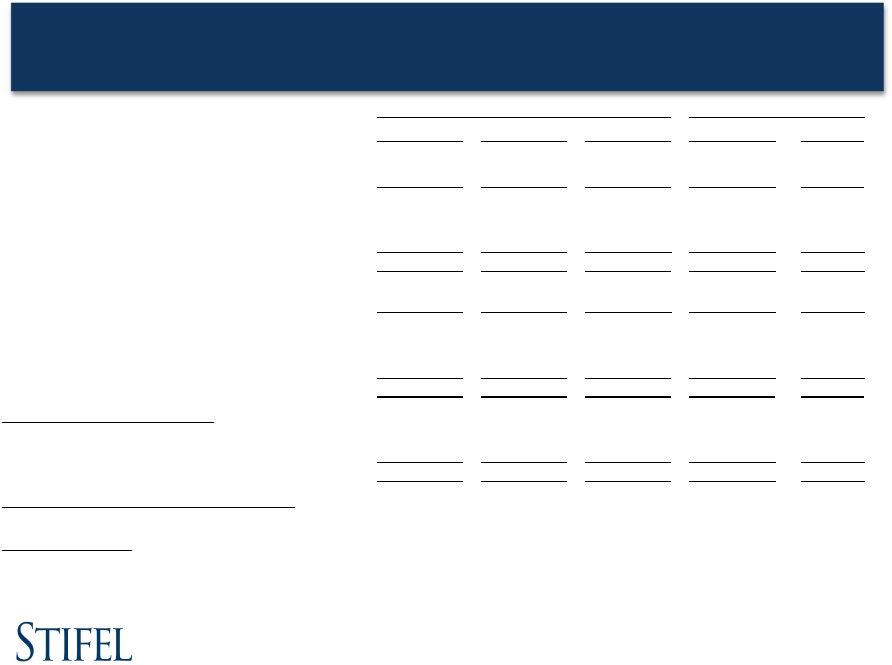

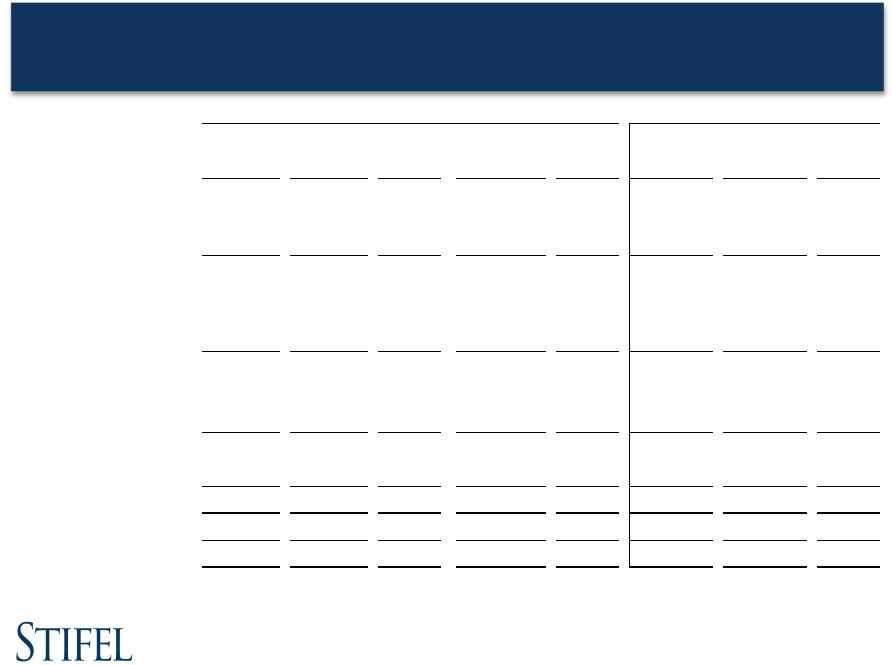

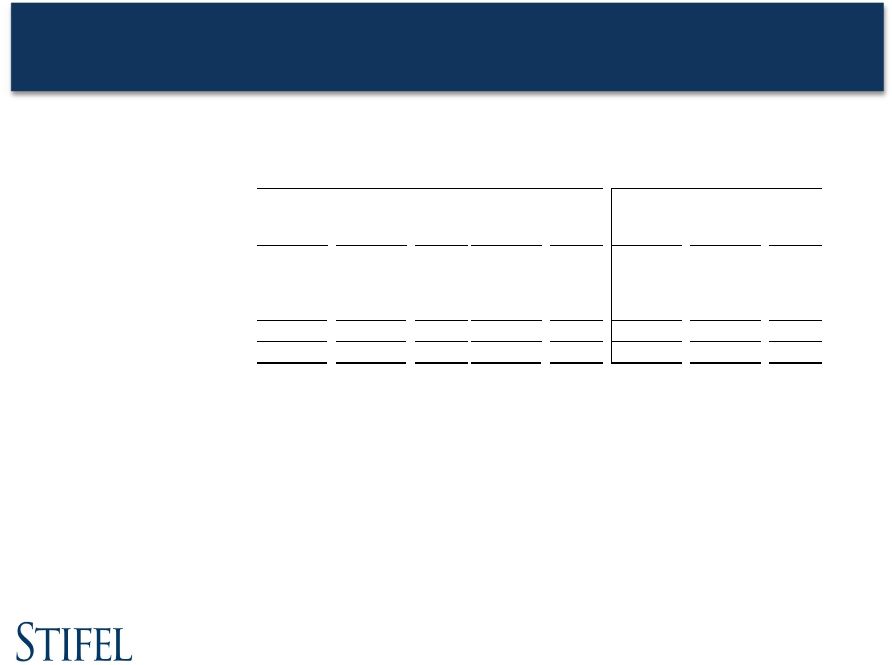

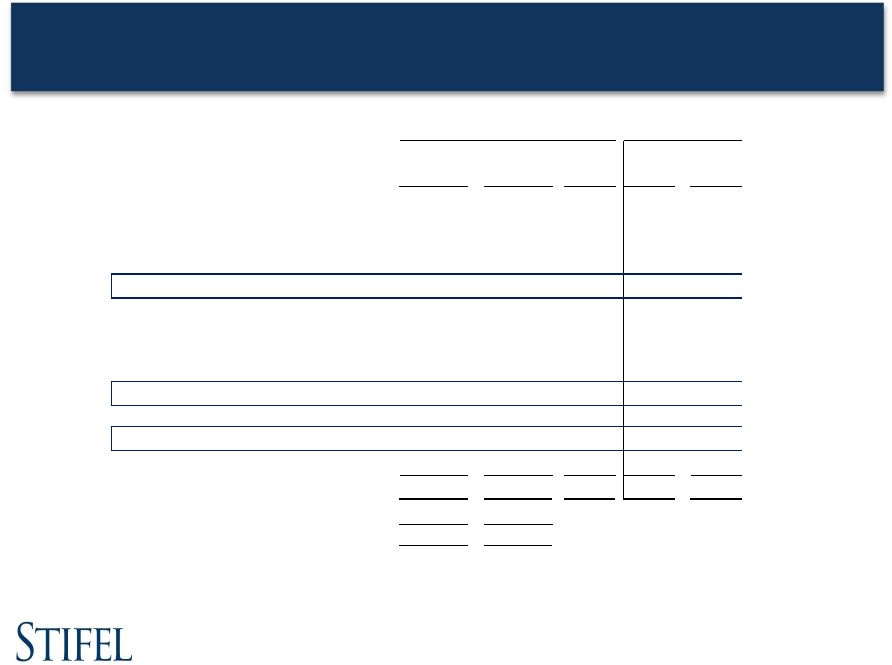

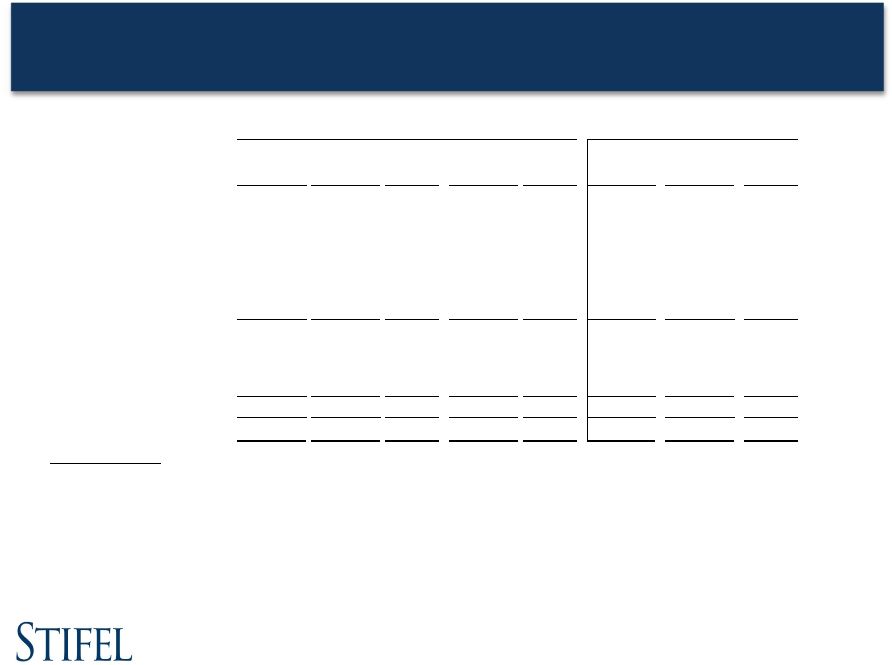

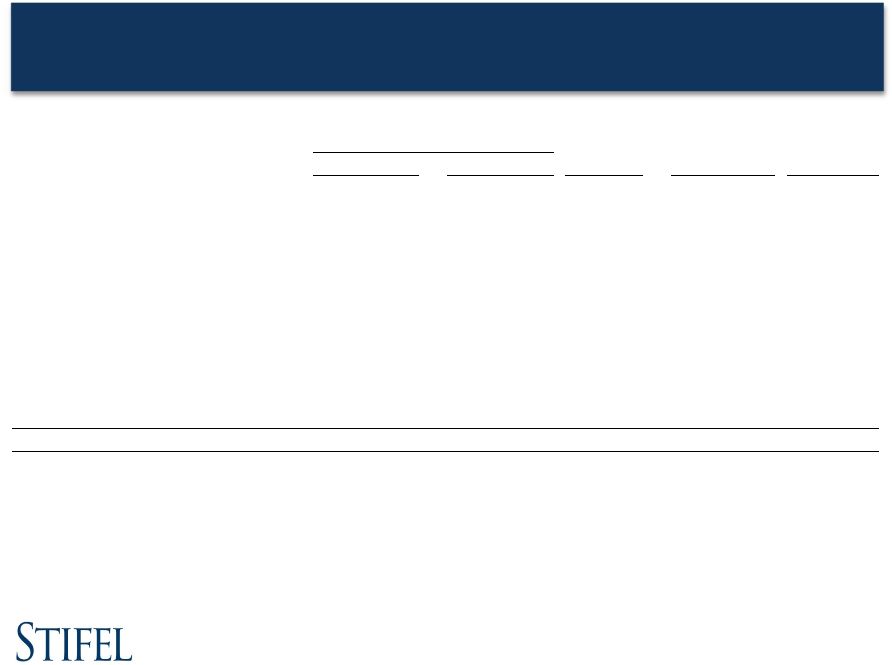

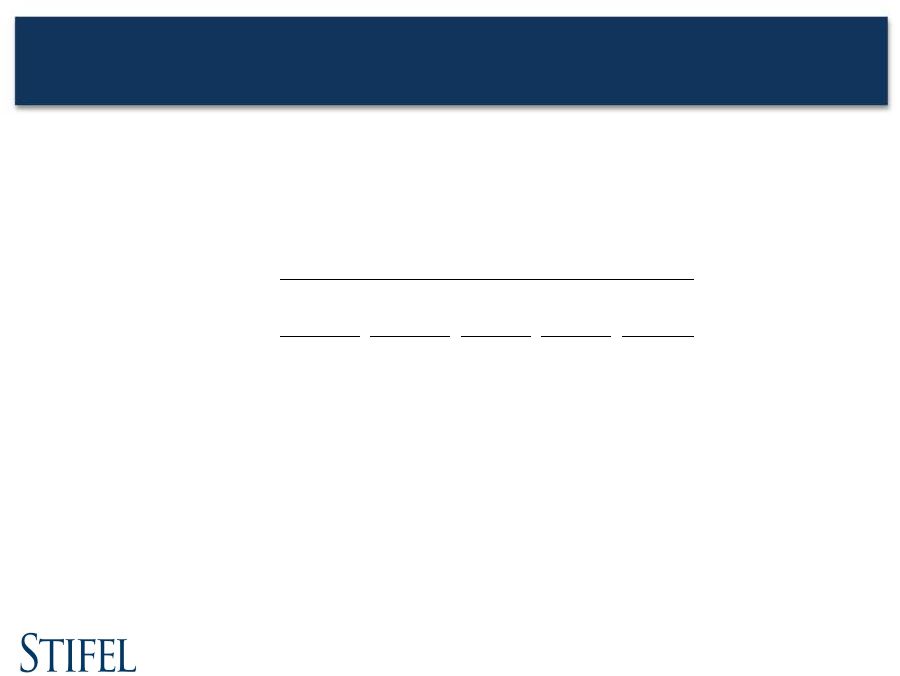

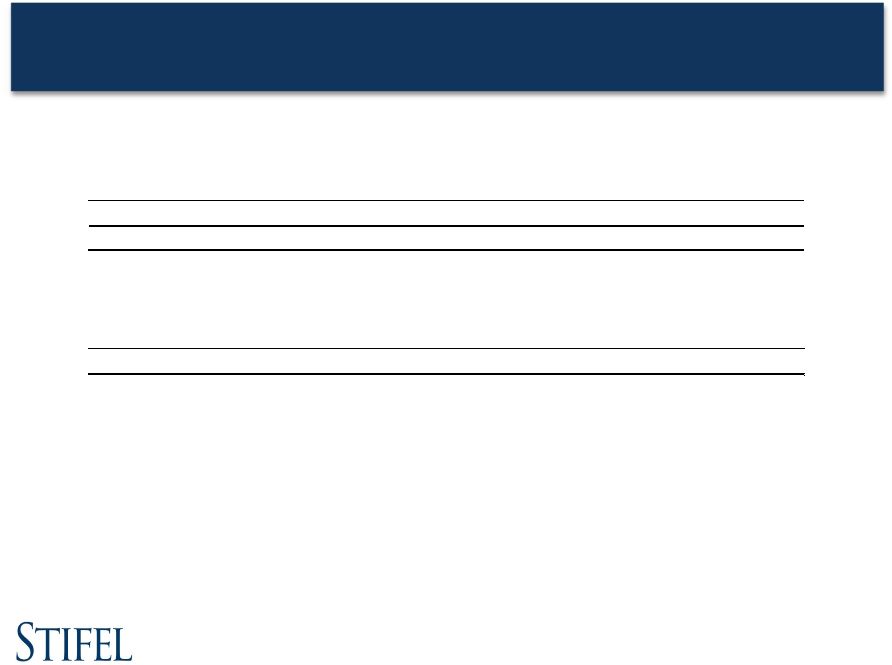

Stifel Financial Corp. Results Year ended December 31, 2013 (1) Non-core adjustments consist of charges related to expensing stock awards issued as retention in connection with the acquisitions of KBW and the Knight Capital Fixed Income business and other merger-related revenues and expenses associated with our acquisitions of KBW, the Knight Capital Fixed Income business, Miller Buckfire and a U.S. tax benefit in connection with discontinuing operations of SN Canada. (2) Core (non-GAAP) results for the year ended December 31, 2012 are the same as GAAP results. _________________________________________________________ ($ in thousands, except per share amounts) Non-GAAP Non-Core GAAP 12/31/12 % Change Total revenues 2,024,538 $ (4,724) $ 2,019,814 $ 1,627,483 $ 24.4% Interest expense 46,198 170 46,368 33,370 38.4% Net revenues 1,978,340 (4,894) 1,973,446 1,594,113 24.1% Compensation and benefits 1,236,991 74,395 1,311,386 1,010,140 22.5% Non-comp operating expenses 446,265 30,566 476,831 354,226 26.0% Total non-interest expenses 1,683,256 104,961 1,788,217 1,364,366 23.4% Income from continuing operations before income taxes 295,084 (109,855) 185,229 229,747 28.4% Provision for income taxes 110,426 (98,104) 12,322 84,451 30.8% Net income from continuing operations 184,658 $ (11,751) $ 172,907 $ 145,296 $ 27.1% Discontinued operations: Loss from discontinued operations, net - (10,894) (10,894) (6,723) (100.0%) Net income 184,658 $ (22,645) $ 162,013 $ 138,573 $ 33.3% Earnings per diluted common share: Income from continuing operations 2.51 $ (0.16) $ 2.35 $ 2.31 $ 8.7% Loss from discontinued operations, net - (0.15) (0.15) (0.11) (100.0%) Earnings per diluted common share 2.51 $ (0.31) $ 2.20 $ 2.20 $ 14.1% Weighted average number of shares outstanding: Diluted 73,504 73,504 62,937 16.8% Ratios to net revenues : Compensation and benefits 62.5% 66.5% 63.4% Non-comp operating expenses 22.6% 24.1% 22.2% Income from continuing operations before income taxes 14.9% 9.4% 14.4% Year Ended December 31, 2013 Year Ended |