement of operations was June 19, 2000. |

15

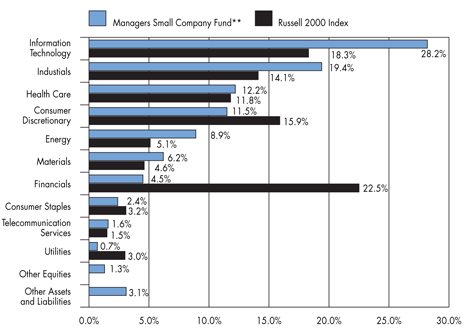

Managers Small Company Fund

Fund Snapshots

December 31, 2006

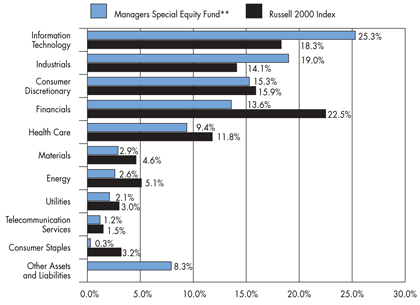

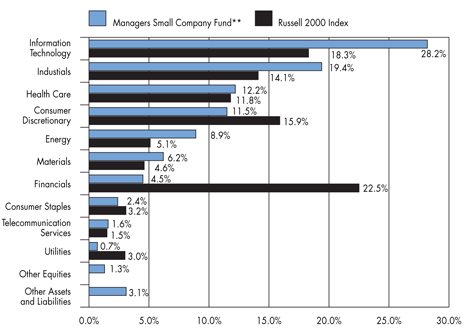

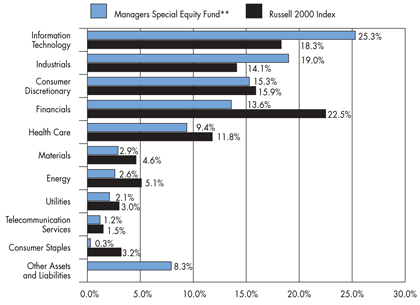

Portfolio Breakdown

| | | | | | |

Industry | | Managers Small

Company Fund** | | | Russell

2000 Index | |

Information Technology | | 28.2 | % | | 18.3 | % |

Industrials | | 19.4 | % | | 14.1 | % |

Health Care | | 12.2 | % | | 11.8 | % |

Consumer Discretionary | | 11.5 | % | | 15.9 | % |

Energy | | 8.9 | % | | 5.1 | % |

Materials | | 6.2 | % | | 4.6 | % |

Financials | | 4.5 | % | | 22.5 | % |

Consumer Staples | | 2.4 | % | | 3.2 | % |

Telecommunication Services | | 1.6 | % | | 1.5 | % |

Utilities | | 0.7 | % | | 3.0 | % |

Other Equities | | 1.3 | % | | 0.0 | % |

Other Assets and Liabilities | | 3.1 | % | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | |

Security Name | | Percentage of

Net Assets | |

Infocrossing, Inc.* | | 1.8 | % |

Sonosite, Inc. | | 1.5 | |

THQ, Inc. | | 1.5 | |

Service Corp. International* | | 1.4 | |

iShares Russell 2000 Index Fund* | | 1.4 | |

Albemarle, Corp. | | 1.3 | |

Fair Issac Corp. | | 1.2 | |

Cincinnati Bell, Inc. | | 1.2 | |

Florida East Coast Industries, Inc. | | 1.2 | |

Avocent Corp. | | 1.2 | |

Top Ten as a Group | | 13.7 | % |

| | | |

| * | Top Ten Holding at June 30, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

16

Managers Small Company Fund

Schedule of Portfolio Investments

December 31, 2006

| | | | | | |

| | | Shares | | | Value |

Common Stocks - 96.9% | | | | | | |

Consumer Discretionary - 11.5% | | | | | | |

1-800-FLOWERS.COM, Inc.* | | 6,575 | | | $ | 40,502 |

Aaron Rents, Inc. | | 5,035 | | | | 144,907 |

Arbitron, Inc. | | 3,250 | | | | 141,180 |

BJ’s Restaurants, Inc.* | | 4,200 | | | | 84,882 |

Carter’s, Inc.* | | 6,550 | | | | 167,025 |

Coldwater Creek, Inc.* | | 12,430 | 2 | | | 304,784 |

Denny’s Corp.* | | 23,150 | | | | 109,037 |

Fred’s, Inc. | | 8,040 | | | | 96,802 |

GameStop Corp.* | | 4,485 | 2 | | | 247,168 |

Guitar Center, Inc.* | | 4,350 | 2 | | | 197,751 |

Insight Enterprises, Inc.* | | 14,805 | | | | 279,370 |

Life Time Fitness, Inc.* | | 6,255 | 2 | | | 303,430 |

Luby’s, Inc.* | | 9,390 | | | | 102,257 |

Multimedia Games, Inc.* | | 12,950 | | | | 124,320 |

O’Reilly Automotive, Inc.* | | 3,725 | 2 | | | 119,423 |

Penn National Gaming, Inc.* | | 3,400 | | | | 141,508 |

Red Robin Gourmet Burgers, Inc.* | | 5,020 | | | | 179,967 |

Ruby Tuesday, Inc. | | 6,300 | | | | 172,872 |

Service Corp. International | | 52,250 | | | | 535,563 |

Shuffle Master, Inc.* | | 9,300 | | | | 243,660 |

Stride Rite Corp., The | | 9,230 | | | | 139,188 |

Toro Co. | | 7,800 | | | | 363,714 |

Tractor Supply Co.* | | 4,300 | 2 | | | 192,253 |

Total Consumer Discretionary | | | | | | 4,431,563 |

Consumer Staples - 2.4% | | | | | | |

Boston Beer Co., Inc.* | | 4,440 | | | | 159,751 |

Central European Distribution Corp.* | | 5,551 | | | | 164,865 |

Elizabeth Arden, Inc.* | | 7,800 | | | | 148,590 |

Performance Food Group Co.* | | 9,900 | | | | 273,636 |

Sensient Technologies Corp. | | 2,170 | | | | 53,382 |

Sunopta, Inc.* | | 8,590 | | | | 75,592 |

Susser Holdings Corp.* | | 2,870 | | | | 51,660 |

Total Consumer Staples | | | | | | 927,476 |

Energy - 8.9% | | | | | | |

Atwood Oceanics, Inc.* | | 3,600 | 2 | | | 176,292 |

Buckeye Partners LP. | | 1,830 | | | | 85,058 |

Core Laboratories N.V.* | | 2,160 | 2 | | | 174,960 |

Delta Petroleum Corp.* | | 6,365 | 2 | | | 147,413 |

Duvernay Oil Corp.* | | 3,400 | | | | 100,674 |

GMX Resources, Inc.* | | 4,640 | | | | 164,720 |

Niko Resources, Ltd. | | 4,700 | | | | 335,909 |

Oceaneeing International Inc.* | | 2,950 | 2 | | | 117,115 |

OMI Corp. | | 14,700 | | | | 311,199 |

Parallel Petroleum Corp.* | | 16,515 | | | | 290,169 |

Seacor Holdings, Inc.* | | 2,500 | 2 | | | 247,850 |

Superior Well Services, Inc.* | | 2,340 | | | | 59,810 |

Tidewater, Inc. | | 3,575 | | | | 172,887 |

TODCO Class A* | | 11,850 | 2 | | | 404,915 |

Ultra Petroleum Corp.* | | 7,425 | | | | 354,544 |

Warren Resources, Inc.* | | 23,850 | | | | 279,522 |

Total Energy | | | | | | 3,423,037 |

Financials - 4.5% | | | | | | |

Amcore Financial, Inc. | | 6,100 | | | | 199,287 |

Boston Private Financial Holdings, Inc. | | 3,275 | | | | 92,388 |

First Republic Bank | | 2,450 | 2 | | | 95,746 |

First State Bancorporation | | 11,200 | | | | 277,200 |

Hub International, Ltd. | | 3,550 | | | | 111,434 |

NorthStar Realty Finance Corp. | | 15,400 | | | | 255,178 |

Signature Bank* | | 9,860 | | | | 305,463 |

Tejon Ranch Co.* | | 2,600 | | | | 145,184 |

UMB Financial Corp. | | 6,500 | | | | 237,315 |

Total Financials | | | | | | 1,719,195 |

Health Care - 12.2% | | | | | | |

Amedisys, Inc.* | | 4,400 | | | | 144,628 |

America Service Group, Inc.* | | 12,450 | | | | 198,827 |

Analogic Corp. | | 3,600 | | | | 202,104 |

Arrow International, Inc. | | 4,400 | | | | 155,672 |

Cooper Companies, Inc., The | | 5,675 | 2 | | | 252,537 |

Covance, Inc.* | | 4,690 | 2 | | | 276,288 |

Emageon, Inc.* | | 8,650 | | | | 132,864 |

Endo Pharmaceuticals Holdings, Inc.* | | 13,450 | | | | 370,951 |

Inverness Medical Innovations, Inc.* | | 6,300 | | | | 243,810 |

IRIS International, Inc.* | | 13,300 | | | | 168,245 |

Martek Biosciences Corp.* | | 2,300 | | | | 53,682 |

HealthExtras, Inc.* | | 2,930 | | | | 70,613 |

Pediatrix Medical Group, Inc.* | | 3,000 | | | | 146,700 |

PSS World Medical, Inc.* | | 15,025 | 2 | | | 293,438 |

Resmed, Inc.* | | 5,895 | 2 | | | 290,152 |

Respironics, Inc.* | | 8,375 | | | | 316,156 |

Rural/Metro Corp.* | | 45,310 | | | | 368,370 |

The accompanying notes are an integral part of these financial statements.

17

Managers Small Company Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares | | | Value |

Health Care - 12.2% (continued) | | | | | | |

Sonosite, Inc.* | | 19,200 | | | $ | 593,856 |

Sunrise Senior Living, Inc.* | | 5,950 | | | | 182,784 |

United Surgical Partners International, Inc.* | | 8,325 | 2 | | | 236,014 |

Total Health Care | | | | | | 4,697,691 |

Industrials - 19.4% | | | | | | |

Actuant Corp., Class A | | 9,035 | | | | 430,518 |

Aeroflex, Inc.* | | 22,210 | | | | 260,301 |

Alliant Techsystems, Inc.* | | 4,300 | 2 | | | 336,217 |

American Ecology Corp. | | 16,650 | | | | 308,192 |

Carlisle Co., Inc. | | 1,875 | | | | 147,187 |

Chicago Bridge & Iron Co. N.V. | | 11,325 | | | | 309,626 |

ChoicePoint, Inc.* | | 4,425 | | | | 174,256 |

Corrections Corp. of America* | | 8,662 | | | | 391,782 |

CoStar Group, Inc.* | | 1,045 | | | | 55,970 |

DeVry, Inc. | | 12,100 | | | | 338,800 |

DRS Technologies, Inc. | | 6,800 | 2 | | | 358,224 |

Dycom Industries, Inc.* | | 12,850 | | | | 271,392 |

EDO Corp. | | 14,350 | | | | 340,669 |

Encore Wire Corp. | | 3,900 | | | | 85,839 |

Florida East Coast Industries, Inc. | | 7,480 | | | | 445,808 |

HIS, Inc., Class A* | | 5,200 | | | | 205,296 |

K&F Industries Holdings, Inc.* | | 13,450 | | | | 305,450 |

Kennametal, Inc. | | 2,300 | | | | 135,355 |

Laureate Education, Inc.* | | 5,500 | 2 | | | 267,465 |

Learning Tree International, Inc.* | | 16,900 | | | | 150,241 |

Manitowoc Co., The | | 4,350 | | | | 258,521 |

Mobile Mini, Inc.* | | 10,725 | | | | 288,931 |

MSC Industrial Direct Co., Class A | | 6,900 | | | | 270,135 |

Navigant Consulting, Inc.* | | 6,950 | | | | 137,332 |

NCI Building Systems, Inc.* | | 4,550 | | | | 235,462 |

Si International, Inc.* | | 4,550 | | | | 147,511 |

Tetra Technologies, Inc.* | | 10,500 | | | | 189,945 |

UTI Worldwide, Inc. | | 9,900 | | | | 296,010 |

Wabash National Corp. | | 7,360 | | | | 111,136 |

Washington Group International, Inc.* | | 3,350 | | | | 200,297 |

Total Industrials | | | | | | 7,453,868 |

Information Technology - 28.2% | | | | | | |

Actuate Corp.* | | 34,010 | | | | 202,019 |

Acxiom Corp. | | 10,225 | | | | 262,271 |

ADC Telecommunications, Inc.* | | 6,200 | 2 | | | 90,086 |

Alliance Data Systems Corp.* | | 4,200 | 2 | | | 262,374 |

aQuantive, Inc.* | | 4,125 | 2 | | | 101,723 |

Arris Group, Inc.* | | 21,990 | | | | 275,095 |

ATMI, Inc.* | | 9,725 | 2 | | | 296,904 |

Avocent Corp.* | | 13,150 | | | | 445,128 |

Benchmark Electronics, Inc.* | | 10,725 | | | | 261,261 |

Ceridian Corp.* | | 9,375 | 2 | | | 262,312 |

Concur Technologies, Inc.* | | 6,320 | | | | 101,373 |

Cypress Semiconductor Corp.* | | 19,650 | 2 | | | 331,496 |

Diebold, Inc. | | 7,450 | | | | 347,170 |

Diodes, Inc.* | | 2,875 | | | | 102,005 |

DTS, Inc.* | | 12,960 | | | | 313,502 |

Euronet Worldwide, Inc.* | | 4,130 | | | | 122,620 |

Fair Isaac Corp. | | 11,300 | | | | 459,345 |

FEI Co.* | | 5,550 | | | | 146,353 |

Infocrossing, Inc.* | | 42,310 | | | | 689,653 |

Intermec, Inc.* | | 3,830 | 2 | | | 92,954 |

Internap Network Services Corp.* | | 6,050 | | | | 120,213 |

International Rectifier Corp.* | | 3,725 | | | | 143,524 |

Macrovision Corp.* | | 6,700 | 2 | | | 189,342 |

Mantech International Corp., Class A* | | 2,440 | 2 | | | 89,865 |

MPS Group, Inc.* | | 13,870 | | | | 196,677 |

NCI, Inc., Class A* | | 5,900 | 2 | | | 90,211 |

NICE Systems, Ltd. * | | 5,940 | | | | 182,833 |

Occam Networks, Inc.* | | 6,030 | | | | 99,495 |

Online Resources Corp.* | | 5,925 | | | | 60,494 |

OPNET Technologies, Inc.* | | 9,925 | | | | 143,416 |

Polycom, Inc.* | | 9,775 | 2 | | | 302,145 |

Powerwave Technologies, Inc.* | | 48,520 | | | | 312,954 |

Progress Software Corp.* | | 6,975 | | | | 194,812 |

Radisys Corp.* | | 9,225 | | | | 153,781 |

RightNow Technologies, Inc.* | | 8,640 | | | | 148,781 |

Rogers Corp.* | | 4,325 | | | | 255,824 |

Sapient Corp.* | | 37,880 | | | | 207,961 |

Silicon Image, Inc.* | | 32,950 | | | | 419,124 |

SRA International, Inc.* | | 8,310 | | | | 222,209 |

Sybase, Inc.* | | 16,600 | 2 | | | 410,020 |

Symmetricom, Inc.* | | 11,045 | | | | 98,521 |

TALX Corp. | | 9,170 | | | | 251,717 |

Tekelec* | | 18,250 | | | | 270,648 |

Tessera Technologies, Inc.* | | 7,300 | 2 | | | 294,482 |

THQ, Inc.* | | 17,150 | 2 | | | 557,718 |

Valueclick, Inc.* | | 11,450 | 2 | | | 270,564 |

Total Information Technology | | | | | | 10,852,975 |

The accompanying notes are an integral part of these financial statements.

18

Managers Small Company Fund

Schedule of Portfolio Investments (continued)

| | | | | | | |

| | | Shares | | | Value | |

Materials - 6.2% | | | | | | | |

Albemarle Corp. | | 7,125 | | | $ | 511,575 | |

American Vanguard Corp. | | 6,375 | | | | 101,363 | |

Cambrex, Corp. | | 12,600 | | | | 286,272 | |

CF Industries Holdings, Inc. | | 4,900 | | | | 125,636 | |

Foundation Coal Holdings, Inc. | | 8,070 | | | | 256,303 | |

Methanex Corp. | | 10,350 | | | | 283,280 | |

Nalco Holding Co.* | | 5,750 | 2 | | | 117,645 | |

Oregon Steel Mills, Inc.* | | 4,250 | | | | 265,243 | |

Schweitzer-Mauduit International, Inc. | | 4,600 | | | | 119,830 | |

Tronox, Inc. | | 19,050 | | | | 300,800 | |

Total Materials | | | | | | 2,367,947 | |

Other Equities - 1.3% | | | | | | | |

iShares Russell 2000 Index Fund | | 6,725 | | | | 524,886 | |

Telecommunication Services - 1.6% | | | | | | | |

Cbeyond, Inc.* | | 4,985 | | | | 152,491 | |

Cincinnati Bell, Inc.* | | 98,570 | | | | 450,465 | |

Total Telecommunication Services | | | | | | 602,956 | |

Utilities - 0.7% | | | | | | | |

Westar Energy, Inc. | | 10,050 | | | | 260,898 | |

Total Common Stocks

(cost $31,241,806) | | | | | | 37,262,492 | |

Other Investment Companies - 25.0%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.32%3 | | 8,431,145 | | | | 8,431,145 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.18% | | 1,159,494 | | | | 1,159,494 | |

Total Other Investment Companies

(cost $9,590,639) | | | | | | 9,590,639 | |

Total Investments - 121.9%

(cost $40,832,445) | | | | | | 46,853,131 | |

Other Assets, less Liabilities - (21.9)% | | | | | | (8,415,089 | ) |

Net Assets - 100.0% | | | | | $ | 38,438,042 | |

The accompanying notes are an integral part of these financial statements.

19

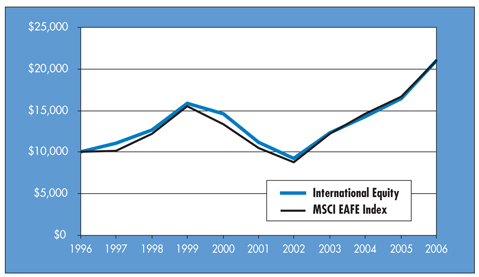

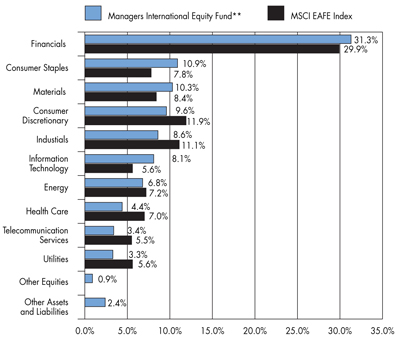

Managers International Equity Fund

Portfolio Managers’ Comments

The Managers International Equity Fund’s (the “Fund”) objective is to achieve long-term capital appreciation. Income is the Fund’s secondary objective.

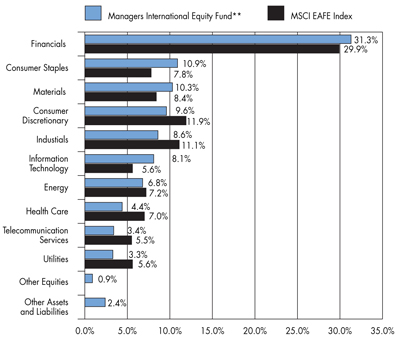

The Managers International Equity Fund ordinarily invests at least 80% of assets in equity securities, and 65% of the assets in common and preferred stocks of companies domiciled outside the United States. The Fund intends to diversify investments among countries and normally to hold securities of non-U.S. companies in not less than three countries. Investments may be made in companies in developed as well as developing countries. The Fund may invest in fixed-income securities denominated in both foreign and domestic currencies and may engage in currency hedging strategies. The Fund may invest in companies of any size. The MSCI EAFE Index is the benchmark for the Fund.

THE PORTFOLIO MANAGERS

The Fund employs multiple portfolio managers who specialize in distinct investment approaches. This “intelligence diversification” not only serves to manage risk, but also helps us tap the markets’ full potential by focusing different analytical insights on each class of investment. Fund management strives to achieve this performance and diversification while ensuring that the Fund operates within the framework of its investment objective and principal investment strategies.

AllianceBernstein L.P.

AllianceBernstein L.P.’s (“Bernstein”) approach to investing is value-based and research driven. The thesis of Bernstein is that human nature leads investors to buy and sell financial assets based on an overreaction to near-term events as they confuse temporary or cyclical characteristics with structural change. Thus, short-term problems, which cause profits and stocks to decline, can create buying opportunities, as investors underestimate the potential for corrective strategies to restore long-term earnings power. The investment team, led by Kevin Simms, attempts to exploit this by using research to separate fact from emotion.

The primary driver of Bernstein’s performance is research-driven security selection. They begin with a broad universe of all companies within the countries of the MSCI All Country World Index ex U.S. universe with a market capitalization greater than $750 million. The investment team screens this universe with a proprietary return model in order to identify the companies with the most attractive value attributes. The model derives an expected return for each company within the universe by assessing companies both from a global industry-based perspective and from a country-based standpoint, based on such factors as price to cash earnings, price to book, return on equity, and price momentum.

The ideal company exhibits many of the following traits:

| | • | | Sound future business prospects |

Portfolio Construction

| | • | | Initial investable universe is comprised of all companies within the countries of the MSCI All Country World Index ex U.S. universe with a market capitalization greater than $750 million |

| | • | | Investment team screens this universe with a proprietary return model in order to identify the companies with the most attractive value attribute |

| | • | | The model derives an expected return for each company within the universe by assessing companies both from a global industry-based perspective and from a country-based standpoint |

| | • | | Factors include price to cash earnings, price to book, return on equity, and price momentum |

| | • | | Analysts perform extensive research, focusing on the most attractively valued stocks |

| | • | | They then build detailed spreadsheets of historical and projected balance-sheet and income-statement information in order to estimate: |

| | • | | Normalized earnings power |

| | • | | Cash flow and asset values for each company for the next five years |

| | • | | Perform simulations to see the potential impact of changes in various financial-statement components |

| | • | | Analysts present their estimates and ratings for each security to the Research Review Committee of the Investment Policy Group (IPG) |

| | • | | The Committee challenges the analysts’ assumptions and conclusions to ensure they are sound. |

The Portfolio

| | • | | Typically holds 35-70 stocks |

��

| | • | | Initial stock weightings are 0.5% - 3.5% |