Stifel Financial (SF) 8-KRegulation FD Disclosure

Filed: 8 Jun 15, 12:00am

Stifel Financial Corp. June 8, 2015 Acquisition of Barclays’ Wealth and Investment Management, Americas (“Barclays Wealth Americas”) Exhibit 99.2 |

2 DISCLAIMER Forward-Looking Statements www.sec.gov, including the sections entitled “Risk Factors” in Stifel’s Form 10-K for the fiscal year ended December 31, 2014. Readers are strongly urged to read the full cautionary statements contained in those materials. We assume no obligation to update any forward-looking statements to reflect events that occur or circumstances that exist after the date on which they were made. Statements in this presentation that relate to the future plans, events, expectations, performance, objectives, and the like of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated and its other subsidiaries (collectively, “Stifel” or the “Company”) and Barclays Wealth and Investment Management, Americas (“Barclays”), may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Future events, risks, and uncertainties, individually or in the aggregate, could cause our actual results to differ materially from those expressed or implied in these forward-looking statements. The material factors and assumptions that could cause actual results to differ materially from current expectations include, without limitation, the following: (1) the inability to close the transaction in a timely manner; (2) the inability to complete the transaction due to the failure to adopt the transaction agreement and approval of the transaction or the failure to satisfy other conditions to completion of the transaction, including required regulatory and other approvals; (3) the failure of the transaction to close for any other reason; (4) the possibility that the integration of Barclays business and operations with those of Stifel may be more difficult and/or take longer than anticipated, may be more costly than anticipated, and may have unanticipated adverse results relating to Barclays or Stifel’s existing businesses; (5) the challenges of integrating and retaining key employees; (6) the effect of the announcement of the transaction on Stifel’s, Barclays, or the combined company’s respective business relationships, operating results, and business generally; (7) the possibility that the anticipated synergies and cost savings of the transaction will not be realized, or will not be realized within the expected time period; (8) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (9) the challenges of maintaining and increasing revenues on a combined company basis following the close of the transaction; (10) diversion of management’s attention from ongoing business operations and opportunities; (11) general competitive, economic, political, and market conditions and fluctuations; (12) actions taken or conditions imposed by the United States and foreign governments; (13) adverse outcomes of pending or threatened litigation or government investigations; (14) the impact of competition in the industries and in the specific markets in which Stifel and Barclays, respectively, operate; and (15) other factors that may affect future results of the combined company described in Stifel’s filings with the U.S. Securities and Exchange Commission (“SEC”) that are available on the SEC’s web site located at |

3 A Powerful Combination of Breadth and Depth Barclays Wealth Americas brings a highly focused organization with deep, high conviction, investment capabilities Stifel brings significant breadth of product and service capabilities that are complementary to Barclays Wealth Americas This combination of depth and breadth, joined with a culture of meritocracy and entrepreneurial, client first thinking = Premier Wealth Management Franchise Unique transaction structure whereby Stifel’s investment will match the business and professionals who join the firm WHY THIS COMBINATION MAKES SENSE |

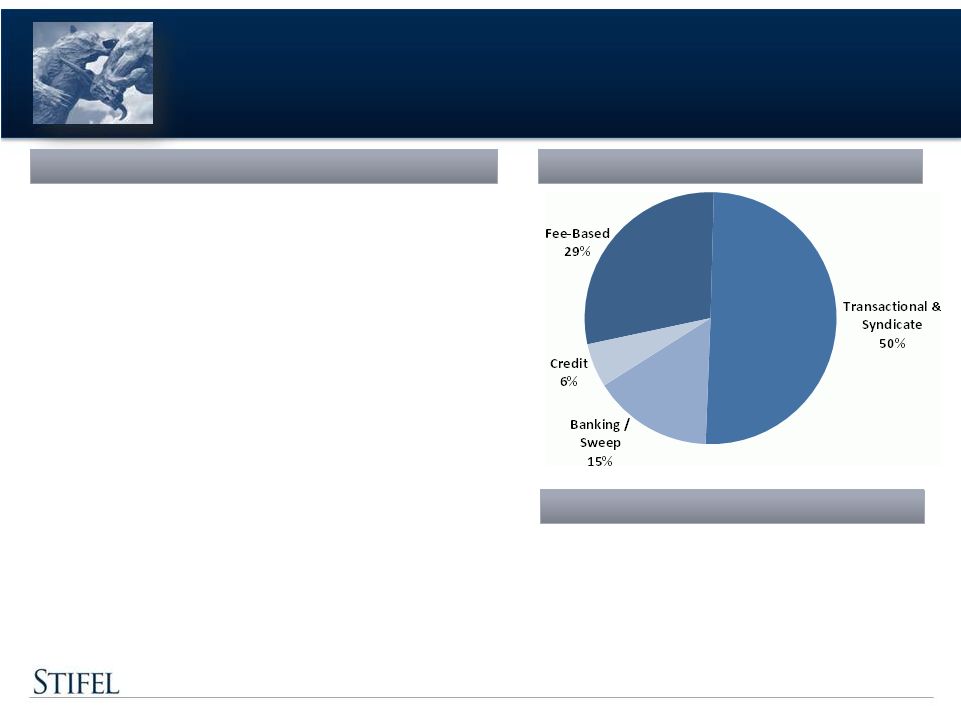

4 • Created following Barclays’ acquisition of the Private Investment Management division of Lehman Brothers in 2008 • Full suite of capabilities including investment advisory and managed money, capital markets (equity, fixed income, credit), custom credit and Reg T (margin) lending and trust services • 12-office footprint covers major wealth centers in the U.S. • Selected statistics: • ~180 IRs • ~$56B of client assets • Average IR tenure is ~9 years • $1.4 billion of on-balance sheet assets and approximately $1.5 billion of client loans held through Barclays’ clearing firm Key Facts • New York • Chicago • Boston • San Francisco • Washington D.C. • Los Angeles • Houston • Dallas • Atlanta • Palm Beach • Miami • Philadelphia OVERVIEW OF BARCLAYS WEALTH AMERICAS 2014 Revenue Contribution Office Locations |

5 • Atlanta • Chicago • Houston • Miami • Palm Beach • San Francisco • Boston • Dallas • Los Angeles • New York • Philadelphia • Washington, D.C. • Stifel has 330 Private Client Group Offices in 45 states FURTHER EXPANSION INTO MAJOR MARKETS |

Stifel - Breadth Stifel - Breadth 12-office footprint covers all major wealth centers in the U.S. Full suite of high-conviction investment capabilities including: Investment advisory and managed money Alternative Investment Capabilities Capital Markets Custom Credit and Reg T (margin) National Delaware Trust services charter Barclays - Depth Barclays - Depth National presence in 330 offices Broad Investment Advisory Platform offers new investment managers and strategies to Barclays IRs Stifel has extensive Asset Management capabilities including 19/19 Investment Counsel, Ziegler Capital, Thomas Weisel Partners, EquityCompass, and Washington Crossing Advisors New Trading and Performance Reporting Technologies Broad Stifel and KBW Research Platforms Broad Stifel/KBW Investment Banking Capabilities Nationally recognized municipal finance franchise COMBINING BREADTH AND DEPTH This combination of depth and breadth, joined with a culture of meritocracy and entrepreneurial, client first thinking = Premier Wealth Management Franchise 6 |

7 SIMILAR HIGH NET WORTH PLATFORMS COMPARING BARCLAYS WEALTH AMERICAS TO STIFEL’S TOP 198 ADVISORS Barclays Stifel Revenues ($s million) Advisory, Fee Based, and Credit (1), (2) 147.7 210.0 Transactional & Capital Markets 184.3 117.4 Total Advisory, Credit, & Brokerage 332.0 327.4 Assets ($s billion) Fee Based AUM (3) 22.7 25.6 Brokerage AUM 35.2 27.6 Total AUM 57.9 53.3 Average Return on Assets 0.57% 0.61% Notes: (1) Barclays data is trailing twelve months as of April 30, 2015 and Stifel’s data is current trailing twelve months. (2) Barclays info is prepared on a pro forma basis based on Stifel’s view of the business. (3) Stifel information is based upon the Company’s view of the assets and production of its top 198 advisors. |

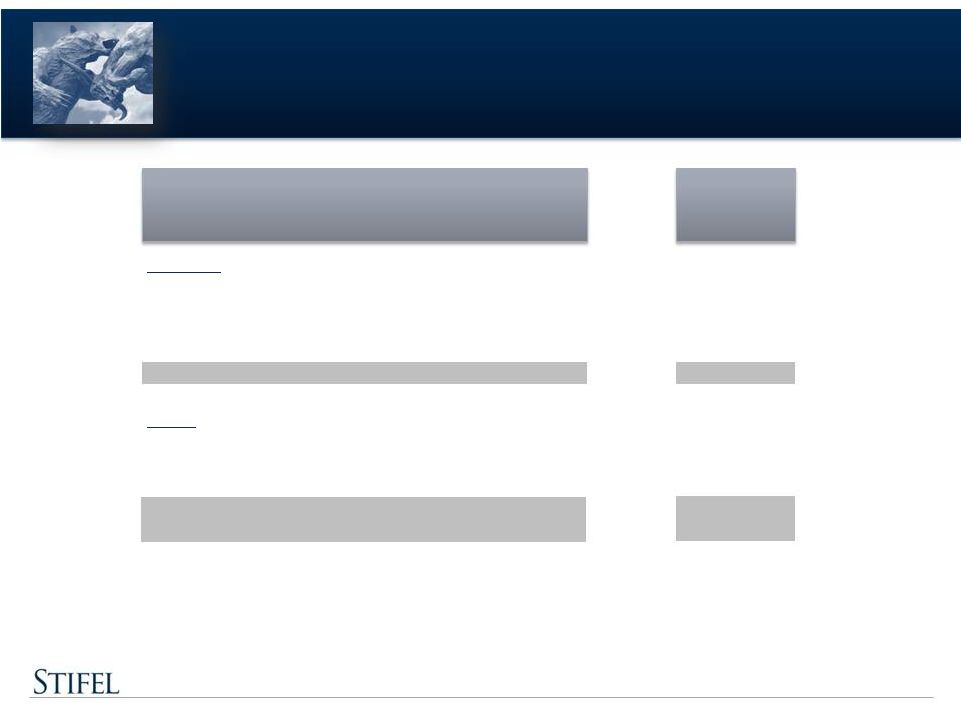

8 TRANSACTION HIGHLIGHTS Transaction Distribution Agreement Financial Impact Required Approvals Target Closing • Acquisition by Stifel of certain assets related to Barclays Wealth Americas • Stifel will hire up to 180 financial advisors currently managing approximately $56 billion in client assets • Barclays has on-balance sheet assets of approximately $1.4 billion, and approximately $1.5 billion of client loans held through Barclays’ clearing firm • Transaction structure is highly variable and scaled based upon the number of advisors that ultimately join Stifel • Stifel will be the U.S. private wealth distribution partner for certain of Barclays’ equities and credit new issue securities in the U.S. • Immediately accretive to Stifel • Revenue contribution expected be approximately $200 million to $325 million • Anticipated pre-tax margins of 20% - 25%, after amortization of retention • Excludes positive balance sheet leverage to a potential rise in interest rates • Stifel expects to issue between 1.0 million and 2.0 million shares • Subject to regulatory approvals and customary conditions • Mid-November of 2015 |

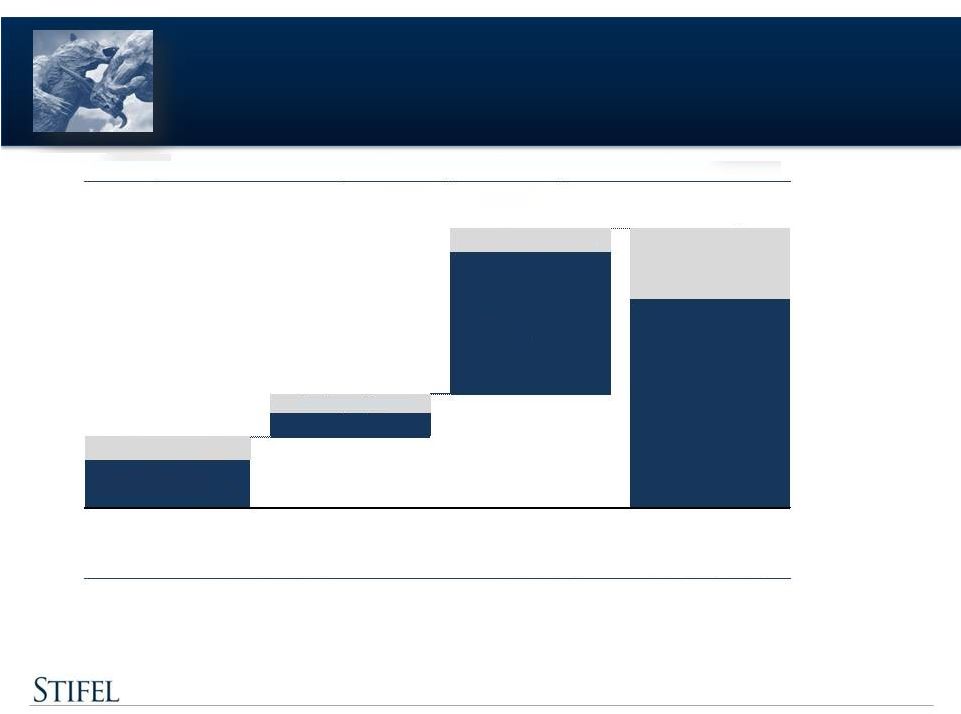

9 IMPACT OF A RISING RATE ENVIRONMENT ~$42mm ~$61MM Barclays - ~$6mm ~$6mm Barclays - ~$1mm ~$13mm Stifel - ~$5mm Barclays - ~$5mm Stifel Bank Remainder of Deposit Fees Projected Stifel Stifel Incremental Pre-Tax Earnings Projected increase in annual pre-tax earnings from a 100 bps rise in short-term rates Fee Waivers Net Interest Income Barclays - ~$12mm Stifel - ~$49mm Stifel - ~$8mm Stifel - ~$36mm Assumptions: (1) Based on an instantaneous change in short-term rates (2) Ultimately, the amount earned by clients and kept by the firm will be based on market/competitive pricing, etc. |

10 • Private Client – 350 financial advisors and support • Revenue production has exceeded expectations • October 2009 • Bank holding company • Grown assets from ~ $100M to $5.2B • April 2007 • Private Client – 75 financial advisors • Public Finance • December 2008 • Private Client – 400 financial advisors • Capital Markets • February 2007 • Asset Management • Over $4 billion in assets • November 2013 • Portfolio of 1-4 family residential mortgages • October 2013 • Customized investment advisory and trust services • November 2014 Private Client Asset Management Bank • 180 Financial advisors with ~$56 billion in client assets • Announced: June 2015 • Customized investment advisory and trust services • Announced: March 2015 TRACK RECORD OF SUCCESSFUL INTEGRATION… |