UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03752

THE MANAGERS FUNDS

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2007 – DECEMBER 31, 2007

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

ANNUAL REPORT

Managers Funds

December 31, 2007

Managers Special Equity Fund

Managers Special Equity Fund

Annual Report – December 31, 2007

| | |

TABLE OF CONTENTS | | Page |

LETTER TO SHAREHOLDERS | | 1 |

| |

ABOUT YOUR FUND’S EXPENSES | | 3 |

| |

INVESTMENT MANAGERS’ COMMENTS, FUND SNAPSHOT,

AND SCHEDULE OF PORTFOLIO INVESTMENTS | | |

| |

Managers Special Equity Fund | | 4 |

| |

FINANCIAL STATEMENTS: | | |

| |

Statement of Assets and Liabilities | | 15 |

| |

Fund’s balance sheet, net asset value (NAV) per share computation and cumulative undistributed amount | | |

| |

Statement of Operations | | 16 |

| |

Detail of sources of income, Fund expenses, and realized and unrealized gains (losses) during the year | | |

| |

Statement of Changes in Net Assets | | 17 |

| |

Detail of changes in Fund assets for the past two years | | |

| |

FINANCIAL HIGHLIGHTS | | 18 |

| |

Historical net asset values per share, distributions, total returns, expense ratios, turnover ratios and net assets | | |

| |

NOTES TO FINANCIAL STATEMENTS | | 19 |

| |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 22 |

| |

TRUSTEES AND OFFICERS | | 23 |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of The Managers Funds or Managers AMG Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholder:

Financial markets became increasingly unsettled as 2007 progressed, beginning with a brief but strong correction in February and then escalating in June when revelations of significant losses from sub-prime mortgage lending and related structured securities started a domino run that has affected the global economy. While the economy gained strength in the early part of the year, in spite of housing weakness, a liquidity crisis initiated by the spreading weakness in sub-prime mortgage loans increased uncertainty about its sustainability. Bonds of all credit quality and duration became unusually volatile, and credit spreads, having been extremely slim, widened dramatically, raising the cost of capital for many borrowers. Naturally the equity markets followed suit and became more volatile as the rising cost of capital pressured corporate profitability, penalized leverage, and hindered merger and acquisition activity.

As has been well documented in the financial press, the broad deterioration in residential housing prices, combined with gradually rising interest rates, put severe stress on low credit-quality (sub-prime) borrowers. Rising defaults pushed several mortgage lenders and leveraged sub-prime mortgage investors toward bankruptcy, and catalyzed a swift and broad flight from various forms of investment risk over the year. These revelations began creating serious liquidity problems in the credit markets late in the second quarter and have been the root of uncertainty and market volatility ever since.

A rapid and at times seemingly indiscriminate flight from risk created unusual patterns of volatility within the bond market. Credit spreads widened significantly beginning in July, as Moody’s and S&P downgraded hundreds of securities, and price moves forced leveraged investors to raise cash any way they could. Since much of the leverage had been funded with short-term debt, the short end of the yield curve bore the brunt of the liquidity crisis. The typically docile commercial paper market seized as demand dried up, and short-term Treasury yields vacillated between 2.9% and 4.9% as investors raced to safety, causing a dislocation in prices. Since then, as the Federal Reserve pumped liquidity into the system and aggressively lowered policy rates, short-term yields have dropped dramatically and the treasury yield curve has steepened. Yet, credit spreads have continued to expand as investment grade yields have not dropped along with treasuries and non-investment grade (Junk) yields have continued to rise. This is because dominoes have continued to fall as large financial institutions continue to discover weaknesses in their portfolios and write billions of dollars off of their balance sheets.

After rallying strongly off of a February trough, the stock market followed the lead of the credit markets by trading sharply down during the liquidity crisis in July, then recovering from late August through October. Not surprisingly, small- and mid-cap stocks reacted more during the price declines, and underperformed large-cap stocks during the year. Interestingly, however, growth indices, which would normally react poorly to a rise in interest rates or a liquidity squeeze, significantly outperformed value indices during the period. We believe this was due to in part to a reversion to the mean since value indices had outperformed growth indices for an extended period of time, and also to technical supply/demand effects brought on by the liquidity crisis. Importantly, we believe this was also the result of extreme weakness in the financials sector, which has a dominant role in most value indices. Stocks recovered in late August and throughout October, as a result of an infusion of liquidity by the Federal Reserve, but corrected again in November and December with evidence mounting that the economy was slowing, and stock investors expressed disappointment that the Fed was not acting even more aggressively, while revelations of subprime losses continued to emanate from financial companies.

Within this environment, Managers Special Equity Fund slightly outperformed its benchmark, providing a marginally negative return for the year. The Managers Class shares returned -0.60%, the Institutional Class shares returned -0.39%, and the benchmark Russell 2000® Index, returned -1.57% for the year. A detailed review of the performance and positioning of the Fund, including a discussion of the subadvisor change we implemented in December 2007, is included within this report.

Our fear that the credit crisis would extend into 2008 has been realized, as lingering credit problems and further revelations of losses by large financial institutions are hindering not only the financial markets, but the economy as well. The increasing possibility that the economy will slide into recession has driven volatility higher, and stock prices lower. The Federal Reserve has been increasingly aggressive in easing rates, and although we think the risk of recession has increased, we still believe that portions of the U.S. and global economies remain healthy. Although foreign and emerging markets economies are by no means decoupled from U.S. impact, they have become increasingly diversified with respect to trading partners, and have increasingly healthy reserves. In sum,

1

Letter to Shareholders (continued)

we continue to believe that investors should maintain their portfolios with allocations near their long-run targets, rebalance if necessary and take full advantage of opportunities to participate in the growth of the global economy.

One of our foremost goals at Managers Investment Group is to structure and manage mutual funds that will help our shareholders and clients become more successful in reaching their investment goals and objectives. Each of our Funds is geared to provide you with exposure to a specific asset class, combination of asset classes, or segment of the market. Investors tend to use our Funds as part of their overall asset allocation in order to structure a well-diversified portfolio intended to meet individual needs. Most of our Funds, like those detailed in this report, are therefore designed to be building blocks.

The following report covers the year ending December 31, 2007. Should you have any questions about this report, or if you’d like to receive a Prospectus and additional information, including fees and expenses, for this or any of the other Funds in our family, please feel free to contact us at 1-800-835-3879, or visit our website at www.managersinvest.com. As always, please read the Prospectus carefully before you invest or send money.

If you are curious about how you can better diversify your investment program, visit the Knowledge Center on our Web site and view our articles in the investment strategies section. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

We thank you for your continued confidence and investment in The Managers Funds.

Sincerely,

John H. Streur

Senior Managing Partner

Managers Investment Group LLC

2

About Your Fund’s Expenses (unaudited)

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Fund incurs only ongoing costs. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table to the right provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table to the right provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | |

Six Months Ended December 31, 2007 | | Expense

Ratio for the

Period | | | Beginning

Account Value

7/01/2007 | | Ending

Account Value

12/31/2007 | | Expenses

Paid During

the Period* |

Managers Special Equity Fund - Managers Shares | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.39 | % | | $ | 1,000 | | $ | 905 | | $ | 6.67 |

Based on Hypothetical 5% Annual Return | | 1.39 | % | | $ | 1,000 | | $ | 1,018 | | $ | 7.07 |

Managers Special Equity Fund - Institutional Shares | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.18 | % | | $ | 1,000 | | $ | 906 | | $ | 5.69 |

Based on Hypothetical 5% Annual Return | | 1.18 | % | | $ | 1,000 | | $ | 1,019 | | $ | 6.01 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

Managers Special Equity Fund

Portfolio Managers’ Comments

The Managers Special Equity Fund’s (the “Fund”) objective is to achieve long-term capital appreciation through a diversified portfolio of equity securities of small and medium-sized companies.

THE PORTFOLIO MANAGERS

The Fund employs multiple portfolio managers who specialize in distinct investment approaches. This “intelligence diversification” is designed to not only manage risk but also to help us tap the markets’ full potential by focusing different analytical insights on each class of investment. Fund management strives to achieve this performance and diversification while ensuring that the Fund operates within the framework of its investment objective and principal investment strategies.

Smith Asset Management Group LP

The Fund’s Board of Trustees approved the addition of Smith Asset Management Group LP (“Smith Group”) to the lineup of subadvisors for the Fund during the second quarter of 2006. Smith Group’s investment process is based on a combination of a well-conceived quantitative screening process coupled with experienced, intelligent fundamental and qualitative analysis. The team is focused on predicting which attractively valued companies will report a succession of positive earnings surprises. The process begins by seeking companies with attractive risk profiles and valuations as well as dramatically improving business fundamentals. To manage risk, Smith Group screens for companies with good corporate governance, strong financial quality, attractive valuation, and moderate portfolio beta. To identify high earnings growth companies, Smith Group screens for rising earnings expectations, improving earnings quality, a high-percentage positive earnings surprise, and high earnings growth rate.

Ideal Company:

Low-risk, as evidenced by:

| | • | | Moderate portfolio beta |

| | • | | Strong financial quality |

| | • | | Good corporate governance |

High earnings growth, as evidenced by:

| | • | | Rising earnings expectations |

| | • | | Improving earnings quality |

| | • | | High percentage positive earnings surprise |

| | • | | High earnings growth rate |

Portfolio Management:

| | • | | Takes a bottom-up stock picking approach |

| | • | | Uses a combination of quantitative and fundamental analysis |

| | • | | Focuses on identifying risks created by corporate governance and financial reporting practices |

| | • | | Builds a portfolio of 100-120 stocks |

The Portfolio:

| | • | | Holdings across all sectors |

| | • | | Individual stock exposure limited to a maximum of 3.0% |

| | • | | Moderate turnover of approximately 50-60% |

| | • | | Sector weighting maximum of two times the Russell 2000® Index |

Sell Discipline:

Portfolio holdings are sold if:

| | • | | A negative earnings surprise is predicted by either the process or management guidance |

| | • | | A negative earnings surprise is actually reported |

| | • | | The stock’s valuation level is too high |

| | • | | A buyout announcement is made |

Donald Smith & Co., Inc.

Donald Smith & Co., Inc. (“Donald Smith”) is a value manager that invests in out-of-favor small-capitalization companies. Donald Smith’s philosophy seeks to identify companies in the bottom decile of price-to-tangible-book-value ratios, with a strong balance sheet, and a positive outlook for earnings potential over the next two to four years. Donald Smith believes that extremely low P/B ratio companies often trade below replacement value, are inherently less risky, and are more likely to be acquired. Furthermore, because only a few investment managers focus on companies in the lowest P/B ratio decile, their stocks may be inefficiently priced and can offer tremendous value.

Donald Smith’s process begins by looking for companies in the lowest 10% of price-to-tangible-book-value ratios with a strong balance sheet and a positive outlook for earnings potential over the next two to four years. Donald Smith also assesses price-to-earnings, price-to-sales, and debt-to-capital ratios to form a “watch list” of about 300 securities. After valuations are addressed, Donald Smith performs fundamental research, including company visits, to assess the quality of the company’s balance sheet and book value. The team is looking for a catalyst for an improvement in earnings potential that is not already reflected in the stock price. A concentrated portfolio of 40-50 stocks is the result. Stocks are sold when a target price has been achieved, usually set at less than 2x book value. Positions may also be sold if the stock appreciates rapidly, if a better idea is found, or if fundamentals deteriorate. Portfolio turnover is low at 20-40% annually.

The ideal company exhibits many of the following traits:

| | • | | Low price-to-book value |

| | • | | Positive earnings potential over the next two to four years |

Portfolio Management:

| | • | | Focuses on lowest decile of price-to-tangible book value stocks |

| | • | | Price-to-earnings, price-to-sales, and debt-to-capital also assessed from valuation standpoint |

| | • | | Concentrates the portfolio in 40-50 stocks |

The Portfolio:

| | • | | Value oriented holdings |

| | • | | Initial stock weightings are generally 3% - 3.5% |

| | • | | Typically holds 40-50 stocks |

| | • | | Average turnover between 20-40% annually |

The following factors influence the sell decision when:

| | • | | Target price is reached, usually less than 2x book value |

| | • | | Stock appreciates rapidly |

| | • | | Fundamentals deteriorate |

4

Managers Special Equity Fund

Portfolio Managers’ Comments (continued)

Lord, Abbett & Co. LLC

In December 2007, the Fund’s Board of Trustees approved the addition of Lord, Abbett & Co. LLC (“Lord Abbett”), to the Fund’s lineup of subadvisors. The team at Lord Abbett led by Tom O’Halloran, selects stocks by focusing on companies that have revenue growth of at least 15%, are experiencing year-to-year operating margin improvement, and are experiencing earnings growth that is driven by top-line growth rather than by one-time events or simple cost-cutting measures. The focus is also on identifying companies with higher quality balance sheets (often captured by finding companies with manageable debt-to-total-capital ratios) and that are already profitable. Once this process is completed, the focus for the team is on forecasting both revenue and earnings growth over the next several years. To achieve this goal, and to find companies that will be growing considerably faster than their industry average, members of the team spend an extensive amount of time understanding the competitive advantages of a firm, the industry dynamics within which they operate, and the strength of management.

A position is sold or trimmed if there is a fundamental change in the business, a more attractive alternative is found, or if a holding reaches a 5% weight in the overall Portfolio.

The Portfolio typically holds between 100 and 150 stocks with no individual holding exceeding 5%. There is a risk constraint that prevents any individual industry from being greater than 25% of the total portfolio weight.

Skyline Asset Management, L.P.

The investment team from Skyline Asset Management, L.P. (“Skyline”) looks for small-capitalization stocks that have below-average valuations with above-average growth prospects. Skyline’s research effort focuses on finding good companies that are overlooked or not widely followed. Typically they invest in firms with market caps of less than $2 billion. The selection process involves using outside research services, computer screens, and internally maintained lists of potential companies/stocks to identify new ideas. These ideas are then screened to determine whether they meet certain basic criteria: relative valuation, capitalization, financial strength, and opportunities for continued growth. This screening process reduces the list from 2,000 names to 150 to 200. This list is then more rigorously analyzed to answer the question: “Why will earnings increase at an above-average rate?” All company documents are analyzed, any available industry or research reports are reviewed, and, most importantly, questions are addressed directly to senior company management.

In addition, other companies in the same industry are reviewed to determine relative valuation of the company being investigated. The final Portfolio will contain 65-85 stocks and is generally fully invested. The Portfolio will tend to be well diversified, and the Portfolio’s P/E ratio will consistently be below that of the Russell 2000® Index. Skyline sells stocks when they rise to a sell target, which is usually a P/E equal to the overall stock market, or if the company’s fundamentals have changed so that the original investment thesis is no longer valid.

The ideal company exhibits many of the following traits:

| | • | | Market capitalization less than $2 billion |

| | • | | Discounted price/earnings ratio relative to the market |

| | • | | Above average growth prospects |

| | • | | Neglected, under followed, and often out of favor |

Portfolio Management:

| | • | | Broad diversification among economic sectors |

| | • | | Keep attentive to earnings |

| | • | | Maintain favorable risk/reward |

The Portfolio:

| | • | | Stocks have a maximum weighting of 5% for each holding |

| | • | | Typically holds 65-85 stocks |

| | • | | Cash equivalents averaging less than 5% |

The following factors influence the sell decision when:

| | • | | P/E equals the market/industry P/E |

| | • | | Holding reaches 5.0% of the portfolio |

Westport Asset Management, Inc.

The investment team at Westport Asset Management, Inc. (“Westport”), led by Andy Knuth, focuses on small-capitalization companies that are determined to have significant upside potential in earnings and ROE over the next few years. Although investing for growth, Andy will purchase stocks only if they are selling at or below the market’s P/E multiple, or below valuations of other companies in the same industry. Implicit in the strategy is that Knuth and his partner Ed Nicklin focus on a small number of issues, and hold them for a long time. The concentration and low turnover enable them to heavily research and monitor each position.

The portfolio manager at Westport is focused on future profits only, and in fact prefers to find businesses that are inherently good but which have gone through a troubling period. Acquisitions or divestitures, management shake-ups, changes in the business cycle, or the development of a proprietary product in a strong industry are all factors that might improve earnings and investor perceptions. The portfolio manager will typically have a concentrated portfolio, and any industry concentrations are merely an outcome of stock selection. Because some of the companies in which he invests may not have earnings, the price-to-trailing-earnings ratio may be high, although the price-to-forward-earnings will be well below average. The management style is patient, usually turning over less than 20% per year.

The ideal company exhibits many of the following traits:

| | • | | Upside potential in earnings and ROE (return on equity) |

| | • | | Low P/E and improving earnings/cash flow |

| | • | | Company driven by entrepreneurial impact |

| | • | | Preference for turnaround story |

Portfolio Management:

| | • | | Has a two to three year time horizon on initial investments |

| | • | | Concentrates the Portfolio and has low turnover |

| | • | | Views any significant industry concentrations as merely an outcome of bottom-up fundamental analysis |

| | • | | May invest in companies that do not have earnings |

The Portfolio:

| | • | | Initial stock weightings will vary depending on liquidity |

| | • | | May have trailing P/E ratios that are higher than the market, but generally forward P/E ratios will be well below the average, because some of the companies Westport invests in may not have earnings |

5

Managers Special Equity Fund

Portfolio Managers’ Comments (continued)

| | • | | Has an average turnover of less than 20% per year |

The portfolio management team will make a sell decision when:

| | • | | A stock reaches a pre-determined price objective |

| | • | | There are negative changes in a company’s fundamentals |

Veredus Asset Management, LLC

The investment philosophy at Veredus Asset Management, LLC (“Veredus”) is based on their belief that positive earnings surprise and positive estimate revision are the key drivers of stock price change. In particular, the Veredus investment team, led by founder Tony Weber, is concerned about the sustainability of this earnings momentum. To that end, the team tends to focus more on the economic performance of a particular company as opposed to more traditional accounting measures. Specifically, the analysts and portfolio managers at Veredus look for companies with strong asset growth and accelerating rates of economic return in excess of their cost of capital. This is what they view as the true definition of wealth creation, or cash flow return on investment (CFROI). Finally, the Veredus team also believes that some technical measures, such as relative strength, flows, and trading volume, can be useful indicators of future stock performance.

The investment team at Veredus starts the research process by screening the entire universe of over 8,000 small companies for upward earnings revisions. Companies are also ranked on the basis of recent estimate changes, considering both absolute and percent change in estimates. This model provides not only a shopping list of potential targets, but the qualification work that Veredus feels is essential to market acceptance. The core of the research effort is placed on calculating the CFROI potential of companies on the target list and how Veredus’ internally developed work compares with current street expectations. The primary focus is assessing CFROI on a sequential basis as opposed to year over year. This gives the investment team a more detailed picture for possibilities of margin expansion, sales growth, and other sources of CFROI leverage. Contact with company management is also essential in researching companies in the small-cap arena.

The ideal investment exhibits many of the following traits:

| | • | | Positive earnings surprise and subsequent upward estimate revisions |

| | • | | Attacking large markets with high barriers to entry |

| | • | | Balance sheet commensurate with income statement |

Portfolio Management:

| | • | | Screens for companies which rank in the top 20% of all companies based on earnings estimate revisions and quarterly earning surprise |

| | • | | Employs extensive fundamental research |

| | • | | Seeks sustainability of company’s fundamental performance |

The investment team will make a sell decision when:

| | • | | There is an anticipated/ actual earnings disappointment |

| | • | | They see deteriorating market mechanics |

| | • | | There is a change in strategic market outlook or better idea develops |

THE YEAR IN REVIEW

Over the 12 months ended December 31, 2007, the Managers Special Equity Fund Managers Class of shares returned -0.60% and the Institutional Class of shares returned -0.39%, both outpacing the -1.57% return for the Russell 2000® Index.

Although small-cap stocks finished the year modestly lower, the path taken throughout the year proved to be anything but straight. The first half of the year saw small-cap stocks continue to move higher, building on the strong performance seen from the asset class over the past several years. Even during this period, signs of what would ultimately cause the market to reverse direction were already being seen. Concerns about subprime lending were increasing, and stocks within the financials sector performed poorly during the first half. The health of the U.S. economy was heavily debated, with concerns of a potential recession and inflation fears at the forefront. Ultimately, these fears came home to roost during the third quarter, as investors became increasingly risk averse. Small-cap stocks declined in the third quarter, although a brief rally in September helped to limit the damage. While the fourth quarter got off to a good start, things quickly turned negative as investors continued to weigh their concerns over deterioration in the credit markets and the possibility of a U.S. recession.

In keeping with the risk-aversion theme, investors showed a preference for large-cap stocks over their small-cap counterparts, and growth stocks outperformed value stocks by a fairly wide margin. Within small-caps, those stocks in the top quintile of market capitalization (the largest small-cap stocks) were the best performers, while those in the bottom quintile were the worst performers for the period. For the year, growth stocks held nearly a 17% lead over value stocks within the small-cap space. Interestingly, many of the sectors within the small-cap market finished the year higher, led by strong performance in materials, energy, and health care, all of which posted solid double-digit returns for the year. Not surprisingly, financials and consumer discretionary were the worst-performing sectors for the year. These two sectors represent more than 35% of the small-cap market and therefore ultimately helped to lead the broader market indices lower for the year.

Similar to the broader markets, the Fund performed well during the first half of the year, generating positive absolute returns and outpacing the performance of the benchmark. Much of this relative performance was the result of strong stock picks within the consumer discretionary and financials sectors, as well as the Fund’s underweight position to the financials sector. As we moved into the third quarter, the markets turned negative, and though the Fund also declined, it held up better than the benchmark. The fourth quarter proved to be particularly challenging, as the Fund lost ground on a relative basis, but still finished ahead of the benchmark for the calendar year. Returns in the consumer discretionary, technology and financials sectors particularly weighed on the Fund’s performance during the final quarter. Consistent with the environment, the Fund’s growth-oriented subadvisors performed well, while the Fund’s value-oriented subadvisors encountered more headwinds in the markets. Among the Fund’s best-performing stocks for the year were DeVry Inc (+86%) and ITT Educational Services (+28%), two stocks in the education services space that bucked the broader trend of difficulties in the consumer discretionary sector. Among the Fund’s worst performers were Spansion Inc (-74%) and Visteon Corp (-48%).

6

Managers Special Equity Fund

Portfolio Managers’ Comments (continued)

LOOKING FORWARD

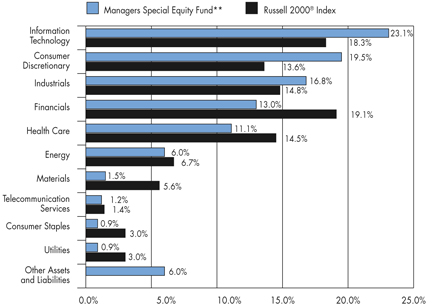

Heading into 2008, stocks within the technology, consumer discretionary, and industrials sectors continue to represent the largest exposures for the Fund, and each of these sector positions represents an overweight relative to the respective exposure in the Index. The Fund continues to hold lower-than-benchmark positions in the financials, materials, and health care sectors. In addition, we believe the Portfolio continues to be attractively valued relative to both its historical and expected earnings growth rates.

On an organizational note, as of December 2007, Kern Capital Management no longer serves as a subadvisor for the Fund.

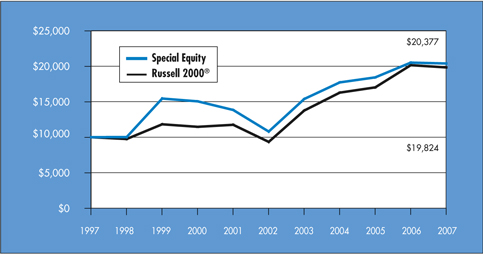

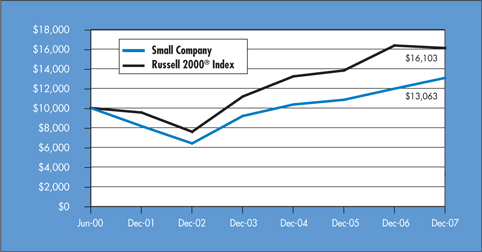

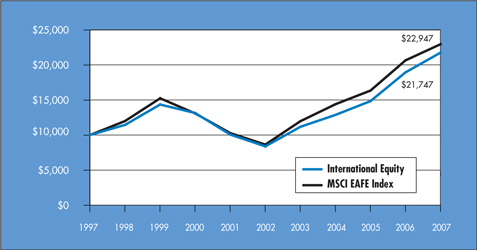

CUMULATIVE TOTAL RETURN PERFORMANCE

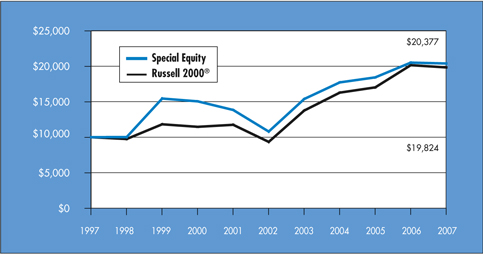

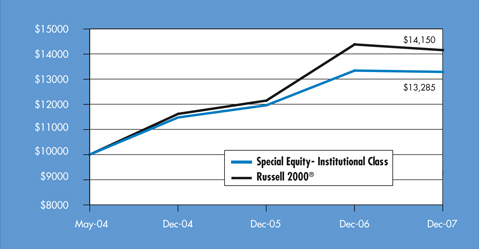

Managers Special Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which measures the performance of the 3,000 largest U.S. companies based on total market capitalization. The Index reflects no deduction for fees, expenses, or taxes. Unlike the Fund, the Russell 2000® Index is unmanaged, is not available for investment, and does not incur expenses. The first chart compares a hypothetical $10,000 investment made in Managers Special Equity Fund– Managers Class on December 31, 1997, to a $10,000 investment made in the Russell 2000® Index for the same time period. The second chart compares a hypothetical $10,000 investment made in Managers Special Equity Fund– Institutional Class on May 3, 2004, to a $10,000 investment made in the Russell 2000® Index for the same time period. The graphs and tables do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Past performance is not indicative of future results.

The table below shows the average annual total returns for Managers Special Equity Fund– Managers Class and the Russell 2000® Index since December 31, 1997 through December 31, 2007.

| | | | | | | | | | | |

Average Annual Total Returns 1 | | One Year | | | Five Years | | | Ten Years | | | Inception Date |

Special Equity - Managers Class 2 | | (0.60 | )% | | 13.56 | % | | 7.38 | % | | 6/1/84 |

Russell 2000® Index | | (1.57 | )% | | 16.25 | % | | 7.08 | % | | |

7

Managers Special Equity Fund

Portfolio Managers’ Comments (continued)

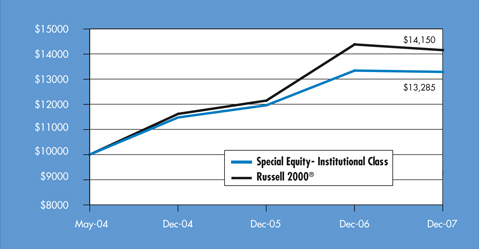

CUMULATIVE TOTAL RETURN PERFORMANCE

The table below shows the average annual total returns for Special Equity– Institutional Class and the Russell 2000® Index since May 3, 2004 through December 31, 2007.

| | | | | | | | |

Average Annual Total Returns 1 | | One Year | | | Since Inception | | | Inception Date |

Special Equity - Institutional Class 2 | | (0.39 | )% | | 8.06 | % | | 5/3/04 |

Russell 2000® Index | | (1.57 | )% | | 9.94 | % | | |

The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our website at www.managersinvest.com.

In choosing a Fund, investors should carefully consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call 800.835.3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Distributed by Managers Distributors, Inc., member FINRA.

The Fund is subject to risks associated with investments in small capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history, and a reliance on one or a limited number of products.

The Russell 2000® Index is a trademark of the Frank Russell Company. Frank Russell® is a trademark of the Frank Russell Company.

1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses. All returns are in U.S. dollars($). |

2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

8

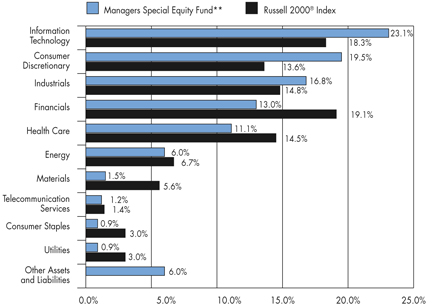

Managers Special Equity Fund

Fund Snapshots

December 31, 2007

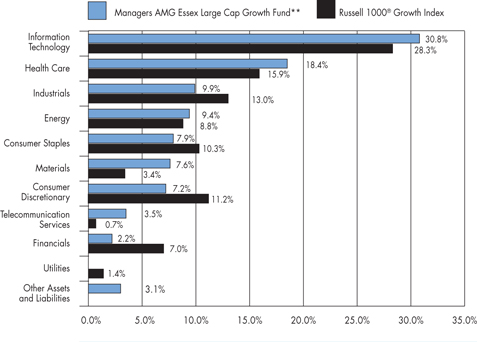

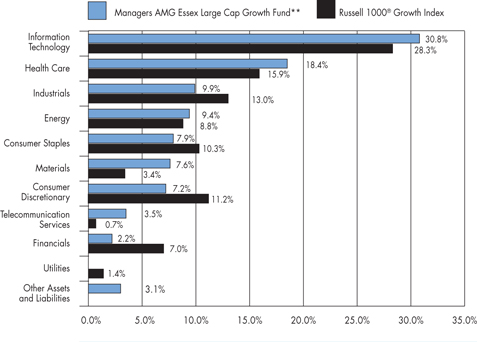

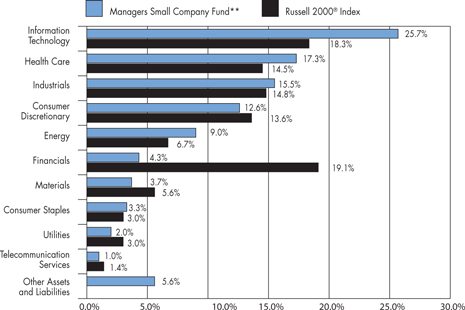

Portfolio Breakdown

| | | | | | |

Industry | | Managers Special

Equity Fund ** | | | Russell 2000®

Index | |

Information Technology | | 23.1 | % | | 18.3 | % |

Consumer Discretionary | | 19.5 | % | | 13.6 | % |

Industrials | | 16.8 | % | | 14.8 | % |

Financials | | 13.0 | % | | 19.1 | % |

Health Care | | 11.1 | % | | 14.5 | % |

Energy | | 6.0 | % | | 6.7 | % |

Materials | | 1.5 | % | | 5.6 | % |

Telecommunication Services | | 1.2 | % | | 1.4 | % |

Consumer Staples | | 0.9 | % | | 3.0 | % |

Utilities | | 0.9 | % | | 3.0 | % |

Other Assets and Liabilities | | 6.0 | % | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | |

Security Name | | Percentage of

Net Assets | |

MI Developments, Inc., Class A* | | 2.3 | % |

DeVry, Inc.* | | 2.3 | |

Air France-KLM, ADR* | | 1.7 | |

Plains Exploration & Production Co. | | 1.6 | |

Semiconductor Manufacturing International Corp.* | | 1.5 | |

ITT Educational Services, Inc.* | | 1.4 | |

Ross Stores, Inc.* | | 1.2 | |

Charles River Laboratories International, Inc. | | 1.2 | |

Saks, Inc. | | 1.1 | |

Illumina, Inc. | | 1.0 | |

| | | |

Top Ten as a Group | | 15.3 | % |

| | | |

| * | Top Ten Holding at June 30, 2007 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

9

Managers Special Equity Fund

Schedule of Portfolio Investments

December 31, 2007

| | | | | | |

| | | Shares | | | Value |

Common Stocks - 94.0% | | | | | | |

Consumer Discretionary - 19.5% | | | | | | |

Aftermarket Technology Corp.* | | 46,300 | | | $ | 1,262,138 |

American Axle & Manufacturing Holdings, Inc. | | 163,500 | | | | 3,044,370 |

Amerigon, Inc.* | | 263,725 | | | | 5,575,146 |

Big 5 Sporting Goods Corp. | | 332,500 | | | | 4,794,650 |

Big Lots, Inc.* | | 907,152 | 2 | | | 14,505,360 |

Buckle, Inc., The | | 46,000 | | | | 1,518,000 |

Capella Education Co.* | | 28,800 | | | | 1,885,248 |

Carter’s, Inc.* | | 194,300 | 2 | | | 3,759,705 |

Chipotle Mexican Grill, Inc.* | | 14,400 | | | | 2,117,808 |

Crocs, Inc.* | | 199,825 | | | | 7,355,558 |

Ctrip.com International, Ltd.* | | 59,201 | | | | 3,402,281 |

Deckers Outdoor Corp.* | | 84,430 | | | | 13,091,716 |

Desarrolladora Homex, S.A.B. de C.V. | | 32,429 | | | | 1,603,614 |

DeVry, Inc. | | 832,900 | | | | 43,277,485 |

Dick’s Sporting Goods, Inc.* | | 384,486 | | | | 10,673,331 |

Dillard’s, Inc., Class A | | 831,200 | | | | 15,609,936 |

DXP Enterprises, Inc.* | | 38,400 | | | | 1,792,512 |

Fossil, Inc.* | | 50,210 | | | | 2,107,816 |

GSI Commerce, Inc.* | | 82,113 | | | | 1,601,204 |

Guess?, Inc. | | 256,775 | | | | 9,729,205 |

Gymboree Corp.* | | 117,400 | 2 | | | 3,576,004 |

Home Inns & Hotels Management, Inc., ADR | | 49,909 | | | | 1,778,757 |

IMAX Corp.* | | 519,489 | | | | 3,542,915 |

INVESTools, Inc. | | 72,631 | | | | 1,288,474 |

ITT Educational Services, Inc.* | | 314,100 | | | | 26,783,307 |

J. Crew Group, Inc.* | | 26,614 | | | | 1,283,061 |

Jack in the Box, Inc.* | | 261,250 | 2 | | | 6,732,412 |

Jos. A. Bank Clothiers, Inc.* | | 299,990 | | | | 8,534,716 |

LKQ Corp.* | | 167,200 | | | | 3,514,544 |

MarineMax, Inc.* | | 234,100 | | | | 3,628,550 |

McCormick & Schmick’s Seafood Restaurants, Inc.* | | 162,000 | 2 | | | 1,932,660 |

Morningstar, Inc.* | | 38,685 | | | | 3,007,759 |

New Oriental Education & Technology Group, Inc., ADR* | | 40,543 | | | | 3,267,360 |

Orient-Express Hotels, Ltd. | | 289,900 | | | | 16,675,048 |

Polaris Industries, Inc. | | 60,900 | 2 | | | 2,909,193 |

Priceline.com, Inc.* | | 104,293 | | | | 11,979,094 |

Red Robin Gourmet Burgers, Inc.* | | 131,600 | | | | 4,209,884 |

Ross Stores, Inc. | | 930,000 | 2 | | | 23,780,100 |

Ruby Tuesday, Inc. | | 457,600 | | | | 4,461,600 |

Saks, Inc. | | 1,023,000 | | | | 21,237,480 |

Shutterfly, Inc.* | | 259,650 | | | | 6,652,233 |

Strayer Education, Inc. | | 16,990 | | | | 2,898,154 |

Tempur-Pedic International, Inc. | | 54,038 | | | | 1,403,367 |

Tupperware Corp. | | 128,100 | 2 | | | 4,231,143 |

Ulta Salon, Cosmetics & Fragrance, Inc. | | 74,679 | | | | 1,280,745 |

Under Armour, Inc., Class A* | | 278,394 | 2 | | | 12,157,466 |

Universal Electronics, Inc.* | | 32,100 | | | | 1,073,424 |

Visteon Corp.* | | 4,395,300 | | | | 19,295,367 |

Warnaco Group, Inc., The* | | 468,900 | | | | 16,317,720 |

Wolverine World Wide, Inc. | | 128,100 | 2 | | | 3,141,012 |

Zumiez, Inc.* | | 62,400 | | | | 1,520,064 |

Total Consumer Discretionary | | | | | | 372,800,696 |

Consumer Staples - 0.9% | | | | | | |

B&G Foods, Inc. | | 317,700 | | | | 3,243,717 |

Central European Distribution Corp.* | | 51,482 | | | | 2,990,075 |

China Nepstar Chain Drugstore Ltd. | | 60,408 | | | | 1,061,973 |

Darling International, Inc.* | | 225,900 | 2 | | | 2,611,404 |

Flowers Food, Inc. | | 153,500 | 2 | | | 3,593,434 |

Nash Finch Co. | | 55,200 | | | | 1,947,456 |

WD-40 Co. | | 39,900 | 2 | | | 1,515,003 |

Total Consumer Staples | | | | | | 16,963,062 |

Energy - 6.0% | | | | | | |

ATP Oil & Gas Corp.* | | 72,900 | 2 | | | 3,684,366 |

Cal Dive International, Inc.* | | 66,312 | | | | 877,971 |

Carrizo Oil & Gas, Inc.* | | 187,294 | | | | 10,254,346 |

Comstock Resources, Inc.* | | 552,300 | 2 | | | 18,778,200 |

Core Laboratories N.V.* | | 13,657 | | | | 1,703,301 |

Dawson Geophysical Co.* | | 54,900 | | | | 3,923,154 |

Dril-Quip, Inc. | | 37,352 | | | | 2,079,012 |

Gulfmark Offshore, Inc.* | | 48,000 | 2 | | | 2,245,920 |

Key Energy Services, Inc.* | | 308,400 | 2 | | | 4,437,876 |

Matrix Service Co.* | | 92,600 | | | | 2,020,532 |

Mitcham Industries, Inc.* | | 34,630 | | | | 711,993 |

Oceaneering International, Inc.* | | 20,824 | | | | 1,402,496 |

Overseas Shipholding Group, Inc. | | 84,768 | | | | 6,309,282 |

Parker Drilling Co.* | | 256,300 | | | | 1,935,065 |

Petroquest Energy, Inc.* | | 237,075 | | | | 3,390,172 |

Plains Exploration & Production Co.* | | 574,745 | 2 | | | 31,036,253 |

SandRidge Energy, Inc.* | | 72,400 | 2 | | | 2,596,264 |

The accompanying notes are an integral part of these financial statements.

10

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares | | | Value |

Energy - 6.0 % (continued) | | | | | | |

Stone Energy Corp.* | | 102,600 | | | $ | 4,812,966 |

Superior Energy Services, Inc. | | 31,290 | | | | 1,077,002 |

USEC, Inc.* | | 247,900 | | | | 2,231,100 |

Willbros Group, Inc.* | | 249,925 | | | | 9,569,628 |

Total Energy | | | | | | 115,076,899 |

Financials - 13.0% | | | | | | |

American Financial Group, Inc. | | 39,250 | | | | 1,133,540 |

American National Insurance Co. | | 68,950 | 2 | | | 8,359,498 |

American Physicians Capital, Inc. | | 24,850 | | | | 1,030,281 |

Aspen Insurance Holdings, Ltd. | | 343,700 | | | | 9,912,308 |

Bank of the Ozarks, Inc. | | 22,500 | | | | 589,500 |

BankUnited Financial Corp., Class A | | 601,088 | | | | 4,147,507 |

BioMed Realty Trust, Inc. | | 53,400 | 2 | | | 1,237,278 |

Brown & Brown, Inc. | | 518,700 | | | | 12,189,450 |

Cohen & Steers, Inc. | | 39,012 | | | | 1,169,190 |

Cowen Group, Inc.* | | 262,853 | | | | 2,499,732 |

Delphi Financial Group, Inc., Class A | | 189,950 | | | | 6,701,436 |

Dollar Financial Corp. | | 56,018 | | | | 1,719,192 |

Downey Financial Corp. | | 368,380 | 2 | | | 11,460,302 |

eHealth, Inc. | | 94,200 | | | | 3,024,762 |

Entertainment Properties Trust | | 23,100 | 2 | | | 1,085,700 |

FCStone Group, Inc. | | 81,000 | | | | 3,728,430 |

Financial Federal Corp. | | 159,800 | | | | 3,561,942 |

GFI Group, Inc.* | | 136,711 | | | | 13,085,977 |

Hanover Insurance Group, Inc. | | 206,200 | | | | 9,443,960 |

Harleysville Group, Inc. | | 18,000 | | | | 636,840 |

Hercules Technology Growth Capital, Inc. | | 247,100 | | | | 3,068,982 |

Hilb, Rogal & Hamilton Co. | | 305,500 | | | | 12,394,135 |

IPC Holdings, Ltd. | | 369,100 | 2 | | | 10,655,917 |

iStar Financial, Inc. | | 297,200 | | | | 7,742,060 |

Jefferies Group, Inc. | | 37,959 | | | | 874,955 |

MCG Capital Corp. | | 334,378 | | | | 3,875,441 |

MI Developments, Inc., Class A | | 1,589,100 | 2 | | | 44,288,216 |

MSCI, Inc. | | 25,744 | | | | 988,570 |

National Western Life Insurance Co., Class A | | 12,000 | | | | 2,488,440 |

Navigators Group, Inc.* | | 12,500 | | | | 812,500 |

Northwest Bancorp, Inc. | | 23,800 | 2 | | | 632,366 |

Old Second Bancorp, Inc. | | 21,300 | | | | 570,627 |

Philadelphia Consolidated Holding Co.* | | 117,500 | 2 | | | 4,623,625 |

Phoenix Companies, Inc., The* | | 133,500 | 2 | | | 1,584,645 |

ProAssurance Corp.* | | 35,600 | 2 | | | 1,955,152 |

Prosperity Bancshares, Inc. | | 234,100 | | | | 6,880,199 |

PS Business Parks, Inc. | | 28,000 | | | | 1,471,400 |

RAM Holdings, Ltd.* | | 421,700 | | | | 2,083,198 |

Reinsurance Group of America, Inc. | | 204,600 | | | | 10,737,408 |

RLI Corp. | | 32,600 | 2 | | | 1,851,354 |

Safety Insurance Group, Inc. | | 17,800 | | | | 651,836 |

Saul Centers, Inc. | | 19,500 | | | | 1,041,885 |

SeaBright Insurance Holdings, Inc.* | | 353,235 | | | | 5,326,784 |

South Financial Group, Inc., The | | 225,000 | | | | 3,516,750 |

Sterling Bancshares, Inc. | | 137,000 | | | | 1,528,920 |

Sterling Financial Corp. | | 291,378 | | | | 4,892,237 |

Sunstone Hotel Investors, Inc. | | 56,900 | 2 | | | 1,040,701 |

SVB Financial Group* | | 62,300 | 2 | | | 3,139,920 |

Tower Group, Inc. | | 74,800 | | | | 2,498,320 |

TradeStation Group, Inc.* | | 358,500 | | | | 5,094,285 |

United PanAm Financial Corp.* | | 180,200 | | | | 922,624 |

Universal American Financial Corp.* | | 86,600 | 2 | | | 2,216,094 |

Total Financials | | | | | | 248,166,371 |

Health Care - 11.1% | | | | | | |

Air Methods Corp.* | | 30,100 | | | | 1,495,067 |

Alexion Pharmaceuticals, Inc. | | 40,695 | | | | 3,053,346 |

Align Technology, Inc.* | | 85,824 | | | | 1,431,544 |

Alliance Imaging, Inc.* | | 523,900 | | | | 5,039,918 |

AMAG Pharmaceuticals, Inc. | | 25,329 | | | | 1,523,033 |

Amedisys, Inc.* | | 60,900 | 2 | | | 2,954,868 |

AMERIGROUP Corp.* | | 163,000 | 2 | | | 5,941,350 |

Amsurg Corp.* | | 54,800 | | | | 1,482,888 |

Array BioPharma, Inc. | | 135,900 | | | | 1,144,278 |

Arthrocare Corp.* | | 50,500 | 2 | | | 2,426,525 |

athenahealth, Inc. | | 27,400 | | | | 986,400 |

BioMarin Pharmaceutical, Inc.* | | 88,600 | | | | 3,136,440 |

Bio-Rad Laboratories, Inc.* | | 38,175 | 2 | | | 3,955,694 |

Bio-Reference Labs, Inc.* | | 13,100 | | | | 428,108 |

Centene Corp.* | | 365,500 | | | | 10,029,320 |

Cepheid, Inc.* | | 161,500 | | | | 4,255,525 |

Charles River Laboratories International, Inc.* | | 335,616 | | | | 22,083,532 |

Conceptus, Inc.* | | 481,401 | | | | 9,262,155 |

Conmed Corp.* | | 57,100 | | | | 1,319,581 |

Cubist Pharmaceuticals, Inc.* | | 200,600 | 2 | | | 4,114,306 |

Five Star Quality Care, Inc. | | 455,100 | | | | 3,777,330 |

HMS Holdings Corp.* | | 69,400 | | | | 2,304,774 |

Hologic, Inc.* | | 157,050 | | | | 10,779,912 |

Illumina, Inc.* | | 331,647 | | | | 19,653,401 |

Immucor, Inc.* | | 115,119 | | | | 3,912,895 |

The accompanying notes are an integral part of these financial statements.

11

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares | | | Value |

Health Care - 11.1% (continued) | | | | | | |

IMS Health, Inc. | | 644,952 | | | $ | 14,859,694 |

inVentiv Health, Inc.* | | 16,800 | 2 | | | 520,128 |

K-V Pharmaceutical Co., Class A* | | 45,856 | | | | 1,308,730 |

LifeCell Corp.* | | 79,700 | | | | 3,435,867 |

Martek Biosciences Corp.* | | 83,800 | | | | 2,478,804 |

Masimo Corp.* | | 61,200 | | | | 2,414,340 |

Medicis Pharmaceutical Corp. | | 41,699 | | | | 1,082,923 |

Meridian Bioscience, Inc. | | 90,700 | | | | 2,728,256 |

Merit Medical Systems, Inc.* | | 57,300 | 2 | | | 796,470 |

Molina Healthcare, Inc.* | | 93,400 | 2 | | | 3,614,580 |

NuVasive, Inc.* | | 62,500 | | | | 2,470,000 |

NxStage Medical, Inc.* | | 119,686 | | | | 1,815,637 |

Omnicell, Inc.* | | 150,500 | | | | 4,052,965 |

Onyx Pharmaceuticals, Inc. | | 69,879 | | | | 3,886,670 |

OSI Pharmaceuticals, Inc.* | | 47,100 | 2 | | | 2,284,821 |

Parexel International Corp.* | | 58,800 | 2 | | | 2,840,040 |

Phase Forward, Inc.* | | 181,300 | | | | 3,943,275 |

Quidel Corp.* | | 87,700 | | | | 1,707,519 |

RehabCare Group, Inc.* | | 34,100 | | | | 769,296 |

Salix Pharmaceuticals Ltd.* | | 168,300 | | | | 1,326,204 |

Skilled Healthcare Group, Inc. | | 46,300 | | | | 677,369 |

Sun Healthcare Group, Inc.* | | 130,200 | | | | 2,235,534 |

Thoratec Corp.* | | 119,900 | | | | 2,180,981 |

TomoTherapy, Inc. | | 73,776 | | | | 1,443,059 |

United Therapeutics Corp.* | | 19,580 | | | | 1,911,987 |

Universal Health Services, Inc., Class B | | 170,000 | | | | 8,704,000 |

Varian, Inc.* | | 62,300 | 2 | | | 4,068,190 |

Wright Medical Group, Inc.* | | 255,534 | | | | 7,453,927 |

Total Health Care | | | | | | 213,503,456 |

Industrials - 16.8% | | | | | | |

AAR Corp.* | | 259,200 | | | | 9,857,376 |

Acco Brands Corp.* | | 270,900 | 2 | | | 4,345,236 |

Administaff, Inc. | | 69,900 | | | | 1,976,772 |

Advisory Board Co., The* | | 35,600 | | | | 2,285,164 |

AeroVironment, Inc. | | 64,500 | | | | 1,560,900 |

Air France-KLM, ADR | | 948,178 | | | | 33,062,966 |

Airtran Holdings, Inc.* | | 293,291 | | | | 2,099,964 |

Alaska Airgroup, Inc.* | | 615,000 | | | | 15,381,150 |

Allegiant Travel Co.* | | 229,300 | | | | 7,369,702 |

Applied Industrial Technologies, Inc. | | 94,200 | 2 | | | 2,733,684 |

Axsys Technologies, Inc.* | | 109,367 | 2 | | | 4,008,301 |

Baldor Electric Co. | | 30,154 | | | | 1,014,984 |

Barnes Group, Inc. | | 90,881 | 2 | | | 3,034,517 |

BE Aerospace, Inc.* | | 61,035 | | | | 3,228,752 |

Brady Corp. | | 101,900 | 2 | | | 3,575,671 |

Bucyrus International, Inc. | | 96,277 | | | | 9,568,971 |

CAI International, Inc.* | | 228,500 | | | | 2,403,820 |

Carlisle Co., Inc. | | 165,300 | 2 | | | 6,121,059 |

CBIZ, Inc.* | | 854,900 | | | | 8,386,569 |

CDI Corp. | | 24,900 | | | | 604,074 |

Ceco Environmental Corp.* | | 28,788 | | | | 316,092 |

Columbus McKinnon Corp.* | | 49,100 | | | | 1,601,642 |

Comfort Systems USA, Inc. | | 388,300 | | | | 4,962,474 |

Consolidated Graphics, Inc.* | | 110,540 | | | | 5,286,023 |

Crane Co. | | 183,900 | | | | 7,889,310 |

Ducommun, Inc.* | | 32,000 | | | | 1,216,000 |

EMCOR Group, Inc.* | | 533,450 | | | | 12,605,423 |

Empresas ICA, S.A. de C.V. | | 57,546 | | | | 1,519,214 |

FTI Consulting, Inc.* | | 62,826 | | | | 3,872,595 |

Genco Shipping & Trading, Ltd. | | 138,100 | | | | 7,562,356 |

Geo Group, Inc., The | | 46,152 | | | | 1,292,256 |

Gorman-Rupp Co. | | 24,475 | | | | 763,620 |

GrafTech International Ltd.* | | 217,200 | 2 | | | 3,855,300 |

Heidrick & Struggles International, Inc.* | | 154,200 | | | | 5,722,362 |

HNI Corp. | | 115,800 | 2 | | | 4,059,948 |

Ii-Vi, Inc.* | | 56,700 | 2 | | | 1,732,185 |

JA Solar Holdings Co., Ltd., ADR* | | 124,850 | | | | 8,715,778 |

Kaydon Corp. | | 39,477 | | | | 2,153,076 |

Layne Christensen Co.* | | 167,984 | | | | 8,266,493 |

Middleby Corp., The* | | 53,736 | 2 | | | 4,117,252 |

Miller Herman, Inc. | | 169,100 | 2 | | | 5,477,149 |

NCI Building Systems, Inc.* | | 224,800 | | | | 6,471,992 |

Perini Corp.* | | 192,675 | 2 | | | 7,980,598 |

Quanta Services, Inc.* | | 274,378 | | | | 7,199,679 |

Robbins & Myers, Inc. | | 78,100 | | | | 5,906,703 |

Ryder System, Inc. | | 70,600 | | | | 3,318,906 |

Skywest, Inc. | | 257,660 | | | | 6,918,171 |

Spherion Corp.* | | 735,400 | | | | 5,353,712 |

Stanley, Inc.* | | 11,429 | | | | 365,957 |

Sunpower Corp., Class A* | | 13,957 | | | | 1,819,853 |

Taser International, Inc.* | | 730,250 | | | | 10,508,298 |

Tecumseh Products Co., Class B* | | 191,688 | | | | 3,782,004 |

Teledyne Technologies, Inc.* | | 62,300 | | | | 3,322,459 |

Toro Co., The | | 111,500 | 2 | | | 6,070,060 |

Triumph Group, Inc. | | 55,275 | 2 | | | 4,551,896 |

The accompanying notes are an integral part of these financial statements.

12

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares | | | Value |

Industrials - 16.8% (continued) | | | | | | |

TurboChef Technologies, Inc.* | | 235,350 | 2 | | $ | 3,883,275 |

URS Corp.* | | 264,670 | | | | 14,379,504 |

Valmont Industries, Inc. | | 32,100 | 2 | | | 2,860,752 |

Wabtec Corp. | | 96,200 | 2 | | | 3,313,128 |

Walter Industries, Inc. | | 150,200 | | | | 5,396,686 |

Watson Wyatt & Co. | | 65,800 | 2 | | | 3,053,778 |

Total Industrials | | | | | | 322,063,591 |

Information Technology - 23.1% | | | | | | |

3PAR, Inc. | | 52,309 | | | | 669,555 |

Airspan Networks, Inc.* | | 250,881 | | | | 441,551 |

AMIS Holdings, Inc.* | | 528,349 | | | | 5,294,057 |

Anixter International, Inc. | | 16,946 | | | | 1,055,227 |

ANSYS, Inc.* | | 129,025 | | | | 5,349,376 |

Ariba, Inc. | | 119,900 | | | | 1,336,885 |

Arris Group, Inc.* | | 354,800 | | | | 3,540,904 |

Art Technology Group, Inc.* | | 263,300 | | | | 1,137,456 |

Aruba Networks, Inc.* | | 178,157 | | | | 2,656,321 |

Aspen Technology, Inc.* | | 790,900 | | | | 12,828,398 |

Atheros Communications, Inc.* | | 110,948 | | | | 3,388,352 |

AuthenTec, Inc.* | | 246,875 | | | | 3,587,094 |

Bankrate, Inc.* | | 106,500 | | | | 5,121,585 |

Benchmark Electronics, Inc.* | | 236,850 | | | | 4,199,350 |

Blackboard, Inc.* | | 211,847 | 2 | | | 8,526,842 |

Bladelogic, Inc.* | | 12,000 | | | | 354,840 |

Borland Software Corp.* | | 351,100 | | | | 1,056,811 |

Bottomline Technologies, Inc.* | | 62,300 | | | | 872,200 |

Checkpoint Systems, Inc.* | | 443,300 | | | | 11,516,934 |

Ciena Corp.* | | 231,925 | 2 | | | 7,910,962 |

Commvault Systems, Inc.* | | 193,300 | | | | 4,094,094 |

COMSCORE, Inc. | | 74,500 | | | | 2,430,935 |

Concur Technologies, Inc.* | | 210,320 | | | | 7,615,687 |

Constant Contact, Inc. | | 23,700 | | | | 509,550 |

Convergys Corp.* | | 189,500 | | | | 3,119,170 |

CSG Systems International, Inc.* | | 153,500 | | | | 2,259,520 |

CyberSource Corp.* | | 100,300 | | | | 1,782,331 |

Daktronics, Inc. | | 61,800 | | | | 1,394,826 |

Data Domain, Inc. | | 51,012 | | | | 1,343,656 |

DealerTrack Holdings, Inc.* | | 62,426 | | | | 2,089,398 |

Deltek, Inc. | | 28,427 | | | | 432,943 |

Diodes, Inc.* | | 149,450 | | | | 4,493,962 |

Double-Take Software, Inc.* | | 233,166 | | | | 5,064,366 |

Dycom Industries, Inc.* | | 437,246 | | | | 11,652,606 |

Electronics for Imaging, Inc.* | | 319,181 | | | | 7,175,189 |

EMS Technologies, Inc.* | | 26,000 | 2 | | | 786,240 |

EnerNOC, Inc.* | | 35,300 | | | | 1,733,230 |

Entropic Communications, Inc. | | 322,141 | | | | 2,345,186 |

Equinix, Inc.* | | 49,200 | | | | 4,972,644 |

Exfo Electro-Optical Engineering, Inc.* | | 832,403 | | | | 4,103,747 |

Factset Research Systems, Inc. | | 17,598 | | | | 980,209 |

Fairchild Semiconductor International, Inc.* | | 336,300 | | | | 4,852,809 |

Falconstor Software, Inc.* | | 467,500 | | | | 5,264,050 |

FEI Co.* | | 280,881 | | | | 6,974,275 |

Flextronics International, Ltd.* | | 268,793 | | | | 3,241,644 |

Greenfield Online, Inc.* | | 41,000 | | | | 599,010 |

Harris Stratex Networks, Inc.* | | 211,822 | | | | 3,537,427 |

Hittite Microwave Corp.* | | 223,875 | | | | 10,692,270 |

Infinera Corp. | | 127,372 | | | | 1,890,200 |

Interwoven, Inc.* | | 73,000 | | | | 1,038,060 |

IXYS Corp.* | | 184,400 | | | | 1,478,888 |

Keynote Systems, Inc.* | | 298,899 | | | | 4,199,531 |

L-1 Identity Solutions, Inc.* | | 403,157 | | | | 7,236,668 |

Lawson Software, Inc.* | | 319,800 | 2 | | | 3,274,752 |

Magma Design Automation, Inc.* | | 63,900 | | | | 780,219 |

Manhattan Associates, Inc.* | | 58,800 | | | | 1,549,968 |

Mattson Technology, Inc.* | | 299,100 | | | | 2,560,296 |

MAXIMUS, Inc. | | 37,900 | | | | 1,463,319 |

MercadoLibre, Inc. | | 82,720 | | | | 6,111,354 |

Monolithic Power Systems, Inc.* | | 245,550 | 2 | | | 5,271,958 |

Netgear, Inc.* | | 215,931 | | | | 7,702,259 |

Netlogic Microsystems, Inc.* | | 50,100 | | | | 1,613,220 |

Neutral Tandem, Inc. | | 13,800 | | | | 262,476 |

Novatel Wireless, Inc.* | | 285,600 | | | | 4,626,720 |

Nuance Communications, Inc.* | | 350,600 | | | | 6,549,208 |

Omniture, Inc.* | | 260,600 | | | | 8,675,374 |

Opnext, Inc.* | | 169 | | | | 1,496 |

Parametric Technology Corp.* | | 440,080 | 2 | | | 7,855,428 |

Perficient, Inc.* | | 78,300 | | | | 1,232,442 |

Perot Systems Corp.* | | 502,010 | | | | 6,777,135 |

Photon Dynamics, Inc.* | | 400,994 | | | | 3,328,250 |

Plantronics, Inc. | | 106,900 | 2 | | | 2,779,400 |

Power Integrations, Inc.* | | 459,600 | | | | 15,824,028 |

PROS Holdings, Inc. | | 45,500 | | | | 892,710 |

QLogic Corp.* | | 376,900 | 2 | | | 5,351,980 |

Quest Software, Inc.* | | 178,200 | 2 | | | 3,286,008 |

Rimage Corp.* | | 216,869 | | | | 5,627,751 |

The accompanying notes are an integral part of these financial statements.

13

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | |

| | | Shares | | | Value | |

Information Technology - 23.1% (continued) | | | | | | | |

Rogers Corp.* | | 153,400 | | | $ | 6,652,958 | |

Rudolph Technologies, Inc.* | | 172,800 | | | | 1,956,096 | |

Scopus Video Neworks, Ltd.* | | 838,896 | | | | 4,563,594 | |

Semiconductor Manufacturing International Corp.* | | 5,592,500 | 2 | | | 29,025,076 | |

Semtech Corp.* | | 276,400 | 2 | | | 4,289,728 | |

Shanda Interactive Entertainment, Ltd.* | | 66,622 | | | | 2,221,177 | |

ShoreTel, Inc. | | 37,100 | | | | 518,287 | |

SINA Corp.* | | 50,424 | | | | 2,234,287 | |

Skyworks Solutions, Inc.* | | 276,900 | 2 | | | 2,353,650 | |

Smart Modular Technology (WWH), Inc.* | | 528,426 | | | | 5,379,377 | |

SonicWALL, Inc.* | | 188,600 | | | | 2,021,792 | |

Spansion, Inc., Class A* | | 2,571,200 | | | | 10,104,816 | |

Starent Networks Corp.* | | 96,000 | | | | 1,752,000 | |

Stratasys, Inc.* | | 213,900 | | | | 5,527,176 | |

Super Micro Computer, Inc.* | | 295,400 | | | | 2,265,718 | |

Synaptics, Inc.* | | 174,000 | | | | 7,161,840 | |

Synchronoss Technologies, Inc.* | | 59,800 | | | | 2,119,312 | |

SYNNEX Corp.* | | 341,000 | | | | 6,683,600 | |

Synopsys, Inc.* | | 356,400 | 2 | | | 9,241,452 | |

Syntel, Inc. | | 114,444 | | | | 4,408,383 | |

Taleo Corp.* | | 208,325 | | | | 6,203,918 | |

The Knot, Inc.* | | 47,500 | | | | 757,150 | |

TNS, Inc. | | 295,400 | | | | 5,243,350 | |

TTM Technologies, Inc.* | | 373,400 | | | | 4,353,844 | |

Utstarcom, Inc.* | | 850,000 | 2 | | | 2,337,500 | |

Vocus, Inc.* | | 87,475 | | | | 3,020,512 | |

Wright Express Corp.* | | 46,210 | | | | 1,639,993 | |

Zoran Corp.* | | 169,100 | | | | 3,806,441 | |

Total Information Technology | | | | | | 443,469,799 | |

Materials - 1.5% | | | | | | | |

Alpha Natural Resources, Inc.* | | 100,298 | | | | 3,257,679 | |

Century Aluminum Co.* | | 35,147 | | | | 1,895,829 | |

Cleveland-Cliffs, Inc. | | 19,497 | | | | 1,965,298 | |

Cytec Industries, Inc. | | 131,900 | | | | 8,122,402 | |

Olin Corp. | | 153,900 | 2 | | | 2,974,887 | |

OM Group, Inc.* | | 81,425 | 2 | | | 4,685,194 | |

Rock-Tenn Co. | | 109,300 | | | | 2,777,313 | |

Zep, Inc.* | | 44,300 | 2 | | | 614,441 | |

Zoltek Companies, Inc.* | | 53,409 | | | | 2,289,644 | |

Total Materials | | | | | | 28,582,687 | |

Telecommunication Services - 1.2% | | | | | | | |

Cbeyond, Inc.* | | 64,455 | | | | 2,513,100 | |

Cincinnati Bell, Inc.* | | 1,410,719 | | | | 6,700,915 | |

General Communication, Inc., Class A* | | 689,585 | | | | 6,033,869 | |

Premiere Global Services, Inc.* | | 154,800 | | | | 2,298,780 | |

Syniverse Holdings, Inc.* | | 367,800 | | | | 5,730,324 | |

Total Telecommunication Services | | | | | | 23,276,988 | |

Utilities - 0.9% | | | | | | | |

Avista Corp. | | 703,000 | | | | 15,142,620 | |

El Paso Electric Co.* | | 85,300 | | | | 2,181,121 | |

Total Utilities | | | | | | 17,323,741 | |

Total Common Stocks

(cost $1,596,332,820) | | | | | | 1,801,227,290 | |

Other Short-Term Investments - 17.1%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.02%3 | | 188,139,436 | | | | 188,139,436 | |

Dreyfus Cash Management Fund, Institutional Class Shares, 4.85% | | 115,209,951 | | | | 115,209,951 | |

Vanguard Prime Money Market Fund, Institutional Class Shares, 4.74% | | 23,967,770 | | | | 23,967,770 | |

Total Other Short-Term Investments

(cost $327,317,157) | | | | | | 327,317,157 | |

Total Investments - 111.1%

(cost $1,923,649,977) | | | | | | 2,128,544,447 | |

Other Assets, less Liabilities - (11.1)% | | | | | | (213,116,977 | ) |

Net Assets - 100.0% | | | | | $ | 1,915,427,470 | |

Based on the approximate cost of investments of $1,946,572,926 for Federal income tax purposes at December 31, 2007, the aggregate gross unrealized appreciation and depreciation were $355,879,286 and $173,907,765, respectively, resulting in net unrealized appreciation of investments of $181,971,521.

| * | Non-income-producing securities. |

1 | Yield shown for an investment company represents the December 31, 2007, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

2 | Some or all of these shares were out on loan to various brokers as of December 31, 2007, amounting to a market value of $180,760,509, or approximately 9.4% of net assets. |

3 | Collateral received from brokers for securities lending was invested in this short-term investment. |

The accompanying notes are an integral part of these financial statements.

14

Managers Special Equity Fund

Statement of Assets and Liabilities

December 31, 2007

| | | |

Assets: | | | |

Investments at value (including securities on loan valued at $180,760,509)* | | $ | 2,128,544,447 |

Receivable for investments sold | | | 10,207,151 |

Receivable for Fund shares sold | | | 3,183,579 |

Dividends, interest and other receivables | | | 1,337,326 |

Prepaid expenses | | | 23,844 |

| | | |

Total assets | | | 2,143,296,347 |

| | | |

Liabilities: | | | |

Payable to Custodian | | | 112,555 |

Payable for Fund shares repurchased | | | 24,722,232 |

Payable upon return of securities loaned | | | 188,139,436 |

Payable for investments purchased | | | 11,619,917 |

Accrued expenses: | | | |

Investment advisory and management fees | | | 1,554,755 |

Administrative fees | | | 431,876 |

Other | | | 1,288,106 |

| | | |

Total liabilities | | | 227,868,877 |

| | | |

Net Assets | | $ | 1,915,427,470 |

| | | |

Managers Shares: | | | |

Net Assets | | $ | 1,668,031,341 |

| | | |

Shares outstanding | | | 25,951,934 |

| | | |

Net asset value, offering and redemption price per share | | $ | 64.27 |

| | | |

Institutional Class Shares: | | | |

Net Assets | | $ | 247,396,129 |

| | | |

Shares outstanding | | | 3,822,918 |

| | | |

Net asset value, offering and redemption price per share | | $ | 64.71 |

| | | |

Net Assets Represent: | | | |

Paid-in capital | | $ | 1,646,019,453 |

Undistributed net investment income | | | 996,473 |

Accumulated net realized gain from investments | | | 63,517,074 |

Net unrealized appreciation of investments | | | 204,894,470 |

| | | |

Net Assets | | $ | 1,915,427,470 |

| | | |

* Investments at cost | | $ | 1,923,649,977 |

The accompanying notes are an integral part of these financial statements.

15

Managers Special Equity Fund

Statement of Operations

For the year ended December 31, 2007

| | | | |

Investment Income: | | | | |

Dividend income | | $ | 20,594,781 | |

Foreign withholding tax | | | (256,622 | ) |

Securities lending fees | | | 1,475,721 | |

| | | | |

Total investment income | | | 21,813,880 | |

| | | | |

Expenses: | | | | |

Investment management fees | | | 23,410,349 | |

Administrative fees | | | 6,502,875 | |

Transfer agent | | | 5,651,419 | |

Professional fees | | | 449,639 | |

Custodian | | | 426,057 | |

Reports to shareholders | | | 196,598 | |

Trustees fees and expenses | | | 141,126 | |

Registration fees | | | 83,243 | |

Miscellaneous | | | 147,362 | |

| | | | |

Total expenses before offsets | | | 37,008,668 | |

| | | | |

Expense reductions | | | (849,457 | ) |

| | | | |

Net expenses | | | 36,159,211 | |

| | | | |

Net investment loss | | | (14,345,331 | ) |

| | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain on investment transactions | | | 468,715,374 | |

Net unrealized depreciation of investments | | | (407,862,046 | ) |

| | | | |

Net realized and unrealized gain | | | 60,853,328 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 46,507,997 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

16

Managers Special Equity Fund

Statement of Changes in Net Assets

For the year ended December 31,

| | | | | | | | |

| | | 2007 | | | 2006 | |

Increase (Decrease) in Net Assets From Operations: | | | | | | | | |

Net investment loss | | | ($14,345,331) | | | | ($3,566,911) | |

Net realized gain on investments | | | 468,715,374 | | | | 459,675,943 | |

Net unrealized depreciation of investments | | | (407,862,046 | ) | | | (106,987,301 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 46,507,997 | | | | 349,121,731 | |

| | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

From net realized gain on investments: | | | | | | | | |

Managers Class | | | (388,900,274 | ) | | | (365,600,521 | ) |

Institutional Class | | | (59,529,931 | ) | | | (80,218,690 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (448,430,205 | ) | | | (445,819,211 | ) |

| | | | | | | | |

From Capital Share Transactions: | | | | | | | | |

Managers Class: | | | | | | | | |

Proceeds from sale of shares | | | 299,186,761 | | | | 497,790,367 | |

Reinvestment of dividends and distributions | | | 359,741,541 | | | | 333,256,656 | |

Cost of shares repurchased | | | (1,188,809,810 | ) | | | (1,038,280,018 | ) |

| | | | | | | | |

Net decrease from capital share transactions | | | (529,881,508 | ) | | | (207,232,995 | ) |

| | | | | | | | |

Institutional Class: | | | | | | | | |

Proceeds from sale of shares | | | 78,116,331 | | | | 146,171,560 | |

Reinvestment of dividends and distributions | | | 53,547,184 | | | | 70,000,901 | |

Cost of shares repurchased | | | (398,129,366 | ) | | | (143,399,760 | ) |

| | | | | | | | |

Net increase (decrease) from capital share transactions | | | (266,465,851 | ) | | | 72,772,701 | |

| | | | | | | | |

Net decrease from capital share transactions | | | (796,347,359 | ) | | | (134,460,294 | ) |

| | | | | | | | |

Total decrease in net assets | | | (1,198,269,567 | ) | | | (231,157,774 | ) |

| | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of year | | | 3,113,697,037 | | | | 3,344,854,811 | |

| | | | | | | | |

End of year | | $ | 1,915,427,470 | | | $ | 3,113,697,037 | |

| | | | | | | | |

End of year undistributed net investment income | | $ | 996,473 | | | $ | 673,439 | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Managers Class: | | | | | | | | |

Sale of shares | | | 3,523,798 | | | | 5,448,864 | |

Reinvested shares from dividends and distribution | | | 5,443,136 | | | | 4,027,757 | |

Shares repurchased | | | (13,771,697 | ) | | | (11,381,596 | ) |

| | | | | | | | |

Net decrease in shares | | | (4,804,763 | ) | | | (1,904,975 | ) |

| | | | | | | | |

Institutional Class: | | | | | | | | |

Sale of shares | | | 898,887 | | | | 1,591,644 | |

Reinvested shares from dividends and distribution | | | 804,737 | | | | 840,044 | |

Shares repurchased | | | (4,606,651 | ) | | | (1,568,031 | ) |

| | | | | | | | |

Net increase (decrease) in shares | | | (2,903,027 | ) | | | 863,657 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

17

Managers Special Equity Fund

Financial Highlights

For a share outstanding throughout each year

| | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

Managers Class: | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Net Asset Value, Beginning of year | | $ | 82.96 | | | $ | 86.78 | | | $ | 90.42 | | | $ | 78.48 | | | $ | 55.08 | |

| | | | | | | | | | | | | | | | | | | | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.51 | )5 | | | (0.14 | )5 | | | (0.54 | )5 | | | (0.56 | ) | | | (0.43 | ) |

Net realized and unrealized gain (loss) on investments | | | 0.55 | 5 | | | 9.88 | 5 | | | 4.18 | 5 | | | 12.50 | | | | 23.83 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.04 | | | | 9.74 | | | | 3.64 | | | | 11.94 | | | | 23.40 | |

| | | | | | | | | | | | | | | | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net realized gain on investments | | | (18.73 | ) | | | (13.56 | ) | | | (7.28 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of year | | $ | 64.27 | | | $ | 82.96 | | | $ | 86.78 | | | $ | 90.42 | | | $ | 78.48 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return 1 | | | (0.60 | )% | | | 11.28 | % | | | 4.00 | % | | | 15.18 | % | | | 42.50 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets | | | 1.43 | % | | | 1.42 | % | | | 1.40 | % | | | 1.40 | % | | | 1.43 | % |

Ratio of total expenses to average net assets 4 | | | 1.46 | % | | | 1.47 | % | | | 1.45 | % | | | 1.45 | % | | | 1.46 | % |

Ratio of net investment loss to average net assets 1 | | | (0.59 | )% | | | (0.15 | )% | | | (0.60 | )% | | | (0.69 | )% | | | (0.72 | )% |

Portfolio turnover | | | 67 | % | | | 76 | % | | | 80 | % | | | 68 | % | | | 64 | % |

Net assets at end of year (000’s omitted) | | $ | 1,668,031 | | | $ | 2,551,703 | | | $ | 2,834,314 | | | $ | 3,415,003 | | | $ | 3,279,318 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| | | For the year ended December 31, | | | For the

period* ended

December 31, | | | | |

Institutional Class: | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | | |

Net Asset Value, Beginning of Period | | $ | 83.56 | | | $ | 87.09 | | | $ | 90.56 | | | $ | 78.91 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.32 | )5 | | | 0.10 | 5 | | | (0.33 | )5 | | | (0.21 | ) | | | | |

Net realized and unrealized gain on investments | | | 0.52 | 5 | | | 9.93 | 5 | | | 4.14 | 5 | | | 11.86 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.20 | | | | 10.03 | | | | 3.81 | | | | 11.65 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net realized gain on investments | | | (19.05 | ) | | | (13.56 | ) | | | (7.28 | ) | | | — | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 64.71 | | | $ | 83.56 | | | $ | 87.09 | | | $ | 90.56 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total Return 1 | | | (0.39 | )% | | | 11.56 | %6 | | | 4.21 | % | | | 14.75 | %2 | | | | |

| | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets | | | 1.20 | % | | | 1.18 | % | | | 1.20 | % | | | 1.20 | %3 | | | | |

Ratio of total expenses to average net assets 4 | | | 1.23 | % | | | 1.23 | % | | | 1.25 | % | | | 1.26 | %3 | | | | |

Ratio of net investment income (loss) to average net assets 1 | | | (0.36 | )% | | | 0.09 | % | | | (0.56 | )% | | | (0.49 | )%3 | | | | |

Portfolio turnover | | | 67 | % | | | 76 | % | | | 80 | % | | | 68 | %2 | | | | |

Net assets at end of period (000’s omitted) | | $ | 247,396 | | | $ | 561,994 | | | $ | 510,541 | | | $ | 274,010 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| * | Commencement of operations was May 3, 2004. |

1 | Total returns and net investment income would have been lower had certain expenses not been reduced. (See Note 1(c) of Notes to Financial Statements.) |

2 | Not Annualized. (See Note 1(c) to the Notes to Financial Statements.) |

4 | Excludes the impact of fee waivers and expense offsets such as brokerage credits, but includes non-reimbursable expenses such as interest and taxes. (See Note 1(c) to the Notes to Financial Statements.) |

5 | Per share numbers have been calculated using average shares. |

6 | The Total Return is based on the Financial Statement Net Asset Values as shown above. |

18

Managers Special Equity Fund

Notes to Financial Statements

December 31, 2007

| 1. | Summary of Significant Accounting Policies |

The Managers Funds (the “Trust”) is an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust is comprised of a number of investment series. Included in this report is the Managers Special Equity Fund (“Special Equity”or the “Fund”).

The Fund offers both Managers Class shares and Institutional Class shares. The Institutional Class shares, which are designed primarily for institutional investors that meet certain administrative and servicing criteria, have a minimum investment of $2,500,000. Managers Class shares are offered to all other investors. Each class represents interest in the same assets of the Fund and the classes are identical except for class specific expenses related to shareholder activity. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund and certain Fund level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Both classes have equal voting privileges except that each class has exclusive voting rights with respect to its services and/or distribution plan.