UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03752

AMG FUNDS III

(Exact name of registrant as specified in charter)

680 Washington Boulevard,

Suite 500, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

680 Washington Boulevard,

Suite 500, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2021 – DECEMBER 31, 2021 (Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | | | | | |

| | | AMG Funds |

| | | | |

| | | December 31, 2021 | | | | |

| | |

| | | Veritas — Asset Management |

| | |

| | | AMG Veritas Asia Pacific Fund |

| | | (formerly AMG Managers Special Equity Fund) |

| | | |

| | | Class N: MGSEX | | Class I: MSEIX |

| | | | |

| | | | | | | |

| | | | |

| | | | | |

| | | |

| amgfunds.com | | 123121 | | AR078 |

| | |

| | AMG Funds Annual Report — December 31, 2021 |

| | | | |

| | | TABLE OF CONTENTS | | PAGE |

| | | |

| | | LETTER TO SHAREHOLDERS | | 2 |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | 3 |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULE OF PORTFOLIO INVESTMENTS | | 4 |

| | | |

| | | FINANCIAL STATEMENTS | | |

| | | |

| | | Statement of Assets and Liabilities | | 13 |

| | | |

| | | Balance sheet, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | | |

| | | |

| | | Statement of Operations | | 15 |

| | | |

| | | Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | |

| | | |

| | | Statements of Changes in Net Assets | | 16 |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | |

| | | |

| | | Financial Highlights | | 17 |

| | | |

| | | Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | |

| | | |

| | | Notes to Financial Statements | | 19 |

| | | |

| | | Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 25 |

| | | |

| | | OTHER INFORMATION | | 26 |

| | | |

| | | TRUSTEES AND OFFICERS | | 27 |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | | | |

| |  | | Letter to Shareholders |

Dear Shareholder:

The fiscal year ended December 31, 2021, was marked by the continued extraordinary recovery amid an unprecedented global effort to stop the COVID-19 pandemic. Equities rallied to new record highs amid better-than-expected corporate earnings, colossal fiscal and monetary stimulus programs, and an improving economic backdrop. Since the market bottom on March 23, 2020, the S&P 500® Index has gained over 119%. Businesses and consumers contended with disrupted supply chains and rising prices on a wide range of goods such as lumber and gasoline, and outbreaks of coronavirus variants kept the world on edge. Volatility increased in September as investors grew more concerned about rising inflation and more hawkish global central bank policies, but equities were resilient and finished the fiscal year with a strong rally.

The S&P 500® gained 28.71% during the year and all sectors produced double-digit returns, but there was very wide dispersion in performance. Energy and real estate led the market with returns of 54.72% and 46.20%, respectively. On the other hand, utilities and consumer staples lagged with returns of 17.63% and 18.63%, respectively. Growth stocks edged out Value stocks as the Russell 1000® Growth Index returned 27.60% compared to the 25.16% return for the Russell 1000® Value Index. Small cap stocks underperformed as the Russell 2000® Index returned 14.82%. Within small caps, the Value-Growth disparity was much more pronounced as the Russell 2000® Value Index returned 28.27% compared to 2.83% for the Russell 2000® Growth Index. Outside the U.S., foreign developed markets lagged their U.S. counterparts with an 11.26% return for the MSCI EAFE Index. A major regulatory crackdown in China shook investor confidence in Chinese equities and caused emerging markets to underperform with a (2.54)% return for the MSCI Emerging Markets Index.

Interest rates lifted off from near-historic lows as the vaccine rollout initiated a return to normalcy and the economic outlook improved. The 10-year Treasury yield rose 59 basis points to 1.52% and ended the year slightly shy of its post-pandemic high. The Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, lost (1.54)% over the period. While risk appetite was strong, rising rates still hurt returns for investment-grade corporate bonds, which lost (1.04)% during the year. The global search for yield helped high-yield bonds outperform the investment-grade market with a 5.28% return as measured by the return of the Bloomberg U.S. Corporate High Yield Bond Index. Municipal bonds benefited from a strong technical backdrop, which drove a 1.52% return for the Bloomberg Municipal Bond Index.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| | | | | | | | | | | | | | |

| Average Annual Total Returns | | Periods ended December 31, 2021* | |

| | | | |

| Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

| | | | |

Large Cap | | (S&P 500® Index) | | | 28.71 | % | | | 26.07 | % | | | 18.47 | % |

| | | | |

Small Cap | | (Russell 2000® Index) | | | 14.82 | % | | | 20.02 | % | | | 12.02 | % |

| | | | |

International | | (MSCI ACWI ex USA) | | | 7.82 | % | | | 13.18 | % | | | 9.61 | % |

| Bonds: | | | | | | | | | | | |

| | | | |

Investment Grade | | (Bloomberg U.S. Aggregate Bond Index) | | | (1.54 | )% | | | 4.79 | % | | | 3.57 | % |

| | | | |

High Yield | | (Bloomberg U.S. Corporate High Yield Bond Index) | | | 5.28 | % | | | 8.83 | % | | | 6.30 | % |

| | | | |

Tax-exempt | | (Bloomberg Municipal Bond Index) | | | 1.52 | % | | | 4.73 | % | | | 4.17 | % |

| | | | |

Treasury Bills | | (ICE BofAML U.S. 6-Month Treasury Bill Index) | | | 0.09 | % | | | 1.23 | % | | | 1.31 | % |

*Source: FactSet. Past performance is no guarantee of future results.

2

| | |

| | About Your Fund’s Expenses |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | |

| | | | | | | | | | |

Six Months Ended

December 31, 2021 | | Expense

Ratio for

the Period | | Beginning

Account

Value

07/01/21 | | Ending

Account

Value

12/31/21 | | Expenses

Paid

During

the Period* |

|

AMG Veritas Asia Pacific Fund | |

| |

Based on Actual Fund Return | | | | |

| | | | |

Class N | | 1.18% | | $1,000 | | $915 | | | $5.70 | |

| | | | |

Class I | | 0.93% | | $1,000 | | $916 | | | $4.49 | |

| | |

Based on Hypothetical 5% Annual Return | | | | |

| | | | |

Class N | | 1.18% | | $1,000 | | $1,019 | | | $6.01 | |

| | | | |

Class I | | 0.93% | | $1,000 | | $1,021 | | | $4.74 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

| | |

| | AMG Veritas Asia Pacific Fund Portfolio Manager’s Comments (unaudited) |

| | | | | | | | |

For the 12 months ended December 31, 2021, AMG Veritas Asia Pacific Fund (formerly AMG Managers Special Equity Fund) (the “Fund”) Class N shares returned 3.16%, compared with the (2.90)% return for the MSCI AC Asia Pacific ex Japan Index, the Fund’s current benchmark, and the 2.83% return for the Russell 2000® Growth Index, the Fund’s former benchmark. On March 17-18, 2021, the Fund’s Board of Trustees approved the appointment of Veritas Asset Management LLP (“Veritas”) as interim subadviser to the Fund effective March 19, 2021. On May 24, the Fund’s principal investment strategies changed from primarily investing in U.S small-cap equity securities to investing in a relatively select group of companies within the Asia Pacific region. On June 18, 2021, the Fund’s shareholders approved the appointment of Veritas as the subadviser to the Fund, the change in the Fund’s name, and its benchmark. Also approved was a change to the Fund’s sub-classification from “diversified” to “non-diversified.” ASIA MARKET OVERVIEW As a brief recap, 2021 started with markets picking up where they had left off in 2020 earning material gains. This continued until the market peaked on February 17, 2021, when the prospect of rising inflation leading to higher bond yields and higher interest rates overcame markets. The key 10-year U.S. Treasury yield rose from 95 basis points to over 170 basis points in short order. The impact on the share price of many high quality, fast growing companies was material, as the implication of using a higher discount rate to value future cash flows meant these cash flows could be worth significantly less, leading to some dramatic falls of between (25)% and (40)% in the share price of a number of businesses owned by the Fund over a three to four week period. This resulted in a market rotation into “value” and share prices of businesses that had been so unloved for so long rose rapidly at the expense of some high quality businesses which were continuing to deliver superb operational performance. The rotation proved to be short lived (it often is in Asia) as markets’ fear of higher inflation subsided, yields fell, and the operational performance of many of the high quality businesses the Fund owns came through in their quarterly and half yearly results as they “proved up.” The impact on the Fund was a performance boost versus the Fund’s current index. During Q3 things started to get really intense as Chinese authorities moved to turn the huge “for-profit” out-of-school education sector into a | | | | not-for-profit industry, resulting in billions of dollars being wiped off the value of companies such as New Oriental and TAL Education that were held and eventually sold during the period. The market was awash with rumors about “who’s next to be regulated out of existence?” Would it be e-commerce companies? Would it be healthcare? Many investors took fright at what they saw as the specter of an Orwellian, authoritarian, anti-business government clamping down and retrenching into its communist origins. From then on, every announcement or piece of regulation or law passed was seen through a negative lens in the West, and this intensified as the common prosperity narrative was, in our view, misinterpreted by many. Then, to add fuel to the fire, came the Evergrande issue. The prospect of the world’s most indebted property company no longer being in a position to service its $300 billion+ of debts and defaulting led to a frenzy of speculation. It’s no wonder some investors were asking themselves if China was still investable. Given the selling pressure that built up during Q4 some have clearly decided it is not, or at least not for now. PERFORMANCE REVIEW For the first three months of the period under the management of the Fund’s prior subadvisers, the Fund underperformed its former benchmark. The Fund’s relative performance benefited from strong stock selection within the health care and industrials sectors, combined with an underweight to the poor performing health care sector. This was more than offset by negative stock selection results within the information technology, consumer discretionary, and materials sectors. For the remainder of the period, the Fund outperformed its current benchmark. During this period, stock selection in China, and the Fund’s near double weighting in India, added the most to the relative outperformance. At the sector level, health care and industrials added most to relative performance, with Indian private hospital group Apollo Hospitals +68% standing out in health care and the solar inverter company Sungrow Power Supply +66% standing out in industrials. The only sector to cause a significant lag was materials—with the Korean battery company LG Chem (29)% accounting for most of the Fund’s exposure to the sector. OUTLOOK Our view has not changed. We categorically believe that China continues to represent a highly attractive opportunity set to deploy capital into some | | | | wonderful businesses that have the tailwind of one or more structural growth drivers, as well as having the capital and management ability to take advantage of the opportunities this presents. One such area on which we are focused is “Made in Asia—part 2.” This is related to companies that benefit from the opportunities by the world’s move to decarbonize—solar and wind—and the supply chain that feeds the industry, i.e. the upgrading of high spec, high tech manufacturing. Asia is home to many of the world’s leading businesses in their respective areas of the renewable energy industry, whether that be a leading inverter manufacturer such as Sungrow Power Supply, or a global leader in photovoltaic film used in solar panels such as Hangzhou First Applied Material, or a global leader in machinery used to manufacture lithium-ion batteries such as WuXi Lead Intelligent Equipment, or indeed the lithium-ion battery manufacturers themselves, Samsung SDI and LG Chem, which among them have over 60% global market share. The point common to all is that we believe they benefit from a multi-year (and potentially multi-decade) structural tailwind, have scale and years of knowhow, are industry leaders, are well run by talented aligned management teams, and are based in Asia. It is entirely possible we could see a reversal of past decades where Asia has imported expertise and machinery to a time where Asia is the exporter of expertise and high spec machinery. Yet it is these types of companies that have suffered in recent weeks leading to the Fund coming back toward the market return for the year. Where-to from here? We believe parts of the Chinese equity market have the potential to be an outstanding place to deploy capital over the coming quarters. In essence, the team believes there are parallels between where we are today and the end of 2015/early 2016 with monetary policy of the U.S. Federal Reserve (the “Fed”) and the People’s Bank of China (“PBOC”) moving in opposite directions—the Fed tightening and PBOC loosening, but in a very targeted way to support stated policy goals. Indeed, this loosening may well have already started following the Politburo meeting in early December and the subsequent Central Economic Work Conference (“CEWC”) on December 10. The Politburo meeting gave the clearest signal yet that China is moving to an easier policy stance. During the meeting it affirmed its pro-growth stance |

| | | | |

| | | | |

4

| | |

| | AMG Veritas Asia Pacific Fund Portfolio Manager’s Comments (continued) |

| | | | | | | | |

and housing policy easing, while calling for “keeping economic growth in a reasonable range and maintaining social stability in 2022 ahead of the 20th Party Congress.” In particular, three policy options stood out; • Cyclical policy would promote consumption and expand effective investment. • The meeting set goals to accelerate affordable housing construction to better meet the reasonable demands of home buyers and promote “virtuous circulation” in the sector. • On social welfare, new fertility policies, a coordinated national pension system and improving the provision of basic public services based on residence. This is part of the common prosperity narrative being put into action—housing for living, not speculation, more affordable housing, seeking to address the needs and improve the lives of the 800 million people who still live on $140 or less per month. | | | | One other important point to mention from the meeting is the wording on “anti-trust” and “disorderly expansion of capital” being dropped. This suggests the regulatory tightening seen in 2021 may be entering a phase focused more on implementation rather than introducing new measures—there may be tweaks but we feel it is unlikely there will be new large scale aggressive policy moves. The subsequent CEWC set out an action plan for growth in 2022. In fact, stabilizing growth was set as the top priority as it pledged to “mobilize all departments and local government with front-loaded infrastructure capex, tax cuts, and a green investment push.” The CEWC is China’s most important and powerful economic execution body and is clearly setting out policy to meet Politburo objectives by, among other things, front loading countercyclical easing, particularly in infrastructure. | | | | The CEWC also emphasized the importance of environmental policy and decarbonization as it pledged “investment before de-investment” in order to boost investment in renewable energy with greater incentives. While 2021 proved to be somewhat disappointing, we move into 2022 with optimism that we may have seen (or at least we started to see) some capitulation in Asian markets, which is starting to present a material valuation gap between markets such as the U.S. and Asia. At the same time, policy in China is moving to support key areas of growth that will benefit not just Chinese business but businesses across Asia involved in supplying industries such as renewable energy. The views expressed represent the opinions of Veritas Asset Management LLP and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

| | | | |

| | | | |

5

| | |

| | AMG Veritas Asia Pacific Fund Portfolio Manager’s Comments (continued) |

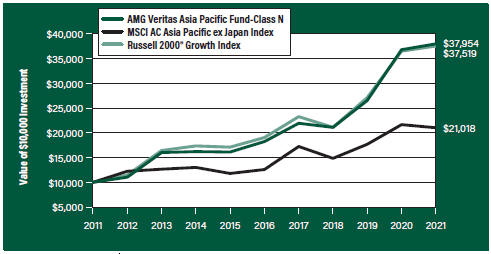

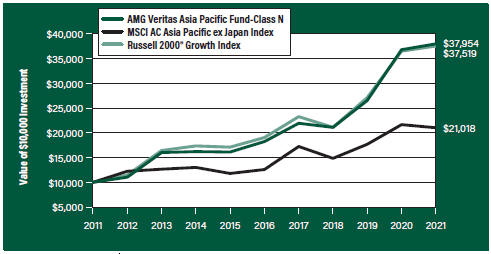

CUMULATIVE TOTAL RETURN PERFORMANCE

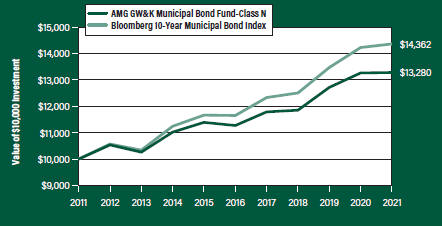

AMG Veritas Asia Pacific Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Veritas Asia Pacific Fund’s Class N shares on December 31, 2011, to a $10,000 investment made in the MSCI AC Asia Pacific ex Japan Index and the Russell 2000® Growth Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Veritas Asia Pacific Fund, MSCI AC Asia Pacific ex Japan Index and the Russell 2000® Growth Index for the same time periods ended December 31, 2021.

| | | | | | | | | | | | |

Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | |

AMG Veritas Asia Pacific Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19 | |

| | | |

Class N | | | 3.16 | % | | | 15.79% | | | | 14.27% | |

| | | |

Class I | | | 3.43 | % | | | 16.09% | | | | 14.51% | |

MSCI AC Asia Pacific ex Japan Index20 | | | (2.90 | %) | | | 10.81% | | | | 7.71% | |

| | | |

Russell 2000® Growth Index21 | | | 2.83 | % | | | 14.53% | | | | 14.14% | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2021. All returns are in U.S. dollars ($). |

|

2 Performance shown for periods prior to March 19, 2021, reflects the performance and investment strategies of the Fund’s previous subadvisers, Federated MDTA LLC, Lord, Abbett & Co. LLC, Ranger Investment Management L.P. and Smith Asset Management Group, L.P. 3 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 4 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. 5 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 6 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. 7 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. |

|

8 The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar investment when converted back to U.S. Dollars. |

|

9 To the extent the Fund focuses its investments in a particular country, group of countries or geographic region, the Fund is particularly susceptible to economic, political, regulatory or other events or conditions affecting such countries or region, and the Fund’s NAV may be more volatile than the NAV of a more geographically diversified fund and may result in losses. |

10 When the Fund has a significant cash balance for a sustained period, the benefit to the Fund of any market upswing may likely be reduced, and the performance may be adversely affected. 11 An investment in participatory notes is subject to market risk. The performance results of participatory notes may not exactly replicate the performance of the underlying securities. An investment in participatory notes is also subject to counterparty risk, relating to the non-U.S. bank or broker-dealer that issues the participatory notes, and maybe subject to liquidity risk. 12 Changes in the general political and social |

6

| | |

| | AMG Veritas Asia Pacific Fund Portfolio Manager’s Comments (continued) |

| | | | | | | | |

environment of a country can have substantial effects on the value of investments exposed to that country. 13 The application of the tax laws and regulations of the People’s Republic of China to income, including capital gains, derived from certain investments of the Fund remains unclear, and may well continue to evolve, possibly with retroactive effect. Any taxes imposed on the investments of the Fund pursuant to such laws and regulations will reduce the Fund’s overall returns. 14 Trading in China A-Shares through Stock Connect is subject to sudden changes in quota limitations, application of trading suspensions, differences in trading days between the People’s Republic of China and Stock Connect, operational risk, clearing and settlement risk and regulatory and taxation risk. 15 The Fund may not be able to value its investments in a manner that accurately reflects their market values, and the Fund may not be able to sell an investment at a price equal to the valuation ascribed to that investment by the Fund. 16 The Fund is subject to the risks associated with investments in emerging markets, such as erratic | | | | earnings patterns, economic and political instability, changing exchange controls, limitations on repatriation of foreign capital and changes in local governmental attitudes toward private investment, possibly leading to nationalization or confiscation of investor assets. 17 A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. 18 The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small-and medium-capitalization companies) when stocks of large-capitalization companies are out of favor. 19 The Fund invests in value stocks, which may perform differently from the market as a whole and maybe undervalued by the market for a long period of time. 20 On March 19, 2021, the benchmark changed from the Russell 2000® Growth Index to the MSCI AC Asia Pacific ex Japan Index. The MSCI AC Asia Pacific ex Japan Index captures large and mid cap representation across certain Developed and Emerging Market countries in the Asia Pacific | | | | region (excluding Japan). Unlike the Fund, the MSCI AC Asia Pacific ex Japan Index is unmanaged, is not available for investment and does not incur expenses. 21 The Russell 2000® Growth Index measures the performance of the Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 2000® Growth Index is unmanaged, is not available for investment and does not incur expenses. The All MSCI data is provided “as is.” The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates, or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. The Russell Indices are trademarks of the London Stock Exchange Group companies. Not FDIC insured, nor bank guaranteed. May lose value. |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

7

| | |

| | AMG Veritas Asia Pacific Fund Fund Snapshots (unaudited) December 31, 2021 |

PORTFOLIO BREAKDOWN

| | |

Sector | | % of Net Assets |

| | |

Information Technology | | 33.5 |

| | |

Industrials | | 11.0 |

| | |

Health Care | | 10.8 |

| | |

Consumer Staples | | 8.8 |

| | |

Communication Services | | 7.4 |

| | |

Consumer Discretionary | | 7.1 |

| | |

Financials | | 6.8 |

| | |

Materials | | 6.5 |

| | |

Real Estate | | 4.3 |

| | |

Energy | | 3.2 |

| | |

Short-Term Investments | | 0.7 |

| | |

Other Assets Less Liabilities | | (0.1) |

TOP TEN HOLDINGS

| | |

Security Name | | % of

Net Assets |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | | 8.2 |

| | |

Samsung Electronics Co., Ltd. (South Korea) | | 8.0 |

| | |

Sungrow Power Supply Co., Ltd., Class A (China) | | 4.8 |

| | |

HDFC Bank, Ltd., ADR (India) | | 4.4 |

| | |

Wuxi Lead Intelligent Equipment Co., Ltd., Class A (China) | | 4.3 |

| | |

Apollo Hospitals Enterprise, Ltd. (CLSA Ltd.) (India) | | 4.2 |

| | |

Sea, Ltd., ADR (Singapore) | | 3.9 |

| | |

Kweichow Moutai Co., Ltd., Class A (China) | | 3.8 |

| | |

Shenzhen Inovance Technology Co., Ltd., Class A (China) | | 3.8 |

| | |

Samsung SDI Co., Ltd. (South Korea) | | 3.6 |

| | |

| | | |

| | |

Top Ten as a Group | | 49.0 |

| | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

8

| | |

| | AMG Veritas Asia Pacific Fund Schedule of Portfolio Investments December 31, 2021 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Common Stocks - 74.1% | | | | | |

| |

Communication Services - 7.4% | | | | | |

| | |

Kakao Corp. (South Korea)* | | | 12,000 | | | | $1,133,188 | |

| | |

Sea, Ltd., ADR (Singapore)* | | | 33,136 | | | | 7,412,854 | |

| | |

Tencent Holdings, Ltd. (China) | | | 92,239 | | | | 5,382,249 | |

| |

Total Communication Services | | | | 13,928,291 | |

| |

Consumer Discretionary - 3.3% | | | | | |

| | |

Alibaba Group Holding, Ltd. (China)* | | | 91,350 | | | | 1,342,442 | |

| | |

Coupang, Inc. (South Korea)* | | | 60,000 | | | | 1,762,800 | |

| | |

Midea Group Co., Ltd., Class A (China) | | | 270,697 | | | | 3,134,824 | |

| |

Total Consumer Discretionary | | | | 6,240,066 | |

| |

Consumer Staples - 3.8% | | | | | |

| | |

Kweichow Moutai Co., Ltd., Class A (China) | | | 22,100 | | | | 7,102,014 | |

| |

Financials - 4.4% | | | | | |

| | |

HDFC Bank, Ltd., ADR (India) | | | 126,816 | | | | 8,251,917 | |

| |

Health Care - 5.4% | | | | | |

| | |

Adeptus Health, Inc. (United States)1,2 | | | 24,574 | | | | 0 | |

| | |

Cochlear, Ltd. (Australia) | | | 15,918 | | | | 2,498,338 | |

| | |

CSL, Ltd. (Australia) | | | 20,974 | | | | 4,436,009 | |

| | |

Guangzhou Kingmed Diagnostics Group Co., Ltd., Class A (China) | | | 169,900 | | | | 2,963,093 | |

| | |

JW Cayman Therapeutics Co., Ltd. (China)*,3 | | | 199,500 | | | | 344,656 | |

| |

Total Health Care | | | | 10,242,096 | |

| |

Industrials - 11.0% | | | | | |

| | |

Centre Testing International Group Co., Ltd., Class A (China) | | | 544,800 | | | | 2,296,081 | |

| | |

Contemporary Amperex Technology Co., Ltd., Class A (China) | | | 24,700 | | | | 2,275,233 | |

| | |

Shenzhen Inovance Technology Co., Ltd., Class A (China) | | | 655,297 | | | | 7,060,501 | |

| | |

Sungrow Power Supply Co., Ltd., Class A (China) | | | 394,700 | | | | 9,032,754 | |

| |

Total Industrials | | | | 20,664,569 | |

| |

Information Technology - 29.9% | | | | | |

| | |

Afterpay, Ltd. (Australia)* | | | 81,597 | | | | 4,925,784 | |

| | |

Hangzhou First Applied Material Co., Ltd., Class A (China) | | | 119,960 | | | | 2,454,573 | |

| | |

Kakao Pay Corp. (South Korea)* | | | 6,970 | | | | 1,023,146 | |

| | |

LONGi Green Energy Technology Co., Ltd., Class A (China) | | | 93,760 | | | | 1,268,582 | |

| | |

MediaTek, Inc. (Taiwan) | | | 25,000 | | | | 1,072,738 | |

| | |

Samsung Electronics Co., Ltd. (South Korea) | | | 229,650 | | | | 15,082,257 | |

| | |

Samsung SDI Co., Ltd. (South Korea)* | | | 12,400 | | | | 6,819,654 | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | | | 701,400 | | | | 15,515,669 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Wuxi Lead Intelligent Equipment Co., Ltd., Class A (China) | | | 689,998 | | | | $8,047,901 | |

| |

Total Information Technology | | | | 56,210,304 | |

| |

Materials - 4.6% | | | | | |

| | |

LG Chem, Ltd. (South Korea) | | | 13,040 | | | | 6,741,186 | |

| | |

Yunnan Energy New Material Co., Ltd., Class A (China) | | | 48,000 | | | | 1,883,698 | |

| |

Total Materials | | | | 8,624,884 | |

| |

Real Estate - 4.3% | | | | | |

| | |

Country Garden Services Holdings Co., Ltd. (China) | | | 399,958 | | | | 2,401,314 | |

| | |

Goodman Group, REIT (Australia) | | | 300,346 | | | | 5,789,717 | |

| |

Total Real Estate | | | | 8,191,031 | |

| | |

Total Common Stocks | | | | | | | | |

(Cost $145,024,046) | | | | | | | 139,455,172 | |

| | |

Participation Notes - 25.3% | | | | | | | | |

| |

Consumer Discretionary - 3.8% | | | | | |

| | |

Titan Co., Ltd. (CLSA Ltd.), 01/09/23 (India) | | | 100,000 | | | | 3,382,897 | |

| | |

Zomato, Ltd. (CLSA Ltd.), 07/22/26 (India) | | | 2,000,000 | | | | 3,696,746 | |

| |

Total Consumer Discretionary | | | | 7,079,643 | |

| |

Consumer Staples - 5.0% | | | | | |

| | |

Hindustan Unilever, Ltd. (CLSA Ltd.), 06/30/25 (India) | | | 194,500 | | | | 6,156,998 | |

| | |

Nestle India, Ltd. (CLSA Ltd.), 02/19/25 (India) | | | 12,300 | | | | 3,255,452 | |

| |

Total Consumer Staples | | | | 9,412,450 | |

| |

Energy - 3.2% | | | | | |

| | |

Reliance Industries Ltd. (CLSA Ltd.), 06/30/25 (India) | | | 84,000 | | | | 2,668,394 | |

| | |

Sungrow Power Supply Co., Ltd. (UBS Securities LLC), 04/21/22 (China) | | | 146,494 | | | | 3,352,532 | |

| |

Total Energy | | | | 6,020,926 | |

| |

Financials - 2.4% | | | | | |

| | |

Kotak Mahindra Bank, Ltd. (CLSA Ltd.), 06/02/25 (India) | | | 187,500 | | | | 4,513,281 | |

| |

Health Care - 5.4% | | | | | |

| | |

Apollo Hospitals Enterprise, Ltd. (CLSA Ltd.), 05/23/22 (India) | | | 118,000 | | | | 7,942,854 | |

| | |

Max Healthcare Institute, Ltd. (CLSA Ltd.), 04/06/26 (India) | | | 378,000 | | | | 2,246,823 | |

| |

Total Health Care | | | | 10,189,677 | |

| |

Information Technology - 3.6% | | | | | |

| | |

Info Edge India, Ltd. (CLSA Ltd.), 12/31/24 (India) | | | 10,000 | | | | 748,406 | |

| | |

Tata Consultancy Services, Ltd. (CLSA Ltd.), 02/25/25 (India) | | | 120,731 | | | | 6,055,329 | |

| |

Total Information Technology | | | | 6,803,735 | |

The accompanying notes are an integral part of these financial statements.

9

| | |

| | AMG Veritas Asia Pacific Fund Schedule of Portfolio Investments (continued) |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Materials - 1.9% | | | | | |

| | |

Asian Paints, Ltd. (CLSA Ltd.), 06/30/25 (India) | | | 78,500 | | | | $3,567,020 | |

| | |

Total Participation Notes | | | | | | | | |

(Cost $39,656,555) | | | | | | | 47,586,732 | |

| | |

Short-Term Investments - 0.7% | | | | | | | | |

|

Other Investment Companies - 0.7% | |

| | |

Dreyfus Government Cash Management Fund, Institutional Shares, 0.03%4 | | | 454,273 | | | | 454,273 | |

| | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.01%4 | | | 454,273 | | | | 454,273 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 0.03%4 | | | 468,038 | | | | $468,038 | |

| | |

Total Short-Term Investments | | | | | | | | |

(Cost $1,376,584) | | | | | | | 1,376,584 | |

| | |

Total Investments - 100.1% | | | | | | | | |

(Cost $186,057,185) | | | | | | | 188,418,488 | |

| | |

Other Assets, less Liabilities - (0.1)% | | | | | | | (184,572 | ) |

| | |

Net Assets - 100.0% | | | | | | $ | 188,233,916 | |

| * | Non-income producing security. |

| 2 | Security’s value was determined by using significant unobservable inputs. |

| 3 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2021, the value of these securities amounted to $344,656 or 0.2% of net assets. |

| 4 | Yield shown represents the December 31, 2021, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

ADR American Depositary Receipt

REIT Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

10

| | |

| | AMG Veritas Asia Pacific Fund Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of December 31, 2021:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 21 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Common Stocks | | | | | | | | | | | | | | | | |

| | | | |

Information Technology | | | $1,023,146 | | | | $55,187,158 | | | | – | | | $ | 56,210,304 | |

| | | | |

Industrials | | | – | | | | 20,664,569 | | | | – | | | | 20,664,569 | |

| | | | |

Communication Services | | | 7,412,854 | | | | 6,515,437 | | | | – | | | | 13,928,291 | |

| | | | |

Health Care | | | – | | | | 10,242,096 | | | | $0 | | | | 10,242,096 | |

| | | | |

Materials | | | – | | | | 8,624,884 | | | | – | | | | 8,624,884 | |

| | | | |

Financials | | | 8,251,917 | | | | – | | | | – | | | | 8,251,917 | |

| | | | |

Real Estate | | | – | | | | 8,191,031 | | | | – | | | | 8,191,031 | |

| | | | |

Consumer Staples | | | – | | | | 7,102,014 | | | | – | | | | 7,102,014 | |

| | | | |

Consumer Discretionary | | | 1,762,800 | | | | 4,477,266 | | | | – | | | | 6,240,066 | |

| | | | |

Participation Notes | | | | | | | | | | | | | | | | |

| | | | |

Health Care | | | – | | | | 10,189,677 | | | | – | | | | 10,189,677 | |

| | | | |

Consumer Staples | | | – | | | | 9,412,450 | | | | – | | | | 9,412,450 | |

| | | | |

Consumer Discretionary | | | – | | | | 7,079,643 | | | | – | | | | 7,079,643 | |

| | | | |

Information Technology | | | – | | | | 6,803,735 | | | | – | | | | 6,803,735 | |

| | | | |

Energy | | | – | | | | 6,020,926 | | | | – | | | | 6,020,926 | |

| | | | |

Financials | | | – | | | | 4,513,281 | | | | – | | | | 4,513,281 | |

| | | | |

Materials | | | – | | | | 3,567,020 | | | | – | | | | 3,567,020 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Other Investment Companies | | | 1,376,584 | | | | – | | | | – | | | | 1,376,584 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities | | $ | 19,827,301 | | | | $168,591,187 | | | | $0 | | | $ | 188,418,488 | |

| | | | | | | | | | | | | | | | |

| 1 | An external pricing service is used to reflect any impact on security value due to market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. |

For the fiscal year ended December 31, 2021 there were no transfers in or out of Level 3.

| | | | |

| | | Common

Stock |

| |

Balance as of December 31, 2020 | | | $68,811 | |

| |

Accrued discounts (premiums) | | | – | |

| |

Realized gain (loss) | | | (107,072 | ) |

| |

Change in unrealized appreciation/depreciation | | | 119,593 | |

| |

Purchases | | | – | |

| |

Sales | | | (81,332 | ) |

| |

Transfers in to Level 3 | �� | | – | |

| |

Transfers out of Level 3 | | | | |

| |

Balance as of December 31, 2021 | | | $0 | |

| |

| | | | |

| |

Net change in unrealized appreciation/depreciation on investments still held at December 31, 2021 | | | $0 | |

The accompanying notes are an integral part of these financial statements.

11

| | |

| | AMG Veritas Asia Pacific Fund Schedule of Portfolio Investments (continued) |

The country allocation in the Schedule of Portfolio Investments at December 31, 2021, was as follows:

| | |

| Country | | % of Long-Term

Investments |

| |

Australia | | 9.4 |

| |

China | | 32.3 |

| |

India | | 28.0 |

| |

Singapore | | 4.0 |

| |

South Korea | | 17.4 |

| |

Taiwan | | 8.9 |

| |

United States | | 0.0 |

| | |

| |

| | 100.0 |

| | |

The accompanying notes are an integral part of these financial statements.

12

| | |

| | Statement of Assets and Liabilities December 31, 2021 |

| | | | |

| | | AMG Veritas

Asia

Pacific Fund |

| |

Assets: | | | | |

| |

Investments at value1 | | | $188,418,488 | |

| |

Dividend and interest receivables | | | 246,667 | |

| |

Receivable for Fund shares sold | | | 56,762 | |

| |

Receivable from affiliate | | | 20,448 | |

| |

Prepaid expenses and other assets | | | 11,208 | |

| |

Total assets | | | 188,753,573 | |

| |

Liabilities: | | | | |

| |

Payable for Fund shares repurchased | | | 220,756 | |

| |

Accrued expenses: | | | | |

| |

Investment advisory and management fees | | | 115,276 | |

| |

Administrative fees | | | 24,354 | |

| |

Shareholder service fees | | | 35,879 | |

| |

Other | | | 123,392 | |

| |

Total liabilities | | | 519,657 | |

| |

| | | | |

| |

Net Assets | | | $188,233,916 | |

| |

1 Investments at cost | | | $186,057,185 | |

The accompanying notes are an integral part of these financial statements.

13

| | |

| | Statement of Assets and Liabilities (continued) |

| | | | |

| | | AMG Veritas

Asia

Pacific Fund | |

| |

Net Assets Represent: | | | | |

Paid-in capital | | | $186,175,597 | |

| |

Total distributable earnings | | | 2,058,319 | |

| |

Net Assets | | | $188,233,916 | |

| |

Class N: | | | | |

| |

Net Assets | | | $166,168,062 | |

| |

Shares outstanding | | | 2,016,038 | |

| |

Net asset value, offering and redemption price per share | | | $82.42 | |

| |

Class I: | | | | |

| |

Net Assets | | | $22,065,854 | |

| |

Shares outstanding | | | 244,766 | |

| |

Net asset value, offering and redemption price per share | | | $90.15 | |

The accompanying notes are an integral part of these financial statements.

14

| | |

| | Statement of Operations For the fiscal year ended December 31, 2021 |

| | | | |

| | | AMG Veritas | |

| | | Asia | |

| | | Pacific Fund | |

| |

Investment Income: | | | | |

| |

Dividend income | | | $1,516,303 | |

| |

Interest income | | | 387 | |

| |

Securities lending income | | | 44,863 | |

| |

Foreign withholding tax | | | (218,287 | ) |

| |

Total investment income | | | 1,343,266 | |

| |

Expenses: | | | | |

| |

Investment advisory and management fees | | | 1,857,412 | |

| |

Administrative fees | | | 345,461 | |

| |

Shareholder servicing fees - Class N | | | 487,717 | |

| |

Custodian fees | | | 81,591 | |

| |

Professional fees | | | 47,757 | |

| |

Reports to shareholders | | | 35,456 | |

| |

Registration fees | | | 32,331 | |

| |

Transfer agent fees | | | 23,182 | |

| |

Trustee fees and expenses | | | 15,914 | |

| |

Interest expense | | | 207 | |

| |

Miscellaneous | | | 8,894 | |

| |

Total expenses before offsets | | | 2,935,922 | |

| |

Expense reimbursements | | | (95,606 | ) |

| |

Expense reductions | | | (695 | ) |

| |

Net expenses | | | 2,839,621 | |

| |

| | | | |

| |

Net investment loss | | | (1,496,355 | ) |

| |

Net Realized and Unrealized Gain: | | | | |

| |

Net realized gain on investments | | | 90,927,326 | |

| |

Net realized loss on foreign currency transactions | | | (123,767 | ) |

| |

Net change in unrealized appreciation/depreciation on investments | | | (79,240,814 | ) |

| |

Net change in unrealized appreciation/depreciation on foreign currency translations | | | 103 | |

| |

Net realized and unrealized gain | | | 11,562,848 | |

| |

| | | | |

| |

Net increase in net assets resulting from operations | | | $10,066,493 | |

The accompanying notes are an integral part of these financial statements.

15

| | |

| | Statements of Changes in Net Assets For the fiscal years ended December 31, |

| | | | | | | | |

| | | AMG Veritas

Asia Pacific Fund | |

| | |

| | | 2021 | | | 2020 | |

| | |

Increase in Net Assets Resulting From Operations: | | | | | | | | |

| | |

Net investment loss | | | $(1,496,355 | ) | | | $(1,688,073 | ) |

| | |

Net realized gain on investments | | | 90,803,559 | | | | 17,151,747 | |

| | |

Net change in unrealized appreciation/depreciation on investments | | | (79,240,711 | ) | | | 54,091,097 | |

| | |

Net increase in net assets resulting from operations | | | 10,066,493 | | | | 69,554,771 | |

| | |

Distributions to Shareholders: | | | | | | | | |

| | |

From net investment income and/or realized gain on investments: | | | | | | | | |

| | |

Class N | | | (78,253,343 | ) | | | (8,646,696 | ) |

| | |

Class I | | | (14,229,481 | ) | | | (1,785,052 | ) |

| | |

From paid-in capital: | | | | | | | | |

| | |

Class N | | | (16,749,799 | ) | | | — | |

| | |

Class I | | | (3,045,760 | ) | | | — | |

| | |

Total distributions to shareholders | | | (112,278,383 | ) | | | (10,431,748 | ) |

| | |

Capital Share Transactions:1 | | | | | | | | |

| | |

Net increase (decrease) from capital share transactions | | | 41,059,273 | | | | (19,630,632 | ) |

| | | | | | | | |

| | |

Total increase (decrease) in net assets | | | (61,152,617 | ) | | | 39,492,391 | |

| | |

Net Assets: | | | | | | | | |

| | |

Beginning of year | | | 249,386,533 | | | | 209,894,142 | |

| | |

End of year | | | $188,233,916 | | | | $249,386,533 | |

| | | | | | | |

1 See Note 1(g) of the Notes to Financial Statements.

The accompanying notes are an integral part of these financial statements.

16

| | |

| | | AMG Veritas Asia Pacific Fund |

| | | Financial Highlights |

| | | For a share outstanding throughout each fiscal year |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended December 31, | |

| | | | | |

| Class N | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 20171 | |

| | | | | |

Net Asset Value, Beginning of Year | | | $147.58 | | | | $111.15 | | | | $114.95 | | | | $119.45 | | | | $99.33 | |

| | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment loss2,3 | | | (0.67 | ) | | | (1.03 | ) | | | (1.03 | ) | | | (0.91 | ) | | | (0.79 | )4 |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | 4.55 | | | | 43.88 | | | | 30.19 | | | | (3.59 | ) | | | 20.91 | |

| | | | | |

Total income (loss) from investment operations | | | 3.88 | | | | 42.85 | | | | 29.16 | | | | (4.50 | ) | | | 20.12 | |

| | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net realized gain on investments | | | (56.87 | ) | | | (6.42 | ) | | | (32.96 | ) | | | — | | | | — | |

| | | | | |

Paid in capital | | | (12.17 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | |

Total distributions to shareholders | | | (69.04 | ) | | | (6.42 | ) | | | (32.96 | ) | | | — | | | | — | |

| | | | | |

Net Asset Value, End of Year | | | $82.42 | | | | $147.58 | | | | $111.15 | | | | $114.95 | | | | $119.45 | |

| | | | | |

Total Return3,5 | | | 3.16 | % | | | 38.74 | % | | | 25.69 | % | | | (3.76 | )% | | | 20.25 | % |

| | | | | |

Ratio of net expenses to average net assets6 | | | 1.27 | % | | | 1.36 | % | | | 1.36 | % | | | 1.36 | % | | | 1.36 | % |

| | | | | |

Ratio of gross expenses to average net assets7 | | | 1.31 | % | | | 1.42 | % | | | 1.42 | % | | | 1.38 | % | | | 1.41 | % |

| | | | | |

Ratio of net investment loss to average net assets3 | | | (0.69 | )% | | | (0.89 | )% | | | (0.76 | )% | | | (0.69 | )% | | | (0.73 | )% |

| | | | | |

Portfolio turnover | | | 222 | % | | | 100 | % | | | 96 | % | | | 113 | % | | | 81 | % |

| | | | | |

Net assets end of year (000’s) omitted | | | $166,168 | | | | $204,794 | | | | $171,801 | | | | $170,744 | | | | $173,607 | |

| | | | | | | | | | | | | | | | | | | | | |

17

| | |

| | | AMG Veritas Asia Pacific Fund |

| | | Financial Highlights |

| | | For a share outstanding throughout each fiscal year |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended December 31, | |

| | | | | |

| Class I | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| | | | | |

Net Asset Value, Beginning of Year | | | $154.81 | | | | $116.08 | | | | $118.57 | | | | $122.90 | | | | $101.95 | |

| | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment loss2,3 | | | (0.48 | ) | | | (0.77 | ) | | | (0.72 | ) | | | (0.60 | ) | | | (0.54 | )4 |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | 4.86 | | | | 45.92 | | | | 31.19 | | | | (3.73 | ) | | | 21.49 | |

| | | | | |

Total income (loss) from investment operations | | | 4.38 | | | | 45.15 | | | | 30.47 | | | | (4.33 | ) | | | 20.95 | |

| | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net realized gain on investments | | | (56.87 | ) | | | (6.42 | ) | | | (32.96 | ) | | | — | | | | — | |

| | | | | |

Paid in capital | | | (12.17 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | |

Total distributions to shareholders | | | (69.04 | ) | | | (6.42 | ) | | | (32.96 | ) | | | — | | | | — | |

| | | | | |

Net Asset Value, End of Year | | | $90.15 | | | | $154.81 | | | | $116.08 | | | | $118.57 | | | | $122.90 | |

| | | | | |

Total Return3,5 | | | 3.43 | % | | | 39.08 | % | | | 26.02 | % | | | (3.52 | )% | | | 20.55 | % |

| | | | | |

Ratio of net expenses to average net assets6 | | | 1.02 | % | | | 1.11 | % | | | 1.11 | % | | | 1.11 | % | | | 1.11 | % |

| | | | | |

Ratio of gross expenses to average net assets7 | | | 1.06 | % | | | 1.17 | % | | | 1.17 | % | | | 1.13 | % | | | 1.16 | % |

| | | | | |

Ratio of net investment loss to average net assets3 | | | (0.44 | )% | | | (0.64 | )% | | | (0.51 | )% | | | (0.44 | )% | | | (0.48 | )% |

| | | | | |

Portfolio turnover | | | 222 | % | | | 100 | % | | | 96 | % | | | 113 | % | | | 81 | % |

| | | | | |

Net assets end of year (000’s) omitted | | | $22,066 | | | | $44,593 | | | | $38,093 | | | | $31,253 | | | | $26,865 | |

| | | | | | | | | | | | | | | | | | | | | |

| 1 | Effective February 27, 2017, Class S shares were renamed Class N shares. |

| 2 | Per share numbers have been calculated using average shares. |

| 3 | Total returns and net investment loss would have been lower had certain expenses not been offset. |

| 4 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.84) and $(0.59) for Class N and Class I, respectively. |

| 5 | The total return is calculated using the published Net Asset Value as of fiscal year end. |

| 6 | Includes reduction from broker recapture amounting to less than 0.01% for the fiscal years ended 2021, 2020, 2019, 2018 and 2017, respectively. |

| 7 | Excludes the impact of expense reimbursement or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes, and extraordinary expenses. (See Note 1(c) and 2 in the Notes to Financial Statements.) |

18

| | |

| | Notes to Financial Statements December 31, 2021 |

1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AMG Funds III (the “Trust”) is an open-end management investment company, organized as a Massachusetts business trust, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust consists of a number of different funds, each having distinct investment management objectives, strategies, risks, and policies. Included in this report is AMG Veritas Asia Pacific Fund (formerly AMG Managers Special Equity Fund) (the “Fund”).

The Fund offers Class N and Class I shares. Each class represents an interest in the same assets of the Fund. Although all share classes generally have identical voting rights, each share class votes separately when required by law. Different share classes may have different net asset values per share to the extent the share classes pay different distribution amounts and/or the expenses of such share classes differ. Each share class has its own expense structure. Please refer to a current prospectus for additional information on each share class.

On March 17-18, 2021, the Board of Trustees of AMG Funds III, (the “Board”) approved Veritas Asset Management LLP (“Veritas”) as the subadviser to the Fund to replace Federated MDTA LLC (“Federated Hermes”), Lord, Abbett & Co. LLC (“Lord Abbett”), Ranger Investment Management L.P. (“Ranger Investment Management”) and Smith Asset Management Group, L.P. (“Smith Asset Management”) effective March 19, 2021, which was subsequently approved by the shareholders of the Fund on June 18, 2021. In conjunction with the subadviser change, the Fund seeks to achieve its investment objective by investing in equity securities listed or traded on exchanges in the Asia Pacific region (excluding Japan). In conjunction with the respective changes in investment strategy, the Fund sold substantially all open positions around the date of the subadviser change that increased the Fund’s portfolio turnover. The Fund also declared a special capital gain distribution on March 24, 2021. In addition, the Board also approved expense changes (See Note 2).

Effective June 18, 2021, the Fund became a non-diversified fund. A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund.

Market disruptions associated with the COVID-19 pandemic have had a global impact, and uncertainty exists as to the long-term implications. Such disruptions can adversely affect assets of the Fund and thus Fund performance.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), including accounting and reporting guidance pursuant to Accounting Standards Codification Topic 946 applicable to investment companies. U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

a. VALUATION OF INVESTMENTS

Equity securities traded on a national securities exchange or reported on the NASDAQ national market system (“NMS”) are valued at the last quoted sales price on the primary exchange or, if applicable, the NASDAQ official closing price or the official closing price of the relevant exchange or, lacking any sales, at the last

quoted bid price. Equity securities traded in the over-the-counter market (other than NMS securities) are valued at the bid price. Foreign equity securities (securities principally traded in markets other than U.S. markets) are valued at the official closing price on the primary exchange or, for markets that either do not offer an official closing price or where the official closing price may not be representative of the overall market, the last quoted sale price.

Fixed income securities purchased with a remaining maturity of 60 days or less are valued at amortized cost, provided that the amortized cost value is approximately the same as the fair value of the security valued without the use of amortized cost. Investments in other open-end registered investment companies are valued at their end of day net asset value per share.

Participation notes (“P-Notes”) are valued using the underlying equity security’s official closing price on the primary exchange or, for markets that either do not offer an official closing price or where the official closing price may not be representative of the overall market, the last quoted sale price.

The Fund’s portfolio investments are generally valued based on independent market quotations or prices or, if none, “evaluative” or other market based valuations provided by third party pricing services approved by the Board. Under certain circumstances, the value of certain Fund portfolio investments may be based on an evaluation of fair value, pursuant to procedures established by and under the general supervision of the Board. The Valuation Committee, which is comprised of the Independent Trustees of the Board, and the Pricing Committee, which is comprised of representatives from AMG Funds LLC (the “Investment Manager”) are the committees appointed by the Board to make fair value determinations. The Fund may use the fair value of a portfolio investment to calculate its net asset value (“NAV”) in the event that the market quotation, price or market based valuation for the portfolio investment is not readily available or otherwise not determinable pursuant to the Board’s valuation procedures, if the Investment Manager or the Pricing Committee believes the quotation, price or market based valuation to be unreliable, or in certain other circumstances. When determining the fair value of an investment, the Pricing Committee and, if required under the Trust’s securities valuation procedures, the Valuation Committee, seeks to determine the price that the Fund might reasonably expect to receive from current sale of that portfolio investment in an arms-length transaction. Fair value determinations shall be based upon consideration of all available facts and information, including, but not limited to (i) attributes specific to the investment; (ii) fundamental and analytical data relating to the investment; and (iii) the value of other comparable securities or relevant financial instruments, including derivative securities, traded on other markets or among dealers.

The values assigned to fair value portfolio investments are based on available information and do not necessarily represent amounts that might ultimately be realized in the future, since such amounts depend on future developments inherent in long-term investments. Because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material. The Board will be presented with a quarterly report showing as of the most recent quarter end, all outstanding securities fair valued by the Fund, including a comparison with the prior quarter end and the percentage of the Fund that the security represents at each quarter end.

With respect to foreign equity securities and certain foreign fixed income securities, the Board has adopted a policy that securities held in the Fund that can be fair valued by the applicable fair value pricing service are fair valued on each

19

| | |

| | Notes to Financial Statements (continued) |

business day provided that each individual price exceeds a pre-established confidence level.

U.S. GAAP defines fair value as the price that a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP also establishes a framework for measuring fair value, and a three level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund.

Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation.

The three-tier hierarchy of inputs is summarized below:

Level 1 – inputs are quoted prices in active markets for identical investments (e.g., equity securities, open-end investment companies)

Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market corroborated inputs) (e.g., debt securities, government securities, foreign currency exchange contracts, swaps, P-Notes, foreign securities utilizing international fair value pricing, fair valued securities with observable inputs)

Level 3 – inputs are significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of investments) (e.g., fair valued securities with unobservable inputs)

Changes in inputs or methodologies used for valuing investments may result in a transfer in or out of levels within the fair value hierarchy. The inputs or methodologies used for valuing investments may not necessarily be an indication of the risk associated with investing in those investments.

b. SECURITY TRANSACTIONS

Security transactions are accounted for as of trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

c. INVESTMENT INCOME AND EXPENSES

Dividend income is recorded on the ex-dividend date. Dividends from foreign securities are recorded on the ex-dividend date, and if after the fact, as soon as the Fund becomes aware of the ex-dividend date, except for Korean securities where dividends are recorded on confirmation date. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Dividend and interest income on foreign securities is recorded gross of any withholding tax. Non-cash dividends included in dividend income, if any, are reported at the fair market value of the securities received. Other income and expenses are recorded on an accrual basis. Expenses that cannot be directly attributed to a Fund are apportioned among the funds in the Trust and other trusts

or funds within the AMG Funds Family of Funds (collectively the “AMG Funds Family”) based upon their relative average net assets or number of shareholders. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund.

The Fund had certain portfolio trades directed to various brokers under a brokerage recapture program. Credits received from the brokerage recapture program are earned and paid on a monthly basis, and are recorded as expense offsets, which serve to reduce the Fund’s overall expense ratio. For the fiscal year ended December 31, 2021, the impact on the expenses and expense ratios was $695 or less than 0.01%.

d. DIVIDENDS AND DISTRIBUTIONS

Fund distributions resulting from either net investment income or realized net capital gains, if any, will normally be declared and paid at least annually in December. Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined in accordance with federal income tax regulations, which may differ from net investment income and net realized capital gains for financial statement purposes (U.S. GAAP). Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Permanent book and tax basis differences, if any, relating to shareholder distributions will result in reclassifications to paid-in capital. Temporary differences arise when certain items of income, expense and gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. There were no permanent differences during the year. Temporary differences are due to wash sale loss deferrals and the deferral of qualified late year losses.

The tax character of distributions paid during the fiscal years ended December 31, 2021 and December 31, 2020 were as follows:

| | | | | | | | |

| | |

| Distributions paid from: | | 2021 | | | 2020 | |

Ordinary income * | | | $37,755,763 | | | | — | |

Long-term capital gains | | | 54,727,061 | | | | $10,431,748 | |

Paid-in capital | | | 19,795,559 | | | | — | |

| | | | | | | | |

| | | $112,278,383 | | | | $10,431,748 | |

| | | | | | | | |

| * | For tax purposes, short-term capital gain distributions, if any, are considered ordinary income distributions. |

As of December 31, 2021, the components of distributable earnings (excluding unrealized appreciation/depreciation) on a tax basis consisted of:

| | |

| |

Late-year loss deferral | | $109,128 |

At December 31, 2021, the cost of investments and the aggregate gross unrealized appreciation and depreciation for federal income tax purposes were as follows:

| | | | | | | | | | | | |

| Cost | | Appreciation | | | Depreciation | | | Net Appreciation | |

| $186,251,144 | | | $18,567,993 | | | | $(16,400,546) | | | | $2,167,447 | |

20

| | |

| | Notes to Financial Statements (continued) |

e. FEDERAL TAXES

The Fund currently qualifies as an investment company and intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, and to distribute substantially all of its taxable income and gains to its shareholders and to meet certain diversification and income requirements with respect to investment companies. Therefore, no provision for federal income or excise tax is included in the accompanying financial statements.

Additionally, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for the foreign jurisdictions in which it invests, the Fund will provide for foreign taxes, and where appropriate, deferred foreign taxes.

Management has analyzed the Fund’s tax positions taken on federal income tax returns as of December 31, 2021, and for all open tax years (generally, the three

prior taxable years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. Additionally, Management is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

f. CAPITAL LOSS CARRYOVERS AND DEFERRALS

As of December 31, 2021, the Fund had no capital loss carryovers for federal income tax purposes. Should the Fund incur net capital losses for the fiscal year ended December 31, 2022, such amounts may be used to offset future realized capital gains indefinitely, and retain their character as short-term and/or long-term.

g. CAPITAL STOCK

The Trust’s Declaration of Trust authorizes for the Fund the issuance of an unlimited number of shares of beneficial interest, without par value. The Fund records sales and repurchases of its capital stock on the trade date.

For the fiscal years ended December 31, 2021 and December 31, 2020, the capital stock transactions by class for the Fund were as follows:

| | | | | | | | | | | | | | | | |

| | | December 31, 2021 | | | December 31, 2020 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | |

Class N: | | | | | | | | | | | | | | | | |

| | | | |

Proceeds from sale of shares | | | 55,947 | | | | $5,742,835 | | | | 32,466 | | | | $3,813,396 | |

| | | | |

Reinvestment of distributions | | | 1,128,609 | | | | 91,981,675 | | | | 58,454 | | | | 8,351,282 | |

| | | | |

Cost of shares repurchased | | | (556,214) | | | | (49,186,622) | | | | (248,844) | | | | (27,811,616) | |

| | | | | | | | | | | | | | | | |

| | | | |

Net increase (decrease) | | | 628,342 | | | | $48,537,888 | | | | (157,924) | | | | $(15,646,938) | |

| | | | | | | | | | | | | | | | |

| | | | |

Class I: | | | | | | | | | | | | | | | | |

| | | | |

Proceeds from sale of shares | | | 63,510 | | | | $7,190,492 | | | | 53,503 | | | | $6,681,747 | |

| | | | |

Reinvestment of distributions | | | 192,066 | | | | 17,088,128 | | | | 11,788 | | | | 1,766,664 | |

| | | | |

Cost of shares repurchased | | | (298,858) | | | | (31,757,235) | | | | (105,414) | | | | (12,432,105) | |

| | | | | | | | | | | | | | | | |

| | | | |

Net decrease | | | (43,282) | | | | $(7,478,615) | | | | (40,123) | | | | $(3,983,694) | |

| | | | | | | | | | | | | | | | |

h. REPURCHASE AGREEMENTS AND JOINT REPURCHASE AGREEMENTS

The Fund may enter into third-party repurchase agreements for temporary cash management purposes and third-party or bilateral joint repurchase agreements for reinvestment of cash collateral on securities lending transactions under the securities lending program offered by The Bank of New York Mellon (“BNYM”) (the “Program”) (collectively, “Repurchase Agreements”). The value of the underlying collateral, including accrued interest, must equal or exceed the value of the Repurchase Agreements during the term of the agreement. For joint repurchase agreements, the Fund participates on a pro rata basis with other clients of BNYM in its share of the underlying collateral under such joint repurchase agreements and in its share of proceeds from any repurchase or other disposition of the underlying collateral. The underlying collateral for all Repurchase Agreements is held in safekeeping by the Fund’s custodian or at the Federal Reserve Bank. If the seller defaults and the value of the collateral declines, or if bankruptcy

proceedings commence with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited. Pursuant to the Program, the Fund is indemnified for such losses by BNYM on joint repurchase agreements.

At December 31, 2021, there are no outstanding Repurchase Agreements for the Fund.

i. FOREIGN CURRENCY TRANSLATION

The books and records of the Fund are maintained in U.S. dollars. The value of investments, assets and liabilities denominated in currencies other than U.S. dollars are translated into U.S. dollars based upon current foreign exchange rates. Purchases and sales of foreign investments, income and expenses are converted into U.S. dollars based on currency exchange rates prevailing on the respective dates of such transactions. Net realized and unrealized gain (loss) on foreign currency transactions represent: (1) foreign exchange gains and losses from the

21

| | |

| | Notes to Financial Statements (continued) |

sale and holdings of foreign currencies; (2) gains and losses between trade date and settlement date on investment securities transactions and foreign currency exchange contracts; and (3) gains and losses from the difference between amounts of interest and dividends recorded and the amounts actually received.

The Fund does not isolate the net realized and unrealized gain or loss resulting from changes in exchange rates from the fluctuations in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

2. AGREEMENTS AND TRANSACTIONS WITH AFFILIATES

The Trust has entered into an investment advisory agreement under which the Investment Manager, a subsidiary and the U.S. retail distribution arm of Affiliated Managers Group, Inc. (“AMG”), serves as investment manager to the Fund and is responsible for the Fund’s overall administration and operations. The Investment Manager selects one or more subadvisers for the Fund (subject to Board approval) and monitors each subadviser’s investment performance, security holdings and investment strategies. The Fund’s investment portfolio is managed by Veritas Asset Management LLP (“Veritas”) who serves pursuant to a subadvisory agreement with the Investment Manager. AMG indirectly owns a majority interest in Veritas. Prior to March 19, 2021, the Fund’s investment portfolio was managed by Federated Hermes, Lord Abbett, Ranger Investment Management and Smith Asset Management.