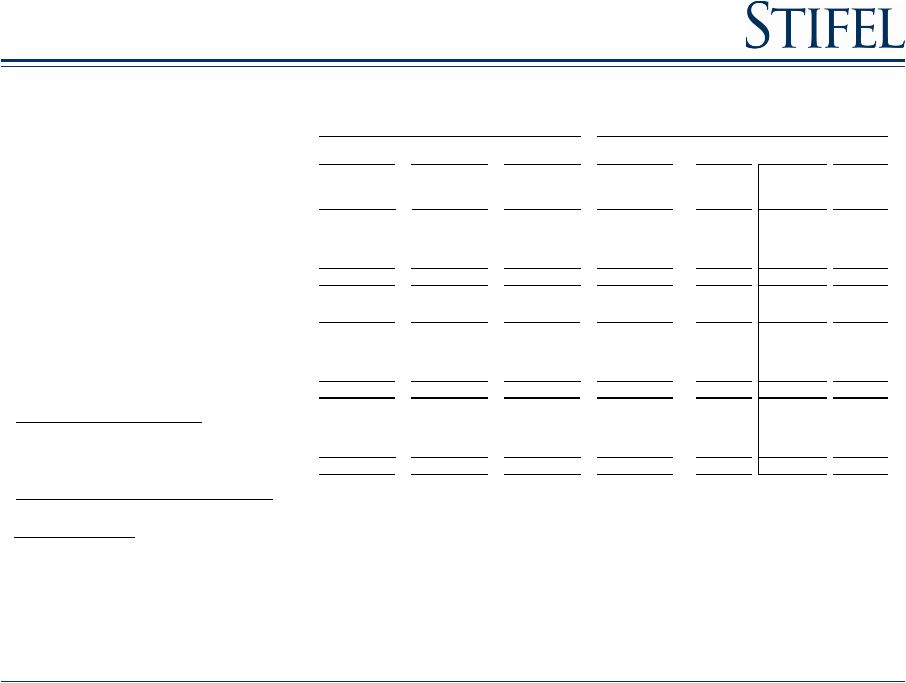

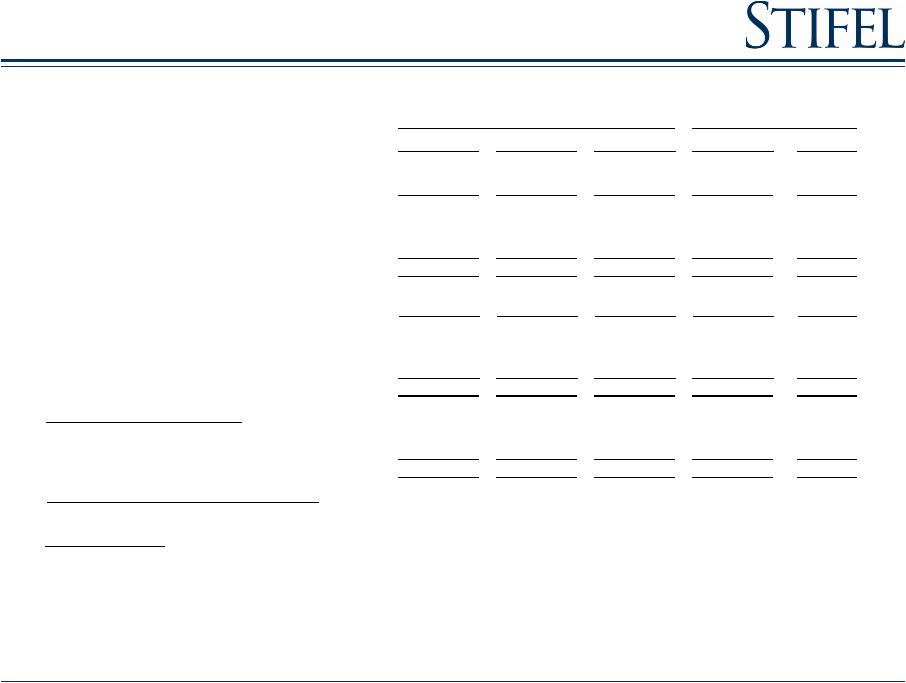

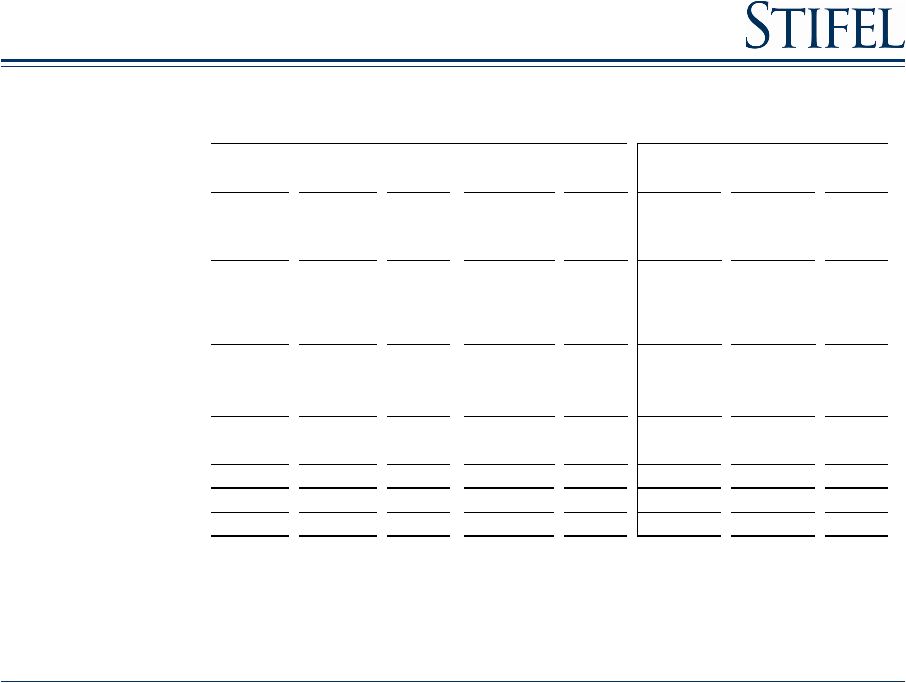

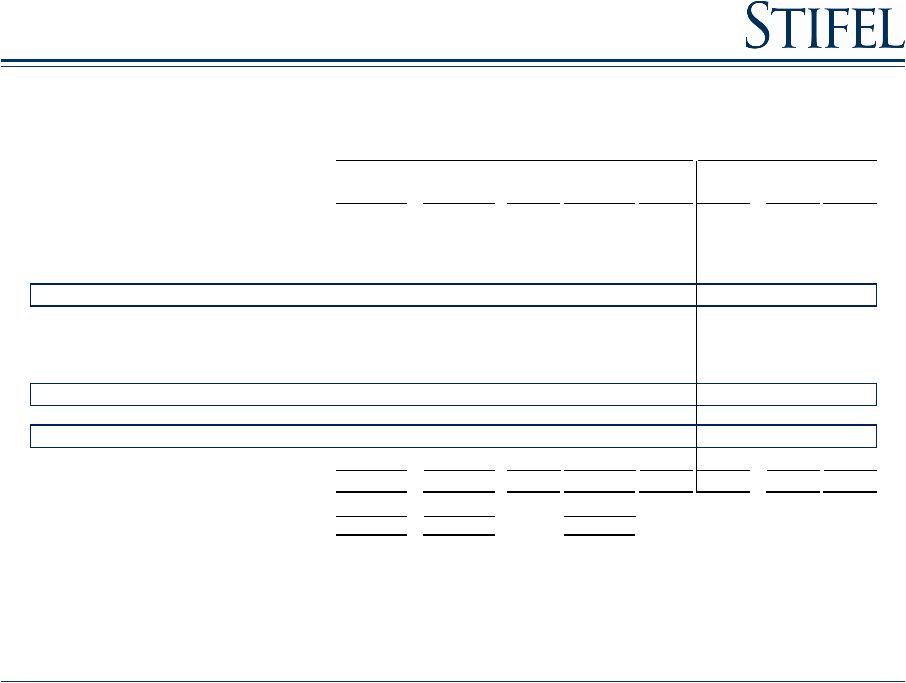

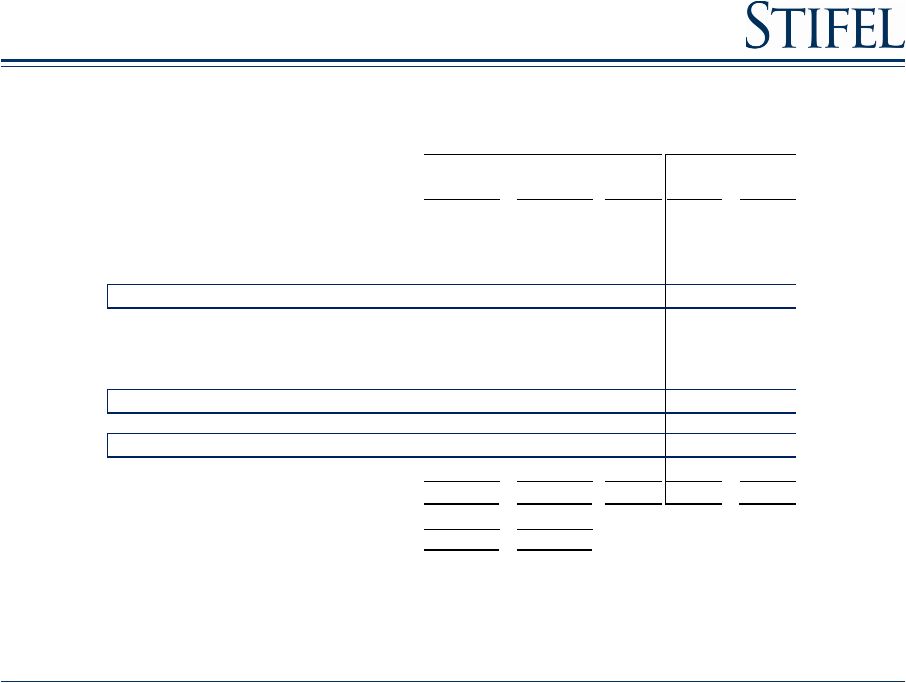

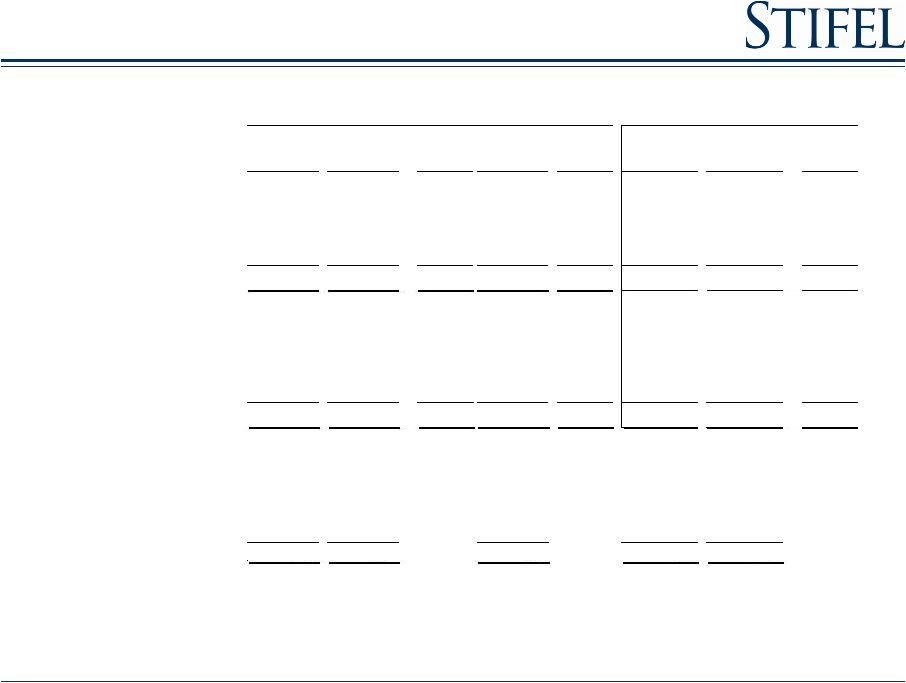

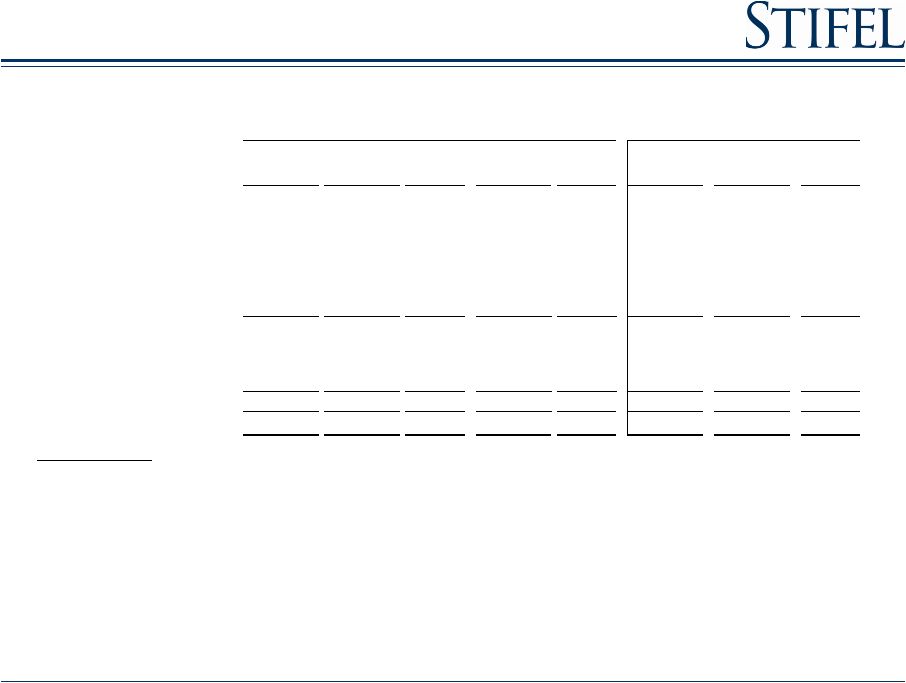

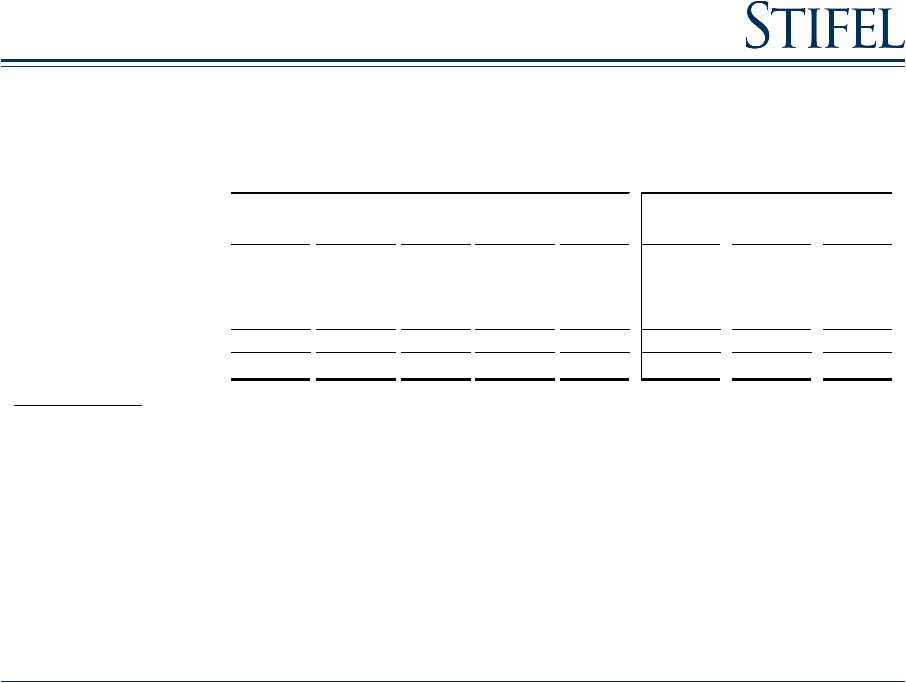

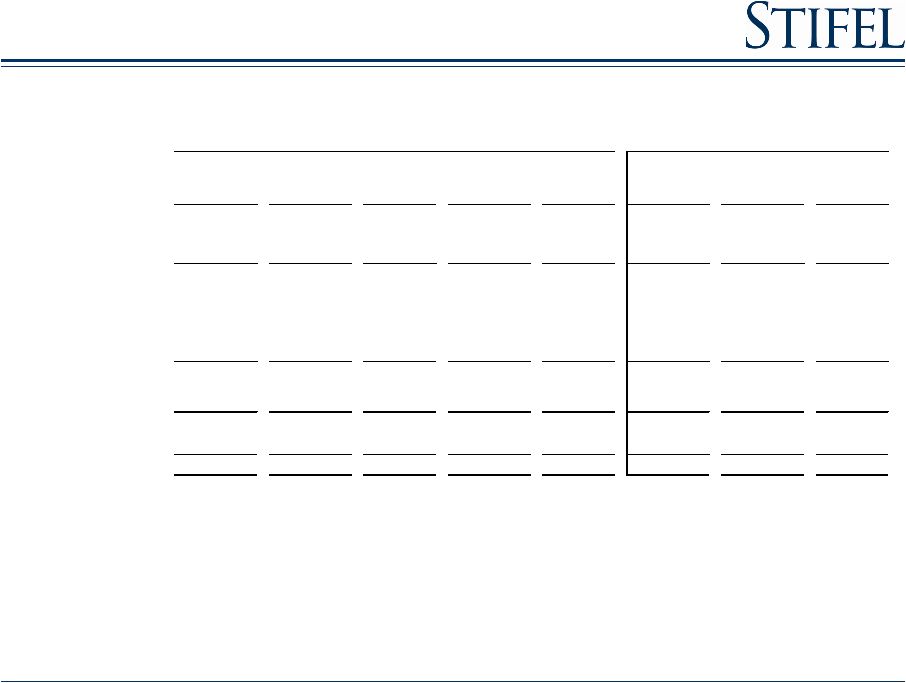

28 Stifel Financial Results Three months ended December 31, 2013 ($ in thousands, except per share amounts) Non-GAAP Non-Core GAAP 12/31/12 % Change 9/30/13 % Change Total revenues 576,236 $ (2,080) $ 574,156 $ 419,885 $ 37.2% 491,169 $ 17.3% Interest expense 11,555 75 11,630 8,602 34.3% 11,535 0.2% Net revenues 564,681 (2,155) 562,526 411,283 37.3% 479,634 $ 17.7% Compensation and benefits 347,263 5,944 353,207 258,148 34.5% 297,374 16.8% Non-comp operating expenses 126,990 4,340 131,330 92,784 36.9% 116,817 8.7% Total non-interest expenses 474,253 10,284 484,537 350,932 35.1% 414,191 14.5% Income from continuing operations before income taxes 90,428 (12,439) 77,989 60,351 49.8% 65,443 38.2% Provision for income taxes 30,609 (4,746) 25,863 17,067 79.3% 25,795 18.7% Net income from continuing operations 59,819 $ (7,693) $ 52,126 $ 43,284 $ 38.2% 39,648 $ 50.9% Discontinued operations: Loss from discontinued operations, net - (3,857) (3,857) (3,330) nm - - Net income 59,819 $ (11,550) $ 48,269 $ 39,954 $ 49.7% 39,648 $ 50.9% Earnings per diluted common share: Income from continuing operations 0.79 $ (0.10) $ 0.69 $ 0.80 $ (1.3%) 0.53 $ 49.1% Loss from discontinued operations - (0.05) (0.05) $ (0.06) - Earnings per diluted common share 0.79 $ (0.15) $ 0.64 $ 0.74 $ 6.8% 0.53 $ 49.1% Weighted average number of shares outstanding: Diluted 75,495 75,495 63,301 19.3% 75,191 0.4% Ratios to net revenues: Compensation and benefits 61.5% 62.8% 62.7% 62.0% Non-comp operating expenses 22.5% 23.3% 22.6% 24.4% Income from continuing operations before income taxes 16.0% 13.9% 14.7% 13.6% Three Months Ended December 31, 2013 Three Months Ended (1) Non-core adjustments consist of merger-related revenues and expenses associated with our acquisitions of KBW, the Knight Capital Fixed Income business, and Miller Buckfire and discontinued operations of SN Canada. (2) Core (non-GAAP) results for the three months ended December 31, 2012 are the same as GAAP results. Results for the three months ended September 30, 2013 are Core (non-GAAP). (1) (2) (2) |